- SUN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B3 Filing

Sunoco (SUN) 424B3Prospectus supplement

Filed: 21 Oct 14, 12:00am

Use these links to rapidly review the document

TABLE OF CONTENTS

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-192335

This preliminary prospectus supplement relates to an effective registration statement under the Securities Act of 1933, but the information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 21, 2014

PRELIMINARY PROSPECTUS SUPPLEMENT

(To the Prospectus dated December 5, 2013)

8,000,000 Common Units

Representing Limited Partner Interests

SUSSER PETROLEUM PARTNERS LP

We are selling 8,000,000 common units representing limited partner interests of Susser Petroleum Partners LP ("common units"). Our common units are listed on the New York Stock Exchange ("NYSE") under the symbol "SUSP." The last reported sales price of our common units on the NYSE on October 17, 2014 was $50.21 per common unit.

Investing in our common units involves risks. You should carefully consider each of the factors described under "Risk Factors" beginning on page S-15 of this prospectus supplement and beginning on page 3 of the accompanying prospectus and the other risk factors incorporated by reference into this prospectus supplement.

| | Per Common Unit | Total | ||

|---|---|---|---|---|

| Public offering price | $ | $ | ||

| Underwriting discount | $ | $ | ||

| Proceeds, before expenses, to Susser Petroleum Partners LP | $ | $ |

The underwriters may also purchase up to an additional 1,200,000 common units on the same terms and conditions as set forth above within 30 days from the date of this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the common units to purchasers on or about , 2014.

Joint Book-Running Managers

| Morgan Stanley | BofA Merrill Lynch | Barclays | ||

| Citigroup | Credit Suisse | Deutsche Bank Securities | ||

| Goldman, Sachs & Co. | Jefferies | J.P. Morgan | ||

| RBC Capital Markets | UBS Investment Bank | Wells Fargo Securities |

Prospectus Supplement dated , 2014.

| Prospectus Supplement | ||||

|---|---|---|---|---|

| | Page | |||

SUMMARY | S-1 | |||

RISK FACTORS | S-15 | |||

USE OF PROCEEDS | S-37 | |||

CAPITALIZATION | S-38 | |||

PRICE RANGE OF COMMON UNITS AND DISTRIBUTIONS | S-39 | |||

MACS AND ALOHA BUSINESSES | S-40 | |||

MATERIAL TAX CONSIDERATIONS | S-42 | |||

UNDERWRITING | S-44 | |||

VALIDITY OF OUR COMMON UNITS | S-51 | |||

EXPERTS | S-51 | |||

INCORPORATION BY REFERENCE | S-51 | |||

FORWARD-LOOKING STATEMENTS | S-53 | |||

Prospectus Dated December 5, 2013 | ||||

| | Page | |||

ABOUT THIS PROSPECTUS | 1 | |||

ABOUT SUSSER PETROLEUM PARTNERS LP | 1 | |||

WHERE YOU CAN FIND MORE INFORMATION | 1 | |||

INFORMATION WE INCORPORATE BY REFERENCE | 1 | |||

RISK FACTORS | 3 | |||

FORWARD-LOOKING STATEMENTS AND ASSOCIATED RISKS | 3 | |||

RATIO OF EARNINGS TO FIXED CHARGES | 4 | |||

USE OF PROCEEDS | 5 | |||

DESCRIPTION OF THE COMMON UNITS AND PREFERRED UNITS | 6 | |||

CASH DISTRIBUTION POLICY AND RESTRICTIONS ON DISTRIBUTIONS | 8 | |||

PROVISIONS OF OUR PARTNERSHIP AGREEMENT RELATING TO CASH DISTRIBUTIONS | 10 | |||

CONFLICTS OF INTEREST AND FIDUCIARY DUTIES | 22 | |||

THE PARTNERSHIP AGREEMENT | 30 | |||

DESCRIPTION OF PARTNERSHIP SECURITIES | 43 | |||

DESCRIPTION OF THE WARRANTS | 44 | |||

DESCRIPTION OF THE RIGHTS | 45 | |||

DESCRIPTION OF DEBT SECURITIES | 46 | |||

INVESTMENT IN SUSSER PETROLEUM PARTNERS LP BY EMPLOYEE BENEFITS PLANS | 55 | |||

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES | 56 | |||

PLAN OF DISTRIBUTION | 68 | |||

LEGAL MATTERS | 70 | |||

EXPERTS | 70 | |||

S-i

Important Notice About Information in this

Prospectus Supplement and the Accompanying Prospectus

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part is the accompanying prospectus, which gives more general information about securities we may offer from time to time, some of which may not apply to this offering of common units.

If the information relating to this offering varies between the prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement.

You should rely only on the information contained in or incorporated by reference in this prospectus supplement, the accompanying prospectus and any free writing prospectus prepared by or on behalf of us. We have not, and the underwriters have not, authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. This prospectus supplement and accompanying prospectus are not an offer to sell or a solicitation of an offer to buy our common units in any jurisdiction where such offer or sale would be unlawful. You should not assume that the information contained in this prospectus supplement or the accompanying prospectus is accurate as of any date other than the date on the front of those documents or that any information we have incorporated by reference is accurate as of any date other than the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since such dates.

The information in this prospectus supplement is not complete. You should review carefully all of the detailed information appearing in this prospectus supplement, the accompanying prospectus and the documents we have incorporated by reference before making any investment decision.

S-ii

This summary highlights information included or incorporated by reference in this prospectus supplement. It does not contain all of the information that may be important to you. You should read carefully the entire prospectus supplement, the accompanying prospectus, the documents incorporated by reference and the other documents to which we refer herein for a more complete understanding of this offering.

As used in this prospectus supplement, the "Partnership," "SUSP," "we," "our," "us" or similar terms refer to Susser Petroleum Partners LP, Susser Petroleum Company LLC, our predecessor for accounting purposes (our "Predecessor"), and our consolidated subsidiaries, as applicable and appropriate. References in this prospectus supplement to our "general partner" refer to Susser Petroleum Partners GP LLC, a Delaware limited liability company and the general partner of the Partnership. References to "ETP" refer to Energy Transfer Partners, L.P., a Delaware limited partnership that owns and controls our general partner. References to "SUSS" refer to Susser Holdings Corporation, an indirect wholly owned subsidiary of ETP. References to "MACS" refer to Mid-Atlantic Convenience Stores, LLC and its wholly owned subsidiaries. References to "Aloha" refer to Aloha Petroleum, Ltd. References to "Sunoco" refer to Sunoco, Inc. and its subsidiaries. All pro forma financial information included in this prospectus supplement give effect to the recent MACS Acquisition and the pending Aloha Acquisition, each as described under "—Recent Developments," and this offering.

We are a growth-oriented Delaware limited partnership formed by SUSS to engage in the primarily fee-based wholesale distribution of motor fuels to SUSS and third parties. We closed the initial public offering ("IPO") of our common units on September 25, 2012. As a result of the MACS Acquisition (as defined in "—Recent Developments" below), we, through our indirect wholly owned subsidiary, Susser Petroleum Property Company LLC, a Delaware limited liability company ("PropCo"), also engage in the retail sale of motor fuel and the operation of convenience stores and such operations will expand following the closing of our pending Aloha Acquisition (as defined in "—Recent Developments" below), which we expect will occur in the fourth quarter of 2014. Please read "MACS and Aloha Businesses."

As of June 30, 2014, SUSS operated 636 retail convenience stores, primarily in growing Texas markets under its proprietaryStripes® convenience store brand. Included in the retail portfolio are 47Sac-N-Pac™ convenience stores located in central Texas that SUSS acquired in January 2014.Stripes® is a leading independent chain of convenience stores in Texas based on store count and retail motor fuel volumes sold. Our business is integral to the success of SUSS's retail operations, and SUSS purchases all of its current, and has contracted to purchase all of its future, motor fuel from us. For the year ended December 31, 2013 and the six months ended June 30, 2014, we distributed 1.1 billion and 571.0 million gallons of motor fuel, respectively, to SUSS'sStripes® andSac-N-Pac™ branded convenience stores and consignment locations, and 517.8 million and 324.2 million gallons of motor fuel, respectively, to other third party customers. We believe we are one of the largest independent motor fuel distributors by gallons in Texas, and among the largest distributors of Valero and Chevron branded motor fuel in the United States. Pro forma for the Acquisitions (as defined in "—Recent Developments" below), for the year ended December 31, 2013 and the six months ended June 30, 2014, we distributed 2,261.9 million and 1,231.9 million gallons of motor fuel, respectively, in connection with our fuel distribution business.

We purchase motor fuel primarily from independent refiners and major oil companies and distribute it throughout Texas and in Louisiana, New Mexico and Oklahoma to (i) SUSS'sStripes® andSac-N-Pac™ branded convenience stores and other independently operated consignment locations where SUSS sells motor fuel to retail customers; (ii) more than 620 convenience stores and retail fuel outlets operated by independent operators, which we refer to as "dealers," pursuant to long-term distribution agreements; and (iii) approximately 1,900 other commercial customers, including unbranded convenience stores, other fuel distributors, school districts and municipalities and other industrial customers. Additionally, following the MACS Acquisition, we operate or supply to approximately 311 retail locations in Virginia, Maryland,

S-1

Tennessee and Georgia, which includes 40TigerMarket™ locations acquired by MACS in May 2014. Following the closing of our pending Aloha Acquisition, which we expect will occur in the fourth quarter of 2014, we will also operate or supply fuel to approximately 98 additional retail locations in Hawaii. For the six months ended June 30, 2014, MACS sold 226.0 million gallons, and Aloha sold 86.7 million gallons, of motor fuel in connection with their respective retail businesses. Please read "MACS and Aloha Businesses."

In addition to distributing motor fuel, we also distribute other petroleum products such as propane and lube oil, and we receive rental income from real estate that we lease or sublease. As of October 17, 2014, we owned 237 convenience stores, including 54 newly built stores that we acquired from SUSS in sale leaseback transactions following our IPO and 129 stores acquired in the MACS Acquisition. As of October 17, 2014, we operated 62 of our 237 owned locations and leased the remaining 175 locations to third parties.

Our wholly owned subsidiary, Susser Petroleum Operating Company LLC, a Delaware limited liability company ("OpCo"), operates a significant majority of our business pursuant to contracts that our counsel has concluded generate qualifying income under Section 7704 of the Internal Revenue Code of 1986, as amended ("qualifying income"). We do not pay U.S. federal income tax on the portion of our business conducted by OpCo. OpCo's wholly owned subsidiary, PropCo, conducts most of our business operations that our counsel has not concluded generate qualifying income. PropCo is classified as a corporation for U.S. federal income tax purposes and pays U.S. federal income tax with respect to its income from such operations.

Our Relationship with Energy Transfer Partners, L.P.

ETP is one of the largest publicly traded master limited partnerships in the United States in terms of equity market capitalization (approximately $20.34 billion as of October 17, 2014). ETP, through its wholly owned operating subsidiaries, is engaged primarily in natural gas and natural gas liquids transportation, storage and fractionation services. ETP is also engaged in refined product and crude oil operations including transportation and retail marketing of gasoline and middle distillates through its subsidiaries. Sunoco, a wholly owned operating subsidiary of ETP, operates a retail business with a network of 439 company-operated retail fuel outlets and convenience stores, approximately 4,400 retail fuel outlets operated by independent operators pursuant to long-term distribution agreements, as well as a commercial fuel distribution business which supplies approximately 600 million gallons per year. Sunoco had motor fuel sales of 5,357.1 million and 2,625.8 million gallons for the year ended December 31, 2013 and the six months ended June 30, 2014, respectively. ETP acquired SUSS on August 29, 2014 (the "Merger"). Prior to the Merger, SUSS owned our general partner, all of the incentive distribution rights and a 50.2% limited partner interest in us. Shortly after the Merger, SUSS's interests in the general partner and the incentive distribution rights were distributed to ETP.

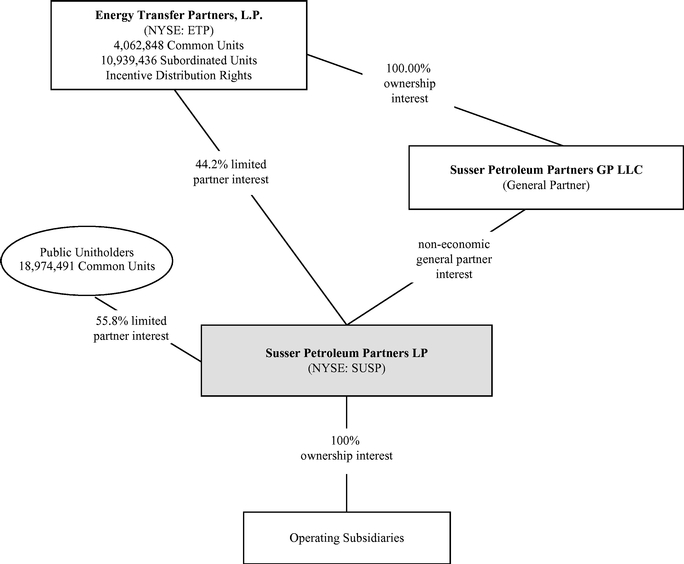

One of our principal strengths is our relationship with ETP. ETP owns (i) an indirect 100% equity interest in SUSS, (ii) 100% of our general partner, (iii) all of our incentive distribution rights and (iv) after giving effect to the completion of this offering, a 44.2% limited partner interest in us (assuming no exercise of the underwriters' option to purchase additional common units). Given ETP's significant ownership in us, we believe ETP will be motivated to promote and support the successful execution of our business strategies. In particular, we believe it will be in ETP's best interest to, and ETP has publically announced its intent to, contribute all of SUSS's and Sunoco's retail and wholesale fuel distribution assets to us over time and to facilitate organic growth opportunities and accretive acquisitions from third parties, although ETP is under no obligation to contribute any assets to us or accept any offer for its assets that we may choose to make. We believe the terms and conditions of all of our agreements with ETP and related affiliates are generally no less favorable to either party than those that could have been negotiated with unaffiliated parties with respect to similar services.

S-2

Our primary business objective is to increase our quarterly cash distribution per unit over time. We intend to accomplish this objective by executing the following strategies:

We believe that we are well positioned to execute our business strategies successfully because of the following competitive strengths:

New Credit Facility

On September 25, 2014, we entered into a new credit agreement among the Partnership, as Borrower, the lenders from time to time party thereto and Bank of America, N.A., as Administrative Agent, Collateral Agent, Swingline Lender and an LC Issuer (the "Credit Agreement"). The Credit Agreement is a $1.25 billion revolving credit facility (the "New Credit Facility"), expiring September 25, 2019, which date may be extended in accordance with the terms of the Credit Agreement. The New Credit Facility can be increased from time to time upon our written request, subject to certain conditions, up to an additional $250 million. Proceeds from the New Credit Facility were used to payoff our existing revolving credit facility entered into on September 25, 2012 (the "2012 Credit Facility").

S-3

MACS Acquisition

On September 25, 2014, we entered into a contribution agreement with ETC M-A Acquisition LLC, an indirect wholly owned subsidiary of ETP ("ETC"), Mid-Atlantic Convenience Stores, LLC, an indirect wholly owned subsidiary of ETP ("MACS"), and ETP to acquire from ETC a 100% membership interest in MACS for (i) $556 million in cash, subject to certain working capital adjustments, and (ii) 3,983,540 of our common units (the "MACS Acquisition"). MACS's business consists of (a) the wholesale distribution of motor fuel and (b) the retail sale of motor fuel and the operation of convenience stores in Virginia, Maryland, Tennessee and Georgia, which include theTigerMarket™ stores acquired by MACS in May 2014. We closed the MACS Acquisition on October 1, 2014 and financed the cash portion of the consideration with borrowings under our New Credit Facility. For additional information on MACS's business, please read "MACS and Aloha Businesses—MACS."

Southside Oil LLC, a Virginia limited liability company and a subsidiary of MACS, conducts a wholesale fuel distribution business and leases real property to third parties, and such businesses will be conducted through OpCo. MACS Retail LLC, a Virginia limited liability company and a subsidiary of MACS, conducts the retail fuel sales business and convenience store operations, and such businesses will be conducted through PropCo. PropCo will be subject to U.S. federal income taxation with respect to such operations.

Pending Aloha Acquisition

On September 25, 2014, we and PropCo, entered into a purchase and sale agreement (the "Aloha Purchase Agreement") with Henger BV Inc. ("Henger") to acquire (the "Aloha Acquisition," and together with the MACS Acquisition, the "Acquisitions") all of the issued and outstanding shares of capital stock of Aloha Petroleum, Ltd. ("Aloha") for total consideration of $240 million in cash, subject to a post-closing earn-out, certain closing adjustments and before transaction costs and expenses. The Aloha Purchase Agreement contains an earn-out provision that would require PropCo to make additional purchase price payments to Henger equal to 50% of the amount by which certain fuel gross profits of Aloha exceed $68.4 million, subject to certain adjustments, each year through December 31, 2022. We plan to finance the pending Aloha Acquisition with borrowings under our New Credit Facility. We expect to close the pending Aloha Acquisition during the fourth quarter of 2014; however, there can be no assurance that the pending Aloha Acquisition will be completed in the anticipated time frame, or at all, or that the anticipated benefits of the pending Aloha Acquisition will be realized. The closing of this offering is not conditioned on the closing of the pending Aloha Acquisition. For additional information on Aloha's business, please read "MACS and Aloha Businesses—Aloha."

Pending Name Change of the Partnership

ETP, which acquired Sunoco in 2012, has decided to change our name to Sunoco LP. Our common units will continue to be traded on the NYSE after this name change but, once the name change is completed, our common units will be traded under the ticker symbol "SUN." The choice of the "SUN" ticker symbol and the change of our name to Sunoco LP reflect ETP's intention to take advantage of the well-established Sunoco brand name and ticker symbol. We expect such changes to occur in the fourth quarter of 2014.

Director and Officer Changes

In connection with the Merger, each of the members of board of directors of our general partner (the "Board"), other than Sam L. Susser, resigned from the Board. These directors were: David P. Engel; Rob L. Jones; Frank A. Risch; Armand S. Shapiro; Bryan F. Smith, Jr.; and Sam J. Susser. Effective August 29, 2014, the following individuals were appointed to the Board: Robert W. Owens; Marshall (Mackie) McCrea, III; Christopher Curia; Martin Salinas, Jr.; K. Rick Turner; Matthew S. Ramsey; and

S-4

William P. Williams. In addition, on September 8, 2014, the size of the Board was increased to include nine directors and Richard D. Brannon was appointed to the Board as an independent director. Mr. Ramsey was appointed as a member and chairman of the Board's Audit Committee, and Mr. Turner and Mr. Williams were appointed as members of the Board's Audit Committee. Mr. Turner was appointed as a member and chairman of the Board's Compensation Committee, and Mr. Ramsey was appointed as member of the Board's Compensation Committee.

Effective August 29, 2014, in connection with Merger, the following management changes occurred: (i) Rocky B. Dewbre was appointed Executive Vice President—Channel Operations of the general partner, (ii) Gail S. Workman was appointed Senior Vice President—Sales and Operations of the general partner and (iii) Robert W. Owens was appointed as President and Chief Executive Officer of the general partner. In addition, E.V. Bonner, Jr., who served as an officer of the general partner prior to the closing of the Merger, left his position with the general partner. Mary E. Sullivan will continue to serve as Executive Vice President and Chief Financial Officer of the general partner.

Preliminary Third Quarter Estimates

We are still in the process of finalizing our financial results for the three months ended September 30, 2014. However, we expect that our financial results for the third quarter of 2014 will be negatively impacted by (i) estimated non-cash charges of between $2 million and $2.5 million primarily relating to the implementation of last-in-first-out accounting method for fuel inventory on August 29, 2014 in connection with the Merger, and (ii) estimated non-recurring transaction costs relating to the Merger, the MACS Acquisition and the pending Aloha Acquisition of between $0.70 million and $0.75 million. The estimates above represent the most current information available to management and we currently expect that these charges will be within the ranges described above.

Our principal executive offices are located at 555 East Airtex Drive, Houston, Texas 77073. Our telephone number is (832) 234-3600. Our internet address ishttp://www.susserpetroleumpartners.com. We make available through our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission (the "SEC"). The SEC maintains an internet site athttp://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

S-5

Our Ownership and Organizational Structure

The following is a simplified diagram of our ownership structure after giving effect to this offering (assuming no exercise of the underwriters' option to purchase additional common units).

Public Common Units | 55.8 | % | ||

Interests of ETP: | ||||

Common Units | 12.0 | % | ||

Subordinated Units | 32.2 | % | ||

General Partner Interest | 0.0 | % | ||

| | | | | |

| 100.0 | % | |||

| | | | | |

| | | | | |

S-6

Common units offered to the public | 8,000,000 common units; 9,200,000 common units if the underwriters exercise in full their option to purchase additional common units. | |

Units outstanding after this offering | 23,037,339 common units, or 24,237,339 common units if the underwriters exercise in full their option to purchase additional common units from us, and 10,939,436 subordinated units. | |

Use of proceeds | We expect to receive net proceeds of approximately $388.9 million from this offering, or approximately $447.3 million if the underwriters exercise in full their option to purchase additional common units from us, in each case after deducting underwriting discounts and commissions and estimated offering expenses payable by us. Our estimate is based on the last reported sale price of our common units on the NYSE on October 17, 2014 of $50.21 per common unit. We intend to use the net proceeds, including any net proceeds from the underwriters' exercise of their option to purchase additional common units, to repay indebtedness under our New Credit Facility and for general partnership purposes. | |

Affiliates of each of the underwriters (except for Jefferies LLC) are lenders under our New Credit Facility and may receive a portion of the proceeds from this offering through the repayment of indebtedness under our New Credit Facility. Please read "Underwriting—Other Relationships." | ||

Cash distributions | We distribute all of our cash on hand at the end of each quarter, after establishment of cash reserves by our general partner and payment of fees and expenses, including payments to our general partner and its affiliates. We refer to this cash as "available cash," and we define its meaning in our partnership agreement. | |

Our partnership agreement requires us to distribute all of our available cash each quarter in the following manner: | ||

• first, to the holders of common units, until each common unit has received the minimum quarterly distribution of $0.4375 plus any arrearages from prior quarters; | ||

• second, to the holders of subordinated units, until each subordinated unit has received the minimum quarterly distribution of $0.4375; and | ||

• third, to all unitholders, pro rata, until each unit has received a distribution of $0.503125. |

S-7

If cash distributions to our unitholders exceed $0.503125 per unit in any quarter, the holders of our incentive distribution rights will receive increasing percentages, up to 50%, of the cash we distribute in excess of that amount. We refer to these distributions as "incentive distributions." Please read "Provisions of Our Partnership Agreement Relating to Cash Distributions" in the accompanying prospectus. | ||

On August 8, 2014, we announced a quarterly cash distribution for the quarter ended June 30, 2014 of $0.5197 per unit that was paid on August 29, 2014 to common and subordinated unitholders of record as of August 19, 2014. This represents an increase of 3.5 percent over the distribution for the quarter ended March 31, 2014 and a 14.8 percent increase over the distribution paid for the quarter ended June 30, 2013. | ||

Issuance of additional units | Our partnership agreement authorizes us to issue an unlimited number of additional units without the approval of our unitholders. | |

Limited voting rights | Our general partner manages and operates us. Unlike the holders of common stock in a corporation, our unitholders have only limited voting rights on matters affecting our business. Our unitholders have no right to elect our general partner or its directors on an annual or other continuing basis. Furthermore, our partnership agreement restricts our unitholders' voting rights by providing that any units held by a person or group that owns 20% or more of any class of units then outstanding, other than our general partner and its affiliates, their transferees and persons who acquired such units with the prior approval of the board of directors of our general partner, cannot be voted on any matter. Our general partner may not be removed except by a vote of the holders of at least 662/3% of the outstanding voting units, including any units owned by our general partner and its affiliates, voting together as a single class. Please read "The Partnership Agreement—Withdrawal or Removal of our General Partner" in the accompanying prospectus for more information. |

S-8

Limited call right | If at any time our general partner and its affiliates own more than 80% of the outstanding common units, our general partner will have the right, but not the obligation, to purchase all of the remaining common units at a price equal to the greater of (1) the average of the daily closing price of the common units over the 20 trading days preceding the date three days before notice of exercise of the call right is first mailed and (2) the highest per-unit price paid by our general partner or any of its affiliates for common units during the 90-day period preceding the date such notice is first mailed. Please read "The Partnership Agreement—Limited Call Right" in the accompanying prospectus for more information. | |

Material federal income tax consequences | For a discussion of the material federal income tax consequences that may be relevant to prospective unitholders who are individual citizens or residents of the United States, please read "Material Tax Considerations" in this prospectus supplement and "Material U.S. Federal Income Tax Consequences" in the accompanying prospectus. | |

Exchange listing | Our common units are listed on the NYSE under the symbol "SUSP." |

S-9

Summary Consolidated Historical and Pro Forma Financial and Operating Data

The following table shows summary consolidated historical financial and operating data of our Predecessor for the periods presented through September 24, 2012, and summary consolidated historical financial and operating data of the Partnership for the periods and as of the dates indicated following September 24, 2012. The financial results for the year ended December 31, 2012 include the results of operations for the Predecessor through September 24, 2012, and the results of operations of the Partnership for the period beginning September 25, 2012, the date the Partnership commenced operations. We derived the information in the following table from, and that information should be read together with and is qualified in its entirety by reference to, our historical consolidated financial statements and the accompanying notes incorporated herein by reference.

The summary pro forma financial data of the Partnership for the year ended December 31, 2013, and as of and for the six months ended June 30, 2014 are derived from our unaudited pro forma condensed combined financial statements included as an exhibit to our Form 8-K/A filed on October 21, 2014. The pro forma balances presented in our Form 8-K/A filed on October 21, 2014 have been prepared as if the transactions below had taken place on June 30, 2014, in the case of the unaudited pro forma condensed combined balance sheet, and as of January 1, 2013, in the case of the unaudited pro forma condensed combined statement of operations for the year ended December 31, 2013 and the six months ended June 30, 2014. We derived the information in the following table from, and that information should be read together with and is qualified in its entirety by reference to, our unaudited pro forma condensed combined financial statements and the notes related thereto incorporated by reference into this prospectus supplement. These transactions include, and the pro forma financial data give effect to, the following:

The following table presents non-GAAP financial measures EBITDA, Adjusted EBITDA and distributable cash flow, which we use in our business as important supplemental measures of our operating performance. EBITDA represents net income before interest expense, income tax expense and depreciation and amortization expense. Adjusted EBITDA further adjusts EBITDA to reflect certain other non-recurring and non-cash items. Distributable cash flow represents Adjusted EBITDA less cash interest expense, cash tax expense, maintenance capital expenditures, and other non-cash adjustments. These measures are not calculated or presented in accordance with generally accepted accounting principles in the United States ("GAAP"). We explain these measures under "—Non-GAAP Financial Measures" below and reconcile each to its most directly comparable financial measures calculated and presented in accordance with GAAP.

The following table should be read together with "Management's Discussion and Analysis of Financial Condition and Results of Operations," included in our Annual Report on Form 10-K for the year ended

S-10

December 31, 2013 and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2014, which are incorporated herein by reference.

| | Historical | Pro Forma | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Fiscal Year Ended December 31, | Six Months Ended June 30, | Year Ended December 31, | Six Months Ended June 30, | ||||||||||||||||||

| | 2011 | 2012 | 2013 | 2013 | 2014 | 2013 | 2014(3) | |||||||||||||||

| | (in thousands, except gross profit per gallon) | |||||||||||||||||||||

| | | | | (unaudited) | (unaudited) | |||||||||||||||||

Statement of Income Data: | ||||||||||||||||||||||

Revenues: | ||||||||||||||||||||||

Motor fuel sales | $ | 3,861,533 | $ | 4,308,853 | $ | 4,476,908 | $ | 2,204,903 | $ | 2,580,780 | $ | 6,417,937 | $ | 3,568,396 | ||||||||

Merchandise | — | — | — | — | — | 142,293 | 82,306 | |||||||||||||||

Rental and other income | 13,447 | 12,559 | 15,671 | 6,411 | 11,832 | 62,025 | 35,210 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Total Revenues | 3,874,980 | 4,321,412 | 4,492,579 | 2,211,314 | 2,592,612 | 6,622,255 | 3,685,912 | |||||||||||||||

Gross profit: | ||||||||||||||||||||||

Motor fuel sales | 31,217 | 41,073 | 57,904 | 27,227 | 34,277 | 179,611 | 99,398 | |||||||||||||||

Merchandise | — | — | — | — | — | 37,876 | 22,330 | |||||||||||||||

Rental and other income | 11,806 | 10,429 | 13,060 | 5,285 | 10,046 | 56,983 | 32,307 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Total gross profit | $ | 43,023 | $ | 51,502 | $ | 70,964 | $ | 32,512 | $ | 44,323 | $ | 274,470 | $ | 154,035 | ||||||||

Operating expenses: | ||||||||||||||||||||||

Selling, general and administrative | 10,559 | 12,013 | 16,814 | 7,548 | 14,570 | 127,566 | 71,359 | |||||||||||||||

Loss (gain) on disposal of assets and impairment charges | 221 | 341 | 324 | 94 | (36 | ) | 1,835 | 223 | ||||||||||||||

Depreciation, amortization and accretion | 6,090 | 7,031 | 8,687 | 3,658 | 6,659 | 35,253 | 29,165 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | 26,062 | 28,090 | 30,026 | 13,003 | 21,193 | 164,654 | 100,747 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Income from operations | 16,961 | 23,412 | 40,938 | 19,509 | 23,130 | 109,816 | 53,288 | |||||||||||||||

Other expense: | ||||||||||||||||||||||

Interest expense, net | (324 | ) | (809 | ) | (3,471 | ) | (1,449 | ) | (3,276 | ) | (37,058 | ) | (12,292 | ) | ||||||||

Other miscellaneous | — | — | — | — | — | (1,426 | ) | (498 | ) | |||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Income before income taxes | 16,637 | 22,603 | 37,467 | 18,060 | 19,854 | 71,332 | 40,498 | |||||||||||||||

Income tax (expense) benefit | (6,039 | ) | (5,033 | ) | (440 | ) | (153 | ) | (127 | ) | (5,553 | ) | (2,684 | ) | ||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Net income | 10,598 | 17,570 | 37,027 | 17,907 | 19,727 | 65,779 | 37,814 | |||||||||||||||

Less: Net income attributable to non-controlling interests | — | — | — | — | — | (2,816 | ) | (1,619 | ) | |||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Net income attributable to Susser Petroleum Partners LP | $ | 10,598 | $ | 17,570 | $ | 37,027 | $ | 17,907 | $ | 19,727 | $ | 62,963 | $ | 36,195 | ||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Other Financial Data: | ||||||||||||||||||||||

Adjusted EBITDA(1) | 23,979 | 31,695 | 51,885 | 24,067 | 31,237 | 147,414 | 83,662 | |||||||||||||||

Distributable Cash Flow(1) | 47,679 | 22,340 | 27,690 | 100,580 | 64,259 | |||||||||||||||||

Capital expenditures | 7,388 | 41,493 | 113,590 | 57,050 | 64,264 | |||||||||||||||||

Cash Flow Data: | ||||||||||||||||||||||

Net cash provided by (used in): | ||||||||||||||||||||||

Operating activities | 14,665 | 16,488 | 50,680 | 37,512 | 11,819 | |||||||||||||||||

Investing activities | (19,153 | ) | (190,949 | ) | 6,358 | (5,530 | ) | (41,673 | ) | |||||||||||||

Financing activities | (21 | ) | 180,973 | (55,640 | ) | (22,246 | ) | 28,473 | ||||||||||||||

Operating Data: | ||||||||||||||||||||||

Total motor fuel gallons sold | 1,312,410 | 1,449,946 | 1,571,034 | 755,923 | 895,182 | 2,261,927 | 1,231,933 | |||||||||||||||

Average motor fuel gross profit cents per gallon(2) | 2.4¢ | 2.8¢ | 3.7¢ | 3.6¢ | 3.8¢ | 8.6¢ | 8.3¢ | |||||||||||||||

S-11

gallon includes only wholesale fuel margins as we did not have retail motor fuel sales prior to the MACS Acquisition and pending Aloha Acquisition.

| | Historical | Pro Forma | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | As of December 31, | As of June 30, | As of June 30, | ||||||||||||||||

| | 2011 | 2012 | 2013 | 2013 | 2014 | 2014 | |||||||||||||

| | (in thousands) | ||||||||||||||||||

| | | | | (unaudited) | (unaudited) | ||||||||||||||

Balance Sheet Data: | |||||||||||||||||||

Cash and cash equivalents | $ | 240 | $ | 6,752 | $ | 8,150 | $ | 16,488 | $ | 6,769 | $ | 52,475 | |||||||

Property and equipment, net | 39,049 | 68,173 | 180,127 | 123,251 | 239,590 | 810,051 | |||||||||||||

Total assets | 231,316 | 355,800 | 390,084 | 386,264 | 459,353 | 1,584,595 | |||||||||||||

Total liabilities | 115,503 | 277,468 | 310,391 | 308,364 | 380,124 | 1,084,736 | |||||||||||||

Total unitholder's equity | 115,813 | 78,332 | 79,693 | 77,900 | 79,229 | 507,013 | |||||||||||||

S-12

We define EBITDA as net income before net interest expense, income tax expense and depreciation and amortization expense. Adjusted EBITDA further adjusts EBITDA to reflect certain other non-recurring and non-cash items. We define distributable cash flow as Adjusted EBITDA less cash interest expense, cash tax expense, maintenance capital expenditures, and other non-cash adjustments. EBITDA, Adjusted EBITDA and distributable cash flow are not financial measures calculated in accordance with GAAP.

We believe EBITDA, Adjusted EBITDA and distributable cash flow are useful to investors in evaluating our operating performance because:

EBITDA, Adjusted EBITDA and distributable cash flow are not recognized terms under GAAP and do not purport to be alternatives to net income (loss) as measures of operating performance or to cash flows from operating activities as a measure of liquidity. EBITDA, Adjusted EBITDA and distributable cash flow have limitations as analytical tools, and one should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. Some of these limitations include:

S-13

The following table presents a reconciliation of net income to EBITDA, Adjusted EBITDA and distributable cash flow:

| | Historical | Pro Forma | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Fiscal Year Ended December 31, | Six Months Ended June 30, | Year Ended December 31, | Six Months Ended June 30, | ||||||||||||||||||

| | 2011 | 2012 | 2013 | 2013 | 2014 | 2013 | 2014 | |||||||||||||||

| | (in thousands) | |||||||||||||||||||||

| | | | | (unaudited) | (unaudited) | |||||||||||||||||

Net income | $ | 10,598 | $ | 17,570 | $ | 37,027 | $ | 17,907 | $ | 19,727 | $ | 65,779 | $ | 37,814 | ||||||||

Depreciation, amortization and accretion | 6,090 | 7,031 | 8,687 | 3,658 | 6,659 | 35,253 | 29,165 | |||||||||||||||

Interest expense, net | 324 | 809 | 3,471 | 1,449 | 3,276 | 37,058 | 12,292 | |||||||||||||||

Income tax expense (benefit) | 6,039 | 5,033 | 440 | 153 | 127 | 5,553 | 2,684 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | 23,051 | 30,443 | 49,625 | 23,167 | 29,789 | 143,643 | 81,955 | |||||||||||||||

Non-cash stock-based compensation | 707 | 911 | 1,936 | 806 | 1,484 | 1,936 | 1,484 | |||||||||||||||

Loss (gain) on disposal of assets and impairment charge | 221 | 341 | 324 | 94 | (36 | ) | 1,835 | 223 | ||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA | $ | 23,979 | $ | 31,695 | $ | 51,885 | $ | 24,067 | $ | 31,237 | $ | 147,414 | $ | 83,662 | ||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Cash interest expense | 3,090 | 1,258 | 3,050 | 35,750 | 11,628 | |||||||||||||||||

State franchise tax expense (cash) | 302 | 141 | 173 | 3,103 | 5,216 | |||||||||||||||||

Maintenance capital expenditures | 814 | 328 | 324 | 7,981 | 2,559 | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Distributable cash flow | $ | 47,679 | $ | 22,340 | $ | 27,690 | $ | 100,580 | $ | 64,259 | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

S-14

Our business is subject to uncertainties and risks. Before you invest in our common units you should carefully consider the risk factors below, as well as the risk factors beginning on page 3 of the accompanying base prospectus and those included in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which are incorporated by reference into this prospectus supplement, together with all of the other information included in this prospectus supplement, the accompanying base prospectus and the documents we incorporate by reference. If any of the risks discussed in the foregoing documents were to occur, our business, financial condition, results of operations and cash flows could be materially adversely affected and you could lose all or part of your investment. Please also read "Forward-Looking Statements."

Risks Related to Our Acquisition Strategy, the Acquisitions and Potential Future Acquisitions

If we are unable to make acquisitions on economically acceptable terms from ETP or third parties, our future growth and ability to increase distributions to unitholders will be limited.

A portion of our strategy to grow our business and increase distributions to unitholders is dependent on our ability to make acquisitions that result in an increase in cash flow. The acquisition component of our growth strategy is based, in large part, on our expectation of ongoing divestitures of retail and wholesale fuel distribution assets by industry participants, including ETP. ETP has no contractual obligations to contribute any assets to us or accept any offer for its assets that we may choose to make. If we are unable to make acquisitions from ETP or third parties for any reason, including if we are unable to identify attractive acquisition candidates or negotiate acceptable purchase contracts, we are unable to obtain financing for these acquisitions on economically acceptable terms, we are outbid by competitors or we or the seller are unable to obtain any necessary consents, our future growth and ability to increase distributions to unitholders will be limited. In addition, if we consummate any future acquisitions, our capitalization and results of operations may change significantly, and unitholders will not have the opportunity to evaluate the economic, financial and other relevant information that we will consider in determining the application of these funds and other resources.

Pursuant to an omnibus agreement between the Partnership and SUSS (the "Omnibus Agreement"), upon the closing of our IPO we were granted a three-year option to purchase up to 75 new or recently constructedStripes® convenience stores from SUSS and lease them back to SUSS on specified terms set forth in a lease agreement, including a specified lease rate, for an initial term of 15 years. However, such specified terms may not be economically favorable to us in the future, and we may not choose to continue to exercise this option.

In addition, we expect to grow through additional sale and leaseback transactions with SUSS beyond the option set forth in the Omnibus Agreement. However, SUSS is under no obligation to pursue acquisitions with us, enter into additional sale and leaseback arrangements with us or generally pursue projects that enhance the value of our business. Finally, we may complete acquisitions which at the time of completion we believe will be accretive, but which ultimately may not be accretive. If any of these events were to occur, our future growth would be limited.

Any acquisitions, including the Acquisitions and any future contributions to us of Sunoco or SUSS assets by ETP, are subject to substantial risks that could adversely affect our financial condition and results of operations and reduce our ability to make distributions to unitholders.

Any acquisitions, including the Acquisitions and any future contributions to us of Sunoco or SUSS assets by ETP, involve potential risks, including, among other things:

S-15

Even if this offering is completed, the pending Aloha Acquisition may not be consummated, which could have an adverse impact on our cash available for distribution.

The closing of this offering is not conditioned on the closing of the pending Aloha Acquisition. The pending Aloha Acquisition is subject to a number of closing conditions that, if not satisfied or waived, would result in the failure of the pending Aloha Acquisition to be consummated. These conditions include, but are not limited to, the accuracy of each party's representations and warranties contained in the Aloha Purchase Agreement, the performance by each party of its respective obligations under the Aloha Purchase Agreement, the absence of any court order or law restraining consummation of the pending Aloha Acquisition and the receipt of all necessary governmental and material third-party consents. Satisfaction of many of these closing conditions is beyond our control and, as a result, we cannot assure you that all of the closing conditions will be satisfied or that the pending Aloha Acquisition will be consummated. Our failure to complete the pending Aloha Acquisition or any delays in completing the pending Aloha Acquisition could have an adverse impact on our operations, prospects and cash available for distribution and could negatively impact the price of our common units. If you decide to purchase our common units, you should be willing to do so whether or not we complete the pending Aloha Acquisition.

Integration of the assets acquired in the Acquisitions, other future acquisitions, or future contributions by ETP with our existing business will be a complex, time-consuming and costly process, particularly given that the acquired assets will significantly increase our size and diversify the geographic areas in which we operate. A failure to successfully integrate the acquired assets with our existing business in a timely manner may have a material adverse effect on our business, financial condition, results of operations or cash flows.

The difficulties of integrating Aloha and MACS, other future acquisitions, or future contributions by ETP with our business include, among other things:

S-16

If any of these risks or unanticipated liabilities or costs were to materialize, then any desired benefits from the Acquisitions, other future acquisitions, or contributions by ETP may not be fully realized, if at all, and our future results of operations could be negatively impacted. In addition, the assets acquired in the Acquisitions, other future acquisitions, or contributions by ETP, may actually perform at levels below the forecasts we used to evaluate the acquired assets, due to factors that are beyond our control. If the acquired assets perform at levels below the forecasts we used to evaluate the Acquisitions, other future acquisitions, or contributions by ETP, then our future results of operations could be negatively impacted.

Also, our reviews of businesses or assets proposed to be acquired are inherently imperfect because it generally is not feasible to perform an in-depth review of businesses and assets involved in each acquisition given time constraints imposed by sellers. Even a detailed review of assets and businesses may not necessarily reveal existing or potential problems, nor will it permit a buyer to become sufficiently familiar with the assets or businesses to fully assess their deficiencies and potential. Inspections may not always be performed on every asset, and environmental problems, such as groundwater contamination, are not necessarily observable even when an inspection is undertaken.

Any acquisitions we complete, including the Acquisitions, are subject to substantial risks that could reduce our ability to make distributions to unitholders.

Even if we do make acquisitions that we believe will increase available cash per unit, these acquisitions may nevertheless result in a decrease in available cash per unit. Any acquisition involves potential risks, including, among other things:

The Acquisitions create direct or increased exposure to risks associated with our operation of retail convenience stores.

We have not historically operated retail convenience stores and the vast majority of our revenues and distributable cash have historically come from the distribution of motor fuels at contracted prices. Consequently, our exposure to the risks associated with operating retail convenience stores has historically been indirect, primarily through the possibility that those risks might lead to volume or margin declines resulting from our distribution of motor fuel to those retail outlets. Pro forma for the completion of the Acquisitions, 22.4% of our 2013 gross profit would have come from retail fuel sales and 13.6% would have

S-17

come from retail merchandise sales. Consequently, the Acquisitions expose us directly and meaningfully to many new risks associated with the retail convenience industry, including retail fuel margin volatility, competition from other retailers, premises liability, food contamination and merchandise defects, health and safety concerns and merchandise supply and distribution risks. Please read "—Risks Related to our Business Following the Acquisitions" which includes a discussion of additional risks to our business based upon our entry into retail operations as a result of the Acquisitions.

Compliance with and liability under local, state and federal environmental regulations related to our pending Aloha Acquisition, including those that require investigation and remediation activities, may require significant expenditures or result in liabilities that could have a material adverse effect on our business.

As with our other businesses, the Aloha business is subject to various federal, state and local environmental laws and regulations, including those relating to the release or discharge of regulated materials into the air, water and soil, the generation, storage, handling, use, transportation and disposal of hazardous materials, the exposure of persons to regulated materials, and the health and safety of our employees. A violation of, liability under or compliance with these laws or regulations or any future environmental laws or regulations, could have a material adverse effect on our business and results of operations and cash available for distribution to our unitholders. With the acquisition of Aloha, we will be subject to a number of additional environmental, health and safety programs. In particular, there are a number of environmental and safety programs applicable to the terminals, including programs to respond to spills and emergencies.

Regulations under the Water Pollution Control Act of 1972 (the "Clean Water Act"), the Oil Pollution Act of 1990 ("OPA 90") and state laws impose regulatory burdens on terminal operations. Spill prevention control and countermeasure requirements of federal laws and state laws require containment to mitigate or prevent contamination of waters in the event of a refined product overflow, rupture, or leak from above-ground pipelines and storage tanks. The Clean Water Act requires us to maintain spill prevention control and countermeasure plans at our terminal facilities with above-ground storage tanks and pipelines. In addition, OPA 90 requires that most fuel transport and storage companies maintain and update various oil spill prevention and oil spill contingency plans. Facilities that are adjacent to water require the engagement of Federally Certified Oil Spill Response Organizations ("OSROs") to be available to respond to a spill on water from above ground storage tanks or pipelines. In addition, the transportation and storage of refined products over and adjacent to water involves risk and potentially subjects us to strict, joint, and potentially unlimited liability for removal costs and other consequences of an oil spill where the spill is into navigable waters, along shorelines or in the exclusive economic zone of the United States. In the event of an oil spill into navigable waters, substantial liabilities could be imposed upon us. The Clean Water Act also imposes restrictions and strict controls regarding the discharge of pollutants into navigable waters. The Clean Water Act can impose substantial potential liability for the violation of permits or permitting requirements. For example, we may incur costs of up to $7 million or more to install impervious liners within secondary containment facilities at a terminal in Hawaii after closing of the Aloha Acquisition to bring the terminal properties into compliance with the federal Claim Water Act, which costs, if realized, may have a material adverse effect on our business, liquidity and results of operations and cash available for distribution to our unitholders. In a related matter, Aloha is in negotiations with the U.S. Environmental Protection Agency ("EPA") and the Department of Justice regarding alleged violations of the Clean Water Act related to a spill from one of the same terminals in 2011. It is possible that the final settlement could be greater than $100,000.

In addition, the terminal operations and associated facilities are subject to the Clean Air Act and comparable state and local statutes. Under these laws, permits may be required before construction can commence on a new source of potentially significant air emissions, and operating permits may be required for sources that are already constructed. If regulations become more stringent, additional emission control technologies may be required to be installed at our facilities. Any such future obligations could require us

S-18

to incur significant additional capital or operating costs. For example, Aloha is in settlement discussions with EPA and the Department of Justice regarding alleged violations of the New Source Performance Standards under the Clean Air Act. It is likely that the final settlement will be greater than $100,000.

Finally, terminal operations are also subject to additional programs and regulations under the Occupational Safety and Health Act ("OSHA"). A violation of, liability under or compliance with these laws or regulations or any future safety laws or regulations, could have a material adverse effect on our business and results of operations and cash available for distribution to our unitholders.

We are relying upon the creditworthiness of Henger, which is indemnifying us for certain liabilities associated with the pending Aloha Acquisition. To the extent Henger is unable to satisfy its obligations to us, we may have no recourse under the Aloha Purchase Agreement and will bear the risk of certain liabilities associated with the pending Aloha Acquisition.

Under the Aloha Purchase Agreement, Henger has agreed to indemnify us and our affiliates out of an escrow account (the "Escrow Account") from any and all claims and losses actually suffered or incurred by us or our affiliates arising out of or relating to the breach of Henger's representations, warranties or covenants or agreements contained in the Aloha Purchase Agreement. Henger's indemnification obligations are generally limited by an aggregate ceiling equal to the Escrow Account, which is $12.0 million. However, this aggregate ceiling does not apply to certain indemnification obligations relating to the breach of Henger's fundamental representations, covenants or agreements contained in the Aloha Purchase Agreement, which are each subject to a ceiling equal to the total cash consideration pursuant to the Aloha Purchase Agreement. Henger has also agreed to indemnify us and our affiliates from certain environmental liabilities, including two specified environmental penalties amounting to $900,000 that Aloha received notice of from the EPA and United States Department of Justice (collectively, the "Environmental Liabilities"). Henger retains responsibility after the closing of the pending Aloha Acquisition for such Environmental Liabilities.

To the extent Henger is unable to satisfy its indemnification obligations to us that are not limited to the Escrow Account, we may have no recourse under the Aloha Purchase Agreement and will bear the risk of certain liabilities associated with the pending Aloha Acquisition that are not covered by the Escrow Account, which could materially adversely affect our financial condition, results of operations or cash flows.

Risks Related to Our Business Following the Acquisitions

We may not have sufficient cash from operations following the establishment of cash reserves and payment of costs and expenses, including cost reimbursements to our general partner, to enable us to pay the minimum quarterly distribution to our unitholders.

We may not have sufficient cash each quarter to pay the full amount of our minimum quarterly distribution of $0.4375 per unit, or $1.75 per unit per year, which will require us to have available cash of approximately $14.9 million per quarter, or $59.5 million per year, based on the number of common and subordinated units to be outstanding following this offering (assuming no exercise of the underwriters' option to purchase additional common units). The amount of cash we can distribute on our common and subordinated units principally depends upon the amount of cash we generate from our operations, which will fluctuate from quarter to quarter based on a number of factors, some of which are beyond our control, including, among other things:

S-19

In addition, the actual amount of cash we will have available for distribution will depend on other factors including:

Historical prices for motor fuel have been volatile and significant changes in such prices in the future may adversely affect the profitability of our retail operations.

Crude oil and domestic petroleum markets are volatile. General economic and political conditions, acts of war or terrorism and instability in oil producing regions, particularly in the Middle East and South America, could significantly impact crude oil supplies and petroleum costs. Significant increases and volatility in petroleum costs could impact consumer demand for motor fuel and convenience merchandise. This volatility makes it extremely difficult to predict the impact future petroleum costs fluctuations will have on our operating results and financial condition. Our recent acquisition of MACS and our pending acquisition of Aloha increases our exposure to such volatility due to the inherently greater degree of volatility in retail, versus wholesale, motor fuel margins. A significant change in any of these factors could materially impact both wholesale and retail fuel margins, the volume of motor fuel we distribute or sell at retail, and overall customer traffic, each of which in turn could have a material adverse effect on our business and results of operations and cash available for distribution to our unitholders.

The convenience store industry is highly competitive and impacted by new entrants and our failure to effectively compete could result in lower sales and lower margins.

The geographic areas in which we operate are highly competitive and marked by ease of entry and constant change in the number and type of retailers offering products and services of the type we sell in our stores. We compete with other convenience store chains, independently owned convenience stores, motor fuel stations, supermarkets, drugstores, discount stores, dollar stores, club stores, mass merchants and local restaurants. Over the past 15 years, several non-traditional retailers, such as supermarkets, hypermarkets, club stores and mass merchants, have impacted the convenience store industry, particularly in the geographic areas in which we operate, by entering the motor fuel retail business. These non-traditional motor fuel retailers have captured a significant share of the motor fuels market, and we expect their market share will continue to grow. In some of our markets, our competitors have been in existence longer and have greater financial, marketing and other resources than we do. As a result, our competitors may be able to respond better to changes in the economy and new opportunities within the industry. To remain

S-20

competitive, we must constantly analyze consumer preferences and competitors' offerings and prices to ensure that we offer a selection of convenience products and services at competitive prices to meet consumer demand. We must also maintain and upgrade our customer service levels, facilities and locations to remain competitive and attract customer traffic to our stores. We may not be able to compete successfully against current and future competitors, and competitive pressures faced by us could have a material adverse effect on our business and results of operations and cash available for distribution to our unitholders.

SUSS is our largest customer, and we are dependent on SUSS for a significant majority of our revenues. Therefore, we are subject to the business risks of SUSS. If SUSS changes its business strategy, is unable to satisfy its obligations under our various commercial agreements for any reason, or significantly reduces the volume of motor fuel it purchases under the SUSS Distribution Contract, our revenues will decline and our financial condition, results of operations, cash flows and ability to make distributions to our unitholders will be adversely affected.

For the year ended December 31, 2013, SUSS accounted for approximately 66.2% of our revenues, 44.5% of our gross profit and 67.0% of our motor fuel volumes sold. We are the exclusive distributor of motor fuel to SUSS's existingStripes® convenience stores and independently operated consignment locations pursuant to our long-term, fee based fuel distribution agreement with SUSS (the "SUSS Distribution Contract"). The SUSS Distribution Contract does not impose any minimum volume obligations on SUSS and SUSS will have a limited ability to removeStripes® convenience stores from the SUSS Distribution Contract. If SUSS changes its business strategy or significantly reduces the volume of motor fuel it purchases for itsStripes® convenience stores and independently operated consignment locations, our cash flows will be adversely impacted. Any event, whether in our areas of operation or otherwise, that materially and adversely affects SUSS's financial condition, results of operation or cash flows may adversely affect our ability to sustain or increase cash distributions to our unitholders. Accordingly, we are indirectly subject to the operational and business risks of SUSS, some which are related to the following:

Finally, we have no control over SUSS, our largest source of revenue and our primary customer. SUSS may elect to pursue a business strategy that does not favor us and our business. Our general partner and its affiliates, including SUSS and ETP, have conflicts of interest with us and limited fiduciary duties and they may favor their own interests to the detriment of us and our unitholders.

S-21

The dangers inherent in the storage of motor fuel could cause disruptions and could expose us to potentially significant losses, costs or liabilities.

We store motor fuel in underground and above ground storage tanks. Our operations are subject to significant hazards and risks inherent in storing motor fuel. These hazards and risks include, but are not limited to, fires, explosions, spills, discharges and other releases, any of which could result in distribution difficulties and disruptions, environmental pollution, governmentally-imposed fines or clean-up obligations, personal injury or wrongful death claims and other damage to our properties and the properties of others. As a result, any such event not covered, or only partially covered, by our insurance could have a material adverse effect on our business, financial condition and results of operations and cash available for distribution to our unitholders.

We may incur costs or liabilities as a result of litigation or adverse publicity resulting from concerns over food quality, product safety, health or other negative events or developments that could cause consumers to avoid our retail locations.

We may be the subject of complaints or litigation arising from food-related illness or product safety which could have a negative impact on our business. Additionally, negative publicity, regardless of whether the allegations are valid, concerning food quality, food safety or other health concerns, food service facilities, employee relations or other matters related to our operations may materially adversely affect demand for our food and other products and could result in a decrease in customer traffic to our retail stores.

It is critical to our reputation that we maintain a consistent level of high quality at our food service facilities and other franchise or fast food offerings. Health concerns, poor food quality or operating issues stemming from one store or a limited number of stores could materially and adversely affect the operating results of some or all of our stores and harm our company-owned brands, continuing favorable reputation, market value and name recognition.

The growth of our wholesale business depends in part on SUSS's ability to construct, open and profitably operate new Stripes® convenience stores. If SUSS does not construct additional Stripes® convenience stores, our growth strategy and ability to increase cash distributions to our unitholders may be adversely affected.

A significant part of our growth strategy is to increase our wholesale fuel distribution volumes and rental income relating to newly constructedStripes® convenience stores. SUSS may not be able to construct and open new convenience stores, and any new stores that SUSS opens may be unprofitable or fail to attract expected volumes of motor fuel sales. Several factors that could affect SUSS's ability to open and profitably operate new stores include:

Furthermore, SUSS is not obligated to construct additionalStripes® convenience stores nor enter into additional sale and leaseback transactions with respect to any newly constructed stores beyond the sale and leaseback option under the Omnibus Agreement. Additionally, under the SUSS Distribution Contract, SUSS will continue to have the right to convert a limited number of stores each year to third-party

S-22

consignment contracts, and the third-party wholesalers party to such consignment contracts would not be obligated to purchase any motor fuel from us. If SUSS were to determine in the future that growth via the construction of additionalStripes® convenience stores or additional sale and leaseback transactions is not attractive or that it is more advantageous to contract for third-party consignment sales of motor fuel at existing or future locations as opposed to SUSS selling the motor fuel, it could adversely impact our ability to grow our motor fuel volumes and rental income and our ability to make distributions to our unitholders could be adversely affected.

A significant decrease in demand for motor fuel in the areas we serve would reduce our ability to make distributions to our unitholders.

A significant decrease in demand for motor fuel in the areas that we serve could significantly reduce our revenues and, therefore, reduce our ability to make or increase distributions to our unitholders. Our revenues are dependent on various trends, such as trends in commercial truck traffic, travel and tourism in our areas of operation, and these trends can change. Furthermore, seasonal fluctuations or regulatory action, including government imposed fuel efficiency standards, may affect demand for motor fuel. Because certain of our operating costs and expenses are fixed and do not vary with the volumes of motor fuel we distribute, our costs and expenses might not decrease ratably or at all should we experience a reduction in our volumes distributed. As a result, we may experience declines in our profit margin if our fuel distribution volumes decrease.

Certain of our contracts with suppliers currently have early payment and volume-related discounts which reduce the price we pay for motor fuel that we purchase from them. If we are unable to renew these contracts on similar terms, our gross profit will correspondingly decrease.

Certain of our contracts with suppliers currently have early payment and volume-related discounts based on the timing of our payment and the market price of the fuel and volumes that we purchase. During the year ended December 31, 2013 we received early payment and volume-related discounts on approximately 41% of all motor fuel volumes purchased. If we were to be unable to qualify for these discounts, or unable to renew these contracts on similar terms, our gross profit would decrease, which could, in turn, reduce our cash available for distribution to our unitholders.

We currently depend on limited principal suppliers for the majority of our motor fuel in each of our operating areas. A failure by a principal supplier to renew our supply agreement or an unexpected change in our supplier relationships could have a material adverse effect on our business.

We currently depend on limited principal suppliers for the majority of our motor fuel in each of our operating areas. If any of our principal suppliers elect not to renew their contracts with us, we may be unable to replace the volume of motor fuel we currently purchase from them on similar terms or at all. Furthermore, an unexpected change in our relationship with our principal fuel suppliers could have a material adverse effect on our business, results of operation and cash available for distribution to our unitholders.

We are exposed to performance risk in our supply chain. If our suppliers are unable to sell to us sufficient amounts of motor fuel products, we may be unable to satisfy our customers' demand for motor fuel.

We rely upon our suppliers to timely provide the volumes and types of motor fuels for which they contract with us. We purchase motor fuels from a variety of suppliers under term contracts. Generally, our supply contracts do not guarantee that we will receive all of the volumes that we need to fulfill the demands of our distribution customers. In times of extreme market demand or supply disruption, we may be unable to acquire enough fuel to satisfy the fuel demand of our customers. Furthermore, the feedstock for a significant portion of our supply comes from other countries, which could be disrupted by political

S-23

events. In the event that such feedstock becomes scarce, whether as a result of political events or otherwise, we may be unable to meet our customers' demand for motor fuel.

We currently depend on a limited number of principal suppliers in each of our operating areas for a substantial portion of our merchandise inventory and our products and ingredients for our food service facilities. A disruption in supply or a change in either relationship could have a material adverse effect on our business.

We currently depend on a limited number of principal suppliers in each of our operating areas for a substantial portion of our merchandise inventory and our products and ingredients for our food service facilities. If any of our principal suppliers elect not to renew their contracts with us, we may be unable to replace the volume of merchandise inventory and products and ingredients we currently purchase from them on similar terms or at all in those operating areas. Further, a disruption in supply or a significant change in our relationship with any of these suppliers could have a material adverse effect on our business and results of operations.

Increasing consumer preferences for alternative motor fuels, or improvements in fuel efficiency, could adversely impact our business.

Any technological advancements, regulatory changes or changes in consumer preferences causing a significant shift toward alternative motor fuels, or non-fuel dependent means of transportation, could reduce demand for the conventional petroleum based motor fuels we currently sell. Additionally, a shift toward electric, hydrogen, natural gas or other alternative or non fuel-powered vehicles could fundamentally change our customers' shopping habits or lead to new forms of fueling destinations or new competitive pressures. Finally, new technologies developed to improve fuel efficiency or governmental mandates to improve fuel efficiency may result in decreased demand for petroleum-based fuel. Any of these outcomes could potentially result in fewer visits to our convenience stores, a reduction in demand from our wholesale customers, decreases in both fuel and merchandise sales revenue or reduced profit margins, any of which could have a material adverse effect on our business, financial condition and results of operations and cash available for distribution to our unitholders.

General economic, financial and political conditions may materially adversely affect our results of operations and financial conditions and cash available for distribution to our unitholders.

General economic, financial and political conditions may have a material adverse effect on our results of operations and financial condition and cash available for distribution to our unitholders. Declines in consumer confidence and/or consumer spending, continuing high unemployment, significant inflationary or deflationary changes or disruptive regulatory or geopolitical events could contribute to increased volatility and diminished expectations for the economy and our markets, including the market for our goods and services, and lead to demand or cost pressures that could negatively and adversely impact our business. Examples of these types or conditions would include a general or prolonged decline or shocks to regional or broader macro-economies; regulatory changes that could impact the markets in which we operate, such as immigration or trade reform laws or regulations prohibiting or limiting hydraulic fracturing, which could reduce demand for our goods and services or lead to pricing, currency or other pressures; or deflationary economic pressures, which could hinder our ability to operate profitably in view of the challenges inherent in making corresponding deflationary adjustments to our cost structure, which includes significant levels of both fixed costs, such as rent and interest expense, that would require significant structural changes to reduce or eliminate as well as variable costs, such as labor expenses, which could reduce profitability if they do not fall as quickly or as much as the prices we are able to charge for our goods and services. The nature of these types of risks, which are often unpredictable, makes them difficult to plan for, or otherwise mitigate, and they are generally uninsurable, which compounds their potential impact on our business.

S-24

Compliance with and liability under existing and future local, state and federal environmental regulation, including those that require investigation and remediation activities, may require significant expenditures or result in liabilities that could have a material adverse effect on our business.

Our business is subject to various federal, state and local environmental laws and regulations, including those relating to underground storage tanks, the release or discharge of regulated materials into the air, water and soil, the generation, storage, handling, use, transportation and disposal of hazardous materials, the exposure of persons to regulated materials, and the health and safety of our employees. A violation of, liability under or compliance with these laws or regulations or any future environmental laws or regulations, could have a material adverse effect on our business and results of operations and cash available for distribution to our unitholders.