On July 15, 2021, the terms of the Credit Facility were amended to, among other things, allow WhiteHorse Credit to reduce the applicable margins for interest rates to 2.35%, extend the non-call period from November 22, 2021 to November 22, 2022, extend the end of the reinvestment period from November 22, 2023 to November 22, 2024 and extend the scheduled termination date from November 22, 2024 to November 22, 2025.

On October 4, 2021, the terms of the Credit Facility were amended to, among other things, established a temporary upsize to the borrowing capacity under the Credit Facility, which allowed WhiteHorse Credit to borrow up to $335,000 for a three-month period beginning on October 4, 2021.

On January 4, 2022, the terms of the Credit Facility were amended to, among other things, continue to establish a temporary upsize to the borrowing capacity under the Credit Facility, which allowed WhiteHorse Credit to borrow up to $335,000 for a four-month period that originally began on October 4, 2021.

On February 4, 2022, the terms of the Credit Facility were further amended to, among other things (i) increase WhiteHorse Credit’s availability under the Credit Facility from $285,000 to $310,000 (the “$25,000 Increase”), (ii) increase the minimum funding amount from $200,000 to $217,000, (iii) extend an additional temporary increase of $25,000 in availability under the Credit Facility, allowing WhiteHorse Credit to borrow up to $335,000 through April 4, 2022 (the “$25,000 Temporary Increase”), and (iv) apply an annual interest rate equal to applicable SOFR plus 2.50% to any borrowings under the $25,000 Increase in the Credit Facility and the $25,000 Temporary Increase in availability under the Credit Facility.

On March 30, 2022, the terms of the Credit Facility were further amended to, among other things: (i) increase WhiteHorse Credit’s availability under the Credit Facility from $310,000 to $335,000; (ii) retain an accordion feature which allows for the expansion of the borrowing limit up to $375,000; and (iii) increase the minimum funding amount from $217,000 to $234,500.

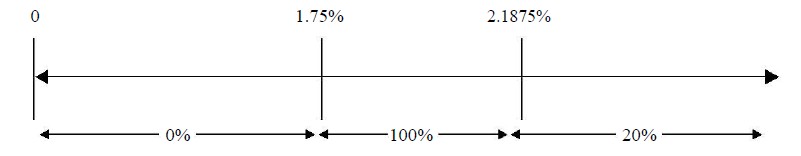

The Credit Facility bears interest at LIBOR plus 2.35% on outstanding USD denominated borrowings up to $285,000 and SOFR plus 2.50% on borrowings above $285,000. The Credit Facility bears interest at EURIBOR for EUR denominated borrowings, CDOR for CAD denominated borrowings, SONIA for GBP denominated, plus, in each case, a spread of 2.35% on outstanding borrowings. The Company is required to pay a non-usage fee which accrues at 0.75% per annum on the average daily unused amount of the financing commitments to the extent the aggregate principal amount available under the Credit Facility has not been borrowed. The minimum borrowing requirement is $234,500. In connection with the Credit Facility, WhiteHorse Credit pledged securities with a fair value of approximately $624,123 as of December 31, 2022 as collateral. The Credit Facility has a maturity date of November 22, 2025.

Under the Credit Facility, the Company has made certain customary representations and warranties and is required to comply with various covenants, including leverage restrictions, reporting requirements and other customary requirements for similar credit facilities. As of December 31, 2022, the Company had $255,145 in outstanding borrowings and $79,855 undrawn under the Credit Facility. As of December 31, 2022, weighted average outstanding borrowings were $264,411 at a weighted average interest rate of 4.04%. As of December 31, 2022, the interest rate in effect on outstanding borrowings was 7.11%. The Company’s ability to draw down undrawn funds under the Credit Facility is determined by collateral and portfolio quality requirements stipulated in the credit and security agreement. As of December 31, 2022, $79,855 was available to be drawn by the Company based on these requirements.

As of December 31, 2021, the Company had $291,637 in outstanding borrowings and $43,363 undrawn under the Credit Facility. As of December 31, 2021, the weighted average outstanding borrowings were $245,934 at a weighted average interest rate of 2.60%. As of December 31, 2021, the interest rate in effect on outstanding borrowings was 2.55%. The Company’s ability to draw down undrawn funds under the Credit Facility is determined by collateral and portfolio quality requirements stipulated in the credit and security agreement. As of December 31, 2021, $43,363 was available to be drawn by the Company based on these requirements.