Filed pursuant to Rule 424(b)(3)

Registration Statement No. 333-238850

PROSPECTUS

84,603,538 Shares of Common Stock

This prospectus relates to the resale from time to time by the selling stockholders named in this prospectus or their transferees, pledgees, donees or successors, of up to 84,603,538 shares of our common stock, consisting of: (i) 4,835,438 shares of our common stock issued to the former stockholders of Naia Rare Diseases, Inc., or Naia Rare Diseases, in connection with the acquisition by us of Naia Rare Diseases, (ii) 38,277,900 shares of our common stock underlying outstanding shares of our Series A Convertible Preferred Stock, or the Series A Preferred Stock, (iii) 38,277,900 shares of our common stock that are underlying the shares of our Series A Convertible Preferred Stock, issuable upon the exercise of warrants issued to investors, (iv) 2,712,300 shares of our common stock that are underlying the shares of our Series A Preferred Stock issuable upon exercise of warrants issued to certain placement agents, and (v) 500,000 shares of common stock that are issuable upon exercise of warrants issued to certain consultants of the Company. These shares were issued in connection with (a) the acquisition by us of Naia Rare Diseases on May 6, 2020, (b) a private placement offering of shares of our Series A Preferred Stock and related warrants, which was completed on May 4, 2020, or the Private Placement, and (c) a consulting agreement between the Company and GP Nurmenkari, Inc., which was effective as of May 4, 2020. We are registering these shares as required by the Naia Rare Diseases merger agreement, the Registration Rights Agreement we entered into in connection with the Private Placement on April 29, 2020, and the consulting agreement with GP Nurmenkari, Inc.

We are not selling any shares of common stock and will not receive any proceeds from the sale of the shares under this prospectus. We have agreed to bear all of the expenses incurred in connection with the registration of these shares. The selling stockholders will pay or assume brokerage commissions and similar charges, if any, incurred for the sale of shares of our common stock.

The selling stockholders may sell the shares described in this prospectus in a number of different ways and at varying prices. We provide more information about how the selling stockholders may sell their shares of common stock in the section entitled “Plan of Distribution” on page 43. The selling stockholders will pay all brokerage fees and commissions and similar expenses. We will pay all expenses (except brokerage fees and commissions and similar expenses) relating to the registration of the shares with the Securities and Exchange Commission. No underwriter or other person has been engaged to facilitate the sale of shares of our common stock in this offering.

Our common stock is traded on the Nasdaq Capital Market under the symbol “NMTR.” On June 17, 2020, the last reported sales price of our common stock was $0.5975 per share.

Investing in our common stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 30 of this prospectus, and under similar headings in any amendments or supplements to this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is June 19, 2020.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC. Under this registration process, the selling stockholders named in this prospectus may from time to time and in one or more offerings sell the shares of our common stock set out under the heading “selling Stockholders.”

You should rely only on the information contained or incorporated by reference in this prospectus and in any prospectus supplement. We have not authorized anyone to give any information or to make any representation other than those contained or incorporated by reference in this prospectus. The selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where it is lawful to do so. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any shares other than the registered shares to which they relate, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy shares in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front of this prospectus or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered or shares are sold on a later date. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus incorporates by reference market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we are not aware of any misstatements regarding the market and industry data presented in this prospectus and the documents incorporated herein by reference, these estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this prospectus, any applicable prospectus supplement and under similar headings in the other documents that are incorporated by reference into this prospectus. Accordingly, you should not place undue reliance on this information.

Before purchasing any shares of common stock, you should carefully read both this prospectus and any prospectus supplement, together with the additional information described under the heading “Where You Can Find More Information.”

Unless the context indicates otherwise, references in this prospectus to “9 Meters,” “Company,” “we,” “us” and “our” refer to 9 Meters Biopharma, Inc. and its subsidiaries.

PROSPECTUS SUMMARY

This summary highlights certain information about us and this offering contained elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our securities and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our securities, you should read the entire prospectus carefully, including “Risk Factors” beginning on page 30, and the consolidated financial statements and related notes incorporated by reference into this prospectus.

Recent Acquisitions

On May 4, 2020, we merged with RDD Pharma, Ltd., or RDD, as a wholly owned subsidiary. Prior to that time, our name was Innovate Biopharmaceuticals, Inc. and in connection with that merger we changed our name to 9 Meters Biopharma, Inc. RDD was an Israeli company focused on orphan and innovative therapies for gastrointestinal disorders.

On May 6, 2020, we acquired Naia Rare Diseases, a company developing drugs for the treatment of short bowel syndrome and other rare gastrointestinal diseases.

Company Overview

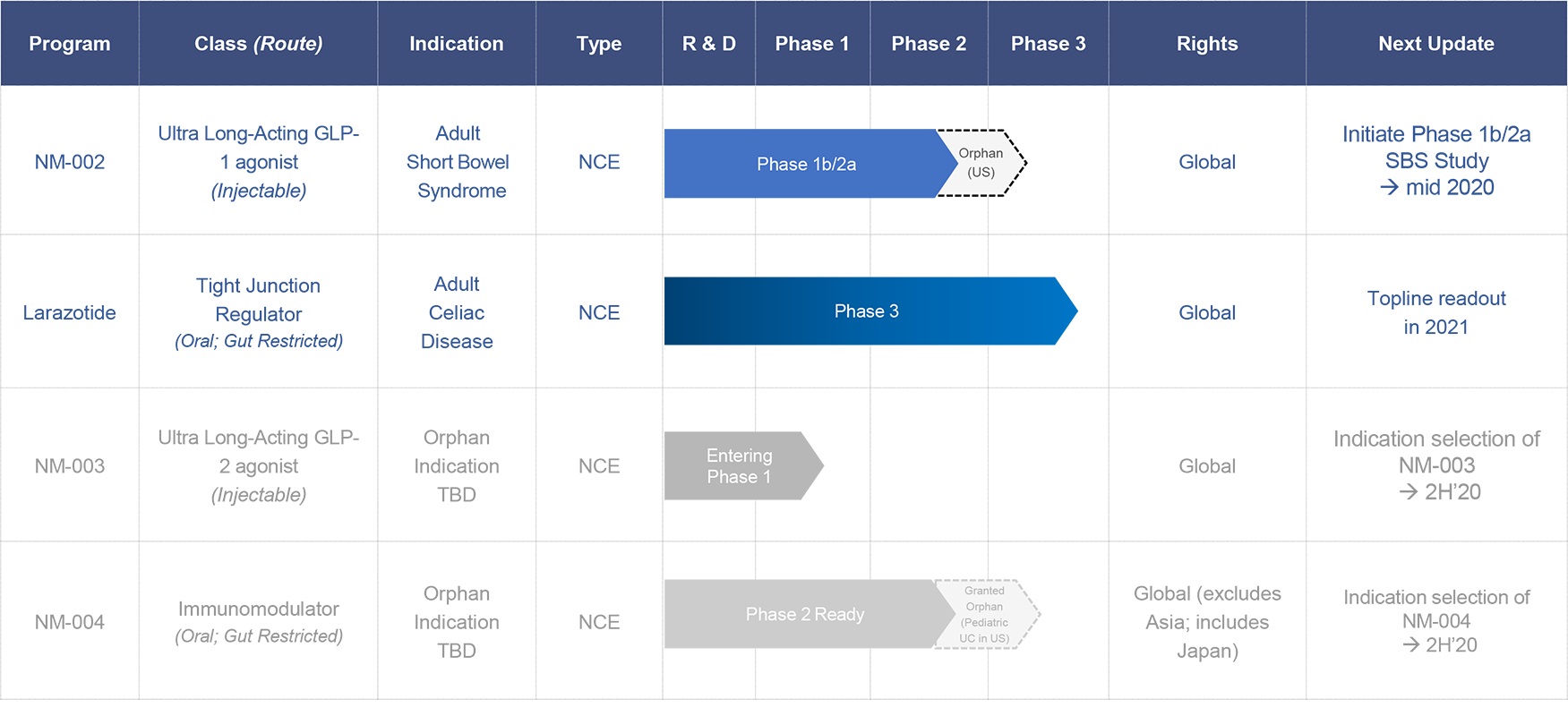

9 Meters Biopharma, Inc. is a clinical-stage biotechnology company focused on orphan, rare and unmet needs in gastroenterology. The Company’s pipeline includes drug candidates for celiac disease, short bowel syndrome (SBS) and two candidates for undisclosed rare and/or orphan diseases. Our pipeline is summarized below:

Short Bowel Syndrome (SBS)

NM-002 is a long-acting injectable GLP-1 agonist being developed for SBS, a debilitating orphan disease with a large underserved market. It affects up to 20,000 people in the U.S. with similar prevalence in Europe. Short bowel syndrome is a group of problems related to poor absorption of nutrients. People with short bowel syndrome cannot absorb enough water, vitamins, minerals, protein, fat, calories, and other nutrients from food. It is a severe disease with life changing consequences such as impaired intestinal absorption, diarrhea and metabolic complications. Patients have life-long dependency on Total Parenteral Nutrition (TPN) with complex parenteral support to survive with risk of life-threatening infections and extra-organ impairment.

The compound links exenatide, a GLP-1 analogue, to a long-acting linker technology and is designed specifically to address the gastric effects in SBS patients by slowing digestive transit time. The asset uses proprietary XTEN® technology to extend the half-life of exenatide, allowing for once- to twice-per-month dosing, thus potentially increasing convenience for patients and caregivers. NM-002 is patent-protected and has received orphan drug designation by the FDA. The Company plans to start a phase 1b/2a study in 2020 in adult patients suffering from SBS.

Celiac Disease (CeD)

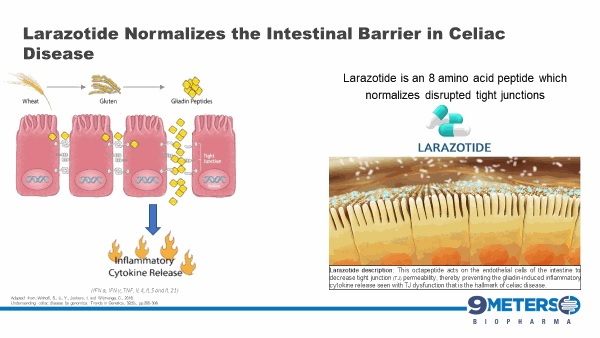

In 2019, we initiated a Phase 3 clinical trial for our lead drug candidate, larazotide acetate or larazotide, for the treatment of celiac disease. Larazotide has the potential to be a first-to-market therapeutic for celiac disease, an unmet medical need affecting an estimated 1% of the U.S. population or more than 3 million individuals Patients with celiac disease have no treatment alternative other than a strict lifelong adherence to a gluten-free diet, which is difficult to maintain and can be deficient in key nutrients. Additionally, current FDA labeling standards allow up to 20 parts per million (ppm) of gluten in “gluten-free” labeled foods, which contains enough gluten to cause celiac symptoms in many patients, including abdominal pain, abdominal cramping, bloating, gas, headaches, ataxia, “brain fog” and fatigue. Long-term ramifications of celiac disease include enteropathy associated T-cell lymphoma (EATL), osteoporosis and anemia.

Larazotide is being investigated as an adjunct to a gluten-free diet for celiac patients who continue to experience symptoms despite adhering to a gluten-free diet. Due to the difficulty of maintaining a gluten-free diet due to lack of easy access to and the higher cost of gluten-free foods, contamination from gluten as well as social pressures, it is estimated that more than half the celiac population experiences multiple, potentially debilitating, symptoms per month. A study from the U.K. indicates that more than 70% of patients diagnosed with celiac disease consume gluten either intentionally or inadvertently (Hall et al. 2013).

Larazotide is an 8-amino acid peptide formulated into an orally administered capsule and has been tested in nearly 600 celiac patients with statistically significant improvement in celiac symptoms. The FDA has granted larazotide Fast Track Designation for celiac disease. Larazotide’s safety profile has been similar to placebo. Additionally, larazotide’s mechanism of action as a tight junction regulator is a new approach to treating autoimmune diseases, such as celiac disease. Multiple pre-clinical studies have shown larazotide causes a reduction in permeability across the intestinal epithelial barrier, making it the only drug candidate known to us which is in clinical trials with this mechanism of action.

With the release of the Phase 2b trial data in 342 celiac patients at the 2014 Digestive Disease Week conference, larazotide became the first and the only drug for the treatment of celiac disease (published data), which met its primary efficacy endpoint with statistical significance. The Phase 2b data showed statistically significant (p=0.022) reduction in abdominal and non-GI (headache) symptoms as measured by the patient reported outcome primary end point for celiac disease created specifically for celiac disease and wholly owned by us (“CeD PRO”). Larazotide has been shown to be safe and effective after being tested in several clinical trials involving nearly 600 patients, most recently in the Phase 2b trial for celiac disease. After a successful End-of-Phase 2 meeting with the FDA, which confirmed the regulatory path forward, we launched the Phase 3 registration program in 2019 and dosed the first patient in August 2019, with top-line data expected in 2021 We have approximately 100 active clinical trial sites with three treatment groups, 0.25 mg of larazotide, 0.5 mg of larazotide and a placebo arm. Site activation and patient enrollment have recently been impacted by the announcement of the RDD Merger and the COVID-19 pandemic. We continue to monitor the evolving situation with COVID-19, which is likely to directly or indirectly impact the pace of enrollment over the next several months. We currently anticipate a readout from the trial in 2021.

NM-003 is a proprietary long-acting GLP-2 agonist and NM-004 is a double-cleaved mesalamine with an immunomodulator. These two assets are being evaluated for development in rare and/or orphan indications. Our product development pipeline is currently positioned as described in the table below.

Corporate Information

We were incorporated under the laws of Delaware under the name Monster Digital, Inc. in November 2010 as a private company. We completed our initial public offering in July 2016. In January 2018, we acquired Innovate Biopharmaceuticals Inc. (“Private Innovate”) through its merger with a wholly owned subsidiary of ours, with Private Innovate surviving as our wholly owned subsidiary. As part of that transaction, Monster Digital, Inc. changed its name to Innovate Biopharmaceuticals, Inc. At that time, we also changed the focus of our business to pharmaceutical research and development. In April 2020, we acquired RDD Pharma, Ltd. through its merger with a wholly owned subsidiary of ours, with RDD Pharma, Ltd. surviving as our wholly owned subsidiary. As part of that transaction, we changed our name from Innovate Biopharmaceuticals, Inc. to 9 Meters Biopharma, Inc. In May 2020, we acquired Naia Rare Diseases, Inc. through its merger with a wholly owned subsidiary of ours.

Our principal executive offices are located at 8480 Honeycutt Road, Suite 120, Raleigh, NC 27615 and our telephone number is (919) 275-1933. Our corporate website address is www.9meters.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Exchange Act, will be made available free of charge on our website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The contents of our website are not incorporated into this Registration Statement on Form S-3 and our reference to the URL for our website is intended to be an inactive textual reference only.

This Registration Statement on Form S-3 contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this Registration Statement on Form S-3, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other company.

Implications of Being an Emerging Growth Company

We are an “emerging growth company” as defined in the JOBS Act and therefore we may take advantage of certain exemptions from various public company reporting requirements. As an “emerging growth company:”

•we will present no more than two years of audited financial statements and no more than two years of related management’s discussion and analysis of financial condition and results of operations;

•we will avail ourselves of the exemption from the requirement to obtain an attestation and report from our auditors on the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act (this exemption was recently extended indefinitely for smaller reporting companies, as defined in Rule 12b-2 of the Exchange Act, with revenue of less than $100 million);

•we will provide less extensive disclosure about our executive compensation arrangements; and

•we will not require stockholder non-binding advisory votes on executive compensation or golden parachute arrangements.

However, we have chosen to irrevocably opt out of the extended transition periods available under the JOBS Act for complying with new or revised accounting standards. We will remain an “emerging growth company” for up to five years, although we will cease to be an “emerging growth company” upon the earliest of (1) December 31, 2021, (2) the last day of the first fiscal year in which our annual gross revenues are $1.07 billion or more, (3) the date on which we have, during the previous rolling three-year period, issued more than $1 billion in non-convertible debt securities and (4) the date on which we are deemed to be a “large accelerated filer” as defined in the Exchange Act.

THE OFFERING

Up to 84,603,538 Shares of Common Stock

This prospectus relates to the resale by the selling stockholders identified in this prospectus of up to 84,603,538 shares of our common stock, consisting of:

| |

| • | 4,835,438 shares of our common stock issued to the Naia Rare Diseases stockholders; |

| |

| • | 38,277,900 shares of our common stock underlying outstanding shares of our Series A Preferred Stock issued to investors in the Private Placement; |

| |

| • | 38,277,900 shares of our common stock that are underlying the shares of our Series A Preferred Stock issuable upon the exercise of warrants issued to investors in the Private Placement (the “Investor Warrants”); and |

| |

| • | 2,712,300 shares of our common stock that are underlying the shares of our Series A Convertible Preferred Stock issuable upon the exercise of warrants issued to certain placement agents in the Private Placement (the “Broker Warrants”), and |

| |

| • | 500,000 shares of our common stock issuable upon the exercise of warrants issued to certain consultants, pursuant to the consulting agreement (the “Consulting Agreement”) between the Company and GP Nurmenkari, Inc., which was effective as of May 4, 2020 (“Consultant Warrants”, together with the Investor Warrants and the Broker Warrants, the “Warrants”). |

|

| | | | |

| Common stock offered by the selling stockholders | 84,603,538 |

| shares |

Common stock outstanding before the offering (1) | 96,251,342 |

| shares |

| Common stock to be outstanding after the offering | 176,019,442 |

| shares |

| Common stock Nasdaq Capital Market Symbol | NMTR |

| |

| | | | |

| (1) | The number of shares of common stock outstanding is based on an aggregate of 96,251,342 shares outstanding as of May 6, 2020, and excludes: • 12,694,680 shares of common stock issuable upon the exercise of options outstanding as of May 6, 2020 at a weighted average exercise price of $1.34 per share, under the 9 Meters 2012 Omnibus Stock Incentive Plan and under the RDD 2008 Global Share Option Plan; • 142,766 shares of common stock reserved for future issuance under the 2012 Omnibus Stock Incentive Plan as of May 6, 2020; • 770,616 shares of common stock issuable upon the exercise of common stock warrants outstanding as of May 6, 2020; • Series A Preferred Stock outstanding convertible into 38,277,900 shares of common stock; and • 38,277,900 shares of common stock underlying the shares of our Series A Preferred Stock issuable upon the exercise of the Broker Warrants and Investor Warrants. |

Private Placement of Preferred Shares and Warrants

On April 29, 2020, we entered into a Securities Purchase Agreement with various investors pursuant to which we agreed to sell approximately 382,779 units, with each unit consisting of (i) one share of our Series A Preferred Stock and (ii) a Class A Warrant to purchase one share of Series A Preferred Stock, which expires on May 4, 2025. The units were sold at a price to the public of $58.94 per unit for aggregate gross proceeds of approximately $22.6 million. We also issued warrants to purchase up to an aggregate of 2,712,300 shares of Series A Preferred Stock to certain placement agents that participated in the Private Placement. Each share of Series A Preferred Stock is convertible into common stock, based on an initial conversion ratio of 1:100, as adjusted in accordance with the Certificate of Designation, upon receipt of the approval of our stockholders. That approval is being sought at the Annual Meeting of Stockholders scheduled to be held on June 30, 2020.

The Private Placement closed on May 4, 2020. At closing, we received net proceeds of approximately $19.2 million after deducting placement agent fees and offering expenses.

William Blair & Company L.L.C. acted as the lead Placement Agent for the offering.

In the offering, we issued an aggregate of (i) 382,779 shares of our Series A Preferred Stock, which are convertible into 38,277,900 shares of common stock, (ii) Investor Warrants to purchase 382,779 shares of our Series A Preferred Stock, which are convertible into 38,277,900 shares of common stock, and (iii) Broker Warrants to purchase 27,123 shares of our Series A Preferred Stock, which are convertible into 2,712,300 shares of common stock.

The exercise price of both the Investor Warrants and the Broker Warrants is $58.94 per share, subject to adjustment for stock splits, stock dividends and similar corporate events. The Investor Warrants and Broker Warrants terminate in five years after date of issuance and are exercisable at any time or times on or after the date of issuance.

In connection with the offering, on April 29, 2020, we also entered into a Registration Rights Agreement with the investors in the Private Placement. Pursuant to the Registration Rights Agreement, we must file with the SEC, no later than 30 days following the closing date of the Private Placement, a registration statement on Form S-3 covering the shares of common stock underlying the shares of Series A Preferred Stock issued in the Private Placement and the shares of common stock underlying the shares of Series A Preferred Stock issuable upon exercise of the Investor Warrants and Broker Warrants.

Naia Rare Diseases Acquisition

On May 6, 2020, we acquired Naia Rare Diseases as our wholly owned subsidiary pursuant to an Agreement and Plan of Merger, dated April 30, 2020. In accordance with the terms of that merger agreement, at the closing, we issued an aggregate of 4,835,438 shares of our common stock, along with cash consideration called for in the merger agreement. We agreed to register for resale the shares of common stock issued to Naia Rare Diseases pursuant to the merger agreement.

Consulting Agreement

We entered into a Consulting Agreement with GP Nurmenkari, Inc. (“GPN”) for certain investor relation services, which was effective as of May 4, 2020. In connection with the Consulting Agreement, we issued to GPN the Consulting Warrants to purchase 500,000 shares of common stock with an exercise price of $0.5894.

Use of Proceeds

The 4,835,438 shares of common stock issued to the Naia Rare Diseases stockholders, the 38,277,900 shares of common stock underlying the shares of Series A Preferred Stock and 40,990,200 shares of common stock underlying the shares of Series A Preferred Stock issuable upon exercise of the Investor Warrants and Broker Warrants and 500,000 shares of common stock issuable upon the exercise of the Warrants will be sold for the accounts of the selling stockholders named in this prospectus. As a result, all proceeds from the sales of the 84,603,538 shares of common stock offered

for resale hereby will go to the selling stockholders and we will not receive any proceeds from the resale of those shares of common stock by the selling stockholders.

We may receive up to a total of approximately $24.5 million in gross proceeds if all of the Warrants are exercised hereunder. However, as we are unable to predict the timing or amount of potential exercises of the Warrants, we have not allocated any proceeds of such exercises to any particular purpose. Accordingly, all such proceeds are allocated to working capital. It is possible that the Warrants may expire and may never be exercised.

We will incur all costs associated with this registration statement and prospectus.

Dividend Policy

We have never paid dividends on our capital stock and do not anticipate paying any dividends for the foreseeable future.

Risk Factors

Investing in our common stock involves a high degree of risk. Please read the information contained under the heading “Risk Factors” beginning on page 30 of this prospectus.

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described in the section entitled “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2019, as filed with the SEC on March 20, 2020, and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, as filed with the SEC on May 15, 2020, and the risks described below. These risks and uncertainties are not the only risks and uncertainties we face. Additional risks and uncertainties not currently known to us, or that we currently view as immaterial, may also impair our business. If any of the risks or uncertainties described in our SEC filings or any additional risks and uncertainties actually occur, our business, financial condition, results of operations and cash flow could be materially and adversely affected. In that case, the trading price of our common stock could decline and you might lose all or part of your investment.

The sale of the shares of our common stock offered hereby will cause dilution for our then existing stockholders and could depress the market price of our common stock.

The conversion of the Series A Preferred Stock and the exercise of the Warrants, depending on the extent to which they are converted and exercised, could be significant and would cause the percentage of our outstanding common stock held by each stockholder immediately prior to such issuance to decrease and such decrease in percentage ownership could be significant. In addition, the possibility of the issuance of these shares, as well as the actual issuance and any subsequent sale of such shares, could substantially reduce the market price for our common stock. This potential dilution and impact on our stock price could impede our ability to obtain future financing.

The RDD merger and acquisition of Naia Rare Diseases will present challenges associated with integrating operations, personnel, and other aspects of the companies and assumption of liabilities.

The results of the combined company following our merger with RDD and acquisition of Naia Rare Diseases will depend in part upon our ability to integrate RDD’s and Naia Rare Diseases’ businesses with our business in an efficient and effective manner. Our attempt to integrate three companies that have previously operated independently may result in significant challenges, and we may be unable to accomplish the integration smoothly or successfully. In particular, the necessity of coordinating geographically dispersed organizations and addressing possible differences in corporate cultures and management philosophies may increase the difficulties of integration. The integration may require the dedication of significant management resources, which may temporarily distract management’s attention from the day-to-day operations of the businesses of the combined company. In addition, the combined company may adjust the way in which RDD, Naia Rare Diseases or we have conducted our respective operations and utilized our respective assets, which may require retraining and development of new procedures and methodologies. The process of integrating operations and making such adjustments could cause an interruption of, or loss of momentum in, the activities of one or more of the combined company’s businesses and the loss of key personnel. Employee uncertainty, lack of focus, or turnover during the integration process may also disrupt the businesses of the combined company. Any inability of

management to integrate the operations of RDD and Naia Rare Diseases into our company successfully could have a material adverse effect on the business and financial condition of the combined company.

In addition, the RDD merger and acquisition of Naia Rare Diseases will subject us to contractual or other obligations and liabilities of RDD and Naia Rare Diseases, some of which may be unknown. Although we and our legal and financial advisors have conducted due diligence on RDD and Naia Rare Diseases and their businesses, there can be no assurance that we are aware of all such obligations and liabilities. These liabilities, and any additional risks and uncertainties related to RDD’s or Naia Rare Diseases’ business not currently known to us or that we may currently be aware of, but that prove to be more significant than assessed or estimated by us, could negatively impact the business, financial condition, and results of operations of the combined company.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains a number of “forward-looking statements.” Specifically, all statements other than statements of historical facts included in this prospectus regarding our financial position, business strategy and plans and objectives of management for future operations are forward-looking statements. These forward-looking statements are based on the beliefs of management at the time these statements were made, as well as assumptions made by and information available to management at that time. When used in this prospectus and the documents incorporated by reference herein, the words “anticipate,” “believe,” “estimate,” “expect,” “may,” “might,” “will,” “continue” and “intend,” and words or phrases of similar import, as they relate to our financial position, business strategy and plans, or objectives of management, are intended to identify forward-looking statements. These statements reflect our view, as of the date hereof, with respect to future events and are subject to risks, uncertainties and assumptions related to various factors.

You should understand that the following important factors, in addition to those discussed in our periodic reports to be filed with the SEC under the Securities Exchange Act of 1934, as amended, or the Exchange Act, could affect our future results and could cause those results to differ materially from those expressed in such forward-looking statements:

| |

| • | impacts of and uncertainty related to COVID-19; |

| |

| • | fluctuations in our financial results and stock price, particularly given market conditions and the potential economic impact of COVID 19; |

| |

| • | our need to raise additional money to fund our operations for the next twelve months as a going concern; |

| |

| • | risks of our clinical trials including, but not limited to, the costs, design, initiation and enrollment (which could be adversely impacted by COVID-19 and resulting social distancing), timing, progress and results of such trials; |

| |

| • | our ability to integrate the post-merger operations, personnel, and other aspects of RDD and Naia Rare Diseases; |

| |

| • | our ability to integrate the RDD and Naia Rare Diseases portfolios of product candidates into our existing business operations; |

| |

| • | our expectations related to the use of proceeds from our financings; |

| |

| • | our expectations regarding our ability to fund our operating expenses and capital expenditure requirements with our cash on hand and proceeds from our financings; |

| |

| • | our ability to meet the requirements for continued listing on the Nasdaq Capital Market; |

| |

| • | our estimates regarding expenses, future revenue, timing of any future revenue, capital requirements and needs for additional financing; |

| |

| • | our limited operating history; |

| |

| • | our ability to develop and implement our planned product development, commercialization, marketing and manufacturing capabilities and strategies for our product candidates; |

| |

| • | the timing of, and our ability to obtain and maintain regulatory approvals for our product candidates; |

| |

| • | the potential advantages of our product candidates; |

| |

| • | the rate and degree of market acceptance and clinical utility of our products; |

| |

| • | our intellectual property position; |

| |

| • | our ability to attract, integrate and retain key personnel; |

| |

| • | the impact of government laws and regulations; |

| |

| • | our competitive position; |

| |

| • | developments relating to our competitors and our industry; |

| |

| • | our ability to maintain and establish collaborations or obtain additional funding; |

| |

| • | general or regional economic conditions; |

| |

| • | changes in U.S. generally accepted accounting principles, or GAAP; and |

| |

| • | changes in the legal, regulatory and legislative environments in the markets in which we operate, including impacts of United States government shut-downs on our ability to raise money and obtain regulatory approval for our products. |

Although we believe that our expectations (including those on which our forward-looking statements are based) are reasonable, we cannot assure you that those expectations will prove to be correct. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described in our forward-looking statements.

Except for our ongoing obligations to disclose material information under the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or any other reason. All subsequent forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to herein. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus and the documents incorporated by reference herein might not occur.

USE OF PROCEEDS

We are not selling any common stock under this prospectus and will not receive any of the proceeds from the sale of shares by the selling stockholders. We may receive up to a total of approximately $24.5 million in gross proceeds if all of the Warrants are exercised hereunder. However, as we are unable to predict the timing or amount of potential exercises of the Warrants, we have not allocated any proceeds of such exercises to any particular purpose. Accordingly, all such proceeds are allocated to working capital. It is possible that the Warrants may expire and may never be exercised.

The selling stockholders will pay any underwriting discounts and commissions and expenses incurred by them for brokerage, accounting, tax or legal services or any other expenses incurred in disposing of the shares. We will bear all other costs, fees and expenses incurred in effecting the registration of the shares covered by this prospectus, including, without limitation, all registration and filing fees, Nasdaq Capital Market listing fees and fees and expenses of our counsel and our auditors.

SELLING STOCKHOLDERS

The shares of common stock being offered by the selling stockholders are as follows:

| |

| • | 4,835,438 shares of our common stock issued to the Naia Rare Diseases stockholders; |

| |

| • | 38,277,900 shares of our common stock underlying outstanding shares of our Series A Convertible Preferred Stock issued to investors in the Private Placement; |

| |

| • | 38,277,900 shares of our common stock that are underlying the shares of our Series A Convertible Preferred Stock issuable upon the exercise of the Investor Warrants; |

| |

| • | 2,712,300 shares of our common stock that are underlying the shares of our Series A Convertible Preferred Stock issuable upon the exercise of the Broker Warrants; and |

| |

| • | 500,000 shares of our common stock issuable upon the exercise of the Consultant Warrants. |

For additional information regarding the issuances of the above-listed shares of common stock, Series A Preferred Stock and Warrants, see the sections captioned “The Offering - Private Placement of Preferred Shares and Warrants”, “The Offering – Naia Rare Diseases Acquisition” and “The Offering - Consulting Agreement” above. We are registering the shares of common stock in order to permit the selling stockholders to offer the shares for resale from time to time. Except as disclosed below and for the ownership of the shares of common stock, Series A Preferred Stock and the Warrants, the selling stockholders have not had any material relationship with us within the past three years.

The following table sets forth information as of May 6, 2020, with respect to the selling stockholders for whom we are registering shares for sale to the public, the number of shares of our common stock beneficially owned by the each selling stockholder prior to this offering, the percentage of common stock beneficially owned by each selling stockholder prior to this offering, the maximum number of shares of our common stock to be sold by each selling stockholder pursuant to this prospectus, the number of shares of our common stock to be beneficially owned by each selling stockholder upon completion of this offering, assuming all such shares are sold, and the percentage of common stock beneficially owned by each selling stockholder after this offering, assuming all such shares are sold. A selling stockholder may not exercise the warrants to the extent that such exercise would cause such selling stockholder, together with its affiliates, to beneficially own in excess of 9.999% (or, at the election of the holder, 4.999%) of the number of shares of common stock outstanding immediately after giving effect to the exercise. However, any selling stockholder may increase or decrease such percentage to any other percentage not in excess of 19.99% upon notice to us, provided that any increase in such percentage shall not be effective until 61 days after such notice.

Applicable percentage ownership is based on 96,251,342 shares of our common stock outstanding as of May 6, 2020. Beneficial ownership is determined in accordance with Rule 13d-3(d) promulgated by the SEC under the Exchange Act.

This table is prepared based on information supplied to us by the selling stockholders. As used in this prospectus, the term “selling stockholders” includes the selling stockholders listed below, and any donees, pledges, transferees or other successors in interest selling shares received after the date of this prospectus from the selling stockholders as a gift, pledge, or other non-sale related transfer. The numbers of shares in the column “Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus” represents all of the shares that each selling stockholder may offer under this prospectus. The selling stockholders may sell some, all or none of their shares offered for sale hereby. The selling stockholders may sell or transfer all or a portion of their shares of our common stock pursuant to an available exemption from the registration requirements of the Securities Act. We do not know how long the selling stockholders will hold the shares before selling them, and we currently have no agreements, arrangements or understandings with any selling stockholder regarding the sale of any of the shares.

|

| | | | | | | | | |

| | Shares of Common Stock Owned Prior to Offering | Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus | Shares of Common Stock Owned After Offering |

Name of Selling Stockholder | Number | Percent | | Number | Percent |

| Pharmascience Inc. | 8,491,907 (1) | 8.5 | % | 3,771,600 |

| 4,720,307 |

| 4.7 | % |

| Adolfo and Donna Carmona | 347,973 | * |

| 339,200 |

| 8,773 |

| * |

|

| Agate JT Healthcare Fund LP | 7,639,630 (2) | 7.7 | % | 3,393,000 |

| 4,246,630 |

| 4.3 | % |

| Alan McIntyre | 67,800 | * |

| 67,800 |

| — |

| * |

|

| Alan Pines & Elisa Pines | 254,400 | * |

| 254,400 |

| — |

| * |

|

| Albert Gentile & Hiedi Gentile | 84,800 | * |

| 84,800 |

| — |

| * |

|

| Alex Harrigan | 42,400 | * |

| 42,400 |

| — |

| * |

|

| Altamont Pharmaceutical Holdings, LLC | 1,357,200 | 1.4 | % | 1,357,200 |

| — |

| * |

|

| Andreas Ammelounx Living Trust | 339,200 | * |

| 339,200 |

| — |

| * |

|

| Andrew & Melissa Fisher | 97,000 | * |

| 84,800 |

| 12,200 |

| * |

|

| Andrew Horan | 169,600 | * |

| 169,600 |

| — |

| * |

|

Anson Investments Master Fund LP (3) | 1,696,600 | 1.7 | % | 1,696,600 |

| — |

| * |

|

| Anthony Barrett | 218,469 | * |

| 169,600 |

| 48,869 |

| * |

|

| Arie A. Giniger | 627,366 (4) | * |

| 278,600 |

| 348,766 |

| * |

|

| Ashit K Vijapura | 169,600 | * |

| 169,600 |

| — |

| * |

|

| B3 Group LLC | 339,200 | * |

| 339,200 |

| — |

| * |

|

| Barry Shemaria | 140,366 | * |

| 135,600 |

| 4,766 |

| * |

|

| Basil Palmeri | 113,366 | * |

| 101,600 |

| 11,766 |

| * |

|

| Billy Smartt | 33,800 | * |

| 33,800 |

| — |

| * |

|

| Bogaski Trust | 33,800 | * |

| 33,800 |

| — |

| * |

|

| Bohdan Rudawski | 169,600 | * |

| 169,600 |

| — |

| * |

|

| BPY Limited | 1,357,200 | 1.4 | % | 1,357,200 |

| — |

| * |

|

| Brian & Andrea Fischhoff | 52,204 | * |

| 42,400 |

| 9,804 |

| * |

|

| Brian Eliot Peierls | 94,200 | * |

| 94,200 |

| — |

| * |

|

| Bruce E. Walenczyk | 169,600 | * |

| 169,600 |

| — |

| * |

|

| Byron H Rubin | 186,600 | * |

| 186,600 |

| — |

| * |

|

| Capital Point Ltd. | 13,273,459 (5) | 13.0 | % | 5,895,400 |

| 7,378,059 |

| 7.2 | % |

| Casimir S. Skrzypczak | 89,600 | * |

| 84,800 |

| 4,800 |

| * |

|

| Chandra Kant Singla | 169,600 | * |

| 169,600 |

| — |

| * |

|

| Christopher Washburn | 47,920 | * |

| 33,800 |

| 14,120 |

| * |

|

CVI Investments Inc. (6) | 1,696,600 | 1.7 | % | 1,696,600 |

| — |

| * |

|

| Darnell Leffel | 339,200 | * |

| 339,200 |

| — |

| * |

|

| David Clarke - GSB Holdings Inc. | 641,638 | * |

| 339,200 |

| 302,438 |

| * |

|

| David R. Rarey | 33,800 | * |

| 33,800 |

| — |

| * |

|

| DeLoach LS Investments, LLC | 169,600 | * |

| 169,600 |

| — |

| * |

|

| Dipen Maun | 169,600 | * |

| 169,600 |

| — |

| * |

|

| District 2 Capital Fund LP | 1,696,600 | 1.7 | % | 1,696,600 |

| — |

| * |

|

|

| | | | | | | | | |

| Donald R. Kendall, Jr | 84,800 | * |

| 84,800 |

| — |

| * |

|

| Donald Sesterhenn | 45,565 | * |

| 33,800 |

| 11,765 |

| * |

|

| Doug Rivers | 1,696,600 | 1.7 | % | 1,696,600 |

| — |

| * |

|

| Douglas Curtiss | 84,800 | * |

| 84,800 |

| — |

| * |

|

| Douglas Zas | 33,800 | * |

| 33,800 |

| — |

| * |

|

| Dr. Frederick B. Epstein | 43,605 | * |

| 33,800 |

| 9,805 |

| * |

|

| Dyke Rogers | 417,640 | * |

| 339,200 |

| 78,440 |

| * |

|

| E. Jeffrey Peierls | 176,430 | * |

| 117,600 |

| 58,830 |

| * |

|

| Edward O'Connell | 67,800 | * |

| 67,800 |

| — |

| * |

|

| El Milagro Ltd | 169,600 | * |

| 169,600 |

| — |

| * |

|

| Evan Harrigan | 42,400 | * |

| 42,400 |

| — |

| * |

|

| FBO William D. Hartley and Janet S. Hartley | 33,200 | * |

| 33,200 |

| — |

| * |

|

| FirstFire Global Opportunities Fund, LLC | 678,600 | * |

| 678,600 |

| — |

| * |

|

| Foster Family Trust | 101,600 | * |

| 101,600 |

| — |

| * |

|

| Frank H. Newton and Elizabeth H. Newton | 33,800 | * |

| 33,800 |

| — |

| * |

|

| Franklin M. Berger | 1,442,000 | 1.5 | % | 1,442,000 |

| — |

| * |

|

| Fuller Trust | 67,800 | * |

| 67,800 |

| — |

| * |

|

| Gerald Woolam | 169,600 | * |

| 169,600 |

| — |

| * |

|

| Gil Mor | 56,259 (7) | * |

| 17,600 |

| 38,659 |

| * |

|

| Glenn Herbolsheimer | 16,800 | * |

| 16,800 |

| — |

| * |

|

| Greg Ginsburg | 84,800 | * |

| 84,800 |

| — |

| * |

|

| Gubbay Investments, LLC | 118,600 | * |

| 118,600 |

| — |

| * |

|

| Howard and Susan Kalka | 131,040 | * |

| 101,600 |

| 29,440 |

| * |

|

| Howard Rice | 64,648 (8) | * |

| 43,200 |

| 21,448 |

| * |

|

Intracoastal Capital, LLC (9) | 678,600 | * |

| 678,600 |

| — |

| * |

|

| James H. Wiesenberg | 50,361 | * |

| 42,400 |

| 7,961 |

| * |

|

| James L. Dritz | 83,488 | * |

| 67,800 |

| 15,688 |

| * |

|

| Jeff Puglisi | 339,200 | * |

| 339,200 |

| — |

| * |

|

| Jeff Sacher | 84,800 | * |

| 84,800 |

| — |

| * |

|

| Jeffery Plotkin | 33,800 | * |

| 33,800 |

| — |

| * |

|

| Jeffrey D. Kelly | 169,600 | * |

| 169,600 |

| — |

| * |

|

| Joel Stone - Barbara Stone Irrevocable Trust | 339,200 | * |

| 339,200 |

| — |

| * |

|

| John A. McClary Jr. | 53,017 | * |

| 50,800 |

| 2,217 |

| * |

|

| John B. Pescitelli | 84,800 | * |

| 84,800 |

| — |

| * |

|

| John M. Day (IRA) | 1,017,800 | 1.0 | % | 1,017,800 |

| — |

| * |

|

| John Q. Joubert & Terri L. Joubert | 169,600 | * |

| 169,600 |

| — |

| * |

|

| John T. Healy | 84,800 | * |

| 84,800 |

| — |

| * |

|

| John V. Wagner, Jr. | 204,898 | * |

| 169,600 |

| 35,298 |

| * |

|

| Jonathan Barrett (Luminus Capital) | 861,602 | * |

| 678,600 |

| 183,002 |

| * |

|

| Joseph O. Manzi | 169,600 | * |

| 169,600 |

| — |

| * |

|

| Kara Hart | 77,604 | * |

| 67,800 |

| 9,804 |

| * |

|

|

| | | | | | | | | |

| Keith Gelles | 169,600 | * |

| 169,600 |

| — |

| * |

|

| Kenneth Klimitchek | 67,800 | * |

| 67,800 |

| — |

| * |

|

| Kumar Patel | 169,600 | * |

| 169,600 |

| — |

| * |

|

| Lars Bader | 1,696,600 | 1.7 | % | 1,696,600 |

| — |

| * |

|

| Lawrence Lytton | 1,017,800 | 1.0 | % | 1,017,800 |

| — |

| * |

|

| Leonard Schiller Revocable Trust | 339,200 | * |

| 339,200 |

| — |

| * |

|

| Leslie F. Olson- TOD Beneficiary Account | 16,800 | * |

| 16,800 |

| — |

| * |

|

| Louis Rozzo | 84,800 | * |

| 84,800 |

| — |

| * |

|

| LPD Investment LTD | 101,600 | * |

| 101,600 |

| — |

| * |

|

| M. Kirk Brimhall | 33,800 | * |

| 33,800 |

| — |

| * |

|

| Marilyn Hemani | 84,800 | * |

| 84,800 |

| — |

| * |

|

| Matthew Headington | 203,400 | * |

| 203,400 |

| — |

| * |

|

| Michael J. Mathieu | 64,400 | * |

| 64,400 |

| — |

| * |

|

| Michael M.. Mainero | 94,605 | * |

| 84,800 |

| 9,805 |

| * |

|

| Michael R. Pate | 30,400 | * |

| 30,400 |

| — |

| * |

|

| Michael Stark | 43,604 | * |

| 33,800 |

| 9,804 |

| * |

|

| Michael Thieleking | 67,800 | * |

| 67,800 |

| — |

| * |

|

| MITZ ZHU YAN,LP | 50,800 | * |

| 50,800 |

| — |

| * |

|

| N Michael Wolsonovich | 56,683 | * |

| 50,800 |

| 5,883 |

| * |

|

| Nikhil Patel | 84,800 | * |

| 84,800 |

| — |

| * |

|

| Nina Desai | 169,600 | * |

| 169,600 |

| — |

| * |

|

| Nomis Bay Ltd | 2,035,800 | 2.1 | % | 2,035,800 |

| — |

| * |

|

| Northlea Partners LLLP | 96,565 | * |

| 84,800 |

| 11,765 |

| * |

|

| OHB Family Trust | 115,610 | * |

| 96,000 |

| 19,610 |

| * |

|

| Pamela M. Baker & Russell S. Baker | 53,410 | * |

| 33,800 |

| 19,610 |

| * |

|

| Peter Colettis | 169,600 | * |

| 169,600 |

| — |

| * |

|

| Peter S. Kastner | 104,410 | * |

| 84,800 |

| 19,610 |

| * |

|

| Praful Patel | 169,600 | * |

| 169,600 |

| — |

| * |

|

| Pranjal Jain | 84,800 | * |

| 84,800 |

| — |

| * |

|

| Prentice Lending LLC | 848,200 | * |

| 848,200 |

| — |

| * |

|

| Puglisi Opportunity Fund | 1,696,600 | 1.7 | % | 1,696,600 |

| — |

| * |

|

| Rajesh Patel | 84,800 | * |

| 84,800 |

| — |

| * |

|

| Rajesh R Patel & Suny Patel | 84,800 | * |

| 84,800 |

| — |

| * |

|

| Rakesh Shah | 169,600 | * |

| 169,600 |

| — |

| * |

|

| Rathin Patel | 84,800 | * |

| 84,800 |

| — |

| * |

|

| Renald J. & Catherine C. Anelle | 169,600 | * |

| 169,600 |

| — |

| * |

|

| Richard & Mary Leslie Kingston | 135,600 | * |

| 135,600 |

| — |

| * |

|

| Richard David | 111,210 | * |

| 101,600 |

| 9,610 |

| * |

|

| Richard Stites | 42,400 | * |

| 42,400 |

| — |

| * |

|

| Robert Curtin | 84,800 | * |

| 84,800 |

| — |

| * |

|

| Robert Forster | 254,400 | * |

| 254,400 |

| — |

| * |

|

| Robert Harrigan | 140,530 | * |

| 118,600 |

| 21,930 |

| * |

|

| Robert Hutton (and Yvonne Hutton) | 678,600 | * |

| 678,600 |

| — |

| * |

|

|

| | | | | | | | | |

| Roger M Morrison | 86,134 | * |

| 84,800 |

| 1,334 |

| * |

|

Sabby Volatility Warrant Master Fund, Ltd. (10) | 5,089,800 | 5.0 | % | 5,089,800 |

| — |

| * |

|

| Satterfield Vintage Investments, LP | 848,200 | * |

| 848,200 |

| — |

| * |

|

| SDL Ventures, LLC | 1,135,460 | 1.2 | % | 1,017,800 |

| 117,660 |

| * |

|

| Stephen Mut | 84,800 | * |

| 84,800 |

| — |

| * |

|

| Stephen Romsdahl | 20,200 | * |

| 20,200 |

| — |

| * |

|

| Steven M. Cohen | 49,488 | * |

| 33,800 |

| 15,688 |

| * |

|

| Suresh Patel | 50,800 | * |

| 50,800 |

| — |

| * |

|

| The Glen Sato & Hope G. Nakamura Trust | 33,800 | * |

| 33,800 |

| — |

| * |

|

| The Menaker Trust | 84,800 | * |

| 84,800 |

| — |

| * |

|

| The Peierls Foundation, Inc. (Non-Profit) | 791,159 | * |

| 527,600 |

| 263,559 |

| * |

|

| Vijay and Tejal V. Patel | 254,400 | * |

| 254,400 |

| — |

| * |

|

| Warberg WF VIII LP | 339,200 | * |

| 339,200 |

| — |

| * |

|

| Zella Tribe (Mark Howells) | 678,600 | * |

| 678,600 |

| — |

| * |

|

| David Bartlow | 16,800 | * |

| 16,800 |

| — |

| * |

|

| Edward J. Sitar | 696,912 (11) | * |

| 135,600 |

| 561,312 |

| * |

|

| Gravitas Capital | 2,000,000 | 2.0 | % | 2,000,000 |

| — |

| * |

|

| Jay Madan | 1,801,548 (12) | 1.9 | % | 169,600 |

| 1,631,948 |

| 1.7 | % |

| John Temperato | 1,110,234 (13) | 1.1 | % | 542,800 |

| 567,434 |

| * |

|

| Jordyn Temperato | 16,800 | * |

| 16,800 |

| — |

| * |

|

| Julie Bartlow | 95,000 | * |

| 95,000 |

| — |

| * |

|

| Lorin K. Johnson | 546,092 (14) | * |

| 169,600 |

| 376,492 |

| * |

|

| Mark A. Sirgo | 797,762 (15) | * |

| 508,800 |

| 288,962 |

| * |

|

| Nir Barak | 572,914 (16) | * |

| 145,200 |

| 427,714 |

| * |

|

| OrbiMed Israel Limited Partnership | 30,562,299 (17) | 27.8 | % | 13,573,000 |

| 16,989,299 |

| 15.5 | % |

| Patricia Daigle | 84,800 | * |

| 84,800 |

| — |

| * |

|

| UD E.F. Peierls for Brian E. Peierls | 61,194 | * |

| 40,800 |

| 20,394 |

| * |

|

| UD E.F. Peierls for E. Jeffrey Peierls | 61,194 | * |

| 40,800 |

| 20,394 |

| * |

|

| UD J.N. Peierls for Brian Eliot Peierls | 77,685 | * |

| 51,800 |

| 25,885 |

| * |

|

| UD J.N. Peierls for E. Jeffrey Peierls | 77,685 | * |

| 51,800 |

| 25,885 |

| * |

|

| UW J.N. Peierls for Brian E. Peierls | 68,147 | * |

| 45,400 |

| 22,747 |

| * |

|

| UW J.N. Peierls for E. Jeffrey Peierls | 68,147 | * |

| 45,400 |

| 22,747 |

| * |

|

| UD Ethel F. Peierls Charitable Lead Trust | 94,175 | * |

| 62,800 |

| 31,375 |

| * |

|

| The Peierls Bypass Trust | 16,290 | * |

| 10,800 |

| 5,490 |

| * |

|

| UD E.S. Peierls for E.F. Peierls et al | 42,319 | * |

| 28,200 |

| 14,119 |

| * |

|

| UW E.S. Peierls for Brian E. Peierls - Accumulation | 56,425 | * |

| 37,600 |

| 18,825 |

| * |

|

|

| | | | | | | | | |

| UW E.S. Peierls for E. Jeffrey Peierls - Accumulation | 32,781 | * |

| 21,800 |

| 10,981 |

| * |

|

| Sandeep Laumas | 1,863,395 (18) | 1.9 | % | 84,800 |

| 1,778,595 |

| 1.8 | % |

| Schyler Temperato | 16,800 | * |

| 16,800 |

| — |

| * |

|

| Shirley Temperato | 33,800 | * |

| 33,800 |

| — |

| * |

|

| Sireesh Appajosyula | 146,542 (19) | * |

| 33,800 |

| 112,742 |

| * |

|

| Stephen D Snyder | 33,800 | * |

| 33,800 |

| — |

| * |

|

| Steve Derby - SDS Capital Partners II, LLC | 2,000,000 | 2.0 | % | 2,000,000 |

| — |

| * |

|

| William Blair & Company L.L.C. | 438,800 | * |

| 438,800 |

| — |

| * |

|

| WestPark Capital, Inc. | 58,900 | * |

| 58,900 |

| — |

| * |

|

| MS Howells | 110,000 | * |

| 110,000 |

| — |

| * |

|

| Craig Sherman | 83,100 | * |

| 83,100 |

| — |

| * |

|

| Vincent LoPriore | 330,000 | * |

| 330,000 |

| — |

| * |

|

| Aaron Segal | 521,600 | * |

| 521,600 |

| — |

| * |

|

| David Landskowsky | 273,600 | * |

| 273,600 |

| — |

| * |

|

| Eric Rubenstein | 273,600 | * |

| 273,600 |

| — |

| * |

|

| Tim Herrman | 167,800 | * |

| 167,800 |

| — |

| * |

|

| Todd Harrigan | 151,400 | * |

| 151,400 |

| — |

| * |

|

| Scott Cardone | 85,400 | * |

| 85,400 |

| — |

| * |

|

| Steven Nicholson | 35,400 | * |

| 35,400 |

| — |

| * |

|

| Albert Pezone | 113,600 | * |

| 113,600 |

| — |

| * |

|

| National Securities Corporation | 42,800 | * |

| 42,800 |

| — |

| * |

|

| Jeff Sacher | 16,100 | * |

| 16,100 |

| — |

| * |

|

| Alden Carrere | 2,400 | * |

| 2,400 |

| — |

| * |

|

| Jim Pinzker | 3,100 | * |

| 3,100 |

| — |

| * |

|

| Richard Goldstein | 2,400 | * |

| 2,400 |

| — |

| * |

|

| Rick Davidson | 2,300 | * |

| 2,300 |

| — |

| * |

|

| Cedars-Sinai Medical Center | 223,991 | * |

| 223,991 |

| — |

| * |

|

| Charles H. Thorne | 97,387 | * |

| 97,387 |

| — |

| * |

|

| Daniel Perez | 14,609 | * |

| 14,609 |

| — |

| * |

|

| David Chernoff | 14,609 | * |

| 14,609 |

| — |

| * |

|

| Fred Craves | 497,332 | * |

| 497,332 |

| — |

| * |

|

| Geller Biopharm Inc. | 19,478 | * |

| 19,478 |

| — |

| * |

|

| Jorge Puente | 14,609 | * |

| 14,609 |

| — |

| * |

|

| Mark Bagnall | 14,609 | * |

| 14,609 |

| — |

| * |

|

| Mark Pimentel | 29,217 | * |

| 29,217 |

| — |

| * |

|

| Naia Limited | 3,482,956 | 3.6 | % | 3,482,956 |

| — |

| * |

|

| Nolan Karp | 194,774 | * |

| 194,774 |

| — |

| * |

|

| Omar Haffar | 14,609 | * |

| 14,609 |

| — |

| * |

|

| Robert Martin | 14,609 | * |

| 14,609 |

| — |

| * |

|

| Robert Williamson III | 14,609 | * |

| 14,609 |

| — |

| * |

|

| Thomas Unger | 4,870 | * |

| 4,870 |

| — |

| * |

|

| JBF Group Holdings, LLC | 38,955 | * |

| 38,955 |

| — |

| * |

|

| Amunix Pharmaceuticals, Inc. | 144,215 | * |

| 144,215 |

| — |

| * |

|

* Less than 1%.

| |

| (1) | Consists of (i) 4,720,307 shares of common stock, (ii) 1,885,800 shares of common stock issuable upon the conversion of Series A Preferred Stock, and (iii) 1,885,800 shares of common stock issuable upon the ultimate conversion of warrants to purchase up to 18,858 shares of Series A Preferred Stock. Excludes 540,135 shares of common stock placed in escrow in accordance with an escrow agreement for a period of six months, in connection with the Company’s merger with RDD Pharma, Ltd. (the “RDD Merger”). |

| |

| (2) | Consists of (i) 4,246,630 shares of common stock, (ii) 1,696,500 shares of common stock issuable upon the conversion of Series A Preferred Stock, and (iii) 1,696,500 shares of common stock issuable upon the ultimate conversion of warrants to purchase up to 16,965 shares of Series A Preferred Stock. Excludes 485,934 shares of common stock placed in escrow in accordance with an escrow agreement for a period of six months, in connection with the RDD Merger. |

| |

| (3) | Anson Advisors Inc. and Anson Funds Management LP, the Co-Investment Advisers of Anson Investments Master Fund LP (“Anson”), hold voting and dispositive power over the common stock held by Anson. Bruce Winson is the managing member of Anson Management GP LLC, which is the general partner of Anson Funds Management LP. Moez Kassam and Amin Nathoo are directors of Anson Advisors Inc. Mr. Winson, Mr. Kassam and Mr. Nathoo each disclaim beneficial ownership of the common stock except to the extent of their pecuniary interest therein. The principal business address of Anson is Walkers Corporate Limited, Cayman Corporate Centre, 27 Hospital Road, George Town, Grand Cayman KY1-9008, Cayman Islands. |

| |

| (4) | Consists of (i) 348,766 shares of common stock, (ii) 139,300 shares of common stock issuable upon the conversion of Series A Preferred Stock, and (iii) 139,300 shares of common stock issuable upon the ultimate conversion of warrants to purchase up to 1,393 shares of Series A Preferred Stock. Excludes 39,909 shares of common stock placed in escrow in accordance with an escrow agreement for a period of six months, in connection with the RDD Merger. |

| |

| (5) | Consists of (i) 7,378,059 shares of common stock, (ii) 2,947,700 shares of common stock issuable upon the conversion of Series A Preferred Stock, and (iii) 2,947,700 shares of common stock issuable upon the ultimate conversion of warrants to purchase up to 29,477 shares of Series A Preferred Stock. Excludes 844,257 shares of common stock placed in escrow in accordance with an escrow agreement for a period of six months, in connection with the RDD Merger. |

| |

| (6) | Heights Capital Management, Inc., the authorized agent of CVI Investments, Inc. (“CVI”), has discretionary authority to vote and dispose of the shares of common stock held by CVI and may be deemed to be the beneficial owner of these shares. Martin Kobinger, in his capacity as Investment Manager of Heights Capital Management, Inc., may also be deemed to have investment discretion and voting power over the shares held by CVI. Mr. Kobinger disclaims any such beneficial ownership of the shares. |

| |

| (7) | Consists of (i) 21,173 shares of common stock, (ii) options to purchase 17,486 shares of common stock held by Mr. Mor that are exercisable within 60 days of May 6, 2020, (iii) 8,800 shares of common stock issuable upon the conversion of Series A Preferred Stock, and (iv) 8,800 shares of common stock issuable upon the ultimate conversion of warrants to purchase up to 88 shares of Series A Preferred Stock. Excludes 2,423 shares of common stock placed in escrow in accordance with an escrow agreement for a period of six months, in connection with the RDD Merger. |

| |

| (8) | Consists of (i) 11,733 shares of common stock, (ii) options to purchase 9,715 shares of common stock held by Mr. Rice that are exercisable within 60 days of May 6, 2020, (iii) 21,600 shares of common stock issuable upon the conversion of Series A Preferred Stock, and (iv) 21,600 shares of common stock issuable upon the ultimate conversion of warrants to purchase up to 216 shares of Series A Preferred Stock. Excludes 1,343 shares of common stock placed in escrow in accordance with an escrow agreement for a period of six months, in connection with the RDD Merger. |

| |

| (9) | Mitchell P. Kopin and Daniel B. Asher, each of whom are managers of Intracoastal Capital LLC (“Intracoastal”), have shared voting control and investment discretion over the securities reported herein that are held by Intracoastal. As a result, each of Mr. Kopin and Mr. Asher may be deemed to have beneficial ownership (as determined under Section 13(d) of the Exchange Act) of the securities reported herein that are held by Intracoastal. |

| |

| (10) | Based on information provided to us by the selling shareholder, Sabby Management, LLC serves as the investment manager of Sabby Volatility Warrant Master Fund, Ltd. (“SVWMF”). Hal Mintz is the manager of Sabby Management, LLC and has voting and investment control of the securities held by SVWMF. Each of Sabby Management, LLC and Hal Mintz disclaims beneficial ownership over the securities beneficially owned by SVWMF except to the extent of their respective pecuniary interest therein. SVWFM’s ability to exercise the warrants is subject to ownership caps prohibiting them from exercising any of the warrants to the extent that after giving effect to such exercise, SVWMF and their affiliates would beneficially own more than 4.999% of the Company’s common stock. |

| |

| (11) | Consists of (i) options to purchase 561,312 shares of common stock held by Mr. Sitar that are exercisable within 60 days of May 6, 2020, (ii) 67,800 shares of common stock issuable upon the conversion of Series A Preferred Stock and (iii) 67,800 shares of common stock issuable upon the ultimate conversion of warrants to purchase up to 6,780 shares of Series A Preferred Stock. |

| |

| (12) | Consists of (i) 79,131 shares of common stock held by Mr. Madan, (ii) 129,593 shares of common stock held by Madan Global, Inc., (iii) 122,104 shares of common stock held by OM Healthcare Partners, LLC, (iv) 122,104 shares of common stock held by OM Healthcare Partners II LLC, (v) 122,104 shares of common stock held by OM Healthcare Partners III LLC, (vi) 450,000 shares of common stock held by MGI Holdings II LLC, (vii) options to purchase 606,912 shares of common stock held by Mr. Madan that are exercisable within 60 days of May 6, 2020, (viii) 84,800 shares of common stock issuable upon the conversion of Series A Preferred Stock, and (ix) 84,800 shares of common stock issuable upon the ultimate conversion of warrants to purchase up to 848 shares of Series A Preferred Stock. |

| |

| (13) | Consists of (i) 39,441 shares of common stock, (ii) options to purchase 527,993 shares of common stock held by Mr. Temperato that are exercisable within 60 days of May 6, 2020, (iii) 271,400 shares of common stock issuable upon the conversion of Series A Preferred Stock, and (iv) 271,400 shares of common stock issuable upon the ultimate conversion of warrants to purchase up to 2,714 shares of Series A Preferred Stock. Excludes 4,513 shares of common stock placed in escrow in accordance with an escrow agreement for a period of six months, in connection with the RDD Merger. |

| |

| (14) | Consists of (i) options to purchase 376,492 shares of common stock held by Dr. Johnson that are exercisable within 60 days of May 6, 2020, (ii) 84,800 shares of common stock issuable upon the conversion of Series A Preferred Stock and (iii) 84,800 shares of common stock issuable upon the ultimate conversion of warrants to purchase up to 8,480 shares of Series A Preferred Stock. |

| |

| (15) | Consists of (i) 39,441 shares of common stock, (ii) 254,400 shares of common stock issuable upon the conversion of Series A Preferred Stock, (iii) 254,400 shares of common stock issuable upon the ultimate conversion of warrants to purchase up to 2,544 shares of Series A Preferred Stock, and (iv) options to purchase 249,521 shares of common stock held by Dr. Sirgo that are exercisable within 60 days of May 6, 2020. Excludes 4,513 shares of common stock placed in escrow in accordance with an escrow agreement for a period of six months, in connection with the RDD Merger. |

| |

| (16) | Consists of (i) 180,971 shares of common stock, (ii) options to purchase 246,743 shares of common stock held by Mr. Barak that are exercisable within 60 days of May 6, 2020, (iii) 72,600 shares of common stock issuable upon the conversion of Series A Preferred Stock, and (iv) 72,600 shares of common stock issuable upon the ultimate conversion of warrants to purchase up to 726 shares of Series A Preferred Stock. Excludes 20,708 shares of common |

stock placed in escrow in accordance with an escrow agreement for a period of six months, in connection with the RDD Merger.

| |

| (17) | Consists of (i) 16,986,521 shares of common stock, (ii) options to purchase 2,778 shares of common stock exercisable within 60 days of May 6, 2020 (iii) 6,786,500 shares of common stock issuable upon the conversion of Series A Preferred Stock and (iv) 6,786,500 shares of common stock issuable upon the ultimate conversion of warrants to purchase up to 67,865 shares of Series A Preferred Stock. Excludes 1,943,734 shares of common stock placed in escrow in accordance with an escrow agreement for a period of six months, in connection with the RDD Merger. The managing member of Orbimed Advisors LLC is Nissim Darvish. |

| |

| (18) | Consists of (i) 18,000 shares of common stock held by Dr. Laumas, (ii) 758,373 shares held by Bearing Circle Capital LLC, (iii) options to purchase 1,002,222 shares of common stock held by Dr. Laumas that are exercisable within 60 days of May 6, 2020, (iv) 42,400 shares of common stock issuable upon the conversion of Series A Preferred Stock, and (v) 42,400 shares of common stock issuable upon the ultimate conversion of warrants to purchase 424 shares of Series A Preferred Stock. Dr. Laumas is affiliated with Bearing Circle Capital LLC and has voting and investment power over the shares held by Bearing Circle Capital LLC. Dr. Laumas disclaims beneficial ownership of the shares held by Bearing Circle Capital LLC except to the extent of his pecuniary interest therein. |

| |

| (19) | Consists of (i) options to purchase 112,742 shares of common stock held by Dr. Appajosyula that are exercisable within 60 days of May 6, 2020, (ii) 16,900 shares of common stock issuable upon the conversion of Series A Preferred Stock, and (iii) 16,900 shares of common stock issuable upon the ultimate conversion of warrants to purchase up to 169 shares of Series A Preferred Stock. |

Relationships with Selling Stockholders

As discussed in greater detail above under the section entitled “The Offering - Private Placement of Preferred Shares and Warrants,” on April 29, 2020, we entered into the Securities Purchase Agreement with certain of the selling stockholders, pursuant to which we sold shares of our Series A Preferred Stock and warrants to purchase shares of our Series A Preferred Stock to those selling stockholders on May 4, 2020, and agreed with those selling stockholders to file a registration statement to enable the resale of the shares of common stock issuable to those selling stockholders and covered by this prospectus. John Temperato, our Chief Executive Officer and a member of our board of directors, Ed Sitar, our Chief Financial Officer, Sireesh Appajosyula, our Senior Vice President of Corporate Development and Operations, Nir Barak, our Senior Vice President of Clinical Affairs, Jay Madan, our former President and Chief Business Officer, and directors Mark Sirgo, Lorin Johnson and Sandeep Laumas participated in the offering and have shares of common stock covered by this prospectus. Orbimed Advisors, LLC also participated in the offering and has shares of common stock covered by this prospectus; Nissim Darvish, a member of our board, is a Senior Managing Director of Orbimed Advisors, LLC.

As discussed in greater detail above under the section entitled “The Offering – Naia Rare Diseases Acquisition,” on April 30, 2020, we entered into the Agreement and Plan of Merger with Naia Rare Diseases and related parties, pursuant to which we acquired Naia Rare Diseases as a wholly owned subsidiary. The acquisition closed on May 6, 2020 and we issued to the Naia Rare Diseases stockholders an aggregate of 4,835,438 shares of our common stock. We agreed to file a registration statement to enable the resale of the shares of common stock issued to the Naia Rare Diseases stockholders and covered by this prospectus.

As discussed above under the section entitled “The Offering – Consulting Agreement”, we entered into a Consulting Agreement with GP Nurmenkari, Inc. (“GPN”) for certain investor relation services, which was effective as of May 4, 2020. In connection with the Consulting Agreement, we issued to GPN a warrant to purchase 500,000 shares of common stock with an exercise price of $0.5894.

PLAN OF DISTRIBUTION

The selling stockholders, which as used herein includes donees, pledgees, transferees or other successors-in-interest selling shares of common stock or interests in shares of common stock received after the date of this prospectus from a selling stockholder as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of common stock or interests in shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The selling stockholders may use any one or more of the following methods when disposing of shares or interests therein:

| |

| • | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

| • | block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

| • | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

| • | an exchange distribution in accordance with the rules of the applicable exchange; |

| |

| • | privately negotiated transactions; |

| |

| • | short sales effected after the date the registration statement of which this prospectus is a part is declared effective by the SEC; |

| |

| • | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

| • | broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per share; |

| |

| • | a combination of any such methods of sale; and |

| |

| • | any other method permitted by applicable law. |

The selling stockholders may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus. The selling stockholders also may transfer the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our common stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling stockholders may also sell shares of our common stock short and deliver these securities to close out their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the selling stockholders from the sale of the common stock offered by them will be the purchase price of the common stock less discounts or commissions, if any. Each of the selling stockholders reserves the right to accept and,

together with their agents from time to time, to reject, in whole or in part, any proposed purchase of common stock to be made directly or through agents. We will not receive any of the proceeds from this offering. Upon any exercise of the warrants by payment of cash, however, we will receive the exercise price of the warrants.

The selling stockholders also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act of 1933, provided that they meet the criteria and conform to the requirements of that rule.

The selling stockholders and any underwriters, broker-dealers or agents that participate in the sale of the common stock or interests therein may be “underwriters” within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares may be underwriting discounts and commissions under the Securities Act. Selling stockholders who are “underwriters” within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act.