FRANKLIN LIBERTY SHORT DURATION U.S. GOVERNMENT ETF

(a series of Franklin ETF Trust)

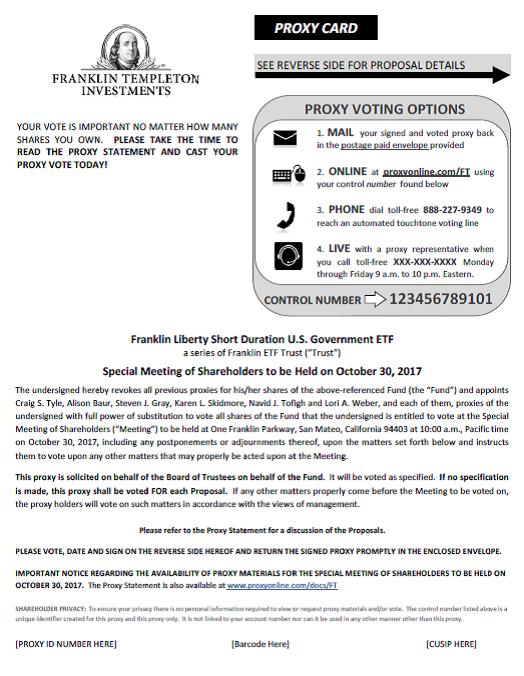

A Special Meeting of Shareholders of Franklin Liberty Short Duration U.S. Government ETF (the "Fund"), the sole series of Franklin ETF Trust (the "Trust"), will be held on October 30, 2017, to vote on three important proposals that affect the Fund. Please read the enclosed materials and cast your vote on the proxy card or voting instruction form.

Voting your shares immediately will help minimize additional solicitation expenses and prevent the need to call you to solicit your vote.

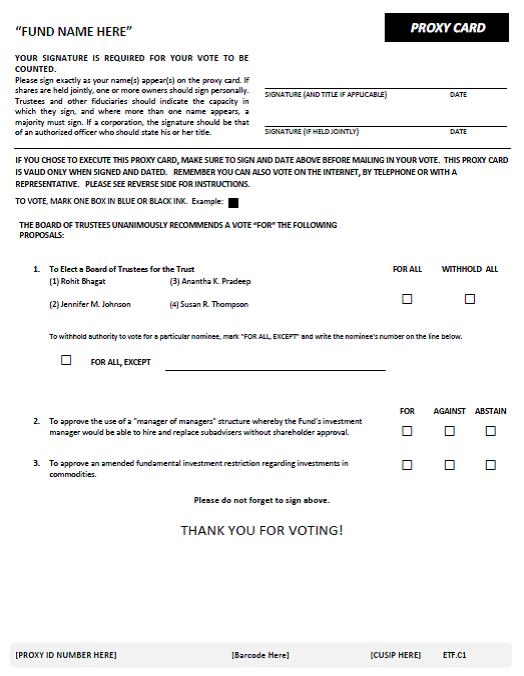

The proposals for the Fund have been carefully reviewed by the Trust's Board of Trustees (the "Board"). The Trustees of the Trust, most of whom are not affiliated with Franklin Templeton Investments, are responsible for looking after your interests as a shareholder of the Fund. The Board unanimously recommends that you vote FOR each proposal.

Voting is quick and easy. Everything you need is enclosed. To cast your vote, simply complete the proxy card or voting instruction form enclosed in this package. Be sure to sign the card or the form before mailing it in the postage-paid envelope. If eligible, you may also vote your shares by touch-tone telephone or through the Internet. Simply call the toll-free number or visit the web site indicated on your proxy card or voting instruction form, and follow the instructions.

We welcome your comments. If you have any questions or would like to quickly vote your shares, please call AST Fund Solutions, LLC, our proxy solicitor, toll-free at 800-967-5068. Agents are available 9:00 a.m. – 10:00 p.m., Eastern time, Monday through Friday, and 10:00 a.m. – 4:00 p.m., Eastern time, Saturday. Thank you for your participation in this important initiative.

The following Q&A is provided to assist you in understanding the proposals that affect the Fund. The proposals are described in greater detail in the enclosed proxy statement. We appreciate your trust in Franklin Templeton Investments and look forward to continuing to help you achieve your financial goals.

Q&A

Important information to help you understand and vote on the proposals

Below is a brief overview of the proposals to be voted upon. The proxy statement provides more information on each proposal. Your vote is important, no matter how large or small your holdings may be.

On what issues am I being asked to vote?

Shareholders are being asked to vote on the following proposals:

| 1. | To elect a Board of Trustees of the Trust. |

| 2. | To approve the use of a "manager of managers" structure whereby the Fund's investment manager will be able to hire and replace subadvisers without shareholder approval. |

| 3. | To approve an amendment to the Fund's current fundamental investment restriction regarding investments in commodities. |

Has the Board approved the proposals?

Yes. The Board has unanimously approved each of the proposals and recommends that you vote to approve each proposal for the Fund.

1. To elect a Board of Trustees.

Who are the current trustees and who are the nominees?

The Franklin Templeton Investments fund complex has a number of separate boards. Most of the current trustees serve on several boards, and the nominees presently serve on the boards of one or more other funds in the Franklin Templeton Investments fund complex. The current Board is composed of the following trustees: Harris J. Ashton, Mary C. Choski, Edith E. Holiday, Gregory E. Johnson, Rupert H. Johnson, Jr., J. Michael Luttig, Larry D. Thompson, and John B. Wilson.

The nominees proposed for election to the Board (each a "Nominee" and collectively, the "Nominees") are:

Nominees for Independent Trustee:

Rohit Bhagat

Anantha K. Pradeep

Susan R. Thompson

Nominee for Interested Trustee:

Jennifer M. Johnson

Management is recommending that the oversight of the Trust and the Fund be shifted from the current Board to the board composed of the Nominees so that the exchange-traded funds ("ETFs") in the Franklin Templeton Investments fund complex, including the Fund, are overseen by the same trustees. The Nominees currently oversee other ETFs in the Franklin Templeton Investments fund complex.

What role does the Board play?

The Board has the responsibility for looking after the interests of the shareholders of the Fund As such, the Board has an obligation to serve the best interests of shareholders in providing oversight of the Fund, including approving policy changes. In addition, the Board, among other things, reviews the Fund's performance, oversees the Fund's activities, and reviews contractual arrangements with the Fund's service providers.

Q&A

What is the affiliation of the Board and Franklin Templeton Investments?

The Board is currently composed of 75% "independent" trustees and two "interested" trustees. Trustees are determined to be "interested" by virtue of, among other things, their affiliation with the Franklin Templeton funds or with Franklin Templeton Investments as fund management. Independent trustees have no affiliation with Franklin Templeton Investments and are compensated by the Trust. The proposed board will continue to be composed of 75% "independent" trustees and will have one "interested" trustee.

| 2. | To approve the use of a "manager of managers" structure whereby the Fund's investment manager will be able to hire and replace subadvisers without shareholder approval. |

What is the purpose of the Manager of Managers Structure?

Shareholders of the Fund are being asked to approve the use of a "manager of managers" structure that would permit the Fund's investment manager, subject to Board approval, to appoint and replace subadvisers that are affiliated with Franklin Templeton Investments, and subadvisers that are not affiliated with Franklin Templeton Investments, without obtaining prior shareholder approval (the "Manager of Managers Structure"). The Manager of Managers Structure would enable the Fund to operate with greater efficiency in the future by allowing the Fund to use both affiliated and unaffiliated subadvisers best suited to its needs without incurring the expense and potential delays that could be associated with obtaining shareholder approvals.

How will the Manager of Managers Structure affect the Fund?

The use of the Manager of Managers Structure will not change the fees paid to the investment manager by the Fund. If the proposal is approved for the Fund, and the Trust's Board and investment manager believe that the use of one or more subadvisers would be in the best interests of the Fund, the Fund's shareholders generally would not be asked to approve hiring a subadviser for the Fund, assuming the conditions of the Manager of Managers Order are met. Rather, the Fund's investment manager, with the approval of the Board, including a majority of the Independent Trustees, would be able to appoint subadvisers and make appropriate changes to the subadvisory agreements without seeking shareholder approval. The Fund would, however, inform shareholders of the hiring of any new subadviser within 90 days after the hiring of the subadviser. The Board of the Trust determined to seek shareholder approval of the Manager of Managers Structure for the Fund in connection with this special shareholder meeting, which was otherwise called for purposes of voting on other matters described in the proxy statement, to avoid additional meeting and proxy solicitation costs in the future.

| 3. | To approve an amendment to the Fund's current fundamental investment restriction regarding investments in commodities. |

What is the fundamental investment restriction regarding investments in commodities?

The Investment Company Act of 1940 (the "1940 Act") requires every investment company to adopt a fundamental investment policy governing investments in commodities. A "fundamental" investment policy may be modified only by a vote of a majority of the investment company's outstanding voting securities (as defined in the 1940 Act).

The Fund's current fundamental investment restriction regarding commodities states that the Fund may not purchase or sell physical commodities, unless acquired as a result of ownership of securities or other instruments, provided however, that the restriction does not prevent the Fund from engaging in certain derivatives and investing in securities or other instruments that are secured by physical commodities.

Q&A

What will be the effect of the amendment to the Fund's current fundamental investment restriction regarding investments in commodities?

Since the initial adoption of this restriction for the Fund, the financial markets and regulatory requirements regarding commodities and commodity interests have evolved. New types of financial instruments have become available as potential investment opportunities, including commodity-linked instruments. The Fund's investment manager believes that it is in the Fund's best interests to amend the current fundamental investment restriction in order to provide the Fund with the flexibility to adapt to continuously changing regulation and to react to changes in the financial markets and the development of new investment opportunities and instruments, in accordance with the Fund's investment goal and subject to oversight by the Trust's Board. Under the proposed restriction, if current applicable law were to change, the Fund would be able to conform to any such new law without shareholders taking further action.

The Board and the Fund's investment manager do not anticipate that the proposed amendment to the Fund's fundamental investment restriction regarding investments in commodities would involve additional material risk to the Fund or affect the way the Fund is currently managed or operated.

Who is AST Fund Solutions, LLC?

AST Fund Solutions, LLC (the "Solicitor") is a company that has been engaged by the Trust, on behalf of the Fund, to assist in the solicitation of proxies. The Solicitor is not affiliated with the Fund or with Franklin Templeton Investments. In order to hold a shareholder meeting, a certain percentage of the Fund's shares (often referred to as "quorum") must be represented at the meeting. If a quorum is not attained, the meeting must adjourn to a future date. The Fund may attempt to reach shareholders through multiple mailings to remind the shareholders to cast their vote. As the meeting approaches, phone calls may be made to shareholders who have not yet voted their shares so that the meeting does not have to be adjourned or postponed.

How many votes am I entitled to cast?

As a shareholder, you are entitled to one vote for each share (and a proportionate fractional vote for each fractional share) you own of the Fund on the record date. The record date is August 21, 2017.

How do I vote my shares?

You can vote your shares by completing and signing the enclosed proxy card or voting instruction form and mailing it in the enclosed postage-paid envelope. If eligible, you may also vote using a touch-tone telephone by calling the toll-free number printed on your proxy card or voting instruction form and following the recorded instructions, or through the Internet by visiting the web site printed on your proxy card or voting instruction form and following the on-line instructions. You can also vote your shares in person at the special meeting of shareholders. If you need any assistance, or have any questions regarding the proposals or how to vote your shares, please call the Solicitor toll-free at 800-967-5068.

How do I sign the proxy card?

Individual Accounts: Shareholders should sign exactly as their names appear on the account registration shown on the proxy card or voting instruction form.

Joint Accounts: Either owner may sign, but the name of the person signing should conform exactly to a name appearing on the account registration as shown on the proxy card or voting instruction form.

All Other Accounts: The person signing must indicate his or her capacity. For example, a trustee for a trust or other entity should sign, "Ann B. Collins, Trustee."

Q&A

FRANKLIN LIBERTY SHORT DURATION U.S. GOVERNMENT ETF

(a series of Franklin ETF Trust)

IMPORTANT SHAREHOLDER INFORMATION

These materials are for a Special Meeting of Shareholders of the Franklin Liberty Short Duration U.S. Government ETF (the "Fund"), the sole series of Franklin ETF Trust (the "Trust"), which will be held at the offices of Franklin Templeton Investments, One Franklin Parkway, San Mateo, California, 94403-1906, on Monday, October 30, 2017 at 10:00 a.m., Pacific time. The enclosed materials discuss the proposals (the "Proposals" or, each, a "Proposal") to be voted on at the meeting, and contain the Notice of Special Meeting of Shareholders, proxy statement and proxy card. A proxy card is, in essence, a ballot. When you vote your proxy, it tells us how you wish to vote on important issues relating to the Fund. If you specify a vote on one or more Proposals, your proxy will be voted as you indicate. If you specify a vote for one or more Proposals, but not all, your proxy will be voted as specified on such Proposal(s) and, on the Proposal(s) for which no vote is specified, your proxy will be voted "FOR" the Proposal(s). If you simply sign, date and return the proxy card, but do not specify a vote on any Proposal, your proxy will be voted "FOR" the Proposal(s).

We urge you to spend a few minutes reviewing the Proposals in the proxy statement. Then, please fill out and sign the proxy card and return it to us so that we know how you would like to vote. When shareholders return their proxies promptly, the Fund may be able to save money by not having to conduct additional solicitations, including other mailings. PLEASE COMPLETE, SIGN AND RETURN the proxy card you receive.

We welcome your comments. If you have any questions or would like to quickly vote your shares, call AST Fund Solutions, LLC, our proxy solicitor, toll free at 800-967-5068. Agents are available 9:00 a.m. - 10:00 p.m., Eastern time, Monday through Friday, and 10:00 a.m. through 4:00 p.m. Eastern time, Saturday.

TELEPHONE AND INTERNET VOTING

For your convenience, you may be able to vote by telephone or through the Internet,

24 hours a day. If your account is eligible, separate instructions are enclosed.

This page intentionally left blank.

FRANKLIN LIBERTY SHORT DURATION U.S. GOVERNMENT ETF

(a series of Franklin ETF Trust)

One Franklin Parkway

San Mateo, California 94403-1906

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

The Board of Trustees of Franklin ETF Trust (the "Trust"), on behalf of Franklin Liberty Short Duration U.S. Government ETF (the "Fund"), has called a Special Meeting of Shareholders of the Fund (the "Meeting"), which will be held at the offices of Franklin Templeton Investments located at One Franklin Parkway, San Mateo, California 94403-1906 on October 30, 2017 at 10:00 a.m., Pacific time.

During the Meeting, shareholders of the Fund will vote on the following Proposals:

| 1. | To elect a Board of Trustees. |

| 2. | To approve the use of a "manager of managers" structure whereby the Fund's investment manager would be able to hire and replace subadvisers without shareholder approval. |

| 3. | To approve an amended fundamental investment restriction regarding investments in commodities. |

By Order of the Board of Trustees,

Craig S. Tyle

Vice President

August __, 2017

Please sign and promptly return the proxy card or voting instruction form in the enclosed self-addressed envelope regardless of the number of shares you own.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL SHAREHOLDER MEETING TO BE HELD ON OCTOBER 30, 2017 The Notice of Special Meeting of Shareholders, proxy statement and form of proxy are available on the Internet at http://www.proxyonline.com/docs/FTproxy. The form of proxy card on the Internet site cannot be used to cast your vote. |

If you have any questions about how to vote or about the Meeting, or wish to obtain directions to be able to attend the Meeting and vote in person, please call AST Fund Solutions, LLC, our proxy solicitor, toll free at 800-967-5068.

PROXY STATEMENT

TABLE OF CONTENTS

| | | Page |

| • | INFORMATION ABOUT VOTING | 1 |

| • | THE PROPOSALS | 3 |

| PROPOSAL 1: | TO ELECT A BOARD OF TRUSTEES | 3 |

| PROPOSAL 2: | TO APPROVE THE USE OF A "MANAGER OF MANAGERS" STRUCTURE WHEREBY THE FUND'S INVESTMENT MANAGER WOULD BE ABLE TO HIRE AND REPLACE SUBADVISERS WITHOUT SHAREHOLDER APPROVAL | 15 |

| PROPOSAL 3: | TO APPROVE AN AMENDED FUNDAMENTAL INVESTMENT RESTRICTION REGARDING INVESTMENTS IN COMMODITIES | 19 |

| • | ADDITIONAL INFORMATION ABOUT THE FUND | 20 |

| • | FURTHER INFORMATION ABOUT VOTING AND THE MEETING | 21 |

| EXHIBITS | | |

| | | |

| Exhibit A – Nominating Committee Charter | A-1 |

FRANKLIN LIBERTY SHORT DURATION U.S. GOVERNMENT ETF

(a series of Franklin ETF Trust)

PROXY STATEMENT

| ¨ | INFORMATION ABOUT VOTING |

Who is asking for my vote?

The Board of Trustees (the "Board") of Franklin ETF Trust (the "Trust"), on behalf of Franklin Liberty Short Duration U.S. Government ETF (the "Fund"), in connection with a Special Meeting of Shareholders of the Fund to be held on October 30, 2017 (the "Meeting"), have requested your vote on three matters.

Who is eligible to vote?

Shareholders of record at the close of business on August 21, 2017 (the "Record Date") are entitled to be present and to vote at the Meeting or any adjourned Meeting. Each share of record of the Fund is entitled to one vote (and a proportionate fractional vote for each fractional share) on each matter presented at the Meeting. The Notice of Special Meeting of Shareholders, the proxy card, the voting instruction card and the proxy statement were first mailed to shareholders of record on or about August 30, 2017.

On what issues am I being asked to vote?

Shareholders are being asked to vote on the following Proposals:

| 1. | To elect a Board of Trustees; |

| 2. | To approve the use of a "manager of managers" structure whereby the Fund's investment manager would be able to hire and replace subadvisers without shareholder approval; and |

| 3. | To approve an amended fundamental investment restriction regarding investments in commodities. |

How does the Board recommend that I vote?

The Board, on behalf of the Fund, unanimously recommends that you vote:

| 1. | FOR the election of all nominees as Trustees of the Trust; |

| 2. | FOR the approval of the use of a manager of managers structure; and |

| 3. | FOR the approval of an amended fundamental investment restriction regarding investments in commodities. |

How do I ensure that my vote is accurately recorded?

You may submit your proxy card or voting instruction form in one of four ways:

| · | By Internet (if eligible). The web address and instructions for voting can be found on the enclosed proxy card or voting instruction form. You will be required to provide your control number located on the proxy card or voting instruction form. |

| · | By Telephone (if eligible). The toll-free number for telephone voting can be found on the enclosed proxy card or voting instruction form. You will be required to provide your control number located on the proxy card or voting instruction form. |

| · | By Mail. Mark the enclosed proxy card or voting instruction form, sign and date it, and return it in the postage-paid envelope we provided. A proxy card with respect to shares held by joint owners may be signed by just one of them, unless at or prior to exercise of such proxy the Fund receives a specific written notice to the contrary from one of the joint owners. |

| · | In Person at the Meeting. You can vote your shares in person at the Meeting. |

Shareholders of record who hold shares directly with the Fund are eligible to vote by Internet or by telephone. If you hold your shares with a broker or other financial intermediary, whether you are eligible to submit your voting instructions by Internet or telephone will depend upon the proxy voting services provided by such broker or other financial intermediary.

If you require additional information regarding the Meeting, you may contact AST Fund Solutions, LLC ("AST"), the proxy solicitor (the "Solicitor"), toll-free at 800-967-5068. Please see the section entitled "FURTHER INFORMATION ABOUT VOTING AND THE MEETING" for more information on the Solicitor.

Proxy cards that are properly signed, dated and received at or prior to the Meeting will be voted as specified. If you specify a vote on any of the Proposals, your proxy will be voted as you indicate. If you specify a vote on one or more Proposals but not the other Proposals, your proxy will be voted as specified on such Proposal(s) and, on the Proposal(s) for which no vote is specified, your proxy will be voted "FOR" the Proposal(s). If you simply sign, date and return the proxy card, but do not specify a vote on any of the Proposals, your proxy will be voted "FOR" the three Proposals.

May I revoke my proxy?

You may revoke your proxy at any time before it is voted by forwarding a written revocation or a later-dated proxy card to the Fund that is received at or prior to the Meeting, or by attending the Meeting and voting in person.

May I attend the Meeting in person?

Shareholders of record at the close of business on the Record Date are entitled to attend the Meeting. Eligible shareholders who intend to attend the Meeting in person will need to bring proof of share ownership, as of the Record Date, and a valid picture identification, such as a driver's license or passport, for admission to the Meeting. Seating is very limited. Shareholders without proof of ownership and identification will not be admitted.

What if my shares are held in a brokerage account?

If your shares are held by your broker, then in order to vote in person at the Meeting, you will need to obtain a "Legal Proxy" from your broker and present it to the Inspector of Elections at the Meeting. Also, in order to revoke your proxy, you may need to forward your written revocation or a later-dated proxy card/voting instruction form to your broker rather than to the Fund.

PROPOSAL 1: TO ELECT A BOARD OF TRUSTEES

The Board unanimously recommends that shareholders of the Fund elect each of the nominees to the Board.

Background

Fund management is recommending that the oversight of the Trust and the Fund be shifted from the current Board to the board composed of the nominees identified below so that the ETFs that are managed by Franklin Investment Management are overseen by the same Trustees.

How are nominees for Trustees selected?

The Board has a Nominating Committee, consisting of John B. Wilson (Chair), Harris J. Ashton, Mary C. Choksi, Edith E. Holiday, J. Michael Luttig and Larry D. Thompson, none of whom is an "interested person" of the Trust as defined by the Investment Company Act of 1940 (the "1940 Act"). Trustees who are not interested persons of the Trust are referred to as the "Independent Trustees," and Trustees who are interested persons of the Trust are referred to as the "Interested Trustees."

The Nominating Committee is responsible for selecting candidates to serve as Trustees for the Trust and recommending such candidates: (a) for selection and nomination as Independent Trustees by the incumbent Independent Trustees and the full Board; and (b) for selection and nomination as Interested Trustees by the full Board. In considering a candidate's qualifications, the Nominating Committee generally considers the potential candidate's educational background, business or professional experience, and reputation. In addition, the Nominating Committee has established as minimum qualifications for Board membership as an Independent Trustee: (1) that such candidate be independent from relationships with the Trust's investment manager and other principal service providers both within the terms and the spirit of the statutory independence requirements specified under the 1940 Act and the rules thereunder; (2) that such candidate demonstrate an ability and willingness to make the considerable time commitment, including personal attendance at Board meetings, believed necessary to his or her function as an effective Board member; and (3) that such candidate have no continuing relationship as a director, officer or board member of any open-end or closed-end investment company other than those within the Franklin Templeton Investments fund complex or a closed-end business development company primarily investing in non-public entities. The Nominating Committee has not adopted any specific policy on the issue of diversity, but will take this into account, among other factors, in its consideration of new candidates to the Board.

When the Board has or expects to have a vacancy, the Nominating Committee receives and reviews information on individuals qualified to be recommended to the full Board as nominees for election as Board members, including any recommendations by "Qualifying Fund Shareholders" (as defined below). Such individuals are evaluated based upon the criteria described above. To date, the Nominating Committee has been able to identify, and expects to continue to be able to identify, from its own resources an ample number of qualified candidates. The Nominating Committee, however, will review recommendations from Qualifying Fund Shareholders to fill vacancies on the Board if these recommendations are submitted in writing and addressed to the Nominating Committee at the Trust's offices at One Franklin Parkway, San Mateo, CA 94403-1906 and are presented with appropriate background material concerning the candidate that demonstrates his or her ability to serve as a Board member, including as an Independent Trustee, of the Trust. A Qualifying Fund Shareholder is a shareholder who: (i) has continuously owned of record, or beneficially through a financial intermediary, shares of the Fund having a net asset value of not less than two hundred and fifty thousand dollars ($250,000) during the twenty-four (24)-month period prior to submitting the recommendation; and (ii) provides a written notice to the Nominating Committee containing the following information: (a) the name and address of the Qualifying Fund Shareholder making the recommendation; (b) the number of shares of the Fund which are owned of record and beneficially by the Qualifying Fund Shareholder and the length of time that such shares have been so owned by the Qualifying Fund Shareholder; (c) a description of all arrangements and understandings between such Qualifying Fund Shareholder and any other person or persons (naming such person or persons) pursuant to which the recommendation is being made; (d) the name, age, date of birth, business address and residence address of the person or persons being recommended; (e) such other information regarding each person recommended by such Qualifying Fund Shareholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the U.S. Securities and Exchange Commission ("SEC") had the nominee been nominated by the Board; (f) whether the shareholder making the recommendation believes the person

recommended would or would not be an "interested person" of the Trust, as defined in the 1940 Act; and (g) the written consent of each person recommended to serve as a Trustee of the Trust if so nominated and elected/appointed.

The Nominating Committee may amend these procedures from time to time, including the procedures relating to the evaluation of nominees and the process for submitting recommendations to the Nominating Committee.

The Board has adopted and approved a formal written charter for the Nominating Committee (the "Charter"). A copy of the Charter is attached to this proxy statement as Exhibit A.

Who are the nominees for Trustees of the Trust?

The nominees proposed for election to the Board (each a "Nominee" and collectively, the "Nominees") are:

Nominees for Independent Trustee:

Rohit Bhagat

Anantha K. Pradeep

Susan R. Thompson

Nominee for Interested Trustee:

Jennifer M. Johnson

None of the Nominees is a member of the Board that currently oversees the Trust and the Fund. Three of the four Nominees would be Independent Trustees, and Jennifer M. Johnson is deemed to be an Interested Trustee nominee. All of the Nominees currently serve on one or more boards of trustees of other investment companies within the Franklin Templeton Investments fund complex. If elected, each Nominee will hold office until the next meeting of shareholders at which Trustees are elected and until his or her successor shall be elected and qualify, or until his or her earlier death, resignation or removal.

The Nominee for Interested Trustee holds director and/or officer positions with, or is a stockholder of, Franklin Resources, Inc. ("Resources") and its affiliates. Resources is a publicly owned holding company, a principal stockholder of which is Rupert H. Johnson, Jr., a current Interested Trustee, who beneficially owned approximately 19.06% of its outstanding shares as of June 30, 2017. The shares deemed to be beneficially owned by Rupert H. Johnson, Jr. include certain shares held by a private charitable foundation for which he is a trustee or by his spouse, for both of which he disclaims beneficial ownership. Resources, a global investment management organization operating as FTI, is primarily engaged, through various subsidiaries, in providing investment management, share distribution, transfer agent and administrative services to a family of investment companies. Resources is a New York Stock Exchange ("NYSE") listed holding company (NYSE: BEN). Rupert H. Johnson, Jr., an Interested Trustee, and Gregory E. Johnson, an Interested Trustee, are the uncle and brother, respectively, of Jennifer M. Johnson, a Nominee. There are no other family relationships among the officers, Trustees or Nominees.

Each Nominee currently is available and has consented to serve if elected. If any of the Nominees should become unavailable, the designated proxy holders will vote in their discretion for another person or persons who may be nominated to serve as Trustee(s).

Each Nominee is standing for election by shareholders of the Trust for the first time. Set forth in the table below are the Nominees and the person(s) who initially recommended the Nominees for consideration as nominees for Board membership:

| Independent Trustee Nominees: | Recommended by: |

| Rohit Bhagat | An incumbent Independent Board Member |

| Anantha K. Pradeep | An incumbent Independent Board Member |

| Susan R. Thompson | An incumbent Independent Board Member |

| | |

| Interested Trustee Nominee: | |

| Jennifer M. Johnson | Executive officers of Franklin Resources, Inc. |

Information on the Nominees appears below, including information on the business activities of the Nominees during the past five years and beyond. In addition to personal qualities, such as integrity, the role of an effective Board member inherently requires the ability to comprehend, discuss and critically analyze materials and issues presented in exercising judgments and reaching informed conclusions relevant to his or her duties and fiduciary obligations. The Board believes that the specific background of each Nominee evidences such ability and is appropriate to his or her serving on the Board. As indicated, Rohit Bhagat has extensive experience in the asset management and financial services industries; Anantha K. Pradeep serves as chief executive officer of a consulting and technology company; Susan R. Thompson has extensive experience in asset management, including serving as president and chief executive officer of an asset management consulting company; and Jennifer M. Johnson is a high ranking executive officer of Franklin Templeton Investments.

Listed below with the business activities of the Nominees are their names and years of birth, and the number of portfolios in the Franklin Templeton Investments fund complex that they oversee. As noted above, none of the Nominees has held any positions with the Trust or served on the Board of the Trust.

Nominees for Independent Trustee:

| Name, Year of Birth and Address | Position | Length of Time Served | Number of Portfolios in Fund Complex Overseen or to be Overseen by Trustee* |

Rohit Bhagat (1964) One Franklin Parkway San Mateo, CA 94403-1906 | Nominee | Not Applicable | 10 |

Other Directorships Held During at Least the Past Five Years: Zentific Investment Management (hedge fund) (2015-present) and Axis Bank (2013-present). |

Principal Occupation During at Least the Past 5 Years: Managing Member, Mukt Capital, LLC (private investment firm) (2014-present); and Advisor, Optimal Asset Management (investment technology and advisory services company) (2015-present); formerly, Chairman, Asia Pacific, BlackRock, Inc. (investment management) (2009-2012); Global Chief Operating Officer, Barclays Global Investors (2005-2009); and Senior Partner, The Boston Consulting Group (management consulting) (1992-2005). |

Anantha Pradeep (1963) One Franklin Parkway San Mateo, CA 94403-1906 | Nominee | Not Applicable | 10 |

Other Directorships Held During at Least the Past Five Years: None. |

Principal Occupation During at Least the Past 5 Years: Chief Executive Officer, Smilables, Inc. (technology company) (2014-present); and Founder and Managing Partner, Consult Meridian, LLC (consulting company) (2009-present); formerly, Founder, BoardVantage. |

Susan R. Thompson (1962) One Franklin Parkway San Mateo, CA 94403-1906 | Nominee | Not Applicable | 10 |

Other Directorships Held During at Least the Past Five Years: None. |

Principal Occupation During at Least the Past 5 Years: President and Chief Executive Officer, Thompson Peak Advisory LLC (asset management consulting) (May 2016-present); formerly, Senior Advisor, BlackRock, Inc. (exclusive asset management consulting) (2015-2016) and Managing Director, BlackRock, Inc. (investment management) (2007-2015). |

Nominee for Interested Trustee:

| Name, Year of Birth and Address | Position | Length of Time Served | Number of Portfolios in Fund Complex Overseen or to be Overseen by Trustee* |

**Jennifer M. Johnson (1964) One Franklin Parkway San Mateo, CA 94403-1906 | Nominee | Not Applicable | 19 |

Other Directorships Held During at Least the Past Five Years: None. |

Principal Occupation During at Least the Past 5 Years: President and Chief Operating Officer, Franklin Resources, Inc.; officer and/or director or trustee, as the case may be, of some of the other subsidiaries of Franklin Resources, Inc. and of four of the investment companies in Franklin Templeton Investments; and formerly, Chief Operating Officer and Executive Vice President, Franklin Resources, Inc. (1994-2015); Executive Vice President of Operations and Technology, Franklin Resources, Inc. (2005-2010); and Senior Vice President, Franklin Resources, Inc. (2003-2005). |

| * | The number of portfolios is based on each separate series of the U.S. registered investment companies within the Franklin Templeton Investments fund complex. These portfolios have a common investment manager or affiliated investment managers, and also may share a common or affiliated underwriter. |

| ** | Jennifer M. Johnson will be considered to be an "interested person" of the Trust under the federal securities laws due to her position as an officer of Resources, which is the parent company of the Fund's investment manager and distributor. |

How often do the Trustees meet and what are Trustees paid?

The role of the Trustees is to provide general oversight of the Trust's business and to ensure that the Fund is operated for the benefit of all the Fund's shareholders. The Board generally anticipates meeting at least four times during the current fiscal year, to review the operations of the Trust and the Fund's investment performance, and will meet more frequently as necessary. The Trustees also oversee the services furnished to the Fund by the investment manager and various other service providers.

During the fiscal year ended May 31, 2017, there were eight meetings of the Board, three meetings of the Audit Committee, and one meeting of the Nominating Committee. The Trust does not currently have a formal policy regarding Trustees' attendance at annual shareholders' meetings. The Trust did not hold, and was not required to hold, an annual meeting at which Trustees were elected during its last fiscal year.

The Nominees for Independent Trustee currently constitute the sole independent board members of one investment company in the Franklin Templeton Investments complex. If elected to the Board, each Nominee for Independent Trustee will be paid a $20,000 annual retainer fee, together with a $5,000 per meeting fee for attendance at regularly scheduled board meetings. To the extent held, a $5,000 per meeting fee ($2,000 per meeting held via telephone) may also be paid for attendance at specially held board meetings. The Board members who serve on the Audit Committee will receive a flat fee of $2,500 per Committee meeting attended in person and $1,000 per telephonic meeting. The chairman of the Audit Committee will receive an additional fee of $10,000 per year. Members of the Audit Committee will not be separately compensated for any committee meeting held on the day of a Board meeting.

If elected to the Board, the Nominees for Independent Trustees will also be reimbursed for expenses incurred in connection with attending Board meetings by each fund in Franklin Templeton Investments for which they serve as a director or trustee. The Nominee for Interested Trustee, if elected to the Board, and certain officers of the Trust who are shareholders of Resources will be not compensated by the Trust for their services, but may be deemed to receive indirect remuneration due to their participation in management fees and other fees received by the Fund's investment manager and its affiliates from the Franklin Templeton funds. The Fund's investment manager or its affiliates pay the salaries and expenses of the officers, and will pay the salary and expenses of the Nominee for Interested Trustee if she is elected to the Board. No pension or retirement benefits are accrued as part of Fund expenses.

The table below indicates the amount each Nominee for Independent Trustee received from the Trust individually, for the fiscal year ended May 31, 2017, and by all funds in the Franklin Templeton Investments fund complex as a whole during the 12 months ended May 31, 2017, as well as the estimated annual benefits, if any, upon retirement.

Nominee for

Independent Trustee | Aggregate Compensation from the Trust | Pension or Retirement Benefits Accrued as Part of Trust Expenses | Estimated Annual Benefits Upon Retirement | Total Compensation from Franklin Templeton Investments Fund Complex | Number of Boards within Franklin Templeton Investment Fund Complex on which the Nominee Serves* |

| Rohit Bhagat | N/A | None | None | $[______] | 1 |

| Anantha K. Pradeep | N/A | None | None | $[______] | 1 |

| Susan R. Thompson | N/A | None | None | $[______] | 1 |

| * | We base the number of boards on the number of U.S. registered investment companies in the Franklin Templeton Investments fund complex. This number does not include the total number of series within each investment company for which the Board members are responsible. The Franklin Templeton Investments Fund complex currently includes 45 U.S. registered investment companies, with approximately 166 U.S. based funds or series. |

The following tables provide the dollar range of equity securities of the Fund and of all U.S. registered funds in the Franklin Templeton Investments fund complex beneficially owned by the Nominees as of May 31, 2017:

Name of Nominee

Independent Trustees: | Dollar Range of Equity Securities in the Fund | Aggregate Dollar Range of Equity Securities in all Portfolios Overseen by the Board Member in Franklin Templeton Investments Fund Complex |

| | | |

Rohit Bhagat | $[_____________] | Over $100,000 |

Anantha K. Pradeep | $[_____________] | $[_____________] |

Susan R. Thompson | $[_____________] | $[_____________] |

| | | |

| Nominee for Interested Trustee: | | |

| | | |

| Jennifer M. Johnson | $[_____________] | Over $100,000 |

There were no purchases or sales of any securities of the investment manager or any of the investment manager's parents or subsidiaries by any Nominee for election as a Trustee of the Trust since the beginning of the Trust's most recently completed fiscal year.

Who are the Executive Officers of the Trust?

Officers of the Trust are appointed by and serve at the pleasure of the Board. If the Nominees are elected by shareholders, the executive officers of the Trust will remain the same:

Patrick O'Connor will serve as President and Chief Executive Officer – Investment Management, replacing Christopher J. Molumphy; Navid J. Tofigh will serve as Vice President and Secretary; and Karen L. Skidmore will serve as Vice President and Assistant Secretary. Information regarding the current Executive Officers of the Trust and the Executive Officers of the Trust if the Nominees are approved by shareholders, is provided below.

Name, Year of Birth and Address1 | Current Position(s) with the Trust | Position if Nominees are Elected | Length of Time Served |

Alison E. Baur (1964) One Franklin Parkway San Mateo, CA 94403-1906 | Vice President | Vice President | Since 2012 |

Principal Occupation During at Least the Past 5 Years: Deputy General Counsel, Franklin Templeton Investments; and officer of some of the other subsidiaries of Franklin Resources, Inc. and of 45 of the investment companies in Franklin Templeton Investments. |

Gaston Gardey (1967) One Franklin Parkway San Mateo, CA 94403-1906 | Treasurer, Chief Financial Officer and Chief Accounting Officer | Treasurer, Chief Financial Officer and Chief Accounting Officer | Since 2012 |

Principal Occupation During at Least the Past 5 Years: Treasurer, U.S. Fund Administration & Reporting, Franklin Templeton Investments; and officer of 27 of the investment companies in Franklin Templeton Investments. |

Aliya S. Gordon (1973)

One Franklin Parkway

San Mateo, CA 94403-1906 | Vice President | Vice President | Since 2012 |

Principal Occupation During at Least the Past 5 Years: Senior Associate General Counsel, Franklin Templeton Investments; and officer of 45 of the investment companies in Franklin Templeton Investments. |

Steven J. Gray (1955)

One Franklin Parkway

San Mateo, CA 94403-1906 | Vice President | Vice President | Since 2012 |

Principal Occupation During at Least the Past 5 Years: Senior Associate General Counsel, Franklin Templeton Investments; Vice President, Franklin Templeton Distributors, Inc. and FT AlphaParity, LLC; and officer of 45 of the investment companies in Franklin Templeton Investments. |

Matthew T. Hinkle (1971)

One Franklin Parkway

San Mateo, CA 94403-1906 | Chief Executive Officer – Finance and Administration | Chief Executive Officer – Finance and Administration | Since June 2017 |

Principal Occupation During Past 5 Years: Senior Vice President, U.S. Fund Administration Reporting & Fund Tax, Franklin Templeton Investments; officer of 45 of the investment companies in Franklin Templeton Investments; and formerly, Vice President, Global Tax (2012-April 2017) and Treasurer/Assistant Treasurer, Franklin Templeton Investments (2009-2017). |

Robert Lim (1948)

One Franklin Parkway

San Mateo, CA 94403-1906 | Vice President – AML Compliance | Vice President – AML Compliance | Since 2016 |

Principal Occupation During at Least the Past 5 Years: Vice President, Franklin Templeton Companies, LLC; Chief Compliance Officer, Franklin Templeton Distributors, Inc. and Franklin Templeton Investor Services, LLC; and officer of 45 of the investment companies in Franklin Templeton Investments. |

Christopher J. Molumphy (1962) One Franklin Parkway San Mateo, CA 94403-1906 | President and Chief Executive Officer – Investment Management | None | Since 2012 |

Principal Occupation During at Least the Past 5 Years: Director and Executive Vice President, Franklin Advisers, Inc.; Executive Vice President, Franklin Templeton Institutional, LLC; and officer of some of the other subsidiaries of Franklin Resources, Inc. and of 22 of the investment companies in Franklin Templeton Investments. |

Kimberly H. Novotny (1972) 300 S.E. 2nd Street Fort Lauderdale, FL 33301-1923 | Vice President | Vice President | Since 2013 |

Principal Occupation During at Least the Past 5 Years: Associate General Counsel, Franklin Templeton Investments; Vice President and Corporate Secretary, Fiduciary Trust International of the South; Vice President, Templeton Investment Counsel, LLC; Assistant Secretary, Franklin Resources, Inc.; and officer of 45 of the investment companies in Franklin Templeton Investments. |

Patrick O'Connor (1967) One Franklin Parkway San Mateo, CA 94403-1906 | None | President and Chief Executive Officer – Investment Management | Not applicable |

Principal Occupation During at Least the Past 5 Years: Senior Vice President, Franklin Advisers, Inc.; officer of one of the investment companies in Franklin Templeton Investments; and formerly, Managing Director, Head of iShares Product Canada, BlackRock (1998-2014). |

Robert C. Rosselot (1960)

300 S.E. 2nd Street

Fort Lauderdale, FL 33301-1923 | Chief Compliance Officer | Chief Compliance Officer | Since 2013 |

Principal Occupation During Past 5 Years: Director, Global Compliance, Franklin Templeton Investments; Vice President, Franklin Templeton Companies, LLC; officer of 45 of the investment companies in Franklin Templeton Investments; and formerly, Senior Associate General Counsel, Franklin Templeton Investments (2007-2013); and Secretary and Vice President, Templeton Group of Funds (2004-2013). |

Karen L. Skidmore (1952)

One Franklin Parkway

San Mateo, CA 94403-1906 | Vice President and Secretary | Vice President and Assistant Secretary | Since 2012 |

Principal Occupation During Past 5 Years: Senior Associate General Counsel, Franklin Templeton Investments; and officer of 45 of the investment companies in Franklin Templeton Investments. |

Navid J. Tofigh (1972)

One Franklin Parkway | Vice President | Vice President and Secretary

| Vice President since 2015 |

San Mateo, CA 94403-1906 | | | since 2015 |

Principal Occupation During Past 5 Years: Associate General Counsel, Franklin Templeton Investments; and officer of 45 of the investment companies in Franklin Templeton Investments. |

Craig S. Tyle (1960)

One Franklin Parkway

San Mateo, CA 94403-1906 | Vice President | Vice President | Since 2012 |

Principal Occupation During Past 5 Years: General Counsel and Executive Vice President, Franklin Resources, Inc.; and officer of some of the other subsidiaries of Franklin Resources, Inc. and of 45 of the investment companies in Franklin Templeton Investments. |

Lori A. Weber (1964) 300 S.E. 2nd Street Fort Lauderdale, FL 33301-1923 | Vice President | Vice President | Since 2012 |

Principal Occupation During at Least the Past 5 Years: Senior Associate General Counsel, Franklin Templeton Investments; Assistant Secretary, Franklin Resources, Inc.; Vice President and Secretary, Templeton Investment Counsel, LLC; and officer of 45 of the investment companies in Franklin Templeton Investments. |

What are the Standing Committees of the Board?

Audit Committee. In addition to the Nominating Committee, the Board currently has a standing Audit Committee.

The Trust's Audit Committee is responsible for the appointment, compensation and retention of the Trust's independent registered public accounting firm ("independent auditors"), including evaluating their independence, recommending the selection of the Trust's auditors to the full Board and meeting with such auditors to consider and review matters relating to the Fund's financial reports and internal auditing. The Audit Committee is currently composed of the following Independent Trustees: J. Michael Luttig, Larry D. Thompson and John B. Wilson (Chair).

Selection of Auditors. The Audit Committee and the Board have selected the firm of PricewaterhouseCoopers LLP ("PwC") as the independent auditors for the Trust's current fiscal year. Representatives of PwC are not expected to be present at the Meeting, but will have the opportunity to make a statement if they wish, and will be available should any matter arise requiring their presence.

Audit Fee Information.

Audit Fees. The aggregate fees paid to PwC for professional services rendered by PwC for the audit of the Fund's annual financial statements or for services that are normally provided by PwC in connection with statutory and regulatory filings or engagements were $28,957 for the fiscal year ended May 31, 2017 and $28,882 for the fiscal year ended May 31, 2016.

Audit-Related Fees. There were no fees paid to PwC for assurance and related services rendered by PwC to the Trust that are reasonably related to the performance of the audit of the Fund's financial statements and are not reported under "Audit Fees" above for the fiscal years ended May 31, 2017 and 2016.

In addition, the Audit Committee pre-approves PwC's engagement for audit-related services to be provided to the Fund's investment manager and any entity controlling, controlled by, or under common control with the investment manager that provides ongoing services to the Trust, which engagements relate directly to the operations and financial reporting of the Trust and the Fund. For the fiscal years ended May 31, 2017 and 2016, there were no fees paid to PwC for such services.

Tax Fees. PwC did not render any tax compliance, tax advice or tax planning services (together, "tax services") to the Fund for its last two fiscal years (ended on May 31, 2017).

In addition, the Audit Committee pre-approves PwC's engagement for tax services to be provided to the Fund's investment manager and any entity controlling, controlled by, or under common control with the investment manager that provides ongoing services to the Trust, which engagements relate directly to the operations and financial reporting of the Trust and the Fund. For the fiscal years ended May 31, 2017 and 2016, there were no fees paid to PwC for such services.

All Other Fees. The aggregate fees paid to PwC for products and services rendered by PwC to the Trust, other than the services reported above, were $0, for the fiscal year ended May 31, 2017, and $71 for the fiscal year ended May 31, 2016.

In addition, there were no fees paid to PwC for products and services rendered by PwC to the Fund's investment manager and any entity controlling, controlled by or under common control with the investment manager that provides ongoing services to the Trust, other than the services reported above.

Aggregate Non-Audit Fees. The aggregate fees paid to PwC for non-audit services provided by PwC to the Trust, to the Fund's investment manager or to any entity controlling, controlled by, or under common control with the investment manager that provides ongoing services to the Trust were $255,000 for the fiscal year ended May 31, 2017 and $663,151 for the fiscal year ended May 31, 2016.

The Audit Committee has considered whether the provision of the non-audit services that were rendered to the Fund's investment manager and to any entity controlling, controlled by, or under common control with the investment manager that provides ongoing services to the Trust is compatible with maintaining PwC's independence.

Audit Committee Pre-Approval Policies and Procedures. As of the date of this proxy statement, the Audit Committee has not adopted written pre-approval policies and procedures within the meaning of Regulation S-X. As a result, all such services described above and provided by PwC must be directly pre-approved by the Audit Committee.

What is the Board's Role in Risk Oversight?

The Board, as a whole, considers risk management issues as part of its general oversight responsibilities throughout the year at regular Board meetings, through regular reports that have been developed by management, in consultation with the Board and its counsel. These reports address certain investment, valuation and compliance matters. The Board also may receive special written reports or presentations on a variety of risk issues, either upon the Board's request or upon the investment manager's initiative. In addition, the Audit Committee of the Board meets regularly with the investment manager's internal audit group to review reports on their examinations of functions and processes within Franklin Templeton Investments that affect the Trust and the Fund.

With respect to investment risk, the Board receives regular written reports describing and analyzing the investment performance of the Fund. In addition, the portfolio managers of the Fund meet regularly with the Board to discuss portfolio performance, including investment risk. To the extent that the Fund changes a particular investment strategy that could have a material impact on the Fund's risk profile, the Board generally is consulted with respect to such change. To the extent that Fund invests in certain complex securities, including derivatives, the Board receives periodic reports containing information about exposure of the Fund to such instruments. In addition, the investment manager's investment risk personnel meet regularly with the Board to discuss a variety of issues, including the impact on the Fund of the investment in particular securities or instruments, such as derivatives and commodities.

With respect to valuation, the Fund's administrator provides regular written reports to the Board that enable the Board to monitor the number of fair valued securities in the Fund's portfolio, the reasons for the fair valuation and the methodology used to arrive at the fair value. Such reports also include information concerning illiquid securities within the Fund's portfolio. The Board also reviews dispositional analysis information on the sale of securities that require special valuation considerations such as illiquid or fair valued securities. In addition, the Trust's Audit Committee reviews valuation procedures and results with the Trust's independent auditors in connection with such Committee's review of the results of the audit of the Fund's year-end financial statements.

With respect to compliance risks, the Board receives regular compliance reports prepared by the investment manager's compliance group and meets regularly with the Trust's Chief Compliance Officer ("CCO") to discuss compliance issues, including compliance risks. In accordance with SEC rules, the Independent Trustees meet regularly in executive session with the CCO and the CCO prepares and presents an annual written compliance report to the Board. The Board adopts compliance policies and procedures for the Trust and approves such procedures for the Fund's service providers. The compliance policies and procedures are specifically designed to detect and prevent violations of the federal securities laws.

The investment manager periodically provides an enterprise risk management presentation to the Board to describe the way in which risk is managed on a complex-wide level. Such presentation covers such areas as investment risk, reputational risk, personnel risk, and business continuity risk.

What is the leadership structure of the Board?

75% or more of Board members consist of Independent Trustees who are not deemed to be "interested persons" by reason of their relationship with the Trust's management or otherwise as provided under the 1940 Act. Currently, the Chairman of the Board is an Interested Trustee. If the Nominees are elected, consistent with the current Franklin Board structure, the Chairman of the Board will continue to be an Interested Trustee, although the Board also would be served by a lead Independent Trustee. The lead Independent Trustee, together with independent counsel, would review proposed agendas for Board meetings and generally act as a liaison with management with respect to questions and issues raised by the Independent Trustees. The lead Independent Trustee also would preside at separate meetings of Independent Trustees held in advance of each scheduled Board meeting where various matters, including those being considered at such Board meeting, are discussed. It is believed such structure and activities assure that proper consideration is given at Board meetings to matters deemed important to the Fund and its shareholders.

What is the Required Vote on Proposal 1?

For Proposal 1, the Nominees will be elected to the Board by the affirmative vote of a plurality of votes cast by the shareholders of the Fund. This means that the Nominees receiving the largest number of votes will be elected to fill the available positions, and a Nominee may be elected even if he or she receives the affirmative vote of less than a majority of the outstanding shares of the Fund.

THE BOARD UNANIMOUSLY RECOMMENDS

A VOTE "FOR" THE ELECTION OF EACH

OF THE NOMINEES TO THE BOARD.

| PROPOSAL 2: | TO APPROVE THE USE OF A "MANAGER OF MANAGERS" STRUCTURE WHEREBY THE FUND'S INVESTMENT MANAGER WOULD BE ABLE TO HIRE AND REPLACE SUBADVISERS WITHOUT SHAREHOLDER APPROVAL |

Background

Pursuant to an investment management agreement between the Trust, on behalf of the Fund, and its investment manager, Franklin Advisers, Inc., the investment manager is responsible for, among other items, managing the assets of the Fund and making decisions with respect to the investment of the Fund's assets and purchases and sales of investment securities on behalf of the Fund, subject to the supervision of the Board.

The Fund's investment manager is wholly-owned by Resources. Many of Resources' subsidiaries that provide investment management services (together, the "Investment Manager Affiliates," and each an "Investment Manager Affiliate") are organized under the laws of different jurisdictions throughout the world for sales, client servicing and tax purposes. Resources operates the Investment Manager Affiliates on a unified basis. For example, the Investment Manager Affiliates generally share order management systems, investment operations support and many compliance policies and procedures. While each Investment Manager Affiliate has its own personnel and resources, including portfolio managers and analysts, and offers specialized management services to clients, the Investment Manager Affiliates generally share support personnel, such as with respect to tax, legal and accounting matters. While not currently contemplated, in the future, the Fund's investment manager may wish to use the portfolio management and trading expertise of personnel employed by an Investment Manager Affiliate in other global locations, thereby providing to Fund shareholders the full benefit of the global resources of Resources. Alternatively, the Fund's investment manager may wish to provide the Fund with the skill and expertise of a subadviser that is not affiliated in any way with Resources or the Fund's investment manager.

Provisions of the 1940 Act that apply to the Fund require that investment management agreements between funds and their investment managers (including subadvisers) be approved by shareholders. The SEC, however, has issued an exemptive order (the "Order") to the Fund's investment manager that permits the investment manager, and any Investment Manager Affiliates and any existing or future registered open-end investment company or series advised by the investment manager or the Investment Manager Affiliates to hire certain new subadvisers without obtaining shareholder approval (the "Manager of Managers Structure"). Under the Order, the hiring of new subadvisers remains subject to the approval of the Board, including a majority of the Independent Trustees, as well as certain other conditions. The Order would allow the Fund's investment manager to hire, without shareholder approval, new subadvisers that are affiliated with the investment manager (e.g., the investment manager and the subadviser are both wholly-owned by the same corporate parent), and new subadvisers that are not affiliated with the investment manager in any way. Before the Fund may rely on the Order, the Fund's use of the Manager of Managers Structure must be approved by a "majority of the outstanding voting securities" of the Fund, as defined in the 1940 Act and discussed below.

Why am I being asked to vote on this Proposal?

The Board determined to seek shareholder approval of the Manager of Managers Structure in connection with the Meeting, which otherwise was called to elect Trustees and to vote on the third matter described in this proxy statement, in order to avoid additional meeting and proxy solicitation costs in the future, in the event that the Fund's investment manager, with the approval of the Board, including a majority of the Independent Trustees, determines that the use of the Manager of Managers Structure is in the best interests of the Fund. The process of seeking shareholder approval could cause delays in executing changes that the Board and the investment manager have determined are in the best interests of the Fund. Seeking shareholder approval typically involves additional expenses, such as hiring a proxy solicitor.

The Fund's investment manager currently does not intend to use the Manager of Managers Structure for the Fund, because near-term changes to the portfolio management

structure for the Fund are not anticipated. However, as noted above, Resources is a global investment management organization with offices and Investment Manager Affiliates located around the world. From time to time, a portfolio manager may relocate from one Investment Manager Affiliate to another in order to gain further experience, or if the Fund's investment manager believes it would be beneficial to the Fund to have access to the investment management expertise of another Investment Manager Affiliate. If the Fund were permitted to rely on the Order, such investment management changes could be effected with Board approval, but without the time and expense associated with obtaining shareholder approval.

How will the Manager of Managers Structure Operate?

Under the Manager of Managers Structure, the investment manager of the Fund will be permitted to appoint and replace subadvisers for the Fund and to enter into and approve amendments to subadvisory agreements without first obtaining shareholder approval. However, the Board, including a majority of the Independent Trustees, must approve any new subadviser and any new or amended subadvisory agreement. In addition, if the Manager of Managers Structure is approved for the Fund, the Fund's investment management agreement will be amended to allow for subadvisory agreements that are not approved by shareholders.

Under the Manager of Managers Structure, the Fund's investment manager would have the overall responsibility, subject to oversight by the Board, to oversee the subadvisers and recommend their hiring, termination and replacement. Specifically, the Order requires the Fund's investment manager to, subject to the review and approval of the Board, including a majority of the Independent Trustees: (a) set the Fund's overall investment strategy; (b) evaluate, select and recommend subadvisers to manage all or a portion of the Fund's assets; and (c) implement procedures reasonably designed to ensure that each subadviser complies with the Fund's investment goal, policies and restrictions. In addition, subject to the review by the Board, the Fund's investment manager is required to: (a) when appropriate, allocate and reallocate the Fund's assets among multiple subadvisers; and (b) monitor and evaluate the performance of the subadvisers. The replacement of the Fund's investment manager or the imposition of material changes to the Fund's investment management agreement would, however, require prior shareholder approval.

If the Fund's investment manager, with the approval of the Board, including a majority of the Independent Trustees, determines that the use of the Manager of Managers Structure is in the best interests of the Fund, the Manager of Managers Structure would without obtaining shareholder approval: (1) enable a new subadviser to commence providing services to the Fund more quickly and with less potential expense to the Fund; (2) permit the Fund's investment manager to allocate and reallocate the Fund's assets among itself and one or more subadvisers; and (3) permit the Board to approve material changes to a subadvisory agreement.

Under the Manager of Managers Structure, upon receiving approval of the Board, including a majority of the Independent Trustees, subadvisers selected by the Fund's investment manager could immediately manage the Fund's assets. The Fund would, however, inform shareholders of the hiring of any new subadviser within 90 days after hiring the subadviser.

How does this Proposal affect my fees as a shareholder of the Fund?

Approval of this Proposal will not affect your fees as a shareholder of the Fund. The Manager of Managers Structure will not at any time entail an increase in the investment management fees paid by the Fund. Further shareholder approval would be necessary to increase the management fees that are payable by the Fund, which is not contemplated.

How does this Proposal affect my right to vote on subadvisory agreements?

If Proposal 2 is approved for the Fund, and the Board and the Fund's investment manager believe that the use of one or more subadvisers would be in the best interests of the Fund, the Fund's shareholders generally would not be asked to approve hiring a subadviser for the Fund, assuming that the conditions of the Order are met. Rather, the Fund's investment manager, with the approval of the Board, including a majority of the Independent Trustees, would be able to appoint subadvisers and make appropriate changes to the subadvisory agreements without seeking shareholder approval. The Fund would, however, inform shareholders of the hiring of any new subadviser within 90 days after the hiring of the subadviser.

Why did the Board approve the Manager of Managers Structure?

The Board, including a majority of the Independent Trustees, approved the Manager of Managers Structure and is recommending that shareholders of the Fund approve the Manager of Managers Structure at the Meeting in order to avoid additional meeting and proxy solicitation costs in the future, in the event that the Fund's investment manager, with the approval of the Board, including a majority of the Independent Trustees, determines that it is in the best interests of the Fund to use the Manager of Managers Structure.

What is the Required Vote on Proposal 2?

For Proposal 2, before the Fund may rely on the Order, the operation of the Fund using the Manager of Managers Structure must be approved by the affirmative vote of a "majority of the outstanding voting securities" of the Fund, which is defined in the 1940 Act as the lesser of: (A) 67% or more of the voting securities of the Fund present at the Meeting, if the holders of more than 50% of the outstanding voting securities of such Fund are present or represented by proxy; or (B) more than 50% of the outstanding voting securities of such Fund.

If Proposal 2 is not approved by the Fund's shareholders, then the investment manager generally would only be able to enter into new or amended subadvisory agreements with shareholder approval, potentially causing delay and expense in making a change deemed beneficial to the Fund and its shareholders by the Board.

THE BOARD UNANIMOUSLY RECOMMENDS THAT

SHAREHOLDERS VOTE "FOR" PROPOSAL 2.

| PROPOSAL 3: | TO APPROVE AN AMENDED FUNDAMENTAL INVESTMENT RESTRICTION REGARDING INVESTMENTS IN COMMODITIES |

Under the 1940 Act, a fund must have a fundamental investment policy governing investments in "commodities." The 1940 Act does not prohibit a fund from investing in commodities.

The Fund's current fundamental investment restriction regarding commodities provides:

[The Fund may not:] purchase or sell physical commodities, unless acquired as a result of ownership of securities or other instruments and provided that this restriction does not prevent the Fund from (i) engaging in transactions involving currencies and futures contracts and options thereon or (ii) investing in securities or other instruments that are secured by physical commodities.

Management is recommending that the Fund amend its current fundamental investment restriction regarding investments in commodities to provide the Fund with the flexibility to adapt to continuously changing regulation and to react to changes in the financial markets and the development of new investment opportunities and instruments, in accordance with the Fund's investment goal and subject to oversight by the Board. Since the adoption of the Fund's current fundamental investment restrictions regarding commodities, the financial markets and related regulation by the SEC, the U.S. Commodity Futures Trading Commission ("CFTC") and other governmental agencies have evolved, and new types of financial instruments have become available as potential investment opportunities, including transactions in commodity-linked instruments. Under the proposed restriction, if current applicable law were to change, the Fund would be able to conform to any such new law without shareholders taking further action.

The proposed standardized fundamental investment restriction regarding investments in commodities is as follows:

[The Fund may not:] Purchase or sell commodities, except to the extent permitted by the 1940 Act or any rules, exemptions or interpretations thereunder that may be adopted, granted or issued by the SEC.

What effect will amending the current commodities restriction have on the Fund?

The proposed fundamental investment restriction would clarify the ability of the Fund to engage in transactions involving currencies and other derivative transactions, such as futures contracts, forward contracts, commodity options and swaps, subject to oversight by the Board. Notwithstanding the flexibility provided by the proposed fundamental investment restriction, the Fund is subject to limitations established from time to time by the Board regarding the use of derivatives. In addition, the Fund, to the extent applicable, currently relies on CFTC Rule 4.5 for an exclusion from commodity pool operator registration, and the investment manager intends to continue to limit the Fund's use of commodity interests to the trading limitations set forth in the rule. Therefore, it is not anticipated that the adoption of the proposed investment restriction

would involve additional material risk to the Fund or affect the way the Fund is currently managed or operated.

What is the required vote on Proposal 3?

To approve Proposal 3, the Fund must receive an affirmative vote of a "majority of the outstanding voting securities" of the Fund, which is defined in the 1940 Act as the lesser of: (A) 67% of the outstanding voting securities of the Fund present at the Meeting, if the holders of more than 50% of the outstanding voting securities of the Fund are present or represented by proxy; or (B) more than 50% of the outstanding voting securities of the Fund.

If shareholders of the Fund do not approve Proposal 3, the Fund will continue to operate in compliance with its current fundamental investment restriction regarding investing in commodities.

THE BOARD UNANIMOUSLY RECOMMENDS

A VOTE "FOR" PROPOSAL 3.

| ¨ | ADDITIONAL INFORMATION ABOUT THE FUND |

The Investment Manager. Franklin Advisers, Inc. is the Fund's investment manager. Pursuant to an investment management agreement, the investment manager for the Fund manages the investment and reinvestment of the Fund's assets. The Fund's investment manager is a direct, wholly owned or majority owned subsidiary of Resources.

The Administrator. Pursuant to a subcontract for administrative services with the Fund's investment manager, Franklin Templeton Services, LLC ("FT Services") provides certain administrative functions for the Fund. FT Services, with its principal address at One Franklin Parkway, San Mateo, California 94403-1906, is an indirect, wholly owned subsidiary of Resources and an affiliate of the Fund's investment manager and the Trust's principal underwriter. The administrative services FT Services provides include preparing and maintaining books, records, and tax and financial reports, and monitoring compliance with regulatory requirements. The fee for administrative services provided by FT Services is paid by the Fund's investment manager based on the Fund's average daily net assets, and is not an addition expense of the Fund.

The Sub-administrator. The Bank of New York Mellon (BNY Mellon) has an agreement with FT Services to provide certain sub-administrative services and facilities for the Fund. The administrative services BNY Mellon provides include, but are not limited to, certain fund accounting, financial reporting, tax, corporate governance and compliance and legal administration services.

The Underwriter. The principal underwriter for the Trust is Franklin Templeton Distributors, Inc. ("FT Distributors"), One Franklin Parkway, San Mateo, California 94403-1906. As the principal underwriter, FT Distributors is entitled to receive underwriting commissions and 12b-1 fees pursuant to a Rule 12b-1 plan adopted by the Board, which fees

would be used for, among other things, advertising expenses and the costs of printing sales material and prospectuses used to offer shares to the public.

The Transfer Agent. BNY Mellon, 111 Sanders Creek Parkway, East Syracuse, NY 13057, acts as the Fund's transfer agent and dividend-paying agent.

The Custodian. The custodian for the Fund is BNY Mellon, Mutual Funds Division, 100 Church Street, New York, New York 10286.

Other Matters. The Fund's audited financial statements and annual report for its last completed fiscal year, and any subsequent semi-annual report to shareholders, are available free of charge. To obtain a copy, please call (800) DIAL BEN® ((800) 342-5236) or forward a written request to Franklin Templeton Investor Services, LLC, P.O. Box 997151, Sacramento, CA 95899-7151.

Shareholders Sharing the Same Address. If two or more shareholders share the same address, only one copy of this proxy statement is being delivered to that address, unless the Fund has received contrary instructions from one or more of the shareholders at that shared address. Upon written or oral request, the Fund will deliver promptly a separate copy of this proxy statement to a shareholder at a shared address. Please call 1-800/DIAL BEN® ((800)342-5236) or forward a written request to Franklin Templeton Investor Services, LLC, P.O. Box 33030, St. Petersburg, Florida 33733-8030, if you would like to (1) receive a separate copy of this proxy statement; (2) receive your annual reports or proxy statements separately in the future; or (3) request delivery of a single copy of annual reports or proxy statements if you are currently receiving multiple copies at a shared address.

Outstanding Shares and Principal Shareholders. As of May 31, 2017, the Fund had 1,751,000 outstanding shares.

To the knowledge of the Trust's management, as of May 31, 2017, there were no entities owning beneficially or of record more than 5% of the outstanding shares of the Fund.

[In addition, to the knowledge of the Trust's management, as of May 31, 2017 and except as noted above under Proposal 1, no Nominee or Board member of the Trust owned 1% or more of the outstanding shares of the Fund, and the Board members and officers of the Trust owned, as a group, less than 1% of the outstanding shares of the Fund.]

Contacting the Board. If a shareholder wishes to send a communication to the Board, such correspondence should be in writing and addressed to the Board at the Trust's offices at One Franklin Parkway, San Mateo, California 94403-1906, Attention: Secretary. The correspondence will be given to the Board for review and consideration.

| ¨ | FURTHER INFORMATION ABOUT VOTING AND THE MEETING |

Solicitation of Proxies. Your vote is being solicited by the Board. AST Fund Solutions, LLC (the "Solicitor") has been engaged to assist in the solicitation of proxies. The total cost of

proxy solicitation is estimated to be approximately $3,000, including expenses. The cost of soliciting proxies, including the fees of a proxy soliciting agent, will be [borne by the Fund].

As the date of the Meeting approaches, certain Fund shareholders may receive a telephone call from a representative of the Solicitor if their votes have not yet been received. Franklin Templeton Investments and the Fund also will reimburse brokerage firms and others for their expenses in forwarding proxy materials to the beneficial owners of shares of the Fund and soliciting them to execute voting instructions. The Trust expects that the solicitation will be primarily by mail, but may also include telephone, facsimile, electronic or other means of communication. Trustees and officers of the Trust, and regular employees and agents of the Fund's investment manager or its affiliates involved in the solicitation of the proxies are not reimbursed.

Authorization to permit the Solicitor to execute proxies may be obtained by telephonic instructions from eligible shareholders of the Fund. Proxies that are obtained telephonically will be recorded in accordance with the procedures set forth below. The Trust believes that these procedures are reasonably designed to ensure that both the identity of the shareholder casting the vote and the voting instructions of the shareholder are accurately determined.