UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-22718 |

| | |

| Two Roads Shared Trust |

| (Exact name of registrant as specified in charter) |

| |

| 225 Pictoria Drive, Suite 450, Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

| | |

| The Corporation Trust Company |

| 1209 Orange Street, Wilmington, DE 19801 |

| (Name and address of agent for service) |

| |

| Registrant’s telephone number, including area code: | 631-490-4300 | |

| | | |

| Date of fiscal year end: | 4/30 | |

| | | |

| Date of reporting period: | 10/31/2024 | |

Item 1. Reports to Stockholders.

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Holbrook Income Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.holbrookfunds.com/resources. You can also request this information by contacting us at 1-877-345-8646.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $66 | 1.29% |

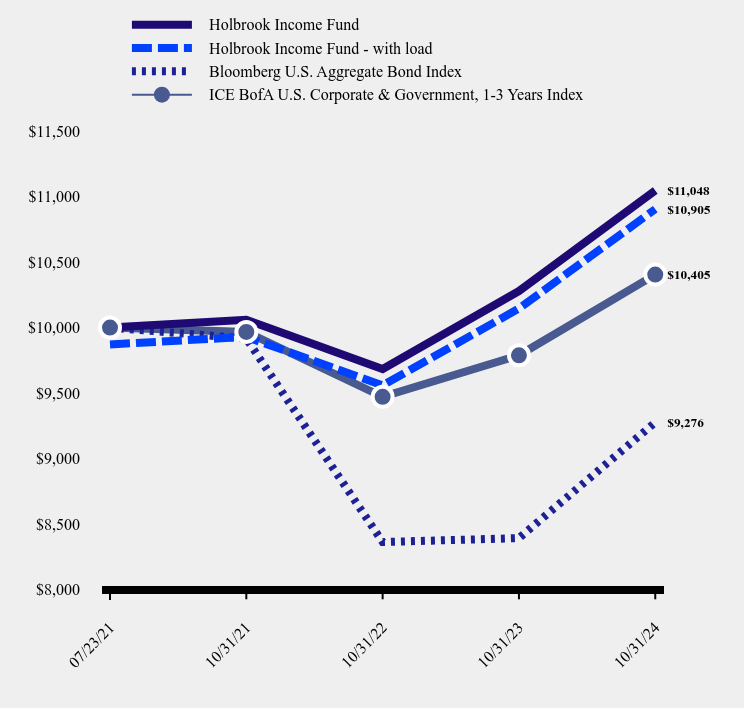

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Holbrook Income Fund | Holbrook Income Fund - with load | Bloomberg U.S. Aggregate Bond Index | ICE BofA U.S. Corporate & Government, 1-3 Years Index |

|---|

| 07/23/21 | $10,000 | $9,871 | $10,000 | $10,000 |

| 10/31/21 | $10,059 | $9,929 | $9,916 | $9,967 |

| 10/31/22 | $9,683 | $9,558 | $8,361 | $9,471 |

| 10/31/23 | $10,279 | $10,146 | $8,391 | $9,788 |

| 10/31/24 | $11,048 | $10,905 | $9,276 | $10,405 |

Average Annual Total Returns

| 6 months | 1 Year | Since Inception (July 23, 2021) |

|---|

| Holbrook Income Fund | | | |

| Without Load | 3.73% | 7.49% | 3.09% |

| With Load | 2.46% | 6.18% | 2.68% |

| Bloomberg U.S. Aggregate Bond Index | 5.31% | 10.55% | -2.27% |

| ICE BofA U.S. Corporate & Government, 1-3 Years Index | 3.71% | 6.31% | 1.22% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$1,730,771,137

- Number of Portfolio Holdings201

- Advisory Fee $6,565,612

- Portfolio Turnover18%

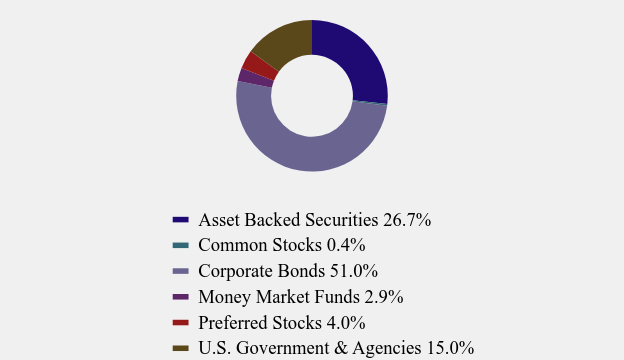

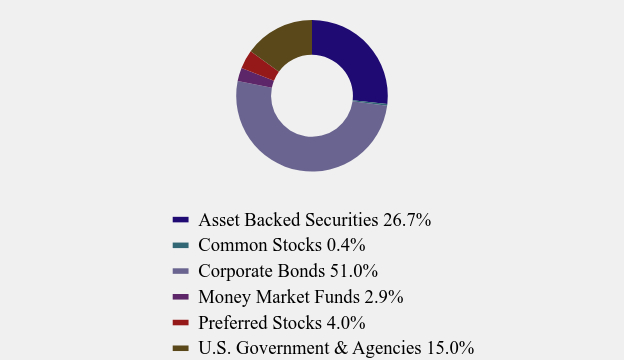

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 26.7% |

| Common Stocks | 0.4% |

| Corporate Bonds | 51.0% |

| Money Market Funds | 2.9% |

| Preferred Stocks | 4.0% |

| U.S. Government & Agencies | 15.0% |

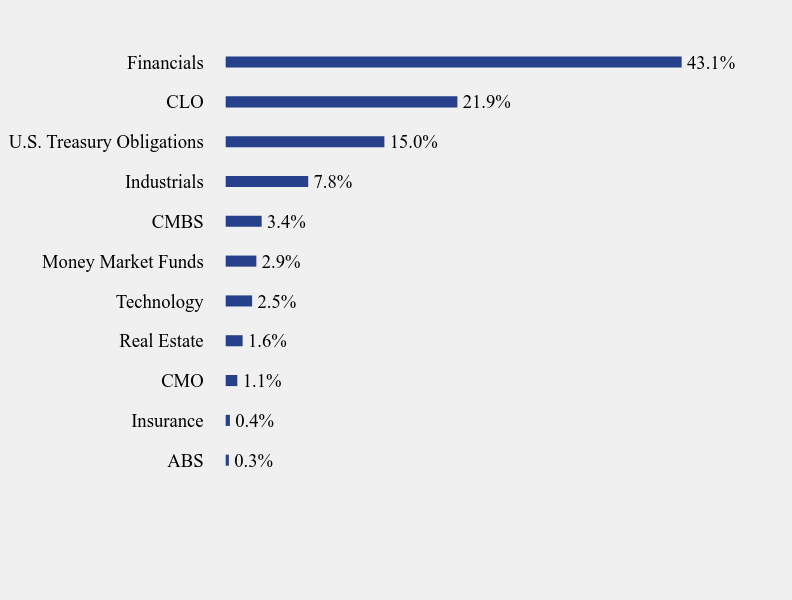

What did the Fund invest in?

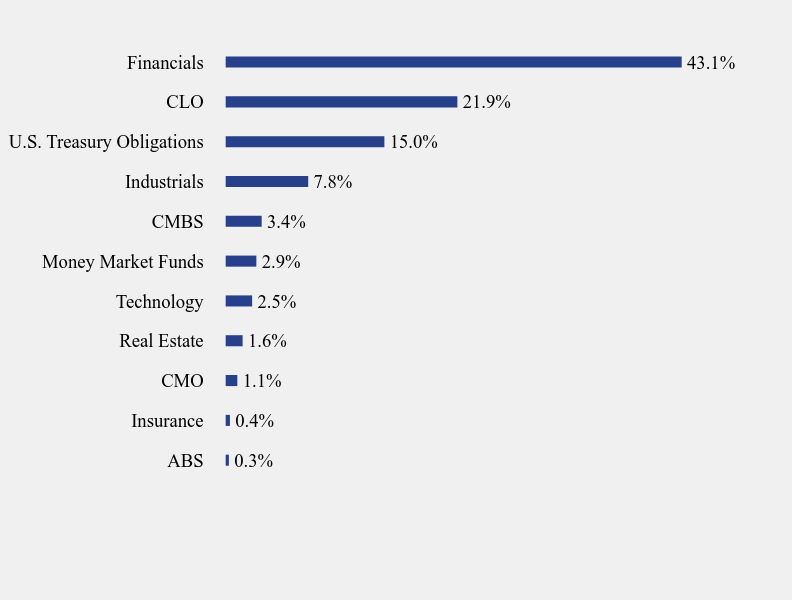

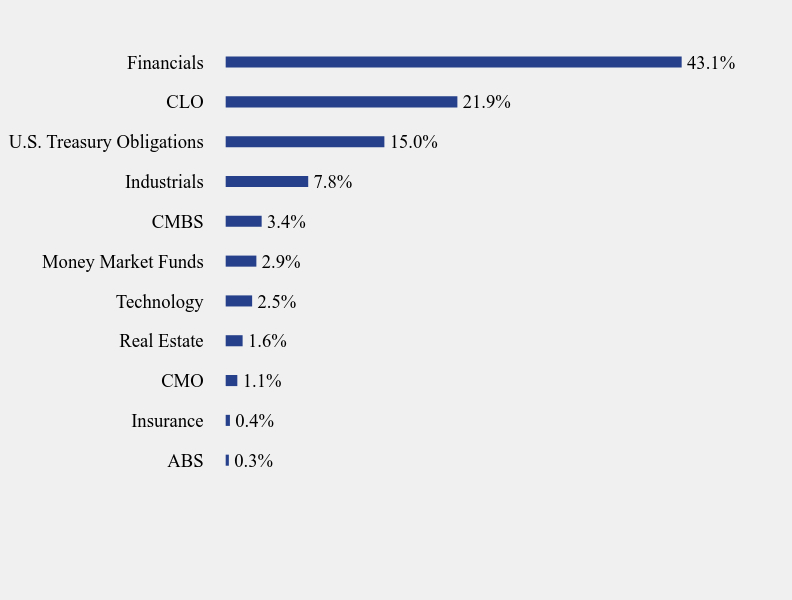

Sector Weighting (% of net assets)

| Value | Value |

|---|

| ABS | 0.3% |

| Insurance | 0.4% |

| CMO | 1.1% |

| Real Estate | 1.6% |

| Technology | 2.5% |

| Money Market Funds | 2.9% |

| CMBS | 3.4% |

| Industrials | 7.8% |

| U.S. Treasury Obligations | 15.0% |

| CLO | 21.9% |

| Financials | 43.1% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| United States Treasury Inflation Indexed Bonds, 2.375%, 01/15/25 | 3.3% |

| B Riley Financial, Inc. | 3.1% |

| United States Treasury Inflation Indexed Bonds, 0.125%, 04/15/25 | 2.9% |

| United States Treasury Inflation Indexed Bonds, 0.375%, 07/15/25 | 2.8% |

| Babcock & Wilcox Enterprises, Inc. | 2.8% |

| Synchronoss Technologies, Inc. | 2.4% |

| United States Treasury Inflation Indexed Bonds, 3.875%, 04/15/29 | 2.4% |

| United States Treasury Inflation Indexed Bonds, 0.125%, 10/15/25 | 2.3% |

| Charah Solutions, Inc. | 2.2% |

| Saratoga Investment Corporation, 4.375%, 02/28/26 | 2.2% |

No material changes occurred during the period ended October 31, 2024.

Holbrook Income Fund - Class A (HOBAX)

Semi-Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://www.holbrookfunds.com/resources), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Holbrook Income Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.holbrookfunds.com/resources. You can also request this information by contacting us at 1-877-345-8646.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $53 | 1.04% |

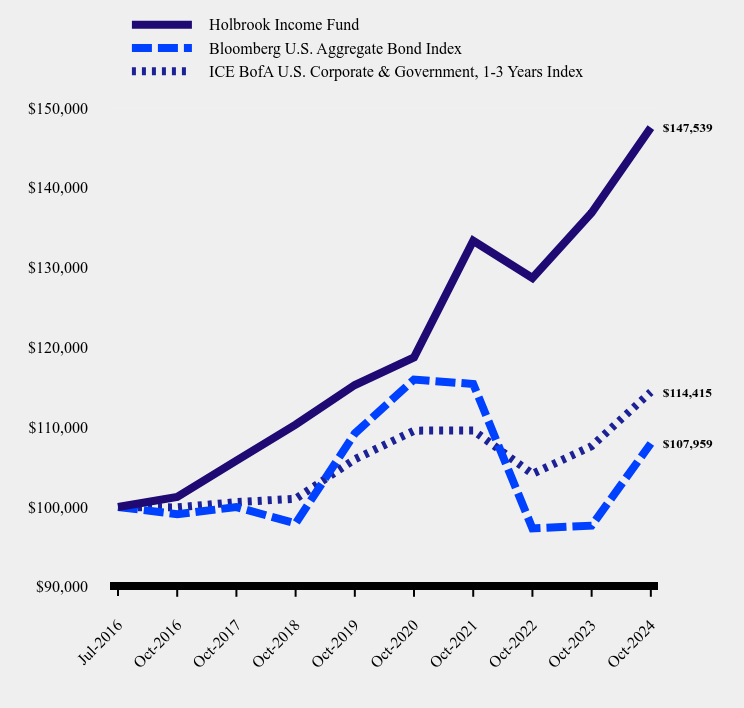

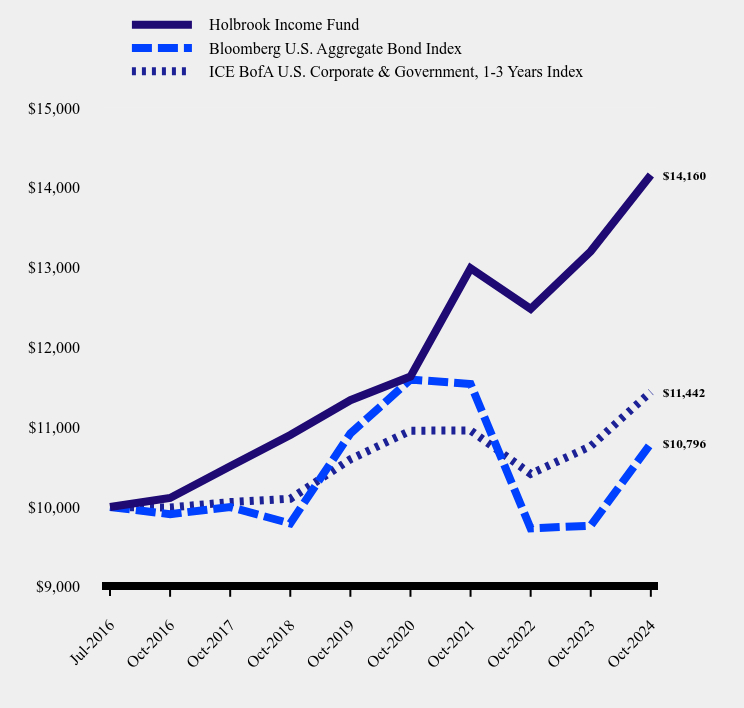

How has the Fund performed since inception?

Total Return Based on $100,000 Investment

| Holbrook Income Fund | Bloomberg U.S. Aggregate Bond Index | ICE BofA U.S. Corporate & Government, 1-3 Years Index |

|---|

| Jul-2016 | $100,000 | $100,000 | $100,000 |

| Oct-2016 | $101,263 | $99,096 | $99,944 |

| Oct-2017 | $105,816 | $99,991 | $100,613 |

| Oct-2018 | $110,324 | $97,938 | $101,026 |

| Oct-2019 | $115,283 | $109,210 | $105,972 |

| Oct-2020 | $118,748 | $115,967 | $109,564 |

| Oct-2021 | $133,353 | $115,412 | $109,591 |

| Oct-2022 | $128,695 | $97,313 | $104,146 |

| Oct-2023 | $136,863 | $97,659 | $107,622 |

| Oct-2024 | $147,539 | $107,959 | $114,415 |

Average Annual Total Returns

| 6 Months | 1 Year | 5 Years | Since Inception (July 6, 2016) |

|---|

| Holbrook Income Fund | 3.96% | 7.80% | 5.06% | 4.79% |

| Bloomberg U.S. Aggregate Bond Index | 5.31% | 10.55% | -0.23% | 0.92% |

| ICE BofA U.S. Corporate & Government, 1-3 Years Index | 3.71% | 6.31% | 1.54% | 1.63% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$1,730,771,137

- Number of Portfolio Holdings201

- Advisory Fee $6,565,612

- Portfolio Turnover18%

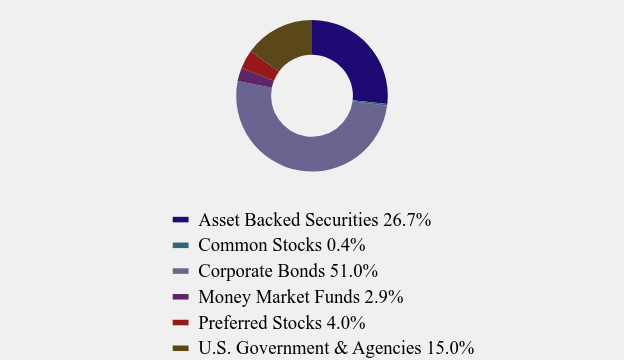

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 26.7% |

| Common Stocks | 0.4% |

| Corporate Bonds | 51.0% |

| Money Market Funds | 2.9% |

| Preferred Stocks | 4.0% |

| U.S. Government & Agencies | 15.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| ABS | 0.3% |

| Insurance | 0.4% |

| CMO | 1.1% |

| Real Estate | 1.6% |

| Technology | 2.5% |

| Money Market Funds | 2.9% |

| CMBS | 3.4% |

| Industrials | 7.8% |

| U.S. Treasury Obligations | 15.0% |

| CLO | 21.9% |

| Financials | 43.1% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| United States Treasury Inflation Indexed Bonds, 2.375%, 01/15/25 | 3.3% |

| B Riley Financial, Inc. | 3.1% |

| United States Treasury Inflation Indexed Bonds, 0.125%, 04/15/25 | 2.9% |

| United States Treasury Inflation Indexed Bonds, 0.375%, 07/15/25 | 2.8% |

| Babcock & Wilcox Enterprises, Inc. | 2.8% |

| Synchronoss Technologies, Inc. | 2.4% |

| United States Treasury Inflation Indexed Bonds, 3.875%, 04/15/29 | 2.4% |

| United States Treasury Inflation Indexed Bonds, 0.125%, 10/15/25 | 2.3% |

| Charah Solutions, Inc. | 2.2% |

| Saratoga Investment Corporation, 4.375%, 02/28/26 | 2.2% |

No material changes occurred during the period ended October 31, 2024.

Holbrook Income Fund - Class I (HOBIX)

Semi-Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://www.holbrookfunds.com/resources), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Holbrook Income Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.holbrookfunds.com/resources. You can also request this information by contacting us at 1-877-345-8646.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor | $79 | 1.54% |

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Holbrook Income Fund | Bloomberg U.S. Aggregate Bond Index | ICE BofA U.S. Corporate & Government, 1-3 Years Index |

|---|

| Jul-2016 | $10,000 | $10,000 | $10,000 |

| Oct-2016 | $10,113 | $9,910 | $9,994 |

| Oct-2017 | $10,510 | $9,999 | $10,061 |

| Oct-2018 | $10,902 | $9,794 | $10,103 |

| Oct-2019 | $11,338 | $10,921 | $10,597 |

| Oct-2020 | $11,634 | $11,597 | $10,956 |

| Oct-2021 | $12,992 | $11,541 | $10,959 |

| Oct-2022 | $12,483 | $9,731 | $10,415 |

| Oct-2023 | $13,204 | $9,766 | $10,762 |

| Oct-2024 | $14,160 | $10,796 | $11,442 |

Average Annual Total Returns

| 6 Months | 1 Year | 5 Years | Since Inception (July 6, 2016) |

|---|

| Holbrook Income Fund | 3.70% | 7.24% | 4.55% | 4.27% |

| Bloomberg U.S. Aggregate Bond Index | 5.31% | 10.55% | -0.23% | 0.92% |

| ICE BofA U.S. Corporate & Government, 1-3 Years Index | 3.71% | 6.31% | 1.54% | 1.63% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$1,730,771,137

- Number of Portfolio Holdings201

- Advisory Fee $6,565,612

- Portfolio Turnover18%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 26.7% |

| Common Stocks | 0.4% |

| Corporate Bonds | 51.0% |

| Money Market Funds | 2.9% |

| Preferred Stocks | 4.0% |

| U.S. Government & Agencies | 15.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| ABS | 0.3% |

| Insurance | 0.4% |

| CMO | 1.1% |

| Real Estate | 1.6% |

| Technology | 2.5% |

| Money Market Funds | 2.9% |

| CMBS | 3.4% |

| Industrials | 7.8% |

| U.S. Treasury Obligations | 15.0% |

| CLO | 21.9% |

| Financials | 43.1% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| United States Treasury Inflation Indexed Bonds, 2.375%, 01/15/25 | 3.3% |

| B Riley Financial, Inc. | 3.1% |

| United States Treasury Inflation Indexed Bonds, 0.125%, 04/15/25 | 2.9% |

| United States Treasury Inflation Indexed Bonds, 0.375%, 07/15/25 | 2.8% |

| Babcock & Wilcox Enterprises, Inc. | 2.8% |

| Synchronoss Technologies, Inc. | 2.4% |

| United States Treasury Inflation Indexed Bonds, 3.875%, 04/15/29 | 2.4% |

| United States Treasury Inflation Indexed Bonds, 0.125%, 10/15/25 | 2.3% |

| Charah Solutions, Inc. | 2.2% |

| Saratoga Investment Corporation, 4.375%, 02/28/26 | 2.2% |

No material changes occurred during the period ended October 31, 2024.

Holbrook Income Fund - Investor (HOBEX)

Semi-Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://www.holbrookfunds.com/resources), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Holbrook Structured Income Fund

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Holbrook Structured Income Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.holbrookfunds.com/resources. You can also request this information by contacting us at 1-877-345-8646.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $84 | 1.64% |

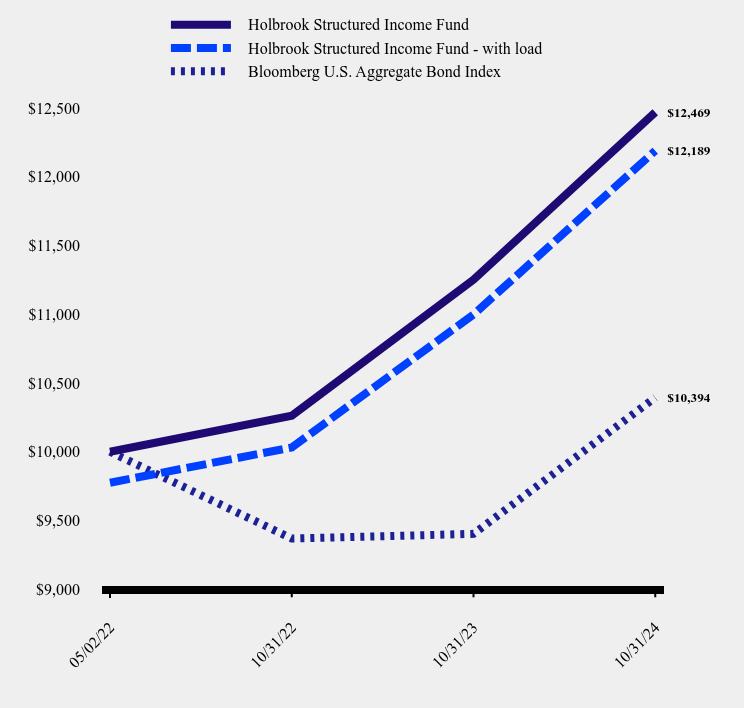

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Holbrook Structured Income Fund | Holbrook Structured Income Fund - with load | Bloomberg U.S. Aggregate Bond Index |

|---|

| 05/02/22 | $10,000 | $9,775 | $10,000 |

| 10/31/22 | $10,262 | $10,031 | $9,369 |

| 10/31/23 | $11,251 | $10,998 | $9,403 |

| 10/31/24 | $12,469 | $12,189 | $10,394 |

Average Annual Total Returns

| 6 months | 1 Year | Since Inception (May 2, 2022) |

|---|

| Holbrook Structured Income Fund | | | |

| Without Load | 4.10% | 10.83% | 9.23% |

| With Load | 1.72% | 8.38% | 8.24% |

| Bloomberg U.S. Aggregate Bond Index | 5.31% | 10.55% | 1.56% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$447,049,214

- Number of Portfolio Holdings142

- Advisory Fee $2,093,889

- Portfolio Turnover20%

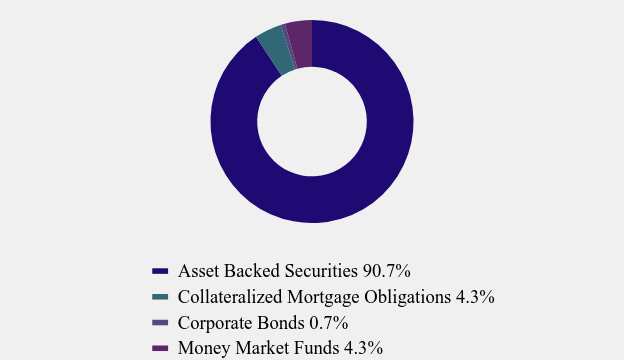

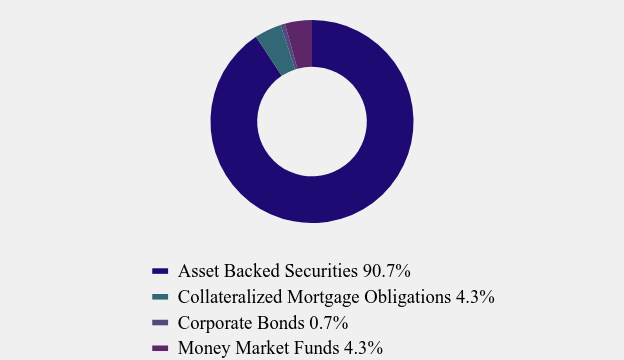

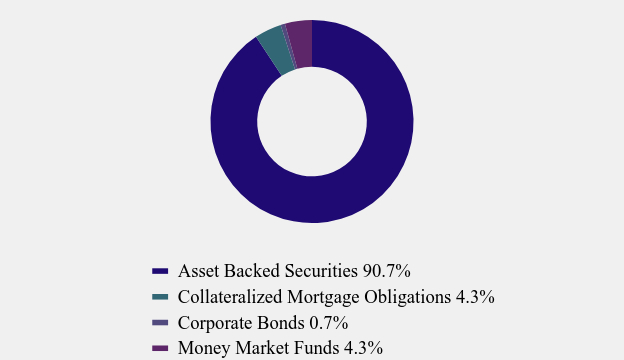

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 90.7% |

| Collateralized Mortgage Obligations | 4.3% |

| Corporate Bonds | 0.7% |

| Money Market Funds | 4.3% |

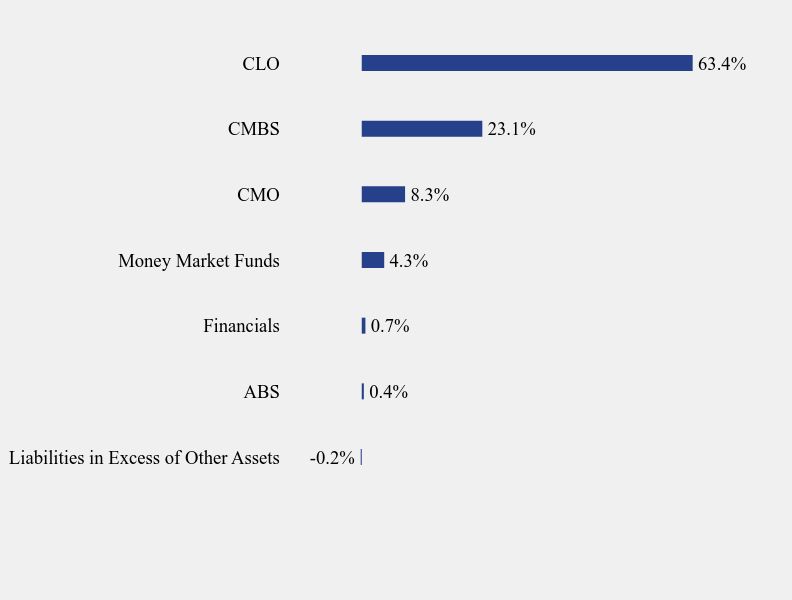

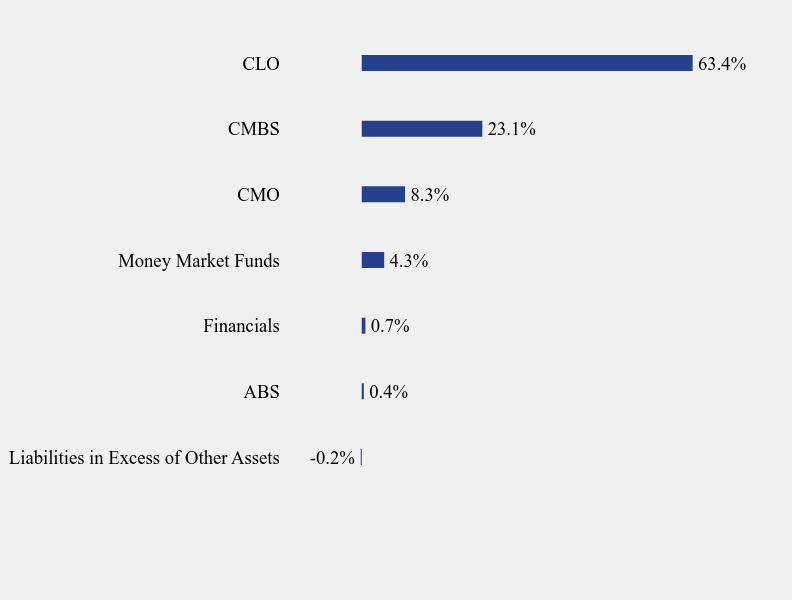

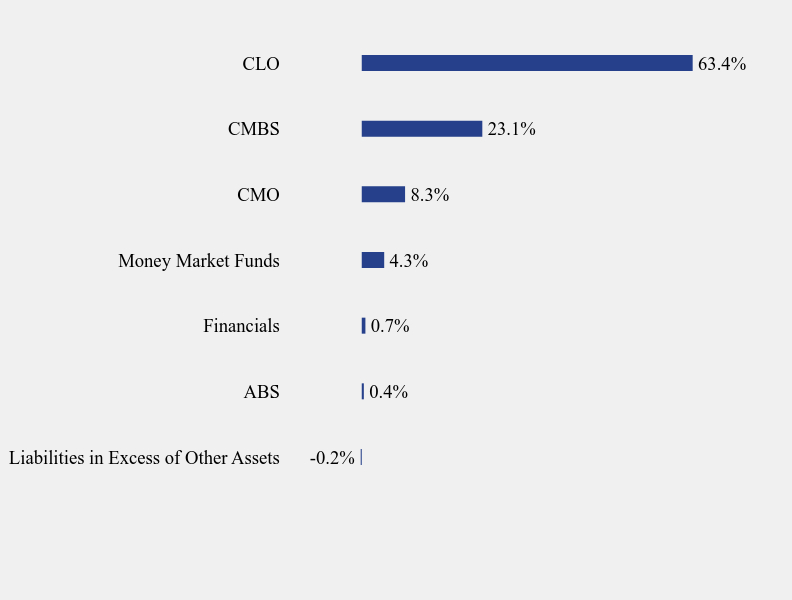

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.2% |

| ABS | 0.4% |

| Financials | 0.7% |

| Money Market Funds | 4.3% |

| CMO | 8.3% |

| CMBS | 23.1% |

| CLO | 63.4% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Dryden Senior Loan Fund, 8.318%, 04/15/28 | 4.2% |

| Halcyon Loan Advisors Funding Ltd., 8.293%, 01/22/31 | 4.0% |

| THL Credit Wind River CLO Ltd., 7.879%, 10/20/30 | 3.6% |

| Capital Funding Multifamily Mortgage Trust, 14.344%, 03/01/25 | 3.1% |

| OZLM XVIII Ltd., 7.768%, 04/15/31 | 2.9% |

| Northwoods Capital XIV-B Ltd., 8.774%, 11/13/31 | 2.8% |

| Parallel Ltd., 7.979%, 07/20/29 | 2.8% |

| Carlyle Global Market Strategies CLO Ltd., 7.829%, 07/20/31 | 2.5% |

| Northwoods Capital XII-B Ltd., 8.358%, 06/15/31 | 2.3% |

| CBAM Ltd., 8.629%, 07/20/30 | 2.2% |

No material changes occurred during the period ended October 31, 2024.

Holbrook Structured Income Fund - Class A (HOSAX)

Semi-Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://www.holbrookfunds.com/resources), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Holbrook Structured Income Fund

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Holbrook Structured Income Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.holbrookfunds.com/resources. You can also request this information by contacting us at 1-877-345-8646.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $72 | 1.39% |

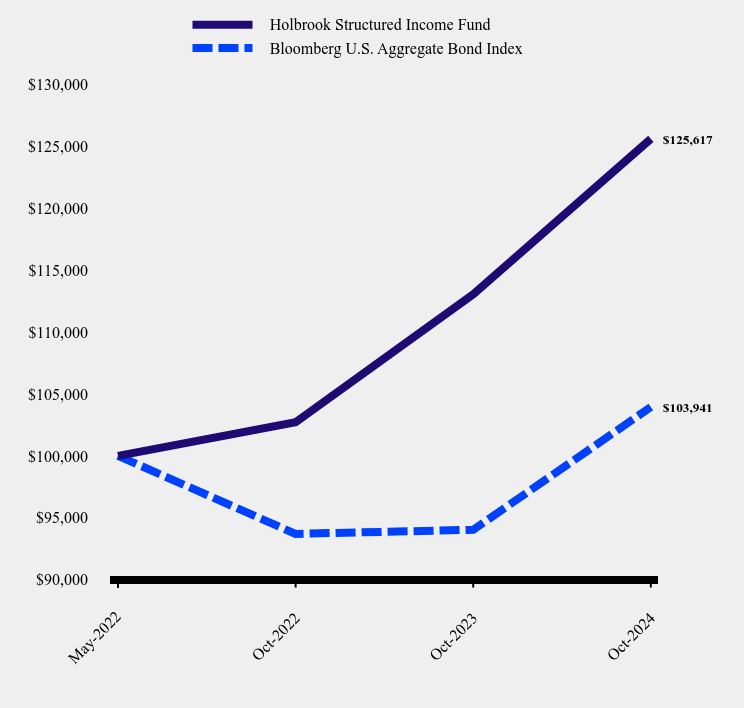

How has the Fund performed since inception?

Total Return Based on $100,000 Investment

| Holbrook Structured Income Fund | Bloomberg U.S. Aggregate Bond Index |

|---|

| May-2022 | $100,000 | $100,000 |

| Oct-2022 | $102,723 | $93,691 |

| Oct-2023 | $113,055 | $94,025 |

| Oct-2024 | $125,617 | $103,941 |

Average Annual Total Returns

| 6 Months | 1 Year | Since Inception (May 2, 2022) |

|---|

| Holbrook Structured Income Fund | 4.34% | 11.11% | 9.56% |

| Bloomberg U.S. Aggregate Bond Index | 5.31% | 10.55% | 1.56% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$447,049,214

- Number of Portfolio Holdings142

- Advisory Fee $2,093,889

- Portfolio Turnover20%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 90.7% |

| Collateralized Mortgage Obligations | 4.3% |

| Corporate Bonds | 0.7% |

| Money Market Funds | 4.3% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.2% |

| ABS | 0.4% |

| Financials | 0.7% |

| Money Market Funds | 4.3% |

| CMO | 8.3% |

| CMBS | 23.1% |

| CLO | 63.4% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Dryden Senior Loan Fund, 8.318%, 04/15/28 | 4.2% |

| Halcyon Loan Advisors Funding Ltd., 8.293%, 01/22/31 | 4.0% |

| THL Credit Wind River CLO Ltd., 7.879%, 10/20/30 | 3.6% |

| Capital Funding Multifamily Mortgage Trust, 14.344%, 03/01/25 | 3.1% |

| OZLM XVIII Ltd., 7.768%, 04/15/31 | 2.9% |

| Northwoods Capital XIV-B Ltd., 8.774%, 11/13/31 | 2.8% |

| Parallel Ltd., 7.979%, 07/20/29 | 2.8% |

| Carlyle Global Market Strategies CLO Ltd., 7.829%, 07/20/31 | 2.5% |

| Northwoods Capital XII-B Ltd., 8.358%, 06/15/31 | 2.3% |

| CBAM Ltd., 8.629%, 07/20/30 | 2.2% |

No material changes occurred during the period ended October 31, 2024.

Holbrook Structured Income Fund - Class I (HOSIX)

Semi-Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://www.holbrookfunds.com/resources), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Holbrook Structured Income Fund

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Holbrook Structured Income Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://www.holbrookfunds.com/resources. You can also request this information by contacting us at 1-877-345-8646.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor | $97 | 1.88% |

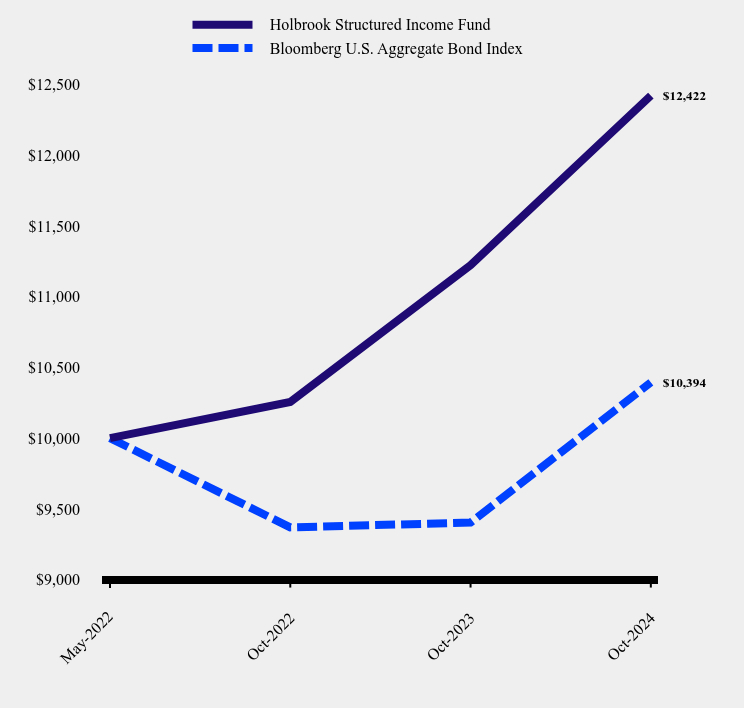

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Holbrook Structured Income Fund | Bloomberg U.S. Aggregate Bond Index |

|---|

| May-2022 | $10,000 | $10,000 |

| Oct-2022 | $10,256 | $9,369 |

| Oct-2023 | $11,223 | $9,403 |

| Oct-2024 | $12,422 | $10,394 |

Average Annual Total Returns

| 6 Months | 1 Year | Since Inception (May 2, 2022) |

|---|

| Holbrook Structured Income Fund | 4.08% | 10.69% | 9.07% |

| Bloomberg U.S. Aggregate Bond Index | 5.31% | 10.55% | 1.56% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$447,049,214

- Number of Portfolio Holdings142

- Advisory Fee $2,093,889

- Portfolio Turnover20%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 90.7% |

| Collateralized Mortgage Obligations | 4.3% |

| Corporate Bonds | 0.7% |

| Money Market Funds | 4.3% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.2% |

| ABS | 0.4% |

| Financials | 0.7% |

| Money Market Funds | 4.3% |

| CMO | 8.3% |

| CMBS | 23.1% |

| CLO | 63.4% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Dryden Senior Loan Fund, 8.318%, 04/15/28 | 4.2% |

| Halcyon Loan Advisors Funding Ltd., 8.293%, 01/22/31 | 4.0% |

| THL Credit Wind River CLO Ltd., 7.879%, 10/20/30 | 3.6% |

| Capital Funding Multifamily Mortgage Trust, 14.344%, 03/01/25 | 3.1% |

| OZLM XVIII Ltd., 7.768%, 04/15/31 | 2.9% |

| Northwoods Capital XIV-B Ltd., 8.774%, 11/13/31 | 2.8% |

| Parallel Ltd., 7.979%, 07/20/29 | 2.8% |

| Carlyle Global Market Strategies CLO Ltd., 7.829%, 07/20/31 | 2.5% |

| Northwoods Capital XII-B Ltd., 8.358%, 06/15/31 | 2.3% |

| CBAM Ltd., 8.629%, 07/20/30 | 2.2% |

No material changes occurred during the period ended October 31, 2024.

Holbrook Structured Income Fund - Investor (HOSTX)

Semi-Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://www.holbrookfunds.com/resources), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Item 2. Code of Ethics. Not applicable.

Item 3. Audit Committee Financial Expert. Not applicable.

Item 4. Principal Accountant Fees and Services. Not applicable.

Item 5. Audit Committee of Listed Registrants. Not applicable.

Item 6. Investments.

| (a) | The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

| |

| |

| |

| |

| |

|

| |

| |

| |

| Holbrook Income Fund |

| Holbrook Structured Income Fund |

| |

| |

| Class I Shares (HOBIX, HOSIX) |

| Investor Class Shares (HOBEX, HOSTX) |

| Class A Shares (HOBAX, HOSAX) |

| |

| |

| Financial Statements |

| |

| October 31, 2024 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Advised by: |

| Holbrook Holdings, Inc. |

| 3225 Cumberland Blvd SE Suite 100 |

| Atlanta, GA 30339 |

| |

| www.holbrookholdings.com |

| 1-877-345-8646 |

| |

| |

| |

| Distributed by Northern Lights Distributors, LLC |

| Member FINRA |

| |

| |

| |

| |

| |

| HOLBROOK INCOME FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| October 31, 2024 |

| Shares | | | | | | | | | | | Fair Value | |

| | | | | COMMON STOCKS — 0.4% | | | | | | | | | | |

| | | | | INSURANCE - 0.4% | | | | | | | | | | |

| | 3,015 | | | Specialty Transportation Holdings, LLC(a)(i)(j) | | | | | | | | $ | 7,313,189 | |

| | | | | | | | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $5,135,960) | | | | | | | | | 7,313,189 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | Coupon Rate | | | | | | |

| | | | | | | | | (%) | | Maturity | | | | |

| | | | | PREFERRED STOCKS — 4.0% | | | | | | | | | | |

| | | | | ASSET MANAGEMENT — 0.7% | | | | | | | | | | |

| | 487,386 | | | Gladstone Investment Corporation | | | | 5.0000 | | 05/01/26 | | | 11,892,218 | |

| | | | | | | | | | | | | | | |

| | | | | INDUSTRIAL INTERMEDIATE PROD — 1.5% | | | | | | | | | | |

| | 1,061,591 | | | Steel Partners Holdings, L.P. | | | | 6.0000 | | 02/27/26 | | | 26,008,980 | |

| | | | | | | | | | | | | | | |

| | | | | REAL ESTATE INVESTMENT TRUSTS — 0.2% | | | | | | | | | | |

| | 124,000 | | | Vinebrook Homes Trust, Inc.(b)(j) | | | | 6.5000 | | 10/07/27 | | | 2,852,000 | |

| | | | | | | | | | | | | | | |

| | | | | REAL ESTATE SERVICES — 1.2% | | | | | | | | | | |

| | 408,000 | | | Greystone SDOF Preferred Equity, LLC(b) | | | | 6.7500 | | 12/23/25 | | | 9,873,600 | |

| | 3,950 | | | UIRC-GSA International, LLC(b) | | | | 6.5000 | | Perpetual | | | 3,594,500 | |

| | 9,180 | | | UIRC-GSA International, LLC(b) | | | | 6.5000 | | Perpetual | | | 8,583,300 | |

| | | | | | | | | | | | | | 22,051,400 | |

| | | | | SPECIALTY FINANCE — 0.4% | | | | | | | | | | |

| | 248,930 | | | PennyMac Mortgage Investment Trust | | | | 8.5000 | | 09/30/28 | | | 6,397,501 | |

| | | | | | | | | | | | | | | |

| | | | | TOTAL PREFERRED STOCKS (Cost $68,430,064) | | | | | | | | | 69,202,099 | |

| | | | | | | | | | | | | | | |

| Principal | | | | | | | | | | | | | |

| Amount ($) | | | | | Spread | | | | | | | | |

| | | | | ASSET BACKED SECURITIES — 26.7% | | | | | | | | | | |

| | | | | CLO — 21.8% | | | | | | | | | | |

| | 3,295,000 | | | ACAS CLO Ltd. Series 2015-1A CRR(b),(c) | | TSFR3M + 2.462% | | 7.0940 | | 10/18/28 | | | 3,300,318 | |

| | 2,575,000 | | | Allegro CLO VI Ltd. Series 2017-2A C(b),(c) | | TSFR3M + 2.062% | | 6.7090 | | 01/17/31 | | | 2,575,888 | |

| | 1,760,000 | | | Allegro CLO VI Ltd. Series 2017-2A D(b),(c) | | TSFR3M + 3.012% | | 7.6590 | | 01/17/31 | | | 1,762,244 | |

| | 3,100,000 | | | AMMC CLO XII Ltd. Series 2013-12A DR(b),(c) | | TSFR3M + 2.962% | | 8.0640 | | 11/10/30 | | | 3,108,466 | |

See accompanying notes which are an integral part of these financial statements.

| HOLBROOK INCOME FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| October 31, 2024 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 26.7% (Continued) | | | | | | | | | | |

| | | | | CLO — 21.8% (Continued) | | | | | | | | | | |

| | 1,360,000 | | | Anchorage Capital CLO Ltd. Series 2018-10A CR(b),(c) | | TSFR3M + 2.050% | | 6.7060 | | 10/15/31 | | $ | 1,362,021 | |

| | 1,375,000 | | | Apex Credit Clo Ltd. Series 2018-1A C(b),(c) | | TSFR3M + 2.212% | | 6.8370 | | 04/25/31 | | | 1,382,563 | |

| | 2,500,000 | | | Ares XXXVII CLO Ltd. Series 2015-4A CRR(b),(c) | | TSFR3M + 2.750% | | 7.4060 | | 10/15/30 | | | 2,506,073 | |

| | 1,095,000 | | | Atlas Senior Loan Fund Ltd. Series 2017-8A C(b),(c) | | TSFR3M + 2.812% | | 7.4590 | | 01/16/30 | | | 1,098,754 | |

| | 4,000,000 | | | Atlas Senior Loan Fund VII Ltd. Series 2016-7A CR(b),(c) | | TSFR3M + 2.762% | | 7.8420 | | 11/27/31 | | | 4,028,292 | |

| | 3,275,000 | | | Atlas Senior Loan Fund XI Ltd. Series 2018-11A C(b),(c) | | TSFR3M + 2.212% | | 6.8290 | | 07/26/31 | | | 3,285,356 | |

| | 4,655,000 | | | Atrium IX Series 9A CR2(b),(c) | | TSFR3M + 2.262% | | 7.3230 | | 05/28/30 | | | 4,669,593 | |

| | 3,645,000 | | | Barings CLO Ltd. Series 2018-3A C(b),(c) | | TSFR3M + 2.162% | | 6.7790 | | 07/20/29 | | | 3,655,323 | |

| | 2,638,000 | | | Barings CLO Ltd. Series 2018-3A(b),(c) | | TSFR3M + 3.162% | | 7.7790 | | 07/20/29 | | | 2,641,907 | |

| | 2,260,000 | | | Battalion CLO VIII Ltd. Series 2015-8A BR2(b),(c) | | TSFR3M + 2.262% | | 6.8940 | | 07/18/30 | | | 2,267,788 | |

| | 905,000 | | | Betony CLO 2 Ltd. Series 2018-1A B(b),(c) | | TSFR3M + 2.112% | | 6.7010 | | 04/30/31 | | | 906,756 | |

| | 2,330,000 | | | BlueMountain CLO Ltd. Series 2015-4A CR(b),(c) | | TSFR3M + 2.162% | | 6.7790 | | 04/20/30 | | | 2,337,384 | |

| | 2,337,500 | | | BlueMountain CLO Ltd. Series 2013-2(b),(c) | | TSFR3M + 2.212% | | 6.8430 | | 10/22/30 | | | 2,347,909 | |

| | 5,100,000 | | | BlueMountain CLO Ltd. Series 2018-3A C(b),(c) | | TSFR3M + 2.462% | | 7.0870 | | 10/25/30 | | | 5,101,117 | |

| | 1,000,000 | | | BlueMountain Fuji US Clo II Ltd. Series 2017-2A(b),(c) | | TSFR3M + 2.412% | | 7.0290 | | 10/20/30 | | | 1,001,964 | |

| | 952,000 | | | Carbone Clo Ltd. Series 2017-1A(b),(c) | | TSFR3M + 2.062% | | 6.6790 | | 01/20/31 | | | 953,220 | |

| | 15,000,000 | | | Carlyle Global Market Strategies CLO Ltd. Series 2013-3A(b),(c) | | TSFR3M + 2.712% | | 7.3680 | | 10/15/30 | | | 15,037,534 | |

| | 6,356,000 | | | Catamaran CLO Ltd. Series 2014-1A BR(b),(c) | | TSFR3M + 2.422% | | 7.0530 | | 04/22/30 | | | 6,381,446 | |

| | 1,000,000 | | | Cathedral Lake V Ltd. Series 2018-5A C(b),(c) | | TSFR3M + 2.712% | | 7.3430 | | 10/21/30 | | | 1,003,336 | |

| | 6,692,000 | | | CBAM Ltd. Series 2017-1A C(b),(c) | | TSFR3M + 2.662% | | 7.2790 | | 07/20/30 | | | 6,702,734 | |

| | 690,000 | | | CBAM Ltd. Series 2018-6A B2R(b),(c) | | TSFR3M + 2.362% | | 7.0180 | | 01/15/31 | | | 691,784 | |

| | 15,000,000 | | | CBAM Ltd. Series 2017-4A D(b),(c) | | TSFR3M + 2.862% | | 7.5180 | | 01/15/31 | | | 15,014,774 | |

| | 1,350,000 | | | CIFC Funding Ltd. Series 2017-2A CR(b),(c) | | TSFR3M + 2.112% | | 6.7290 | | 04/20/30 | | | 1,354,533 | |

| | 8,000,000 | | | Clear Creek CLO Ltd. Series 2015-1A CR(b),(c) | | TSFR3M + 2.212% | | 6.8290 | | 10/20/30 | | | 8,015,120 | |

| | 111,826 | | | Clover Credit Partners CLO III Ltd. Series 2017-1A B(b),(c) | | TSFR3M + 2.112% | | 6.7680 | | 10/15/29 | | | 111,890 | |

| | 500,000 | | | Dryden 49 Senior Loan Fund Series 2017-49A CR(b),(c) | | TSFR3M + 2.312% | | 6.9440 | | 07/18/30 | | | 500,115 | |

| | 355,000 | | | Dryden 54 Senior Loan Fund Series 2017-54A C(b),(c) | | TSFR3M + 2.412% | | 7.0290 | | 10/19/29 | | | 356,176 | |

| | 1,100,000 | | | Dryden 55 CLO Ltd. Series 2018-55A C(b),(c) | | TSFR3M + 2.162% | | 6.8180 | | 04/15/31 | | | 1,103,740 | |

| | 1,500,000 | | | Eaton Vance Clo Ltd. Series 2015-1A DR(b),(c) | | TSFR3M + 2.762% | | 7.3790 | | 01/20/30 | | | 1,501,529 | |

| | 670,000 | | | Eaton Vance CLO Ltd. Series 2014-1RA C(b),(c) | | TSFR3M + 2.362% | | 7.0180 | | 07/15/30 | | | 670,647 | |

| | 3,550,000 | | | Elevation CLO Ltd. Series 2014-2A CR(b),(c) | | TSFR3M + 2.462% | | 7.1090 | | 10/15/29 | | | 3,558,982 | |

| | 4,350,000 | | | Elevation CLO Ltd. Series 2018-10A B(b),(c) | | TSFR3M + 2.162% | | 6.7790 | | 10/20/31 | | | 4,351,910 | |

| | 4,484,862 | | | Ellington Clo I Ltd. Series 2017-1A CR(b),(c) | | TSFR3M + 3.262% | | 7.9180 | | 10/15/29 | | | 4,504,694 | |

| | 10,000,000 | | | Ellington Clo II Ltd. Series 2017-2A C(b),(c) | | TSFR3M + 3.162% | | 8.2800 | | 02/15/29 | | | 10,049,609 | |

See accompanying notes which are an integral part of these financial statements.

| HOLBROOK INCOME FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| October 31, 2024 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 26.7% (Continued) | | | | | | | | | | |

| | | | | CLO — 21.8% (Continued) | | | | | | | | | | |

| | 2,020,000 | | | Galaxy XIX CLO Ltd. Series 2015-19A BRR(b),(c) | | TSFR3M + 2.112% | | 6.7460 | | 07/24/30 | | $ | 2,020,659 | |

| | 1,000,000 | | | Galaxy XXI CLO Ltd. Series 2015-21A DR(b),(c) | | TSFR3M + 2.912% | | 7.5290 | | 04/20/31 | | | 1,000,978 | |

| | 480,000 | | | Galaxy Xxviii Clo Ltd. Series 2018-28A C(b),(c) | | TSFR3M + 2.212% | | 6.8680 | | 07/15/31 | | | 480,890 | |

| | 1,175,000 | | | Greywolf CLO V Ltd. Series 2015-1A BR(b),(c) | | TSFR3M + 2.262% | | 6.8870 | | 01/27/31 | | | 1,176,741 | |

| | 3,628,000 | | | Halcyon Loan Advisors Funding Ltd. Series 2017-2A(b),(c) | | TSFR3M + 2.362% | | 7.0090 | | 01/17/30 | | | 3,631,309 | |

| | 8,650,000 | | | Halcyon Loan Advisors Funding Ltd. Series 2018-2A B(b),(c) | | TSFR3M + 2.612% | | 7.2430 | | 01/22/31 | | | 8,668,277 | |

| | 500,000 | | | Harbourview CLO VII-R Series 7RA B(b),(c) | | TSFR3M + 1.962% | | 6.5940 | | 07/18/31 | | | 501,567 | |

| | 1,405,369 | | | Highbridge Loan Management Series 3A-2014 A2R(b),(c) | | TSFR3M + 1.962% | | 6.5940 | | 07/18/29 | | | 1,405,436 | |

| | 563,000 | | | HPS Loan Management Ltd. Series 13A-18 CR(b),(c) | | TSFR3M + 2.150% | | 6.8060 | | 10/15/30 | | | 563,893 | |

| | 23,000,000 | | | ICG US CLO Ltd. Series 2014-3A CRR(b),(c) | | TSFR3M + 3.112% | | 7.7370 | | 04/25/31 | | | 23,028,841 | |

| | 12,400,000 | | | Jefferson Mill CLO Ltd. Series 2015-1A CRR(b),(c) | | TSFR3M + 2.550% | | 7.1820 | | 10/20/31 | | | 12,511,599 | |

| | 9,600,000 | | | JMP Credit Advisors CLO V Ltd. Series 2018-1A D(b),(c) | | TSFR3M + 3.612% | | 8.2590 | | 07/17/30 | | | 9,609,398 | |

| | 7,373,800 | | | KKR CLO 13 Ltd. Series 13 DR(b),(c) | | TSFR3M + 2.462% | | 7.1090 | | 01/16/28 | | | 7,383,032 | |

| | 4,590,000 | | | LCM XXV Ltd. Series 25A(b),(c) | | TSFR3M + 2.562% | | 7.1790 | | 07/20/30 | | | 4,608,622 | |

| | 530,000 | | | Marble Point Clo X Ltd. Series 2017-1A C(b),(c) | | TSFR3M + 2.612% | | 7.2680 | | 10/15/30 | | | 530,657 | |

| | 2,050,000 | | | MidOcean Credit CLO III Series 2014-3A CR(b),(c) | | TSFR3M + 2.262% | | 6.8790 | | 04/21/31 | | | 2,057,620 | |

| | 3,930,000 | | | Mountain View CLO, LLC Series 2017-1A CR(b),(c) | | TSFR3M + 2.612% | | 7.2590 | | 10/16/29 | | | 3,931,136 | |

| | 12,350,000 | | | Northwoods Capital XII-B Ltd. Series 2018-12BA CR(b),(c) | | TSFR3M + 2.050% | | 6.9970 | | 06/15/31 | | | 12,365,140 | |

| | 4,550,000 | | | Northwoods Capital XVI Ltd. Series 2017-16A C(b),(c) | | TSFR3M + 2.412% | | 7.5300 | | 11/15/30 | | | 4,555,979 | |

| | 1,500,000 | | | OCP CLO Ltd. Series 2014-7A B1RR(b),(c) | | TSFR3M + 2.512% | | 7.1290 | | 07/20/29 | | | 1,504,926 | |

| | 505,000 | | | OCP CLO Ltd. Series 2014-5A BR(b),(c) | | TSFR3M + 2.062% | | 6.6790 | | 04/26/31 | | | 505,922 | |

| | 6,305,000 | | | Octagon Investment Partners 30 Ltd. Series 2017-1A BR(b),(c) | | TSFR3M + 2.212% | | 6.8290 | | 03/17/30 | | | 6,316,683 | |

| | 500,000 | | | Octagon Investment Partners XIV Ltd. Series 2012-1A BRR(b),(c) | | TSFR3M + 2.362% | | 7.0180 | | 07/15/29 | | | 502,165 | |

| | 4,970,000 | | | OZLM VI Ltd. Series 2014-6A CT(b),(c) | | TSFR3M + 2.638% | | 7.2860 | | 04/17/31 | | | 4,977,902 | |

| | 1,275,000 | | | OZLM XVIII Ltd. Series 2018-18A C(b),(c) | | TSFR3M + 2.112% | | 6.7680 | | 04/15/31 | | | 1,279,350 | |

| | 1,485,000 | | | OZLM XX Ltd. Series 2018-20A B(b),(c) | | TSFR3M + 2.212% | | 6.8290 | | 04/20/31 | | | 1,488,119 | |

| | 460,000 | | | Palmer Square Loan Funding Ltd. Series 2021-2A C(b),(c) | | TSFR3M + 2.662% | | 7.7900 | | 05/20/29 | | | 460,374 | |

| | 400,000 | | | Palmer Square Loan Funding Ltd. Series 2021-3A B(b),(c) | | TSFR3M + 2.012% | | 6.6290 | | 07/20/29 | | | 400,301 | |

| | 1,000,000 | | | Pikes Peak CLO 1 Series 2018-1A C(b),(c) | | TSFR3M + 2.362% | | 6.9960 | | 07/24/31 | | | 1,003,476 | |

| | 4,139,684 | | | Ready Capital Mortgage Financing, LLC Series 2023-FL11 A(b),(c) | | TSFR1M + 2.374% | | 7.1120 | | 10/25/39 | | | 4,156,082 | |

| | 1,425,000 | | | Regatta XIV Funding Ltd. Series 2018-3A DR(b),(c) | | TSFR3M + 2.800% | | 7.4260 | | 10/25/31 | | | 1,433,550 | |

| | 1,137,000 | | | Saranac CLO I Ltd. Series 2013-1A CR(b),(c) | | TSFR3M + 3.112% | | 7.7290 | | 07/26/29 | | | 1,144,949 | |

| | 4,000,000 | | | Saranac Clo VII Ltd. Series 2014-2A CR(b),(c) | | TSFR3M + 2.512% | | 7.6400 | | 11/20/29 | | | 4,006,180 | |

| | 250,000 | | | Shackleton CLO Ltd. Series 2013-4RA(b),(c) | | TSFR3M + 2.162% | | 6.8180 | | 04/13/31 | | | 250,302 | |

See accompanying notes which are an integral part of these financial statements.

| HOLBROOK INCOME FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| October 31, 2024 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 26.7% (Continued) | | | | | | | | | | |

| | | | | CLO — 21.8% (Continued) | | | | | | | | | | |

| | 2,750,000 | | | Shackleton CLO Ltd. Series 2014-5RA C(b),(c) | | TSFR3M + 2.412% | | 7.5440 | | 05/07/31 | | $ | 2,766,794 | |

| | 2,128,218 | | | Shelter Growth CRE Issuer Ltd. Series 2022-FL4 A(b),(c) | | TSFR1M + 2.296% | | 7.0550 | | 06/17/37 | | | 2,135,471 | |

| | 5,500,000 | | | Sound Point CLO II Ltd. Series 2013-1A A3R(b),(c) | | TSFR3M + 2.112% | | 6.7290 | | 01/26/31 | | | 5,513,635 | |

| | 2,000,000 | | | SOUND POINT CLO III-R LTD Series 2013-2RA D(b),(c) | | TSFR3M + 3.212% | | 7.8680 | | 04/15/29 | | | 2,007,770 | |

| | 3,787,764 | | | Sound Point Clo XV Ltd. Series 2017-1A CR(b),(c) | | TSFR3M + 2.312% | | 6.9380 | | 01/23/29 | | | 3,792,415 | |

| | 16,824,500 | | | Sound Point Clo XV Ltd. Series 2017-1A D(b),(c) | | TSFR3M + 3.862% | | 8.4880 | | 01/23/29 | | | 16,856,163 | |

| | 2,890,000 | | | Sound Point Clo XVI Ltd. Series 2017-2A CR(b),(c) | | TSFR3M + 2.462% | | 7.0870 | | 07/25/30 | | | 2,893,110 | |

| | 17,500,000 | | | SOUND POINT CLO XVII Series 2017-3A B(b),(c) | | TSFR3M + 2.212% | | 6.8290 | | 10/20/30 | | | 17,541,877 | |

| | 1,175,000 | | | Steele Creek Clo Ltd. Series 2017-1A C(b),(c) | | TSFR3M + 2.162% | | 6.8180 | | 10/15/30 | | | 1,178,630 | |

| | 980,000 | | | Steele Creek CLO Ltd. Series 2014-1RA C(b),(c) | | TSFR3M + 2.212% | | 6.8290 | | 04/21/31 | | | 983,430 | |

| | 1,140,000 | | | Symphony CLO XVI Ltd. Series 2015-16A C1RR(b),(c) | | TSFR3M + 2.200% | | 6.8560 | | 10/15/31 | | | 1,143,830 | |

| | 662,000 | | | TCI-Symphony CLO Ltd. Series 2017-1A CR(b),(c) | | TSFR3M + 2.062% | | 6.7180 | | 07/15/30 | | | 663,256 | |

| | 10,800,000 | | | THL Credit Wind River CLO Ltd. Series 2014-3K C(b),(c) | | TSFR3M + 2.562% | | 7.2180 | | 10/15/30 | | | 10,885,276 | |

| | 6,000,000 | | | THL Credit Wind River CLO Ltd. Series 2015-1A DR(b),(c) | | TSFR3M + 3.262% | | 7.8790 | | 10/20/30 | | | 6,021,578 | |

| | 3,000,000 | | | VENTURE XIII CLO Ltd. Series 2013-13A CR(b),(c) | | TSFR3M + 2.562% | | 7.5000 | | 09/10/29 | | | 3,001,569 | |

| | 4,000,000 | | | VENTURE XIII CLO Ltd. Series 2013-13A DR(b),(c) | | TSFR3M + 3.562% | | 8.5000 | | 09/10/29 | | | 4,014,336 | |

| | 85,978 | | | Venture XVIII CLO Ltd. Series 2014-18A BR(b),(c) | | TSFR3M + 1.912% | | 6.5680 | | 10/15/29 | | | 85,988 | |

| | 4,500,000 | | | Venture XVIII CLO Ltd. Series 2014-18A DR(b),(c) | | TSFR3M + 3.362% | | 8.0180 | | 10/15/29 | | | 4,506,633 | |

| | 3,500,000 | | | Venture XXVIII CLO Ltd. Series 2017-28A C2R(b),(c) | | TSFR3M + 2.462% | | 7.0790 | | 07/20/30 | | | 3,513,675 | |

| | 322,299 | | | Voya CLO Ltd. Series 2015-1A BR(b),(c) | | TSFR3M + 1.962% | | 6.5940 | | 01/18/29 | | | 323,030 | |

| | 2,740,000 | | | Voya CLO Ltd. Series 2015-1A CR(b),(c) | | TSFR3M + 2.612% | | 7.2440 | | 01/18/29 | | | 2,760,383 | |

| | 2,530,000 | | | Voya CLO Ltd. Series 2014-2A BRR(b),(c) | | TSFR3M + 2.362% | | 7.0090 | | 04/17/30 | | | 2,537,248 | |

| | 2,500,000 | | | Voya CLO Ltd. Series 2014-4A BR2(b),(c) | | TSFR3M + 2.352% | | 7.0080 | | 07/14/31 | | | 2,512,963 | |

| | 780,000 | | | Wellfleet CLO Ltd. Series 2015-1A CR4(b),(c) | | TSFR3M + 2.362% | | 6.9790 | | 07/20/29 | | | 780,975 | |

| | 1,800,000 | | | Wellfleet CLO Ltd. Series 2018-1A C(b),(c) | | TSFR3M + 2.212% | | 6.8590 | | 07/17/31 | | | 1,806,046 | |

| | 8,825,000 | | | Zais Clo 11 Ltd. Series 2018-11A CR(b),(c) | | TSFR3M + 2.450% | | 7.0670 | | 01/20/32 | | | 8,862,584 | |

| | 3,000,000 | | | Zais Clo 14 Ltd. Series 2020-14A DR2(b),(c) | | TSFR3M + 3.300% | | 7.9560 | | 04/15/32 | | | 3,005,586 | |

| | 3,900,000 | | | Zais Clo 7 Ltd. Series 2017-2A C(b),(c) | | TSFR3M + 2.712% | | 7.3680 | | 04/15/30 | | | 3,922,105 | |

| | 187,376 | | | Zais CLO 8 Ltd. Series 2018-1A D(b),(c) | | TSFR3M + 2.912% | | 7.5680 | | 04/15/29 | | | 187,385 | |

| | | | | | | | | | | | | | 376,869,285 | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 1.1% | | | | | | | | | | |

| | 4,220,809 | | | Cascade Funding Mortgage Trust Series 2022-AB2 M3(b),(d) | | | | 2.0000 | | 02/25/52 | | | 3,488,997 | |

| | 2,301,942 | | | Imperial Fund Mortgage Trust Series 2022-NQM7 A1(b),(e) | | | | 7.3690 | | 11/25/67 | | | 2,328,164 | |

| | 960,393 | | | MFA Trust Series 2023-RTL1 A1(b),(e) | | | | 7.5750 | | 08/25/27 | | | 961,917 | |

See accompanying notes which are an integral part of these financial statements.

| HOLBROOK INCOME FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| October 31, 2024 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 26.7% (Continued) | | | | | | | | | | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 1.1% (Continued) | | | | | | | | | | |

| | 5,000,000 | | | RMF Proprietary Issuance Trust Series 2022-2 M3(b),(d) | | | | 3.7500 | | 06/25/62 | | $ | 3,179,339 | |

| | 12,500,000 | | | RMF Proprietary Issuance Trust Series 2022-3 M3(b),(d) | | | | 4.0000 | | 08/25/62 | | | 8,359,949 | |

| | 373,669 | | | Verus Securitization Trust Series 2023-1 A1(b),(e) | | | | 5.8500 | | 12/25/67 | | | 374,487 | |

| | 176,510 | | | Verus Securitization Trust Series 2023-3 A2(b),(e) | | | | 6.4380 | | 03/25/68 | | | 177,034 | |

| | 537,963 | | | Verus Securitization Trust Series 2023-5 A1(b),(e) | | | | 6.4760 | | 06/25/68 | | | 543,385 | |

| | | | | | | | | | | | | | 19,413,272 | |

| | | | | NON AGENCY CMBS — 3.4% | | | | | | | | | | |

| | 4,960,000 | | | BAMLL Commercial Mortgage Securities Trust Series 2019-BPR DMP(b),(d) | | | | 3.8950 | | 11/05/32 | | | 4,486,814 | |

| | 2,672,869 | | | BB-UBS Trust Series 2012-TFT(b) | | | | 2.8900 | | 06/05/30 | | | 2,503,646 | |

| | 5,594,436 | | | BPR Trust Series 2021-WILL A(b),(c) | | TSFR1M + 1.864% | | 6.6680 | | 06/15/38 | | | 5,570,948 | |

| | 5,000,000 | | | BX Commercial Mortgage Trust Series 2019-IMC E(b),(c) | | TSFR1M + 2.196% | | 7.0000 | | 04/15/34 | | | 4,887,922 | |

| | 10,025,000 | | | GS Mortgage Securities Corp Trust Series 2018-3PCK B(b),(c) | | TSFR1M + 2.864% | | 7.6680 | | 09/15/31 | | | 9,869,568 | |

| | 10,463,000 | | | GS Mortgage Securities Trust Series 2010-C1 C(b),(d) | | | | 5.6350 | | 08/10/43 | | | 10,215,108 | |

| | 5,520,000 | | | Hudsons Bay Simon JV Trust Series 2015-HB10 B10(b) | | | | 4.9060 | | 08/05/34 | | | 5,178,272 | |

| | 1,000,000 | | | JPMBB Commercial Mortgage Securities Trust Series 2014-C25 B(d) | | | | 4.3470 | | 11/15/47 | | | 916,720 | |

| | 5,678,582 | | | Morgan Stanley Capital I, Inc. Series 2024-BPR2 A(b) | | | | 7.2910 | | 05/05/29 | | | 5,875,667 | |

| | 1,600,000 | | | Morgan Stanley Capital I, Inc. Series 2024-BPR2 C(b),(d) | | | | 8.7520 | | 05/05/29 | | | 1,626,635 | |

| | 1,328,038 | | | XCAL MORTGAGE TRUST Series 2019-1 A(b),(c) | | TSFR1M + 3.864% | | 9.2080 | | 12/31/24 | | | 351,221 | |

| | 1,873,572 | | | XCALI Mortgage Trust Series 2020-5 A(b),(c) | | TSFR1M + 3.370% | | 8.2140 | | 03/31/25 | | | 1,874,268 | |

| | 5,000,000 | | | X-Caliber Funding, LLC Series 2023-MF9 A(b),(c) | | TSFR1M + 3.250% | | 8.1000 | | 06/30/25 | | | 5,003,477 | |

| | | | | | | | | | | | | | 58,360,266 | |

| | | | | OTHER ABS — 0.4% | | | | | | | | | | |

| | 2,000,000 | | | FMC GMSR Issuer Trust Series 2022-GT1 A(b) | | | | 6.1900 | | 04/25/27 | | | 1,982,592 | |

| | 2,175,080 | | | HRR Funding, LLC Series 2021-1(b)(i) | | | | 9.0000 | | 12/20/36 | | | 1,522,556 | |

| | 1,449,727 | | | New Residential Mortgage, LLC Series 2020-FNT1 A(b) | | | | 5.4370 | | 06/25/25 | | | 1,443,444 | |

| | 728,648 | | | New Residential Mortgage, LLC Series 2020-FNT2 A(b) | | | | 5.4370 | | 07/25/25 | | | 725,289 | |

| | 507,295 | | | Pagaya AI Debt Trust Series 2024-2 A(b) | | | | 6.3190 | | 08/15/31 | | | 511,632 | |

| | 592,855 | | | Pagaya AI Debt Trust Series 2024-3 A(b) | | | | 6.2580 | | 10/15/31 | | | 598,013 | |

| | | | | | | | | | | | | | 6,783,526 | |

| | | | | TOTAL ASSET BACKED SECURITIES (Cost $493,215,764) | | | | | | | | | 461,426,349 | |

See accompanying notes which are an integral part of these financial statements.

| HOLBROOK INCOME FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| October 31, 2024 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 51.0% | | | | | | | | | | |

| | | | | ASSET MANAGEMENT — 29.9% | | | | | | | | | | |

| | 22,754,000 | | | Apollo Investment Corporation | | | | 5.2500 | | 03/03/25 | | $ | 22,600,611 | |

| | 2,840,978 | | | B Riley Financial, Inc. | | | | 5.5000 | | 03/31/26 | | | 53,268,339 | |

| | 26,240,000 | | | Capital Southwest Corporation | | | | 4.5000 | | 01/31/26 | | | 25,452,800 | |

| | 340,313 | | | Crescent Capital BDC, Inc. | | | | 5.0000 | | 05/25/26 | | | 8,252,590 | |

| | 26,800,000 | | | Fidus Investment Corporation | | | | 4.7500 | | 01/31/26 | | | 25,955,964 | |

| | 4,305,000 | | | Fidus Investment Corporation | | | | 3.5000 | | 11/15/26 | | | 3,972,503 | |

| | 33,994,000 | | | Gladstone Capital Corporation | | | | 5.1250 | | 01/31/26 | | | 33,484,090 | |

| | 595,227 | | | Great Elm Capital Corporation | | | | 5.8750 | | 06/30/26 | | | 14,600,918 | |

| | 30,000 | | | Great Elm Capital Corporation | | | | 8.1250 | | 12/31/29 | | | 755,100 | |

| | 314,431 | | | Horizon Technology Finance Corporation | | | | 4.8750 | | 03/30/26 | | | 7,692,554 | |

| | 20,103,000 | | | Investcorp Credit Management BDC, Inc. | | | | 4.8750 | | 04/01/26 | | | 19,353,343 | |

| | 2,000,000 | | | Medallion Financial Corporation(b) | | | | 7.5000 | | 12/30/27 | | | 1,862,590 | |

| | 30,894,000 | | | Monroe Capital Corporation | | | | 4.7500 | | 02/15/26 | | | 30,121,650 | |

| | 85,114 | | | Newtek Business Services Corporation | | | | 5.5000 | | 02/01/26 | | | 2,093,804 | |

| | 16,000,000 | | | NewtekOne, Inc.(b) | | | | 8.1250 | | 02/01/25 | | | 16,036,022 | |

| | 15,401,000 | | | OFS Capital Corporation | | | | 4.7500 | | 02/10/26 | | | 14,948,589 | |

| | 38,690,000 | | | PennantPark Floating Rate Capital Ltd. | | | | 4.2500 | | 04/01/26 | | | 37,322,557 | |

| | 26,064,000 | | | PennantPark Investment Corporation | | | | 4.5000 | | 05/01/26 | | | 25,229,553 | |

| | 29,743,000 | | | PennantPark Investment Corporation | | | | 4.0000 | | 11/01/26 | | | 28,036,330 | |

| | 33,500,000 | | | Portman Ridge Finance Corporation | | | | 4.8750 | | 04/30/26 | | | 32,283,033 | |

| | 38,827,000 | | | Saratoga Investment Corporation | | | | 4.3750 | | 02/28/26 | | | 37,460,879 | |

| | 12,432,000 | | | Saratoga Investment Corporation | | | | 4.3500 | | 02/28/27 | | | 11,580,995 | |

| | 407,643 | | | Saratoga Investment Corporation | | | | 6.0000 | | 04/30/27 | | | 9,913,878 | |

| | 518,495 | | | Trinity Capital, Inc. | | | | 7.0000 | | 01/16/25 | | | 13,055,704 | |

| | 20,075,000 | | | Trinity Capital, Inc. | | | | 4.3750 | | 08/24/26 | | | 19,033,029 | |

| | 6,630,000 | | | Trinity Capital, Inc. | | | | 4.2500 | | 12/15/26 | | | 6,305,819 | |

| | 603,672 | | | Trinity Capital, Inc. | | | | 7.8750 | | 09/30/29 | | | 15,260,828 | |

| | | | | | | | | | | | | | 515,934,072 | |

| | | | | BANKING — 1.7% | | | | | | | | | | |

| | 25,620 | | | NewtekOne, Inc. | | | | 8.5000 | | 06/01/29 | | | 645,112 | |

| | 30,000 | | | NexBank Capital, Inc.(b),(c) | | TSFR3M + 5.200% | | 9.7930 | | 07/01/72 | | | 28,275,000 | |

| | | | | | | | | | | | | | 28,920,112 | |

| | | | | COMMERCIAL SUPPORT SERVICES — 2.2% | | | | | | | | | | |

| | 2,064,206 | | | Charah Solutions, Inc. (j) | | | | 8.5000 | | 08/31/26 | | | 38,683,220 | |

See accompanying notes which are an integral part of these financial statements.

| HOLBROOK INCOME FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| October 31, 2024 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 51.0% (Continued) | | | | | | | | | | |

| | | | | ELECTRICAL EQUIPMENT — 4.1% | | | | | | | | | | |

| | 1,996,250 | | | Babcock & Wilcox Enterprises, Inc. | | | | 8.1250 | | 02/28/26 | | $ | 47,670,450 | |

| | 1,014,866 | | | Babcock & Wilcox Enterprises, Inc. | | | | 6.5000 | | 12/31/26 | | | 22,560,471 | |

| | | | | | | | | | | | | | 70,230,921 | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES — 1.3% | | | | | | | | | | |

| | 276,443 | | | Arlington Asset Investment Corporation(j) | | | | 6.0000 | | 08/01/26 | | | 6,540,641 | |

| | 1,259,975 | | | B Riley Financial, Inc. | | | | 5.0000 | | 12/31/26 | | | 16,354,476 | |

| | | | | | | | | | | | | | 22,895,117 | |

| | | | | MACHINERY — 0.0%(f) | | | | | | | | | | |

| | 2,500,000 | | | Briggs & Stratton Corporation(g) | | | | 6.8750 | | 12/15/20 | | | 9,375 | |

| | | | | | | | | | | | | | | |

| | | | | REAL ESTATE INVESTMENT TRUSTS — 0.2% | | | | | | | | | | |

| | 210,500 | | | HC Government Realty Trust, Inc.(b) | | | | 7.0000 | | 08/14/27 | | | 3,946,875 | |

| | | | | | | | | | | | | | | |

| | | | | SOFTWARE — 2.4% | | | | | | | | | | |

| | 1,713,572 | | | Synchronoss Technologies, Inc. | | | | 8.3750 | | 06/30/26 | | | 42,188,143 | |

| | | | | | | | | | | | | | | |

| | | | | SPECIALTY FINANCE — 9.2% | | | | | | | | | | |

| | 18,421,000 | | | ACRES Commercial Realty Corporation | | | | 5.7500 | | 08/15/26 | | | 17,324,825 | |

| | 161,376 | | | Atlanticus Holdings Corporation | | | | 9.2500 | | 01/31/29 | | | 3,992,442 | |

| | 1,500,000 | | | Broadmark Realty Capital, Inc.(b) | | | | 5.0000 | | 11/15/26 | | | 1,361,950 | |

| | 1,000,000 | | | Dakota Financial, LLC(b) | | | | 5.0000 | | 09/30/26 | | | 943,065 | |

| | 2,000,000 | | | First Help Financial, LLC(b) | | | | 6.0000 | | 11/15/26 | | | 1,892,686 | |

| | 4,000,000 | | | InvestCo, LLC / Preston Ventures, LLC / LS(b) | | | | 5.1250 | | 08/13/26 | | | 3,793,000 | |

| | 3,250,000 | | | Medallion Financial Corporation B(b) | | | | 7.2500 | | 02/26/26 | | | 3,130,377 | |

| | 5,000,000 | | | MMP Capital, LLC(b) | | | | 9.5000 | | 10/18/29 | | | 5,000,000 | |

| | 4,000,000 | | | National Funding, Inc.(b) | | | | 5.7500 | | 08/31/26 | | | 3,786,227 | |

| | 27,703,000 | | | Nexpoint Real Estate Finance, Inc. | | | | 5.7500 | | 05/01/26 | | | 26,215,139 | |

| | 15,000,000 | | | Nexpoint Real Estate Finance, Inc.(b) | | | | 5.7500 | | 05/01/26 | | | 14,194,248 | |

| | 29,778,836 | | | OWS Cre Funding I, LLC Series 2021-MARG A(b),(c) | | US0001M + 4.900% | | 9.8600 | | 09/15/25 | | | 29,824,290 | |

| | 5,000,000 | | | PDOF MSN Issuer, LLC(b),(c) | | SOFRRATE + 4.500% | | 9.3100 | | 03/01/25 | | | 4,942,790 | |

| | 1,092,496 | | | Ready Capital Corporation | | | | 5.7500 | | 02/15/26 | | | 26,962,801 | |

See accompanying notes which are an integral part of these financial statements.

| HOLBROOK INCOME FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| October 31, 2024 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 51.0% (Continued) | | | | | | | | | | |

| | | | | SPECIALTY FINANCE — 9.2% (Continued) | | | | | | | | | | |

| | 182,689 | | | Ready Capital Corporation | | | | 6.2000 | | 07/30/26 | | $ | 4,472,227 | |

| | 2,000,000 | | | Regent Capital Corporation(b) | | | | 6.0000 | | 12/28/26 | | | 1,879,911 | |

| | 61,886 | | | Sachem Capital Corporation | | | | 7.7500 | | 09/30/25 | | | 1,544,668 | |

| | 150,606 | | | Sachem Capital Corporation | | | | 6.0000 | | 12/30/26 | | | 3,367,279 | |

| | 2,000,000 | | | X-Caliber Funding, LLC(b) | | | | 5.0000 | | 03/01/25 | | | 1,978,616 | |

| | 3,000,000 | | | X-Caliber Funding, LLC(b) | | | | 5.0000 | | 10/01/25 | | | 2,931,476 | |

| | | | | | | | | | | | | | 159,538,017 | |

| | | | | TOTAL CORPORATE BONDS (Cost $837,124,872) | | | | | | | | | 882,345,852 | |

| | | | | | | | | | | | | | | |

| | | | | U.S. GOVERNMENT & AGENCIES — 15.0% | | | | | | | | | | |

| | | | | U.S. TREASURY INFLATION PROTECTED — 15.0% | | | | | | | | | | |

| | 56,781,020 | | | United States Treasury Inflation Indexed Bonds | | | | 2.3750 | | 01/15/25 | | | 56,596,011 | |

| | 51,186,240 | | | United States Treasury Inflation Indexed Bonds | | | | 0.1250 | | 04/15/25 | | | 50,480,583 | |

| | 49,115,650 | | | United States Treasury Inflation Indexed Bonds | | | | 0.3750 | | 07/15/25 | | | 48,509,778 | |

| | 41,249,820 | | | United States Treasury Inflation Indexed Bonds | | | | 0.1250 | | 10/15/25 | | | 40,490,921 | |

| | 12,003,600 | | | United States Treasury Inflation Indexed Bonds | | | | 0.1250 | | 04/15/26 | | | 11,661,104 | |

| | 38,298,000 | | | United States Treasury Inflation Indexed Bonds | | | | 3.8750 | | 04/15/29 | | | 41,538,255 | |

| | 10,004,500 | | | United States Treasury Inflation Indexed Bonds | | | | 1.6250 | | 10/15/29 | | | 9,933,754 | |

| | | | | | | | | | | | | | 259,210,406 | |

| | | | | TOTAL U.S. GOVERNMENT & AGENCIES (Cost $259,759,906) | | | | | | | | | 259,210,406 | |

| | | | | | | | | | | | | | | |

| Shares | | | | | | | | | | | | | |

| | | | | SHORT-TERM INVESTMENTS — 2.9% | | | | | | | | | | |

| | | | | MONEY MARKET FUNDS - 2.9% | | | | | | | | | | |

| | 50,947,881 | | | First American Government Obligations Fund, 4.78% (Cost $50,947,881)(h) | | | | | | | | | 50,947,881 | |

| | | | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 100.0% (Cost $1,714,614,447) | | | | | | | | $ | 1,730,445,776 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 0.0% | | | | | | | | | 325,361 | |

| | | | | NET ASSETS - 100.0% | | | | | | | | $ | 1,730,771,137 | |

See accompanying notes which are an integral part of these financial statements.

| HOLBROOK INCOME FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| October 31, 2024 |

| LLC | - Limited Liability Company |

| | |

| LTD | - Limited Company |

| | |

| SOFRRATE | United States SOFR Secured Overnight Financing Rate |

| | |

| TSFR1M | Term Secured Overnight Financing Rate 1 Month |

| | |

| TSFR3M | Term Secured Overnight Financing Rate 3 Month |

| | |

| US0001M | ICE LIBOR USD 1 Month |

| (a) | Non-income producing security. |

| (b) | Security exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933. The security may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of October 31, 2024 the total market value of 144A securities is 611,192,152 or 35.3% of net assets. |

| (c) | Variable rate security; the rate shown represents the rate on October 31, 2024. |

| (d) | Variable or floating rate security, the interest rate of which adjusts periodically based on changes in current interest rates and prepayments on the underlying pool of assets. |

| (e) | Step bond. Coupon rate is fixed rate that changes on a specified date. The rate shown is the current rate at October 31, 2024. |

| (f) | Percentage rounds to less than 0.1%. |

| (g) | Represents issuer in default on interest payments; non-income producing security. |

| (h) | Rate disclosed is the seven day effective yield as of October 31, 2024. |

| (i) | The value of this security has been determined in good faith by the Adviser as the Valuation Designee pursuant to valuation procedures approved by the Board of Trustees. |

| (j) | The security is illiquid; total illiquid securities represent 3.2% of net assets. |

See accompanying notes which are an integral part of these financial statements.

| HOLBROOK STRUCTURED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| October 31, 2024 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 90.9% | | | | | | | | | | |

| | | | | AGENCY CMBS — 2.6% | | | | | | | | | | |

| | 2,230,000 | | | FREMF Mortgage Trust Series 2018-K732 C(a),(b) | | | | 4.1940 | | 05/25/25 | | $ | 2,207,775 | |

| | 2,525,000 | | | FREMF Mortgage Trust Series 2018-K733 C(a),(b) | | | | 4.2070 | | 09/25/25 | | | 2,484,092 | |

| | 2,000,000 | | | FREMF Mortgage Trust Series 2015-K46 B(a),(b) | | | | 3.8210 | | 04/25/48 | | | 1,984,852 | |

| | 2,000,000 | | | FREMF Mortgage Trust Series 2015-K47 B(a),(b) | | | | 3.7090 | | 06/25/48 | | | 1,980,146 | |

| | 1,637,000 | | | FREMF Mortgage Trust Series 2015-K47 C(a),(b) | | | | 3.7090 | | 06/25/48 | | | 1,619,772 | |

| | 1,235,000 | | | FREMF Mortgage Trust Series 2018-K75 B(a),(b) | | | | 3.9740 | | 04/25/51 | | | 1,196,406 | |

| | | | | | | | | | | | | | 11,473,043 | |

| | | | | AUTO LOAN — 0.1% | | | | | | | | | | |

| | 538,000 | | | Luxury Lease Partners Auto Lease Trust Series 2024-4 B(a) | | | | 10.4910 | | 07/15/30 | | | 541,475 | |

| | | | | | | | | | | | | | | |

| | | | | CLO — 63.4% | | | | | | | | | | |

| | 495,000 | | | 1828 CLO Ltd. Series 2016-1A CR(a),(c) | | TSFR3M + 3.612% | | 8.2680 | | 10/15/31 | | | 496,288 | |

| | 1,070,000 | | | Anchorage Capital CLO Ltd. Series 2018-10A DR(a),(c) | | TSFR3M + 2.950% | | 7.6060 | | 10/15/31 | | | 1,073,577 | |

| | 5,000,000 | | | Apidos CLO XVIII Series 2018-18A D(a),(c) | | TSFR3M + 3.412% | | 8.0430 | | 10/22/30 | | | 5,031,970 | |

| | 1,750,000 | | | Apidos CLO XX Series 2015-20A DR(a),(c) | | TSFR3M + 5.962% | | 10.6090 | | 07/16/31 | | | 1,755,332 | |

| | 1,000,000 | | | Apidos CLO XXIX Series 2018-29A D(a),(c) | | TSFR3M + 5.512% | | 10.1370 | | 07/25/30 | | | 1,003,633 | |

| | 4,300,000 | | | Apidos CLO XXVIII Series 2017-28A D(a),(c) | | TSFR3M + 5.762% | | 10.3790 | | 01/20/31 | | | 4,321,831 | |

| | 750,000 | | | Atlas Senior Loan Fund Ltd. Series 2017-8A C(a),(c) | | TSFR3M + 2.812% | | 7.4590 | | 01/16/30 | | | 752,571 | |

| | 416,000 | | | Betony CLO 2 Ltd. Series 2018-1A C(a),(c) | | TSFR3M + 3.162% | | 7.7510 | | 04/30/31 | | | 416,862 | |

| | 3,329,000 | | | Black Diamond Clo Ltd. Series 2017-1A C(a),(c) | | TSFR3M + 4.212% | | 8.8460 | | 04/24/29 | | | 3,338,055 | |

| | 4,260,000 | | | Canyon Capital CLO Ltd. Series 2021-1RA D(a),(c) | | TSFR3M + 3.262% | | 7.9180 | | 07/15/30 | | | 4,261,184 | |

| | 3,600,000 | | | Carlyle C17 CLO Ltd. Series C17A CR(a),(c) | | TSFR3M + 3.062% | | 7.6510 | | 04/30/31 | | | 3,623,400 | |

| | 10,995,000 | | | Carlyle Global Market Strategies CLO Ltd. Series 2015-1A DR3(a),(c) | | TSFR3M + 3.212% | | 7.8290 | | 07/20/31 | | | 11,080,200 | |

| | 3,725,000 | | | CARLYLE US CLO Ltd. Series 2018-2A D(a),(c) | | TSFR3M + 5.512% | | 10.1680 | | 10/15/31 | | | 3,734,313 | |

| | 1,448,798 | | | Catamaran CLO Ltd. Series 2014-1A CR(a),(c) | | TSFR3M + 3.692% | | 8.3230 | | 04/22/30 | | | 1,459,664 | |

| | 10,000,000 | | | CBAM Ltd. Series 2017-1A D(a),(c) | | TSFR3M + 4.012% | | 8.6290 | | 07/20/30 | | | 10,015,280 | |

| | 5,000,000 | | | CBAM Ltd. Series 2017-1A E(a),(c) | | TSFR3M + 6.762% | | 11.3790 | | 07/20/30 | | | 5,009,245 | |

| | 1,000,000 | | | CIFC Funding Ltd. Series 2015-3A ER(a),(c) | | TSFR3M + 5.212% | | 9.8290 | | 04/19/29 | | | 1,001,751 | |

| | 2,110,932 | | | Clover Credit Partners CLO III Ltd. Series 2017-1A D(a),(c) | | TSFR3M + 4.012% | | 8.6680 | | 10/15/29 | | | 2,113,596 | |

| | 18,730,000 | | | Dryden Senior Loan Fund Series 2017-47A D(a),(c) | | TSFR3M + 3.662% | | 8.3180 | | 04/15/28 | | | 18,769,201 | |

| | 500,000 | | | Eaton Vance CLO Ltd. Series 2014-1RA D(a),(c) | | TSFR3M + 3.312% | | 7.9680 | | 07/15/30 | | | 501,014 | |

| | 5,880,000 | | | Elevation CLO Ltd. Series 2017-6A D(a),(c) | | TSFR3M + 3.912% | | 8.5680 | | 07/15/29 | | | 5,891,407 | |

| | 7,737,500 | | | Elevation CLO Ltd. Series 2017-6A E(a),(c) | | TSFR3M + 6.862% | | 11.5180 | | 07/15/29 | | | 7,768,535 | |

| | 750,000 | | | Elevation CLO Ltd. Series 2014-2A CR(a),(c) | | TSFR3M + 2.462% | | 7.1090 | | 10/15/29 | | | 751,898 | |

See accompanying notes which are an integral part of these financial statements.

| HOLBROOK STRUCTURED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| October 31, 2024 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 90.9% (Continued) | | | | | | | | | | |

| | | | | CLO — 63.4% (Continued) | | | | | | | | | | |

| | 4,500,000 | | | Elevation CLO Ltd. Series 2014-2A DR(a),(c) | | TSFR3M + 3.462% | | 8.1090 | | 10/15/29 | | $ | 4,510,071 | |

| | 2,110,000 | | | Elevation CLO Ltd. Series 2017-8A D(a),(c) | | TSFR3M + 3.132% | | 7.7570 | | 10/25/30 | | | 2,124,770 | |

| | 4,074,451 | | | Ellington CLO IV Ltd. Series 2019-4A D1(a),(c) | | TSFR3M + 5.762% | | 10.4180 | | 04/15/29 | | | 4,095,100 | |

| | 3,000,000 | | | Fillmore Park CLO Ltd Series 2018-1A(a),(c) | | TSFR3M + 3.162% | | 7.8180 | | 07/15/30 | | | 3,006,942 | |

| | 3,800,000 | | | Flatiron CLO 18 Ltd. Series 2018-1A E(a),(c) | | TSFR3M + 5.412% | | 10.0590 | | 04/17/31 | | | 3,802,390 | |

| | 2,000,000 | | | Galaxy XXI CLO Ltd. Series 2015-21A ER(a),(c) | | TSFR3M + 5.512% | | 10.1290 | | 04/20/31 | | | 1,995,302 | |

| | 4,900,000 | | | Galaxy XXVII CLO Ltd. Series 2018-27A E(a),(c) | | TSFR3M + 6.042% | | 11.1370 | | 05/16/31 | | | 4,894,831 | |

| | 375,000 | | | Goldentree Loan Opportunities XII Ltd. Series 2016-12A ER(a),(c) | | TSFR3M + 5.662% | | 10.2790 | | 07/21/30 | | | 375,438 | |

| | 1,300,000 | | | Guggenheim CLO Ltd. Series 2020-1A ER(a),(c) | | TSFR3M + 7.412% | | 12.0680 | | 04/15/31 | | | 1,302,343 | |

| | 17,900,000 | | | Halcyon Loan Advisors Funding Ltd. Series 2018-2A C(a),(c) | | TSFR3M + 3.662% | | 8.2930 | | 01/22/31 | | | 17,985,938 | |

| | 4,000,000 | | | Highbridge Loan Management Ltd. Series 2013-2A CR(a),(c) | | TSFR3M + 3.162% | | 7.7790 | | 10/20/29 | | | 4,007,584 | |

| | 2,833,255 | | | JMP Credit Advisors Clo IV Ltd. Series 2017-1A E(a),(c) | | TSFR3M + 7.062% | | 11.7090 | | 07/17/29 | | | 2,837,746 | |

| | 250,000 | | | JMP Credit Advisors CLO V Ltd. Series 2018-1A C(a),(c) | | TSFR3M + 2.612% | | 7.2590 | | 07/17/30 | | | 250,278 | |

| | 1,775,000 | | | KKR CLO 10 Ltd. Series 10 DR(a),(c) | | TSFR3M + 3.612% | | 8.5580 | | 09/15/29 | | | 1,778,252 | |

| | 5,000,000 | | | KKR CLO Ltd. Series 13 ER(a),(c) | | TSFR3M + 5.212% | | 9.8590 | | 01/16/28 | | | 5,014,465 | |

| | 1,000,000 | | | LCM XXIII Ltd. Series 23A CR(a),(c) | | TSFR3M + 3.562% | | 8.1790 | | 10/20/29 | | | 1,001,779 | |

| | 2,150,000 | | | Madison Park Funding XXVII Ltd. Series 2018-27A D(a),(c) | | TSFR3M + 5.262% | | 9.8790 | | 04/20/30 | | | 2,150,718 | |

| | 387,000 | | | Madison Park Funding XXVIII Ltd. Series 2018-28A D(a),(c) | | TSFR3M + 2.962% | | 7.6180 | | 07/15/30 | | | 387,783 | |

| | 1,962,500 | | | Marathon CLO VIII Ltd. Series 2015-8A CR(a),(c) | | TSFR3M + 3.792% | | 8.4240 | | 10/18/31 | | | 1,964,592 | |

| | 3,000,000 | | | Marble Point CLO XI Ltd. Series 2017-2A D(a),(c) | | TSFR3M + 3.062% | | 7.6940 | | 12/18/30 | | | 3,020,010 | |

| | 820,000 | | | Mountain View CLO, LLC Series 2017-1A D(a),(c) | | TSFR3M + 3.862% | | 8.5090 | | 10/16/29 | | | 823,077 | |

| | 8,710,000 | | | Nassau Ltd. Series 2017-IA C(a),(c) | | TSFR3M + 4.112% | | 8.7680 | | 10/15/29 | | | 8,762,399 | |

| | 500,000 | | | Neuberger Berman CLO XVIII Ltd. Series 2014-18A DR2(a),(c) | | TSFR3M + 6.182% | | 10.7990 | | 10/21/30 | | | 497,859 | |

| | 10,350,000 | | | Northwoods Capital XII-B Ltd. Series 2018-12BA D(a),(c) | | TSFR3M + 3.412% | | 8.3580 | | 06/15/31 | | | 10,396,585 | |

| | 12,500,000 | | | Northwoods Capital XIV-B Ltd. Series 2018-14BA D(a),(c) | | TSFR3M + 3.662% | | 8.7740 | | 11/13/31 | | | 12,553,688 | |

| | 2,900,000 | | | OCP CLO Ltd. Series 2014-7A DRR(a),(c) | | TSFR3M + 6.092% | | 10.7090 | | 07/20/29 | | | 2,897,294 | |

| | 8,000,000 | | | Octagon Investment Partners 39 Ltd. Series 2018-3A D(a),(c) | | TSFR3M + 3.212% | | 7.8290 | | 10/20/30 | | | 8,032,392 | |

| | 1,000,000 | | | OSD CLO Ltd. Series 2021-23A E(a),(c) | | TSFR3M + 6.262% | | 10.9090 | | 04/17/31 | | | 1,002,552 | |

| | 13,000,000 | | | OZLM XVIII Ltd. Series 2018-18A D(a),(c) | | TSFR3M + 3.112% | | 7.7680 | | 04/15/31 | | | 13,047,489 | |

| | 750,000 | | | Palmer Square Loan Funding Ltd. Series 2021-2A D(a),(c) | | TSFR3M + 5.262% | | 10.3900 | | 05/20/29 | | | 750,449 | |

| | 500,000 | | | Palmer Square Loan Funding Ltd. Series 2021-3A D(a),(c) | | TSFR3M + 5.262% | | 9.8790 | | 07/20/29 | | | 500,898 | |

| | 250,000 | | | Palmer Square Loan Funding Ltd. Series 2021-4A C(a),(c) | | TSFR3M + 2.862% | | 7.5180 | | 10/15/29 | | | 250,798 | |

| | 2,250,000 | | | Palmer Square Loan Funding Ltd. Series 2021-4A D(a),(c) | | TSFR3M + 5.262% | | 9.9180 | | 10/15/29 | | | 2,253,769 | |

| | 1,250,000 | | | Palmer Square Loan Funding Ltd. Series 2022-1A E(a),(c) | | TSFR3M + 7.200% | | 11.8470 | | 04/15/30 | | | 1,250,389 | |

See accompanying notes which are an integral part of these financial statements.

| HOLBROOK STRUCTURED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| October 31, 2024 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 90.9% (Continued) | | | | | | | | | | |

| | | | | CLO — 63.4% (Continued) | | | | | | | | | | |

| | 12,295,000 | | | Parallel Ltd. Series 2017-1A DR(a),(c) | | TSFR3M + 3.362% | | 7.9790 | | 07/20/29 | | $ | 12,341,721 | |

| | 3,750,000 | | | PPM CLO Ltd. Series 2018-1A D(a),(c) | | TSFR3M + 3.512% | | 8.1680 | | 07/15/31 | | | 3,771,293 | |

| | 485,000 | | | RR 4 LTD Series 2018-4A C(a),(c) | | TSFR3M + 3.212% | | 7.8680 | | 04/15/30 | | | 485,768 | |

| | 5,000,000 | | | Symphony Static CLO I Ltd. Series 2021-1A E1(a),(c) | | TSFR3M + 5.612% | | 10.2370 | | 10/25/29 | | | 5,003,355 | |

| | 250,000 | | | TCI-Flatiron CLO Ltd. Series 2017-1(a),(c) | | TSFR3M + 3.012% | | 8.1130 | | 11/17/30 | | | 250,684 | |

| | 1,500,000 | | | TCI-Flatiron CLO Ltd. Series 2017-1A E(a),(c) | | TSFR3M + 6.612% | | 11.7130 | | 11/18/30 | | | 1,505,561 | |

| | 841,190 | | | Telos CLO Ltd. Series 2014-5A DR(a),(c) | | TSFR3M + 3.562% | | 8.2090 | | 04/17/28 | | | 842,315 | |

| | 4,000,000 | | | THL Credit Wind River CLO Ltd Series 2014-1(a),(c) | | TSFR3M + 3.262% | | 7.8940 | | 07/18/31 | | | 4,026,692 | |

| | 700,000 | | | THL Credit Wind River CLO Ltd. Series 2018-1A D(a),(c) | | TSFR3M + 3.162% | | 7.8180 | | 07/15/30 | | | 700,920 | |

| | 16,000,000 | | | THL Credit Wind River CLO Ltd. Series 2015-1A DR(a),(c) | | TSFR3M + 3.262% | | 7.8790 | | 10/20/30 | | | 16,057,541 | |

| | 2,250,000 | | | THL Credit Wind River CLO Ltd. Series 2018-3A E(a),(c) | | TSFR3M + 5.912% | | 10.5290 | | 01/20/31 | | | 2,254,718 | |

| | 4,400,000 | | | Venture XXVI CLO Ltd. Series 2017-26A D(a),(c) | | TSFR3M + 4.512% | | 9.1290 | | 01/20/29 | | | 4,412,694 | |

| | 1,854,000 | | | Voya CLO Ltd. Series 2013-2A CR(a),(c) | | TSFR3M + 3.012% | | 7.6370 | | 04/25/31 | | | 1,858,553 | |

| | 722,941 | | | Zais CLO 5 Ltd. Series 2016-2A C(a),(c) | | TSFR3M + 4.762% | | 9.4180 | | 10/15/28 | | | 725,485 | |

| | 5,595,000 | | | Zais Clo 6 Ltd. Series 2017-1A D(a),(c) | | TSFR3M + 4.142% | | 8.7980 | | 07/15/29 | | | 5,610,621 | |

| | | | | | | | | | | | | | 283,544,698 | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 5.1% | | | | | | | | | | |

| | 2,835,871 | | | A&D Mortgage Trust Series 2024-NQM3 A1(a),(d) | | | | 6.4510 | | 07/25/69 | | | 2,860,503 | |

| | 990,991 | | | A&D Mortgage Trust Series 2024-NQM4 A1(a) | | | | 5.4640 | | 08/25/69 | | | 986,182 | |

| | 1,055,202 | | | Cascade Funding Mortgage Trust Series 2022-AB2 M3(a),(b) | | | | 2.0000 | | 02/25/52 | | | 872,249 | |

| | 2,500,000 | | | CFMT, LLC Series 2024-HB15 M3(a),(b) | | | | 4.0000 | | 08/25/34 | | | 2,201,985 | |

| | 1,000,000 | | | CFMT, LLC Series 2024-HB15 M4(a),(b) | | | | 4.0000 | | 08/25/34 | | | 797,040 | |

| | 2,236,891 | | | Chase Home Lending Mortgage Trust Series Series 2024-7 A6(a),(b) | | | | 6.0000 | | 06/25/55 | | | 2,235,478 | |

| | 78,710 | | | EFMT Series 2023-1 A2(a),(d) | | | | 6.2400 | | 02/25/68 | | | 78,758 | |

| | 1,349,185 | | | JP Morgan Mortgage Trust Series 2023-10 A6(a),(b) | | | | 6.0000 | | 05/25/54 | | | 1,352,192 | |

| | 787,728 | | | Morgan Stanley Residential Mortgage Loan Trust Series 2024-2 A5(a),(b) | | | | 6.0000 | | 03/25/54 | | | 786,472 | |

| | 1,850,302 | | | OBX Trust Series 2024-NQM8 A1(a),(d) | | | | 6.2330 | | 05/25/64 | | | 1,865,742 | |

| | 1,000,000 | | | Onity Loan Investment Trust Series 2024-HB2 M3(a) | | | | 5.0000 | | 08/25/37 | | | 914,610 | |

| | 2,250,000 | | | Onity Loan Investment Trust Series 2024-HB2 M4(a) | | | | 5.0000 | | 08/25/37 | | | 1,846,128 | |

| | 1,603,865 | | | PRKCM Trust Series 2023-AFC3 A1(a) | | | | 6.5840 | | 09/25/58 | | | 1,620,744 | |

| | 3,723,173 | | | PRKCM Trust Series 2024-HOME1 A1(a),(d) | | | | 6.4310 | | 05/25/59 | | | 3,784,993 | |

| | 664,921 | | | Verus Securitization Trust Series 2023-2 A1(a),(d) | | | | 6.1930 | | 03/25/68 | | | 667,606 | |

| | | | | | | | | | | | | | 22,870,682 | |

See accompanying notes which are an integral part of these financial statements.

| HOLBROOK STRUCTURED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| October 31, 2024 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 90.9% (Continued) | | | | | | | | | | |

| | | | | NON AGENCY CMBS — 19.4% | | | | | | | | | | |

| | 192,000 | | | BAMLL Commercial Mortgage Securities Trust Series 2019-BPR EMP(a),(b) | | | | 3.8950 | | 11/05/32 | | $ | 170,033 | |

| | 2,500,000 | | | BPR Trust Series 2021-WILL D(a),(c) | | TSFR1M + 5.114% | | 9.9180 | | 06/15/38 | | | 2,477,020 | |

| | 8,658,000 | | | BX Commercial Mortgage Trust Series 2019-IMC F(a),(c) | | TSFR1M + 2.946% | | 7.7500 | | 04/15/34 | | | 8,421,729 | |

| | 196,000 | | | BX Commercial Mortgage Trust Series 2019-IMC G(a),(c) | | TSFR1M + 3.646% | | 8.4500 | | 04/15/34 | | | 187,832 | |

| | 4,250,000 | | | Capital Funding Mortgage Trust Series 2024-28 B(a),(c) | | TSFR1M + 11.000% | | 15.4440 | | 11/01/26 | | | 4,250,000 | |

| | 4,000,000 | | | Capital Funding Mortgage Trust Series 2024-29 B(a),(c) | | TSFR1M + 9.500% | | 14.2000 | | 11/01/26 | | | 4,000,000 | |

| | 13,884,554 | | | Capital Funding Multifamily Mortgage Trust Series 2022-PM01 B(a),(c) | | TSFR1M + 9.500% | | 14.3440 | | 03/01/25 | | | 13,869,272 | |

| | 6,650,695 | | | COMM Mortgage Trust Series 2014-UBS5 XA(b),(e) | | | | 0.7820 | | 09/10/47 | | | 67 | |

| | 5,122,988 | | | COMM Mortgage Trust Series 2015-CR23 XA(b),(e) | | | | 0.9520 | | 05/10/48 | | | 8,579 | |

| | 3,568,649 | | | COMM Mortgage Trust Series 2015-LC21 XA(b),(e) | | | | 0.6080 | | 07/10/48 | | | 4,268 | |

| | 4,544,605 | | | CSMC Trust Series 2016-NXSR XA(b),(e) | | | | 0.8210 | | 12/15/49 | | | 43,324 | |

| | 1,752,620 | | | FREMF Mortgage Trust Series 2020-KF76 B(a),(c) | | SOFR30A + 2.864% | | 8.0280 | | 01/25/30 | | | 1,720,098 | |

| | 6,000,000 | | | GS Mortgage Securities Corp Trust Series 2018-3PCK C(a),(c) | | TSFR1M + 3.614% | | 8.4180 | | 09/15/31 | | | 5,875,278 | |

| | 3,000,000 | | | GS Mortgage Securities Trust Series 2013-GC10 D(a),(b) | | | | 4.5370 | | 02/10/46 | | | 2,917,410 | |

| | 2,000,000 | | | GSMS Trust Series 2024-FAIR D(a),(b) | | | | 7.9490 | | 07/15/29 | | | 2,026,979 | |

| | 1,215,000 | | | Independence Plaza Trust Series 2018-INDP A(a) | | | | 3.7630 | | 07/10/35 | | | 1,188,395 | |

| | 19,539,000 | | | J.P. Morgan Chase Commercial Mortgage Securities Series 2019-ICON XB(a),(b),(e) | | | | 0.7920 | | 01/05/34 | | | 159,567 | |

| | 27,233,543 | | | J.P. M organ Chase Commercial Mortgage Securities Series 2019-ICON XA(a),(b),(e) | | | | 1.5090 | | 01/05/34 | | | 325,528 | |

| | 880,000 | | | JP Morgan Chase Commercial Mortgage Securities Series 2020-NNN DFX(a) | | | | 3.6200 | | 01/16/37 | | | 466,565 | |

| | 5,000,000 | | | Morgan Stanley Capital I, Inc. Series 2024-BPR2 B(a) | | | | 8.5420 | | 05/05/29 | | | 5,203,271 | |

| | 6,000,000 | | | Morgan Stanley Capital I, Inc. Series 2024-BPR2 C(a),(b) | | | | 8.7520 | | 05/05/29 | | | 6,099,882 | |

| | 3,518,242 | | | Wells Fargo Commercial Mortgage Trust Series 2015-LC22 XA(b),(e) | | | | 0.8830 | | 09/15/58 | | | 13,709 | |

| | 3,000,000 | | | WP Glimcher Mall Trust Series 2015-WPG C(a),(b) | | | | 3.5160 | | 06/05/35 | | | 2,573,100 | |

| | 471,250 | | | XCALI Mortgage Trust Series 2021-10 B1(a),(c) | | TSFR1M + 8.120% | | 12.9640 | | 12/31/24 | | | 466,964 | |

| | 374,715 | | | XCALI Mortgage Trust Series 2020-5 B1(a),(c) | | TSFR1M + 8.370% | | 13.5710 | | 03/31/25 | | | 373,794 | |

| | 419,048 | | | X-Caliber Funding, LLC Series 2023-MF9 B1(a),(c) | | TSFR1M + 6.500% | | 11.3500 | | 11/15/24 | | | 419,173 | |

| | 4,600,000 | | | X-Caliber Funding, LLC Series 2023-HOAKS A(a),(c) | | TSFR1M + 3.500% | | 8.3440 | | 05/15/25 | | | 4,595,153 | |

| | 3,335,000 | | | X-Caliber Funding, LLC Series 2023-DMNK B1(a),(c) | | TSFR1M + 6.500% | | 11.3440 | | 05/15/25 | | | 3,330,618 | |

| | 4,165,000 | | | X-Caliber Funding, LLC Series 2021-7 B1(a),(c) | | TSFR3M + 6.000% | | 10.9590 | | 01/06/26 | | | 4,141,118 | |

| | 4,000,000 | | | X-Caliber Funding, LLC Series 2024-OPAL A(a),(c) | | TSFR1M + 4.000% | | 8.8440 | | 02/15/26 | | | 4,009,607 | |

| | 2,450,000 | | | X-Caliber Funding, LLC Series 2024-OPAL B1(a),(c) | | TSFR1M + 6.000% | | 10.8440 | | 02/15/26 | | | 2,457,755 | |

| | 5,000,000 | | | X-Caliber Funding, LLC Series 2024-SURF A(a) | | | | 12.0000 | | 08/04/27 | | | 5,052,810 | |

| | | | | | | | | | | | | | 86,848,898 | |

See accompanying notes which are an integral part of these financial statements.

| HOLBROOK STRUCTURED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| October 31, 2024 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 90.9% (Continued) | | | | | | | | | | |

| | | | | OTHER ABS — 0.3% | | | | | | | | | | |

| | 274,308 | | | Pagaya AI Debt Trust Series 2023-6 A(a) | | | | 7.1280 | | 06/16/31 | | $ | 274,738 | |

| | 367,017 | | | Pagaya AI Debt Trust Series 2024-1 A(a) | | | | 6.6600 | | 07/15/31 | | | 371,500 | |

| | 484,973 | | | Reach Abs Trust Series 2024-1A A(a) | | | | 6.3000 | | 02/18/31 | | | 488,079 | |

| | | | | | | | | | | | | | 1,134,317 | |

| | | | | TOTAL ASSET BACKED SECURITIES (Cost $405,973,763) | | | | | | | | | 406,413,113 | |

| | | | | | | | | | | | | | | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 4.3% | | | | | | | | | | |

| | | | | CMBS — 1.0% | | | | | | | | | | |

| | 2,665,000 | | | FREMF Mortgage Trust Series 2019-K736(a),(b) | | | | 3.8850 | | 07/25/26 | | | 2,584,309 | |

| | 1,771,000 | | | FREMF Mortgage Trust Series 2015-K50(a),(b) | | | | 3.7770 | | 10/25/48 | | | 1,750,177 | |

| | | | | | | | | | | | | | 4,334,486 | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 3.3% | | | | | | | | | | |

| | 1,931,663 | | | Fannie Mae REMICS Series 2024-20 CV | | | | 5.5000 | | 04/25/35 | | | 1,933,964 | |

| | 2,000,000 | | | Fannie Mae REMICS Series 2024-84 A | | | | 5.0000 | | 09/25/50 | | | 1,978,205 | |

| | 1,907,478 | | | Fannie Mae REMICS Series 2024-63 HA | | | | 5.0000 | | 06/25/52 | | | 1,884,510 | |

| | 1,708,484 | | | Freddie Mac REMICS Series 5428 DM | | | | 6.5000 | | 11/25/44 | | | 1,721,011 | |

| | 1,844,983 | | | Freddie Mac REMICS Series 5444 AB | | | | 5.5000 | | 09/25/49 | | | 1,843,392 | |

| | 1,855,946 | | | Freddie Mac REMICS Series 5438 H | | | | 5.5000 | | 06/25/50 | | | 1,854,630 | |

| | 1,833,820 | | | Freddie Mac REMICS Series 5423 A | | | | 5.0000 | | 11/25/50 | | | 1,821,012 | |