Delek Logistics Partners, LP Investor Presentation November 2013

Forward-Looking Statements 2 These slides and any accompanying oral presentation contain forward-looking statements by Delek Logistics Partners, LP (defined as “we”, “our”) that are based upon our current expectations and involve a number of risks and uncertainties. Statements concerning current estimates, expectations and projections about our future results, performance, prospects and opportunities and other statements, concerns, or matters that are not historical facts are "forward-looking statements," as that term is defined under United States securities laws. Investors are cautioned that the following important factors, among others, may affect these forward-looking statements: our dependence on Delek US Holdings Inc. (“Delek US”) for the substantial majority of our contribution margin; the timing and extent of changes in commodity prices; the suspension, reduction or termination of Delek US' performance or obligations under our commercial agreements; disruptions due to equipment interruption or failure at our facilities, Delek US' facilities or third-party facilities on which our business is dependent; general economic conditions; competitive conditions in our industry; actions taken by our customers and competitors; the demand for crude oil, refined products and transportation and storage services; our ability to successfully implement our business plan; operating hazards and other risks incidental to transporting, storing and gathering crude oil and refined products; large customer defaults; changes in the availability and cost of capital; changes in tax status; the effects of existing and future laws and governmental regulations; and other risks contained in our filings with the United States Securities and Exchange Commission, including, but not limited to our 2012 Annual Report filed on Form 10-K. Forward-looking statements should not be read as a guarantee of future performance or results and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management's good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. We undertake no obligation to update or revise any such forward-looking statements.

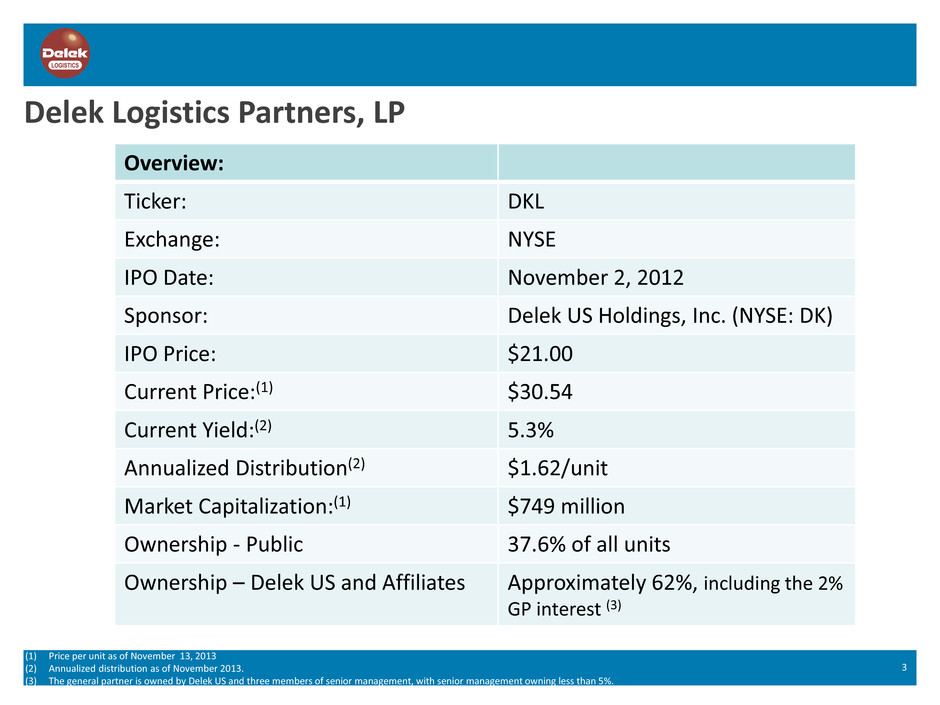

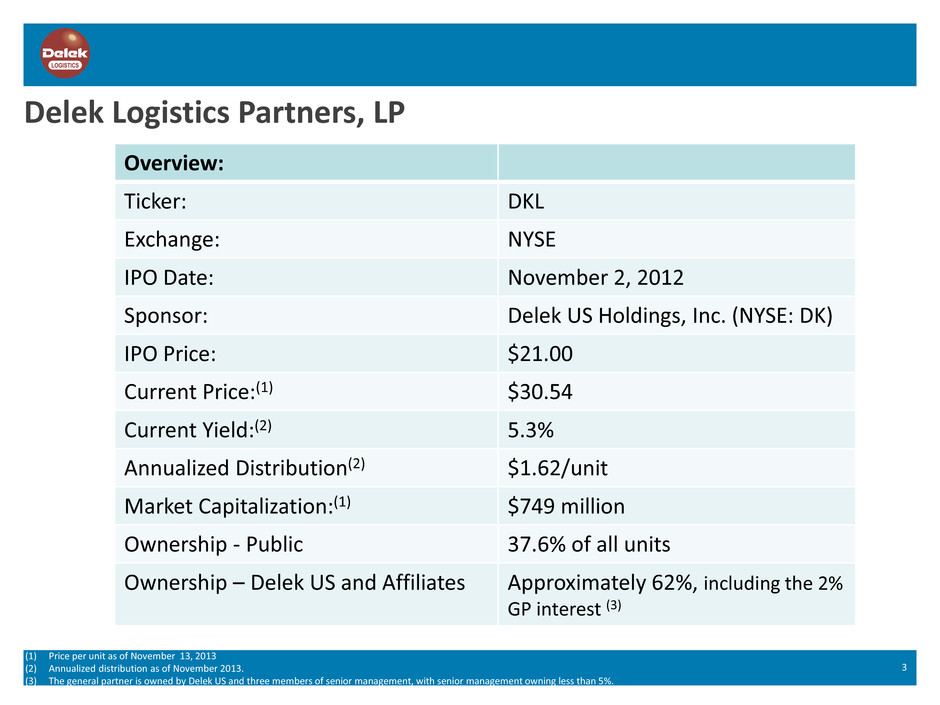

Delek Logistics Partners, LP Overview: Ticker: DKL Exchange: NYSE IPO Date: November 2, 2012 Sponsor: Delek US Holdings, Inc. (NYSE: DK) IPO Price: $21.00 Current Price:(1) $30.54 Current Yield:(2) 5.3% Annualized Distribution(2) $1.62/unit Market Capitalization:(1) $749 million Ownership - Public 37.6% of all units Ownership – Delek US and Affiliates Approximately 62%, including the 2% GP interest (3) (1) Price per unit as of November 13, 2013 (2) Annualized distribution as of November 2013. (3) The general partner is owned by Delek US and three members of senior management, with senior management owning less than 5%. 3

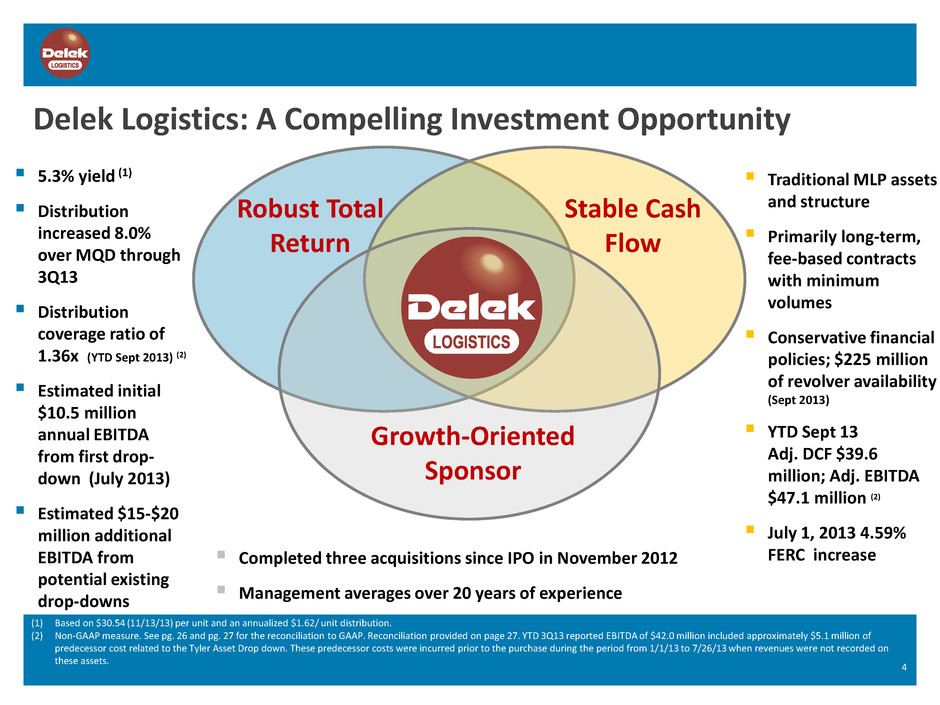

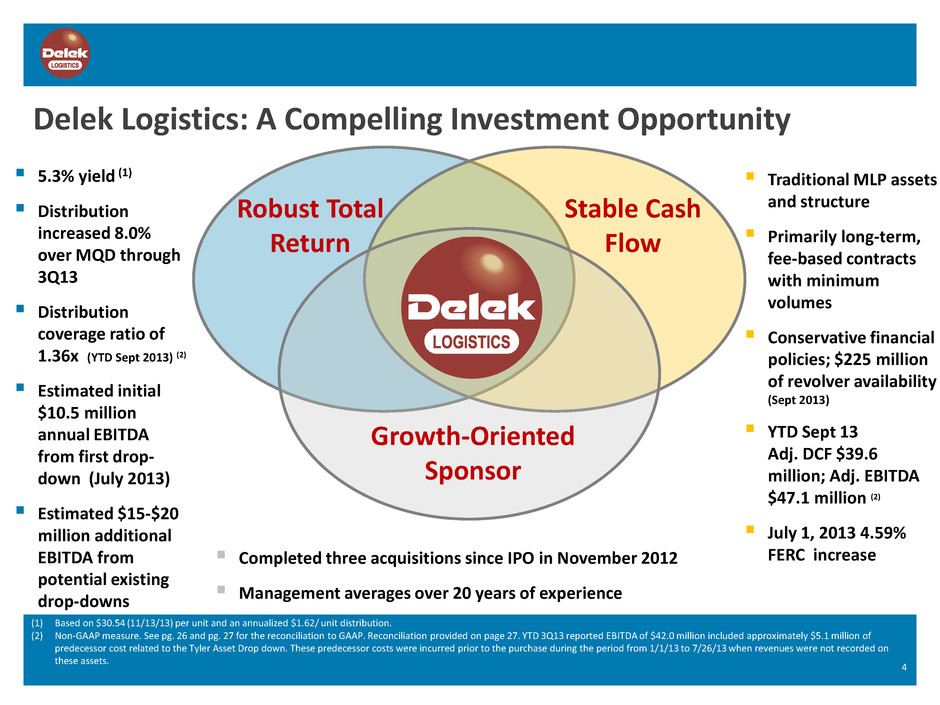

Delek Logistics: A Compelling Investment Opportunity 4 5.3% yield (1) Distribution increased 8.0% over MQD through 3Q13 Distribution coverage ratio of 1.36x (YTD Sept 2013) (2) Estimated initial $10.5 million annual EBITDA from first drop- down (July 2013) Estimated $15-$20 million additional EBITDA from potential existing drop-downs Completed three acquisitions since IPO in November 2012 Management averages over 20 years of experience Traditional MLP assets and structure Primarily long-term, fee-based contracts with minimum volumes Conservative financial policies; $225 million of revolver availability (Sept 2013) YTD Sept 13 Adj. DCF $39.6 million; Adj. EBITDA $47.1 million (2) July 1, 2013 4.59% FERC increase (1) Based on $30.54 (11/13/13) per unit and an annualized $1.62/ unit distribution. (2) Non-GAAP measure. See pg. 26 and pg. 27 for the reconciliation to GAAP. Reconciliation provided on page 27. YTD 3Q13 reported EBITDA of $42.0 million included approximately $5.1 million of predecessor cost related to the Tyler Asset Drop down. These predecessor costs were incurred prior to the purchase during the period from 1/1/13 to 7/26/13 when revenues were not recorded on these assets. Stable Cash Flow Robust Total Return Growth-Oriented Sponsor

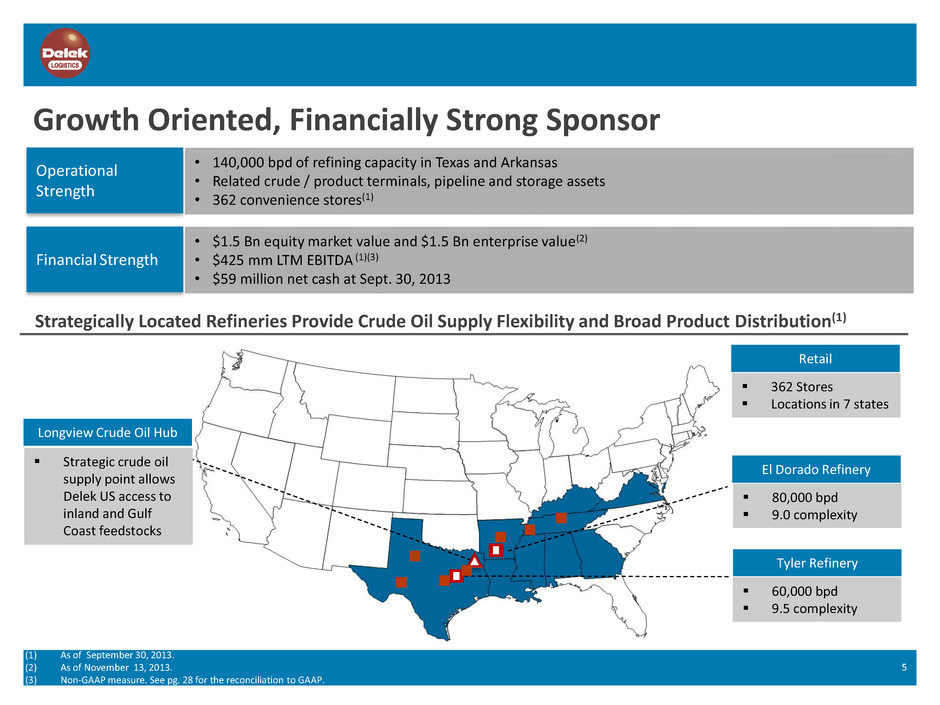

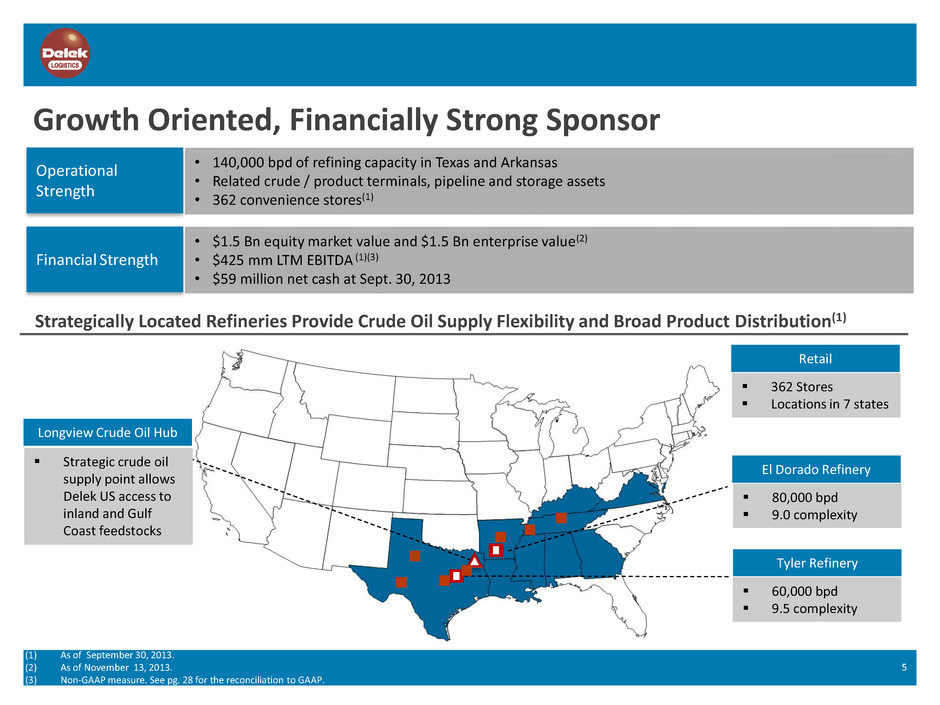

Growth Oriented, Financially Strong Sponsor • 140,000 bpd of refining capacity in Texas and Arkansas • Related crude / product terminals, pipeline and storage assets • 362 convenience stores(1) Operational Strength 5 (1) As of September 30, 2013. (2) As of November 13, 2013. (3) Non-GAAP measure. See pg. 28 for the reconciliation to GAAP. Strategically Located Refineries Provide Crude Oil Supply Flexibility and Broad Product Distribution(1) 60,000 bpd 9.5 complexity Tyler Refinery 80,000 bpd 9.0 complexity El Dorado Refinery Longview Crude Oil Hub Strategic crude oil supply point allows Delek US access to inland and Gulf Coast feedstocks 362 Stores Locations in 7 states Retail • $1.5 Bn equity market value and $1.5 Bn enterprise value(2) • $425 mm LTM EBITDA (1)(3) • $59 million net cash at Sept. 30, 2013 Financial Strength

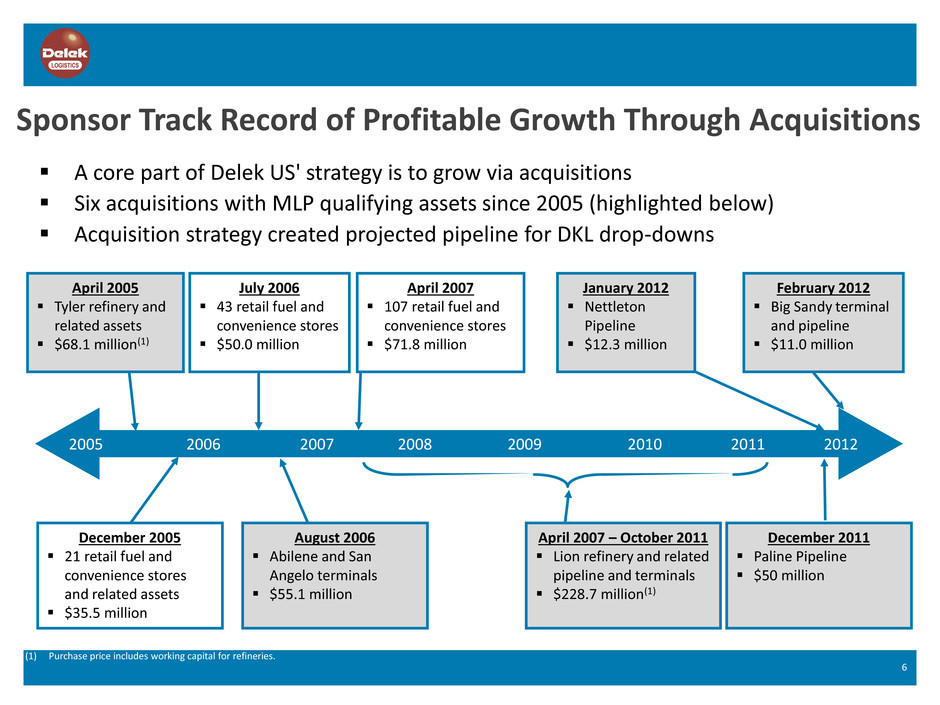

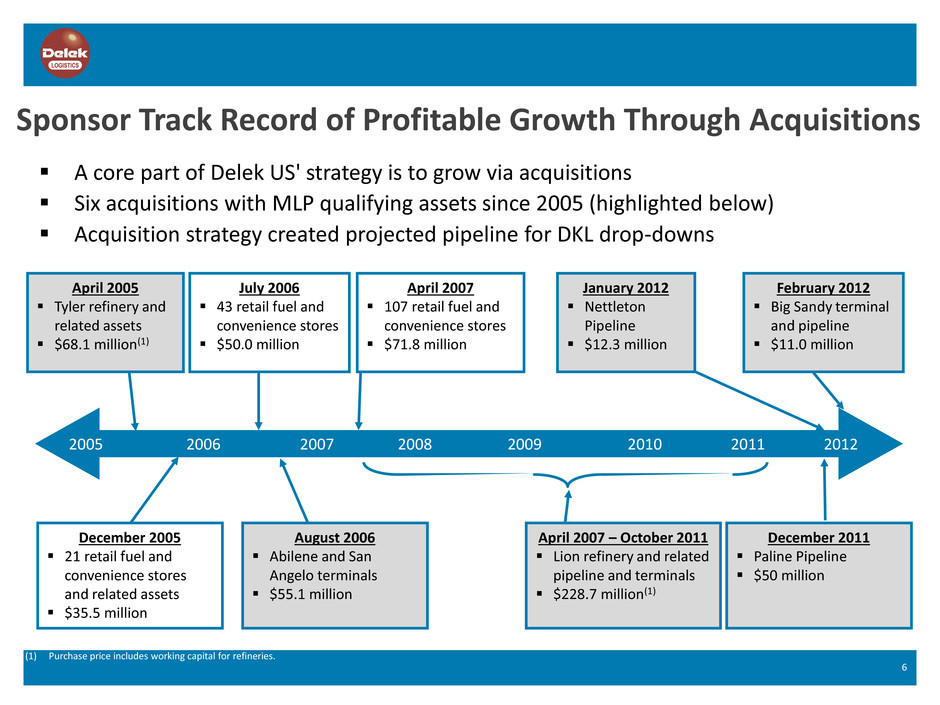

Sponsor Track Record of Profitable Growth Through Acquisitions 6 2005 2006 2007 2008 2009 2010 2011 2012 April 2005 Tyler refinery and related assets $68.1 million(1) August 2006 Abilene and San Angelo terminals $55.1 million July 2006 43 retail fuel and convenience stores $50.0 million April 2007 107 retail fuel and convenience stores $71.8 million December 2005 21 retail fuel and convenience stores and related assets $35.5 million April 2007 – October 2011 Lion refinery and related pipeline and terminals $228.7 million(1) January 2012 Nettleton Pipeline $12.3 million February 2012 Big Sandy terminal and pipeline $11.0 million December 2011 Paline Pipeline $50 million A core part of Delek US' strategy is to grow via acquisitions Six acquisitions with MLP qualifying assets since 2005 (highlighted below) Acquisition strategy created projected pipeline for DKL drop-downs (1) Purchase price includes working capital for refineries.

Delek Logistics Partners, LP Overview

8 Stable, Fee-Based Cash Flows Assets support Delek US' highly profitable and strategically located inland refining system Inflation-indexed fees for most contracts Majority of all margin generated by long term, fee-based contracts with volume minimums Agreements with Delek US cap maintenance capex and limit Delek US force majeure abilities Limited commodity price exposure Primarily Traditional, stable MLP assets

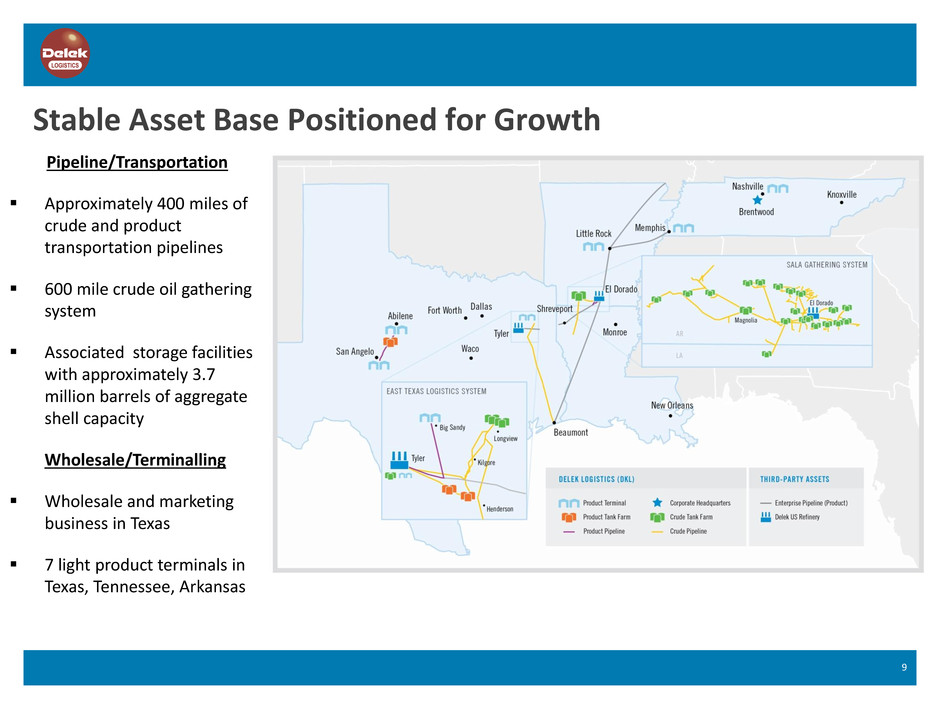

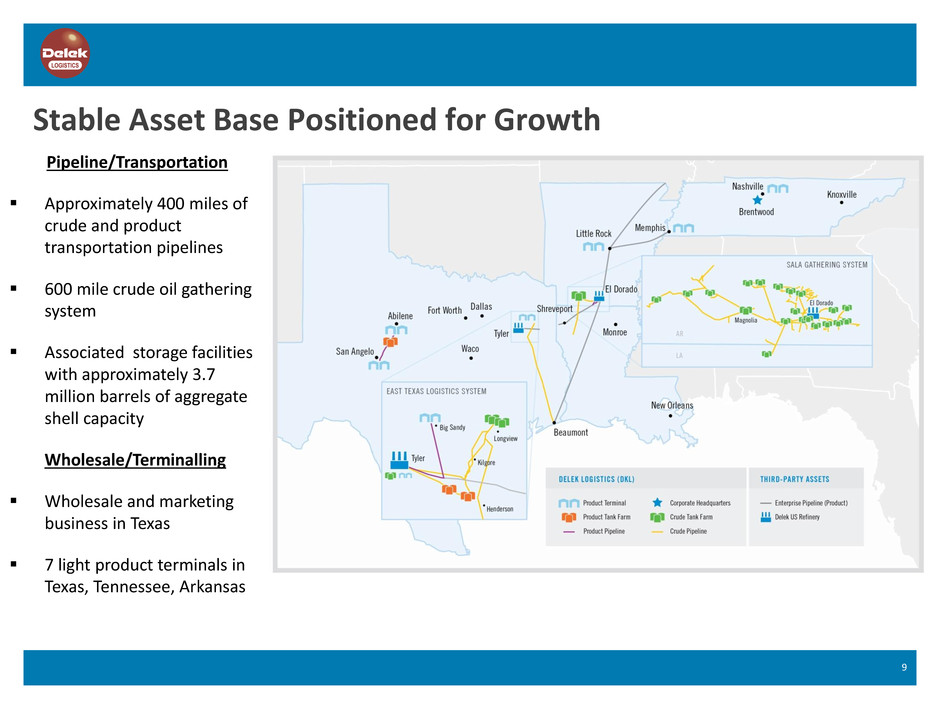

Stable Asset Base Positioned for Growth 9 Pipeline/Transportation Approximately 400 miles of crude and product transportation pipelines 600 mile crude oil gathering system Associated storage facilities with approximately 3.7 million barrels of aggregate shell capacity Wholesale/Terminalling Wholesale and marketing business in Texas 7 light product terminals in Texas, Tennessee, Arkansas

Continued Increase in SALA Gathering System 10 • SALA provides access to local Arkansas crude to Delek US’s El Dorado refinery. • 600 mile crude oil gathering system, primarily within a 60-mile radius of the El Dorado refinery. • Positive outlook due to development in Brown Dense area. (1) Delek US acquired majority ownership of Lion Oil in April 2011 and volumes in 2011 are based on 247 days of operations following the acquisition . 15,813 15,900 17,676 20,747 22,236 - 5,000 10,000 15,000 20,000 25,000 30,000 2009 2010 2011 2012 YTD 3Q13 B ar re ls per d ay Crude Volume (bpd) (1)

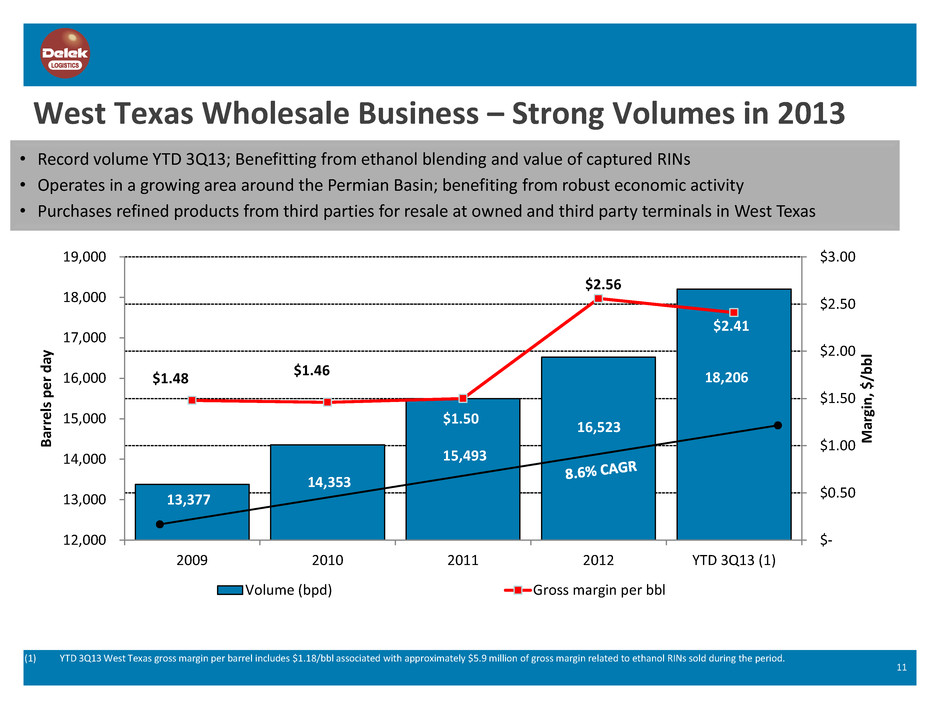

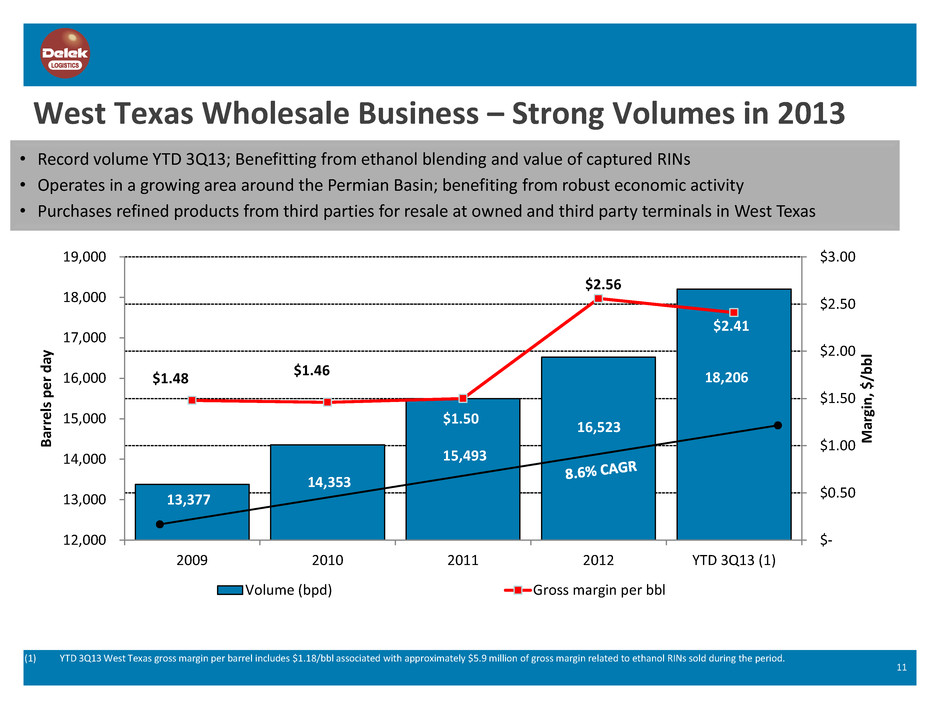

West Texas Wholesale Business – Strong Volumes in 2013 11 • Record volume YTD 3Q13; Benefitting from ethanol blending and value of captured RINs • Operates in a growing area around the Permian Basin; benefiting from robust economic activity • Purchases refined products from third parties for resale at owned and third party terminals in West Texas (1) YTD 3Q13 West Texas gross margin per barrel includes $1.18/bbl associated with approximately $5.9 million of gross margin related to ethanol RINs sold during the period. 13,377 14,353 15,493 16,523 18,206 $1.48 $1.46 $1.50 $2.56 $2.41 12,000 13,000 14,000 15,000 16,000 17,000 18,000 19,000 2009 2010 2011 2012 YTD 3Q13 (1) $- $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 B ar re ls p er d ay M ar gi n , $/ b b l Volume (bpd) Gross margin per bbl

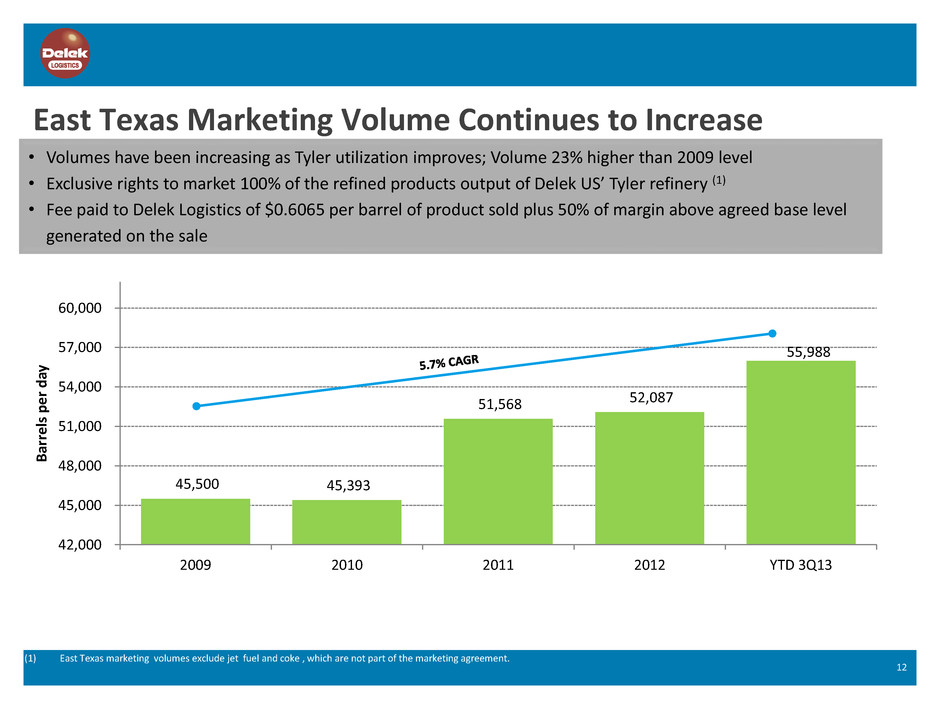

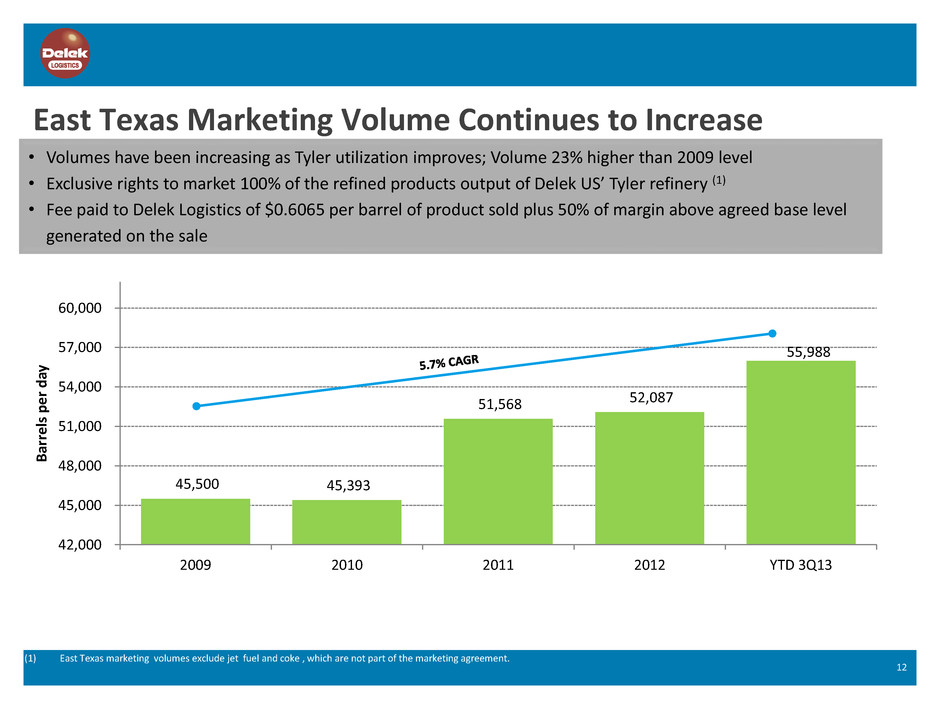

East Texas Marketing Volume Continues to Increase 12 (1) East Texas marketing volumes exclude jet fuel and coke , which are not part of the marketing agreement. • Volumes have been increasing as Tyler utilization improves; Volume 23% higher than 2009 level • Exclusive rights to market 100% of the refined products output of Delek US’ Tyler refinery (1) • Fee paid to Delek Logistics of $0.6065 per barrel of product sold plus 50% of margin above agreed base level generated on the sale 45,500 45,393 51,568 52,087 55,988 42,000 45,000 48,000 51,000 54,000 57,000 60,000 2009 2010 2011 2012 YTD 3Q13 B ar re ls p er d ay

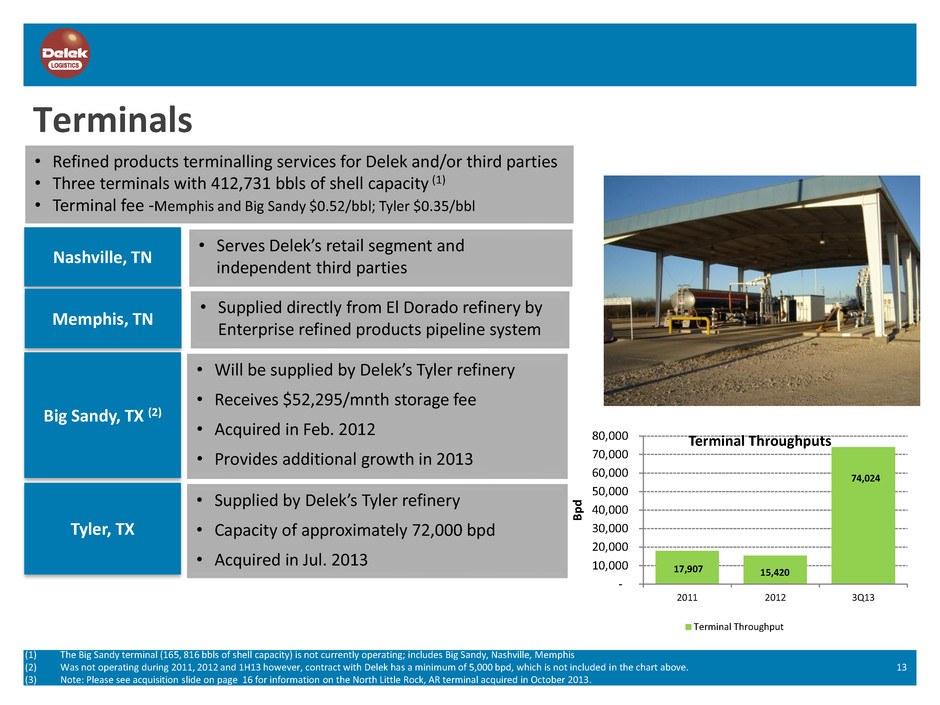

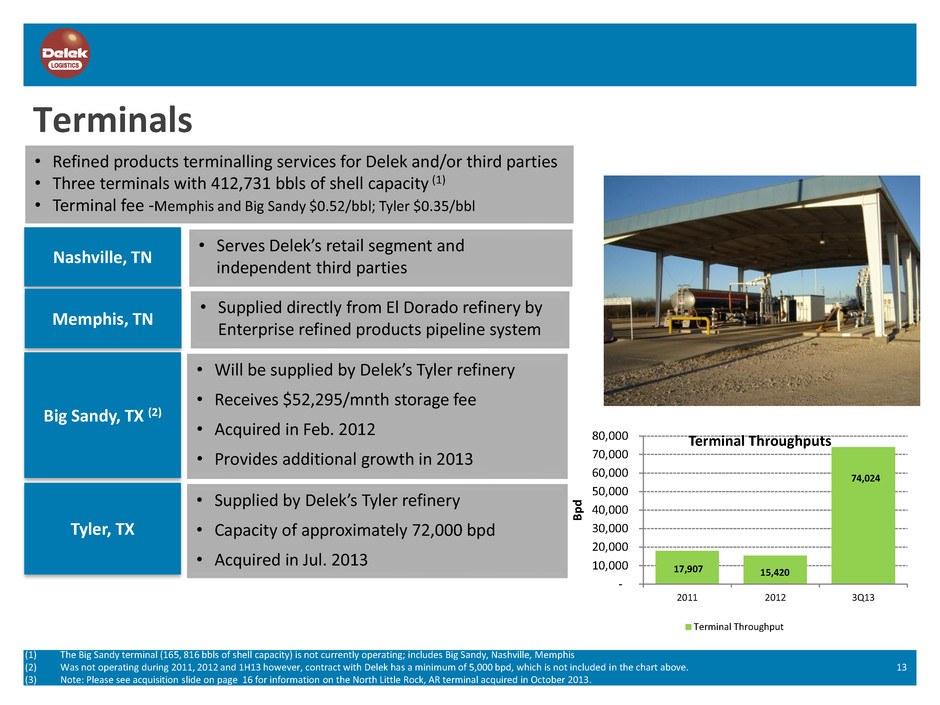

Terminals 13 • Serves Delek’s retail segment and independent third parties Nashville, TN • Refined products terminalling services for Delek and/or third parties • Three terminals with 412,731 bbls of shell capacity (1) • Terminal fee -Memphis and Big Sandy $0.52/bbl; Tyler $0.35/bbl (1) The Big Sandy terminal (165, 816 bbls of shell capacity) is not currently operating; includes Big Sandy, Nashville, Memphis (2) Was not operating during 2011, 2012 and 1H13 however, contract with Delek has a minimum of 5,000 bpd, which is not included in the chart above. (3) Note: Please see acquisition slide on page 16 for information on the North Little Rock, AR terminal acquired in October 2013. Memphis, TN • Supplied directly from El Dorado refinery by Enterprise refined products pipeline system Big Sandy, TX (2) • Will be supplied by Delek’s Tyler refinery • Receives $52,295/mnth storage fee • Acquired in Feb. 2012 • Provides additional growth in 2013 17,907 15,420 74,024 - 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 2011 2012 3Q13 B p d Terminal Throughputs Terminal Throughput Tyler, TX • Supplied by Delek’s Tyler refinery • Capacity of approximately 72,000 bpd • Acquired in Jul. 2013

Delek Logistics Strategy 14 Generate Consistent Growth Generate Stable Cash Flow Pursue Organic Expansion Optimize Existing Assets Pursue Accretive Acquisitions

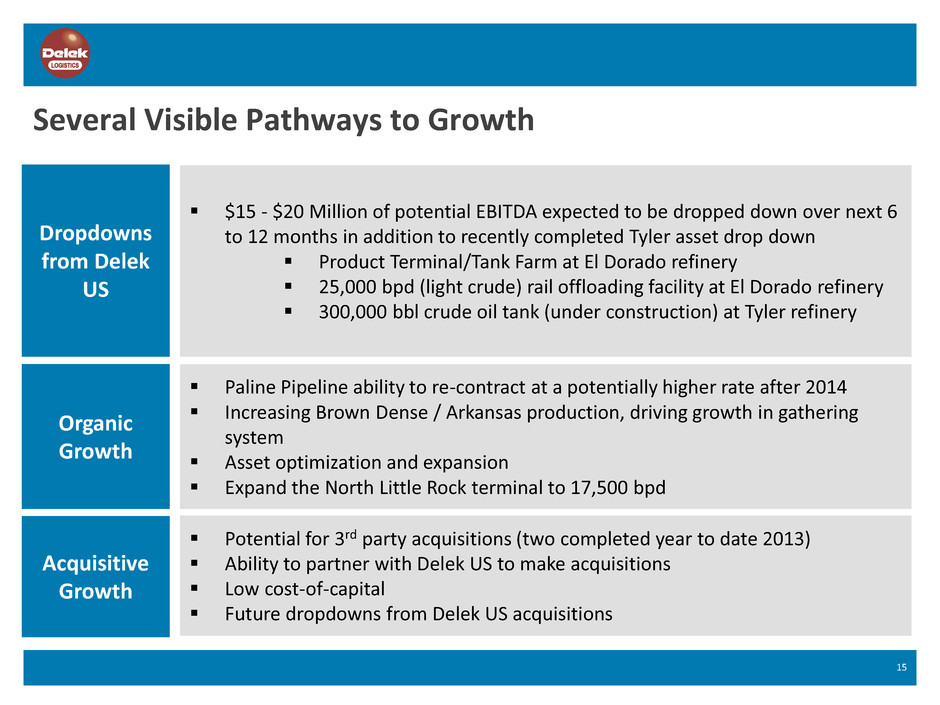

Several Visible Pathways to Growth 15 Dropdowns from Delek US Organic Growth Acquisitive Growth $15 - $20 Million of potential EBITDA expected to be dropped down over next 6 to 12 months in addition to recently completed Tyler asset drop down Product Terminal/Tank Farm at El Dorado refinery 25,000 bpd (light crude) rail offloading facility at El Dorado refinery 300,000 bbl crude oil tank (under construction) at Tyler refinery Paline Pipeline ability to re-contract at a potentially higher rate after 2014 Increasing Brown Dense / Arkansas production, driving growth in gathering system Asset optimization and expansion Expand the North Little Rock terminal to 17,500 bpd Potential for 3rd party acquisitions (two completed year to date 2013) Ability to partner with Delek US to make acquisitions Low cost-of-capital Future dropdowns from Delek US acquisitions

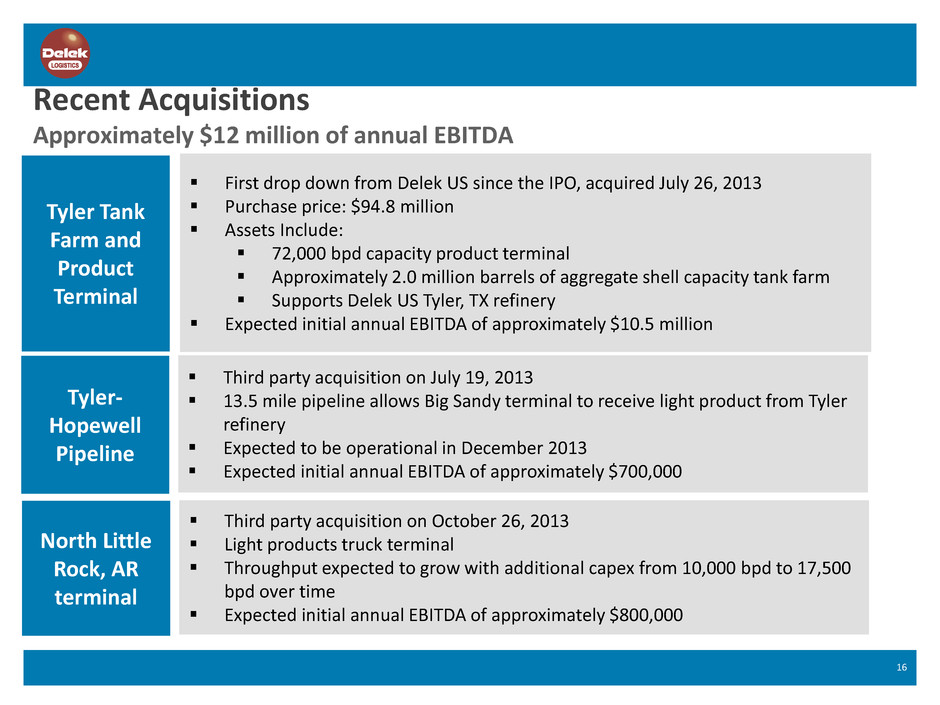

Recent Acquisitions Approximately $12 million of annual EBITDA 16 Tyler Tank Farm and Product Terminal First drop down from Delek US since the IPO, acquired July 26, 2013 Purchase price: $94.8 million Assets Include: 72,000 bpd capacity product terminal Approximately 2.0 million barrels of aggregate shell capacity tank farm Supports Delek US Tyler, TX refinery Expected initial annual EBITDA of approximately $10.5 million Tyler- Hopewell Pipeline Third party acquisition on July 19, 2013 13.5 mile pipeline allows Big Sandy terminal to receive light product from Tyler refinery Expected to be operational in December 2013 Expected initial annual EBITDA of approximately $700,000 North Little Rock, AR terminal Third party acquisition on October 26, 2013 Light products truck terminal Throughput expected to grow with additional capex from 10,000 bpd to 17,500 bpd over time Expected initial annual EBITDA of approximately $800,000

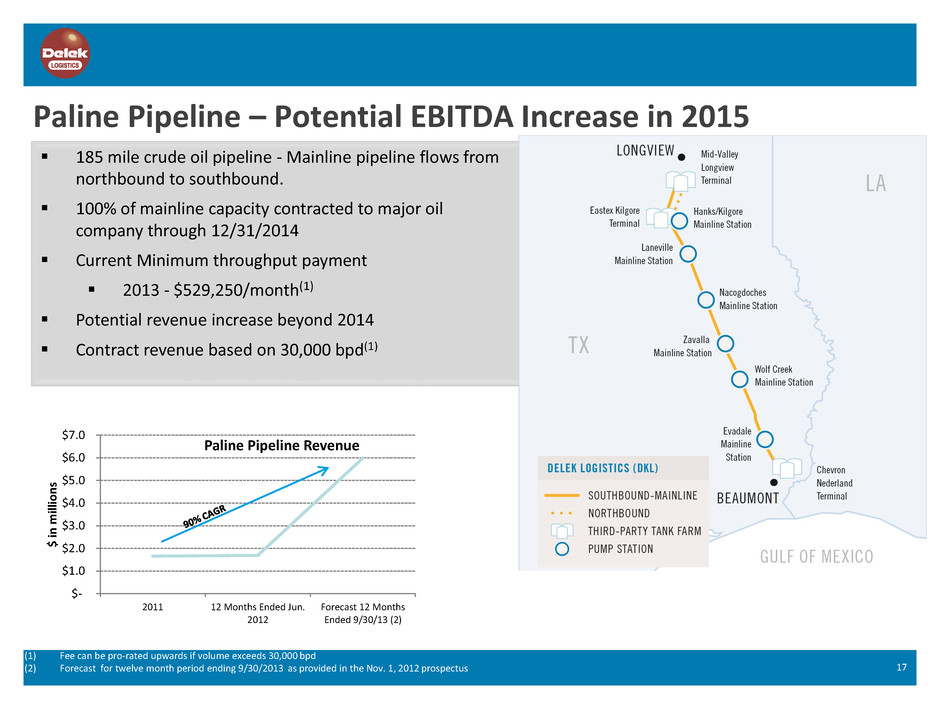

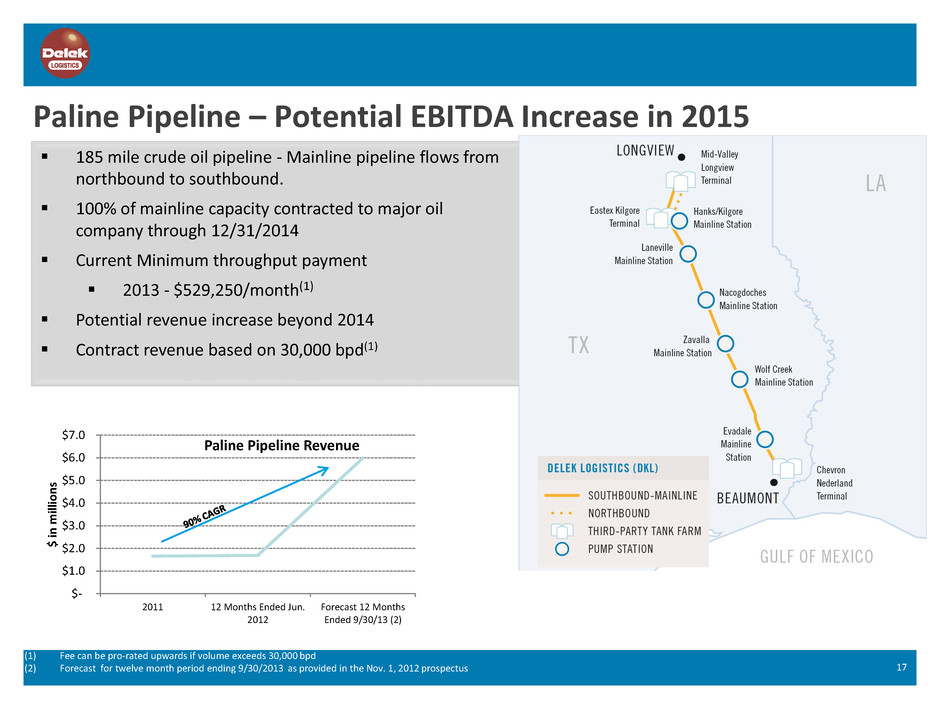

Paline Pipeline – Potential EBITDA Increase in 2015 17 (1) Fee can be pro-rated upwards if volume exceeds 30,000 bpd (2) Forecast for twelve month period ending 9/30/2013 as provided in the Nov. 1, 2012 prospectus 185 mile crude oil pipeline - Mainline pipeline flows from northbound to southbound. 100% of mainline capacity contracted to major oil company through 12/31/2014 Current Minimum throughput payment 2013 - $529,250/month(1) Potential revenue increase beyond 2014 Contract revenue based on 30,000 bpd(1) $- $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 2011 12 Months Ended Jun. 2012 Forecast 12 Months Ended 9/30/13 (2) $ in m ill io n s Paline Pipeline Revenue

Financial Overview

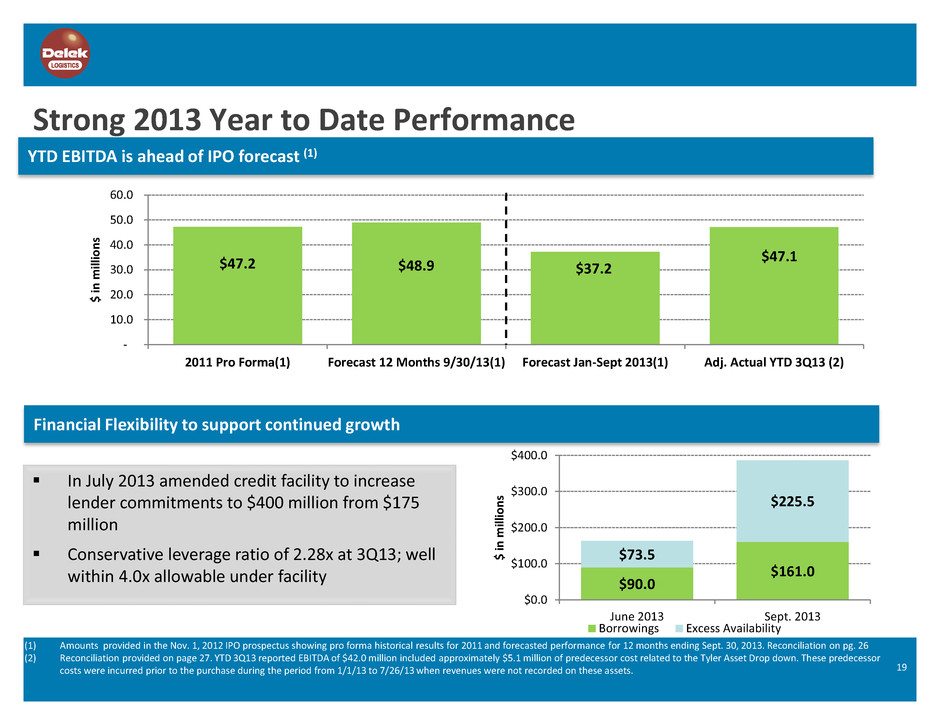

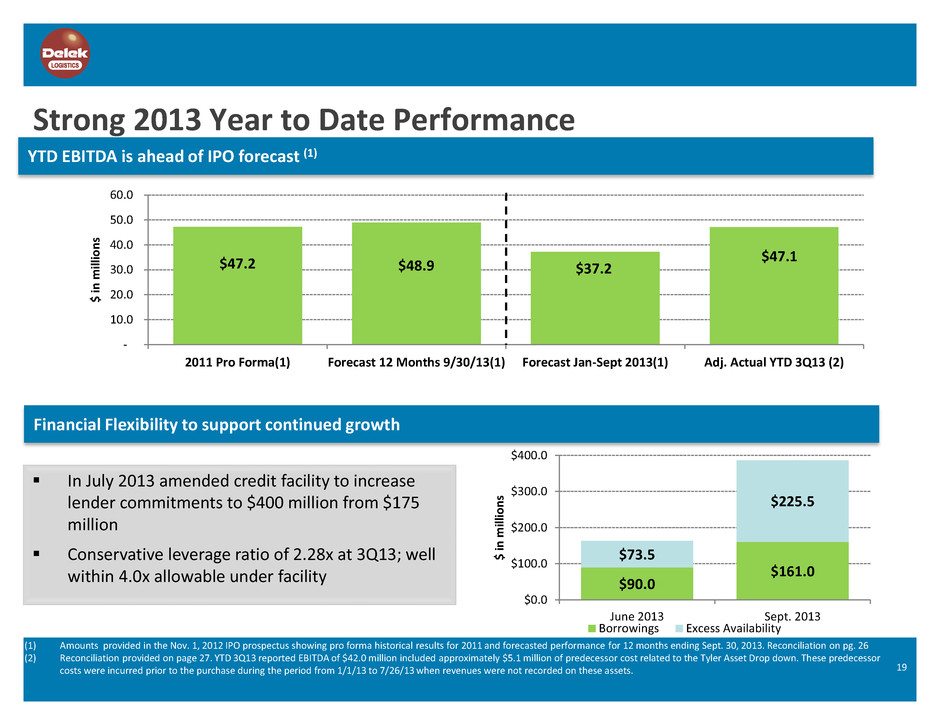

Strong 2013 Year to Date Performance 19 (1) Amounts provided in the Nov. 1, 2012 IPO prospectus showing pro forma historical results for 2011 and forecasted performance for 12 months ending Sept. 30, 2013. Reconciliation on pg. 26 (2) Reconciliation provided on page 27. YTD 3Q13 reported EBITDA of $42.0 million included approximately $5.1 million of predecessor cost related to the Tyler Asset Drop down. These predecessor costs were incurred prior to the purchase during the period from 1/1/13 to 7/26/13 when revenues were not recorded on these assets. YTD EBITDA is ahead of IPO forecast (1) $47.2 $48.9 $37.2 $47.1 - 10.0 20.0 30.0 40.0 50.0 60.0 2011 Pro Forma(1) Forecast 12 Months 9/30/13(1) Forecast Jan-Sept 2013(1) Adj. Actual YTD 3Q13 (2) $ in m ill io n s $90.0 $161.0 $73.5 $225.5 $0.0 $100.0 $200.0 $300.0 $400.0 June 2013 Sept. 2013 $ in m ill io n s Borrowings Excess Availability Financial Flexibility to support continued growth In July 2013 amended credit facility to increase lender commitments to $400 million from $175 million Conservative leverage ratio of 2.28x at 3Q13; well within 4.0x allowable under facility

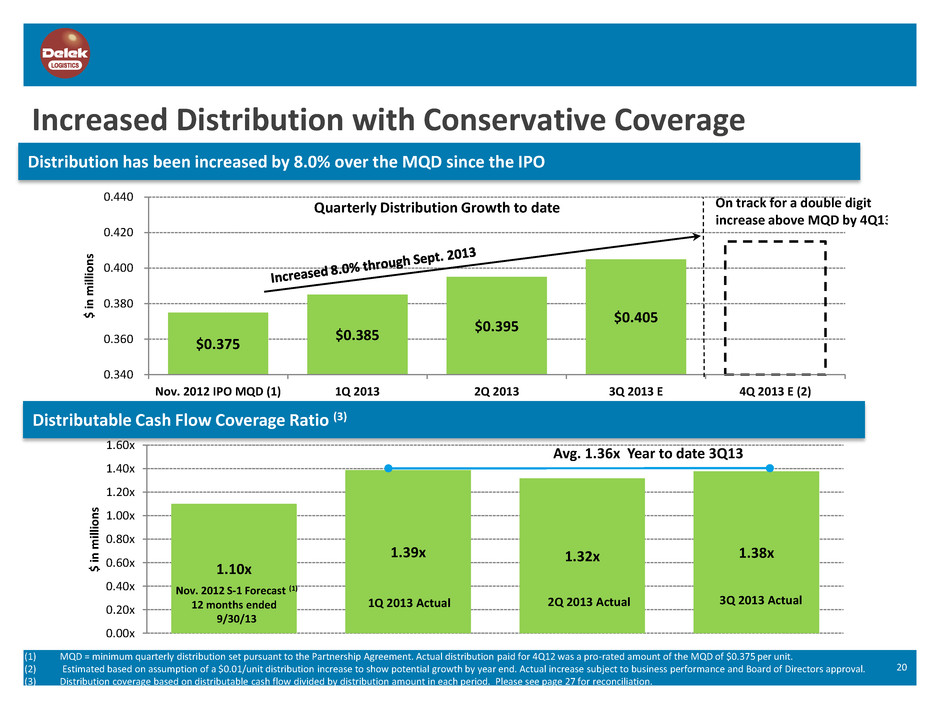

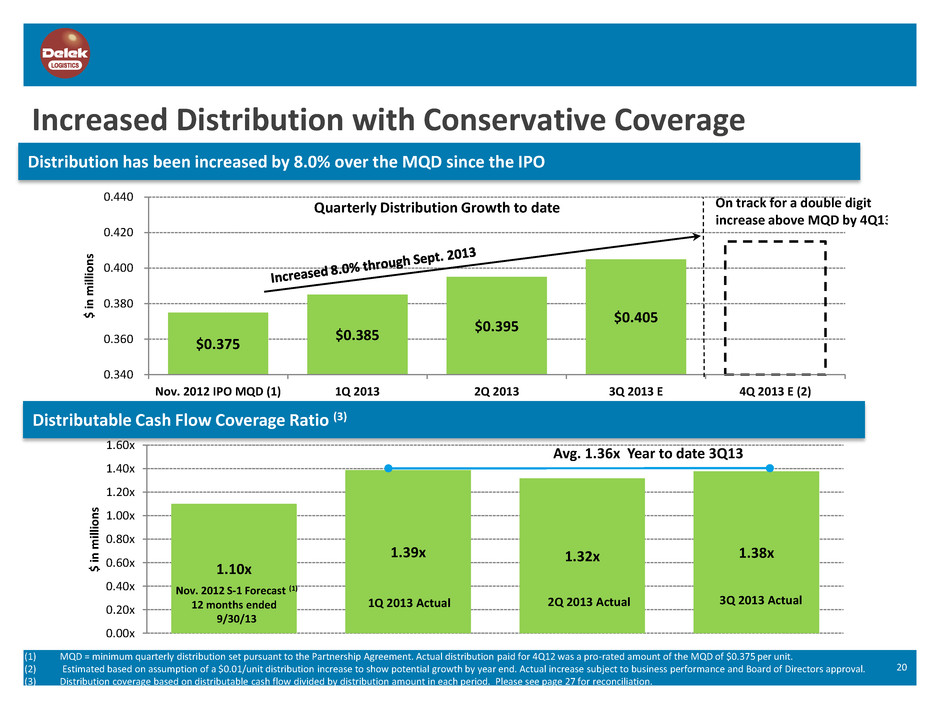

Increased Distribution with Conservative Coverage 20 (1) MQD = minimum quarterly distribution set pursuant to the Partnership Agreement. Actual distribution paid for 4Q12 was a pro-rated amount of the MQD of $0.375 per unit. (2) Estimated based on assumption of a $0.01/unit distribution increase to show potential growth by year end. Actual increase subject to business performance and Board of Directors approval. (3) Distribution coverage based on distributable cash flow divided by distribution amount in each period. Please see page 27 for reconciliation. Distribution has been increased by 8.0% over the MQD since the IPO $0.375 $0.385 $0.395 $0.405 0.340 0.360 0.380 0.400 0.420 0.440 Nov. 2012 IPO MQD (1) 1Q 2013 2Q 2013 3Q 2013 E 4Q 2013 E (2) $ in m ill io n s Quarterly Distribution Growth to date On track for a double digit increase above MQD by 4Q13 1.10x 1.39x 1.32x 1.38x 0.00x 0.20x 0.40x 0.60x 0.80x 1.00x 1.20x 1.40x 1.60x $ in m ill io n s Avg. 1.36x Year to date 3Q13 Nov. 2012 S-1 Forecast (1) 12 months ended 9/30/13 1Q 2013 Actual 2Q 2013 Actual 3Q 2013 Actual Distributable Cash Flow Coverage Ratio (3)

Appendix

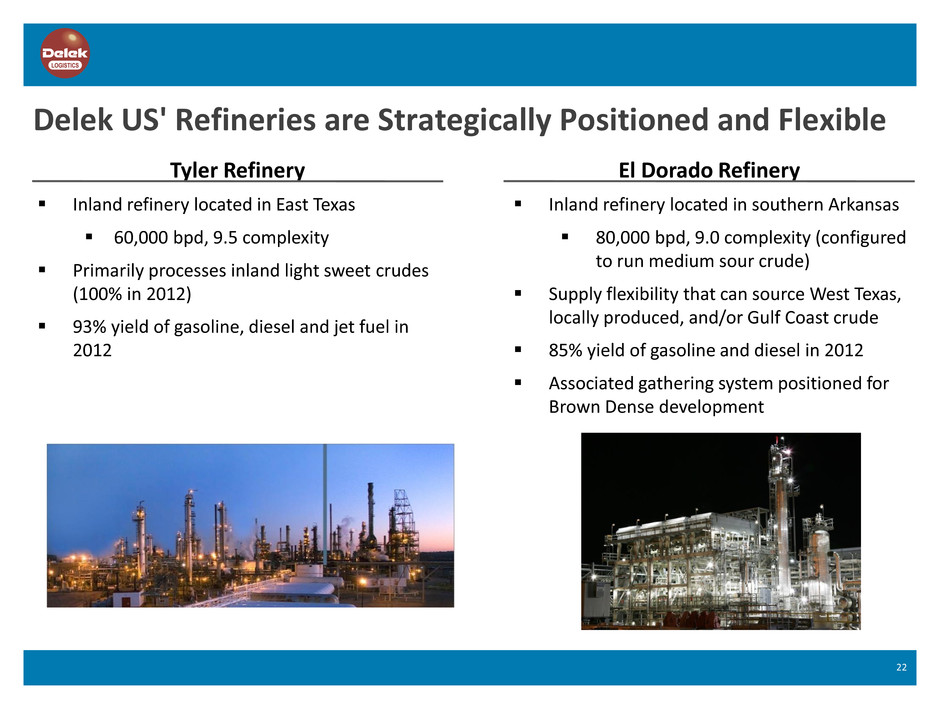

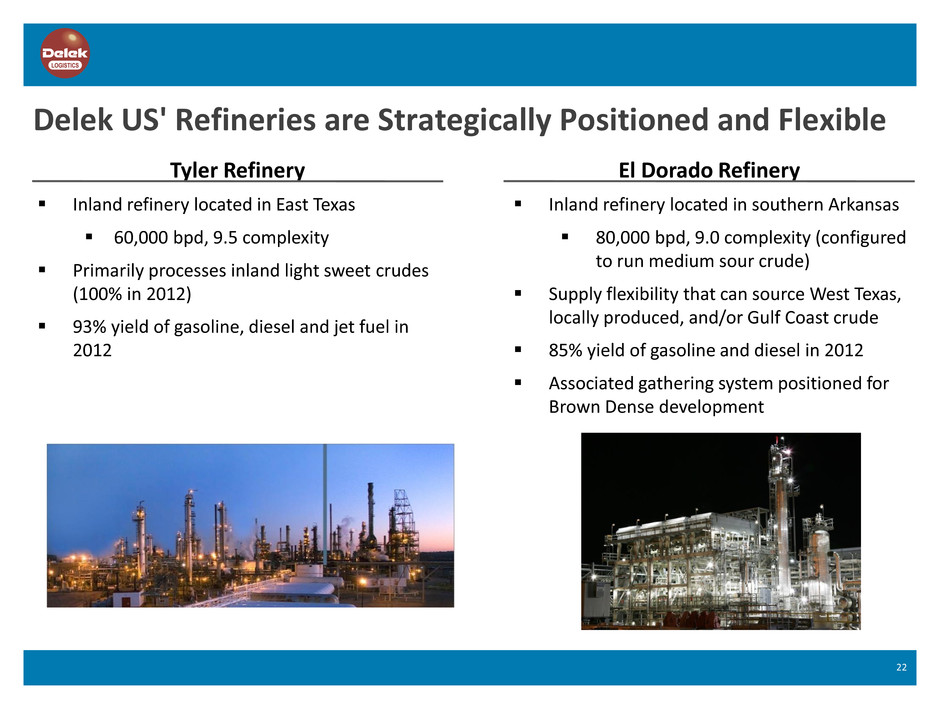

Delek US' Refineries are Strategically Positioned and Flexible 22 Inland refinery located in East Texas 60,000 bpd, 9.5 complexity Primarily processes inland light sweet crudes (100% in 2012) 93% yield of gasoline, diesel and jet fuel in 2012 El Dorado Refinery Tyler Refinery Inland refinery located in southern Arkansas 80,000 bpd, 9.0 complexity (configured to run medium sour crude) Supply flexibility that can source West Texas, locally produced, and/or Gulf Coast crude 85% yield of gasoline and diesel in 2012 Associated gathering system positioned for Brown Dense development

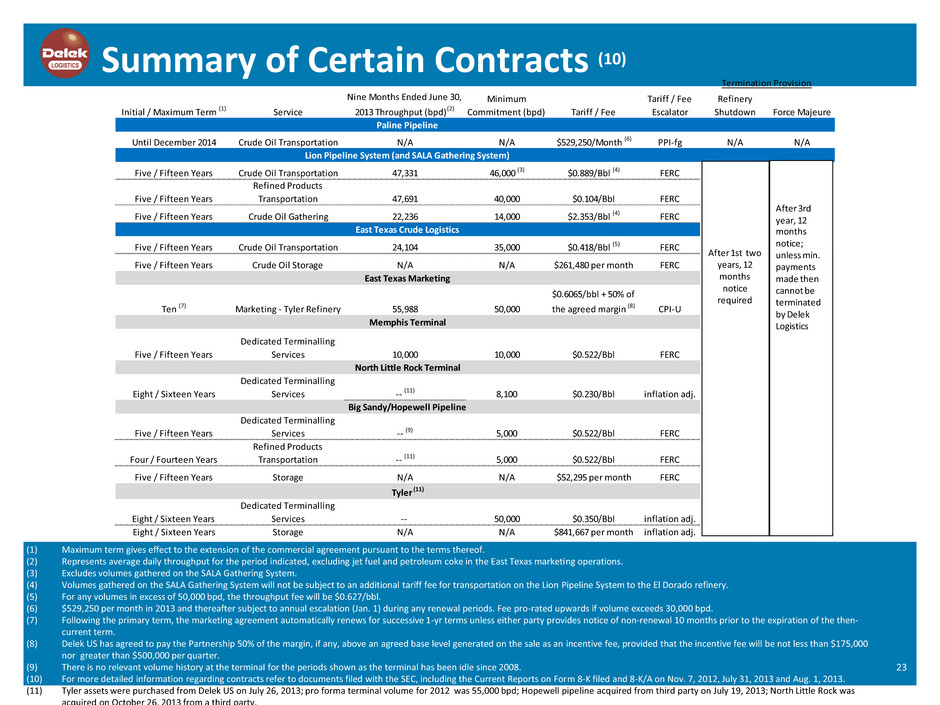

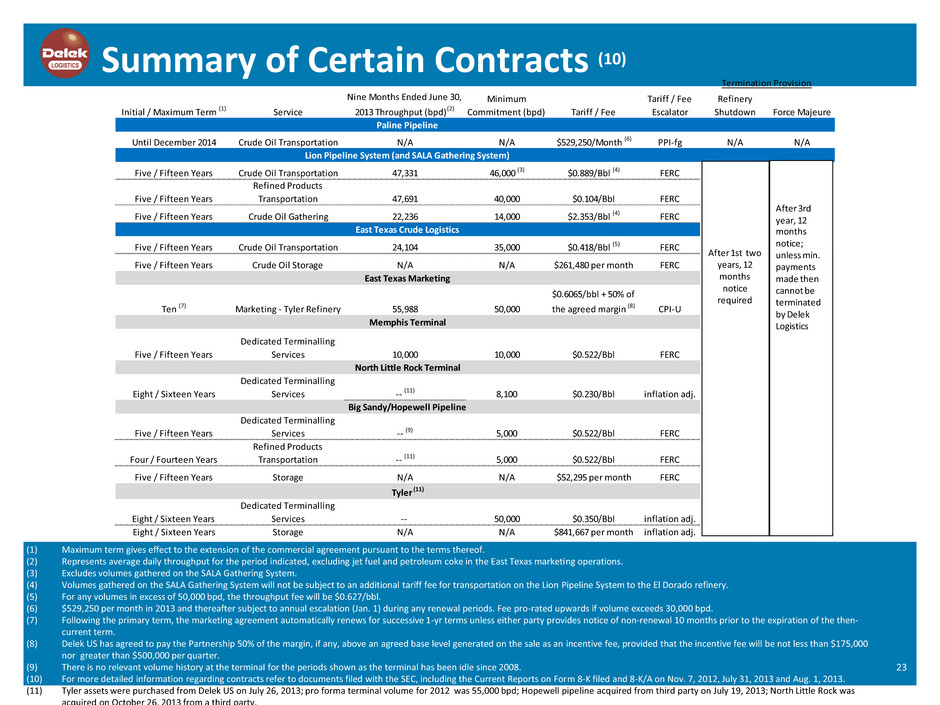

Summary of Certain Contracts (10) 23 (1) Maximum term gives effect to the extension of the commercial agreement pursuant to the terms thereof. (2) Represents average daily throughput for the period indicated, excluding jet fuel and petroleum coke in the East Texas marketing operations. (3) Excludes volumes gathered on the SALA Gathering System. (4) Volumes gathered on the SALA Gathering System will not be subject to an additional tariff fee for transportation on the Lion Pipeline System to the El Dorado refinery. (5) For any volumes in excess of 50,000 bpd, the throughput fee will be $0.627/bbl. (6) $529,250 per month in 2013 and thereafter subject to annual escalation (Jan. 1) during any renewal periods. Fee pro-rated upwards if volume exceeds 30,000 bpd. (7) Following the primary term, the marketing agreement automatically renews for successive 1-yr terms unless either party provides notice of non-renewal 10 months prior to the expiration of the then- current term. (8) Delek US has agreed to pay the Partnership 50% of the margin, if any, above an agreed base level generated on the sale as an incentive fee, provided that the incentive fee will be not less than $175,000 nor greater than $500,000 per quarter. (9) There is no relevant volume history at the terminal for the periods shown as the terminal has been idle since 2008. (10) For more detailed information regarding contracts refer to documents filed with the SEC, including the Current Reports on Form 8-K filed and 8-K/A on Nov. 7, 2012, July 31, 2013 and Aug. 1, 2013. (11) Tyler assets were purchased from Delek US on July 26, 2013; pro forma terminal volume for 2012 was 55,000 bpd; Hopewell pipeline acquired from third party on July 19, 2013; North Little Rock was acquired on October 26, 2013 from a third party. Initial / Maximum Term (1) Service Nine Months Ended June 30, 2013 Throughput (bpd)(2) Minimum Commitment (bpd) Tariff / Fee Tariff / Fee Escalator Refinery Shutdown Force Majeure Until December 2014 Crude Oil Transportation N/A N/A $529,250/Month (6) PPI-fg N/A N/A Five / Fifteen Years Crude Oil Transportation 47,331 46,000 (3) $0.889/Bbl (4) FERC Five / Fifteen Years Refined Products Transportation 47,691 40,000 $0.104/Bbl FERC Five / Fifteen Years Crude Oil Gathering 22,236 14,000 $2.353/Bbl (4) FERC Five / Fifteen Years Crude Oil Transportation 24,104 35,000 $0.418/Bbl (5) FERC Five / Fifteen Years Crude Oil Storage N/A N/A $261,480 per month FERC Ten (7) Marketing - Tyler Refinery 55,988 50,000 $0.6065/bbl + 50% of the agreed margin (8) CPI-U Five / Fifteen Years Dedicated Terminalling Services 10,000 10,000 $0.522/Bbl FERC Eight / Sixteen Years Dedicated Terminalling Services -- (11) 8,100 $0.230/Bbl inflation adj. Five / Fifteen Years Dedicated Terminalling Services -- (9) 5,000 $0.522/Bbl FERC Four / Fourteen Years Refined Products Transportation -- (11) 5,000 $0.522/Bbl FERC Five / Fifteen Years Storage N/A N/A $52,295 per month FERC Eight / Sixteen Years Dedicated Terminalling Services -- 50,000 $0.350/Bbl inflation adj. Eight / Sixteen Years Storage N/A N/A $841,667 per month inflation adj. Tyler (11) Big Sandy/Hopewell Pipeline Lion Pipeline System (and SALA Gathering System) North Little Rock Terminal Paline Pipeline East Texas Marketing Memphis Terminal Termination Provision East Texas Crude Logistics After 1st two years, 12 months notice required After 3rd year, 12 months notice; unless min. payments made then cannot be terminated by Delek Logistics

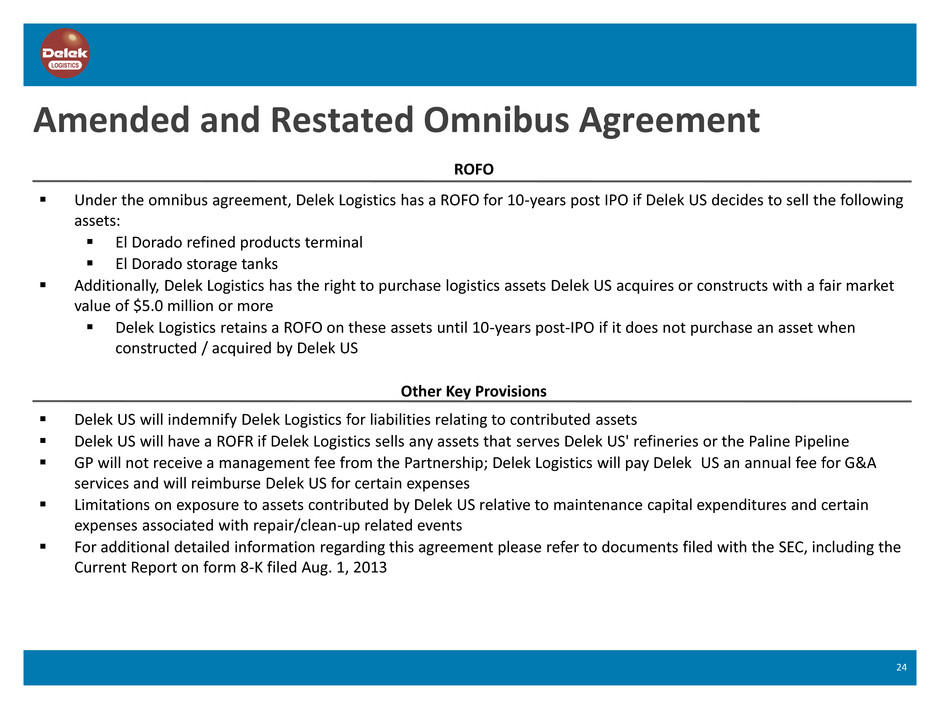

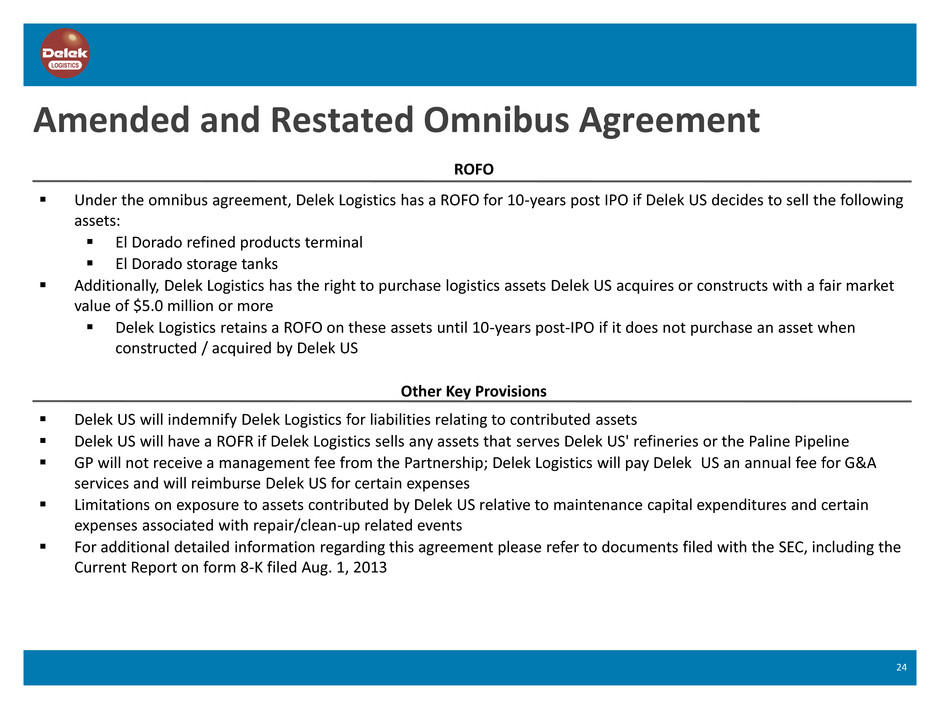

Amended and Restated Omnibus Agreement 24 Under the omnibus agreement, Delek Logistics has a ROFO for 10-years post IPO if Delek US decides to sell the following assets: El Dorado refined products terminal El Dorado storage tanks Additionally, Delek Logistics has the right to purchase logistics assets Delek US acquires or constructs with a fair market value of $5.0 million or more Delek Logistics retains a ROFO on these assets until 10-years post-IPO if it does not purchase an asset when constructed / acquired by Delek US ROFO Other Key Provisions Delek US will indemnify Delek Logistics for liabilities relating to contributed assets Delek US will have a ROFR if Delek Logistics sells any assets that serves Delek US' refineries or the Paline Pipeline GP will not receive a management fee from the Partnership; Delek Logistics will pay Delek US an annual fee for G&A services and will reimburse Delek US for certain expenses Limitations on exposure to assets contributed by Delek US relative to maintenance capital expenditures and certain expenses associated with repair/clean-up related events For additional detailed information regarding this agreement please refer to documents filed with the SEC, including the Current Report on form 8-K filed Aug. 1, 2013

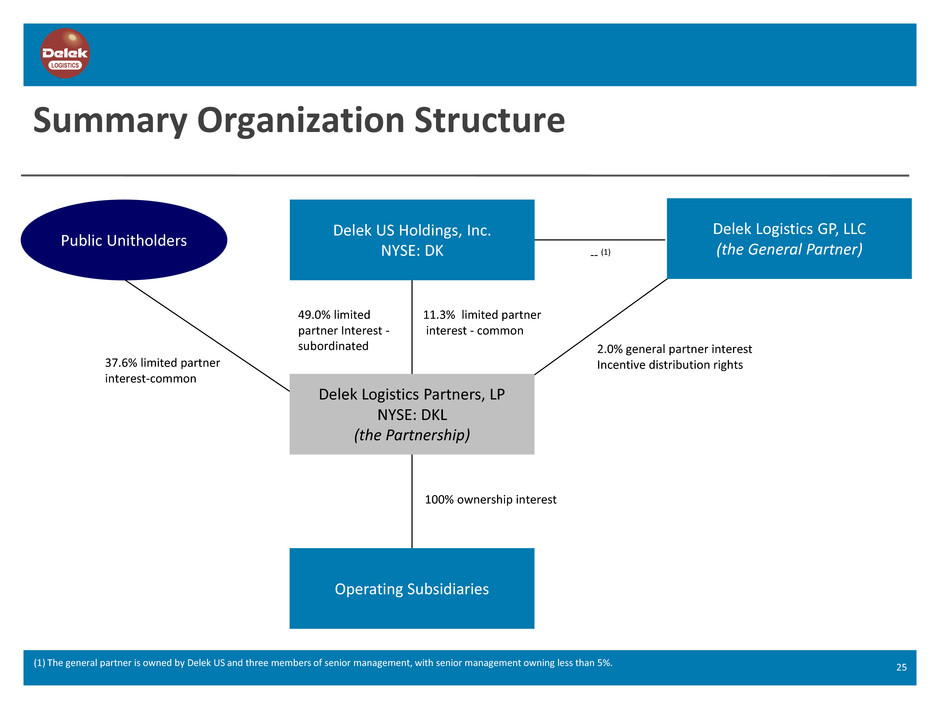

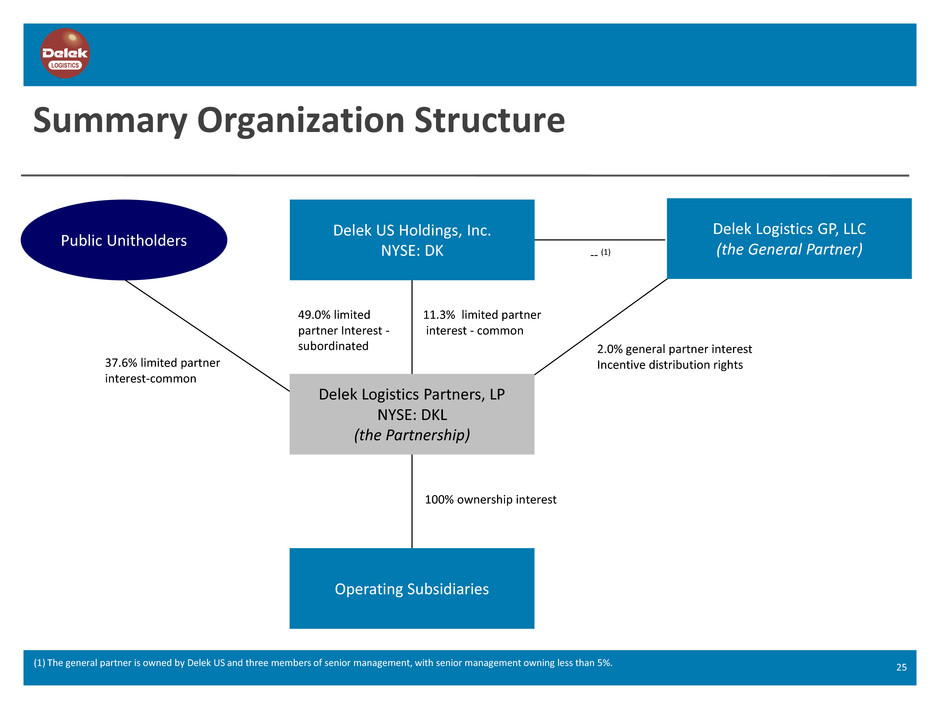

Summary Organization Structure 25 37.6% limited partner interest-common -- (1) 2.0% general partner interest Incentive distribution rights Delek Logistics Partners, LP NYSE: DKL (the Partnership) 100% ownership interest Public Unitholders Operating Subsidiaries 11.3% limited partner interest - common Delek Logistics GP, LLC (the General Partner) Delek US Holdings, Inc. NYSE: DK 49.0% limited partner Interest - subordinated (1) The general partner is owned by Delek US and three members of senior management, with senior management owning less than 5%.

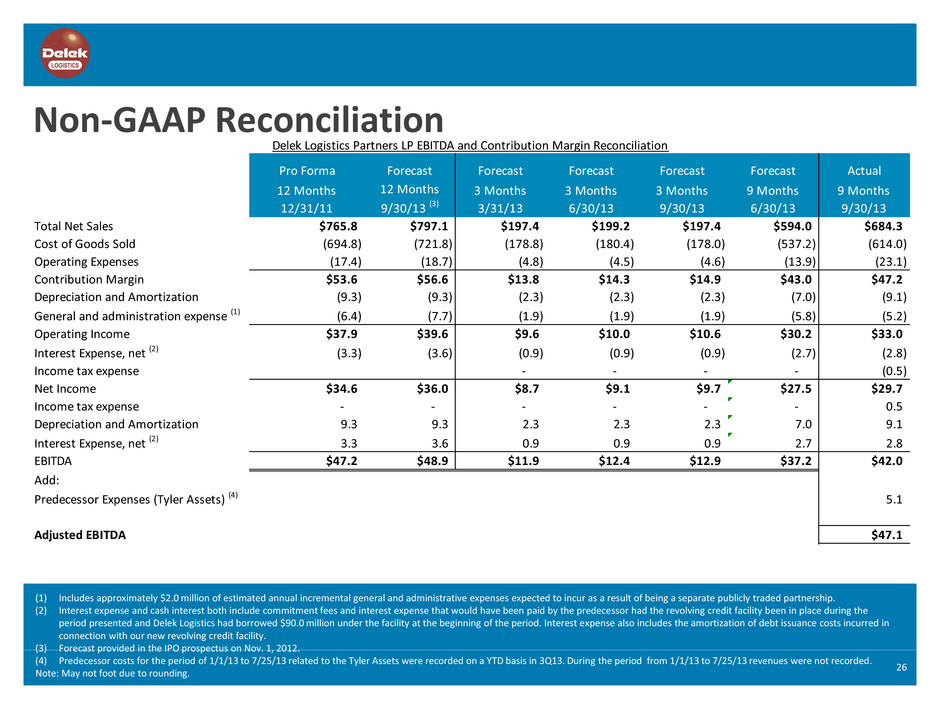

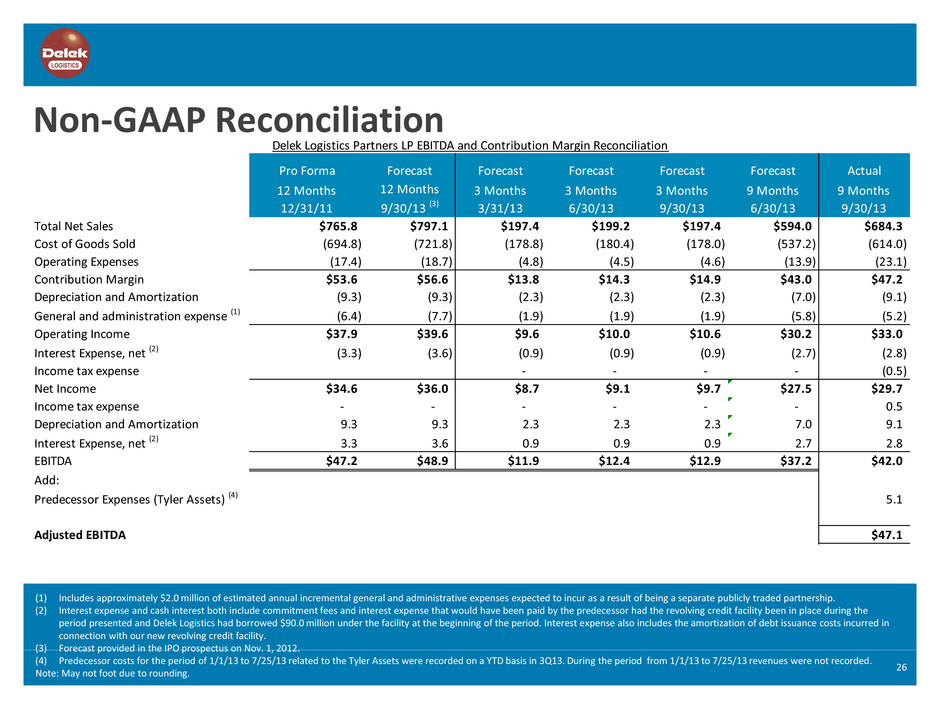

Non-GAAP Reconciliation 26 (1) Includes approximately $2.0 million of estimated annual incremental general and administrative expenses expected to incur as a result of being a separate publicly traded partnership. (2) Interest expense and cash interest both include commitment fees and interest expense that would have been paid by the predecessor had the revolving credit facility been in place during the period presented and Delek Logistics had borrowed $90.0 million under the facility at the beginning of the period. Interest expense also includes the amortization of debt issuance costs incurred in connection with our new revolving credit facility. (3) Forecast provided in the IPO prospectus on Nov. 1, 2012. (4) Predecessor costs for the period of 1/1/13 to 7/25/13 related to the Tyler Assets were recorded on a YTD basis in 3Q13. During the period from 1/1/13 to 7/25/13 revenues were not recorded. Note: May not foot due to rounding. Pro Forma Forecast Forecast Forecast Forecast Forecast Actual 12 Months 12/31/11 12 Months 9/30/13 (3) 3 Months 3/31/13 3 Months 6/30/13 3 Months 9/30/13 9 Months 6/30/13 9 Months 9/30/13 Total Net Sales $765.8 $797.1 $197.4 $199.2 $197.4 $594.0 $684.3 Cost of Goods Sold (694.8) (721.8) (178.8) (180.4) (178.0) (537.2) (614.0) Operating Expenses (17.4) (18.7) (4.8) (4.5) (4.6) (13.9) (23.1) Contribution Margin $53.6 $56.6 $13.8 $14.3 $14.9 $43.0 $47.2 Depreciation and Amortization (9.3) (9.3) (2.3) (2.3) (2.3) (7.0) (9.1) General and administration expense (1) (6.4) (7.7) (1.9) (1.9) (1.9) (5.8) (5.2) Operating Income $37.9 $39.6 $9.6 $10.0 $10.6 $30.2 $33.0 Interest Expense, net (2) (3.3) (3.6) (0.9) (0.9) (0.9) (2.7) (2.8) Income tax expense - - - - (0.5) Net Income $34.6 $36.0 $8.7 $9.1 $9.7 $27.5 $29.7 Income tax expense - - - - - - 0.5 Depreciation and Amortization 9.3 9.3 2.3 2.3 2.3 7.0 9.1 Interest Expense, net (2) 3.3 3.6 0.9 0.9 0.9 2.7 2.8 EBITDA $47.2 $48.9 $11.9 $12.4 $12.9 $37.2 $42.0 Add: Predecessor Expenses (Tyler Assets) (4) 5.1 Adjusted EBITDA $47.1 Delek Logistics Partners LP EBITDA and Contribution Margin Reconciliation

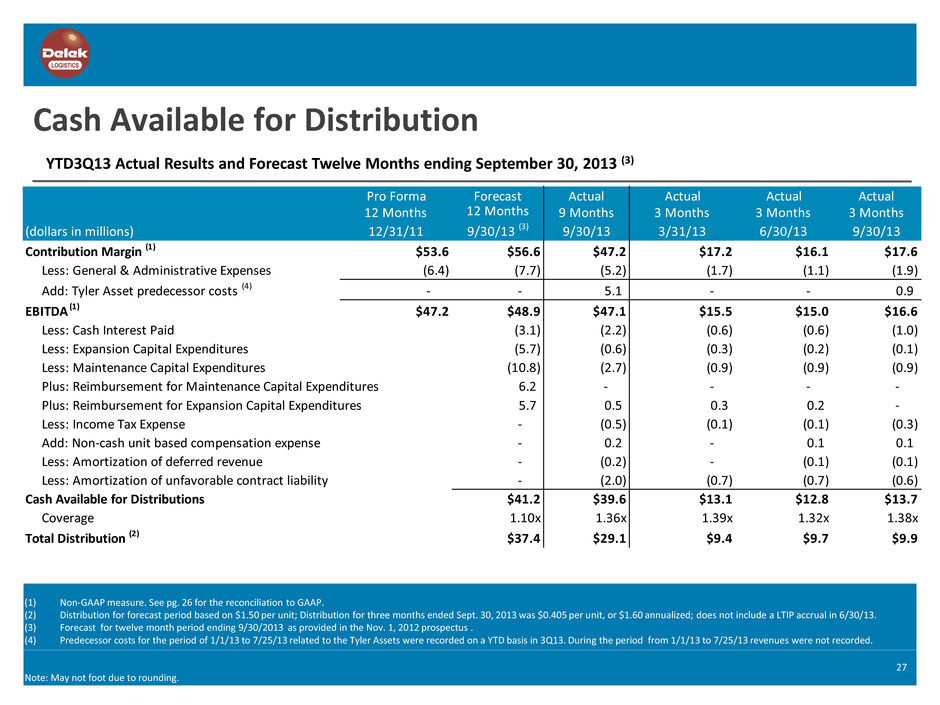

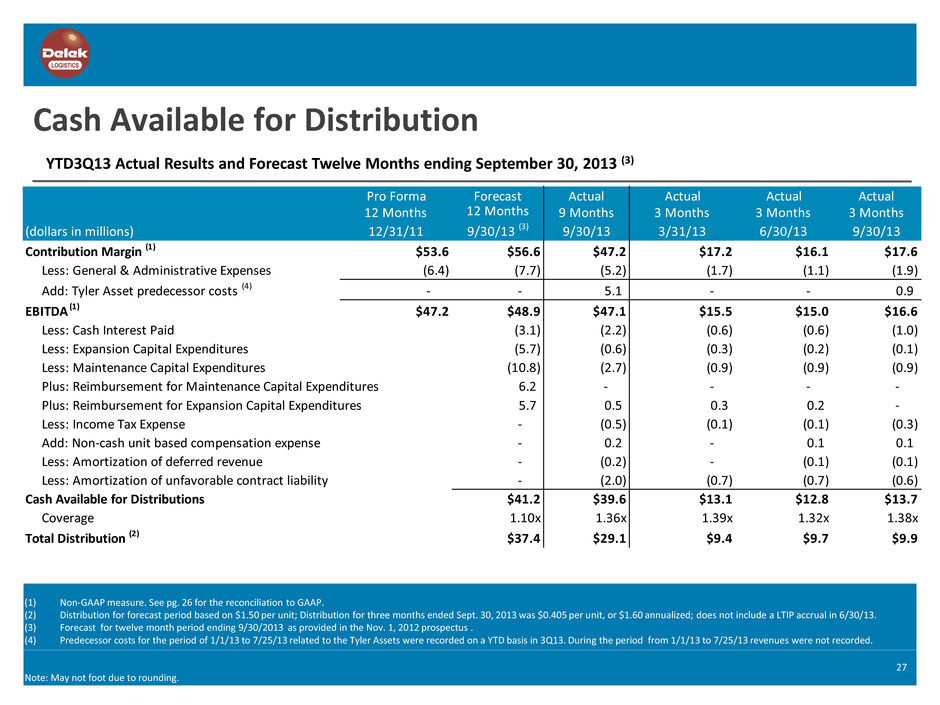

Cash Available for Distribution 27 YTD3Q13 Actual Results and Forecast Twelve Months ending September 30, 2013 (3) (1) Non-GAAP measure. See pg. 26 for the reconciliation to GAAP. (2) Distribution for forecast period based on $1.50 per unit; Distribution for three months ended Sept. 30, 2013 was $0.405 per unit, or $1.60 annualized; does not include a LTIP accrual in 6/30/13. (3) Forecast for twelve month period ending 9/30/2013 as provided in the Nov. 1, 2012 prospectus . (4) Predecessor costs for the period of 1/1/13 to 7/25/13 related to the Tyler Assets were recorded on a YTD basis in 3Q13. During the period from 1/1/13 to 7/25/13 revenues were not recorded. Note: May not foot due to rounding. Pro Forma Forecast Actual Actual Actual Actual (dollars in millions) 12 Months 12/31/11 12 Months 9/30/13 (3) 9 Months 9/30/13 3 Months 3/31/13 3 Months 6/30/13 3 Months 9/30/13 Contribution Margin (1) $53.6 $56.6 $47.2 $17.2 $16.1 $17.6 Less: General & Administrative Expenses (6.4) (7.7) (5.2) (1.7) (1.1) (1.9) Add: Tyler Asset predecessor costs (4) - - 5.1 - - 0.9 EBITDA (1) $47.2 $48.9 $47.1 $15.5 $15.0 $16.6 Less: Cash Interest Paid (3.1) (2.2) (0.6) (0.6) (1.0) Less: Expansion Capital Expenditures (5.7) (0.6) (0.3) (0.2) (0.1) Less: Maintenance Capital Expenditures (10.8) (2.7) (0.9) (0.9) (0.9) Plus: Reimbursement for Maintenance Capital Expenditures 6.2 - - - - Plus: Reimbursement for Expansion Capital Expenditures 5.7 0.5 0.3 0.2 - Less: Income Tax Expense - (0.5) (0.1) (0.1) (0.3) Add: Non-cash unit based compensation expense - 0.2 - 0.1 0.1 L ss: Amortization of deferred revenue - (0.2) - (0.1) (0.1) Less: Amortization of unfavorable contract liability - (2.0) (0.7) (0.7) (0.6) Cash Available for Distributions $41.2 $39.6 $13.1 $12.8 $13.7 Coverage 1.10x 1.36x 1.39x 1.32x 1.38x Total Distribution (2) $37.4 $29.1 $9.4 $9.7 $9.9

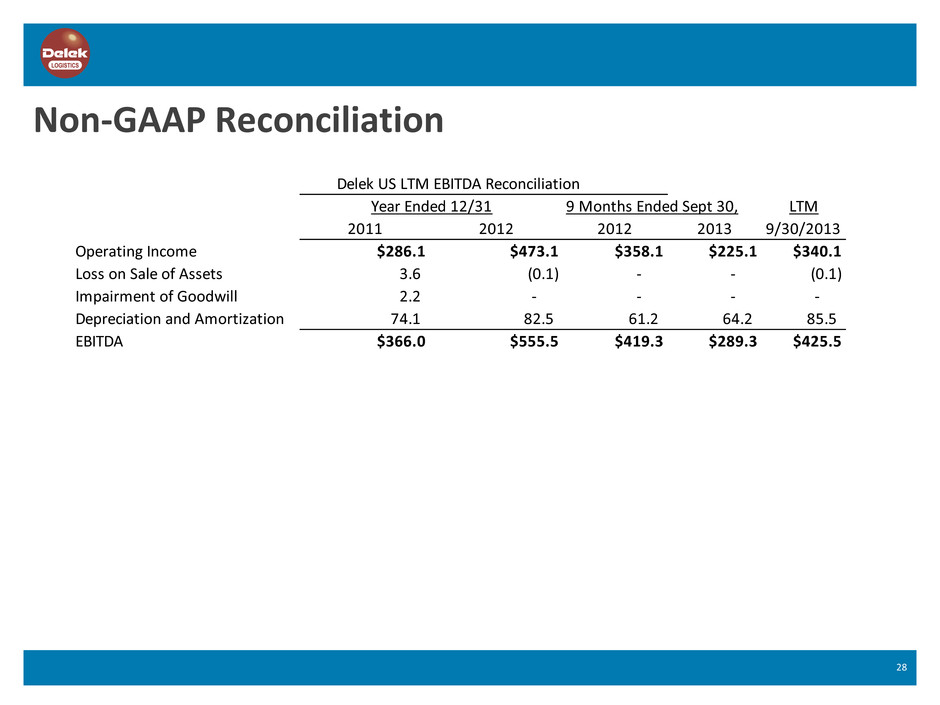

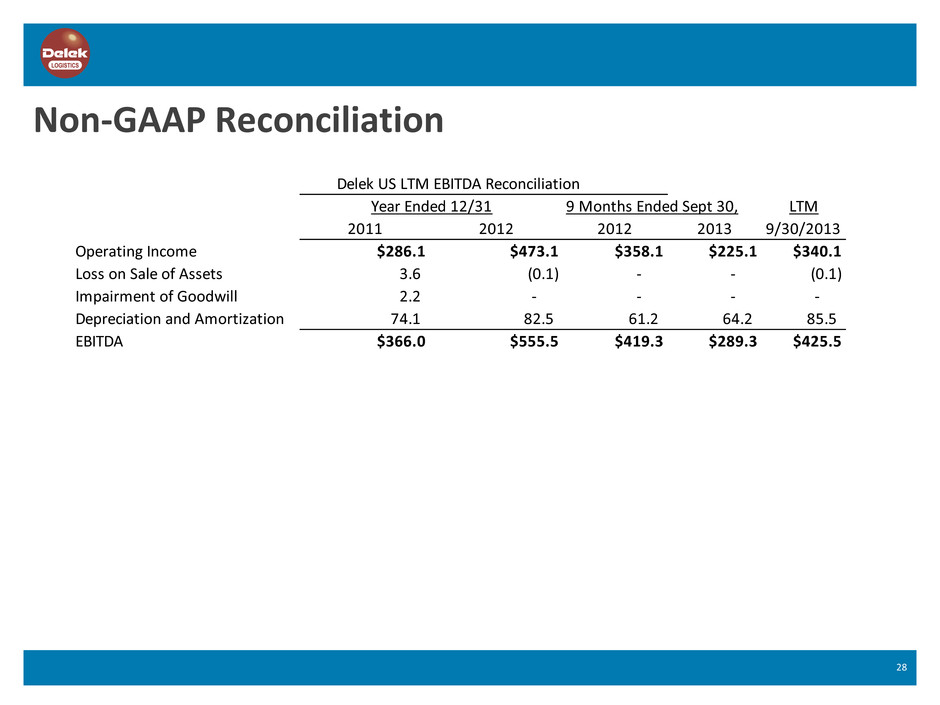

Non-GAAP Reconciliation 28 9 Months Ended Sept 30, LTM 2011 2012 2012 2013 9/30/2013 Operating Income $286.1 $473.1 $358.1 $225.1 $340.1 Loss on Sale of Assets 3.6 (0.1) - - (0.1) Impairment of Goodwill 2.2 - - - - Depreciation and Amortization 74.1 82.5 61.2 64.2 85.5 EBITDA $366.0 $555.5 $419.3 $289.3 $425.5 Year Ended 12/31 Delek US LTM EBITDA Reconciliation

29 Investor Relations Contact: Assi Ginzburg Keith Johnson Executive Vice President, CFO Vice President of Investor Relations 615-435-1452 615-435-1366