Exhibit 99.2 Red River Pipeline System Unaudited Financial Statements March 31, 2019

Red River Pipeline System Index Page(s) Unaudited Financial Statements Balance Sheets: As of March 31, 2019 and December 31, 2018 3 Statements of Operations: For the three months ended March 31, 2019 and 2018 4 Statements of Changes in Net Parent Investment: For the three months ended March 31, 2019 and 2018 5 Statements of Cash Flows: For the three months ended March 31, 2019 and 2018 6 Notes to Unaudited Financial Statements 7-13 2

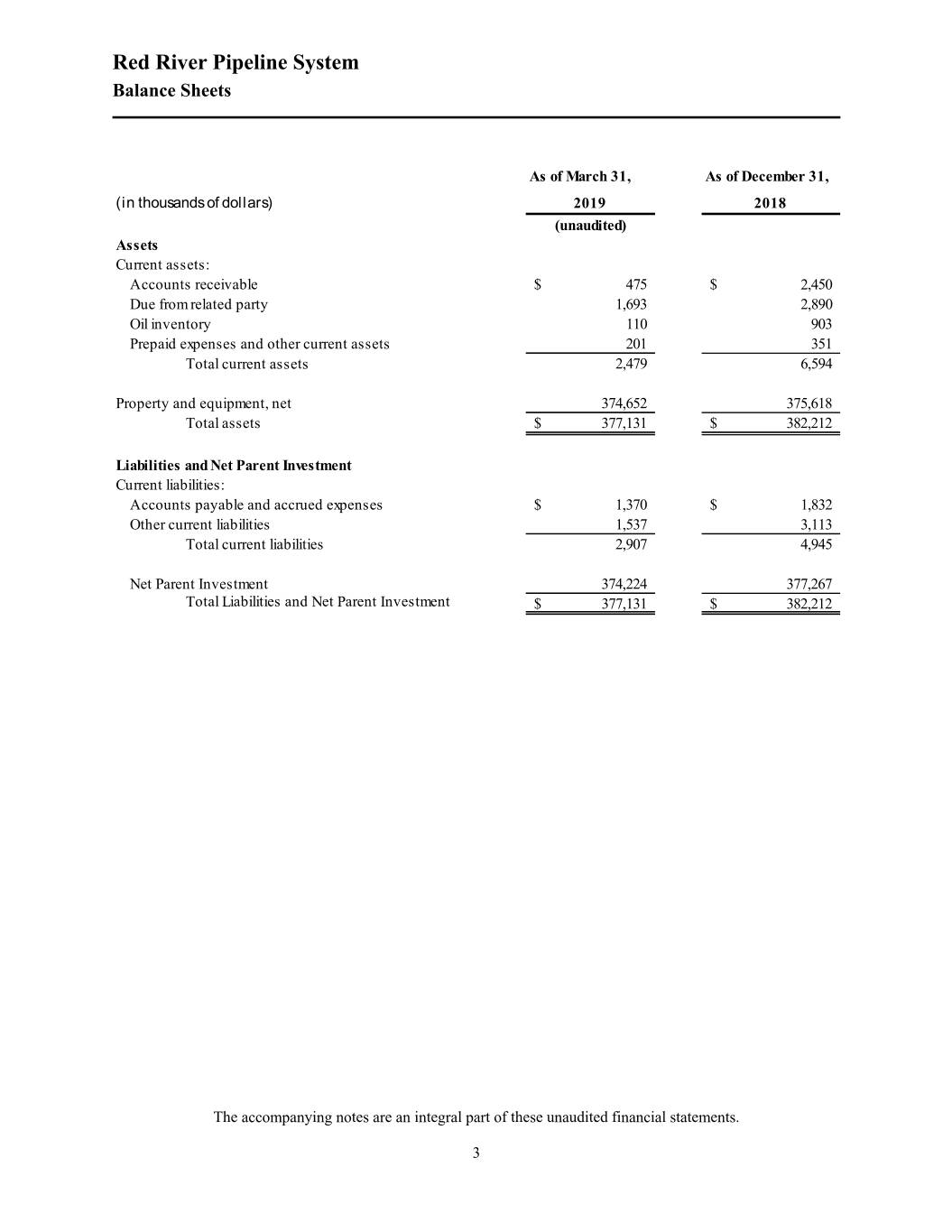

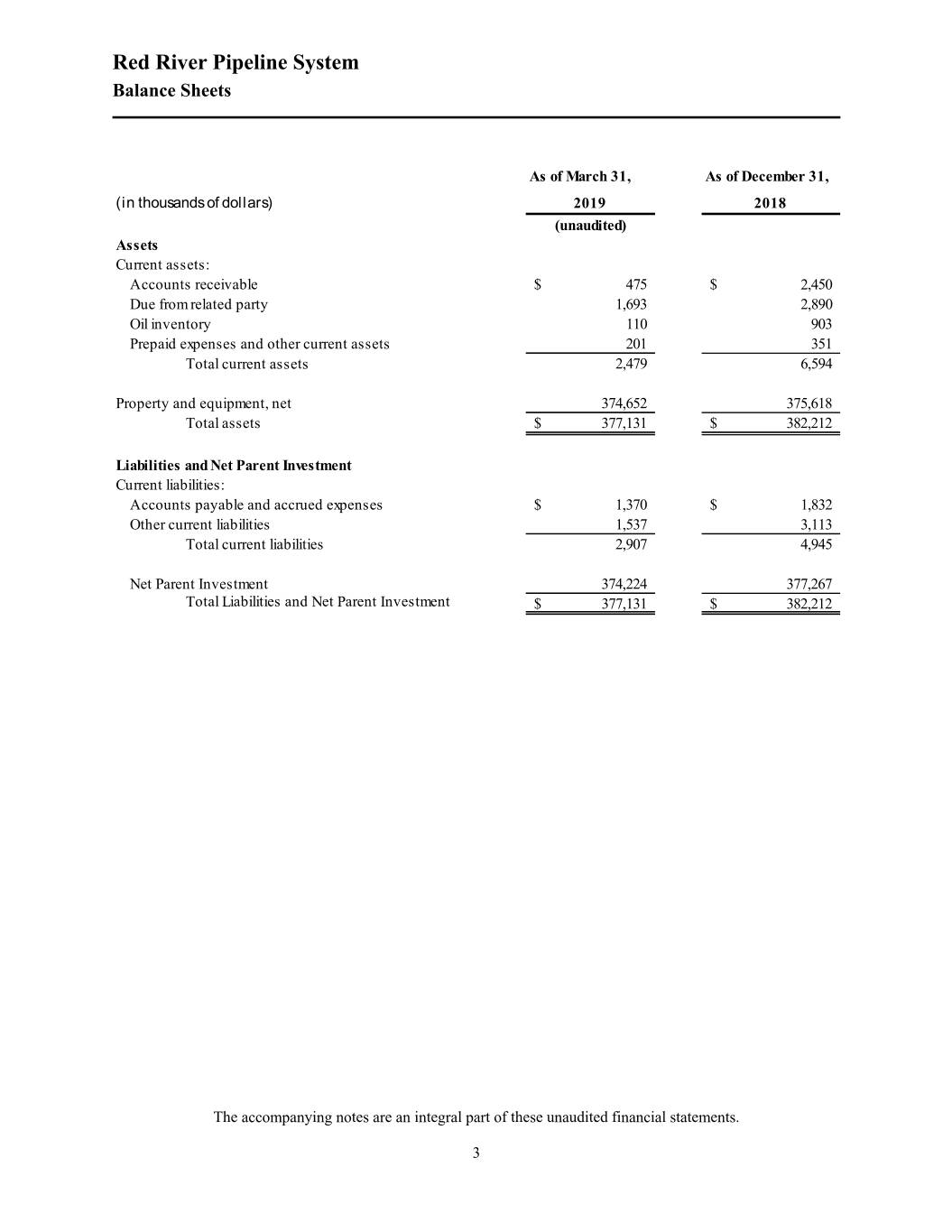

Red River Pipeline System Balance Sheets As of March 31, As of December 31, (in thousands of dollars) 2019 2018 (unaudited) Assets Current assets: Accounts receivable $ 475 $ 2,450 Due from related party 1,693 2,890 Oil inventory 110 903 Prepaid expenses and other current assets 201 351 Total current assets 2,479 6,594 Property and equipment, net 374,652 375,618 Total assets $ 377,131 $ 382,212 Liabilities and Net Parent Investment Current liabilities: Accounts payable and accrued expenses $ 1,370 $ 1,832 Other current liabilities 1,537 3,113 Total current liabilities 2,907 4,945 Net Parent Investment 374,224 377,267 Total Liabilities and Net Parent Investment $ 377,131 $ 382,212 The accompanying notes are an integral part of these unaudited financial statements. 3

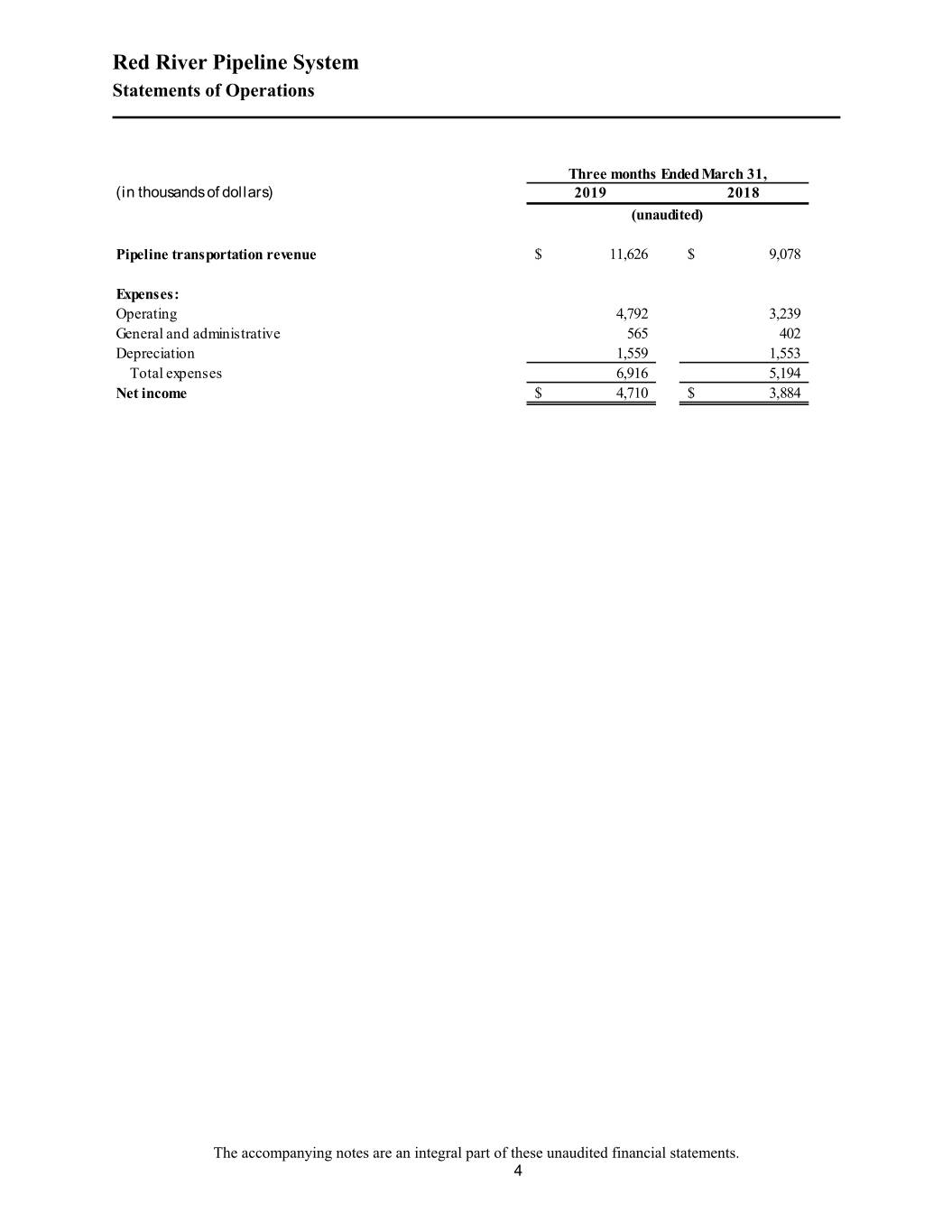

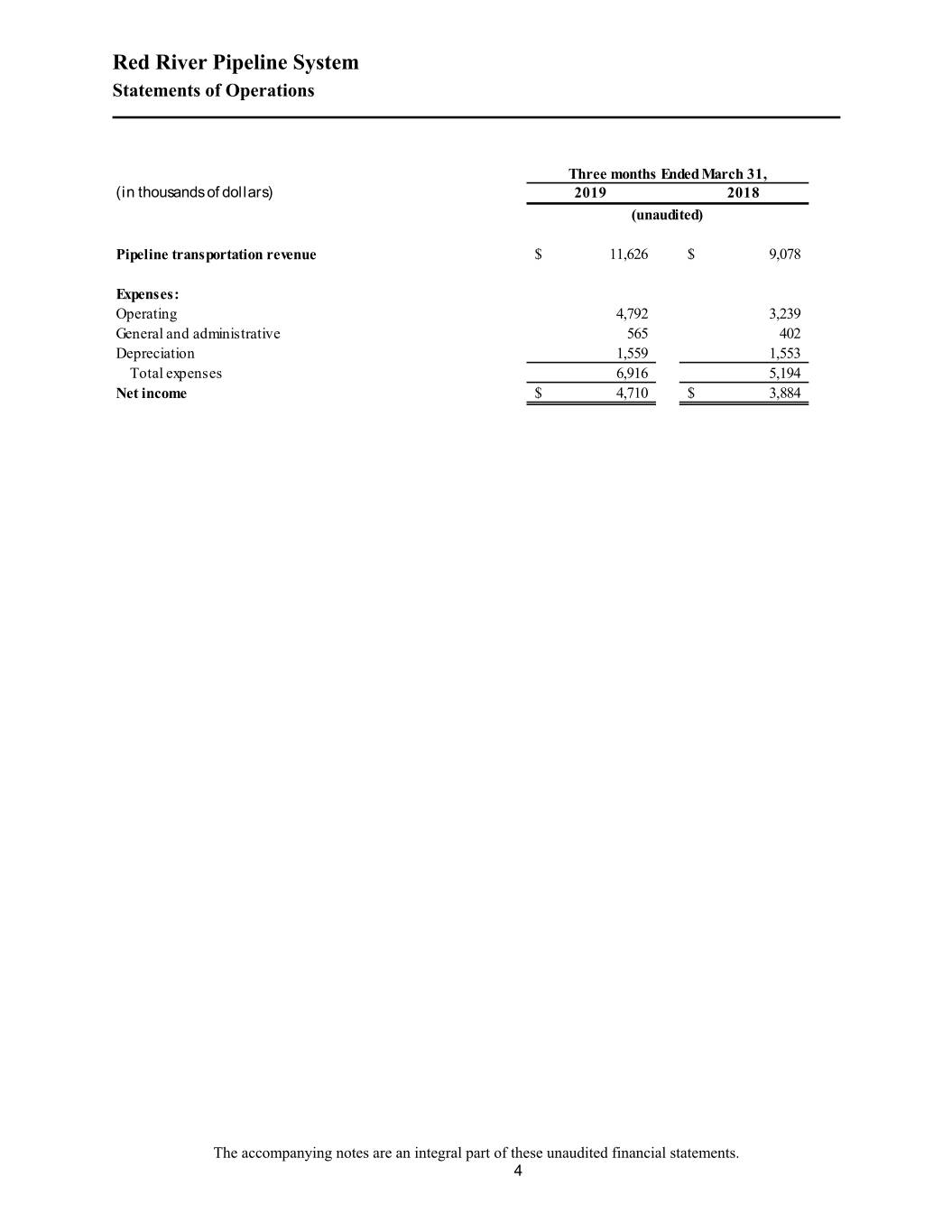

Red River Pipeline System Statements of Operations Three months Ended March 31, (in thousands of dollars) 2019 2018 (unaudited) Pipeline transportation revenue $ 11,626 $ 9,078 Expe ns e s : Operating 4,792 3,239 General and administrative 565 402 Depreciation 1,559 1,553 Total expenses 6,916 5,194 Net income $ 4,710 $ 3,884 The accompanying notes are an integral part of these unaudited financial statements. 4

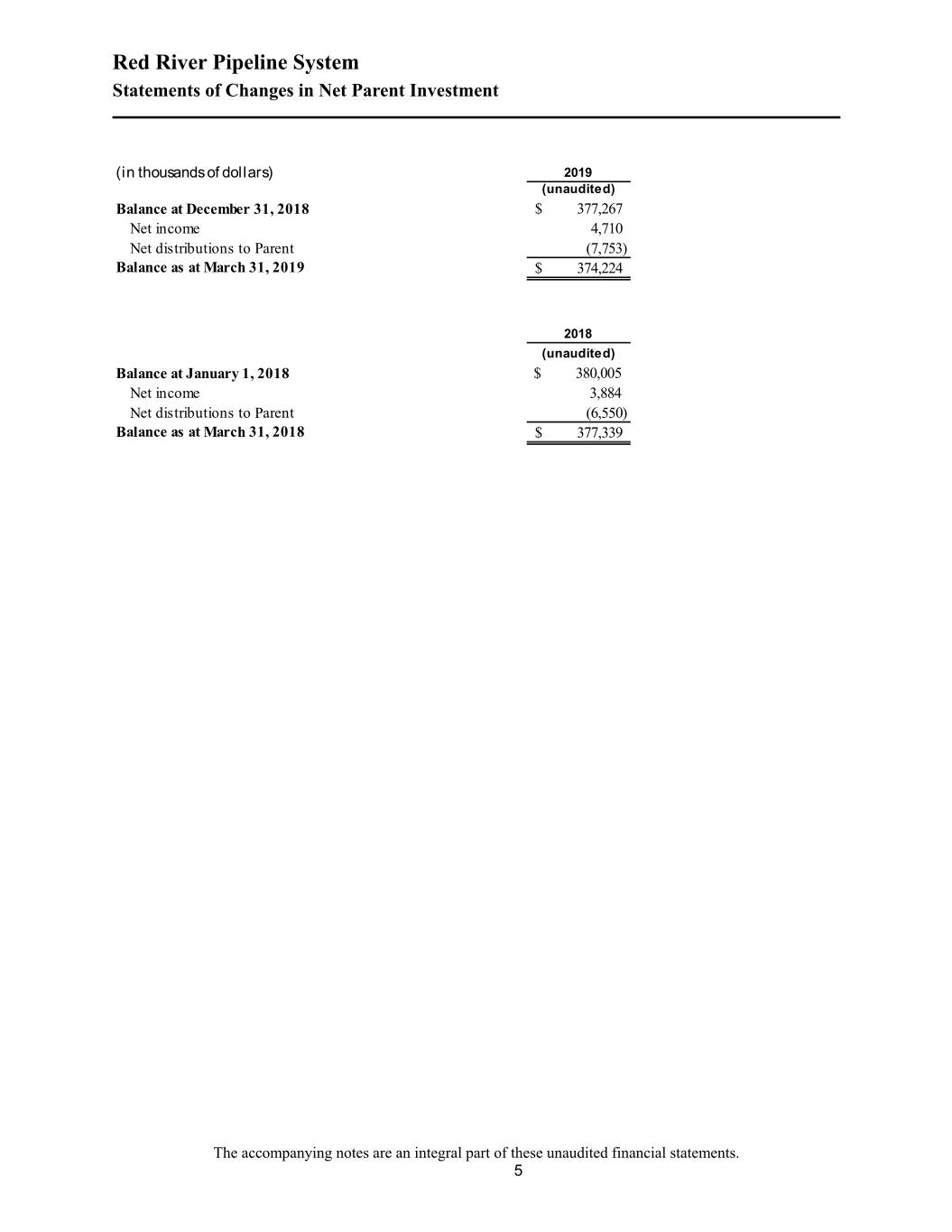

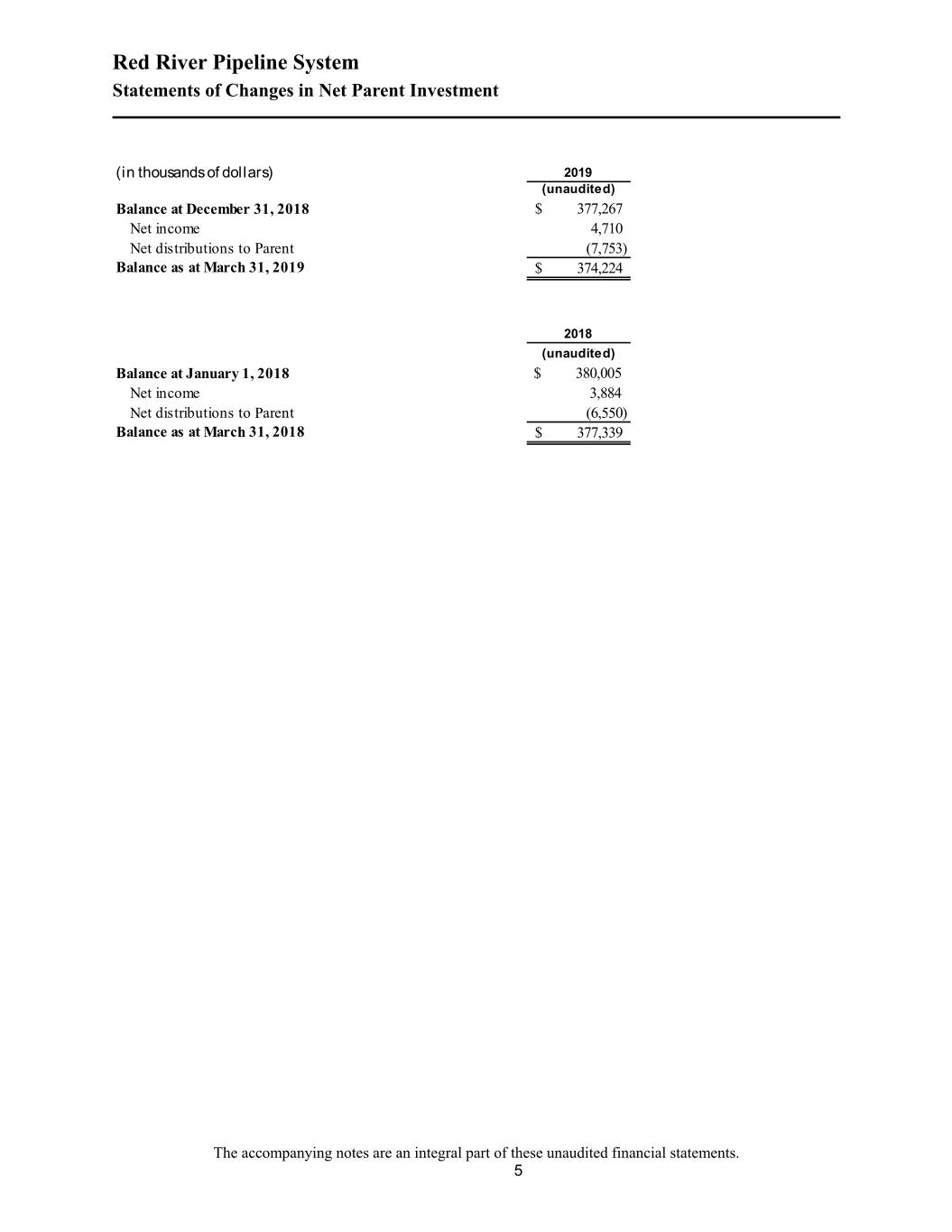

Red River Pipeline System Statements of Changes in Net Parent Investment (in thousands of dollars) 2019 (unaudited) Balance at December 31, 2018 $ 377,267 Net income 4,710 Net distributions to Parent (7,753) Balance as at March 31, 2019 $ 374,224 2018 (unaudited) Balance at January 1, 2018 $ 380,005 Net income 3,884 Net distributions to Parent (6,550) Balance as at March 31, 2018 $ 377,339 The accompanying notes are an integral part of these unaudited financial statements. 5

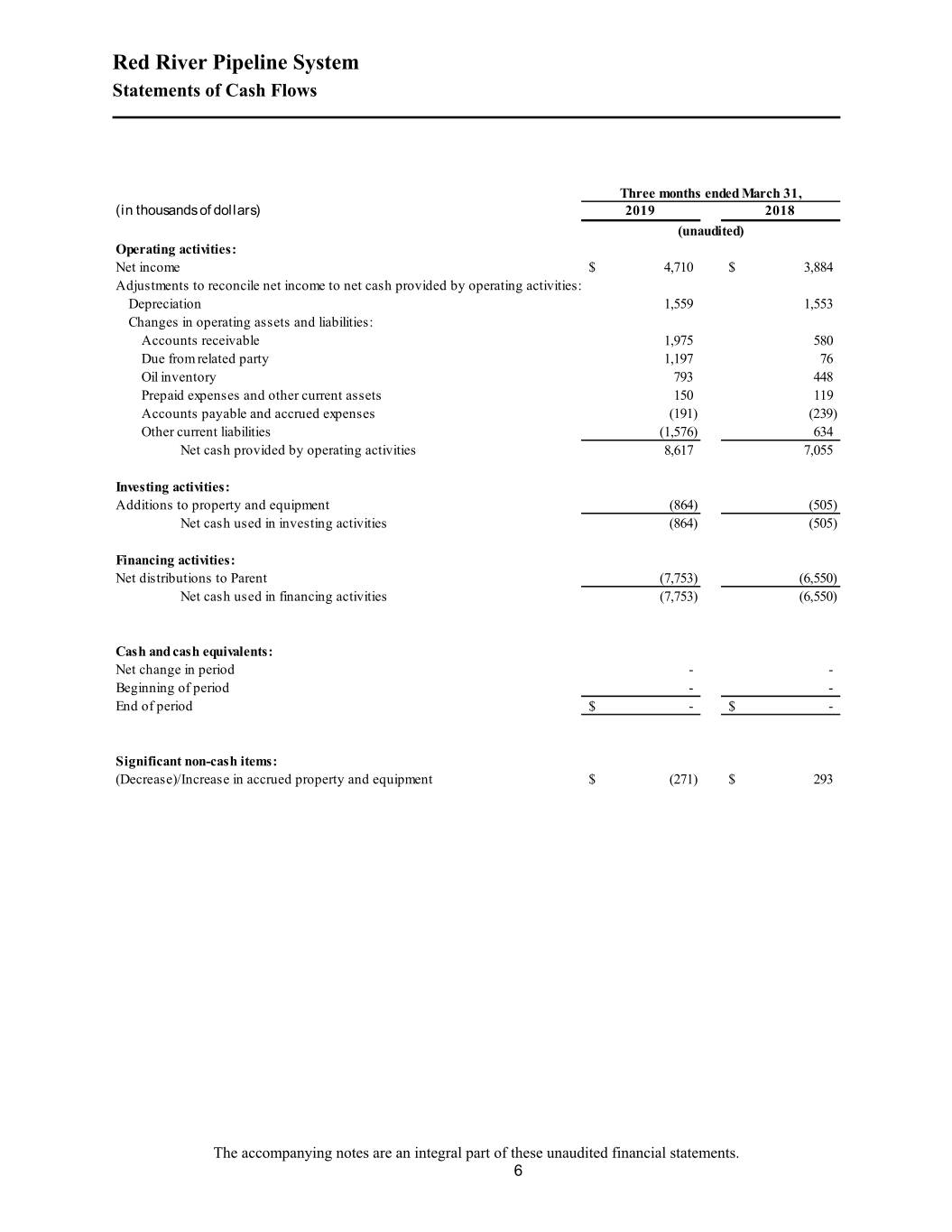

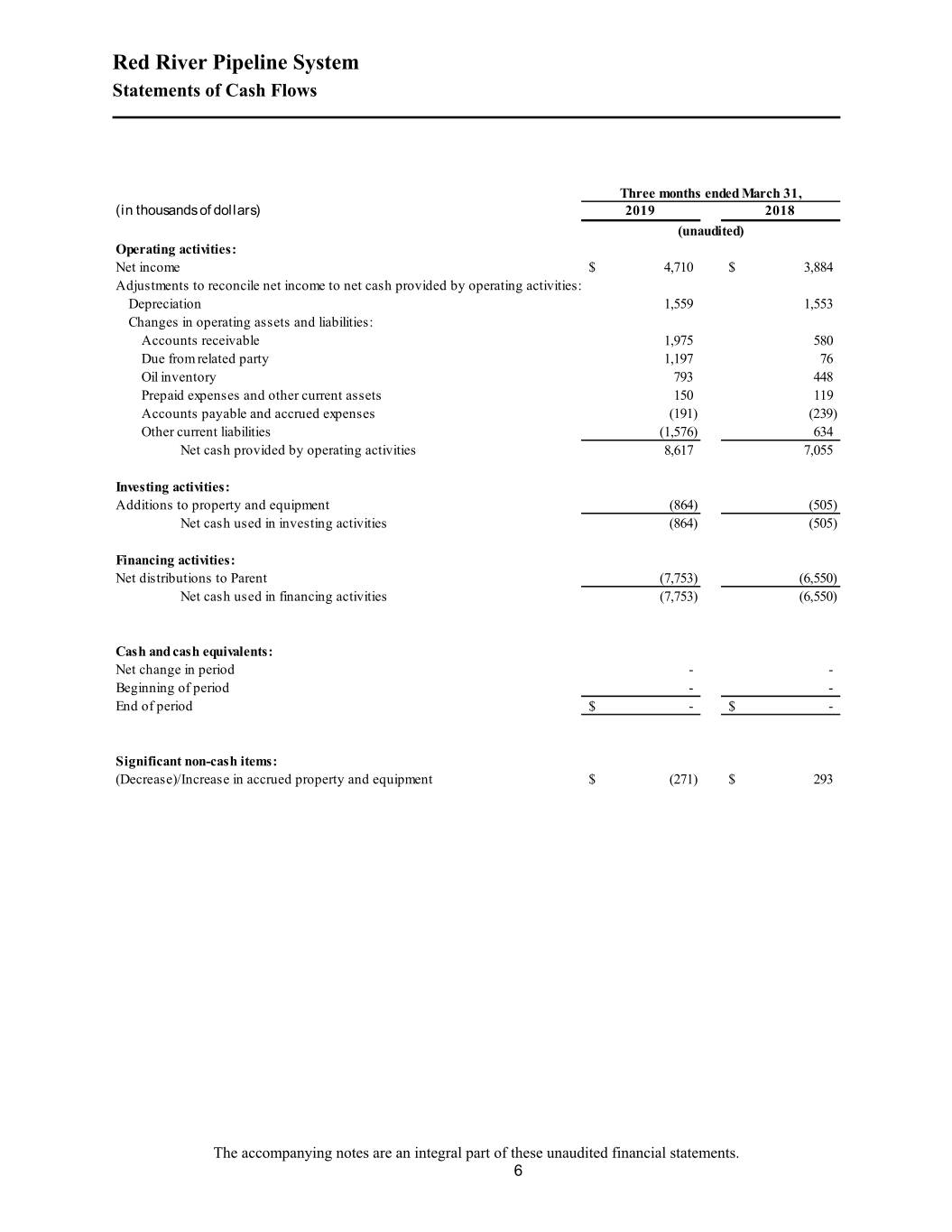

Red River Pipeline System Statements of Cash Flows Three months ended March 31, (in thousands of dollars) 2019 2018 (unaudited) Operating activities: Net income $ 4,710 $ 3,884 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation 1,559 1,553 Changes in operating assets and liabilities: Accounts receivable 1,975 580 Due from related party 1,197 76 Oil inventory 793 448 Prepaid expenses and other current assets 150 119 Accounts payable and accrued expenses (191) (239) Other current liabilities (1,576) 634 Net cash provided by operating activities 8,617 7,055 Investing activities: Additions to property and equipment (864) (505) Net cash used in investing activities (864) (505) Financing activities: Net distributions to Parent (7,753) (6,550) Net cash used in financing activities (7,753) (6,550) Cash and cash equivalents: Net change in period - - Beginning of period - - End of period $ - $ - Significant non-cash items: (Decrease)/Increase in accrued property and equipment$ (271) $ 293 The accompanying notes are an integral part of these unaudited financial statements. 6

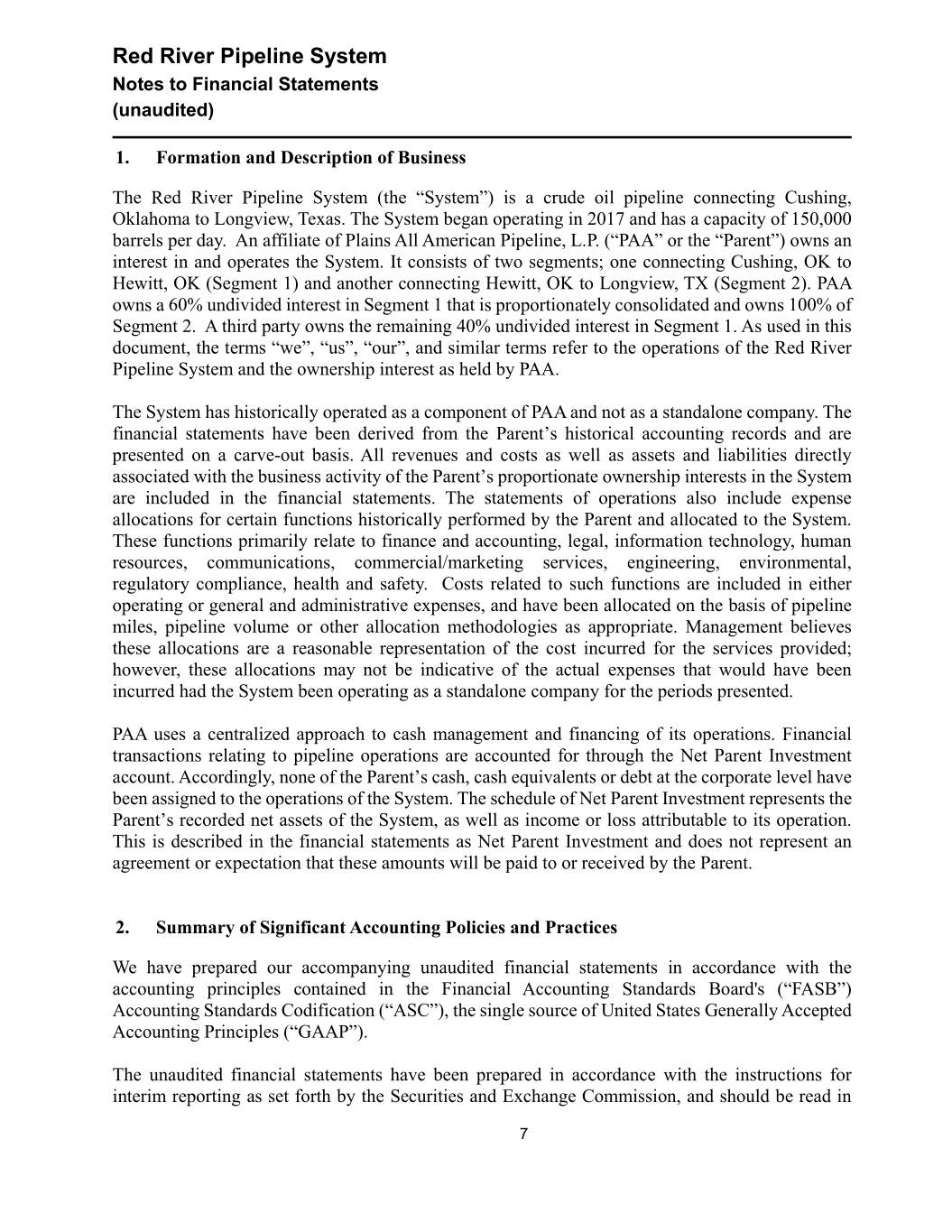

Red River Pipeline System Notes to Financial Statements (unaudited) 1. Formation and Description of Business The Red River Pipeline System (the “System”) is a crude oil pipeline connecting Cushing, Oklahoma to Longview, Texas. The System began operating in 2017 and has a capacity of 150,000 barrels per day. An affiliate of Plains All American Pipeline, L.P. (“PAA” or the “Parent”) owns an interest in and operates the System. It consists of two segments; one connecting Cushing, OK to Hewitt, OK (Segment 1) and another connecting Hewitt, OK to Longview, TX (Segment 2). PAA owns a 60% undivided interest in Segment 1 that is proportionately consolidated and owns 100% of Segment 2. A third party owns the remaining 40% undivided interest in Segment 1. As used in this document, the terms “we”, “us”, “our”, and similar terms refer to the operations of the Red River Pipeline System and the ownership interest as held by PAA. The System has historically operated as a component of PAA and not as a standalone company. The financial statements have been derived from the Parent’s historical accounting records and are presented on a carve-out basis. All revenues and costs as well as assets and liabilities directly associated with the business activity of the Parent’s proportionate ownership interests in the System are included in the financial statements. The statements of operations also include expense allocations for certain functions historically performed by the Parent and allocated to the System. These functions primarily relate to finance and accounting, legal, information technology, human resources, communications, commercial/marketing services, engineering, environmental, regulatory compliance, health and safety. Costs related to such functions are included in either operating or general and administrative expenses, and have been allocated on the basis of pipeline miles, pipeline volume or other allocation methodologies as appropriate. Management believes these allocations are a reasonable representation of the cost incurred for the services provided; however, these allocations may not be indicative of the actual expenses that would have been incurred had the System been operating as a standalone company for the periods presented. PAA uses a centralized approach to cash management and financing of its operations. Financial transactions relating to pipeline operations are accounted for through the Net Parent Investment account. Accordingly, none of the Parent’s cash, cash equivalents or debt at the corporate level have been assigned to the operations of the System. The schedule of Net Parent Investment represents the Parent’s recorded net assets of the System, as well as income or loss attributable to its operation. This is described in the financial statements as Net Parent Investment and does not represent an agreement or expectation that these amounts will be paid to or received by the Parent. 2. Summary of Significant Accounting Policies and Practices We have prepared our accompanying unaudited financial statements in accordance with the accounting principles contained in the Financial Accounting Standards Board's (“FASB”) Accounting Standards Codification (“ASC”), the single source of United States Generally Accepted Accounting Principles (“GAAP”). The unaudited financial statements have been prepared in accordance with the instructions for interim reporting as set forth by the Securities and Exchange Commission, and should be read in 7

Red River Pipeline System Notes to Financial Statements (unaudited) conjunction with our December 31, 2018 financial statements. All adjustments (consisting only of normal recurring adjustments) that in the opinion of management were necessary for a fair statement of the results for the interim periods have been reflected. The balance sheet data as of December 31, 2018 was derived from audited financial statements, but does not include all disclosures required by GAAP. The results of operations for the three months ended March 31, 2019 should not be taken as indicative of results to be expected for the entire year. Accounting Standards Updates Adopted During the Period In February 2016, the FASB issued Accounting Standards Update (“ASU”) 2016-02, Leases, (followed by a series of related accounting standard updates (collectively referred to as “Topic 842”)), that revised the existing accounting model for leases. The most significant changes are the clarification of the definition of a lease and required lessee recognition on the balance sheet of right- of-use assets and lease liabilities with lease terms of more than 12 months (with the election of the practical expedient to exclude short-term leases on the balance sheet), including extensive quantitative and qualitative disclosures. This guidance became effective for interim and annual periods beginning after December 15, 2018. We adopted this guidance effective January 1, 2019. We elected the package of practical expedients permitted under the transition guidance within the new standard, which among other things, allowed us to carry forward the historical accounting related to lease identification, classification and indirect costs. We also elected the practical expedient related to land easements, allowing us to carry forward our accounting treatment for land easements on existing agreements. Further, we elected the practical expedient which provides us with an optional transitional method, thereby applying the new guidance at the effective date, without adjusting the comparative periods and, if necessary, recognizing a cumulative-effect adjustment to the opening balance of Net Parent Investment upon adoption at January 1, 2019. We did not elect the practical expedient related to using hindsight in determining the lease term as this was not relevant following our election of the optional transitional method. We have implemented a process to evaluate the impact of adopting this guidance on each type of lease contract we have entered into with counterparties. Our implementation team determined appropriate changes to our business processes, systems and controls to support recognition and disclosure under the new standard. There were no material impacts to our Balance Sheet, Statement of Operations or Cash Flows. In addition to the above, which primarily relates to our accounting as a lessee, our accounting from a lessor perspective remains unchanged under Topic 842. Use of Estimates The preparation of financial statements in conformity with GAAP requires us to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities as of the balance sheet date. The most significant estimates involve (i) the useful lives of components of property and equipment; and (ii) valuation and recoverability of long-lived assets including property and equipment. The carrying amounts of our accounts receivable, accounts payable and accrued liabilities approximate their fair values due to their short-term nature. Although we believe these estimates are reasonable, actual results can differ from these estimates. 8

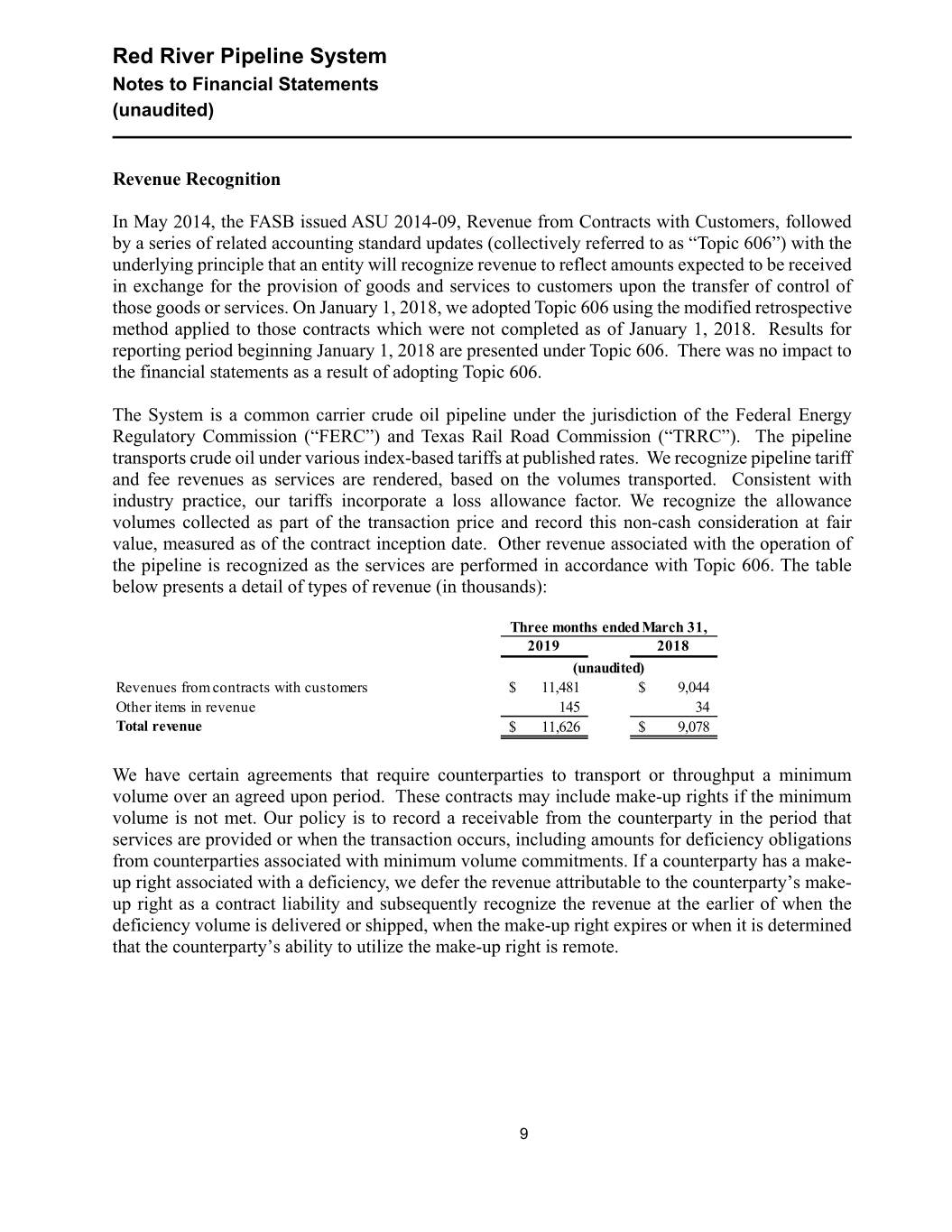

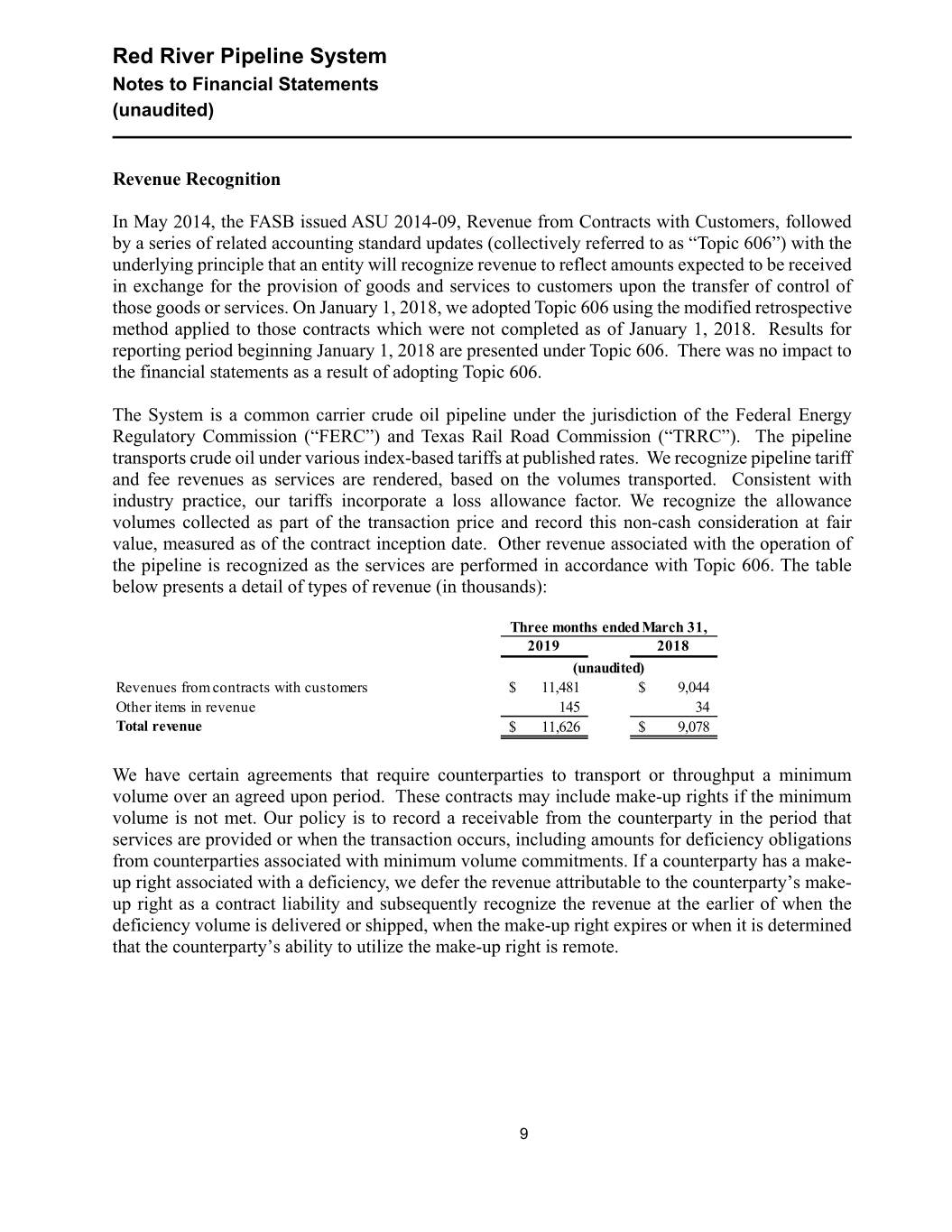

Red River Pipeline System Notes to Financial Statements (unaudited) Revenue Recognition In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers, followed by a series of related accounting standard updates (collectively referred to as “Topic 606”) with the underlying principle that an entity will recognize revenue to reflect amounts expected to be received in exchange for the provision of goods and services to customers upon the transfer of control of those goods or services. On January 1, 2018, we adopted Topic 606 using the modified retrospective method applied to those contracts which were not completed as of January 1, 2018. Results for reporting period beginning January 1, 2018 are presented under Topic 606. There was no impact to the financial statements as a result of adopting Topic 606. The System is a common carrier crude oil pipeline under the jurisdiction of the Federal Energy Regulatory Commission (“FERC”) and Texas Rail Road Commission (“TRRC”). The pipeline transports crude oil under various index-based tariffs at published rates. We recognize pipeline tariff and fee revenues as services are rendered, based on the volumes transported. Consistent with industry practice, our tariffs incorporate a loss allowance factor. We recognize the allowance volumes collected as part of the transaction price and record this non-cash consideration at fair value, measured as of the contract inception date. Other revenue associated with the operation of the pipeline is recognized as the services are performed in accordance with Topic 606. The table below presents a detail of types of revenue (in thousands): Three months ended March 31, 2019 2018 (unaudited) Revenues from contracts with customers$ 11,481 $ 9,044 Other items in revenue 145 34 Total revenue $ 11,626 $ 9,078 We have certain agreements that require counterparties to transport or throughput a minimum volume over an agreed upon period. These contracts may include make-up rights if the minimum volume is not met. Our policy is to record a receivable from the counterparty in the period that services are provided or when the transaction occurs, including amounts for deficiency obligations from counterparties associated with minimum volume commitments. If a counterparty has a make- up right associated with a deficiency, we defer the revenue attributable to the counterparty’s make- up right as a contract liability and subsequently recognize the revenue at the earlier of when the deficiency volume is delivered or shipped, when the make-up right expires or when it is determined that the counterparty’s ability to utilize the make-up right is remote. 9

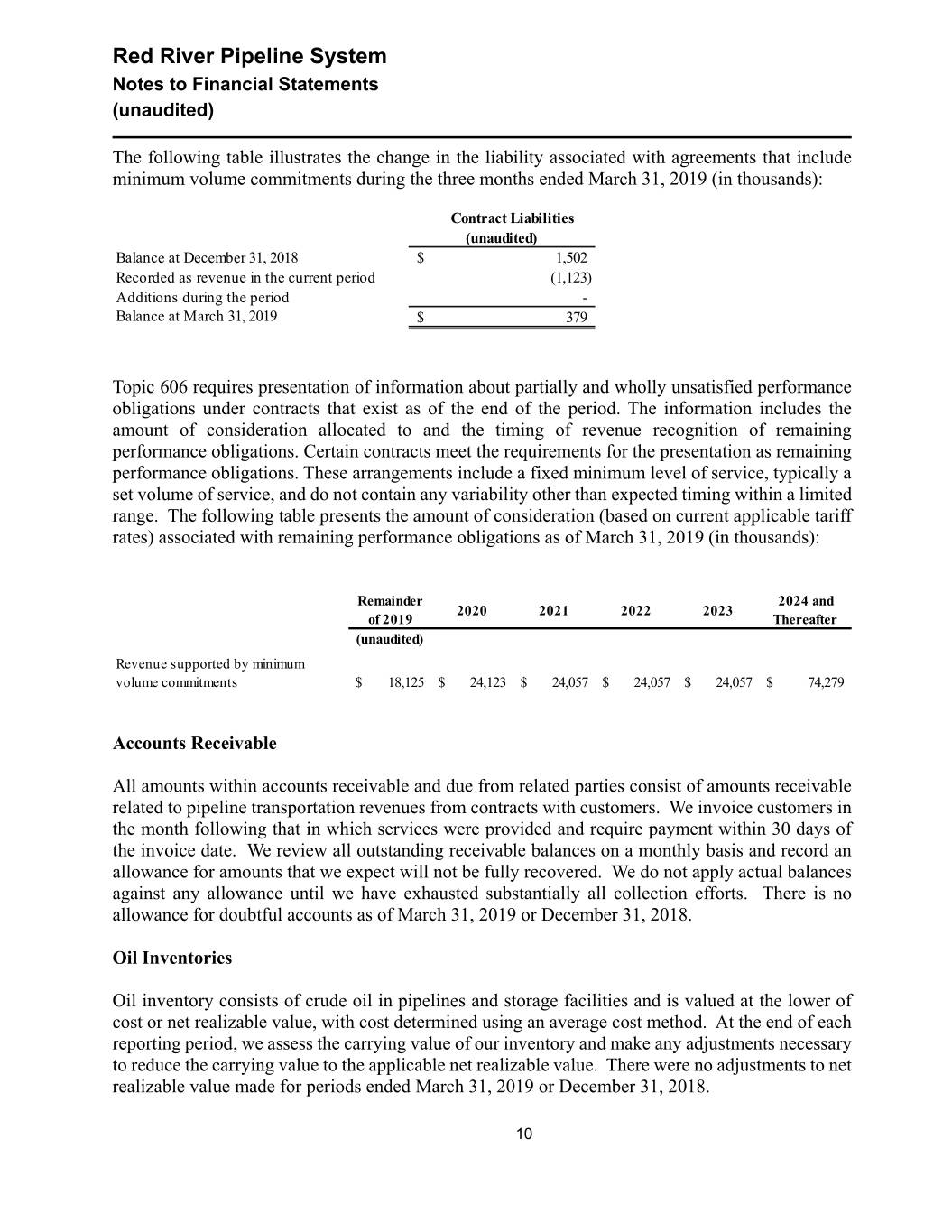

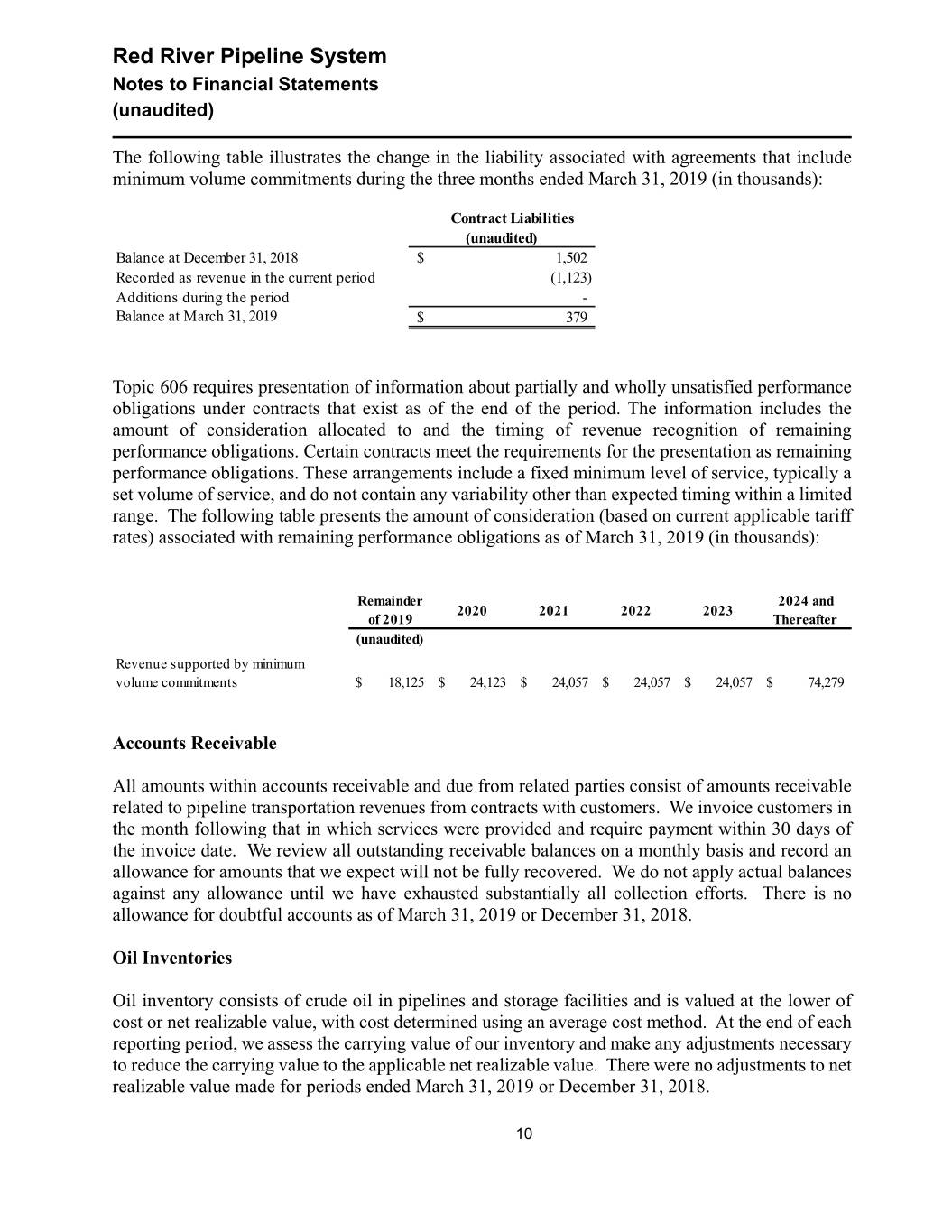

Red River Pipeline System Notes to Financial Statements (unaudited) The following table illustrates the change in the liability associated with agreements that include minimum volume commitments during the three months ended March 31, 2019 (in thousands): Contract Liabilities (unaudited) Balance at December 31, 2018$ 1,502 Recorded as revenue in the current period (1,123) Additions during the period - Balance at March 31, 2019 $ 379 Topic 606 requires presentation of information about partially and wholly unsatisfied performance obligations under contracts that exist as of the end of the period. The information includes the amount of consideration allocated to and the timing of revenue recognition of remaining performance obligations. Certain contracts meet the requirements for the presentation as remaining performance obligations. These arrangements include a fixed minimum level of service, typically a set volume of service, and do not contain any variability other than expected timing within a limited range. The following table presents the amount of consideration (based on current applicable tariff rates) associated with remaining performance obligations as of March 31, 2019 (in thousands): Remainder 2024 and 2020 2021 2022 2023 of 2019 Thereafter (unaudited) Revenue supported by minimum volume commitments $ 18,125 $ 24,123 $ 24,057 $ 24,057 $ 24,057 $ 74,279 Accounts Receivable All amounts within accounts receivable and due from related parties consist of amounts receivable related to pipeline transportation revenues from contracts with customers. We invoice customers in the month following that in which services were provided and require payment within 30 days of the invoice date. We review all outstanding receivable balances on a monthly basis and record an allowance for amounts that we expect will not be fully recovered. We do not apply actual balances against any allowance until we have exhausted substantially all collection efforts. There is no allowance for doubtful accounts as of March 31, 2019 or December 31, 2018. Oil Inventories Oil inventory consists of crude oil in pipelines and storage facilities and is valued at the lower of cost or net realizable value, with cost determined using an average cost method. At the end of each reporting period, we assess the carrying value of our inventory and make any adjustments necessary to reduce the carrying value to the applicable net realizable value. There were no adjustments to net realizable value made for periods ended March 31, 2019 or December 31, 2018. 10

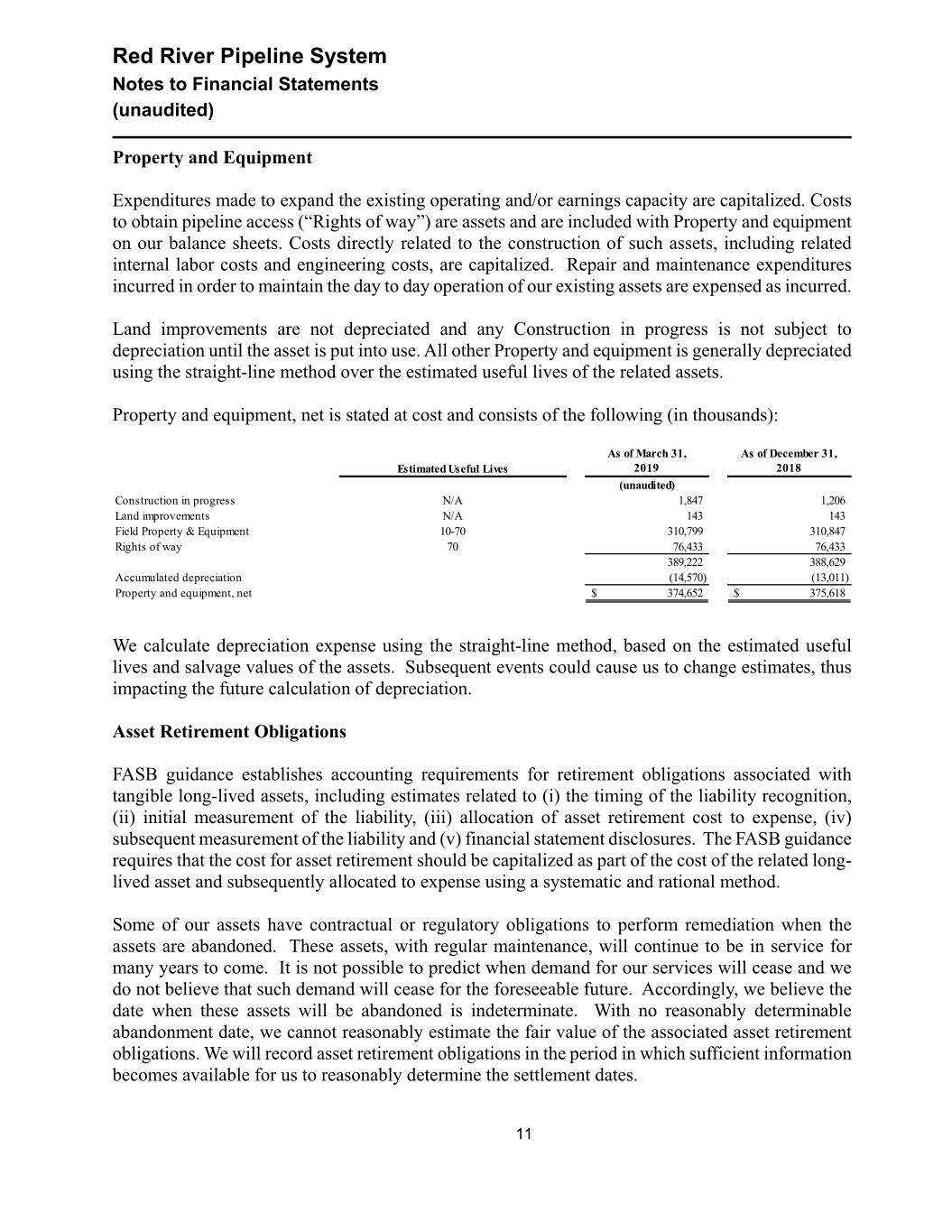

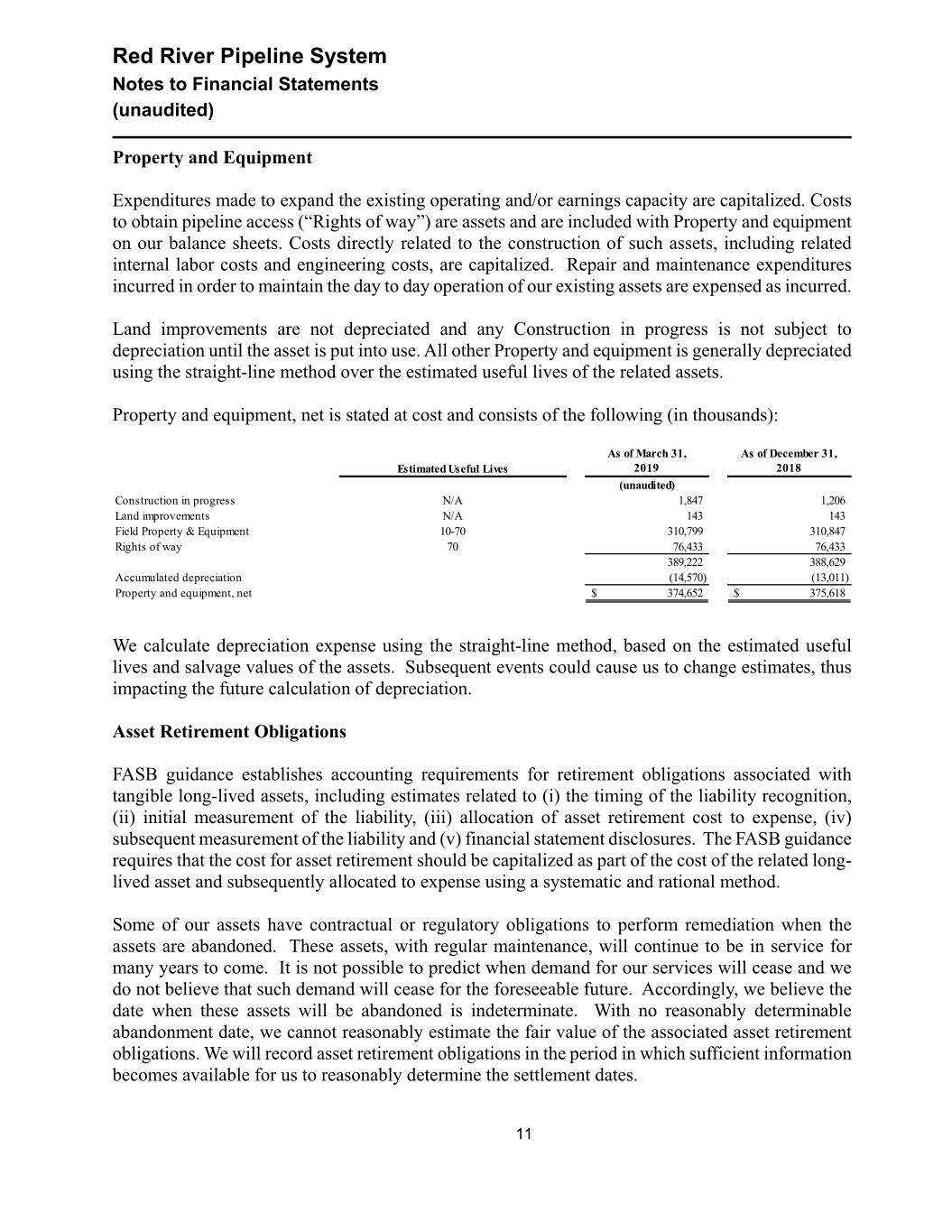

Red River Pipeline System Notes to Financial Statements (unaudited) Property and Equipment Expenditures made to expand the existing operating and/or earnings capacity are capitalized. Costs to obtain pipeline access (“Rights of way”) are assets and are included with Property and equipment on our balance sheets. Costs directly related to the construction of such assets, including related internal labor costs and engineering costs, are capitalized. Repair and maintenance expenditures incurred in order to maintain the day to day operation of our existing assets are expensed as incurred. Land improvements are not depreciated and any Construction in progress is not subject to depreciation until the asset is put into use. All other Property and equipment is generally depreciated using the straight-line method over the estimated useful lives of the related assets. Property and equipment, net is stated at cost and consists of the following (in thousands): As of March 31, As of December 31, Estimated Useful Lives 2019 2018 (unaudited) Construction in progress N/A 1,847 1,206 Land improvements N/A 143 143 Field Property & Equipment 10-70 310,799 310,847 Rights of way 70 76,433 76,433 389,222 388,629 Accumulated depreciation (14,570) (13,011) Property and equipment, net $ 374,652 $ 375,618 We calculate depreciation expense using the straight-line method, based on the estimated useful lives and salvage values of the assets. Subsequent events could cause us to change estimates, thus impacting the future calculation of depreciation. Asset Retirement Obligations FASB guidance establishes accounting requirements for retirement obligations associated with tangible long-lived assets, including estimates related to (i) the timing of the liability recognition, (ii) initial measurement of the liability, (iii) allocation of asset retirement cost to expense, (iv) subsequent measurement of the liability and (v) financial statement disclosures. The FASB guidance requires that the cost for asset retirement should be capitalized as part of the cost of the related long- lived asset and subsequently allocated to expense using a systematic and rational method. Some of our assets have contractual or regulatory obligations to perform remediation when the assets are abandoned. These assets, with regular maintenance, will continue to be in service for many years to come. It is not possible to predict when demand for our services will cease and we do not believe that such demand will cease for the foreseeable future. Accordingly, we believe the date when these assets will be abandoned is indeterminate. With no reasonably determinable abandonment date, we cannot reasonably estimate the fair value of the associated asset retirement obligations. We will record asset retirement obligations in the period in which sufficient information becomes available for us to reasonably determine the settlement dates. 11

Red River Pipeline System Notes to Financial Statements (unaudited) Income Taxes The Parent is not subject to U.S. federal income taxes; rather the tax effect of our operations is passed through to the unitholders of the Parent. State and any other income-based tax based on the System’s revenue and operations for the three months ended March 31, 2019 and March 31, 2018 was immaterial. Accordingly, no provision for federal or other income tax is included in the accompanying unaudited financial statements. 3. Commitments and Contingencies Commitments The System does not have any material commitments or contractual obligations at March 31, 2019 or December 31, 2018. Contingencies We are subject to numerous federal, state, and local laws which regulate the discharge of materials into the environment or that otherwise relate to the protection of the environment. We may be involved in regulatory disputes, litigation, and claims arising out of our operations in the normal course of business. However, we are not currently a party to any legal or regulatory proceedings, the resolution of which could have a material adverse effect on our business, financial condition, or results of operations. We record environmental liabilities when environmental assessments and/or remedial efforts are probable and the amounts can be reasonably estimated. Generally, our recording of these accruals coincides with our completion of a feasibility study or our commitment to a formal plan of action. We do not discount our environmental remediation liabilities to present value. As of March 31, 2019 and December 31, 2018 we have no reserve for environmental liabilities. 4. Related Party Transactions All direct costs incurred in pipeline operations are recognized by us along with additional allocations for operating costs and other general and administrative costs. The total amount of these allocations from PAA was approximately $2.3 million and $1.2 million for the three months ended March 31, 2019 and 2018, respectively. We record tariff revenues and sale of inventory related to transactions with a wholly-owned subsidiary of PAA. For the three months ended March 31, 2019 and 2018, we recognized $4.4 million and $2.8 million, respectively, in revenue from such transactions and have balances due from related parties of $1.7 million at March 31, 2019 and $2.9 million at December 31, 2018. 12

Red River Pipeline System Notes to Financial Statements (unaudited) 5. Subsequent Events Effective May 1, 2019 the Parent entered into an agreement to sell a 33% equity ownership interest of our interest in the System to Delek US Holdings, Inc. We did not identify any other subsequent events or transactions after the balance sheet date through July 24, 2019, the date the unaudited financial statements were available to be issued. 13