UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2017

_________________

Commission File Number: 001-35658

GRUPO FINANCIERO SANTANDER MÉXICO, S.A.B. de C.V.

(Exact Name of Registrant as Specified in Its Charter)

SANTANDER MEXICO FINANCIAL GROUP, S.A.B. de C.V.

(Translation of Registrant’s Name into English)

Avenida Prolongación Paseo de la Reforma 500

Colonia Lomas de Santa Fe

Delegación Álvaro Obregón

01219, Ciudad de México

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

GRUPO FINANCIERO SANTANDER MÉXICO, S.A.B. de C.V.

TABLE OF CONTENTS

| ITEM | |

| | |

| 1. | Fourth quarter 2016 earnings release of Grupo Financiero Santander México, S.A.B. de C.V. |

| 2. | Fourth quarter and full-year 2016 earnings presentation of Grupo Financiero Santander México, S.A.B. de C.V. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | GRUPO FINANCIERO SANTANDER MÉXICO, S.A.B. de C.V. |

| | |

| | | By: | /s/ Héctor Chávez López |

| | | | Name: | Héctor Chávez López |

| | | | Title: | Executive Director of Investor Relations |

Date: January 30, 2017

Item 1

TABLE OF CONTENTS

| I. | CEO Message / Key Highlights for the Quarter |

| II. | Summary of 4Q16 Consolidated Results |

| III. | Analysis of 4Q16 Consolidated Results |

| IV. | Relevant Events & Representative Activities and Transactions |

| VI. | Sustainability and Social Responsibility |

| VIII. | 4Q16 Earnings Call Dial-In Information |

| XII. | Notes to the Financial Statements |

| 2 |

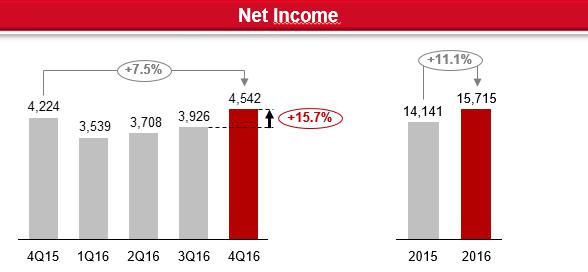

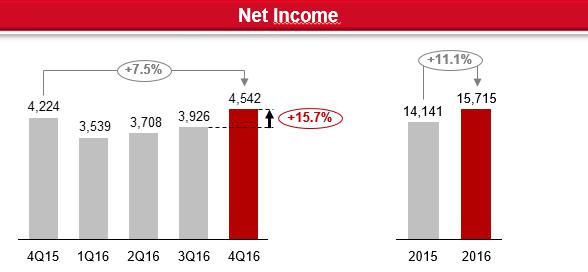

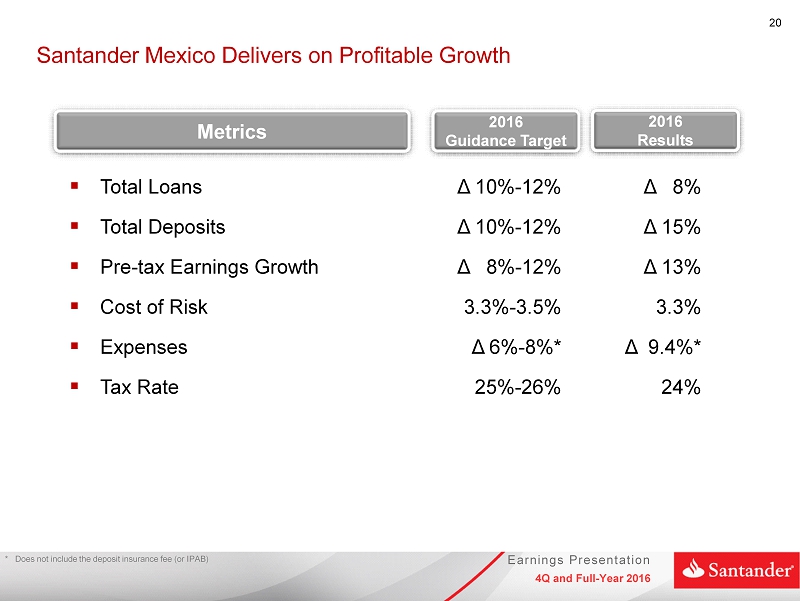

Grupo Financiero Santander México Reports Fourth Quarter 2016 Net Income of Ps.4,542 Million

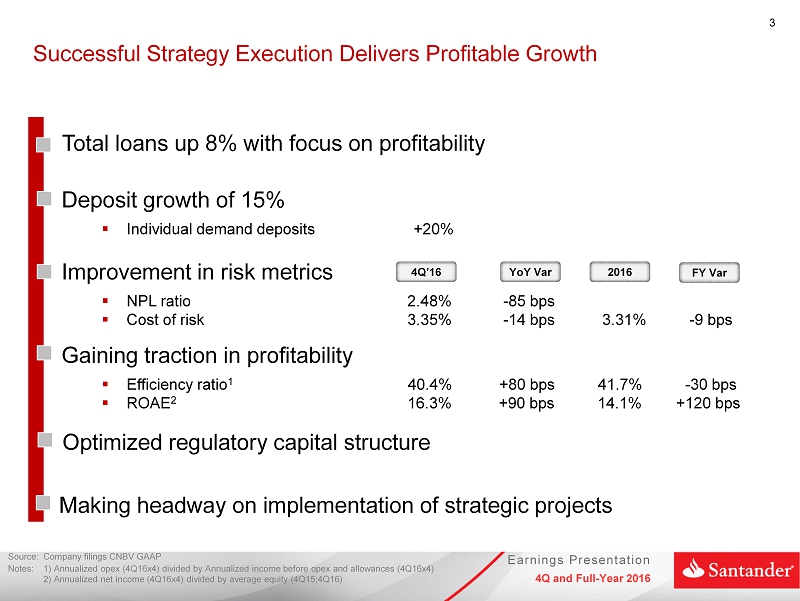

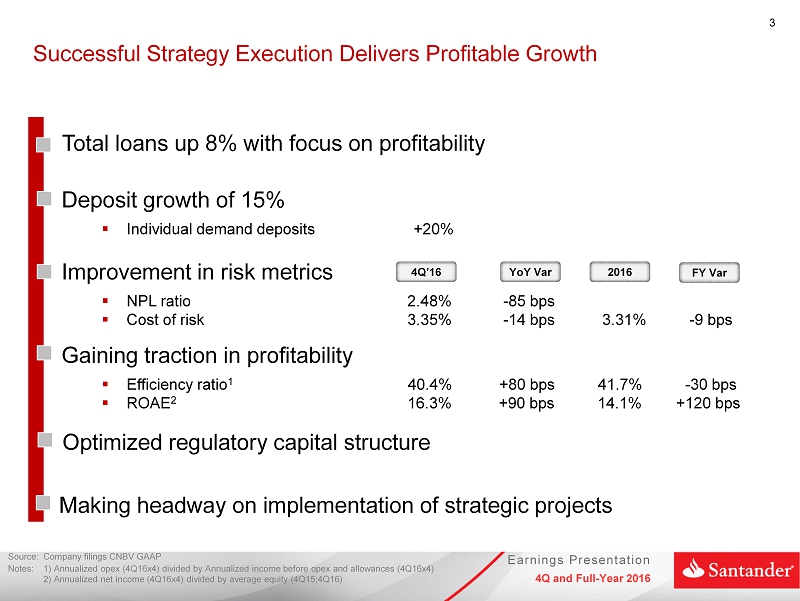

- Profitable growth strategy drives 7.5% YoY increase in net income for the quarter and 11.1% on a cumulative basis

- Loan growth underpinned by increases in retail segments

- Improving profiability and efficiency ratios

- Maintaining focus on asset quality

Mexico City – January 27, 2017, Grupo Financiero Santander México, S.A.B. de C.V., (NYSE: BSMX; BMV: SANMEX), (“Santander México”), one of the leading financial groups in Mexico, today announced financial results for the three-month and twelve-month periods ending December 31, 2016.

Santander México reported net income for 4Q16 of Ps.4.542 million, representing YoY and QoQ increases of 7.5% and 15.7%, respectively. For 12M16, net income amounted to Ps.15,715 million, reflecting an 11.1% increase from 12M15.

HIGHLIGHTS

| Income Statement Data | 4Q16 | 3Q16 | 4Q15 | % YoY | % QoQ | 2016 | 2015 | % YoY |

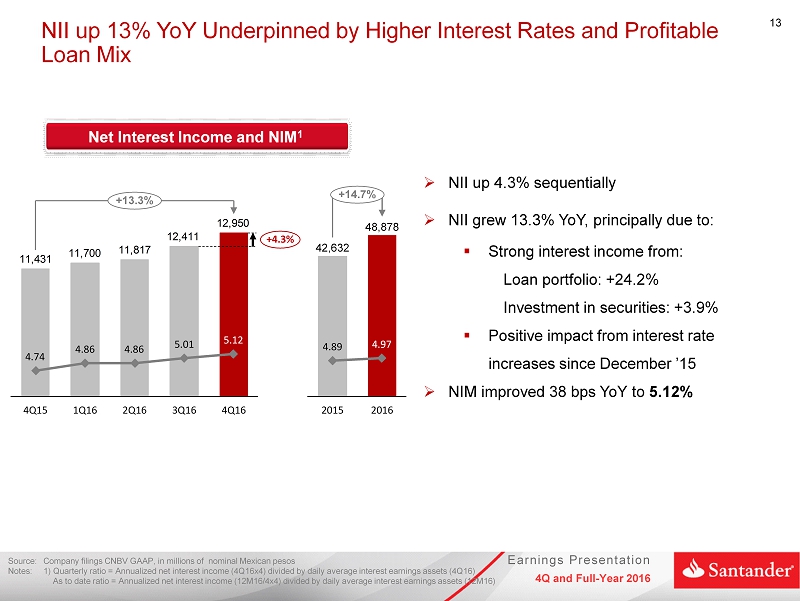

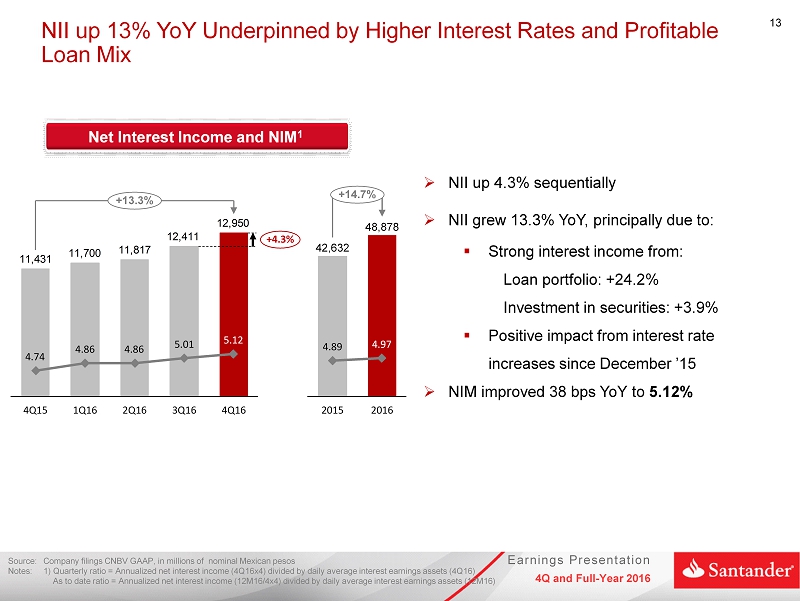

| Net interest income | 12,950 | 12,411 | 11,431 | 13.3 | 4.3 | 48,878 | 42,632 | 14.7 |

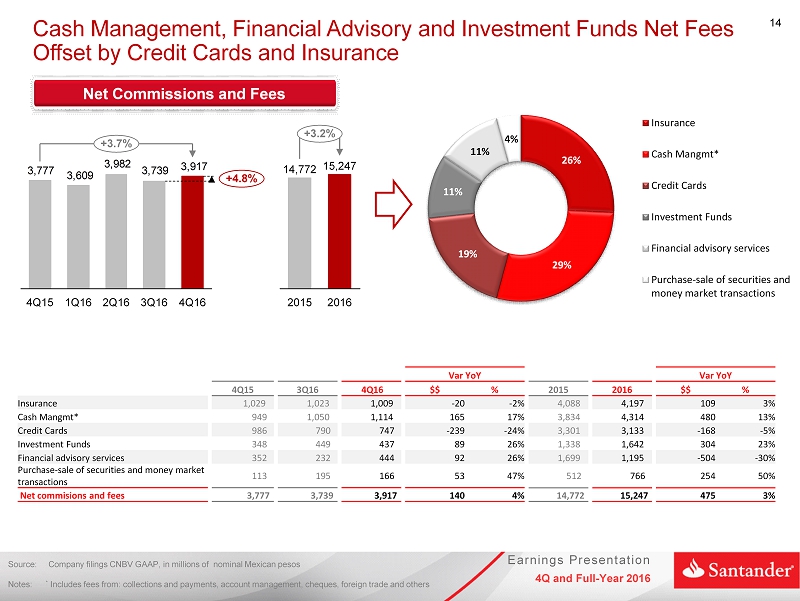

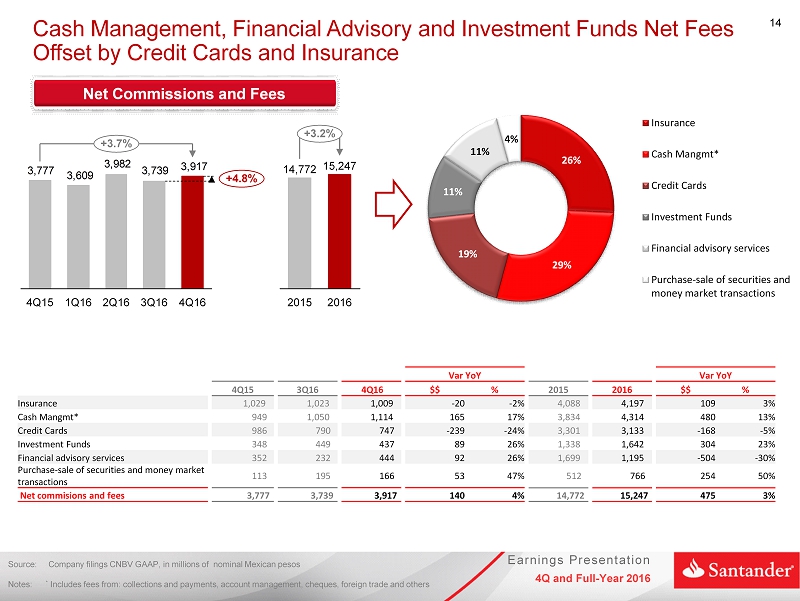

| Fee and commission, net | 3,917 | 3,739 | 3,777 | 3.7 | 4.8 | 15,247 | 14,772 | 3.2 |

| Core revenues | 16,867 | 16,150 | 15,208 | 10.9 | 4.4 | 64,125 | 57,404 | 11.7 |

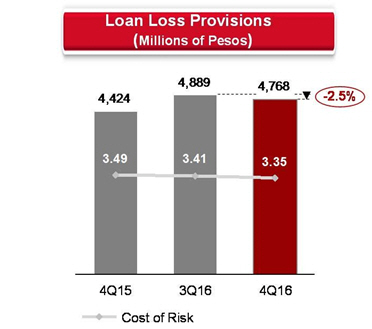

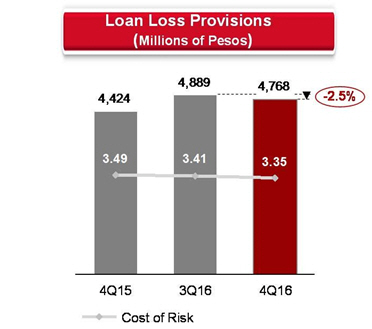

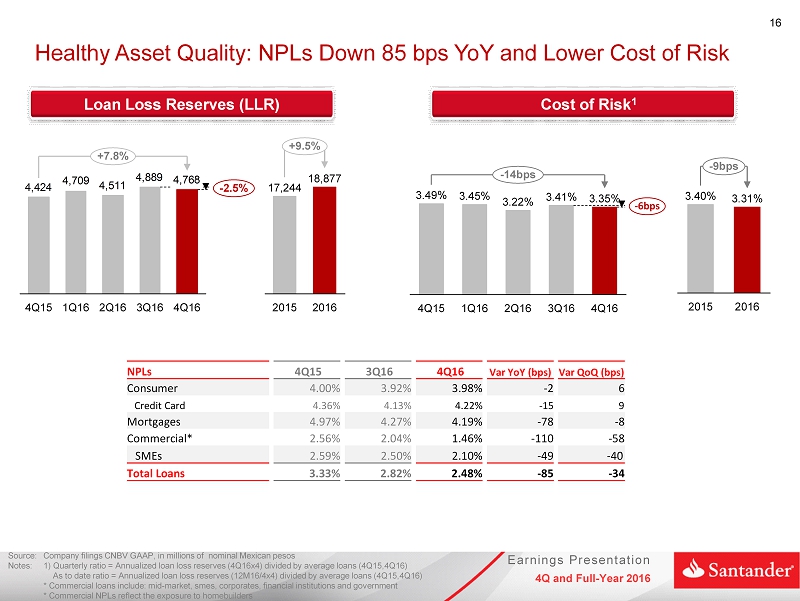

| Provisions for loan losses | 4,768 | 4,889 | 4,424 | 7.8 | (2.5) | 18,877 | 17,244 | 9.5 |

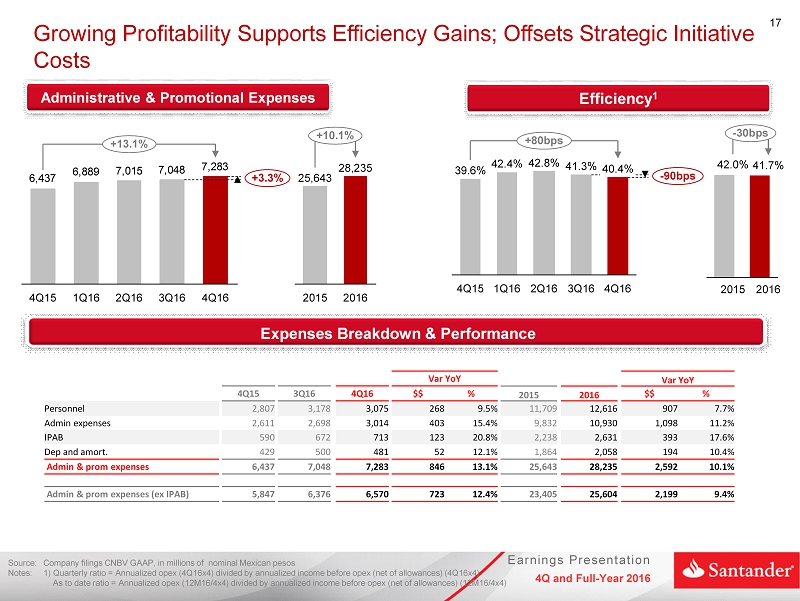

| Administrative and promotional expenses | 7,283 | 7,048 | 6,437 | 13.1 | 3.3 | 28,235 | 25,643 | 10.1 |

| Net income | 4,542 | 3,926 | 4,224 | 7.5 | 15.7 | 15,715 | 14,141 | 11.1 |

| Net income per share1 | 2.32 | 1.65 | 2.08 | 11.5 | 40.6 | 2.32 | 2.08 | 11.5 |

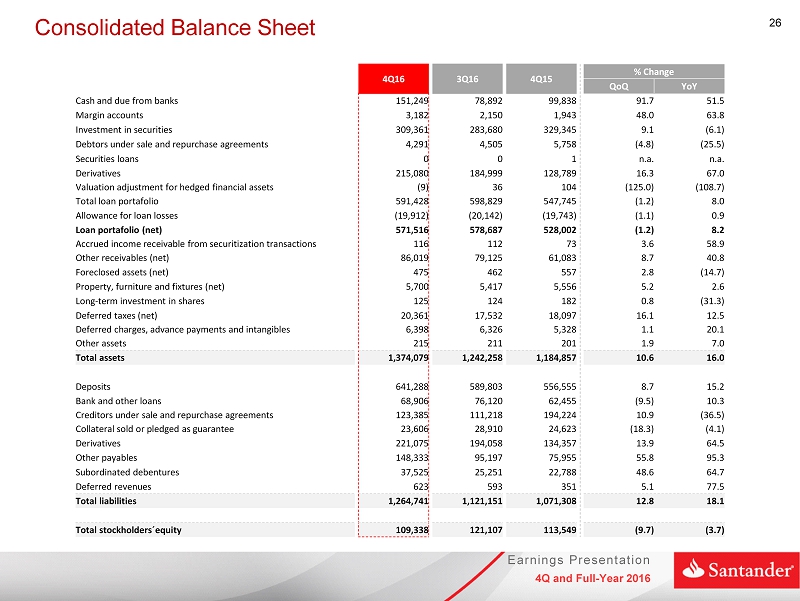

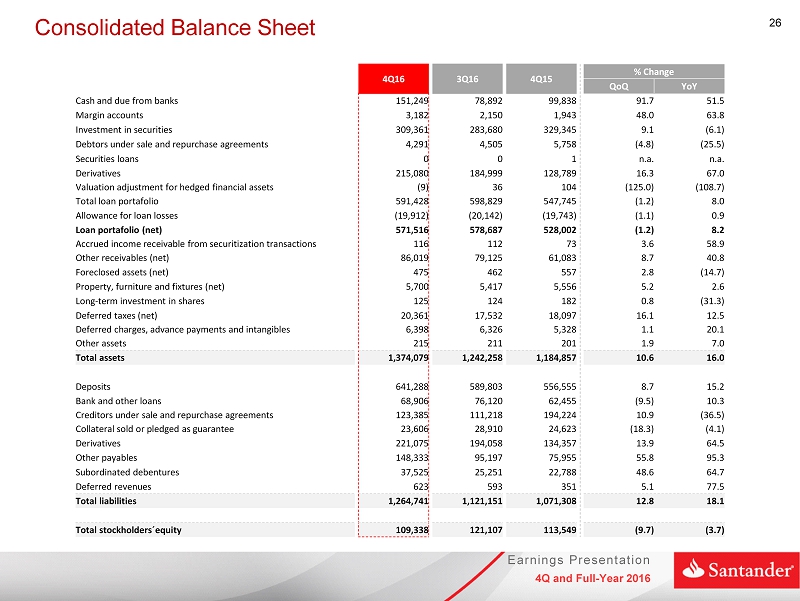

| Balance Sheet Data | 4Q16 | 3Q16 | 4Q15 | % YoY | % QoQ | 4Q16 | 4Q15 | % YoY |

| Total assets | 1,374,079 | 1,242,258 | 1,184,857 | 16.0 | 10.6 | 1,374,079 | 1,184,857 | 16.0 |

| Total loans | 591,428 | 598,829 | 547,745 | 8.0 | (1.2) | 591,428 | 547,745 | 8.0 |

| Deposits | 593,485 | 542,191 | 516,432 | 14.9 | 9.5 | 593,485 | 516,432 | 14.9 |

| Shareholders´s equity | 109,338 | 121,107 | 113,549 | (3.7) | (9.7) | 109,338 | 113,549 | (3.7) |

| Key Ratios | 4Q16 | 3Q16 | 4Q15 | bps YoY | bps QoQ | 2016 | 2015 | bps YoY |

| Net interest margin | 5.12% | 5.01% | 4.74% | 37.5 | 10.2 | 4.97% | 4.89% | 8.3 |

| Net loans to deposits ratio | 96.3% | 106.7% | 102.2% | (594.2) | (1,043.3) | 96.3% | 102.2% | (594.2) |

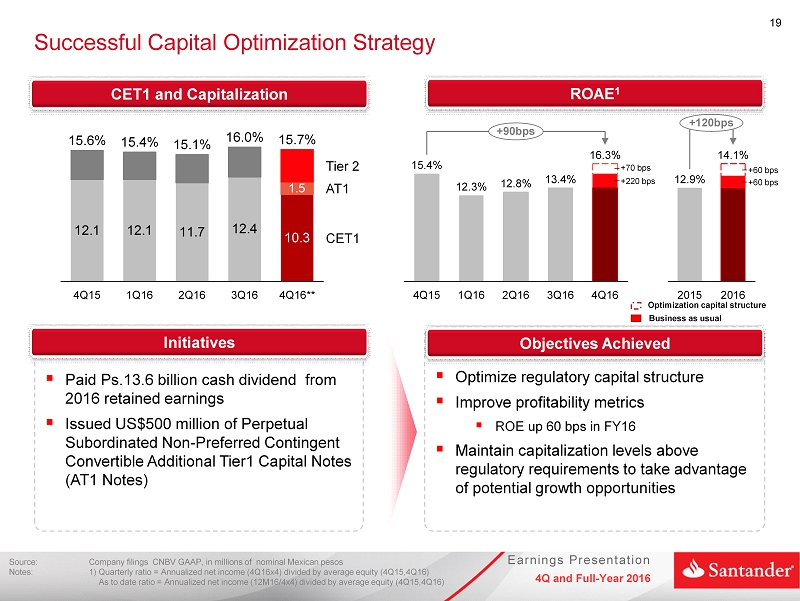

| ROAE | 16.3% | 13.4% | 15.4% | 86.8 | 291.8 | 14.1% | 12.9% | 118.3 |

| ROAA | 1.4% | 1.3% | 1.6% | (17.2) | 12.6 | 1.2% | 1.3% | (10.4) |

| Efficiency ratio | 40.4% | 41.3% | 39.6% | 78.1 | (97.5) | 41.7% | 42.0% | (32.1) |

| Capital ratio | 15.7% | 16.0% | 15.6% | 14.0 | (27.0) | 15.7% | 15.6% | 14.0 |

| NPLs ratio | 2.48% | 2.82% | 3.33% | (84.9) | (34.1) | 2.48% | 3.33% | (84.9) |

| Cost of Risk | 3.3% | 3.4% | 3.5% | (14.4) | (6.3) | 3.3% | 3.4% | (8.9) |

| Coverage ratio | 135.6% | 119.1% | 108.2% | 2,742.0 | 1,648.6 | 135.6% | 108.2% | 2,742.0 |

| Operating Data | 4Q16 | 3Q16 | 4Q15 | % YoY | % QoQ | 4Q16 | 4Q15 | % YoY |

| Branches and Offices2 | 1,389 | 1,387 | 1,377 | 0.9 | 0.1 | 1,389 | 1,377 | 0.9 |

| ATMs | 6,825 | 6,620 | 5,989 | 14.0 | 3.1 | 6,825 | 5,989 | 14.0 |

| Customers | 13,553,067 | 13,150,684 | 12,471,093 | 8.7 | 3.1 | 13,553,067 | 12,471,093 | 8.7 |

| Employees | 16,976 | 16,828 | 17,208 | (1.3) | 0.9 | 16,976 | 17,208 | (1.3) |

1) Accumulated EPS, net of treasury shares (compensation plan) and discontinued operations. Calculated by using weighted shares.

2) As of 4Q16 includes: 1,075 branches (including 120 branches with Select service) + 18 SM E offices + 7 SM E branches + 131 cash desks (including 1 cash desk with Select service) + 13 Select offices + 43 Select units + 58 Select boxes + 19 Select corner + 25 brokerage house branches

| 3 |

Héctor Grisi, Grupo Financiero Santander México’s Executive President and CEO, commented:“After my first year as Chief Executive, I am proud to report that we achieved sustained profitable growth in the fourth quarter, capping twelve months of disciplined execution toward our goal of becoming a client-centric organisation. Looking forward, the experience of our team, investment in innovation and uncompromising focus on profitable growth, give us confidence against an uncertain global backdrop.

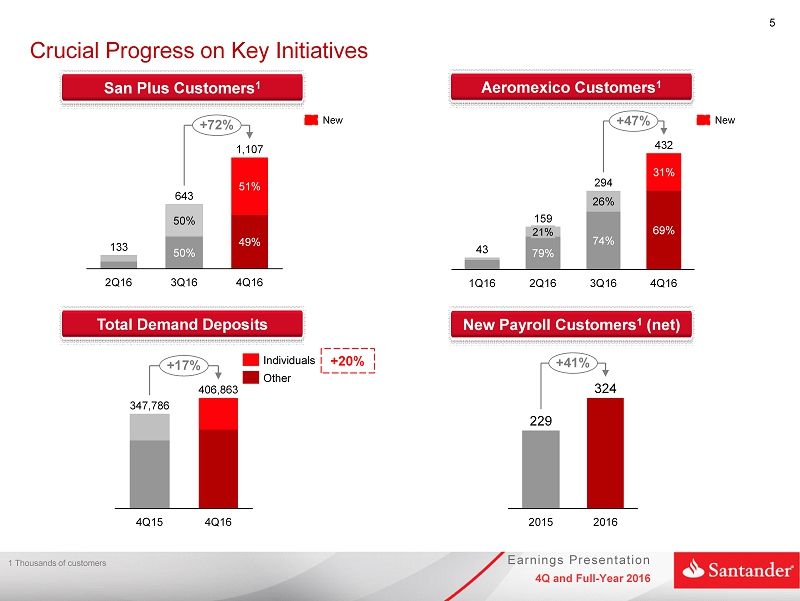

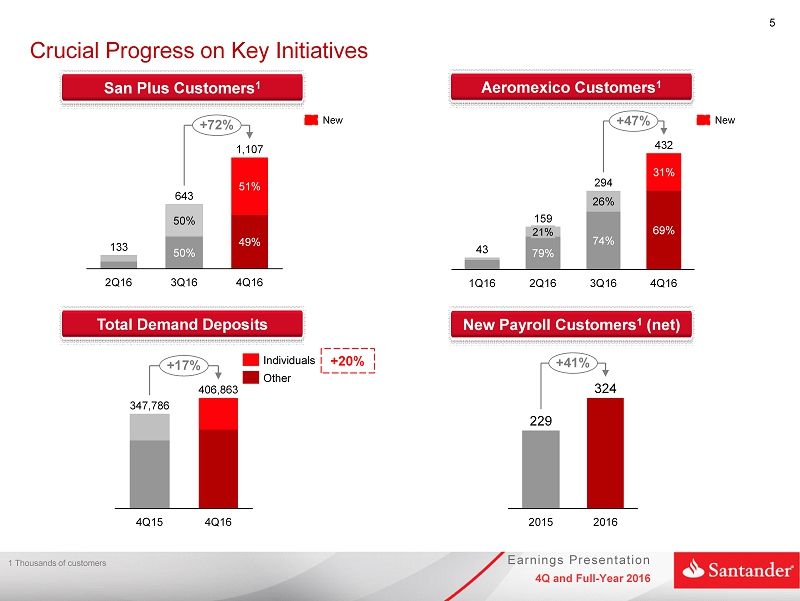

Our initiatives to attract new clients are gaining momentum. Santander Plus grew customers by 72% in the quarter to over 1.1 million clients, 51% of which are new to the bank. Our Aeromexico co-branded card had over 430,000 clients at year-end, 30% of which are new. Importantly, we are achieving strong cross-sell levels among new clients across our mortgages, funds and deposit portfolios. Digital customers also continue to expand, up 52% during 2016 to over 1.3 million.

We closed the year with strong asset quality across all metrics, and were particularly pleased with our recent capital optimization initiatives which boosted ROAE.

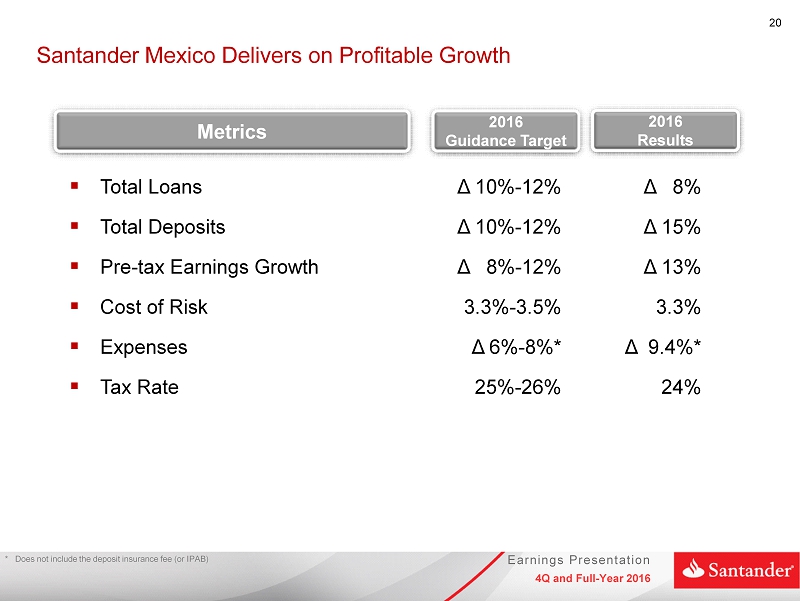

Our focus on profitability meant loan growth moderated to 8% YoY, though a 23% rise in interest income underpinned healthy NII expansion. Overall, we posted a 11% YoY rise in annual net income, despite a far higher effective tax rate.

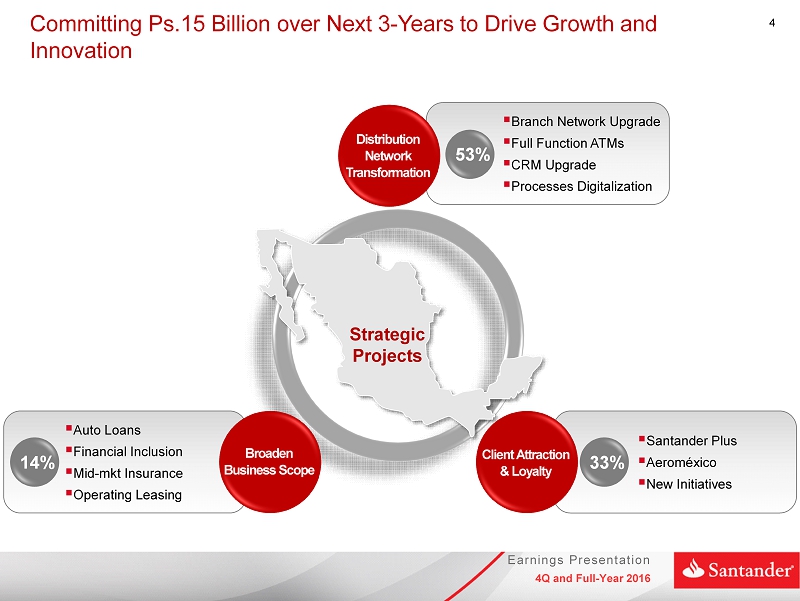

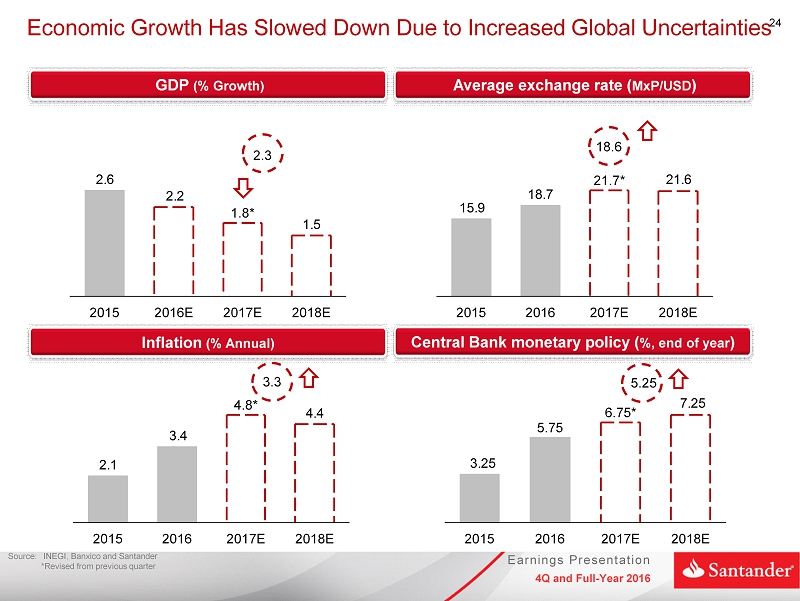

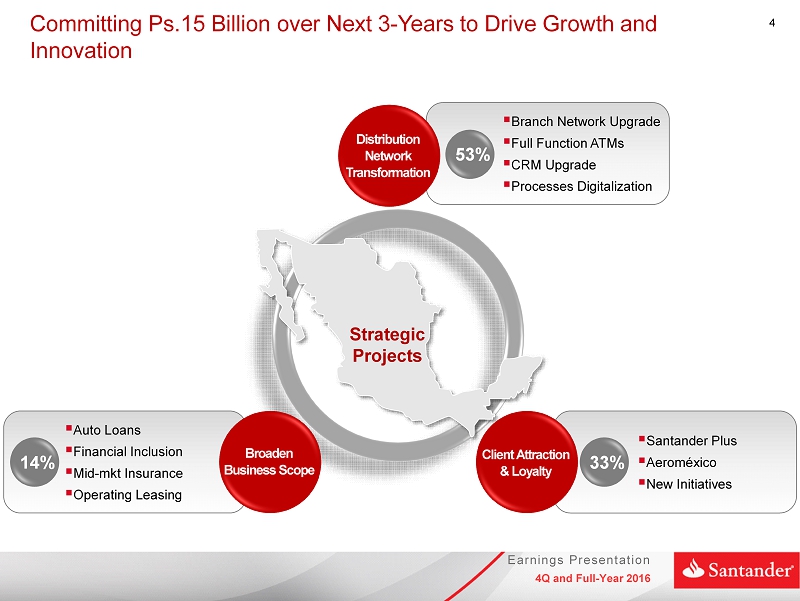

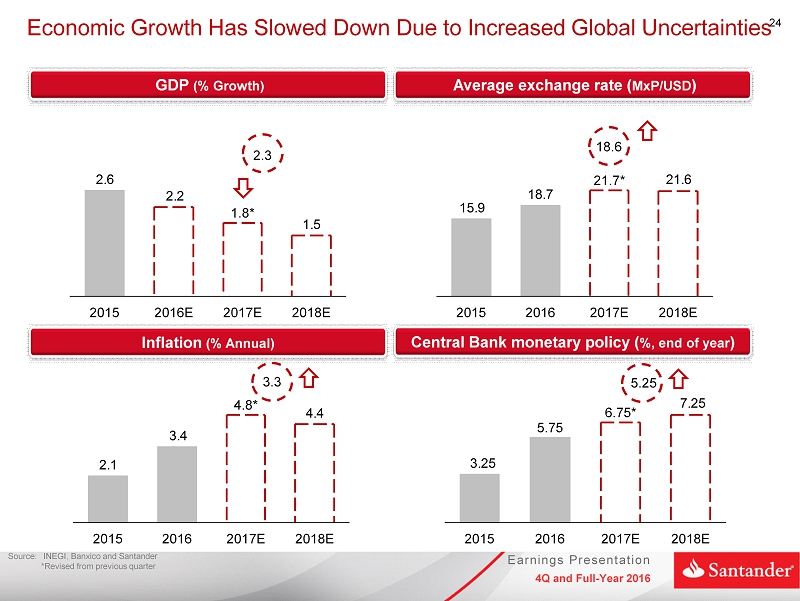

In the current environment, we have modest GDP growth estimates and forecast ongoing peso weakness. While we expect this to impact loan growth, we are confident in our ability to continue delivering on our strategic initiatives. As announced in December, we are investing an additional $15 billion pesos between 2017 and 2019 to support our goal of becoming Mexico’s profitable growth market leader. We look to the year ahead with cautious optimism and a commitment to ongoing discipline in our execution.”

| 4 |

SUMMARY OF FOURTH QUARTER 2016 CONSOLIDATED RESULTS

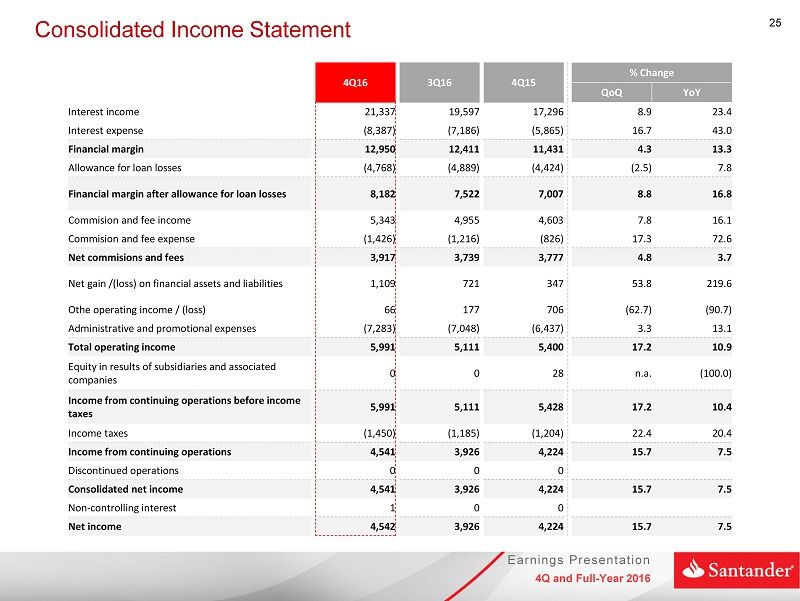

| Income statement | | | | | | | | | | | |

| Millions of Mexican pesos | | | | | % Variation | | | | | % Variation |

| | 4Q16 | 3Q16 | 4Q15 | | QoQ | YoY | | 12M16 | 12M15 | | 16/15 |

| Net interest income | 12,950 | 12,411 | 11,431 | | 4.3 | 13.3 | | 48,878 | 42,632 | | 14.7 |

| Provisions for loan losses | (4,768) | (4,889) | (4,424) | | (2.5) | 7.8 | | (18,877) | (17,244) | | 9.5 |

| Net interest income after provisions for loan losses | 8,182 | 7,522 | 7,007 | | 8.8 | 16.8 | | 30,001 | 25,388 | | 18.2 |

| Commission and fee income, net | 3,917 | 3,739 | 3,777 | | 4.8 | 3.7 | | 15,247 | 14,772 | | 3.2 |

| Net gain (loss) on financial assets and liabilities | 1,109 | 721 | 347 | | 53.8 | 219.6 | | 3,127 | 2,265 | | 38.1 |

| Other operating income | 66 | 177 | 706 | | (62.7) | (90.7) | | 484 | 1,379 | | (64.9) |

| Administrative and promotional expenses | (7,283) | (7,048) | (6,437) | | 3.3 | 13.1 | | (28,235) | (25,643) | | 10.1 |

| Operating income | 5,991 | 5,111 | 5,400 | | 17.2 | 10.9 | | 20,624 | 18,161 | | 13.6 |

| Equity in results of associated companies | 0 | 0 | 28 | | 0.0 | (100.0) | | 0 | 81 | | (100.0) |

| Operating income before income taxes | 5,991 | 5,111 | 5,428 | | 17.2 | 10.4 | | 20,624 | 18,242 | | 13.1 |

| Income taxes (net) | (1,450) | (1,185) | (1,204) | | 22.4 | 20.4 | | (4,909) | (4,100) | | 19.7 |

| Income from continuing operations | 4,541 | 3,926 | 4,224 | | 15.7 | 7.5 | | 15,715 | 14,142 | | 11.1 |

| Non-controlling interest | 1 | 0 | 0 | | 0.0 | 0.0 | | 0 | (1) | | 0.0 |

| Net income | 4,542 | 3,926 | 4,224 | | 15.7 | 7.5 | | 15,715 | 14,141 | | 11.1 |

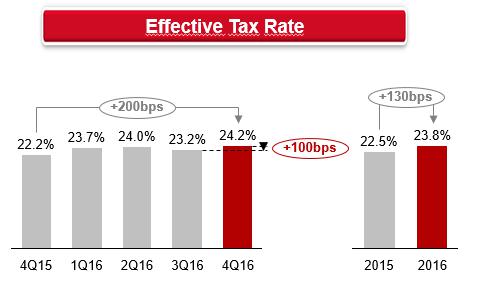

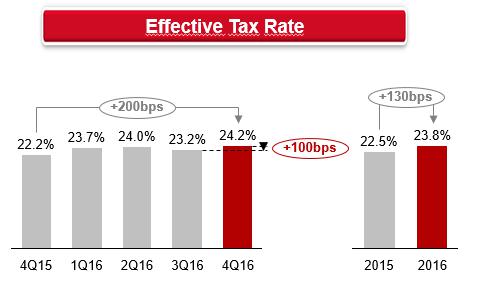

| Effective tax rate (%) | 24.2 | 23.2 | 22.2 | | | | | 23.8 | 22.5 | | |

| | | | | | | | | | | | | |

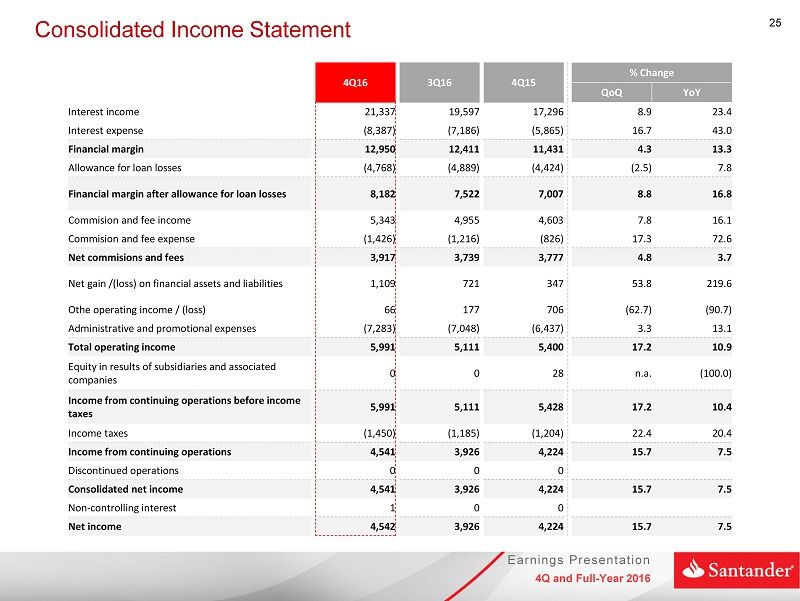

Net income

Santander México reported net income for the quarter of Ps.4,542 million, representing YoY and QoQ increases of 7.5% and 15.7%, respectively. Net income for 12M16 increased by 11.1% to Ps.15,715 million.

4Q16 vs 4Q15

The 7.5% year-on-year growth in net income was principally driven by the following increases:

| i) | a 13.3%, or Ps.1,519 million, in net interest income, mainly reflecting higher interest income from the loan portfolio; |

| ii) | a Ps.762 million in net gains on financial assets and liabilities; and |

| 5 |

| iii) | a 3.7%, or Ps.140 million, in net commissions and fees, mainly resulting from financial advisory, investment funds and foreign trade fees. |

These contributions to net income were partially offset by:

| i) | a 13.1%, or Ps.846 million, increase in administrative and promotional expenses, mainly due to higher technology services expenses, personnel expenses, professional fees and contributions to the bank savings protection system (IPAB), resulting from a higher deposit base and other funding sources; |

| ii) | a 90.7%, or Ps.640 million, decrease in other operating income, mainly due to higher provisions for legal and tax contingencies and higher write-offs and bankruptcies; |

| iii) | a 7.8%, or Ps.344 million, increase in provisions for loan losses, mainly driven by loan volume growth; and |

| iv) | a 20.4%, or Ps.246 million, increase in income taxes, that resulted in a 24.2% effective tax rate in the quarter compared to 22.2% in 4Q15. |

12M16 vs 12M15

Net income growth of 11.1% for 12M16, is mainly explained by the following increases:

| i) | a 14.7%, or Ps.6,246 million, in net interest income, mainly reflecting higher interest income from investment in securities and from the loan portfolio, which resulted from higher interest rates and solid loan growth; |

| ii) | a 38.1%, or Ps.862 million, in net gains on financial assets and liabilities; and |

| iii) | a 3.2%, or Ps.475 million, in net commissions and fees, mainly resulting from growth in investment funds, purchase-sale of securities and money market transactions, collections and payments, foreign trade and insurance; and partly offset by lower fees from financial advisory and credit and debit card fees. |

These contributions to net income were partially offset by:

| i) | a 10.1%, or Ps.2,592 million, increase in administrative and promotional expenses, mainly explained by higher salaries and employee benefits, professional fees and contributions to the IPAB resulting from a higher deposit base and other funding sources; followed by increases in technology services, depreciation and amortization and promotional and advertising expenses; |

| ii) | a 9.5%, or Ps.1,633 million, increase in provisions for loan losses, which reflects: i) business volume growth, with significant contributions from credit cards and payroll loans; ii) provisions in 1Q16 resulting from the exposure to some of the loans that were restructured during 2014 and were past due for 18 months, as well as other corporates that are on our watch list; and iii) higher provisions in connection with mortgages (mainly related to the change in the charge-off period, explained in 1Q16); |

| iii) | a 64.9%, or Ps.895 million, decrease in other operating income, which mainly resulted from an increase inprovisions for legal and tax contingencies andwrite-offs and bankruptcies expenses which were partly offset by higher recoveries of previously written-off loans; and |

| iv) | a 19.7%, or Ps.809 million, increase in tax expenses, that resulted in a 23.8% effective tax rate in 12M16, which compares with 22.5% in 12M15. |

| 6 |

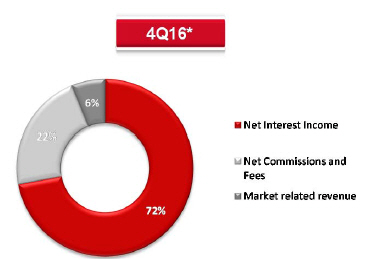

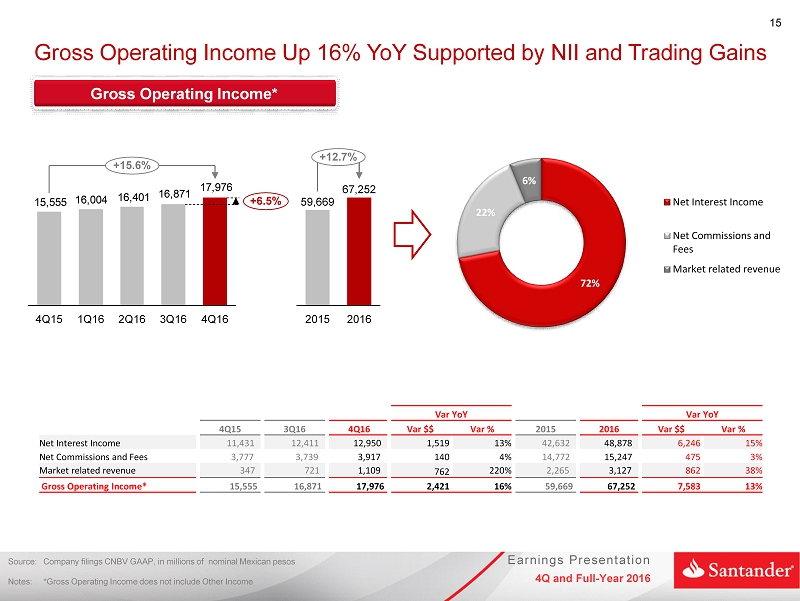

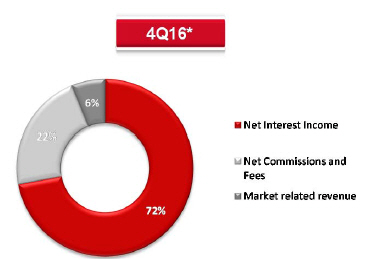

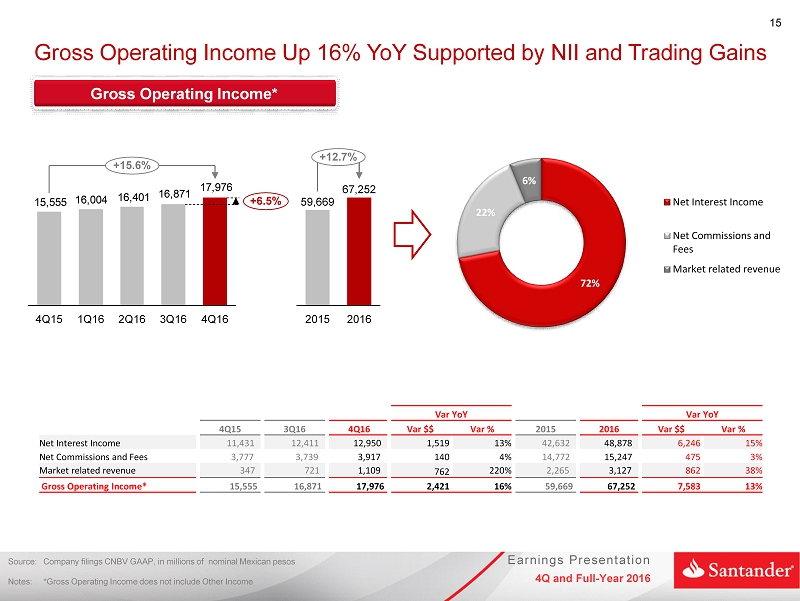

Gross Operating Income

Santander México’s gross operating income for 4Q16 totaled Ps.17,976 million, representing YoY and QoQ increases of 15.6% and 6.5%, respectively, and is broken down as follows:

* Gross Operating Income does not include Other Income

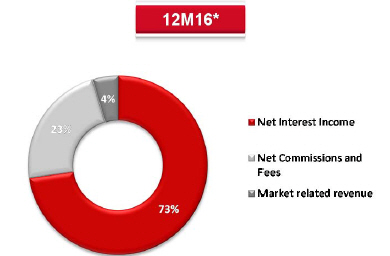

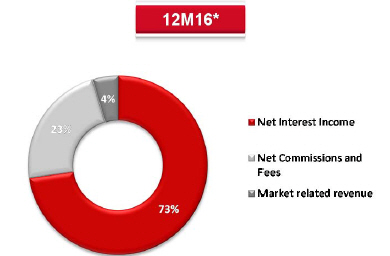

Gross operating income for 12M16 amounted to Ps.67,252 million, increasing 12.7% from 12M15, and is broken down as follows:

*Gross Operating Income does not include Other Income

Profit Before Taxes

Profit before taxes in 4Q16 amounted to Ps.5,991 million, reflecting YoY and QoQ increases of 10.9% and 17.2%, respectively.

Profit before taxes for 12M16 amounted to Ps.20,624 million, and increased 13.1% YoY, mainly explained by higher net interest income, trading gains and net commissions and fees, which were partially offset by higher expenses, provisions for loan losses and lower income from other operating income.

| 7 |

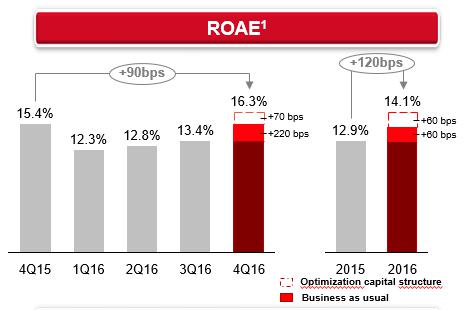

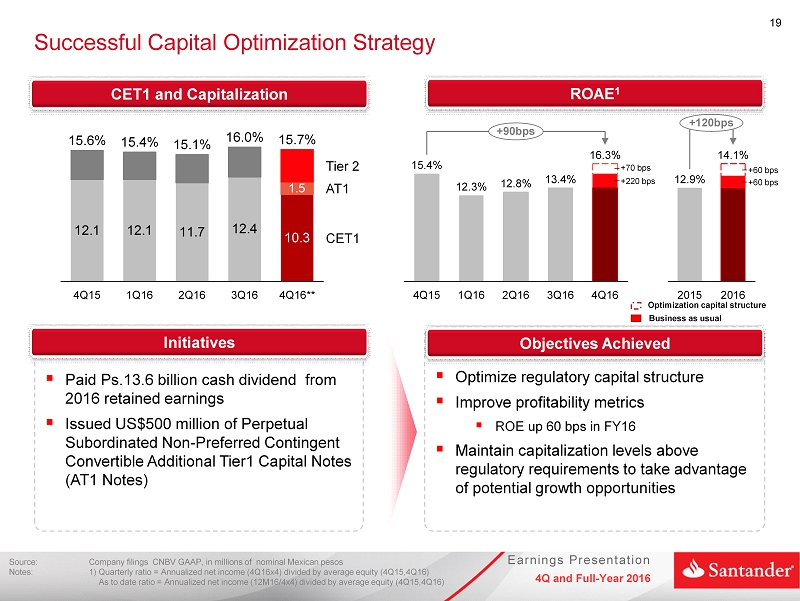

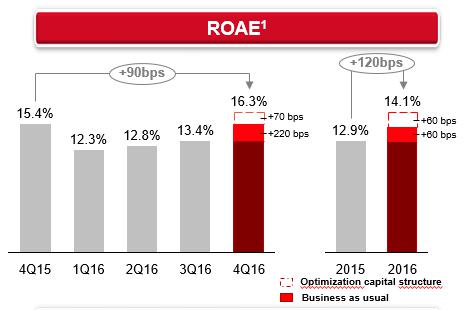

Return on Average Equity (ROAE)

Last December Santander México implemented a series of initiatives to further optimize our capital structure, which included:

| § | A MXN$13.6 billion cash dividend from retained earnings. |

| § | We also issued US$ 500 million of Perpetual Subordinated Non-Preferred Contingent Convertible Additional Tier 1 Capital – Basel III compliant Notes. This innovative structure was the first of its kind in Mexico. Our parent company, Banco Santander acquired 88% of the AT1 Notes maintaining its commitment to invest in Mexico. |

In addition to optimizing our capital structure, these initiatives have allowed us to improve profitability metrics and maintain capitalization levels above regulatory requirements to take advantage of future growth opportunities.

As a result, ROAE for the year improved by 120 basis points to 14.1%. Without this transaction, ROAE would have been 13.5%.

Meanwhile, ROAE in 4Q16 was 16.3%, improving 90 basis points from 15.4% in 4Q15 and 290 basis points from 13.4% in 3Q16. Without the aforementioned transaction, ROAE for the quarter would have been 15.6%.

1 Quarterly ratio = Annualized net income (4Q16x4) divided by average equity (4Q15,4Q16)

As to date ratio = Annualized net income (12M16/4x4) divided by average equity (4Q15,4Q16)

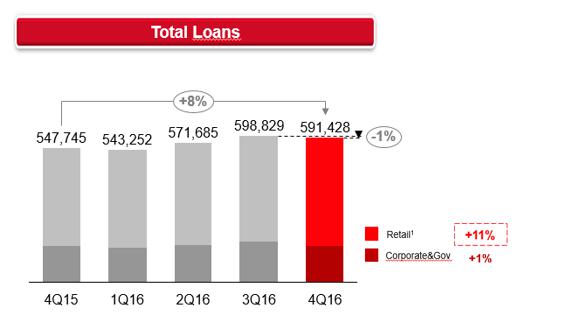

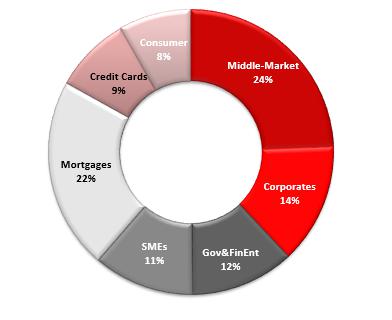

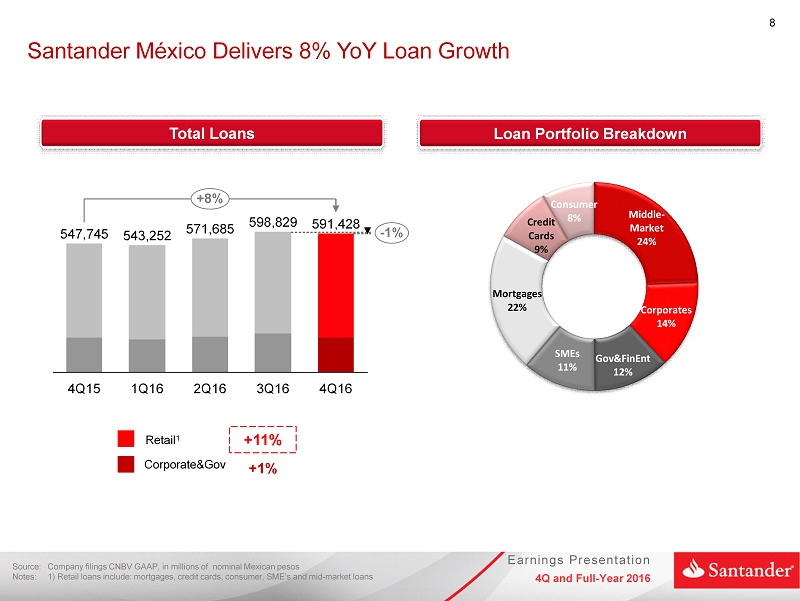

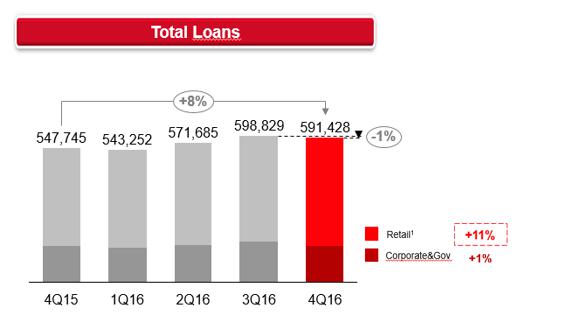

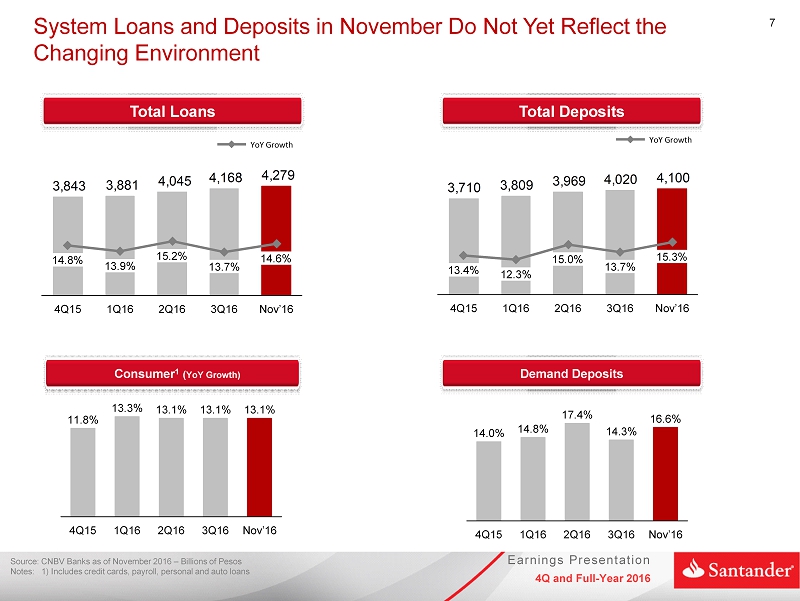

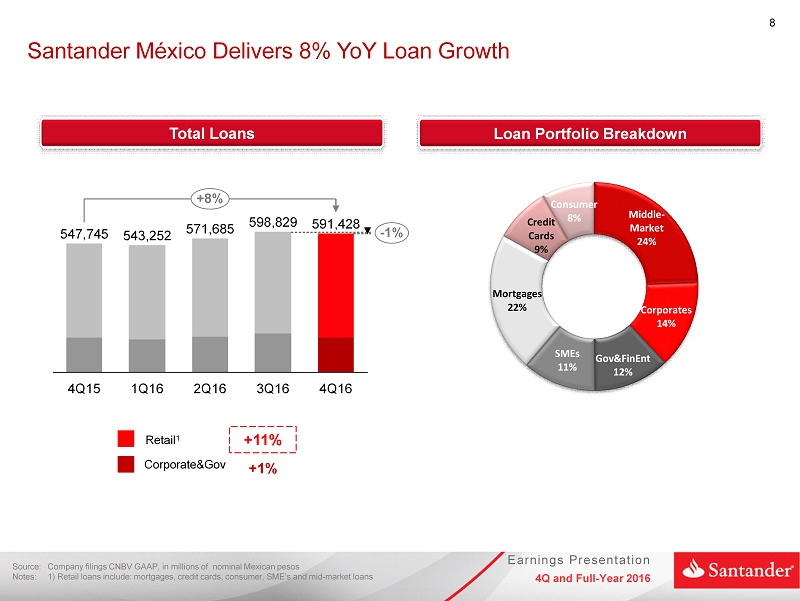

Loan portfolio growth

Santander México’s total loan portfolio as of 4Q16 increased YoY by 8.0%, or Ps.43,683 million, to Ps.591,428 million, and decreased by 1.2%, or Ps.7,401 million, on a sequential basis.

In 4Q16, Santander México’s loan portfolio reflects a contraction in corporate and government loan growth as we maintained a strong focus on profitability.

Individual loans in December were also soft, resulting from the combination of stiffer competition and a more prudent risk-pricing approach given the economic environment.

| 8 |

| 1) | Retail loans include: consumer, credit cards, mortgages, SMEs and mid-market. |

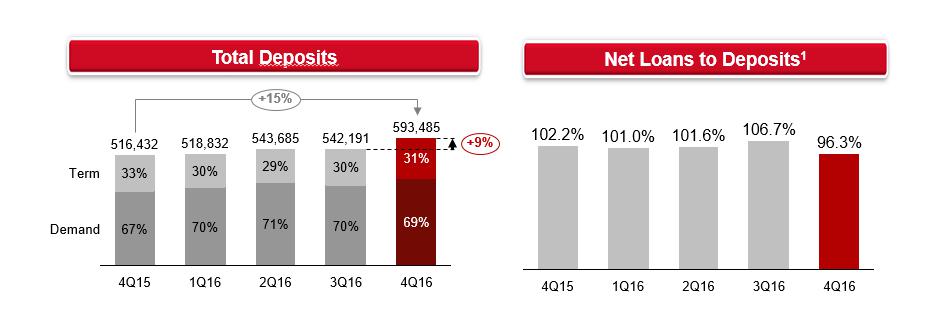

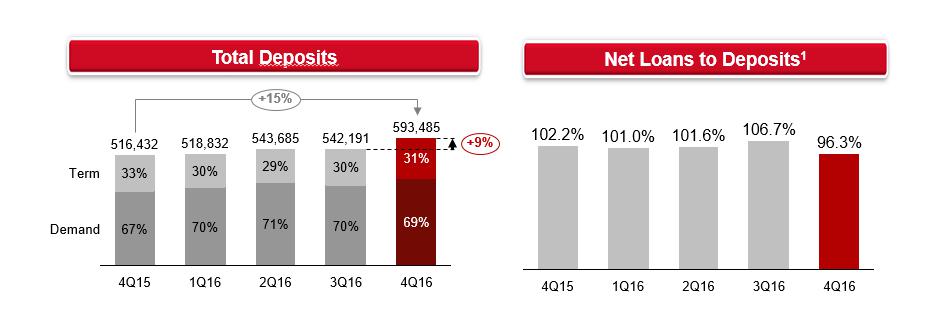

Deposits and loans to deposit ratio

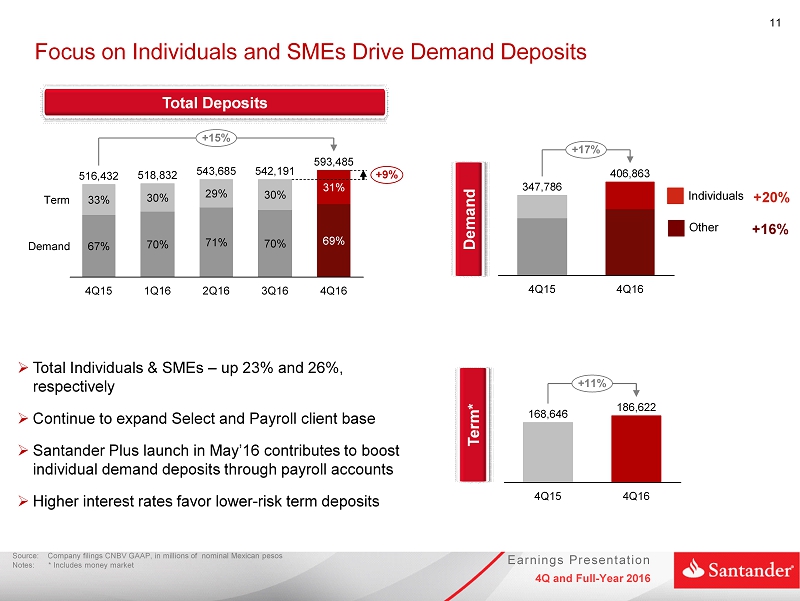

In 4Q16, deposits increased 14.9% YoY and 9.5% sequentially, representing 46.9% of Santander México’s total funding sources. This deposit base provides a stable cost of funding to support Santander México’s continued growth.

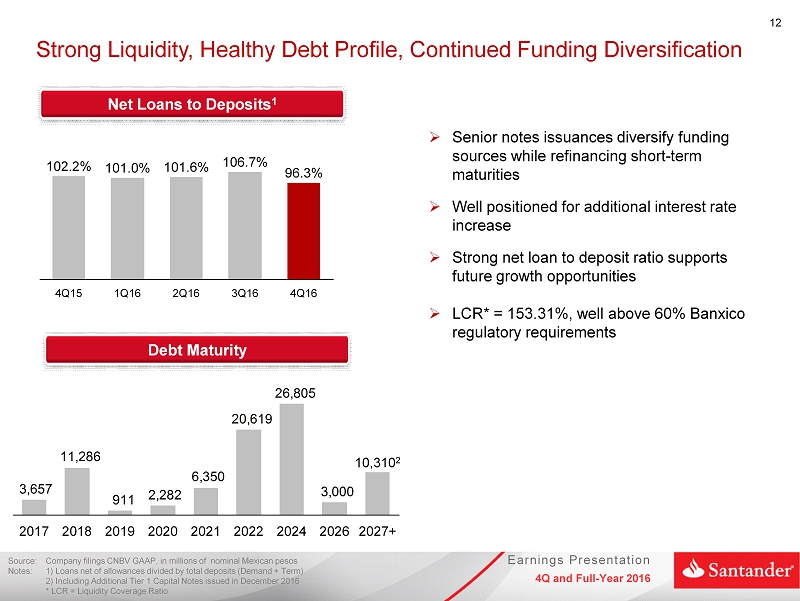

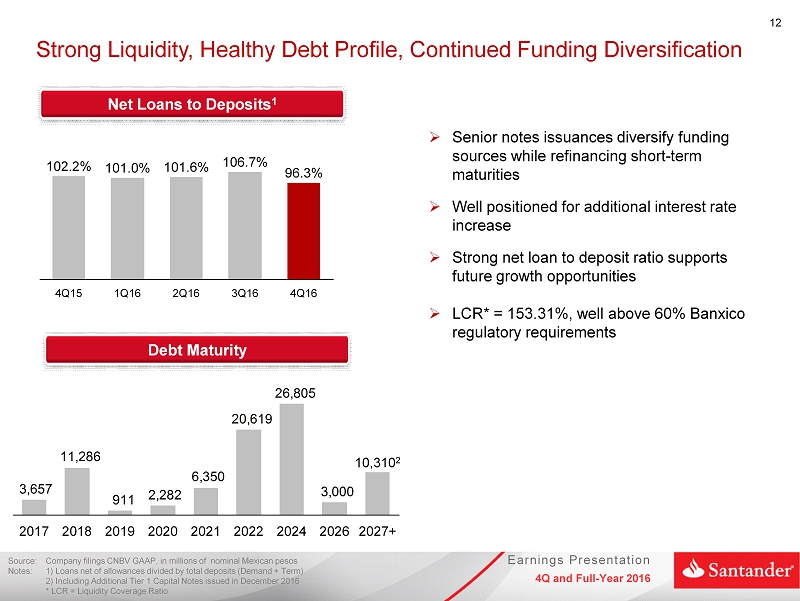

The net loan to deposit ratio stood at 96.3% in 4Q16, which compares with 102.2% in 4Q15 and 106.7% in 3Q16, providing Santander México with a comfortable funding position to leverage future growth opportunities.

In 4Q16, demand deposits represented 68.6% of total deposits which compare with 67.3% in 4Q15.

1 Loans net of allowances divided by total deposits (Demand + Term)

| 9 |

ANALYSIS OF FOURTH QUARTER 2016 CONSOLIDATED RESULTS

(Amounts expressed in millions of pesos, except where otherwise stated)

Net interest income

| Net interest income | | | | | | | | | | | | | | |

| Millions of Mexican pesos | | | | | | | | % Variation | | | | | % Variation |

| | | 4Q16 | | 3Q16 | | 4Q15 | | QoQ | YoY | | 12M16 | 12M15 | | 16/15 |

| Interest on funds available | | 478 | | 374 | | 317 | | 27.8 | 50.8 | | 1,633 | 1,322 | | 23.5 |

| Interest on margin accounts | | 203 | | 129 | | 103 | | 57.4 | 97.1 | | 572 | 366 | | 56.3 |

| Interest and yield on securities | | 3,510 | | 3,413 | | 3,379 | | 2.8 | 3.9 | | 13,633 | 10,723 | | 27.1 |

| Interest and yield on loan portfolio – excluding credit cards | | 12,933 | | 12,001 | | 10,352 | | 7.8 | 24.9 | | 46,912 | 39,031 | | 20.2 |

| Interest and yield on loan portfolio related to credit card transactions | | 3,057 | | 2,841 | | 2,499 | | 7.6 | 22.3 | | 11,090 | 9,794 | | 13.2 |

| Commissions collected on loan originations | | 236 | | 221 | | 213 | | 6.8 | 10.8 | | 821 | 733 | | 12.0 |

| Interest and premium on sale and repurchase agreements and securities loans | | 920 | | 618 | | 433 | | 48.9 | 112.5 | | 2,294 | 1,804 | | 27.2 |

| Interest income | | 21,337 | | 19,597 | | 17,296 | | 8.9 | 23.4 | | 76,955 | 63,773 | | 20.7 |

| | | | | | | | | | | | | | | |

| Daily average interest earnings assets* | | 1,012,339 | | 990,022 | | 964,219 | | 2.3 | 5.0 | | 982,984 | 871,957 | | 12.7 |

| | | | | | | | | | | | | | | |

| Interest from customer deposits – demand deposits | | (1,611) | | (1,372) | | (841) | | 17.4 | 91.6 | | (5,057) | (3,194) | | 58.3 |

| Interest from customer deposits – time deposits | | (1,864) | | (1,444) | | (1,099) | | 29.1 | 69.6 | | (5,800) | (4,361) | | 33.0 |

| Interest from credit instruments issued | | (600) | | (562) | | (373) | | 6.8 | 60.9 | | (2,111) | (1,361) | | 55.1 |

| Interest on bank and other loans | | (771) | | (723) | | (571) | | 6.6 | 35.0 | | (2,667) | (2,107) | | 26.6 |

| Interest on subordinated capital notes | | (418) | | (419) | | (424) | | (0.2) | (1.4) | | (1,670) | (1,737) | | (3.9) |

| Interest and premium on sale and repurchase agreements and securities loans | | (3,123) | | (2,666) | | (2,557) | | 17.1 | 22.1 | | (10,772) | (8,381) | | 28.5 |

| Interest expense | | (8,387) | | (7,186) | | (5,865) | | 16.7 | 43.0 | | (28,077) | (21,141) | | 32.8 |

| | | | | | | | | | | | | | | |

| Net interest income | | 12,950 | | 12,411 | | 11,431 | | 4.3 | 13.3 | | 48,878 | 42,632 | | 14.7 |

* Includes funds available, margin accounts, investments in securities, loan portfolio and sale and repurchase agreements

Net interest income in 4Q16 increased YoY by 13.3%, or Ps.1,519 million, to Ps.12,950 million and QoQ by 4.3%, or Ps.539 million.

The 13.3% YoY increase in net interest income resulted from the combined effect of:

| i) | A 23.4%, or Ps.4,041 million, increase in interest income, to Ps.21,337 million, explained by increases of Ps.37,245 million, or 3.8%, in average interest-earning assets and 131 basis points in the average interest income rate; and |

| ii) | A 43.0%, or Ps.2,522 million, increase in interest expense, to Ps.8,387 million, resulting from increases of Ps.53,523 million, or 6.1%, in interest-bearing liabilities and 92 basis points in the average interest rate. |

Results for the quarter show the full benefit from three interest rate increases that took place during the year until June ’16, and to a lesser extent the last one in September, along with our profitable loan mix.

The net interest margin ratio (NIM) calculated with daily average interest-earning assets for 4Q16 stood at 5.12% which compares to 4.74% in 4Q15, and improved 11 bps from 5.01% in 3Q16 mainly reflecting higher interest rates and solid volume growth.

| 10 |

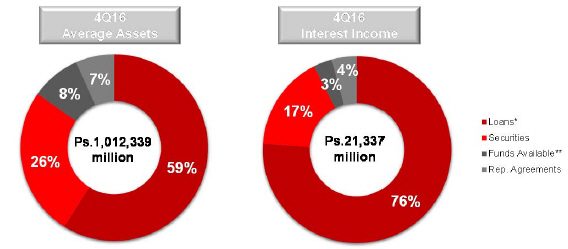

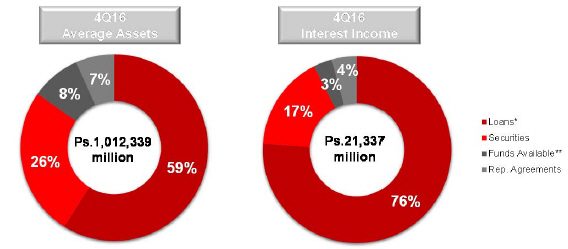

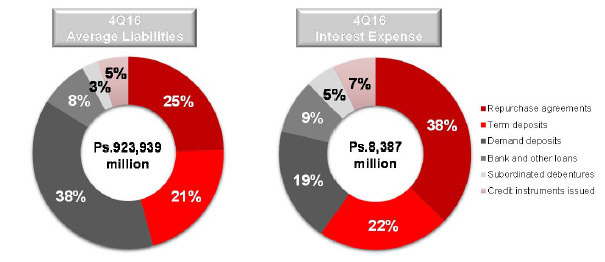

Interest Income

Santander México’s main source of recurring interest income comes from the loan portfolio, which in 4Q16 accounted for 76.0% of interest income and 59.0% of average interest earning assets. Interest income and average interest earning assets are comprised as follows:

*Includes commissions collected on loan origination

**Includes margin accounts

The average interest rate on interest-earning assets for 4Q16 stood at 8.25%, increasing 131 basis points from 6.94% in 4Q15.

Interest income for 4Q16 increased by 23.4%, or Ps.4,041 million, to Ps.21,337 million. On a sequential basis, interest income rose by 8.9%, or Ps.1,740 million.

The 23.4% YoY rise in interest income mainly reflects increases of:

| i) | 24.2%, or Ps.3,162 million, in interest income from our total loan portfolio and commissions on loan origination, which resulted from the combined effect of a Ps.71,335 million, or 13.6%, increase in the average loan portfolio volume, and a 91 basis points increase in the average interest rate. |

Higher average loan portfolio volume is explained by increases across all segments and products, as follows:

| § | 16.6%, or Ps.52,800 million, in the commercial portfolio, mainly reflecting increases of Ps.19,601 million, or 15.4%, Ps.14,358 million, or 83.2%, Ps.12,761 million, or 11.2% and Ps.5,995 million, or 10.0%, in mid-market, institutions, corporates and SMEs, respectively; |

| § | 7.6%, or Ps.9,003 million, in mortgages; |

| § | 10.8%, or Ps.4,696 million, in consumer loans; and |

| § | 10.4%, or Ps.4,836 million, in credit card loans. |

Growth in the average loan portfolio volume was further supported by a 91 basis point increase in the average interest rate earned on this portfolio.

Variation in the average interest rate earned is broken down as follows:

| § | A 132 basis points increase in the commercial portfolio, from 5.91% in 4Q15 to 7.23% in 4Q16. This increase mainly resulted from our prioritization of returns on risk-weighted assets and increases in the reference rate. |

| 11 |

| § | An 228 basis points increase in credit cards, from 21.07% to 23.35%, reflecting an increase from previous quarters, as a result of an improvement in the composition of our credit card portfolio, where this quarter we observed a reduction in the share of customers who pay their outstanding balances in full therefore not contributing to interest income; and |

| § | A 30 basis points increase in mortgages, from 9.46% to 9.76%. |

| § | These increases were partly offset by a 58 basis points decrease in consumer loans (excluding credit cards), from 24.37% to 23.79%. |

| ii) | 112.5%, or Ps.487 million, in sale and repurchase agreement transactions, which resulted from a Ps.14,931 million, or 28.4%, increase in the average volume, together with a 211 basis points increase in the average interest rate earned; |

| iii) | 3.9%, or Ps.131 million, in interest income from our investment in securities portfolio, due to a combined effect of a Ps.67,266 million, or 20.5%, decrease in average volume of this portfolio, together with a 123 basis points increase in the average interest rate earned; |

| iv) | 50.8%, or Ps.161 million, in funds available, which resulted from the combined effect of a Ps.5,451 million, or 14.2%, increase in the average volume, together with a 104 basis points increase in the average interest rate earned; and |

| v) | 97.1%, or Ps.100 million, in margin accounts, which resulted from a Ps.12,794 million, or 42.3%, increase in the average volume together with an 52 basis points increase in the average interest rate earned. |

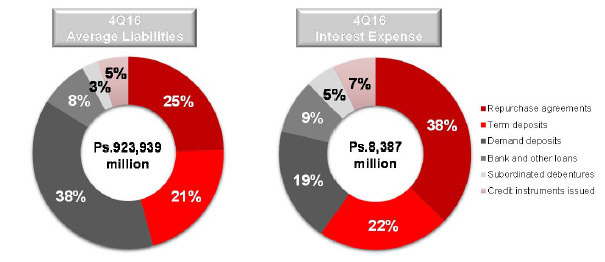

Interest Expense

Santander México’s main sources of funding are customer deposits and repurchase agreements. In 4Q16 these accounted for 41.4% and 37.2% of interest expense, respectively; and 59.3% and 24.6% of average interest liabilities, respectively. Santander México’s funding structure is broken down as follows:

The average interest rate on interest-bearing liabilities increased 91 basis points to 3.55% in 4Q16.

Interest expense for 4Q16 increased 43.0%, or Ps.2,522 million, to Ps.8,387 million. On a sequential basis, interest expense increased by 16.7%, or Ps.1,201 million.

| 12 |

The 43.0% YoY rise in interest expense mainly reflects increases of:

| i) | 91.6%, or Ps.770 million, on interest paid on demand deposits, due to a Ps.82,716 million, or 30.8%, increase in the average volume together with a 57 basis point increase in the average interest rate paid; |

| ii) | 69.6%, or Ps.765 million, in term deposits, which resulted from a 114 basis points increase in the average interest rate paid, and a Ps.29,183 million, or 17.5%, increase in the average volume; |

| iii) | 22.1%, or Ps.566 million, in interest paid on sale and repurchase agreement transactions, which resulted from the combined effect of a Ps.82,069 million, or 26.6%, decrease in the average volume which was more than offset by a 215 basis points increase in the average interest rate paid; |

| iv) | 60.9%, or Ps.227 million, in credit instruments issued, which resulted from a Ps.10,751 million, or 29.1%, increase in the average volume of credit instruments issued together with a 98 basis points increase in the average interest rate paid. These increases mainly reflect the banks’ debt issuances that the bank did in the last year pursuing the strategy of increasing the duration of its funding through the issuance of mid and long term debt financing, in light of the prevailing rising interest rate environment; and |

| v) | 35.0%, or Ps.200 million, in bank and other loans, mainly due to a Ps.8,906 million, or 13.3%, increase in the average volume, together with a 64 basis points increase in the average interest rate paid. |

| 13 |

Commission and fee income, net

| Commission and fee income, net | | | | | | | | |

| Millions of Mexican pesos | | | | | | | | % |

| | | | | % Variation | | | Variation |

| | 4Q16 | 3Q16 | 4Q15 | QoQ | YoY | 12M16 | 12M15 | 16/15 |

| Commission and fee income, net | | | | | | | |

| Debit and credit card | 1,656 | 1,548 | 1,424 | 7.0 | 16.3 | 6,027 | 5,196 | 16.0 |

| Account management | 257 | 249 | 220 | 3.2 | 16.8 | 951 | 896 | 6.1 |

| Collection services | 579 | 577 | 530 | 0.3 | 9.2 | 2,334 | 2,114 | 10.4 |

| Investment funds | 437 | 450 | 350 | (2.9) | 24.9 | 1,646 | 1,363 | 20.8 |

| Insurance | 1,030 | 1,043 | 1,004 | (1.2) | 2.6 | 4,272 | 4,106 | 4.0 |

| Purchase-sale of securities | | | | | | | | |

| and money market | | | | | | | | |

| transactions | 268 | 255 | 204 | 5.1 | 31.4 | 1,031 | 814 | 26.7 |

| Checks trading | 68 | 62 | 65 | 9.7 | 4.6 | 253 | 257 | (1.6) |

| Foreign trade | 304 | 244 | 233 | 24.6 | 30.5 | 1,080 | 866 | 24.7 |

| Financial advisory services | 446 | 233 | 365 | 91.4 | 22.2 | 1,222 | 1,745 | (30.0) |

| Other | 298 | 294 | 208 | 1.4 | 43.3 | 1,142 | 889 | 28.5 |

| Total | 5,343 | 4,955 | 4,603 | 7.8 | 16.1 | 19,958 | 18,246 | 9.4 |

| | | | | | | | | |

| Commission and fee expense | | | | | | | | |

| Debit and credit card | (909) | (758) | (438) | 19.9 | 107.5 | (2,894) | (1,895) | 52.7 |

| Investment funds | 0 | (1) | (2) | 100.0 | 100.0 | (4) | (25) | (84.0) |

| Insurance | (21) | (20) | 25 | 5.0 | (184.0) | (75) | (18) | 316.7 |

| Purchase-sale of securities | | | | | | | | |

| and money market | | | | | | | | |

| transactions | (102) | (60) | (91) | 70.0 | 12.1 | (265) | (302) | (12.3) |

| Checks trading | (9) | (5) | (6) | 80.0 | 50.0 | (26) | (23) | 13.0 |

| Foreign trade | (3) | (5) | 0 | (40.0) | 0.0 | (8) | 0 | 0.0 |

| Financial advisory services | (2) | (1) | (13) | 100.0 | (84.6) | (27) | (46) | (41.3) |

| Other | (380) | (366) | (301) | 3.8 | 26.2 | (1,412) | (1,165) | 21.2 |

| Total | (1,426) | (1,216) | (826) | 17.3 | 72.6 | (4,711) | (3,474) | 35.6 |

| | | | | | | | |

| Commission and fee income, net | | | | | | | |

| Debit and credit card | 747 | 790 | 986 | (5.4) | (24.2) | 3,133 | 3,301 | (5.1) |

| Account management | 257 | 249 | 220 | 3.2 | 16.8 | 951 | 896 | 6.1 |

| Collection services | 579 | 577 | 530 | 0.3 | 9.2 | 2,334 | 2,114 | 10.4 |

| Investment funds | 437 | 449 | 348 | (2.7) | 25.6 | 1,642 | 1,338 | 22.7 |

| Insurance | 1,009 | 1,023 | 1,029 | (1.4) | (1.9) | 4,197 | 4,088 | 2.7 |

| Purchase-sale of securities | | | | | | | | |

| and money market | | | | | | | | |

| transactions | 166 | 195 | 113 | (14.9) | 46.9 | 766 | 512 | 49.6 |

| Checks trading | 59 | 57 | 59 | 3.5 | 0.0 | 227 | 234 | (3.0) |

| Foreign trade | 301 | 239 | 233 | 25.9 | 29.2 | 1,072 | 866 | 23.8 |

| Financial advisory services | 444 | 232 | 352 | 91.4 | 26.1 | 1,195 | 1,699 | (29.7) |

| Other | (82) | (72) | (93) | 13.9 | (11.8) | (270) | (276) | (2.2) |

| Total | 3,917 | 3,739 | 3,777 | 4.8 | 3.7 | 15,247 | 14,772 | 3.2 |

In 4Q16, net commission and fee income totaled Ps.3,917 million, increasing YoY by 3.7%, or Ps.140 million, and by 4.8%, or Ps.178 million QoQ.

| 14 |

The main contributor to net commissions and fees in the quarter were cash management1 fees, which accounted for 28.4% of the total, followed by insurance, debit and credit cards, which accounted for 25.8% and 19.1% of total commissions and fees, respectively.

Commission and fee income, net

Breakdown (%) | | | | | |

| | 4Q16 | 3Q16 | 4Q15 | 12M16 | 12M15 |

| Debit and credit card | 19.1 | 21.1 | 26.1 | 20.5 | 22.3 |

| Account management | 6.6 | 6.7 | 5.8 | 6.2 | 6.1 |

| Collection services | 14.8 | 15.4 | 14.0 | 15.3 | 14.3 |

| Investment funds | 11.2 | 12.0 | 9.2 | 10.8 | 9.1 |

| Insurance | 25.8 | 27.4 | 27.2 | 27.5 | 27.7 |

| Purchase-sale of securities and money market | | | | | |

| transactions | 4.2 | 5.2 | 3.0 | 5.0 | 3.5 |

| Checks trading | 1.5 | 1.5 | 1.6 | 1.5 | 1.6 |

| Foreign trade | 7.7 | 6.4 | 6.2 | 7.0 | 5.9 |

| Financial advisory services | 11.3 | 6.2 | 9.3 | 7.8 | 11.5 |

| Other | (2.1) | (1.9) | (2.5) | (1.8) | (1.9) |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

The 3.7% YoY increase in net commissions and fees in 4Q16 mainly resulted from the following increases:

| i) | 26.1%, or Ps.92 million, in financial advisory fees, resulting from closing a few transactions in a challenging macro environment which has slowed the pace of execution; |

| ii) | 25.6%, or Ps.89 million, in investment funds reflecting a better priced mix and the increase in interest rates from the Mexican Central Bank since December 2015; |

| iii) | 29.2%, or Ps.68 million, in foreign trade fees mainly resulting from Santander México’s continued strong focus on growing the foreign trade business, leveraging its wide product offering, and strong presence in the international business as it advises companies on their foreign trade transactions, direct investments and leveraging platform improvements. |

| iv) | 46.9%, or Ps.53 million, in purchase-sale of securities and money market transactions; and |

| v) | 9.2%, or Ps.49 million, in collection and payments, mainly resulting from our continued focus on being an integral part of our clients’ liquidity management efforts, which led to increased transactional activity. Our Santander Plus program also contributed positively to this result. |

These positive contributions to net commissions and fees, were partly offset by:

| i) | a 24.2%, or Ps.239 million, decrease in debit and credit cards fees. This line remains impacted by higher reward and issuance costs from the successful performance of the Santander-Aeromexico co-branded credit card. Fees were also affected by peso depreciation, as some of the fees paid in connection with the credit and debit card business are dollarized. Note however that commissions and fee income on credit cards rose 16.3% reflecting higher credit card usage; and |

| ii) | a 1.9%, or Ps.20 million, in insurance fees, reflecting good performance in our online platform for car insurance which was more than offset by continued soft SME demand and lower individual credit-related insurance. |

__________________

1Cash management fees include fees from: collections and payments, account management, checks, foreign trade and others

| 15 |

Net gain (loss) on financial assets and liabilities

| Net gain (loss) on financial assets and liabilities | | | | | | | | | |

| Millions of Mexican pesos | | | | % Variation | | | | % Variation |

| | 4Q16 | 3Q16 | 4Q15 | QoQ | YoY | 12M16 | 12M15 | | 16/15 |

| Valuation | | | | | | | | | |

| Foreign Exchange | (141) | (233) | 608 | (39.5) | (123.2) | 37 | 719 | | (94.9) |

| Derivatives | 2,329 | 200 | (489) | 1,064.5 | (576.3) | (517) | 8,225 | | (106.3) |

| Shares | (43) | 71 | (361) | (160.6) | (88.1) | 105 | (90) | | 216.7 |

| Debt instruments | 13 | (125) | (76) | 110.4 | 117.1 | 501 | (967) | | 151.8 |

| Valuation result | 2,158 | (87) | (318) | (2,580.5) | (778.6) | 126 | 7,887 | | (98.4) |

| Purchase / sale of securities | | | | | | | | | |

| Foreign Exchange | 304 | 507 | (572) | (40.0) | 153.1 | 1,038 | (1,407) | | 173.8 |

| Derivatives | (1,680) | (51) | 1,415 | (3,194.1) | (218.7) | 707 | (5,134) | | 113.8 |

| Shares | (18) | 29 | (47) | (162.1) | (61.7) | 66 | 65 | | 1.5 |

| Debt instruments | 345 | 323 | (131) | 6.8 | 363.4 | 1,190 | 854 | | 39.3 |

| Purchase -sale result | (1,049) | 808 | 665 | (229.8) | (257.7) | 3,001 | (5,622) | | 153.4 |

| Total | 1,109 | 721 | 347 | 53.8 | 219.6 | 3,127 | 2,265 | | 38.1 |

In 4Q16, Santander México reported a Ps.1,109 million net gain from financial assets and liabilities, which compares with gains of Ps.347 million in 4Q15 and Ps.721 million in 3Q16.

The Ps.1,109 million net gain from financial assets and liabilities in the quarter is mainly explained by:

| i) | a Ps.2,158 million valuation gain which resulted from gains of Ps.2,329 million and Ps.13 million in derivative instruments and debt instruments, respectively. Gains that were partly offset by Ps.141 million and Ps.43 million losses in the valuation result of foreign trade and share instruments. |

This net gain was partially offset by:

| i) | a Ps.1,049 million purchase-sale loss principally related to losses of Ps.1,680 million and Ps.18 million in derivatives and share instruments, respectively, which were partially offset by purchase-sale gains of Ps.345 million and Ps.304 million in debt and foreign exchange instruments, respectively. |

| 16 |

Other operating income

| Other operating income | | | | | | | | | | | |

| Millions of Mexican pesos | | | | | % Variation | | | | | % Variation |

| | 4Q16 | 3Q16 | 4Q15 | | QoQ | YoY | | 12M16 | 12M15 | | 16/15 |

| | | | | | | | | | | | |

| Recovery of previously written-off loans | 863 | 584 | 860 | | 47.8 | 0.3 | | 2,567 | 2,443 | | 5.1 |

| Cancellation of liabilities and reserves | 79 | 77 | 77 | | 2.6 | 2.6 | | 322 | 329 | | (2.1) |

| Interest on personnel loans | 48 | 41 | 30 | | 17.1 | 60.0 | | 161 | 114 | | 41.2 |

| Allowance for losses on foreclosed assets | (31) | (23) | (24) | | 34.8 | 29.2 | | (108) | (88) | | 22.7 |

| Profit from sale of foreclosed assets | 78 | 100 | 43 | | (22.0) | 81.4 | | 279 | 237 | | 17.7 |

| Technical advisory services | 3 | 3 | 3 | | 0.0 | 0.0 | | 11 | 16 | | (31.3) |

| Portfolio recovery legal expenses and costs | (308) | (293) | (321) | | 5.1 | (4.0) | | (1,258) | (1,215) | | 3.5 |

| Write-offs and bankruptcies | (357) | (192) | (72) | | 85.9 | 395.8 | | (1,041) | (828) | | 25.7 |

| Provision for legal and tax contingencies | (324) | (114) | 59 | | 184.2 | (649.2) | | (661) | 15 | | (4,506.7) |

| IPAB ("Indemnity") provisions and payments | (3) | (2) | (2) | | 50.0 | 50.0 | | (8) | (6) | | 33.3 |

| Income from acquisition of Scotiabank portfolio | 0 | 0 | 0 | | 0.0 | 0.0 | | 0 | 177 | | (100.0) |

| Others | 18 | (4) | 53 | | 550.0 | (66.0) | | 220 | 185 | | 18.9 |

| | | | | | | | | | | | |

| Total | 66 | 177 | 706 | | (62.7) | (90.7) | | 484 | 1,379 | | (64.9) |

Other income in 4Q16 totaled Ps.66 million, down from Ps.706 million in 4Q15 and from Ps.177 million in 3Q16.

The Ps.640 million YoY decrease in other income was mainly driven by:

| i) | a Ps.383 million increase in provisions for legal and tax contingencies; and |

| ii) | a Ps.285 million increase in write-offs and bankruptcies. |

| 17 |

Administrative and promotional expenses

Administrative and promotional expenses consist of personnel costs such as payroll and benefits, promotion and advertising expenses, and other general expenses. Personnel expenses consist mainly of salaries, social security contributions, bonuses and our long-term incentive plan for our executives. Other general expenses are mainly related to technology and systems, administrative services - mainly outsourced in the areas of information technology - taxes and duties, professional fees, contributions to bank savings protection system (IPAB), rental of properties and hardware, advertising and communication, surveillance and cash courier services and expenses related to maintenance, conservation and repair, among others.

| Administrative and promotional expenses |

| Millions of Mexican pesos | | | | | % Variation | | | | | % Variation |

| | 4Q16 | 3Q16 | 4Q15 | | QoQ | YoY | | 12M16 | 12M15 | | 16/15 |

| Salaries and employee benefits | 3,075 | 3,178 | 2,807 | | (3.2) | 9.5 | | 12,616 | 11,709 | | 7.7 |

| Credit card operation | 72 | 82 | 55 | | (12.2) | 30.9 | | 301 | 314 | | (4.1) |

| Professional fees | 394 | 248 | 168 | | 58.9 | 134.5 | | 900 | 458 | | 96.5 |

| Leasehold | 415 | 491 | 555 | | (15.5) | (25.2) | | 1,846 | 1,844 | | 0.1 |

| Promotional and advertising expenses | 73 | 393 | 243 | | (81.4) | (70.0) | | 835 | 659 | | 26.7 |

| Taxes and duties | 384 | 288 | 320 | | 33.3 | 20.0 | | 1,437 | 1,366 | | 5.2 |

| Technology services (IT) | 797 | 561 | 527 | | 42.1 | 51.2 | | 2,631 | 2,400 | | 9.6 |

| Depreciation and amortization | 481 | 500 | 429 | | (3.8) | 12.1 | | 2,058 | 1,864 | | 10.4 |

| Contributions to Instituto de protección al ahorro Bancario (IPAB) | 713 | 672 | 590 | | 6.1 | 20.8 | | 2,631 | 2,238 | | 17.6 |

| Cash protection | 187 | 153 | 146 | | 22.2 | 28.1 | | 699 | 611 | | 14.4 |

| Others | 692 | 482 | 597 | | 43.6 | 15.9 | | 2,281 | 2,180 | | 4.6 |

| | | | | | | | | | | | |

| Total | 7,283 | 7,048 | 6,437 | | 3.3 | 13.1 | | 28,235 | 25,643 | | 10.1 |

Santander México’s administrative and promotional expenses are broken down as follows:

| Administrative and promotional expenses |

| Breakdown (%) |

| | 4Q16 | | 3Q16 | | 4Q15 | | 12M16 | | 12M15 |

| Salaries and employee benefits | 42.2 | | 45.1 | | 43.6 | | 44.7 | | 45.7 |

| Credit card operation | 1.0 | | 1.2 | | 0.9 | | 1.1 | | 1.2 |

| Professional fees | 5.4 | | 3.5 | | 2.6 | | 3.2 | | 1.8 |

| Leasehold | 5.7 | | 7.0 | | 8.6 | | 6.5 | | 7.2 |

| Promotional and advertising expenses | 1.0 | | 5.6 | | 3.8 | | 3.0 | | 2.6 |

| Taxes and duties | 5.3 | | 4.1 | | 5.0 | | 5.1 | | 5.3 |

| Technology services (IT) | 10.9 | | 8.0 | | 8.2 | | 9.3 | | 9.4 |

| Depreciation and amortization | 6.6 | | 7.1 | | 6.7 | | 7.3 | | 7.3 |

| Contributions to bank savings protection system (IPAB) | 9.8 | | 9.5 | | 9.2 | | 9.3 | | 8.7 |

| Cash protection | 2.6 | | 2.2 | | 2.3 | | 2.5 | | 2.4 |

| Others | 9.5 | | 6.8 | | 9.3 | | 8.1 | | 8.5 |

| | | | | | | | | | |

| Total | 100.0 | | 100.0 | | 100.0 | | 100.0 | | 100.0 |

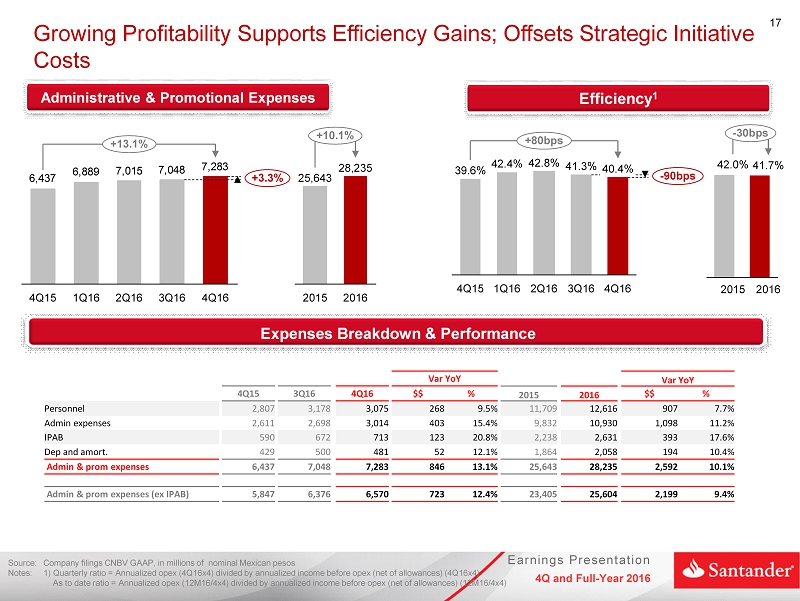

Administrative and promotional expenses in 4Q16 amounted to Ps.7,283 million which compares with Ps.6,437 million in 4Q15 and Ps.7,048 million in 3Q16, increasing 13.1% YoY and 3.3% QoQ.

| 18 |

The 13.3% YoY rise in administrative and promotional expenses was mainly due to the following increases:

| i) | 51.2%, or Ps.270 million, in technology services, mainly reflecting Santander México’s investment to strengthen our business and drive innovation to better serve clients; |

| ii) | 9.5%, or Ps.268 million, in salaries and employee benefits; |

| iii) | 134.5%, or Ps.226 million in professional fees, mainly related to IT consulting fees in connection with our ongoing technological upgrade; and |

| iv) | 20.8%, or Ps.123 million, in contributions to the bank savings protection system (IPAB) reflecting growth in funding sources. |

These increases were partly offset by:

| i) | a Ps.170 million, or 70.0% decrease in promotional and advertising expenses; and |

| ii) | a Ps.140 million, or 25.2% decrease in leaseholds. |

Excluding the deposit insurance fee, expenses for the quarter increased by 12.4% YoY.

Expenses continue to reflect cost management initiatives that translate into an optimized operating structure, mitigating costs resulting from the investment in strategic businesses.

The efficiency ratio for the quarter stood at 40.4%, increasing by 80 basis points YoY and decreasing by 90 basis points QoQ.

The recurrence ratio for 4Q16 was 58.2%, which compares to 62.1% reported in 4Q15 and 58.5% in 3Q16.

On a cumulative basis, administrative and promotional expenses amounted to Ps.28,235 million, reflecting a YoY increase of 10.1%. Excluding the deposit insurance fee, expenses increased by 9.4% YoY. Strong core earnings allowed us to improve the efficiency ratio for 12M16 by 30 basis points YoY to 41.7% from 42.0% in 12M15.

| 1) | Quarterly ratio = Annualized opex (4Q16x4) divided by annualized income before opex (net of allowances) (4Q16x4) |

As to date ratio = Annualized opex (12M16/4x4) divided by annualized income before opex (net of allowances) (12M16/4x4)

| 19 |

Income Taxes

In 4Q16 Santander México reported a tax expense of Ps.1,450 million compared to tax expenses of Ps.1,204 million in 4Q15 and Ps.1,185 million in 3Q16. The effective tax rate for the quarter was 24.2%, which compares to 22.2% reported in 4Q15 and 23.2% in 3Q16.

On a cumulative basis, the effective tax rate for 12M16 stood at 23.8%, 130 basis points higher than the 22.5% for 12M15.

Contribution to net income by subsidiary

Reported net income in 4Q16 was Ps.4,542 million, representing increases of 7.5% YoY and 15.7% QoQ.

Casa de Bolsa Santander, the brokerage business, reported a net loss of Ps.26 million in 4Q16, compared with a net gain of Ps.8 million in 4Q15 and a net gain of Ps.22 million in 3Q16.

The Holding (Grupo Financiero) reported a net loss of Ps.29 million in 4Q16, compared with net losses of Ps.20 million in 4Q15 and Ps.2 million in 3Q16.

| Earnings contribution by subsidiary |

| Millions of Mexican Pesos | | | | | | | | | | | |

| | | | | | % Variation | | | | | % Variation |

| | 4Q16 | 3Q16 | 4Q15 | | QoQ | YoY | | 12M16 | 12M15 | | 16/15 |

| Banking business1/ | 4,597 | 3,906 | 4,236 | | 17.7 | 8.5 | | 15,750 | 14,186 | | 11.0 |

| Brokerage | (26) | 22 | 8 | | (218.2) | (425.0) | | 12 | 12 | | 0.0 |

| Holding | (29) | (2) | (20) | | (1,350.0) | (45.0) | | (47) | (57) | | (17.5) |

| Net income attributable to Grupo Financiero Santander México | 4,542 | 3,926 | 4,224 | | 15.7 | 7.5 | | 15,715 | 14,141 | | 11.1 |

1/Includes Sofomes

| 20 |

LOAN PORTFOLIO AND ASSET QUALITY

Loan portfolio

The evolution of the loan portfolio continues to show solid growth, with segment diversification and increases across core businesses.

| Portfolio Breakdown | | | | | |

| Millions of Mexican pesos | | | | | % Variation |

| | 4Q16 | 3Q16 | 4Q15 | | QoQ | | YoY |

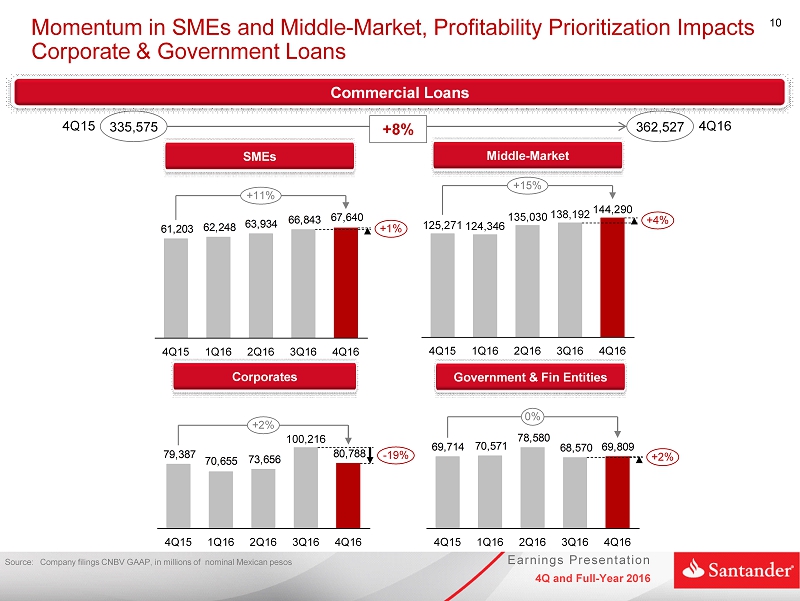

| Commercial | 362,527 | 373,821 | 335,575 | | (3.0) | | 8.0 |

| Middle- market | 144,290 | 138,192 | 125,271 | | 4.4 | | 15.2 |

| Corporates | 80,788 | 100,216 | 79,387 | | (19.4) | | 1.8 |

| SME´s | 67,640 | 66,843 | 61,203 | | 1.2 | | 10.5 |

| Government & Financial | | | | | | | |

| Entities | 69,809 | 68,570 | 69,714 | | 1.8 | | 0.1 |

| Individuals | 228,901 | 225,008 | 212,170 | | 1.7 | | 7.9 |

| Consumer | 100,065 | 98,280 | 91,693 | | 1.8 | | 9.1 |

| Credit Cards | 51,537 | 50,702 | 47,775 | | 1.6 | | 7.9 |

| Other Consumer | 48,528 | 47,578 | 43,918 | | 2.0 | | 10.5 |

| Mortgages | 128,836 | 126,728 | 120,477 | | 1.7 | | 6.9 |

| Total | 591,428 | 598,829 | 547,745 | | (1.2) | | 8.0 |

The total loan portfolio rose YoY by 8.0%, or Ps. 43,683 million, to Ps. 591,428 million in 4Q16. On a sequential basis, the total loan portfolio decreased 1.2%, or Ps.7,401 million.

In 4Q16, Santander México’s loan portfolio reflects a contraction in corporate and government loan growth as we pursued our strategy of keeping a strong focus on profitability. Individual loans were also soft, reflecting the combination of stiffer competition and a more prudent risk-pricing approach given the economic environment.

| 21 |

| Loan portfolio breakdown |

Millions of Mexican Pesos | | | | | | | |

| | 4Q16 | % | | 3Q16 | % | | 4Q15 | % |

| Performing loans | | | | | | | | |

| Commercial | 357,229 | 60.4 | | 366,182 | 61.1 | | 326,979 | 59.7 |

| | | | | | | | | |

| Individuals | 219,516 | 37.1 | | 215,739 | 36.0 | | 202,518 | 37.0 |

| Consumer | 96,082 | 16.2 | | 94,425 | 15.8 | | 88,029 | 16.1 |

| Credit cards | 49,364 | 8.3 | | 48,610 | 8.1 | | 45,691 | 8.3 |

| Other consumer | 46,718 | 7.9 | | �� 45,815 | 7.7 | | 42,338 | 7.7 |

| Mortgages | 123,434 | 20.9 | | 121,314 | 20.3 | | 114,489 | 20.9 |

| Total performing loans | 576,745 | 97.5 | | 581,921 | 97.2 | | 529,497 | 96.7 |

| | | | | | | | | |

| Non-performing loans | | | | | | | | |

| Commercial | 5,298 | 0.9 | | 7,639 | 1.3 | | 8,596 | 1.6 |

| | | | | | | | | |

| Individuals | 9,385 | 1.6 | | 9,269 | 1.5 | | 9,652 | 1.8 |

| Consumer | 3,983 | 0.7 | | 3,855 | 0.6 | | 3,664 | 0.7 |

| Credit cards | 2,173 | 0.4 | | 2,092 | 0.3 | | 2,084 | 0.4 |

| Other consumer | 1,810 | 0.3 | | 1,763 | 0.3 | | 1,580 | 0.3 |

| Mortgages | 5,402 | 0.9 | | 5,414 | 0.9 | | 5,988 | 1.1 |

| Total non-performing loans | 14,683 | 2.5 | | 16,908 | 2.8 | | 18,248 | 3.3 |

| | | | | | | | | |

| Total loan portfolio | | | | | | | | |

| Commercial | 362,527 | 61.3 | | 373,821 | 62.4 | | 335,575 | 61.3 |

| Individuals | 228,901 | 38.7 | | 225,008 | 37.6 | | 212,170 | 38.7 |

| Consumer | 100,065 | 16.9 | | 98,280 | 16.4 | | 91,693 | 16.7 |

| Credit cards | 51,537 | 8.7 | | 50,702 | 8.5 | | 47,775 | 8.7 |

| Other consumer | 48,528 | 8.2 | | 47,578 | 7.9 | | 43,918 | 8.0 |

| Mortgages | 128,836 | 21.8 | | 126,728 | 21.2 | | 120,477 | 22.0 |

| Total loan portfolio | 591,428 | 100 | | 598,829 | 100 | | 547,745 | 100 |

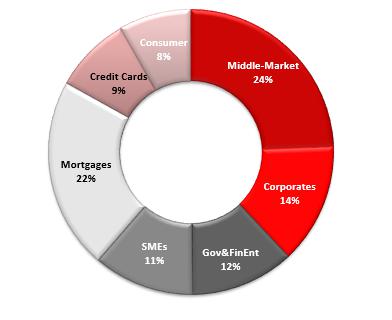

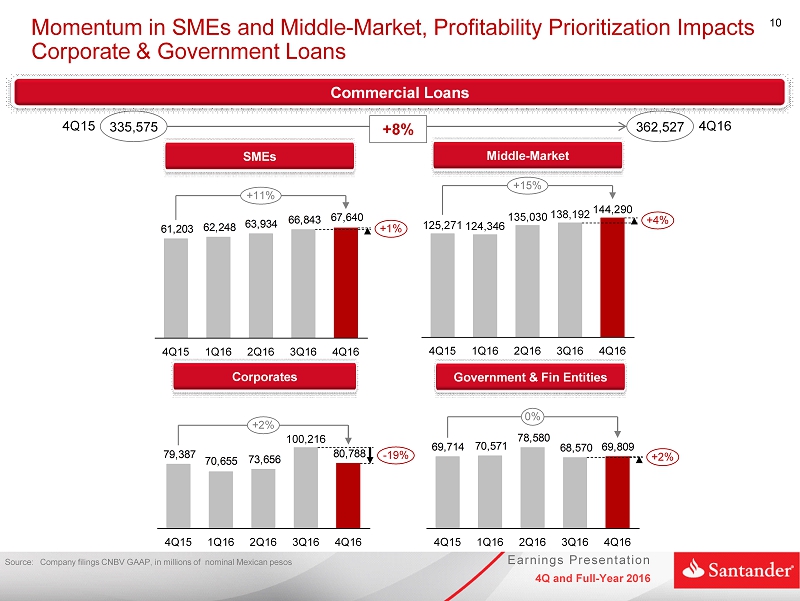

TheCommercial loan portfolio is comprised of loans to business and commercial entities, as well as loans to government entities and financial institutions, and represented 61.3% of the total loan portfolio. Excluding loans to government entities and financial institutions, the commercial loan portfolio accounted for 49.5% of the total loan portfolio.

As of 4Q16, commercial loans increased 8.0% YoY, as Santander México continues to focus on returns on risk-weighted assets and experiences higher competition across all segments. Mid-market loans and SMEs posted a 15.2% and 10.5% YoY growth, respectively, while corporate loans grew 1.8%. SME maintained a stable growth as we continue implementing a stronger focus on returns on risk weighted assets and risk-based pricing, supported by effective commercial initiatives targeted to the SME2 segment which includes mid-to high SMEs. Corporate loans posted soft growth in the quarter as we had some large payments of short-term loans and maintained our focus on returns in a highly competitive environment. Finally, loans to government and financial entities increased 0.1% YoY.

On a sequential basis, the commercial loan portfolio decreased 3.0%, reflecting a fall of 19.4% in corporate loans. SMEs and middle-market grew 1.2% and 4.4%, respectively, while loans to government and financial entities increased 1.8%.

| 22 |

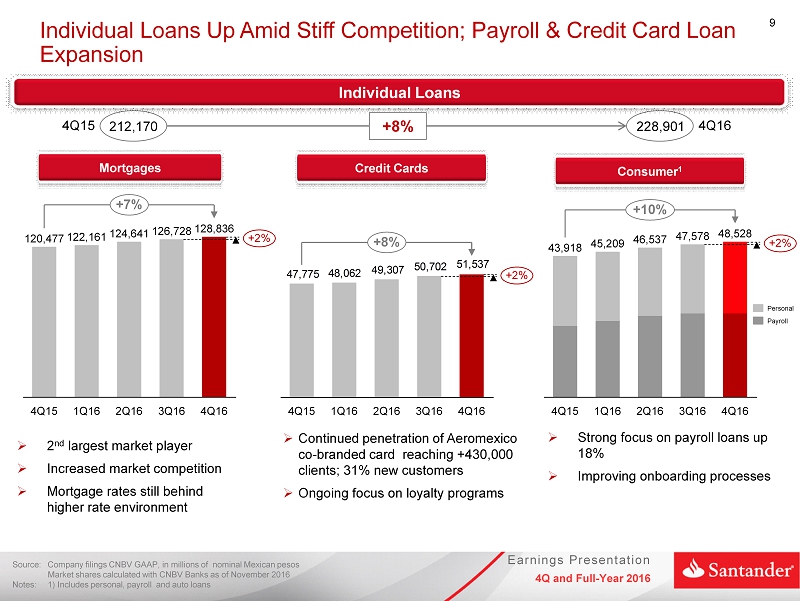

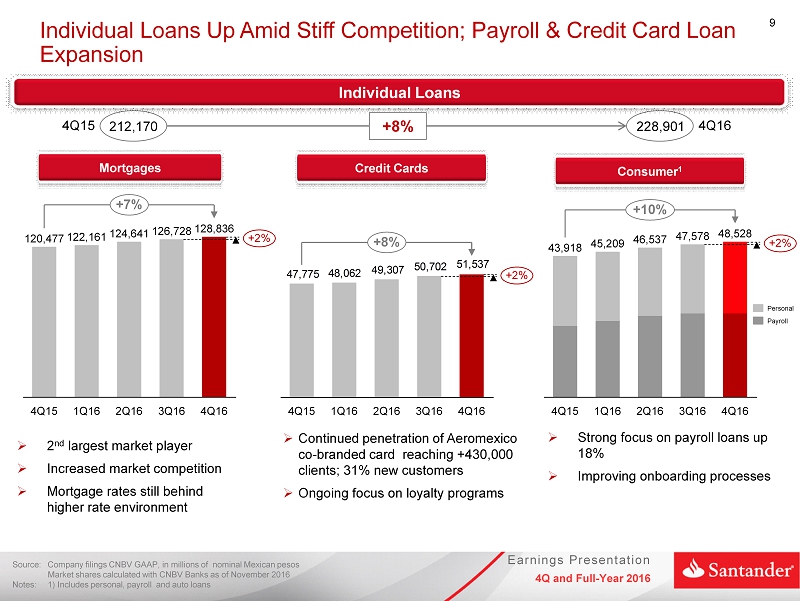

TheIndividual loan portfoliocomprised of mortgages, consumer and credit card loans, represented 38.7% of the total loan portfolio and increased 7.9% YoY showing resilient consumer demand and strong competition in these markets. Mortgage loans, credit card and consumer loans, represented 21.8%, 8.7% and 8.2% of the total loan portfolio, respectively.

Credit cards grew 7.9% YoY and 1.6% sequentially, supported by higher usage of our full suite of credit cards and the successful performance of the Santander-Aeromexico co-branded credit card. Consumer loans increased 10.5% YoY and 2.0% QoQ, reflecting strong performance in payroll loans which rose 18.0% YoY and 0.5% QoQ, reflecting our strategy to focus on this value added proposition for our clients through the launch of the Santander Plus program. Finally, mortgages increased 6.9% YoY and 1.7% sequentially, driven by ongoing targeting of the middle-market and residential segments. However, mortgage activity remained soft as high-end real estate transactions typically quoted in US dollars were impacted by high FX volatility, the hike in interest rates and increased competition.

Asset quality

| Asset quality | | | | | | |

| Millions of Mexican pesos | | | | | | |

| | | | | | % Variation |

| | 4Q16 | 3Q16 | 4Q15 | | QoQ | YoY |

| Total loans | 591,428 | 598,829 | 547,745 | | (1.2) | 8.0 |

| Performing loans | 576,745 | 581,921 | 529,497 | | (0.9) | 8.9 |

| Non-performing loans | 14,683 | 16,908 | 18,248 | | (13.2) | (19.5) |

| | | | | | | |

| Allowance for loan losses | (19,912) | (20,142) | (19,743) | | (1.1) | 0.9 |

| Charge-offs | (6,246) | (4,246) | (4,126) | | 47.1 | 51.4 |

| | | | | | | |

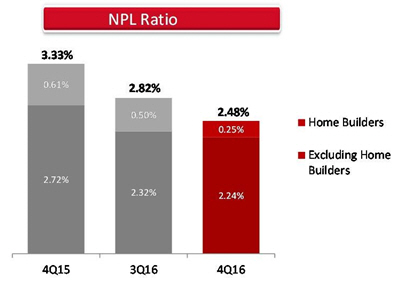

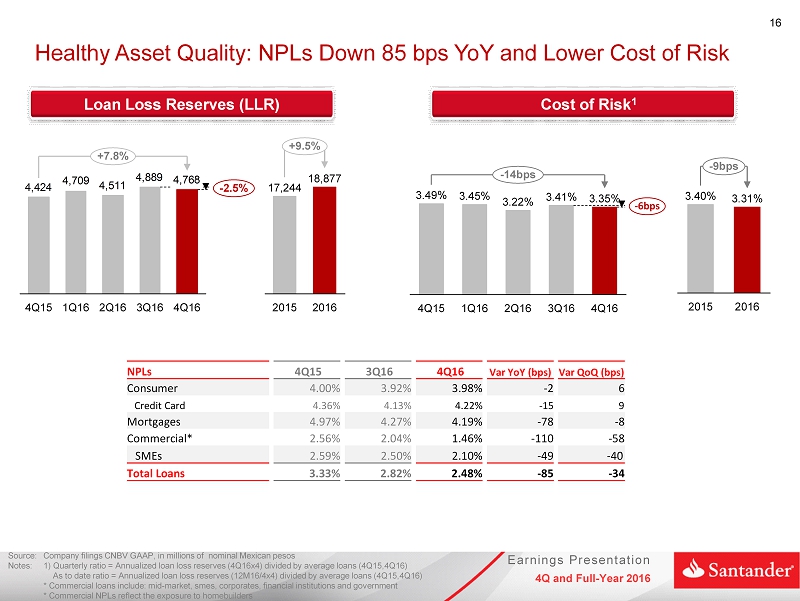

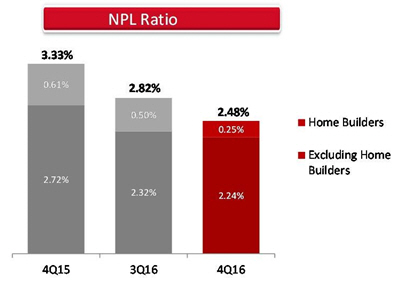

| Non-performing loan ratio | 2.48% | 2.82% | 3.33% | | (34)bp | (85)bp |

| Coverage ratio | 135.6% | 119.1% | 108.2% | | 1,650 bp | 2,740bp |

| Cost of Risk* | 3.35% | 3.41% | 3.49% | | (6)bp | (14)bp |

* Cost of risk is calculated using annualized cumulative provisions for loan losses for the period

Non-performing loans at the end of 4Q16 decreased YoY by Ps.3,565 million, or 19.5%, to Ps.14,683 million, and QoQ fell by 13.2%, or Ps.2,225 million.

On a YoY basis, decreases of Ps.3,298 million, or 38.4%, in commercial loans and Ps.586 million, or 9.8%, in mortgages, were partly offset by an increase of Ps.319 million, or 8.7%, in consumer loans (including credit cards). On a sequential basis, Santander México reported decreases in non-performing loans of Ps.2,341 million, or 30.6%, in commercial loans and Ps.12 million, or 0.2%, in mortgages, partly offset by a Ps.128 million, or 3.3%, increase in consumer loans (including credit cards).

The YoY decline in non-performing commercial loans mainly resulted further progress by homebuilders registered in 4Q16.

The YoY and QoQ decreases in non-performing mortgage loans, mainly resulted from an internal change in the charge-off policy for the mortgages originated at Santander Hipotecario and Santander Vivienda, which was reduced from 48 months to 36 months, following the extension made in 2015 from 12 months to 36 months for those mortgages originated at the bank, thus unifying the overall charge-off criteria in this segment. This unification of criteria will continue to be gradually implemented.

The breakdown of the non-performing loan portfolio is as follows: commercial loans 36.1%, mortgage loans 36.8% and consumer loans (including credit cards) 27.1%.

| 23 |

| Non-Performing Loan Ratios () | | | | | |

| % | 4Q16 | | 3Q16 | | 4Q15 |

| | | | | | |

| Commercial | 1.46 | | 2.04 | | 2.56 |

| | | | | | |

| Individuals | | | | | |

| Consumer | 3.98 | | 3.92 | | 4.00 |

| Credit Card | 4.22 | | 4.13 | | 4.36 |

| Other consumer | 3.73 | | 3.71 | | 3.60 |

| Mortgages | 4.19 | | 4.27 | | 4.97 |

| Total | 2.48 | | 2.82 | | 3.33 |

The abovementioned variations to non-performing loans led to an improvement in the NPL ratio, down to 2.48% in 4Q16, decreasing by 85 basis points from 3.33% in 4Q15 and 34 basis point lower than the 2.82% reported in 3Q16.

The NPL ratio for 4Q16 continues to reflect Santander México’s exposure to homebuilders. Our total exposure to homebuilders as of 4Q16 decreased further QoQ by Ps.1,595 million to Ps.2,201 million, while non-performing loans also decreased by Ps.1,574 million to Ps.1,505 million.

Excluding the impact of the homebuilders, the NPL ratio for 4Q16 would have been 2.24%. The current NPL ratio continues to reflect loan portfolio growth combined with Santander México’s stringent credit scoring model and ongoing monitoring of loan portfolio quality.

During 4Q16, provisions for loan losses amounted to Ps.4,768 million, which represented an YoY increase of Ps.344 million, or 7.8%, and a decrease of Ps.121 million, or 2.5%, on a sequential basis.

The 7.8% YoY increase in provisions mainly resulted from business volume growth, with significant contributions from credit cards and payroll loans.

Cost of risk in 4Q16 stood at 3.35%, which compares to 3.49% and 3.41% reported in 4Q15 and 3Q16, respectively.

On a cumulative basis, provisions for loan losses increased by 9.5%, or Ps.1,633 million, mainly reflecting:

| i) | significant business volume growth, with sizeable contributions from credit cards and payroll loans; |

| ii) | provisions in 1Q16 resulting from the exposure to some of the loans that were restructured during 2014 and were past due for 18 months, as well as other corporates that are on our watch list; and |

| iii) | higher provisions in connection with mortgages (mainly related to the change in the charge-off period). |

| 24 |

Cost of risk for 12M16 stood at 3.31%, which compares to 3.40% in 12M15.

The coverage ratio for the quarter improved to 135.6%, from 108.2% in 4Q15 and 119.1% in 3Q16. The YoY improvement in the coverage ratio was mainly due to lower non-performing loans in the commercial segment, reflecting further improvements in negotiations with homebuilders.

* Cost of risk is calculated using annualized cumulative provisions for loan losses for the period

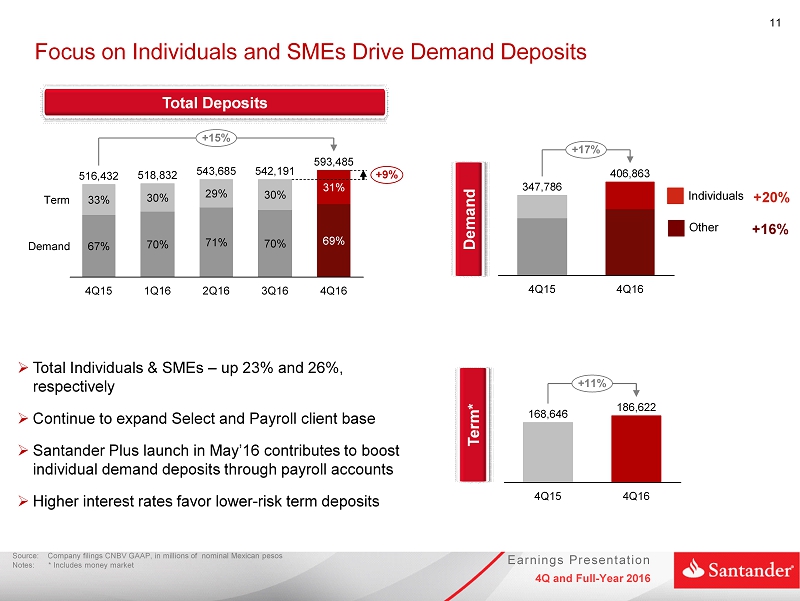

TOTAL DEPOSITS

Total deposits at the end of 4Q16 amounted to Ps.593,485 million, representing an increase of 14.9% YoY and a 9.5% sequentially. Demand deposits reached Ps.406,863 million, increasing 17.0% YoY and 8.0% sequentially. Term deposits reached Ps.186,622 million, up 10.7% YoY and 12.9% QoQ.

Santander México continues to implement its strategy of further enhancing customer service. Campaigns targeting the SMEs and middle-market segments, together with products offered to middle- and high-income clients have resulted in increases of 19.7% and 25.5% in demand deposits from individuals and SMEs, respectively.

| 25 |

LIQUIDITY COVERAGE RATIO

Pursuant Banxico’s and CNBV regulatory requirements, the average Liquidity Coverage Ratio (LCR or CCL by its Spanish acronym) for 4Q16 was 153.31% which compares to 111.76% in 3Q16. (Please refer to note 25 of this report).

CAPITALIZATION AND ROAE

| Capitalization | | | | | | |

| Millions of Mexican Pesos | | 4Q16 | | 3Q16 | | 4Q15 |

| | | | | | | |

| CET1 | | 71,487 | | 87,719 | | 80,328 |

| Tier 1 | | 81,785 | | 87,719 | | 80,328 |

| Tier 2 | | 27,453 | | 25,472 | | 23,311 |

| Total Capital | | 109,238 | | 113,191 | | 103,639 |

| | | | | | | |

| Risk-weighted assets | | | | | | |

| Credit risk | | 546,272 | | 546,494 | | 487,440 |

| Credit, market and operational risk | | 693,902 | | 707,175 | | 664,122 |

| | | | | | | |

| Credit risk ratios: | | | | | | |

| CET1 | | 13.1 | | 16.1 | | 16.5 |

| Tier 1 (%) | | 15.0 | | 16.1 | | 16.5 |

| Tier 2 (%) | | 5.0 | | 4.7 | | 4.8 |

| Capitalization ratio (%) | | 20.0 | | 20.7 | | 21.3 |

| | | | | | | |

| Total capital ratios: | | | | | | |

| CET1 | | 10.3 | | 12.4 | | 12.1 |

| Tier 1 (%) | | 11.8 | | 12.4 | | 12.1 |

| Tier 2 (%) | | 3.9 | | 3.6 | | 3.5 |

| Capitalization ratio (%) | | 15.7 | | 16.0 | | 15.6 |

Last December we implemented a series of initiatives to further optimize our capital structure, which included:

| § | A MXN$13.6 billion cash dividend from retained earnings. |

| § | We also issued US$ 500 million of Perpetual Subordinated Non-Preferred Contingent Convertible Additional Tier 1 Capital – Basel III compliant Notes. This innovative structure that was the first of its kind in Mexico. Our parent company, Banco Santander acquired 88% of the AT1 Notes maintaining its commitment to invest in Mexico. |

In addition to optimizing our capital structure, these initiatives have allowed us to improve profitability metrics and maintain capitalization levels above regulatory requirements to take advantage of future growth opportunities.

On December 20, 2016, the CNBV received authorization for our request to change the methodology for the Operational Risk Capital Requirement, establishing the substitution of the basic method by the alternative standard method (ASA) for the month of November 2016. This measure contributed to Banco Santander Mexico in savings in capitalization levels by 80 basis point.

| 26 |

As a result, ROAE for the year improved by 120 basis points to 14.1%; without this transaction it would have been 13.5%.

Meanwhile, ROAE in 4Q16 was 16.3%, improving 90 basis points from 15.4% in 4Q15 and 290 basis points from 13.4% in 3Q16. Without the aforementioned transaction, ROAE for the quarter would have been 15.6%.

Banco Santander México’s capital ratio at period end 4Q16 was 15.7%, which compares to 15.6% and 16.0% at 4Q15 and 3Q16, respectively. The 15.7% capital ratio was comprised of 10.3% fundamental (CET1), 1.5% additional Tier 1 and 3.9% Complementary Capital (Tier 2).

As of November 2016, Banco Santander México is classified within Category 1 in accordance with Article 134bis of the Mexican Banking Law, and remains in this category per the preliminary results dated September 2016, which is the most recent available analysis.

LEVERAGE RATIO

In accordance with CNBV regulatory requirements, delivered in June 14, 2016, the leverage ratio for December 2016 was 6.35%, September 2016 7.72%, 7.43% in June 2016, 7.33% in March 2016 and 7.24% in December 2015.

This index is based on regulatory guidelines established in the following way: the result of dividing the core capital of conformity with Article 2 Bis 6 (CUB) between adjusted assets.

| 27 |

RELEVANT EVENTS & REPRESENTATIVE ACTIVITIES AND TRANSACTIONS

Relevant Events

Santander México announced the merger of Santander Hipotecario, S.A. de C.V., Sociedad Financiera de Objeto Múltiple, Entidad Regulada, Grupo Financiero Santander México with Santander Vivienda S.A. de C.V., Sociedad Financiera de Objeto Múltiple, Entidad Regulada, Grupo Financiero Santander México, both of which are parts of the Financial Group

On December 30, 2016, both companies held their respective General Extraordinary Shareholders Meetings, in which their shareholders approved the merger of Santander Hipotecario with Santander Vivienda (surviving company).

Santander México announced the settlement of its perpetual subordinated non-preferred contingent convertible additional Tier 1 capital notes

On December 29, 2016 Grupo Financiero Santander México announced it successfully settled its U.S.$500 million aggregate principal amount of 8.500% Perpetual Subordinated Non-Preferred Contingent Convertible. The AT1 Notes were sold for 100.000% of their principal amount. Banco Santander, S.A. (Spain) purchased approximately 88% of the aggregate amount of the AT1 Notes.

Santander México announced the pricing of its perpetual subordinated non-preferred contingent convertible additional tier 1 capital notes

On December 23, 2016, the Group announced that it priced U.S.$500 million aggregate principal amount of 8.500% Perpetual Subordinated Non-Preferred Contingent Convertible Additional Tier 1 Capital Notes. The AT1 Notes were sold for 100.000% of their principal amount and each AT1 Note is mandatorily convertible, in certain regulatory circumstances, into ordinary shares of the Company at the higher of the volume weighted average of the ordinary shares closing price on the Mexican Stock, Banco Santander, S.A. (Spain) purchased 88% of the aggregate amount of the AT1 Notes.

Santander México announced the resolution of their shareholder meeting

On December 22, 2016, the entity announced the hold of its respective General Ordinary Shareholders Meeting, at which the payment of a cash dividend to shareholders was approved from retained earnings in the amount of Ps.13,624 million, paid on December 30, 2016.

Santander México announced that it will allocate $15 billion pesos over the next three years to support growth and drive innovation

On December 8, 2016, Santander México announced its plans to allocate $15 billion Mexican Pesos between 2017 to 2019, for investments and initiatives to support business growth.

Santander México announced the resolutions of their shareholders meetings

On December 5, 2016, Santander México announced that, in connection with the previously announced capital structure efficiency strategy, held it General Ordinary and Extraordinary Shareholder Meetings approving resolutions which included: the issuance of a financial instrument which follows the required guidelines to be Basel III compliant, and qualifies as an Additional Tier 1 instrument under Mexican laws and regulations, in an aggregate amount of up to U.S.$500 million. Banco Santander S.A. (Spain) expressed its intention to purchase approximately 75% of the aggregate amount of the above mentioned financial instrument at market terms and to ensure its complete subscription.

Ordinary and Extraordinary General Shareholders Meeting

On December 5, 2016, Santander México held its General Ordinary Shareholders Meeting and approved among other items:

| · | The approval of the composition of the Board of Directors as indicated below: |

| 28 |

| Non Independent Directors "F" Series |

| Mr. Marcos Alejandro Martínez Gavica | Director |

| Mr. Héctor Blas Grisi Checa | Director |

| Mr. Rodrigo Echenique Gordillo | Director |

| Mr. Ángel Rivera Congosto | Director |

| Mr. Rodrigo Brand de Lara | Director |

| Mr. Vittorio Corbo Lioi | Alternate Director |

| Mr. Francisco Javier Hidalgo Blazquez | Alternate Director |

| Mr. Pedro José Moreno Cantalejo | Alternate Director |

| Independent Directors "F" Series |

| Mr. Guillermo Güemez García | Director |

| Mr. Joaquín Vargas Guajardo | Director |

| Mr. Juan Gallardo Thurlow | Director |

| Mr. Antonio Purón Mier y Terán | Director |

| Mr. Eduardo Carredano Fernández | Alternate Director |

| Mr. Jesús Federico Reyes Heroles González Garza | Alternate Director |

| Consejeros Serie “B” Independientes |

| Mr. Fernando Ruíz Sahagún | Director |

| Mr. Alberto Torrado Martínez | Director |

| Ms. Gina Lorenza Diez Barroso Azcárraga | Director |

| Mr. Enrique Krauze Kleinbort | Alternate Director |

| Mr. Guillermo Francisco Vogel Hinojosa | Alternate Director |

| · | It was approved that the Company carry out an issue of Perpetual Subordinated Non-Preferred Contingent Convertible Additional Tier 1 Capital Notes are Additional Tier 1 Capital (capital básico no fundamental). Such issue shall be carried out pursuant to the requirements stipulated in Annex 1-R and other applicable regulations, in local or international markets. |

| · | Approved that the net resources received by the Company derived from the issue of the Equity Securities, shall be used to acquire equity securities issued by Banco Santander México. |

| · | It was approved an increment in the variable share capital, via the issue of new share stocks, all of them to be kept as treasury stocks as authorized capital to guarantee the conversion of debt into shares with respect to the Issue. |

| · | It was approved the amendment of the second article and the addition of the Article Twelfth Bis to the corporate bylaws, to remove Santander Hipotecario, S.A. de C.V as a financial entity member of the group and to incorporate the terms and conditions to consider the Perpetual Subordinated Non-Preferred Contingent Convertible Additional Tier 1 Capital Notes as part of the Tier 1 Capital (capital básico no fundamental) |

| · | It was approved the amendment to the Single Accountability Agreement executed by Grupo Financiero Santander México, S.A.B. de C.V., and its financial entities, in order to eliminate Santander Hipotecario, S.A. de C.V., as financial entity part of Grupo Financiero Santander México. |

Grupo Financiero Santander México announced the resolutions of it shareholders’ meeting

On November 8, 2016, announced that its Board of Directors determined, among other things, to call Ordinary and Extraordinary General Shareholders’ Meetings, to be held on December 5, 2016, where, among other topics, it will be submitted for approval of its shareholders: (i) declare the payment of a cash dividend, from its retained earnings; and (ii) the authorization, subject to market conditions and corporate, regulatory and government approvals for the issuance of a financial instrument which follows the required guidelines to be Basel III compliant, and qualifies as an Additional Tier 1 instrument under Mexican laws and regulations, in an aggregate amount up to U.S.$500 million. These resolutions are part of a broad strategy to optimize Banco Santander México's, the principal subsidiary of the Company, capital utilization as it seeks to produce higher returns on equity.

| 29 |

Representative Transactions

Santander México in the Credit Facility Club Deal ofIEnova

Santander México participated in a four-year Credit Facility Club Deal of IEnova for US$150 million.

Santander México in the Syndicated Loan ofEl Puerto de Liverpool

Santander México as Mandated Lead Arranger in a five-year syndicated loan ofEl Puerto de Liverpool S.A.B. de C.V.for Ps.3 billion.

Santander México in the multi-currency Credit Facility ofGrupo Bimbo

Santander México participated in a five-year multi-currency Credit Facility ofGrupo Bimbo S.A.B. de C.V. for US$200 million.

Santander México in the Club Deal ofEl Palacio de Hierro

Santander México participated in a five-year Club Deal ofEl Palacio de Hierro, S.A.B. de C.V. for Ps.1 billion.

Santander México in the Syndicated Loan ofGrupo Industrial Saltillo

Santander México as Joint Bookrunner in a five-year syndicated loan ofGrupo Industrial Saltillo, S.A.B. de C.V. for US$326.5 million.

Santander México in the structuring and financing withGrupo Clisa and Howard Energy Partners

Santander México participated in the structuring and eight-year term financing for the construction and operation of a gas pipeline withGrupo Clisa and Howard Energy Partners for US$334 million.

Santander México as Joint Bookrunner in the debt issuance ofUNIFIN

Santander México as Joint Bookrunner for Ps.2.5 billion in the five-year debt issuance ofUNIFIN Financiera, S.A.B. de C.V. SOFOM ENR, the book building had an over subscription of ~2.36x.

SUSTAINABILITY AND SOCIAL RESPONSIBILITY

First Edition of the Innovation Challenge

On December 29, 2016, the first edition of the Innovation Challenge was held, a competition organized bySantander Seguros,Zurich Santander andUniversia, which main objective is to create new products and services that meet millennials’ needs.

Santander México launched the "Formula Santander" Scholarship Program

On October 26, 2016, Santander México launched the "Formula Santander" Scholarship Program to help promote education and opportunity for young people by offering academic residences in Spain, Argentina, Brazil, Chile, Colombia, Peru and Uruguay for 100 Mexican students from higher education institutions that have agreements withSantander Universidades.

For more information about Santander México – Sustainbility and social responsibility:

https://servicios.santander.com.mx/comprometidos/images/archivos/Reporte2015.pdf

CREDIT RATINGS

On December 22, 2016, Fitch Ratings assigned ratings to Grupo Financiero Santander Mexico (GFSM):

including its Viability Rating (VR) at 'bbb+', Long-term Foreign Currency Issuer Default Ratings (IDRs) at

'BBB+', and Short-term Foreign and Local Currency Rating at 'F2'. Fitch has also assigned a Support Rating of '2' and National Long and Short term ratings of 'AAA(mex)/F1+(mex). The Rating Outlook for the long term ratings is Stable.

At the same time Fitch assigned GFSM’s issue up to USD500 million perpetual subordinated non preferred contingent convertible capital notes a long term rating of 'BB'.

| 30 |

On December 22, 2016, Moody’s affirmed Banco Santander México’s (the Bank) baa2 baseline credit assessment (BCA). All other Moody's ratings for the Bank remain unchanged.

Moody's also assigned a Ba1 (hyb) global local currency junior subordinated debt rating and A1.mx (hyb) Mexican National Scale junior subordinated debt rating to the proposed perpetual non-cumulative capital notes with principal conversion issued by Grupo Financiero Santander México.

On December 15, 2016, Fitch Ratings conducted a portfolio review of selected Mexican Financial Institutions (FIs), including Banco Santander México, following the revision of Mexico's sovereign rating Outlook to Negative from Stable on Dec. 9, 2016. All Fitch’s ratings for the Bank remain unchanged.

On December 7, 2016, Fitch Ratings took the following rating actions on Banco Santander México: upgraded to 'BBB-' from 'BB+' the Long-term Basel III compliant Tier 2 subordinated notes. All other ratings for the Bank were affirmed. The Rating Outlook for the long-term ratings is Stable.

| Grupo Financiero Santander México | Moody’s | | Fitch Ratings |

| Global Scale | | | |

| Foreign currency | | | |

| Long term | ---- | | BBB+ |

| Short term | ---- | | F2 |

| | | | |

| Local currency | | | |

| Long term | ---- | | BBB+ |

| | | | |

| Short term | ---- | | F2 |

| | | | |

| National scale | | | |

| Long term | ---- | | AAA(mex) |

| Short term | ---- | | F1+(mex) |

| | | | |

| Rating viability (VR) | ---- | | bbb+ |

| Support (SR) | ---- | | 2 |

| | | | |

| Outlook | ---- | | Stable |

| | | | |

| International Issuances | | | |

| | | | |

| Perpetual Subordinated Non-Preferred Contingent Convertible Additional Tier 1 Capital Notes (AT1) | | | |

| Global Scale | | | |

| Foreign currency | | | |

| Long term | (P) Ba1 (hyb) | | BB |

| Local currency | | | |

| Long term | Ba1(hyb) | | ---- |

| National scale | | | |

| Long term | A1.mx (hyb) | | ---- |

| | | | |

| Last publication: | 22-Dec-16 | | 22-Dec-16 |

| Banco Santander México | Moody’s | | Fitch Ratings |

| Global scale | | | |

| Foreign currency | | | |

| Long term | A3 | | BBB+ |

| Short term | P-2 | | F2 |

| | | | |

| Local currency | | | |

| Long term | A3 | | BBB+ |

| 31 |

| Short Term | P-2 | | F2 |

| | | | |

| National scale | | | |

| Long term | Aaa.mx | | AAA(mex) |

| Short Term | Mx-1 | | F1+(mex) |

| | | | |

| Rating viability (VR) | ---- | | bbb+ |

| Support | ---- | | 2 |

| Counterparty risk Assessments (CR) | | | |

| Long Term | A2 (cr) | | ---- |

| | | | |

| Short Term | P-1 (cr) | | ---- |

| | | | |

| Standalone BCA | baa2 | | ---- |

| Standalone Adjusted BCA | baa1 | | ---- |

| | | | |

| Outlook | Negative | | Stable |

| | | | |

| International Issuances | | | |

| | | | |

| Tier 2 Subordinated Capital Notes due 2024 | Baa3 | | BB+ |

| | | |

| Long-term senior unsecured global notes due 2022 | A3 | | BBB+ |

| | | | |

| Last publication: | Dec-22-2016 | | Dec-07-2016 |

| Santander Consumo | Moody´s | | Fitch Ratings |

| National Scale | | | |

| Long term | ---- | | AAA (mex) |

| Short Term | ---- | | F1+ (mex) |

| | | | |

| Unsecured bonds Issuance Program | | | |

| | | | |

| Global Scale | | | |

| Local currency | | | |

| Short term | P-2 | | ---- |

| | | | |

| National Scale | | | |

| Short Term | MX-1 | | F1+ (mex) |

| | | | |

| Standalone Credit Profile (SCP) | ba3 | | ---- |

| Outlook | Stable | | Stable |

| | | | |

| Last publication: | May-16-2016 | | June-27-2016 |

| Brokerage - Casa de Bolsa Santander | Moody´s | | Fitch Ratings |

| Global scale | | | |

| Local currency | | | |

| Long term | Baa1 | | ---- |

| Short term | P-2 | | ---- |

| | | | |

| National scale | | | |

| Local currency | | | |

| Long term | Aa1.mx | | AAA(mex) |

| Short term | Mx-1 | | F1+(mex) |

| | | | |

| Standalone BCA | b1 | | ---- |

| Outlook | Negative | | Stable |

| | | | |

| Last publication: | Nov-03-2016 | | June-27-2016 |

Notes:

| 32 |

§ BCA = Baseline Credit Assessment

§ SR = Support Rating

§ VR = Viability Rating

§ SCP = Standalone Credit Profile

§ CR= Counterparty Risk Assessments

| 33 |

4Q16 EARNINGS CALL DIAL-IN INFORMATION

| Date: | Friday, January 27, 2017 |

| Time: | 10:00 AM (MCT); 11:00 AM (US ET) |

| | |

| Dial-in Numbers: | 1-877-407-4018 US & Canada 1-201-689-8471 International & Mexico |

| Access Code: | Please ask for Santander México Earnings Call |

| Webcast: | http://public.viavid.com/index.php?id=122496 |

Replay: Starting: Friday, January 27, 2017 at 2:00 pm US ET, and Wednesday, February 1, 2017 at 11:59 pm US ET Dial-in number: 1-844-512-2921 US & Canada; 1-412-317-6671 International & Mexico Access Code: 13647351

ANALYST COVERAGE

Actinver, Bank of America Merrill Lynch, Barclays, BBVA, Brasil Plural, Banco BTG Pactual, Citi, Credit Suisse, Deutsche Bank, EVA Dimensions, GBM, Goldman Sachs, HSBC, JP Morgan, Morgan Stanley, Morningstar, Nau Securities, Scotiabank and UBS.

Santander México is covered by the aforementioned analysts. Please note that any opinions, estimates or forecasts regarding the performance of Santander México issued by these analysts reflect their own views, and therefore do not represent the opinions, estimates or forecasts of Santander México or its management. Although Santander México may refer to or distribute such statements, this does not imply that Santander México agrees with or endorses any information, conclusions or recommendations included therein.

DEFINITION OF RATIOS

ROAE:Annualized net income divided by average equity

EFFICIENCY:Annualized administrative and promotional expenses divided by annualized gross operating income (before administrative and promotional expenses and allowances).

RECURRENCY:Annualized net fees divided by annualized administrative and promotional expenses (net of amortizations and depreciations).

NIM:Financial margin divided by daily average interest earnings assets.

COST OF RISK:Annualized provisions for loan losses divided by average loan portfolio

Note:

| · | Annualized figures consider |

| o | Quarterly ratio = 4Q16x4 |

| · | Average figures are calculated using 4Q15 and 4Q16 |

| 34 |

ABOUT GRUPO FINANCIERO SANTANDER MÉXICO, S.A.B. DE C.V. (NYSE: BSMX; BMV: SANMEX)

Grupo Financiero Santander México, S.A.B. de C.V. (Santander México), one of Mexico’s leading financial services holding companies, provides a wide range of financial and related services, including retail and commercial banking, securities brokerage, financial advisory and other related investment activities. Santander México offers a multichannel financial services platform focused on mid- to high-income individuals and small- to medium-sized enterprises, while also providing integrated financial services to larger multinational companies in Mexico. As of December 31, 2016, Santander México had total assets of Ps.1,374 billion under Mexican Banking GAAP and more than 13.5 million customers. Headquartered in Mexico City, the Company operates 1,075 branches and 314 offices nationwide and has a total of 16,976 employees.