PROSPECTUS Filed Pursuant to Rule 424(b)(5)

Registration No. 333-249268

9 METERS BIOPHARMA, INC.

Up to $37,352,318

Common Stock

We have entered into a Sales Agreement, dated July 22, 2020 and amended on October 2, 2020, with Truist Securities, Inc. (formerly, SunTrust Robinson Humphrey, Inc.), or Truist, relating to shares of our common stock, par value $0.0001 per share, offered by this prospectus. In accordance with the terms of the Sales Agreement, we may offer and sell our common stock having an aggregate offering price of up to $37,352,318 from time to time through Truist acting as our sales agent, at our discretion. In addition, as of October 8, 2020, we had issued and sold shares of our common stock having an aggregate offering price of $2,647,682 pursuant to the Sales Agreement under our prior shelf registration statement on Form S-3 (SEC File No. 333-223669), utilizing a prior prospectus dated July 13, 2018 and prospectus supplement dated July 22, 2020.

Our common stock is listed on the Nasdaq Capital Market under the symbol “NMTR”. On October 7, 2020, the last reported sale price of our common stock as reported on the Nasdaq Capital Market was $0.8119 per share.

Sales of our common stock, if any, under this prospectus may be made in sales deemed to be an “at the market offering” as defined in Rule 415 promulgated under the Securities Act of 1933, as amended, or the Securities Act, or in privately negotiated transactions. Subject to terms of the Sales Agreement, Truist is not required to sell any specific number or dollar amount of securities but will act as our sales agent using commercially reasonable efforts consistent with its normal trading and sales practices, on mutually agreed terms between Truist and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

Truist will be entitled to a commission of 3.0% of the gross sales price per share sold under the Sales Agreement. See “Plan of Distribution” on page 21 for additional information regarding Truist’s compensation. In connection with the sale of our common stock on our behalf, Truist may be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Truist may be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to Truist against certain civil liabilities, including liabilities under the Securities Act.

We are an “emerging growth company” under the federal securities laws and, as such, we are subject to reduced public company disclosure standards.

INVESTING IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD REVIEW CAREFULLY THE RISKS AND UNCERTAINTIES DESCRIBED UNDER THE HEADING “RISK FACTORS” ON PAGE 13 OF THIS PROSPECTUS, AND UNDER SIMILAR HEADINGS IN THE DOCUMENTS THAT ARE INCORPORATED BY REFERENCE INTO THIS PROSPECTUS.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus are truthful or complete. Any representation to the contrary is a criminal offense.

Truist Securities

The date of this prospectus is October 9, 2020

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the SEC, using a “shelf” registration process. The $37.4 million of common stock that may be offered, issued and sold under this prospectus is included in the $200 million of securities originally registered to be offered, issued and sold by us pursuant to our shelf registration statement.

We have not, and the sales agent has not, authorized anyone to provide you with information different from that which is contained in or incorporated by reference in this prospectus, any prospectus supplement or any free writing prospectus that we may authorize for use in connection with this offering. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give to you. No one is making offers to sell or seeking offers to buy these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in this prospectus is accurate as of the date on the front cover of this prospectus only and that any information we have incorporated by reference herein is accurate only as of the date given in the document incorporated by reference regardless of the time of delivery of this prospectus, any prospectus supplement, any related free writing prospectus, or any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since those dates.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless the context indicates otherwise, references in this prospectus to “9 Meters”, “Company”, “we”, “us” and “our” refer to 9 Meters Biopharma, Inc. and its subsidiaries. Furthermore, in May 2020 we changed the name of our company from Innovate Biopharmaceuticals, Inc. to 9 Meters Biopharma, Inc. Accordingly, any reference to Innovate Biopharmaceuticals, Inc. in the documents incorporated by reference means 9 Meters Biopharma, Inc.

This prospectus contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other company.

PROSPECTUS SUMMARY

This summary highlights certain information about us and this offering contained elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our securities, you should read the entire prospectus carefully, including the “Risk Factors” on page 13 of this prospectus and in the documents incorporated by reference into this prospectus, and the consolidated financial statements and related notes incorporated by reference into this prospectus.

Recent Acquisitions

On April 30, 2020, we merged with RDD, with RDD becoming our wholly owned subsidiary. Prior to that time, our name was Innovate Biopharmaceuticals, Inc. and in connection with that merger we changed our name to 9 Meters Biopharma, Inc. RDD is an Israeli company focused on orphan and innovative therapies for gastrointestinal disorders.

On May 6, 2020, we acquired Naia Rare Diseases, Inc., a company developing drugs for the treatment of short bowel syndrome and other rare gastrointestinal diseases.

Company Overview

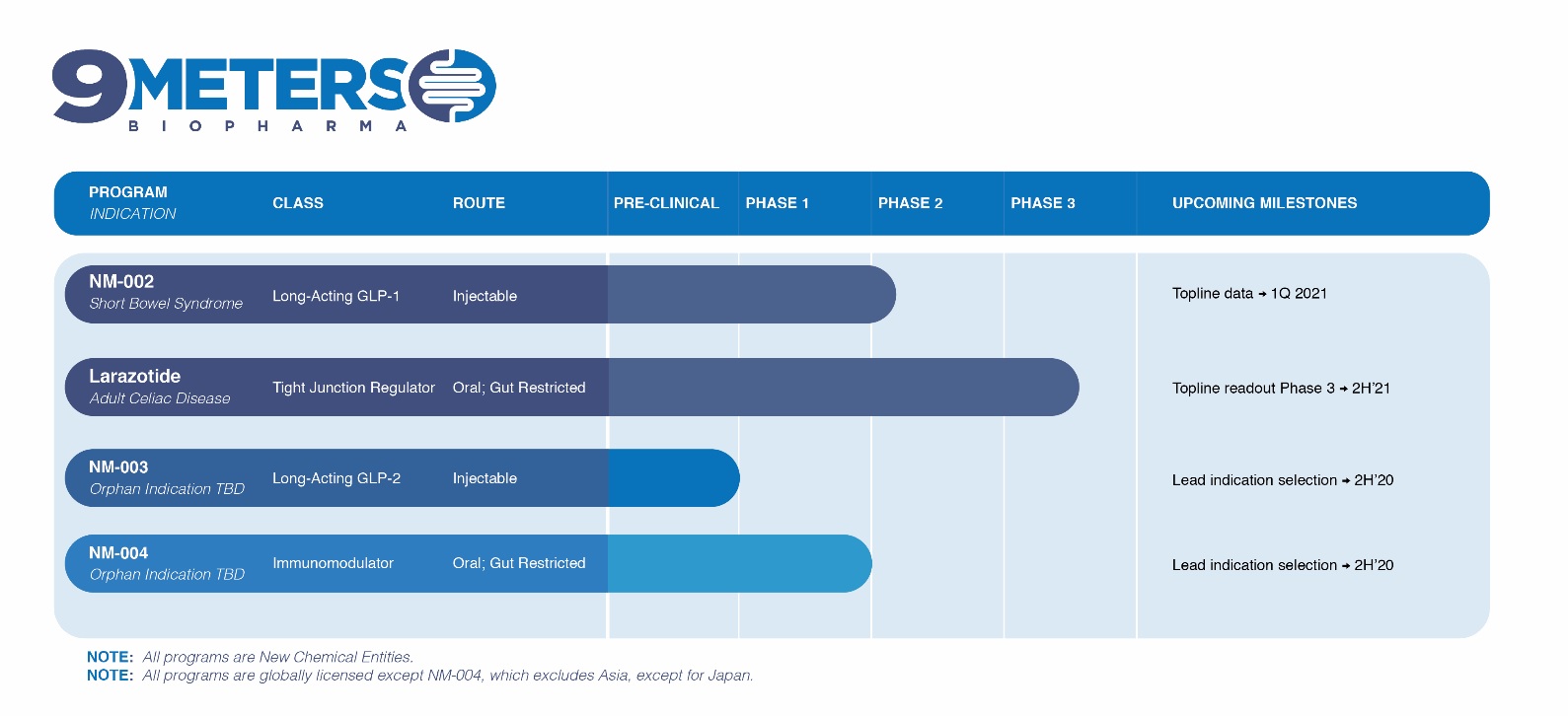

9 Meters Biopharma, Inc. is a clinical-stage biotechnology company focused on rare and unmet needs in gastroenterology. The Company’s pipeline includes drug candidates for short bowel syndrome (SBS), celiac disease and two candidates for undisclosed rare and/or orphan diseases. Our pipeline and expected development milestones for our product candidates are summarized below:

Short Bowel Syndrome (SBS)

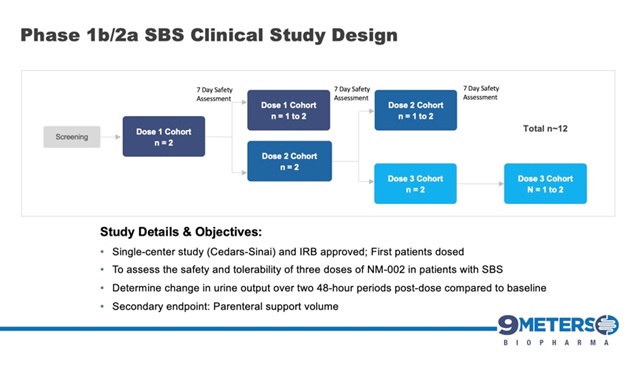

NM-002 is a long-acting injectable GLP-1 agonist being developed for SBS, a debilitating orphan disease with a large underserved market. It affects up to 20,000 people in the U.S. with similar prevalence in Europe. Short bowel syndrome is a group of problems related to poor absorption of nutrients. People with short bowel syndrome cannot absorb enough water, vitamins, minerals, protein, fat, calories, and other nutrients from food. It is a severe disease with life changing consequences such as impaired intestinal absorption, diarrhea and metabolic complications. Patients have life-long dependency on Parenteral Support (PS) to survive with risk of life-threatening infections and extra-organ impairment.

The concept of exenatide, the active portion of NM-002, for the treatment of adults with SBS, was studied in a proof-of-concept testing the hypothesis that a GLP-1 agonist may improve the nutritional state and the intestinal symptoms of these patients (Kunkel, et. al, 2011). In addition to improving nutritional status and quality of life in a small group of patients given short-acting exenatide, the study showed that several of the patients were able to eliminate PS with a substantial reduction in bowel movements, illustrating a drug effect on the malabsorptive diarrhea seen in this patient type. Furthermore, safety, pharmacokinetics and pharmacodynamics of a single-dose placebo-controlled trial of NM-002 was shown in patients with type 2 diabetes as a single ascending subcutaneous dose in six different cohorts of six doses escalating from 12.5 mg to 200 mg (Cleland et. al. 2012). The data showed NM-002 was well tolerated at all doses including the maximum 200 mg dose. Gastrointestinal adverse events were mild and transient, occurring prior to Cmax and resolving in less than 24 hours. There were no serious adverse events reported and no patients dropped out of the study.

The compound fuses exenatide, a GLP-1 analogue, to a long-acting linker technology and is designed specifically to address the gastric effects in SBS patients by slowing digestive transit time. The asset uses proprietary XTEN® technology to extend the half-life of exenatide, allowing for once- to twice-per-month dosing, thus potentially increasing convenience for patients and caregivers. NM-002 is patent-protected and has received orphan drug designation by the FDA. The Company initiated its phase 1b/2a study in adult patients suffering from SBS in June 2020 and announced in July 2020 that the first patients had been dosed. Topline results are expected in the first quarter of 2021.

Celiac Disease (CeD)

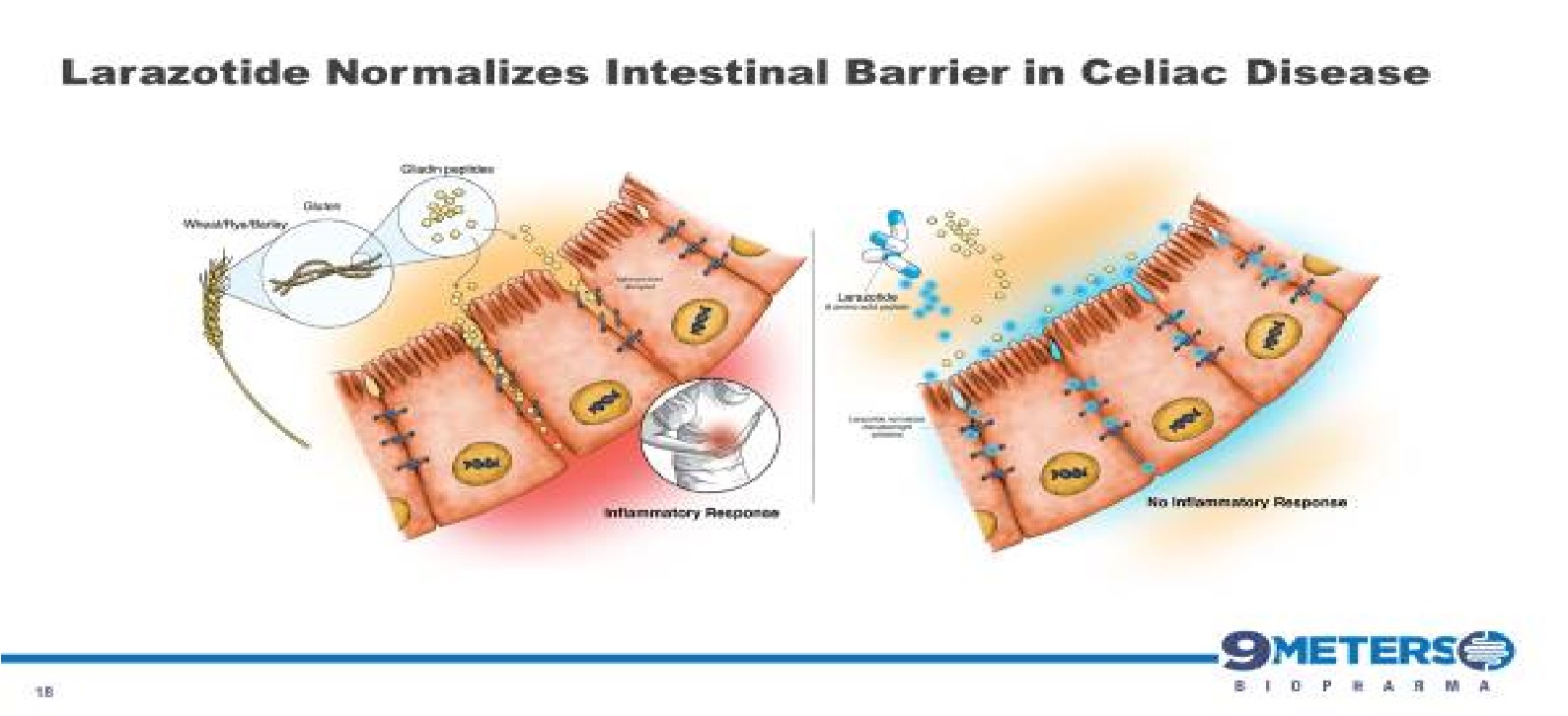

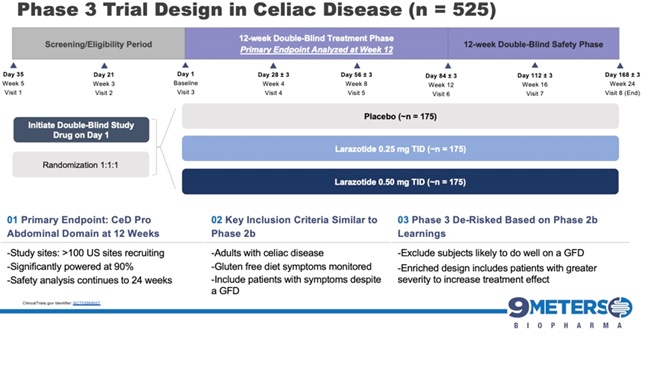

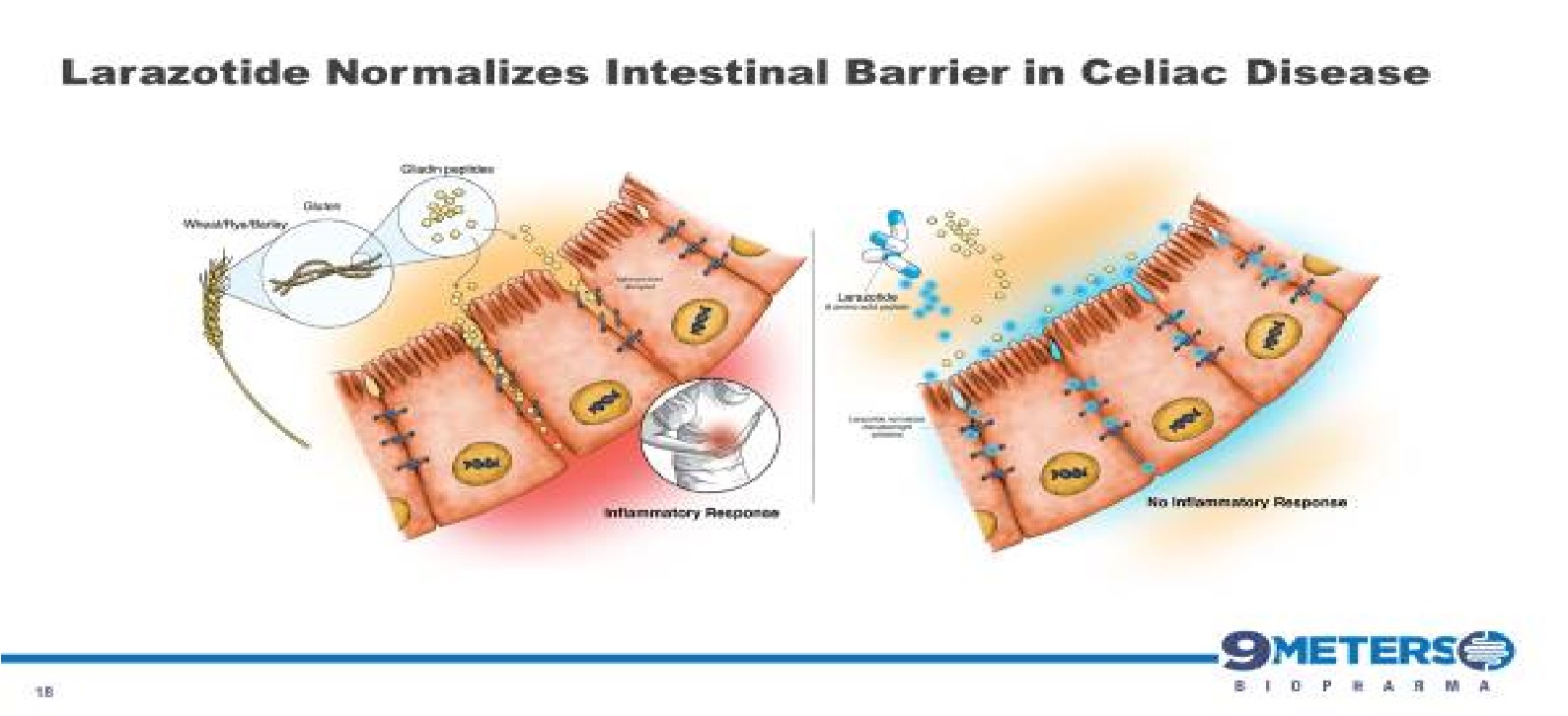

In 2019, we initiated a Phase 3 clinical trial for our lead drug candidate, larazotide acetate or larazotide, for the treatment of celiac disease. Larazotide has the potential to be a first-to-market therapeutic for celiac disease, an unmet medical need affecting an estimated 1% of the U.S. population or more than 3 million individuals. Patients with celiac disease have no treatment alternative other than a strict lifelong adherence to a gluten-free diet, which is difficult to maintain and can be deficient in key nutrients. Additionally, current FDA labeling standards allow up to 20 parts per million (ppm) of gluten in “gluten-free” labeled foods, which contains enough gluten to cause celiac symptoms in many patients, including abdominal pain, abdominal cramping, bloating, gas, headaches, ataxia, “brain fog” and fatigue. Long-term ramifications of celiac disease include enteropathy associated T-cell lymphoma (EATL), osteoporosis and anemia.

Larazotide is being investigated as an adjunct to a gluten-free diet for celiac patients who continue to experience symptoms despite adhering to a gluten-free diet. Due to the difficulty of maintaining a gluten-free diet due to lack of easy access to and the higher cost of gluten-free foods, contamination from gluten as well as social pressures, it is estimated that more than half the celiac population experiences multiple, potentially debilitating, symptoms per month. A study from the U.K. indicates that more than 70% of patients diagnosed with celiac disease consume gluten either intentionally or inadvertently (Hall et al. 2013).

Larazotide is an 8-amino acid peptide formulated into an orally administered capsule and prior to the Phase 3 clinical trial had been tested in nearly 600 celiac patients with statistically significant improvement in celiac symptoms. The FDA has granted larazotide Fast Track Designation for celiac disease. Larazotide’s safety profile has been similar to placebo. Additionally, larazotide’s mechanism of action as a tight junction regulator is a new approach to treating autoimmune diseases, such as celiac disease. Multiple pre-clinical studies have shown larazotide causes a reduction in permeability across the intestinal epithelial barrier, making it the only drug candidate known to us which is in clinical trials with this mechanism of action.

With the release of the Phase 2b trial data in 342 celiac patients at the 2014 Digestive Disease Week conference, larazotide became the first and the only drug for the treatment of celiac disease (published data), which met its primary efficacy endpoint with statistical significance. The Phase 2b data showed statistically significant (p=0.022) reduction in abdominal and non-GI (headache) symptoms as measured by the patient reported outcome primary end point for celiac disease created specifically for celiac disease and wholly owned by us (“CeD PRO”). Larazotide has been shown to be safe and effective after being tested in several clinical trials involving nearly 600 patients, most recently in the Phase 2b trial for celiac disease. After a successful End-of-Phase 2 meeting with the FDA, which confirmed the regulatory path forward, we launched the Phase 3 registration program in 2019 and dosed the first patient in August 2019, with top-line data expected in 2021 We have approximately 115 active clinical trial sites with three treatment groups, 0.25 mg of larazotide, 0.5 mg of larazotide and a placebo arm.

An interim analysis will model the original statistical basis for the trial’s sample size calculation after 50% of the randomized patients have completed the 12-week treatment period in each cohort. The interim analysis will assess the protocol-defined sample size assumptions only and will be completed by an independent third party. Under these conditions there will be no sacrifice of the original 90% power to detect a treatment effect in the trial.The full trial is expected to reach topline readout by the end of 2021.

We continue to monitor the evolving situation with COVID-19, which potentially may directly or indirectly impact the pace of enrollment over the next several months.

Other Assets

NM-003 is a proprietary long-acting GLP-2 agonist and NM-004 is a double-cleaved mesalamine with an immunomodulator. These two assets are being evaluated for development in rare and/or orphan indications via an ongoing probability of technical and regulatory success analysis.

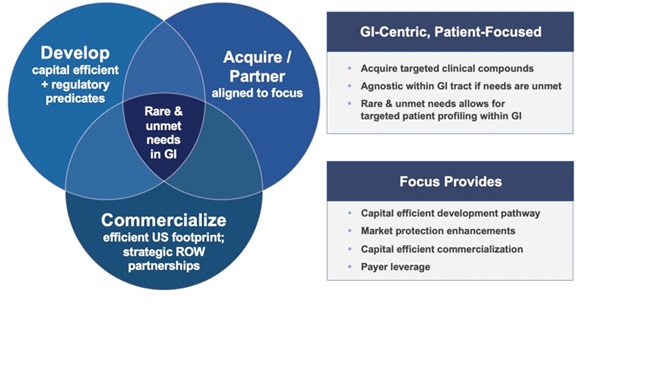

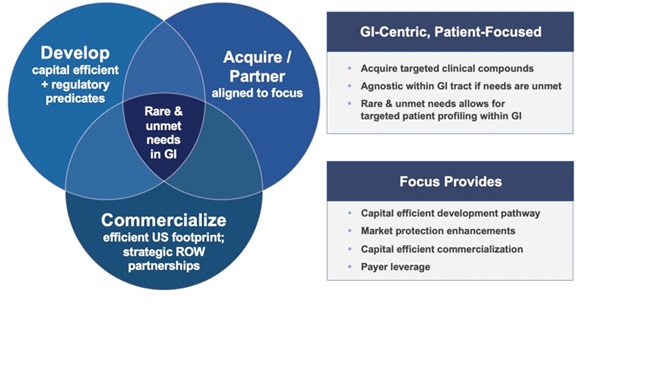

Corporate Strategy & Business Development

Our corporate strategy centers around developing drug candidates for rare and unmet needs in gastroenterology via a capital efficient pathway to approval with defined regulatory predicates or what we believe are straight-forward go/no-go scenarios based on discussions with various regulatory agencies. We plan to develop such candidates through the drug development process of clinical trials in humans from Phase 1 to approval and Phase IV studies, by acquiring clinical stage drug programs from companies willing to partner with our expertise of in-licensing, developing and commercializing products in the gastroenterology marketplace. Our current pipeline evaluation will continue as our candidates move through this process, whereby we plan to commercialize rare and unmet need products with a small U.S. commercial footprint while engaging in discussions for rest-of-world and global partnerships as appropriate. From a business development and in-licensing perspective, we seek to become a leader in developing and marketing products that fit rare and unmet needs in gastroenterological disorders. We will continue to seek partners for in-licensing appropriate products for U.S. development while seeking companies interested in marketing our treatments in the rest-of-world territories including select global partnerships, for high unmet need indications which benefit patients from GI and primary care physician commercial effort.

Corporate Information

We were incorporated under the laws of Delaware under the name Monster Digital, Inc. in November 2010 as a private company. We completed our initial public offering in July 2016. In January 2018, we acquired Innovate Biopharmaceuticals Inc. (“Private Innovate”) through its merger with a wholly owned subsidiary of ours, with Private Innovate surviving as our wholly owned subsidiary. As part of that transaction, Monster Digital, Inc. changed its name to Innovate Biopharmaceuticals, Inc. At that time, we also changed the focus of our business to pharmaceutical research and development. In April 2020, we acquired RDD Pharma, Ltd. through its merger with a wholly owned subsidiary of ours, with RDD Pharma, Ltd. surviving as our wholly owned subsidiary. As part of that transaction, we changed our name from Innovate Biopharmaceuticals, Inc. to 9 Meters Biopharma, Inc. In May 2020, we acquired Naia Rare Diseases, Inc. through its merger with a wholly owned subsidiary of ours.

Our principal executive offices are located at 8480 Honeycutt Road, Suite 120, Raleigh, NC 27615 and our telephone number is (919) 275-1933. Our corporate website address is www.9meters.com. Our Annual Reports on Form 10-K,Quarterly

Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, will be made available free of charge on our website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The contents of our website are not incorporated into this prospectus supplement and our reference to the URL for our website is intended to be an inactive textual reference only.

Implications of Being an Emerging Growth Company

We are an “emerging growth company” as defined in the JOBS Act and therefore we may take advantage of certain exemptions from various public company reporting requirements. As an “emerging growth company”:

| |

| • | we will present no more than two years of audited financial statements and no more than two years of related management’s discussion and analysis of financial condition and results of operations; |

| |

| • | we will avail ourselves of the exemption from the requirement to obtain an attestation and report from our auditors on the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act (this exemption was recently extended indefinitely for smaller reporting companies, as defined in Rule 12b-2 of the Exchange Act, with revenue of less than $100 million); |

| |

| • | we will provide less extensive disclosure about our executive compensation arrangements; and |

| |

| • | we will not require stockholder non-binding advisory votes on executive compensation or golden parachute arrangements. |

However, we have chosen to irrevocably opt out of the extended transition periods available under the JOBS Act for complying with new or revised accounting standards. We will remain an “emerging growth company” for up to five years, although we will cease to be an “emerging growth company” upon the earliest of (1) December 31, 2021, (2) the last day of the first fiscal year in which our annual gross revenues are $1.07 billion or more, (3) the date on which we have, during the previous rolling three-year period, issued more than $1 billion in non-convertible debt securities, and (4) the date on which we are deemed to be a “large accelerated filer” as defined in the Exchange Act.

THE OFFERING

|

| | |

| Common stock offered by us | | Shares of our common stock having an aggregate offering price of up to $37,352,318. |

| | | |

| Common stock to be outstanding after the offering | | Up to 182,238,943 shares of our common stock, assuming sales of 46,006,057 shares of our common stock in this offering at an assumed offering price of $0.8119 per share, which was the last reported sale price of our common stock on the Nasdaq Capital Market on October 7, 2020. The actual number of shares issued will vary depending on the sales prices at which our common stock is sold under this offering. |

| | | |

| Plan of Distribution | | “At the market offering” that may be made from time to time through our sales agent, Truist. See “Plan of Distribution” on page 21 of this prospectus. |

| | | |

| Use of Proceeds | | We intend to use the net proceeds from this offering for general corporate purposes. See “Use of Proceeds” on page 18 of this prospectus. |

| | | |

| Risk Factors | | Investing in our common stock involves a high degree of risk. See the information contained in or incorporated by reference under the heading “Risk Factors” on page 13 of this prospectus and in the documents incorporated by reference into this prospectus and any free writing prospectus that we authorize for use in connection with this offering. |

| | | |

| Nasdaq Capital Market symbol | | “NMTR” |

The number of shares of common stock outstanding is based on an aggregate of 136,232,886 shares outstanding as of June 30, 2020, and excludes:

| |

| • | 6,028,781 shares of common stock issuable upon the exercise of options outstanding as of June 30, 2020 at a weighted average exercise price of $1.53 per share under the Innovate 2015 Stock Incentive Plan (the “Private Innovate Plan”); |

| |

| • | 5,651,726 shares of common stock issuable upon the exercise of options outstanding as of June 30, 2020 at a weighted average exercise price of $1.25 per share under the Company’s 2012 Omnibus Incentive Plan (the “Omnibus Plan”) |

| |

| • | 14,726,818 shares of common stock reserved for future issuance under the Omnibus Plan as of June 30, 2020; |

| |

| • | 1,014,173 shares of common stock issuable upon the exercise of options outstanding as of June 30, 2020 at a weighted average exercise price of $0.63 per share, under the option grant agreements granted to RDD employees and assumed by the Company in accordance with their terms, pursuant to the Agreement and Plan of Merger with RDD, dated as of October 6, 2019, as amended on December 17, 2019; and |

| |

| • | 40,949,619 shares of common stock issuable upon the exercise of common stock warrants outstanding as of June 30, 2020 at a weighted average price of $0.80 per share, with a weighted average remaining life of 4.8 years. |

RISK FACTORS

Investing in our securities involves risks. Before making an investment decision, you should carefully consider the risks and other information we include or incorporate by reference in this prospectus, and in any free writing prospectus that we have authorized for use in connection with this offering. In particular, you should consider the risk factors described under the heading “Risk Factors” in our most recent Annual Report on Form 10-K, as may be revised or supplemented by our subsequent Quarterly Reports on Form 10-Q or Current Reports of Form 8-K, each of which are on file with the SEC and are incorporated herein by reference, and which may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. In addition to those risk factors, there may be additional risks and uncertainties that are not currently known to us or that we currently deem immaterial. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The occurrence of any of these risks might cause you to lose all or part of your investment in our common stock.

You may experience immediate and substantial dilution.

The offering price per share in this offering may exceed the net tangible book value per share of our common stock outstanding prior to this offering. Assuming that an aggregate of 46,006,057 shares of our common stock are sold during the term of the Sales Agreement with Truist at a price of $0.8119 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on October 7, 2020, for aggregate gross proceeds of $37.4 million, after deducting commissions and estimated aggregate offering expenses payable by us, you will experience immediate dilution of $0.60 per share, representing the difference between our as-adjusted net tangible book value per share as of June 30, 2020, after giving effect to this offering and the assumed offering price. The exercise of outstanding stock options and warrants may result in further dilution of your investment. See the section entitled “Dilution” below for a more detailed illustration of the dilution you would incur if you participate in this offering.

You may experience future dilution as a result of future equity offerings.

In order to raise additional capital, we may at any time, including during the pendency of this offering, offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that might not be the same as the price per share in this offering. We may sell shares or other securities in any other offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock, or securities convertible or exchangeable into common stock, in future transactions may be higher or lower than the price per share paid by investors in this offering.

We have broad discretion in the use of our cash and cash equivalents, including any net proceeds we receive in this offering, and might not use them effectively.

Our management has broad discretion to use our cash and cash equivalents, including any net proceeds we receive in this offering, to fund our operations and could spend these funds in ways that do not improve our results of operations or enhance the value of our common stock, and you will not have the opportunity as part of your investment decision to assess whether the net proceeds are being used appropriately. The failure by our management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business, cause the price of our common stock to decline and delay the development of our product candidates. Pending their use to fund our operations, we may invest our cash and cash equivalents, including any net proceeds from this offering, in a manner that does not produce income or that loses value.

Sales of our common stock in this offering, or the perception that such sales may occur, could cause the market price of our common stock to fall.

We may issue and sell shares of our common stock for aggregate gross proceeds of up to $37.4 million from time to time in connection with this offering. The actual number of shares of common stock that may be issued and sold in this offering, as well as the timing of any such sales, will depend on a number of factors, including, among others, the prices at which any shares are actually sold in this offering (which may be influenced by market conditions, the trading price of our common stock and other factors) and our determinations as to the appropriate timing, sources and amounts of funding we need. The

issuance and sale from time to time of these new shares of common stock, or the mere fact that we are able to issue and sell these shares in this offering, could cause the market price of our common stock to decline.

Because we do not intend to declare cash dividends on our shares of common stock in the foreseeable future, stockholders must rely on appreciation of the value of our common stock for any return on their investment.

We have never declared or paid cash dividends on our common stock. We currently anticipate that we will retain future earnings, if any, for the development, operation and expansion of our business and do not anticipate declaring or paying any cash dividends in the foreseeable future. In addition, the terms of any existing or future debt agreements may preclude us from paying dividends. As a result, we expect that only appreciation of the price of our common stock, if any, will provide a return to investors in this offering for the foreseeable future.

It is not possible to predict the actual number of shares of common stock we will sell under the Sales Agreement, or the gross proceeds resulting from those sales.

Subject to certain limitations in the Sales Agreement and compliance with applicable law, we have the discretion to deliver a placement notice to Truist at any time throughout the term of the Sales Agreement. The number of shares that are sold through Truist after the delivery of a placement notice will fluctuate based on a number of factors, including the market price of our common stock during the sales period, the limits we set with Truist in any applicable placement notice, and the demand for our common stock during the sales period. Because the price per share will fluctuate during this offering, it is not currently possible to predict the number of shares that will be sold or the gross proceeds to be raised in connection with those sales.

The RDD merger and acquisition of Naia Rare Diseases will present challenges associated with integrating operations, personnel, and other aspects of the companies and assumption of liabilities.

The results of the combined company following our merger with RDD in April 2020, and acquisition of Naia Rare Diseases in May 2020, will depend in part upon our ability to integrate RDD’s and Naia Rare Diseases’ businesses with our business in an efficient and effective manner. Our attempt to integrate three companies that have previously operated independently may result in significant challenges, and we may be unable to accomplish the integration smoothly or successfully. In particular, the necessity of coordinating geographically dispersed organizations and addressing possible differences in corporate cultures and management philosophies may increase the difficulties of integration. The integration may require the dedication of significant management resources, which may temporarily distract management’s attention from the day-to-day operations of the businesses of the combined company. In addition, the combined company may adjust the way in which RDD, Naia Rare Diseases or we have conducted our respective operations and utilized our respective assets, which may require retraining and development of new procedures and methodologies. The process of integrating operations and making such adjustments could cause an interruption of, or loss of momentum in, the activities of one or more of the combined company’s businesses and the loss of key personnel. Employee uncertainty, lack of focus, or turnover during the integration process may also disrupt the businesses of the combined company. Any inability of management to integrate the operations of RDD and Naia Rare Diseases into our company successfully could have a material adverse effect on the business and financial condition of the combined company.

In addition, the RDD merger and acquisition of Naia Rare Diseases subject us to contractual or other obligations and liabilities of RDD and Naia Rare Diseases, some of which may be unknown. Although we and our legal and financial advisors have conducted due diligence on RDD and Naia Rare Diseases and their businesses, there can be no assurance that we are aware of all such obligations and liabilities. These liabilities, and any additional risks and uncertainties related to RDD’s or Naia Rare Diseases’ business not currently known to us or that we may currently be aware of, but that prove to be more significant than assessed or estimated by us, could negatively impact the business, financial condition, and results of operations of the combined company.

If we fail to meet the requirements for continued listing on the Nasdaq Capital Market, our common stock could be delisted from trading, which would decrease the liquidity of our common stock and our ability to raise additional capital.

We previously disclosed that we had been notified by the Nasdaq Stock Market LLC (“Nasdaq”) that for 30 consecutive business days the bid price for the Company’s common stock had closed below the minimum $1.00 per share requirement for continued inclusion on the Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (the "Rule"). In accordance with Nasdaq Listing Rule 5810(c)(3)(A) and Nasdaq Listing Rule 5810(c)(3)(C), Nasdaq informed the Company that it had a compliance period of 180 calendar days, or until June 1, 2020, to regain compliance with the Rule, which date was tolled due to the COVID-19 pandemic to August 17, 2020.

On August 18, 2020, the Company received a delisting determination letter from the Nasdaq Stock Market Listing Qualifications Department due to the Company’s failure to regain compliance with the Rule, and that it did not meet any of the initial listing requirements. On August 20, 2020, the Company appealed the determination by requesting a hearing before a Hearings Panel, which took place on September 24, 2020. On October 6, 2020, the Company received formal notice that the Hearings Panel granted the Company's request for an extension through February 15, 2021 to evidence compliance with the Rule. In order to comply with the Rule, the Company must have a closing bid price of at least $1.00 per share for a minimum of ten, but generally not more than twenty, consecutive business days by February 15, 2021.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus contain a number of “forward-looking statements”. Specifically, all statements other than statements of historical facts included in this prospectus regarding our financial position, business strategy and plans and objectives of management for future operations are forward-looking statements. These forward-looking statements are based on the beliefs of management at the time these statements were made, as well as assumptions made by and information available to management at that time. When used in this prospectus supplement and the accompanying prospectus and the documents incorporated by reference herein and therein, the words “anticipate”, “believe”, “estimate”, “expect”, “may”, “might”, “will”, “continue” and “intend”, and words or phrases of similar import, as they relate to our financial position, business strategy and plans, or objectives of management, are intended to identify forward-looking statements. These statements reflect our view, as of the date hereof, with respect to future events and are subject to risks, uncertainties and assumptions related to various factors.

You should understand that the following important factors, in addition to those discussed in our periodic reports to be filed with the SEC under the Exchange Act could affect our stock price or future results and could cause those results to differ materially from those expressed in such forward-looking statements:

| |

| • | impacts of and uncertainty related to COVID-19; |

| |

| • | fluctuations in our financial results and stock price, particularly given market conditions and the potential economic impact of COVID-19; |

| |

| • | our ability to meet the requirements for continued listing on the Nasdaq Capital Market; |

| |

| • | our need to raise additional money to fund our operations for the next twelve months to continue as a going concern; |

| |

| • | risks of our clinical trials including, but not limited to, the costs, design, initiation and enrollment (which could be adversely impacted by COVID-19 and resulting social distancing), timing, progress and results of such trials; |

| |

| • | our ability to integrate the post-merger operations, personnel, and other aspects of RDD and Naia Rare Diseases; |

| |

| • | our ability to integrate the RDD and Naia Rare Diseases portfolios of product candidates into our existing business operations; |

| |

| • | our expectations related to the use of proceeds from our financings; |

| |

| • | our expectations regarding our ability to fund our operating expenses and capital expenditure requirements with our cash on hand and proceeds from our financings; |

| |

| • | our estimates regarding expenses, future revenue, timing of any future revenue, capital requirements and needs for additional financing; |

| |

| • | litigation related to our status as a public company, including securities related litigation, breach of fiduciary duty claims or claims regarding alleged internal control failures; |

| |

| • | our limited operating history; |

| |

| • | our ability to develop and implement our planned product development, commercialization, marketing and manufacturing capabilities and strategies for our product candidates; |

| |

| • | the timing of, and our ability to obtain and maintain regulatory approvals for our product candidates; |

| |

| • | the potential advantages of our product candidates; |

| |

| • | the rate and degree of market acceptance and clinical utility of our product candidates; |

| |

| • | our intellectual property position; |

| |

| • | our ability to attract, integrate and retain key personnel; |

| |

| • | the impact of government laws and regulations; |

| |

| • | our competitive position; |

| |

| • | developments relating to our competitors and our industry; |

| |

| • | our ability to maintain and establish collaborations or obtain additional funding; |

| |

| • | general or regional economic conditions; |

| |

| • | changes in U.S. generally accepted accounting principles, or GAAP; and |

| |

| • | changes in the legal, regulatory and legislative environments in the markets in which we operate, including impacts of United States government shut-downs on our ability to raise money and obtain regulatory approval for our products. |

Although we believe that our expectations (including those on which our forward-looking statements are based) are reasonable, we cannot assure you that those expectations will prove to be correct. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described in our forward-looking statements.

Except for our ongoing obligations to disclose material information under the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or any other reason. All subsequent forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to herein. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus and the documents incorporated by reference herein might not occur.

USE OF PROCEEDS

We may issue and sell up to $37.4 million of our common stock from time to time. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. There can be no assurance that we will sell any shares under or fully utilize the Sales Agreement with Truist as a source of financing.

We intend to use the net proceeds from this offering for general corporate purposes.

As of the date of this prospectus, we cannot specify with certainty any of the particular uses of the proceeds, if any, from this offering. Accordingly, we will retain broad discretion over the use of any such proceeds. Pending the use of the net proceeds, if any, from this offering as described above, we intend to invest the net proceeds in investment-grade, interest-bearing instruments.

DILUTION

If you purchase shares in this offering, you will experience dilution to the extent of the difference between the public offering price of the shares and the net tangible book value per share of our common stock immediately after this offering.

Our net tangible book value as of June 30, 2020 was $3.0 million or $0.02 per share of common stock. Net tangible book value per share is determined by dividing our total tangible assets, less total liabilities, by the number of our shares of common stock outstanding as of June 30, 2020. Dilution in net tangible book value per share represents the difference between the amount per share paid by purchasers of shares in this offering and the net tangible book value per share of our common stock immediately after this offering.

After giving effect to the assumed sale of $37,352,318 of our common stock in this offering, which results in 46,006,057 shares of our common stock at an assumed offering price of $0.8119 per share, which was the last reported sale price of our common stock on the Nasdaq Capital Market on October 7, 2020, and after deducting commissions and estimated offering expenses payable by us, our as adjusted net tangible book value as of June 30, 2020 would have been approximately $39.2 million, or $0.21 per share. This represents an immediate increase in net tangible book value of $0.19 per share to existing stockholders and immediate dilution of $0.60 per share to investors purchasing our common stock in this offering at the assumed offering price. The following table illustrates this dilution on a per share basis:

|

| | | | |

| Assumed public offering price per share | | $ | 0.8119 |

|

| Net tangible book value per share as of June 30, 2020 | | $ | 0.02 |

|

| Increase per share attributable to this offering | | $ | 0.19 |

|

| As adjusted net tangible book value per share as of June 30, 2020 after this offering | | $ | 0.21 |

|

| Dilution per share to new investors participating in this offering | | $ | 0.60 |

|

The number of shares of common stock outstanding is based on an aggregate of 136,232,886 shares outstanding as of June 30, 2020, and excludes:

| |

| • | 6,028,781 shares of common stock issuable upon the exercise of options outstanding as of June 30, 2020 at a weighted average exercise price of $1.53 per share under the Private Innovate Plan; |

| |

| • | 5,651,726 shares of common stock issuable upon the exercise of options outstanding as of June 30, 2020 at a weighted average exercise price of $1.25 per share under the Omnibus Plan; |

| |

| • | 14,726,818 shares of common stock reserved for future issuance under the Omnibus Plan as of June 30, 2020; |

| |

| • | 1,014,173 shares of common stock issuable upon the exercise of options outstanding as of June 30, 2020 at a weighted average exercise price of $0.63 per share, under the option grant agreements granted to RDD employees and assumed by the Company in accordance with their terms, pursuant to the Agreement and Plan of Merger with RDD, dated as of October 6, 2019, as amended on December 17, 2019; and |

| |

| • | 40,949,619 shares of common stock issuable upon the exercise of common stock warrants outstanding as of June 30, 2020 at a weighted average price of $0.80 per share, with a weighted average remaining life of 4.8 years. |

The table above assumes for illustrative purposes that an aggregate of 46,006,057 shares of our common stock are sold during the term of the Sales Agreement with the agent at a price of $0.8119 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on October 7, 2020, for aggregate gross proceeds of $37,352,318. The shares sold in this offering, if any, will be sold from time to time at various prices. An increase of $0.25 per share in the price at which the shares are sold from the assumed offering price of $0.8119 per share, assuming all of our common stock in the aggregate amount of $37,352,318 during the term of the Sales Agreement with the agent is sold at that price, would increase

our adjusted net tangible book value per share after the offering to $0.23 per share and would increase the dilution in net tangible book value per share to new investors in this offering to $0.83 per share, after deducting commissions and estimated offering expenses payable by us. A decrease of $0.25 per share in the price at which the shares are sold from the assumed offering price of $0.8119 per share, assuming all of our common stock in the aggregate amount of $37,352,318 is sold at that price, would decrease our adjusted net tangible book value per share after the offering to $0.19 per share and would decrease the dilution in net tangible book value per share to new investors in this offering to $0.37 per share, after deducting commissions and estimated offering expenses payable by us. This information is supplied for illustrative purposes only.

We may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities may result in further dilution to our shareholders. To the extent that outstanding options or warrants outstanding as of June 30, 2020 have been or may be exercised or other shares issued, investors purchasing our common stock in this offering may experience further dilution.

PLAN OF DISTRIBUTION

We have entered into the Sales Agreement with Truist, as amended by Amendment No. 1 thereto, dated as of October 2, 2020, under which we may issue and sell from time to time up to $37,352,318 of our common stock through Truist as our sales agent. Sales of our common stock, if any, will be made at market prices by any method that is deemed to be an “at the market offering” as defined in Rule 415 under the Securities Act, including sales made directly on the Nasdaq Capital Market or any other trading market for our common stock. If authorized by us in writing, the agent may purchase shares of our common stock as principal. As of October 8, 2020, we have issued and sold an aggregate of 3,496,045 shares of our common stock for aggregate gross proceeds of approximately $2,647,682 under the Sales Agreement pursuant to our registration statement on Form S-3 (SEC File No. 333-223669), utilizing a prior prospectus dated July 13, 2018 and prospectus supplement dated July 22, 2020.

The agent will offer our common stock subject to the terms and conditions of the Sales Agreement on a daily basis or as otherwise agreed upon by us and the agent. We will designate the maximum amount of common stock to be sold through the agent on a daily basis or otherwise determine such maximum amount together with the agent. Subject to the terms and conditions of the Sales Agreement, the agent will use its commercially reasonable efforts to sell on our behalf all of the shares of common stock requested to be sold by us. We may instruct the agent not to sell common stock if the sales cannot be effected at or above the price designated by us in any such instruction. The agent or we may suspend the offering of our common stock being made through the agent under the Sales Agreement upon proper notice to the other party. The agent and we each have the right, by giving written notice as specified in the Sales Agreement, to terminate the Sales Agreement in each party’s sole discretion at any time.

The aggregate compensation payable to Truist as sales agent equals 3.0% of the gross sales price of the shares sold through it pursuant to the Sales Agreement. We have also agreed to reimburse the agent for up to $50,000 of the actual outside legal expenses incurred by the agent and up to $10,000 of filing fees and associated legal expenses of the agent’s outside counsel for filings with the Financial Industry Regulatory Authority in connection with the transactions contemplated by the Sales Agreement. We estimate that the total expenses in connection with the transactions contemplated by the Sales Agreement payable by us, excluding commissions payable to the agent under the Sales Agreement, will be approximately $143,000.

The remaining sales proceeds, after deducting any expenses payable by us and any transaction fees imposed by any governmental, regulatory, or self-regulatory organization in connection with the sales, will equal our net proceeds for the sale of such common stock.

The agent will provide written confirmation to us following the close of trading on the Nasdaq Capital Market on each day in which common stock is sold through it as sales agent under the Sales Agreement. Each confirmation will include the number of shares of common stock sold through the agent as sales agent on that day, the volume weighted average price of the shares sold, the percentage of the daily trading volume and the net proceeds to us.

Settlement for sales of common stock will occur, unless the parties agree otherwise, on the second business day that is also a trading day following the date on which any sales were made in return for payment of the net proceeds to us. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

In connection with the sales of our common stock on our behalf, the agent may be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation paid to the agent may be deemed to be underwriting commissions or discounts. We have agreed in the Sales Agreement to provide indemnification and contribution to the agent against certain liabilities, including liabilities under the Securities Act. As sales agent, the agent will not engage in any transactions that stabilizes our common stock.

Our common stock is listed on the Nasdaq Capital Market and trades under the symbol “NMTR.”

The agent and/or its affiliates have provided, and may in the future provide, various investment banking and other financial services for us for which services they have received, and may in the future receive, customary fees.

DESCRIPTION OF OUR CAPITAL STOCK

The following description of our common stock is a summary and is subject to the applicable provisions of the General Corporation Law of the State of Delaware (the “DGCL”), our amended and restated certificate of incorporation, as amended (“Certificate of Incorporation”), and our amended and restated bylaws (“Bylaws”). Copies of our Certificate of Incorporation and our Bylaws are incorporated by reference as exhibits to the registration statement of which this prospectus is a part. We encourage you to read our Certificate of Incorporation, our Bylaws and the applicable provisions of the DGCL for additional information.

General

Our authorized capital stock consists of 360,000,000 shares of common stock, par value $0.0001, of which 136,232,886 shares were issued and outstanding as of June 30, 2020, and 10,000,000 shares of preferred stock, none of which are issued and outstanding. Our preferred stock and/or common stock may be issued from time to time without prior approval by our stockholders. Our preferred stock and/or common stock may be issued for such consideration as may be fixed from time to time by our Board of Directors.

Common Stock

The holders of our common stock (i) have equal ratable rights to dividends from funds legally available therefore when, as and if declared by our Board of Directors; (ii) are entitled to share in all of our assets available for distribution to holders of common stock upon liquidation, dissolution or winding up of our affairs; (iii) do not have preemptive, subscription or conversion rights and no redemption or sinking fund provisions or rights; and (iv) are entitled to one non-cumulative vote per share on all matters on which stockholders may vote, meaning that the holders of 50.1% of our outstanding shares of common stock, voting for the election of directors, can elect all of the directors to be elected, and in such event, the holders of the remaining shares will not be able to elect any of our directors.

Preferred Stock

The Certificate of Incorporation authorizes our Board of Directors to issue preferred stock in one or more classes or one or more series within any class from time to time. The voting powers, designations, preferences, qualifications, limitations, restrictions and other rights of our preferred stock will be determined by our Board of Directors at that time.

Options

As of June 30, 2020, under the Private Innovate Plan there were 6,028,781 shares of common stock issuable upon the exercise of options outstanding at a weighted average exercise price of $1.53 per share. As of June 30, 2020, under the Omnibus Plan there were 5,651,726 shares of common stock issuable upon the exercise of options outstanding at a weighted average exercise price of $1.25 per share. As of June 30, 2020, under the option grant agreements granted to RDD employees and assumed by the Company in accordance with their terms, there were 1,014,173 shares of common stock issuable upon the exercise of options at a weighted average exercise price of $0.63 per share. Any future grants will be made under the Omnibus Plan, and as of June 30, 2020, there were 14,726,818 shares of common stock reserved for future issuance under the Omnibus Plan.

Warrants

As of June 30, 2020, we had outstanding warrants to purchase an aggregate of 40,949,619 shares of our common stock at a weighted average price of $0.80 per share, with a weighted average remaining life of 4.8 years.

Anti-Takeover Effects of Our Certificate of Incorporation and Bylaws and Certain Provisions of the DGCL

General. Our Certificate of Incorporation contains provisions that could have an anti-takeover effect, including provisions that:

| |

| • | grant our Board of Directors the authority to issue up to 10,000,000 shares of preferred stock and fix the price, rights, preferences, privileges and restrictions of such preferred stock without any further vote or action by our stockholders; |

| |

| • | provide for a classified board of directors; |

| |

| • | provide that vacancies on the board of directors may be filled only by a majority of directors then in office, even though less than a quorum; |

| |

| • | eliminate cumulative voting in the election of directors; |

| |

| • | prohibit director removal without cause and only allow removal with cause, and allow amendment of certain provisions of our Certificate of Incorporation and our Bylaws only, in the case of such removal with cause or amendment, by the vote of the holders of at least two-thirds of all then-outstanding shares of our common stock; |

| |

| • | grant our board of directors the exclusive authority to increase or decrease the size of the board of directors; |

| |

| • | permit stockholders to only take actions at a duly called annual or special meeting and not by written consent; |

| |

| • | prohibit stockholders from calling a special meeting of stockholders; and |

| |

| • | authorize our board of directors, by a majority vote, to amend the Bylaws. |

Our Bylaws also contain provisions that could have an anti-takeover effect, including provisions that require that stockholders give advance notice to nominate directors or submit proposals for consideration at stockholder meetings.

Exclusive Forum. Unless we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware shall, to the fullest extent permitted by law, be the sole and exclusive forum for (i) any derivative action or proceeding brought on behalf of the Company, (ii) any action asserting a claim of breach of fiduciary duty owed by, or other wrongdoing by, any director, officer, employee or agent of the Company to the Company or our stockholders, creditors or other constituents, (iii) any action asserting a claim arising pursuant to any provision of the DGCL, our Certificate of Incorporation or our Bylaws, (iv) any action to interpret, apply, enforce or determine the validity of our Certificate of Incorporation or Bylaws or (v) any action asserting a claim governed by the internal affairs doctrine; in each case, subject to the Court of Chancery having personal jurisdiction over the indispensable parties named as defendants therein; provided that, if and only if the Court of Chancery of the State of Delaware dismisses any such action for lack of subject matter jurisdiction, such action may be brought in another state or federal court sitting in the State of Delaware. Although our Certificate of Incorporation and our Bylaws include these provisions, it is possible that a court could rule that such provisions are inapplicable or unenforceable.

DGCL Section 203. We are subject to the anti-takeover provisions of Section 203 of the DGCL, which limits the ability of stockholders owning in excess of 15% of our outstanding voting stock to merge or combine with us. These provisions could discourage potential acquisition proposals and could delay or prevent a change in control transaction. They could also have the effect of discouraging others from making tender offers for our common stock, including transactions that may be in your best interests. These provisions may also prevent changes in our management or limit the price that certain investors are willing to pay for our common stock.

Listing on the Nasdaq Capital Market

Our common stock is listed on the Nasdaq Capital Market under the symbol “NMTR.”

Transfer Agent

The transfer agent of our common stock is Equiniti Group plc (EQ). Their address is 1110 Centre Pointe Curve, Suite 101, Mendota Heights, MN 55120.

LEGAL MATTERS

The validity of the securities being offered hereby will be passed upon for us by Wyrick Robbins Yates & Ponton LLP, Raleigh, North Carolina. Certain legal matters relating to this offering will be passed upon for Truist by Goodwin Procter LLP, New York, New York.

EXPERTS

Mayer Hoffman McCann P.C., our independent registered public accounting firm, has audited our balance sheets as of December 31, 2019 and 2018, and the related statements of operations and comprehensive loss, stockholders’ deficit and cash flows for each of the two years in the period ended December 31, 2019, and the related notes, as set forth in their report, which report expresses an unqualified opinion and includes an explanatory paragraph relating to the existence of substantial doubt about our ability to continue as a going concern. We have incorporated by reference the financial statements in this prospectus in reliance on the report of Mayer Hoffman McCann P.C. given on their authority as experts in accounting and auditing in giving said reports.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. We also filed a registration statement on Form S-3, including exhibits, under the Securities Act with respect to the common stock offered by this prospectus. This prospectus is a part of that registration statement, but does not contain all of the information included in the registration statement or the exhibits. You can find our public filings with the SEC on the internet at a web site maintained by the SEC located at www.sec.gov.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” the information that we file with the SEC, which means that we can disclose important information to you by referring you to those documents. The documents incorporated by reference are:

| |

| • | our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, filed with the SEC on March 20, 2020; |

| |

| • | our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2020, filed with the SEC on May 15, 2020; |

| |

| • | our Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2020, filed with the SEC on August 13, 2020; |

| |

| • | our Current Reports on Form 8-K, filed with the SEC on January 10, 2020, January 22, 2020, February 12, 2020, February 14, 2020, February 18, 2020, March 12, 2020, March 19, 2020, April 6, 2020, April 9, 2020, April 21, 2020, April 22, 2020, May 4, 2020, May 5, 2020, May 8, 2020, May 11, 2020, May 27, 2020, June 24, 2020, June 29, 2020, June 30, 2020, July 2, 2020, July 6, 2020, July 21, 2020, July 22, 2020, July 28, 2020, August 4, 2020, August 13, 2020, August 21, 2020, August 31, 2020, September 8, 2020, October 2, 2020 and October 6, 2020, and our Current Report on Form 8-K/A filed on June 12, 2020; and |

| |

| • | the description of our common stock contained in our Registration Statement on Form 8-A as filed with the SEC on June 7, 2016 pursuant to Section 12(b) of the Exchange Act, including any amendments or reports filed for the purpose of updating such description. |

| |

| • | our definitive proxy statement on Schedule 14A for the special meeting of stockholders held on February 14, 2020, filed with the SEC pursuant to Section 14 of the Exchange Act on January 22, 2020. |

| |

| • | our definitive proxy statement on Schedule 14A for the annual meeting of stockholders held on June 30, 2020, filed with the SEC pursuant to Section 14 of the Exchange Act on June 2, 2020. |

In addition, all documents subsequently filed by us pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act prior to the filing of a post-effective amendment which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this prospectus and to be a part hereof from the date of filing of such documents. However, any documents or portions thereof, whether specifically listed above or filed in the future, that are not deemed “filed” with the SEC, including without limitation any information furnished pursuant to Item 2.02 or 7.01 of Form 8-K or certain exhibits furnished pursuant to Item 9.01 of Form 8-K, shall not be deemed to be incorporated by reference in this prospectus.

Any statement in a document incorporated by reference or deemed to be incorporated by reference in this prospectus shall be deemed to be modified or superseded for the purposes of this prospectus to the extent that a statement contained herein or in any other subsequently filed document which also is incorporated or deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will provide, without charge, to each person, including any beneficial owner, to whom a copy of this prospectus is delivered, upon such person’s written or oral request, a copy of any and all of the information incorporated by reference in this prospectus, other than exhibits to such documents, unless such exhibits are specifically incorporated by reference into the information incorporated by reference into this prospectus. Requests should be directed to the Secretary at 9 Meters Biopharma, Inc., 8480 Honeycutt Road, Suite 120, Raleigh, NC 27615, phone (919) 275-1933. You may also find these documents in the “Investors” section of our website, www.9meters.com. The information on our website is not incorporated into this prospectus.

$37,352,318

Common Stock

PROSPECTUS

Truist Securities

October 9, 2020