|

| | | | | | |

| | Earnings Release and Supplemental Information | | |

| | | | | | |

| | | | | | |

| | | Table of Contents | | | |

| | | | | | |

| | | Earnings Release | 3 | |

| | | Consolidated Statements of Operations | 8 | |

| | | Consolidated Balance Sheets | 9 | |

| | | Consolidated Statements of Operations (5 quarters) | 10 | |

| | | Consolidated Balance Sheets (5 quarters) | 11 | |

| | | Consolidated Statement of Cash Flow | 12 | |

| | | NOI and Reconciliation of Net Income (Loss) to Adjusted EBITDA | 14 | |

| | | Reconciliation of Net Income (Loss) to FFO, Normalized FFO and AFFO | 15 | |

| | | Market Capitalization Summary and Reconciliation of Net Debt | 16 | |

| | | Colocation Square Footage (CSF) and Utilization | 17 | |

| | | 2015 Guidance | 18 | |

| | | Data Center Portfolio | 19 | |

| | | NRSF Under Development / Land Available for Future Development | 21 | |

| | | Leasing Statistics - Lease Signings | 22 | |

| | | Customer Diversification | 23 | |

| | | Lease Distribution | 24 | |

| | | Lease Expirations | 25 | |

| | | Dividend and AFFO per Share Growth | 26 | |

| | | | | | |

| | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | Quarter Ending December 31, 2014 | | |

Exhibit 99.1

CyrusOne Reports Fourth Quarter 2014 Earnings

Year-over-Year AFFO Growth of 43% and Revenue Growth of 20%

DALLAS (February 18, 2015) - Global data center service provider CyrusOne Inc. (NASDAQ: CONE), which specializes in providing highly reliable enterprise-class, carrier-neutral data center properties to the Fortune 1000, today announced fourth quarter and full year 2014 earnings.

Highlights

| |

| • | Fourth quarter revenue of $86.9 million and full year revenue of $330.9 million increased 20% and 26%, respectively, over fourth quarter and full year 2013 |

| |

| • | Fourth quarter Normalized FFO of $31.2 million and AFFO of $29.8 million increased 32% and 43%, respectively, over the fourth quarter of 2013 |

| |

| • | Full year Normalized FFO of $112.9 million and AFFO of $111.7 million increased 43% and 54%, respectively, over full year 2013 |

| |

| • | Fourth quarter Adjusted EBITDA of $44.6 million and full year Adjusted EBITDA of $169.3 million increased 12% and 22%, respectively over fourth quarter and full year 2013 |

| |

| • | Announcing a 50% increase in the quarterly dividend and distribution for the first quarter of 2015 to $0.315 per share on common shares and common share equivalents, up from $0.21 per share in 2014 |

| |

| • | Leased 44,000 colocation square feet in the fourth quarter, with utilization remaining high at 88%, increasing full year 2014 leasing to 236,000 colocation square feet and bringing development yield to 18% |

| |

| • | Added three Fortune 1000 companies as new customers in the fourth quarter, increasing the total number of Fortune 1000 customers to 144, and fifteen Fortune 1000 companies for full year 2014 |

“CyrusOne had another outstanding year, with high growth rates across all key metrics, the addition of nearly 60 logos including 15 Fortune 1000 customers, and the introduction of an East Coast presence with the addition of Northern Virginia to our portfolio,” said Gary Wojtaszek, president and chief executive officer of CyrusOne. “Our success in attracting Fortune 1000 customers, which have outsourced less than 15% of their business, we believe will continue to enable us to deliver meaningful shareholder value through long-term growth in our FFO and appropriate increases in our dividend, highlighted by our 50% increase in the dividend payout for the quarter.”

Fourth Quarter 2014 Financial Results

Revenue was $86.9 million for the fourth quarter, compared to $72.3 million for the same period in 2013, an increase of 20%. Operating income of $11.2 million improved $2.2 million from the fourth quarter of 2013, as a $14.6 million increase in revenue and the impact of $3.0 million in asset impairments and transaction costs in the fourth quarter of 2013 were partially offset by increases in property operating expenses of $7.7 million, depreciation and amortization of $4.0 million, and sales, general and administrative expenses of $3.6 million. Net loss was $11.8 million for the fourth quarter, compared to a net loss of $3.8 million for the same period in 2013.

Net operating income (NOI)1 was $54.9 million for the fourth quarter, compared to $48.0 million in the same period in 2013, an increase of 14%. The increase in NOI was driven by the increase in revenue, partially offset by additional property operating costs from new facilities and expansions at existing facilities. Adjusted EBITDA2 was $44.6 million for the fourth quarter, compared to $39.9 million in the same period in 2013, an increase of 12%. The Adjusted EBITDA margin of 51.3% in the fourth quarter declined from 55.2% in the same period in 2013, primarily driven by increased electricity usage as well as the incremental expenses associated with the Company’s additional Sarbanes-Oxley compliance requirements resulting from the Company’s successful market-cap growth into large accelerated filer status in 2014.

Normalized Funds From Operations (Normalized FFO)3 was $31.2 million for the fourth quarter, compared to $23.6 million in the same period in 2013, an increase of 32%. The increase in Normalized FFO was primarily due to growth in Adjusted EBITDA as well as a decrease in interest expense. Normalized FFO per diluted common share or common share equivalent4 was $0.48 in the fourth quarter of 2014. Adjusted Funds From Operations (AFFO)5 was $29.8 million for the fourth quarter, compared to $20.8 million in the same period in 2013, an increase of 43%.

Full Year 2014 Financial Results

Revenue for the full year was $330.9 million, compared to $263.5 million in 2013, an increase of 26%. Net loss for the full year was $14.5 million compared to $35.8 million in 2013. The Company’s higher Adjusted EBITDA, the impacts of transaction-related compensation and asset impairments in 2013, and lower interest and income tax expense were partially offset by higher depreciation and amortization, loss on extinguishment of debt, and stock-based compensation.

Adjusted EBITDA increased 22% to $169.3 million from $138.7 million in 2013. Normalized FFO for the full year increased to $112.9 million in 2014 from $78.7 million in 2013, an increase of 43%. AFFO for the full year was $111.7 million, an increase of 54% from $72.4 million in 2013.

Leasing Activity

CyrusOne leased approximately 44,000 colocation square feet (CSF), or 5.3 MW of power, in the fourth quarter. Leases signed in the fourth quarter represent approximately $0.9 million in monthly recurring rent, or approximately $11 million in annualized contracted GAAP revenue6 excluding estimates for pass-through power. Including estimates of pass-through power charges, the leases signed this quarter represent approximately $14 million of annualized GAAP revenue once the customer has fully ramped in. The Company added three new Fortune 10007 customers in the fourth quarter, bringing the total to 144 customers in the Fortune 1000 and 669 customers in total as of December 31, 2014. The weighted average lease term of the new leases based on square footage was 69 months, and approximately 78% of the CSF was leased to metered customers with the remainder leased on a full service basis. Recurring rent churn8 for the fourth quarter of 2014 was 1.7%, compared to 1.1% for the fourth quarter of 2013.

Portfolio Utilization and Development

As of December 31, 2014, CyrusOne had approximately 1,225,000 CSF across 25 facilities, an increase of approximately 172,000, or 16%, from a year ago. CSF utilization9 for the fourth quarter was 88%, compared to 85% in the same period in 2013. In the fourth quarter of 2014, the Company completed construction on its Phoenix 2 facility, adding approximately 103,000 NRSF, including 37,000 leased CSF. In early 2015, CyrusOne completed construction on its new facility in Northern Virginia, adding approximately 129,000 NRSF, including 30,000 CSF. Construction continues on new facilities in San Antonio and Houston, with the Company expecting to add a total of approximately 453,000 NRSF and 90,000 CSF in the first half of 2015. The Company also expects to begin construction on an additional 56,000 CSF at its Carrollton facility in Dallas and an additional 36,000 CSF at its Phoenix 2 facility in the first half of 2015.

Balance Sheet and Liquidity

As of December 31, 2014, the Company had $659.8 million of long term debt, cash of $36.5 million, and $315.0 million available under its unsecured revolving credit facility. Net debt10 was $636.7 million as of December 31, 2014, approximately 26% of the Company's total enterprise value or 3.6x Adjusted EBITDA for the last quarter annualized. Available liquidity11 was $351.5 million as of December 31, 2014.

In November and December of 2014, the Company repurchased a portion of its outstanding 6 3/8% Senior Notes due 2022 having an aggregate face value of $150.2 million for a purchase price of $163.0 million.

Dividend and Distribution

On November 4, 2014, the Company announced a dividend and distribution of $0.21 per share of common stock and common stock equivalent for the fourth quarter of 2014. The dividend / distribution was paid on January 9, 2015, to stockholders and unitholders of record at the close of business on December 26, 2014.

Additionally, today the Company is announcing a dividend and distribution of $0.315 per share of common stock and common stock equivalent for the first quarter of 2015. The dividend / distribution will be paid on April 15, 2015, to stockholders and unitholders of record at the close of business on March 27, 2015.

Guidance

CyrusOne is issuing the following guidance for full year 2015:

|

| | |

| Category | 2014 Results | 2015 Guidance |

| Total Revenue | $331 million | $370 - $385 million |

| Base Revenue | $290 million | $322 - $332 million |

| Metered Power Reimbursements | $41 million | $48 - $53 million |

| Adjusted EBITDA | $169 million | $185 - $195 million |

| Normalized FFO per diluted common share or common share equivalent* | $1.73 | $1.90 - $2.00 |

| Capital Expenditures | $284 million | $215 - $240 million |

Development** | $280 million | $210 - $230 million |

| Recurring | $4 million | $5 - $10 million |

* Assumes weighted average diluted common share or common share equivalents for 2015 of 66 million.

** Development capital is inclusive of capital used for the acquisition of land for future development.

The annual guidance provided above represents forward-looking statements, which are based on current economic conditions, internal assumptions about the Company's existing customer base and the supply and demand dynamics of the markets in which CyrusOne operates.

Upcoming Conferences and Events

| |

| • | Citi Global Property CEO Conference on March 1-4 in Miami |

Conference Call Details

CyrusOne will host a conference call on February 18, 2015, at 1:00 PM Eastern Time (12:00 PM Central Time) to discuss its results for the fourth quarter of 2014. A live webcast of the conference call will be available under the “Investor Relations” tab in the “Events and Presentations” section of the Company's website at http://investor.cyrusone.com/events.cfm. The U.S. conference call dial-in number is 1-866-652-5200, and the international dial-in number is 1-412-317-6060. A replay will be available one hour after the conclusion of the earnings call on February 18, 2015, until 9:00 AM Eastern Time (8:00 AM Central Time) on February 26, 2015. The U.S. toll-free replay dial-in number is 1-877-344-7529 and the international replay dial-in number is 1-412-317-0088. The replay access code is 10058835.

Safe Harbor

This release and the documents incorporated by reference herein contain forward-looking statements regarding future events and our future results that are subject to the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, are statements that could be deemed forward-looking statements. These statements are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as "expects," "anticipates," "predicts," "projects," "intends," "plans," "believes," "seeks," "estimates," "continues," "endeavors," "strives," "may," variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future financial performance, our anticipated growth and trends in our businesses, and other characterizations of future events or circumstances are forward-looking statements. Readers are cautioned these forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially and adversely from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this release and those discussed in other documents we file with the Securities and Exchange Commission (SEC). More information on potential risks and uncertainties is available in our recent filings with the SEC, including CyrusOne's Form 10-K report, Form 10-Q reports, and Form 8-K reports. Actual results may differ materially and adversely from those expressed in any forward-looking statements. We undertake no obligation to revise or update any forward-looking statements for any reason.

Use of Non-GAAP Financial Measures

This press release contains certain non-GAAP financial measures that management believes are helpful in understanding the Company's business, as further discussed within this press release. These financial measures, which include Funds From Operations, Normalized Funds From Operations, Adjusted EBITDA, Net Operating Income and Net debt should not be construed as being more important than comparable

GAAP measures. Detailed reconciliations of these non-GAAP financial measures to comparable GAAP financial measures have been included in the tables that accompany this release and are available in the Investor Relations section of www.cyrusone.com.

Management uses FFO, Normalized FFO, Adjusted EBITDA, NOI and AFFO as supplemental performance measures because they provide performance measures that, when compared year over year, capture trends in occupancy rates, rental rates and operating costs. The Company also believes that, as widely recognized measures of the performance of real estate investment trusts (REITs) and other companies, these measures will be used by investors as a basis to compare its operating performance with that of other companies. Other companies may not calculate these measures in the same manner, and, as presented, they may not be comparable to others. Therefore, FFO, Normalized FFO, NOI, AFFO and Adjusted EBITDA should be considered only as supplements to net income as measures of our performance. FFO, Normalized FFO, NOI, AFFO and Adjusted EBITDA should not be used as measures of liquidity or as indicative of funds available to fund the Company's cash needs, including the ability to make distributions. These measures also should not be used as substitutes for cash flow from operating activities computed in accordance with U.S. GAAP.

1Net Operating Income (NOI) is defined as revenue less property operating expenses. Amortization of deferred leasing costs is presented in depreciation and amortization, which is excluded from NOI. CyrusOne has not historically incurred any tenant improvement costs. Our sales and marketing costs consist of salaries and benefits for our internal sales staff, travel and entertainment, office supplies, marketing and advertising costs. General and administrative costs include salaries and benefits of our senior management and support functions, legal and consulting costs, and other administrative costs. Marketing and advertising costs are not property-specific, rather these costs support our entire portfolio. As a result, we have excluded these marketing and advertising costs from our NOI calculation, consistent with the treatment of general and administrative costs, which also support our entire portfolio.

2Adjusted EBITDA is defined as net income (loss) as defined by U.S. GAAP before noncontrolling interests plus interest expense, income tax (benefit) expense, depreciation and amortization, non-cash compensation, transaction costs and transaction-related compensation, including acquisition pursuit costs, restructuring costs, loss on extinguishment of debt, asset impairments, (gain) loss on sale of real estate improvements, and other special items. Other companies may not calculate Adjusted EBITDA in the same manner. Accordingly, the Company's Adjusted EBITDA as presented may not be comparable to others.

3Normalized Funds From Operations (Normalized FFO) is defined as Funds From Operations (FFO) plus transaction costs, including acquisition pursuit costs, transaction-related compensation, (gain) loss on extinguishment of debt, restructuring costs and other special items. FFO is net (loss) income computed in accordance with U.S. GAAP before noncontrolling interests, (gain) loss from sales of real estate improvements, real estate-related depreciation and amortization, amortization of customer relationship intangibles, and real estate and customer relationship intangible impairments. Because the value of the customer relationship intangibles is inextricably connected to the real estate acquired, CyrusOne believes the amortization and impairments of such intangibles is analogous to real estate depreciation and impairments; therefore, the Company adds the customer relationship intangible amortization and impairments back for similar treatment with real estate depreciation and impairments. CyrusOne's customer relationship intangibles are primarily associated with the acquisition of Cyrus Networks in 2010 and, at the time of acquisition, represented 22% of the value of the assets acquired. The Company believes its Normalized FFO calculation provides a comparable measure to that used by others in the industry.

4Normalized FFO per diluted common share or common share equivalent is defined as Normalized FFO divided by the average diluted common shares and common share equivalents outstanding for the quarter, which were 65,316,202 for the fourth quarter of 2014.

5Adjusted Funds From Operations (AFFO) is defined as Normalized FFO plus amortization of deferred financing costs, non-cash compensation, and non-real estate depreciation and amortization, less deferred revenue and straight line rent adjustments, leasing commissions, recurring capital expenditures, and non-cash corporate income tax benefit and expense.

6Annualized GAAP revenue is equal to monthly recurring rent, defined as average monthly contractual rent during the term of the lease, multiplied by 12. It can be shown both inclusive and exclusive of the Company’s estimate of customer reimbursements for metered power.

7Fortune 1000 customers include subsidiaries whose ultimate parent is a Fortune 1000 company or a foreign or private company of equivalent size.

8Recurring rent churn is calculated as any reduction in recurring rent due to customer terminations, service reductions or net pricing decreases as a percentage of rent at the beginning of the period, excluding any impact from metered power reimbursements or other usage-based billing.

9Utilization is calculated by dividing CSF under signed leases for available space (whether or not the contract has commenced billing) by total CSF. Utilization rate differs from percent leased presented in the Data Center Portfolio table because utilization rate excludes office space and supporting infrastructure net rentable square footage and includes CSF for signed leases that have not commenced billing. Management uses utilization rate as a measure of CSF leased.

10Net debt provides a useful measure of liquidity and financial health. The Company defines Net Debt as long-term debt and capital lease obligations, offset by cash, cash equivalents, and temporary cash investments.

11Liquidity is calculated as cash, cash equivalents, and temporary cash investments on hand, plus the undrawn capacity on CyrusOne's revolving credit facility.

About CyrusOne

CyrusOne (NASDAQ: CONE) specializes in highly reliable enterprise-class, carrier-neutral data center properties. The Company provides mission-critical data center facilities that protect and ensure the continued operation of IT infrastructure for more than 665 customers, including nine of the Fortune 20 and 144 of the Fortune 1000 companies.

CyrusOne's data center offerings provide the flexibility, reliability, and security that enterprise customers require and are delivered through a tailored, customer service-focused platform designed to foster long-term relationships. CyrusOne is committed to full transparency in communication, management, and service delivery throughout its 25 data centers worldwide.

Investor Relations:

Michael Schafer

972-350-0060

investorrelations@cyrusone.com

CyrusOne Inc.

Condensed Consolidated and Combined Statements of Operations

(Dollars in millions, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

December 31, | | | | | | Twelve Months Ended

December 31, | | | | |

| | | Change | | Change |

| | | 2014 | | 2013 | | $ | | % | | 2014 | | 2013 | | $ | | % |

| Revenue | | $ | 86.9 |

| | $ | 72.3 |

| | $ | 14.6 |

| | 20 | % | | $ | 330.9 |

| | $ | 263.5 |

| | $ | 67.4 |

| | 26 | % |

| Costs and expenses: | | | | | | | | | | | | | | | | |

| Property operating expenses | | 32.0 |

| | 24.3 |

| | 7.7 |

| | 32 | % | | 124.5 |

| | 93.2 |

| | 31.3 |

| | 34 | % |

| Sales and marketing | | 3.1 |

| | 2.6 |

| | 0.5 |

| | 19 | % | | 12.8 |

| | 10.6 |

| | 2.2 |

| | 21 | % |

| General and administrative | | 9.9 |

| | 6.8 |

| | 3.1 |

| | 46 | % | | 34.6 |

| | 28.0 |

| | 6.6 |

| | 24 | % |

| Depreciation and amortization | | 30.6 |

| | 26.6 |

| | 4.0 |

| | 15 | % | | 118.0 |

| | 95.2 |

| | 22.8 |

| | 24 | % |

| Restructuring charges | | — |

| | — |

| | — |

| | n/m |

| | — |

| | 0.7 |

| | (0.7 | ) | | (100 | )% |

| Transaction costs | | 0.1 |

| | 0.2 |

| | (0.1 | ) | | (50 | )% | | 1.0 |

| | 1.4 |

| | (0.4 | ) | | (29 | )% |

| Transaction-related compensation | | — |

| | — |

| | — |

| | n/m |

| | — |

| | 20.0 |

| | (20.0 | ) | | (100 | )% |

| Asset impairments | | — |

| | 2.8 |

| | (2.8 | ) | | (100 | )% | | — |

| | 2.8 |

| | (2.8 | ) | | (100 | )% |

| Total costs and expenses | | 75.7 |

| | 63.3 |

| | 12.4 |

| | 20 | % | | 290.9 |

| | 251.9 |

| | 39.0 |

| | 15 | % |

| Operating income | | 11.2 |

| | 9.0 |

| | 2.2 |

| | 24 | % | | 40.0 |

| | 11.6 |

| | 28.4 |

| | 245 | % |

| Interest expense | | 9.1 |

| | 11.5 |

| | (2.4 | ) | | (21 | )% | | 39.5 |

| | 43.7 |

| | (4.2 | ) | | (10 | )% |

| Other income | | — |

| | — |

| | — |

| | n/m |

| | — |

| | (0.1 | ) | | 0.1 |

| | (100 | )% |

| Loss on extinguishment of debt | | 13.6 |

| | — |

| | 13.6 |

| | n/m |

| | 13.6 |

| | 1.3 |

| | 12.3 |

| | 946 | % |

| Income (loss) before income taxes | | (11.5 | ) | | (2.5 | ) | | (9.0 | ) | | 360 | % | | (13.1 | ) | | (33.3 | ) | | 20.2 |

| | (61 | )% |

| Income tax expense | | (0.3 | ) | | (1.1 | ) | | 0.8 |

| | (73 | )% | | (1.4 | ) | | (2.3 | ) | | 0.9 |

| | (39 | )% |

| Loss on sale of real estate improvements | | — |

| | (0.2 | ) | | 0.2 |

| | (100 | )% | | — |

| | (0.2 | ) | | 0.2 |

| | (100 | )% |

| Net income (loss) | | (11.8 | ) | | (3.8 | ) | | (8.0 | ) | | n/m |

| | (14.5 | ) | | (35.8 | ) | | 21.3 |

| | (59 | )% |

| Net loss attributed to Predecessor | | — |

| | — |

| | — |

| | n/m |

| | — |

| | (20.2 | ) | | 20.2 |

| | (100 | )% |

| Noncontrolling interest in net income (loss) | | (4.8 | ) | | (2.5 | ) | | (2.3 | ) | | 92 | % | | (6.7 | ) | | (10.3 | ) | | 3.6 |

| | (35 | )% |

| Net income (loss) attributed to common stockholders | | $ | (7.0 | ) | | $ | (1.3 | ) | | $ | (5.7 | ) | | 438 | % | | $ | (7.8 | ) | | $ | (5.3 | ) | | $ | (2.5 | ) | | 47 | % |

| Loss per common share - basic and diluted | | $ | (0.19 | ) | | $ | (0.06 | ) | | | | | | $ | (0.30 | ) | | $ | (0.28 | ) | |

|

| | |

CyrusOne Inc.

Condensed Consolidated Balance Sheets

(Dollars in millions)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| | | December 31, | | December 31, | | Change |

| | | 2014 | | 2013 | | $ | | % |

| Assets | | | | | | | | |

| Investment in real estate: | | | | | | | | |

| Land | | $ | 89.7 |

| | $ | 89.3 |

| | $ | 0.4 |

| | — | % |

| Buildings and improvements | | 812.6 |

| | 783.7 |

| | 28.9 |

| | 4 | % |

| Equipment | | 349.1 |

| | 190.2 |

| | 158.9 |

| | 84 | % |

| Construction in progress | | 127.0 |

| | 57.3 |

| | 69.7 |

| | 122 | % |

| Subtotal | | 1,378.4 |

| | 1,120.5 |

| | 257.9 |

| | 23 | % |

| Accumulated depreciation | | (327.0 | ) | | (236.7 | ) | | (90.3 | ) | | 38 | % |

| Net investment in real estate | | 1,051.4 |

| | 883.8 |

| | 167.6 |

| | 19 | % |

| Cash and cash equivalents | | 36.5 |

| | 148.8 |

| | (112.3 | ) | | (75 | )% |

| Rent and other receivables | | 60.9 |

| | 41.2 |

| | 19.7 |

| | 48 | % |

| Goodwill | | 276.2 |

| | 276.2 |

| | — |

| | — | % |

| Intangible assets, net | | 68.9 |

| | 85.9 |

| | (17.0 | ) | | (20 | )% |

| Due from affiliates | | 0.8 |

| | 0.6 |

| | 0.2 |

| | 33 | % |

| Other assets | | 91.8 |

| | 70.3 |

| | 21.5 |

| | 31 | % |

| Total assets | | $ | 1,586.5 |

| | $ | 1,506.8 |

| | $ | 79.7 |

| | 5 | % |

| Liabilities and Equity | | | | | |

| |

|

| Accounts payable and accrued expenses | | $ | 69.9 |

| | $ | 66.8 |

| | $ | 3.1 |

| | 5 | % |

| Deferred revenue | | 65.7 |

| | 55.9 |

| | 9.8 |

| | 18 | % |

| Due to affiliates | | 7.3 |

| | 8.5 |

| | (1.2 | ) | | (14 | )% |

| Capital lease obligations | | 13.4 |

| | 16.7 |

| | (3.3 | ) | | (20 | )% |

| Long-term debt | | 659.8 |

| | 525.0 |

| | 134.8 |

| | 26 | % |

| Other financing arrangements | | 53.4 |

| | 56.3 |

| | (2.9 | ) | | (5 | )% |

| Total liabilities | | 869.5 |

| | 729.2 |

| | 140.3 |

| | 19 | % |

| Equity: | |

| | | |

| |

|

| Preferred stock, $.01 par value, 100,000,000 authorized; no shares issued or outstanding | | — |

| | — |

| | — |

| | — | % |

| Common stock, $.01 par value, 500,000,000 shares authorized and 38,651,517 and 21,991,669 shares issued and outstanding at December 31, 2014 and December 31, 2013, respectively | | 0.4 |

| | 0.2 |

| | 0.2 |

| | 100 | % |

| Paid in capital | | 516.5 |

| | 340.7 |

| | 175.8 |

| | 52 | % |

| Accumulated deficit | | (55.9 | ) | | (18.9 | ) | | (37.0 | ) | | 196 | % |

| Other Comprehensive Income | | (0.3 | ) | | — |

| | (0.3 | ) | | n/m |

|

| Total shareholders’ equity | | 460.7 |

| | 322.0 |

| | 138.7 |

| | 43 | % |

| Noncontrolling interest | | 256.3 |

| | 455.6 |

| | (199.3 | ) | | (44 | )% |

| Total equity | | 717.0 |

| | 777.6 |

| | (60.6 | ) | | (8 | )% |

| Total liabilities and shareholders’ equity | | $ | 1,586.5 |

| | $ | 1,506.8 |

| | $ | 79.7 |

| | 5 | % |

CyrusOne Inc.

Condensed Consolidated and Combined Statements of Operations

(Dollars in millions, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| For the three months ended: | | December 31, | | September 30, | | June 30, | | March 31, | | December 31, |

| | | 2014 | | 2014 | | 2014 | | 2014 | | 2013 |

| Revenue: | | | | | | | | | |

|

|

| Base Revenue | | $ | 75.4 |

| | $ | 73.9 |

| | $ | 71.4 |

| | $ | 69.4 |

| | $ | 66.0 |

|

| Metered Power Reimbursements | | 11.5 |

| | 10.9 |

| | 10.3 |

| | 8.1 |

| | 6.3 |

|

| Total Revenue | | 86.9 |

| | 84.8 |

| | 81.7 |

| | 77.5 |

| | 72.3 |

|

| Costs and expenses: | | | | | | | | | | |

| Property operating expenses | | 32.0 |

| | 33.0 |

| | 31.8 |

| | 27.7 |

| | 24.3 |

|

| Sales and marketing | | 3.1 |

| | 3.2 |

| | 3.5 |

| | 3.0 |

| | 2.6 |

|

| General and administrative | | 9.9 |

| | 9.0 |

| | 8.4 |

| | 7.3 |

| | 6.8 |

|

| Depreciation and amortization | | 30.6 |

| | 30.0 |

| | 29.8 |

| | 27.6 |

| | 26.6 |

|

| Restructuring charges | | — |

| | — |

| | — |

| | — |

| | — |

|

| Transaction costs | | 0.1 |

| | — |

| | 0.8 |

| | 0.1 |

| | 0.2 |

|

| Asset impairments | | — |

| | — |

| | — |

| | — |

| | 2.8 |

|

| Total costs and expenses | | 75.7 |

| | 75.2 |

| | 74.3 |

| | 65.7 |

| | 63.3 |

|

| Operating income | | 11.2 |

| | 9.6 |

| | 7.4 |

| | 11.8 |

| | 9.0 |

|

| Interest expense | | 9.1 |

| | 9.0 |

| | 10.7 |

| | 10.7 |

| | 11.5 |

|

| Other income | | — |

| | — |

| | — |

| | — |

| | — |

|

| Loss on extinguishment of debt | | 13.6 |

| | — |

| | — |

| | — |

| | — |

|

| Income (loss) before income taxes | | (11.5 | ) | | 0.6 |

| | (3.3 | ) | | 1.1 |

| | (2.5 | ) |

| Income tax expense | | (0.3 | ) | | (0.4 | ) | | (0.3 | ) | | (0.4 | ) | | (1.1 | ) |

| Loss on sale of real estate improvements | | — |

| | — |

| | — |

| | — |

| | (0.2 | ) |

| Net income (loss) from continuing operations | | (11.8 | ) | | 0.2 |

| | (3.6 | ) | | 0.7 |

| | (3.8 | ) |

| Noncontrolling interest in net income (loss) | | (4.8 | ) | | 0.1 |

| | (2.5 | ) | | 0.5 |

| | (2.5 | ) |

| Net income (loss) attributed to common stockholders | | $ | (7.0 | ) | | $ | 0.1 |

| | $ | (1.1 | ) | | $ | 0.2 |

| | $ | (1.3 | ) |

| Loss per common share - basic and diluted | | $ | (0.19 | ) | | $ | — |

| | $ | (0.06 | ) | | $ | — |

| | $ | (0.06 | ) |

CyrusOne Inc.

Condensed Consolidated Balance Sheets

(Dollars in millions)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| | | December 31,

2014 | | September 30,

2014 | | June 30, 2014 | | March 31, 2014 | | December 31,

2013 |

| Assets | | | | | | | | | | |

| Investment in real estate: | | | | | | | | | | |

| Land | | $ | 89.7 |

| | $ | 89.7 |

| | $ | 89.7 |

| | $ | 89.6 |

| | $ | 89.3 |

|

| Buildings and improvements | | 812.6 |

| | 796.6 |

| | 791.7 |

| | 787.0 |

| | 783.7 |

|

| Equipment | | 349.1 |

| | 312.5 |

| | 298.8 |

| | 206.4 |

| | 190.2 |

|

| Construction in progress | | 127.0 |

| | 120.9 |

| | 59.5 |

| | 99.4 |

| | 57.3 |

|

| Subtotal | | 1,378.4 |

| | 1,319.7 |

| | 1,239.7 |

| | 1,182.4 |

| | 1,120.5 |

|

| Accumulated depreciation | | (327.0 | ) | | (303.5 | ) | | (280.6 | ) | | (257.6 | ) | | (236.7 | ) |

| Net investment in real estate | | 1,051.4 |

| | 1,016.2 |

| | 959.1 |

| | 924.8 |

| | 883.8 |

|

| Cash and cash equivalents | | 36.5 |

| | 30.4 |

| | 49.3 |

| | 125.2 |

| | 148.8 |

|

| Rent and other receivables | | 60.9 |

| | 59.1 |

| | 61.5 |

| | 42.4 |

| | 41.2 |

|

| Goodwill | | 276.2 |

| | 276.2 |

| | 276.2 |

| | 276.2 |

| | 276.2 |

|

| Intangible assets, net | | 68.9 |

| | 73.2 |

| | 77.4 |

| | 81.7 |

| | 85.9 |

|

| Due from affiliates | | 0.8 |

| | 1.3 |

| | 0.5 |

| | 0.9 |

| | 0.6 |

|

| Other assets | | 91.8 |

| | 81.6 |

| | 82.1 |

| | 76.9 |

| | 70.3 |

|

| Total assets | | $ | 1,586.5 |

| | $ | 1,538.0 |

| | $ | 1,506.1 |

| | $ | 1,528.1 |

| | $ | 1,506.8 |

|

| Liabilities and Equity | | | | | | | | | | |

| Accounts payable and accrued expenses | | $ | 69.9 |

| | $ | 100.2 |

| | $ | 83.9 |

| | $ | 88.8 |

| | $ | 66.8 |

|

| Deferred revenue | | 65.7 |

| | 66.1 |

| | 66.7 |

| | 64.8 |

| | 55.9 |

|

| Due to affiliates | | 7.3 |

| | 7.4 |

| | 7.4 |

| | 10.8 |

| | 8.5 |

|

| Capital lease obligations | | 13.4 |

| | 14.2 |

| | 15.0 |

| | 15.5 |

| | 16.7 |

|

| Long-term debt | | 659.8 |

| | 555.0 |

| | 525.0 |

| | 525.0 |

| | 525.0 |

|

| Other financing arrangements | | 53.4 |

| | 55.1 |

| | 57.1 |

| | 56.4 |

| | 56.3 |

|

| Total liabilities | | 869.5 |

| | 798.0 |

| | 755.1 |

| | 761.3 |

| | 729.2 |

|

| Shareholders’ Equity: | | | | | | | | | | |

| Preferred stock, $.01 par value, 100,000,000 authorized; no shares issued or outstanding | | — |

| | — |

| | — |

| | — |

| | — |

|

| Common stock, $.01 par value, 500,000,000 shares authorized and 38,651,517 and 21,991,669 shares issued and outstanding at December 31, 2014 and December 31, 2013, respectively | | 0.4 |

| | 0.4 |

| | 0.4 |

| | 0.2 |

| | 0.2 |

|

| Paid in capital | | 516.5 |

| | 513.7 |

| | 511.1 |

| | 342.9 |

| | 340.7 |

|

| Accumulated deficit | | (55.9 | ) | | (40.8 | ) | | (32.7 | ) | | (23.5 | ) | | (18.9 | ) |

| Other Comprehensive Income | | (0.3 | ) | | — |

| | — |

| | — |

| | — |

|

| Total shareholders’ equity | | 460.7 |

| | 473.3 |

| | 478.8 |

| | 319.6 |

| | 322.0 |

|

| Noncontrolling interests | | 256.3 |

| | 266.7 |

| | 272.2 |

| | 447.2 |

| | 455.6 |

|

| Total shareholders' equity | | 717.0 |

| | 740.0 |

| | $ | 751.0 |

| | $ | 766.8 |

| | 777.6 |

|

| Total liabilities and shareholders’ equity | | $ | 1,586.5 |

| | $ | 1,538.0 |

| | $ | 1,506.1 |

| | $ | 1,528.1 |

| | $ | 1,506.8 |

|

CyrusOne Inc.

Condensed Consolidated Statement of Cash Flow

(Dollars in millions)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2014 | | Three Months Ended December 31, 2013 | | Year Ended December 31, 2014 | | Year Ended December 31, 2013 |

| Cash flows from operating activities: | | | | | | | |

| Net loss | $ | (11.8 | ) | | $ | (3.8 | ) | | $ | (14.5 | ) | | $ | (35.8 | ) |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | 30.6 |

| | 26.6 |

| | 118.0 |

| | 95.2 |

|

| Provision for bad debt write off | (0.1 | ) | | 0.1 |

| | 0.8 |

| | 0.4 |

|

| Asset impairments | — |

| | 2.8 |

| | — |

| | 2.8 |

|

| Loss on extinguishment of debt | 13.6 |

| | — |

| | 13.6 |

| | 1.3 |

|

| Noncash interest expense | 0.7 |

| | 1.3 |

| | 3.4 |

| | 4.1 |

|

| Deferred income tax expense (benefit), including valuation allowance change | — |

| | 0.6 |

| | — |

| | 0.9 |

|

| Stock-based compensation expense | 2.7 |

| | 1.1 |

| | 10.3 |

| | 6.2 |

|

| Changes in operating assets and liabilities, net of effects of acquisitions: | | | | | | | |

| Increase in receivables and other assets | (5.7 | ) | | (14.8 | ) | | (37.0 | ) | | (25.3 | ) |

| Increase (decrease) in accounts payable and accrued expenses | (7.2 | ) | | (1.8 | ) | | 6.9 |

| | 5.9 |

|

| Increase (decrease) in deferred revenues | (0.4 | ) | | 0.8 |

| | 9.8 |

| | 3.1 |

|

| (Decrease) Increase in payables to related parties | 0.4 |

| | 1.7 |

| | (0.2 | ) | | 19.9 |

|

| Other | — |

| | — |

| | — |

| | 0.7 |

|

| Net cash provided by operating activities | 22.8 |

| | 14.6 |

| | 111.1 |

| | 79.4 |

|

| Cash flows from investing activities: | | | | | | | |

| Capital expenditures – acquisitions of real estate | — |

| | (14.7 | ) | | — |

| | (48.0 | ) |

| Capital expenditures – other | (89.3 | ) | | (48.3 | ) | | (284.2 | ) | | (180.6 | ) |

| Release of restricted cash | — |

| | — |

| | — |

| | 6.3 |

|

| Other | — |

| | (0.2 | ) | | — |

| | (0.2 | ) |

| Net cash used in investing activities | (89.3 | ) | | (63.2 | ) | | (284.2 | ) | | (222.5 | ) |

| Cash flows from financing activities: | | | | | | | |

| Issuance of common stock | 0.1 |

| | — |

| | 356.0 |

| | 360.5 |

|

| Stock issuance costs | — |

| | — |

| | (1.3 | ) | | — |

|

| IPO costs | — |

| | (3.2 | ) | | — |

| | (26.6 | ) |

| Acquisition of operating partnership units | — |

| | — |

| | (355.9 | ) | | — |

|

| Dividends paid | (13.5 | ) | | (10.3 | ) | | (50.9 | ) | | (31.0 | ) |

| Borrowings from revolving credit agreement | 285.0 |

| | — |

| | 315.0 |

| | — |

|

| Payments on revolving credit facility | (30.0 | ) | | — |

| | (30.0 | ) | | — |

|

| Payments on senior notes | (150.2 | ) | | — |

| | (150.2 | ) | | — |

|

| Payments on capital lease obligations | 0.1 |

| | (1.6 | ) | | (3.0 | ) | | (5.9 | ) |

| Payments on financing obligations | (0.9 | ) | | (0.7 | ) | | (0.9 | ) | | (0.7 | ) |

| Payment to buyout capital leases | — |

| | — |

| | — |

| | (9.6 | ) |

| Payment to buyout other financing arrangements | — |

| | — |

| | — |

| | (10.2 | ) |

| Debt issuance costs | (5.2 | ) | | — |

| | (5.2 | ) | | (1.3 | ) |

| Payment of debt extinguishment costs | (12.8 | ) | | — |

| | (12.8 | ) | | — |

|

|

| | | | | | | | | | | | | | | |

| Contributions from/(distributions to) parent, net | — |

| | — |

| | — |

| | 0.2 |

|

| Net cash provided by (used in) by financing activities | 72.6 |

| | (15.8 | ) | | 60.8 |

| | 275.4 |

|

| Net (decrease) increase in cash and cash equivalents | 6.1 |

| | (64.4 | ) | | (112.3 | ) | | 132.3 |

|

| Cash and cash equivalents at beginning of period | 30.4 |

| | 213.2 |

| | 148.8 |

| | 16.5 |

|

| Cash and cash equivalents at end of period | $ | 36.5 |

| | $ | 148.8 |

| | $ | 36.5 |

| | $ | 148.8 |

|

| | | | | | | | |

| Supplemental disclosures | | | | | | | |

| Cash paid for interest, net of amount capitalized | $ | 18.9 |

| | $ | 18.9 |

| | $ | 41.3 |

| | $ | 41.0 |

|

| Cash paid for income taxes | — |

| | — |

| | 0.4 |

| | — |

|

| Capitalized interest | 1.6 |

| | — |

| | 4.6 |

| | 1.6 |

|

| Noncash investing and financing transactions: | | | | | | | |

| Acquisition of property in accounts payable and other liabilities | 26.8 |

| | 51.5 |

| | 26.8 |

| | 51.5 |

|

| Contribution receivable from Parent related to transaction-related compensation | — |

| | 19.6 |

| | — |

| | 19.6 |

|

| Dividend payable | 14.3 |

| | 10.4 |

| | 14.3 |

| | 10.4 |

|

| Deferred IPO costs | — |

| | — |

| | — |

| | 1.7 |

|

| Deferred IPO costs reclassified to additional paid in capital | — |

| | — |

| | — |

| | 9.5 |

|

| Reclass of equipment to held for sale | — |

| | 0.3 |

| | — |

| | 0.3 |

|

| Noncash additions to fixed assets through other financing arrangements | — |

| | 4.0 |

| | — |

| | 4.0 |

|

CyrusOne Inc.

Net Operating Income and Reconciliation of Net Income (Loss) to Adjusted EBITDA

(Dollars in millions)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended | | | | | | Three Months Ended |

| | | December 31, | | Change | | December 31, | | September 30, | | June 30, | | March 31, | | December 31, |

| | | 2014 | | 2013 | | $ | | % | | 2014 | | 2014 | | 2014 | | 2014 | | 2013 |

| Net Operating Income | | | | | | | | | | | | | | | | | | |

| Revenue | | $ | 330.9 |

| | $ | 263.5 |

| | $ | 67.4 |

| | 26% | | $ | 86.9 |

| | $ | 84.8 |

| | $ | 81.7 |

| | $ | 77.5 |

| | $ | 72.3 |

|

| Property operating expenses | | 124.5 |

| | 93.2 |

| | 31.3 |

| | 34% | | 32.0 |

| | 33.0 |

| | 31.8 |

| | 27.7 |

| | 24.3 |

|

| Net Operating Income (NOI) | | $ | 206.4 |

| | $ | 170.3 |

| | $ | 36.1 |

| | 21% | | $ | 54.9 |

| | $ | 51.8 |

| | $ | 49.9 |

| | $ | 49.8 |

| | $ | 48.0 |

|

| NOI as a % of Revenue | | 62.4 | % | | 64.6 | % | | | | | | 63.2 | % | | 61.1 | % | | 61.1 | % | | 64.3 | % | | 66.4 | % |

| Reconciliation of Net (Loss) Income to Adjusted EBITDA: | | | | | | | | | | | | | | | | | | |

| Net (loss) income | | $ | (14.5 | ) | | $ | (35.8 | ) | | $ | 21.3 |

| | (59)% | | $ | (11.8 | ) | | $ | 0.2 |

| | $ | (3.6 | ) | | $ | 0.7 |

| | $ | (3.8 | ) |

| Adjustments: | | | | | | | |

| | | | | | | | | | |

| Interest expense | | 39.5 |

| | 43.7 |

| | (4.2 | ) | | (10)% | | 9.1 |

| | 9.0 |

| | 10.7 |

| | 10.7 |

| | 11.5 |

|

| Other income | | — |

| | (0.1 | ) | | 0.1 |

| | n/m | | — |

| | — |

| | — |

| | — |

| | — |

|

| Income tax expense | | 1.4 |

| | 2.3 |

| | (0.9 | ) | | (39)% | | 0.3 |

| | 0.4 |

| | 0.3 |

| | 0.4 |

| | 1.1 |

|

| Depreciation and amortization | | 118.0 |

| | 95.2 |

| | 22.8 |

| | 24% | | 30.6 |

| | 30.0 |

| | 29.8 |

| | 27.6 |

| | 26.6 |

|

| Restructuring charges | | — |

| | 0.7 |

| | (0.7 | ) | | n/m | | — |

| | — |

| | — |

| | — |

| | — |

|

| Legal claim costs | | — |

| | 0.7 |

| | (0.7 | ) | | n/m | | — |

| | — |

| | — |

| | — |

| | — |

|

| Transaction costs | | 1.0 |

| | 1.4 |

| | (0.4 | ) | | (29)% | | 0.1 |

| | — |

| | 0.8 |

| | 0.1 |

| | 0.2 |

|

| Stock-based compensation | | 10.3 |

| | 6.3 |

| | 4.0 |

| | 63% | | 2.7 |

| | 2.6 |

| | 2.8 |

| | 2.2 |

| | 1.3 |

|

| Asset impairments | | — |

| | 2.8 |

| | (2.8 | ) | | n/m | | — |

| | — |

| | — |

| | — |

| | 2.8 |

|

| Loss on extinguishment of debt | | 13.6 |

| | 1.3 |

| | 12.3 |

| | n/m | | 13.6 |

| | — |

| | — |

| | — |

| | — |

|

| Gain on sale of real estate improvements | | — |

| | 0.2 |

| | (0.2 | ) | | n/m | | — |

| | — |

| | — |

| | — |

| | 0.2 |

|

| Transaction-related compensation | | — |

| | 20.0 |

| | (20.0 | ) | | n/m | | — |

| | — |

| | — |

| | — |

| | — |

|

| Adjusted EBITDA | | $ | 169.3 |

| | $ | 138.7 |

| | $ | 30.6 |

| | 22% | | $ | 44.6 |

| | $ | 42.2 |

| | $ | 40.8 |

| | $ | 41.7 |

| | $ | 39.9 |

|

| Adjusted EBITDA as a % of Revenue | | 51.2 | % | | 52.6 | % | | | | | | 51.3 | % | | 49.8 | % | | 49.9 | % | | 53.8 | % | | 55.2 | % |

CyrusOne Inc.

Reconciliation of Net Income (Loss) to FFO, Normalized FFO, and AFFO

(Dollars in millions)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended | | | | | | Three Months Ended |

| | | December 31, | | Change | | December 31, 2014 | | September 30, 2014 | | June 30, 2014 | | March 31, 2014 | | December 31,

2013 |

| 2014 | | 2013 | | $ | | % | | |

| Reconciliation of Net (Loss) Income to FFO and Normalized FFO: | | | | | | | | | | | | | | | | | | |

| Net (loss) income | | $ | (14.5 | ) | | $ | (35.8 | ) | | $ | 21.3 |

| | (59 | )% | | $ | (11.8 | ) | | $ | 0.2 |

| | $ | (3.6 | ) | | $ | 0.7 |

| | $ | (3.8 | ) |

| Adjustments: | | | | | | | | | | | | | | | | | | |

| Real estate depreciation and amortization | | 95.9 |

| | 70.6 |

| | 25.3 |

| | 36 | % | | 25.1 |

| | 24.5 |

| | 24.1 |

| | 22.2 |

| | 20.0 |

|

| Amortization of customer relationship intangibles | | 16.9 |

| | 16.8 |

| | 0.1 |

| | 1 | % | | 4.2 |

| | 4.2 |

| | 4.3 |

| | 4.2 |

| | 4.2 |

|

| Real estate impairments | | — |

| | 2.8 |

| | (2.8 | ) | | n/m |

| | — |

| | — |

| | — |

| | — |

| | 2.8 |

|

| Gain on sale of real estate improvements | | — |

| | 0.2 |

| | (0.2 | ) | | n/m |

| | — |

| | — |

| | — |

| | — |

| | 0.2 |

|

| Funds from Operations (FFO) | | $ | 98.3 |

| | $ | 54.6 |

| | 43.7 |

| | n/m |

| | $ | 17.5 |

| | $ | 28.9 |

| | $ | 24.8 |

| | $ | 27.1 |

| | $ | 23.4 |

|

| Transaction-related compensation | | — |

| | 20.0 |

| | (20.0 | ) | | n/m |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Loss on extinguishment of debt | | 13.6 |

| | 1.3 |

| | 12.3 |

| | n/m |

| | 13.6 |

| | — |

| | — |

| | — |

| | — |

|

| Restructuring charges | | — |

| | 0.7 |

| | (0.7 | ) | | n/m |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Legal claim costs | | — |

| | 0.7 |

| | (0.7 | ) | | n/m |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Transaction costs | | 1.0 |

| | 1.4 |

| | (0.4 | ) | | (29 | )% | | 0.1 |

| | — |

| | 0.8 |

| | 0.1 |

| | 0.2 |

|

| Normalized Funds from Operations (Normalized FFO) | | $ | 112.9 |

| | $ | 78.7 |

| | $ | 34.2 |

| | 43 | % | | $ | 31.2 |

| | $ | 28.9 |

| | $ | 25.6 |

| | $ | 27.2 |

| | $ | 23.6 |

|

| Normalized FFO per diluted common share or common share equivalent | | $ | 1.73 |

| | $ | 1.22 |

| | $ | 0.51 |

| | 42 | % | | $ | 0.48 |

| | $ | 0.44 |

| | $ | 0.39 |

| | $ | 0.42 |

| | $ | 0.37 |

|

| Weighted Average diluted common share and common share equivalent outstanding | | 65.3 |

| | 64.6 |

| | 0.7 |

| | 1 | % | | 65.3 |

| | 65.3 |

| | 65.3 |

| | 65.0 |

| | 64.6 |

|

| Reconciliation of Normalized FFO to AFFO: | | | | | | | | | | | | | | | | | | |

| Normalized FFO | | $ | 112.9 |

| | $ | 78.7 |

| | 34.2 |

| | 43 | % | | $ | 31.2 |

| | $ | 28.9 |

| | $ | 25.6 |

| | $ | 27.2 |

| | $ | 23.6 |

|

| Adjustments: | | | | | | | | | | | | | | | | | | |

| Amortization of deferred financing costs | | 3.4 |

| | 4.1 |

| | (0.7 | ) | | (17 | )% | | 0.7 |

| | 0.9 |

| | 0.9 |

| | 0.9 |

| | 1.3 |

|

| Stock-based compensation | | 10.3 |

| | 6.3 |

| | 4.0 |

| | 63 | % | | 2.7 |

| | 2.6 |

| | 2.8 |

| | 2.2 |

| | 1.3 |

|

| Non-real estate depreciation and amortization | | 5.2 |

| | 7.8 |

| | (2.6 | ) | | (33 | )% | | 1.4 |

| | 1.2 |

| | 1.4 |

| | 1.2 |

| | 2.4 |

|

| Deferred revenue and straight line rent adjustments | | (10.5 | ) | | (13.9 | ) | | 3.4 |

| | (24 | )% | | (2.3 | ) | | (1.5 | ) | | (3.7 | ) | | (3.0 | ) | | (4.2 | ) |

| Leasing commissions | | (5.8 | ) | | (6.8 | ) | | 1.0 |

| | (15 | )% | | (2.9 | ) | | (0.9 | ) | | (1.4 | ) | | (0.6 | ) | | (1.7 | ) |

| Recurring capital expenditures | | (3.8 | ) | | (4.2 | ) | | 0.4 |

| | (10 | )% | | (1.0 | ) | | (2.1 | ) | | (0.3 | ) | | (0.4 | ) | | (1.9 | ) |

| Deferred income tax expense | | — |

| | 0.4 |

| | (0.4 | ) | | n/m |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Adjusted Funds from Operations (AFFO) | | $ | 111.7 |

| | $ | 72.4 |

| | $ | 39.3 |

| | 54 | % | | $ | 29.8 |

| | $ | 29.1 |

| | $ | 25.3 |

| | $ | 27.5 |

| | $ | 20.8 |

|

CyrusOne Inc.

Market Capitalization Summary and Reconciliation of Net Debt

(Unaudited)

Market Capitalization

|

| | | | | | | | | | | |

| | | Shares or Equivalents Outstanding | | Market Price as of December 31, 2014 | | Market Value Equivalents (in millions) |

| Common shares | | 38,651,517 |

| | $ | 27.55 |

| | $ | 1,064.8 |

|

| Operating Partnership units | | 26,601,835 |

| | $ | 27.55 |

| | 732.9 |

|

| Net Debt | |

| |

| | 636.7 |

|

| Total Enterprise Value (TEV) | | | |

| | $ | 2,434.4 |

|

| Net Debt as a % of TEV | | | | | | 26.2 | % |

| Net Debt to LQA Adjusted EBITDA | | | | | | 3.6x |

|

Reconciliation of Net Debt

|

| | | | | | | | | | | | | | | | | | | | |

| (dollars in millions) | | December 31, | | September 30, | | June 30, | | March 31, | | December 31, |

| | | 2014 | | 2014 | | 2014 | | 2014 | | 2013 |

| Long-term debt | | $ | 659.8 |

| | $ | 555.0 |

| | $ | 525.0 |

| | $ | 525.0 |

| | $ | 525.0 |

|

| Capital lease obligations | | 13.4 |

| | 14.2 |

| | 15.0 |

| | 15.5 |

| | 16.7 |

|

| Less: | | | | | | | | | | |

| Cash and cash equivalents | | (36.5 | ) | | (30.4 | ) | | (49.3 | ) | | (125.2 | ) | | (148.8 | ) |

| Net Debt | | $ | 636.7 |

| | $ | 538.8 |

| | $ | 490.7 |

| | $ | 415.3 |

| | $ | 392.9 |

|

CyrusOne Inc.

Colocation Square Footage (CSF) and Utilization

(Unaudited)

|

| | | | | | | | | | | | |

| | | As of December 31, 2014 | | As of December 31, 2013 |

| Market | | Colocation

Space (CSF)(a) | | CSF

Utilized(b) | | Colocation

Space (CSF)(a) | | CSF

Utilized(b) |

| Cincinnati | | 420,223 |

| | 90 | % | | 419,231 |

| | 89 | % |

| Dallas | | 294,969 |

| | 86 | % | | 231,598 |

| | 80 | % |

| Houston | | 255,094 |

| | 85 | % | | 230,718 |

| | 91 | % |

| Phoenix | | 114,026 |

| | 100 | % | | 36,654 |

| | 67 | % |

| Austin | | 59,995 |

| | 87 | % | | 54,003 |

| | 69 | % |

| San Antonio | | 43,843 |

| | 100 | % | | 43,487 |

| | 100 | % |

| Chicago | | 23,298 |

| | 58 | % | | 23,298 |

| | 52 | % |

| International | | 13,200 |

| | 80 | % | | 13,200 |

| | 78 | % |

| Total Footprint | | 1,224,648 |

| | 88 | % | | 1,052,189 |

| | 85 | % |

| |

| (a) | CSF represents the NRSF at an operating facility that is currently leased or readily available for lease as colocation space, where customers locate their servers and other IT equipment. |

| |

| (b) | Utilization is calculated by dividing CSF under signed leases for colocation space (whether or not the customer has occupied the space) by total CSF. |

CyrusOne Inc.

2015 Guidance

(Unaudited)

|

| | |

| Category | 2014 Results | 2015 Guidance |

| Total Revenue | $331 million | $370 - $385 million |

| Base Revenue | $290 million | $322 - $332 million |

| Metered Power Reimbursements | $41 million | $48 - $53 million |

| Adjusted EBITDA | $169 million | $185 - $195 million |

| Normalized FFO per diluted common share or common share equivalent* | $1.73 | $1.90 - $2.00 |

| | | |

| Capital Expenditures | $284 million | $215 - $240 million |

Development** | $280 million | $210 - $230 million |

| Recurring | $4 million | $5 - $10 million |

|

| |

| * | Assumes weighted average diluted common share or common share equivalents for 2015 of 66 million. |

| ** | Development capital is inclusive of capital used for the acquisition of land for future development. |

The annual guidance provided above represents forward-looking statements, which are based on current economic conditions, internal assumptions about the Company's existing customer base and the supply and demand dynamics of the markets in which CyrusOne operates.

CyrusOne Inc.

Data Center Portfolio

As of December 31, 2014

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Operating Net Rentable Square Feet (NRSF)(a) | | Powered

Shell

Available

for Future

Development

(NRSF)(j) | | Available UPS

Capacity

(MW)(k) |

| Facilities | Metro Area | | Annualized

Rent(b) | | Colocation

Space

(CSF)(c) | | CSF Leased(d) | | CSF Utilized (e) | | Office & Other(f) | | Office & Other Leased(g) | | Supporting

Infrastructure(h) | | Total(i) | |

| Westway Park Blvd., Houston, TX (Houston West 1) | Houston | | $ | 52,457,037 |

| | 112,133 |

| | 97 | % | | 97 | % | | 10,563 |

| | 98 | % | | 37,063 |

| | 159,759 |

| | 3,000 |

| | 28 |

|

| S. State Highway 121 Business Lewisville, TX (Lewisville)* | Dallas | | 38,366,836 |

| | 108,687 |

| | 96 | % | | 97 | % | | 11,279 |

| | 96 | % | | 59,345 |

| | 179,311 |

| | — |

| | 18 |

|

| West Seventh St., Cincinnati, OH (7th Street)*** | Cincinnati | | 35,253,793 |

| | 212,664 |

| | 92 | % | | 92 | % | | 5,744 |

| | 100 | % | | 171,561 |

| | 389,969 |

| | 37,000 |

| | 13 |

|

| Southwest Fwy., Houston, TX (Galleria) | Houston | | 33,512,474 |

| | 63,469 |

| | 77 | % | | 77 | % | | 23,259 |

| | 51 | % | | 24,927 |

| | 111,655 |

| | — |

| | 14 |

|

| W. Frankford, Carrollton, TX (Frankford) | Dallas | | 25,322,096 |

| | 170,627 |

| | 77 | % | | 78 | % | | 13,745 |

| | 71 | % | | 66,020 |

| | 250,392 |

| | 272,000 |

| | 18 |

|

| South Ellis Street Chandler, AZ (Phoenix 1) | Phoenix | | 20,937,731 |

| | 77,504 |

| | 99 | % | | 100 | % | | 34,471 |

| | 10 | % | | 38,441 |

| | 150,416 |

| | 31,000 |

| | 27 |

|

| Kingsview Dr., Lebanon, OH (Lebanon) | Cincinnati | | 20,031,449 |

| | 65,303 |

| | 83 | % | | 84 | % | | 44,886 |

| | 72 | % | | 52,950 |

| | 163,139 |

| | 65,000 |

| | 14 |

|

| Westover Hills Blvd, San Antonio, TX (San Antonio 1) | San Antonio | | 18,637,788 |

| | 43,843 |

| | 100 | % | | 100 | % | | 5,989 |

| | 89 | % | | 45,606 |

| | 95,438 |

| | 11,000 |

| | 12 |

|

| Industrial Rd., Florence, KY (Florence) | Cincinnati | | 16,345,633 |

| | 52,698 |

| | 100 | % | | 100 | % | | 46,848 |

| | 87 | % | | 40,374 |

| | 139,920 |

| | — |

| | 9 |

|

| Westway Park Blvd., Houston, TX (Houston West 2) | Houston | | 12,919,914 |

| | 79,492 |

| | 73 | % | | 74 | % | | 3,112 |

| | 59 | % | | 56,432 |

| | 139,036 |

| | 12,000 |

| | 12 |

|

| Metropolis Dr., Austin, TX (Austin 2) | Austin | | 9,644,277 |

| | 43,772 |

| | 78 | % | | 87 | % | | 912 |

| | 79 | % | | 22,666 |

| | 67,350 |

| | — |

| | 5 |

|

| Knightsbridge Dr., Hamilton, OH (Hamilton)* | Cincinnati | | 9,235,796 |

| | 46,565 |

| | 77 | % | | 78 | % | | 1,077 |

| | 100 | % | | 35,336 |

| | 82,978 |

| | — |

| | 10 |

|

| Parkway Dr., Mason, OH (Mason) | Cincinnati | | 6,022,440 |

| | 34,072 |

| | 100 | % | | 100 | % | | 26,458 |

| | 98 | % | | 17,193 |

| | 77,723 |

| | — |

| | 4 |

|

| E. Ben White Blvd., Austin, TX (Austin 1)* | Austin | | 5,634,831 |

| | 16,223 |

| | 87 | % | | 87 | % | | 21,476 |

| | 100 | % | | 7,517 |

| | 45,216 |

| | — |

| | 2 |

|

| Kestral Way (London)** | London | | 5,488,782 |

| | 10,000 |

| | 99 | % | | 99 | % | | — |

| | — | % | | — |

| | 10,000 |

| | — |

| | 1 |

|

| Midway Rd., Carrollton, TX (Midway)** | Dallas | | 5,408,662 |

| | 8,390 |

| | 100 | % | | 100 | % | | — |

| | — | % | | — |

| | 8,390 |

| | — |

| | 1 |

|

| South Ellis Street Chandler, AZ (Phoenix 2) | Phoenix | | 2,349,948 |

| | 36,522 |

| | 100 | % | | 100 | % | | 5,540 |

| | 36 | % | | 20,784 |

| | 62,846 |

| | — |

| | 6 |

|

| Springer St., Lombard, IL (Lombard) | Chicago | | 2,229,308 |

| | 13,516 |

| | 73 | % | | 74 | % | | 4,115 |

| | 100 | % | | 12,230 |

| | 29,861 |

| | 29,000 |

| | 3 |

|

| Marsh Lane, Carrollton, TX (Marsh Ln)** | Dallas | | 2,226,028 |

| | 4,245 |

| | 100 | % | | 100 | % | | — |

| | — | % | | — |

| | 4,245 |

| | — |

| | 1 |

|

| Goldcoast Dr., Cincinnati, OH (Goldcoast) | Cincinnati | | 1,484,798 |

| | 2,728 |

| | 100 | % | | 100 | % | | 5,280 |

| | 100 | % | | 16,483 |

| | 24,491 |

| | 14,000 |

| | 1 |

|

| Bryan St., Dallas, TX (Bryan St)** | Dallas | | 908,954 |

| | 3,020 |

| | 51 | % | | 51 | % | | — |

| | — | % | | — |

| | 3,020 |

| | — |

| | 1 |

|

| McAuley Place, Blue Ash, OH (Blue Ash)* | Cincinnati | | 529,162 |

| | 6,193 |

| | 39 | % | | 39 | % | | 6,950 |

| | 100 | % | | 2,166 |

| | 15,309 |

| | — |

| | 1 |

|

| E. Monroe St., South Bend, IN (Monroe St.) | South Bend | | 446,245 |

| | 6,350 |

| | 33 | % | | 33 | % | | — |

| | — | % | | 6,478 |

| | 12,828 |

| | 4,000 |

| | 1 |

|

| Crescent Circle, South Bend, IN (Blackthorn)* | South Bend | | 361,582 |

| | 3,432 |

| | 43 | % | | 43 | % | | — |

| | — | % | | 5,125 |

| | 8,557 |

| | 11,000 |

| | 1 |

|

| Jurong East (Singapore)** | Singapore | | 316,189 |

| | 3,200 |

| | 19 | % | | 19 | % | | — |

| | — | % | | — |

| | 3,200 |

| | — |

| | 1 |

|

| Total | | | $ | 326,071,753 |

| | 1,224,648 |

| | 88 | % | | 88 | % | | 271,704 |

| | 74 | % | | 738,697 |

| | 2,235,049 |

| | 489,000 |

| | 198 |

|

| |

| * | Indicates properties in which we hold a leasehold interest in the building shell and land. All data center infrastructure has been constructed by us and owned by us. |

| |

| ** | Indicates properties in which we hold a leasehold interest in the building shell, land, and all data center infrastructure. |

| |

| *** | The information provided for the West Seventh Street (7th St.) property includes data for two facilities, one of which we lease and one of which we own. |

| |

| (a) | Represents the total square feet of a building under lease or available for lease based on engineers' drawings and estimates but does not include space held for development or space used by CyrusOne. |

| |

| (b) | Represents monthly contractual rent (defined as cash rent including customer reimbursements for metered power) under existing customer leases as of December 31, 2014, multiplied by 12. For the month of December 2014, our total portfolio annualized rent was $326.1 million, customer reimbursements were $46.2 million annualized and consisted of reimbursements by customers across all facilities with separately metered power. Customer reimbursements under leases with separately metered power vary from month-to-month based on factors such as our customers’ utilization of power and the suppliers’ pricing of power. From January 1, 2013 through December 31, 2014, customer reimbursements under leases with separately metered power constituted between 8.9% and 14.2% of annualized rent. After giving effect to abatements, free rent and other straight-line adjustments, our annualized effective rent as of December 31, 2014 was $336.5 million. Our annualized effective rent was greater than our annualized rent as of December 31, 2014 because our positive straight-line and other adjustments and amortization of deferred revenue exceeded our negative straight-line adjustments due to factors such as the timing of contractual rent escalations and customer prepayments for services. |

| |

| (c) | CSF represents the NRSF at an operating facility that is currently leased or readily available for lease as colocation space, where customers locate their servers and other IT equipment. |

| |

| (d) | Percent leased is determined based on CSF being billed to customers under signed leases as of December 31, 2014 divided by total CSF. Leases signed but not commenced as of December 2014 are not included. |

| |

| (e) | Utilization is calculated by dividing CSF under signed leases for colocation space (whether or not the customer has occupied the space) by total CSF. |

| |

| (f) | Represents the NRSF at an operating facility that is currently leased or readily available for lease as space other than CSF, which is typically office and other space. |

| |

| (g) | Percent leased is determined based on Office & Other space being billed to customers under signed leases as of December 31, 2014 divided by total Office & Other space. Leases signed but not commenced as of December 2014 are not included. |

| |

| (h) | Represents infrastructure support space, including mechanical, telecommunications and utility rooms, as well as building common areas. |

| |

| (i) | Represents the NRSF at an operating facility that is currently leased or readily available for lease. This excludes existing vacant space held for development. |

| |

| (j) | Represents space that is under roof that could be developed in the future for operating NRSF, rounded to the nearest 1,000. |

| |

| (k) | UPS capacity (also referred to as critical load) represents the aggregate power available for lease and exclusive use by customers from the facility’s installed universal power supplies (UPS) expressed in terms of megawatts. The capacity reported is for non-redundant megawatts, as we can develop flexible solutions to our customers at multiple resiliency levels. Does not sum to total due to rounding. |

CyrusOne Inc.

NRSF Under Development

As of December 31, 2014

(Dollars in millions)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | NRSF Under Development (a) | | | | Under Development Costs(b) |

| Facilities | Metro Area | Colocation Space (CSF) | | Office & Other | | Supporting Infrastructure | | Powered Shell(c) | | Total | | UPS MW Capacity (d) | | Actual to Date(e) | | Estimated Costs to Completion | | Total |

| W. Frankford Rd. (Carrollton) | Dallas | 56,000 |

| | 12,000 |

| | 18,000 |

| | — |

| | 86,000 |

| | 3.0 |

| | $ | 4 |

| | $16-20 | | $20-24 |

| Westover Hills Blvd. (San Antonio 2) | San Antonio | 30,000 |

| | 20,000 |

| | 25,000 |

| | 49,000 |

| | 124,000 |

| | 3.0 |

| | 26 |

| | 14-17 | | 40-43 |

| Westway Park Blvd. (Houston West 3) | Houston | 60,000 |

| | 10,000 |

| | 10,000 |

| | 249,000 |

| | 329,000 |

| | 6.0 |

| | 29 |

| | 24-30 | | 53-59 |

| South Ellis Street, Chandler, AZ (Phoenix 2) | Phoenix | 36,000 |

| | — |

| | 4,000 |

| | — |

| | 40,000 |

| | — |

| | 3 |

| | 1-2 | | 4-5 |

| Ridgetop Circle, Sterling, VA (Northern VA) | Northern Virginia | 30,000 |

| | 16,000 |

| | 35,000 |

| | 48,000 |

| | 129,000 |

| | 6.0 |

| | 39 |

| | 4-5 | | 44-45 |

| Total | | 212,000 |

| | 58,000 |

| | 92,000 |

| | 346,000 |

| | 708,000 |

| | 18.0 |

| | $ | 101 |

| | $59-74 | | $161-176 |

| |

| (a) | Represents NRSF at a facility for which activities have commenced or are expected to commence in the next 2 quarters to prepare the space for its intended use. Estimates and timing are subject to change. |

| |

| (b) | Represents management’s estimate of the total costs required to complete the current NRSF under development. There may be an increase in costs if customers require greater power density. |

| |

| (c) | Represents NRSF under construction that, upon completion, will be powered shell available for future development into operating NRSF. |

| |

| (d) | UPS Capacity (also referred to as critical load) represents the aggregate power available for lease to and exclusive use by customers from the facility’s installed universal power supplies (UPS) expressed in terms of megawatts. The capacity presented is for non-redundant megawatts, as we can develop flexible solutions to our customers at multiple resiliency levels. |

| |

| (e) | Capex-to-date is the cash investment as of December 31, 2014. There may be accruals above this amount for work completed, for which cash has not yet been paid. |

CyrusOne Inc.

Land Available for Future Development (Acres)

As of December 31, 2014

(Unaudited)

|

| | | |

| | | As of |

| Market | | December 31, 2014 |

| Cincinnati | | 98 |

|

| Dallas | | — |

|

| Houston | | 20 |

|

| Virginia | | 10 |

|

| Austin | | 22 |

|

| Phoenix | | 37 |

|

| San Antonio | | 13 |

|

| Chicago | | — |

|

| International | | — |

|

| Total Available | | 200 |

|

CyrusOne Inc.

Leasing Statistics - Lease Signings

As of December 31, 2014

(Dollars in thousands)

(Unaudited)

|

| | | | | | | | | | |

| | | | | | | | | Annualized | | Weighted |

| | | Number | | Total CSF | | Total kW | | GAAP | | Average |

| Period | | of Leases(a) | | Signed(b) | | Signed(c) | | Revenue ($000)(d) | | Lease Term(e) |

| Q4'14 | | 335 | | 44,000 | | 5,262 | | $11,397 | | 69 |

| Prior 4Q Avg. | | 279 | | 59,750 | | 11,033 | | $13,845 | | 69 |

| Q3'14 | | 287 | | 33,000 | | 3,410 | | $8,332 | | 79 |

| Q2'14 | | 275 | | 59,000 | | 17,374 | | $17,215 | | 91 |

| Q1'14 | | 270 | | 100,000 | | 16,058 | | $18,075 | | 64 |

| Q4'13 | | 283 | | 47,000 | | 7,250 | | $11,756 | | 43 |

| |

| (a) | Number of leases represents each agreement with a customer. A lease agreement could include multiple spaces, and a customer could have multiple leases. |

| |

| (b) | CSF represents the NRSF at an operating facility that is leased as colocation space, where customers locate their servers and other IT equipment. |

| |

| (c) | Represents maximum contracted kW that customers may draw during lease period. Additionally, we can develop flexible solutions for our customers at multiple resiliency levels, and the kW signed is unadjusted for this factor. |

| |

| (d) | Excludes estimates for pass-through power. Annualized GAAP revenue is equal to monthly recurring rent, defined as average monthly contractual rent during the term of the lease, multiplied by 12. |

| |

| (e) | Calculated on a CSF-weighted basis. |

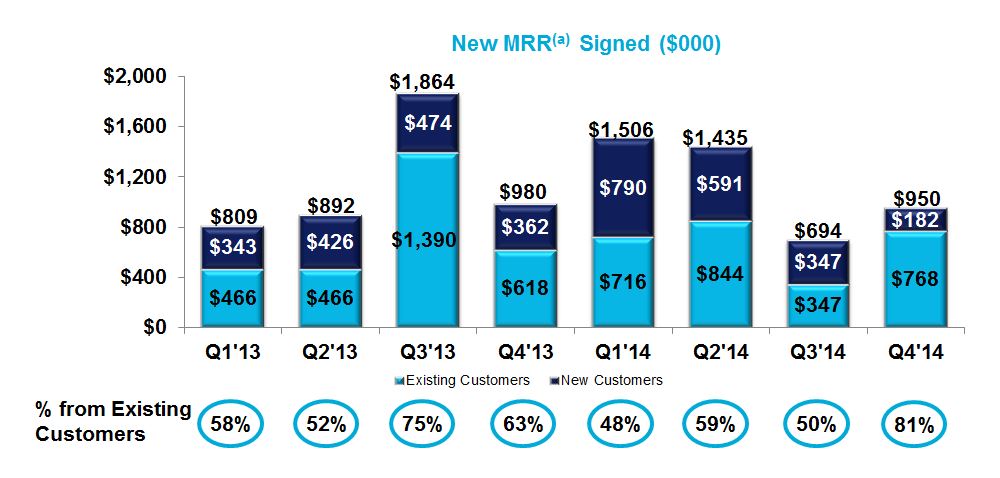

CyrusOne Inc.

New MRR Signed - Existing vs. New Customers

As of December 31, 2014

(Dollars in thousands)

(Unaudited)

| |

| (a) | Monthly recurring rent is defined as average monthly contractual rent during the term of the lease. Contractual rent does not include metered power reimbursements. |

CyrusOne Inc.

Customer Diversification(a)

As of December 31, 2014

(Unaudited)

|

| | | | | | | | | | | | | |

| | Principal Customer Industry | | Number of

Locations | | Annualized

Rent(b) | | Percentage of

Portfolio

Annualized

Rent(c) | | Weighted

Average

Remaining

Lease Term in

Months(d) |

| 1 | Energy | | 2 | | $ | 21,670,137 |

| | 6.6 | % | | 34.2 |

|

| 2 | Telecommunications (CBI)(e) | | 8 | | 20,188,964 |

| | 6.2 | % | | 18.4 |

|

| 3 | Information Technology | | 1 | | 15,473,502 |

| | 4.7 | % | | 51.0 |

|

| 4 | Information Technology | | 3 | | 15,401,712 |

| | 4.7 | % | | 42.2 |

|

| 5 | Telecommunication Services | | 2 | | 15,179,310 |

| | 4.7 | % | | 37.8 |

|

| 6 | Research and Consulting Services | | 3 | | 14,715,147 |

| | 4.5 | % | | 16.3 |

|

| 7 | Energy | | 5 | | 13,281,282 |

| | 4.1 | % | | 7.9 |

|

| 8 | Information Technology | | 2 | | 9,736,358 |

| | 3.0 | % | | 30.0 |

|

| 9 | Financials | | 1 | | 6,000,225 |

| | 1.8 | % | | 65.0 |

|

| 10 | Telecommunication Services | | 5 | | 5,265,673 |

| | 1.6 | % | | 52.0 |

|

| 11 | Energy | | 2 | | 4,944,360 |

| | 1.5 | % | | 19.0 |

|

| 12 | Information Technology | | 1 | | 4,830,477 |

| | 1.5 | % | | 11.4 |

|

| 13 | Energy | | 1 | | 4,805,574 |

| | 1.5 | % | | 14.7 |

|

| 14 | Consumer Staples | | 1 | | 4,788,363 |

| | 1.5 | % | | 88.1 |

|

| 15 | Information Technology | | 1 | | 4,665,712 |

| | 1.4 | % | | 74.0 |

|

| 16 | Information Technology | | 2 | | 4,063,820 |

| | 1.2 | % | | 63.2 |

|

| 17 | Financials | | 6 | | 3,955,165 |

| | 1.2 | % | | 61.1 |

|

| 18 | Energy | | 4 | | 3,942,776 |

| | 1.2 | % | | 10.6 |

|

| 19 | Energy | | 1 | | 3,729,003 |

| | 1.1 | % | | 17.3 |

|

| 20 | Energy | | 2 | | 3,423,904 |

| | 1.1 | % | | 24.9 |

|

| | | | | | $ | 180,061,464 |

| | 55.1 | % | | 33.9 |

|

| |

| (b) | Represents monthly contractual rent (defined as cash rent including customer reimbursements for metered power) under existing customer leases as of December 31, 2014, multiplied by 12. For the month of December 2014, our total portfolio annualized rent was $326.1 million, and customer reimbursements were $46.2 million annualized, consisting of reimbursements by customers across all facilities with separately metered power. Customer reimbursements under leases with separately metered power vary from month-to-month based on factors such as our customers’ utilization of power and the suppliers’ pricing of power. From January 1, 2013 through December 31, 2014, customer reimbursements under leases with separately metered power constituted between 8.9% and 14.2% of annualized rent. After giving effect to abatements, free rent and other straight-line adjustments, our annualized effective rent for our total portfolio as of December 31, 2014 was $336.5 million. Our annualized effective rent was greater than our annualized rent as of December 31, 2014 because our positive straight-line and other adjustments and amortization of deferred revenue exceeded our negative straight-line adjustments due to factors such as the timing of contractual rent escalations and customer prepayments for services. |

| |

| (c) | Represents the customer’s total annualized rent divided by the total annualized rent in the portfolio as of December 31, 2014, which was approximately $326.1 million. |

| |

| (d) | Weighted average based on customer’s percentage of total annualized rent expiring and is as of December 31, 2014, assuming that customers exercise no renewal options and exercise all early termination rights that require payment of less than 50% of the remaining rents. Early termination rights that require payment of 50% or more of the remaining lease payments are not assumed to be exercised because such payments approximate the profitability margin of leasing that space to the customer, such that we do not consider early termination to be economically detrimental to us. |

| |

| (e) | Includes information for both Cincinnati Bell Technology Solutions (CBTS) and Cincinnati Bell Telephone and two customers that have contracts with CBTS. We expect the contracts for these two customers to be assigned to us, but the consents for such assignments have not yet been obtained. Excluding these customers, Cincinnati Bell Inc. and subsidiaries represented 2.4% of our annualized rent as of December 31, 2014. |

CyrusOne Inc.

Lease Distribution

As of December 31, 2014

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

NRSF Under Lease(a) | | Number of Customers(b) | | Percentage of All Customers | | Total Leased NRSF(c) | | Percentage of Portfolio Leased NRSF | | Annualized Rent(d) | | Percentage of Annualized Rent |

| 0-999 | | 484 |

| | 73 | % | | 95,342 |

| | 5 | % | | $ | 37,213,773 |

| | 11 | % |

| 1,000-2,499 | | 66 |

| | 10 | % | | 99,148 |

| | 5 | % | | 20,428,533 |

| | 6 | % |

| 2,500-4,999 | | 39 |

| | 6 | % | | 141,283 |

| | 7 | % | | 26,318,396 |

| | 8 | % |

| 5,000-9,999 | | 31 |

| | 5 | % | | 220,539 |

| | 12 | % | | 55,091,724 |

| | 17 | % |

| 10,000+ | | 40 |

| | 6 | % | | 1,359,823 |

| | 71 | % | | 187,019,327 |

| | 58 | % |

| Total | | 660 |

| | 100 | % | | 1,916,135 |

| | 100 | % | | $ | 326,071,753 |

| | 100 | % |

| |

| (a) | Represents all leases in our portfolio, including colocation, office and other leases. |

| |

| (b) | Represents the number of customers occupying data center, office and other space as of December 31, 2014. This may vary from total customer count as some customers may be under contract, but have yet to occupy space. |

| |

| (c) | Represents the total square feet at a facility under lease and that has commenced billing, excluding space held for development or space used by CyrusOne. A customer’s leased NRSF is estimated based on such customer’s direct CSF or office and light-industrial space plus management’s estimate of infrastructure support space, including mechanical, telecommunications and utility rooms, as well as building common areas. |

| |