Exhibit 99.1

BENITEC BIOPHARMA LIMITED

ABN 64 068 943 662

NOTICE OF 2018 ANNUAL GENERAL MEETING

Notice is hereby given that the 2018 Annual General Meeting of the Shareholders of Benitec Biopharma Limited (“the Company” or "Benitec") will be held at the offices of Grant Thornton, Level 17, 383 Kent Street, Sydney NSW 2000 on Thursday, 8 November 2018 at 10.00am AEDT.

Further details in respect of each of the resolutions proposed in this Notice of Meeting are set out in the Explanatory Memorandum accompanying this Notice. The details of the resolutions contained in the Explanatory Memorandum should be read together with, and form part of, this Notice of Meeting.

AGENDA

2018 ANNUAL FINANCIAL STATEMENTS

To lay before the Meeting and consider the Annual Financial Statements of the Company for the financial year ended 30 June 2018 together with the declaration of the Directors, the Directors’ Report, the Remuneration Report and the Auditor’s Report.

RESOLUTION 1: NON-BINDING RESOLUTION – REMUNERATION REPORT

To consider and, if thought fit, to pass the following resolution as a non-binding ordinary resolution:

“That the Company approve the adoption of the Remuneration Report, included within the Directors’ Report, for the year ended 30 June 2018.”

Voting Exclusion Statement:

In accordance with theCorporations Act 2001(Cth) (“Corporations Act”), a person must not vote on this Resolution if they are, and the Company will disregard any votes cast on this Resolution in any capacity by or on behalf of, a member of the Key Management Personnel within the meaning of the Corporations Act (including the Directors) or any of that person’s closely related parties within the meaning of the Corporations Act (such as close family members and any controlled companies of those persons) (collectively referred to as “Restricted Voters”). However, the person may vote and the Company need not disregard a vote if:

| · | it is cast by the person as a proxy appointed in writing that specifies the way the proxy is to vote on the resolution; and |

| · | it is not cast on behalf of a Restricted Voter. |

The Chair of the Meeting may cast votes on the Resolution as a proxy, other than on behalf of a Restricted Voter, where the written appointment of the Chair as proxy (which may include appointment of the Chair as a proxy by default in the absence of another person) does not specify the way the proxy is to vote on the Resolution but expressly authorises the Chair to exercise the proxy even if the Resolution is connected directly or indirectly with the remuneration of a member of the Key Management Personnel.

RESOLUTION 2: RE-ELECTION OF DIRECTOR – MR J KEVIN BUCHI

To consider and, if thought fit, to pass the following resolution as an ordinary resolution:

"That Mr J Kevin Buchi, a Director who retires by rotation in accordance with the Constitution of the Company, being eligible, is re-elected as a Director of the Company."

| 1 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

RESOLUTION 3: SPECIAL RESOLUTION - APPROVAL OF 10% PLACEMENT CAPACITY

To consider, and if thought fit, pass with or without amendment the following resolution as a special resolution:

“That for the purposes of ASX Listing Rule 7.1A, Shareholders approve the Company having the capacity to issue fully paid ordinary shares in the capital of the Company up to the maximum number permitted under ASX Listing Rule 7.1A.2 as described in the Explanatory Memorandum which accompanies and forms part of this Notice of Meeting.”

Voting Exclusion Statement:

The Company will disregard any votes cast in favour of this Resolution by or on behalf of:

| · | persons who may participate in the proposed issue and persons who might obtain a benefit except a benefit solely in the capacity of a holder of Shares, if the resolution is passed; and |

| · | an associate of those persons. |

However, the Company need not disregard a vote if:

| · | it is cast by a person as proxy for a person who is entitled to vote, in accordance with the directions on the Proxy Form; or |

| · | it is cast by the person chairing the meeting as proxy for a person who is entitled to vote, in accordance with a direction on the Proxy Form to vote as the proxy decides. |

RESOLUTION 4: RE-APPROVAL OF OPTION PLAN

To consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“That for the purposes of ASX Listing Rule 7.2 Exception 9 and for all other purposes, Shareholders re-approve the Option Plan as described in the Explanatory Memorandum which accompanies and forms part of this Notice of Meeting.”

Voting Exclusion Statement:

The Company will disregard any votes cast in favour of this Resolution by or on behalf of:

| · | a Director (except a Director who is ineligible to participate in the Option Plan); and |

| · | an associate of that person. |

In accordance with the Corporations Act, a member of the Key Management Personnel (within the meaning of the Corporations Act) or a Restricted Voter cannot vote as proxy if their appointment does not specify the way in which the proxy is to vote.

However, the Company need not disregard a vote if:

| · | it is cast by the person as proxy for a person who is entitled to vote, in accordance with the directions on the Proxy Form; or |

| · | it is cast by the person chairing the meeting as proxy for a person who is entitled to vote, in accordance with a direction on the Proxy Form to vote as the proxy decides, provided that the Proxy Form expressly authorises the Chair to exercise the proxy even if the Resolution is connected directly or indirectly with the remuneration of a member of the Key Management Personnel. |

| 2 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

RESOLUTION 5: APPROVAL TO ISSUE OPTIONS TO DR JEREL BANKS

To consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“That Shareholders approve:

| (a) | for the purpose of ASX Listing Rule 10.14 and for all other purposes, the issue of 10,000,000 Options to Dr Jerel Banks each with an exercise price of $0.2278; and |

| (b) | for the purpose of Part 2D.2 of the Corporations Act and for all other purposes, the giving of a benefit to Dr Jerel Banks in connection with any early vesting of those Options on his retirement from a managerial or executive office (within the meaning of section 200AA of the Corporations Act) in the Company or a related body corporate of the Company, |

in each case in accordance with the Option Plan and on the terms and conditions described in the Explanatory Memorandum which accompanies and forms part of this Notice of Meeting.”

Voting Exclusion Statement:

The Company will disregard any votes cast in favour of this Resolution by or on behalf of:

| · | a Director (except a Director who is ineligible to participate in the Option Plan); and |

| · | an associate of that person. |

In accordance with the Corporations Act, a member of the Key Management Personnel (within the meaning of the Corporations Act) or a Restricted Voter cannot vote as proxy if their appointment does not specify the way in which the proxy is to vote.

However, the Company need not disregard a vote if:

| · | it is cast by the person as proxy for a person who is entitled to vote, in accordance with the directions on the Proxy Form; or |

| · | it is cast by the person chairing the meeting as proxy for a person who is entitled to vote, in accordance with a direction on the Proxy Form to vote as the proxy decides, provided that the Proxy Form expressly authorises the Chair to exercise the proxy even if the Resolution is connected directly or indirectly with the remuneration of a member of the Key Management Personnel. |

OTHER BUSINESS

To consider any other business that may be brought before the Meeting in accordance with the Constitution and the Corporations Act.

By the order of the Board

Oliver Kidd

Company Secretary

Dated: 5 October 2018

The accompanying Proxy Instructions and Explanatory Memorandum form part of this Notice of Meeting.

| 3 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| PROXY & VOTING INSTRUCTIONS |

Voting entitlements

The Board has determined, in accordance with the Constitution and Regulation 7.11.37 of theCorporations Regulations 2001 (Cth) that a Shareholder’s voting entitlement at the Meeting will be taken to be the entitlement of that person shown in the register of members as at 7:00pm AEDT on Tuesday, 6 November 2018.

On a poll, members have one vote for every Share held. Holders of options are not entitled to a vote for any options held.

Proxy Instructions

A member entitled to vote has a right to appoint a proxy. If a member is entitled to cast two or more votes they may appoint one or two proxies and specify the percentage of votes each proxy is entitled to exercise. If the appointment does not specify the proportion or number of votes each proxy may exercise, each proxy may exercise half of the votes in which case any fraction of votes will be disregarded. The proxy may, but need not, be a member of the Company.

The Proxy Form (and the power of attorney or other authority, if any, under which the Proxy Form is signed) must be deposited at the share registry of the Company using one of the below methods to arrive not less than 48 hours before the time for holding the Meeting, or adjourned meeting as the case may be, at which the individual named in the Proxy Form proposed to vote.

| · | Online atwww.investorvote.com.au (instructions on how to lodge online can be found on the Proxy Form) |

| · | By post to Computershare Investor Services Pty Ltd, GPO Box 242, Melbourne, Victoria 3001 |

| · | By fax to 1800 783 447 (within Australia) or (03) 9473 2555 (outside Australia) |

| · | In person at ComputerShare Investor Services Pty Ltd located at 452 Johnson Street, Abbotsford, Victoria 3067 |

The Proxy Form must be signed by the member or his/her attorney duly authorised in writing or, if the member is a corporation, in a manner permitted by the Corporations Act. A proxy given by a foreign corporation must be executed in accordance with the laws of that corporation’s place of incorporation. If you sign the Proxy Form and do not appoint a proxy, you will have appointed the Chairman of the meeting as your proxy.

A Proxy Form is enclosed with this Notice.

How the Chairman will vote undirected proxies

The Chairman intends to vote any undirected proxy in favour of all Resolutions

If you appoint the Chairman as your proxy, or the Chairman is appointed your proxy by default, you will be taken to authorise the Chairman to exercise the proxy even if the Resolution is connected directly or indirectly with the remuneration of a member of the Key Management Personnel.

Proxies that are undirected on Resolution 1

If you appoint a Director other than the Chairman, any other Key Management Personnel or any of their closely related parties, he or she as proxy cannot vote on Resolution 1 unless you direct him or her how to vote on the Resolution. The Remuneration Report identifies Key Management Personnel for the year ending 30 June 2018. Their closely related parties are defined in the Corporations Act and include specified family members, dependents and companies they control.

If you are eligible to vote on Resolution 1 and chose to appoint a proxy, you are encouraged to direct your proxy how to vote on the Resolutions by marking either "For", "Against" or "Abstain" on the Proxy Form for the Resolution if you want your Shares to be voted on the Resolution.

| 4 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| PROXY & VOTING INSTRUCTIONS |

Corporate Representatives

Any corporation which is a member of the Company may appoint a proxy, as set out above, or authorise (by certificate under common seal or other form of execution authorised by the laws of that corporation’s place of incorporation, or in any other manner satisfactory to the chairperson of the Meeting) a natural person to act as its representative at any general meeting or appoint an attorney. Corporate representatives are requested to bring appropriate evidence of appointment as a representative in accordance with the Constitution. Attorneys are requested to bring the original or a certified copy of the power of attorney pursuant to which they were appointed. Proof of identity will also be required for corporate representatives and attorneys.

Special Resolution

Resolutions 3 is proposed as a special resolution. For a special resolution to be passed, at least 75% of the votes validly cast on the Resolution by Shareholders (by number of Shares) must be in favour of the Resolution.

Definitions

Capitalised terms in this Notice or the Explanatory Memorandum are defined in Schedule 1.

| 5 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| EXPLANATORY MEMORANDUM |

This Explanatory Memorandum has been prepared for the information of members of Benitec in connection with the business to be conducted at the Annual General Meeting of Shareholders of the Company to be held at offices of Grant Thornton, Level 17, 383 Kent Street, Sydney NSW 2000 on Thursday, 8 November 2018 at 10.00am AEDT.

This Explanatory Memorandum should be read in conjunction with the accompanying Notice of Meeting.

OVERVIEW OF BUSINESS OF THE MEETING

This meeting will deal with the usual items of business for an Annual General Meeting - these are referred to below as the "Ordinary Business".

In addition, the meeting will consider an item of "Special Business" - this relates to the approval to increase the Company's placement capacity under ASX Listing Rule 7.1A to 25% (that is, by an additional 10% from what is permitted under ASX Listing Rule 7.1).

ORDINARY BUSINESS

2018 Annual Financial Statements

Section 317 of the Corporations Act requires each of the Annual Financial Report (which includes the Annual Financial Statements and Director’s Declaration), the Director’s Report, Remuneration Report and the Auditor’s Report for the last financial year to be laid before the Annual General Meeting. The Constitution also provides for these reports to be received and considered at that meeting. There is no requirement for these reports to be formally approved by Shareholders.

Shareholders attending the Annual General Meeting will have the opportunity to put questions to the Board and make comments on matters contained in that Annual Financial Report and the management of the Company. A representative of the auditor will be invited to attend to answer questions about the audit of the Company’s Annual Financial Statements.

In addition to asking questions at the meeting, Shareholders may address written questions to the Chairman about the management of the Company or to the Company’s auditor, Grant Thornton, if the question is relevant to:

| · | the content of the auditor’s report; or |

| · | the conduct of its audit of the annual financial report to be considered at the meeting. |

Note: Under section 250PA(1) of the Corporations Act, a Shareholder must submit the question to the Company no later than the fifth business day before the day on which the Annual General Meeting is held.

Written questions for the auditor must be delivered by Thursday, 1 November 2018. Please send any written questions to:

The Company Secretary

Suite 1201, 99 Mount Street

North Sydney NSW 2060

or via email to: okidd@benitec.com

The reports referred to in the Notice of Meeting are included in the 2018 Annual Financial Report, which at their election, has been made available to all Shareholders on-line or by post. If you have not elected to receive a hard copy of the Company’s 2018 Annual Financial Report and wish to access it online, it is available at the Company’s website www.benitec.com under the heading “Investors”.

No resolution is required to be moved in respect of this item.

| 6 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| EXPLANATORY MEMORANDUM |

Resolution 1: Non-binding Resolution – Remuneration Report

The Company is required by section 250R(2) of the Corporations Act 2001 (Cth), to propose a resolution that the Remuneration Report of Benitec Biopharma Limited be adopted. The Remuneration Report is contained within the Directors' Report in the 2018 Annual Financial Report and sets out the Company’s remuneration arrangements for Directors.

Shareholders attending the Meeting will have the opportunity to discuss and put questions in respect of the Remuneration Report, and Shareholders will be asked to vote on a non-binding resolution to adopt the Remuneration Report.

This Resolution is advisory only and does not bind the Company or its Directors. The Board will consider the outcome of the vote and comments made by Shareholders on the Remuneration Report at the Meeting when reviewing the Company's remuneration policies. Under the Corporations Act, if 25% or more of votes that are cast are voted against the adoption of the Remuneration Report at two consecutive annual general meetings (treating the Meeting as the first such meeting), Shareholders will be required to vote at the second of those annual general meetings on a resolution (a "spill resolution") that another meeting be held within 90 days at which all of the Directors (other than the Managing Director and CEO) must be put up for re-election. At the 2017 Annual General Meeting greater than 75% of the votes cast on the adoption of the Remuneration Report contained in the Company's 2017 Annual Financial Statements was in favour of its adoption and therefore on this occasion a spill resolution will not be required in the event that 25% or more of votes that are cast are against the adoption of the Remuneration Report.

A person must not vote (unless as a proxy of a person permitted to vote, as provided for in this paragraph) if they are a member of the Company’s Key Management Personnel. Any undirected proxies held by Directors (other than the Chairman of the Meeting) or other Key Management Personnel or any of their closely related parties must not be voted on this Resolution. Undirected proxies held by the Chairman of the Meeting will be voted in accordance with the authorisation in the Proxy Form (in which case the Chairman of the Meeting will vote undirected proxies in favour of the Resolution). 'Closely related parties' are defined by the Corporations Act, and include specified family members, dependents and companies they control.

If you are eligible to vote on this Resolution and chose to appoint a proxy, you are encouraged to direct your proxy how to vote on this Resolution by marking either "For", "Against" or "Abstain" on the Proxy Form for this Resolution if you want your Shares to be voted on that item of business.

Resolution 2: Re-election of Director – Mr J Kevin Buchi

Article 20.1(a)(i) of the Constitution requires that at each Annual General Meeting the number of Directors which does not exceed one third of the Directors automatically retire from office and are eligible for re- appointment. Article 20.1(d) provides that the Directors who retire by reason of this rule are those who have been in office the longest since last being re-elected. Mr J Kevin Buchi will retire by rotation at this meeting, is eligible for re-election and is seeking re-election as a Director at this Meeting.

Mr J Kevin Buchi was appointed Non-Executive Director on 11 April 2013 and was last re-elected a Director on 12 November 2015.

Kevin most recently served as the CEO of TetraLogic Pharmaceuticals Corporation, a public U.S. Biotechnology Company. Prior to that, Kevin served as Chief Executive Officer (‘CEO’) of Cephalon, Inc. through its $6.8 billion acquisition by Teva Pharmaceutical Industries (‘Teva’) in October 2011. After the acquisition he served as Corporate Vice President, Global Branded Products of Teva. Kevin joined Cephalon, Inc. in 1991 and held various positions, including Chief Operating Officer, Chief Financial Officer and Head of Business Development prior to being appointed CEO.

| 7 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| EXPLANATORY MEMORANDUM |

Mr Buchi has an interest in 1,448,210 Shares and 840,000 Options.

The Directors (with Mr Buchi abstaining) recommend that Shareholders vote in favour of this Resolution.

SPECIAL BUSINESS

Resolution 3: Special Resolution - Approval of 10% Placement Capacity

Under ASX Listing Rule 7.1A certain companies may seek shareholder approval by special resolution passed at an annual general meeting to have the additional capacity to issue equity securities in the same class as already listed securities which do not exceed 10% of the existing ordinary share capital without further shareholder approval.

Approval under this Resolution is sought for the Company to issue ordinary shares under ASX Listing Rule 7.1A.

If this Resolution is approved the Company may make an issue of Shares under ASX Listing Rule 7.1A at any time (either on a single date or progressively) up until the earlier of:

| · | the date which is 12 months after the date of this Annual General Meeting; or |

| · | the date on which Shareholders approve a transaction under ASX Listing Rule 11.1.2 (a significant change to the nature or scale of the Company’s activities) or ASX Listing Rule 11.2 (disposal of the Company’s main undertaking), |

after either of which dates an approval under ASX Listing Rule 7.1A ceases to be valid.

Accordingly, the approval given if this Resolution is passed will cease to be valid on the earlier of 8 November 2019 (being the date 12 months after the date of this Meeting) or the date on which holders of the Company’s ordinary securities approve a transaction under ASX Listing Rules 11.1.2 or 11.2.

At the date of this Explanatory Memorandum, the Company is an ‘eligible entity’, and therefore able to seek approval under ASX Listing Rule 7.1A, as it is not included in the S&P/ASX300 and has a market capitalisation less than the amount prescribed by ASX (currently $300 million). If at the time of this Meeting the Company is no longer an eligible entity, this Resolution will be withdrawn.

Any securities under ASX Listing Rule 7.1A issued must be in the same class as an existing class of quoted equity securities. The Company currently has on issue only one class of equity securities - being 257,029,426 Shares.

The exact maximum number of Shares which may be issued in the capital of the Company under the approval sought by this Resolution will be determined in accordance with the following formula prescribed in ASX Listing Rule 7.1A.2:

(A x D) – E

where:

| A | is the number of Shares on issue 12 months before the date of issue or agreement to issue: |

| (i) | plus the number of Shares issued in the 12 months under an exception in ASX Listing Rule 7.2; |

| (ii) | plus the number of partly paid shares that became fully paid in the 12 months; |

| 8 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| EXPLANATORY MEMORANDUM |

| (iii) | plus the number of Shares issued in the 12 months with approval of holders of Shares under ASX Listing Rule 7.1 and 7.4 (this does not include an issue of Shares under the entity’s 15% placement capacity without Shareholder approval); |

| (iv) | less the number of Shares cancelled in the 12 months; |

| D | is 10%; and |

| E | is the number of equity securities issued or agreed to be issued under ASX Listing Rule 7.1A.2 in the 12 months before the date of the issue or agreement to issue that are not issued with the approval of Shareholders under ASX Listing Rule 7.1 or 7.4. |

The ability of the Company to make an issue under ASX Listing Rule 7.1A is in addition to its 15% placement capacity under ASX Listing Rule 7.1. The effect of this Resolution will be to allow the Company to issue Shares under ASX Listing Rule 7.1A without using the Company’s 15% placement capacity under ASX Listing Rule 7.1.

As at the date of this Explanatory Memorandum, the Company has 257,029,426 Shares on issue and has capacity to issue:

| · | 38,771,413 equity securities under ASX Listing Rule 7.1 (ie. 15%); and |

| · | subject to Shareholder approval being sought under this Resolution, 25,702,942 Shares under ASX Listing Rule 7.1A (ie. 10%). |

The actual number of Shares which may be issued under ASX Listing Rule 7.1A (and ASX Listing Rule 7.1) will be a function of the number of Shares on issue at the time an issue is proposed as calculated per the formula set out above.

The issue price of the Shares issued under ASX Listing Rule 7.1A will be determined at the time of issue. The minimum price at which the Shares the subject of this Resolution will be issued is 75% of the volume weighted average sale price (“VWAP”) of the Company’s Shares over the 15 days on which trades in that class were recorded immediately before either:

| · | the date on which the price at which the securities are to be issued is agreed; or |

| · | if the securities are not issued within five ASX trading days of the date in the above paragraph, then the date on which the securities are issued. |

If this Resolution is approved, and the Company issues Shares under ASX Listing Rule 7.1A, the existing Shareholders’ voting power in the Company will be diluted. There is a risk that:

| · | the market price for the Shares may be significantly lower on the issue date than on the date of the approval of this Resolution; and |

| · | the Shares issued under ASX Listing Rule 7.1A may be issued at a price that is at a discount (as described above) to market price for the Shares on the issue date, |

which may have an effect on the amount of funds raised by the issue.

The table set out below shows the dilution of existing Shareholders on the basis of:

| · | The current market price of the Shares and the current number of ordinary securities as at the date of this Explanatory Memorandum. |

| 9 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| EXPLANATORY MEMORANDUM |

| · | Two examples where the number of Shares on issue (“A” in the formula set out above) has increased by 128,514,713 shares (i.e. 50%) and 100% (i.e. doubled). The number of Shares on issue may increase as a result of issues of Shares that do not require Shareholder approval (for example, pro-rata entitlements issues) or as a result of future placements under ASX Listing Rule 7.1 that are approved by Shareholders. |

| · | Two examples of where the issue price of Shares has decreased by 50% and increased by 50% as against the market price as at the date of this Explanatory Memorandum. |

Shareholders should note that there is a risk that:

| (i) | the market price for the Shares may be significantly lower on the issue date than on the date of the Meeting; and |

| (ii) | the Shares may be issued at a price that is at a discount to the market price for those Shares on the date of issue. |

| Dilution | ||||||||||||||||

| Issue price 8.25 cents ($0.0825) (50% decrease)** | Issue Price 16.5 cents ($0.165)** | Issue price 33 cents $0.33 (100% increase)** | ||||||||||||||

| Variable “A” ASX Listing Rule 7.1A.2 | “A” is the current number of Shares on issue of 257,029,426 Shares | Shares issued - 10% voting dilution | 25,702,943 | 25,702,943 | 25,702,943 | |||||||||||

| Funds raised | $ | 2,120,492.80 | $ | 4,240,985.60 | $ | 8,481,971.19 | ||||||||||

| “A” is a 50% increase (128,514,713 Shares) in current shares on issue to a total of 385,544,139 Shares on issue * | Shares issued - 10% voting dilution | 38,554,414 | 38,554,414 | 38,554,414 | ||||||||||||

| Funds raised | $ | 3,180,739.16 | $ | 6,361,478.31 | $ | 12,722,956,62 | ||||||||||

| “A” is a 100% increase (257,029,426 Shares) in current Shares on issue to a total of 514,058,852 Shares on issue * | 10% voting dilution | 51,405,886 | 51,405,886 | 51,405,886 | ||||||||||||

| Funds raised | $ | 4,240,985.60 | $ | 8,481,971.19 | $ | 16,963,942.38 | ||||||||||

Notes:

| (i) | The table assumes that: |

| a) | the Company issues the maximum number of Shares available under ASX Listing Rule 7.1A; |

| b) | the Company has not issued any equity securities in the prior 12 months that were not issued under an exception in ASX Listing Rule 7.2, with approval under ASX Listing Rules 7.1 or 7.1A, or with subsequent approval under ASX Listing Rule 7.4; |

| c) | no options are exercised resulting in Shares being issued before the date of the issue of Shares under ASX Listing Rule 7.1A. |

| 10 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| EXPLANATORY MEMORANDUM |

| (ii) | The table does not show an example of dilution that may be caused to a particular Shareholder by reason of issues of Shares under ASX Listing Rule 7.1A based on that Shareholder’s holding at the date of this Explanatory Memorandum. All Shareholders should consider the dilution caused to their own Shareholding depending on their specific circumstances. |

| (iii) | The table shows the effect of an issue of Shares under ASX Listing Rule 7.1A, not under the Company’s 15% placement capacity under ASX Listing Rule 7.1. |

| * | Any issue of Shares is required to be made in accordance with the ASX Listing Rules. Any issue made other than under the Company's 15% placement capacity (ASX Listing Rule 7.1) or the Company’s additional 10% placement capacity (Listing Rule 7.1A) and not otherwise made under an exception in ASX Listing Rule 7.2 (for example, a pro-rata rights issue) would require Shareholder approval. |

| ** | Based on closing price of the Shares on ASX on 26 September 2018. |

If this Resolution is approved the Company will have the ability to issue in the 12 months from the date of this 2018 AGM up to 10% of its issued capital without further Shareholder approval and therefore allow it to take advantage of opportunities to obtain further funds if required and available in the future.

As at the date of this Explanatory Memorandum, the Company has not formed an intention to offer any Shares under ASX Listing Rule 7.1A to any particular person or at any particular time. The total amount that may be raised by the issue of equity securities under ASX Listing Rule 7.1A will depend on the issue price of the Shares which will be determined at the time of issue. In some circumstances, the Company may issue Shares under ASX Listing Rule 7.1A for non-cash consideration (for example, in lieu of cash payments to consultants, suppliers or vendors). While the Company has not formed an intention to offer any Shares under ASX Listing Rule 7.1A, some of the purposes for which the Company may issue Shares under ASX Listing Rule 7.1A include (but are not limited to):

| · | Raising funds to be applied to the Company’s working capital requirements and develop the Company’s existing projects. |

| · | Acquiring assets. In these circumstances, the issue of the Shares may be made in substitution for the Company making cash payment for the assets. If the Company elects to issue the Shares for the purpose of acquiring assets then the Company will release to the market a valuation of the assets prior to issuing the Shares. |

| · | Paying suppliers or consultants of the Company. |

Details regarding the purposes for which any particular issue under ASX Listing Rule 7.1A is made will be more fully detailed in an announcement to the ASX made pursuant to ASX Listing Rule 7.1A.4 and ASX Listing Rule 3.10.5A at the time the issue is made.

The allottees of equity securities to be issued under the 10% placement capacity have not yet been determined. However, the allottees of equity securities could consist of current Shareholders or new investors (or both). No securities will be offered to related parties or associates of related parties of the Company.

| 11 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| EXPLANATORY MEMORANDUM |

The Company will determine the allottees at the time of the issue under the 10% placement capacity, having regard to the following factors:

| (i) | the purpose of the issue; |

| (ii) | the capital raising and acquisition opportunities available to the Company; |

| (iii) | alternative methods for raising funds available to the Company at that time, including, but not limited to, an entitlement issue or other offer where existing Shareholders may participate; |

| (iv) | the effect of the issue of the equity securities on the control of the Company; |

| (v) | the Company’s circumstances, including, but not limited to, its financial position solvency, and likely future capital requirements; |

| (vi) | prevailing market conditions; and |

| (vii) | advice from corporate, financial and broking advisers (if applicable). |

The Company previously obtained approval from Shareholders pursuant to ASX Listing Rule 7.1A at the 2017 Annual General Meeting (the “Previous Approval”).

As at the date of this Notice, no shares have been issued by the Company pursuant to the Previous Approval.

Instead, during the 12 months preceding the date of the Meeting (being the period commencing 8 November 2017 and ending on 7 November 2018), the Company has issued 52,536,692 equity securities representing approximately 21.11% of the total number of equity securities on issue at the commencement of that 12 month period.

For the purposes of ASX Listing Rule 7.3A.6, further details of the issues of equity securities by the Company during the 12 month period preceding the date of the Meeting are set out in Annexure B.

In accordance with the requirements of ASX Listing Rule 7.1A.4, if the Company issues equity securities pursuant to ASX Listing Rule 7.1A (that is, being the additional 10% placement capacity the subject of the approval sought under Resolution 3), it will give ASX:

| (i) | a list of the recipients of the equity securities and the number of equity securities issued to each (not for release to the market), in accordance with ASX Listing Rule 7.1A.4(a); and |

| (ii) | the information required by ASX Listing Rule 3.10.5A for release to the market, in accordance with ASX Listing Rule 7.1A.4(b). |

This Resolution is a special resolution. For a special resolution to be passed, at least 75% of the votes validly cast on the Resolution by Shareholders (by number of Shares) must be in favour of the resolution.

The Directors of the Company believe that this Resolution is in the best interests of the Company and unanimously recommend that Shareholders vote in favour of this Resolution.

A voting exclusion statement is set out in the Notice of Meeting. As at the date of this Notice, the Company has not invited any person to participate in an issue of equity securities under ASX Listing Rule 7.1A. Therefore, unless an invitation is made to an existing Shareholder prior to the meeting (and noting there is no present intention to do so) no existing Shareholders will be excluded from voting on the Resolution.

| 12 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| EXPLANATORY MEMORANDUM |

Resolution 4: Adoption of Option Plan

Resolution 4 proposes to adopt the Benitec Officers’ and Employees’ Share Option Plan (“Option Plan”). The Option Plan was first adopted by Shareholders at the Company’s 2015 Annual General Meeting.

As noted in the 2015 Notice of Annual General Meeting, the objectives of the Option Plan are to:

| · | provide eligible officers and employees with an additional incentive to improve the performance of the Company; |

| · | attract and retain officers and employees essential or desirable for the continued growth and development of the Company; |

| · | promote and foster loyalty and support amongst eligible officers and employees for the benefit of the Company; and |

| · | enhance the relationship between the Company and eligible officers and employees for the long term mutual benefit of all parties. |

The Directors consider that the objectives of the Option Plan still remain applicable to the Company.

ASX Listing Rule requirements

ASX Listing Rule 7.1 specifies that Shareholder approval is required for an issue of securities if the issue, when aggregated with the securities issued by the Company during the previous 12 months, exceeds 15% of the number of securities on issue at the commencement of the 12 month period.

ASX Listing Rule 7.2 Exception 9 allows securities issued under an employee incentive scheme within 3 years of shareholder approval to be exempt from the 15% placement capacity.

The Company first sought approval of the Option Plan at the Company’s 2015 Annual General Meeting. As the 3 year period will expire on 11 November 2018 unless renewed, the purpose of this Resolution is to renew Shareholder approval for a further 3 year period for the purposes of ASX Listing 7.2 Exception 9.

Information required under Listing Rule 7.2 Exception 9

| Number of Options issued since last approval | The Company has issued 19,020,000 Options since the Option Plan was last approved on 12 November 2015. | |

| Voting exclusion statement | The Company will disregard any votes cast in favour of this Resolution by or on behalf of:

· a Director (except a Director who is ineligible to participate in the Option Plan); and

· an associate of that person.

However, the Company need not disregard a vote if:

· it is cast by a person as proxy for a person who is entitled to vote, in accordance with the directions on the Proxy Form; or

· it is cast by the person chairing the meeting as proxy for a person who is entitled to vote, in accordance with a direction on the Proxy Form to vote as the proxy decides. |

| 13 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| EXPLANATORY MEMORANDUM |

| Summary of Option Plan | ||

| What securities are granted under the Option Plan? | Options will be granted, each being eligible to subscribe for one fully paid ordinary share in the Company, subject to the ASX Listing Rules and the terms of the Option Plan.

A Share issued on the exercise of an Option will rank equally with all other Shares on issue. | |

| Who can participate? | Any employee (including any director, part-time or full-time employee or consultant) of the Company or its subsidiaries who is declared by the Board to be eligible. | |

| How are eligible employees invited? | The Board may from time to time determine that an eligible officer or employee may participate in the Option Plan by issuing a written invitation and inviting the eligible person to apply for the grant of a specified number of Options. The invitation may be made on the terms determined by the Board, including as to:

· the method of calculation of the exercise price for the Options;

· the number of Options for which that eligible person may apply;

· the exercise period;

· the exercise conditions; and

· the date and time by which acceptance from the eligible person must be returned to the Company.

The eligible employee must return the application form duly completed and signed to the Company by the due date and time, together with a cheque for any amount payable in respect of the grant of the Options (if any). | |

| Will Options be listed on the ASX? | No, Options granted under the Option Plan will not be listed. | |

| Are there any exercise conditions? | The Board may determine in its sole discretion the nature of any exercise conditions. | |

| What is the exercise price? | The Board will determine the exercise price of the Options in its sole discretion. Options may not be exercised unless the exercise conditions (if any) have been met. | |

| Are the Options transferable? | An Option granted under the Option Plan is not transferrable unless required by law (including transfer upon death or bankruptcy of the Option holder) or with the Board’s written approval. | |

| What happens on death or retirement of the eligible officer or employee? | If an eligible officer or employee dies or retires:

· if the exercise conditions have not been met, the Board may in its discretion waive any such conditions and allow the Options to be exercised within a period determined by the Board of up to 6 months; or

· if the exercise conditions have been met, the Options may be exercised by the participant or his or her personal representative within a period determined by the Board of up to 12 months. | |

| 14 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| EXPLANATORY MEMORANDUM |

| When do the Options lapse? | Options lapse if not exercised within the due date for exercising the Options, or if any exercise conditions are not met by the due date. The exercise period will not exceed seven years from the date of grant.

On expiry of Options, the Company will repay to the participant the price paid for the of the Options (if any). | |

| Adjustments | Subject to the ASX Listing Rules and applicable law, if the Company makes any new issues of securities or alterations to its capital by way of a rights issue, bonus issue or other distribution of capital, reduction of capital or reconstruction of capital, the Board may in its discretion make adjustments to a participant’s Options on any basis it sees fit to minimise any advantage or disadvantage accruing to the participant as a result of such corporate actions or alterations to capital. | |

| Can the Option Plan be amended? | Subject to the ASX Listing Rules, the Board may at any time amend the Option Plan. However, no such amendment may be made if the amendment reduces the rights of any holder of Options issued to them prior to the date of the amendment, other than an amendment that is introduced primarily:

· for the purpose of complying with or conforming to present or future legislation governing or regulating the maintenance or operation of the Option Plan;

· to correct any manifest error or mistake;

· to take into consideration possible adverse tax implications in respect of the plan including changes to applicable tax legislation or the interpretation of that legislation by a court of competent jurisdiction or any rulings from taxation authorities administering such legislation,

unless otherwise agreed to in writing by all holders of Options. | |

| Who manages and administers the Option Plan? | The Option Plan is managed and administered by the Board. | |

| Option Plan limits | The Company may only issue Options under the Option Plan if:

· the number of Options to be issued;

· the number of Shares which would be issued if all of the current Options issued under any employee incentive scheme were exercised;

· the number of Shares which have been issued as a result of the exercise of Options issued under any employee incentive scheme, where the Options were issued during the preceding five years; and

· all other Shares issued pursuant to any employee incentive scheme during the preceding five years,

but excluding any Options granted or Shares issued by way of or as a result of certain excluded offers, would exceed 5% of the then current number of Shares on issue. |

| 15 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| EXPLANATORY MEMORANDUM |

In the interests of corporate governance the Directors have abstained from making a recommendation in respect of this Resolution.

Resolution 5: Approval to issue Options to Dr Jerel Banks

Resolution 5 seeks Shareholder approval for the issue of 10,000,000 Options to Dr Jerel Banks under the Option Plan. Dr Banks is currently the Executive Chairman of the Company. The Company wishes to grant the Options to Dr Banks as part Dr Bank’s long term incentives under his remuneration package. The terms of the Options are as follows:

| Issue price | Nil | |

| Exercise price | $0.2278 | |

| Grant date | 26 June 2018 | |

| Vesting date | · 3,333,333 Options will vest on 26 June 2019 and become exercisable;

· 3,333,333 Options will vest on 26 June 2020 and become exercisable; and

· 3,333,334 Options will vest on 26 June 2021 and become exercisable. | |

| Expiry date | 26 June 2023, or the date of resignation or dismissal from the position of director or other engagement or employment (if any), provided however that:

· if retirement occurs after reaching the age determined by the Board to be normal retirement age or in any other circumstances within the approval of the Board, then the Options may be exercised in full within 90 days of the date of retirement (or a greater period determined by the Board); or

· if resignation is due to ill health or accident, or if made redundant, the Options may be exercised in full within 90 days of the date of resignation or redundancy (or a greater period determined by the Board). |

The full terms and conditions of the Options issued to Dr Banks are set out in Annexure C to this Explanatory Memorandum.

ASX Listing Rule 10.14

ASX Listing Rule 10.14 provides that an entity must not permit a director or an associate of a director to acquire securities under any employee incentive scheme without the approval of ordinary shareholders. As Dr Banks is a Director, this Resolution 5 seeks Shareholder approval for the purpose of ASX Listing Rule 10.14.

| 16 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| EXPLANATORY MEMORANDUM |

Information required under Listing Rule 10.15

| The maximum number of securities that may be acquired | 10,000,000 Options, which if and when vested will be exercisable into 10,000,000 Shares | |

| The price, or the formula for calculation the price, for each security to be acquired under the scheme | There is no price payable for the grant of the Options.

The exercise price for each Option is $0.2278. | |

| The names of all persons referred to in ASX Listing Rule 10.14 who received securities under the scheme since the last approval, the number of the securities received and acquisition price for each security | Approval under ASX Listing Rule 10.14 was last sought on 12 November 2015 in respect of the following:

· 1,400,000 Options issued to Mr Peter Francis (Non-Executive Director) with an exercise price of $0.77;

· 2,800,000 Options issued to Dr Peter French (former Director) with an exercise price of $0.77;

· 840,000 Options issued to Mr Kevin Buchi (Non-Executive Director) with an exercise price of $0.77;

· 840,000 Options issued to Dr John Chiplin (former Director) with an exercise price of $0.77; and

· 840,000 Options issued to Mr Iain Ross (former Director) with an exercise price of $0.77.

None of the above Options have been exercised. No further Options have been granted to any persons referred to in ASX Listing Rule 10.14 since last approval. | |

| The names of all persons referred to in rule 10.14 entitled to participate in the scheme | · Dr Jerel Banks, Executive Chairman

· Ms Megan Boston, Executive Director

· Mr Kevin Buchi, Non-Executive Director

· Mr Peter Francis, Non-Execution Director | |

| Voting exclusion statement | The Company will disregard any votes cast in favour of this Resolution by or on behalf of Dr Jerel Banks or his associates.

However, the Company need not disregard a vote if:

· it is cast by the person as proxy for a person who is entitled to vote, in accordance with the directions on the Proxy Form; or

· it is cast by the person chairing the meeting as proxy for a person who is entitled to vote, in accordance with a direction on the Proxy Form to vote as the proxy decides. | |

| The terms of any loan in relation to the acquisition | Not applicable | |

| The date by which the entity will issue the securities | Expected to be within 5 business days following approval by Shareholders at this Meeting. |

| 17 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| EXPLANATORY MEMORANDUM |

The full terms and conditions of the Options issued to Dr Banks are set out in Annexure C to this Explanatory Memorandum.

Chapter 2E of the Corporations Act

Pursuant to Chapter 2E of the Corporations Act, if a public company proposes to provide a financial benefit to a related party, the company must:

| · | obtain the approval of the public company’s members in the manner set out in sections 217 to 227 of the Corporations Act; and |

| · | give the benefit within 15 months following such approval, |

unless the giving of the financial benefit falls within an exception set out in sections 210 to 216 of the Corporations Act.

Section 211 provides that member approval is not needed to give a financial benefit if the benefit is remuneration to a related party as an officer or employee of a public company and it is reasonable given:

| · | the circumstances of the public company giving the remuneration; and |

| · | the related party’s circumstances (including the responsibilities involved in the office or employment). |

Dr Jerel Banks is considered to be a related party of the Company. However, the Directors have resolved that Shareholder approval pursuant to Chapter 2E of the Corporations Act is not required in respect of the issue of Options to Dr Banks on the basis that the exception under section 211 is applicable.

Section 200B of the Corporations Act

Section 200B of the Corporations Act prohibits a company from providing a benefit in connection with the retirement from a managerial or executive office (“Employment Retirement Benefit”) unless an exception applies or shareholder approval is obtained in accordance with section 200E of the Corporations Act.

The terms of the Options proposed to be granted to Dr Jerel Banks provide that if Dr Banks retires after reaching the retirement age as determined by the Board to be normal retirement age or in any other circumstances within the approval of the Board, then the Options may be exercised in full within 90 days of the date of retirement (or a greater period determined by the Board). The acceleration of the Options due to retirement may constitute a benefit prohibited under section 200B. Shareholder approval is therefore required for the Company to satisfy the proposed terms of the Options to be granted to Dr Banks. The Board has not at this time specified any retirement age or other circumstances which may cause section 200B to be triggered.

The value of the benefit that may be obtained by Dr Banks cannot be presently ascertained, but matters, events and circumstances that will, or are likely to, affect the calculation of that value include:

| · | the number of unvested Options held by Dr Banks at the time of retirement; and |

| · | the market price of the Shares at the time of exercise of the Options that vest upon Dr Banks’ retirement from office in the circumstances described above. |

The Directors (with Dr Jerel Banks abstaining) recommend that Shareholders vote in favour of this Resolution.

| 18 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| EXPLANATORY MEMORANDUM |

Annexure A – Defined Terms

In this Notice of Meeting and Explanatory Memorandum, unless otherwise specified, the following terms have the given meanings:

| Annual General MeetingorMeeting | Annual General Meeting of Shareholders the subject of this Notice of Meeting to be held at 10.00am (AEDT) on Thursday, 8 November 2018. | |

| ASX | ASX Limited (ACN 008 624 691) and, where the context permits, the Australian Securities Exchange operated by ASX Limited. | |

| ASX Listing Rules | The official listing rules of ASX as amended from time to time. | |

| Board | The board of Directors from time to time. | |

| CompanyorBenitec | Benitec Biopharma Limited ABN 64 068 943 662. | |

| Constitution | The constitution of the Company. | |

| Corporations Act | TheCorporations Act 2001 (Cth). | |

| Director | A director of the Company. | |

| Employment Retirement Benefit | A benefit given in connection with the retirement from a managerial or executive office. | |

| Explanatory Memorandum | Explanatory Memorandum accompanying the Notice of Meeting. | |

| Key Management Personnel | Those persons having authority and responsibility for planning, directing and controlling the activities of the Company, directly or indirectly, including any Director (whether executive or otherwise). | |

| NoticeorNotice of Meeting | The notice convening the General Meeting, which accompanies this Explanatory Memorandum. | |

| Option | An option issued in the capital of the Company. | |

| Option Plan | The Benitec Officers’ and Employees’ Share Option Plan. | |

| Proxy Form | Proxy Form attached to the Notice of Meeting. | |

| Remuneration Report | The section of the Directors’ report for the year ended 30 June 2018 that is included under section 300A(1) of the Corporations Act. | |

| Resolution | A resolution in the Notice of Meeting. | |

| Restricted Voter | A member of the Key Management Personnel or any of their closely related parties. | |

| Share | A fully paid ordinary share in the capital of the Company. | |

| Shareholder | A registered holder of a Share. |

| 19 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| EXPLANATORY MEMORANDUM |

Annexure B – Details of Issued Equity Securities

| No. | Date of Issue | Number | Class | Persons to whom the securities were issued | Issue price (AUD) | Discount/Premium to market price (%) | Consideration | Purpose | ||||||||

| 1 | 11/04/2018 | 650,000 | Unlisted options to acquire fully paid ordinary shares in the Company at an exercise price of $0.298 per option. | Employees under the Company’s Employee Share Option Plan | Nil | Not applicable | Nil consideration. | The Options have been issued to employees of the Company under the Plan. | ||||||||

| 2 | 4/05/2018 | 15,444,020 | Fully paid ordinary shares in the Company ranking equally with the Company’s existing shares | Placement to institutional investor Highbridge Capital Management LLC | $0.17 | Closing Price: $0.165

3% premium | $2,600,000 | Funds used = $2,600,000.

General corporate purposes, including funding the progress of Benitec’s OPMD program towards clinical proof of concept and the continued funding of the scientific development of Benitec’s other pipeline programs. | ||||||||

| 3 | 4/06/2018 | 36,442,672 | Fully paid ordinary shares in the Company ranking equally with the Company’s existing shares | Pro rate renounceable entitlement offer to eligible shareholders | $0.17 | Closing Price: $0.16

6.3% premium | $6,195,254 | Funds used = $4,400,000.

General corporate purposes, including funding the progress of Benitec’s OPMD program towards clinical proof of concept and the continued funding of the scientific development of Benitec’s other pipeline programs. |

| 20 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| EXPLANATORY MEMORANDUM |

Annexure C – Terms of Options

Each option is issued pursuant to and subject to the terms and conditions of the Benitec Directors’ and Employees Share Option Plan (‘Option Plan’) applying as at the date of issue and on the terms set out below (’Option’). Each Option entitles the holder of the Option ('Option Holder') to subscribe for and be allotted one fully paid ordinary share ('Share') in Benitec Biopharma Limited ACN 068 943 662 ('Company').

| 1. | Each Option is exercisable at any time during the period ('Option Period') from the date of vesting and expiring at the earliest to occur of the following dates: |

| (a) | 5.00pm Melbourne time on the fifth anniversary of the Option grant date; or |

| (b) | the date of retirement, resignation or dismissal from the position of director or other engagement or employment (if any) of the Option Holder with the consolidated entity (as defined in theCorporations Act 2001 (Cth) (‘Corporations Act’)) of Benitec Limited ('Consolidated Entity'), |

and PROVIDED THAT the limitations on the time of exercise of the Options set out above (excluding the limitations in paragraph 13) shall be subject to the overriding conditions that:

| (c) | if retirement occurs after reaching the age determined by the Board to be normal retirement age or in any other circumstances with the approval of the Board, the Option Holder may exercise his or her options in full within 90 days after the date of retirement, or such other period, being not less than 90 days, as determined by the Board of Directors (in its sole and absolute discretion) immediately following the date of retirement; and |

| (d) | if resignation is due to ill health or accident or a dismissal is due to redundancy, or in any other circumstances with the approval of the Board, the Option Holder may exercise his or her options in full within 90 days after the date of the resignation or dismissal, or such other period, being not less than 90 days, as determined by the Board of Directors (in its sole and absolute discretion) immediately following the date of resignation or dismissal. |

| 2. | Subject to paragraphs 1 and 13, the Options may be exercised wholly or in part by giving notice in writing ('Notice of Exercise') to the Board at any time during the Option Period, provided however that Options cannot be exercised at any time if doing so would be in breach or potential breach of the Corporations Act or the Securities Trading Policy of the Company or any other policy adopted by the Board in respect of acquiring, trading or otherwise dealing in securities of the Company. |

| 3. | The Options vest, and the Exercise Conditions applicable to the Options, are as follows: |

| (a) | one third of the Options are exercisable on the first anniversary of the grant date. If the resulting number of Options contains a fraction, such number shall be rounded down to the next lowest whole number; |

| (b) | one third of the Options are exercisable on the second anniversary of the grant date. If the resulting number of Options contains a fraction, such number shall be rounded down to the next lowest whole number; |

| (c) | the balance of the Options are exercisable on the third anniversary of the grant date; |

| (d) | the vesting of the Options are subject to continued engagement or employment with the Company. Where such engagement or employment with the Company ceases before vesting other than in the event of termination for cause: |

| (i) | if none of the Options have vested, the unvested Options in paragraph (a) (but not in paragraphs (b) and (c)) will vest calculated pro-rata to the period of time between the grant date and the date of cessation of employment; |

| 21 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| EXPLANATORY MEMORANDUM |

| (ii) | if the Options in paragraph (a) have vested but the Options in paragraph (b) have not vested, the unvested Options in paragraph (b) (but not in paragraph (c)) will vest calculated pro-rata to the period of time between the first anniversary of the grant date and the date of cessation of employment; and |

| (iii) | if the Options in paragraph (b) have vested but the Options in paragraph (c) have not vested, the unvested Options in paragraph (c) will vest calculated pro-rata to the period of time between the second anniversary of the grant date and the date of cessation of employment; |

| (e) | in the event of termination for cause, no Options would vest; and |

| (f) | in the event of the Company being the subject of a successful takeover bid or change of control, the Board may determine the manner in which Options are to be treated in accordance with the Option Plan. |

| 4. | Notwithstanding paragraph 1, but subject to paragraph 13, if an Option Holder dies during the Option Period applicable to the Option Holder, the legal personal representative of the Option Holder may exercise all or any of the Options held at the date of death on behalf of the estate of the Option Holder provided that such exercise must be made any time after the death of the Option Holder but not later than 90 days, or such other period, being not less than 90 days, as determined by the Board of Directors (in its sole and absolute discretion) immediately following the death of the Option Holder, after the date of granting of probate or grant or letters of administration (as appropriate) or the Options will lapse and the amount paid to acquire the Options, if any, will be forfeited. Further, in the event the Option Holder dies during the Option Period, the Company has an obligation to inform the Option Holder's legal personal representative in writing, within 30 days after the date of granting of probate or grant or letters of administration (as appropriate), of his/her right to exercise the Options in accordance with terms of this clause. |

| 5. | The exercise price per Option (which is payable immediately upon exercise) is AUD$0.2278 (22.78 cents) (‘Exercise Price’). |

| 6. | The Options are not capable of being transferred or encumbered by the Option Holder, and will immediately lapse if it is transferred or encumbered, unless it is transferred or encumbered: |

| (a) | as provided for and in accordance with the Option Plan; |

| (b) | by force of law upon death to the Option Holder 's legal personal representative; |

| (c) | upon bankruptcy to the Option Holder 's trustee in bankruptcy; or |

| (d) | with the prior written approval of the Board. |

| 7. | On receipt by the Company of the Notice of Exercise and payment of the Exercise Price, the Company must, within 14 business days (as defined in the Listing Rules of ASX) allot to the Option Holder one ordinary share in respect of each Option exercised by the Option Holder and despatch the relevant acknowledgment of issue as soon as is reasonably practicable. |

| 8. | Shares allotted on the exercise of any Options will rank equally in all respects with the then existing issued ordinary fully paid shares in the Company and will be subject to the provisions of the Constitution of the Company. |

| 9. | Adjustments to the number of Shares over which Options exist and/or the Exercise Price may be made as described in paragraph 11 to take account of changes to the capital structure of the Company by way of pro rata issues or bonus issues. The Company agrees to notify all Option Holders and ASX within 1 month after the record date of a pro rata bonus issue, of any adjustment to the number of Shares over which the Options exist and/or any adjustment to the Exercise Price. |

| 22 |

| BENITEC BIOPHARMA LIMITED |

| NOTICE OF 2018 ANNUAL GENERAL MEETING |

| EXPLANATORY MEMORANDUM |

| 10. | Subject to paragraphs 9, 11 and 12, Options do not confer rights to participate in new issues of securities of the Company without exercising the option. |

| 11. | The method of adjustment for the purpose of paragraph 9 shall be in accordance with Listing Rules 6.22.2 and 6.22.3 of the Listing Rules of ASX, which currently states: |

| (a) | Pro-rata issues |

Where a pro-rata issue (except a bonus issue) is made to the holders of fully paid ordinary shares in the Company, the Exercise price of an Option may be reduced according to the following formula:

O' = O –E [P – (S+D)]

N+1

| where: |

O' = the new exercise price of the Option.

O = the old exercise price of the Option.

E = the number of underlying securities into which one Option is exercisable.

P = the average market price per share (weighted by reference to volume) of the underlying securities during the 5 trading days ending on the day before the ex rights date or ex entitlements date.

S = the subscription price for a security under the pro rata issue.

D = the dividend (in the case of a trust, distribution) due but not yet paid on the existing underlying securities (except those to be issued under the pro rata issue).

N = the number of securities with rights or entitlements that must be held to receive a right to one new security.

| (b) | Pro-Rata Bonus Issues |

If there is a bonus issue to the holders of the underlying securities of the Company, the number of securities over which the Option is exercisable may be increased by the number of securities, which the holder of the Option would have received if the Option had been exercised before the record date for the bonus issue.

| 12. | In the event of any reconstruction (including consolidation, subdivision, reduction or return) of the issued capital of the Company, the number of Options or the exercise price of the Options or both will be reconstructed in accordance with the Listing Rules of ASX applying at the time of the reconstruction. |

| 13. | All unexercised Options will lapse in the event of the liquidation of the Company. |

| 14. | The Company will apply to the ASX (and any other stock exchange on which the Shares in the Company are quoted and listed) for, and will use its best endeavours to obtain, quotation and listing of all Shares allotted on the exercise of any Options. The Company will not apply for quotation or listing of the Options on any stock exchange. |

| 15. | Subject to paragraph 13, each Option is personal to the Option Holder named on the front of the Option Certificate and is not transferable, transmissible or assignable provided that the personal representative of an Option Holder may on the death of that Option Holder exercise Options in accordance with paragraph 4. |

| 23 |

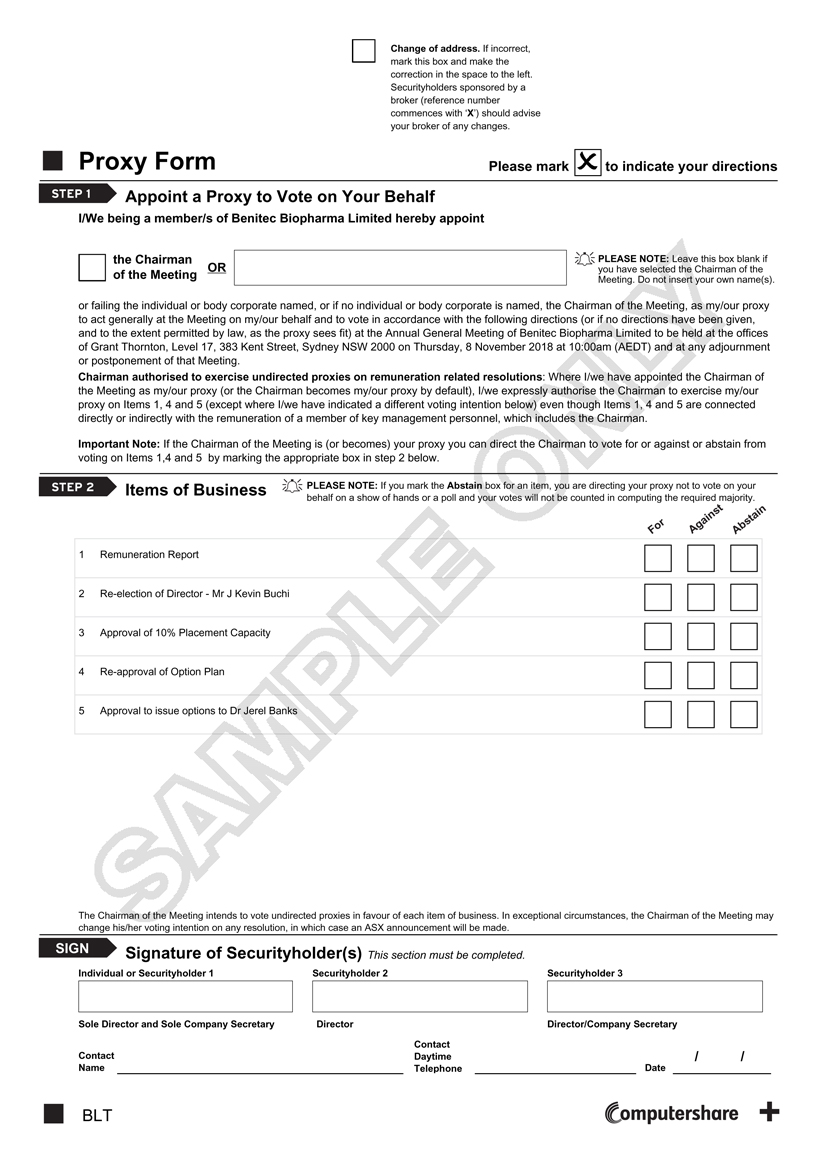

BENITEC BIOPHARMA silencing genes for life® ABN 64 068 943 662 Lodge your vote: Online: www.investorvote.com.au By Mail: Computershare Investor Services Pty Limited GPO Box 242 Melbourne Victoria 3001 Australia Alternatively you can fax your form to (within Australia) 1800 783 447 (outside Australia) +61 3 9473 2555 For Intermediary Online subscribers only (custodians) www.intermediaryonline.com For all enquiries call: (within Australia) 1300 850 505 (outside Australia) +61 3 9415 4000 Proxy Form Vote and view the annual report online Go to www.investorvote.com.au or scan the QR Code with your mobile device. Follow the instructions on the secure website to vote. Your access information that you will need to vote: Control Number: 182174 SRN/HIN: PLEASE NOTE: For security reasons it is important that you keep your SRN/HIN confidential. For your vote to be effective it must be received by 10.00am (AEDT) on Tuesday, 6 November 2018 How to Vote on Items of Business All your securities will be voted in accordance with your directions. Appointment of Proxy Voting 100% of your holding: Direct your proxy how to vote by marking one of the boxes opposite each item of business. If you do not mark a box your proxy may vote or abstain as they choose (to the extent permitted by law). If you mark more than one box on an item your vote will be invalid on that item. Voting a portion of your holding: Indicate a portion of your voting rights by inserting the percentage or number of securities you wish to vote in the For, Against or Abstain box or boxes. The sum of the votes cast must not exceed your voting entitlement or 100%. Appointing a second proxy: You are entitled to appoint up to two proxies to attend the meeting and vote on a poll. If you appoint two proxies you must specify the percentage of votes or number of securities for each proxy, otherwise each proxy may exercise half of the votes. When appointing a second proxy write both names and the percentage of votes or number of securities for each in Step 1 overleaf. A proxy need not be a securityholder of the Company. Signing Instructions for Postal Forms Individual: Where the holding is in one name, the securityholder must sign. Joint Holding: Where the holding is in more than one name, all of the securityholders should sign. Power of Attorney: If you have not already lodged the Power of Attorney with the registry, please attach a certified photocopy of the Power of Attorney to this form when you return it. Companies: Where the company has a Sole Director who is also the Sole Company Secretary, this form must be signed by that person. If the company (pursuant to section 204A of the Corporations Act 2001) does not have a Company Secretary, a Sole Director can also sign alone. Otherwise this form must be signed by a Director jointly with either another Director or a Company Secretary. Please sign in the appropriate place to indicate the office held. Delete titles as applicable. Attending the Meeting Bring this form to assist registration. If a representative of a corporate securityholder or proxy is to attend the meeting you will need to provide the appropriate “Certificate of Appointment of Corporate Representative” prior to admission. A form of the certificate may be obtained from Computershare or online at www.investorcentre.com under the help tab, "Printable Forms". Comments & Questions: If you have any comments or questions for the company, please write them on a separate sheet of paper and return with this form. GO ONLINE TO VOTE, or turn over to complete the form 239498_0_COSMOS_Sample_Proxy/000001/000001/i This Document is printed on Greenhouse FriendlyTM ENVI Laser Carbon Neutral Paper

Change of address. If incorrect, mark this box and make the correction in the space to the left. Securityholders sponsored by a broker (reference number commences with ‘X’) should advise your broker of any changes. Proxy Form Please mark X to indicate your directions STEP 1 Appoint a Proxy to Vote on Your Behalf I/We being a member/s of Benitec Biopharma Limited hereby appoint the Chairman of the Meeting OR PLEASE NOTE: Leave this box blank if you have selected the Chairman of the Meeting. Do not insert your own name(s). or failing the individual or body corporate named, or if no individual or body corporate is named, the Chairman of the Meeting, as my/our proxy to act generally at the Meeting on my/our behalf and to vote in accordance with the following directions (or if no directions have been given, and to the extent permitted by law, as the proxy sees fit) at the Annual General Meeting of Benitec Biopharma Limited to be held at the offices of Grant Thornton, Level 17, 383 Kent Street, Sydney NSW 2000 on Thursday, 8 November 2018 at 10:00am (AEDT) and at any adjournment or postponement of that Meeting. Chairman authorised to exercise undirected proxies on remuneration related resolutions: Where I/we have appointed the Chairman of the Meeting as my/our proxy (or the Chairman becomes my/our proxy by default), I/we expressly authorise the Chairman to exercise my/our proxy on Items 1, 4 and 5 (except where I/we have indicated a different voting intention below) even though Items 1, 4 and 5 are connected directly or indirectly with the remuneration of a member of key management personnel, which includes the Chairman. Important Note: If the Chairman of the Meeting is (or becomes) your proxy you can direct the Chairman to vote for or against or abstain from voting on Items 1,4 and 5 by marking the appropriate box in step 2 below. STEP 2 Items of Business PLEASE NOTE: If you mark the Abstain box for an item, you are directing your proxy not to vote on your behalf on a show of hands or a poll and your votes will not be counted in computing the required majority. For Against Abstain 1 Remuneration Report 2 Re-election of Director - Mr J Kevin Buchi 3 Approval of 10% Placement Capacity 4 Re-approval of Option Plan 5 Approval to issue options to Dr Jerel Banks The Chairman of the Meeting intends to vote undirected proxies in favour of each item of business. In exceptional circumstances, the Chairman of the Meeting may change his/her voting intention on any resolution, in which case an ASX announcement will be made. SIGN Signature of Securityholder(s) This section must be completed. Individual or Securityholder 1 Securityholder 2 Securityholder 3 Sole Director and Sole Company Secretary Director Director/Company Secretary Contact Name Contact Daytime Telephone Date BLT Computershare