13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com Fourth Quarter 2013 Financial Results February 20, 2014

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com Safe Harbor 2 This presentation contains forward-looking statements regarding future events and our future results that are subject to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, are statements that could be deemed forward-looking statements. These statements are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “predicts,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “endeavors,” “strives,” “may,” variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future financial performance, our anticipated growth and trends in our businesses, and other characterizations of future events or circumstances are forward-looking statements. Readers are cautioned these forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially and adversely from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this release and those discussed in other documents we file with the Securities and Exchange Commission (SEC). More information on potential risks and uncertainties is available in our recent filings with the SEC, including CyrusOne’s Form 10-K and Form 8-Ks. Actual results may differ materially and adversely from those expressed in any forward-looking statements. We undertake no obligation to revise or update any forward-looking statements for any reason.

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com Highlights Fourth quarter revenue of $72.3 million increased 25% over the fourth quarter of 2012; full year revenue of $263.5 million increased 19% over 2012 Fourth quarter Normalized FFO of $23.6 million and AFFO of $20.8 million increased 40% and 54%, respectively, over the fourth quarter of 2012 2013 full year Normalized FFO of $78.7 million and AFFO of $72.4 million increased 17% and 36%, respectively, over 2012 Fourth quarter Adjusted EBITDA of $39.9 million and full year Adjusted EBITDA of $138.7 million increased 40% and 20%, respectively, over fourth quarter and full year 2012 Leased 47,000 CSF(1) in the fourth quarter, with utilization remaining high at 85% Announcing a 31% increase in the quarterly dividend for the first quarter of 2014 to $0.21 per share on common shares and common share equivalents, up from $0.16 per share in 2013 Purchased 14 acres of land in Northern Virginia, establishing a presence on the East Coast, and 22 acres in Austin for future data center expansion Fourth Quarter and Full Year 2013 Note: 1. Colocation square feet (CSF) represents NRSF currently leased or available for lease as colocation space, where customers locate their servers and other IT equipment. Net rentable square feet (NRSF) represents the total square feet of a building currently leased or available for lease, based on engineers’ drawings and estimates but does not include space held for development or space used by CyrusOne. 3

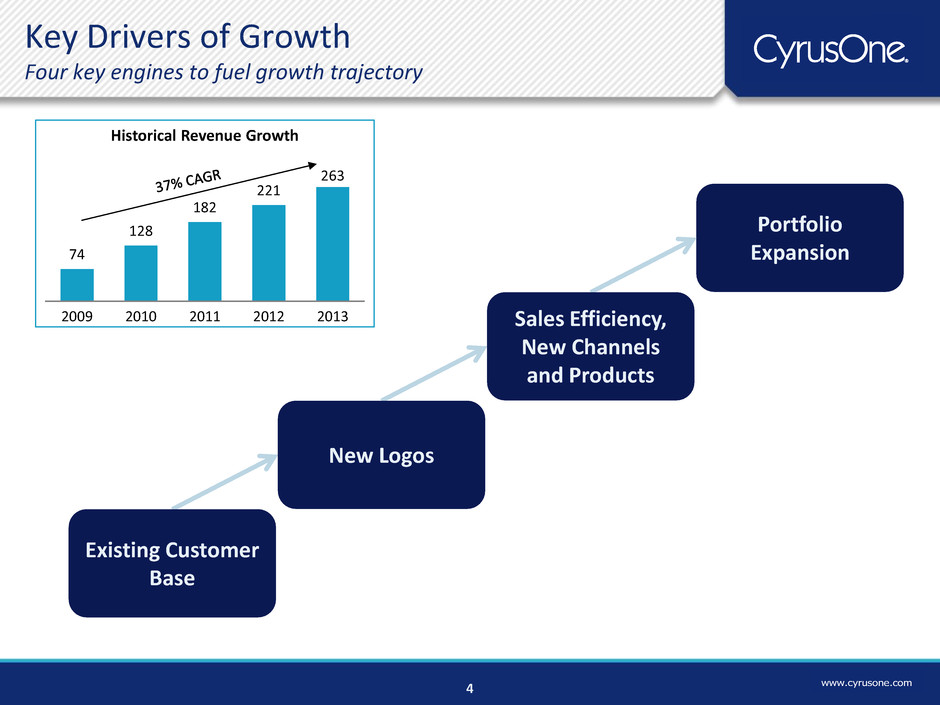

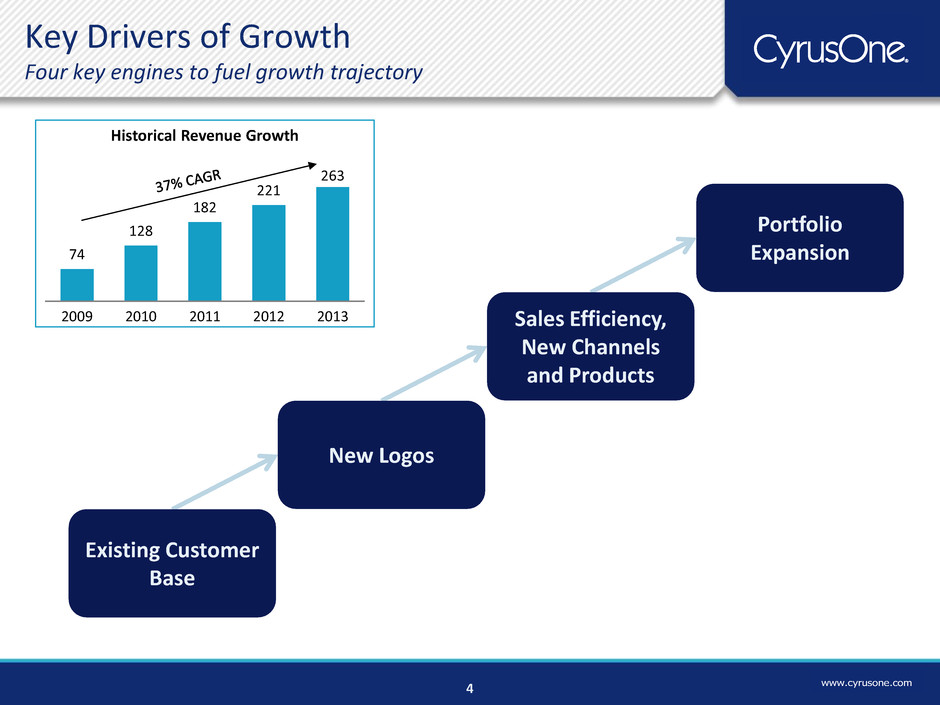

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com4 Historical Revenue Growth 74 128 182 221 263 2009 2010 2011 2012 2013 Key Drivers of Growth Four key engines to fuel growth trajectory Portfolio Expansion Existing Customer Base New Logos Sales Efficiency, New Channels and Products

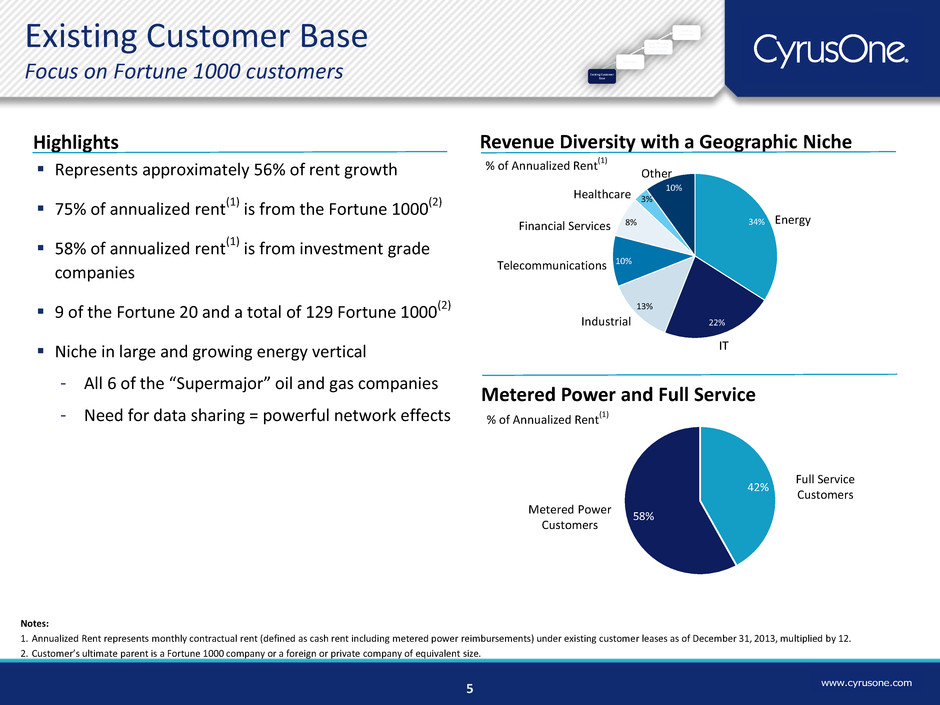

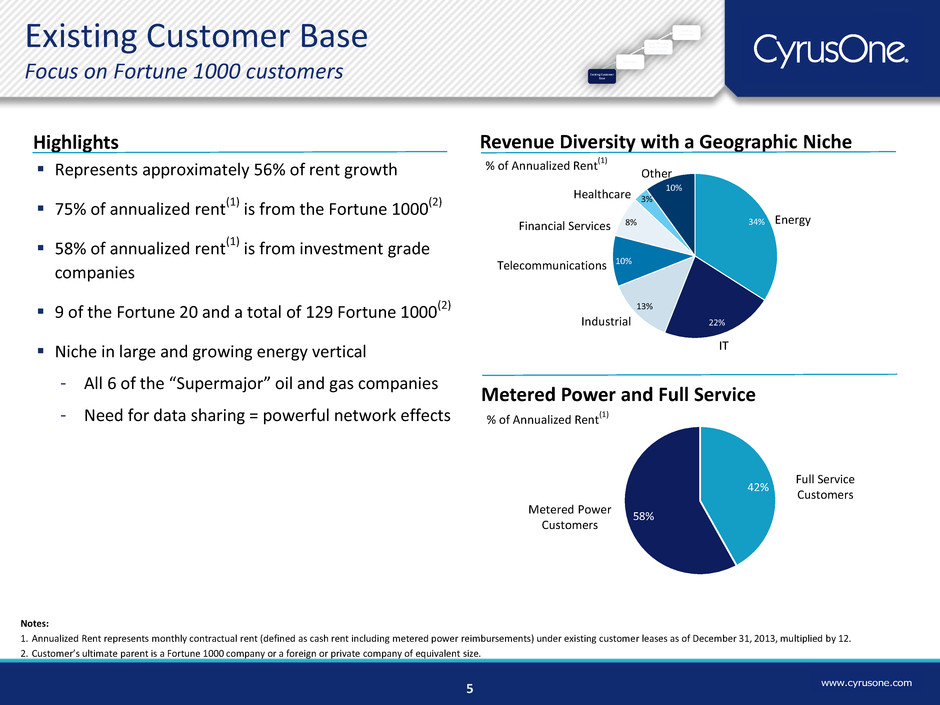

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com 34% 22% 13% 10% 8% 3% 10% 42% 58% Represents approximately 56% of rent growth 75% of annualized rent(1) is from the Fortune 1000(2) 58% of annualized rent(1) is from investment grade companies 9 of the Fortune 20 and a total of 129 Fortune 1000(2) Niche in large and growing energy vertical - All 6 of the “Supermajor” oil and gas companies - Need for data sharing = powerful network effects Notes: 1. Annualized Rent represents monthly contractual rent (defined as cash rent including metered power reimbursements) under existing customer leases as of December 31, 2013, multiplied by 12. 2. Customer’s ultimate parent is a Fortune 1000 company or a foreign or private company of equivalent size. Revenue Diversity with a Geographic Niche Energy Other Telecommunications Financial Services Healthcare IT Full Service Customers Metered Power Customers % of Annualized Rent (1) Metered Power and Full Service % of Annualized Rent (1) 5 Industrial Highlights Existing Customer Base Focus on Fortune 1000 customers Portfolio Expansion Existing Customer Base New Logos Sales Efficiency, New Channels and Products

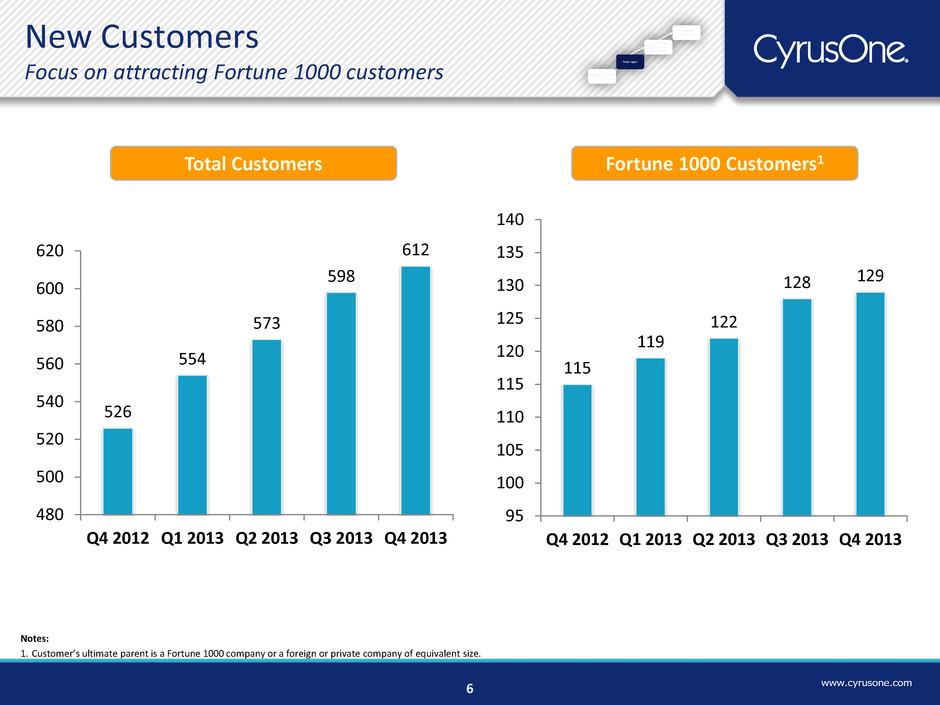

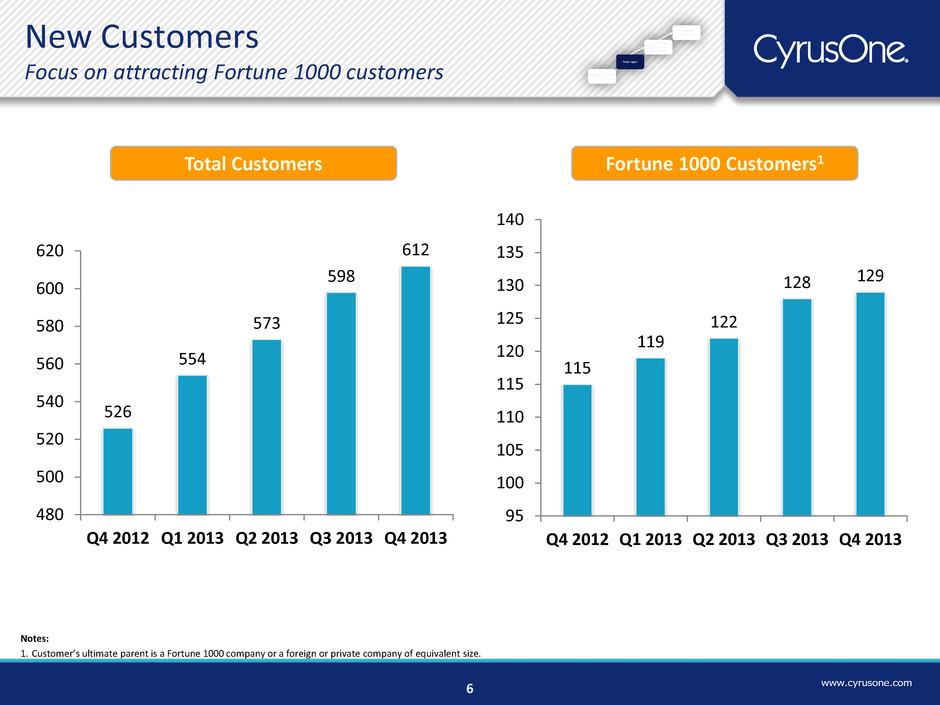

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com 526 554 573 598 612 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 480 500 520 540 560 580 600 620 115 119 122 128 129 95 100 105 110 115 120 125 130 135 140 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Total Customers Fortune 1000 Customers1 New Customers Focus on attracting Fortune 1000 customers Notes: 1. Customer’s ultimate parent is a Fortune 1000 company or a foreign or private company of equivalent size. 6 Portfolio Expansion Existing Customer Base New Logos Sales Efficiency, New Channels and Products

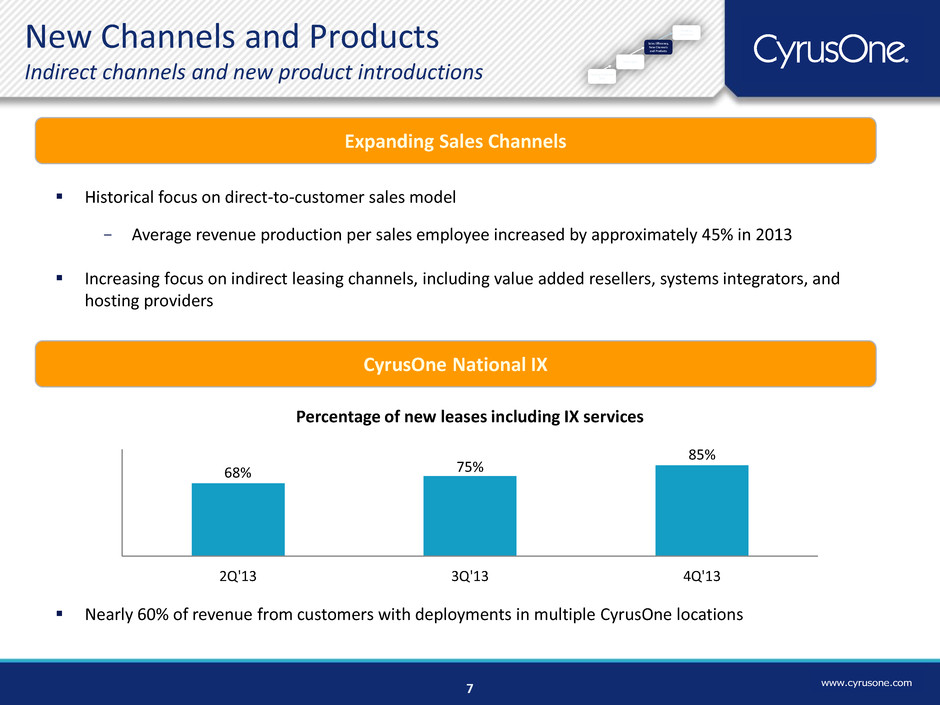

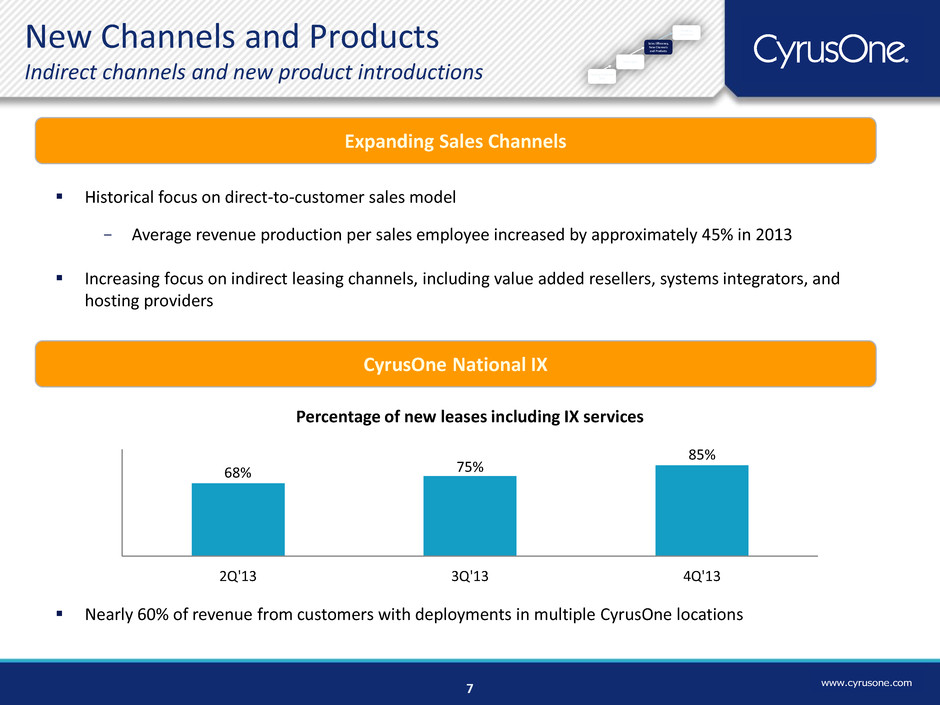

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com7 Expanding Sales Channels Historical focus on direct-to-customer sales model - Average revenue production per sales employee increased by approximately 45% in 2013 Increasing focus on indirect leasing channels, including value added resellers, systems integrators, and hosting providers CyrusOne National IX 68% 75% 85% 2Q'13 3Q'13 4Q'13 Percentage of new leases including IX services New Channels and Products Indirect channels and new product introductions Nearly 60% of revenue from customers with deployments in multiple CyrusOne locations Portfolio Expansion Existing Customer Base New Logos Sales Efficiency, New Channels and Products

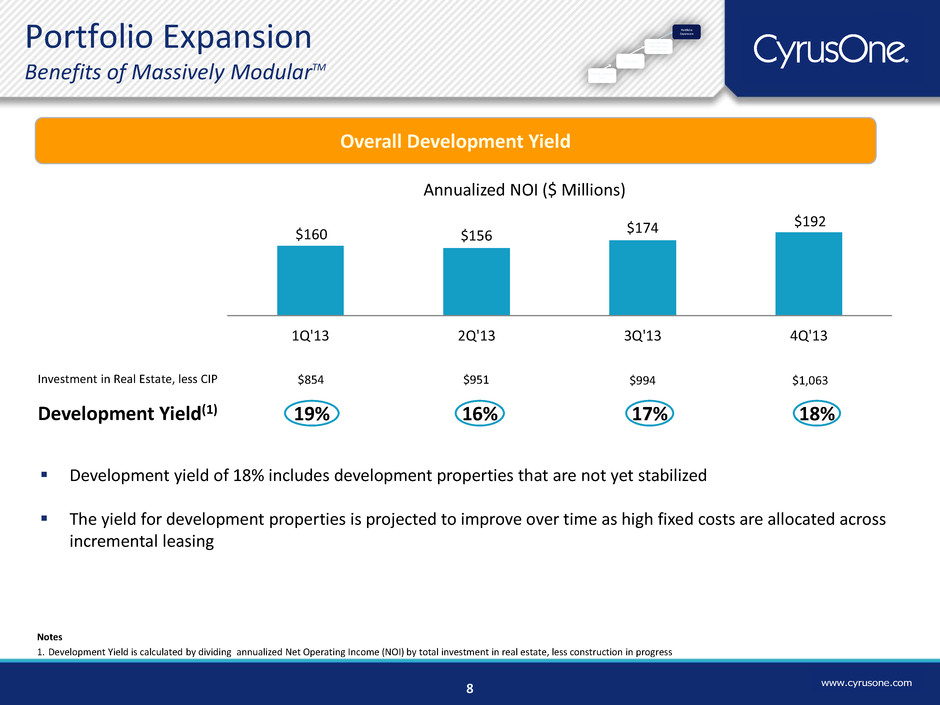

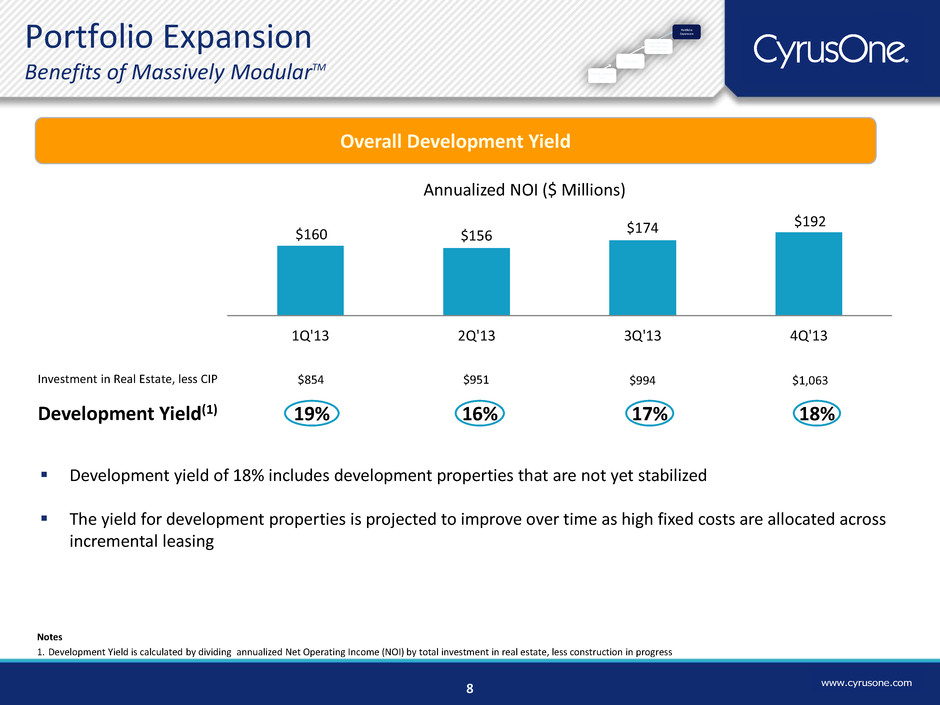

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com8 Notes 1. Development Yield is calculated by dividing annualized Net Operating Income (NOI) by total investment in real estate, less construction in progress Development yield of 18% includes development properties that are not yet stabilized The yield for development properties is projected to improve over time as high fixed costs are allocated across incremental leasing Overall Development Yield 16% Development Yield(1) 17% Investment in Real Estate, less CIP $951 $994 Annualized NOI ($ Millions) $160 $156 $174 $192 1Q'13 2Q'13 3Q'13 4Q'13 18% $1,063 19% $854 Portfolio Expansion Benefits of Massively ModularTM Portfolio Expansion Existing Customer Base New Logos Sales Efficiency, New Channels and Products

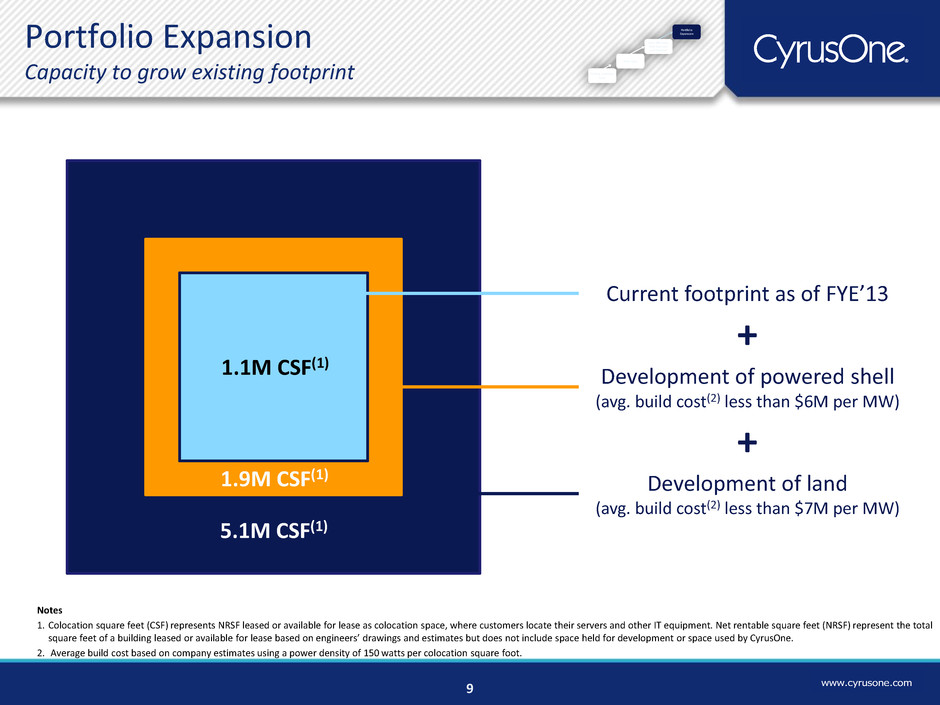

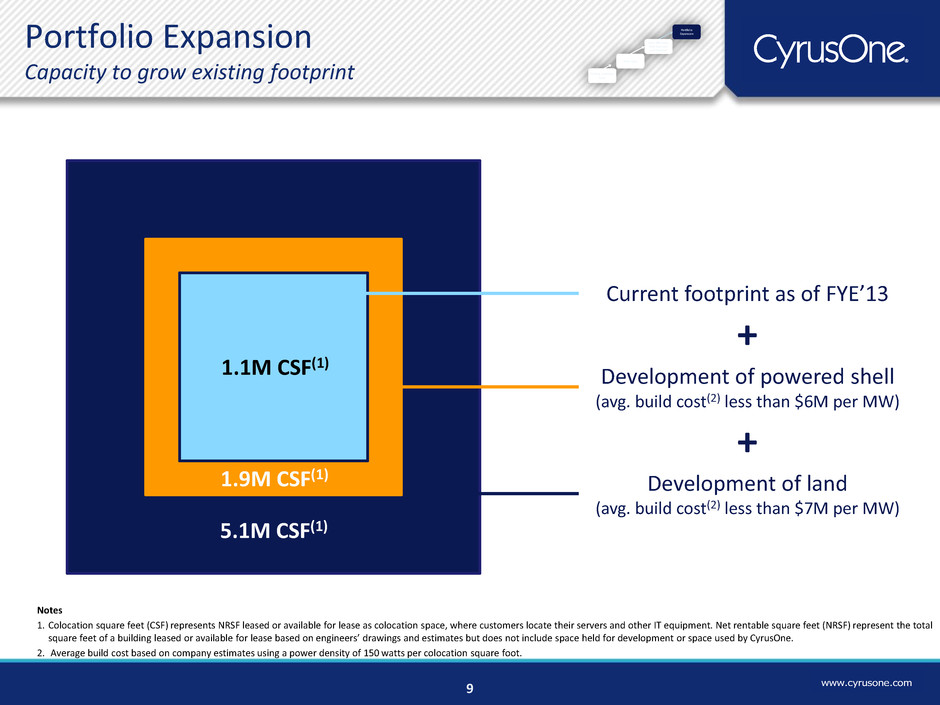

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com Portfolio Expansion Capacity to grow existing footprint 5.1M CSF(1) 1.9M CSF(1) 1.1M CSF(1) Development of powered shell (avg. build cost(2) less than $6M per MW) Current footprint as of FYE’13 Development of land (avg. build cost(2) less than $7M per MW) 9 Notes 1. Colocation square feet (CSF) represents NRSF leased or available for lease as colocation space, where customers locate their servers and other IT equipment. Net rentable square feet (NRSF) represent the total square feet of a building leased or available for lease based on engineers’ drawings and estimates but does not include space held for development or space used by CyrusOne. 2. Average build cost based on company estimates using a power density of 150 watts per colocation square foot. Portfolio Expansion Existing Customer Base New Logos Sales Efficiency, New Channels and Products + +

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com10 New Market - Northern Virginia Expansions in Existing Markets - San Antonio #2 and Houston West #3 Portfolio Expansion New markets and expansions in existing markets Portfolio Expansion Existing Customer Base New Logos Sales Efficiency, New Channels and Products

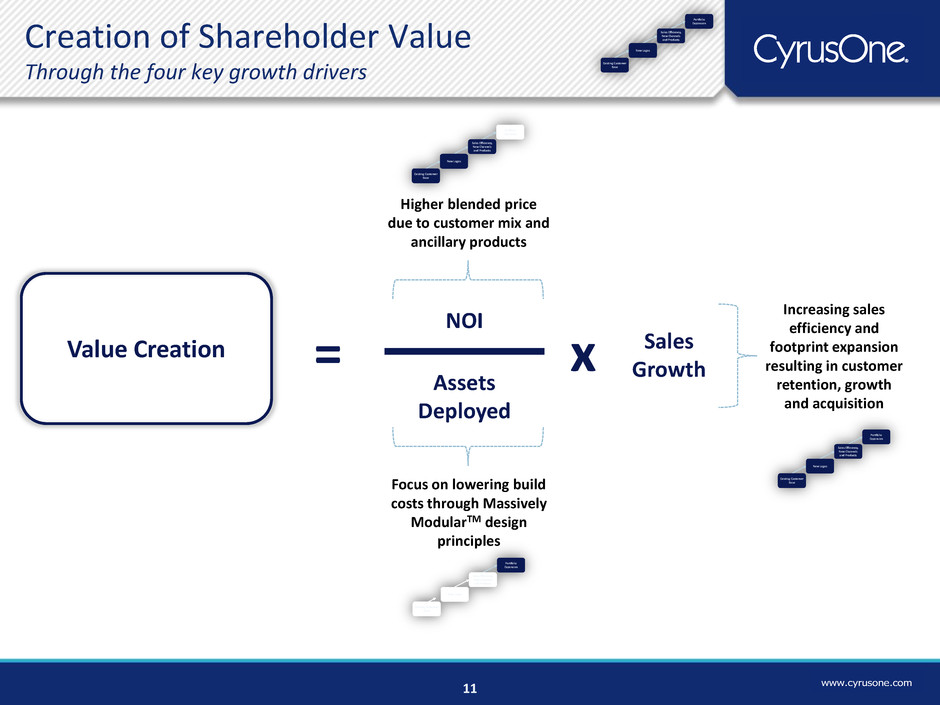

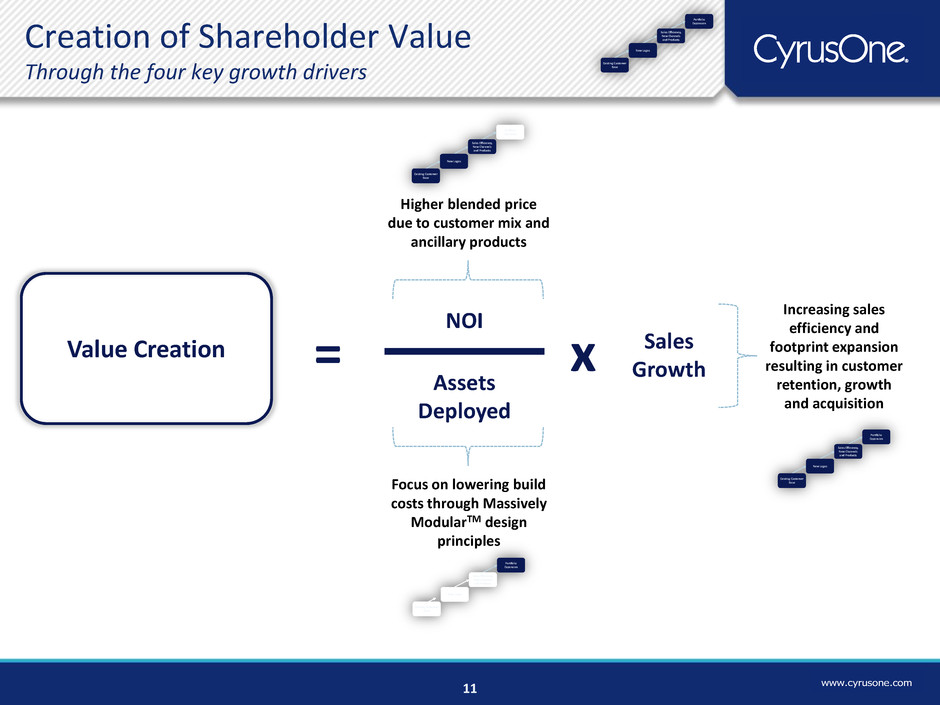

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com11 Creation of Shareholder Value Through the four key growth drivers Portfolio Expansion Existing Customer Base New Logos Sales Efficiency, New Channels and Products Value Creation = NOI Assets Deployed x Sales Growth Higher blended price due to customer mix and ancillary products Focus on lowering build costs through Massively ModularTM design principles Increasing sales efficiency and footprint expansion resulting in customer retention, growth and acquisition Portfolio Expansion Existing Customer Base New Logos Sales Efficiency, New Channels and Products Portfolio Expansion Existing Customer Base New Logos Sales Efficiency, New Channels and Products Portfolio Expansion Existing Customer Base New Logos Sales Efficiency, New Channels and Products

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com Fourth Quarter Review

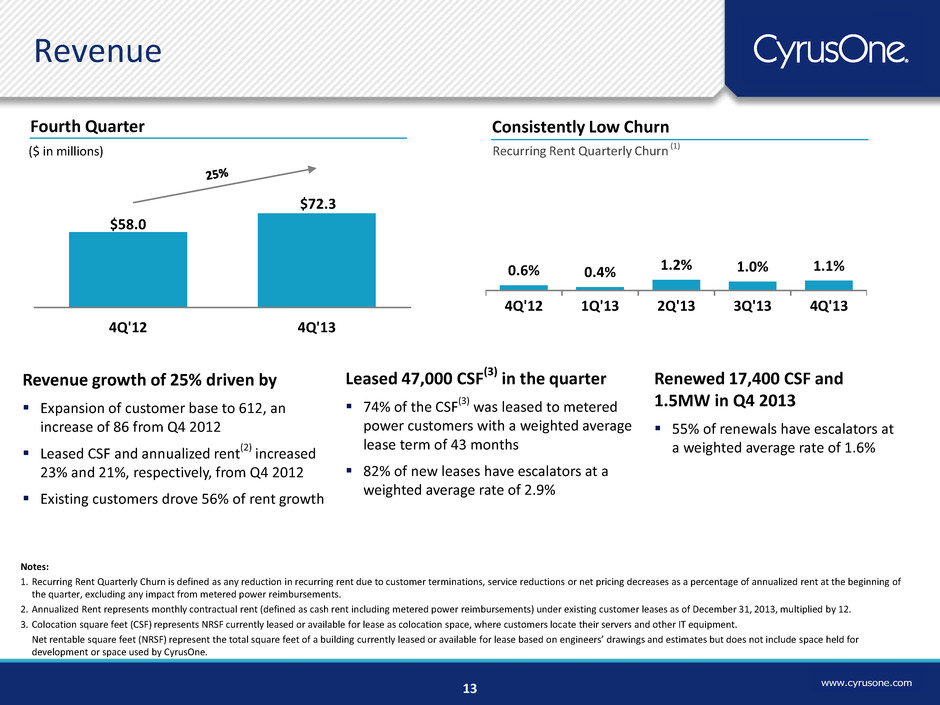

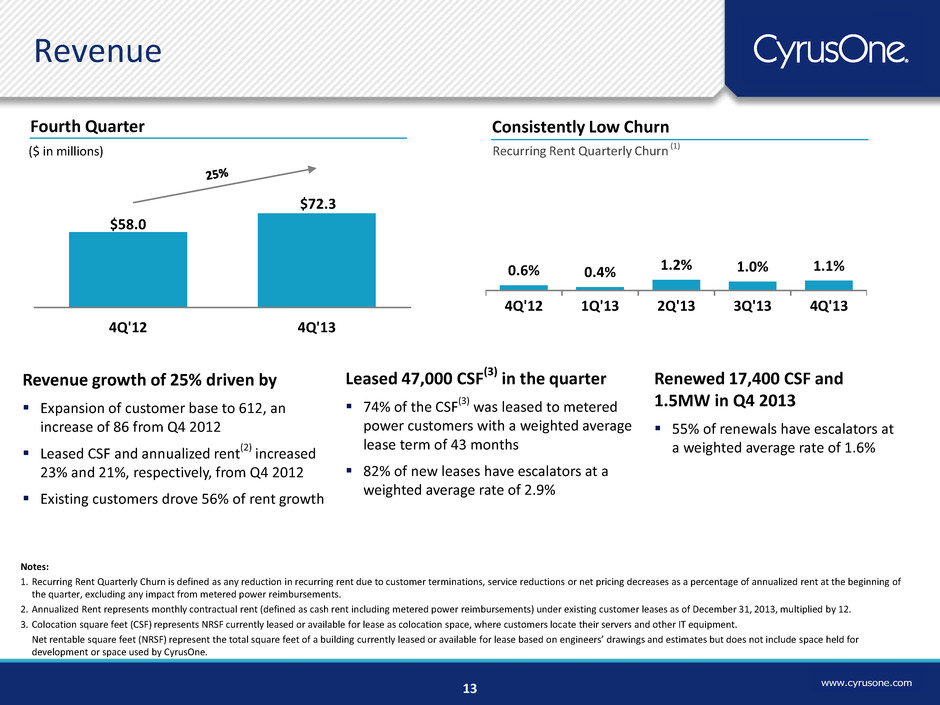

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com $58.0 $72.3 4Q'12 4Q'13 Revenue Fourth Quarter ($ in millions) 13 0.6% 0.4% 1.2% 1.0% 1.1% 4Q'12 1Q'13 2Q'13 3Q'13 4Q'13 Consistently Low Churn Recurring Rent Quarterly Churn (1) Notes: 1. Recurring Rent Quarterly Churn is defined as any reduction in recurring rent due to customer terminations, service reductions or net pricing decreases as a percentage of annualized rent at the beginning of the quarter, excluding any impact from metered power reimbursements. 2. Annualized Rent represents monthly contractual rent (defined as cash rent including metered power reimbursements) under existing customer leases as of December 31, 2013, multiplied by 12. 3. Colocation square feet (CSF) represents NRSF currently leased or available for lease as colocation space, where customers locate their servers and other IT equipment. Net rentable square feet (NRSF) represent the total square feet of a building currently leased or available for lease based on engineers’ drawings and estimates but does not include space held for development or space used by CyrusOne. Leased 47,000 CSF(3) in the quarter 74% of the CSF(3) was leased to metered power customers with a weighted average lease term of 43 months 82% of new leases have escalators at a weighted average rate of 2.9% Renewed 17,400 CSF and 1.5MW in Q4 2013 55% of renewals have escalators at a weighted average rate of 1.6% Revenue growth of 25% driven by Expansion of customer base to 612, an increase of 86 from Q4 2012 Leased CSF and annualized rent(2) increased 23% and 21%, respectively, from Q4 2012 Existing customers drove 56% of rent growth

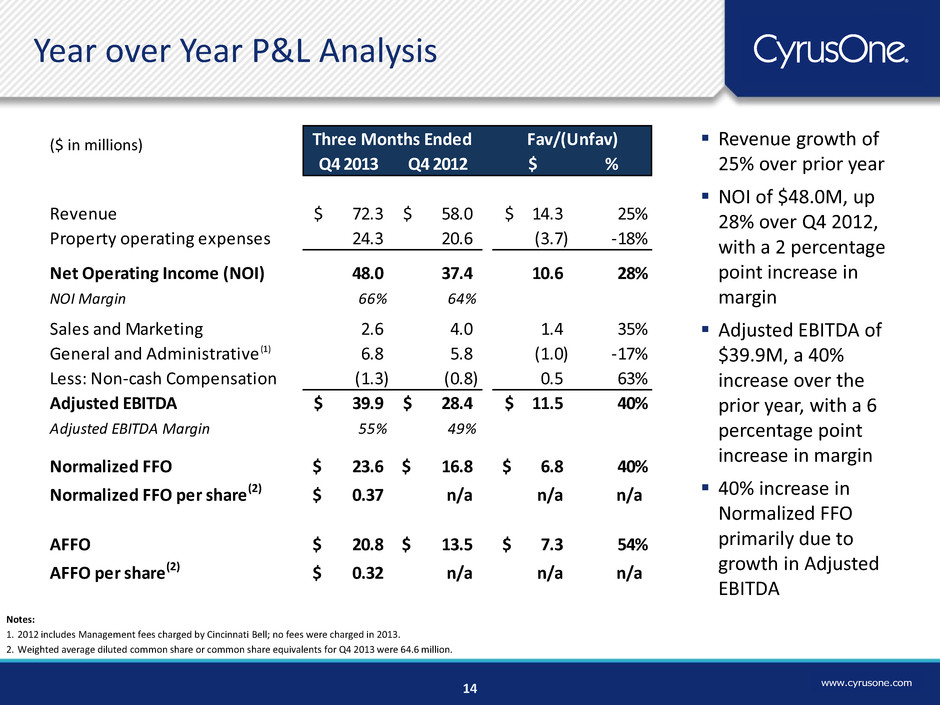

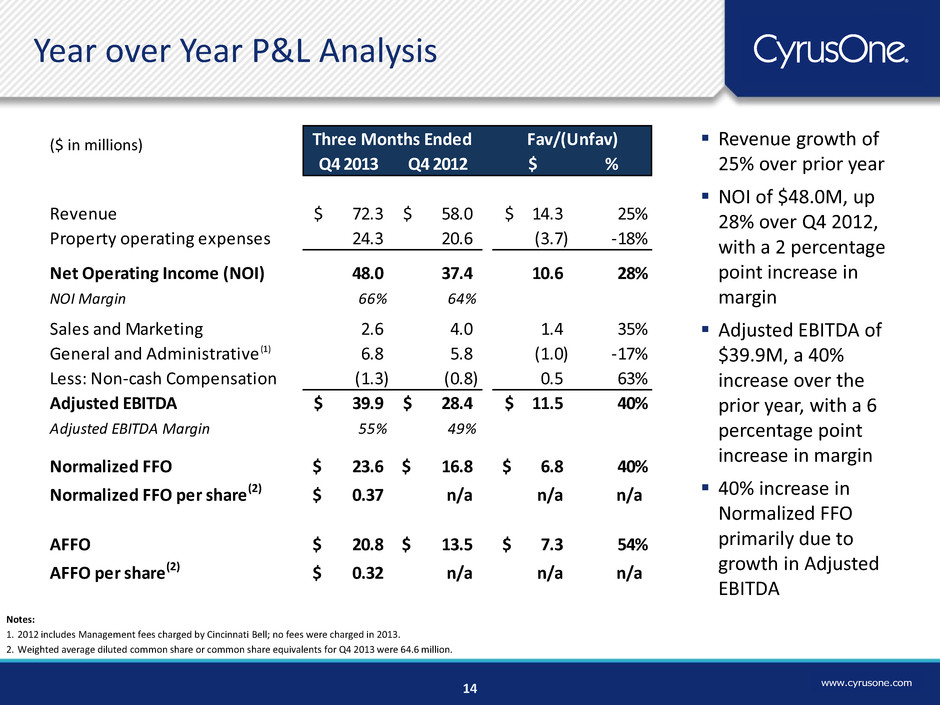

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com Revenue growth of 25% over prior year NOI of $48.0M, up 28% over Q4 2012, with a 2 percentage point increase in margin Adjusted EBITDA of $39.9M, a 40% increase over the prior year, with a 6 percentage point increase in margin 40% increase in Normalized FFO primarily due to growth in Adjusted EBITDA 14 Year over Year P&L Analysis Notes: 1. 2012 includes Management fees charged by Cincinnati Bell; no fees were charged in 2013. 2. Weighted average diluted common share or common share equivalents for Q4 2013 were 64.6 million. ($ in millions) Q4 2013 Q4 2012 $ % Revenue 72.3$ 58.0$ 14.3$ 25% Property operating expenses 24.3 20.6 (3.7) -18% Net Operating Income (NOI) 48.0 37.4 10.6 28% NOI Margin 66% 64% Sales and Marketing 2.6 4.0 1.4 35% General and Administrative (1) 6.8 5.8 (1.0) -17% Less: Non-cash Compensation (1.3) (0.8) 0.5 63% Adjusted EBITDA 39.9$ 28.4$ 11.5$ 40% Adjusted EBITDA Margin 55% 49% N rmalized FFO 23.6$ 16.8$ 6.8$ 40% Normalized FFO pe share(2) 0.37$ n/a n/a n/a AFFO 20.8$ 13.5$ 7.3$ 54% AFFO per share(2) 0.32$ n/a n/a n/a Three Months Ended Fav/(Unfav)

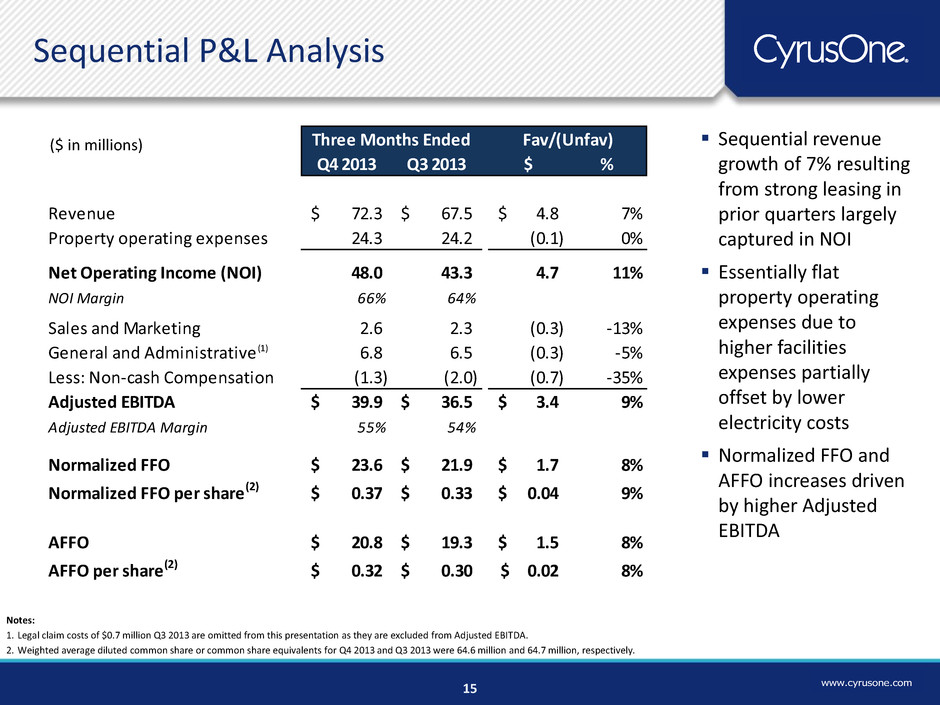

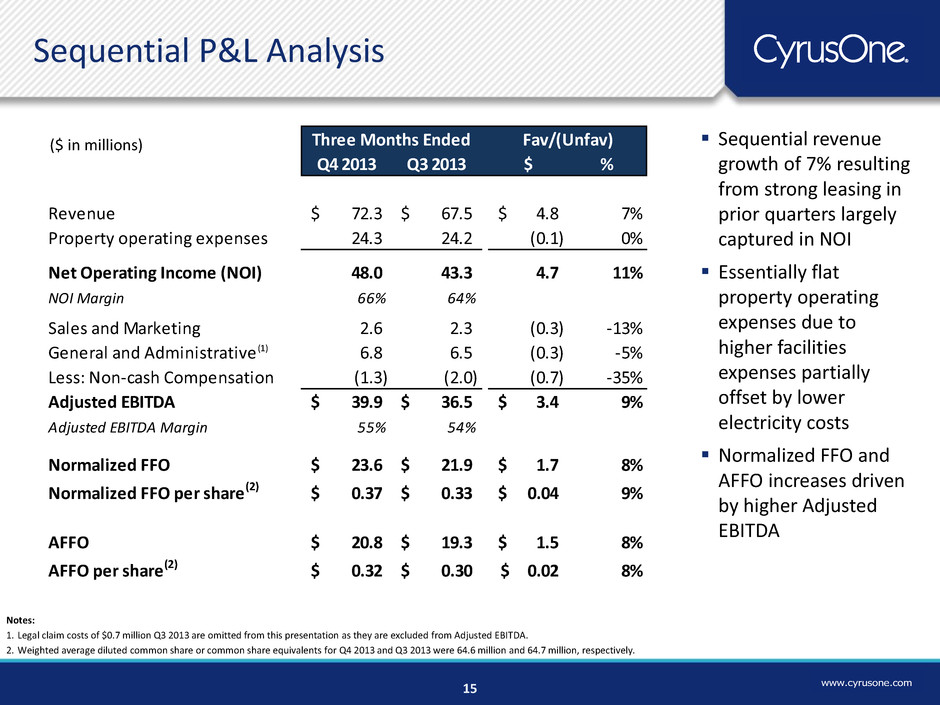

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com Sequential revenue growth of 7% resulting from strong leasing in prior quarters largely captured in NOI Essentially flat property operating expenses due to higher facilities expenses partially offset by lower electricity costs Normalized FFO and AFFO increases driven by higher Adjusted EBITDA 15 Sequential P&L Analysis Notes: 1. Legal claim costs of $0.7 million Q3 2013 are omitted from this presentation as they are excluded from Adjusted EBITDA. 2. Weighted average diluted common share or common share equivalents for Q4 2013 and Q3 2013 were 64.6 million and 64.7 million, respectively. ($ in millions) Q4 2013 Q3 2013 $ % Revenue 72.3$ 67.5$ 4.8$ 7% Property operating expenses 24.3 24.2 (0.1) 0% Net Operating Income (NOI) 48.0 43.3 4.7 11% NOI Margin 66% 64% Sales and Marketing 2.6 2.3 (0.3) -13% General and Administrative (1) 6.8 6.5 (0.3) -5% Less: Non-cash Compensation (1.3) (2.0) (0.7) -35% Adjusted EBITDA 39.9$ 36.5$ 3.4$ 9% Adjusted EBITDA Margin 55% 54% N rmalized FFO 23.6$ 21.9$ 1.7$ 8% Normalized FFO per share(2) 0.37$ 0.33$ 0.04$ 9% AFFO 20.8$ 19.3$ 1.5$ 8% AFFO per share(2) 0.32$ 0.30$ 0.02$ 8% Three Months Ended Fav/(Unfav)

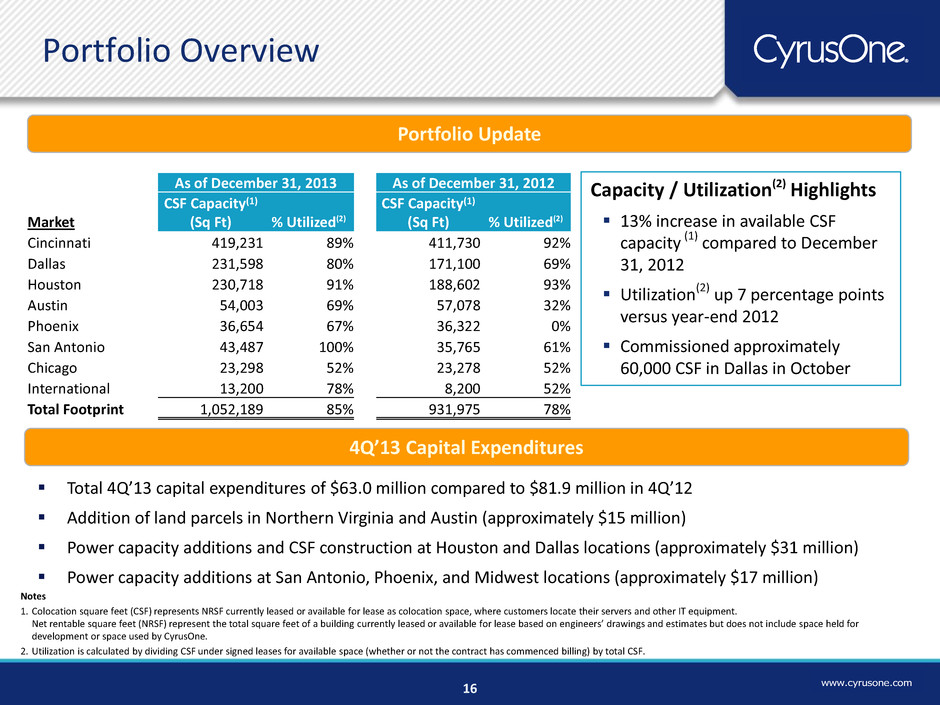

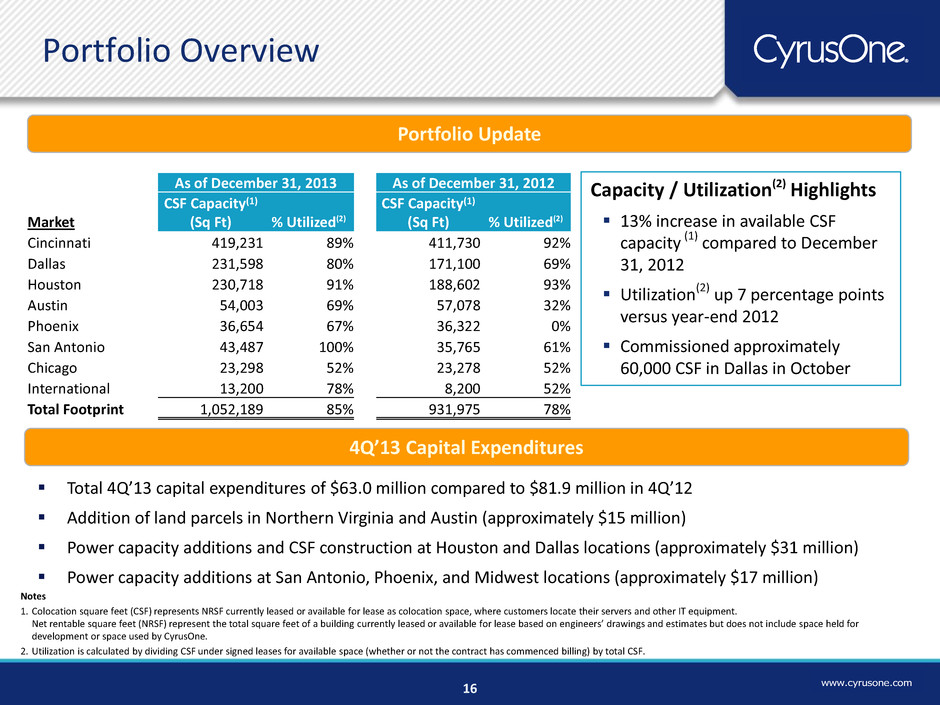

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com Portfolio Overview Portfolio Update 16 (1) (1) Notes 1. Colocation square feet (CSF) represents NRSF currently leased or available for lease as colocation space, where customers locate their servers and other IT equipment. Net rentable square feet (NRSF) represent the total square feet of a building currently leased or available for lease based on engineers’ drawings and estimates but does not include space held for development or space used by CyrusOne. 2. Utilization is calculated by dividing CSF under signed leases for available space (whether or not the contract has commenced billing) by total CSF. As of December 31, 2013 As of December 31, 2012 Market CSF Capacity(1) (Sq Ft) % Utilized(2) CSF Capacity(1) (Sq Ft) % Utilized(2) Cincinnati 419,231 89% 411,730 92% Dallas 231,598 80% 171,100 69% Houston 230,718 91% 188,602 93% Austin 54,003 69% 57,078 32% Phoenix 36,654 67% 36,322 0% San Antonio 43,487 100% 35,765 61% Chicago 23,298 52% 23,278 52% International 13,200 78% 8,200 52% Total Footprint 1,052,189 85% 931,975 78% Capacity / Utilization(2) Highlights 13% increase in available CSF capacity (1) compared to December 31, 2012 Utilization(2) up 7 percentage points versus year-end 2012 Commissioned approximately 60,000 CSF in Dallas in October (87%) (88%) (88%) (78%) (2) 4Q’13 Capital Expenditures Total 4Q’13 capital expenditures of $63.0 million compared to $81.9 million in 4Q’12 Addition of land parcels in Northern Virginia and Austin (approximately $15 million) Power capacity additions and CSF construction at Houston and Dallas locations (approximately $31 million) Power capacity additions at San Antonio, Phoenix, and Midwest locations (approximately $17 million)

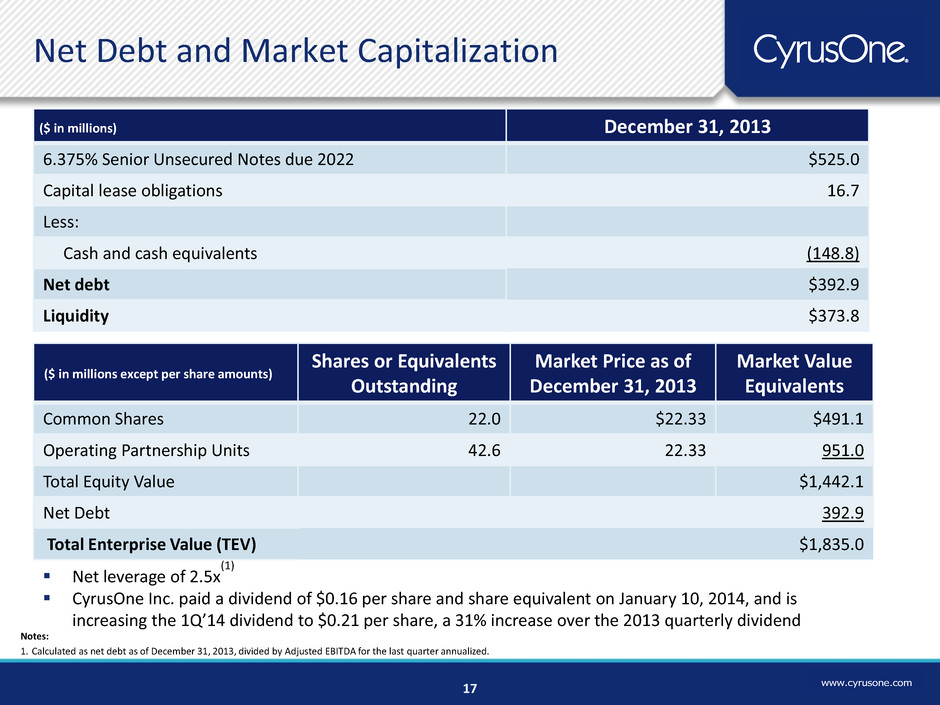

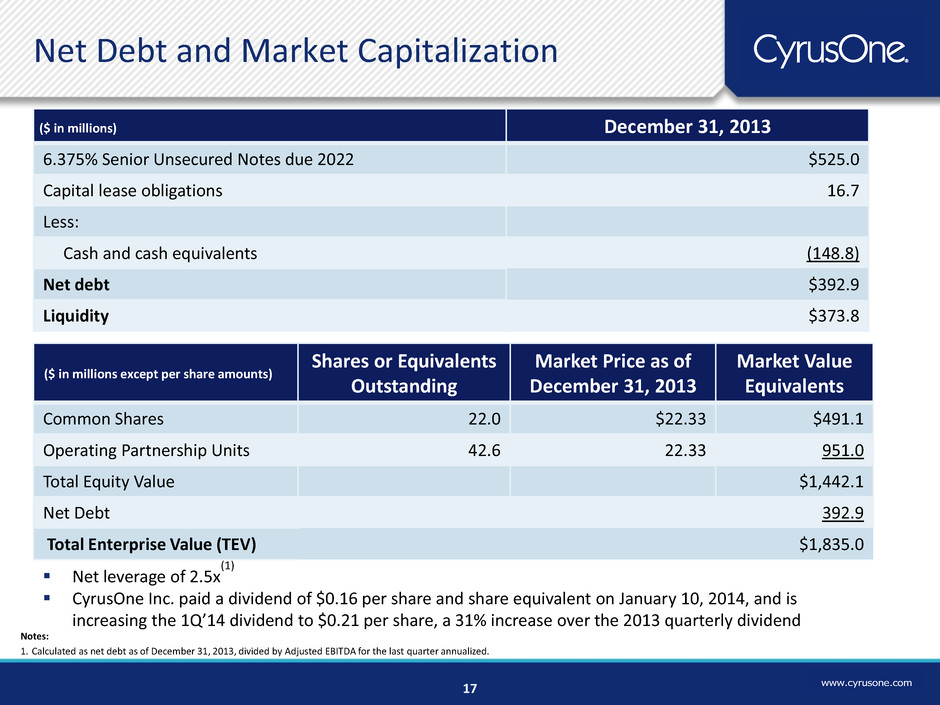

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com 11 December 31, 2013 6.375% Senior Unsecured Notes due 2022 $525.0 Capital lease obligations 16.7 Less: Cash and cash equivalents (148.8) Net debt $392.9 Liquidity $373.8 17 ($ in millions) Notes: 1. Calculated as net debt as of December 31, 2013, divided by Adjusted EBITDA for the last quarter annualized. Shares or Equivalents Outstanding Market Price as of December 31, 2013 Market Value Equivalents Common Shares 22.0 $22.33 $491.1 Operating Partnership Units 42.6 22.33 951.0 Total Equity Value $1,442.1 Net Debt 392.9 Total Enterprise Value (TEV) $1,835.0 Net leverage of 2.5x (1) CyrusOne Inc. paid a dividend of $0.16 per share and share equivalent on January 10, 2014, and is increasing the 1Q’14 dividend to $0.21 per share, a 31% increase over the 2013 quarterly dividend Net Debt and Market Capitalization ($ in millions except per share amounts)

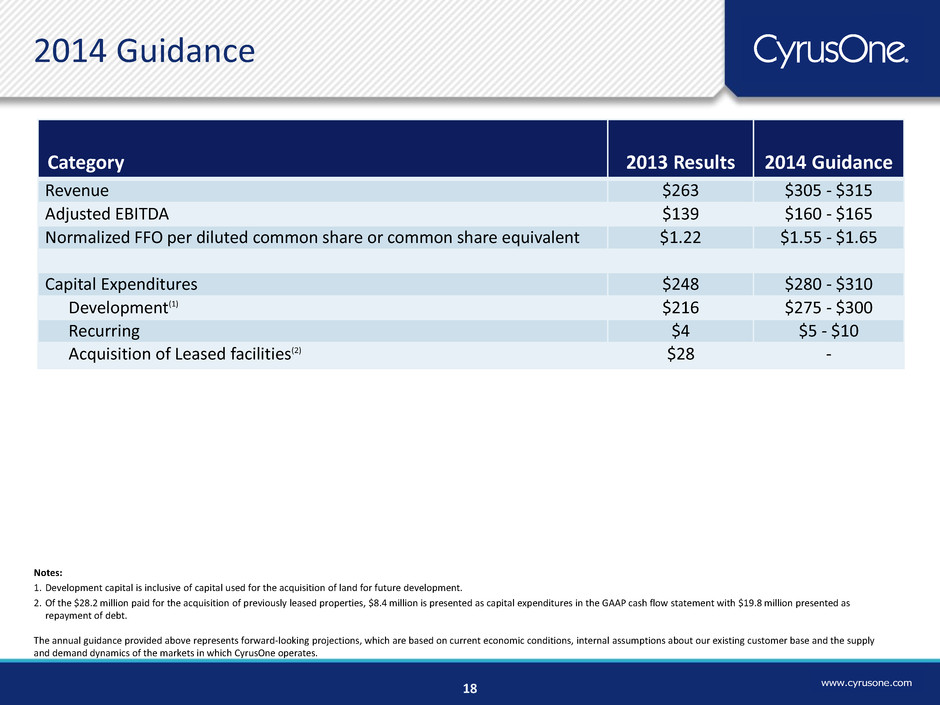

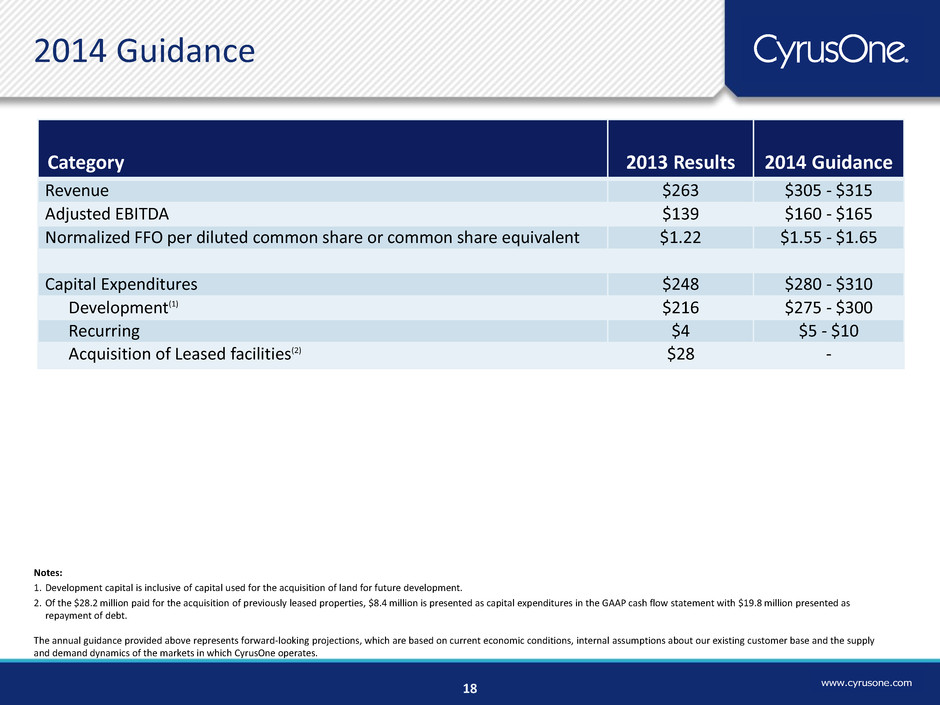

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com 2014 Guidance Category 2013 Results 2014 Guidance Revenue $263 $305 - $315 Adjusted EBITDA $139 $160 - $165 Normalized FFO per diluted common share or common share equivalent $1.22 $1.55 - $1.65 Capital Expenditures $248 $280 - $310 Development(1) $216 $275 - $300 Recurring $4 $5 - $10 Acquisition of Leased facilities(2) $28 - 18 ($ in millions except per share amounts) Notes: 1. Development capital is inclusive of capital used for the acquisition of land for future development. 2. Of the $28.2 million paid for the acquisition of previously leased properties, $8.4 million is presented as capital expenditures in the GAAP cash flow statement with $19.8 million presented as repayment of debt. The annual guidance provided above represents forward-looking projections, which are based on current economic conditions, internal assumptions about our existing customer base and the supply and demand dynamics of the markets in which CyrusOne operates. Category esults c v - Adj st EBIT - r aliz FF er ilut c shar r c share e ivale t . 1.5 - 1.6 a ital it r s - velop t(1) - c rri g - isition f L ase facilities(2) -

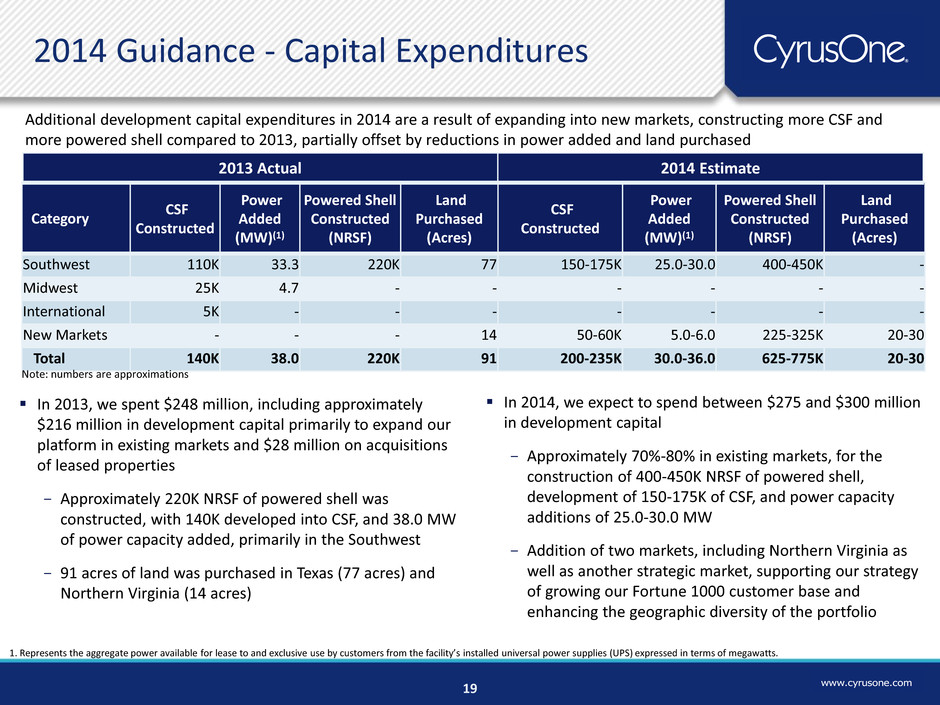

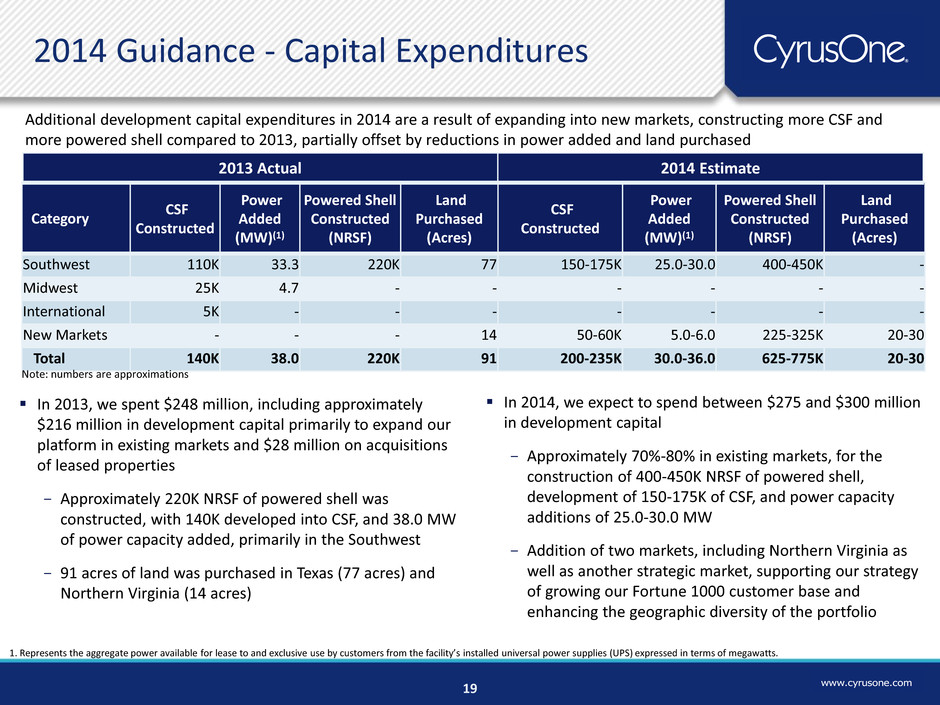

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com 2014 Guidance - Capital Expenditures 19 ($ in millions except per share amounts) In 2013, we spent $248 million, including approximately $216 million in development capital primarily to expand our platform in existing markets and $28 million on acquisitions of leased properties - Approximately 220K NRSF of powered shell was constructed, with 140K developed into CSF, and 38.0 MW of power capacity added, primarily in the Southwest - 91 acres of land was purchased in Texas (77 acres) and Northern Virginia (14 acres) In 2014, we expect to spend between $275 and $300 million in development capital - Approximately 70%-80% in existing markets, for the construction of 400-450K NRSF of powered shell, development of 150-175K of CSF, and power capacity additions of 25.0-30.0 MW - Addition of two markets, including Northern Virginia as well as another strategic market, supporting our strategy of growing our Fortune 1000 customer base and enhancing the geographic diversity of the portfolio Additional development capital expenditures in 2014 are a result of expanding into new markets, constructing more CSF and more powered shell compared to 2013, partially offset by reductions in power added and land purchased Category CSF Constructed Power Added (MW)(1) Powered Shell Constructed (NRSF) Land Purchased (Acres) CSF Constructed Power Added (MW)(1) Powered Shell Constructed (NRSF) Land Purchased (Acres) Southwest 110K 33.3 220K 77 150-175K 25.0-30.0 400-450K - Midwest 25K 4.7 - - - - - - International 5K - - - - - - - New Markets - - - 14 50-60K 5.0-6.0 225-325K 20-30 Total 140K 38.0 220K 91 200-235K 30.0-36.0 625-775K 20-30 Note: numbers are approximations 1. Represents the aggregate power available for lease to and exclusive use by customers from the facility’s installed universal power supplies (UPS) expressed in terms of megawatts. 2013 Actual 2014 Estimate

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com Total CSF (Est. FYE’14 vs. FYE’13) 20 ($ in millions except per share amounts) 2014 Development Projects Expected Q1 completion of construction of 38K CSF and addition of 6 MW of power at Houston West 2 Construction of shell for Houston West 3 (320K NRSF) Shell and CSF construction and power capacity addition at San Antonio 2 CSF construction and power capacity addition at Dallas location CSF construction at Phoenix location Northern Virginia and second new market development Total CSF (sq ft 000) FYE '13 FY'14 CSF FYE'14 Act. Constructed Est. Cincinnati 419 - 419 Dallas 232 55-60 287-292 Houston 231 35-40 266-271 Austin 54 5 59 Phoenix 37 35-40 72-77 San Antonio 43 20-30 63-73 Chicago 23 - 23 International 13 - 13 New Markets - 50-60 50-60 Total 1,052 200-235 1,252-1,287

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com . . See Earnings Release Supplement at www.cyrusone.com for reconciliations of Non-GAAP financial measures

13 29 93 204 223 234 255 153 0 0 116 173 20 157 197 231 240 245 104 203 241 238 235 236 0 116 173 www.cyrusone.com