As filed with the Securities and Exchange Commission on October 16 , 2014

Registration No. 333-182301

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

PRE-EFFECTIVE AMENDMENT NO. 5

to

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

GREENHAVEN COAL FUND

(Exact name of Registrant as specified in its charter)

| Delaware | 6221 | 90-6214629 |

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

3340 Peachtree Road, Suite 1910

Atlanta, Georgia 30326

(404) 239-7941

(Address, including zip code, and telephone number, including area code,

of Registrant’s principal executive offices)

Cooper Anderson

c/o GreenHaven Coal Services, LLC

3340 Peachtree Road, Suite 1910

Atlanta, Georgia 30326

(404) 239-7941

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies of communications to: | |

Eliot Robinson Terrence Childers Bryan Cave LLP 1201 West Peachtree Street, NW Atlanta, Georgia 30309 |

Kathleen Moriarty Peter Shea Katten Muchin Rosenman LLP 575 Madison Avenue New York, New York 10022 |

Approximate date of commencement of proposed sale to the public:As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Non-accelerated filer x (Do not check if a smaller reporting company) | Accelerated filer o Smaller reporting company o |

Calculation of Registration Fee

Title of each class of securities to be registered |

Proposed maximum aggregate offering price | Amount of registration fee (1) (2) | ||||||

| Shares | $ | 390,000,000.00 | $ | 53,196.00 | ||||

(1) The amount of the registration fee for the indicated securities has been calculated in reliance upon Rule 457(o) under the Securities Act of 1933.

(2) Previously paid.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

| Per Share | Per Basket | |||||||

| Price of the Initial Baskets (1) | $ | 30.00 | $ | 750,000.00 | ||||

ii | ||

| 3 | ||

| 8 | ||

| 17 | ||

| 19 | ||

| 22 | ||

| 24 | ||

| 28 | ||

| 34 | ||

| 35 | ||

| 45 | ||

| 46 | ||

| 47 | ||

| 48 | ||

| 51 | ||

| 52 | ||

| 55 | ||

| 56 | ||

| 56 | ||

| 57 | ||

| 67 | ||

| 69 | ||

| 70 | ||

| 72 | ||

| 72 | ||

| 72 | ||

Report of Independent Registered Public Accounting Firm | F-[ ] |

| i |

| ii |

| 3 |

| Offering of the Shares | The Fund intends to continuously offer Baskets of 25,000 Shares to certain authorized participants (each an “Authorized Participant”) at a price based on the NAV per Share. See “Authorized Participants.” Authorized Participants, in turn, may offer Shares to the public at offering prices that are expected to be influenced by a variety of factors. An Authorized Participant may receive commissions or fees from investors who purchase Shares through their commission or fee-based brokerage accounts. See “Description of the Shares” and “Creation and Redemption of Shares.” | ||

| Exchange Symbol | The Shares are expected to be listed on the NYSE Arca under the symbol “TONS.” Prior to the date of this prospectus, there has been no public market for the Shares. | ||

| CUSIP | 39525T 100 | ||

| Affiliates and Agents | Sponsor | GreenHaven Coal Services, LLC | |

| Trustee | Christiana Trust, a division of Wilmington Savings Fund Society, FSB | ||

| Initial Commodity Brokers | Morgan Stanley & Co. LLC ADM Investor Services, Inc. | ||

| Initial Execution Broker | TFS Energy Futures LLC | ||

| Administrator (and Transfer Agent) | Bank of New York Mellon | ||

| Marketing Agent (and Distributor) | ALPS Distributors, Inc. | ||

| 4 |

| Initial Authorized Participant | It is expected that after the date of this prospectus, an initial Authorized Participant will, subject to certain conditions, purchase an aggregate of 100,000 Shares in four Baskets (the “Initial Baskets”) at an initial purchase price of $30.00 per Share, or $3,000,000 in the aggregate. See “Plan of Distribution.” | |

| Creation and Redemption of Shares | The Fund will create and redeem Shares from time to time, but only in one or more whole Baskets. Except when aggregated in Baskets, the Shares are not redeemable securities. Authorized Participants pay a transaction fee of $500 per creation or redemption order to the Administrator. See “Creation and Redemption of Shares.” | |

| Authorized Participants | Each Authorized Participant must (1) be a registered broker-dealer or other securities market participant such as a bank or other financial institution that is not required to register as a broker-dealer to engage in securities transactions, (2) be a participant in The Depository Trust Company (“DTC”), and (3) have entered into a participant agreement with the Fund (the “Participant Agreement”). See “Authorized Participants.” | |

| Net Asset Value | The NAV equals the market value of the Fund’s total assets less total liabilities calculated in accordance with GAAP. Under the Fund’s current operational procedures, the Administrator calculates the NAV once each NYSE Arca trading day. The Administrator uses the CME settlement price (typically determined after 5:00 p.m. New York time) for the contracts traded on the CME Facilities. The NAV for a particular trading day is released after 5:00 p.m. New York time and will be posted at www.greenhavenfunds.com. The Sponsor anticipates that the NYSE Arca will disseminate the indicative fund value on a per Share basis every 15 seconds during regular NYSE Arca trading hours. | |

| Segregated Accounts/ Interest Income | The Sponsor estimates that (i) approximately 10% of the NAV will be held as margin deposits in segregated accounts with a Commodity Broker, in accordance with applicable CFTC rules, and (ii) approximately 90% of the NAV will be held to pay current obligations and as reserves in the form of U.S. Treasuries, cash and/or cash equivalents in segregated accounts with a Commodity Broker. The Fund will be credited with all interest earned on its deposits. See “Use of Proceeds.” | |

| Clearance and Settlement | The Shares are evidenced by global certificates on deposit with DTC and registered in the name of Cede & Co., as nominee for DTC. The Shares are available only in book-entry form. Registered or beneficial owners of the Shares (“Shareholders”) may hold their Shares through DTC, if they are participants in DTC, or indirectly through entities that are participants in DTC. See “The Securities Depository; Book-Entry Only System; Global Security.” | |

| U.S. Federal Income Tax Considerations | The Fund is classified as a partnership for U.S. federal income tax purposes. Accordingly, it is expected that the Fund will not incur U.S. federal income tax liability and each beneficial owner of the Shares will have tax liability on its allocable share of the Fund’s income, gain, loss, deduction and other items. See “Certain Material U.S. Federal Income Tax Considerations.” | |

| Distributions | The Fund will make distributions at the discretion of the Sponsor. Because the Sponsor does not presently intend to make ongoing distributions, a Shareholder’s income tax liability with respect to Shares held will, in all likelihood, exceed any distributions from the Fund. See “Description of the Shares—Distributions” and “Certain Material U.S. Federal Income Tax Considerations.” | |

| Reports to Shareholders | The Sponsor will furnish an annual report of the Fund in the manner required by the rules and regulations of the United States Securities and Exchange Commission (the “SEC”) as well as with those reports required by the CFTC and the NFA, including, but not limited to, an annual audited financial statement examined and certified by an independent registered public accounting firm, and any other reports required by any other governmental authority that has jurisdiction over the activities of the Fund. Monthly account statements conforming to CFTC and NFA requirements, as well as the annual and quarterly reports and other filings made with the SEC, will be posted at www.greenhavenfunds.com. Shareholders of record will also be provided with appropriate information to permit them to file U.S. federal and state income tax returns (on a timely basis) with respect to Shares held. Additional reports may be posted at www.greenhavenfunds.com at the discretion of the Sponsor or as required by regulatory authorities. See “The Trust Agreement—Reports to Shareholders.” | |

| 5 |

| Termination Events | The Fund may be dissolved at any time and for any reason by the Sponsor with written notice to the Shareholders. See “The Trust Agreement—Fund Termination Events.” | |

| Mandatory Redemption | If the Sponsor gives at least fifteen (15) days’ written notice to a Shareholder, then the Sponsor may for any reason, in its sole discretion, require the mandatory redemption of all or part of the Shares held by any such Shareholder at the NAV per Share calculated as of the date of redemption; provided, however, that the provision of the written notice to a Shareholder does not obligate the Fund to affect any redemption. If the Sponsor does not give at least fifteen (15) days’ written notice to a Shareholder, then it may only require mandatory redemption of all or any portion of the Shares held by any such Shareholder in the following circumstances: |

| (i) | the Shareholder made a misrepresentation to the Fund or the Sponsor in connection with its purchase of Shares; or | |||

| (ii) | the Shareholder’s ownership of Shares would result in the violation of any law or regulation applicable to the Fund or a Shareholder. | |||

The primary purpose of this mandatory redemption authority is to ensure that the Fund complies with applicable regulatory and listing requirements, including CFTC or futures position limits, that may restrict the size of the Fund and the investment portfolio. The Sponsor anticipates that it will exercise this authority only to the extent that it reasonably believes is necessary or appropriate for the Fund to comply with applicable legal and listing requirements and only after first exercising commercially reasonable efforts to comply with the applicable requirements without exercise of such redemption authority. The Fund may also use the mandatory redemption right in the context of a general liquidation of the Fund’s assets. | ||||

See “The Trust Agreement—Mandatory Redemption.” | ||||

| Fiscal Year | The fiscal year of the Fund ends on December 31 of each year. | |||

| Investment Risks | An investment in the Shares is speculative and involves a high degree of risk. Prospective investors should be aware that: | |||

● | An investor could lose a substantial portion or all of its investment. | ||

| ● | Commodity trading is highly speculative, and the Fund is likely to be volatile and could suffer from periods of prolonged decline in value. | ||

| ● | The Fund has not commenced operations, so there is no performance history to serve as a basis for investors to evaluate an investment in the Fund. | ||

| ● | The structure and operation of the Fund may involve conflicts of interest. | ||

| ● | Investors will have no rights to participate in the management of the Fund and will have to rely on the duties and judgment of the Sponsor to manage the Fund. | ||

| ● | Currently, although coal futures markets are only subject to position limits in the expiration month and position accountability limits in the other months, regulatory authorities may in the future apply position limits to all coal futures delivery months, which could limit the Fund’s investment objective. | ||

| ● | Investors may choose to use the Fund as a means of indirectly investing in coal. There is the risk that the daily changes in the price of the Shares on the NYSE Arca, if so listed, will not closely track the daily changes in Coal Futures or spot coal prices due to a variety of reasons, which may limit an investor’s ability to use an investment in the Shares as a cost-effective way to invest indirectly in coal or as a hedge against the risk of loss in coal-related transactions. |

| ● | Investors may choose to use the Fund as a means of investing indirectly in coal, and there are risks involved in such an investment. For example, the risks and hazards that are inherent in coal production or consumption may cause the price of coal, coal derivatives and the Shares to fluctuate significantly. | ||

| ● | Investors in the Fund will receive a Schedule K-1 which reports their allocable portion of tax items. Schedule K-1’s are complex and, especially for individual investors, usually involve the engagement of tax experts. The Fund uses certain conventions and makes certain assumptions when preparing the Schedule K-1’s which if not accepted by the IRS could result in income, gain, loss and deduction being adjusted or reallocated in a manner that adversely affects one or more Shareholders. | ||

| ● | The Sponsor expects to manage the Fund’s positions in Coal Futures so that the Fund’s assets are not leveraged (i.e., the notional value of the Fund’s investments never exceeds 100% of its U.S. Treasuries, cash and/or cash equivalents held as margin or otherwise). There is no assurance that the Sponsor will successfully implement this investment strategy. If the Fund becomes leveraged, an investor could lose all or substantially all of its investment if the Fund’s trading positions suddenly turn unprofitable. | ||

See “Risk Factors” for a description of certain additional risks that prospective investors should consider before investing in the Shares. | |||

| 6 |

Income/Expense | Per Share (1) | Per Basket (2) | ||||||||||||||

| Initial Selling Price | $ | 30.00 | 100 | % | $ | 750,000.00 | 100 | % | ||||||||

| Sponsor Fee (3) | 0.29 | 0.95 | 7,125.00 | 0.95 | ||||||||||||

| Brokerage Commissions and Fees (4)(5) | 0.09 | 0.30 | 2,250.00 | 0.30 | ||||||||||||

| Organizational and Offering Expenses (6) | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||

| Routine Operational, Administrative and Other Ordinary Expenses (7)(8) | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||

| Interest Income (9) | 0.01 | 0.03 | 225.00 | 0.03 | ||||||||||||

Annual Breakeven (10) | $ | 0.37 | 1.22 | % | $ | 9,150.00 | 1.22 | % | ||||||||

| (1) | Assumes that the Shares have a constant month-end NAV and is based on $30.00 as the NAV per Share. The actual NAV of the Fund will differ. |

| (2) | Assumes that the Baskets have a constant month-end NAV and is based on $750,000.00 as the NAV per Basket. The actual NAV of the Fund will differ. |

| ( 3 ) | The Fund is contractually obligated to pay the Sponsor a Sponsor Fee of 0.95% per annum on average NAV, payable monthly. From the Sponsor Fee, the Sponsor will be responsible for paying the fees and expenses of the Administrator, the Marketing Agent and the Trustee, and the routine operational, administrative and other ordinary expenses of the Fund, in each case subject to reimbursement by the Fund (other than marketing-related expenses). See “ Charges —Fees and Expenses” . |

| (4) | Investors may pay customary brokerage commissions to their brokers in connection with the purchases of Shares. Because brokerage commission rates will vary from investor to investor, brokerage commissions are not included in the Breakeven Table. Investors are encouraged to review the terms of their brokerage accounts for details on applicable charges. |

| ( 5 ) | The Fund is subject to brokerage commissions ( not expected to be higher than 0.30% per annum of the Fund’s average daily NAV ) including applicable exchange fees, NFA fees, give up fees, pit brokerage fees and other transaction related fees and expenses charged in connection with trading activities for the Fund’s investments in CFTC-regulated investments. The effects of trading spreads, financing costs associated with Coal Futures, and costs relating to the purchase of U.S. Treasuries or similar high credit quality short-term fixed-income or similar securities are not included in this analysis . |

| ( 6 ) | Expenses incurred in connection with organizing the Fund and the initial offering of its Shares will be paid by the Sponsor, and expenses incurred in connection with the continuous offering of Shares of the Fund after the commencement of its trading operations will be paid by the Sponsor , in each case subject to reimbursement by the Fund in the future. See “ Charges —Fees and Expenses—Accrual” . |

| ( 7 ) | The Fund’s estimated routine operational, administrative and other ordinary expenses, except as limited by the Trust Agreement (e.g., other than brokerage commissions) are paid by the Sponsor , subject to reimbursement by the Fund in the future. See “ Charges —Fees and Expenses—Accrual” below. |

| (8) | In connection with orders to create and redeem Baskets, Authorized Participants will pay a transaction fee in the amount of $500 per order. Because these transaction fees arede minimis in amount, are charged on a transaction by transaction basis (and not on a Basket by Basket basis), and are expected to be borne by the Authorized Participants, they have not been included in the Breakeven Table. |

| ( 9 ) | Assumes 100% of the NAV will be invested at an estimated rate of 0.03%, based upon the yield on 90 day U.S. Treasury Bills as of the date of this prospectus. The actual rate will vary. |

| (10) | The percentage of revenue required for the Fund to breakeven at the end of the first twelve (12) months of an investment, by definition, is expected to be 1.22% per annum the Fund’s average daily NAV. |

| 7 |

| ● | the location, availability, quality and price of competing fuels such as natural gas and oil, and alternative energy sources such as hydroelectric and nuclear power; |

| ● | technological developments in the traditional and alternative energy industries; |

| ● | global demand for electricity and steel; |

| ● | energy, environmental, fiscal and other governmental programs and policies; |

| ● | weather and other environmental conditions; |

| ● | global or regional political, economic or financial events and conditions; |

| ● | global coal inventories, production rates and production costs; |

| ● | currency exchange rates; and |

| ● | the general sentiment of market participants. |

| 8 |

| ● | the Fund may not be able to purchase or sell the exact amount of Coal Futures required to meet its investment objective; |

| ● | coal market disruptions may prevent the Fund from purchasing Coal Futures at a particular price, or at all; |

| ● | regulatory or other extraordinary circumstances may limit the Fund’s ability to create or redeem Baskets; |

| ● | the Fund will pay certain of its fees and expenses, including brokerage fees and expenses, extraordinary expenses, and the Sponsor Fee, and a significant increase in the Fund’s liabilities and expenses could lead to underperformance of the Fund relative to daily percentage changes in the Coal Futures; |

| ● | to avoid being leveraged, the Fund will always attempt to invest slightly under 100% of its assets in Coal Futures, which could lead to underperformance of the Fund relative to daily percentage changes in the Coal Futures; |

| ● | an imperfect correlation between the performance of Coal Futures held by the Fund and the Fund’s NAV; |

| ● | bid-ask spreads; |

| ● | market illiquidity or disruption; |

| ● | rounding of Share prices; |

| ● | the amount of Coal Futures liquidated to satisfy redemption requests; |

| ● | the need to conform the Fund’s portfolio holdings to comply with investment restrictions or policies, or regulatory or tax law requirements; and |

| ● | early and unanticipated closings of the markets on which the holdings of the Fund trade, resulting in the inability of the Fund to execute intended portfolio transactions. |

| 9 |

| 10 |

| 11 |

| 12 |

| 13 |

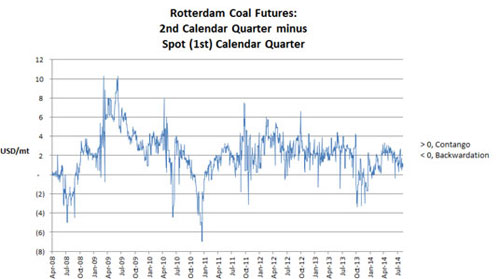

Coal Futures have historically been in a state of contango. If such a state of contango continues to persist, an investor in the Fund may experience a decrease in their return relative to spot coal prices. In addition, contango may cause a decrease in the value of the Shares in the Fund over time .

| 14 |

| 15 |

| 16 |

| 17 |

| ● | approximately 10% of the NAV will be held as margin deposits in the form of U.S. Treasuries, cash and/or cash equivalents in segregated accounts with a Commodity Broker, in accordance with the applicable CFTC rules; and |

| ● | approximately 90% of the NAV will be held to pay current obligations and as reserves in the form of U.S. Treasuries, cash and/or cash equivalents in segregated accounts with a Commodity Broker. |

| ● | held as margin or collateral; and |

| ● | held in U.S. Treasuries, cash and/or cash equivalents to pay current obligations and as reserves. |

| 18 |

● | Lignite. Lignite is geologically young coal that has the lowest carbon content (approximately 25% to 35%), and consequently the lowest energy content, of the four ranks of coal. Lignite has a heat value ranging between 4,000 and 8,300 BTUs-per-pound. Sometimes called brown coal, lignite is mainly used for electric power generation primarily in power plants close in proximity to the source. |

● | Sub-Bituminous. Sub-bituminous coal contains about 35% to 45% carbon and has a heat value between 8,300 and 13,000 BTUs-per-pound. Approximately half of the coal produced within North America is sub-bituminous. Although the heat value of sub-bituminous coal is lower than bituminous, it tends to be lower in sulfur content and cleaner burning. |

| ● | Bituminous. Bituminous, or black coal, is the most abundant type of coal. Bituminous contains approximately 45% to 86% carbon and has a heat value between 10,500 and 15,500 BTUs-per-pound. Bituminous has little water content or other impurities except for sulfur, and is easily ignited. |

| ● | Anthracite. Anthracite coal contains approximately 92% to 98% carbon and has a heat value of nearly 15,000 BTUs-per-pound. Anthracite has a heat value greater than that of Bituminous, but is hard to light, scarcer and more expensive. |

| 1 | Source: U.S. Energy Information Administration: (http://www.eia.gov/cfapps/ipdbproject/IEDIndex3.cfm?tid=1&pid=1&aid=24). | |

| 2 | Source: U.S. Energy Administration Association: (http://www.eia.gov/beta/coal/data/browser/#/topic/41?agg=0,2,1&rank=g&freq=A&start=2001&end=2012&ctype=map<ype=pin&rtype=s&maptype=0&rse=0&pin=) | |

| 19 |

| 3 | Source: BP Statistical Review of World Energy, 2013, page 33: (http://www.bp.com/content/dam/bp/pdf/Energy-economics/statistical-review-2014/BP-statistical-review-of-world-energy-2014-full-report.pdf) |

| 4 | Source: US Energy Information Administration, 2014: (http://www.eia.gov/cfapps/ipdbproject/IEDIndex3.cfm?tid=1&=1&=24) |

| 5 | Source: Cornot-Gandolphe, Sylvie. “Global Coal Trade From Tightness to Oversupply.” February 2013. Institut Francais des Relations Internationales , page 11. ( http://www.ifri.org/ ?page=contribution-detail&id=7570&lang=uk) |

| 6 | Source: EuroStat, October 2014: (http://epp.eurostat.ec.europa.eu/statistics_explained/index.php/Coal_consumption_statistics) |

| 20 |

| Source: Bloomberg |

| 7 | Source: “Coal Industry Across Europe.” 5thEdition 2013. European Association for Coal and Lignite , page 31. (http://www.euracoal.org/pages/medien.php?idpage=1410) |

| 8 | Source: Cornot-Gandolphe, Sylvie. “Global Coal Trade From Tightness to Oversupply.” February 2013. Institut Francais des Relations Internationales, page 32. (http://www.ifri.org/?page=contribution-detail&lang=uk) |

| 9 | Source: Port of Rotterdam website. October 2014: (http://www.portofrotterdam.com/en/Port/port-in-general/Pages/default.aspx) |

| 10 | Source: EuroStat, October 2014: ( http://epp.eurostat.ec.europa.eu/statistics_explained/index.php/File:Hard_coal_imports_into_EU-28_by_country_of_origin,_2013_(%25_based_on_kt).png) |

| 11 | Neither the Fund, the Sponsor, nor any of their affiliates are sponsored, endorsed, or promoted by, or otherwise associated with, Argus Media, IHGS Global Ltd., or the CME Group. |

| 12 | Source: Argus Media: |

| 13 | Source: IHS McCloskey, November 2010: ( http://cr.mccloskeycoal.com/journals/McCloskey/McCloskeyCR/Issue_249_-_26_November_2010/attachments/Methodology_May%202012_(October%202013%20Edited%20Version).pdf ) |

| 21 |

| ● | Easily Accessible and Relatively Cost Efficient. As the Shares are expected to be listed on the NYSE Arca, investors can access the market for Coal Futures through a traditional brokerage account. The Sponsor believes that investors will be able to more effectively implement strategic and tactical asset allocation strategies that are affected by changes in the price of coal by investing in the Shares as compared to other means of investing in coal. |

| 22 |

| ● | Exchange-traded and Transparent. The Shares are expected to trade on the NYSE Arca, providing investors with an efficient means to implement various investment strategies. Furthermore, the Sponsor will attempt to cause the composition of the Fund’s investment portfolio to be posted at www.greenhavenfunds.com daily, providing investors with a clear and timely picture of the Fund’s holdings. |

| ● | Competitively Priced. The Sponsor’s fee and certain other expenses paid by the Fund represent costs to an investor purchasing Shares. An investor’s decision to purchase Shares may be influenced by such fees and expenses relative to the costs associated with investing in coal by other means. |

| ● | a requirement to disclose only two years of audited financial statements, selected financial data and related Management’s Discussion and Analysis of Financial Condition and Results of Operations; |

| ● | reduced disclosure about its executive compensation arrangements; |

| ● | no requirement to hold nonbinding advisory shareholder votes on executive compensation or golden parachute arrangements; |

| ● | an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; and |

| ● | the option to use an extended transition period for complying with new or revised accounting standards. |

| 23 |

| Income/Expense | Per Share (1) | Per Basket (2) | |||||||||||

| Initial Selling Price | $ | 30.00 | 100 | % | $ | 750,000.00 | 100 | % | |||||

Sponsor Fee (3) | 0.29 | 0.95 | 7,125.00 | 0.95 | |||||||||

Brokerage Commissions and Fees (4)(5) | 0.09 | 0.30 | 2,250.00 | 0.30 | |||||||||

Organizational and Offering Expenses (6) | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||

Routine Operational, Administrative and Other Ordinary Expenses (7)(8) | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||

Interest Income (9) | 0.01 | 0.03 | 225.00 | 0.03 | |||||||||

Annual Breakeven (10) | $ | 0.37 | 1.22 | % | $ | 9,150.00 | 1.22 | % | |||||

| (1) | Assumes that the Shares have a constant month-end NAV and is based on $30.00 as the NAV per Share. The actual NAV of the Fund will differ. |

| (2) | Assumes that the Baskets have a constant month-end NAV and is based on $750,000.00 as the NAV per Basket. The actual NAV of the Fund will differ. |

| (3) | The Fund is contractually obligated to pay the Sponsor a Sponsor Fee of 0.95% per annum on average NAV, payable monthly. From the Sponsor Fee, the Sponsor will be responsible for paying the fees and expenses of the Administrator, the Marketing Agent and the Trustee, and the routine operational, administrative and other ordinary expenses of the Fund, in each case subject to reimbursement by the Fund (other than marketing-related expenses). See “—Fees and Expenses” below. |

| (4) | Investors may pay customary brokerage commissions to their brokers in connection with the purchases of Shares. Because brokerage commission rates will vary from investor to investor, brokerage commissions are not included in the Breakeven Table. Investors are encouraged to review the terms of their brokerage accounts for details on applicable charges. |

| (5) | The Fund is subject to brokerage commissions (not expected to be higher than 0.30% per annum of the Fund’s average daily NAV) including applicable exchange fees, NFA fees, give up fees, pit brokerage fees and other transaction related fees and expenses charged in connection with trading activities for the Fund’s investments in CFTC-regulated investments. The effects of trading spreads, financing costs associated with Coal Futures, and costs relating to the purchase of U.S. Treasuries or similar high credit quality short-term fixed-income or similar securities are not included in this analysis. |

| (6) | Expenses incurred in connection with organizing the Fund and the initial offering of its Shares will be paid by the Sponsor, and expenses incurred in connection with the continuous offering of Shares of the Fund after the commencement of its trading operations will be paid by the Sponsor, in each case subject to reimbursement by the Fund in the future. See “—Fees and Expenses—Accrual” below. |

| (7) | The Fund’s estimated routine operational, administrative and other ordinary expenses, except as limited by the Trust Agreement (e.g., other than brokerage commissions) are paid by the Sponsor, subject to reimbursement by the Fund in the future. See “—Fees and Expenses—Accrual” below. |

| (8) | In connection with orders to create and redeem Baskets, Authorized Participants will pay a transaction fee in the amount of $500 per order. Because these transaction fees are de minimis in amount, are charged on a transaction by transaction basis (and not on a Basket by Basket basis), and are expected to be borne by the Authorized Participants, they have not been included in the Breakeven Table. |

| (9) | Assumes 100% of the NAV will be invested at an estimated rate of 0.03%, based upon the yield on 90 day U.S. Treasury Bills as of the date of this prospectus. The actual rate will vary. |

| (10) | The percentage of revenue required for the Fund to breakeven at the end of the first twelve (12) months of an investment, by definition, is expected to be 1.22% per annum the Fund’s average daily NAV. |

| 24 |

| ● | registration fees, exchange listing fees, prepaid licensing fees, filing fees, escrow fees and taxes; |

| ● | costs of preparing, printing (including typesetting), amending, supplementing, mailing and distributing this prospectus and the exhibits hereto; |

| ● | costs of qualifying, printing (including typesetting), amending, supplementing, mailing and distributing sales materials used in connection with the offering and issuance of the Shares; |

| ● | travel, telephone and other expenses in connection with the offering and issuance of the Shares; and |

| ● | accounting, auditing and legal fees (including disbursements related thereto) incurred in connection therewith. |

| ● | the routine expenses associated with the preparation of monthly, quarterly, annual and other reports required by applicable U.S. federal and state regulatory authorities; |

| ● | accounting, auditing and legal fees (including disbursements related thereto); |

| ● | printing, mailing and other marketing-related costs; |

| ● | exchange listing fees, prepaid licensing fees, filing fees, escrow fees and taxes; |

| ● | payment for fees and costs associated with distribution, marketing, custody and transfer agency services to the Fund (see “—Fees Payable to Service Providers” below); and |

| ● | SEC and FINRA registration fees. |

| ● | the Sponsor Fee; and |

| ● | the Fund’s brokerage fees and expenses incurred in connection with the purchase and sale of Coal Futures and U.S. Treasuries. |

| 25 |

| Service Provider | Annual Compensation | |

GreenHaven Coal Services, LLC Sponsor | 0.95% of the average annual NAV (1) | |

Christiana Trust Trustee | $2,500 annually (2) | |

Morgan Stanley & Co. LLC ADM Investor Services, Inc. TFS Energy Futures LLC Initial Brokers | Up to 0.30% of the average annual NAV (3) | |

The Bank of New York Mellon Administrator | Fees for Fund administration equal: (4) (i) 0.065% of the average annual NAV up to $500 million; and (ii) 0.05% of the average annual NAV in excess of $500 million. | |

ALPS Distributors, Inc. Marketing Agent | Marketing Services (5) 0.06% of the average annual NAV Distribution Services (6) $50,000.00 annually |

| (1) | Payable by the Fund. The Sponsor will not allocate any of its organizational or ongoing operational expenses to the Fund. The Sponsor will not earn interest on any Sponsor Fee or advanced Fund expenses prior to payment of such liabilities. The Sponsor, from time to time, may temporarily waive all or a portion of the Sponsor Fee at its discretion for a stated period of time. Presently, the Sponsor does not intend to waive any of its fee. |

| (2) | Payable by the Sponsor. The Fund is also obligated to pay a one time set up fee to the Trustee at launch. |

| (3) | Payable by the Fund. 0.30% is an estimate of the annual percentage of NAV payable to a Commodity Broker for clearing and transacting Coal Futures and to the Execution Broker for brokerage fees charged in connection with Block Trades placed through ClearPort. All Commodity Broker and Execution Broker fees and expenses will be determined on a contract-by-contract basis. Accordingly, neither the Fund nor the Sponsor can give any assurance that the total fees, commissions and expenses paid to a Commodity Broker and the Execution Broker will not exceed the stated fee estimate. |

| (4) | Payable by the Sponsor. In addition, the Sponsor will reimburse the Administrator for such out-of-pocket expenses (e.g., telecommunication charges, postage and delivery charges, record retention costs, reproduction charges and transportation and lodging costs) as are incurred by the Administrator in performing its services to the Fund. |

| (5) | Payable by the Sponsor. In addition, the Sponsor will reimburse the Marketing Agent for its reasonable out-of-pocket expenses incurred and advances made by the Marketing Agent with respect to its performance of marketing-related services to the Fund. |

| (6) | Payable by the Sponsor. In addition, the Sponsor will reimburse the Marketing Agent for its reasonable out-of-pocket expenses incurred and advances made by the Marketing Agent with respect to its performance of distribution-related services to the Fund. |

| 26 |

| 27 |

| ● | arranging for the creation of the Fund, the registration of the Shares for public offering in the United States and the listing of the Shares; |

| ● | selecting the Commodity Brokers, Execution Broker(s), Administrator, Marketing Agent, auditor, legal counsel and other service providers and negotiating the applicable agreements and fees on behalf of the Fund; |

| ● | monitoring the performance of the Fund’s portfolio and reallocating assets within the portfolio with a view to achieving the Fund’s investment objective; |

| ● | developing and administering a marketing plan for the Fund and preparing marketing materials regarding the Shares, in each case in conjunction with the Marketing Agent; |

| ● | maintaining a website for the Fund; and |

| ● | performing such other services as the Sponsor believes that the Fund may from time to time require. |

| 28 |

| 29 |

| 30 |

| 31 |

| Date | Month | NAV | Rate of Return | |||||||||

| 1/30/2009 | January | $ | 21.80 | -0.55 | % | |||||||

| 2/27/2009 | February | $ | 20.87 | -4.27 | % | |||||||

| 3/31/2009 | March | $ | 21.73 | 4.12 | % | |||||||

| 4/30/2009 | April | $ | 21.69 | -0.18 | % | |||||||

| 5/29/2009 | May | $ | 24.21 | 11.62 | % | |||||||

| 6/30/2009 | June | $ | 22.73 | -6.11 | % | |||||||

| 7/31/2009 | July | $ | 23.44 | 3.12 | % | |||||||

| 8/30/2009 | August | $ | 23.19 | -1.07 | % | |||||||

| 9/30/2009 | September | $ | 23.89 | 3.02 | % | |||||||

| 10/30/2009 | October | $ | 24.94 | 4.40 | % | |||||||

| 11/30/2009 | November | $ | 26.09 | 4.61 | % | |||||||

| 12/31/2009 | December | $ | 26.22 | 0.50 | % | |||||||

| FY 2009 | 19.62 | % | ||||||||||

| 1/31/2010 | January | $ | 25.09 | -4.31 | % | |||||||

| 2/28/2010 | February | $ | 25.67 | 2.31 | % | |||||||

| 3/31/2010 | March | $ | 25.07 | -2.34 | % | |||||||

| 4/30/2010 | April | $ | 25.76 | 2.75 | % | |||||||

| 5/31/2010 | May | $ | 24.50 | -4.89 | % | |||||||

| 6/30/2010 | June | $ | 24.92 | 1.71 | % | |||||||

| 7/30/2010 | July | $ | 26.42 | 6.02 | % | |||||||

| 8/31/2010 | August | $ | 26.21 | -0.79 | % | |||||||

| 9/30/2010 | September | $ | 28.14 | 7.36 | % | |||||||

| 10/29/2010 | October | $ | 29.76 | 5.76 | % | |||||||

| 11/30/2010 | November | $ | 29.67 | -0.30 | % | |||||||

| 12/31/2010 | December | $ | 32.88 | 10.82 | % | |||||||

| FY 2010 | 25.40 | % | ||||||||||

| 1/31/2011 | January | $ | 34.01 | 3.44 | % | |||||||

| 2/28/2011 | February | $ | 35.16 | 3.38 | % | |||||||

| 3/31/2011 | March | $ | 35.20 | 0.11 | % | |||||||

| 4/29/2011 | April | $ | 36.34 | 3.24 | % | |||||||

| 5/31/2011 | May | $ | 34.87 | -4.05 | % | |||||||

| 6/30/2011 | June | $ | 33.59 | -3.67 | % | |||||||

| 32 |

| Date | Month | NAV | Rate of Return | |||||||||

| 7/30/2011 | July | $ | 34.48 | 2.65 | % | |||||||

| 8/31/2011 | August | $ | 35.23 | 2.18 | % | |||||||

| 9/30/2011 | September | $ | 30.46 | -13.54 | % | |||||||

| 10/29/2011 | October | $ | 32.21 | 5.75 | % | |||||||

| 11/30/2011 | November | $ | 31.12 | -3.38 | % | |||||||

| 12/31/2011 | December | $ | 29.96 | -3.73 | % | |||||||

| FY 2011 | -8.88 | % | ||||||||||

| 1/31/2012 | January | $ | 31.29 | 4.44 | % | |||||||

| 2/29/2012 | February | $ | 31.70 | 1.31 | % | |||||||

| 3/30/2012 | March | $ | 30.35 | -4.26 | % | |||||||

| 4/30/2012 | April | $ | 29.51 | -2.77 | % | |||||||

| 5/31/2012 | May | $ | 26.95 | -8.68 | % | |||||||

| 6/29/2012 | June | $ | 28.43 | 5.50 | % | |||||||

| 7/31/2012 | July | $ | 29.65 | 4.30 | % | |||||||

| 8/31/2012 | August | $ | 30.35 | 2.36 | % | |||||||

| 9/30/2012 | September | $ | 30.57 | 0.72 | % | |||||||

| 10/31/2012 | October | $ | 29.56 | -3.30 | % | |||||||

| 11/30/2012 | November | $ | 29.82 | 0.88 | % | |||||||

| 12/31/2012 | December | $ | 28.85 | -3.25 | % | |||||||

| FY 2012 | -3.70 | % | ||||||||||

| 1/31/2013 | January | $ | 29.50 | 2.18 | % | |||||||

| 2/28/2013 | February | $ | 28.21 | -4.31 | % | |||||||

| 3/31/2013 | March | $ | 28.26 | 0.18 | % | |||||||

| 4/30/2013 | April | $ | 27.65 | -2.16 | % | |||||||

| 5/31/2013 | May | $ | 26.89 | -2.75 | % | |||||||

| 6/30/2013 | June | $ | 25.76 | -4.20 | % | |||||||

| 7/31/2013 | July | $ | 26.01 | 0.97 | % | |||||||

| 8/31/2013 | August | $ | 26.84 | 3.19 | % | |||||||

| 9/30/2013 | September | $ | 26.48 | -1.34 | % | |||||||

| 10/31/2013 | October | $ | 26.15 | -1.25 | % | |||||||

| 11/30/2013 | November | $ | 25.84 | -1.19 | % | |||||||

| 12/31/2013 | December | $ | 25.70 | -0.54 | % | |||||||

| FY 2013 | -10.92 | % | ||||||||||

| 1/31/2014 | January | $ | 25.87 | 0.66 | % | |||||||

| 2/28/2014 | February | $ | 27.80 | 7.46 | % | |||||||

| 3/31/2014 | March | $ | 28.19 | 1.40 | % | |||||||

| 4/30/2014 | April | $ | 28.74 | 1.95 | % | |||||||

| 5/31/2014 | May | $ | 27.78 | -3.34 | % | |||||||

| 6/30/2014 | June | $ | 27.91 | 0.47 | % | |||||||

| 7/31/2014 | July | $ | 26.62 | -4.62 | % | |||||||

| 8/31/2014 | August | $ | 26.25 | -1.39 | % | |||||||

| 9/30/2014 | September | $ | 24.79 | -5.56 | % | |||||||

| YTD 2014 | -3.54 | % | ||||||||||

| 33 |

| 34 |

| 35 |

| 36 |

| 37 |

| 38 |

| 39 |

| 40 |

| 41 |

| 42 |

| 43 |

| 44 |

| ● | fund accounting records; |

| ● | ledgers with respect to assets, liabilities, capital, income and expenses; and |

| ● | trading and related documents received from futures commission merchants. |

| 45 |

| ● | consulting with the Sponsor and its affiliates with respect to marketing and sales strategies; |

| ● | reviewing marketing-related legal documents and contracts; |

| ● | reviewing and consulting on sales and marketing materials; |

| ● | providing support to national account managers and wholesalers, including assistance with the implementation of sales strategy; |

| ● | consulting with the Sponsor and its affiliates with respect to FINRA and SEC compliance; and |

| ● | maintaining books and records related to the Marketing Agent’s marketing-related services provided to the Fund. |

| ● | reviewing distribution-related legal documents and contracts; |

| ● | coordinating the processing of Basket creations and redemptions; and |

| ● | coordinating and assisting with the maintenance of creation and redemption records. |

| 46 |

| 47 |

| 48 |

| 49 |

| 50 |

| 51 |

| ● | all marketing materials will be maintained at the offices of the Marketing Agent; |

| ● | creation and redemption books and records and certain financial books and records (including Fund accounting records, ledgers with respect to assets, liabilities, capital, income and expenses, the registrar, transfer journals and related details) will be maintained by the Administrator; and |

| ● | all other books and records of the Fund (including minute books and other general corporate records, trading records and related reports and other items received from the Fund’s Commodity Brokers and counterparties) will be maintained by the Sponsor. |

| Marketing Agent: | ALPS Distributors, Inc. 1290 Broadway, Suite 1100 Denver, Colorado 80203 (800) 320-2577 |

| Administrator: | Bank of New York Mellon One Wall Street New York, New York 10286 (718) 315-4412 |

| Sponsor: | GreenHaven Coal Services, LLC 3340 Peachtree Road, Suite 1910 Atlanta, Georgia 30326 (404) 239-7941 |

| 52 |

| 53 |

| (i) | the Shareholder made a misrepresentation to the Fund or the Sponsor in connection with its purchase of Shares; or |

| (ii) | the Shareholder’s ownership of Shares would result in the violation of any law or regulation applicable to the Fund or a Shareholder. |

| 54 |

| 55 |

| 56 |

| 57 |

| 58 |

| 59 |

| 60 |

| 61 |

Tax on Net Investment Income

In addition to regular income taxation and alternative minimum income taxation, a 3.8% tax will be imposed on some or all of the net investment income of certain individuals with modified adjusted gross income of over $200,000 ($250,000 in the case of joint filers) and the undistributed net investment income of certain estates and trusts (the “Medicare Tax”). For these purposes, it is expected that all or a substantial portion of a non-corporate Shareholder’s share of Fund income will be net investment income. In addition, certain Fund expenses may not be deducted in determining the amount of income of a non-corporate Shareholder’s net investment income subject to the Medicare Tax.

| 62 |

| 63 |

| 64 |

| 65 |

| 66 |

| 67 |

| 68 |

| 69 |

| 70 |

| 71 |

| 72 |

| F-1 |

| F-2 |

| PROSPECTUS | ||

| SAI-1 |

| The Futures Markets | SAI-3 |

| SAI-2 |

PART II—INFORMATION NOT REQUIRED IN PROSPECTUS

Item 13. Other Expenses of Issuance and Distribution.

Set forth below is an estimate (except as indicated) of the amount of fees and expenses to be incurred in connection with the issuance and distribution of the securities being registered. These expenses shall be paid by GreenHaven Coal Services, LLC, the sponsor of the Registrant (the “Sponsor”).

| Amount | |

| SEC registration fee | $53,196 |

| NYSE Arca Listing Fee | $15,000 |

| FINRA filing fees | $58,500 |

| Auditor���s fees and expenses (estimate) | $40,000 |

| Legal fees and expenses (estimate) | $180,000 |

| Printing expense (estimate) | $30,000 |

| Total | $376,696 |

Item 14. Indemnification of Directors and Officers.

Section 2.04 of the Registrant’s Declaration of Trust and Trust Agreement (the “Trust Agreement”) between Christiana Trust, a division of Wilmington Savings Fund Society, FSB, the Registrant’s trustee (the “Trustee”), and the Sponsor provides that the Trustee, (in its capacity as Trustee and individually) and its successors, assigns, legal representatives, officers, directors, employees, agents and servants (each a “Trustee Indemnified Party”, shall be indemnified and held harmless against any and all liabilities, obligations, losses, damages, penalties, taxes (excluding any taxes payable by the Trustee on or measured by any compensation received by the Trustee for its services or any indemnity payments received by the Trustee), claims, actions, suits, costs, expenses or disbursements (including legal fees and expenses) of any kind and nature whatsoever which may be imposed on, incurred by or asserted against the Trustee Indemnified Parties in any way relating to or arising out of the formation, operation or termination of the Registrant, the execution, delivery and performance of any other agreements to which the Registrant is a party or the action or inaction of the Trustee thereunder, except for claims resulting from the gross negligence, willful misconduct or recklessness of the Trustee Indemnified Parties.

Section 4.10 of the Trust Agreement provides that the Sponsor and its Affiliates (as defined therein), successors, assigns, legal representatives, officers, directors, employees, agents and servant (each a “Sponsor Indemnified Party”), shall be indemnified from the Fund and held harmless against all claims, losses, liabilities and expenses, including but not limited to amounts paid in satisfaction of judgments or settlements, in compromise or as fines and penalties, and counsel fees reasonably incurred by any Sponsor Indemnified Party, in connection with the defense or disposition of any action, suit or other proceeding, whether civil or criminal, before any court or administrative or legislative body, in which such Sponsor Indemnified Party may be or may have been involved as a party or otherwise or with which such Sponsor Indemnified Party may be or may have been threatened, while in office or thereafter, by reason of any alleged act or omission as a Sponsor Indemnified Party or by reason of his or her being or having been such a Sponsor Indemnified Party except with respect to any matter as to which such Sponsor Indemnified Party shall have been finally adjudicated in any such action, suit or other proceeding not to have acted in good faith in the reasonable belief that such Sponsor Indemnified Party’s action was in the best interests of the Fund and except that no Sponsor Indemnified Party shall be indemnified against any liability to the Fund or its Shareholders by reason of willful misconduct or gross negligence of such Sponsor Indemnified Party.

Item 15. Recent Sales of Unregistered Securities.

Not applicable.

Item 16. Exhibits and Financial Statement Schedules.

(a) Exhibits

Exhibit Number | Description | ||

| 3.1* | GreenHaven Coal Fund Amended and Restated Trust Agreement | ||

| 5.1** | Opinion of Young Conaway Stargatt & Taylor, LLP as to legality | ||

| 8.1** | Form of Opinion of Bryan Cave LLP as to tax matters | ||

| 10.1*** | Form of Authorized Participant Agreement | ||

| 10.2**** | Form of Marketing Agent Agreement | ||

| 10.3* | Administrative Services Agreement | ||

| 23.1 | Consent of Young Conaway Stargatt & Taylor, LLP (included in Exhibit 5.1) | ||

| 23.2 | Consent of Bryan Cave LLP (to be included in Exhibit 8.1) | ||

| 23.3* | Consent of Grant Thornton for GreenHaven Coal Index Fund | ||

| 23.4* | Consent of Grant Thornton for GreenHaven Coal Services, LLC | ||

* To be filed by pre-effective amendment.

** Previously filed as an exhibit to Pre-Effective Amendment to Form S-1 filed on March 21, 2013.

*** Previously filed as an exhibit to Pre-Effective Amendment to Form S-1 filed on August 23, 2012.

**** Previously filed as an exhibit to Pre-Effective Amendment to Form S-1 filed on October 24, 2012.

| II-1 |

(b) Financial Statement Schedules

Not applicable.

Item 17. Undertakings.

The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) If the Registrant is relying on Rule 430B (§230.430B of this chapter):

(A) Each prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance or Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of an included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability proposes of the issuer and any person that is at that date an underwriter such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initialbona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchase with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; or

(ii) If the Registrant is subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

| II-2 |

(5) That, for the purpose of determining liability of the Registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities:

The undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

(6) That insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question of whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

| II-3 |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Atlanta, Georgia, on October 16 , 2014.

| GREENHAVEN COAL INDEX FUND | |||

| By: | GreenHaven Coal Services, LLC,Sponsor | ||

| By: | /s/ Ashmead Pringle | ||

| Chief Executive Officer | |||

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities* and on the dates indicated.

| Signature | Capacity | Date | ||

| /s/ Ashmead Pringle | Chief Executive Officer (principal executive officer) | October 16 , 2014 | ||

| Ashmead Pringle | ||||

| /s/ Cooper Anderson | Chief Financial Officer (principal financial officer and principal accounting officer) | October 16 , 2014 | ||

| Cooper Anderson |

| * | The Registrant is a trust and the persons are signing in their capacities as officers of GreenHaven Coal Services, LLC, the Sponsor of the Registrant. |