UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant o

Filed by a Party other than the Registrant x

Check the appropriate box:

o Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

¨ Definitive Proxy Statement

o Definitive Additional Materials

x Soliciting Material Under Rule 14a-12

JAVELIN MORTGAGE INVESTMENT CORP. |

| (Name of Registrant as Specified in Its Charter) |

WOLVERINE ASSET MANAGEMENT, LLC WOLVERINE HOLDINGS, L.P. WOLVERINE TRADING PARTNERS, INC. CHRISTOPHER L. GUST ROBERT R. BELLICK STEVE JOUNG ERIC W. MUEHLHAUSER OLOF S. NELSON NORMAN J. RICE, III DONALD J. TRINGALI JOHN D. ZIEGELMAN |

| (Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials:

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Wolverine Asset Management, LLC, together with its affiliates, intends to make a preliminary filing with the Securities and Exchange Commission of a proxy statement and an accompanying proxy card to be used to solicit votes for the election of a highly-qualified slate of director nominees to the Board of Directors of JAVELIN Mortgage Investment Corp., a Maryland corporation, at the Company’s upcoming 2016 annual meeting of stockholders, or any other meeting of stockholders held in lieu thereof, and any adjournments, postponements, reschedulings or continuations thereof.

On December 15, 2015, Wolverine Asset Management, LLC issued the following press release:

Wolverine Asset Management Delivers Letter to Board of Directors of JAVELIN Mortgage Investment Corp.

Highlights Serious Concerns Regarding JAVELIN’S Consistent Record of Underperformance, Problematic Fee Structure and Conflicts of Interest within Management and the Board

Highly Skeptical of JAVELIN’S Recently Announced, Half-Hearted Changes Which Were Only Made After Wolverine Disclosed its Intention to Nominate Director Candidates

Has Nominated Six Highly Qualified Candidates for Election to the Board at the 2016 Annual Meeting

CHICAGO and NEW YORK, Dec. 15, 2015 /PRNewswire/ -- Wolverine Asset Management, LLC (“WAM”), the manager for Wolverine Flagship Fund Trading Limited, a multi-strategy private investment fund with approximately $1.6 billion in assets under management, and one of the largest shareholders of JAVELIN Mortgage Investment Corp. (NYSE: JMI) (“JAVELIN” or the “Company”) with beneficial ownership of approximately 5.1% of the Company’s outstanding shares, today announced that it has sent a letter to the JAVELIN Board of Directors (the “Board”), the full text of which is below.

WAM also announced today that it has nominated six highly qualified candidates – Steve Joung, Eric W. Muehlhauser, Olof S. Nelson, Norman J. Rice, III, Donald J. Tringali, and John D. Ziegelman – for election to the JAVELIN Board at the 2016 Annual Meeting of Shareholders.

The full text of the letter follows:

December 15, 2015

Board of Directors

JAVELIN Mortgage Investment Corp.

3001 Ocean Drive, Suite 201

Vero Beach, FL 32963

Dear Members of the Board,

Wolverine Asset Management, LLC (“WAM”) is the manager for Wolverine Flagship Fund Trading Limited (“WFF”), a multi-strategy private investment fund with approximately $1.6 billion in assets under management. As of the close of business on December 14, 2015, WFF has a beneficial ownership interest1 in approximately 5.1% of the outstanding shares2 of JAVELIN Mortgage Investment Corp. (“JMI” or the “Company”).

We appreciate the dialogue we have had with management and the Company’s Board of Directors (the “Board”) over the past seven months, and we are pleased at yesterday morning’s attempts to correct a fraction of the Company’s substantial problems. Regrettably, we note two items that detract from your presumed shareholder-friendly actions. First and foremost, it was not until our discussions reached the point of our threatening to nominate a competing slate for the Board that any tangible response to our concerns occurred. Second, yesterday’s market response shows clear skepticism over the adequacy of your plan for restoring lost shareholder value and curing the problematic status quo that exists at JMI.

Today, we have delivered to the Company a formal notice of our nomination of a slate of six (6) highly qualified director candidates for election to the Board at JMI’s 2016 Annual Meeting of Shareholders (the “2016 Annual Meeting”). We have taken this step because we have grown increasingly concerned with the direction of the Company under current leadership. Specifically, we hold the view that management cannot deliver value through continued operations based on the foregoing: i) a consistent record of underperformance, ii) a fee structure that is in direct conflict with shareholder interests, despite amendments announced in yesterday’s press release, and (iii) conflicts of interest within management and the current Board. Given the small size of the Company and limited set of options, our analysis suggests the best value-enhancing outcome for shareholders at this point would be to liquidate the portfolio and distribute the proceeds to shareholders. Our director candidates are committed to considering any actions that would lead to shareholder value maximization, up to and including full liquidation.

Consistent Record of Underperformance

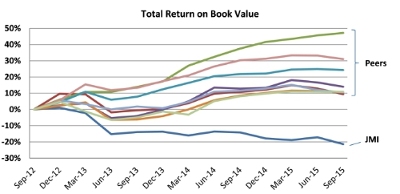

The latest quarterly results show that JMI’s book value has dropped by 51% since the October 2012 IPO. Total return on book value has been -22% over the same period. This compares to an average total return of +20% for its peer group3. A 42% underperformance is astonishingly disappointing given the similarity of assets. Furthermore, this underperformance has been consistent, as JMI has underperformed its peer group average in 10 out of 12 quarters, and based on the Company’s recent disclosures and our estimates, yet again in the current quarter. Our expectation would be that an asset management contract is terminated or investor capital fully redeemed on the back of such dismal performance. Investors have an entrenched Board and shareholder-unfriendly structure to thank for ARMOUR Capital Management LP’s (“ACM”) continued role in (mis)managing the JMI portfolio.

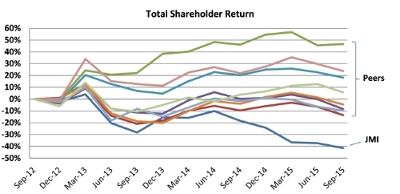

The story is worse for JMI’s share price: the stock has dropped 72%, from $20 at IPO to $5.56 as of 12/14/15. Adding back dividends results in a total return to shareholders of -42% in the three years since IPO, compared to a +1% average for the peer group over that same period.

Fee Structure that is in Direct Conflict with Shareholder Interests

In this period of dramatic underperformance, management has reaped a windfall. Management fees have become excessive as a percentage of shareholder equity. The management fee is calculated as 1.5% of gross issuance proceeds (net of share buybacks), which effectively means the manager receives a constant dollar amount regardless of performance. This structure runs counter to shareholder interests in two ways: i) if the book value declines from losses, the effective fee as a percentage of shareholder equity rises, and ii) there is a disincentive for management to repurchase shares, as it reduces the management fee. The 51% drop in book value since IPO has resulted in the 1.5% fee ballooning to 3.1% of current book value, making JMI’s the highest management fee in the sector, as a direct result of having the worst performance.

Administrative expenses have also increased as a percentage of the declining equity, since many of the costs are fixed. Using the average of the previous four quarters’ expenses and most recent quarterly book value, the current administrative expense rate is 2.7% per year. Combining this with the 3.1% management fee results in an untenable total fee and expense burden of 5.8%, creating an additional 240 basis points of drag on investor returns relative to the peer group average of 3.4%.

We held discussions with the management team in May 2015 in which we specifically highlighted our concerns about the fees and expenses. While seven months should have been ample time to implement a fee structure less deviant from industry norms, it was only after an investor filled out an approximately 240-page nomination package that the Board was spurred to action. Optically, your agreed-upon management fee rebate to 1.5% of Total Stockholders’ Equity trims JMI’s untenable fee structure toward your peer average. Yet the fee rebate is subject to retraction at the sole discretion of ACM without any input from the Board. Additionally, it is structured as a rebate rather than a top-line reduction, which means that the egregious termination fee for ACM would remain unchanged at an astonishing 9.3% of book value. The fact that such a change was only made once WAM’s intention to nominate a full slate became clear makes us skeptical that any part of these supposed shareholder-friendly actions will remain in place without continued, exhaustive pressure from one or more large shareholders. The reduction in Board member expenses is similarly discretionary and equally easy to repeal once shareholder pressure eases.

Conflicts of Interest within Management and the Current Board

We are also highly concerned with conflicts of interest among the Board as well as the manager. The four non-independent directors on the Board each has an economic participation in the management fees through partnership in the external manager, and thus a strong incentive to vote against share repurchases or any other action that might reduce the size of the fee-paying asset base. Additionally, ACM’s agreement for managing the much larger (and higher fee-paying) portfolio of ARMOUR Residential REIT, Inc. raises the question of time allocation, attention and focus on JMI.

JMI shares currently trade at around 58% of book value, based on recent Company disclosures and share price on 12/14/154. At such a deep discount, every share bought at $5.56, when combined with $9.79 in net asset sales, results in a $4.23 gain on book value, or a 76% return on invested capital. This type of instantaneous return vastly outweighs any expected returns from investing in MBS at full value.

We have met and spoken with JMI’s co-CEO’s, who are also Board members, several times since May 2015. In each instance we voiced our concerns over the poor performance, significant discount to book value, and the need to take action that would create value for shareholders. We expressed our desire for significant share repurchases and a rationalization of fees and expenses to a sustainable level. After a wholly inadequate 0.7% of outstanding shares were repurchased in mid-2015, there have been none in the past five months. Performance has continued to deteriorate, and shares have continued to trade at 58-65% of book value. Management has repeatedly stated on earnings calls and in direct conversations that they do not intend to repurchase shares due to concerns about repo counterparty relationships and operational scale.

The only thing to date that has remedied this intransigent behavior has been the threat of our severe step of nominating a competing slate to assume control of the Board. The December 14 announcement of an expansion in the share repurchase program, if it is actually executed, is a stunning reversal from Company comments just a few short weeks ago. If the Company failed to exercise this option when it was authorized to repurchase up to 1.4 million shares, how can investors expect different behavior just because the Board increased the repurchase program to 2.0 million shares? It is hard for any investor to believe that either management or the Board is truly considering his or her best interests if any suggestion not attached to a proxy is met with calculated dismissal.

Liquidation and Recovery

While share repurchases at the current discount to book value creates exceptional value for shareholders, the concerns about size and scale are not without merit. Shrinking the company further would also exacerbate the problem with administrative expenses. However, to continue on the current path will likely lead to further book value erosion and sub-par performance, which would likely result in an even greater share price discount, resulting in a downward spiral for shareholders. Due to its small scale, the Company must be willing to consider all alternatives, including a full liquidation of the Company if that is the only credible path towards maximizing shareholder value. Unfortunately, the Board’s direct economic interest in maintaining the status quo has led to an unwillingness to even consider this or other value-enhancing options.

For example, liquidation would result in recovery of approximately 87-89% of book value for shareholders, after factoring in the excessive management termination fee (9%) as well as execution and administrative costs (2-4%). In our recent discussions, management noted a similar estimate of 86%. Using the most recent company updated book value estimate of $9.79, our estimate would result in liquidation proceeds of $8.52-8.71 per share. This would provide shareholders a 53-57% gain over the recent share price of $5.56.

Management has repeatedly stated that the overall portfolio is small enough that shrinking it further would cause the Company to become irrelevant to its counterparties. We agree with that assessment. Fortunately for JMI investors, the small size of the portfolio mitigates the concern that trades taken to unwind the portfolio might be large or awkward enough to have an outsized secondary market impact.

The current situation is unsustainable. Without further and more drastic action, the market will continue to price JMI shares at a substantial discount to its potential value under alternative approaches. Nominating a slate of director candidates is an extraordinary step for us, but we cannot allow the value-destructive status quo to persist. We remain prepared to continue our dialogue, however, if we cannot reach a mutually agreeable resolution, we are fully prepared to solicit the support of our fellow shareholders to elect six new Board members who are committed to representing the best interests of all JMI shareholders.

Respectfully,

Christopher Gust

Chief Investment Officer

On Behalf of Wolverine Asset Management, LLC

About Wolverine Asset Management, LLC

Wolverine Asset Management, LLC is an alternative asset management firm that seeks to generate absolute returns for its investors by investing in the equity, credit, commodity and volatility asset classes through strategies uncorrelated to the direction of financial markets. For more information visit www.wolvefunds.com.

Contact:

Wolverine

Onu Odim , (646) 485-6685

oodim@wolvefunds.com

Asha Olasa, (312) 884-3101

aolasa@wolvefunds.com

1 WAM, as investment manager of WFF, is deemed to have beneficial ownership of the shares of JMI. The sole member and manager of WAM is Wolverine Holdings, L.P. (“WH”). Wolverine Trading Partners, Inc. (“WTP”) is the general partner of WH. Each of Christopher L. Gust and Robert R. Bellick may be deemed to control WTP.

2 11,924,443 shares outstanding, as reported in the Company’s quarterly report on Form 10-Q filed on November 6, 2015.

3 Peer group defined as equal weight of AMTG, CIM, IVR, MFA, MITT, MTGE, TWO and WMC.

4 Closing share price on 12/14/15 was 5.56. Most recent book value estimate was 9.74-9.84 as of 11/19/15, provided in the Company’s latest presentation on its website.

SOURCE Wolverine Asset Management, LLC

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Wolverine Asset Management, LLC, together with the other participants named herein (collectively, “Wolverine”), intends to make a preliminary filing with the Securities and Exchange Commission (“SEC”) of a proxy statement and an accompanying proxy card to be used to solicit votes for the election of its director nominees at the 2016 annual meeting of shareholders of JAVELIN Mortgage Investment Corp. (the “Company”).

WOLVERINE ADVISES ALL SHAREHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THE SOLICITATION WILL PROVIDE COPIES OF THESE MATERIALS WITHOUT CHARGE UPON REQUEST.

The participants in the proxy solicitation are Wolverine Asset Management, LLC (“WAM”), Wolverine Holdings, L.P. (“WH”), Wolverine Trading Partners, Inc.(“WTP”), Christopher L. Gust, Robert R. Bellick, Steve Joung, Eric W. Muehlhauser, Olof S. Nelson, Norman J. Rice, III, Donald J. Tringali and John D. Ziegelman (collectively, the “Participants”).

As of the date hereof, WAM, as the investment manager of Wolverine Flagship Fund Trading Limited (“Flagship”), may be deemed the beneficial owner of the 605,017 shares of Common Stock owned by Flagship. As of the date hereof, Flagship possesses economic exposure to an aggregate of 19,066 shares of Common Stock due to certain cash-settled total return swap agreements. WH, as the sole member and manager of WAM, and the sole member and manager of Wolverine Trading, LLC (“WT”) may be deemed the beneficial owner of the (i) 605,017 shares of Common Stock owned by WAM and (ii) 6,528 shares of Common Stock owned by WT. WTP, as the sole general partner of WH, may be deemed the beneficial owner of the (i) 605,017 shares of Common Stock owned by WAM and (ii) 6,528 shares of Common Stock owned by WT. Mr. Gust, a controlling shareholder of WTP, may be deemed the beneficial owner of the (i) 605,017 shares of Common Stock owned by WAM and (ii) 6,528 shares of Common Stock owned by WT. Mr. Bellick, a controlling shareholder of WTP, may be deemed the beneficial owner of the (i) 605,017 shares of Common Stock owned by WAM and (ii) 6,528 shares of Common Stock owned by WT. As of the date hereof, Mr. Joung may be deemed to beneficially own 2,500 shares of Common Stock held by Archon Capital LLC, an affiliate of Mr. Joung. As of the date hereof, Mr. Rice directly owned 2,400 shares of Common Stock. As of the date hereof, none of Messrs. Muehlhauser, Nelson, Tringali and Ziegelman directly owned any shares of Common Stock.