Filed by MPLX LP

Commission File No.: 001-35714

Pursuant to Rule 425 under the

Securities Act of 1933, as amended

Subject Company:

MarkWest Energy Partners, L.P.

Commission File No.: 001-31239

MPLX LP posted a link to the presentation below on its website.

This presentation contains forward-looking statements within the meaning of federal securities laws regarding MPLX LP (“MPLX”), Marathon Petroleum Corporation (“MPC”), and MarkWest Energy Partners, L.P. (“MWE”). These forward-looking statements relate to, among other things, expectations, estimates and projections concerning the business and operations of MPLX, MPC, and MWE . You can identify forward-looking statements by words such as “anticipate,” “believe,” “estimate,” "objective," “expect,” “forecast,” "guidance," “imply,” "plan," “project,” "potential," “could,” “may,” “should,” “would,” “will” or other similar expressions that convey the uncertainty of future events or outcomes. Such forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond the companies’ control and are difficult to predict. In addition to other factors described herein that could cause MPLX’s or MWE’s actual results to differ materially from those implied in these forward-looking statements, negative capital market conditions, including a persistence or increase of the current yield on common units, which is higher than historical yields, could adversely affect MPLX’s ability to meet its distribution growth guidance, particularly with respect to the later years of such guidance. Factors that could cause MPLX's or MWE’s actual results to differ materially from those implied in the forward-looking statements include: the ability to complete the proposed merger of MPLX and MWE on anticipated terms and timetable; the ability to obtain approval of the transaction by the unitholders of MWE and satisfy other conditions to the closing of the transaction contemplated by the merger agreement; risk that the synergies from the MPLX/MWE transaction may not be fully realized or may take longer to realize than expected; disruption from the MPLX/MWE transaction making it more difficult to maintain relationships with customers, employees or suppliers; risks relating to any unforeseen liabilities of MWE or MPLX, as applicable; the adequacy of MPLX's and MWE's respective capital resources and liquidity, including, but not limited to, availability of sufficient cash flow to pay distributions, and the ability to successfully execute their business plans and implement their growth strategies; the timing and extent of changes in commodity prices and demand for crude oil, refined products, feedstocks or other hydrocarbon-based products; volatility in and/or degradation of market and industry conditions; completion of pipeline capacity by competitors; disruptions due to equipment interruption or failure, including electrical shortages and power grid failures; the suspension, reduction or termination of MPC's obligations under MPLX’s commercial agreements; each company’s ability to successfully implement its growth plan, whether through organic growth or acquisitions; modifications to earnings and distribution growth objectives; federal and state environmental, economic, health and safety, energy and other policies and regulations; changes to MPLX’s capital budget; other risk factors inherent to MPLX or MWE’s industry; and the factors set forth under the heading "Risk Factors" in MPLX's Annual Report on Form 10-K for the year ended Dec. 31, 2014, filed with the Securities and Exchange Commission (SEC); and the factors set forth under the heading "Risk Factors" in MWE's Annual Report on Form 10-K for the year ended Dec. 31, 2014, and Quarterly Report on Form 10-Q for the quarter ended September 30, 2015, filed with the SEC. These risks, as well as other risks associated with MPLX, MWE and the proposed transaction are also more fully discussed in the joint proxy statement and prospectus included in the registration statement on Form S-4 filed by MPLX and declared effective by the SEC on October 29, 2015. Factors that could cause MPC’s actual results to differ materially from those implied in the forward-looking statements include: risks described above relating to the MPLX/MWE proposed merger; changes to the expected construction costs and timing of pipeline projects; volatility in and/or degradation of market and industry conditions; the availability and pricing of crude oil and other feedstocks; slower growth in domestic and Canadian crude supply; an easing or lifting of the U.S. crude oil export ban; completion of pipeline capacity to areas outside the U.S. Midwest; consumer demand for refined products; transportation logistics; the reliability of processing units and other equipment; MPC’s ability to successfully implement growth opportunities; modifications to MPLX earnings and distribution growth objectives; federal and state environmental, economic, health and safety, energy and other

policies and regulations; MPC’s ability to successfully integrate the acquired Hess retail operations and achieve the strategic and other expected objectives relating to the acquisition; changes to MPC’s capital budget; other risk factors inherent to MPC’s industry; and the factors set forth under the heading "Risk Factors" in MPC's Annual Report on Form 10-K for the year ended Dec. 31, 2014, filed with SEC. In addition, the forward-looking statements included herein could be affected by general domestic and international economic and political conditions. Unpredictable or unknown factors not discussed here, in MPLX’s Form 10-K, in MPC’s Form 10-K, or in MWE’s Form 10-K and Form 10-Qs could also have material adverse effects on forward-looking statements. Copies of MPLX's Form 10-K are available on the SEC website, MPLX's website at http://ir.mplx.com or by contacting MPLX's Investor Relations office. Copies of MPC's Form 10-K are available on the SEC website, MPC's website at http://ir.marathonpetroleum.com or by contacting MPC's Investor Relations office. Copies of MWE’s Form 10-K and Form 10-Qs are available on the SEC website, MWE’s website at http://investor.markwest.com or by contacting MWE’s Investor Relations office.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the proposed acquisition of MWE by MPLX. In connection with the proposed acquisition, MWE and MPLX have filed relevant materials with the SEC, including MPLX’s registration statement on Form S-4 that includes a definitive joint proxy statement and a prospectus and was declared effective by the SEC on October 29, 2015. Investors and security holders are urged to read all relevant documents filed with the SEC, including the definitive joint proxy statement and prospectus, because they contain important information about the proposed transaction. Investors and security holders are able to obtain the documents free of charge at the SEC’s website, http://www.sec.gov, or for free from MPLX LP at its website, http://ir.mplx.com, or in writing at 200 E. Hardin Street, Findlay, Ohio 45840, Attention: Corporate Secretary, or for free from MWE by contacting Investor Relations by phone at 1-(866) 858-0482 or by email at investorrelations@markwest.com.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any investor or securityholder. However MPLX and MWE and their respective directors and executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the holders of MWE common units with respect to the proposed transaction. Information about MPLX’s directors and executive officers is available in MPLX’s Annual Report on Form 10-K filed with the SEC on February 27, 2015 and MPLX’s current report on Form 8-K, as filed with the SEC on March 9, 2015. Information about MWE’s directors and executive officers is set forth in the proxy statement for MWE’s 2015 Annual Meeting of Common Unitholders, which was filed with the SEC on April 23, 2015 and MWE’s current reports on Form 8-K, as filed with the SEC on May 5, 2015, May 19, 2015 and June 8, 2015, and in the definitive joint proxy statement filed by MPLX, which was declared effective by the SEC on October 29, 2015. To the extent holdings of MWE securities have changed since the amounts contained in the definitive joint proxy statement filed by MPLX, which was declared effective by the SEC on October 29, 2015, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Investors may obtain additional information regarding the interest of such participants by reading the definitive joint proxy statement and prospectus regarding the acquisition. These documents may be obtained free of charge from the SEC’s website http://www.sec.gov, or from MWE and MPLX using the contact information above.

Non-Solicitation

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

INVESTOR PRESENTATION November 12, 2015

NON-GAAP FINANCIAL MEASURES / FORWARD-LOOKING STATEMENTS 2 Mar kW est E n er g y Part n e rs , L .P . i s a mas te r l i m i te d part n e rs h i p t hat ow ns a n d o p erat e s m i d str e am s er v ice s r e lat e d b us i n es s es . Mar kW est has a lea d i n g pr e se nc e i n ma n y nat ura l gas r e sou rce p lay s i nc l u d i n g t h e Marce l l u s S ha l e , Ut ica Sha l e , H uro n/B e re a S ha le , Haynesv i l l e Sha le , Woodford Sha le and Grani te Wash format ion where i t prov ides midstream serv ices to i t s producer customers . Caut ionary Statement Regardin g Fo rward-Looking Statement s T h is com m u n icat io n i nc l u d es “forwar d- look i n g st ate me n ts . ” A l l s tat em e nt s ot he r t ha n stat e m e nts o f h is tor ica l fact s i nc l u d e d o r i nco r porat e d h e r e in may c ons t i t ut e forwar d- loo k i ng stat em e n ts t hat i nvo l v e a n u mb e r o f r i s ks a n d u nc er ta i nt i e s . Th e se stat e m en ts ma y i nc lu d e stat e m e nts r egar d i n g t h e pro pos e d acq u i s i t io n o f t h e Part n e rs h i p b y MPL X, th e e x pect e d t i m eta b l e for co m p le t i n g t h e t ran sact ion, b e n ef i t s an d sy n er g i es o f t h e t ra n sact io n, f ut u r e op por t u n i t i e s for t h e comb i n e d com pa ny a n d an y ot he r stat e me n t s re gar d i n g t he Par tn e rs h i p’s a n d MPL X’s f u tu r e op erat io n s, ant ic i pat e d b u s in e ss l e ve l s , f ut ur e ear n i n gs an d d is t r i b ut io n s , p la n ne d act iv i t i es , an t ic i pat e d g ro wth, mar k et o p por t un i t i es , s t rat eg i e s a n d com p et i t i on. A l l s uc h fo rward- loo k i n g stat e me n ts i n vo l v e es t i mat e s an d ass u m pt io ns t hat ar e s u bj ect to a n u m b er o f r i s ks , u nce rta i nt i es a n d oth er factor s t hat cou l d cause act ua l r es u l t s to d i f f e r mat er ia l l y f rom t hos e e x pr e ss e d or i m p l ie d i n s uc h stat e m en ts . Factor s tha t cou l d ca us e o r con tr i b u te to suc h d i f f er e nce s i n c l ud e : factors r e lat i ng to t h e sa t i s fact io n o f th e con d i t io ns to t h e pro pos e d t ra n s act io n, i nc l u d i ng r e g u lato ry ap p rova l s an d t he r e q u ir e d ap pro va l o f t h e Partn e rs h i p’s u n i t ho l d er s ; t he pa rt i es ’ ab i l i t y to me e t e x p ectat io ns r e gar d i ng t h e t i m i ng a n d tax t r eat m e nt o f t h e pro po se d t ra nsact io n; t h e pos s i b i l i t y t hat t h e com b i ne d co mpa n y ma y b e u nab l e to ach i e v e ex p ect ed s y ne rg i e s an d o p e rat i n g ef f ic i e nc i e s i n co n n ect ion wit h t h e t ra nsact io n w it h i n t he ex p ect e d t i m e-f ram es or at a l l ; t h e i nt eg rat io n o f t h e Par t ne rs h i p b e i n g mor e d i f f ic u l t , t im e-co ns u m i n g or cost l y t ha n e x p ecte d; th e e f f ect o f an y cha n g es r e s u l t i n g f ro m t h e p r opos e d t ra n sact io n i n cu stom e r, su p p l i e r an d ot h er b u s i n es s r e lat io ns h i p s ; ge n e ra l mar k et p erce p t ion o f th e p ropo s e d t ra nsact io n; ex po s ur e to laws u i ts an d co nt i ng e nc i es assoc iat e d wit h MPL X; t h e ab i l i ty to attract a n d r eta i n k ey p er so nn e l ; pr e va i l i n g ma rk et con d it io n s; c han g es i n t h e eco no m ic an d f i na nc ia l con d it io n s o f t he Par tn e rs h i p an d MPL X; u nce rta i nt i e s and matt e rs b eyo n d t h e cont ro l o f ma nag e m en t; an d t h e oth er r i sk s d i scu ss e d i n t h e p er io d ic re po rts f i l e d w i th t h e SEC, i nc l ud i n g t h e Partn er s h i p’s an d MPL X’s A n n ua l R e port s o n Fo rm 1 0-K for th e yea r e n d e d D ece m be r 31, 2014 and t h e Part n er sh i p’ s R epo rt o n Fo rm 10- Q for t h e q uar t er e nd e d S e pt e m be r 30, 2015. Thes e r i sk s , as we l l as o t h er r i s k s as s o c iate d wit h t h e Part n e rs h i p, MPL X an d t h e pro po s e d t ran sact ion ar e a lso m ore f u l ly d isc us s ed i n t h e p rox y stat em e n t an d p ros p ect us i nc l ud e d i n t he r eg i st rat i on s tat em e nt on For m S-4 f i l e d w it h t h e SEC by MP L X and d ec lar ed e f f ect iv e b y t h e SEC on Octo b er 29 , 2015. The Part n e rs h i p has ma i le d t h e pro x y stat e m e nt /p ros p ect us to i t s u n i t ho l d er s . Th e fo rward- lo ok i n g stat em e n ts s hou l d b e co n s id e re d in l ig h t o f a l l th e se factors . In ad d i t ion , o th er r i sk s a nd unc er ta i n t i es no t pr es e n t ly k nown t o th e Partn er s h i p or MPL X or t h at t he Part n er sh i p or MPL X cons i d er s i mmat e r ia l cou l d a f f ect t he accuracy o f th e forward - look i n g stat e m en ts . Th e r ead e r i s ca ut io n ed n ot to r e l y u n d u l y o n t h es e forwar d- loo k i ng stat e m e nt s . Th e Par t ne rs h i p a n d MPL X do es no t u nd e rtak e a n y duty to update any fo rward- look in g statement except as require d by law.

ADDITIONAL INFORMATION 3 Addit i o na l Informat i o n and Where to F ind I t T h is com m u n icat ion may b e d e e m e d to b e so l ic i tat io n mat e r ia l i n r e s p ect o f th e pro pos e d acq u is i t io n o f th e Part n er sh i p b y MPL X. I n co nn ect io n wit h t h e pro p ose d acq u i s i t io n, t h e Partn er s h i p an d MPL X hav e f i l e d r e l e van t mat er ia l s w it h t he SEC, i nc l u d i ng MPL X’ s re g is t rat io n s tat em e n t on For m S-4 t hat i nc l ud e s a d ef i n i t i v e pro xy stat e me n t an d a pro s pect u s an d was d ec la re d ef f ect i v e by t h e S E C on Octo be r 29 , 2015. Inv esto rs an d s ec ur i ty ho l d er s are ur g e d to rea d a l l r e le va nt docu m e nts f i l e d wit h t h e SEC, i nc l u d i n g th e d ef i n i t i v e p rox y s tat em e n t an d p ros p ect us , b ecaus e th ey co nta i n i m por tan t i nfor mat io n a bou t t he pro pos e d t ra n sact io n. I n v est ors a n d sec ur i ty ho l de rs ar e ab l e to obta i n t h e doc u me n t s f r ee o f char g e at th e SEC’s we bs i te , ht t p:/ /www.sec .go v, or for f r e e f r om th e Partn er s h i p b y contact i n g In v esto r R e lat io ns b y p h on e at 1- (866) 858-0482 or b y e ma i l a t i n ve sto rr e la t io n s@ma rkw est .co m or f or f r e e f rom MPL X LP at i t s we b s i t e , ht t p:/ / i r . m p lx .com, or in wr i t i n g at 200 E . H ard i n St re e t , F i n d lay , O h i o 45840, Att e nt io n: Cor p orat e Secretary . Part ic ip a nt s in Sol ic i t at i o n T h is com m u n icat io n i s not a so l ic i tat io n o f a pro x y f rom an y i nv e stor or s ec ur i t y ho l d er . Howe v er , t h e Partn e rs h i p an d i t s d i recto rs an d ex ec ut i v e o f f ic er s a n d c er ta i n e m p lo y ee s may b e d e em e d to b e par t ic i p ants i n t h e so l ic i tat io n o f p rox i e s f rom t h e ho l d er s o f Partn er s h i p com mo n u n it s w i th r es p ect to t h e pr opos e d t ra nsact io n. I nfor mat io n a bou t t h e Par tn e rs h i p’s d i r ectors an d e x e cut i v e o f f ic er s i s se t fort h i n t h e pro xy stat e m e nt for th e P artn e rs h i p’ s 2015 A n n ual M e et i n g o f Com mo n U n it h o l d er s , wh ich was f i l e d w i th t h e SEC on A p r i l 23 , 2015 an d th e Par tn e rs h i p’ s cu rr e nt re po r ts o n For m 8-K , as f i l e d wi t h t h e SEC on May 5 , 2015, May 19, 2015 an d J u n e 8 , 2015, and in th e pro s pect us f i l e d b y MPL X on Octo b er 30, 2015 and t h e r e lat e d Re g i stra t ion Stat e m e nt on Fo rm S-4 , wh ic h was d ec la re d ef f ect i v e b y t h e SEC on Octob er 29 , 2015. Infor m at io n abo ut MPL X’s d i r ectors an d ex ec ut i v e o f f ice rs i s ava i la b le i n MPL X’s A n n ua l Re port o n For m 10-K f i l e d with t h e SEC o n F e br uar y 27, 2015 and MPL X’s cu rr e nt r e port o n Fo rm 8-K , a s f i l e d wi t h t he SEC on M arch 9 , 2015. To th e ext e n t ho l d i n gs o f Part n er s h ip s ecu r i t i e s hav e c han g e d s i nce t h e amo u nt s co nta i ne d i n th e d ef i n i t iv e p rox y stat e m en t f i l e d by t h e Part n ers h i p, suc h cha ng e s ha v e b e e n or w i l l b e r ef l ect ed o n Sta t e me n ts o f Cha n g e i n Own er s h i p on Fo rm 4 f i le d wi th t h e SEC. I n v esto rs ma y o b ta i n ad d it io na l i nfor mat io n r e gar d i ng t h e i nt er es t o f s u ch part ic i pa nts b y r ea d i n g t h e jo i nt pro xy s tat em e n t an d pro s pect u s r e gar d i n g t h e acqu i s i t io n. T h es e docu m e nt s ma y b e ob ta i ne d f r e e o f c harg e f ro m t h e SEC’s we bs i te h tt p: //www.sec . gov , or f rom the Partnershi p and MPL X us ing the contact informat ion above. Non-Sol i c i t a t i o n T h is co mm u n icat io n sha l l not co ns t i t ut e a n o f fe r to s e l l o r t he so l ic i tat io n o f an o f f e r to s e l l o r t h e so l ic i tat io n o f an o f f er to b u y a n y sec ur i t ie s , no r s ha l l t h er e b e an y sa l e o f s ec ur i t i e s i n a n y j u r is d ic t io n i n wh ic h s uch o f f er , so l ic i tat io n or sa l e wo u l d b e u n lawfu l p r ior to r e g ist rat io n o r q ua l i f i cat io n u n d er t he s ec ur i t i es laws o f a n y s uch j u r is d ic t io n. No o f f er o f s ecu r i t i es s ha l l be made except by means of a prospectus meet ing the requi rements of Sect ion 10 of the Secur i t ies Act o f 1933, as amended.

MWE AND MPLX – A STRATEGIC COMBINATION THAT WILL DELIVER ENHANCED VALUE Powerful combination with ability to capitalize on significant growth opportunities to deliver increased value to unitholders ◦ Multiple platforms with vast opportunities to drive growth and capture commercial synergies ◦ Enhanced access to lower cost of debt and equity capital Compelling value to MWE unitholders ◦ Significant and immediate premium with recent increase in cash consideration of $400 MM ◦ $1.075 Bn cash contribution by MPC represents >70% of incremental IDRs MPC expects to receive in aggregate from 2016 through 2019 ◦ Peer-leading distribution growth and substantially lower equity yield will enhance investor returns and deliver long-term value accretion ◦ MWE unitholders will own ~73% of MPLX common units after closing Strong sponsor, Marathon Petroleum Corporation (MPC), 4th largest U.S. refiner, is dedicated to the success of the combined partnership ◦ Reaffirmed commitment to grow MPLX's distribution at a mid-20% CAGR through 2019 ◦ MPC possesses numerous tools to facilitate / achieve such growth ◦ Inventory of drop-down assets is ≥$1.6 Bn of EBITDA The MarkWest Board conducted a thorough strategic review process and recommends the combination with MPLX 4

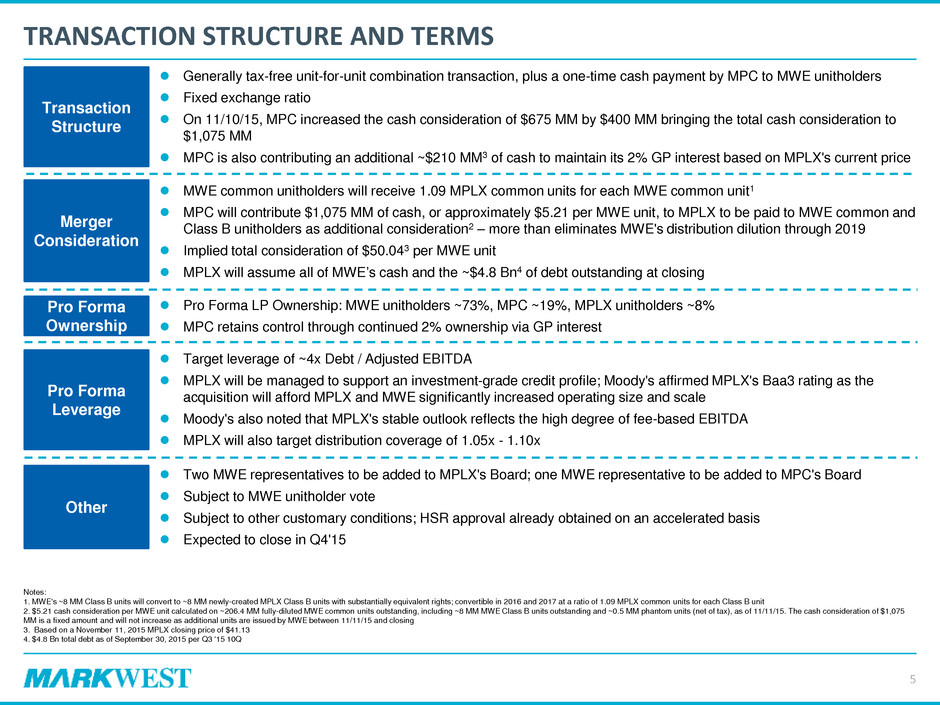

TRANSACTION STRUCTURE AND TERMS Merger Consideration Other Transaction Structure MWE common unitholders will receive 1.09 MPLX common units for each MWE common unit1 MPC will contribute $1,075 MM of cash, or approximately $5.21 per MWE unit, to MPLX to be paid to MWE common and Class B unitholders as additional consideration2 – more than eliminates MWE's distribution dilution through 2019 Implied total consideration of $50.043 per MWE unit MPLX will assume all of MWE’s cash and the ~$4.8 Bn4 of debt outstanding at closing Two MWE representatives to be added to MPLX's Board; one MWE representative to be added to MPC's Board Subject to MWE unitholder vote Subject to other customary conditions; HSR approval already obtained on an accelerated basis Expected to close in Q4'15 Generally tax-free unit-for-unit combination transaction, plus a one-time cash payment by MPC to MWE unitholders Fixed exchange ratio On 11/10/15, MPC increased the cash consideration of $675 MM by $400 MM bringing the total cash consideration to $1,075 MM MPC is also contributing an additional ~$210 MM3 of cash to maintain its 2% GP interest based on MPLX's current price Pro Forma Ownership Pro Forma LP Ownership: MWE unitholders ~73%, MPC ~19%, MPLX unitholders ~8% MPC retains control through continued 2% ownership via GP interest Notes: 1. MWE's ~8 MM Class B units will convert to ~8 MM newly-created MPLX Class B units with substantially equivalent rights; convertible in 2016 and 2017 at a ratio of 1.09 MPLX common units for each Class B unit 2. $5.21 cash consideration per MWE unit calculated on ~206.4 MM fully-diluted MWE common units outstanding, including ~8 MM MWE Class B units outstanding and ~0.5 MM phantom units (net of tax), as of 11/11/15. The cash consideration of $1,075 MM is a fixed amount and will not increase as additional units are issued by MWE between 11/11/15 and closing 3. Based on a November 11, 2015 MPLX closing price of $41.13 4. $4.8 Bn total debt as of September 30, 2015 per Q3 '15 10Q Pro Forma Leverage Target leverage of ~4x Debt / Adjusted EBITDA MPLX will be managed to support an investment-grade credit profile; Moody's affirmed MPLX's Baa3 rating as the acquisition will afford MPLX and MWE significantly increased operating size and scale Moody's also noted that MPLX's stable outlook reflects the high degree of fee-based EBITDA MPLX will also target distribution coverage of 1.05x - 1.10x 5

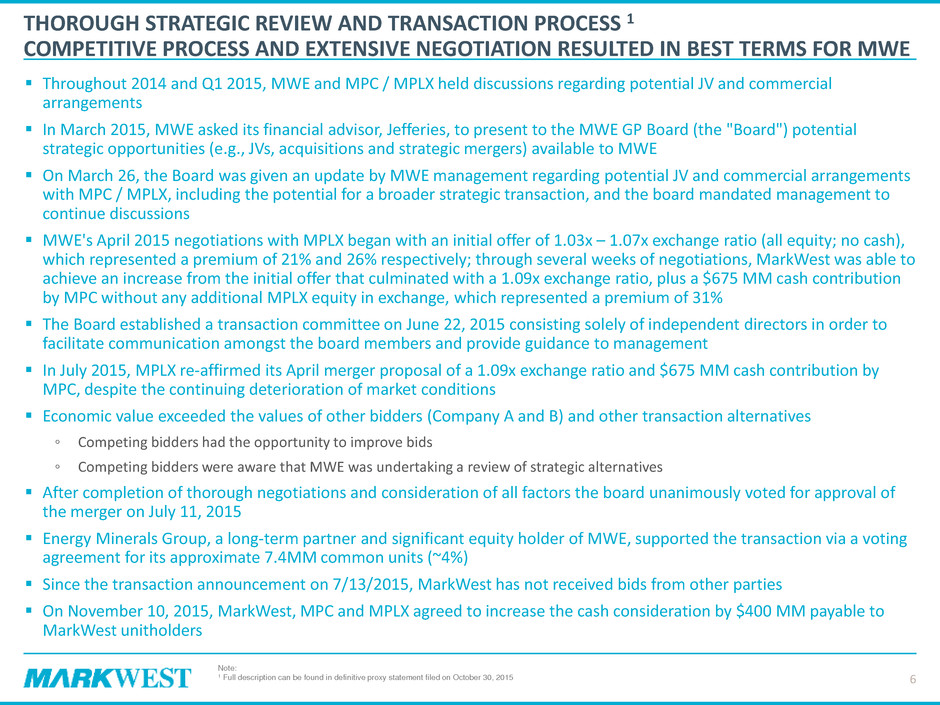

THOROUGH STRATEGIC REVIEW AND TRANSACTION PROCESS 1 COMPETITIVE PROCESS AND EXTENSIVE NEGOTIATION RESULTED IN BEST TERMS FOR MWE Throughout 2014 and Q1 2015, MWE and MPC / MPLX held discussions regarding potential JV and commercial arrangements In March 2015, MWE asked its financial advisor, Jefferies, to present to the MWE GP Board (the "Board") potential strategic opportunities (e.g., JVs, acquisitions and strategic mergers) available to MWE On March 26, the Board was given an update by MWE management regarding potential JV and commercial arrangements with MPC / MPLX, including the potential for a broader strategic transaction, and the board mandated management to continue discussions MWE's April 2015 negotiations with MPLX began with an initial offer of 1.03x – 1.07x exchange ratio (all equity; no cash), which represented a premium of 21% and 26% respectively; through several weeks of negotiations, MarkWest was able to achieve an increase from the initial offer that culminated with a 1.09x exchange ratio, plus a $675 MM cash contribution by MPC without any additional MPLX equity in exchange, which represented a premium of 31% The Board established a transaction committee on June 22, 2015 consisting solely of independent directors in order to facilitate communication amongst the board members and provide guidance to management In July 2015, MPLX re-affirmed its April merger proposal of a 1.09x exchange ratio and $675 MM cash contribution by MPC, despite the continuing deterioration of market conditions Economic value exceeded the values of other bidders (Company A and B) and other transaction alternatives ◦ Competing bidders had the opportunity to improve bids ◦ Competing bidders were aware that MWE was undertaking a review of strategic alternatives After completion of thorough negotiations and consideration of all factors the board unanimously voted for approval of the merger on July 11, 2015 Energy Minerals Group, a long-term partner and significant equity holder of MWE, supported the transaction via a voting agreement for its approximate 7.4MM common units (~4%) Since the transaction announcement on 7/13/2015, MarkWest has not received bids from other parties On November 10, 2015, MarkWest, MPC and MPLX agreed to increase the cash consideration by $400 MM payable to MarkWest unitholders Note: 1 Full description can be found in definitive proxy statement filed on October 30, 2015 6

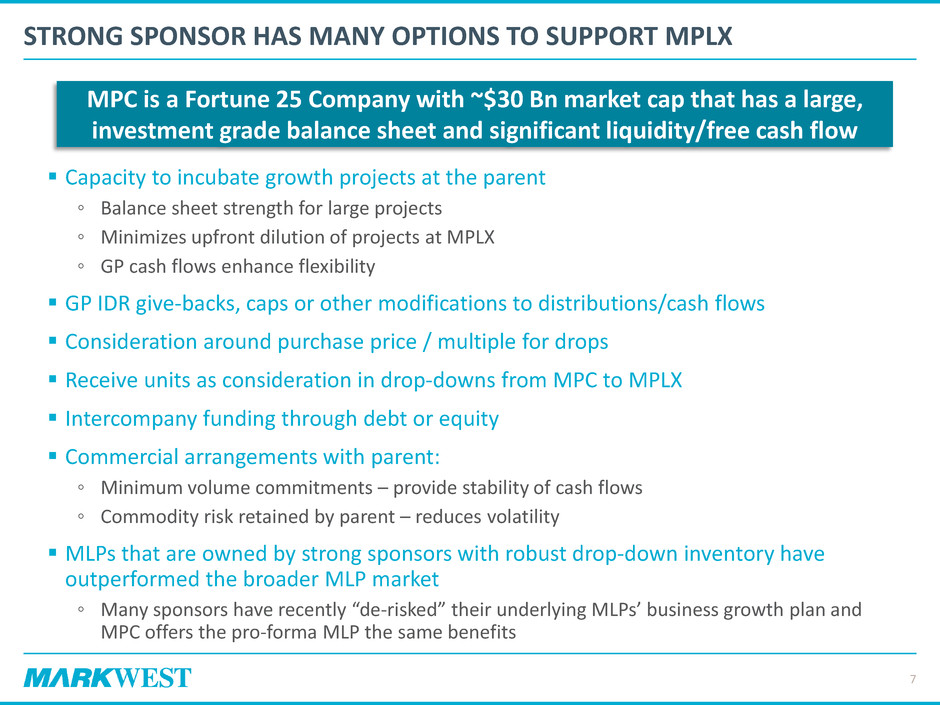

STRONG SPONSOR HAS MANY OPTIONS TO SUPPORT MPLX Capacity to incubate growth projects at the parent ◦ Balance sheet strength for large projects ◦ Minimizes upfront dilution of projects at MPLX ◦ GP cash flows enhance flexibility GP IDR give-backs, caps or other modifications to distributions/cash flows Consideration around purchase price / multiple for drops Receive units as consideration in drop-downs from MPC to MPLX Intercompany funding through debt or equity Commercial arrangements with parent: ◦ Minimum volume commitments – provide stability of cash flows ◦ Commodity risk retained by parent – reduces volatility MLPs that are owned by strong sponsors with robust drop-down inventory have outperformed the broader MLP market ◦ Many sponsors have recently “de-risked” their underlying MLPs’ business growth plan and MPC offers the pro-forma MLP the same benefits 7 MPC is a Fortune 25 Company with ~$30 Bn market cap that has a large, investment grade balance sheet and significant liquidity/free cash flow

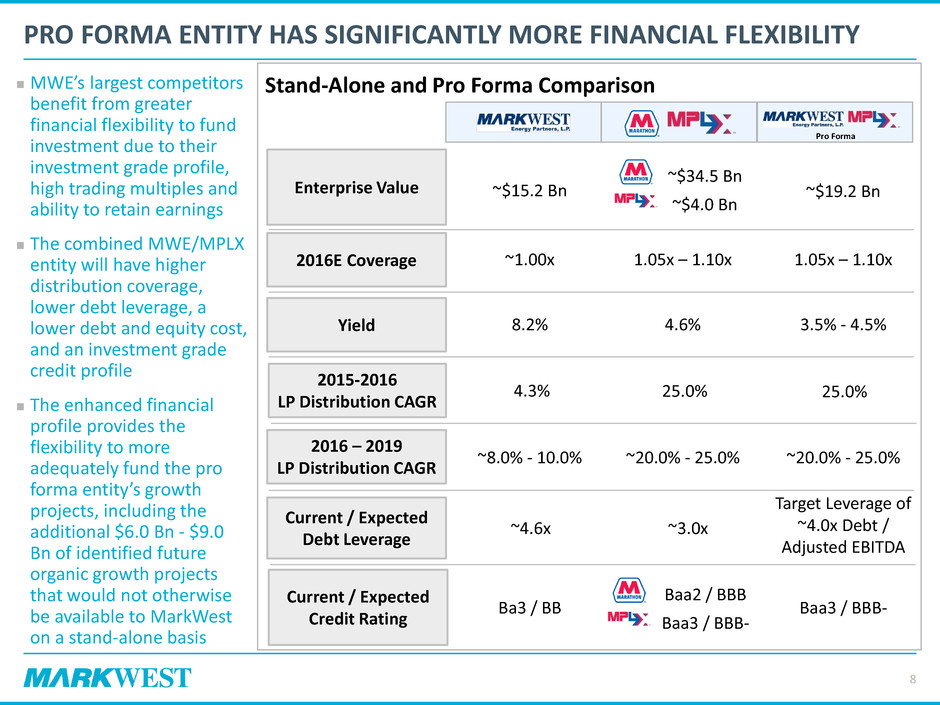

Stand-Alone and Pro Forma Comparison Baa2 / BBB Baa3 / BBB- Enterprise Value 2016E Coverage Yield Current / Expected Debt Leverage 2016 – 2019 LP Distribution CAGR Pro Forma Ba3 / BB ~$15.2 Bn ~$4.0 Bn ~$34.5 Bn ~$19.2 Bn 1.05x – 1.10x ~1.00x 1.05x – 1.10x 8.2% 4.6% 3.5% - 4.5% ~8.0% - 10.0% ~20.0% - 25.0% ~20.0% - 25.0% Baa3 / BBB- Current / Expected Credit Rating Target Leverage of ~4.0x Debt / Adjusted EBITDA ~3.0x ~4.6x MWE’s largest competitors benefit from greater financial flexibility to fund investment due to their investment grade profile, high trading multiples and ability to retain earnings The combined MWE/MPLX entity will have higher distribution coverage, lower debt leverage, a lower debt and equity cost, and an investment grade credit profile The enhanced financial profile provides the flexibility to more adequately fund the pro forma entity’s growth projects, including the additional $6.0 Bn - $9.0 Bn of identified future organic growth projects that would not otherwise be available to MarkWest on a stand-alone basis 8 PRO FORMA ENTITY HAS SIGNIFICANTLY MORE FINANCIAL FLEXIBILITY 2015-2016 LP Distribution CAGR 4.3% 25.0% 25.0%

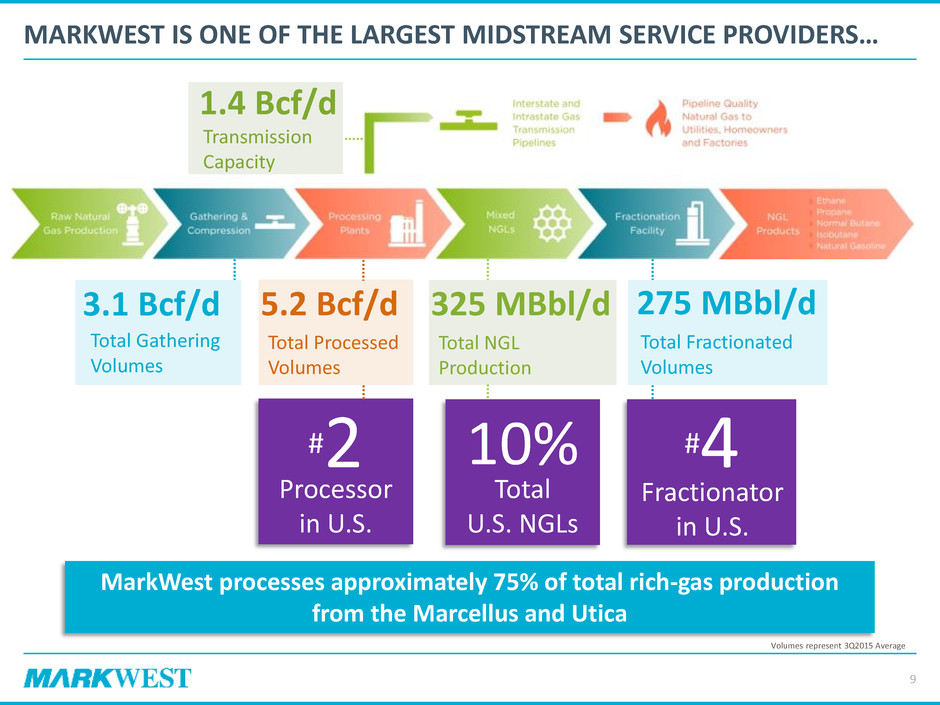

3.1 Bcf/d Total Gathering Volumes MARKWEST IS ONE OF THE LARGEST MIDSTREAM SERVICE PROVIDERS… Total Processed Volumes 5.2 Bcf/d 275 MBbl/d Total Fractionated Volumes 9 Volumes represent 3Q2015 Average MarkWest processes approximately 75% of total rich-gas production from the Marcellus and Utica Total NGL Production 325 MBbl/d #2 Processor in U.S. #4 Transmission Capacity 1.4 Bcf/d 10% Total U.S. NGLs Fractionator in U.S.

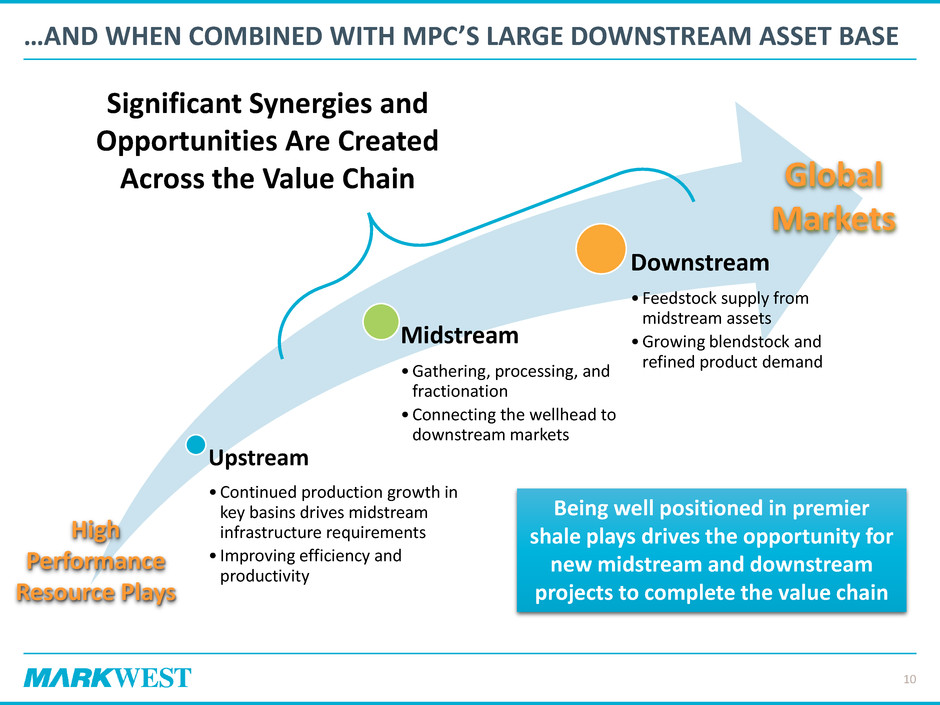

Upstream •Continued production growth in key basins drives midstream infrastructure requirements • Improving efficiency and productivity Midstream •Gathering, processing, and fractionation •Connecting the wellhead to downstream markets Downstream • Feedstock supply from midstream assets •Growing blendstock and refined product demand …AND WHEN COMBINED WITH MPC’S LARGE DOWNSTREAM ASSET BASE Global Markets High Performance Resource Plays Being well positioned in premier shale plays drives the opportunity for new midstream and downstream projects to complete the value chain 10 Significant Synergies and Opportunities Are Created Across the Value Chain

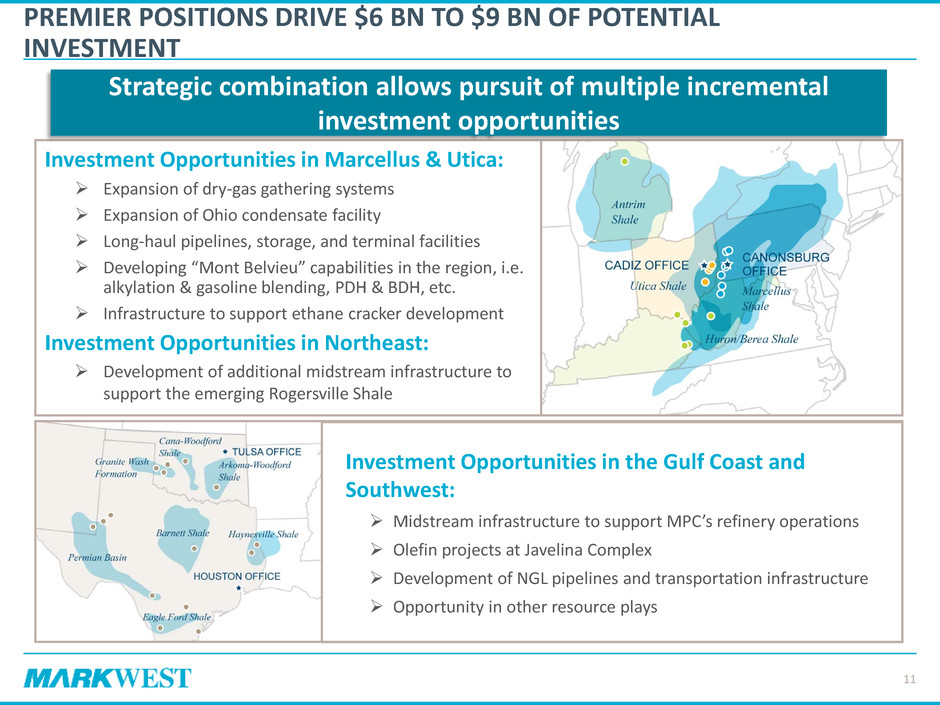

PREMIER POSITIONS DRIVE $6 BN TO $9 BN OF POTENTIAL INVESTMENT Investment Opportunities in Marcellus & Utica: Expansion of dry-gas gathering systems Expansion of Ohio condensate facility Long-haul pipelines, storage, and terminal facilities Developing “Mont Belvieu” capabilities in the region, i.e. alkylation & gasoline blending, PDH & BDH, etc. Infrastructure to support ethane cracker development Investment Opportunities in Northeast: Development of additional midstream infrastructure to support the emerging Rogersville Shale Investment Opportunities in the Gulf Coast and Southwest: Midstream infrastructure to support MPC’s refinery operations Olefin projects at Javelina Complex Development of NGL pipelines and transportation infrastructure Opportunity in other resource plays Strategic combination allows pursuit of multiple incremental investment opportunities 11

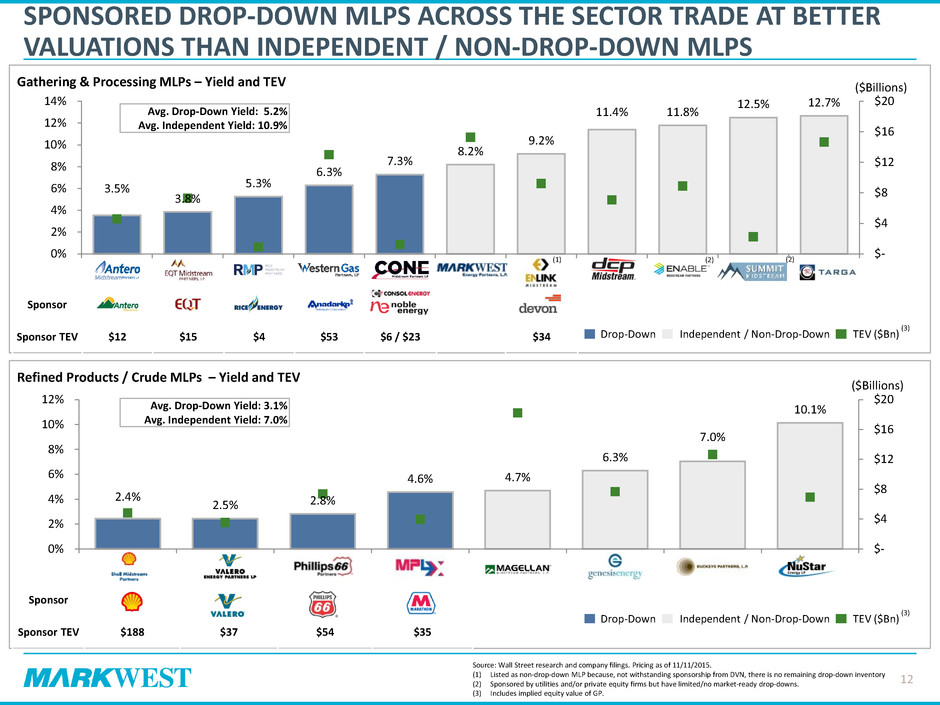

2.4% 2.5% 2.8% 4.6% 4.7% 6.3% 7.0% 10.1% $- $4 $8 $12 $16 $20 0% 2% 4% 6% 8% 10% 12% SHLX VLP PSXP MPLX MMP GEL BPL NS Gathering & Processing MLPs – Yield and TEV 3.5% 3.8% 5.3% 6.3% 7.3% 8.2% 9.2% 11.4% 11.8% 12.5% 12.7% $- $4 $8 $12 $16 $20 0% 2% 4% 6% 8% 10% 12% 14% AM EQM RMP WES CNNX MWE ENLK DPM ENBL SMLP NGLS Refined Products / Crude MLPs – Yield and TEV Sponsor Sponsor TEV $188 $37 $54 $35 Sponsor Sponsor TEV $12 $15 $4 $53 $6 / $23 SPONSORED DROP-DOWN MLPS ACROSS THE SECTOR TRADE AT BETTER VALUATIONS THAN INDEPENDENT / NON-DROP-DOWN MLPS Source: Wall Street research and company filings. Pricing as of 11/11/2015. (1) Listed as non-drop-down MLP because, not withstanding sponsorship from DVN, there is no remaining drop-down inventory (2) Sponsored by utilities and/or private equity firms but have limited/no market-ready drop-downs. (3) Includes implied equity value of GP. ($Billions) Avg. Drop-Down Yield: 3.1% Avg. Independent Yield: 7.0% Avg. Drop-Down Yield: 5.2% Avg. Independent Yield: 10.9% Drop-Down Independent / Non-Drop-Down TEV ($Bn) (3) 12 ($Billions) $34 (1) (2) (2) Drop-Down Independent / Non-Drop-Down TEV ($Bn) (3)

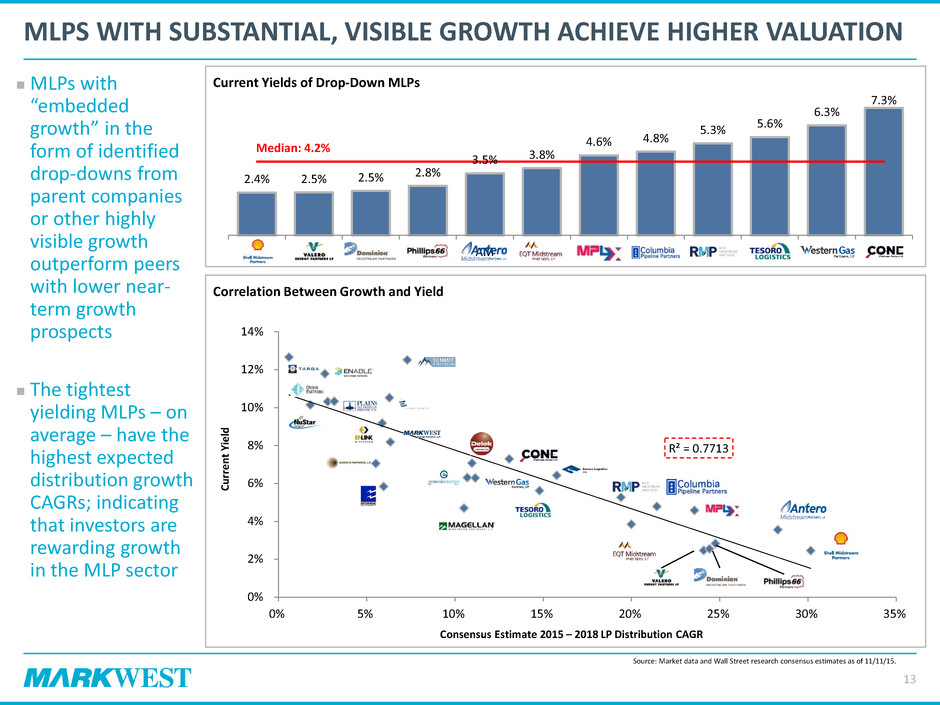

R² = 0.7713 0% 2% 4% 6% 8% 10% 12% 14% 0% 5% 10% 15% 20% 25% 30% 35% Current Yields of Drop-Down MLPs 2.4% 2.5% 2.5% 2.8% 3.5% 3.8% 4.6% 4.8% 5.3% 5.6% 6.3% 7.3% SHLX VLP DM PSXP AM EQM MPLX CPPL RMP TLLP WES CNNX Correlation Between Growth and Yield MLPS WITH SUBSTANTIAL, VISIBLE GROWTH ACHIEVE HIGHER VALUATION Median: 4.2% Consensus Estimate 2015 – 2018 LP Distribution CAGR Cu rr en t Yi el d Source: Market data and Wall Street research consensus estimates as of 11/11/15. MLPs with “embedded growth” in the form of identified drop-downs from parent companies or other highly visible growth outperform peers with lower near- term growth prospects The tightest yielding MLPs – on average – have the highest expected distribution growth CAGRs; indicating that investors are rewarding growth in the MLP sector 13

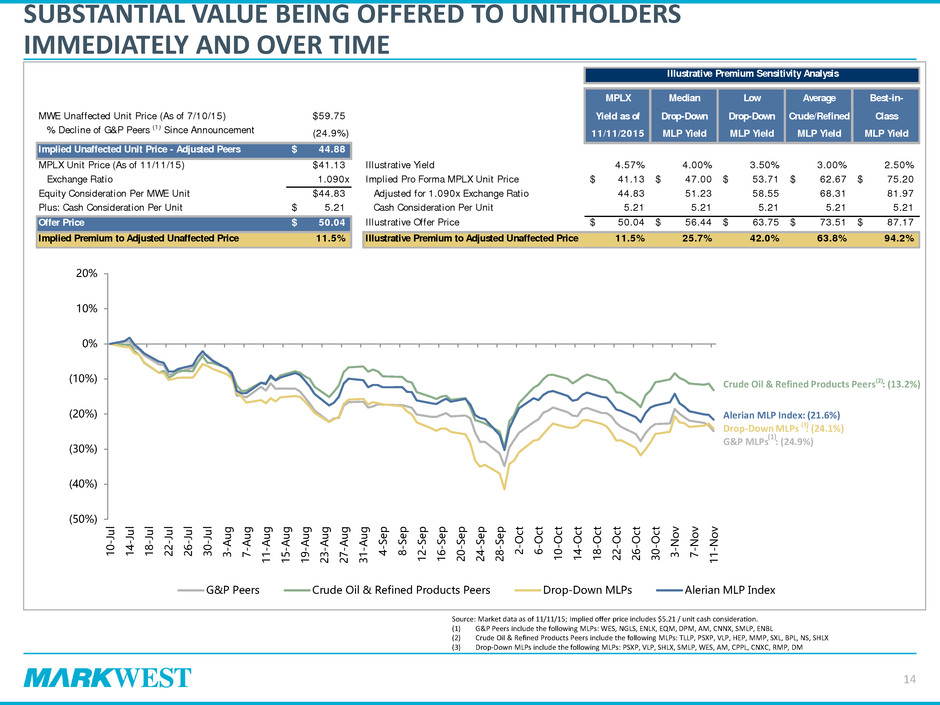

SUBSTANTIAL VALUE BEING OFFERED TO UNITHOLDERS IMMEDIATELY AND OVER TIME Source: Market data as of 11/11/15; Implied offer price includes $5.21 / unit cash consideration. (1) G&P Peers include the following MLPs: WES, NGLS, ENLK, EQM, DPM, AM, CNNX, SMLP, ENBL (2) Crude Oil & Refined Products Peers include the following MLPs: TLLP, PSXP, VLP, HEP, MMP, SXL, BPL, NS, SHLX (3) Drop-Down MLPs include the following MLPs: PSXP, VLP, SHLX, SMLP, WES, AM, CPPL, CNXC, RMP, DM 14 Crude Oil & Refined Products Peers : (13.2%) (2) G&P MLPs : (24.9%) Drop-Down MLPs : (24.1%) (3) (1) Alerian MLP Index: (21.6%) Illustrative Premium Sensitivity Analysis MPLX Median Low Average Best-in- MWE Unaffected Unit Price (As of 7/10/15) $59.75 Yield as of Drop-Down Drop-Down Crude/Refined Class % Decline of G&P Peers (1) Since Announcement (24.9%) 11/11/2015 MLP Yield MLP Yield MLP Yield MLP Yield Implied Unaffected Unit Price - Adjusted Peers 44.88$ MPLX Unit Price (As of 11/11/15) $41.13 Illustrative Yield 4.57% 4.00% 3.50% 3.00% 2.50% Exchange Ratio 1.090x Implied Pro Forma MPLX Unit Price 41.13$ 47.00$ 53.71$ 62.67$ 75.20$ Equity Consideration Per MWE Unit $44.83 Adjusted for 1.090x Exchange Ratio 44.83 51.23 58.55 68.31 81.97 Plus: Cash Consideration Per Unit 5.21$ Cash Consideration Per Unit 5.21 5.21 5.21 5.21 5.21 Offer Price 50.04$ Illustrative Offer Price 50.04$ 56.44$ 63.75$ 73.51$ 87.17$ Implied Premium to Adjusted Unaffected Price 11.5% Illustrative Premium to Adjusted Unaffected Price 11.5% 25.7% 42.0% 63.8% 94.2% (50%) (40%) (30%) (20%) (10%) 0% 10% 20% 10 -J ul 14 -J ul 18 -J ul 22 -J ul 26 -J ul 30 -J ul 3- A ug 7- A ug 11 -A ug 15 -A ug 19 -A ug 23 -A ug 27 -A ug 31 -A ug 4- Se p 8- Se p 12 -S ep 16 -S ep 20 -S ep 24 -S ep 28 -S ep 2- O ct 6- O ct 10 -O ct 14 -O ct 18 -O ct 22 -O ct 26 -O ct 30 -O ct 3- N ov 7- N ov 11 -N ov G&P Peers Crude Oil & Refined Products Peers Drop-Down MLPs Alerian MLP Index

DISTRIBUTIONS TO MWE UNITHOLDERS Distribution Growth Guidance: ◦ MPLX expects compound annual distribution growth rate of ≥25% through 2017 and approximately 20% annual distribution growth in years 2018 and 2019 ◦ MWE forecasts a 4.3% distribution growth rate in 2016 and also expects to be able to achieve an 8% to 10% annual distribution growth rate from 2017 to 2020 Upfront cash payment of ~$5.21 per unit more than offsets the difference between MWE’s standalone distribution and MPLX’s forecasted distribution through 2019 15 Upfront cash payment of ~$5.21 per unit more than addresses dilution concerns and provides additional accretion of ~$1.00 - ~$1.50 per unit

COMBINATION BENEFITS TO MARKWEST UNITHOLDERS Substantial economic value offered to unitholders through upfront cash consideration of ~$5.21 per unit, and potential for meaningful equity value accretion given 1.09x exchange ratio Peer-leading distribution growth profile anchored by combined organic growth prospects and MPC's substantial drop-down inventory Greater operational diversification and enhanced fee-based cash flows provide enhanced stability in this environment Access to substantially lower cost equity and debt capital $6 Bn - $9 Bn of incremental commercial growth opportunities to be executed together Strong sponsorship in MPC that is committed to the growth and success of the combined partnership 16

1515 ARAPAHOE STREET TOWER 1, SUITE 1600 DENVER, COLORADO 80202 PHONE: 303-925-9200 INVESTOR RELATIONS: 866-858-0482 EMAIL: INVESTORRELATIONS@MARKWEST.COM WEBSITE: WWW.MARKWEST.COM