UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22801

Franklin ETF Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway

San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Alison Baur

One Franklin Parkway

San Mateo, CA 94403-1096

(Name and address of agent for service)

Registrant’s telephone number, including area code: 650-312-2000

Date of fiscal year end: March 31

Date of reporting period: 03/31/2023

| Item 1. | Reports to Stockholders. |

| | (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1.) |

ANNUAL REPORT

FRANKLIN SHORT DURATION U.S. GOVERNMENT ETF

Formerly, Franklin Liberty Short Duration U.S. Government ETF

A Series of Franklin ETF Trust

March 31, 2023

Visit franklintempleton.com for fund

updates and documents, or to find helpful

financial planning tools.

| | | | | | | | |

| Not FDIC Insured | | | | | May Lose Value | | | | | No Bank Guarantee |

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 1 |

ANNUAL REPORT

Franklin Short Duration U.S. Government ETF

Formerly, Franklin Liberty Short Duration U.S. Government ETF

This annual report for Franklin Short Duration U.S. Government ETF covers the fiscal year ended March 31, 2023.

Your Fund’s Goal and Main Investments

The Fund seeks to provide a high level of current income as is consistent with prudent investing, while seeking preservation of capital, by normally investing at least 80% of its net assets in securities issued or guaranteed by the U.S. government, its agencies or instrumentalities.1 The Fund currently targets an estimated portfolio duration of three years or less.

Performance Overview

For the 12 months under review, the Fund posted cumulative total returns of +0.18% based on market price and +0.24% based on net asset value. In comparison, the Bloomberg U.S. Government Index: 1-3 Year Component, which includes U.S. dollar-denominated, fixed-rate, nominal U.S. Treasuries and U.S. agency debentures with at least one year up to, but not including, three years to final maturity, posted a +0.23% cumulative total return for the same period.2 You can find more of the Fund’s performance data in the Performance Summary beginning on page 4.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Economic and Market Overview

The U.S. bond market, as measured by the Bloomberg U.S. Aggregate Bond Index, posted a -4.78% total return for the 12-month period ended March 31, 2023.2 High inflation amid a strong labor market led to significantly tighter monetary policy, reducing the value of most bonds. While interest rates increased along the yield curve for all U.S. Treasury maturities, relatively large increases in shorter-term interest rates

| | | | |

| Portfolio Composition* | | | |

| |

| 3/31/23 | | | |

| |

| | | % of Total

Net Assets | |

MBS ARMs | | | 44.4% | |

MBS Fixed Rate | | | 25.1% | |

U.S. Treasuries | | | 31.0% | |

U.S. Agencies | | | 3.3% | |

Short-Term Investments & Other Net Assets | | | -3.8% | |

*Figures reflect certain derivatives held in the portfolio (or their underlying reference assets) and may not total 100% or may be negative due to rounding, use of any derivatives, unsettled trades or other factors.

led the yield curve to invert during the period as investors became increasingly concerned about the economic outlook.

In an effort to control inflation, the U.S. Federal Reserve (Fed) raised the federal funds target rate at each of its eight meetings during the period to end at a range of 4.75%–5.00%, a full 450 basis points higher than at the beginning of the period. The Fed noted in its March 2023 meeting that inflation remained elevated amid robust job growth and low unemployment. Despite its goal of 2% long-run inflation, the Fed softened its firm outlook on future rate hikes. Furthermore, the Fed indicated it would continue to reduce its U.S. Treasury (UST) and agency debt and mortgage-backed security holdings.

UST bonds, as measured by the Bloomberg U.S. Treasury Index, posted a -4.51% total return for the 12-month period.2 The 10-year UST yield, which moves inversely to price, increased sharply amid high inflation and the Fed’s tightening monetary stance. Mortgage-backed securities (MBS), as measured by the Bloomberg U.S. MBS Fixed Rate Index, posted a -4.85% total return for the period as mortgage rates rose to the highest level in over two decades and modest prepayment rates led to increasing interest-rate sensitivity.2

Corporate bond prices also declined, constrained by inflation, rising interest rates and concerns about the impact of

1. Some securities owned by the Fund, but not shares of the Fund, are guaranteed by the U.S. government, its agencies or instrumentalities as to timely payment of principal and interest. The Fund’s net asset value, trading price and yield are not guaranteed and will fluctuate with market conditions. Please see the Fund’s prospectus for the level of credit support offered by government agency or instrumentality issues.

2. Source: Morningstar. Treasuries, if held to maturity, offer a fixed rate of return and a fixed principal value; their interest payments and principal are guaranteed.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Schedule of Investments (SOI). The SOI begins on page 9.

| | | | | | | | | | |

| | | | | | |

| 2 | | | | | | | | Annual Report | | franklintempleton.com |

FRANKLIN SHORT DURATION U.S. GOVERNMENT ETF

elevated interest rates on corporate borrowing costs and the wider economy. In this environment, high-yield corporate bonds, as represented by the Bloomberg U.S. Corporate High Yield Index, posted a -3.34% total return, while investment-grade corporate bonds, as represented by the Bloomberg U.S. Corporate Investment Grade Index, posted a -5.55% total return.2

Investment Strategy

Under normal market conditions, the Fund invests at least 80% of its net assets in securities issued or guaranteed by the U.S. government, its agencies, or instrumentalities. The Fund currently targets an estimated portfolio duration of three years or less. The Fund generally invests 50%–80% of its assets in mortgage securities issued or guaranteed by the U.S. government, its agencies, or instrumentalities, including adjustable-rate mortgage securities (ARMs) and collateralized mortgage obligations (CMOs). The Fund also invests in direct U.S. government obligations (such as Treasury bonds, bills and notes) and in securities issued or guaranteed by the U.S. government, its agencies or instrumentalities, including government-sponsored entities. All of the Fund’s principal investments are debt securities, including bonds, notes and debentures. To pursue its investment goal, the Fund may invest in certain interest rate-related derivatives, principally U.S. Treasury futures contracts and options on interest rate/bond futures. The use of these derivatives may allow the Fund to obtain net long or short exposures to selected interest rates or durations. These derivatives may be used to hedge risks associated with the Fund’s other portfolio investments and to manage the duration of the Fund’s portfolio. The Fund is an actively managed exchange-traded fund (ETF) that does not seek to replicate the performance of a specified index. The Fund may have a higher degree of portfolio turnover than funds that seek to replicate the performance of an index.

Manager’s Discussion

Over the previous 12 months, the U.S. economic story was one of inflation, Fed action, and volatility. Inflation became a large issue as the year-over-year change in the Consumer Price Index (CPI) pushed higher into the summer months, reaching 9.1% in June 2022, the highest level since 1981, before trending lower. The U.S. job market also showed strong resilience with a monthly average of 362,000 jobs created during the 12-month period under review. The unemployment rate fell to 3.4% in January 2023, the lowest level since 1969.

The Fed was slow to act on inflation and considered the rapid price increases to be “transitory.” The Fed capitulated and initiated a program of rapid rate increases at a pace not seen

since the 1980s. Over the period under review, the Fed raised its policy rate by a total of 4.50%, taking it to a restrictive level of 4.75%–5.00%. U.S. Treasury (UST) yields rose over the period, with the benchmark 10-year UST rising 113 basis points. March 2023 saw significant volatility across fixed income markets as turmoil in the global banking sector led to a strong risk-off shift in sentiment.

During the period, agency MBS spreads widened as the Fed continued to allow its holdings to roll off its balance sheet, forcing money managers to absorb most of the excess supply demanding higher spreads. Additionally, the vast majority of the MBS universe became unattractive for refinancing, slowing prepayment levels and extending duration.

The Fund’s yield curve exposure was the primary contributor to outperformance versus the benchmark. The Fund was positioned with less duration than the benchmark overall, especially on the two-year part of the curve. The Fund’s exposure to MBS was the largest negative contributor to performance as spreads widened. The Fund’s exposure to agency ARMs and agency CMOs also detracted from performance as spreads in the sectors widened in sympathy with MBS spreads.

The Fund invested in USTs, agency debentures, agency mortgage pass-through securities and other U.S. government-related bonds and cash investments. We looked for valuations we considered attractive within lower interest-rate risk government bond markets with a focus on high current income. We used UST futures and options on UST futures for duration and convexity management.

Thank you for your participation in Franklin Short Duration U.S. Government ETF. We look forward to serving your future investment needs.

Patrick Klein, Ph.D.

Paul Varunok

Neil Dhruv

Portfolio Management Team

The foregoing information reflects our analysis, opinions and portfolio holdings as of March 31, 2023, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 3 |

FRANKLIN SHORT DURATION U.S. GOVERNMENT ETF

Performance Summary as of March 31, 2023

Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Total returns do not include brokerage commissions that may be payable on secondary market transactions. The performance tables and graph do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing fund shares. The price used to calculate market return (Market Price) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary trading (11/6/13), the NAV of the Fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV.

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 3/31/231

| | | | | | | | | | | | | | | | |

| | |

| | | Cumulative Total Return2 | | | Average Annual Total Return2 | |

| | | Based on

NAV3 | | | Based on

market price4 | | | Based on

NAV3 | | | Based on

market price4 | |

1-Year | | | +0.24% | | | | +0.18% | | | | +0.24% | | | | +0.18% | |

5-Year | | | +4.78% | | | | +4.64% | | | | +0.94% | | | | +0.91% | |

Since Inception (11/4/13) | | | +8.42% | | | | +8.00% | | | | +0.86% | | | | +0.82% | |

| | | | |

| Distribution Rate5 | | 30-Day Standardized Yield6 | |

3.56% | | | 3.90% | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 6 for Performance Summary footnotes

| | | | | | | | | | |

| | | | | | |

| 4 | | | | | | | | Annual Report | | franklintempleton.com |

FRANKLIN SHORT DURATION U.S. GOVERNMENT ETF

PERFORMANCE SUMMARY

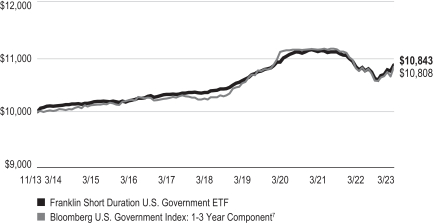

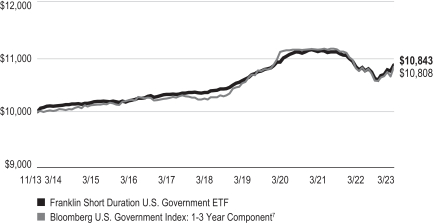

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return is calculated at net asset value and represents the change in value of an investment over the periods shown. It includes any Fund fees and expenses, and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

11/4/13–3/31/23

See page 6 for Performance Summary footnotes

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 5 |

FRANKLIN SHORT DURATION U.S. GOVERNMENT ETF

PERFORMANCE SUMMARY

Distributions (4/1/22–3/31/23)

|

|

Net Investment

Income |

$1.91452 |

Total Annual Operating Expenses8

All investments involve risks, including possible loss of principal. Interest rate movements, unscheduled mortgage prepayments and other risk factors will affect the Fund’s share price and yield. Bond prices, and thus a fund’s share price, generally move in the opposite direction of interest rates. Therefore, as the prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. Events such as the spread of deadly diseases, disasters, and financial, political or social disruptions, may heighten risks and adversely affect performance. The Fund’s prospectus also includes a discussion of the main investment risks.

ETFs trade like stocks, fluctuate in market value and may trade at prices above or below their net asset value. Brokerage commissions and ETF expenses will reduce returns.

1. Gross expenses are the Fund’s total annual operating expenses as of the Fund’s prospectus available at the time of publication. Net expenses are capped under a contractual agreement, which cannot be terminated prior to 7/31/23 without Board consent. Actual expenses may be higher and may impact portfolio returns.

2. Total return calculations represent the cumulative and average annual changes in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

3. Assumes reinvestment of distributions based on net asset value.

4. Assumes reinvestment of distributions based on market price.

5. Distribution rate is based on an annualization of the 23.8920 cent per share March dividend and the NAV of $90.45 per share on 3/31/23.

6. The Fund’s 30-day standardized yield is calculated over a trailing 30-day period using the yield to maturity on bonds and/or the dividends accrued on stocks. It may not equal the Fund’s actual income distribution rate, which reflects the Fund’s past dividends paid to shareholders.

7. Source: FactSet. The Bloomberg U.S. Government Index: 1-3 Year Component includes U.S. dollar-denominated, fixed-rate, nominal U.S. Treasuries and U.S. agency debentures (securities issued by U.S. government-owned or government-sponsored entities, and debt explicitly guaranteed by the U.S. government) with at least one year up to, but not including, three years to final maturity.

8. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| | | | | | | | | | |

| | | | | | |

| 6 | | | | | | | | Annual Report | | franklintempleton.com |

FRANKLIN SHORT DURATION U.S. GOVERNMENT ETF

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares; and (2) ongoing Fund costs, including management fees and other Fund expenses. All funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value.” You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | |

| | | | Actual (actual return after expenses) | | | Hypothetical (5% annual return before expenses) | | | | |

| | | | | |

Beginning

Account

Value 10/1/22 | | | Ending

Account

Value 3/31/23 | | | Expenses

Paid During

Period 10/1/22–3/31/231,2 | | | Ending

Account

Value 3/31/23 | | | Expenses

Paid During

Period 10/1/22–3/31/231,2 | | | Net Annualized

Expense Ratio2 | |

| | $1,000 | | | $ | 1,023.04 | | | $ | 1.21 | | | $ | 1,023.73 | | | $ | 1.21 | | | | 0.24 | % |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 182/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 7 |

FRANKLIN ETF TRUST

Financial Highlights

Franklin Short Duration U.S. Government ETF

| | | | | | | | | | | | | | | | | | | | |

| |

| | | Year Ended March 31, | |

| | | | | |

| | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| | | | | |

Per share operating performance

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | $ | 92.17 | | | $ | 95.24 | | | $ | 94.84 | | | $ | 94.40 | | | $ | 95.18 | |

| | | | |

| | | | | |

| Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment incomeb | | | 1.65 | | | | 0.41 | | | | 0.79 | | | | 2.11 | | | | 1.95 | |

| | | | | |

Net realized and unrealized gains (losses) | | | (1.46 | ) | | | (2.72 | ) | | | 0.89 | | | | 0.85 | | | | (0.03 | ) |

| | | | |

| | | | | |

Total from investment operations | | | 0.19 | | | | (2.31 | ) | | | 1.68 | | | | 2.96 | | | | 1.92 | |

| | | | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (1.91 | ) | | | (0.76 | ) | | | (1.28 | ) | | | (2.52 | ) | | | (2.70 | ) |

| | | | |

| | | | | |

Net asset value, end of year | | $ | 90.45 | | | $ | 92.17 | | | $ | 95.24 | | | $ | 94.84 | | | $ | 94.40 | |

| | | | |

| | | | | |

Total returnc | | | 0.24% | | | | (2.45)% | | | | 1.77% | | | | 3.18% | | | | 2.04% | |

| | | | | |

| Ratios to average net assets | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses before waiver and payments by affiliates | | | 0.25% | | | | 0.30% | | | | 0.37% | | | | 0.43% | | | | 0.44% | |

| | | | | |

Expenses net of waiver and payments by affiliates | | | 0.24% | | | | 0.25% | d | | | 0.24% | | | | 0.23% | | | | 0.25% | d |

| | | | | |

Net investment income | | | 1.82% | | | | 0.43% | | | | 0.82% | | | | 2.23% | | | | 2.06% | |

| | | | | |

| Supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s) | | | $203,612 | | | | $359,566 | | | | $435,827 | | | | $187,395 | | | | $125,177 | |

| | | | | |

Portfolio turnover ratee | | | 196.59% | | | | 156.78% | | | | 210.16% | | | | 169.35% | | | | 104.49% | |

| | | | | |

Portfolio turnover rate excluding mortgage dollar rollse,f | | | 107.64% | | | | 84.03% | | | | 189.55% | | | | 105.08% | | | | 64.69% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of creation unit Fund shares in relation to income earned, adjustments to interest income for the inflation index bonds, and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period.

dBenefit of expense reduction rounds to less than 0.01%.

ePortfolio turnover rate includes portfolio transactions that are executed as a result of the Fund offering and redeeming Creation Units solely for cash (“Cash creations”).

fSee Note 1(d) regarding mortgage dollar rolls.

| | | | | | | | | | |

| | | | | | |

| 8 | | | | | | | | Annual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

FRANKLIN ETF TRUST

Schedule of Investments, March 31, 2023

Franklin Short Duration U.S. Government ETF

| | | | | | | | | | |

| | | |

| | | | | Principal Amount | | | Value | |

| | | U.S. Government and Agency Securities 34.3% | | | | | | |

| | Dragon 2012 LLC, secured bond, 1.972%, 3/12/24 | | $ | 9,477 | | | $ | 9,309 | |

| | Export-Import Bank of the U.S., | | | | | | | | |

| | senior secured note, 1.90%, 7/12/24 | | | 826,720 | | | | 809,488 | |

| | secured note, 2.628%, 11/12/26 | | | 1,037,982 | | | | 1,014,859 | |

| a | | KE Export Leasing LLC, 2013-A, secured note, FRN, 5.183%, (3-Month USD LIBOR + 0.23%), 2/28/25 | | | 355,772 | | | | 354,598 | |

| | MSN 41079 and 41084 Ltd., 1.631%, 12/14/24 | | | 797,292 | | | | 772,321 | |

| | Petroleos Mexicanos, 2.378%, 4/15/25 | | | 350,000 | | | | 340,734 | |

| | Reliance Industries Ltd., | | | | | | | | |

| | 2.512%, 1/15/26 | | | 562,500 | | | | 538,794 | |

| | senior secured note, 2.06%, 1/15/26 | | | 750,000 | | | | 713,588 | |

| | U.S. International Development Finance Corp., | | | | | | | | |

| | 2.12%, 3/20/24 | | | 366,667 | | | | 356,989 | |

| | 4.01%, 5/15/30 | | | 1,295,000 | | | | 1,281,584 | |

| | U.S. Treasury Note, | | | | | | | | |

| | 1.25%, 8/31/24 | | | 7,000,000 | | | | 6,704,824 | |

| | 1.75%, 6/30/24 | | | 5,300,000 | | | | 5,129,820 | |

| | 2.75%, 5/15/25 | | | 5,000,000 | | | | 4,870,215 | |

| | 3.00%, 6/30/24 | | | 23,000,000 | | | | 22,595,254 | |

| | 3.125%, 8/15/25 | | | 15,000,000 | | | | 14,722,559 | |

| | 4.50%, 11/15/25 | | | 9,000,000 | | | | 9,134,473 | |

| | Ulani MSN 37894, senior bond, 2.184%, 12/20/24 | | | 608,696 | | | | 592,319 | |

| | | | | | | | | | |

| | Total U.S. Government and Agency Securities (Cost $70,903,929) | | | | | | | 69,941,728 | |

| | | | | | | | | | |

| | | Mortgage-Backed Securities 69.5% | | | | | | |

| b | | Federal Home Loan Mortgage Corp. (FHLMC) Adjustable Rate 33.9% | | | | | | |

| | FHLMC, 2.82%, (12-Month USD LIBOR +/- MBS Margin), 4/01/34 | | | 3,252 | | | | 3,173 | |

| | FHLMC, 3.021%, (12-Month USD LIBOR +/- MBS Margin), 3/01/35 | | | 112,138 | | | | 110,133 | |

| | FHLMC, 3.213%, (12-Month USD LIBOR +/- MBS Margin), 4/01/37 | | | 22,227 | | | | 21,705 | |

| | FHLMC, 3.214%, (12-Month USD LIBOR +/- MBS Margin), 8/01/34 | | | 88,766 | | | | 88,907 | |

| | FHLMC, 3.29%, (12-Month USD LIBOR +/- MBS Margin), 9/01/36 | | | 11,206 | | | | 11,004 | |

| | FHLMC, 3.341%, (12-Month USD LIBOR +/- MBS Margin), 5/01/35 | | | 1,884 | | | | 1,844 | |

| | FHLMC, 3.452%, (12-Month USD LIBOR +/- MBS Margin), 5/01/36 | | | 8,387 | | | | 8,194 | |

| | FHLMC, 3.487%, (12-Month USD LIBOR +/- MBS Margin), 6/01/37 | | | 585 | | | | 572 | |

| | FHLMC, 3.513%, (12-Month USD LIBOR +/- MBS Margin), 2/01/36 | | | 25,983 | | | | 25,534 | |

| | FHLMC, 3.52%, (12-Month USD LIBOR +/- MBS Margin), 4/01/36 | | | 44,243 | | | | 44,379 | |

| | FHLMC, 3.591%, (12-Month USD LIBOR +/- MBS Margin), 10/01/36 | | | 8,195 | | | | 8,147 | |

| | FHLMC, 3.618%, (12-Month USD LIBOR +/- MBS Margin), 12/01/35 | | | 79,584 | | | | 78,363 | |

| | FHLMC, 3.636%, (12-Month USD LIBOR +/- MBS Margin), 1/01/42 | | | 52,153 | | | | 52,623 | |

| | FHLMC, 3.648%, (12-Month USD LIBOR +/- MBS Margin), 1/01/36 | | | 5,941 | | | | 5,986 | |

| | FHLMC, 3.668%, (12-Month USD LIBOR +/- MBS Margin), 11/01/42 | | | 271,245 | | | | 274,316 | |

| | FHLMC, 3.674%, (US 1 Year CMT T-Note +/- MBS Margin), 7/01/33 | | | 23,798 | | | | 24,102 | |

| | FHLMC, 3.709%, (US 1 Year CMT T-Note +/- MBS Margin), 6/01/34 | | | 15,637 | | | | 15,573 | |

| | FHLMC, 3.711%, (US 1 Year CMT T-Note +/- MBS Margin), 7/01/29 | | | 19,011 | | | | 18,700 | |

| | FHLMC, 3.736%, (12-Month USD LIBOR +/- MBS Margin), 9/01/35 | | | 78,932 | | | | 77,783 | |

| | FHLMC, 3.788%, (12-Month USD LIBOR +/- MBS Margin), 3/01/35 | | | 91,685 | | | | 91,469 | |

| | FHLMC, 3.828%, (12-Month USD LIBOR +/- MBS Margin), 3/01/35 | | | 26,198 | | | | 26,500 | |

| | FHLMC, 3.853%, (US 1 Year CMT T-Note +/- MBS Margin), 7/01/35 | | | 213,933 | | | | 218,082 | |

| | FHLMC, 3.853%, (12-Month USD LIBOR +/- MBS Margin), 9/01/37 | | | 369,972 | | | | 375,311 | |

| | FHLMC, 3.855%, (12-Month USD LIBOR +/- MBS Margin), 6/01/37 | | | 34,134 | | | | 33,710 | |

| | FHLMC, 3.861%, (12-Month USD LIBOR +/- MBS Margin), 5/01/35 | | | 141,086 | | | | 143,081 | |

| | FHLMC, 3.876%, (12-Month USD LIBOR +/- MBS Margin), 12/01/36 | | | 24,712 | | | | 24,965 | |

| | FHLMC, 3.877%, (12-Month USD LIBOR +/- MBS Margin), 5/01/42 | | | 344,835 | | | | 349,493 | |

| | FHLMC, 3.882%, (12-Month USD LIBOR +/- MBS Margin), 9/01/36 | | | 687 | | | | 686 | |

| | FHLMC, 3.913%, (12-Month USD LIBOR +/- MBS Margin), 7/01/43 | | | 1,007,664 | | | | 1,022,035 | |

| | FHLMC, 3.914%, (US 1 Year CMT T-Note +/- MBS Margin), 1/01/38 | | | 417,481 | | | | 424,773 | |

| | FHLMC, 3.927%, (US 1 Year CMT T-Note +/- MBS Margin), 9/01/36 | | | 934,199 | | | | 956,982 | |

| | FHLMC, 3.938%, (12-Month USD LIBOR +/- MBS Margin), 9/01/36 | | | 26,223 | | | | 26,653 | |

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 9 |

FRANKLIN ETF TRUST

SCHEDULE OF INVESTMENTS

Franklin Short Duration U.S. Government ETF (continued)

| | | | | | | | | | |

| | | |

| | | | | Principal Amount | | | Value | |

| | | Mortgage-Backed Securities (continued) | | | | | | |

| b | | Federal Home Loan Mortgage Corp. (FHLMC) Adjustable Rate (continued) | | | | | | |

| | FHLMC, 3.942%, (12-Month USD LIBOR +/- MBS Margin), 1/01/37 | | $ | 6,422 | | | $ | 6,482 | |

| | FHLMC, 3.958%, (12-Month USD LIBOR +/- MBS Margin), 1/01/38 | | | 18,478 | | | | 18,225 | |

| | FHLMC, 3.966%, (US 1 Year CMT T-Note +/- MBS Margin), 11/01/36 | | | 8,015 | | | | 8,210 | |

| | FHLMC, 3.967%, (US 1 Year CMT T-Note +/- MBS Margin), 7/01/36 | | | 22,872 | | | | 23,485 | |

| | FHLMC, 3.975%, (US 1 Year CMT T-Note +/- MBS Margin), 8/01/33 | | | 15,426 | | | | 15,134 | |

| | FHLMC, 3.987%, (12-Month USD LIBOR +/- MBS Margin), 3/01/36 | | | 160,986 | | | | 162,795 | |

| | FHLMC, 3.997%, (12-Month USD LIBOR +/- MBS Margin), 7/01/35 | | | 4,637 | | | | 4,588 | |

| | FHLMC, 4.009%, (12-Month USD LIBOR +/- MBS Margin), 9/01/36 | | | 3,864 | | | | 3,836 | |

| | FHLMC, 4.028%, (US 1 Year CMT T-Note +/- MBS Margin), 3/01/35 | | | 8,006 | | | | 8,187 | |

| | FHLMC, 4.038%, (US 1 Year CMT T-Note +/- MBS Margin), 7/01/37 | | | 27,057 | | | | 27,241 | |

| | FHLMC, 4.05%, (US 1 Year CMT T-Note +/- MBS Margin), 9/01/27 | | | 50 | | | | 49 | |

| | FHLMC, 4.054%, (12-Month USD LIBOR +/- MBS Margin), 1/01/37 | | | 1,678 | | | | 1,653 | |

| | FHLMC, 4.061%, (6-Month USD LIBOR +/- MBS Margin), 1/01/26 | | | 63 | | | | 64 | |

| | FHLMC, 4.107%, (12-Month USD LIBOR +/- MBS Margin), 1/01/36 | | | 11,038 | | | | 10,883 | |

| | FHLMC, 4.111%, (12-Month USD LIBOR +/- MBS Margin), 8/01/36 | | | 1,172 | | | | 1,163 | |

| | FHLMC, 4.114%, (12-Month USD LIBOR +/- MBS Margin), 1/01/36 | | | 4,427 | | | | 4,377 | |

| | FHLMC, 4.119%, (US 1 Year CMT T-Note +/- MBS Margin), 6/01/37 | | | 53,649 | | | | 52,305 | |

| | FHLMC, 4.124%, (12-Month USD LIBOR +/- MBS Margin), 3/01/36 | | | 4,859 | | | | 4,794 | |

| | FHLMC, 4.155%, (US 1 Year CMT T-Note +/- MBS Margin), 9/01/29 | | | 79,992 | | | | 78,207 | |

| | FHLMC, 4.164%, (US 1 Year CMT T-Note +/- MBS Margin), 1/01/37 | | | 17,868 | | | | 17,517 | |

| | FHLMC, 4.174%, (US 1 Year CMT T-Note +/- MBS Margin), 1/01/35 | | | 5,624 | | | | 5,696 | |

| | FHLMC, 4.179%, (US 1 Year CMT T-Note +/- MBS Margin), 7/01/34 | | | 88,820 | | | | 90,987 | |

| | FHLMC, 4.182%, (US 1 Year CMT T-Note +/- MBS Margin), 5/01/36 | | | 715,792 | | | | 732,182 | |

| | FHLMC, 4.193%, (US 1 Year CMT T-Note +/- MBS Margin), 1/01/28 | | | 365 | | | | 360 | |

| | FHLMC, 4.217%, (6-Month USD LIBOR +/- MBS Margin), 9/01/30 | | | 654 | | | | 640 | |

| | FHLMC, 4.25%, (US 1 Year CMT T-Note +/- MBS Margin), 7/01/34 | | | 5,197 | | | | 5,125 | |

| | FHLMC, 4.32%, (US 1 Year CMT T-Note +/- MBS Margin), 9/01/33 | | | 2,242 | | | | 2,267 | |

| | FHLMC, 4.322%, (US 1 Year CMT T-Note +/- MBS Margin), 10/01/35 | | | 58,182 | | | | 59,602 | |

| | FHLMC, 4.334%, (US 1 Year CMT T-Note +/- MBS Margin), 1/01/29 | | | 2,236 | | | | 2,193 | |

| | FHLMC, 4.336%, (US 1 Year CMT T-Note +/- MBS Margin), 9/01/30 | | | 6 | | | | 6 | |

| | FHLMC, 4.339%, (US 1 Year CMT T-Note +/- MBS Margin), 4/01/29 | | | 166 | | | | 164 | |

| | FHLMC, 4.343%, (US 1 Year CMT T-Note +/- MBS Margin), 10/01/33 | | | 10,620 | | | | 10,773 | |

| | FHLMC, 4.344%, (US 1 Year CMT T-Note +/- MBS Margin), 10/01/33 | | | 59,875 | | | | 61,036 | |

| | FHLMC, 4.35%, (US 1 Year CMT T-Note +/- MBS Margin), 11/01/33 | | | 79,001 | | | | 80,476 | |

| | FHLMC, 4.367%, (US 1 Year CMT T-Note +/- MBS Margin), 10/01/38 | | | 50,738 | | | | 49,453 | |

| | FHLMC, 4.37%, (US 1 Year CMT T-Note +/- MBS Margin), 1/01/36 | | | 7,550 | | | | 7,739 | |

| | FHLMC, 4.375%, (US 1 Year CMT T-Note +/- MBS Margin), 11/01/33 | | | 12,369 | | | | 12,231 | |

| | FHLMC, 4.375%, (US 1 Year CMT T-Note +/- MBS Margin), 11/01/33 | | | 11,448 | | | | 11,467 | |

| | FHLMC, 4.375%, (US 1 Year CMT T-Note +/- MBS Margin), 11/01/34 | | | 21,765 | | | | 22,282 | |

| | FHLMC, 4.375%, (US 1 Year CMT T-Note +/- MBS Margin), 11/01/34 | | | 22,553 | | | | 23,099 | |

| | FHLMC, 4.386%, (US 1 Year CMT T-Note +/- MBS Margin), 12/01/35 | | | 143,032 | | | | 146,934 | |

| | FHLMC, 4.481%, (US 1 Year CMT T-Note +/- MBS Margin), 2/01/36 | | | 23,215 | | | | 23,703 | |

| | FHLMC, 4.484%, (US 1 Year CMT T-Note +/- MBS Margin), 2/01/35 | | | 16,807 | | | | 17,139 | |

| | FHLMC, 4.534%, (US 1 Year CMT T-Note +/- MBS Margin), 11/01/33 | | | 25,867 | | | | 25,646 | |

| | FHLMC, 4.726%, (SOFR +/- MBS Margin), 12/25/30 | | | 1,421,879 | | | | 1,396,316 | |

| | FHLMC, 4.756%, (SOFR +/- MBS Margin), 4/25/31 | | | 1,379,223 | | | | 1,365,556 | |

| | FHLMC, 4.766%, (US 1 Year CMT T-Note +/- MBS Margin), 10/01/29 | | | 3,274 | | | | 3,222 | |

| | FHLMC, 4.776%, (SOFR +/- MBS Margin), 1/25/29 | | | 808,253 | | | | 800,484 | |

| | FHLMC, 4.816%, (SOFR +/- MBS Margin), 1/25/29 | | | 3,000,000 | | | | 2,976,179 | |

| | FHLMC, 4.839%, (1-Month USD LIBOR +/- MBS Margin), 12/25/30 | | | 612,482 | | | | 604,174 | |

| | FHLMC, 4.859%, (1-Month USD LIBOR +/- MBS Margin), 2/25/25 | | | 174,248 | | | | 173,477 | |

| | FHLMC, 4.879%, (1-Month USD LIBOR +/- MBS Margin), 3/25/25 | | | 380,554 | | | | 378,952 | |

| | FHLMC, 4.889%, (1-Month USD LIBOR +/- MBS Margin), 3/25/28 | | | 80,375 | | | | 79,150 | |

| | FHLMC, 4.896%, (SOFR +/- MBS Margin), 5/25/29 | | | 3,000,000 | | | | 2,983,925 | |

| | FHLMC, 4.899%, (1-Month USD LIBOR +/- MBS Margin), 5/25/25 | | | 95,591 | | | | 95,196 | |

| | FHLMC, 4.909%, (1-Month USD LIBOR +/- MBS Margin), 1/25/28 | | | 386,954 | | | | 383,774 | |

| | FHLMC, 4.919%, (1-Month USD LIBOR +/- MBS Margin), 12/25/24 | | | 162,448 | | | | 161,867 | |

| | | | | | | | | | |

| | | | | | |

| 10 | | | | | | | | Annual Report | | franklintempleton.com |

FRANKLIN ETF TRUST

SCHEDULE OF INVESTMENTS

Franklin Short Duration U.S. Government ETF (continued)

| | | | | | | | | | |

| | | |

| | | | | Principal Amount | | | Value | |

| | | Mortgage-Backed Securities (continued) | | | | | | |

| b | | Federal Home Loan Mortgage Corp. (FHLMC) Adjustable Rate (continued) | | | | | | |

| | FHLMC, 4.929%, (1-Month USD LIBOR +/- MBS Margin), 12/25/30 | | $ | 1,731,317 | | | $ | 1,711,113 | |

| | FHLMC, 4.958%, (SOFR +/- MBS Margin), 2/25/32 | | | 1,806,852 | | | | 1,793,552 | |

| | FHLMC, 4.959%, (1-Month USD LIBOR +/- MBS Margin), 8/25/27 | | | 839,878 | | | | 835,567 | |

| | FHLMC, 4.959%, (1-Month USD LIBOR +/- MBS Margin), 6/25/28 | | | 276,545 | | | | 274,615 | |

| | FHLMC, 4.969%, (1-Month USD LIBOR +/- MBS Margin), 11/25/24 | | | 43,379 | | | | 43,292 | |

| | FHLMC, 4.969%, (1-Month USD LIBOR +/- MBS Margin), 7/25/30 | | | 2,060,782 | | | | 2,042,919 | |

| | FHLMC, 4.969%, (1-Month USD LIBOR +/- MBS Margin), 8/25/30 | | | 488,003 | | | | 482,984 | |

| | FHLMC, 4.969%, (1-Month USD LIBOR +/- MBS Margin), 11/25/30 | | | 748,805 | | | | 740,625 | |

| | FHLMC, 4.984%, (1-Month USD LIBOR +/- MBS Margin), 12/15/48 | | | 729,676 | | | | 713,348 | |

| | FHLMC, 4.989%, (1-Month USD LIBOR +/- MBS Margin), 9/25/30 | | | 1,707,796 | | | | 1,684,485 | |

| | FHLMC, 4.999%, (1-Month USD LIBOR +/- MBS Margin), 9/25/24 | | | 203,238 | | | | 202,928 | |

| | FHLMC, 4.999%, (1-Month USD LIBOR +/- MBS Margin), 9/25/30 | | | 787,039 | | | | 781,908 | |

| | FHLMC, 5.009%, (1-Month USD LIBOR +/- MBS Margin), 8/25/24 | | | 2,660 | | | | 2,657 | |

| | FHLMC, 5.009%, (1-Month USD LIBOR +/- MBS Margin), 11/25/27 | | | 136,468 | | | | 135,741 | |

| | FHLMC, 5.018%, (SOFR +/- MBS Margin), 4/25/32 | | | 3,000,000 | | | | 2,979,919 | |

| | FHLMC, 5.019%, (1-Month USD LIBOR +/- MBS Margin), 8/25/24 | | | 70,242 | | | | 70,148 | |

| | FHLMC, 5.019%, (1-Month USD LIBOR +/- MBS Margin), 8/25/30 | | | 2,255,388 | | | | 2,240,662 | |

| | FHLMC, 5.029%, (1-Month USD LIBOR +/- MBS Margin), 8/25/24 | | | 1,054,036 | | | | 1,052,725 | |

| | FHLMC, 5.029%, (1-Month USD LIBOR +/- MBS Margin), 6/25/27 | | | 616,447 | | | | 614,161 | |

| | FHLMC, 5.029%, (1-Month USD LIBOR +/- MBS Margin), 6/25/30 | | | 877,422 | | | | 871,942 | |

| | FHLMC, 5.039%, (1-Month USD LIBOR +/- MBS Margin), 5/25/24 | | | 347,714 | | | | 347,361 | |

| | FHLMC, 5.039%, (1-Month USD LIBOR +/- MBS Margin), 3/25/27 | | | 17,124 | | | | 16,990 | |

| | FHLMC, 5.039%, (1-Month USD LIBOR +/- MBS Margin), 6/25/30 | | | 1,107,723 | | | | 1,100,829 | |

| | FHLMC, 5.048%, (SOFR +/- MBS Margin), 6/25/32 | | | 3,000,000 | | | | 2,986,186 | |

| | FHLMC, 5.069%, (1-Month USD LIBOR +/- MBS Margin), 8/25/25 | | | 130,579 | | | | 130,330 | |

| | FHLMC, 5.084%, (1-Month USD LIBOR +/- MBS Margin), 12/15/39 | | | 148,825 | | | | 148,738 | |

| | FHLMC, 5.108%, (SOFR +/- MBS Margin), 6/25/32 | | | 3,000,000 | | | | 2,999,060 | |

| | FHLMC, 5.109%, (1-Month USD LIBOR +/- MBS Margin), 6/25/26 | | | 505,628 | | | | 504,122 | |

| | FHLMC, 5.109%, (1-Month USD LIBOR +/- MBS Margin), 5/25/29 | | | 1,241,098 | | | | 1,234,453 | |

| | FHLMC, 5.109%, (1-Month USD LIBOR +/- MBS Margin), 6/25/30 | | | 2,086,513 | | | | 2,073,774 | |

| | FHLMC, 5.134%, (1-Month USD LIBOR +/- MBS Margin), 10/15/40 | | | 1,200,413 | | | | 1,175,278 | |

| | FHLMC, 5.139%, (1-Month USD LIBOR +/- MBS Margin), 5/25/30 | | | 1,342,703 | | | | 1,335,438 | |

| | FHLMC, 5.149%, (1-Month USD LIBOR +/- MBS Margin), 4/25/26 | | | 922,220 | | | | 919,579 | |

| | FHLMC, 5.159%, (1-Month USD LIBOR +/- MBS Margin), 2/25/26 | | | 1,604,360 | | | | 1,600,539 | |

| | FHLMC, 5.159%, (1-Month USD LIBOR +/- MBS Margin), 7/25/26 | | | 1,369,745 | | | | 1,367,601 | |

| | FHLMC, 5.169%, (1-Month USD LIBOR +/- MBS Margin), 1/25/26 | | | 535,546 | | | | 534,417 | |

| | FHLMC, 5.169%, (1-Month USD LIBOR +/- MBS Margin), 10/25/26 | | | 2,046,230 | | | | 2,043,375 | |

| | FHLMC, 5.179%, (1-Month USD LIBOR +/- MBS Margin), 12/25/29 | | | 1,736,777 | | | | 1,733,433 | |

| | FHLMC, 5.189%, (1-Month USD LIBOR +/- MBS Margin), 7/25/29 | | | 899,277 | | | | 896,296 | |

| | FHLMC, 5.189%, (1-Month USD LIBOR +/- MBS Margin), 8/25/29 | | | 1,299,676 | | | | 1,295,324 | |

| | FHLMC, 5.189%, (1-Month USD LIBOR +/- MBS Margin), 9/25/29 | | | 707,662 | | | | 705,997 | |

| | FHLMC, 5.199%, (1-Month USD LIBOR +/- MBS Margin), 3/25/29 | | | 1,843,678 | | | | 1,837,811 | |

| | FHLMC, 5.209%, (1-Month USD LIBOR +/- MBS Margin), 12/25/28 | | | 1,516,792 | | | | 1,513,589 | |

| | FHLMC, 5.209%, (1-Month USD LIBOR +/- MBS Margin), 2/25/29 | | | 687,307 | | | | 685,159 | |

| | FHLMC, 5.229%, (1-Month USD LIBOR +/- MBS Margin), 11/25/28 | | | 752,756 | | | | 751,188 | |

| | FHLMC, 5.369%, (1-Month USD LIBOR +/- MBS Margin), 2/25/27 | | | 627,100 | | | | 629,630 | |

| | FHLMC, 5.456%, (US 1 Year CMT T-Note +/- MBS Margin), 8/01/24 | | | 234 | | | | 233 | |

| | FHLMC, 5.469%, (1-Month USD LIBOR +/- MBS Margin), 3/25/30 | | | 1,339,293 | | | | 1,341,368 | |

| | | | | | | | | | |

| | | | | | | | | 68,990,834 | |

| | | | | | | | | | |

| | | Federal Home Loan Mortgage Corp. (FHLMC) Fixed Rate 7.8% | | | | | | |

| | FHLMC, 0.75%, 5/25/44 | | | 1,771,405 | | | | 1,426,347 | |

| | FHLMC, 0.799%, 5/25/30 | | | 2,403,249 | | | | 2,095,838 | |

| | FHLMC, 0.826%, 2/25/31 | | | 850,822 | | | | 726,845 | |

| | FHLMC, 1.054%, 8/25/26 | | | 1,866,686 | | | | 1,758,283 | |

| | FHLMC, 2.00%, 2/25/50 | | | 970,819 | | | | 825,651 | |

| | FHLMC, 2.745%, 1/25/26 | | | 1,500,000 | | | | 1,436,571 | |

| | FHLMC, 2.995%, 12/25/25 | | | 1,500,000 | | | | 1,447,247 | |

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 11 |

FRANKLIN ETF TRUST

SCHEDULE OF INVESTMENTS

Franklin Short Duration U.S. Government ETF (continued)

| | | | | | | | | | |

| | | |

| | | | | Principal Amount | | | Value | |

| | | Mortgage-Backed Securities (continued) | | | | | | |

| | | Federal Home Loan Mortgage Corp. (FHLMC) Fixed Rate (continued) | | | | | | |

| | FHLMC, 3.062%, 12/25/24 | | $ | 1,500,000 | | | $ | 1,458,707 | |

| | FHLMC, 3.458%, 8/25/23 | | | 1,807,070 | | | | 1,794,392 | |

| | FHLMC, 3.49%, 1/25/24 | | | 2,000,000 | | | | 1,974,184 | |

| | FHLMC, 3.50%, 6/01/26 | | | 140,529 | | | | 137,932 | |

| | FHLMC, 4.00%, 3/01/49 | | | 890,898 | | | | 866,707 | |

| | | | | | | | | | |

| | | | | | | | | 15,948,704 | |

| | | | | | | | | | |

| b | | Federal National Mortgage Association (FNMA) Adjustable Rate 8.4% | | | | | | |

| | FNMA, 2.426%, (6-Month USD LIBOR +/- MBS Margin), 9/01/33 | | | 552 | | | | 539 | |

| | FNMA, 2.541%, (12-Month USD LIBOR +/- MBS Margin), 3/01/34 | | | 57,649 | | | | 56,958 | |

| | FNMA, 2.746%, (12-Month USD LIBOR +/- MBS Margin), 5/01/35 | | | 17,588 | | | | 17,740 | |

| | FNMA, 2.802%, (US 1 Year CMT T-Note +/- MBS Margin), 2/01/25 | | | 1,312 | | | | 1,303 | |

| | FNMA, 2.845%, (6-Month USD LIBOR +/- MBS Margin), 11/01/33 | | | 268 | | | | 262 | |

| | FNMA, 2.969%, (12-Month USD LIBOR +/- MBS Margin), 3/01/35 | | | 1,370 | | | | 1,348 | |

| | FNMA, 3.14%, (12-Month USD LIBOR +/- MBS Margin), 5/01/35 | | | 56,974 | | | | 57,715 | |

| | FNMA, 3.186%, (12-Month USD LIBOR +/- MBS Margin), 3/01/35 | | | 3,147 | | | | 3,109 | |

| | FNMA, 3.191%, (12-Month USD LIBOR +/- MBS Margin), 10/01/34 | | | 2,826 | | | | 2,759 | |

| | FNMA, 3.268%, (6-Month USD LIBOR +/- MBS Margin), 11/01/33 | | | 4,169 | | | | 4,068 | |

| | FNMA, 3.284%, (6-Month USD LIBOR +/- MBS Margin), 5/01/32 | | | 1,115 | | | | 1,087 | |

| | FNMA, 3.302%, (6-Month USD LIBOR +/- MBS Margin), 11/01/35 | | | 3,274 | | | | 3,257 | |

| | FNMA, 3.32%, (6-Month USD LIBOR +/- MBS Margin), 11/01/35 | | | 4,941 | | | | 4,905 | |

| | FNMA, 3.348%, (US 1 Year CMT T-Note +/- MBS Margin), 6/01/35 | | | 18,094 | | | | 18,040 | |

| | FNMA, 3.415%, (US 1 Year CMT T-Note +/- MBS Margin), 5/01/33 | | | 20,041 | | | | 20,456 | |

| | FNMA, 3.415%, (12-Month USD LIBOR +/- MBS Margin), 6/01/36 | | | 16,183 | | | | 16,428 | |

| | FNMA, 3.422%, (6-Month USD LIBOR +/- MBS Margin), 1/01/25 | | | 385 | | | | 381 | |

| | FNMA, 3.488%, (US 1 Year CMT T-Note +/- MBS Margin), 5/01/33 | | | 9,650 | | | | 9,481 | |

| | FNMA, 3.496%, (US 1 Year CMT T-Note +/- MBS Margin), 5/01/36 | | | 8,780 | | | | 8,658 | |

| | FNMA, 3.497%, (12-Month USD LIBOR +/- MBS Margin), 6/01/35 | | | 31,810 | | | | 31,708 | |

| | FNMA, 3.515%, (12-Month USD LIBOR +/- MBS Margin), 7/01/36 | | | 25,664 | | | | 25,185 | |

| | FNMA, 3.52%, (6-Month USD LIBOR +/- MBS Margin), 11/01/34 | | | 14,656 | | | | 14,331 | |

| | FNMA, 3.532%, (US 1 Year CMT T-Note +/- MBS Margin), 5/01/36 | | | 16,253 | | | | 16,026 | |

| | FNMA, 3.585%, (US 1 Year CMT T-Note +/- MBS Margin), 8/01/39 | | | 2,533 | | | | 2,521 | |

| | FNMA, 3.601%, (11th District COF +/- MBS Margin), 10/01/27 | | | 77 | | | | 76 | |

| | FNMA, 3.601%, (12-Month USD LIBOR +/- MBS Margin), 11/01/36 | | | 18,297 | | | | 18,519 | |

| | FNMA, 3.615%, (12-Month USD LIBOR +/- MBS Margin), 10/01/35 | | | 3,083 | | | | 3,022 | |

| | FNMA, 3.623%, (12-Month USD LIBOR +/- MBS Margin), 10/01/34 | | | 17,574 | | | | 17,370 | |

| | FNMA, 3.644%, (6-Month USD LIBOR +/- MBS Margin), 4/01/36 | | | 1,514 | | | | 1,500 | |

| | FNMA, 3.648%, (12-Month USD LIBOR +/- MBS Margin), 2/01/36 | | | 15,143 | | | | 15,259 | |

| | FNMA, 3.655%, (6-Month USD LIBOR +/- MBS Margin), 4/01/36 | | | 4,011 | | | | 3,955 | |

| | FNMA, 3.662%, (6-Month USD LIBOR +/- MBS Margin), 11/01/35 | | | 258,341 | | | | 258,364 | |

| | FNMA, 3.664%, (12-Month USD LIBOR +/- MBS Margin), 11/01/35 | | | 125,521 | | | | 126,991 | |

| | FNMA, 3.69%, (US 1 Year CMT T-Note +/- MBS Margin), 3/01/38 | | | 3,102 | | | | 3,073 | |

| | FNMA, 3.694%, (6-Month USD LIBOR +/- MBS Margin), 8/01/33 | | | 2,645 | | | | 2,637 | |

| | FNMA, 3.695%, (12-Month USD LIBOR +/- MBS Margin), 1/01/35 | | | 34,685 | | | | 34,233 | |

| | FNMA, 3.717%, (12-Month USD LIBOR +/- MBS Margin), 7/01/35 | | | 4,492 | | | | 4,548 | |

| | FNMA, 3.725%, (6-Month USD LIBOR +/- MBS Margin), 6/01/34 | | | 68,446 | | | | 68,772 | |

| | FNMA, 3.746%, (US 1 Year CMT T-Note +/- MBS Margin), 4/01/34 | | | 26,007 | | | | 25,705 | |

| | FNMA, 3.749%, (12-Month USD LIBOR +/- MBS Margin), 12/01/33 | | | 857 | | | | 839 | |

| | FNMA, 3.755%, (12-Month USD LIBOR +/- MBS Margin), 4/01/40 | | | 170,449 | | | | 168,378 | |

| | FNMA, 3.76%, (11th District COF +/- MBS Margin), 8/01/29 | | | 4,636 | | | | 4,575 | |

| | FNMA, 3.761%, (12-Month USD LIBOR +/- MBS Margin), 1/01/38 | | | 55,416 | | | | 55,983 | |

| | FNMA, 3.762%, (12-Month USD LIBOR +/- MBS Margin), 11/01/36 | | | 77,735 | | | | 77,425 | |

| | FNMA, 3.763%, (12-Month USD LIBOR +/- MBS Margin), 8/01/37 | | | 52,539 | | | | 51,578 | |

| | FNMA, 3.77%, (12-Month USD LIBOR +/- MBS Margin), 5/01/38 | | | 730,887 | | | | 741,188 | |

| | FNMA, 3.773%, (12-Month USD LIBOR +/- MBS Margin), 4/01/44 | | | 1,256,919 | | | | 1,272,770 | |

| | FNMA, 3.78%, (12-Month USD LIBOR +/- MBS Margin), 5/01/37 | | | 100,462 | | | | 99,694 | |

| | FNMA, 3.81%, (12-Month USD LIBOR +/- MBS Margin), 7/01/42 | | | 1,116,422 | | | | 1,134,750 | |

| | FNMA, 3.812%, (12-Month USD LIBOR +/- MBS Margin), 9/01/35 | | | 81,831 | | | | 81,096 | |

| | | | | | | | | | |

| | | | | | |

| 12 | | | | | | | | Annual Report | | franklintempleton.com |

FRANKLIN ETF TRUST

SCHEDULE OF INVESTMENTS

Franklin Short Duration U.S. Government ETF (continued)

| | | | | | | | | | |

| | | |

| | | | | Principal Amount | | | Value | |

| | | Mortgage-Backed Securities (continued) | | | | | | |

| b | | Federal National Mortgage Association (FNMA) Adjustable Rate (continued) | | | | | | |

| | FNMA, 3.82%, (12-Month USD LIBOR +/- MBS Margin), 7/01/35 | | $ | 32,926 | | | $ | 32,386 | |

| | FNMA, 3.837%, (12-Month USD LIBOR +/- MBS Margin), 9/01/42 | | | 570,477 | | | | 579,652 | |

| | FNMA, 3.842%, (12-Month USD LIBOR +/- MBS Margin), 9/01/37 | | | 279,808 | | | | 283,808 | |

| | FNMA, 3.865%, (6-Month USD LIBOR +/- MBS Margin), 12/01/34 | | | 6,937 | | | | 6,787 | |

| | FNMA, 3.866%, (US 1 Year CMT T-Note +/- MBS Margin), 1/01/32 | | | 5,701 | | | | 5,676 | |

| | FNMA, 3.867%, (12-Month USD LIBOR +/- MBS Margin), 12/01/34 | | | 4,598 | | | | 4,642 | |

| | FNMA, 3.871%, (12-Month USD LIBOR +/- MBS Margin), 5/01/35 | | | 63,133 | | | | 64,264 | |

| | FNMA, 3.873%, (12-Month USD LIBOR +/- MBS Margin), 7/01/34 | | | 183 | | | | 180 | |

| | FNMA, 3.873%, (12-Month USD LIBOR +/- MBS Margin), 2/01/35 | | | 29,372 | | | | 28,724 | |

| | FNMA, 3.879%, (12-Month USD LIBOR +/- MBS Margin), 6/01/35 | | | 6,664 | | | | 6,664 | |

| | FNMA, 3.886%, (12-Month USD LIBOR +/- MBS Margin), 1/01/35 | | | 18,276 | | | | 18,397 | |

| | FNMA, 3.892%, (12-Month USD LIBOR +/- MBS Margin), 1/01/35 | | | 5,062 | | | | 4,953 | |

| | FNMA, 3.90%, (12-Month USD LIBOR +/- MBS Margin), 11/01/34 | | | 3,730 | | | | 3,761 | |

| | FNMA, 3.904%, (12-Month USD LIBOR +/- MBS Margin), 8/01/44 | | | 1,151,175 | | | | 1,170,732 | |

| | FNMA, 3.931%, (12-Month USD LIBOR +/- MBS Margin), 12/01/34 | | | 10,283 | | | | 10,148 | |

| | FNMA, 3.932%, (12-Month USD LIBOR +/- MBS Margin), 1/01/35 | | | 13,605 | | | | 13,721 | |

| | FNMA, 3.939%, (US 1 Year CMT T-Note +/- MBS Margin), 12/01/40 | | | 168,419 | | | | 172,505 | |

| | FNMA, 3.94%, (12-Month USD LIBOR +/- MBS Margin), 12/01/34 | | | 83,283 | | | | 82,204 | |

| | FNMA, 3.94%, (12-Month USD LIBOR +/- MBS Margin), 12/01/39 | | | 16,411 | | | | 16,618 | |

| | FNMA, 3.943%, (US 1 Year CMT T-Note +/- MBS Margin), 9/01/39 | | | 346 | | | | 339 | |

| | FNMA, 3.947%, (12-Month USD LIBOR +/- MBS Margin), 3/01/42 | | | 186,975 | | | | 189,203 | |

| | FNMA, 3.951%, (US 1 Year CMT T-Note +/- MBS Margin), 4/01/40 | | | 29,424 | | | | 29,770 | |

| | FNMA, 3.952%, (12-Month USD LIBOR +/- MBS Margin), 7/01/35 | | | 4,333 | | | | 4,250 | |

| | FNMA, 3.956%, (12-Month USD LIBOR +/- MBS Margin), 9/01/37 | | | 87,947 | | | | 89,290 | |

| | FNMA, 3.959%, (US 1 Year CMT T-Note +/- MBS Margin), 8/01/29 | | | 262 | | | | 259 | |

| | FNMA, 3.96%, (12-Month USD LIBOR +/- MBS Margin), 2/01/35 | | | 8,457 | | | | 8,546 | |

| | FNMA, 3.967%, (12-Month USD LIBOR +/- MBS Margin), 10/01/40 | | | 272,458 | | | | 277,904 | |

| | FNMA, 3.972%, (12-Month USD LIBOR +/- MBS Margin), 8/01/38 | | | 222,581 | | | | 225,653 | |

| | FNMA, 3.973%, (12-Month USD LIBOR +/- MBS Margin), 1/01/33 | | | 14,493 | | | | 14,216 | |

| | FNMA, 3.979%, (12-Month USD LIBOR +/- MBS Margin), 8/01/37 | | | 31,721 | | | | 32,330 | |

| | FNMA, 3.979%, (12-Month USD LIBOR +/- MBS Margin), 9/01/40 | | | 38,266 | | | | 39,183 | |

| | FNMA, 3.991%, (12-Month USD LIBOR +/- MBS Margin), 1/01/35 | | | 28,289 | | | | 27,965 | |

| | FNMA, 4.00%, (12-Month USD LIBOR +/- MBS Margin), 10/01/33 | | | 17,917 | | | | 17,577 | |

| | FNMA, 4.00%, (US 1 Year CMT T-Note +/- MBS Margin), 8/01/36 | | | 74,405 | | | | 76,218 | |

| | FNMA, 4.001%, (6-Month USD LIBOR +/- MBS Margin), 12/01/24 | | | 65 | | | | 64 | |

| | FNMA, 4.008%, (US 1 Year CMT T-Note +/- MBS Margin), 7/01/38 | | | 103,815 | | | | 102,172 | |

| | FNMA, 4.014%, (US 1 Year CMT T-Note +/- MBS Margin), 2/01/37 | | | 21,720 | | | | 21,280 | |

| | FNMA, 4.018%, (12-Month USD LIBOR +/- MBS Margin), 12/01/32 | | | 1,271 | | | | 1,245 | |

| | FNMA, 4.022%, (US 1 Year CMT T-Note +/- MBS Margin), 12/01/40 | | | 491,318 | | | | 502,299 | |

| | FNMA, 4.026%, (12-Month USD LIBOR +/- MBS Margin), 1/01/37 | | | 19,967 | | | | 19,548 | |

| | FNMA, 4.049%, (US 1 Year CMT T-Note +/- MBS Margin), 12/01/37 | | | 19,599 | | | | 20,068 | |

| | FNMA, 4.062%, (12-Month USD LIBOR +/- MBS Margin), 1/01/41 | | | 126,181 | | | | 128,233 | |

| | FNMA, 4.063%, (6-Month USD LIBOR +/- MBS Margin), 2/01/35 | | | 9,176 | | | | 8,936 | |

| | FNMA, 4.094%, (12-Month USD LIBOR +/- MBS Margin), 9/01/37 | | | 277 | | | | 274 | |

| | FNMA, 4.106%, (US 1 Year CMT T-Note +/- MBS Margin), 9/01/33 | | | 2,432 | | | | 2,395 | |

| | FNMA, 4.115%, (US 1 Year CMT T-Note +/- MBS Margin), 12/01/40 | | | 36,072 | | | | 36,526 | |

| | FNMA, 4.122%, (12-Month USD LIBOR +/- MBS Margin), 3/01/36 | | | 9,798 | | | | 9,686 | |

| | FNMA, 4.124%, (US 1 Year CMT T-Note +/- MBS Margin), 12/01/34 | | | 3,497 | | | | 3,482 | |

| | FNMA, 4.127%, (US 1 Year CMT T-Note +/- MBS Margin), 9/01/34 | | | 8,532 | | | | 8,396 | |

| | FNMA, 4.131%, (12-Month USD LIBOR +/- MBS Margin), 8/01/36 | | | 42,001 | | | | 41,411 | |

| | FNMA, 4.14%, (US 1 Year CMT T-Note +/- MBS Margin), 10/01/34 | | | 40,548 | | | | 41,522 | |

| | FNMA, 4.143%, (US 1 Year CMT T-Note +/- MBS Margin), 9/01/39 | | | 31,360 | | | | 32,056 | |

| | FNMA, 4.171%, (US 1 Year CMT T-Note +/- MBS Margin), 12/01/33 | | | 55,171 | | | | 54,267 | |

| | FNMA, 4.184%, (US 1 Year CMT T-Note +/- MBS Margin), 9/01/35 | | | 54,358 | | | | 54,995 | |

| | FNMA, 4.188%, (1 Year CMT +/- MBS Margin), 1/01/31 | | | 14,822 | | | | 14,519 | |

| | FNMA, 4.19%, (US 1 Year CMT T-Note +/- MBS Margin), 8/01/32 | | | 4,470 | | | | 4,413 | |

| | FNMA, 4.19%, (12-Month USD LIBOR +/- MBS Margin), 4/01/33 | | | 5,020 | | | | 4,914 | |

| | FNMA, 4.193%, (1 Year CMT +/- MBS Margin), 6/01/40 | | | 26,092 | | | | 26,334 | |

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 13 |

FRANKLIN ETF TRUST

SCHEDULE OF INVESTMENTS

Franklin Short Duration U.S. Government ETF (continued)

| | | | | | | | | | |

| | | |

| | | | | Principal Amount | | | Value | |

| | | Mortgage-Backed Securities (continued) | | | | | | |

| b | | Federal National Mortgage Association (FNMA) Adjustable Rate (continued) | | | | | | |

| | FNMA, 4.193%, (1 Year CMT +/- MBS Margin), 11/01/40 | | $ | 7,828 | | | $ | 7,628 | |

| | FNMA, 4.195%, (12-Month USD LIBOR +/- MBS Margin), 12/01/35 | | | 17,281 | | | | 17,563 | |

| | FNMA, 4.21%, (12-Month USD LIBOR +/- MBS Margin), 3/01/35 | | | 32,851 | | | | 32,365 | |

| | FNMA, 4.23%, (12-Month USD LIBOR +/- MBS Margin), 8/01/35 | | | 2,954 | | | | 2,904 | |

| | FNMA, 4.242%, (US 1 Year CMT T-Note +/- MBS Margin), 7/01/35 | | | 17,461 | | | | 17,248 | |

| | FNMA, 4.252%, (11th District COF +/- MBS Margin), 8/01/28 | | | 12,142 | | | | 12,051 | |

| | FNMA, 4.268%, (US 1 Year CMT T-Note +/- MBS Margin), 3/01/25 | | | 355 | | | | 353 | |

| | FNMA, 4.28%, (US 1 Year CMT T-Note +/- MBS Margin), 1/01/33 | | | 7,663 | | | | 7,490 | |

| | FNMA, 4.298%, (US 1 Year CMT T-Note +/- MBS Margin), 11/01/34 | | | 11,774 | | | | 11,641 | |

| | FNMA, 4.30%, (US 1 Year CMT T-Note +/- MBS Margin), 8/01/28 | | | 173 | | | | 171 | |

| | FNMA, 4.305%, (US 1 Year CMT T-Note +/- MBS Margin), 6/01/32 | | | 241 | | | | 239 | |

| | FNMA, 4.319%, (US 1 Year CMT T-Note +/- MBS Margin), 12/01/34 | | | 35,278 | | | | 36,029 | |

| | FNMA, 4.356%, (US 1 Year CMT T-Note +/- MBS Margin), 9/01/35 | | | 54,427 | | | | 53,844 | |

| | FNMA, 4.376%, (US 1 Year CMT T-Note +/- MBS Margin), 7/01/33 | | | 464 | | | | 460 | |

| | FNMA, 4.398%, (US 1 Year CMT T-Note +/- MBS Margin), 10/01/34 | | | 10,551 | | | | 10,845 | |

| | FNMA, 4.399%, (6-Month USD LIBOR +/- MBS Margin), 4/01/36 | | | 2,359 | | | | 2,398 | |

| | FNMA, 4.407%, (US 1 Year CMT T-Note +/- MBS Margin), 10/01/33 | | | 1,427 | | | | 1,463 | |

| | FNMA, 4.424%, (US 1 Year CMT T-Note +/- MBS Margin), 2/01/35 | | | 20,753 | | | | 20,426 | |

| | FNMA, 4.468%, (1 Year CMT +/- MBS Margin), 11/01/35 | | | 10,635 | | | | 10,325 | |

| | FNMA, 4.514%, (1 Year CMT +/- MBS Margin), 11/01/35 | | | 14,725 | | | | 14,286 | |

| | FNMA, 4.525%, (US 1 Year CMT T-Note +/- MBS Margin), 7/01/28 | | | 630 | | | | 621 | |

| | FNMA, 4.562%, (US 1 Year CMT T-Note +/- MBS Margin), 1/01/28 | | | 563 | | | | 557 | |

| | FNMA, 4.595%, (1 Year CMT +/- MBS Margin), 11/01/35 | | | 9,902 | | | | 9,664 | |

| | FNMA, 4.611%, (US 1 Year CMT T-Note +/- MBS Margin), 5/01/35 | | | 8,258 | | | | 8,295 | |

| | FNMA, 4.613%, (1 Year CMT +/- MBS Margin), 11/01/35 | | | 10,623 | | | | 10,356 | |

| | FNMA, 4.621%, (1 Year CMT +/- MBS Margin), 10/01/35 | | | 67,271 | | | | 65,807 | |

| | FNMA, 4.669%, (1 Year CMT +/- MBS Margin), 11/01/35 | | | 92,374 | | | | 91,170 | |

| | FNMA, 4.692%, (12-Month USD LIBOR +/- MBS Margin), 3/01/36 | | | 13,102 | | | | 13,481 | |

| | FNMA, 4.708%, (US 1 Year CMT T-Note +/- MBS Margin), 12/01/30 | | | 1,492 | | | | 1,467 | |

| | FNMA, 4.72%, (1 Year CMT +/- MBS Margin), 11/01/35 | | | 37,627 | | | | 36,991 | |

| | FNMA, 4.733%, (1 Year CMT +/- MBS Margin), 11/01/35 | | | 17,056 | | | | 16,792 | |

| | FNMA, 4.755%, (1 Year CMT +/- MBS Margin), 11/01/35 | | | 29,297 | | | | 28,891 | |

| | FNMA, 4.766%, (1 Year CMT +/- MBS Margin), 11/01/35 | | | 17,483 | | | | 17,217 | |

| | FNMA, 4.805%, (6-Month USD LIBOR +/- MBS Margin), 3/01/36 | | | 1,669 | | | | 1,689 | |

| | FNMA, 4.837%, (1 Year CMT +/- MBS Margin), 10/01/35 | | | 188,480 | | | | 185,657 | |

| | FNMA, 4.839%, (1 Year CMT +/- MBS Margin), 11/01/35 | | | 72,064 | | | | 71,084 | |

| | FNMA, 4.879%, (6-Month USD LIBOR +/- MBS Margin), 3/01/28 | | | 1,002 | | | | 999 | |

| | FNMA, 4.902%, (6-Month USD LIBOR +/- MBS Margin), 1/01/35 | | | 1,688 | | | | 1,697 | |

| | FNMA, 4.982%, (1 Year CMT +/- MBS Margin), 10/01/36 | | | 27,657 | | | | 27,652 | |

| | FNMA, 5.027%, (1 Year CMT +/- MBS Margin), 9/01/36 | | | 17,713 | | | | 17,595 | |

| | FNMA, 5.033%, (6-Month USD LIBOR +/- MBS Margin), 5/01/36 | | | 9,435 | | | | 9,440 | |

| | FNMA, 5.049%, (1 Year CMT +/- MBS Margin), 5/01/36 | | | 30,771 | | | | 30,829 | |

| | FNMA, 5.05%, (6-Month USD LIBOR +/- MBS Margin), 5/01/33 | | | 5,669 | | | | 5,667 | |

| | FNMA, 5.05%, (6-Month USD LIBOR +/- MBS Margin), 5/01/35 | | | 932 | | | | 938 | |

| | FNMA, 5.07%, (6-Month USD LIBOR +/- MBS Margin), 2/01/36 | | | 183,761 | | | | 188,071 | |

| | FNMA, 5.106%, (6-Month USD LIBOR +/- MBS Margin), 6/01/35 | | | 6,162 | | | | 6,215 | |

| | FNMA, 5.195%, (1-Month USD LIBOR +/- MBS Margin), 10/25/58 | | | 1,375,807 | | | | 1,329,088 | |

| | FNMA, 5.245%, (6-Month USD LIBOR +/- MBS Margin), 3/01/34 | | | 4,047 | | | | 4,064 | |

| | FNMA, 5.245%, (1-Month USD LIBOR +/- MBS Margin), 5/25/40 | | | 426,142 | | | | 418,122 | |

| | FNMA, 5.245%, (1-Month USD LIBOR +/- MBS Margin), 9/25/46 | | | 879,988 | | | | 865,994 | |

| | FNMA, 5.245%, (1-Month USD LIBOR +/- MBS Margin), 10/25/46 | | | 766,226 | | | | 754,426 | |

| | FNMA, 5.295%, (1-Month USD LIBOR +/- MBS Margin), 10/25/41 | | | 1,622,745 | | | | 1,609,430 | |

| | FNMA, 5.295%, (1-Month USD LIBOR +/- MBS Margin), 7/25/49 | | | 1,678,179 | | | | 1,628,821 | |

| | FNMA, 5.402%, (6-Month USD LIBOR +/- MBS Margin), 11/01/33 | | | 1,585 | | | | 1,583 | |

| | FNMA, 5.416%, (6-Month USD LIBOR +/- MBS Margin), 3/01/35 | | | 52,604 | | | | 52,653 | |

| | FNMA, 5.454%, (6-Month USD LIBOR +/- MBS Margin), 7/01/35 | | | 4,088 | | | | 4,174 | |

| | FNMA, 5.512%, (6-Month USD LIBOR +/- MBS Margin), 2/01/33 | | | 51,811 | | | | 52,739 | |

| | | | | | | | | | |

| | | | | | |

| 14 | | | | | | | | Annual Report | | franklintempleton.com |

FRANKLIN ETF TRUST

SCHEDULE OF INVESTMENTS

Franklin Short Duration U.S. Government ETF (continued)

| | | | | | | | | | |

| | | |

| | | | | Principal Amount | | | Value | |

| | | Mortgage-Backed Securities (continued) | | | | | | |

| b | | Federal National Mortgage Association (FNMA) Adjustable Rate (continued) | | | | | | |

| | FNMA, 5.584%, (6-Month USD LIBOR +/- MBS Margin), 9/01/27 | | $ | 1,319 | | | $ | 1,317 | |

| | FNMA, 5.743%, (US 1 Year CMT T-Note +/- MBS Margin), 3/01/33 | | | 19,728 | | | | 19,679 | |

| | | | | | | | | | |

| | | | | | | | | 17,118,786 | |

| | | | | | | | | | |

| | | Federal National Mortgage Association (FNMA) Fixed Rate 17.1% | | | | | | |

| | FNMA, 0.785%, 7/25/30 | | | 2,914,329 | | | | 2,626,425 | |

| | FNMA, 1.75%, 1/25/43 | | | 1,045,745 | | | | 910,947 | |

| | FNMA, 3.00%, 10/25/45 | | | 1,081,540 | | | | 1,025,227 | |

| | FNMA, 3.50%, 9/01/25 | | | 15,885 | | | | 15,632 | |

| | FNMA, 3.50%, 10/01/25 | | | 152,023 | | | | 149,551 | |

| | FNMA, 3.50%, 3/01/26 | | | 135,994 | | | | 133,611 | |

| | FNMA, 3.50%, 8/01/26 | | | 27,861 | | | | 27,348 | |

| | FNMA, 3.50%, 8/01/26 | | | 13,879 | | | | 13,618 | |

| | FNMA, 3.50%, 10/01/26 | | | 895 | | | | 878 | |

| | FNMA, 3.50%, 10/01/26 | | | 1,416 | | | | 1,390 | |

| | FNMA, 3.50%, 10/01/26 | | | 4,507 | | | | 4,422 | |

| | FNMA, 3.50%, 1/01/27 | | | 7,198 | | | | 7,064 | |

| | FNMA, 3.50%, 1/01/27 | | | 179,060 | | | | 175,922 | |

| | FNMA, 3.50%, 1/01/27 | | | 3,427 | | | | 3,361 | |

| | FNMA, 3.50%, 4/01/27 | | | 53,204 | | | | 52,187 | |

| | FNMA, 3.50%, 7/01/27 | | | 193,731 | | | | 190,336 | |

| | FNMA, 3.50%, 5/01/31 | | | 53,119 | | | | 52,139 | |

| c | | FNMA, 5.00%, 4/15/53 | | | 9,239,000 | | | | 9,215,181 | |

| | FNMA, 5.50%, 3/01/53 | | | 10,066,440 | | | | 10,177,094 | |

| c | | FNMA, 5.50%, 4/15/53 | | | 5,957,000 | | | | 6,017,617 | |

| | FNMA, 6.00%, 4/01/53 | | | 1,980,000 | | | | 2,022,962 | |

| c | | FNMA, 6.00%, 4/15/53 | | | 2,000,000 | | | | 2,041,484 | |

| | | | | | | | | | |

| | | | | | | | | 34,864,396 | |

| | | | | | | | | | |

| b | | Government National Mortgage Association (GNMA) Adjustable Rate 2.1% | | | | | | |

| | GNMA, 5.061%, (1-Month USD LIBOR +/- MBS Margin), 4/20/37 | | | 1,359,604 | | | | 1,352,071 | |

| | GNMA, 5.091%, (1-Month USD LIBOR +/- MBS Margin), 6/20/41 | | | 1,820,513 | | | | 1,797,505 | |

| | GNMA, 5.328%, (1-Month USD LIBOR +/- MBS Margin), 1/16/40 | | | 1,027,154 | | | | 1,025,700 | |

| | | | | | | | | | |

| | | | | | | | | 4,175,276 | |

| | | | | | | | | | |

| | | Government National Mortgage Association (GNMA) Fixed Rate 0.2% | | | | | | |

| | GNMA, 2.50%, 9/20/27 | | | 318,000 | | | | 312,819 | |

| | | | | | | | | | |

| | Total Mortgage-Backed Securities (Cost $144,689,759) | | | | | | | 141,410,815 | |

| | | | | | | | | | |

| | Total Investments before Short Term Investments (Cost $215,593,688) | | | | | | | 211,352,543 | |

| | | | | | | | | | |

| | | |

| | | | | Shares | | | | |

| | | Short Term Investments (Cost $8,118,307) 4.0% | | | | | | |

| | Money Market Funds 4.0% | | | | | | | | |

| d,e | | Institutional Fiduciary Trust Money Market Portfolio, 4.37% | | | 8,118,307 | | | | 8,118,307 | |

| | | | | | | | | | |

| | Total Investments (Cost $223,711,995) 107.8% | | | | | | | 219,470,850 | |

| | Other Assets, less Liabilities (7.8)% | | | | | | | (15,858,877 | ) |

| | | | | | | | | | |

| | Net Assets 100.0% | | | | | | $ | 203,611,973 | |

| | | | | | | | | | |

aThe coupon rate shown represents the value inclusive of any caps or floors, if applicable, in effect at period end.

bAdjustable Rate Mortgage-Backed Security (ARM); the rate shown is the effective rate at period end. ARM rates are not based on a published reference rate and spread, but instead pass-through weighted average interest income inclusive of any caps or floors, if applicable, from the underlying mortgage loans pool in which the majority of mortgages pay interest based on the index shown at their designated reset dates plus a spread, less the applicable servicing and guaranty fee (MBS margin).

cSecurity purchased on a to-be-announced (TBA) basis. See Note 1(b).

dThe rate shown is the annualized seven-day effective yield at period end.

eSee Note 3(c) regarding investments in affiliated management investment companies.

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | | | | | | 15 |

FRANKLIN ETF TRUST

SCHEDULE OF INVESTMENTS

Franklin Short Duration U.S. Government ETF (continued)

At March 31, 2023, the Fund had the following futures contracts outstanding. See Note 1(c).

| | | | | | | | | | | | | | | | | | | | |

| Futures Contracts | | | | | | | | | | | | | | | |

| | | | | |

| Description | | Type | | | Number of

Contracts | | | Notional

Value* | | | Expiration

Date | | | Value/Unrealized

Appreciation

(Depreciation) | |

| Interest Rate Contracts | | | | | | | | | | | | | | | |

U.S. Treasury 2 Yr. Note | | | Long | | | | 168 | | | $ | 34,684,125 | | | | 6/30/23 | | | $ | 350,861 | |

U.S. Treasury 10 Yr. Note | | | Short | | | | 88 | | | | 10,113,125 | | | | 6/21/23 | | | | (327,375 | ) |

U.S. Treasury 10 Yr. Ultra | | | Short | | | | 1 | | | | 121,141 | | | | 6/21/23 | | | | (4,509 | ) |

U.S. Treasury Long Bond | | | Short | | | | 24 | | | | 3,147,750 | | | | 6/21/23 | | | | (151,536 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total Futures Contracts | | | $ | (132,559 | ) |

| | | | | | | | | | | | | | | | | | | | |

*As of period end.

See Note 7 regarding other derivative information.

See abbreviations on page 26.

| | | | | | | | | | |

| | | | | | |

| 16 | | | | | | | | Annual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

FRANKLIN ETF TRUST

FINANCIAL STATEMENTS

Statement of Assets and Liabilities

March 31, 2023

Franklin Short Duration U.S. Government ETF

| | | | |

| |

Assets: | | | | |

Investments in securities: | | | | |

Cost – Unaffiliated issuers | | $ | 215,593,688 | |

Cost – Non-controlled affiliates (Note 3c) | | | 8,118,307 | |

| | | | |

Value – Unaffiliated issuers | | $ | 211,352,543 | |

Value – Non-controlled affiliates (Note 3c) | | | 8,118,307 | |

Receivables: | | | | |

Investment securities sold | | | 79,309 | |

Interest | | | 807,278 | |

Deposits with broker for: | | | | |

Futures contracts | | | 341,701 | |

| | | | |

Total assets | | | 220,699,138 | |

| | | | |

Liabilities: | | | | |

Payables: | | | | |

Investment securities purchased | | | 17,007,746 | |

Management fees | | | 48,247 | |

Variation margin on futures contracts | | | 31,172 | |

| | | | |

Total liabilities | | | 17,087,165 | |

| | | | |

Net assets, at value | | $ | 203,611,973 | |

| | | | |

Net assets consist of: | | | | |

Paid-in capital | | $ | 231,953,327 | |

Total distributable earnings (loss) | | | (28,341,354 | ) |

| | | | |

Net assets, at value | | $ | 203,611,973 | |

| | | | |

Shares outstanding | | | 2,251,000 | |

| | | | |

Net asset value per share | | $ | 90.45 | |

| | | | |

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | The accompanying notes are an integral part of these financial statements. | Annual Report | | | | | | | | 17 |

FRANKLIN ETF TRUST

FINANCIAL STATEMENTS

Statement of Operations

for the year ended March 31, 2023

Franklin Short Duration U.S. Government ETF

| | | | |

| |

Investment income: | | | | |

Dividends: | | | | |

Non-controlled affiliates (Note 3c) | | $ | 81,601 | |

Interest: | | | | |

Unaffiliated issuers: | | | | |

Paydown gain (loss) | | | (439,221 | ) |

Paid in casha | | | 5,790,341 | |

| | | | |

Total investment income | | | 5,432,721 | |

| | | | |

Expenses: | | | | |

Management fees (Note 3a) | | | 658,893 | |

| | | | |

Total expenses | | | 658,893 | |

| | | | |

Expense reductions (Note 4) | | | (15,879 | ) |

| | | | |

Net expenses | | | 643,014 | |

| | | | |

Net investment income | | | 4,789,707 | |

| | | | |

Realized and unrealized gains (losses): | | | | |

Net realized gain (loss) from: | | | | |

Investments: | | | | |

Unaffiliated issuers | | | (11,670,756 | ) |

Futures contracts | | | 2,554,888 | |

| | | | |

Net realized gain (loss) | | | (9,115,868 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments: | | | | |

Unaffiliated issuers | | | 4,025,262 | |

Futures contracts | | | (970,225 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) | | | 3,055,037 | |

| | | | |

Net realized and unrealized gain (loss) | | | (6,060,831 | ) |

| | | | |

Net increase (decrease) in net assets resulting from operations | | $ | (1,271,124 | ) |

| | | | |

aIncludes amortization of premium and accretion.

| | | | | | | | | | |

| | | | | | |

| 18 | | | | | | | | Annual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

FRANKLIN ETF TRUST

FINANCIAL STATEMENTS

Statements of Changes in Net Assets

Franklin Short Duration U.S. Government ETF

| | | | | | | | |

| | | Year Ended March 31, | |

| | | 2023 | | | 2022 | |

Increase (decrease) in net assets: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 4,789,707 | | | $ | 1,891,741 | |

Net realized gain (loss) | | | (9,115,868 | ) | | | (3,795,247 | ) |

Net change in unrealized appreciation (depreciation) | | | 3,055,037 | | | | (8,210,787 | ) |

| | | | |

Net increase (decrease) in net assets resulting from operations | | | (1,271,124 | ) | | | (10,114,293 | ) |

| | | | |

Distributions to shareholders (Note 1f) | | | (5,203,276 | ) | | | (3,570,598 | ) |

| | | | |

Capital share transactions (Note 2) | | | (149,479,794 | ) | | | (62,575,596 | ) |

| | | | |

Net increase (decrease) in net assets | | | (155,954,194 | ) | | | (76,260,487 | ) |

Net assets: | | | | | | | | |

Beginning of year | | | 359,566,167 | | | | 435,826,654 | |

| | | | |

End of year | | $ | 203,611,973 | | | $ | 359,566,167 | |

| | | | |

| | | | | | | | | | |

| | | | | | |

| franklintempleton.com | | The accompanying notes are an integral part of these financial statements. | Annual Report | | | | | | | | 19 |

FRANKLIN ETF TRUST

FRANKLIN SHORT DURATION U.S. GOVERNMENT ETF

Notes to Financial Statements

1. Organization and Significant Accounting Policies

Franklin ETF Trust (Trust) is registered under the Investment Company Act of 1940 (1940 Act) as an open-end management investment company, consisting of one fund, Franklin Short Duration U.S. Government ETF (Fund) and follows the accounting and reporting guidance in Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services—Investment Companies (ASC 946) and applies the specialized accounting and reporting guidance in U.S. Generally Accepted Accounting Principles (U.S. GAAP), including, but not limited to, ASC 946. The Fund is an exchange traded fund (ETF) and is actively managed, thus it is not designed to track an index.

Effective August, 1, 2022, the Fund changed its name from Franklin Liberty Short Duration U.S. Government ETF to Franklin Short Duration U.S. Government ETF.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Fund calculates the net asset value (NAV) per share each business day as of 4 p.m. Eastern time or the regularly scheduled close of the New York Stock Exchange (NYSE), whichever is earlier. Under compliance policies and procedures approved by the Fund’s Board of Trustees (the Board), the Board has designated the Fund’s investment manager as the valuation designee and has responsibility for oversight of valuation. The investment manager is assisted by the Fund’s administrator in performing this responsibility, including leading the cross-functional Valuation Committee (VC). The Fund may utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Debt securities generally trade in the over-the-counter market rather than on a securities exchange. The Fund’s pricing services use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity

may not exist or is limited, the pricing services also utilize proprietary valuation models which may consider market characteristics such as benchmark yield curves, credit spreads, estimated default rates, anticipated market interest rate volatility, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair value. Derivative financial instruments listed on an exchange are valued at the official closing price of the day.

Investments in open-end mutual funds are valued at the closing NAV.

The Fund has procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the Fund primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed.

b. Securities Purchased on a TBA Basis

The Fund purchases securities on a to-be-announced (TBA) basis, with payment and delivery scheduled for a future date. These transactions are subject to market fluctuations and are subject to the risk that the value at delivery may be more or less than the trade date purchase price.

c. Derivative Financial Instruments

The Fund invested in derivative financial instruments in order to manage risk or gain exposure to various other investments or markets. Derivatives are financial contracts based on an underlying or notional amount, require no initial investment or an initial net investment that is smaller than would normally be required to have a similar response to changes in market factors, and require or permit net settlement. Derivatives contain various risks including the potential inability of the counterparty to fulfill their obligations under the terms of the contract, the potential for an illiquid secondary market, and/or the potential for market movements which expose the Fund

| | | | | | | | | | |

| | | | | | |

| 20 | | | | | | | | Annual Report | | franklintempleton.com |

FRANKLIN ETF TRUST

NOTES TO FINANCIAL STATEMENTS

Franklin Short Duration U.S. Government ETF (continued)

to gains or losses in excess of the amounts shown in the Statement of Assets and Liabilities. Realized gain and loss and unrealized appreciation and depreciation on these contracts for the period are included in the Statement of Operations.