united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22718

Two Roads Shared Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-490-4300

Date of fiscal year end: 10/31

Date of reporting period: 4/30/24

Item 1. Reports to Stockholders.

| |

| |

| |

| |

| |

|

| |

| |

| |

| |

| |

| Semi-Annual Report |

| April 30, 2024 |

| |

| |

| |

| |

| |

| |

| |

| Recurrent MLP & Infrastructure Fund |

| Class I Shares (RMLPX) |

| |

| |

| |

| |

| |

| |

| |

| 1-833-RECURRENT |

| (1-833-732-8773) |

| www.recurrentadvisors.com |

| |

| |

| |

| Distributed by Northern Lights Distributors, LLC |

| Member FINRA |

| |

| |

| |

| | | |

| |

| This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which contains information about the Fund’s investment objective, risks, fees and expenses. Investors are reminded to read the prospectus carefully before investing in the Fund. |

Recurrent MLP & Infrastructure Fund – Fiscal H1 2024 at a glance

First and foremost, before we discuss the performance of the Recurrent MLP & Infrastructure Fund (“RMLPX” or the “Fund”), we want to thank all of our clients – current and prospective – for their trust and support. It is thanks to your confidence that RMLPX has grown from $631mm to $841mm since October 31, 2023, the end of our last fiscal year.

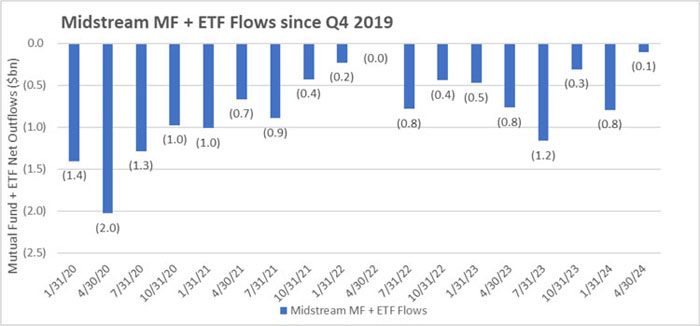

We find ourselves in a multi-year recovery in the “midstream” energy infrastructure sector where we invest. Given the severity of the downturn that preceded this recovery, and the fears of oil and gas obsolescence which were propagated by the financial media during the COVID pandemic, many investors have remained skeptical or apathetic towards the energy and midstream sectors, despite the robust energy sector rally that has taken place over the last four years. We would note that the start of this four-year period coincides almost exactly with the COVID lockdowns of March and April 2020. What evidence do we have for this supposed investor apathy towards the midstream energy rally? We offer this striking evidence: despite a dramatic rally during the four years ended April 30, 2024*, the sector-focused funds and ETFs which focus on the midstream energy sector have not seen a single three-month period of net inflows during this four-year window.

As we discuss in our semi-annual portfolio manager letter below, we believe a variety of factors – including ongoing investor apathy towards the midstream sector, as well as regulations which limit capital expenditures (“capex”) by making the construction of new competitive infrastructure nearly impossible – will contribute to continued capital discipline for the industry, helping to ensure that a large share of free cash flow (FCF) continues to benefit shareholders in the form of growing dividends, share repurchases, and declining debt.

During the first half of fiscal 2024 (from November 1, 2023 through April 30, 2024), RMLPX generated a +20.62% total return, outperforming the +17.60% return of the Alerian MLP Index (AMZ) by +3.02%. From the Fund’s November 2, 2017 inception through April 30, 2024, RMLPX has returned +89.16% (+10.32% on an annualized basis), exceeding the AMZ’s +80.34% gross total return by +8.82%, and exceeding the AMZ’s +9.53% annualized return by +0.79%.

The performance data quoted here represents past performance. For performance data current to the most recent month end, please call (833)-RECURRENT. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Per the fee table in the Fund’s March 1, 2024 prospectus, total Annual Operating Expenses are 1.10% for RMLPX. The Adviser has agreed to cap total fund expenses for the fund (excluding certain expenses) at 1.25% through at least March 1, 2025, although the Adviser has not used the expense cap since 2021.

| * | In the four years ended April 30, 2024, the Alerian MLP Index, or AMZ, is up +190.86%, (30.57% annualized) and the Recurrent MLP & Infrastructure Fund, or RMLPX, is up +196.78% (31.23% annualized). |

Recurrent MLP & Infrastructure Fund – Market Update

For those who say it’s time to sell midstream, we would note that investors have already been busy selling during every single quarter of this four-year-old midstream rally

Since early 2020, the midstream energy sector has been one of the few asset classes – outside of the technology sector – to dramatically outperform the S&P 500. A reasonable market observer might expect new investors to be pouring into the sector. One might expect that the sector’s appeal would be further enhanced by its substantial dividends, which are growing at a time when many investors are searching for alternative sources of yield following the period of historic interest rate and bond market volatility in 2021-2023.

Well, anyone anticipating strong and growing investor interest in midstream since COVID would be wrong, at least so far. Despite strong fundamentals and strong relative and absolute performance, midstream funds – including all actively-managed midstream mutual funds and ETFs, as well as all passively-managed midstream funds – have experienced unrelenting outflows during a time when it might be expected that investor interest would be increasing.

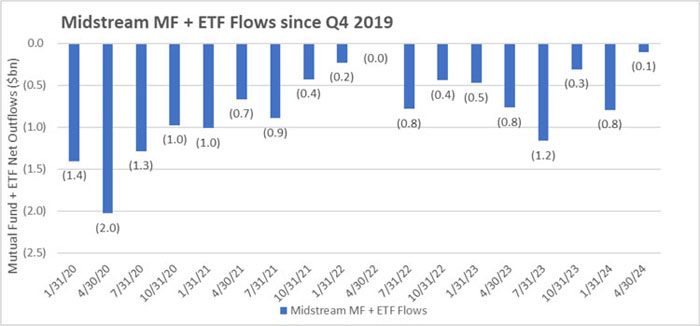

Exhibit 1: every single 3-month period since late 2019 has seen net outflows from midstream investment products, totalling $14bn in total net outflows since the acute COVID selloff in Q1 2020

Source: Recurrent research, Bloomberg.

Note: Funds included in the analysis above include the funds ranked in the Morningstar “Energy Limited Partnership” category as well as passive funds and ETFs focused on “midstream” energy infrastructure. Tickers include INFRX, INFFX, INFIX, MLPPX, INFJX, INFKX, INFEX, MLXAX, MLXCX, MLXIX, BEIYX, CCCAX, CCCCX, CCCNX, MLOAX, MLOCX, MLOIX, MLORX, MLOZX, NXGAX, DMPAX, DMPCX, DMPIX, DMPSX, EGLAX, EGLCX, EGLIX, EGLNX, EIPIX, EIPFX, GLEAX, GLECX, GLEPX, GLEIX, GAMPX, GLERX, GLESX, GLPAX, GLPCX, GMLPX, GLPIX, GMNPX, GLPRX, GLPSX, HMSIX, HMSFX, HEFAX, HEFCX, HEFYX, ILPAX, ILPCX, ILPRX, ILPFX, ILPQX, ILPYX, MLPLX, MLPMX, SPMJX, SPMPX, OSPPX, MLPNX, MLPAX, MLPGX, SPMGX, SPMHX, OSPAX, MLPOX, MLPDX, MLPRX, SPNNX, SPMQX, OSPMX, MLPZX, MLPTX, MLPEX, SPMWX, SPMVX, OSPSX, MLPTX, OMLPX, OMLCX, SPNMX, OMLYX, SPMKX, OMLIX, JAMLX, MLPCX, JMLPX, AMLPX, MLCPX, IMLPX, CSHAX, CSHCX, CSHZX, CSHNX, PRPAX, PRPCX, PRPQX, PRPZX, RMLPX, SMAPX, SMFPX, SMLPX, SMRPX, SOAEX, SACEX, TORTX, TORCX, TORIX, TMLAX, TMCLX, TMLPX, VLPAX, VLPCX, VLPIX, WMLPX, AMLP, AMJ, MLPX, AMZA, MLPA.

While the midstream sector has defied its relatively low valuation by steadily growing earnings and cash flow over the past 5 years (including during the period most severely impacted by the pandemic), many investors have remained unconvinced. We have attempted in previous investor communications to highlight the resilience of midstream cash flows. We have also conducted and shared extensive research to contextualize the potential for oil and gas demand destruction as a result of a rapid transition to electric vehicles (“EVs”) or a rapid transition to solar and wind power generation. In all reasonably probable cases, we have found that the significant valuation discount applied to the midstream sector is difficult to justify based on the potential for modest demand declines over a multi-decade forecast horizon.

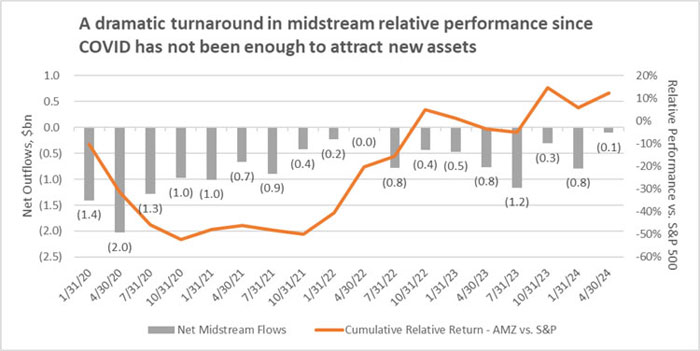

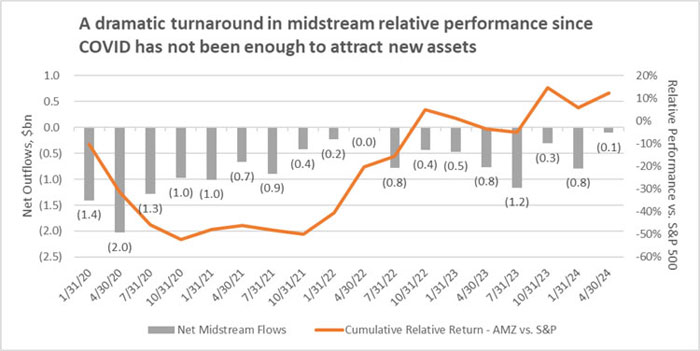

Perhaps more persuasive than any of our research is the relative performance of the midstream sector, which is shown below. Even including the impact of COVID during 2020, the midstream sector has outperformed the broad equity market (represented by the S&P 500) by 12% over the last 4 years, or 2.27% annualized. If we were to measure relative performance over the 3.5 years since the relative performance nadir of October 31, 2020 through April 30, 2024, the midstream sector has outperformed the S&P by 169%, or 25.96% on an annualized basis.

Exhibit 2: outperformance vs. the S&P 500 over the past 4 years (including COVID!) has not been enough to entice investors back to the midstream sector

Source: Recurrent research, Bloomberg.

Note: See footnote from exhibit 1 for a full list of mutual funds and ETFs included in this study.

The referenced market indices and indicators are shown for general market comparison and are not meant to represent the fund. Investors cannot invest directly in an index. The indices shown are for informational purposes only and are not reflective of any investment. As it is not possible to invest in indices, the data shown does not reflect or compare features of an actual investment, such as its objectives, costs and expenses, liquidity, safety, guarantees or insurance, fluctuation of principal or return, or tax features. Past performance is no guarantee of future results.

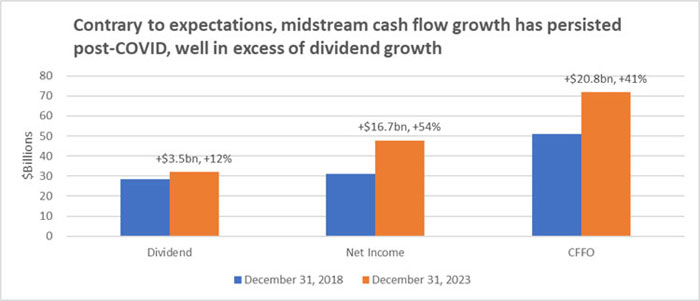

Post-2020, many investors (us included) were content for midstream to emulate tobacco’s “low growth / high payout” model – but midstream has grown and delivered high payouts

In previous letters, we explored a comparison between the midstream sector following COVID and the tobacco sector after the landmark 1999 DOJ lawsuit against the industry. We noted some clear analogs, including the fact that both industries found their growth initiatives under increasing regulatory scrutiny. Additionally, both businesses enjoyed stable and robust cash flows, even during and following a period of significant regulatory scrutiny.

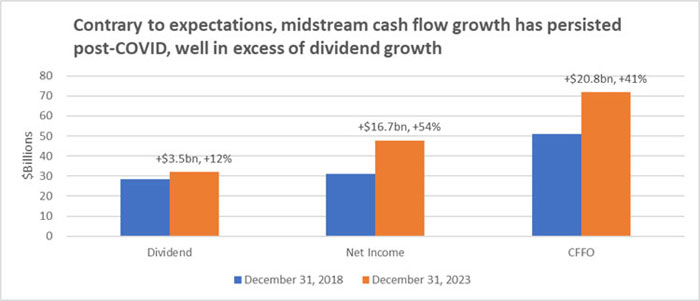

In the past several years, the comparison between tobacco and midstream energy infrastructure has come under strain, as the volume of oil and gas produced in North America, as well as demand for oil and gas globally, has meaningfully outpaced many market expectations, and midstream cash flows and earnings have grown commensurately, as shown below.

Exhibit 3: midstream sector cash flows have grown during the largest demand disruption in modern history

Source: Recurrent research, Bloomberg.

Note: Study includes the following midstream companies: Kinder Morgan Inc, Energy Transfer LP, Semgroup Corp-Class A, Delek Logistics Partners LP, Mplx LP, Enbridge Energy Partners LP, Phillips 66 Partners LP, Nustar Energy LP, Rm Partners LP, Enable Midstream Partners LP, Targa Resources Corp, Cheniere Energy Inc, Boardwalk Pipeline Partners, Crestwood Equity Partners LP, Magellan Midstream Partners, Spectra Energy Partners LP, Western Midstream Partners L, Andeavor Logistics LP, DCP Midstream LP, Buckeye Partners LP, Tallgrass Energy LP-Class A, Plains All Amer Pipeline LP, Noble Midstream Partners LP, Sunoco LP, Eqm Midstream Partners LP, Williams Cos Inc, Argent Mid Cap Etf, Enterprise Products Partners, Archrock Inc, Usa Compression Partners LP, Equitrans Midstream Corp, Oneok Inc, Enbridge Inc, Spectra Energy Llc, Kinetik Holdings Inc, Enlink Midstream Llc, Pembina Pipeline Corp, Altagas Ltd, Keyera Corp

While the last four years have been good for midstream, how should investors think about the risks of the 2024 election season? Is the midstream “scarcity premium” at risk?

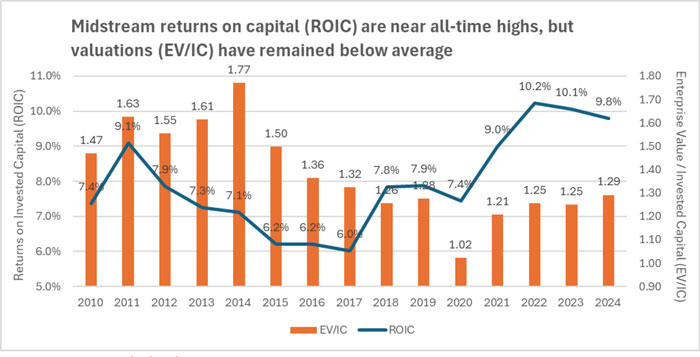

We frequently receive questions from clients and prospects about the impact of the upcoming US presidential election season, and what potential impacts the election could have on the general trend of midstream capital discipline, which has kept capital investment relatively low, supported returns on capital and operating cash flows, and ensured that significant cash remains available for midstream dividend payouts. Perhaps most importantly, by keeping construction activity low, regulatory scrutiny has created a “scarcity premium” for midstream assets.

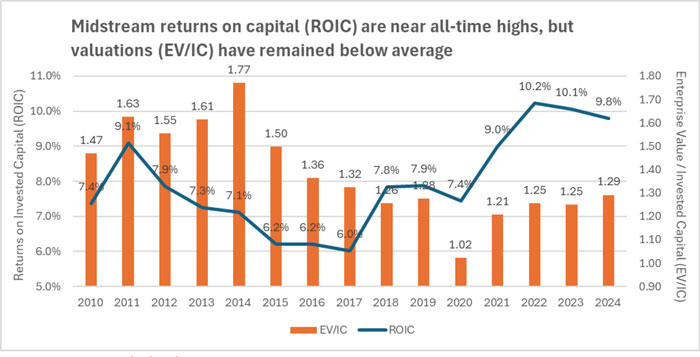

Midstream energy infrastructure is far from a dying or obsolescent industry, when viewed through an economic lens. Midstream has seen 4+ years of robust earnings growth and improving returns on invested capital (ROIC). This improvement has undoubtedly been helped by the fact that the midstream industry has moved from “growth” to “cash flow harvesting,” as we have noted in previous investor letters. In a completely unregulated market, it is natural to expect that strong cash flows would attract competition and new investment. However, despite improving returns, midstream valuations remain stuck at modest premiums vs. invested capital (“IC”). Enterprise Value-to-IC valuations are also much lower than pre-2015 levels, despite the fact that capital efficiency (measured by ROICs) is significantly higher than pre-2015 levels, as shown below.

Exhibit 4: midstream capital spending has been restrained, supporting returns on invested capital

Source: Recurrent research, Bloomberg.

Note: Study includes the midstream companies noted in exhibit 3.

This lack of EV/IC valuation improvement is noteworthy for 2 reasons:

| - | Higher Returns: first, assets generating 10% unlevered returns (like midstream assets today) should be more valuable than assets generating 6% to 8% returns (as midstream assets did during 2010-2020), not less valuable. It is possible that growth expectations have fallen to offset this higher ROIC, |

but as we noted above, midstream earnings continue to grow robustly, and oil and gas production continues to climb.

| - | Higher newbuild costs: second, midstream assets have become harder (and more expensive) to build. The depreciated historical cost (reflected in IC) understates the current replacement value of pipeline assets. Opposition to new pipelines should widen the economic moat, and increase the value of existing pipes. |

Could this second advantage disappear? In light of the approaching election, we’ve been asked by investors, “could a Republican win in November trigger a wave of new pipeline construction?” As we discuss below, we believe there are economic and demographic reasons that opposition to pipeline construction is secular, and unlikely to subside regardless of who wins in November. We are unlikely to see a surge in capex, and the “scarcity premium” for existing assets should continue to grow.

Americans living in high-growth states with expensive homes are increasingly opposed to ALL non-residential development

For over a decade, the anti-development (“NIMBY,” or “not in my backyard”) movement has galvanized opposition to pipelines (and other types of construction). It is often construed as a partisan, political, or even environmental movement. The reality is actually much simpler: it is rational risk-averse economic behavior.

As homes get more expensive (as a multiple of household income), homeowners are increasingly opposed to any new development which could adversely impact home prices. Unsurprisingly, NIMBY has emerged first in the least affordable states, primarily on the coasts. In the least affordable states, median home price = 5 to 10 years of median pretax household income – perhaps decades of after-tax savings. In areas where homes are a huge piece of family net worth, opposition to non-residential construction has increased dramatically in the last 10-20 years. The irony, of course, is that opposing new construction all but guarantees future cost-of-living increases – insuring the future of the NIMBY movement.

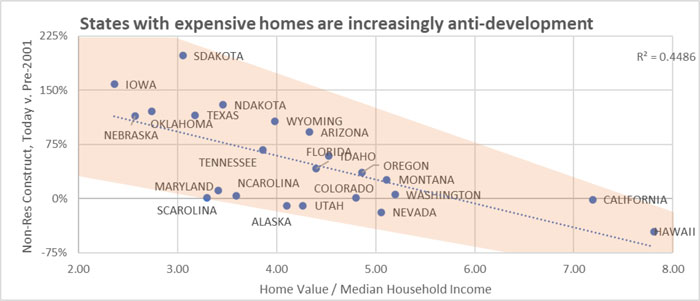

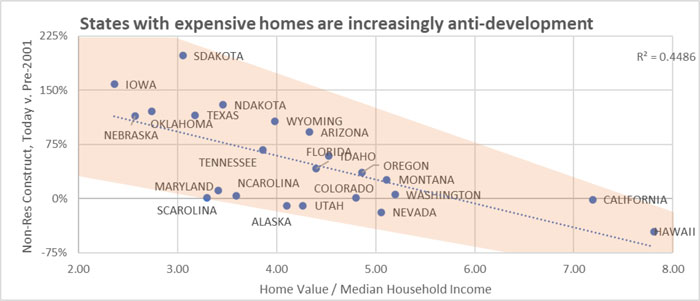

Below, we see economic data across the 25 fastest-growing state economies. This is where development should be increasing to support GDP growth. Instead, non-residential construction activity has stagnated or even declined in areas where home owners simply have too much to lose (as reflected in high ratios of home value to median household income).

Exhibit 5: there is a clear trend of slower growth in construction activity in states with higher-priced homes

Source: Recurrent Advisors’ research, Census Bureau, Zillow, US Bureau of Economic Analysis (BEA), Bloomberg, public filings.

While Americans are increasingly opposed to all construction near their home, pipelines have been met with even more resistance

While homeowners are increasingly resistant to new development, pipelines have stood out as a category that has seen exceptional opposition. Pipes are arguably victims of their own success – often operated in silence, out of sight, at low cost to the consumer.

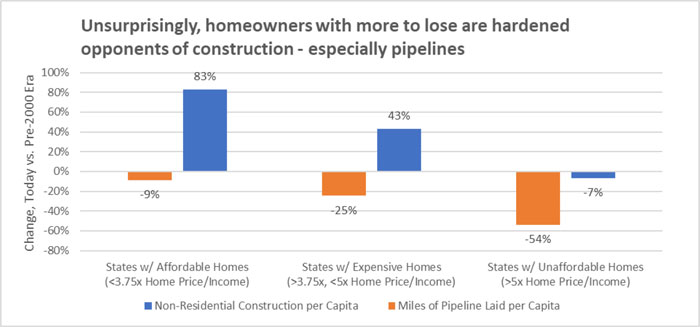

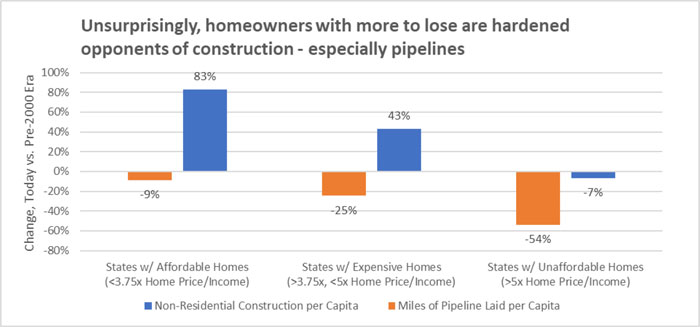

Again, we study the 25 states with the highest GDP growth – areas where we would expect demand for new development to remain elevated. We see that in more affordable areas (where NIMBYism is weaker or absent), non-residential construction is +83% since the late 1990s, and pipeline construction per capita has stayed consistent with levels of 20+ years ago. In less affordable areas (which are hotbeds of NIMBYism), non-residential construction is down slightly (-7%), despite strong GDP growth, and pipeline construction has declined dramatically (-54%) in the last 20+ years.

Exhibit 6: the NIMBY movement has fought pipeline construction more than other forms of construction

Source: BEA, PHMSA, Recurrent Advisors’ research, Bloomberg, public filings.

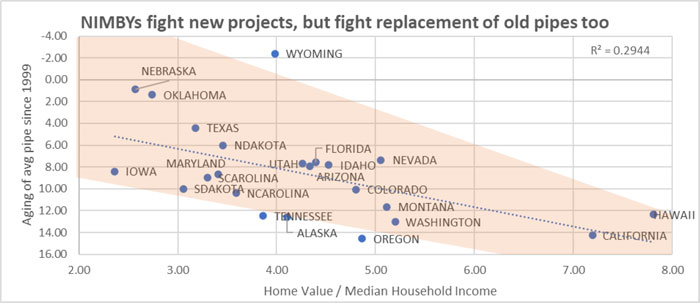

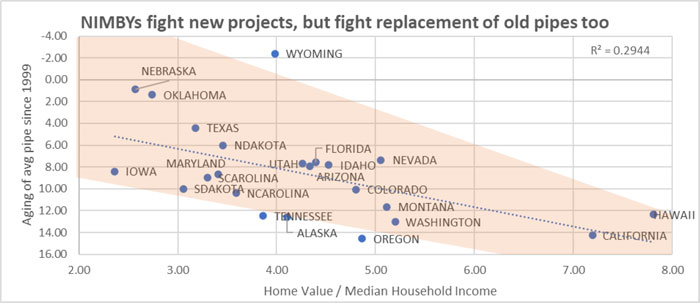

In another illustration of the self-perpetuating nature of the NIMBY movement, the opposition to pipelines (including long-distance pipelines, as well as consumer-facing utility distribution lines) means that pipeline replacements are happening more slowly (or not at all) in high-cost jurisdictions. In a cruel irony, the NIMBY advocates who have spread the misinformation that pipelines are dangerous, are in fact, making pipelines more dangerous by preventing their timely replacement.

Exhibit 7: the NIMBY movement has fought new projects as well as simple asset maintenance

Source: Census Bureau, BEA, PHMSA, Recurrent Advisors’ research, Bloomberg, public filings.

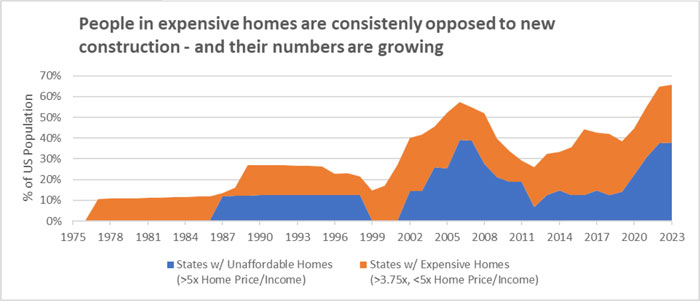

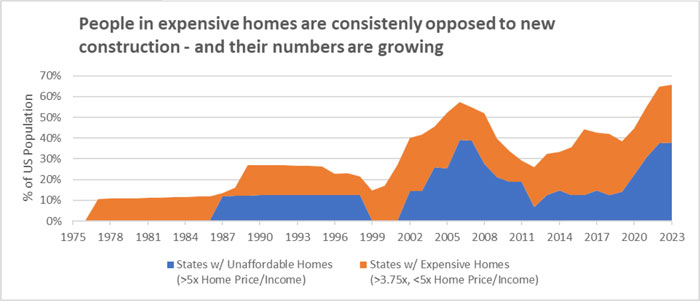

The rise of the NIMBY (“not in my backyard”) movement will not die with one election – it is a reflection of long-term economic trends

It’s reasonable to ask, “hasn’t living on the beach always been expensive? Why did the NIMBY movement emerge now?” The answer is simple: homes have only recently become so expensive that any adverse development – an unsightly cellphone tower, a lower-end apartment, or *gasp* a pipeline right-of-way – could be perceived as having a life-changing impact on homeowners’ net worth. Of course, the success of anti-infrastructure activism means that any special interest group now has a tried-and-true playbook to drag once-streamlined environmental reviews into years of expensive review and endless goalpost-shifting.

A little over a decade ago, <10% of the US population lived in an unaffordable home (>5x price/income ratio) and 25% lived in expensive homes (>3.75x). Today, despite the highest mortgage rates in 15+ years, nearly 40% of Americans live where the median home is unaffordable and 65% live in states where the median home is >3.75 median household income. An increasing number of American homeowners view any development as a risk that could cause years – or decades – of after-tax income to evaporate.

Exhibit 8: all states with expensive homes are anti-development – and all states are seeing rising prices

Source: Recurrent Advisors’ research, Bloomberg, public filings.

Opposition to new pipeline construction is likely to increase as long as home values increase –one likely result is that existing pipeline assets will become more valuable

While the future of pipeline approvals and construction is impossible to forecast, there is a strong argument that NIMBYism is likely to grow further, rather than shrink. In many mid-priced states (Texas, Georgia, Carolinas, Tennessee, Florida), population growth is being driven by cities where affordability is low and falling rapidly, and the newest arrivals paying up for homes in rapid-growth cities like Austin, Nashville, Tampa and Miami are unlikely to take a kind view of a pipeline being laid through their high-price neighborhood. In short, this economic reality makes us think that energy infrastructure assets are uniquely positioned to appreciate in value as pipeline demand increases, and society refuses to build.

Once again, thank you to all of our investors who have supported us and placed their confidence in us. As we ourselves are also significant owners in the fund, we are excited to see what we believe will be a continued increase in cash returns from the investments in the RMLPX portfolio.

Best regards,

Brad Olsen and Mark Laskin

Co-Founders and Portfolio Managers

Recurrent Investment Advisors

Advisor to the Recurrent MLP & Infrastructure Fund

The views in this report are those of the Fund’s management. This report contains certain forward-looking statements about factors that may affect the performance of the Fund in the future. These statements are based on the Fund’s management’s predictions and expectations concerning certain future events such as the performance of the economy as a whole and of specific industry sectors. Management believes these forward-looking statements are reasonable, although they are inherently uncertain and difficult to predict.

Alerian MLP Index is a composite of the most prominent energy master limited partnerships calculated by VettaFi using a float-adjusted market capitalization methodology. Investments cannot be made in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges.

Alerian MLP Index is a servicemark of VettaFi LLC (“VettaFi”) and their use is granted under a license from VettaFi. VettaFi does not guarantee the accuracy and/or completeness of Alerian MLP Index or any data included therein and VettaFi shall have no liability for any errors, omissions, interruptions or defects therein. VettaFi makes no warranty, express or implied, representations or promises, as to results to be obtained by Licensee, or any other person or entity from the use of the Alerian MLP Index or any data included therein. VettaFi makes no express or implied warranties, representations or promises, regarding the originality, merchantability, suitability, non-infringement, or fitness for a particular purpose or use with respect to the Alerian MLP Index or any data included therein. Without limiting any of the foregoing, in no event shall VettaFi have any liability for any direct, indirect, special, incidental, punitive, consequential, or other damages (including lost profits), even if notified of the possibility of such damages.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Recurrent Funds. This and other important information about the Funds is contained in the prospectus, which can be obtained by calling 833-RECURRENT. The prospectus should be read carefully before investing. The Recurrent Funds are distributed by Northern Lights Distributors, LLC, member FINRA/SIPC.

Recurrent Investment Advisors is not affiliated with Northern Lights Distributors, LLC.

Important Risk Disclosure (RMLPX)

Mutual Funds involve risk including the potential loss of principal. Higher turnover and frequent trading my result is higher costs. Cash available for distribution by MLPs may vary and could be affected by the entity’s operations, including capital expenditures, operating, acquisition, construction, exploration and borrowing costs, reducing the amount of cash an MLP has available for distribution. The Fund may focus on one or more industries, sectors or geographic regions of the economy and the value of an investment may fluctuate more widely than if it were diversified. Tax risks associated with the Fund include fund structure risk, MLP tax risk, and tax estimation/NAV risk. Cyber-attacks or failures affecting the Fund or service providers may adversely impact the Fund or its shareholders.

The Fund invests primarily in the energy sector and infrastructure industry and is susceptible to adverse economic, environmental, and regulatory concerns. Additional risks include acquisition, catastrophic event, commodity price, depletion, natural resource, supply/demand and weather risk. The purchase of IPO shares may involve high transaction cost, market and liquidity risks. The investment strategies employed by the Advisor may not result in an increase in value or performance. Overall equity market risk may affect the value of individual instruments in which the Fund invests. Holders of MLPs have limited control and voting rights, additionally, there are certain tax risks and conflicts of interest between holders of MLPs and the general partner.

3391-NLD-05/30/2024

| Recurrent MLP & Infrastructure Fund |

| PORTFOLIO REVIEW (Unaudited) |

| April 30, 2024 |

| |

The Fund’s performance figures* for the periods ended April 30, 2024, compared to its benchmark:

| | | | Annualized |

| | Six Months | One Year | Three Year | Five Year | Since Inception (a) |

| Recurrent MLP & Infrastructure Fund - Class I | 20.62% | 32.17% | 26.82% | 12.26% | 10.32% |

| Alerian MLP Index (Total Return)** | 17.60% | 34.46% | 26.03% | 11.51% | 9.53% |

| | | | | | |

| (a) | Inception date is November 2, 2017. |

| * | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Total returns for periods of less than one year are not annualized. Total returns would have been lower absent the advisor fee waiver. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. The Advisor has contractually agreed to waive fees and/or reimburse expenses to the Fund until at least March 1, 2025 to ensure that the Fund’s total annual operating expenses after expense waiver and reimbursement (excluding any front-end or contingent deferred loads; brokerage fees and commissions; acquired fund fees and expenses; borrowing costs such as interest and dividend expenses on securities sold short, taxes; and extraordinary expenses, such as litigation expenses) will not exceed 1.25% of average daily net assets attributable to Class I shares. This agreement may be terminated by the Fund’s Board of Trustees on 60 days’ written notice to the Advisor. The Fund’s total annual fund operating expense ratio, gross of fee waivers or expense reimbursements is 1.10% for Class I shares per the fee table in the Fund’s Prospectus dated March 1, 2024. These fee waivers and expense reimbursements are subject to possible recoupment from the Fund in future years on a rolling three year basis (within three years after the fees have been waived or reimbursed) if such recoupment can be achieved within the foregoing expense limits as well as any expense limitation that was in effect at the time the waiver or reimbursement was made. Fee waiver and reimbursement arrangements can decrease the Fund’s expenses and increase its performance. For performance information current to the most recent month-end, please call 1-833-732-8773. |

| ** | The Alerian MLP Index (Total Return) is a composite of the 50 most prominent energy master limited partnerships calculated by Standard & Poor’s using a float-adjusted market capitalization methodology. Investors cannot invest directly in an index or benchmark. Index returns are gross of any fees, brokerage commissions, taxes, or other expenses of investing. |

| Holdings by type of Investment | | % of Net Assets | |

| Common Stocks | | | 70.9 | % |

| Master Limited Partnerships | | | 26.6 | % |

| Short-Term Investment | | | 2.0 | % |

| Other Assets in Excess of Liabilities | | | 0.5 | % |

| | | | 100.0 | % |

Please refer to the Schedule of Investments that follows in this semi-annual report for a detail of the Fund’s holdings.

| RECURRENT MLP & INFRASTRUCTURE FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| April 30, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 70.9% | | | | |

| | | | | OIL & GAS PRODUCERS - 70.9% | | | | |

| | 1,328,605 | | | AltaGas Ltd. | | $ | 29,124,604 | |

| | 2,902,445 | | | Cenovus Energy, Inc. | | | 59,674,268 | |

| | 264,198 | | | Cheniere Energy, Inc. | | | 41,695,728 | |

| | 265,000 | | | DT Midstream, Inc. | | | 16,483,000 | |

| | 364,734 | | | Enbridge, Inc. | | | 12,962,646 | |

| | 2,782,350 | | | Equitrans Midstream Corporation | | | 37,645,196 | |

| | 1,294,560 | | | Keyera Corporation | | | 33,211,447 | |

| | 1,766,964 | | | Kinder Morgan, Inc. | | | 32,300,102 | |

| | 134,559 | | | Marathon Petroleum Corporation | | | 24,452,061 | |

| | 583,978 | | | ONEOK, Inc. | | | 46,204,339 | |

| | 1,354,549 | | | Pembina Pipeline Corporation | | | 47,680,125 | |

| | 264,306 | | | Phillips 66 | | | 37,851,262 | |

| | 1,333,608 | | | Suncor Energy, Inc. | | | 50,930,490 | |

| | 336,779 | | | Targa Resources Corporation | | | 38,413,013 | |

| | 169,390 | | | TC Energy Corporation | | | 6,072,632 | |

| | 144,163 | | | Valero Energy Corporation | | | 23,047,339 | |

| | 734,467 | | | Viper Energy, Inc. | | | 28,027,261 | |

| | 804,932 | | | Williams Companies, Inc. (The) | | | 30,877,192 | |

| | | | | TOTAL COMMON STOCKS (Cost $436,909,013) | | | 596,652,705 | |

| | | | | | | | | |

| | | | | MASTER LIMITED PARTNERSHIPS — 26.6% | | | | |

| | | | | METALS & MINING - 2.7% | | | | |

| | 1,001,080 | | | Alliance Resource Partners, L.P. | | | 22,454,224 | |

| | | | | | | | | |

| | | | | OIL & GAS PRODUCERS - 23.9% | | | | |

| | 3,706,546 | | | Energy Transfer, L.P. | | | 58,303,969 | |

| | 1,298,593 | | | Enterprise Products Partners, L.P. | | | 36,464,491 | |

| | 2,623,833 | | | Plains GP Holdings, L.P., Class A | | | 47,779,999 | |

| | 292,988 | | | Sunoco, L.P. | | | 16,495,224 | |

| | 1,251,885 | | | Western Midstream Partners, L.P. | | | 42,689,279 | |

| | | | | | | | 201,732,962 | |

| | | | | | | | | |

| | | | | TOTAL MASTER LIMITED PARTNERSHIPS (Cost $154,625,360) | | | 224,187,186 | |

| | | | | | | | | |

See accompanying notes to financial statements.

| RECURRENT MLP & INFRASTRUCTURE FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| April 30, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENT — 2.0% | | | | |

| | | | | MONEY MARKET FUND - 2.0% | | | | |

| | 16,593,771 | | | First American Government Obligations Fund, Class X, 5.23% (Cost $16,593,771)(a) | | $ | 16,593,771 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 99.5% (Cost $608,128,144) | | $ | 837,433,662 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 0.5% | | | 4,506,067 | |

| | | | | NET ASSETS - 100.0% | | $ | 841,939,729 | |

| | | | | | | | | |

| L.P. | - Limited Partnership |

| | |

| Ltd. | - Limited Company |

| | |

| (a) | Rate disclosed is the seven day effective yield as of April 30, 2024. |

| | |

See accompanying notes to financial statements.

| Recurrent MLP & Infrastructure Fund |

| STATEMENT OF ASSETS AND LIABILITIES (Unaudited) |

| April 30, 2024 |

| |

| ASSETS | | | | |

| Investment securities: | | | | |

| At cost | | $ | 608,128,144 | |

| At fair value | | $ | 837,433,662 | |

| Receivable for Fund shares sold | | | 1,129,767 | |

| Dividends receivable | | | 4,026,302 | |

| Interest receivable | | | 54,472 | |

| Prepaid expenses & other assets | | | 153,973 | |

| TOTAL ASSETS | | | 842,798,176 | |

| | | | | |

| LIABILITIES | | | | |

| Advisory fees payable | | | 618,669 | |

| Payable for Fund shares redeemed | | | 191,690 | |

| Payable to related parties | | | 27,716 | |

| Accrued expenses and other liabilities | | | 20,372 | |

| TOTAL LIABILITIES | | | 858,447 | |

| NET ASSETS | | $ | 841,939,729 | |

| | | | | |

| Net Assets Consist Of: | | | | |

| Paid in capital ($0 par value, unlimited shares authorized) | | $ | 586,849,531 | |

| Accumulated earnings | | | 255,090,198 | |

| NET ASSETS | | $ | 841,939,729 | |

| | | | | |

| Net Asset Value Per Share: | | | | |

| Class I Shares: | | | | |

| Net Assets | | $ | 841,939,729 | |

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | | | 37,249,850 | |

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share | | $ | 22.60 | |

| | | | | |

See accompanying notes to financial statements.

| Recurrent MLP & Infrastructure Fund |

| STATEMENT OF OPERATIONS (Unaudited) |

| For the Six Months Ended April 30, 2024 |

| |

| INVESTMENT INCOME | | | | |

| Dividends (Foreign taxes withheld: $755,245) | | $ | 17,757,987 | |

| Interest | | | 416,051 | |

| TOTAL INVESTMENT INCOME | | | 18,174,038 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees | | | 3,244,284 | |

| Administrative services fees | | | 223,438 | |

| Third party administrative services fees | | | 184,627 | |

| Transfer agent fees | | | 117,111 | |

| Registration fees | | | 42,809 | |

| Custodian fees | | | 28,157 | |

| Printing and postage expenses | | | 22,044 | |

| Chief compliance officer fees | | | 14,627 | |

| Audit and tax fees | | | 9,947 | |

| Legal fees | | | 8,433 | |

| Trustees fees and expenses | | | 7,842 | |

| Insurance fees | | | 7,246 | |

| Other expenses | | | 10,115 | |

| TOTAL EXPENSES | | | 3,920,680 | |

| NET INVESTMENT INCOME | | | 14,253,358 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | | | | |

| Net realized gain/(loss) on: | | | | |

| Investments | | | 24,623,452 | |

| Foreign currency translations | | | (5,630 | ) |

| Total realized gain | | | 24,617,822 | |

| | | | | |

| Net change in unrealized appreciation on: | | | | |

| Investments | | | 98,133,212 | |

| Foreign currency translations | | | 1,499 | |

| Total change in unrealized appreciation | | | 98,134,711 | |

| | | | | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 122,752,533 | |

| | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 137,005,891 | |

| | | | | |

See accompanying notes to financial statements.

| Recurrent MLP & Infrastructure Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| |

| | | Six Months Ended | | | Year Ended | |

| | | April 30, 2024 | | | October 31, | |

| | | (Unaudited) | | | 2023 | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 14,253,358 | | | $ | 19,968,126 | |

| Net realized gain on investments | | | 24,617,822 | | | | 19,181,467 | |

| Net change in unrealized appreciation on investments | | | 98,134,711 | | | | 5,349,119 | |

| Net increase in net assets resulting from operations | | | 137,005,891 | | | | 44,498,712 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Total distributions paid | | | (22,541,114 | ) | | | (29,349,244 | ) |

| Return of capital | | | — | | | | (6,480,004 | ) |

| Net decrease in net assets from distributions to shareholders | | | (22,541,114 | ) | | | (35,829,248 | ) |

| | | | | | | | | |

| FROM SHARES OF BENEFICIAL INTEREST | | | | | | | | |

| Proceeds from shares sold: | | | 128,908,768 | | | | 287,432,240 | |

| Net asset value of shares issued in reinvestment of distributions: | | | 16,446,824 | | | | 25,572,169 | |

| Payments for shares redeemed: | | | (48,645,580 | ) | | | (82,406,423 | ) |

| Net increase in net assets from shares of beneficial interest | | | 96,710,012 | | | | 230,597,986 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 211,174,789 | | | | 239,267,450 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year/period | | | 630,764,940 | | | | 391,497,490 | |

| End of year/period | | $ | 841,939,729 | | | $ | 630,764,940 | |

| | | | | | | | | |

| SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 6,152,085 | | | | 15,292,319 | |

| Shares reinvested | | | 780,800 | | | | 1,379,714 | |

| Shares redeemed | | | (2,333,331 | ) | | | (4,403,310 | ) |

| Net increase in shares of beneficial interest outstanding | | | 4,599,554 | | | | 12,268,723 | |

| | | | | | | | | |

See accompanying notes to financial statements.

| Recurrent MLP & Infrastructure Fund |

| FINANCIAL HIGHLIGHTS |

| |

Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Year/Period

| | | Class I | |

| | | For the Six Months Ended | | | For the Year Ended | | | For the Year Ended | | | For the Year Ended | | | For the Year Ended | | | For the Year Ended | |

| | | April 30, 2024 | | | October 31, | | | October 31, | | | October 31, | | | October 31, | | | October 31, | |

| | | (Unaudited) | | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| Net asset value, beginning of year/period | | $ | 19.32 | | | $ | 19.21 | | | $ | 15.54 | | | $ | 8.92 | | | $ | 17.18 | | | $ | 18.14 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Activity from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (1) | | | 0.41 | | | | 0.73 | | | | 0.51 | | | | 0.35 | | | | 0.46 | | | | 0.58 | |

| Net realized and unrealized gain/(loss) on investments (2) | | | 3.52 | | | | 0.68 | | | | 4.46 | | | | 7.57 | | | | (7.53 | ) | | | (0.24 | ) |

| Total from investment operations | | | 3.93 | | | | 1.41 | | | | 4.97 | | | | 7.92 | | | | (7.07 | ) | | | 0.34 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.65 | ) | | | (0.40 | ) | | | (0.18 | ) | | | (0.18 | ) | | | (0.07 | ) | | | (0.25 | ) |

| Net realized gains | | | — | | | | (0.65 | ) | | | — | | | | — | | | | — | | | | — | |

| Return of capital | | | — | | | | (0.25 | ) | | | (1.12 | ) | | | (1.12 | ) | | | (1.12 | ) | | | (1.05 | ) |

| Total distributions | | | (0.65 | ) | | | (1.30 | ) | | | (1.30 | ) | | | (1.30 | ) | | | (1.19 | ) | | | (1.30 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year/period | | $ | 22.60 | | | $ | 19.32 | | | $ | 19.21 | | | $ | 15.54 | | | $ | 8.92 | | | $ | 17.18 | |

| Total return (3) | | | 20.62 | % | | | 7.85 | % | | | 33.76 | % | | | 91.87 | % | | | (42.41 | )% | | | 1.53 | % |

| Net assets, at end of year/period (000’s) | | $ | 841,940 | | | $ | 630,765 | | | $ | 391,497 | | | $ | 221,659 | | | $ | 89,797 | | | $ | 54,765 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of gross expenses to average net assets (4) | | | 1.09 | % (8) | | | 1.10 | % | | | 1.15 | % | | | 1.25 | % | | | 1.38 | % (7) | | | 1.75 | % |

| Ratio of net expenses to average net assets (4) | | | 1.09 | % (8) | | | 1.10 | % | | | 1.23 | % (5) | | | 1.25 | % (5) | | | 1.26 | % (6,7) | | | 1.25 | % (6) |

| Ratio of net investment income to average net assets | | | 3.95 | % (8) | | | 3.88 | % | | | 2.93 | % | | | 2.59 | % | | | 3.89 | % | | | 3.13 | % |

| Portfolio Turnover Rate | | | 6 | % (9) | | | 7 | % | | | 10 | % | | | 22 | % | | | 32 | % | | | 52 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the year/period. |

| (2) | Net realized and unrealized gain/(loss) on investments per share are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with aggregate gains/(losses) in the statement of operations due to the share transactions for the period. |

| (3) | Total returns are historical and assume changes in share price and reinvestment of dividends and distributions. Total returns for periods of less than one year are not annualized. Total returns may be impacted by fee waivers/recapture. |

| (4) | Does not include the expenses of other investment companies in which the Fund invests, if any. |

| (5) | Represents the ratio of expenses to average net assets inclusive of the Advisor’s recapture of waived/reimbursed fees from prior periods. |

| (6) | Represents the ratio of expenses to average net assets net of fee waivers and/or expense reimbursements by the Advisor. |

| (7) | Includes tax expenses. If these expenses were excluded, the ratio of gross expenses to average net assets would be 1.37% and the ratio of net expenses to average net assets would be 1.25%. |

See accompanying notes to financial statements.

| Recurrent MLP & Infrastructure Fund |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) |

| April 30, 2024 |

Recurrent MLP & Infrastructure Fund (the “Fund”), is a series of shares of beneficial interest of the Two Roads Shared Trust (the “Trust”), a statutory trust organized under the laws of the State of Delaware on June 8, 2012, and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, open-end management investment company. The Fund offers Class I shares. The Fund commenced investment operations for Class I shares on November 2, 2017. The Fund’s investment objective is to seek total return including substantial current income from a portfolio of master limited partnerships (“MLPs”) and energy infrastructure investments.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles in the United States of America (“U.S. GAAP”) . The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The Fund is a registered investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services – Investment Companies”.

Securities Valuation – Securities listed on an exchange are valued at the last quoted sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ at the NASDAQ Official Closing Price. In the absence of a sale, such securities shall be valued at the mean between the current bid and ask prices on the primary exchange on the day of valuation. Short-term debt obligations having 60 days or less remaining until maturity, at the time of purchase, may be valued at amortized cost which approximates fair value.

The Fund may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable. These securities will be valued using the “fair value” procedures approved by the Trustees of the Trust (the “Board”). The Board has appointed the Advisor as its valuation designee (the “Valuation Designee”) for all fair value determinations and responsibilities, other than overseeing pricing service providers used by the Trust. This designation is subject to Board oversight and certain reporting and other requirements designed to facilitate the Board’s ability effectively to oversee the designee’s fair value determinations. The Valuation Designee may also enlist third party consultants such a valuation specialist at a public accounting firm, valuation consultant or financial officer of a security issuer on an as-needed basis to assist the Valuation Designee in determining a security-specific fair value. The Board is responsible for reviewing and approving fair value methodologies utilized by the Valuation Designee, approval of which shall be based upon whether the Valuation Designee followed the valuation procedures approved by the Board.

Valuation of Underlying Funds – The Fund may invest in portfolios of open-end or closed-end investment companies (the “Underlying Funds”). The Underlying Funds value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value according to the methods established by the board of directors of the Underlying Funds.

Open-end investment companies are valued at their respective net asset values as reported by such investment companies. The shares of many closed-end investment companies, after their initial public offering, frequently trade at a price per share, which is different than the net asset value per share. The difference represents a market premium or market discount of such shares. There can be no assurances that the market discount or market premium on shares of any closed-end investment company purchased by the Fund will not change.

Master Limited Partnerships (“MLPs”) – An MLP is an entity receiving partnership taxation treatment under the Internal Revenue Code of 1986, as amended (the “Code”) the partnership interests or “units” of which are traded on securities exchanges like shares of corporate stock. To qualify as an MLP for U.S. federal income tax purposes, an entity must receive at least 90% of its income from qualifying sources such as interest, dividends, income and gain from mineral or natural resources activities, income and gain from the transportation or storage of certain fuels, and, in certain circumstances, income

| Recurrent MLP & Infrastructure Fund |

| NOTES TO FINANCIAL STATEMENTS (Unaudited)(Continued) |

| April 30, 2024 |

and gain from commodities or futures, forwards and options with respect to commodities. For this purpose, mineral or natural resources activities include exploration, development, production, mining, refining, marketing and transportation (including pipelines) of oil and gas, minerals, geothermal energy, fertilizer, timber or industrial source carbon dioxide.

A typical MLP consists of a general partner and limited partners; however, some entities receiving partnership taxation treatment under the Code are established as limited liability companies (“LLCs”). The general partner of an MLP manages the partnership, has an ownership stake in the partnership and in some cases the general partners are eligible to receive an incentive distribution. The limited partners provide capital to the partnership, receive common units of the partnership, have a limited role in the operation and management of the partnership and are entitled to receive cash distributions with respect to their units. Currently, most MLPs operate in the energy, natural resources and real estate sectors. Due to their partnership structure, MLPs generally do not pay income taxes. Thus, unlike investors in corporate securities, direct MLP investors are generally not subject to double taxation (i.e., corporate level tax and tax on corporate dividends).

Fair Valuation Process – The applicable investments are valued by the Valuation Designee pursuant to valuation procedures approved by the Board. For example, fair value determinations are required for the following securities: (i) securities for which market quotations are insufficient or not readily available on a particular business day (including securities for which there is a short and temporary lapse in the provision of a price by the regular pricing source); (ii) securities for which, in the judgment of the Valuation Designee, the prices or values available do not represent the fair value of the instrument; factors which may cause the Valuation Designee to make such a judgment include, but are not limited to, the following: only a bid price or an asked price is available; the spread between bid and asked prices is substantial; the frequency of sales; the thinness of the market; the size of reported trades; and actions of the securities markets, such as the suspension or limitation of trading; (iii) securities determined to be illiquid; and (iv) securities with respect to which an event that affects the value thereof has occurred (a “significant event”) since the closing prices were established on the principal exchange on which they are traded, but prior to the Fund’s calculation of its net asset value. Specifically, interests in commodity pools or managed futures pools are valued on a daily basis by reference to the closing market prices of each futures contract or other asset held by a pool, as adjusted for pool expenses. Restricted or illiquid securities, such as private investments or non-traded securities are valued based upon the current bid for the security from two or more independent dealers or other parties reasonably familiar with the facts and circumstances of the security (who should take into consideration all relevant factors as may be appropriate under the circumstances). If a current bid from such independent dealers or other independent parties is unavailable, the Valuation Designee shall determine the fair value of such security using the following factors: (i) the type of security; (ii) the cost at date of purchase; (iii) the size and nature of the Fund’s holdings; (iv) the discount from market value of unrestricted securities of the same class at the time of purchase and subsequent thereto; (v) information as to any transactions or offers with respect to the security; (vi) the nature and duration of restrictions on disposition of the security and the existence of any registration rights; (vii) how the yield of the security compares to similar securities of companies of similar or equal creditworthiness; (viii) the level of recent trades of similar or comparable securities; (ix) the liquidity characteristics of the security; (x) current market conditions; and (xi) the market value of any securities into which the security is convertible or exchangeable.

The Fund utilizes various methods to measure the fair value of all of its investments on a recurring basis. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that a Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument in an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing a Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

| Recurrent MLP & Infrastructure Fund |

| NOTES TO FINANCIAL STATEMENTS (Unaudited)(Continued) |

| April 30, 2024 |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of April 30, 2024 for the Fund’s assets and liabilities measured at fair value:

| Assets * | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 596,652,705 | | | $ | — | | | $ | — | | | $ | 596,652,705 | |

| Master Limited Partnerships | | | 224,187,186 | | | | — | | | | — | | | | 224,187,186 | |

| Short-Term Investment | | | 16,593,771 | | | | — | | | | — | | | | 16,593,771 | |

| Total Investments | | $ | 837,433,662 | | | $ | — | | | $ | — | | | $ | 837,433,662 | |

| * | Refer to the Portfolio of Investments for classification. |

The Fund did not hold any Level 2 or 3 securities during the six months ended April 30, 2024.

Security Transactions and Investment Income – Security transactions are accounted for on trade date basis. Interest income is recognized on an accrual basis. Discounts are accreted and premiums are amortized on securities purchased over the lives of the respective securities. Dividend income is recorded on the ex-dividend date. Distributions received from the Fund’s investments in MLPs generally are comprised of income and return of capital. The Fund records investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on historical information available from each MLP and these estimates may subsequently be revised. Realized gains or losses from sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds.

Foreign Currency Translations – The accounting records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency, and income receipts and expense payments are translated into U.S. dollars using the prevailing exchange rate at the London market close. Purchases and sales of securities are translated into U.S. dollars at the contractual currency rates established at the approximate time of the trade.

Net realized gains and losses on foreign currency transactions represent net gains and losses from currency realized between the trade and settlement dates on securities transactions and the difference between income accrued versus income received. The effects of changes in foreign currency exchange rates on investments in securities are included with the net realized and unrealized gain or loss on investments.

Dividends and Distributions to Shareholders – Dividends from net investment income are declared and distributed quarterly for the Fund. Dividends from net realized gains are distributed annually. Dividends from net investment income and distributions from net realized gains are recorded on ex-dividend date and determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. These “book/tax” differences are considered either temporary (i.e., deferred losses, capital loss carry forwards) or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment. Temporary differences do not require reclassification.

Federal Income Taxes – It is the Fund’s policy to qualify as a regulated investment company by complying with the provisions of the Internal Revenue Code that are applicable to regulated investment companies and to distribute substantially all of their taxable income and net realized gains to shareholders. Therefore, no federal income tax provision has been recorded.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years ended October 31, 2020-October 31, 2022, or expected to be taken in the Fund’s October 31, 2023 year-end tax returns. The Fund identifies its major tax jurisdictions as U.S. Federal, Ohio, and foreign jurisdictions where the Fund

| Recurrent MLP & Infrastructure Fund |

| NOTES TO FINANCIAL STATEMENTS (Unaudited)(Continued) |

| April 30, 2024 |

makes significant investments. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

Expenses – Expenses of the Trust that are directly identifiable to a specific fund are charged to that fund. Expenses, which are not readily identifiable to a specific fund, are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and the relative sizes of the funds in the Trust.

Indemnification – The Trust indemnifies its officers and Trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Fund enter into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, the risk of loss due to these warranties and indemnities appears to be remote.

| 3. | INVESTMENT TRANSACTIONS AND ASSOCIATED RISKS |

For the six months ended April 30, 2024, the aggregate purchases and sales of investments (excluding short-term investments) was $127,339,731 and $40,516,224, respectively.

Principal Investment Risks – The Fund’s investments in securities, financial instruments and derivatives expose it to various risks, certain of which are discussed below. Please refer to the Fund’s prospectus and statement of additional information (“SAI”) for further information regarding the risks associated with the Fund’s investments, which include but are not limited to active trading risk, cash flow risk, concentration risk, cybersecurity risk, energy sector focus risk, energy infrastructure industry focus risks (including acquisition risk, catastrophic event risk, commodity price risk, depletion risk, environmental and regulatory risk, interest rate risk, natural resources risk, supply and demand risk, and weather risk), equity risk, gap risk, geographic and sector risk, IPO risk, liquidity risk, management risk, market capitalization risk, market events risk, market risk, master limited partnership risk, MLP tax risk, non-diversification risk, portfolio turnover risk, RIC qualification risk, and volatility risk.

Concentration Risk – Because the Fund may focus on one or more industries or sectors of the economy, its performance depends in large part on the performance of those sectors or industries. As a result, an adverse economic, business, regulatory or political development affecting that industry may cause the value of an investment may fluctuate more widely than it would in a fund that is diversified across industries and sectors.

Energy Sector Focus Risk – The Fund focuses its investments in the energy sector which is comprised of energy, industrial, consumer, infrastructure and logistics companies, and will therefore be susceptible to adverse economic, environmental, business, regulatory or other occurrences affecting that sector. The energy markets have experienced significant volatility in recent periods, including a historic drop in crude oil and natural gas prices in April 2020 attributable to the significant decrease in demand for oil and other energy commodities as a result of the slowdown in economic activity due to the COVID-19 pandemic as well as price competition among key oil-producing countries. The low price environment caused financial hardship for energy companies and led to energy companies defaulting on debt and filing for bankruptcy. The energy sector has historically experienced substantial price volatility. At times, the performance of these investments may lag the performance of other sectors or the market as a whole. Companies operating in the energy sector are subject to specific risks, including, among others, fluctuations in commodity prices; reduced consumer demand for commodities such as oil, natural gas or petroleum products; reduced availability of natural gas or other commodities for transporting, processing, storing or delivering; slowdowns in new construction; extreme weather or other natural disasters; and threats of attack by terrorists on energy assets. Additionally, energy sector companies are subject to substantial government regulation and changes in the regulatory environment for energy companies may adversely impact their profitability. Over time, depletion of natural gas reserves and other energy reserves may also affect the profitability of energy companies.

| Recurrent MLP & Infrastructure Fund |

| NOTES TO FINANCIAL STATEMENTS (Unaudited)(Continued) |

| April 30, 2024 |

Energy Infrastructure Industry Focus Risk – A substantial percentage of the Fund invests primarily in the energy infrastructure industry. As a result, the Fund will therefore be susceptible to adverse economic, environmental or regulatory occurrences affecting the energy infrastructure industry. Risks associated with investments in MLPs and other companies operating in the energy infrastructure industry include but are not limited to the following:

| ○ | Acquisition Risk – Energy infrastructure companies owned by the Fund may depend on their ability to make acquisitions that increase adjusted operating surplus per unit in order to increase distributions to unit holders. |

| ○ | Catastrophic Event Risk – MLPs and other companies operating in the energy infrastructure industry are subject to many dangers inherent in the production, exploration, management, transportation, processing and distribution of natural gas, natural gas liquids, crude oil, refined petroleum and petroleum products and other hydrocarbons. Any occurrence of a catastrophic event, such as a terrorist attack, could bring about a limitation, suspension or discontinuation of the operations of MLPs and other companies operating in the energy infrastructure industry. |

| ○ | Commodity Price Risk – MLPs and other companies operating in the energy infrastructure industry may be affected by fluctuations in the prices of energy commodities. Fluctuations in energy infrastructure commodity prices would directly impact companies that own such energy infrastructure commodities and could indirectly impact companies that engage in transportation, storage, processing, distribution or marketing of such energy infrastructure commodities. |

| ○ | Depletion Risk – Energy infrastructure companies engaged in the exploration, development, management, gathering or production of energy commodities face the risk that commodity reserves are depleted over time. Such companies seek to increase their reserves through expansion of their current businesses, acquisitions, further development of their existing sources of energy infrastructure commodities or exploration of new sources of energy infrastructure commodities or by entering into long-term contracts for additional reserves; however, there are risks associated with each of these potential strategies. |

| ○ | Environmental and Regulatory Risk – Companies operating in the energy infrastructure industry are subject to significant regulation of their operations by federal, state and local governmental agencies. Additionally, voluntary initiatives and mandatory controls have been adopted or are being studied and evaluated, both in the United States (the “U.S.”) and worldwide, to address current potentially hazardous environmental issues, including hydraulic fracturing and related waste disposal and geological concerns, as well as those that may develop in the future. The Fund cannot predict whether regulatory agencies will take any action to adopt new regulations or provide guidance that will adversely impact the energy infrastructure industry. In addition, the new administration has recently announced several initiatives aimed at addressing climate change. It is unclear how these initiatives could impact the Fund’s investments. The current presidential administration could significantly impact the regulation of U.S. financial markets and it is not possible to predict, what, if any, changes will be made or their potential effect on the economy, securities markets, energy infrastructure and natural resources markets, real estate markets, existing trade, tax and energy and infrastructure policies, among others. Additionally, actions taken may impact different sectors of the energy and natural resources markets in disparate ways or may impact specific issuers in a given sector in differing ways. The Adviser cannot predict the effects of changing regulations or policies on the Fund’s portfolio, and the Fund may be affected by governmental action in ways that are not foreseeable. There is a possibility that such actions could have a significant adverse effect on the Fund and its ability to achieve its investment objective. At any time after the date of this Prospectus, legislation or regulation may be enacted that could negatively affect the assets of the Fund or the issuers of such assets or may change the way in which the Fund itself is regulated. |

| ○ | Interest Rate Risk – Rising interest rates could increase the cost of capital thereby increasing operating costs and reducing the ability of MLPs and other companies operating in the energy industry to carry out acquisitions or expansions in a cost-effective manner. Rising interest rates may also impact the price of energy infrastructure securities as the yields on alternative investments increase. |

| ○ | Natural Resources Risk – The Fund’s investments in natural resources issuers (including MLPs) is susceptible to adverse economic, environmental, business, regulatory or other occurrences affecting that sector. The natural resources sector has historically experienced substantial price volatility. At times, the performance of these investments may lag the performance of other sectors or the market as a whole. Companies operating in the natural resources sector are subject to specific risks, including, among others, fluctuations in commodity prices; reduced consumer demand for commodities such as oil, natural gas or petroleum products; reduced availability of natural gas or other commodities for transporting, processing, storing or delivering; slowdowns in new construction; domestic and global competition, extreme weather or other natural disasters; and threats of attack by terrorists on energy assets. Additionally, natural resource sector companies are subject to substantial government regulation, including |

| Recurrent MLP & Infrastructure Fund |

| NOTES TO FINANCIAL STATEMENTS (Unaudited)(Continued) |

| April 30, 2024 |

environmental regulation and liability for environmental damage, and changes in the regulatory environment for energy companies may adversely impact their profitability. Over time, depletion of natural gas reserves and other natural resources reserves may also affect the profitability of natural resources companies.

| ○ | Supply and Demand Risk – Companies in the energy infrastructure industry may be impacted by the levels of supply and demand for energy infrastructure commodities. The demand for oil and other energy commodities was adversely impacted by the market disruption and slowdown in economic activity resulting from the COVID-19 pandemic. Future pandemics could lead to reduced production and price volatility. |

| ○ | Weather Risk – Weather plays a role in the seasonality of some energy infrastructure companies’ cash flows, and extreme weather conditions could adversely affect performance and cash flows of those companies. |

Equity Risk – Common stocks are susceptible to general stock market fluctuations, volatile increases and decreases in value as market confidence in and perceptions of their issuers change, and unexpected trading activity among retail investors. Factors that may influence the price of equity securities include developments affecting a specific company or industry, or changing economic, political or market conditions. Preferred stocks are subject to the risk that the dividend on the stock may be changed or omitted by the issuer, and that participation in the growth of an issuer may be limited.

Market Risk – Overall market risk may affect the value of individual instruments in which the Fund invests. The Fund is subject to the risk that the securities markets will move down, sometimes rapidly and unpredictably, based on overall economic conditions and other factors, which may negatively affect the Fund’s performance. Factors such as domestic and foreign (non-U.S.) economic growth and market conditions, real or perceived adverse economic or political conditions, military conflict, acts of terrorism, social unrest, natural disasters, recessions, inflation, changes in interest rate levels, supply chain disruptions, sanctions, the spread of infectious illness or other public health threats, lack of liquidity in the bond or other markets, volatility in the equities markets, adverse investor sentiment, and political events affect the securities markets. U.S. and foreign stock markets have experienced periods of substantial price volatility in the past and may do so again in the future. Securities markets also may experience long periods of decline in value. A change in financial condition or other event affecting a single issuer or market may adversely impact securities markets as a whole. Rates of inflation have recently risen. The value of assets or income from an investment may be worth less in the future as inflation decreases the value of money. As inflation increases, the real value of the Fund’s assets can decline as can the value of the Fund’s distributions. When the value of the Fund’s investments goes down, your investment in the Fund decreases in value and you could lose money.

Local, state, regional, national or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on the Fund and its investments and could result in decreases to the Fund’s net asset value. Political, geopolitical, natural and other events, including war, terrorism, trade disputes, government shutdowns, market closures, natural and environmental disasters, epidemics, pandemics and other public health crises and related events and governments’ reactions to such events have led, and in the future may lead, to economic uncertainty, decreased economic activity, increased market volatility and other disruptive effects on U.S. and global economies and markets. Such events may have significant adverse direct or indirect effects on the Fund and its investments. For example, a widespread health crisis such as a global pandemic could cause substantial market volatility, exchange trading suspensions and closures, impact the ability to complete redemptions, and affect Fund performance. A health crisis may exacerbate other pre-existing political, social and economic risks. In addition, the increasing interconnectedness of markets around the world may result in many markets being affected by events or conditions in a single country or region or events affecting a single or small number of issuers.

Master Limited Partnership Risk – An investment in MLP units involves certain risks which differ from an investment in the securities of a corporation. Holders of MLP units have limited control and voting rights on matters affecting the partnership. In addition, there are certain tax risks associated with an investment in MLP units and conflicts of interest exist between common unit holders of MLPs and the general partner, including those arising from incentive distribution payments. The MLP market may be adversely impacted by negative investor perceptions, such as reaction to reduced distributions. Risks of MLPs include the following: a decrease in the production of natural gas, natural gas liquids, crude oil, coal or other energy commodities or a decrease in the volume of such commodities available for transportation, mining, processing, storage or distribution may adversely impact the financial performance of MLPs or MLP-related securities. In addition, investing in MLPs involves certain risks related to investing in the underlying assets of the MLPs. The amount of cash that

| Recurrent MLP & Infrastructure Fund |

| NOTES TO FINANCIAL STATEMENTS (Unaudited)(Continued) |

| April 30, 2024 |

any MLP has available to pay its unit holders in the form of distributions/dividends depends on the amount of cash flow generated from such company’s operations. Cash flow from operations will vary from quarter to quarter and is largely dependent on factors affecting the MLP’s operations and factors affecting the energy, natural resources or real estate sectors in general. MLPs were adversely impacted by the reduced demand for oil and other energy commodities as a result of the slowdown in economic activity resulting from the spread of the COVID-19 pandemic, which triggered an unprecedented sell-off of energy pipeline and midstream companies in 2020. Recently, global oil prices have experienced significant volatility, including a period where an oil-price futures contract fell into negative territory for the first time in history. Reduced production and continued oil price volatility may adversely impact the value of the Fund’s investments in MLPs and energy infrastructure companies.

MLP Tax Risk – Historically, MLPs have been able to offset a significant portion of their taxable income with tax deductions, including depreciation and amortization expense deductions. A change in current tax law, or a change in the business of a given MLP, could result in an MLP being treated as a corporation or other form of taxable entity for U.S. federal income tax purposes, which would result in the MLP being required to pay U.S. federal income tax, excise tax or other form of tax on its taxable income. The classification of an MLP as a corporation or other form of taxable entity for U.S. federal income tax purposes could have the effect of reducing the amount of cash available for distribution by the MLP and could cause any such distributions received by the Fund to be taxed as dividend income, return of capital, or capital gain. Thus, if any of the MLPs owned by the Fund were treated as corporations or other forms of taxable entity for U.S. federal income tax purposes, the after-tax return to the Fund with respect to its investment in such MLPs could be materially reduced which could cause a material decrease in the net asset value per share (“NAV”) of the Fund’s shares.

| 4. | INVESTMENT ADVISORY AGREEMENT AND TRANSACTIONS WITH RELATED PARTIES |

Recurrent Investment Advisors, LLC serves as the Fund’s investment advisor. Pursuant to an advisory agreement with the Trust on behalf of the Fund, the Advisor, under the oversight of the Board, directs the daily operations of the Fund and supervises the performance of administrative and professional services provided by others. As compensation for its services and the related expenses borne by the Advisor, the Fund pays the Advisor a fee computed and accrued daily paid monthly, based on the Fund’s average daily net assets and is computed at the annual rate of 0.90%. Pursuant to the advisory agreement, the Fund incurred $3,244,284 in advisory fees for the six months ended April 30, 2024. As of April 30, 2024, the amount due to Advisor from the Fund was $618,669.