JAVELIN Mortgage Investment Corp. Company Update September 9, 2015

PLEASE READ: Important Regulatory and Yield Risk Disclosures Certain statements made in this presentation regarding JAVELIN Mortgage Investment Corporation (“JAVELIN” or the “Company”), and any other statements regarding JAVELIN’s future expectations, beliefs, goals or prospects constitute forward-looking statements made within the meaning of Section 21E of the Securities Exchange Act of 1934. Any statements that are not statements of historical fact (including statements containing the words “believes,” “plans,” “anticipates,” “expects,” “estimates” and similar expressions) should also be considered forward-looking statements. Forward-looking statements include but are not limited to statements regarding the projections for JAVELIN’s business and plans for future growth and operational improvements. A number of important factors could cause actual results or events to differ materially from those indicated by such forward-looking statements. JAVELIN assumes no obligation to update the information in this communication, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. This material is for information purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation for any securities, financial instruments, or common or privately issued stock. The statements, information and estimates contained herein are based on information that the presenter believes to be reliable as of today's date, but cannot be represented that such statements, information or estimates are complete or accurate. Actual realized yields, durations and net durations described herein will depend on a number of factors that cannot be predicted with certainty. Estimated yields do not reflect any of the costs of operation of JAVELIN. THE INFORMATION PRESENTED HEREIN IS UNAUDITED AND UNREVIEWED. 2

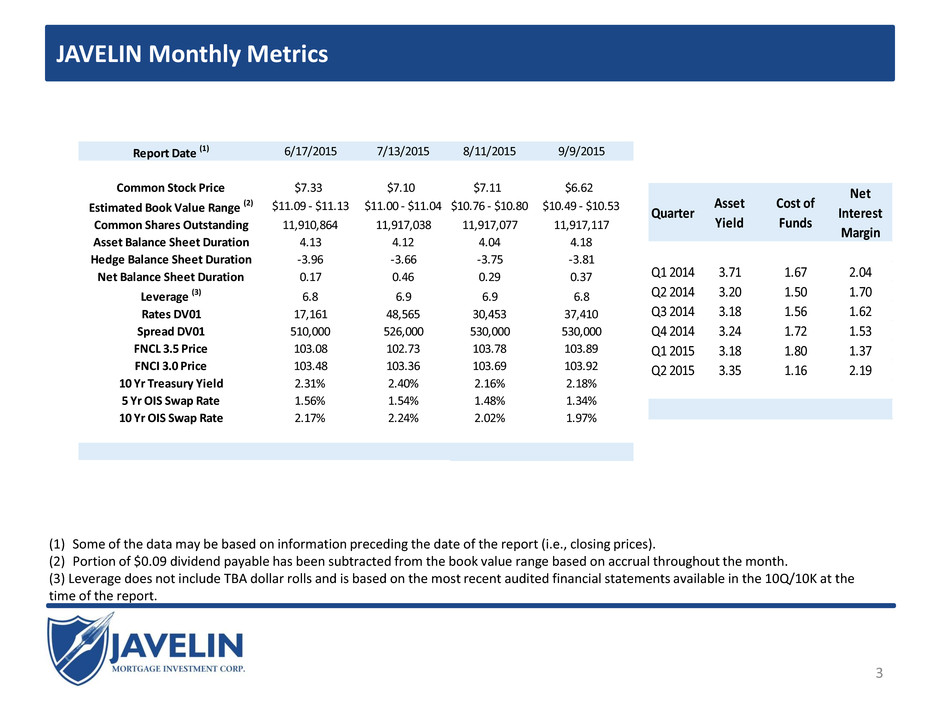

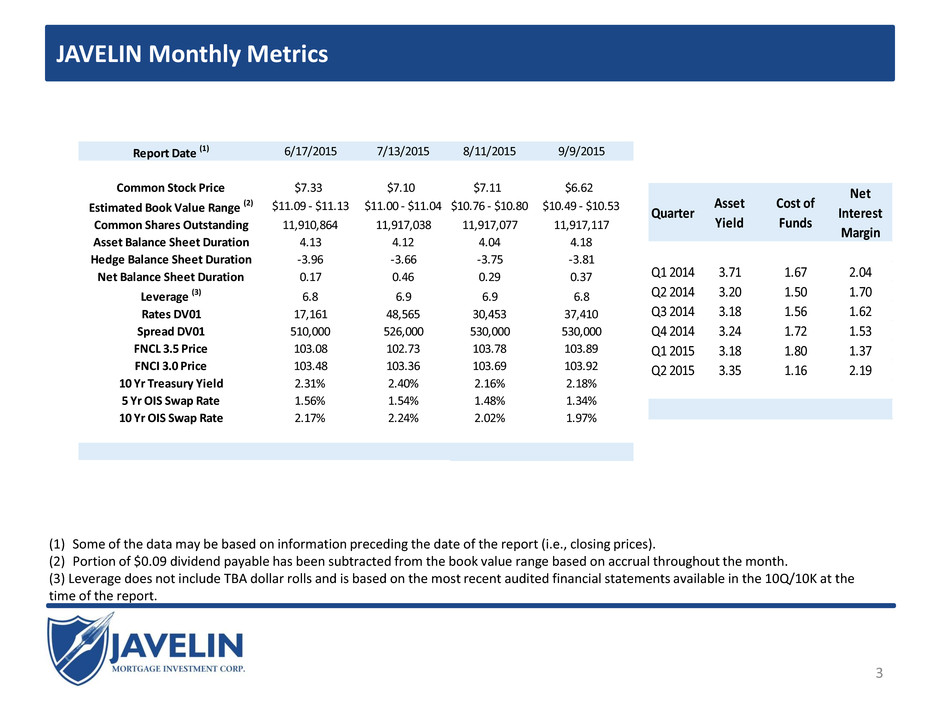

JAVELIN Monthly Metrics 3 (1) Some of the data may be based on information preceding the date of the report (i.e., closing prices). (2) Portion of $0.09 dividend payable has been subtracted from the book value range based on accrual throughout the month. (3) Leverage does not include TBA dollar rolls and is based on the most recent audited financial statements available in the 10Q/10K at the time of the report. Quarter Asset Yield Cost of Funds Net Interest Margin Q1 2014 3.71 1.67 2.04 Q2 2014 3.20 1.50 1.70 Q3 2014 3.18 1.56 1.62 Q4 2014 3.24 1.72 1.53 Q1 2015 3.18 1.80 1.37 Q2 2015 3.35 1.16 2.19 Report Date (1) 6/17/2015 7/13/2015 8/11/2015 9/9/2015 Common Stock Price $7.33 $7.10 $7.11 $6.62 Estimated Book Value Range (2) $11.09 - $11.13 $11.00 - $11.04 $10.76 - $10.80 $10.49 - $10.53 Common Shares Outstanding 11,910,864 11,917,038 11,917,077 11,917,117 Asset Balance Sheet Duration 4.13 4.12 4.04 4.18 Hedge Balance Sheet Duration -3.96 -3.66 -3.75 -3.81 Net Balance Sheet Duration 0.17 0.46 0.29 0.37 Leverage (3) 6.8 6.9 6.9 6.8 Rates DV01 17,161 48,565 30,453 37,410 Spread DV01 510,000 526,000 530,000 530,000 FNCL 3.5 Price 103.08 102.73 103.78 103.89 FNCI 3.0 Price 103.48 103.36 103.69 103.92 10 Yr Treasury Yield 2.31% 2.40% 2.16% 2.18% 5 Yr OIS Swap Rate 1.56% 1.54% 1.48% 1.34% 10 Yr OIS Swap Rate 2.17% 2.24% 2.02% 1.97%

JAVELIN Capitalization, Dividend Policy, Transparency and Manager • Portfolio and liability details are updated monthly at www.javelinreit.com. • Agency premium amortization is expensed monthly as it occurs.(1) • Hedge positions are marked-to-market daily (GAAP/Tax differences). • Non-Executive Board Chairman and Lead Independent Director. Transparency and Governance 4 JAVELIN REIT Manager • JAVELIN is externally managed by ARMOUR Capital Management LP. Common Stock Dividend Policy Capitalization • 11,917,117 shares of common stock outstanding (NYSE: “JMI”). • Estimated book value of common stock of $125.2 million. • JAVELIN pays common stock dividends monthly. • Dividends are announced based on estimates of core and taxable REIT income. Information as of 9/8/2015. (1) Due to the prepayment lockout feature of our Agency multifamily securities, their premium is amortized using a level yield methodology.

JAVELIN Balance Sheet Targets JAVELIN invests in Agency and Non-Agency mortgage securities. Balance sheet target of 1.5 or less. • 4.18 gross asset duration of Agency and Non-Agency securities. • -3.81 hedge duration. • 0.37 net balance sheet duration. Hedge a minimum of 40% of fixed rate assets and funding rate risk. • $616.3 million in hedges (swaps). • 60.0% of assets hedged (30.8% with current paying swaps). • 67.8% of repurchase agreements hedged (34.8% with current paying swaps). Hold 40% of unlevered equity in cash between prepayment periods. • $29.1 million in total liquidity. • $14.1 million in true cash. • $5.7 million in unlevered securities. • $9.2 million in principal and interest receivable Long term debt to equity target of 7.5x - 8.0x. • $909.2 million in net REPO borrowings. • 6.8x Q2 2015 shareholders’ equity (not including TBA dollar rolls). 5 Assets Duration Hedging Liquidity Leverage Information as of 9/8/2015.

JAVELIN Investment Equity Allocation 6 Estimates as of 9/8/2015 and does not include forward settling trades. Equity allocation is based on market value of unlevered securities plus haircut on repurchase agreements. Allocation does not include equity invested in cash and hedges.

JAVELIN Portfolio Strategy and Investment Methodology JAVELIN will utilize ACM’s proprietary analytical approach as well as Intex, Bloomberg, BlackRock Solutions and other third- party systems to analyze mortgage investment opportunities both for Agency and Non-Agency mortgage securities. Strong bias toward a “buy and hold” strategy, with occasional sales made as market conditions change. The investment team considers an array of factors, both bottom up and top down: Non-Agency Structure Analysis o Seniority, subordination model. o Model completeness and accuracy. o Litigation and policy risks. Agency & Non-Agency Class Analysis o Prepayment history. o Prepayment expectations. o Premium/discount. o Liquidity. Agency & Non-Agency Loan Analysis o Original and current loan balance. o Year of origination. o Originating company, third-party originators. o Loan seasoning. o Principal amortization schedule. o Original loan-to-value ratio. o Geography. o 96% of JMI’s 15yr MBS are between 85k – 175k loan balances. Agency Pool Analysis o Only “pass-through” securities. No CMO’s. o Prepayment history and expectations. o Premium over par. o “Hedgability.” o Liquidity. o Diversify broadly to limit idiosyncratic pool risk. 7 Information as of 9/8/2015.

JAVELIN Agency & Non-Agency Portfolio Duration 8 Information and pricing as of 9/8/2015. Some totals may not foot due to rounding. Legacy Prime Fixed 2.6% 26.9$ 83.1% 85.2% 6.02/5.46 0.76 Legacy Prime Hybrid 1.4% 14.9$ 77.3% 87.8% 2.33/2.84 1.13 Legacy Alt-A Fixed 7.4% 76.4$ 78.7% 82.7% 5.88/5.25 0.51 Legacy Alt-A Hybrid 0.7% 7.3$ 80.4% 82.5% 2.58/2.88 0.00 New Issue Prime Fixed 1.1% 11.4$ 91.4% 97.1% 3.69/3.97 6.07 Credit Risk Transfer 3.3% 33.9$ 97.2% 97.6% 4.37/4.06 0.17 NPL/RPLs 7.6% 78.5$ 99.9% 99.7% 3.44/5.08 2.80 Total or Weighted Average 24.3% 249.3$ 88.9% 91.3% 4.51/4.78 1.49 Weighted Average Net/Gross Estimated Effective Duration Using Current Values Non-Agency Securities Current Value (millions) Weighted Average Purchase Price Weighted Average Current Market Price Percent of Portfolio Agency Multifamily Ballooning in 120 Months or Less 15.3% 156.9$ 102.2% 103.6% 3.19/4.38 7.32 Fixed Rates Maturing Betw en 0 and 120 Months 0.2% 2.2$ 105.5% 106.4% 3.50/3.75 3.24 Fixed Rates Maturing Between 121 and 180 Months 39.2% 402.9$ 104.1% 105.0% 3.19/3.70 4.03 Fixed Rates Maturing Between 181 and 240 Months 2.5% 25.8$ 106.2% 103.6% 3.08/3.52 4.25 Fixed Rates Maturing Betwe n 241 and 360 Months 12.0% 1 3.1 105.8 103.9 3.50/4.27 5.65 FNCL 3.5 TBA 6.5 67.2 103.3 103.4 3.50/4.10 4.69 Total or Weighted Average 75.7% 7 8.1 104.0 104.4 3.26 3.96 5.0 Agency Securities Current Value (millions) Weighted Average Purchase Price Weighted Average Current Market Price Estimated Effective Duration Using Current Values Percent of Portfolio Weighted Average Net/Gross

JAVELIN Hedge Portfolio 9 Information and pricing as of 9/8/2015. Some totals may not foot due to rounding. Forward Starting Weighted Average Months to Start Weighted Average Underlying Term (Months) Notional Amount (millions) Weighted Average Rate Interest Rate Swap 10 60 100.0$ 1.95 Interest Rate Swap 7 120 200.0$ 2.07 Total or Weighted Average 8 100 $ 300.0 2.03 Current Paying Remaining Term Weighted Average Remaining Term (Months) Notional Amount (millions) Weighted Average Rate Interest Rate Swap 0-12 Months 0 -$ 0.00 Interest Rate Swap 13-24 Months 0 -$ 0.00 Interest Rate Swap 25-36 Months 29 100.0$ 0.73 Interest Rate Swap 37-48 Months 0 -$ 0.00 Interest Rate Swap 49-60 Months 50 60.0$ 1.59 Interest Rate Swap 61-72 Months 0 -$ 0.00 Interest Rate Swap 73-84 Months 0 -$ 0.00 Interest Rate Swap 85-96 Months 93 76.3$ 2.05 Interest Rate Swap 97-108 Months 97 80.0$ 2.04 Interest Rate Swap 109-120 Months 0 -$ 0.00 Interest Rate Swap 121-132 Months 0 -$ 0.00 Total or Weighted Average 66 $ 316.3 1.54

JAVELIN Balance Sheet Hedge Metrics 10 (1) The duration contribution to the balance sheet is based on effective duration and market value. Information and pricing as of 9/8/2015. Some totals may not foot due to rounding. Agency & Non-Agency Assets 1,027.4$ 30.8% 60.0% REPO Balance 909.2$ 34.8% 67.8% Total Hedge % (All Hedges) Current Hedge % (Current Paying) Repo Amount (millions) Agency Assets 3.81 Non-Agency Legacy Assets 0.07 Non-Agency New Issue Assets 0.29 Interest Rate Swaps -3.81 Net Balance Sheet 0.37 Duration Contribution to Balance Sheet (1)

JAVELIN Agency Portfolio Constant Prepayment Rates (“CPR”) 11 JAVELIN expenses premium amortization monthly as it occurs. Constant Prepayment Rate (“CPR”) is the annualized equivalent of single monthly mortality (“SMM”). CPR attempts to predict the percentage of principal that will prepay over the next twelve months based on historical principal pay downs. CPR is reported on the 4th business day of the month for the previous month's prepayment activity.

JAVELIN Agency & Non-Agency Repo Composition 12 (1) JAVELIN has 29 lending counterparties. Information as of 9/8/2015. Some totals may not foot due to rounding. Wells Fargo Bank, N.A. 118.4$ 12.9% 32 20 20 Mitsubishi UFJ Securities (USA), Inc. 94.8$ 10.3% 98 11 22 ICBC Financial Services LLC 86.0$ 9.4% 48 14 24 Nomura Securities International, Inc. 75.4$ 8.2% 33 7 7 Daiwa Securities America Inc. 72.0$ 7.9% 49 2 2 Credit Suisse Securities (USA) LLC 70.6$ 7.7% 89 42 80 Royal Bank of Canada 53.9$ 5.9% 68 30 73 Barclays Capital Inc. 50.3$ 5.5% 92 5 7 UBS Securities LLC 50.0$ 5.5% 927 448 594 BNP Paribas Securities Corp. 44.7$ 4.9% 30 3 17 Mizuho Securities USA Inc. 40.5$ 4.4% 92 31 31 Merrill Lynch, Pierce, Fenner & Smith Inc. 31.2$ 3.4% 36 13 22 E D & F Man Capital Markets Inc. 28.8$ 3.1% 45 6 38 Morgan Stanley & Co. LLC 21.0$ 2.3% 60 10 10 Guggenheim Securities, LLC 20.7$ 2.3% 32 6 6 KGS-Alpha Capital Markets, L.P. 19.6$ 2.1% 61 28 28 CRT Capital Group LLC 19.1$ 2.1% 30 15 15 Citigroup Global Markets Inc. 10.1$ 1.1% 92 24 35 J.P. Morgan Securities LLC 9.1$ 1.0% 91 83 83 T tal or Weighted Average 916.2$ 100.0% 106 40 REPO Counter-Party(1) Principal Borrowed (millions) Percentage of REPO Positions with JAVELIN Weighted Average Original Term in Days Longest Remaining Term in Days Weighted Average Remaining Term in Days Weighted Average Repo Rate 0.72% Weighted Average Haircut 9.51% September Paydowns (7.0)$ Net REPO after Paydowns 909.2$ Debt to Quarter End Shareholders' Equity Ratio 6.8

3001 Ocean Drive Suite 201 Vero Beach, FL 32963 772-617-4340 13