Third Quarter 2024 Earnings October 23, 2024 Chris Cartwright, President and CEO Todd Cello, CFO Exhibit 99.2

2@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. Non-GAAP Financial InformationForward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of TransUnion’s management and are subject to significant risks and uncertainties. Actual results may differ materially from those described in the forward-looking statements. Factors that could cause TransUnion’s actual results to differ materially from those described in the forward-looking statements include: macroeconomic effects and changes in market conditions, including the impact of inflation, risk of recession and industry trends and adverse developments in the debt, consumer credit and financial services markets, including the impact on the carrying value of our assets in all of the markets where we operate; our ability to provide competitive services and prices; our ability to retain or renew existing agreements with large or long-term customers; our ability to maintain the security and integrity of our data; our ability to deliver services timely without interruption; our ability to maintain our access to data sources; government regulation and changes in the regulatory environment; litigation or regulatory proceedings; our ability to effectively manage our costs; our efforts to execute our transformation plan and achieve the anticipated benefits and savings; our ability to remediate existing material weakness in internal control over financial reporting and maintain effective internal control over financial reporting and disclosure controls and procedures; economic and political stability in the United States and international markets where we operate; our ability to effectively develop and maintain strategic alliances and joint ventures; our ability to timely develop new services and the market’s willingness to adopt our new services; our ability to manage and expand our operations and keep up with rapidly changing technologies; our ability to acquire businesses, successfully secure financing for our acquisitions, timely consummate our acquisitions, successfully integrate the operations of our acquisitions, control the costs of integrating our acquisitions and realize the intended benefits of such acquisitions; our ability to protect and enforce our intellectual property, trade secrets and other forms of unpatented intellectual property; geopolitical conditions and other risks associated with our international operations; the ability of our outside service providers and key vendors to fulfill their obligations to us; further consolidation in our end-customer markets; the increased availability of free or inexpensive consumer information; losses against which we do not insure; risks related to our indebtedness, including our ability to make timely payments of principal and interest and our ability to satisfy covenants in the agreements governing our indebtedness; our ability to maintain our liquidity; share repurchase plans; our reliance on key management personnel; and other one-time events and other factors that can be found in our Annual Report on Form 10-K for the year ended December 31, 2023, and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, which are filed with the Securities and Exchange Commission and are available on TransUnion’s website (www.transunion.com/tru) and on the Securities and Exchange Commission’s website (www.sec.gov). TransUnion undertakes no obligation to publicly release the result of any revisions to these forward-looking statements to reflect the impact of events or circumstances that may arise after the date of this presentation. This investor presentation includes certain non-GAAP measures that are more fully described in the appendices to the presentation. Exhibit 99.1, “Press release of TransUnion dated October 23, 2024, announcing results for the quarter ended September 30, 2024,” under the heading ‘Non-GAAP Financial Measures,’” furnished to the Securities and Exchange Commission on October 23, 2024. These financial measures should be reviewed in conjunction with the relevant GAAP financial measures and are not presented as alternative measures of GAAP. Other companies in our industry may define or calculate these measures differently than we do, limiting their usefulness as comparative measures. Because of these limitations, these non-GAAP financial measures should not be considered in isolation or as substitutes for performance measures calculated in accordance with GAAP. Reconciliations of these non-GAAP financial measures to their most directly comparable GAAP financial measures for each of the periods included in this presentation are included in the Appendices at the back of this investor presentation..

3@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. Third quarter 2024 highlights1 Transformation program progress2 Third quarter 2024 financial results3 Fourth quarter and full-year 2024 guidance4

4@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. *Revenue growth figures referenced above are organic constant currency. International revenue grew double digits* for 14th straight quarter. Double- digit growth in India, Latin America, Asia Pacific and Africa U.S. Markets revenue +12% led by mortgage, insurance and breach; Financial Services ex- mortgage growth accelerated Organic constant currency revenue +12%, +8% excluding mortgage Exceeded guidance on Revenue, Adjusted EBITDA and Adjusted Diluted EPS Prepaid $25M in debt for a year-to- date total of $105M; Leverage Ratio now ~3.1x For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. Third quarter 2024 highlights

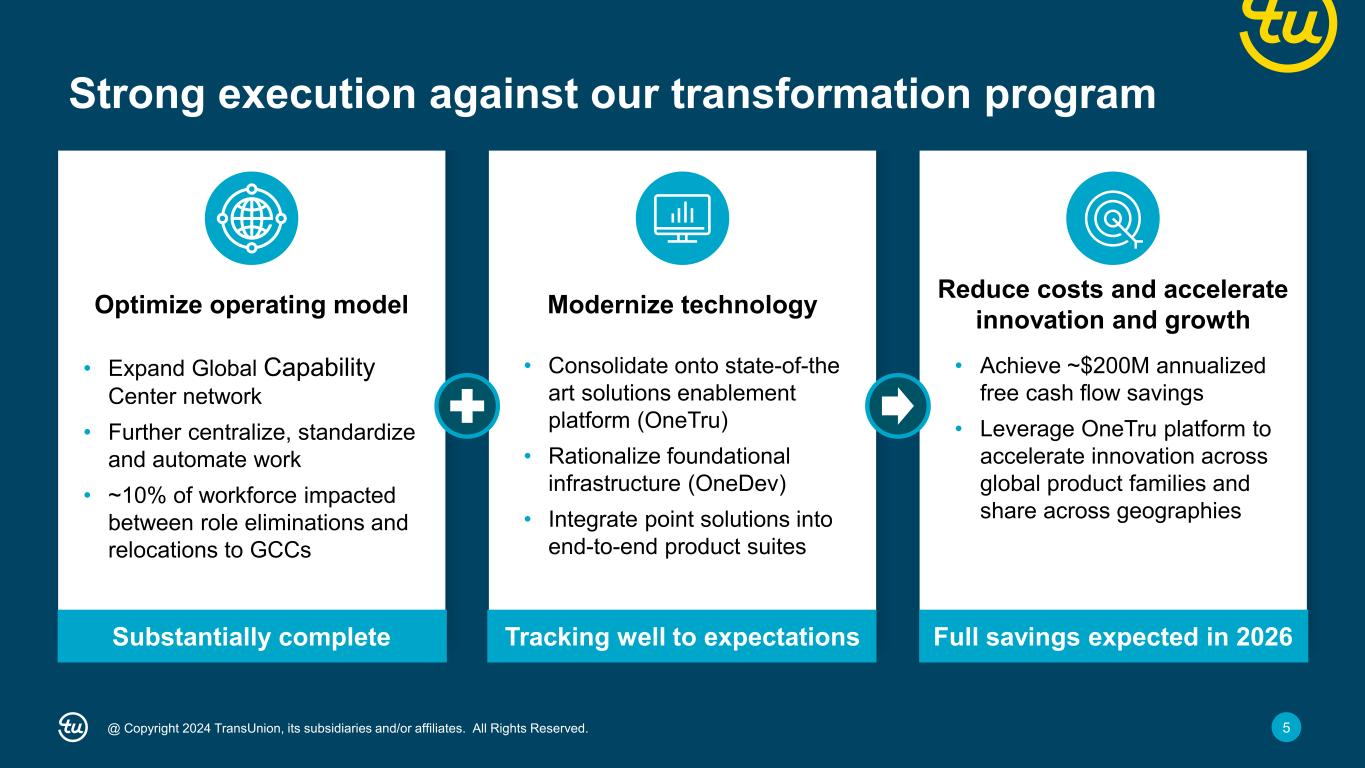

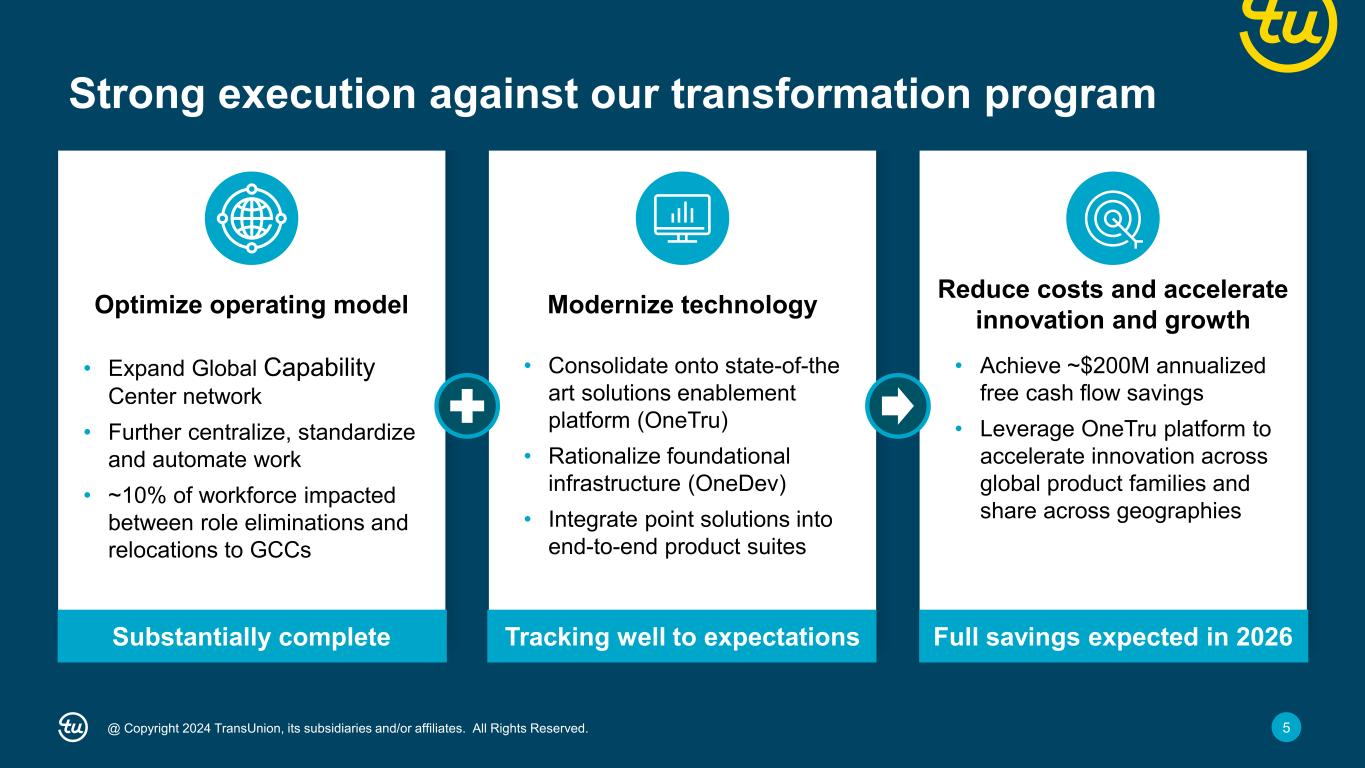

5@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. • Expand Global Capability Center network • Further centralize, standardize and automate work • ~10% of workforce impacted between role eliminations and relocations to GCCs • Consolidate onto state-of-the art solutions enablement platform (OneTru) • Rationalize foundational infrastructure (OneDev) • Integrate point solutions into end-to-end product suites • Achieve ~$200M annualized free cash flow savings • Leverage OneTru platform to accelerate innovation across global product families and share across geographies Optimize operating model Modernize technology Reduce costs and accelerate innovation and growth Strong execution against our transformation program Substantially complete Tracking well to expectations Full savings expected in 2026

6@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. • Local workforce reductions substantially complete in early 2024 • New positions filled in the GCCs as of 9/30 – Increased senior management roles in GCCs to support deep talent pools • Implemented rigorous transition playbook – Systematically track and document knowledge transfer – Train, develop and assess recent hires Completed role relocations to Global Capability Centers (GCCs), driving material cost savings in 2024 India Africa Costa Rica ~1,000 ~4,700 ~5,600 2021 2023 Q3 2024 Optimize Operating Model Global Capability Centers Headcount Milestones

7@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. Delivered modernized capabilities and product innovations powered by OneTru Modernize Technology Recent Milestones TruIQ Data Enrichment On-demand credit data Launched on Snowflake with strong contract wins and growing pipeline FactorTrust Short-term lending bureau Went live with new capabilities including triggers, Innovation Labs, new attributes and enhanced pre-screens TruValidate Fraud suite Launched for general availability and signed first new customer in competitive win TruAudience Marketing suite Unified Neustar and TransUnion segmentation and audience platforms for common delivery layer for customers SHAPE Internal analytics environment Completing conversion of all data, analytic tools, models, and data scientists to OneTru by year-end; decommission legacy platform in early 2025

8@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. Focus on customer migrations and product innovation over course of 2025; add new markets for migration to OneTru Modernize Technology 2025 priorities Consumer Solutions Consolidate credit and identity services platforms on OneTru and launch new direct-to-consumer interface U.S. Credit Launch end-to-end capabilities on OneTru and migrate customers over course of 2025 India Credit Migrate all data and analytics work onto OneTru; launch TruIQ Analytics Suite and Innovation Labs International bureau migrations Evaluate additional bureau migrations beyond U.S. and India

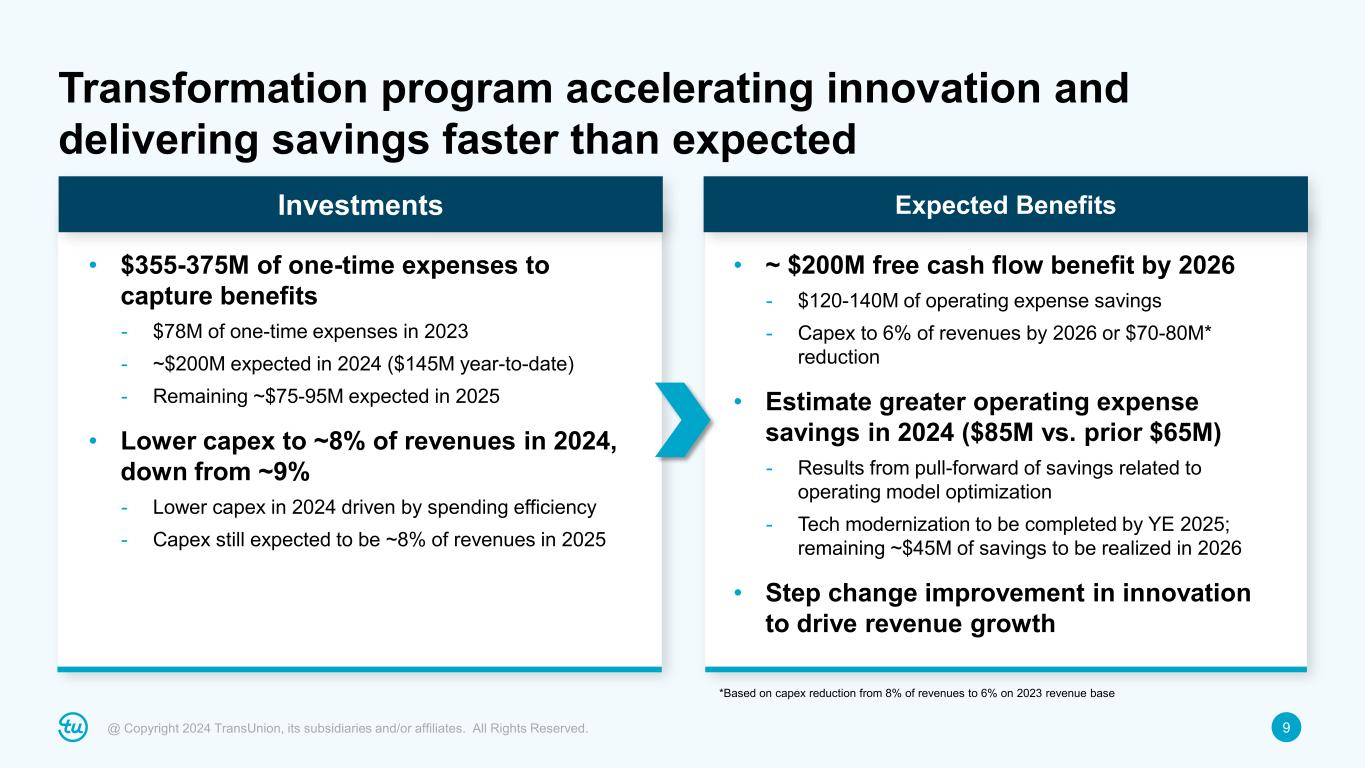

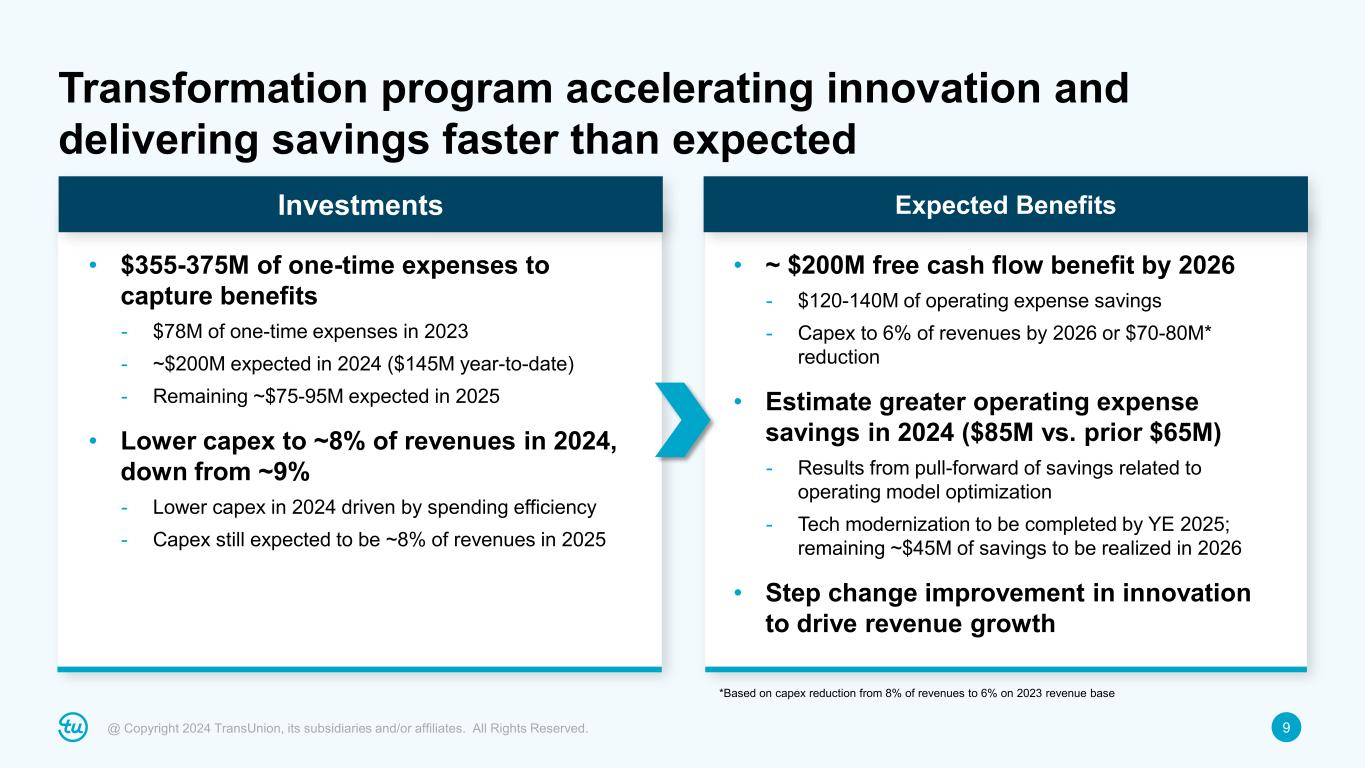

9@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. • $355-375M of one-time expenses to capture benefits - $78M of one-time expenses in 2023 - ~$200M expected in 2024 ($145M year-to-date) - Remaining ~$75-95M expected in 2025 • Lower capex to ~8% of revenues in 2024, down from ~9% - Lower capex in 2024 driven by spending efficiency - Capex still expected to be ~8% of revenues in 2025 • ~ $200M free cash flow benefit by 2026 - $120-140M of operating expense savings - Capex to 6% of revenues by 2026 or $70-80M* reduction • Estimate greater operating expense savings in 2024 ($85M vs. prior $65M) - Results from pull-forward of savings related to operating model optimization - Tech modernization to be completed by YE 2025; remaining ~$45M of savings to be realized in 2026 • Step change improvement in innovation to drive revenue growth *Based on capex reduction from 8% of revenues to 6% on 2023 revenue base Investments Expected Benefits Transformation program accelerating innovation and delivering savings faster than expected

10@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. Consolidated third quarter 2024 highlights For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. Reported ($M) Y/Y Change Revenue $1,085 12% Organic Constant Currency Revenue 12% Adjusted EBITDA $394 11% Adjusted EBITDA Margin 36.3% (50)bps Adjusted Diluted EPS $1.04 14% • Organic constant currency revenue growth of +12%, or +8% excluding mortgage • Strong underlying margin expansion excluding impact of lower margin breach revenues (80bps drag) and last year’s lower incentive compensation (100bps+ impact) Q3 2024 Results

11@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. U.S. Markets third quarter 2024 highlights Note: Rows may not foot due to rounding. For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. • U.S. Financial Services +17%, or +4% excluding mortgage − Card & Banking +5% − Consumer Lending +2% − Auto +1% − Mortgage +63%, compared to inquiries -8% • Emerging Verticals +3% led by double-digit growth in Insurance • Consumer Interactive +21% driven by recent breach remediation wins Reported ($M) Reported Y/Y FX Impact Organic Constant Currency Revenue $848 12% – 12% Financial Services 367 17% – 17% Emerging Verticals 307 3% – 3% Consumer Interactive 174 21% – 21% Adjusted EBITDA $320 9% – 9% Q3 2024 Results

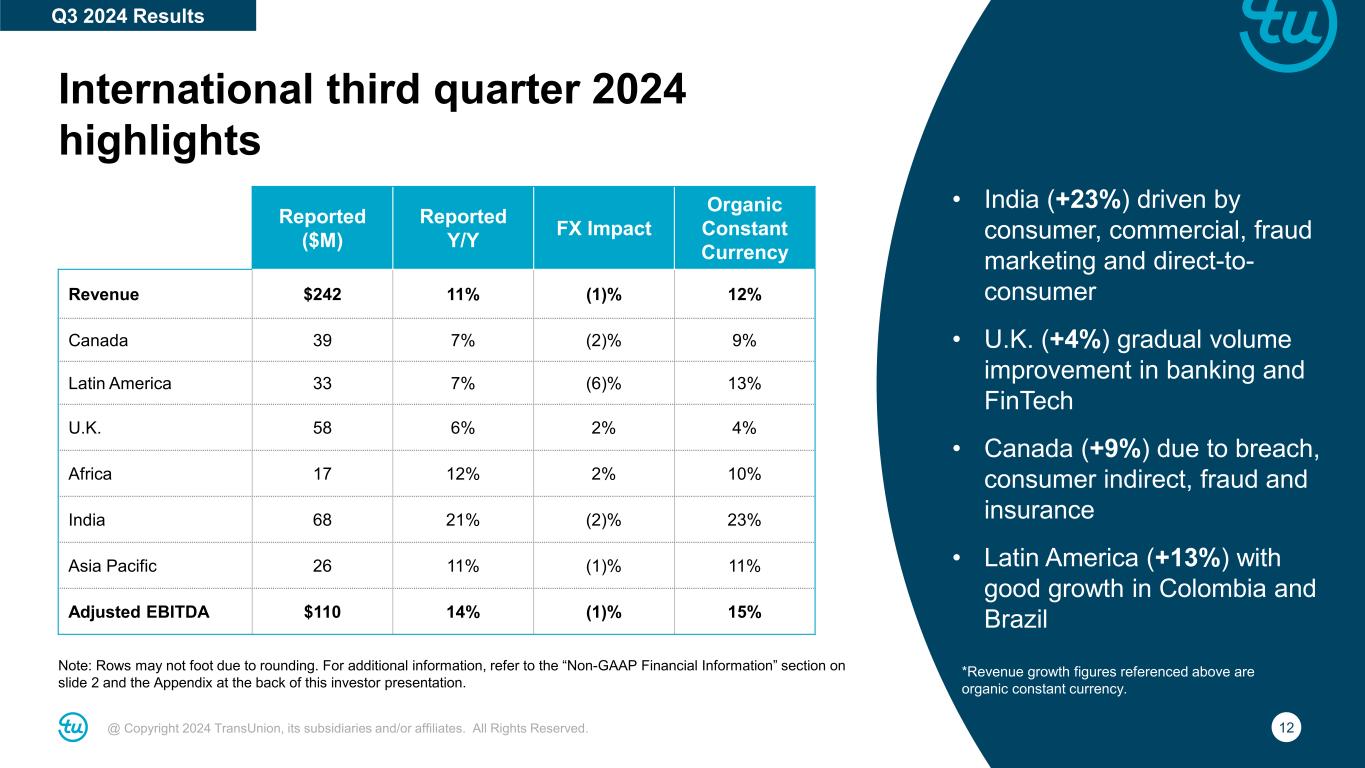

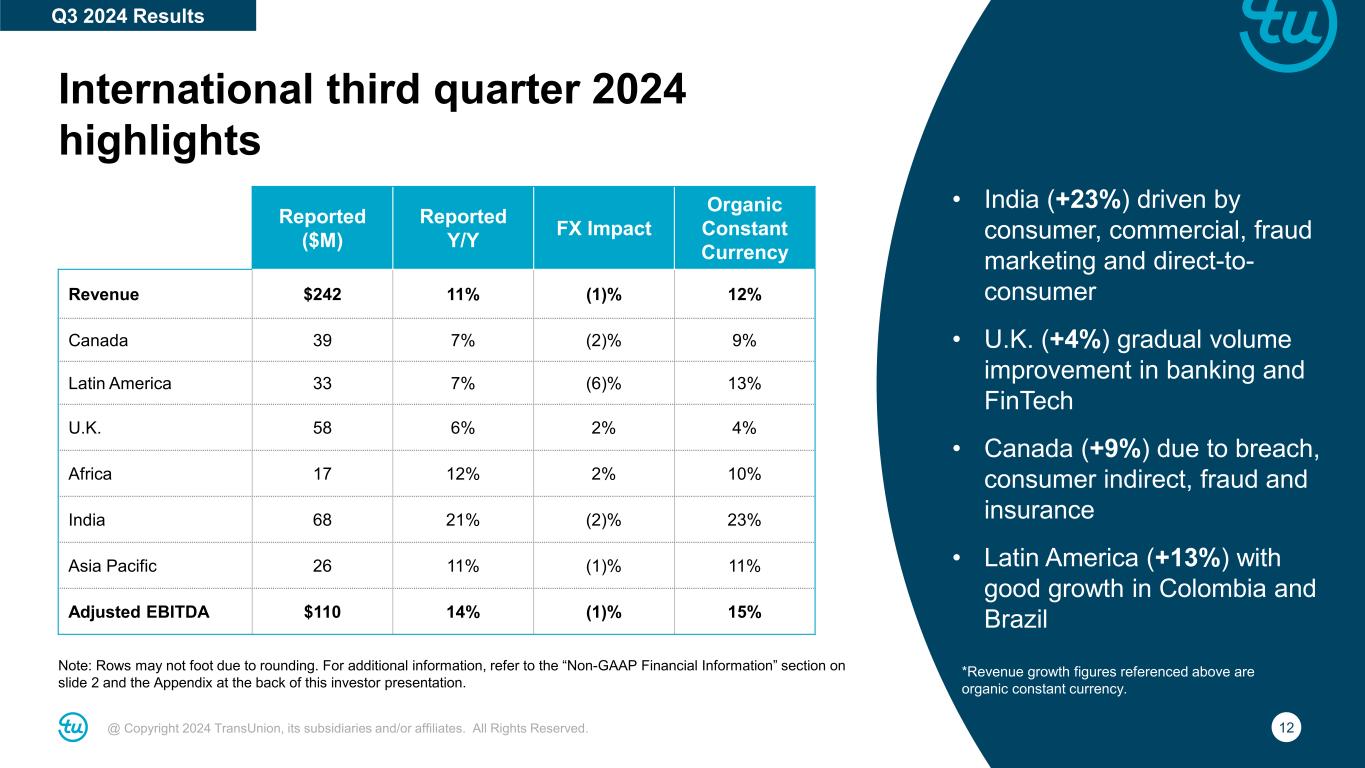

12@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. International third quarter 2024 highlights Note: Rows may not foot due to rounding. For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. • India (+23%) driven by consumer, commercial, fraud marketing and direct-to- consumer • U.K. (+4%) gradual volume improvement in banking and FinTech • Canada (+9%) due to breach, consumer indirect, fraud and insurance • Latin America (+13%) with good growth in Colombia and Brazil Reported ($M) Reported Y/Y FX Impact Organic Constant Currency Revenue $242 11% (1)% 12% Canada 39 7% (2)% 9% Latin America 33 7% (6)% 13% U.K. 58 6% 2% 4% Africa 17 12% 2% 10% India 68 21% (2)% 23% Asia Pacific 26 11% (1)% 11% Adjusted EBITDA $110 14% (1)% 15% *Revenue growth figures referenced above are organic constant currency. Q3 2024 Results

13@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 1We define Leverage Ratio as net debt divided by Consolidated Adjusted EBITDA for the most recent twelve-month period including twelve months of Adjusted EBITDA from significant acquisitions. Net debt is defined as total debt less cash and cash equivalents as reported on the balance sheet as of the end of the period. Total debt is netted for deferred financing fees / original issue discount. Note: For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. Excess cash targeted for debt prepayment Leverage Ratio1 4.3x 3.9x 3.4x 3.1x 4.1x 3.5x 3.1x 3.5x 3.8x 3.6x 3.1x ~3x <3.0x 2015 IPO 2015 2016 2017 2018 2019 2020 2021 2022 2023 Q3 2024 YE 2024 Target Balance Sheet • Roughly $5.2 billion of debt and $643 million cash at quarter-end • $25 million debt prepayment in Q3; $105 million year-to- date • Average effective cost of debt (net of swaps) of 4.7%, below current SOFR

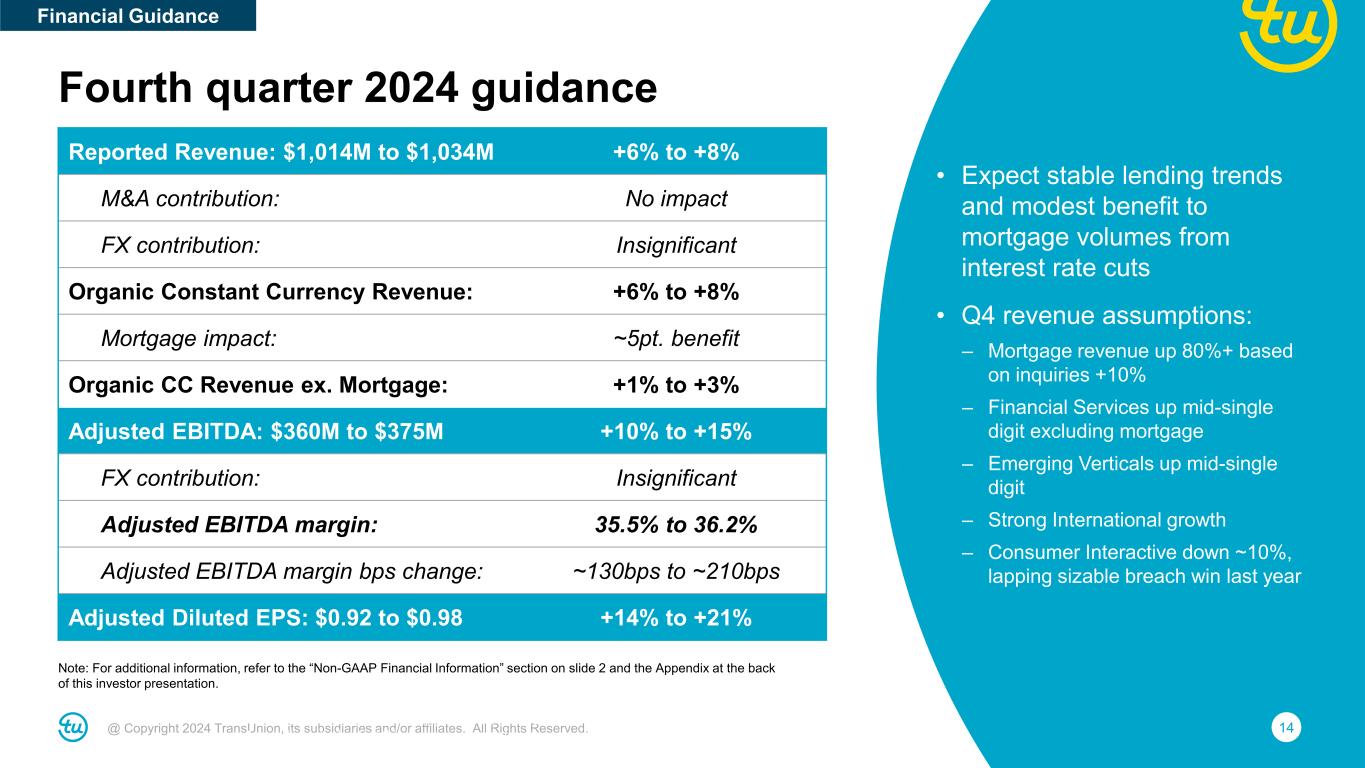

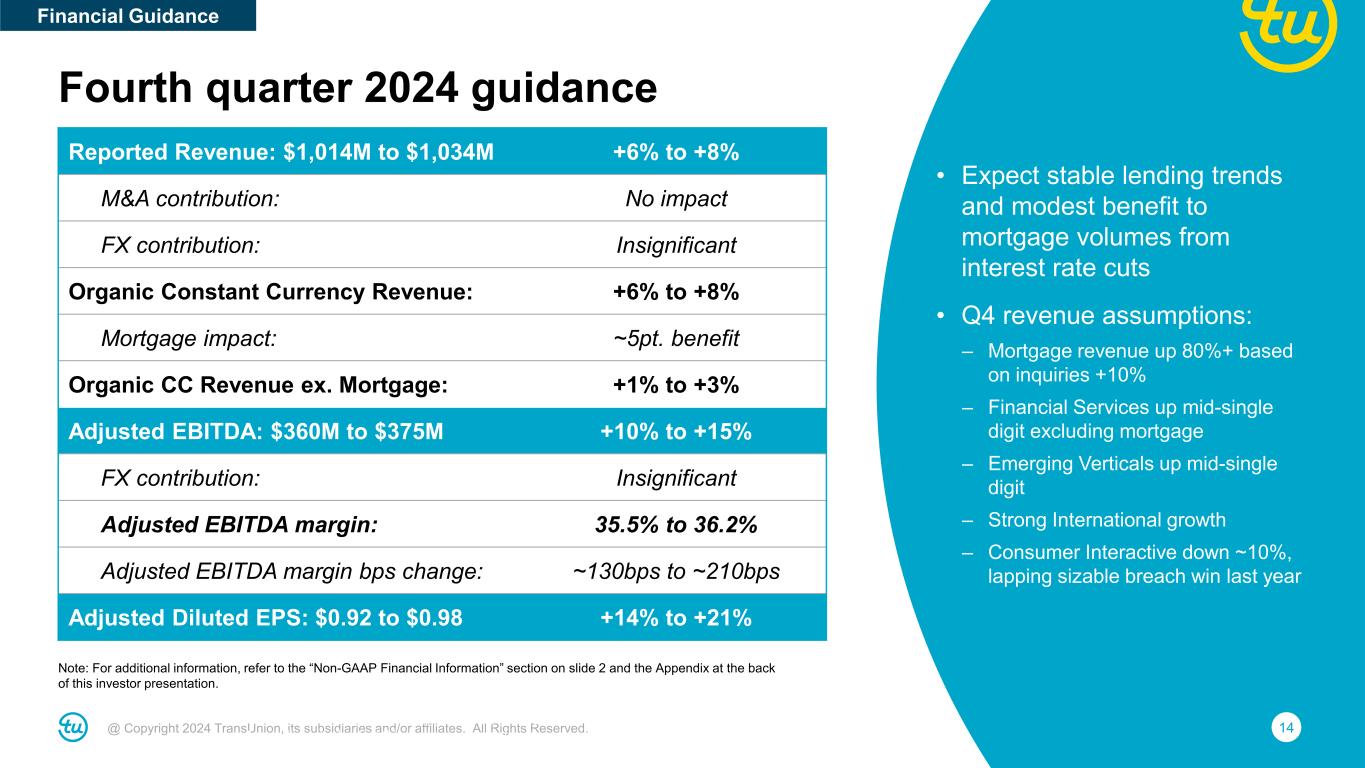

14@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. Reported Revenue: $1,014M to $1,034M +6% to +8% M&A contribution: No impact FX contribution: Insignificant Organic Constant Currency Revenue: +6% to +8% Mortgage impact: ~5pt. benefit Organic CC Revenue ex. Mortgage: +1% to +3% Adjusted EBITDA: $360M to $375M +10% to +15% FX contribution: Insignificant Adjusted EBITDA margin: 35.5% to 36.2% Adjusted EBITDA margin bps change: ~130bps to ~210bps Adjusted Diluted EPS: $0.92 to $0.98 +14% to +21% Note: For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. Fourth quarter 2024 guidance • Expect stable lending trends and modest benefit to mortgage volumes from interest rate cuts • Q4 revenue assumptions: – Mortgage revenue up 80%+ based on inquiries +10% – Financial Services up mid-single digit excluding mortgage – Emerging Verticals up mid-single digit – Strong International growth – Consumer Interactive down ~10%, lapping sizable breach win last year Note: For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. Financial Guidance

15@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. • Guidance raise driven by Q3 outperformance and ongoing business momentum • U.S. mortgage: Expect ~60% revenue growth based on less than 5% inquiry decline – U.S. mortgage was ~10% of LTM revenues Note: For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. Full-year 2024 revenue guidance Reported Revenue: $4.161B to $4.181B ~+9% M&A contribution: No impact FX contribution: Insignificant Organic Constant Currency Revenue: ~+9% Mortgage impact: ~4pt. benefit Organic CC Revenue ex. Mortgage: ~+5% Organic Growth Assumptions • U.S. Markets up high-single digit (up low-single digit excluding mortgage) – Financial Services up mid-teens (up low-single digit excluding mortgage) – Emerging Verticals up mid-single digit – Consumer Interactive up low-single digit • International up low-double digit (constant-currency) Note: For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. Financial Guidance

16@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. The adjusted tax rate guidance of ~23.5% reflects expected full year GAAP effective rate of ~23.2% plus the elimination of discrete adjustments and other items totaling ~0.3%. For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. Full-year 2024 Adjusted EBITDA, Adjusted Diluted EPS and other guidance Adjusted EBITDA: $1.488B to $1.503B +11% to +12% FX contribution: Insignificant Adjusted EBITDA margin: 35.8% to 36.0% Adjusted EBITDA margin bps change: +70bps to +90bps Adjusted Diluted EPS: $3.87 to $3.93 +15% to +17% Adjusted Tax Rate: ~23.5% Total D&A: ~$535M D&A ex. step-up from 2012 change in control and subsequent acquisitions: ~$250M Net Interest Expense: ~$245M CapEx: ~8% of revenue • Anticipate using excess cash for debt prepayment; however, guidance assumes no further debt prepayment • One-time costs related to transformation program expected to total ~$200M in 2024 ($145M year-to-date) Financial Guidance

17@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. Achieved key milestones in transformation, driving material savings and accelerating innovation Exceeded Q3 guidance for revenue, Adjusted EBITDA and Adjusted Diluted EPS Raising 2024 guidance, now expect 9% revenue growth and 15% to 17% Adjusted Diluted EPS growth Note: For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation.

18@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. Q&A

19@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. Appendices and Non-GAAP Reconciliations

20@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. U.S. Markets revenue composition (FY 2023) Financial Services: ~$1.2B Emerging Verticals: ~$1.2B Consumer Interactive: ~$0.6B Card & Banking 35% Consumer Lending 23% Mortgage 22% Auto 20% Insurance 25% Tech, Retail & E- Commerce 22%Tele- Communications 20% Media 14% Tenant & Employment Screening 7% Collections 6% Public Sector 5% Direct 33% Indirect 67% Note: ~1% of revenue in administrative/other

@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 21 Debt profile and 2024F interest expense bridge Debt Profile (09/30/24) 2024F Interest Expense Bridge Notional ($B) Expiry Rate Term Loan Tranche Term Loan A-4 1.3 Jun’29 SOFR + 1.50% Term Loan B-5 0.6 Nov’26 SOFR + CSA + 1.75% Term Loan B-7 1.9 Dec’28 SOFR + 2.00% Term Loan B-8 1.5 Jun’31 SOFR + 1.75% Swaps* June 2022 1.1 Jun’25 Receive SOFR, Pay 0.87% December 2021 1.6 Dec’26 Receive SOFR, Pay 1.39% December 2022 1.3 Dec’24 Receive SOFR, Pay 4.36% • ~75% of debt is currently swapped to fixed rate • 2024 net interest expense guidance assumes no additional debt prepayment or incremental debt $267M ~$245M ~($12M) ~($9M) ~($1M) 2023 Net Interest Expense 2023 / 2024 Prepayments Refinancings SOFR/ Other 2024F Net Interest Expense

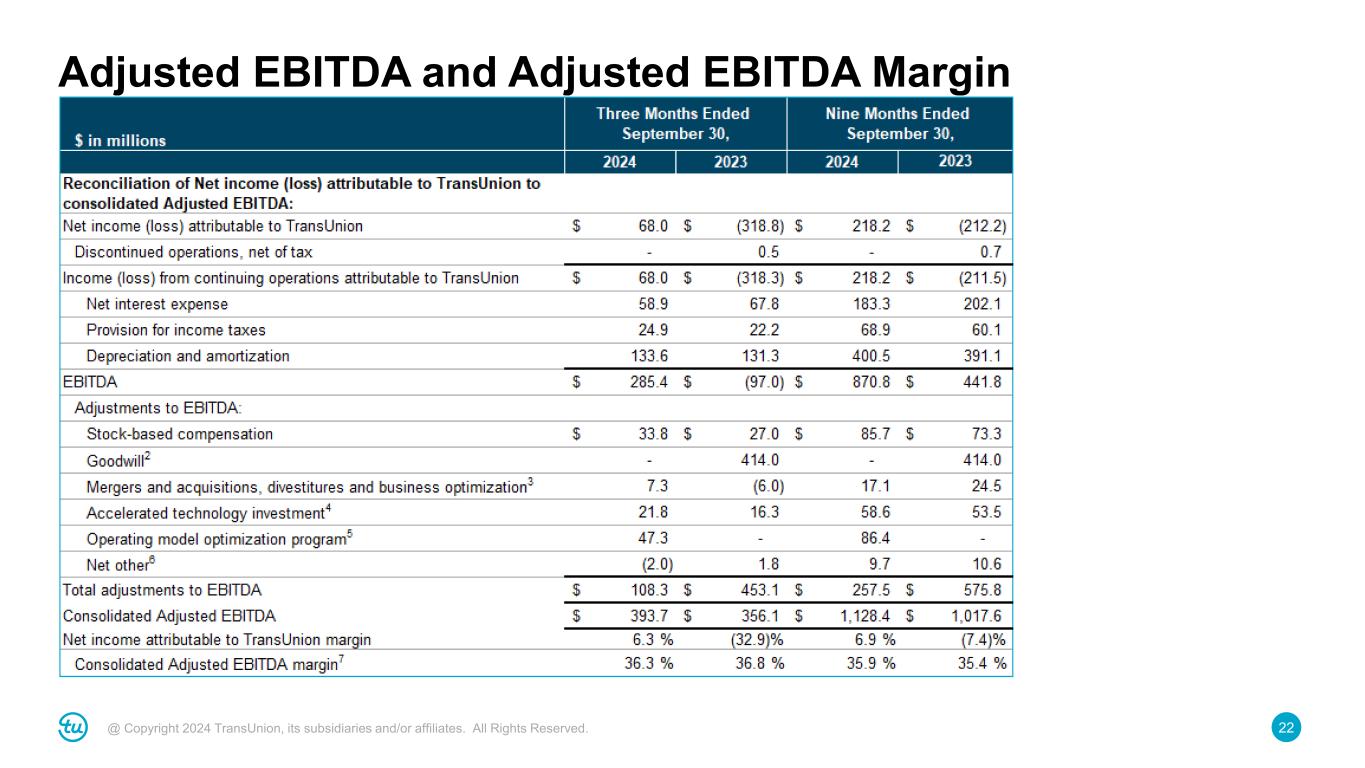

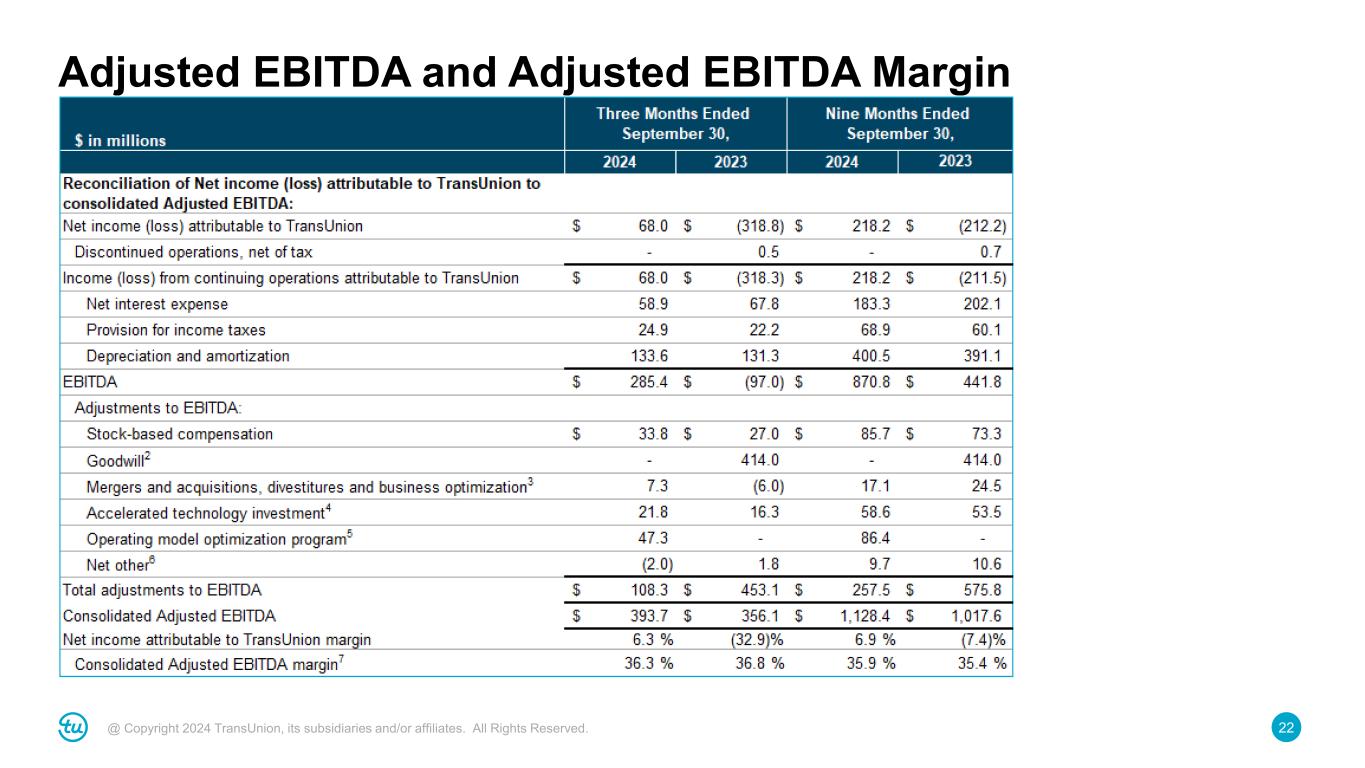

22@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. Adjusted EBITDA and Adjusted EBITDA Margin

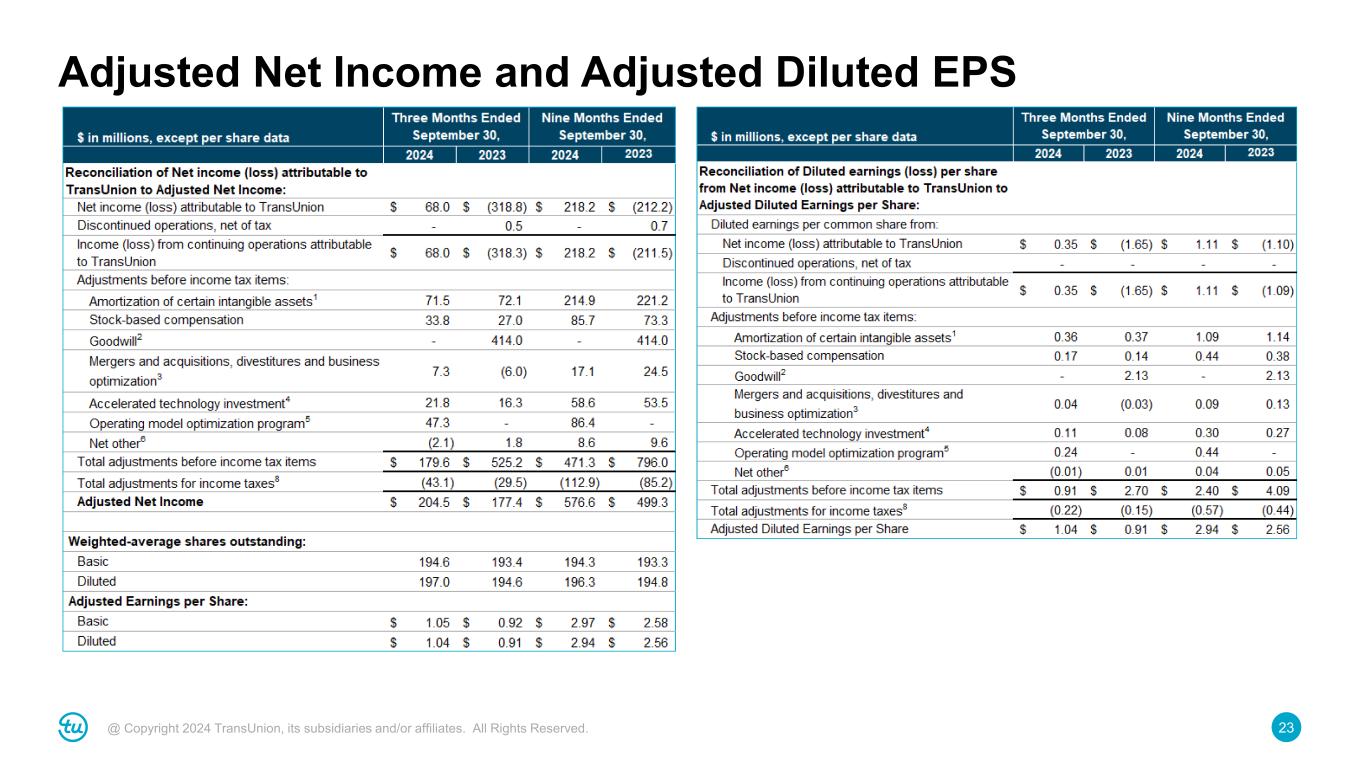

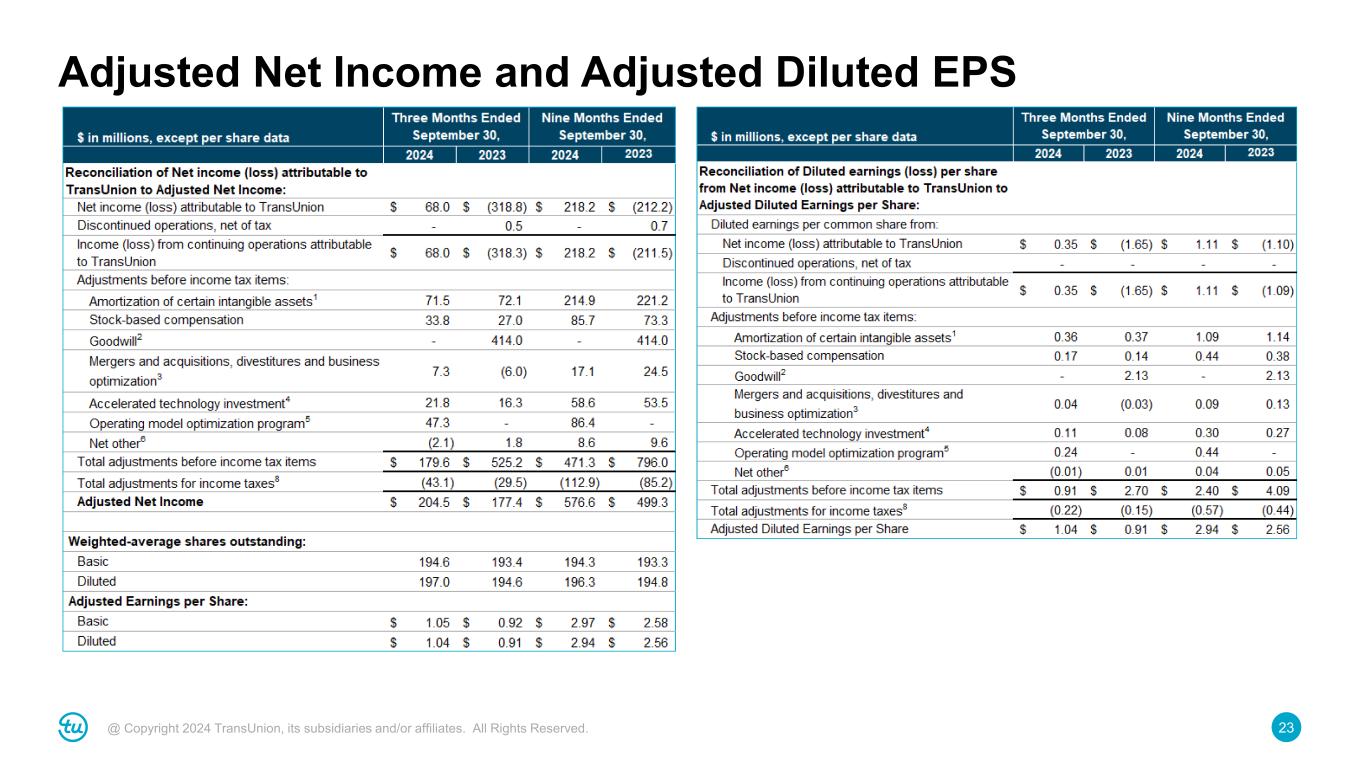

23@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. Adjusted Net Income and Adjusted Diluted EPS

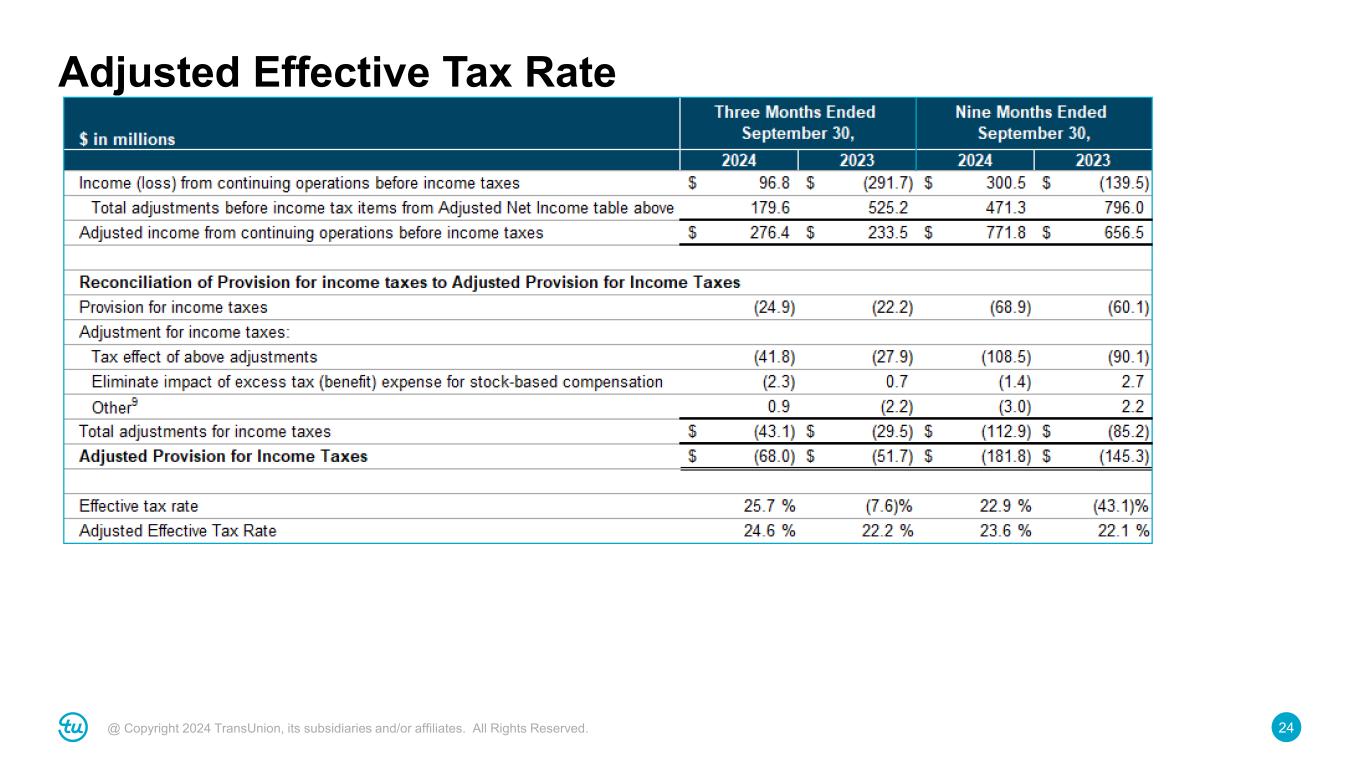

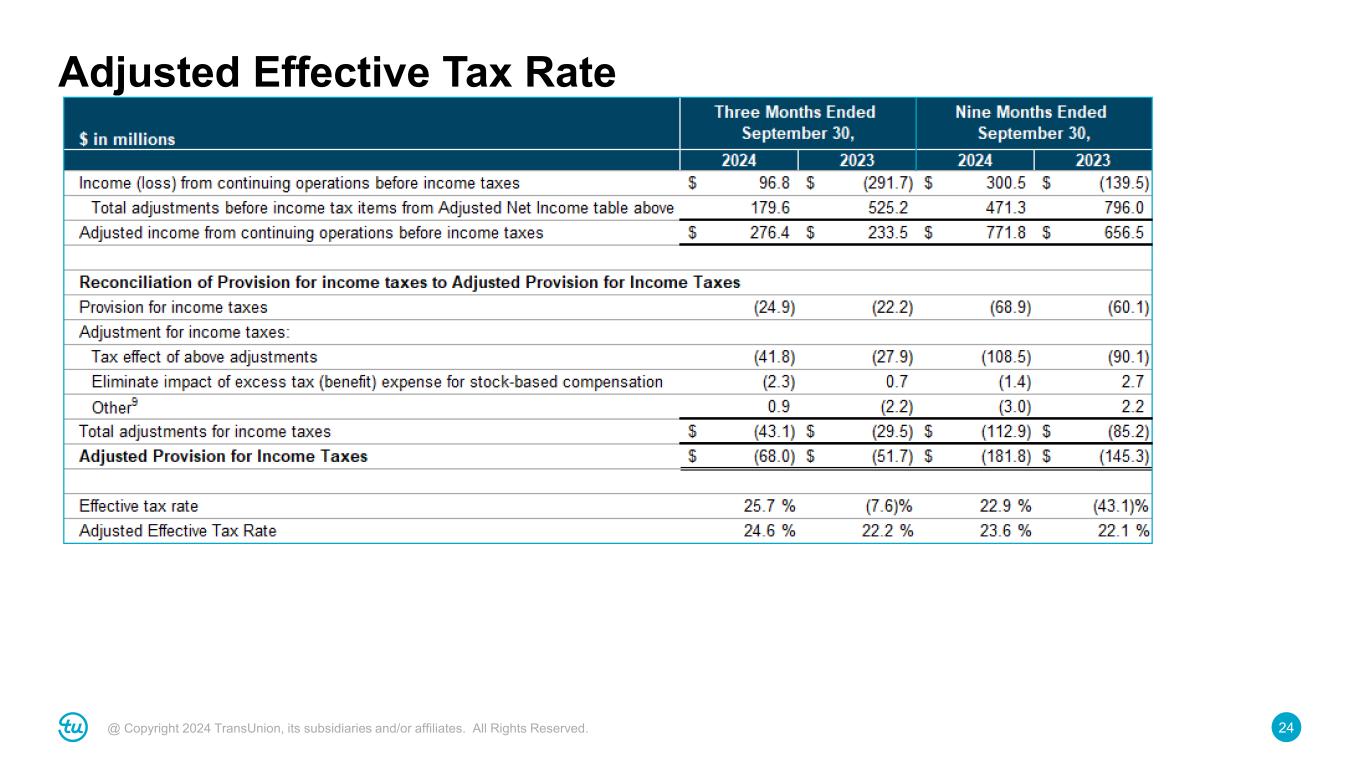

24@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. Adjusted Effective Tax Rate

25@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. Leverage Ratio

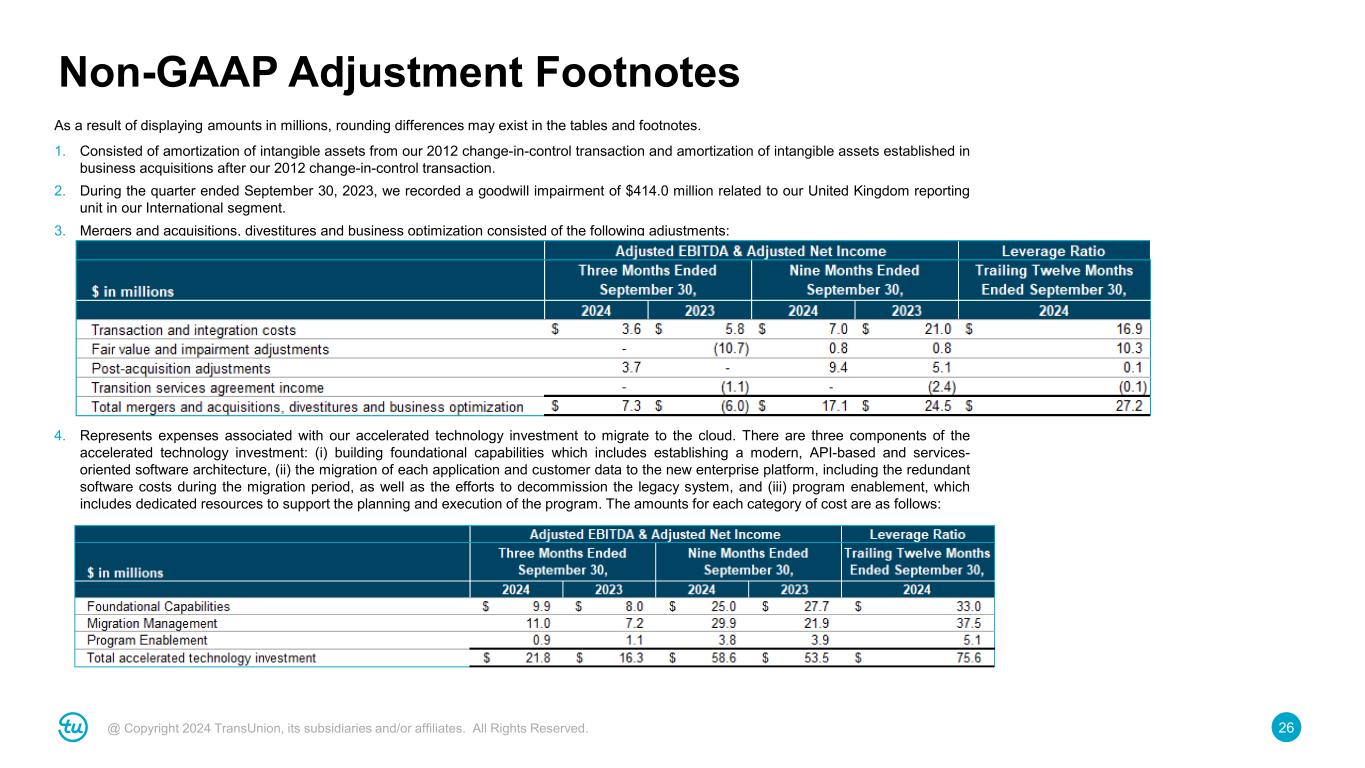

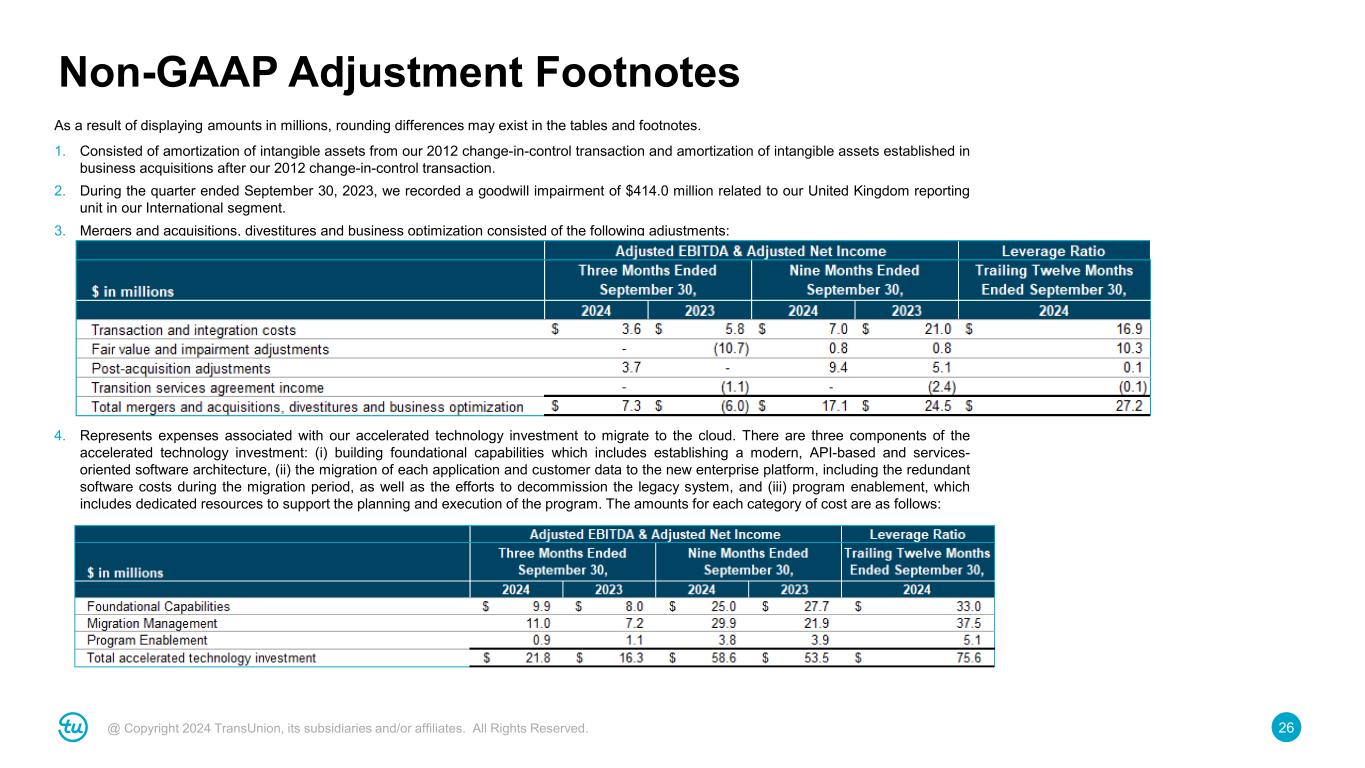

26@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. Non-GAAP Adjustment Footnotes As a result of displaying amounts in millions, rounding differences may exist in the tables and footnotes. 1. Consisted of amortization of intangible assets from our 2012 change-in-control transaction and amortization of intangible assets established in business acquisitions after our 2012 change-in-control transaction. 2. During the quarter ended September 30, 2023, we recorded a goodwill impairment of $414.0 million related to our United Kingdom reporting unit in our International segment. 3. Mergers and acquisitions, divestitures and business optimization consisted of the following adjustments: 4. Represents expenses associated with our accelerated technology investment to migrate to the cloud. There are three components of the accelerated technology investment: (i) building foundational capabilities which includes establishing a modern, API-based and services- oriented software architecture, (ii) the migration of each application and customer data to the new enterprise platform, including the redundant software costs during the migration period, as well as the efforts to decommission the legacy system, and (iii) program enablement, which includes dedicated resources to support the planning and execution of the program. The amounts for each category of cost are as follows:

27@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. Non-GAAP Adjustment Footnotes 5. Operating model optimization consisted of the following adjustments: 6. Net other consisted of the following adjustments: 7. Consolidated Adjusted EBITDA margin is calculated by dividing Consolidated Adjusted EBITDA by total revenue. 8. Total adjustments for income taxes represents the total of adjustments discussed to calculate the Adjusted Provision for Income Taxes 9. Other adjustments for income taxes include:

28@ Copyright 2024 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. Adjusted EBITDA and Adjusted EPS Guidance As a result of displaying amounts in millions, rounding differences may exist in the table. 1. These adjustments include the same adjustments we make to our Adjusted EBITDA and Adjusted Net Income as discussed in the Non-GAAP Financial Measures section of our Earnings Release. 2. Consolidated Adjusted EBITDA margin is calculated by dividing Consolidated Adjusted EBITDA by total revenue.