QuickLinks -- Click here to rapidly navigate through this documentFiled pursuant to Rule 424(b)(3)

Registration No. 333-182132

PROSPECTUS

Harvest Operations Corp.

67/8% Senior Notes due 2017

(US$500,000,000 aggregate principal amount) and related guarantees which have been registered under the Securities Act of 1933

for

all outstanding 67/8% Senior Notes due 2017

(US$500,000,000 aggregate principal amount) and related guarantees

The Notes and the Guarantees

- •

- We are offering to exchange US$500,000,000 of our outstanding 67/8% Senior Notes due 2017 and certain related guarantees, which were issued on October 4, 2010 and which we refer to as the initial notes, for a like aggregate amount of our registered 67/8% Senior Notes due 2017 and certain related guarantees, which we refer to as the exchange notes. The exchange notes will be issued under the existing Note Indenture (as defined below) dated as of October 4, 2010.

- •

- The exchange notes will be guaranteed by all of our existing and future restricted subsidiaries that guarantee the Credit Facility (as defined below) and every future restricted subsidiary that guarantees certain debt.

- •

- The exchange notes and the guarantees will be our general unsecured senior obligations and will be effectively subordinated to all of our and the guarantors' existing and future secured debt to the extent of the assets securing that secured debt. In addition, the exchange notes will be effectively subordinated to all of the liabilities of our subsidiaries that are not guaranteeing the exchange notes, to the extent of the assets of those subsidiaries.

- •

- The exchange notes will be redeemable at a redemption price equal to 100% of the principal amount of the notes being redeemed plus a make-whole redemption premium, plus accrued and unpaid interest to the redemption date. We may also redeem all of the notes at any time in the event that certain changes affecting Canadian withholding taxes occur.

Terms of the exchange offer

- •

- It will expire at 5:00 p.m., New York City time, on August 1, 2012, unless we extend it.

- •

- If all the conditions to this exchange offer are satisfied, we will exchange all of our initial notes that are validly tendered and not withdrawn for the exchange notes.

- •

- You may withdraw your tender of initial notes at any time before the expiration of this exchange offer.

- •

- The exchange notes that we will issue you in exchange for your initial notes will be substantially identical to your initial notes except that, unlike your initial notes, the exchange notes will have no transfer restrictions or registration rights.

- •

- The exchange notes that we will issue you in exchange for your initial notes are new securities with no established market for trading.

Before participating in this exchange offer, please refer to the section in this prospectus entitled "Risk Factors" commencing on page 14.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of those exchange notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act of 1933, as amended, which we refer to as the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for initial notes where those initial notes were acquired by that broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 180 days after the effective date of this registration statement, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See "Plan of Distribution."

The date of this prospectus is July 3, 2012.

TABLE OF CONTENTS

| | |

| |

|

|---|

Presentation of Our Financial Information | | i |

Non-GAAP Financial Measures | | i |

Predecessor Presentation | | ii |

Exchange Rate Data | | ii |

Note Regarding Reserves Data and Other Oil And Gas Information | | iii |

Glossary of Certain Terms and Definitions | | iv |

Prospectus Summary | | 1 |

Risk Factors | | 14 |

Special Note Regarding Forward-Looking Statements | | 30 |

Use of Proceeds | | 33 |

Capitalization | | 34 |

Selected Historical Financial Information | | 35 |

Management's Discussion and Analysis of Financial Condition and Results of Operations | | 39 |

Business | | 74 |

Management | | 105 |

Related Party Transactions | | 113 |

Principal Stockholder | | 114 |

Description of Other Indebtedness | | 115 |

The Exchange Offer | | 116 |

Description of Notes | | 124 |

Book-Entry, Delivery and Form | | 147 |

Federal Income Tax Considerations | | 167 |

Plan of Distribution | | 172 |

Legal Matters | | 173 |

Independent Qualified Reserves Evaluators | | 173 |

Experts | | 173 |

Available Information | | 173 |

Index to Financial Statements | | F-1 |

PRESENTATION OF OUR FINANCIAL INFORMATION

The financial data presented herein for Harvest Operations Corp. and Harvest Energy Trust is from the unaudited and audited consolidated financial statements. The consolidated financial statements of Harvest Operations (as defined below) for 2012, 2011 and 2010 have been prepared in accordance with IFRS (as defined below). The December 31, 2010 consolidated financial statements were initially prepared in accordance with pre-IFRS Canadian GAAP (as defined below), consistent with the prior years and the periods ended December 31, 2009, 2008 and 2007. The consolidated financial information as at and for the year ended December 31, 2010 have been adjusted in accordance with IFRS 1 "First-time Adoption of International Financial Reporting Standards", and therefore the financial information set forth in this prospectus for the year ended December 31, 2010 may differ from information previously published. Harvest adopted IFRS with a transition date of January 1, 2010. For details regarding the adjustments made with respect to the comparative data refer to Note 27 to the annual audited consolidated financial statements contained in this prospectus. The selected historical consolidated financial information presented elsewhere in this prospectus is condensed and may not contain all of the information that readers should consider. This selected financial data should be read in conjunction with the annual audited consolidated financial statements, the notes thereto and the section entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations." The amounts presented herein for the years 2009, 2008, and 2007 reflect the adjustments made to conform with U.S. GAAP (as defined below).

We present our financial statements in Canadian dollars. In this prospectus, except where otherwise indicated, all dollar amounts are expressed in Canadian dollars. References to Canadian dollars, Cdn$, C$ or $ are to the currency of Canada and references to U.S. dollars or US$ are to the currency of the United States.

NON-GAAP FINANCIAL MEASURES

Harvest uses certain financial reporting measures that are commonly used as benchmarks within the petroleum and natural gas industry hereinafter referred to as "non-GAAP" such as: "cash contribution", "operating netbacks", "operating netback prior to/after hedging", "operating income (loss)", "gross margin (loss)", "total debt", "total financial debt", "total capitalization", "EBITDA", "secured debt to annualized EBITDA", "total debt to annualized EBITDA", "secured debt to total capitalization", "total debt to total capitalization" and "interest coverage ratio".

"Operating netbacks" are reported on a per boe basis and used extensively in the Canadian energy sector for comparative purposes. "Operating netbacks" include revenues, operating expenses, transportation and marketing expenses, and realized gains or losses on risk management contracts. "Cash contribution" represents cash from operating activities adjusted to remove the change in non-cash working capital and settlements of decommissioning liabilities; this measure is also used extensively in the Canadian energy sector for comparative purposes, although it is referred to using various different titles. "Gross margin (loss)" is commonly used in the refining industry to reflect the net funds received from the sale of refined products after considering the cost to purchase the feedstock and is calculated by deducting purchased products for resale and processing from total revenue. "Operating income (loss)" is commonly used for comparative purposes in the petroleum and natural gas and refining industries to reflect operating results before items not directly related to operations. "Total debt", "total financial debt", "total capitalization", and "EBITDA" are used to assist management in assessing liquidity and the Corporation's ability to meet financial obligations. "Secured debt to annualized EBITDA", "total debt to annualized EBITDA", "secured debt to total capitalization", "total debt to total capitalization" and "interest coverage ratio" are terms defined in the Credit Facility and the Note Indenture for the purpose of calculation of Harvest's financial covenants. The non-GAAP measures do not have any standardized meaning prescribed by U.S. GAAP, Canadian GAAP or IFRS and may not be comparable to similar measures used by other issuers. The

i

determination of the non-GAAP measures have been illustrated throughout this prospectus, with reconciliations to IFRS measures and/or account balances, except for EBITDA which is shown below under "Selected Historical Financial Information—Reconciliation of EBITDA."

PREDECESSOR PRESENTATION

On December 22, 2009, KNOC Canada (as defined below) purchased all of the issued and outstanding Trust Units (as defined below) of Harvest Energy Trust. The acquisition of all the issued and outstanding Trust Units resulted in a change of control in which KNOC Canada became the sole unit holder of the Trust (as defined below). On May 1, 2010, an internal reorganization was completed pursuant to which the Trust was dissolved and the Trust's wholly owned subsidiary and the manager of the Trust, Harvest Operations Corp., was amalgamated into KNOC Canada to continue as one corporation under the name Harvest Operations Corp. The carrying values of Harvest's assets and liabilities were determined from the existing carrying values of KNOC Canada's assets and liabilities and therefore reflect the fair values established through the KNOC Acquisition (as defined below).

The Trust meets the definition of a predecessor as described in Exchange Act Rule 12b-2 and Securities Act Rule 405; therefore, certain historical financial information related to the Trust is included in this prospectus. Accordingly, the financial information presented in this prospectus for the year ended and as at December 31, 2011 and 2010 and any later period, is that of Harvest Operations Corp. (the successor company) while any comparative periods represent the financial information of Harvest Energy Trust (the predecessor company). As at December 31, 2009 the internal reorganization had not yet taken place; therefore, both Harvest Energy Trust and KNOC Canada existed at this date. However, KNOC Canada was incorporated on October 9, 2009 and did not have any results of operations or cash flows between October 9, 2009 and December 31, 2009, aside from capital contributions from KNOC to finance the KNOC Acquisition and cash used in the KNOC Acquisition; as such, the financial information presented for the year ended and as at December 31, 2009 is that of the Trust, unless otherwise stated, as this provides more relevant information in comparing the results of operations.

EXCHANGE RATE DATA

The following table sets forth, the high and low exchange rates between the Canadian dollar and the U.S. dollar for each month during the previous six months, the low and high exchange rates for Canadian dollars based on the Bank of Canada noon rates. Such rates are set forth as U.S. dollars per $1.00. The exchange rate information presented below is based on the Bank of Canada noon rates.

| | | | | | | |

| | High | | Low | |

|---|

May 2012 | | | 1.0164 | | | 0.9663 | |

April 2012 | | | 1.0197 | | | 0.9961 | |

March 2012 | | | 1.0153 | | | 0.9985 | |

February 2012 | | | 1.0136 | | | 0.9984 | |

January 2012 | | | 1.0014 | | | 0.9735 | |

December 2011 | | | 0.9896 | | | 0.9610 | |

ii

The average exchange rates between the Canadian dollar and the U.S. dollar for the five most recent financial years are as follows:

| | | | |

| | Average | |

|---|

2011 | | | 1.0110 | |

2010 | | | 0.9709 | |

2009 | | | 0.8757 | |

2008 | | | 0.9381 | |

2007 | | | 0.9304 | |

The exchange rate between the Canadian dollar and the U.S. dollar on June 29, 2012 was US$0.9813.

NOTE REGARDING RESERVES DATA AND OTHER OIL AND GAS INFORMATION

In order to facilitate comparability of oil and gas disclosure with that provided by U.S. and other international issuers, the oil and gas information included in this prospectus is disclosed in accordance with U.S. disclosure requirements and practices. Such information may differ from the corresponding information prepared in accordance with Canadian standards pursuant to National Instrument 51-101—Standards of Disclosure for Oil and Gas Activities of the Canadian Securities Administrators ("NI 51-101"), which imposes oil and gas disclosure standards for Canadian public companies engaged in oil and gas activities.

The primary differences between the current U.S. requirements and the NI 51-101 requirements are that the U.S. standards require (i) disclosure only of proved reserves, whereas NI 51-101 requires disclosure of proved and probable reserves; (ii) that the reserves and related future net revenue be estimated under existing economic and operating conditions, i.e., historic 12-month average price, whereas NI 51-101 requires disclosure of reserves and related future net revenue using forecast prices and costs; and (iii) that a discount rate of 10% be used when determining the present value of future net revenue to be derived from the reserves. In addition, under U.S. disclosure standards, reserves and production information is required to be disclosed on a net basis (after royalties). The definitions of proved reserves also differ, but according to the Canadian Oil and Gas Evaluation Handbook, the reference source for the definition of proved reserves under NI 51-101, differences in the estimated proved reserves quantities based on constant prices should not be material.

According to the SEC, proved oil and gas reserves are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible from a given date forward, from known reservoirs and under existing economic conditions, operating methods and government regulations. Prices include consideration of future price changes only to the extent provided by contractual arrangements in existence at year-end.

The current U.S. requirements permit, but do not require, the disclosure of probable reserves information. We are voluntarily providing reserves and production information for both proved and probable reserves. The SEC has defined probable reserves as those additional reserves that are less certain to be recovered than proved reserves, but which, together with proved reserves, are as likely as not to be recovered.

iii

GLOSSARY OF CERTAIN TERMS AND DEFINITIONS

Certain other terms used herein but not defined herein are defined in NI 51-101 and SEC regulations and, unless the context otherwise requires, shall have the same meanings herein as in SEC regulations.

"6.40% Debentures Due 2012" means the 6.40% convertible unsecured subordinated debentures of Harvest Operations due October 31, 2012.

"7.25% Debentures Due 2013" means the 7.25% convertible unsecured subordinated debentures of Harvest Operations due September 30, 2013.

"7.25% Debentures Due 2014" means the 7.25% convertible unsecured subordinated debentures of Harvest Operations due February 28, 2014.

"7.50% Debentures Due 2015" means the 7.50% convertible unsecured subordinated debentures of Harvest Operations due May 31, 2015.

"77/8% Senior Notes" means the Corporation's 77/8% Senior Notes due 2011.

"ABCA" means theBusiness Corporations Act (Alberta), together with any or all regulations promulgated thereunder, as amended from time to time.

"BlackGold" means the BlackGold oil sands project acquired by the Corporation from KNOC on August 6, 2010, more fully described in Note 26 of the Corporation's audited consolidated financial statements for the year ended December 31, 2011 included in this registration statement.

"Breeze Trust No. 1" means Harvest Breeze Trust No. 1, a trust established under the laws of the Province of Alberta, wholly owned by Harvest Operations.

"Breeze Trust No. 2" means Harvest Breeze Trust No. 2, a trust established under the laws of the Province of Alberta, wholly owned by Harvest Operations.

"Canadian GAAP" means accounting principles generally accepted in Canada.

"COGE Handbook" means the Canadian Oil and Gas Evaluation Handbook prepared jointly by the Society of Petroleum Evaluation Engineers (Calgary chapter) and the Canadian Institute of Mining, Metallurgy & Petroleum.

"Credit Facility" means the $800 million revolving credit facility, as amended, provided by a syndicate of lenders to Harvest Operations as more fully described in Note 10 of the Corporation's audited consolidated financial statements for the year ended December 31, 2011 included in this registration statement.

"Debentures" means, collectively, the 6.40% Debentures Due 2012, the 7.25% Debentures Due 2013, the 7.25% Debentures Due 2014 and the 7.50% Debentures Due 2015.

"Debenture Indenture" means (i) the trust indenture dated January 29, 2004 among Harvest Operations and Valiant Trust Company, as trustee, providing for the issue of debentures, as supplemented by the third supplemental indenture dated November 22, 2006 in respect of the 7.25% Debentures Due 2013, the fourth supplemental indenture dated February 1, 2007 in respect of the 7.25% Debentures Due 2014, the fifth supplemental indenture dated April 25, 2008 in respect of the 7.50% Debentures Due 2015, the sixth supplemental indenture dated April 30, 2010 and the seventh supplemental indenture dated May 1, 2010 and (ii) the trust indenture dated January 15, 2003 between VERT and Computershare Trust Company of Canada as trustee, providing for the issue of debentures, as supplemented by the first supplemental indenture dated October 20, 2005 in respect of the 6.40% Debentures Due 2012, the second supplemental indenture dated February 3, 2006, the third supplemental indenture dated April 30, 2010 and the fourth supplemental indenture dated May 1, 2010.

iv

"Downstream" means the Corporation's petroleum refining and marketing segment operating under the North Atlantic trade name, comprised of a medium gravity sour crude hydrocracking refinery with a 115,000 bbls/d nameplate capacity and a marketing division with 55 gasoline outlets, 3 commercial cardlock locations, a retail heating fuels business and a commercial and wholesale petroleum products business, predominantly located in the Province of Newfoundland and Labrador.

"EPC" means engineering, procurement and construction.

"Farmout" means an agreement whereby a third party agrees to pay for all or a portion of the drilling of a well on one or more of the Properties in order to earn an interest therein.

"Future Net Revenue" means the estimated net amount to be received with respect to the development and production of reserves computed by deducting, from estimated future revenues, estimated future royalty obligations, costs related to the development and production of reserves and abandonment and reclamation costs (corporate general and administrative expenses and financing costs are not deducted).

"GLJ" means GLJ Petroleum Consultants Ltd., independent oil and natural gas reserves evaluators of Calgary, Alberta.

"Gross" means:

- (a)

- in relation to Harvest and the Operating Subsidiaries' interest in production and reserves, its "Corporation gross reserves", which are Harvest and the Operating Subsidiaries' interest (operating and non-operating) share before deduction of royalties and without including any royalty interest of Harvest and the Operating Subsidiaries;

- (b)

- in relation to wells, the total number of wells in which Harvest and the Operating Subsidiaries have an interest; and

- (c)

- in relation to properties, the total area of properties in which Harvest and the Operating Subsidiaries have an interest.

"Harvest Board" means the board of directors of Harvest Operations.

"Harvest Operations" means Harvest Operations Corp., a corporation amalgamated under the laws of the Province of Alberta.

"Independent Reserves Evaluators" means McDaniel and GLJ, who evaluated the crude oil, natural gas liquids and natural gas reserves of Harvest and the Operating Subsidiaries as at December 31, 2011, in accordance with the standards contained in the COGE Handbook and the reserve definitions and other requirements contained in NI 51-101 and Rule 4-10 of Regulation S-X.

"IFRS" means International Financial Reporting Standards as issued by the International Accounting Standards Board ("IASB").

"KNOC" means Korea National Oil Corporation.

"KNOC Acquisition" means the purchase by KNOC Canada of all of the issued and outstanding Trust Units of the Trust for total consideration of approximately $1.8 billion and the assumption of approximately $2.3 billion of debt.

"KNOC Arrangement" means the plan of arrangement for the KNOC Acquisition implemented pursuant to Section 193 of the ABCA involving, among others, the Trust, Harvest Operations, KNOC Canada, KNOC and the holders of Trust Units, which became effective on December 22, 2009.

"KNOC Canada" means KNOC Canada Ltd., a corporation incorporated under the laws of the Province of Alberta.

v

"McDaniel" means McDaniel & Associates Consultants Ltd., independent oil and natural gas reserves evaluators of Calgary, Alberta.

"Net" means:

- (a)

- in relation to Harvest and the Operating Subsidiaries' interest in production and reserves, Harvest and the Operating Subsidiaries' interest (operating and non-operating) share after deduction of royalties obligations, plus Harvest and the Operating Subsidiaries' royalty interest in production or reserves;

- (b)

- in relation to wells, the number of wells obtained by aggregating Harvest and the Operating Subsidiaries' working interest in each of its gross wells; and

- (c)

- in relation to Harvest and the Operating Subsidiaries' interest in a property, the total area in which Harvest and the Operating Subsidiaries have an interest multiplied by the working interest owned by Harvest and the Operating Subsidiaries.

"NI 51-101" means National Instrument 51-101—Standards of Disclosure for Oil and Gas Activities.

"North Atlantic" means North Atlantic Refining Limited, a private company wholly owned by Harvest Operations, and all wholly owned subsidiaries of North Atlantic Refining Limited.

"Note Indenture" or "indenture" means the trust indenture made as of October 4, 2010 between U.S. Bank National Association as trustee thereunder and Harvest Operations, providing for the issuance of the notes.

"Operating Subsidiaries" means Redearth Partnership (prior to September 30, 2010), Breeze Resources Partnership, Breeze Trust No. 1, Breeze Trust No. 2, and Hay River Partnership, each (other than Redearth Partnership with respect to which the Corporation held a 60% interest prior to its dissolution) a direct or indirect wholly owned subsidiary of the Corporation, and "Operating Subsidiary" means any of them.

"Person" includes an individual, a body corporate, a trust, a union, a pension fund, a government and a governmental agency.

"Production" means, with respect to the Upstream operations the produced petroleum, natural gas and natural gas liquids attributed to the Properties and with respect to the Downstream operations, the production of refined petroleum products at the Refinery.

"Properties" means the working, royalty or other interests of Harvest and the Operating Subsidiaries in any petroleum and natural gas rights, tangibles and miscellaneous interests, including properties which may be acquired by Harvest and the Operating Subsidiaries from time to time.

"Purchase and Sale Agreement" means the purchase and sale agreement dated August 22, 2006 between the Corporation and Vitol Refining Group B.V. providing for the purchase of the outstanding shares of North Atlantic and the entering into of the Supply and Offtake Agreement.

"Redearth Partnership" means the general partnership formed on August 23, 2002 under the laws of the Province of Alberta. In September 2010 Harvest acquired 100% ownership interest, thereafter, Redearth Partnership was dissolved and Harvest Operations became the owner of all the assets and assumed all of the liabilities of the Redearth Partnership.

"Refinery" means the 115,000 barrel per day medium gravity sour crude hydrocracking refinery located in the Province of Newfoundland and Labrador, owned by North Atlantic Refining Limited.

"Reserves Report" means, collectively, the reports prepared by the Independent Reserve Evaluators evaluating the crude oil, natural gas liquids and natural gas reserves of Harvest and the Operating Subsidiaries as at December 31, 2011, in accordance with the standards contained in the COGE

vi

Handbook and the reserve definitions and other requirements contained in NI 51-101 and SEC regulations.

"SEC" means the United States Securities and Exchange Commission.

"Supply and Offtake Agreement" or "SOA" means the supply and offtake agreement dated October 19, 2006 and as amended October 12, 2009 entered into between North Atlantic and Vitol Refining, S.A. ("Vitol").

"Supply and Offtake Agreement (2011)" or "SOA (2011)" means the supply and offtake agreement dated October 11, 2011 and as amended December 19, 2011 entered into between North Atlantic and Macquarie Energy Canada Ltd. ("MEC").

"Trust" means Harvest Energy Trust.

"Trust Unit" means a trust unit of the Trust and unless the context otherwise requires means ordinary Trust Units of the Trust.

"Trustee" means U.S. Bank National Association in its capacity as trustee under the Note Indenture.

"TSX" means the Toronto Stock Exchange.

"Upstream" means Harvest's petroleum and natural gas segment, consisting of the exploitation, production and subsequent sale of petroleum, natural gas and natural gas liquids in Alberta, Saskatchewan and British Columbia.

"U.S. GAAP" means accounting principles generally accepted in the United States.

"Viking" means Viking Holdings Inc., an amalgamation predecessor of Harvest Operations.

"Working Interest" means an undivided interest held by a party in an oil and/or natural gas or mineral lease granted by a Crown or freehold mineral owner, which interest gives the holder the right to "work" the property (lease) to explore for, develop, produce and market the lease substances but does not include, among other things, a royalty, overriding royalty, gross overriding royalty, net profits interest or other interest that entitles the holder thereof to a share of production or proceeds of sale of production without a corresponding right or obligation to "work" the property.

vii

The following terms have the following meanings in this registration statement:

| | |

/d | | Per day |

3-D | | Three dimensional |

AECO | | AECO "C" hub price index for Alberta natural gas |

API | | The measure of the density or gravity of liquid petroleum products |

boe | | Barrel of oil equivalent, using the conversion factor of 6 mcf of natural gas being equivalent to one bbl of oil, unless otherwise specified. Boes may be misleading, particularly if used in isolation. A boe conversion ratio of 6 mcf:1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead |

bbl | | Barrel |

bbls | | Barrels |

EOR | | Enhanced oil recovery |

GJ | | Gigajoule |

H2S | | Hydrogen sulfide gas |

Mbbls | | Thousand barrels |

Mboe | | Thousand barrels of oil equivalent |

mcf | | Thousand cubic feet |

MMboe | | Million barrels of oil equivalent |

MMcf | | Million cubic feet |

NGLs | | Natural gas liquids |

SAGD | | Steam-assisted gravity drainage is an enhanced oil recovery technology for producing heavy crude oil and bitumen |

WTI | | West Texas Intermediate, the reference price in U.S. dollars at Cushing, Oklahoma for crude oil of standard grade |

$000 | | Thousands of dollars |

$millions | | Millions of dollars |

The following table sets forth certain conversions between Standard Imperial Units and the International System of Units (or metric units).

| | | | |

To Convert From | | To | | Multiply By |

|---|

mcf | | cubic metres | | 28.174 |

cubic metres | | cubic feet | | 35.494 |

bbls | | cubic metres | | 0.159 |

feet | | metres | | 0.305 |

metres | | feet | | 3.281 |

miles | | kilometres | | 1.609 |

kilometres | | miles | | 0.621 |

acres | | hectares | | 0.405 |

hectares | | acres | | 2.471 |

viii

PROSPECTUS SUMMARY

This summary may not contain all of the information that may be important to you. You should read this prospectus carefully in its entirety before making an investment decision. In particular, you should read the sections entitled "Risk Factors" and "Special Note Regarding Forward-Looking Statements" included elsewhere in this prospectus, as well as the audited consolidated financial statements and notes thereto and related Management's Discussion and Analysis of Financial Condition and Results of Operations included elsewhere in this prospectus.

Unless we state otherwise or the context otherwise requires, the terms (i) "we," "us," "our," "Harvest," and the "Corporation," refer to Harvest Operations Corp. and its subsidiaries, (ii) "Harvest Operations" refers to Harvest Operations Corp. and not its subsidiaries and (iii) "Harvest Energy Trust" refers to Harvest Energy Trust and its subsidiaries.

As used in this prospectus, the term "initial notes" refers to the 67/8% Senior Notes due 2017 that were issued on October 4, 2010 in a private offering, and the term "exchange notes" refers to the 67/8% Senior Notes due 2017 offered under this prospectus. The term "notes" refers to the initial notes and the exchange notes, collectively. Certain additional terms used in this prospectus are defined in "Glossary of Certain Terms and Definitions".

Overview

Harvest Operations was incorporated under the ABCA on May 14, 2002. All of the issued and outstanding common shares of Harvest Operations are owned by KNOC. Established in 1979, KNOC is a leading international oil and gas exploration and production company wholly owned by the Government of Korea. KNOC's founding principle is to secure oil supplies for the nation of Korea by exploring for and developing oilfields and holding petroleum reserves. As at December 31, 2011, Harvest's gross proved reserves represented approximately 39% of KNOC's gross proved reserves. Additionally, Harvest's crude oil and natural gas production represented 29% of KNOC's consolidated 2011 petroleum and natural gas production.

Harvest is a significant operator in Canada's energy industry offering stakeholders exposure to an integrated structure with Upstream (exploration, development and production of crude oil, bitumen and natural gas) and Downstream (refining and marketing of distillate, gasoline and fuel oil) segments. Harvest's Upstream oil and gas production is complemented by our long-life refining business that focuses on the safe and efficient operation of a medium gravity sour-crude refinery located in the Province of Newfoundland and Labrador and the associated retail and marketing operations.

Harvest Operations manages the affairs of the Operating Subsidiaries and North Atlantic, and is responsible for providing all of the technical, engineering, geological, land management, financial, administrative and commodity marketing services relating to Harvest's Upstream operations.

In the Upstream Operations, Harvest employs a disciplined approach to acquiring, developing and operating large resource-in-place producing properties using best-in-class technologies. Harvest's Upstream operations are located in the Western Canadian sedimentary basin. Harvest has a high degree of operational control as it is the operator of properties that generate the majority of Harvest's production. The Corporation believes that this "hands on" approach allows it to better manage capital expenditures and accumulate institutional expertise in its operating regions.

Harvest's Downstream business, operating under the North Atlantic trade name, is comprised of a medium gravity sour crude oil hydrocracking refinery with a 115,000 barrels per stream day nameplate capacity and a petroleum marketing business that is composed of five business segments. The Downstream operations are predominantly located in the Province of Newfoundland and Labrador.

1

Refining is primarily a margin based business in which the feedstocks and the refined products are commodities. Both crude oil and refined products in each regional market react to a different set of supply/demand and transportation pressures and refiners must balance a number of competing factors in deciding what type of crude oil to process, what kind of equipment to invest in and what range of products to manufacture. As most refinery operating costs are relatively fixed, the goal is to maximize the yield of high value refined products and to minimize crude oil and other feedstock costs. The value and yield of refined products are a function of the refinery equipment and the characteristics of the crude oil feedstock, while the cost of feedstock depends on the type of crude oil. The refining industry depends on its ability to earn an acceptable rate of return in its marketplace where prices are set by international as well as local markets.

Recent Developments

In 2011, Harvest issued $505.4 million of equity to KNOC to fund the acquisition of assets from Hunt Oil Company of Canada Inc. and Hunt Oil Alberta Inc. (collectively "Hunt"). See "Business—Recent Developments."

On April 29, 2011, Harvest extended the term of the Credit Facility by two years to April 30, 2015. On December 16, 2011, the Credit Facility was further amended to increase the capacity of the facility from $500 million to $800 million. Under the Credit Facility, Harvest and certain subsidiaries (designated as restricted subsidiaries) have provided the lenders security over all of the assets of Harvest Operations and of the restricted subsidiaries, excluding the BlackGold assets.

2

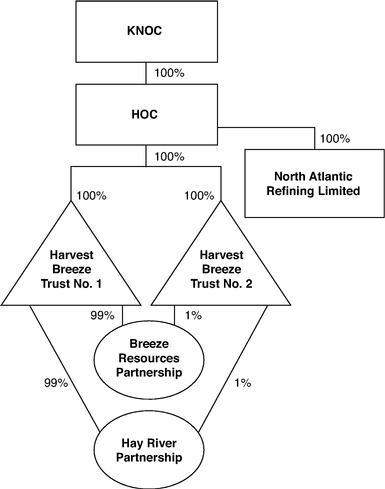

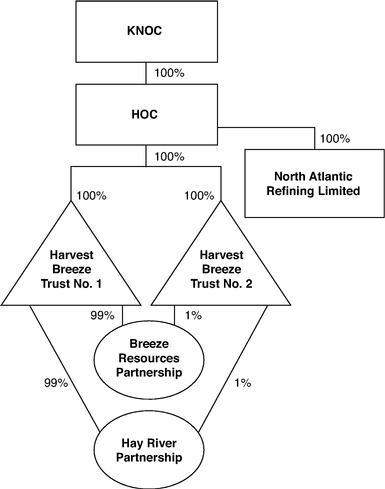

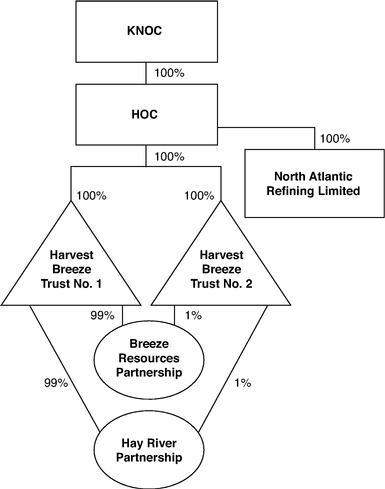

Corporate Structure

Harvest is a wholly owned subsidiary of KNOC. The corporate structure including significant subsidiaries is set forth below. Harvest's remaining subsidiaries and partnerships did not have assets or sales and operating revenues which, in the aggregate, exceeded 20 percent of the total consolidated assets or total consolidated sales and operating revenues of Harvest as at and for the year ended March 31, 2012:

Additional Information

The head and principal office of Harvest is located at Suite 2100, 330 - 5th Avenue S.W., Calgary, Alberta T2P 0L4 and the telephone number is (403) 265-1178. The registered office of Harvest is located at Suite 4500, Bankers Hall East 855 - 2nd Street S.W., Calgary, Alberta T2P 4K7.

3

Summary of the Exchange Offer

| | |

Exchange Offer | | We are offering to exchange US$500,000,000 aggregate principal amount of our exchange notes for a like aggregate principal amount of our initial notes. In order to exchange your initial notes, you must properly tender them and we must accept your tender. We will exchange all outstanding initial notes that are properly tendered and not validly withdrawn. |

Expiration Date | | This exchange offer will expire at 5:00 p.m., New York City time, on August 1, 2012, unless we decide to extend it. |

Conditions to the

Exchange Offer | | We will complete this exchange offer only if: |

| | • there is no change in the laws and regulations which would impair our ability to proceed with this exchange offer; |

| | • there is no change in the current interpretation of the staff of the SEC permitting resales of the exchange notes; and |

| | • there is no stop order issued by the SEC that would suspend the effectiveness of the registration statement which includes this prospectus or the qualification of the exchange notes under the Trust Indenture Act of 1939. |

| | Please refer to the section in this prospectus entitled "The Exchange Offer—Conditions to the Exchange Offer." |

Procedures for Tendering

Initial Notes | | To participate in this exchange offer, you must complete, sign and date the letter of transmittal or its facsimile and transmit it, together with your initial notes to be exchanged and all other documents required by the letter of transmittal, to U.S. Bank National Association, as exchange agent, at its address indicated under "The Exchange Offer—Exchange Agent." In the alternative, you can tender your initial notes by book-entry delivery following the procedures described in this prospectus. For more information on tendering your notes, please refer to the section in this prospectus entitled "The Exchange Offer—Procedures for Tendering Initial Notes." |

Special Procedures for

Beneficial Owners | | If you are a beneficial owner of initial notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your initial notes in the exchange offer, you should contact the registered holder promptly and instruct that person to tender on your behalf. |

Guaranteed Delivery

Procedures | | If you wish to tender your initial notes and you cannot get the required documents to the exchange agent on time, you may tender your notes by using the guaranteed delivery procedures described under the section of this prospectus entitled "The Exchange Offer—Procedures for Tendering Initial Notes—Guaranteed Delivery Procedure." |

| | |

4

| | |

Withdrawal Rights | | You may withdraw the tender of your initial notes at any time before 5:00 p.m., New York City time, on the expiration date of the exchange offer. To withdraw, you must send a written or facsimile transmission notice of withdrawal to the exchange agent at its address indicated under "The Exchange Offer—Exchange Agent" before 5:00 p.m., New York City time, on the expiration date of the exchange offer. |

Acceptance of Initial

Notes and Delivery of

Exchange Notes | | If all the conditions to the completion of this exchange offer are satisfied, we will accept any and all initial notes that are properly tendered in this exchange offer on or before 5:00 p.m., New York City time, on the expiration date. We will return any initial note that we do not accept for exchange to you without expense promptly after the expiration date. We will deliver the exchange notes to you promptly after the expiration date and acceptance of your initial notes for exchange. Please refer to the section in this prospectus entitled "The Exchange Offer—Acceptance of Initial Notes for Exchange; Delivery of Exchange Notes." |

Federal Income Tax

Considerations Relating

to the Exchange Offer | | Exchanging your initial notes for exchange notes will not be a taxable event to you for Canadian or United States federal income tax purposes. Please refer to the section of this prospectus entitled "Federal Income Tax Considerations." |

Exchange Agent | | U.S. Bank National Association is serving as exchange agent in the exchange offer. |

Fees and Expenses | | We will pay the expenses related to this exchange offer. Please refer to the section of this prospectus entitled "The Exchange Offer—Fees and Expenses." |

Use of Proceeds | | We will not receive any proceeds from the issuance of the exchange notes. We are making this exchange offer solely to satisfy certain of our obligations under our registration rights agreement entered into with Banc of America Securities LLC, HSBC Securities (USA) Inc., CIBC World Markets Corp., Mitsubishi UFJ Securities (USA) Inc., NBF Securities (USA) Corp., Scotia Capital (USA) Inc. and TD Securities (USA) LLC, which we refer to as the registration rights agreement, in connection with the offering of the initial notes. |

Consequences to Holders

Who Do Not Participate

in the Exchange Offer | | If you do not participate in this exchange offer: |

| | • except as set forth in the next paragraph, you will not necessarily be able to require us to register your initial notes under the Securities Act; |

| | • you will not be able to resell, offer to resell or otherwise transfer your initial notes unless they are registered under the Securities Act or unless you resell, offer to resell or otherwise transfer them under an exemption from the registration requirements of, or in a transaction not subject to, registration under the Securities Act; and |

5

| | |

| | • the trading market for your initial notes will become more limited to the extent other holders of initial notes participate in the exchange offer. |

| | You will not be able to require us to register your initial notes under the Securities Act unless: |

| | • you are prohibited by law or SEC policy from participating in the exchange offer; |

| | • you may not resell the exchange notes you acquire in the exchange offer to the public without delivering a prospectus and that the prospectus contained in the exchange offer registration statement is not appropriate or available for such resales by you; or |

| | • you are a broker-dealer and hold initial notes acquired directly from us or one of our affiliates. |

| | In these cases, the registration rights agreement requires us to file a registration statement for a continuous offering in accordance with Rule 415 under the Securities Act for the benefit of the holders of the initial notes described in this paragraph. We do not currently anticipate that we will register under the Securities Act any notes that remain outstanding after completion of the exchange offer. |

| | Please refer to the section of this prospectus entitled "The Exchange Offer—Your Failure to Participate in the Exchange Offer Will Have Adverse Consequences." |

Resales | | It may be possible for you to resell the notes issued in the exchange offer without compliance with the registration and prospectus delivery provisions of the Securities Act, subject to the conditions described under "—Obligations of Broker-Dealers" below. |

| | To tender your initial notes in this exchange offer and resell the exchange notes without compliance with the registration and prospectus delivery requirements of the Securities Act, you must make the following representations: |

| | • you are authorized to tender the initial notes and to acquire exchange notes, and that we will acquire good and unencumbered title to those initial notes; |

| | • the exchange notes acquired by you are being acquired in the ordinary course of business; |

| | • you have no arrangement or understanding with any person to participate in a distribution of the exchange notes and are not participating in, and do not intend to participate in, the distribution of such exchange notes; |

| | • you are not an "affiliate," as defined in Rule 405 under the Securities Act, of ours, or you will comply with the registration and prospectus delivery requirements of the Securities Act to the extent applicable; |

| | • if you are not a broker-dealer, you are not engaging in, and do not intend to engage in, a distribution of exchange notes; and |

6

| | |

| | • if you are a broker-dealer, initial notes to be exchanged were acquired by you as a result of market-making or other trading activities and you will deliver a prospectus in connection with any resale, offer to resell or other transfer of such exchange notes. |

| | Please refer to the sections of this prospectus entitled "The Exchange Offer—Procedure for Tendering Initial Notes—Proper Execution and Delivery of Letters of Transmittal," "Risk Factors—Risks Relating to the Exchange Offer—Some persons who participate in the exchange offer must deliver a prospectus in connection with resales of the exchange notes" and "Plan of Distribution." |

Obligations of Broker-

Dealers | | If you are a broker-dealer (1) who receives exchange notes, you must acknowledge that you will deliver a prospectus in connection with any resales of the exchange notes, (2) who acquired the initial notes as a result of market making or other trading activities, you may use the exchange offer prospectus as supplemented or amended, in connection with resales of the exchange notes, or (3) who acquired the initial notes directly from us in the initial offering and not as a result of market making and trading activities, you must, in the absence of an exemption, comply with the registration and prospectus delivery requirements of the Securities Act in connection with resales of the exchange notes. |

7

Summary of Terms of the Exchange Notes

| | |

Issuer | | Harvest Operations Corp. |

Exchange Notes | | Up to US$500 million aggregate principal amount of 67/8% Senior Notes due 2017. The form and terms of the exchange notes are the same as the form and terms of the initial notes except that the issuance of the exchange notes is registered under the Securities Act, the exchange notes will not bear legends restricting their transfer and the exchange notes will not be entitled to registration rights under our registration rights agreement. The exchange notes will evidence the same debt as the initial notes, and both the initial notes and the exchange notes will be governed by the same Note Indenture. |

Maturity | | October 1, 2017. |

Interest Payment Dates | | The exchange notes will bear interest at a rate per annum equal to 67/8% payable semi-annually, on April 1 and October 1 of each year, commencing on October 1, 2012. |

Ranking | | The exchange notes will rank equal in right of payment to all of our existing and future unsecured unsubordinated indebtedness and senior in right of payment to all future subordinated indebtedness, including our outstanding Debentures. The notes will be effectively subordinated to any of our existing and future secured indebtedness to the extent of the value of the assets securing such indebtedness. Additionally, the notes will be effectively subordinated to all liabilities, including trade payables, of any subsidiaries that are not guarantors. |

| | The exchange note guarantees will rank equal in right of payment with all existing and future unsecured unsubordinated indebtedness of the guarantors. In addition, the exchange note guarantees will be effectively subordinated to all of the guarantors' secured obligations to the extent of the collateral securing such obligations. |

| | As at March 31, 2012: |

| | • we had total indebtedness of approximately $1,767 million outstanding on a consolidated basis ($1,759 million net of deferred finance charges), 28.2% of which was represented by the initial notes, including $734.0 million principal amount of subordinated debt; |

| | • the guarantors guaranteed borrowings under our Credit Facility and the initial notes but had no additional indebtedness outstanding; and |

| | • on a combined basis, the subsidiaries that are not guaranteeing the notes would have had no indebtedness and other liabilities of $13.9 million. |

Optional Redemption | | We may redeem the exchange notes, in whole or in part, at any time at a redemption price equal to 100% of the principal amount thereof, plus a make whole redemption premium. |

| | See "Description of Notes—Optional Redemption." |

8

| | |

Tax Redemption | | The exchange notes may also be redeemed at our option, in whole but not in part, under certain circumstances relating to changes in applicable tax laws as described under "Description of Notes—Tax Redemption." |

Change of Control | | If we experience specific kinds of change of control, we must give holders the opportunity to sell their notes to us at a price of 101% of their principal amount, plus accrued and unpaid interest to the repurchase date. See "Description of Notes—Repurchase of Notes upon a Change of Control." |

Basic Covenants of the

Indenture | | The covenants contained in the Note Indenture, among other things, limit our ability and the ability of our restricted subsidiaries to: |

| | • incur additional indebtedness; |

| | • pay dividends or make other restricted payments; |

| | • enter into certain types of transactions with our affiliates; |

| | • allow our restricted subsidiaries to issue guarantees; |

| | • merge, consolidate or sell substantially all of our assets. |

| | These covenants are subject to a number of important exceptions, limitations and qualifications that are described under "Description of Notes—Certain Covenants." |

Use of Proceeds | | We will not receive any proceeds from the issuance of the exchange notes in exchange for the outstanding initial notes. We are making this exchange solely to satisfy our obligations under the registration rights agreement entered into in connection with the offering of the initial notes. |

Absence of a Public

Market for the Exchange

Notes | | The exchange notes are new securities with no established market for them. We cannot assure you that a market for these exchange notes will develop or that this market will be liquid. Please refer to the section of this prospectus entitled "Risk Factors—Risks Related to the Notes—Your ability to transfer the notes may be limited by the absence of an active trading market, and an active trading market may not develop for the notes." |

Form of the Exchange

Notes | | The exchange notes will be represented by one or more permanent global securities in registered form deposited on behalf of The Depository Trust Company, or DTC, with U.S. Bank National Association, as custodian. You will not receive exchange notes in certificated form unless one of the events described in the section of this prospectus entitled "Description of Notes—Book-Entry, Delivery and Form—Exchanges of Book-Entry Notes for Certificated Notes" occurs. Instead, beneficial interests in the exchange notes will be shown on, and transfers of these exchange notes will be effected only through, records maintained in book-entry form by DTC with respect to its participants. |

9

| | |

Risk Factors | | See "Risk Factors" beginning on page 14 for a discussion of factors you should carefully consider before deciding to invest in the exchange notes. |

For additional information regarding the notes, see the "Description of Notes" section of this prospectus.

10

Summary Historical Financial Information

The summary historical financial data presented below as at and for each of the three-month periods ended March 31, 2012 and March 31, 2011 have been derived from, and should be read together with, our unaudited interim consolidated financial statements and accompanying notes included elsewhere in this prospectus and other operational data. The summary historical financial data presented below as at and for each of the years in the two-year period ended December 31, 2011 have been derived from, and should be read together with, our audited consolidated financial statements and the accompanying notes included elsewhere in this prospectus. The unaudited and audited consolidated financial statements referred to above are reported in Canadian dollars and have been prepared in accordance with IFRS.

The summary historical financial data presented below are qualified in their entirety by the more detailed information appearing in our consolidated financial statements and the related notes, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and other financial information included elsewhere in this prospectus. Historical results are not necessarily indicative of results expected for any future period.

| | | | | | | |

In accordance with IFRS | | Three Months Ended March 31, | |

|---|

($000's, except where noted) | | 2012 | | 2011 | |

|---|

FINANCIAL | | | | | | | |

Revenues(1) | | | 1,426,140 | | | 1,248,924 | |

Cash from operating activities | | | 85,110 | | | 146,828 | |

Net income (loss) | | | (72,081 | ) | | 37,961 | |

Bank loan | | |

531,619 | | |

29,660 | |

Convertible debentures | | | 741,237 | | | 744,490 | |

Senior notes | | | 486,611 | | | 470,676 | |

| | | | | | |

Total financial debt(2) | | | 1,759,467 | | | 1,244,826 | |

Total assets | | |

6,322,250 | | |

6,041,118 | |

UPSTREAM OPERATIONS | | | | | | | |

Daily sales volumes (boe/d) | | | 60,550 | | | 53,331 | |

Average realized price | | | | | | | |

Oil and NGLs ($/bbl)(3) | | | 79.32 | | | 73.75 | |

Gas ($/mcf) | | | 2.29 | | | 3.83 | |

Operating netback prior to hedging ($/boe)(2) | | | 29.21 | | | 33.67 | |

Capital asset additions (excluding acquisitions) | | |

238,592 | | |

237,649 | |

Property and business acquisitions (dispositions), net | | | (1,988 | ) | | 515,496 | |

Abandonment and reclamation expenditures | | | 6,587 | | | 1,967 | |

Net wells drilled | | | 60.4 | | | 104.9 | |

Net undeveloped land acquired in business combinations (acres)(4) | | | — | | | 223,405 | |

Net undeveloped land additions (acres) | | | 44,931 | | | 53,480 | |

DOWNSTREAM OPERATIONS | | | | | | | |

Average daily throughput (bbl/d) | | | 100,000 | | | 97,438 | |

Average refining margin (US$/bbl) | | | 4.58 | | | 10.96 | |

Capital asset additions | | |

13,263 | | |

35,879 | |

- (1)

- Revenues are net of royalties and the effective portion of Harvest's realized crude oil hedges.

- (2)

- This is a non-GAAP measure; please refer to "Non-GAAP Financial Measures" in this prospectus.

- (3)

- Excludes the effect of risk management contracts designated as hedges.

- (4)

- Excludes carried interest lands acquired in business combinations.

11

| | | | | | | |

In accordance with IFRS | | Year Ended December 31, | |

|---|

($000's, except for per share amounts) | | 2011 | | 2010 | |

|---|

Income statement data | | | | | | | |

Net revenues | | | | | | | |

Upstream | | | 1,091,414 | | | 852,247 | |

Downstream | | | 3,239,455 | | | 3,105,957 | |

| | | | | | |

Total | | | 4,330,869 | | | 3,958,204 | |

| | | | | | |

Operating loss | | | (36,089 | ) | | (49,613 | ) |

Net loss | | | (104,657 | ) | | (81,163 | ) |

Net loss per common share | | | | | | | |

Basic | | | (0.28 | ) | | (0.27 | ) |

Diluted | | | (0.28 | ) | | (0.27 | ) |

Distributions/dividends declared | | |

— | | |

— | |

Distributions/dividends declared—U.S. dollars(1) | | | — | | | — | |

Distributions declared, per common share | | | — | | | — | |

| | | | | | | |

In accordance with IFRS | | As at December 31, | |

|---|

($000's) | | 2011 | | 2010 | |

|---|

Balance sheet data | | | | | | | |

Total assets | | | 6,284,370 | | | 5,388,740 | |

Net assets | | | 3,453,644 | | | 3,016,855 | |

Shareholder's capital | | | 3,860,786 | | | 3,355,350 | |

Temporary equity | | | — | | | — | |

Capital expenditures | | | | | | | |

Upstream | | | 1,246,148 | | | 953,674 | |

Downstream | | | 284,244 | | | 71,234 | |

| | | | | | |

Total | | | 1,530,392 | | | 1,024,908 | |

| | | | | | |

Share data | | | | | | | |

Weighted average common shares outstanding | | | | | | | |

Basic and diluted | | | 377,908,587 | | | 303,005,645 | |

| | | | | | | |

| | Year Ended December 31, | |

|---|

($000's) | | 2011 | | 2010 | |

|---|

Other Financial Information | | | | | | | |

EBITDA(2) | | | 617,819 | | | 518,520 | |

- (1)

- Translated using the average noon buying rate as disclosed in "Exchange Rate Information".

- (2)

- In evaluating EBITDA you should be aware that in the future we may incur charges and other items similar to those used in calculating EBITDA. EBITDA has limitations as an analytical tool and you should not consider it in isolation or as substitute for analysis of our results as reported under IFRS. Some of these limitations are:

- •

- it does not reflect every cash expenditure future cash requirements for taxes and capital expenditures or contractual commitments;

- •

- it does not reflect the significant interest expense or the cash requirements necessary to service interest or principal payments on our debt;

- •

- although depletion depreciation and amortization are non-cash charges the assets being depleted depreciated and amortized will often have to be replaced in the future and EBITDA does not reflect any cash requirements for such replacements; and

12

- •

- other companies in our industry may calculate these EBITDA differently than we do limiting its usefulness as comparative measure

You should compensate for these limitations by relying primarily on our IFRS results and using EBITDA only supplementally. See our consolidated financial statements and the related notes thereto included elsewhere in this prospectus. EBITDA is not intended as an alternative to net income as an indicator of our operating performance nor as an alternative to any other measure of performance in conformity with IFRS. You should therefore not place undue reliance on EBITDA or ratios calculated using that measure.

EBITDA is defined in Harvest's Credit Facility as earnings before finance costs, income tax expense or recovery, depletion, depreciation and amortization "DD&A", exploration and evaluation costs, impairment of assets, unrealized gains or losses on risk management contracts, unrealized gains or losses on foreign exchange, gains or losses on disposition of assets and other non-cash items. The following is a reconciliation of EBITDA to net loss, the nearest IFRS measure:

| | | | | | | | | | | |

| |

| | Twelve Months

Ended | | Twelve Months Ended December 31, | |

|---|

| | ($000's) | | March 31, 2012 | | 2011 | | 2010 | |

|---|

| | Net loss | | | (214,699 | ) | | (104,657 | ) | | (81,163 | ) |

| | DD&A | | | 657,007 | | | 626,698 | | | 553,732 | |

| | Unrealized (gains) losses on risk management contracts | | | 2,222 | | | (746 | ) | | (2,358 | ) |

| | Unrealized (gains) losses on foreign exchange | | | 9,408 | | | 2,555 | | | (1,875 | ) |

| | Unsuccessful exploration and evaluation costs | | | 15,824 | | | 17,757 | | | 2,858 | |

| | Impairment of PP&E | | | 21,843 | | | — | | | 13,661 | |

| | Gains on disposition of PP&E | | | (7,749 | ) | | (7,883 | ) | | (741 | ) |

| | Income tax recovery | | | (56,320 | ) | | (29,827 | ) | | (65,309 | ) |

| | Finance costs | | | 108,946 | | | 109,127 | | | 100,808 | |

| | Other non-cash items | | | (328 | ) | | 4,795 | | | (1,093 | ) |

| | | | | | | | | |

| | EBITDA(a) | | | 536,154 | | | 617,819 | | | 518,520 | |

| | | | | | | | | |

- (a)

- As stipulated by the Credit Facility, annualized EBITDA is a twelve month rolling EBITDA which also includes net income impact from acquisition or disposition as if the transaction had been effected at the beginning of the period. As such, the March 31, 2012 annualized EBITDA is $1.4 million lower than EBITDA and 2011 annualized EBITDA is $5.0 million (2010—$9.8 million) higher than EBITDA.

Earnings to Fixed Charges Ratio

The earnings to fixed charges ratios presented below have been derived from the consolidated financial statements prepared in accordance with IFRS for 2010 to 2012. For the years 2007 to 2009, the ratios have been derived using the figures from the consolidated financial statements prepared in accordance with Canadian GAAP as well as based on the figures resulting from the U.S. GAAP reconciliation. If the ratio indicates less than one-to-one coverage, the dollar amount of the deficiency has been disclosed.

| | | | | | | | | | |

| | Three Months

Ended | | Year Ended December 31, | |

|---|

| | March 31, 2012 | | 2011 | | 2010 | |

|---|

Earnings to fixed charges ratio(1) | | | — | | | — | | | — | |

Deficiency($000's) | | | 97,674 | | | 143,123 | | | 146,869 | |

| | | | | | | | | | |

| | (Previous Canadian GAAP)

Year Ended December 31, | |

|---|

| | 2009 | | 2008 | | 2007 | |

|---|

Earnings to fixed charges ratio(1) | | | — | | | 3.19 | | | 1.25 | |

Deficiency($000's) | | | 964,177 | | | nil | | | nil | |

| | | | | | | | | | |

| | (U.S. GAAP)

Year Ended December 31, | |

|---|

| | 2009 | | 2008 | | 2007 | |

|---|

Earnings to fixed charges ratio(1) | | | — | | | — | | | 1.86 | |

Deficiency($000's) | | | 694,364 | | | 1,347,230 | | | nil | |

- (1)

- This is a non-GAAP measure; please refer to "Non-GAAP Financial Measures" in this prospectus.

13

RISK FACTORS

Investing in the notes involves a high degree of risk. You should carefully consider the following factors in addition to the other information set forth in this prospectus before you decide to invest in the notes. The following risks could materially and adversely affect our ability to make payments with respect to the notes, our business or our financial condition or results of operations. In any such case, you may lose all or part of your original investment.

Risks Related to Our Indebtedness and the Notes

Our indebtedness may limit our financial and operating flexibility, and we may incur additional debt, which could increase the risks associated with our substantial indebtedness.

As at March 31, 2012, we had total indebtedness under the Credit Facility, our Debentures and the notes of approximately $1,767 million ($1,759 million net of deferred finance charges). Our substantial indebtedness could have material adverse consequences for our business, and may:

- •

- require us to dedicate a large portion of our cash flow to pay principal and interest on our indebtedness, which will reduce the availability of our cash flow to fund working capital, capital expenditures, research and development expenditures and other business activities;

- •

- increase our vulnerability to general adverse economic and industry conditions;

- •

- limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

- •

- restrict our ability to make strategic acquisitions or dispositions or exploit business opportunities;

- •

- place us at a competitive disadvantage compared to our competitors that have less debt; and

- •

- limit our ability to borrow additional funds (even when necessary to maintain adequate liquidity) or dispose of assets.

Under the Credit Facility, the Debentures Indenture and the Note Indenture, we may incur additional indebtedness. If new debt is added to our existing debt levels, the related risks that we now face would increase.

Variations in interest rates on our current and/or future financing arrangements may result in significant increases in our borrowing costs.

Harvest is permitted to borrow funds to finance the purchase of assets, incur capital expenditures, repay other obligations and finance working capital. Variations in interest rates could result in significant changes in the amount required to be applied to debt service.

Interest and principal amounts payable pursuant to notes will be payable in U.S. dollars. Harvest is permitted to borrow funds under the Credit Facility in U.S. dollars and would be required to settle interest and principal amounts in the same currency. Variations in the Canadian/U.S. currency exchange rate could result in a significant increase in the amount of the interest and principal payments under the notes and Credit Facility.

The notes and the guarantees will not be secured by any of our assets and therefore will be effectively subordinated to our existing and future secured indebtedness.

The notes and the guarantees will be general unsecured obligations ranking effectively junior in right of payment to all existing and future secured debt, including indebtedness under the Credit Facility, to the extent of the collateral securing such debt. In addition, the Note Indenture permits the incurrence of additional debt, some of which may be secured debt. In the event that we or a guarantor

14

is declared bankrupt, becomes insolvent or is liquidated or reorganized, creditors whose debt is secured by our or the guarantors' assets will be entitled to the remedies available to secured holders under applicable laws, including the foreclosure of the collateral securing such debt, before any payment may be made with respect to the notes or the affected guarantees. As a result, there may be insufficient assets to pay amounts due on the notes and holders of the notes may receive less, if anything, ratably, than holders of secured indebtedness. As of March 31, 2012, the total amount of secured debt that we had outstanding was $534.7 million ($531.6 million net of deferred finance charges), with approximately $265.3 million of undrawn borrowing capacity available under the Credit Facility. We may also incur additional senior secured indebtedness.

The notes are structurally subordinated to the existing and future liabilities of our subsidiaries that do not guarantee the notes to the extent of the assets of such non-guarantor subsidiaries.

Certain of our subsidiaries will not guarantee the notes. The notes will be structurally subordinated to all existing and future liabilities of our subsidiaries that do not guarantee the notes. Therefore, our rights and the rights of our creditors to participate in the assets of any subsidiary in the event that such a subsidiary is liquidated or reorganized are subject to the prior claims of such subsidiary's creditors. As a result, all indebtedness and other liabilities, including trade payables, of the non-guarantor subsidiaries, whether secured or unsecured, must be satisfied before any of the assets of such subsidiaries would be available for distribution, upon a liquidation or otherwise, to us in order for us to meet our obligations with respect to the notes. To the extent that we may be a creditor with recognized claims against any subsidiary, our claims would still be subject to the prior claims of such subsidiary's creditors to the extent that they are secured or senior to those held by us.

As of March 31, 2012, our non-guarantor subsidiaries had no indebtedness and approximately $14.0 million of other liabilities, including trade payables and accrued expenses. The non-guarantor subsidiaries represented approximately 2% of our consolidated revenues and approximately 0% of our consolidated EBITDA, respectively, for the twelve months ended March 31, 2012 and at March 31, 2012 represented approximately 0% of our consolidated assets (excluding intercompany receivables).

Our ability to generate the significant amount of cash needed to pay interest and principal on the notes and service our other debt and financial obligations and our ability to refinance all or a portion of our indebtedness or obtain additional financing depends on many factors beyond our control.

Our ability to make payments on and to refinance our indebtedness, including the notes, depends on our ability to generate cash in the future. We are subject to general economic, climatic, industry, financial, competitive, legislative, regulatory and other factors that are beyond our control. In particular, economic conditions could adversely affect our ability to repay our indebtedness, including the notes. As a result, we may need to refinance all or a portion of our indebtedness, including the notes, on or before maturity. Our ability to refinance debt or obtain additional financing will depend on, among other things:

- •

- our financial condition at the time;

- •

- restrictions in the Note Indenture and restrictions in the agreements governing our other indebtedness; and

- •

- other factors, including financial and capital markets or oil and natural gas industry conditions.

We may not be able to refinance any of our indebtedness, including the notes, on commercially reasonable terms, or at all. If our operations do not generate sufficient cash flow from operations, and additional borrowings or refinancings are not available to us, we may not have sufficient cash to enable us to meet all of our obligations, including payments on the notes. As well, to the extent that external capital, including debt financing, from banks or other creditors, becomes limited, unavailable or

15

available on less economic terms, Harvest's ability to fund the necessary capital investments to maintain, develop, and/or expand its petroleum and/or natural gas reserves, to continue construction on its BlackGold assets and to debottleneck its refinery operations will be impaired.

We may be unable to repurchase the notes upon a change of control.

Upon the occurrence of a Change of Control (as defined in the Note Indenture), we will be required to offer to repurchase all outstanding notes at a price of 101% of their principal amount plus accrued and unpaid interest. Any Change of Control also would constitute a default under the Credit Facility. Therefore, upon the occurrence of a Change of Control, the lenders under the Credit Facility would have the right to accelerate the payment obligations with respect to outstanding loans under the facility, and if so accelerated, we would be required to pay all of our outstanding obligations under such facility. Our source of funds for any such purchase of the notes will be available cash, cash generated from our subsidiaries or other sources, including borrowings, sales of assets or sales of equity. The sources of cash may not be adequate to permit us to repurchase the notes upon a Change of Control. Any failure on our part to offer to repurchase the notes, or to repurchase notes tendered following a Change of Control, may result in a default under the Note Indenture and may be an event of default under the agreements governing our other indebtedness. For further information, see "Description of Notes—Repurchase of Notes upon a Change of Control."

The terms of the Note Indenture provide only limited protection against significant events that could adversely impact your investment in the notes.

Upon the occurrence of a Change of Control you will have the right to require us to repurchase the notes as provided in the Note Indenture, and on the terms set forth in the notes. However, the Change of Control provisions will not afford you protection in the event of certain highly leveraged transactions that may adversely affect you. For example, any leveraged recapitalization, refinancing, restructuring or acquisition initiated by us generally will not constitute a Change of Control (as defined in the Note Indenture). As a result, we could enter into any such transaction even though the transaction could increase the total amount of our outstanding indebtedness, adversely affect our capital structure or credit rating or otherwise adversely affect the holders of the notes. If any such transaction were to occur, the value of your notes could decline. The Note Indenture does not contain any financial covenants or other provisions that would afford the holders of the notes any substantial protection in the event we participate in a highly leveraged transaction.

Certain laws may permit courts to void the guarantees of the notes in specific circumstances, which would interfere with the payment of the guarantees.

Under certain bankruptcy and fraudulent transfer laws, any guarantee of the notes made by any of our subsidiaries could be voided, or claims under the guarantee made by any of our subsidiaries could be subordinated to all other obligations of any such subsidiary, if the subsidiary, at the time it incurred the obligations under such guarantee:

- •

- incurred the obligations with the intent to hinder, delay or defraud creditors; or

- •

- received less than reasonably equivalent value in exchange for incurring those obligations; and

- (1)

- was insolvent or rendered insolvent by reason of that incurrence;

- (2)

- was engaged in a business or transaction for which the subsidiary's remaining assets constituted unreasonably small capital; or

- (3)

- intended to incur, or believed that it would incur, debts beyond our ability to pay those debts as they mature.

16

The Note Indenture limits the liability of each guarantor on its guarantee to the maximum amount that such guarantor could incur without risk that its guarantee would be subject to avoidance as a fraudulent transfer. However, this limitation may not protect such guarantees from fraudulent transfer challenges or, if it does, that the remaining amount due and collectible under the guarantees would suffice, if necessary, to pay the notes in full when due. In a recent Florida bankruptcy case, this kind of provision was found to be unenforceable and, as a result, the subsidiary guarantees in that case were found to be fraudulent conveyances. We do not know if that case will be followed if there is litigation on this point under the Note Indenture. However, if it is followed, the risk that the guarantees will be found to be fraudulent conveyances will be significantly increased.

A legal challenge to the obligations under any guarantee on fraudulent conveyance grounds could focus on any benefits received in exchange for the incurrence of those obligations. We believe that each of our subsidiaries making a guarantee received reasonably equivalent value for incurring the guarantee, but a court may disagree with our conclusion or elect to apply a different standard in making its determination. A court could thus void the obligations under a guarantee, subordinate it to a guarantor's other debt or take other action detrimental to the holders of the notes. The measures of insolvency for purposes of the fraudulent transfer laws vary depending on the law applied in the proceeding to determine whether a fraudulent transfer has occurred. Generally, however, an entity would be considered insolvent if:

- •

- the sum of its debts, including contingent liabilities, is greater than the fair saleable value of all of its assets;

- •

- the present fair saleable value of its assets is less than the amount that would be required to pay its probable liabilities on its existing debts, including contingent liabilities, as they become absolute and mature; or

- •

- it cannot pay its debts as they become due.

Your ability to transfer the exchange notes may be limited by the absence of an active trading market, and an active trading market may not develop for the exchange notes.

The exchange notes are a new issue of securities for which there is no established trading market. We do not intend to list the exchange notes on any national or regional securities exchange or seek approval for quotation through any automated quotation system. An active trading market may not develop for the exchange notes. Subsequent to their initial issuance, the exchange notes may trade at a discount from their initial offering price, depending upon prevailing interest rates, the market for similar notes, our operating performance and financial condition and other factors.

You might have difficulty enforcing your rights against us and our directors and officers.