UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22736

Columbia ETF Trust I

(Exact name of registrant as specified in charter)

290 Congress Street

Boston, MA 02210

(Address of principal executive offices) (Zip code)

Daniel J. Beckman

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, MA 02210

Ryan C. Larrenaga, Esq.

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, MA 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: (800) 345-6611

Date of fiscal year end: Last Day of March

Date of reporting period: September 30, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia Short Duration High Yield ETF

Semi-Annual Shareholder Report | September 30, 2024

This semi-annual shareholder report contains important information about Columbia Short Duration High Yield ETF (the Fund) for the period of September 5, 2024 to September 30, 2024. You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature. You can also request this information by contacting us at 1-800-426-3750.

What were the Fund costs for the reporting period?

(Based on a hypothetical $10,000 investment)

| Fund | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment |

|---|

| Columbia Short Duration High Yield ETF | $3Footnote Reference(a) | 0.44%Footnote Reference(b) |

| Footnote | Description |

Footnote(a) | Based on operations from September 5, 2024 (commencement of operations) through the stated period end. Had the Fund been open the entire reporting period, expenses shown in the table above would have been higher. |

Footnote(b) | Annualized. |

| Fund net assets | $26,235,078 |

| Total number of portfolio holdings | 269 |

| Portfolio turnover for the reporting period | 0% |

Columbia Short Duration High Yield ETF | SSR338_00_(11/24) | 1

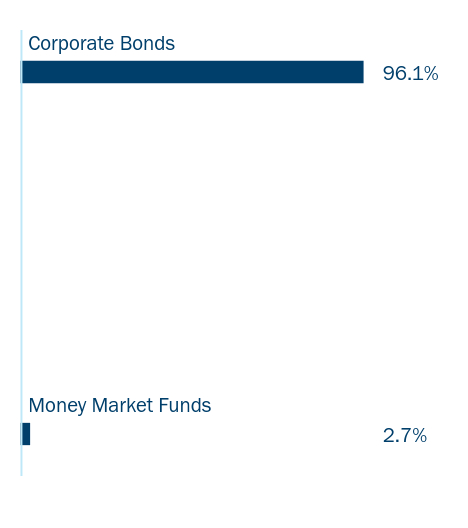

Graphical Representation of Fund Holdings

The tables below show the investment makeup of the Fund represented as a percentage of the Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund’s portfolio composition is subject to change.

| CCO Holdings LLC / CCO Holdings Capital Corp. 02/01/2028 5.000% | 1.3% |

| Clearway Energy Operating LLC 03/15/2028 4.750% | 1.1% |

| Trivium Packaging Finance BV 08/15/2026 5.500% | 1.0% |

| Six Flags Entertainment Corp. 04/15/2027 5.500% | 1.0% |

| Cloud Software Group, Inc. 03/31/2029 6.500% | 1.0% |

| Ziggo Bond Co. BV 01/15/2027 6.000% | 0.8% |

| Hudbay Minerals, Inc. 04/01/2026 4.500% | 0.8% |

| 1011778 BC ULC / New Red Finance, Inc. 01/15/2028 4.375% | 0.8% |

| Carnival Corp. 03/01/2027 5.750% | 0.8% |

| TransDigm, Inc. 03/01/2029 6.375% | 0.8% |

| Value | Value |

|---|

| Money Market Funds | 2.7% |

| Corporate Bonds | 96.1% |

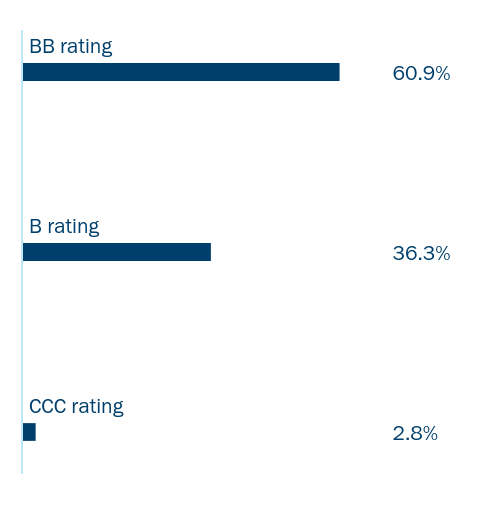

Credit Quality Allocation

| Value | Value |

|---|

| CCC rating | 2.8% |

| B rating | 36.3% |

| BB rating | 60.9% |

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s Ratings, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. If a security is not rated by Moody's Ratings, S&P and Fitch, but has a rating by Kroll and/or DBRS, the same methodology is applied to those bonds that would otherwise be not rated. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, federal tax information and proxy voting information, visit the Fund’s website included at the beginning of this report or scan the QR code below.

Columbia Management Investment Advisers, LLC serves as the investment manager to the ETFs. The ETFs are distributed by ALPS Distributors, Inc., which is not affiliated with Columbia Management Investment Advisers, LLC, or its parent company, Ameriprise Financial, Inc.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

© 2024 Columbia Management Investment Advisers, LLC.

Not FDIC or NCUA Insured • No Financial Institution Guarantee • May Lose Value

Columbia Short Duration High Yield ETF | SSR338_00_(11/24) | 2

Columbia U.S. High Yield ETF

Semi-Annual Shareholder Report | September 30, 2024

This semi-annual shareholder report contains important information about Columbia U.S. High Yield ETF (the Fund) for the period of September 5, 2024 to September 30, 2024. You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature. You can also request this information by contacting us at 1-800-426-3750.

What were the Fund costs for the reporting period?

(Based on a hypothetical $10,000 investment)

| Fund | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment |

|---|

| Columbia U.S. High Yield ETF | $3Footnote Reference(a) | 0.46%Footnote Reference(b) |

| Footnote | Description |

Footnote(a) | Based on operations from September 5, 2024 (commencement of operations) through the stated period end. Had the Fund been open the entire reporting period, expenses shown in the table above would have been higher. |

Footnote(b) | Annualized. |

| Fund net assets | $26,298,159 |

| Total number of portfolio holdings | 427 |

| Portfolio turnover for the reporting period | 0% |

Columbia U.S. High Yield ETF | SSR339_00_(11/24) | 1

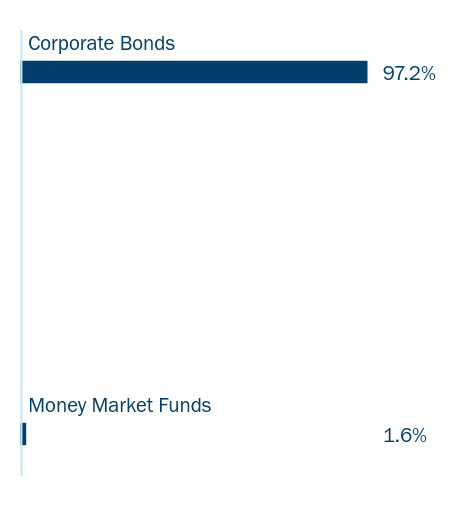

Graphical Representation of Fund Holdings

The tables below show the investment makeup of the Fund represented as a percentage of the Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund’s portfolio composition is subject to change.

| TransDigm, Inc. 03/01/2029 6.375% | 0.8% |

| CCO Holdings LLC / CCO Holdings Capital Corp. 02/01/2031 4.250% | 0.7% |

| Cloud Software Group, Inc. 09/30/2029 9.000% | 0.6% |

| Tenet Healthcare Corp. 11/01/2027 5.125% | 0.5% |

| Cloud Software Group, Inc. 03/31/2029 6.500% | 0.5% |

| CCO Holdings LLC / CCO Holdings Capital Corp. 01/15/2034 4.250% | 0.5% |

| CCO Holdings LLC / CCO Holdings Capital Corp. 05/01/2032 4.500% | 0.5% |

| Howard Midstream Energy Partners LLC 07/15/2028 8.875% | 0.4% |

| Starwood Property Trust, Inc. 04/01/2029 7.250% | 0.4% |

| Nexstar Media, Inc. 07/15/2027 5.625% | 0.4% |

| Value | Value |

|---|

| Money Market Funds | 1.6% |

| Corporate Bonds | 97.2% |

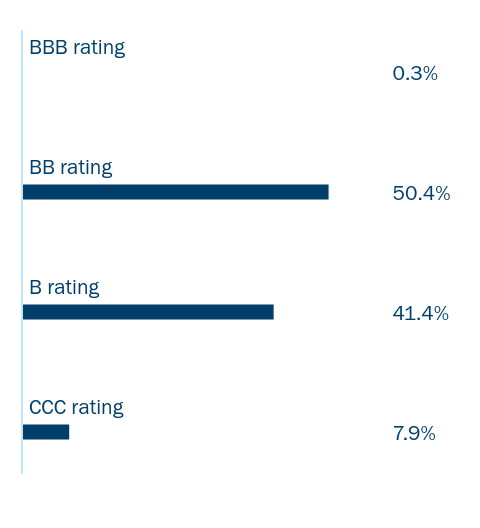

Credit Quality Allocation

| Value | Value |

|---|

| CCC rating | 7.9% |

| B rating | 41.4% |

| BB rating | 50.4% |

| BBB rating | 0.3% |

Bond ratings on Fund holdings are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s Ratings, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. If a security is not rated by Moody's Ratings, S&P and Fitch, but has a rating by Kroll and/or DBRS, the same methodology is applied to those bonds that would otherwise be not rated. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily.

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, federal tax information and proxy voting information, visit the Fund’s website included at the beginning of this report or scan the QR code below.

Columbia Management Investment Advisers, LLC serves as the investment manager to the ETFs. The ETFs are distributed by ALPS Distributors, Inc., which is not affiliated with Columbia Management Investment Advisers, LLC, or its parent company, Ameriprise Financial, Inc.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

© 2024 Columbia Management Investment Advisers, LLC.

Not FDIC or NCUA Insured • No Financial Institution Guarantee • May Lose Value

Columbia U.S. High Yield ETF | SSR339_00_(11/24) | 2

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) The registrant’s “Schedule I – Investments in securities of unaffiliated issuers” (as set forth in 17 CFR 210.12-12) is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Not

FDIC

or

NCUA

Insured

No

Financial

Institution

Guarantee

May

Lose

Value

Semiannual

Financial

Statements

and

Additional

Information

September

30,

2024

(Unaudited)

Columbia

Short

Duration

High

Yield

ETF

Columbia

U.S.

High

Yield

ETF

Portfolio

of

Investments

3

Statement

of

Assets

and

Liabilities

18

Statement

of

Operations

19

Statement

of

Changes

in

Net

Assets

20

Financial

Highlights

21

Notes

to

Financial

Statements

23

Approval

of

Investment

Management

Services

Agreement

29

PORTFOLIO

OF

INVESTMENTS

Columbia

Short

Duration

High

Yield

ETF

September

30,

2024

(Unaudited)

(Percentages

represent

value

of

investments

compared

to

net

assets)

Investments

in

Securities

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

statement.

Corporate

Bonds

96.1%

Issue

Description

Principal

Amount

($)

Value

($)

Aerospace

&

Defense

2.0%

TransDigm,

Inc.

4.625%,

01/15/29

75,000

72,498

4.875%,

05/01/29

34,000

33,102

5.500%,

11/15/27

50,000

49,832

6.375%,

03/01/29

(a)

200,000

206,276

6.750%,

08/15/28

(a)

150,000

154,530

Total

516,238

Airlines

2.6%

Air

Canada

3.875%,

08/15/26

(a)

200,000

194,775

American

Airlines,

Inc.

8.500%,

05/15/29

(a)

125,000

132,539

American

Airlines,

Inc./AAdvantage

Loyalty

IP

Ltd.

5.500%,

04/20/26

(a)

72,917

72,701

5.750%,

04/20/29

(a)

75,000

74,903

United

Airlines,

Inc.

4.375%,

04/15/26

(a)

100,000

98,493

4.625%,

04/15/29

(a)

125,000

120,774

Total

694,185

Automotive

1.5%

Clarios

Global

LP

/

Clarios

US

Finance

Co.

6.750%,

05/15/28

(a)

125,000

128,856

IHO

Verwaltungs

GmbH

4.750%,

09/15/26

(a),(b)

50,000

49,213

6.000%,

05/15/27

(a),(b)

75,000

73,733

ZF

North

America

Capital,

Inc.

4.750%,

04/29/25

(a)

50,000

49,588

6.875%,

04/14/28

(a)

100,000

101,044

Total

402,434

Brokerage/Asset

Managers/Exchanges

1.0%

AG

Issuer

LLC

6.250%,

03/01/28

(a)

142,000

139,240

AG

TTMT

Escrow

Issuer

LLC

8.625%,

09/30/27

(a)

78,000

79,920

Aretec

Group,

Inc.

7.500%,

04/01/29

(a)

40,000

38,006

Total

257,166

Building

Materials

3.9%

American

Builders

&

Contractors

Supply

Co.,

Inc.

3.875%,

11/15/29

(a)

75,000

70,130

4.000%,

01/15/28

(a)

75,000

72,187

Beacon

Roofing

Supply,

Inc.

4.125%,

05/15/29

(a)

125,000

117,802

4.500%,

11/15/26

(a)

125,000

123,133

Interface,

Inc.

5.500%,

12/01/28

(a)

75,000

73,658

James

Hardie

International

Finance

DAC

5.000%,

01/15/28

(a)

181,000

179,304

Standard

Industries,

Inc.

4.750%,

01/15/28

(a)

100,000

97,949

5.000%,

02/15/27

(a)

151,000

149,887

Summit

Materials

LLC

/

Summit

Materials

Finance

Corp.

5.250%,

01/15/29

(a)

100,000

99,064

White

Cap

Buyer

LLC

6.875%,

10/15/28

(a)

50,000

50,489

Total

1,033,603

Cable

and

Satellite

4.4%

CCO

Holdings

LLC

/

CCO

Holdings

Capital

Corp.

5.000%,

02/01/28

(a)

350,000

340,563

5.125%,

05/01/27

(a)

75,000

73,769

Corporate

Bonds

(continued)

Issue

Description

Principal

Amount

($)

Value

($)

5.375%,

06/01/29

(a)

125,000

120,401

Sirius

XM

Radio,

Inc.

3.125%,

09/01/26

(a)

125,000

120,831

4.000%,

07/15/28

(a)

50,000

47,169

5.000%,

08/01/27

(a)

150,000

147,788

Virgin

Media

Secured

Finance

PLC

5.500%,

05/15/29

(a)

100,000

95,880

Ziggo

Bond

Co.

BV

6.000%,

01/15/27

(a)

200,000

199,893

Total

1,146,294

Chemicals

3.8%

Axalta

Coating

Systems

LLC

/

Axalta

Coating

Systems

Dutch

Holding

B

BV

4.750%,

06/15/27

(a)

75,000

74,438

Element

Solutions,

Inc.

3.875%,

09/01/28

(a)

100,000

95,299

HB

Fuller

Co.

4.250%,

10/15/28

75,000

71,932

INEOS

Finance

PLC

6.750%,

05/15/28

(a)

75,000

75,848

7.500%,

04/15/29

(a)

50,000

52,264

Ineos

Quattro

Finance

2

PLC

9.625%,

03/15/29

(a)

100,000

107,000

Ingevity

Corp.

3.875%,

11/01/28

(a)

50,000

46,887

Olympus

Water

US

Holding

Corp.

4.250%,

10/01/28

(a)

100,000

95,446

9.750%,

11/15/28

(a)

125,000

133,489

SNF

Group

SACA

3.125%,

03/15/27

(a)

75,000

71,338

WR

Grace

Holdings

LLC

4.875%,

06/15/27

(a)

125,000

123,168

5.625%,

08/15/29

(a)

50,000

46,963

Total

994,072

Construction

Machinery

2.2%

H&E

Equipment

Services,

Inc.

3.875%,

12/15/28

(a)

150,000

140,756

Herc

Holdings,

Inc.

5.500%,

07/15/27

(a)

175,000

174,817

6.625%,

06/15/29

(a)

75,000

77,710

Ritchie

Bros

Holdings,

Inc.

6.750%,

03/15/28

(a)

175,000

181,025

Total

574,308

Consumer

Cyclical

Services

2.2%

APX

Group,

Inc.

6.750%,

02/15/27

(a)

50,000

50,137

Arches

Buyer,

Inc.

4.250%,

06/01/28

(a)

175,000

160,941

ASGN,

Inc.

4.625%,

05/15/28

(a)

100,000

97,184

Match

Group

Holdings

II

LLC

4.625%,

06/01/28

(a)

205,000

199,318

Prime

Security

Services

Borrower

LLC

/

Prime

Finance,

Inc.

6.250%,

01/15/28

(a)

75,000

75,012

Total

582,592

Consumer

Products

1.8%

Acushnet

Co.

7.375%,

10/15/28

(a)

50,000

52,732

CD&R

Smokey

Buyer,

Inc.

/

Radio

Systems

Corp.

9.500%,

10/15/29

(a)

74,000

74,046

Newell

Brands,

Inc.

4.875%,

06/01/25

50,000

49,721

PORTFOLIO

OF

INVESTMENTS

(continued)

Columbia

Short

Duration

High

Yield

ETF

September

30,

2024

(Unaudited)

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

statement.

Corporate

Bonds

(continued)

Issue

Description

Principal

Amount

($)

Value

($)

5.700%,

04/01/26

75,000

75,190

6.375%,

09/15/27

75,000

76,036

Prestige

Brands,

Inc.

5.125%,

01/15/28

(a)

100,000

99,109

Scotts

Miracle-Gro

Co.

(The)

5.250%,

12/15/26

50,000

49,769

Total

476,603

Diversified

Manufacturing

2.8%

Esab

Corp.

6.250%,

04/15/29

(a)

50,000

51,417

Gates

Corp.

6.875%,

07/01/29

(a)

98,000

101,531

Madison

IAQ

LLC

5.875%,

06/30/29

(a)

50,000

48,718

Resideo

Funding,

Inc.

4.000%,

09/01/29

(a)

75,000

70,636

TK

Elevator

Holdco

GmbH

7.625%,

07/15/28

(a)

50,000

50,309

TK

Elevator

US

Newco,

Inc.

5.250%,

07/15/27

(a)

125,000

123,710

Velocity

Vehicle

Group

LLC

8.000%,

06/01/29

(a)

50,000

52,044

WESCO

Distribution,

Inc.

6.375%,

03/15/29

(a)

150,000

155,019

7.250%,

06/15/28

(a)

74,000

75,764

Total

729,148

Electric

5.1%

Clearway

Energy

Operating

LLC

4.750%,

03/15/28

(a)

309,000

303,280

NextEra

Energy

Operating

Partners

LP

3.875%,

10/15/26

(a)

125,000

121,729

4.500%,

09/15/27

(a)

75,000

73,277

7.250%,

01/15/29

(a)

125,000

131,757

NRG

Energy

Inc.

3.375%,

02/15/29

(a)

75,000

69,933

NRG

Energy,

Inc.

5.750%,

01/15/28

125,000

125,917

Pattern

Energy

Operations

LP

/

Pattern

Energy

Operations,

Inc.

4.500%,

08/15/28

(a)

50,000

48,324

TerraForm

Power

Operating

LLC

4.750%,

01/15/30

(a)

25,000

23,915

5.000%,

01/31/28

(a)

150,000

148,455

Vistra

Operations

Co.

LLC

5.000%,

07/31/27

(a)

175,000

173,880

5.625%,

02/15/27

(a)

125,000

124,839

Total

1,345,306

Environmental

0.6%

Waste

Pro

USA

Inc

5.500%,

02/15/26

(a)

150,000

149,479

Finance

Companies

4.8%

GGAM

Finance

Ltd.

6.875%,

04/15/29

(a)

75,000

78,076

8.000%,

02/15/27

(a)

125,000

130,679

8.000%,

06/15/28

(a)

25,000

26,814

Navient

Corp.

6.750%,

06/25/25

116,000

116,745

6.750%,

06/15/26

50,000

51,128

OneMain

Finance

Corp.

3.500%,

01/15/27

50,000

47,780

3.875%,

09/15/28

90,000

83,475

7.125%,

03/15/26

100,000

102,162

Corporate

Bonds

(continued)

Issue

Description

Principal

Amount

($)

Value

($)

9.000%,

01/15/29

25,000

26,487

Provident

Funding

Associates

LP

/

PFG

Finance

Corp.

6.375%,

06/15/25

(a)

100,000

100,004

9.750%,

09/15/29

(a)

54,000

55,019

Rocket

Mortgage

LLC

/

Rocket

Mortgage

Co.-Issuer,

Inc.

2.875%,

10/15/26

(a)

200,000

192,059

3.625%,

03/01/29

(a)

75,000

70,567

United

Wholesale

Mortgage

LLC

5.500%,

11/15/25

(a)

25,000

25,018

5.750%,

06/15/27

(a)

150,000

149,130

Total

1,255,143

Food

and

Beverage

1.9%

Darling

Ingredients,

Inc.

5.250%,

04/15/27

(a)

126,000

125,341

Post

Holdings,

Inc.

5.500%,

12/15/29

(a)

50,000

49,643

5.625%,

01/15/28

(a)

100,000

100,863

Triton

Water

Holdings,

Inc.

6.250%,

04/01/29

(a)

63,000

62,909

US

Foods,

Inc.

4.750%,

02/15/29

(a)

50,000

48,789

6.875%,

09/15/28

(a)

100,000

104,250

Total

491,795

Foreign

Government

Obligations

1.1%

NOVA

Chemicals

Corp.

4.250%,

05/15/29

(a)

75,000

69,735

5.250%,

06/01/27

(a)

50,000

49,465

8.500%,

11/15/28

(a)

150,000

160,316

Total

279,516

Gaming

1.4%

Caesars

Entertainment,

Inc.

4.625%,

10/15/29

(a)

100,000

95,161

7.000%,

02/15/30

(a)

50,000

52,244

Churchill

Downs,

Inc.

5.500%,

04/01/27

(a)

125,000

124,536

Light

&

Wonder

International,

Inc.

7.000%,

05/15/28

(a)

100,000

100,768

Total

372,709

Health

Care

6.2%

Acadia

Healthcare

Co.,

Inc.

5.000%,

04/15/29

(a)

75,000

71,475

5.500%,

07/01/28

(a)

101,000

98,345

Avantor

Funding,

Inc.

4.625%,

07/15/28

(a)

125,000

122,218

Bausch

+

Lomb

Corp.

8.375%,

10/01/28

(a)

50,000

52,887

Catalent

Pharma

Solutions,

Inc.

3.125%,

02/15/29

(a)

50,000

49,133

Charles

River

Laboratories

International,

Inc.

4.250%,

05/01/28

(a)

75,000

72,880

CHS/Community

Health

Systems,

Inc.

5.625%,

03/15/27

(a)

150,000

147,530

Encompass

Health

Corp.

4.500%,

02/01/28

25,000

24,536

5.750%,

09/15/25

26,000

25,934

IQVIA,

Inc.

5.000%,

10/15/26

(a)

100,000

99,749

Medline

Borrower

LP

3.875%,

04/01/29

(a)

125,000

118,339

5.250%,

10/01/29

(a)

125,000

122,651

PORTFOLIO

OF

INVESTMENTS

(continued)

Columbia

Short

Duration

High

Yield

ETF

September

30,

2024

(Unaudited)

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

statement.

Corporate

Bonds

(continued)

Issue

Description

Principal

Amount

($)

Value

($)

Medline

Borrower

LP/Medline

Co.-Issuer,

Inc.

6.250%,

04/01/29

(a)

125,000

128,902

Select

Medical

Corp.

6.250%,

08/15/26

(a)

125,000

125,795

Teleflex,

Inc.

4.625%,

11/15/27

25,000

24,646

Tenet

Healthcare

Corp.

4.625%,

06/15/28

50,000

49,116

5.125%,

11/01/27

175,000

174,482

6.125%,

10/01/28

125,000

126,036

Total

1,634,654

Home

Construction

0.4%

Taylor

Morrison

Communities,

Inc.

5.750%,

01/15/28

(a)

100,000

101,675

Independent

Energy

3.5%

Civitas

Resources,

Inc.

8.375%,

07/01/28

(a)

132,000

137,951

CNX

Resources

Corp.

6.000%,

01/15/29

(a)

50,000

50,275

Hilcorp

Energy

I

LP

/

Hilcorp

Finance

Co.

5.750%,

02/01/29

(a)

50,000

48,681

6.250%,

11/01/28

(a)

150,000

149,847

Matador

Resources

Co.

6.875%,

04/15/28

(a)

155,000

157,553

Permian

Resources

Operating

LLC

5.375%,

01/15/26

(a)

26,000

25,902

5.875%,

07/01/29

(a)

41,000

41,051

8.000%,

04/15/27

(a)

125,000

128,696

SM

Energy

Co.

6.750%,

08/01/29

(a)

125,000

125,493

Southwestern

Energy

Co.

5.375%,

02/01/29

50,000

49,796

Total

915,245

Leisure

7.9%

Boyne

USA,

Inc.

4.750%,

05/15/29

(a)

125,000

120,381

Carnival

Corp.

5.750%,

03/01/27

(a)

200,000

202,610

6.000%,

05/01/29

(a)

175,000

177,102

7.625%,

03/01/26

(a)

30,000

30,299

Cedar

Fair

LP

/

Canada's

Wonderland

Co.

/

Magnum

Management

Corp.

/

Millennium

Op

5.375%,

04/15/27

125,000

124,543

6.500%,

10/01/28

100,000

101,287

Cinemark

USA,

Inc.

5.250%,

07/15/28

(a)

181,000

177,950

Live

Nation

Entertainment,

Inc.

4.750%,

10/15/27

(a)

150,000

147,965

5.625%,

03/15/26

(a)

18,000

17,964

NCL

Corp.

Ltd.

5.875%,

03/15/26

(a)

125,000

125,024

5.875%,

02/15/27

(a)

100,000

100,301

Royal

Caribbean

Cruises

Ltd.

4.250%,

07/01/26

(a)

100,000

98,842

5.500%,

04/01/28

(a)

100,000

101,256

5.500%,

08/31/26

(a)

100,000

100,981

Six

Flags

Entertainment

Corp.

5.500%,

04/15/27

(a)

275,000

273,177

Viking

Cruises

Ltd.

5.875%,

09/15/27

(a)

75,000

74,871

Corporate

Bonds

(continued)

Issue

Description

Principal

Amount

($)

Value

($)

7.000%,

02/15/29

(a)

100,000

101,239

Total

2,075,792

Lodging

0.7%

Hilton

Grand

Vacations

Borrower

Escrow

LLC

/

Hilton

Grand

Vacations

Borrower

Esc

5.000%,

06/01/29

(a)

50,000

47,501

Marriott

Ownership

Resorts

Inc.

4.500%,

06/15/29

(a)

50,000

47,010

Marriott

Ownership

Resorts,

Inc.

4.750%,

01/15/28

100,000

95,977

Total

190,488

Media

and

Entertainment

1.6%

Clear

Channel

Outdoor

Holdings,

Inc.

5.125%,

08/15/27

(a)

75,000

73,730

9.000%,

09/15/28

(a)

125,000

132,891

Outfront

Media

Capital

LLC

/

Outfront

Media

Capital

Corp.

4.250%,

01/15/29

(a)

50,000

47,622

5.000%,

08/15/27

(a)

75,000

74,516

Univision

Communications,

Inc.

6.625%,

06/01/27

(a)

50,000

50,152

8.000%,

08/15/28

(a)

50,000

51,136

Total

430,047

Metals

and

Mining

2.5%

Constellium

SE

3.750%,

04/15/29

(a)

75,000

70,051

5.625%,

06/15/28

(a)

125,000

124,871

Hudbay

Minerals,

Inc.

4.500%,

04/01/26

(a)

209,000

206,793

6.125%,

04/01/29

(a)

50,000

50,734

Kaiser

Aluminum

Corp.

4.625%,

03/01/28

(a)

75,000

72,608

Novelis

Corp.

3.250%,

11/15/26

(a)

50,000

48,322

4.750%,

01/30/30

(a)

75,000

72,616

Total

645,995

Midstream

5.4%

Antero

Midstream

Partners

LP

/

Antero

Midstream

Finance

Corp.

5.375%,

06/15/29

(a)

50,000

49,537

5.750%,

01/15/28

(a)

50,000

50,062

5.750%,

03/01/27

(a)

100,000

100,165

Delek

Logistics

Partners

LP

/

Delek

Logistics

Finance

Corp.

8.625%,

03/15/29

(a)

150,000

157,924

DT

Midstream,

Inc.

4.125%,

06/15/29

(a)

50,000

47,828

EQM

Midstream

Partners

LP

4.500%,

01/15/29

(a)

75,000

73,369

6.000%,

07/01/25

(a)

125,000

125,225

6.375%,

04/01/29

(a)

25,000

25,830

6.500%,

07/01/27

(a)

25,000

25,742

7.500%,

06/01/27

(a)

50,000

51,497

NuStar

Logistics

LP

5.625%,

04/28/27

50,000

50,216

5.750%,

10/01/25

75,000

75,048

6.000%,

06/01/26

25,000

25,167

Sunoco

LP

7.000%,

05/01/29

(a)

104,000

108,722

Sunoco

LP

/

Sunoco

Finance

Corp.

6.000%,

04/15/27

25,000

25,077

7.000%,

09/15/28

(a)

99,000

102,770

Venture

Global

Calcasieu

Pass

LLC

3.875%,

08/15/29

(a)

75,000

70,877

PORTFOLIO

OF

INVESTMENTS

(continued)

Columbia

Short

Duration

High

Yield

ETF

September

30,

2024

(Unaudited)

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

statement.

Corporate

Bonds

(continued)

Issue

Description

Principal

Amount

($)

Value

($)

Venture

Global

LNG,

Inc.

8.125%,

06/01/28

(a)

125,000

130,313

9.500%,

02/01/29

(a)

100,000

112,429

Total

1,407,798

Oil

Field

Services

1.3%

Archrock

Partners

LP

/

Archrock

Partners

Finance

Corp.

6.250%,

04/01/28

(a)

75,000

75,352

Kodiak

Gas

Services

LLC

7.250%,

02/15/29

(a)

75,000

77,650

Nabors

Industries,

Inc.

7.375%,

05/15/27

(a)

50,000

50,119

Transocean

Titan

Financing

Ltd.

8.375%,

02/01/28

(a)

50,000

51,511

USA

Compression

Partners

LP

/

USA

Compression

Finance

Corp

6.875%,

09/01/27

100,000

100,902

Total

355,534

Other

Industry

0.6%

Williams

Scotsman,

Inc.

4.625%,

08/15/28

(a)

111,000

107,924

6.625%,

06/15/29

(a)

50,000

51,512

Total

159,436

Other

REIT

2.4%

Ladder

Capital

Finance

Holdings

LLLP

/

Ladder

Capital

Finance

Corp.

4.250%,

02/01/27

(a)

125,000

121,860

4.750%,

06/15/29

(a)

50,000

48,859

5.250%,

10/01/25

(a)

100,000

99,775

Park

Intermediate

Holdings

LLC

/

PK

Domestic

Property

LLC

/

PK

Finance

Co.-Issuer

5.875%,

10/01/28

(a)

175,000

174,647

RHP

Hotel

Properties

LP

/

RHP

Finance

Corp.

7.250%,

07/15/28

(a)

100,000

104,661

RLJ

Lodging

Trust

LP

3.750%,

07/01/26

(a)

75,000

73,357

Total

623,159

Packaging

2.9%

Ardagh

Metal

Packaging

Finance

USA

LLC

/

Ardagh

Metal

Packaging

Finance

PLC

3.250%,

09/01/28

(a)

75,000

68,671

4.000%,

09/01/29

(a)

25,000

22,317

6.000%,

06/15/27

(a)

125,000

125,864

Berry

Global,

Inc.

4.500%,

02/15/26

(a)

100,000

98,730

Clydesdale

Acquisition

Holdings,

Inc.

6.625%,

04/15/29

(a)

50,000

50,495

Sealed

Air

Corp.

4.000%,

12/01/27

(a)

50,000

48,317

5.000%,

04/15/29

(a)

38,000

37,433

Sealed

Air

Corp./Sealed

Air

Corp.

US

6.125%,

02/01/28

(a)

50,000

50,850

Trivium

Packaging

Finance

BV

5.500%,

08/15/26

(a)

255,000

253,679

Total

756,356

Pharmaceuticals

0.2%

Organon

&

Co.

/

Organon

Foreign

Debt

Co.-Issuer

BV

4.125%,

04/30/28

(a)

50,000

48,058

Property

&

Casualty

2.5%

Alliant

Holdings

Intermediate

LLC

/

Alliant

Holdings

Co.-Issuer

4.250%,

10/15/27

(a)

50,000

47,886

6.750%,

10/15/27

(a)

100,000

99,651

6.750%,

04/15/28

(a)

199,000

202,188

Corporate

Bonds

(continued)

Issue

Description

Principal

Amount

($)

Value

($)

AmWINS

Group,

Inc.

6.375%,

02/15/29

(a)

125,000

127,992

AssuredPartners,

Inc.

5.625%,

01/15/29

(a)

50,000

48,182

BroadStreet

Partners,

Inc.

5.875%,

04/15/29

(a)

25,000

23,907

HUB

International

Ltd.

5.625%,

12/01/29

(a)

100,000

98,082

Total

647,888

Restaurants

1.3%

1011778

BC

ULC

/

New

Red

Finance,

Inc.

4.375%,

01/15/28

(a)

213,000

207,335

6.125%,

06/15/29

(a)

125,000

128,499

Total

335,834

Retailers

2.5%

Asbury

Automotive

Group,

Inc.

4.500%,

03/01/28

125,000

121,760

Bath

&

Body

Works,

Inc.

5.250%,

02/01/28

50,000

49,877

Group

1

Automotive,

Inc.

4.000%,

08/15/28

(a)

100,000

95,424

6.375%,

01/15/30

(a)

25,000

25,410

LCM

Investments

Holdings

II

LLC

4.875%,

05/01/29

(a)

50,000

48,035

Lithia

Motors

Inc.

3.875%,

06/01/29

(a)

25,000

23,339

Lithia

Motors,

Inc.

4.625%,

12/15/27

(a)

75,000

73,302

PetSmart,

Inc.

/

PetSmart

Finance

Corp.

4.750%,

02/15/28

(a)

125,000

119,834

7.750%,

02/15/29

(a)

100,000

98,643

Total

655,624

Technology

9.3%

Block,

Inc.

2.750%,

06/01/26

50,000

48,461

Camelot

Finance

SA

4.500%,

11/01/26

(a)

150,000

147,798

Central

Parent

LLC

/

CDK

Global

II

LLC

/

CDK

Financing

Co.,

Inc.

8.000%,

06/15/29

(a)

50,000

52,022

Central

Parent,

Inc.

/

CDK

Global,

Inc.

7.250%,

06/15/29

(a)

75,000

76,690

Clarivate

Science

Holdings

Corp.

4.875%,

07/01/29

(a)

50,000

48,119

Cloud

Software

Group,

Inc.

6.500%,

03/31/29

(a)

275,000

273,696

9.000%,

09/30/29

(a)

50,000

50,888

Entegris,

Inc.

3.625%,

05/01/29

(a)

75,000

70,117

4.375%,

04/15/28

(a)

125,000

120,672

Gen

Digital,

Inc.

6.750%,

09/30/27

(a)

75,000

77,093

HealthEquity,

Inc.

4.500%,

10/01/29

(a)

50,000

48,357

Helios

Software

Holdings,

Inc.

/

ION

Corporate

Solutions

Finance

Sarl

4.625%,

05/01/28

(a)

100,000

92,228

ION

Trading

Technologies

Sarl

5.750%,

05/15/28

(a)

75,000

70,118

Iron

Mountain,

Inc.

4.875%,

09/15/27

(a)

125,000

124,051

5.000%,

07/15/28

(a)

25,000

24,658

5.250%,

03/15/28

(a)

125,000

124,513

PORTFOLIO

OF

INVESTMENTS

(continued)

Columbia

Short

Duration

High

Yield

ETF

September

30,

2024

(Unaudited)

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

statement.

Notes

to

Portfolio

of

Investments

Corporate

Bonds

(continued)

Issue

Description

Principal

Amount

($)

Value

($)

7.000%,

02/15/29

(a)

125,000

130,212

NCR

Atleos

Corp.

9.500%,

04/01/29

(a)

125,000

137,615

NCR

Voyix

Corp.

5.000%,

10/01/28

(a)

130,000

127,551

Neptune

Bidco

US,

Inc.

9.290%,

04/15/29

(a)

50,000

48,949

Open

Text

Corp.

3.875%,

02/15/28

(a)

75,000

71,600

Seagate

HDD

Cayman

4.750%,

01/01/25

51,000

50,796

Shift4

Payments

LLC

/

Shift4

Payments

Finance

Sub,

Inc.

4.625%,

11/01/26

(a)

150,000

148,427

SS&C

Technologies,

Inc.

5.500%,

09/30/27

(a)

125,000

125,015

ZoomInfo

Technologies

LLC/ZoomInfo

Finance

Corp.

3.875%,

02/01/29

(a)

156,000

144,120

Total

2,433,766

Transportation

Services

0.4%

Avis

Budget

Car

Rental

LLC

/

Avis

Budget

Finance,

Inc.

4.750%,

04/01/28

(a)

25,000

23,482

5.375%,

03/01/29

(a)

50,000

46,746

5.750%,

07/15/27

(a)

50,000

49,758

Total

119,986

Wireless

0.3%

SBA

Communications

Corp.

3.875%,

02/15/27

75,000

73,072

Wirelines

1.1%

Frontier

Communications

Holdings

LLC

5.875%,

10/15/27

(a)

100,000

100,401

Iliad

Holding

SASU

6.500%,

10/15/26

(a)

125,000

126,295

7.000%,

10/15/28

(a)

75,000

76,339

Total

303,035

Total

Corporate

Bonds

(Cost

$25,085,138)

25,214,033

Money

Market

Funds

2.7%

Shares

Value

($)

Dreyfus

Treasury

Securities

Cash

Management,

Institutional

Shares

4.879%

(c)

716,662

716,662

Total

Money

Market

Funds

(Cost

$716,662)

716,662

Total

Investments

in

Securities

(Cost

$25,801,800)

25,930,695

Other

Assets

&

Liabilities,

Net

304,383

Net

Assets

26,235,078

(a)

Represents

privately

placed

and

other

securities

and

instruments

exempt

from

Securities

and

Exchange

Commission

registration

(collectively,

private

placements),

such

as

Section

4(a)(2)

and

Rule

144A

eligible

securities,

which

are

often

sold

only

to

qualified

institutional

buyers.

At

September

30,

2024,

the

total

value

of

these

securities

amounted

to

$22,765,530,

which

represents

86.78%

of

total

net

assets.

(b)

Payment-in-kind

security.

Interest

can

be

paid

by

issuing

additional

par

of

the

security

or

in

cash.

(c)

The

rate

shown

is

the

seven-day

current

annualized

yield

at

September

30,

2024.

PORTFOLIO

OF

INVESTMENTS

(continued)

Columbia

Short

Duration

High

Yield

ETF

September

30,

2024

(Unaudited)

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

statement.

Fair

Value

Measurements

The

Fund

categorizes

its

fair

value

measurements

according

to

a

three-level

hierarchy

that

maximizes

the

use

of

observable

inputs

and

minimizes

the

use

of

unobservable

inputs

by

prioritizing

that

the

most

observable

input

be

used

when

available.

Observable

inputs

are

those

that

market

participants

would

use

in

pricing

an

investment

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

are

those

that

reflect

the

Fund’s

assumptions

about

the

information

market

participants

would

use

in

pricing

an

investment.

An

investment’s

level

within

the

fair

value

hierarchy

is

based

on

the

lowest

level

of

any

input

that

is

deemed

significant

to

the

asset's

or

liability’s

fair

value

measurement.

The

input

levels

are

not

necessarily

an

indication

of

the

risk

or

liquidity

associated

with

investments

at

that

level.

For

example,

certain

U.S.

government

securities

are

generally

high

quality

and

liquid,

however,

they

are

reflected

as

Level

2

because

the

inputs

used

to

determine

fair

value

may

not

always

be

quoted

prices

in

an

active

market.

Fair

value

inputs

are

summarized

in

the

three

broad

levels

listed

below:

Level

1

—

Valuations

based

on

quoted

prices

for

investments

in

active

markets

that

the

Fund

has

the

ability

to

access

at

the

measurement

date.

Valuation

adjustments

are

not

applied

to

Level

1

investments.

Level

2

—

Valuations

based

on

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

prepayment

speeds,

credit

risks,

etc.).

Level

3

—

Valuations

based

on

significant

unobservable

inputs

(including

the

Fund’s

own

assumptions

and

judgment

in

determining

the

fair

value

of

investments).

Inputs

that

are

used

in

determining

fair

value

of

an

investment

may

include

price

information,

credit

data,

volatility

statistics,

and

other

factors.

These

inputs

can

be

either

observable

or

unobservable.

The

availability

of

observable

inputs

can

vary

between

investments,

and

is

affected

by

various

factors

such

as

the

type

of

investment,

and

the

volume

and

level

of

activity

for

that

investment

or

similar

investments

in

the

marketplace.

The

inputs

will

be

considered

by

the

Investment

Manager,

along

with

any

other

relevant

factors

in

the

calculation

of

an

investment’s

fair

value.

The

Fund

uses

prices

and

inputs

that

are

current

as

of

the

measurement

date,

which

may

include

periods

of

market

dislocations.

During

these

periods,

the

availability

of

prices

and

inputs

may

be

reduced

for

many

investments.

This

condition

could

cause

an

investment

to

be

reclassified

between

the

various

levels

within

the

hierarchy.

Investments

falling

into

the

Level

3

category

are

primarily

supported

by

quoted

prices

from

brokers

and

dealers

participating

in

the

market

for

those

investments.

However,

these

may

be

classified

as

Level

3

investments

due

to

lack

of

market

transparency

and

corroboration

to

support

these

quoted

prices.

Additionally,

valuation

models

may

be

used

as

the

pricing

source

for

any

remaining

investments

classified

as

Level

3.

These

models

may

rely

on

one

or

more

significant

unobservable

inputs

and/or

significant

assumptions

by

the

Investment

Manager.

Inputs

used

in

valuations

may

include,

but

are

not

limited

to,

financial

statement

analysis,

capital

account

balances,

discount

rates

and

estimated

cash

flows,

and

comparable

company

data.

The

Fund's

Board

of

Trustees

(the

Board)

has

designated

the

Investment

Manager,

through

its

Valuation

Committee

(the

Committee),

as

valuation

designee,

responsible

for

determining

the

fair

value

of

the

assets

of

the

Fund

for

which

market

quotations

are

not

readily

available

using

valuation

procedures

approved

by

the

Board.

The

Committee

consists

of

voting

and

non-voting

members

from

various

groups

within

the

Investment

Manager's

organization,

including

operations

and

accounting,

trading

and

investments,

compliance,

risk

management

and

legal.

The

Committee

meets

at

least

monthly

to

review

and

approve

valuation

matters,

which

may

include

a

description

of

specific

valuation

determinations,

data

regarding

pricing

information

received

from

approved

pricing

vendors

and

brokers

and

the

results

of

Board-approved

valuation

policies

and

procedures

(the

Policies).

The

Policies

address,

among

other

things,

instances

when

market

quotations

are

or

are

not

readily

available,

including

recommendations

of

third

party

pricing

vendors

and

a

determination

of

appropriate

pricing

methodologies;

events

that

require

specific

valuation

determinations

and

assessment

of

fair

value

techniques;

securities

with

a

potential

for

stale

pricing,

including

those

that

are

illiquid,

restricted,

or

in

default;

and

the

effectiveness

of

third-party

pricing

vendors,

including

periodic

reviews

of

vendors.

The

Committee

meets

more

frequently,

as

needed,

to

discuss

additional

valuation

matters,

which

may

include

the

need

to

review

back-testing

results,

review

time-

sensitive

information

or

approve

related

valuation

actions.

Representatives

of

Columbia

Management

Investment

Advisers,

LLC

report

to

the

Board

at

each

of

its

regularly

scheduled

meetings

to

discuss

valuation

matters

and

actions

during

the

period,

similar

to

those

described

earlier.

The

following

table

is

a

summary

of

the

inputs

used

to

value

the

Fund’s

investments

at

September

30,

2024:

Level

1

($)

Level

2

($)

Level

3

($)

Total

($)

Investments

in

Securities

Corporate

Bonds

–

25,214,033

–

25,214,033

Money

Market

Funds

716,662

–

–

716,662

Total

Investments

in

Securities

716,662

25,214,033

–

25,930,695

See

the

Portfolio

of

Investments

for

all

investment

classifications

not

indicated

in

the

table.

The

Fund’s

assets

assigned

to

the

Level

2

input

category

are

generally

valued

using

the

market

approach,

in

which

a

security's

value

is

determined

through

reference

to

prices

and

information

from

market

transactions

for

similar

or

identical

assets.

PORTFOLIO

OF

INVESTMENTS

Columbia

U.S.

High

Yield

ETF

September

30,

2024

(Unaudited)

(Percentages

represent

value

of

investments

compared

to

net

assets)

Investments

in

Securities

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

statement.

Corporate

Bonds

97.2%

Issue

Description

Principal

Amount

($)

Value

($)

Aerospace

&

Defense

3.3%

AAR

Escrow

Issuer

LLC

6.750%,

03/15/29

(a)

50,000

51,988

Bombardier,

Inc.

7.000%,

06/01/32

(a)

50,000

52,292

8.750%,

11/15/30

(a)

100,000

109,807

Spirit

Aerosystems

,

Inc.

4.600%,

06/15/28

50,000

47,759

9.750%,

11/15/30

(a)

50,000

55,772

TransDigm

,

Inc.

4.625%,

01/15/29

50,000

48,332

6.375%,

03/01/29

(a)

200,000

206,275

6.625%,

03/01/32

(a)

100,000

104,225

6.750%,

08/15/28

(a)

100,000

103,020

6.875%,

12/15/30

(a)

75,000

78,540

Total

858,010

Airlines

1.4%

Allegiant

Travel

Co.

7.250%,

08/15/27

(a)

50,000

49,448

American

Airlines,

Inc.

8.500%,

05/15/29

(a)

50,000

53,016

American

Airlines,

Inc./

AAdvantage

Loyalty

IP

Ltd.

5.500%,

04/20/26

(a)

29,167

29,080

5.750%,

04/20/29

(a)

100,000

99,870

Jetblue

Airways

Corp.

/

Jetblue

Loyalty

LP

9.875%,

09/20/31

(a)

50,000

52,665

United

Airlines,

Inc.

4.375%,

04/15/26

(a)

50,000

49,247

4.625%,

04/15/29

(a)

50,000

48,309

Total

381,635

Automotive

2.0%

Adient

Global

Holdings

Ltd.

7.000%,

04/15/28

(a)

50,000

51,516

8.250%,

04/15/31

(a)

50,000

53,079

Allison

Transmission,

Inc.

3.750%,

01/30/31

(a)

50,000

45,398

Clarios

Global

LP

/

Clarios

US

Finance

Co.

6.750%,

05/15/28

(a)

75,000

77,313

Garrett

Motion

Holdings,

Inc.

/

Garrett

LX

I

Sarl

7.750%,

05/31/32

(a)

50,000

51,206

Goodyear

Tire

&

Rubber

Co.

(The)

4.875%,

03/15/27

50,000

48,876

5.250%,

04/30/31

50,000

45,085

JB

Poindexter

&

Co.,

Inc.

8.750%,

12/15/31

(a)

50,000

52,940

Phinia

,

Inc.

6.750%,

04/15/29

(a)

50,000

51,708

Tenneco,

Inc.

8.000%,

11/17/28

(a)

50,000

46,200

Total

523,321

Banking

0.4%

Ally

Financial,

Inc.

6.700%,

02/14/33

50,000

51,245

Western

Alliance

Bancorp

3.000%,

(3M

U.S.

T-Bill

MMY

+

2.250%),

06/15/31

(b)

50,000

46,025

Total

97,270

Brokerage/Asset

Managers/Exchanges

1.3%

AG

Issuer

LLC

6.250%,

03/01/28

(a)

50,000

49,028

Corporate

Bonds

(continued)

Issue

Description

Principal

Amount

($)

Value

($)

Aretec

Group,

Inc.

10.000%,

08/15/30

(a)

50,000

53,272

Coinbase

Global,

Inc.

3.375%,

10/01/28

(a)

50,000

44,980

Compass

Group

Diversified

Holdings

LLC

5.250%,

04/15/29

(a)

50,000

48,560

Hunt

Cos.,

Inc.

5.250%,

04/15/29

(a)

50,000

48,358

StoneX

Group,

Inc.

7.875%,

03/01/31

(a)

50,000

53,260

Vfh

Parent

LLC

/

Valor

Co.-Issuer,

Inc.

7.500%,

06/15/31

(a)

50,000

52,500

Total

349,958

Building

Materials

2.5%

Builders

FirstSource

,

Inc.

4.250%,

02/01/32

(a)

50,000

46,199

6.375%,

03/01/34

(a)

50,000

51,933

Cornerstone

Building

Brands,

Inc.

9.500%,

08/15/29

(a)

100,000

102,747

Eco

Material

Technologies,

Inc.

7.875%,

01/31/27

(a)

50,000

50,516

Mohegan

Tribal

Gaming

Authority

8.000%,

02/01/26

(a)

50,000

49,454

Smyrna

Ready

Mix

Concrete

LLC

8.875%,

11/15/31

(a)

100,000

107,892

Specialty

Building

Products

Holdings

LLC

/

Sbp

Finance

Corp.

6.375%,

09/30/26

(a)

50,000

49,821

Standard

Building

Solutions,

Inc.

6.500%,

08/15/32

(a)

50,000

51,884

Standard

Industries,

Inc.

4.375%,

07/15/30

(a)

100,000

94,522

Summit

Materials

LLC

/

Summit

Materials

Finance

Corp.

7.250%,

01/15/31

(a)

50,000

52,975

Total

657,943

Cable

and

Satellite

5.2%

Cable

One,

Inc.

4.000%,

11/15/30

(a)

50,000

39,797

CCO

Holdings

LLC

/

CCO

Holdings

Capital

Corp.

4.250%,

02/01/31

(a)

200,000

176,641

4.250%,

01/15/34

(a)

150,000

123,173

4.500%,

08/15/30

(a)

100,000

90,520

4.500%,

05/01/32

150,000

129,649

4.750%,

03/01/30

(a)

100,000

91,874

5.000%,

02/01/28

(a)

100,000

97,304

5.125%,

05/01/27

(a)

100,000

98,359

Directv

Financing

LLC

8.875%,

02/01/30

(a)

50,000

50,372

Directv

Financing

LLC

/

Directv

Financing

Co.-Obligor,

Inc.

5.875%,

08/15/27

(a)

100,000

98,054

Sirius

XM

Radio,

Inc.

4.000%,

07/15/28

(a)

100,000

94,339

4.125%,

07/01/30

(a)

100,000

90,770

5.000%,

08/01/27

(a)

100,000

98,525

Viasat

,

Inc.

5.625%,

04/15/27

(a)

100,000

94,454

Total

1,373,831

Chemicals

2.9%

Chemours

Co.

(The)

4.625%,

11/15/29

(a)

50,000

44,764

Element

Solutions,

Inc.

3.875%,

09/01/28

(a)

100,000

95,299

PORTFOLIO

OF

INVESTMENTS

(continued)

Columbia

U.S.

High

Yield

ETF

September

30,

2024

(Unaudited)

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

statement.

Corporate

Bonds

(continued)

Issue

Description

Principal

Amount

($)

Value

($)

Ingevity

Corp.

3.875%,

11/01/28

(a)

50,000

46,887

Methanex

Corp.

5.125%,

10/15/27

50,000

49,460

Olin

Corp.

5.125%,

09/15/27

100,000

99,412

Olympus

Water

US

Holding

Corp.

9.750%,

11/15/28

(a)

100,000

106,791

Parkland

Corp.

4.625%,

05/01/30

(a)

75,000

70,766

Scih

Salt

Holdings,

Inc.

4.875%,

05/01/28

(a)

50,000

48,296

SK

Invictus

Internediate

II

Sarl

5.000%,

10/30/29

(a)

50,000

47,927

Tronox

,

Inc.

4.625%,

03/15/29

(a)

50,000

46,676

Windsor

Holdings

III

LLC

8.500%,

06/15/30

(a)

50,000

53,510

WR

Grace

Holdings

LLC

5.625%,

08/15/29

(a)

50,000

46,963

Total

756,751

Construction

Machinery

1.3%

EquipmentShare.Com,

Inc.

8.625%,

05/15/32

(a)

50,000

52,510

H&E

Equipment

Services,

Inc.

3.875%,

12/15/28

(a)

50,000

46,919

Herc

Holdings,

Inc.

5.500%,

07/15/27

(a)

50,000

49,948

6.625%,

06/15/29

(a)

50,000

51,807

Ritchie

Bros

Holdings,

Inc.

7.750%,

03/15/31

(a)

50,000

53,349

United

Rentals

North

America,

Inc.

5.250%,

01/15/30

50,000

50,035

6.125%,

03/15/34

(a)

50,000

51,661

Total

356,229

Consumer

Cyclical

Services

3.3%

Allied

Universal

Holdco

LLC

7.875%,

02/15/31

(a)

50,000

51,108

Allied

Universal

Holdco

LLC

/

Allied

Universal

Finance

Corp.

9.750%,

07/15/27

(a)

100,000

100,167

Allied

Universal

Holdco

LLC/Allied

Universal

Finance

Corp./Atlas

Luxco

4

Sarl

4.625%,

06/01/28

(a)

50,000

47,012

Apx

Group,

Inc.

5.750%,

07/15/29

(a)

50,000

49,497

Arches

Buyer

Inc.

6.125%,

12/01/28

(a)

50,000

42,851

Bcpe

Empire

Holdings,

Inc.

7.625%,

05/01/27

(a)

50,000

50,157

Garda

World

Security

Corp.

6.000%,

06/01/29

(a)

75,000

72,075

Geo

Group,

Inc.

(The)

10.250%,

04/15/31

50,000

53,367

Go

Daddy

Operating

Co.

LLC

/

GD

Finance

Co.,

Inc.

5.250%,

12/01/27

(a)

50,000

49,906

Match

Group

Holdings

II

LLC

4.625%,

06/01/28

(a)

50,000

48,614

Prime

Security

Services

Borrower

LLC

/

Prime

Finance,

Inc.

5.750%,

04/15/26

(a)

100,000

100,505

Service

Corp.

International

4.000%,

05/15/31

75,000

69,380

Corporate

Bonds

(continued)

Issue

Description

Principal

Amount

($)

Value

($)

Staples,

Inc.

10.750%,

09/01/29

(a)

100,000

97,067

Wash

Multifamily

Acquisition,

Inc.

5.750%,

04/15/26

(a)

50,000

49,759

Total

881,465

Consumer

Products

1.8%

Coty,

Inc./HFC

Prestige

Products,

Inc./HFC

Prestige

International

US

LLC

6.625%,

07/15/30

(a)

75,000

77,922

Edgewell

Personal

Care

Co.

5.500%,

06/01/28

(a)

50,000

49,687

Energizer

Holdings,

Inc.

4.375%,

03/31/29

(a)

75,000

71,040

Newell

Brands,

Inc.

6.375%,

09/15/27

50,000

50,690

6.625%,

09/15/29

100,000

101,215

Perrigo

Finance

Unlimited

Co.

4.900%,

06/15/30

50,000

48,709

Tempur

Sealy

International,

Inc.

3.875%,

10/15/31

(a)

75,000

66,808

Total

466,071

Diversified

Manufacturing

1.2%

Chart

Industries,

Inc.

7.500%,

01/01/30

(a)

50,000

52,719

EMRLD

Borrower

LP

/

Emerald

Co.-Issuer,

Inc.

6.625%,

12/15/30

(a)

100,000

103,102

Husky

Injection

Molding

Systems

Ltd.

/

Titan

Co.-Borrower

LLC

9.000%,

02/15/29

(a)

50,000

52,000

Madison

IAQ

LLC

5.875%,

06/30/29

(a)

50,000

48,718

WESCO

Distribution,

Inc.

6.625%,

03/15/32

(a)

50,000

52,057

Total

308,596

Electric

2.8%

Calpine

Corp.

4.625%,

02/01/29

(a)

100,000

96,576

5.125%,

03/15/28

(a)

50,000

49,272

Clearway

Energy

Operating

LLC

3.750%,

02/15/31

(a)

50,000

45,776

Lightning

Power

LLC

7.250%,

08/15/32

(a)

50,000

52,500

NextEra

Energy

Operating

Partners

LP

7.250%,

01/15/29

(a)

100,000

105,406

NRG

Energy

Inc.

3.375%,

02/15/29

(a)

50,000

46,622

NRG

Energy,

Inc.

3.625%,

02/15/31

(a)

50,000

45,335

PG&E

Corp.

5.000%,

07/01/28

50,000

49,593

TerraForm

Power

Operating

LLC

4.750%,

01/15/30

(a)

50,000

47,831

Vistra

Operations

Co.

LLC

4.375%,

05/01/29

(a)

100,000

96,826

6.875%,

04/15/32

(a)

100,000

105,271

Total

741,008

Environmental

0.4%

GFL

Environmental,

Inc.

4.750%,

06/15/29

(a)

50,000

48,741

6.750%,

01/15/31

(a)

50,000

52,465

Total

101,206

PORTFOLIO

OF

INVESTMENTS

(continued)

Columbia

U.S.

High

Yield

ETF

September

30,

2024

(Unaudited)

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

statement.

Corporate

Bonds

(continued)

Issue

Description

Principal

Amount

($)

Value

($)

Finance

Companies

4.2%

FirstCash

Inc

5.625%,

01/01/30

(a)

50,000

49,566

Fortress

Transportation

And

Infrastructure

Investors

LLC

7.000%,

06/15/32

(a)

50,000

52,480

7.875%,

12/01/30

(a)

50,000

53,886

Freedom

Mortgage

Corp.

12.000%,

10/01/28

(a)

100,000

109,311

12.250%,

10/01/30

(a)

50,000

56,012

Goeasy

Ltd.

7.625%,

07/01/29

(a)

50,000

51,811

Nationstar

Mortgage

Holdings,

Inc.

5.125%,

12/15/30

(a)

100,000

95,913

Navient

Corp.

4.875%,

03/15/28

50,000

48,344

9.375%,

07/25/30

50,000

55,472

OneMain

Finance

Corp.

3.500%,

01/15/27

50,000

47,780

3.875%,

09/15/28

50,000

46,375

7.875%,

03/15/30

50,000

52,296

Pennymac

Financial

Services,

Inc.

7.875%,

12/15/29

(a)

100,000

106,572

Rocket

Mortgage

LLC

/

Rocket

Mortgage

Co.-Issuer

Inc.

4.000%,

10/15/33

(a)

50,000

44,919

Rocket

Mortgage

LLC

/

Rocket

Mortgage

Co.-Issuer,

Inc.

3.875%,

03/01/31

(a)

50,000

46,054

Springleaf

Finance

Corp.

5.375%,

11/15/29

100,000

96,050

United

Wholesale

Mortgage

LLC

5.500%,

04/15/29

(a)

50,000

48,695

5.750%,

06/15/27

(a)

50,000

49,710

Total

1,111,246

Food

and

Beverage

2.8%

Aramark

Services,

Inc.

5.000%,

02/01/28

(a)

50,000

49,818

B&G

Foods,

Inc.

8.000%,

09/15/28

(a)

50,000

52,288

BellRing

Brands,

Inc.

7.000%,

03/15/30

(a)

50,000

52,295

Darling

Ingredients,

Inc.

6.000%,

06/15/30

(a)

50,000

50,461

Lamb

Weston

Holdings,

Inc.

4.375%,

01/31/32

(a)

50,000

46,364

Performance

Food

Group,

Inc.