UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2015

Commission File Number: 001-35658

GRUPO FINANCIERO SANTANDER MÉXICO, S.A.B. de C.V.

(Exact Name of Registrant as Specified in Its Charter)

SANTANDER MEXICO FINANCIAL GROUP, S.A.B. de C.V.

(Translation of Registrant’s Name into English)

Avenida Prolongación Paseo de la Reforma 500

Colonia Lomas de Santa Fe

Delegación Álvaro Obregón

01219 México, D.F.

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

GRUPO FINANCIERO SANTANDER MÉXICO, S.A.B. de C.V.

TABLE OF CONTENTS

| ITEM | |

| | |

| 1. | Investor Day 2015 presentation to investors and analysts from Marcos Martínez Gavica (Santander Group Country Head Mexico) |

Important Note: Grupo Financiero Santander México, S.A.B. de C.V. (the “Group”) is hereby furnishing a presentation released by the Group’s parent company, Banco Santander, S.A., containing financial information and certain targets for selected Group and Banco Santander (México), S.A. Institución de Banca Múltiple, Grupo Financiero Santander México (the “Bank”) indicators in 2018, based on assumptions believed by the Group’s management to be reasonable. However, it must be noted that the financial figures in this presentation are presented under accounting principles that differ from Mexican Banking GAAP. For example, cost of risk under Mexican Banking GAAP is not calculated net of recoveries and therefore would be higher if presented under Mexican Banking GAAP. In addition, Mexican Banking GAAP requires inclusion of IPAB contributions as part of expenses, which impacts the efficiency ratio as calculated under Mexican Banking GAAP. Therefore, these financial figures and other financial figures included in this presentation are not entirely comparable to those published by the Group in its annual report on Form 20-F under IFRS or the financials published locally in Mexico by the Group and the Bank under Mexican Banking GAAP. Neither the Group nor the Bank has published any forecast of similar figures in IFRS or Mexican Banking GAAP.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | GRUPO FINANCIERO SANTANDER MÉXICO, S.A.B. de C.V. |

| | | By: | /s/ Gerardo Manuel Freire Alvarado |

| | | | Name: | Gerardo Manuel Freire Alvarado |

| | | | Title: | Executive Director of Investor Relations |

Date: September 24, 2015

|

Marcos Mart[]nez Gavica

Country Head Mexico

|

|

Banco Santander (M[]xico) S.A. ("Santander M[]xico) and Banco Santander, S.A.

("Santander") both caution that this presentation contains forward-looking

statements. These forward-looking statements are found in various places

throughout this presentation and include, without limitation, statements

concerning our future business development and economic performance. While

these forward-looking statements represent our judgment and future expectations

concerning the development of our business, a number of risks, uncertainties

and other important factors could cause actual developments and results to

differ materially from our expectations. These factors include, but are not

limited to: (1) general market, macroeconomic, governmental and regulatory

trends; (2) movements in local and international securities markets, currency

exchange rates and interest rates; (3) competitive pressures; (4) technological

developments; and (5) changes in the financial position or credit worthiness of

our customers, obligors and counterparties. The risk factors that we have

indicated in our past and future filings and reports, including those with the

Securities and Exchange Commission of the United States of America (the "SEC")

could adversely affect our business and financial performance. Other unknown or

unpredictable factors could cause actual results to differ materially from

those in the forward-looking statements.

Forward-looking statements speak only as of the date on which they are made and

are based on the knowledge, information available and views taken on the date

on which they are made; such knowledge, information and views may change at any

time. Santander does not undertake any obligation to update or revise any

forward-looking statement, whether as a result of new information, future

events or otherwise.

The information contained in this presentation is subject to, and must be read

in conjunction with, all other publicly available information, including, where

relevant any fuller disclosure document published by Santander. Any person at

any time acquiring securities must do so only on the basis of such person's own

judgment as to the merits or the suitability of the securities for its purpose

and only on such information as is contained in such public information having

taken all such professional or other advice as it considers necessary or

appropriate in the circumstances and not in reliance on the information

contained in the presentation. In making this presentation available, Santander

gives no advice and makes no recommendation to buy, sell or otherwise deal in

shares in Santander or in any other securities or investments whatsoever.

Neither this presentation nor any of the information contained therein

constitutes an offer to sell or the solicitation of an offer to buy any

securities. No offering of securities shall be made in the United States except

pursuant to registration under the U.S. Securities Act of 1933, as amended, or

an exemption therefrom. Nothing contained in this presentation is intended to

constitute an invitation or inducement to engage in investment activity for the

purposes of the prohibition on financial promotion in the U.K. Financial

Services and Markets Act 2000.

Note: Statements as to historical performance, share price or financial

accretion are not intended to mean that future performance, share price or

future earnings (including earnings per share) for any period will necessarily

match or exceed those of any prior year. Nothing in this presentation should be

construed as a profit forecast.

Note: The businesses included in each of the geographical segments and the

accounting principles under which their results are presented by Grupo

Santander may differ from the business included in the public subsidiaries in

such geographies and the accounting principles applied locally. Accordingly,

the results of operations and trends shown by Grupo Santander for its

geographical segments may differ materially from those disclosed locally by

such subsidiaries.

Helping people and businesses prosper

|

|

Agenda

1 Market and financial system

2 Strengths and opportunities

3 Strategy

4 Targets

Helping people and businesses prosper

|

|

Agenda

1 Market and financial system

2 Strengths and opportunities

3 Strategy

4 Targets

Helping people and businesses prosper

|

|

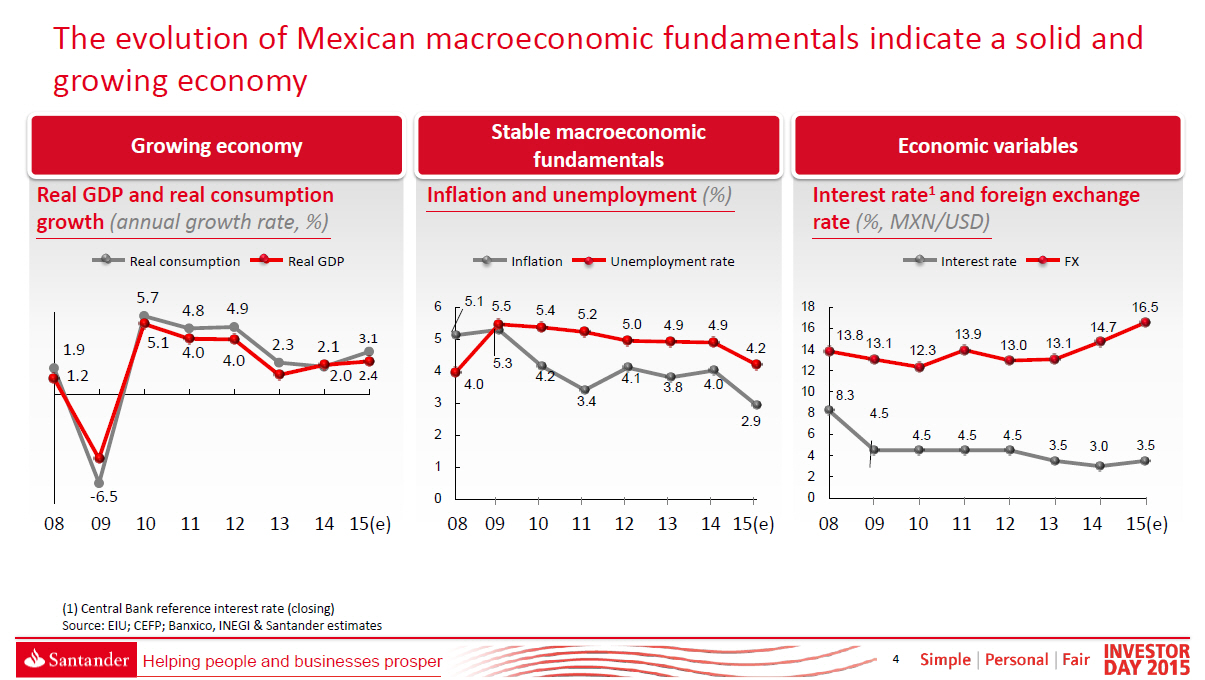

The evolution of Mexican macroeconomic fundamentals indicate a solid and

growing economy

Growing economy

Real GDP and real consumption growth (annual growth rate, %)

Real consumption Real GDP

5.7

4.8 4.9

5.1 2.3 2.1 3.1 1.9 (4.0) 4.0 1.2 2.0 2.4

-6.5

08 09 10 11 12 13 14 15(e)

Stable macroeconomic fundamentals

Inflation and unemployment (%)

Inflation Unemployment rate

6 5.1 5.5

5.4 5.2

5.0 4.9 4.9 5 4.2 5.3

4 4.2

4.0 4.1 4.0 3.8

3 3.4

2.9 2

1

0

08 09 10 11 12 13 14 15(e)

Economic variables

Interest rate(1) and foreign exchange rate (%, MXN/USD)

Interest rate FX

18 16.5

16 14.7 13.8 13.9

14 13.1 13.0 13.1 12.3 12

10 8.3

8 4.5

6 4.5 4.5 4.5

3.5 3.0 3.5 4 2 0

08 09 10 11 12 13 14 15(e)

(1) Central Bank reference interest rate (closing) Source: EIU; CEFP; Banxico,

INEGI and Santander estimates

Helping people and businesses prosper

|

|

The Mexican banking industry is solid and has high growth potential, with five

key factors that will continue to drive its expansion

A solid banking industry[]

[] Second largest in LATAM's

[] Underpenetrated market (23% loan to GDP in Mexico vs. 47% LATAM average(1))

[] 10% CAGR loans and deposits volumes (2007-2014)

[] Stable regulatory environment

[] Healthy liquidity and risk position with NPLs constant at 3% for the past 5

years

[] where 5 key factors will drive further growth

Favourable macroeconomic environment

Positive demographic and socio-economic evolution

Low and increasing bank penetration

Credit opportunities for Micro and SMEs

Growth opportunity in retail and commercial banking

Source: World Bank: Bank Regulation and Supervision Survey, CNBV, Press

clippings, ABM,

INEGI, World Bank Enterprise survey 2010, McKinsey MSME financing Model,

McKinsey Global Institute analysis (1) Considers Brazil, Chile, Colombia,

Mexico and Peru

Helping people and businesses prosper

|

|

Agenda

1 Market and financial system

2 Strengths and opportunities

3 Strategy

4 Targets

Helping people and businesses prosper

|

|

Santander has a leading franchise in Mexico []

Santander Mexico Ranking Market Shares Infrastructure Ranking

[] []60.7bn in assets [] []28.4bn in loans [] []27.5bn in deposits []

[]6.2bn in equity

14%

(12%) 12% (11%) 10%

(9%) 9% 8%

Income Income

Income Employees Expenses Branches Volumes Net Op. Profit before

taxes Gross Op. Net

[] 1,114 branches(1)

[] 16,768 employee

[] 5,756 ATMs

[] 6.7MM active customers

(1) Complemented by cash desks (ventanillas), and Santander Select branches

(including Centros Select, Espacios Select and box branches) as of 1H'15

Source: CNBV and Santander Mexico as of 1H[]15

Helping people and businesses prosper

|

|

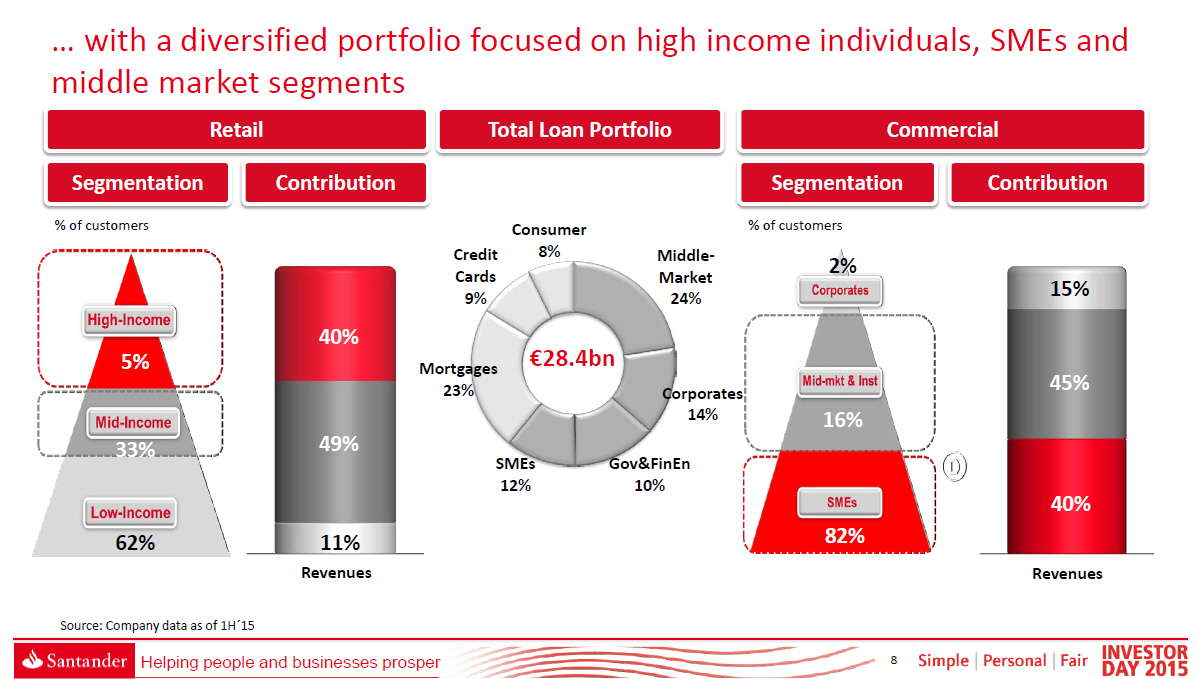

[] with a diversified portfolio focused on high income individuals, SMEs and

middle market segments

Retail Total Loan Portfolio Commercial

Segmentation Contribution Segmentation Contribution

% of customers

5% 33% 62%

40%

49%

11%

Revenues

Consumer

Credit 8% Middle-Cards Market

9% 24%

[]28.4bn

Mortgages

23% Corporates 14%

SMEs GovandFinEn 12% 10%

% of customers

2% 16% 82%

15%

45%

40%

Revenues

Source: Company data as of 1H[]15

Helping people and businesses prosper

|

|

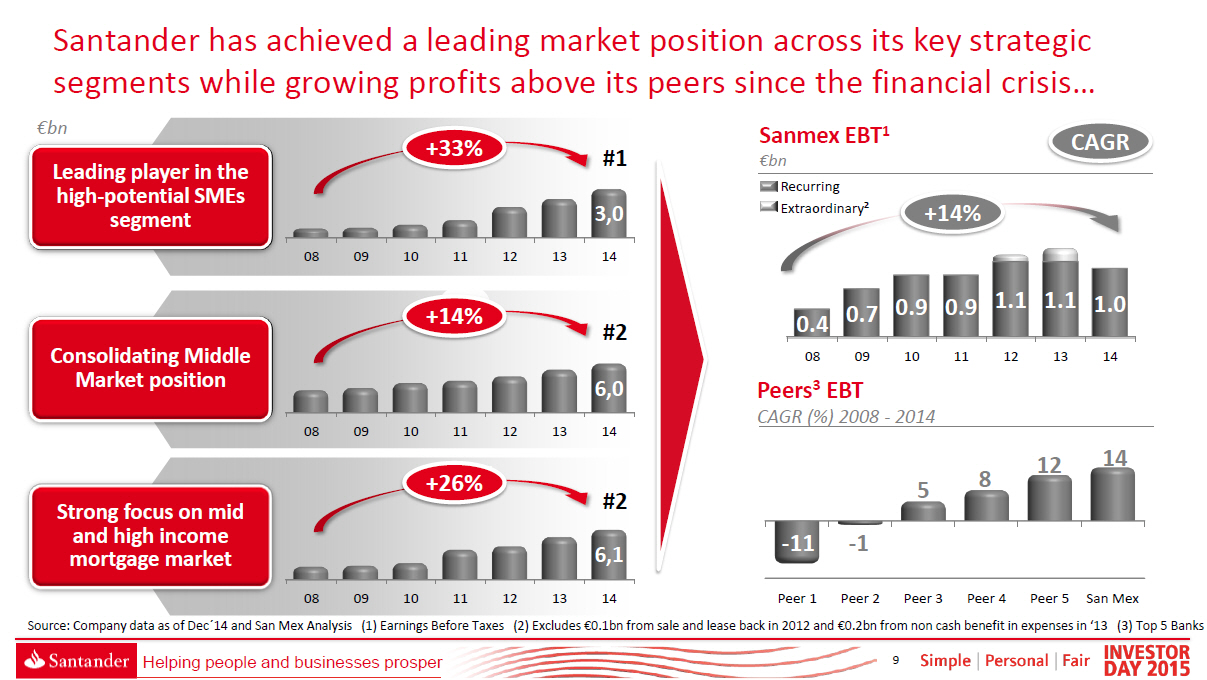

Santander has achieved a leading market position across its key strategic

segments while growing profits above its peers since the financial crisis[]

[]bn

Leading player in the high-potential SMEs segment

Consolidating Middle Market position

Strong focus on mid and high income mortgage market

Sanmex EBT(1) CAGR

[]bn

Recurring

Extraordinary(2) +14%

0.9 0.9 1.1 1.1 1.0 0.4 0.7

08 09 10 11 12 13 14

Peers(3) EBT

CAGR (%) 2008 - 2014

15 12 14

10 5 8

5 0

-5 -11 -1

10 15

Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 San Mex

Source: Company data as of Dec[]14 and San Mex Analysis (1) Earnings Before

Taxes (2) Excludes []0.1bn from sale and lease back in 2012 and []0.2bn from

non cash benefit in expenses in '13 (3) Top 5 Banks

Helping people and businesses prosper

|

|

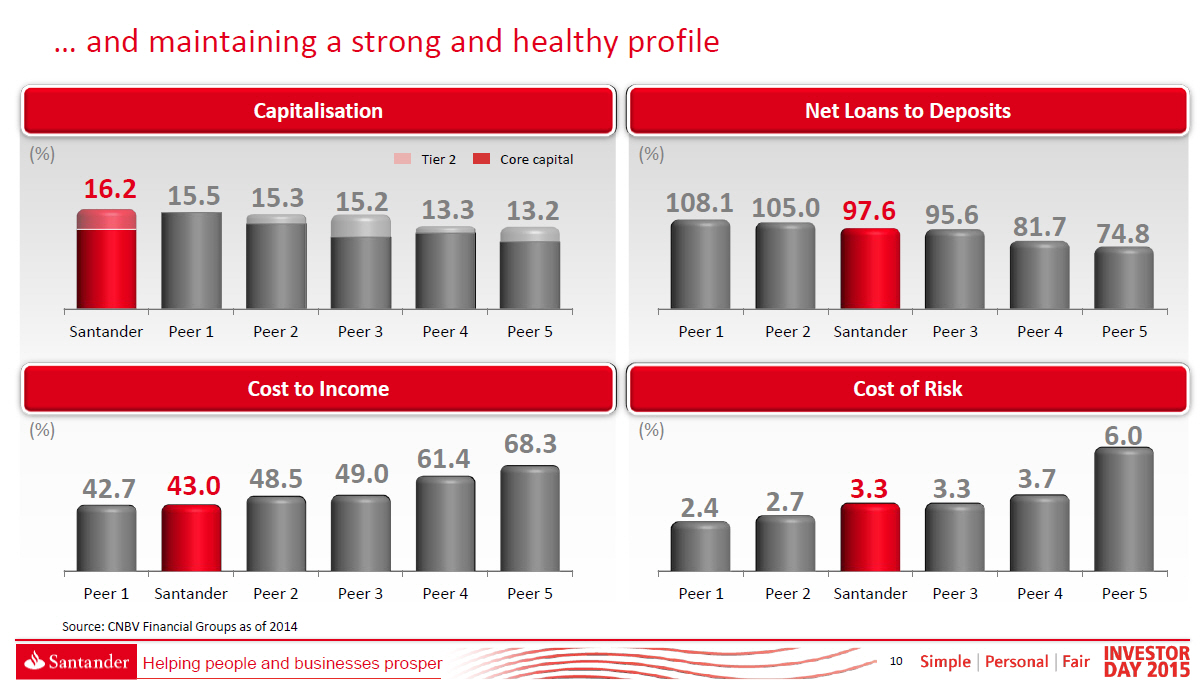

[] and maintaining a strong and healthy profile

Capitalisation Net Loans to Deposits

Tier 2 Core capital (%)

16.2 15.5 15.3 15.2 108.1

13.3 13.2 105.0 97.6 95.6

81.7 74.8

Santander Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 1 Peer 2 Santander Peer 3

Peer 4 Peer 5

Cost to Income Cost of Risk

68.3 (%) 6.0 61.4 43.0 48.5 49.0 3.3 3.7 42.7 2.7 3.3 2.4

Peer 1 Santander Peer 2 Peer 3 Peer 4 Peer 5 Peer 1 Peer 2 Santander Peer 3

Peer 4 Peer 5

Source: CNBV Financial Groups as of 2014

Helping people and businesses prosper

|

|

Agenda

1 Market and financial system

2 Strengths and opportunities

3 Strategy

4 Targets

Helping people and businesses prosper

|

|

Santander Mexico aims to be the market leader in profitability and growth

through a focus on innovation and operational transformation

Goals

Strategic priorities

Enablers

Be the market leader in profitability and growth

STRENGTHEN POSITION

IN RETAIL

[] Retain existing

customers

[] Become their primary

bank

[] Acquire new high-

potential customers

CONSOLIDATE KEY

MARKETS

[] SMEs and

mid-market

[] Corporate banking

[] Mortgages

[] Technology and infrastructure

(OPERATING) [] Talent, quality and processes

MODEL [] Marketing and branding

Helping people and businesses prosper

|

|

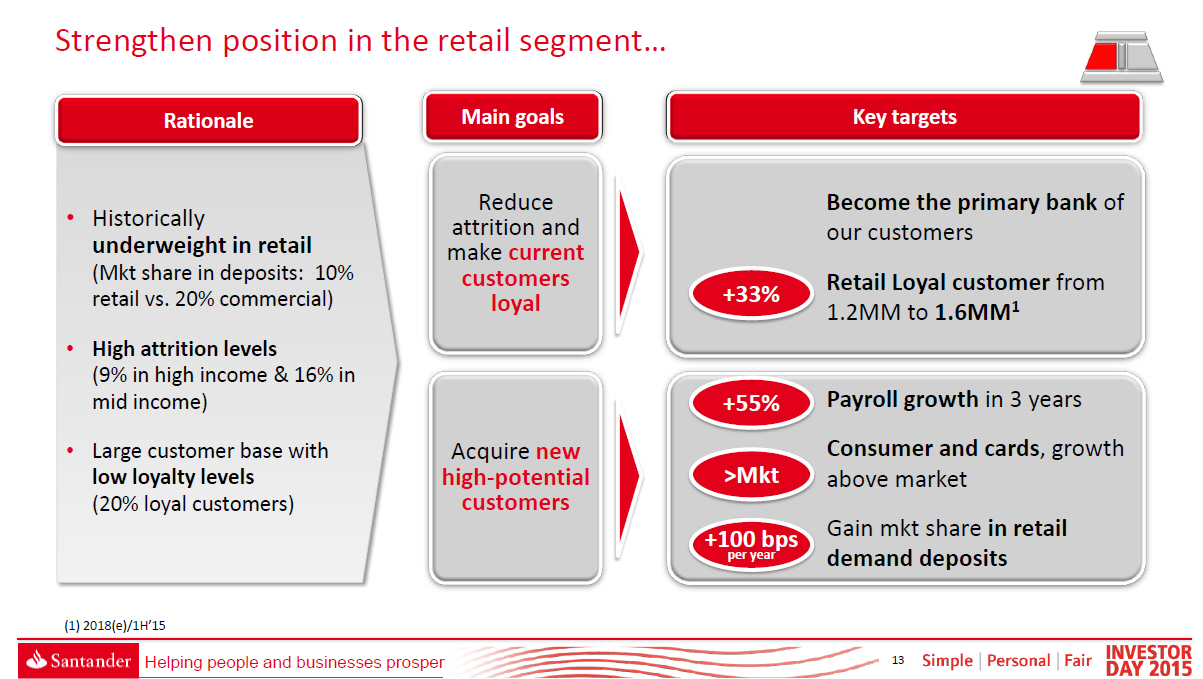

Strengthen position in the retail segment[]

Rationale

[] Historically underweight in retail

(Mkt share in deposits: 10% retail vs. 20% commercial)

[] High attrition levels

(9% in high income and 16% in mid income)

[] Large customer base with low loyalty levels

(20% loyal customers)

Main goals

Reduce attrition and make current customers loyal

Acquire new high-potential customers

Key targets

Become the primary bank of our customers

+33% [] Retail Loyal customer from 1.2MM to 1.6MM (1)

+55% Payroll growth in 3 years Consumer and cards, growth

)Mkt above market

+100 bps Gain mkt share in retail per year demand deposits

(1) 2018(e)/1H'15

Helping people and businesses prosper

|

|

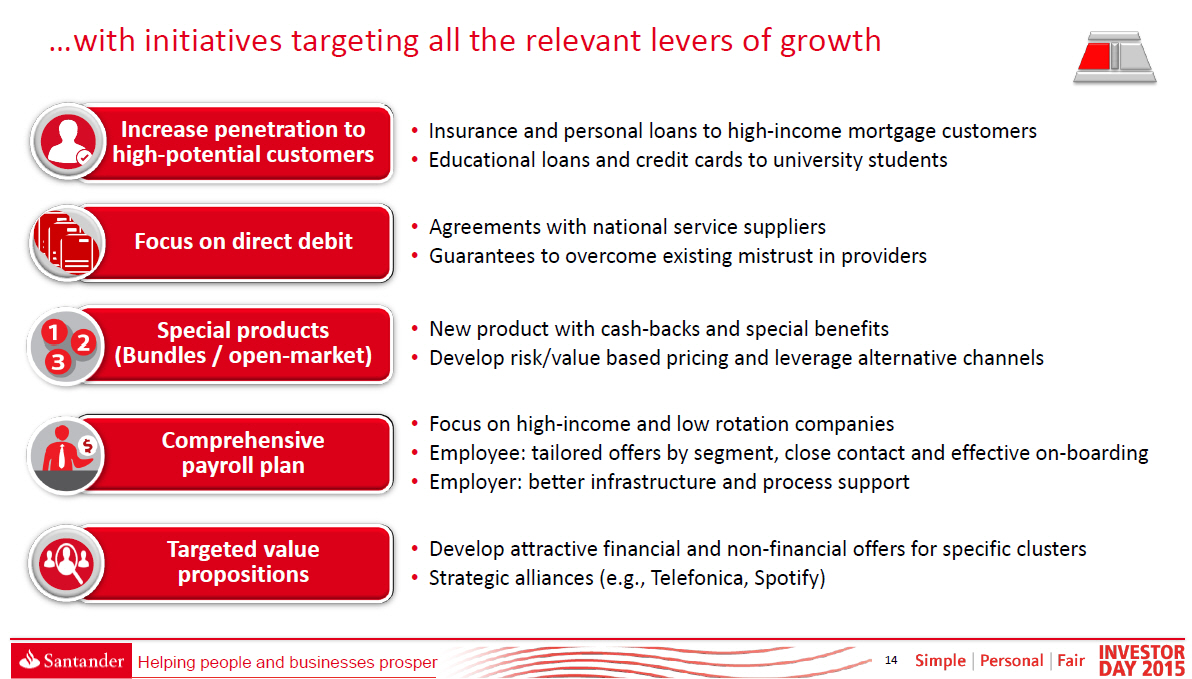

[]with initiatives targeting all the relevant levers of growth

Increase penetration to high-potential customers

Focus on direct debit

Special products (Bundles / open-market)

Comprehensive payroll plan

Targeted value propositions

[] Insurance and personal loans to high-income mortgage customers []

Educational loans and credit cards to university students

[] Agreements with national service suppliers

[] Guarantees to overcome existing mistrust in providers

[] New product with cash-backs and special benefits

[] Develop risk/value based pricing and leverage alternative channels

[] Focus on high-income and low rotation companies

[] Employee: tailored offers by segment, close contact and effective

on-boarding [] Employer: better infrastructure and process support

[] Develop attractive financial and non-financial offers for specific clusters

[] Strategic alliances (e. g. , Telefonica, Spotify)

Helping people and businesses prosper

|

|

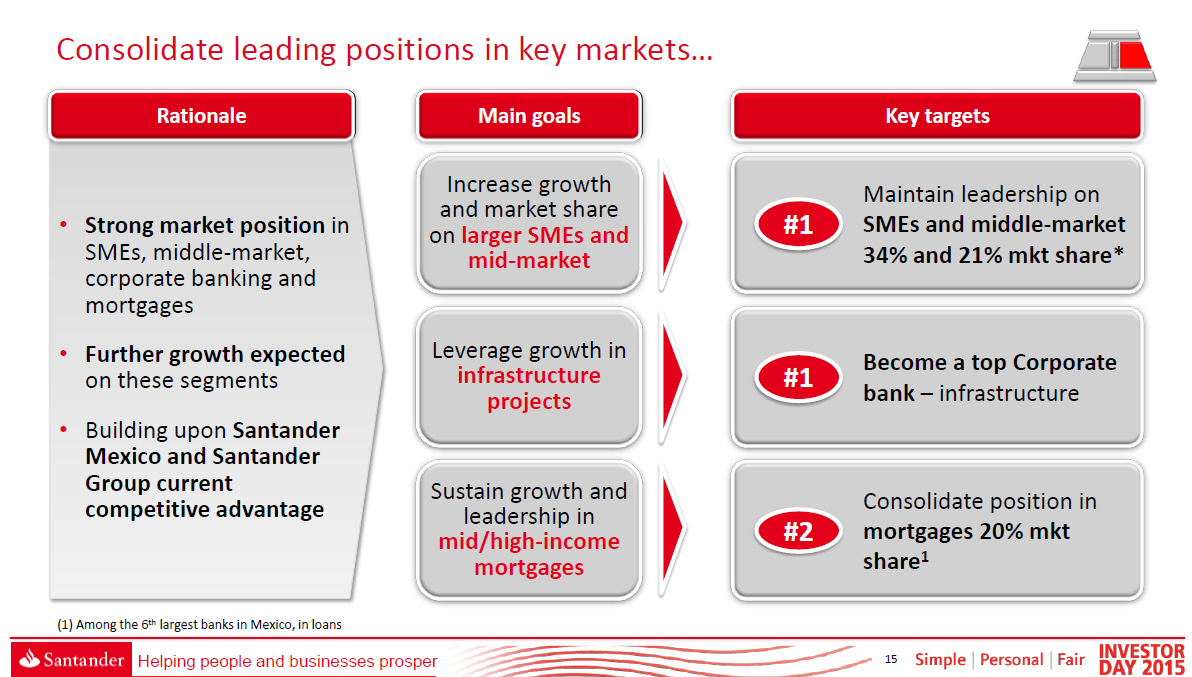

Consolidate leading positions in key markets[]

Rationale

[] Strong market position in SMEs, middle-market, corporate banking and

mortgages

[] Further growth expected on these segments

[] Building upon Santander Mexico and Santander Group current competitive

advantage

Main goals

Increase growth and market share on larger SMEs and mid-market

Leverage growth in infrastructure projects

Sustain growth and leadership in mid/high-income mortgages

Key targets

Maintain le Maintain leadership ondership on

#1SMEsSMEs and middle-marketand middle-market 34% and 34% and 21% mkt share*

21% mkt share*

Become Become a top Corporatea top cor orate #1 bank --i frastructu e

bank -- infrastructure

Consolidate position in

#2 mortgages 20% mkt share(1)

(1) Among the 6(th) largest banks in Mexico, in loans

Helping people and businesses prosper

|

|

[] leveraging Santander's position and experience

SMEs and mid-market

Corporate banking

Mid and high-income mortgages

[] Create exclusive commercial offer for SMEs II (focus on fee income)

[] Direct payment to suppliers

[] Collaboration agreements (Amex, Telefonica)

[] Sector-specific packages (Agro, Comex)

[] Leverage on Santander's competitive advantages

[] Strong relationships and track record

[] Combine global network and local presence

[] Focus on Santander financed home-developments

[] Simplify the credit substitution process

[] Re-launch liquidity credit initiatives

Helping people and businesses prosper

|

|

To successfully achieve these goals, Santander Mexico needs to execute a deep

operating model transformation

Technology and infrastructure

Upgrade to state-of-the-art technology

[] Infrastructure (multi-function ATM network)

[] Channels (online/mobile)

[] CRM (segment/big data)

Talent, quality and processes

Improve satisfaction and customer experience

[] Corporate culture

[] Personnel retention, training and career plan

[] Customer service

[] Operating processes

Brand / Marketing

Position Santander as the

'Top of mind' bank

[] Marketing and brand awareness strategy

[] Commercial actions

(high-visibility product promotions)

Helping people and businesses prosper

|

|

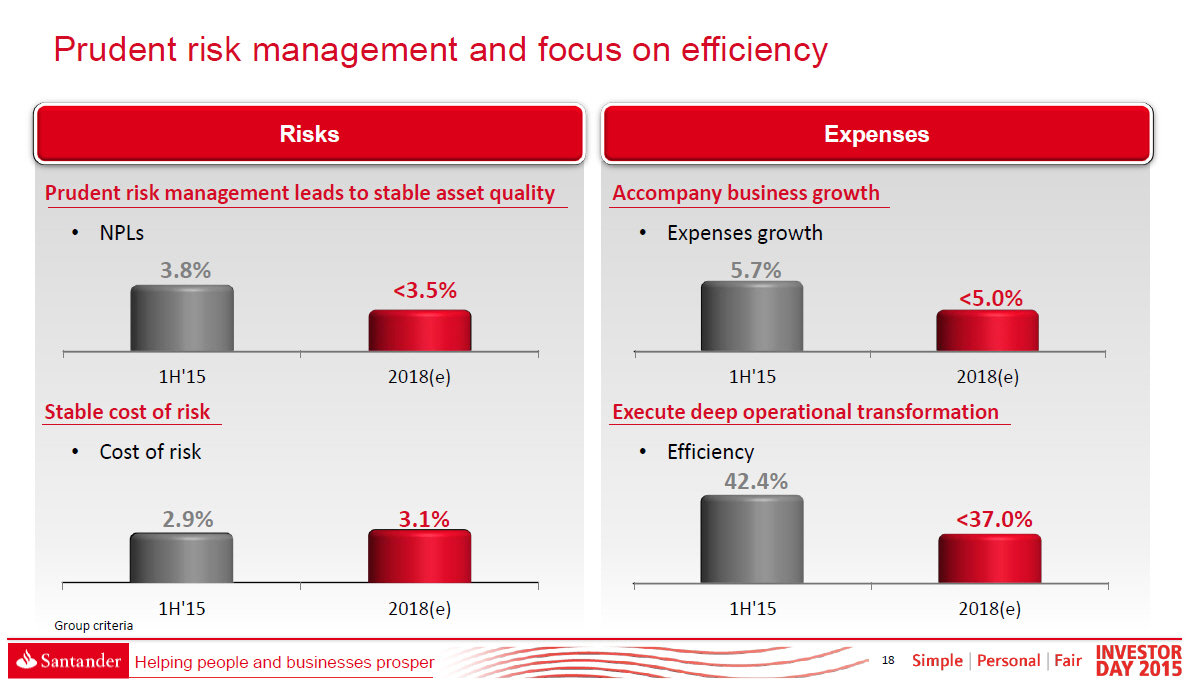

Risks

Prudent risk management leads to stable asset quality

[] NPLs

3.8%

(3.5%

1H'15 2018(e)

Stable cost of risk

[] Cost of risk

2.9% 3.1%

1H'15 2018(e)

Group criteria

Expenses

Accompany business growth

[] Expenses growth

5.7%

(5.0%

1H'15 2018(e)

Execute deep operational transformation

[] Efficiency

42.4%

(37.0%

1H'15 2018(e)

Helping people and businesses prosper

|

|

Agenda

1 Market and financial system

2 Strengths and opportunities

3 Strategy

4 Targets

Helping people and businesses prosper

|

|

2018 Mexico targets

1H'15 2018

Great Place to Work bank ranking(1) Top 9 Top 5

People

Commercial Team Turnover 14.7% 12%

------------- ------------------------------------ -------- --------

Total loyal customers (MM) 1.3 1.7

Digital customers (MM) 0.8 1.8

Customers Customer satisfaction Top 4 Top 3

Growth in business volumes )Mkt )Mkt

Fee income CAGR 2%(2) 10%(3)

------------- ------------------------------------ -------- --------

FL CET1 12.5% )10%

Shareholders RoTE 13.4% )16%

C/I ratio 42.4% (37%

NPL ratio 3.8% (3.5%

------------- ------------------------------------ -------- --------

Communities Number of scholarships 2016-2018 (k) 17.6

Note: Group criteria except FL CET1 (1) Out of 42 companies in the financial

sector (2) 1H'14-1H'15 (3) 2015-2018

Helping people and businesses prosper

|

|

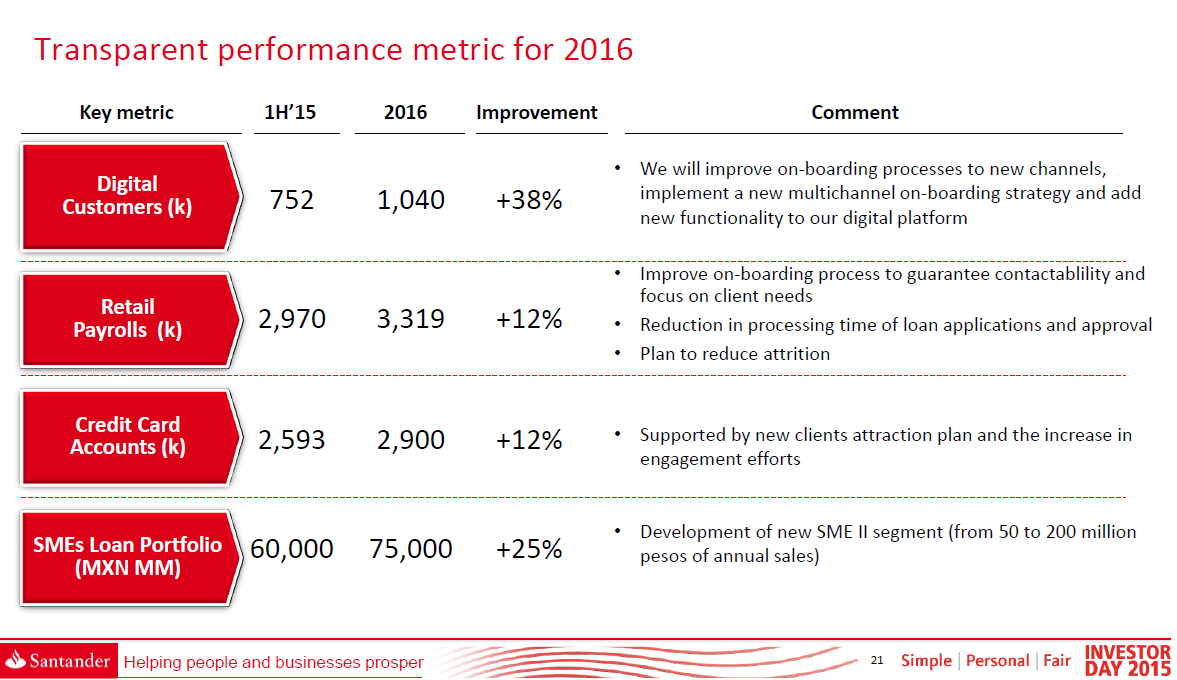

Transparent performance metric for 2016

Key metric 1H'15 2016 Improvement Comment

---------------------------- -------- ------- ----------- --------------------------------------------------------------

[] We will improve on-boarding processes to new channels,

Customers Digital (k) 752 1,040 +38% implement a new multichannel on-boarding strategy and add

new functionality to our digital platform

---------------------------- -------- ------- ----------- --- --------------------------------------------------------------

[] Improve on-boarding process to guarantee contactablility and

focus on client needs

Payrolls Retail (k) 2,970 3,319 +12% [] Reduction in processing time of loan applications and approval

[] Plan to reduce attrition

---------------------------- -------- ------- ----------- --- --------------------------------------------------------------

Credit Card

Accounts (k) 2,593 2,900 +12% [] Supported by new clients attraction plan and the increase in

engagement efforts

---------------------------- -------- ------- ----------- --- --------------------------------------------------------------

[] Development of new SME II segment (from 50 to 200 million

SMEs Loan Portfolio 60,000 75,000 +25% pesos of annual sales)

(MXN MM)

Helping people and businesses prosper

|

|

Key takeaways

Mexico has high potential for growth in a strong and healthy financial system

Santander Mexico is well positioned to take advantage of this potential to

become the market leader in profitability and growth[]

[]by strengthening our position in the retail segment and consolidating our

leadership position in key markets through[]

[]an operational transformation focused on quality and technological innovation

Helping people and businesses prosper

|