Exhibit 99.2

| | |

| | First Quarter 2020 |

| | | | |

Table of Contents | | Page | |

Summary | | | | |

Company Profile | | | 3 | |

Financial Highlights | | | 4 | |

Selected Property Data | | | | |

Property Summary Net Operating Income | | | 5 | |

Net Operating Income and Initial Free Rent Burn-Off | | | 6 | |

Leasing Activity | | | 7 | |

Portfolio Expirations and Vacates Summary | | | 9 | |

Property Detail | | | 10 | |

Tenant Lease Expirations | | | 11 | |

Largest Tenants and Portfolio Tenant Diversification by Industry | | | 14 | |

Capital Expenditures and Redevelopment Program | | | 15 | |

Observatory Summary | | | 16 | |

Financial information | | | | |

Condensed Consolidated Balance Sheets | | | 17 | |

Condensed Consolidated Statements of Income | | | 18 | |

Core FFO, Modified FFO, FFO, FAD and EBITDA | | | 19 | |

Consolidated Debt Analysis | | | | |

Debt Summary | | | 20 | |

Debt Detail | | | 21 | |

Debt Maturities | | | 22 | |

Ground Leases | | | 22 | |

Supplemental Definitions | | | 23 | |

Forward-looking Statements

We make forward-looking statements in this supplemental package within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. You should not rely on them as predictions of future events. For these statements, we claim the protections of the safe harbor for forward-looking statements contained in such Sections.

You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “contemplates,” “aims,” “continues,” “would” or “anticipates” or similar words or phrases in the positive or negative. In particular, forward looking statements include those pertaining to our capital resources, portfolio performance, dividend policy, results of operations, anticipated growth in our portfolio from operations, acquisitions, and market conditions and demographics.

Forward-looking statements involve numerous risks and uncertainties, many of which are difficult to predict and generally beyond our control. They depend on assumptions, data or methods which may be incorrect or imprecise, and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all).

The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: (i) economic, political and social impact of, and uncertainty relating to, the COVID-19 pandemic, including (a) the effectiveness or lack of effectiveness of governmental relief in providing assistance to businesses that have suffered significant declines in revenues as a result of mandatory business shut-downs, “shelter-in-place” or “stay-at-home” orders and social distancing practices, as well as individuals adversely impacted by the COVID-19 pandemic, (b) the duration of any such orders or other formal recommendations for social distancing and the speed and extent to which revenues of the Company’s tenants, particularly retail, and the Observatory recover following the lifting of any such orders or recommendations, (c) the potential impact of any such events on the obligations of the Company’s tenants to make rent and other payments or honor other commitments, (d) international and national disruption of travel and tourism with a resulting decline in Observatory visitors, and (e) macroeconomic conditions, such as a disruption of, or lack of access to, the capital markets, and general volatility adversely impacting the market price of the Company’s Class A common stock and publicly-traded partnership units of the Operating Partnership; (ii) resolution of legal proceedings involving the Company; (iii) reduced demand for office or retail space; (iv) changes in our business strategy; (v) changes in technology and market competition that affect utilization of our broadcast or other facilities; (vi) changes in domestic or international tourism, including due to health crises such as the COVID-19 pandemic, geopolitical events and/or currency exchange rates, which may cause a decline in Observatory visitors; (vii) defaults on, early terminations of, or non-renewal of, leases by tenants; (viii) increases in the Company’s borrowing costs as a result of changes in interest rates and other factors, including the potential phasing out of LIBOR after 2021; (ix) declining real estate valuations and impairment charges; (x) termination or expiration of our ground leases; (xi) our ability to pay down, refinance, restructure or extend our indebtedness as it becomes due and potential limitations on our ability to borrow additional funds in compliance with drawdown conditions and financial covenants; (xii) decreased rental rates or increased vacancy rates; (xiii) our failure to redevelop and reposition properties, or to execute any newly planned capital project successfully or on the anticipated timeline or at the anticipated costs; (xiv) difficulties in identifying properties to acquire and completing acquisitions; (xv) risks related to our development projects (including our Metro Tower development site) and capital projects, including the cost of construction delays and cost overruns; (xvi) impact of changes in governmental regulations, tax laws and rates and similar matters; (xvii) our failure to qualify as a REIT; and (xviii) environmental uncertainties and risks related to adverse weather conditions, rising sea levels and natural disasters. For a further discussion of these and other factors that could impact the Company’s future results, performance or transactions, see the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019, and other risks described in documents subsequently filed by the Company from time to time with the Securities and Exchange Commission.

Page 2

| | |

| | First Quarter 2020 |

COMPANY PROFILE

Empire State Realty Trust, Inc., or the Company, is a leading real estate investment trust (REIT) that owns, manages, operates, acquires and repositions office and retail properties in Manhattan and the greater New York metropolitan area, including the Empire State Building, the world’s most famous building.

BOARD OF DIRECTORS

| | |

| Anthony E. Malkin | | Chairman and Chief Executive Officer |

| William H. Berkman | | Director, Chair of Finance Committee |

| Leslie D. Biddle | | Director |

| Thomas J. DeRosa | | Director |

| Steven J. Gilbert | | Director, Lead Director |

| S. Michael Giliberto | | Director, Chair of Audit Committee |

| Patricia S. Han | | Director |

| James D. Robinson IV | | Director, Chair of Compensation and Nominating/Corporate Governance Committees |

EXECUTIVE MANAGEMENT

| | |

| Anthony E. Malkin | | Chairman and Chief Executive Officer |

| John B. Kessler | | President and Chief Operating Officer |

| Thomas P. Durels | | Executive Vice President, Real Estate |

| Thomas N. Keltner, Jr. | | Executive Vice President, General Counsel and Secretary |

COMPANY INFORMATION

| | | | |

| Corporate Headquarters | | Investor Relations | | New York Stock Exchange |

| 111 West 33rd Street, 12th Floor | | Greg Faje | | Trading Symbol:ESRT |

| New York, NY 10120 | | IR@empirestaterealtytrust.com | | |

| www.empirestaterealtytrust.com | | | | |

| (212) 687-8700 | | | | |

RESEARCH COVERAGE

| | | | | | |

| Bank of America Merrill Lynch | | James Feldman | | (646) 855-5808 | | james.feldman@baml.com |

| BMO Capital Markets Corp. | | John Kim | | (212) 885-4115 | | jp.kim@bmo.com |

| BTIG | | Thomas Catherwood | | (212) 738-6140 | | tcatherwood@btig.com |

| Citi | | Michael Bilerman | | (212) 816-1383 | | michael.bilerman@citi.com |

| | Emmanuel Korchman | | (212) 816-1382 | | emmanuel.korchman@citi.com |

| Evercore ISI | | Steve Sakwa | | (212) 446-9462 | | steve.sakwa@evercoreisi.com |

| | Jason Green | | (212) 446-9449 | | jason.green@evercoreisi.com |

| Green Street Advisors | | Daniel Ismail | | (949) 640-8780 | | dismail@greenstreetadvisors.com |

| Goldman Sachs | | Richard Skidmore | | (801) 741-5459 | | richard.skidmore@gs.com |

| KeyBanc Capital Markets | | Jordan Sadler | | (917) 368-2280 | | jsadler@key.com |

| | Craig Mailman | | (917) 368-2316 | | cmailman@key.com |

| Stifel Nicolaus & Company, Inc. | | John Guinee | | (443) 224-1307 | | jwguinee@stifel.com |

| Wells Fargo Securities, LLC | | Blaine Heck | | (443) 263-6529 | | blaine.heck@wellsfargo.com |

Page 3

| | |

| | First Quarter 2020 Financial Highlights (unaudited and dollars in thousands, except per share amounts) |

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

Selected Items: | | March 31,

2020 | | | December 31,

2019 | | | September 30,

2019 | | | June 30,

2019 | | | March 31,

2019 | |

Revenue | | $ | 170,224 | | | $ | 194,933 | | | $ | 192,873 | | | $ | 176,244 | | | $ | 167,293 | |

Net income | | $ | 8,288 | | | $ | 28,720 | | | $ | 26,784 | | | $ | 18,930 | | | $ | 9,856 | |

Cash net operating income(1) | | $ | 81,528 | | | $ | 103,992 | | | $ | 98,757 | | | $ | 93,737 | | | $ | 80,080 | |

Core funds from operations (“Core FFO”)(1) | | $ | 53,712 | | | $ | 74,935 | | | $ | 71,810 | | | $ | 64,476 | | | $ | 56,672 | |

Core funds available for distribution (“Core

FAD”)(1) | | $ | 37,738 | | | $ | 41,903 | | | $ | 54,650 | | | $ | 48,235 | | | $ | 41,179 | |

Core FFO per share—diluted | | $ | 0.18 | | | $ | 0.25 | | | $ | 0.24 | | | $ | 0.22 | | | $ | 0.19 | |

Diluted weighted average shares | | | 292,645,000 | | | | 296,852,000 | | | | 298,151,000 | | | | 298,131,000 | | | | 298,049,000 | |

Dividends declared and paid per share | | $ | 0.105 | | | $ | 0.105 | | | $ | 0.105 | | | $ | 0.105 | | | $ | 0.105 | |

Portfolio Statistics: | | | | | | | | | | | | | | | | | | | | |

Number of properties | | | 20 | | | | 20 | | | | 20 | | | | 20 | | | | 20 | |

Total rentable square footage | | | 10,135,413 | | | | 10,138,057 | | | | 10,134,495 | | | | 10,134,435 | | | | 10,130,875 | |

Percent occupied(2) | | | 88.7 | % | | | 88.6 | % | | | 89.4 | % | | | 90.2 | % | | | 88.8 | % |

Percent leased(3) | | | 91.1 | % | | | 91.2 | % | | | 91.7 | % | | | 92.2 | % | | | 91.5 | % |

Observatory Metrics: | | | | | | | | | | | | | | | | | | | | |

Number of visitors(4) | | | 422,000 | | | | 894,000 | | | | 1,042,000 | | | | 968,000 | | | | 601,000 | |

Change in visitors year over year | | | (29.8 | %) | | | (5.5 | %) | | | (10.7 | %) | | | (7.7 | %) | | | (6.7 | %) |

Observatory revenues(5) | | $ | 19,544 | | | $ | 37,730 | | | $ | 37,575 | | | $ | 32,895 | | | $ | 20,569 | |

Change in revenues year over year | | | (5.0 | %) | | | 9.2 | % | | | (6.6 | %) | | | (6.6 | %) | | | (3.2 | %) |

Ratios: | | | | | | | | | | | | | | | | | | | | |

Consolidated Debt to Total Market Capitalization(6) | | | 47.8 | % | | | 28.2 | % | | | 27.7 | % | | | 29.8 | % | | | 28.5 | % |

Consolidated Net Debt to Total Market Capitalization(6) | | | 35.5 | % | | | 25.2 | % | | | 24.1 | % | | | 23.6 | % | | | 21.6 | % |

Consolidated Debt and Perpetual Preferred Units to Total Market Capitalization(6) | | | 49.5 | % | | | 29.7 | % | | | 28.2 | % | | | 30.2 | % | | | 28.9 | % |

Consolidated Net Debt and Perpetual Preferred Units to Total Market Capitalization(6) | | | 37.6 | % | | | 26.8 | % | | | 24.5 | % | | | 24.0 | % | | | 22.0 | % |

Consolidated Debt to EBITDA(7) | | | 7.3x | | | | 4.8x | | | | 4.6x | | | | 5.3x | | | | 5.2x | |

Consolidated Net Debt to EBITDA(7) | | | 4.4x | | | | 4.1x | | | | 3.8x | | | | 3.9x | | | | 3.6x | |

Interest Coverage Ratio | | | 4.3x | | | | 5.0x | | | | 4.8x | | | | 4.4x | | | | 4.0x | |

Core FFO Payout Ratio(8) | | | 61 | % | | | 43 | % | | | 45 | % | | | 50 | % | | | 56 | % |

Core FAD Payout Ratio(9) | | | 87 | % | | | 76 | % | | | 59 | % | | | 66 | % | | | 77 | % |

Class A common stock price at quarter end | | $ | 8.96 | | | $ | 13.96 | | | $ | 14.27 | | | $ | 14.81 | | | $ | 15.80 | |

Average closing price | | $ | 12.24 | | | $ | 14.04 | | | $ | 14.12 | | | $ | 15.48 | | | $ | 15.36 | |

Dividends per share—annualized | | $ | 0.42 | | | $ | 0.42 | | | $ | 0.42 | | | $ | 0.42 | | | $ | 0.42 | |

Dividend yield(10) | | | 4.7 | % | | | 3.0 | % | | | 2.9 | % | | | 2.8 | % | | | 2.7 | % |

Series 2013 Private Perpetual Preferred Units outstanding ($16.62 liquidation value) | | | 1,560,360 | | | | 1,560,360 | | | | 1,560,360 | | | | 1,560,360 | | | | 1,560,360 | |

Series 2019 Private Perpetual Preferred Units outstanding ($13.52 liquidation value) | | | 4,664,038 | | | | 4,610,383 | | | | — | | | | — | | | | — | |

Class A common stock | | | 176,112,860 | | | | 180,877,597 | | | | 179,131,090 | | | | 176,991,123 | | | | 175,557,910 | |

Class B common stock | | | 1,015,149 | | | | 1,016,799 | | | | 1,018,463 | | | | 1,029,782 | | | | 1,035,327 | |

Operating partnership units | | | 120,548,216 | | | | 117,757,653 | | | | 124,107,019 | | | | 126,870,876 | | | | 128,232,650 | |

| | | | | | | | | | | | | | | | | | | | |

Total common stock and operating partnership units outstanding(11) | | | 297,676,225 | | | | 299,652,049 | | | | 304,256,572 | | | | 304,891,781 | | | | 304,825,887 | |

| | | | | | | | | | | | | | | | | | | | |

Notes:

| (1) | Represents non-GAAP financial measures. For a discussion on what these metrics represent and why the Company presents them, see page 23 and for a reconciliation of these metrics to net income, see pages 5 and 19. |

| (2) | Based on leases signed and commenced as of end of period. |

| (3) | Represents occupancy and includes signed leases not commenced. |

| (4) | Reflects the number of visitors who pass through the turnstile, excluding visitors who make a second visit on the same ticket at no additional charge. |

| (5) | Observatory revenues include the fixed license fee received from WDFG North America, the Observatory gift shop operator. See page 16. |

| (6) | Market capitalization represents the sum of (i) Company’s common stock per share price as of March 31, 2020 multiplied by the total outstanding number of shares of common stock and operating partnership units as of March 31, 2020; (ii) the number of Series 2014 perpetual preferred units at March 31, 2020 multiplied by $16.62, (iii) the number of Series 2019 perpetual preferred units at March 31, 2020 multiplied by $13.52, and (iv) our outstanding indebetedness as of March 31, 2020. |

| (7) | Calculated based on trailing 12 months EBITDA. |

| (8) | Represents the amount of Core FFO paid out in distributions. |

| (9) | Represents the amount of Core FAD paid out in distributions. |

| (10) | Based on the closing price per share of Class A common stock on March 31, 2020. |

| (11) | As of March 31, 2020, the Company has had conversions from operating partnership units and Class B common shares to Class A common shares totaling 55.5 million shares or approximately $497 million at a closing share price of $8.96. This represents a 67% increase in the number of Class A shares since the IPO. |

Page 4

| | |

| | First Quarter 2020 Property Summary—Same Store Net Operating Income (“NOI”) by Quarter (unaudited and dollars in thousands) |

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | March 31,

2020 | | | December 31,

2019 | | | September 30,

2019 | | | June 30,

2019 | | | March 31,

2019 | |

Same Store Total Portfolio | | | | | | | | | | | | | | | | | | | | |

Revenues | | $ | 150,123 | | | $ | 155,664 | | | $ | 152,633 | | | $ | 142,655 | | | $ | 146,016 | |

Operating expenses | | | (73,053 | ) | | | (76,051 | ) | | | (79,824 | ) | | | (70,826 | ) | | | (73,518 | ) |

| | | | | | | | | | | | | | | | | | | | |

Same store property NOI | | | 77,070 | | | | 79,613 | | | | 72,809 | | | | 71,829 | | | | 72,498 | |

Straight-line rent | | | (8,193 | ) | | | (6,276 | ) | | | (5,174 | ) | | | (3,203 | ) | | | (5,404 | ) |

Above/below-market rent revenue amortization | | | (908 | ) | | | (1,530 | ) | | | (1,682 | ) | | | (1,745 | ) | | | (2,354 | ) |

Below-market ground lease amortization | | | 1,958 | | | | 1,958 | | | | 1,957 | | | | 1,958 | | | | 1,958 | |

| | | | | | | | | | | | | | | | | | | | |

Total same store property cash NOI—excluding lease termination fees | | $ | 69,927 | | | $ | 73,765 | | | $ | 67,910 | | | $ | 68,839 | | | $ | 66,698 | |

| | | | | | | | | | | | | | | | | | | | |

Percent increase over prior year | | | 4.8 | % | | | 6.9 | % | | | 2.0 | % | | | 0.2 | % | | | 0.1 | % |

| | | | | | | | | | | | | | | | | | | | |

Property cash NOI | | $ | 69,927 | | | $ | 73,765 | | | $ | 67,910 | | | $ | 68,839 | | | $ | 66,698 | |

Observatory cash NOI | | | 11,390 | | | | 28,987 | | | | 28,486 | | | | 24,535 | | | | 12,994 | |

Lease termination fees | | | 211 | | | | 1,240 | | | | 2,361 | | | | 363 | | | | 388 | |

| | | | | | | | | | | | | | | | | | | | |

Total portfolio same store cash NOI | | $ | 81,528 | | | $ | 103,992 | | | $ | 98,757 | | | $ | 93,737 | | | $ | 80,080 | |

| | | | | | | | | | | | | | | | | | | | |

Same Store Manhattan Office Portfolio(1) | | | | | | | | | | | | | | | | | | | | |

Revenues | | $ | 128,909 | | | $ | 132,672 | | | $ | 130,214 | | | $ | 120,249 | | | $ | 123,290 | |

Operating expenses | | | (62,670 | ) | | | (65,509 | ) | | | (68,516 | ) | | | (60,152 | ) | | | (62,665 | ) |

| | | | | | | | | | | | | | | | | | | | |

Same store property NOI | | | 66,239 | | | | 67,163 | | | | 61,698 | | | | 60,097 | | | | 60,625 | |

Straight-line rent | | | (8,338 | ) | | | (6,705 | ) | | | (5,319 | ) | | | (4,163 | ) | | | (5,408 | ) |

Above/below-market rent revenue amortization | | | (908 | ) | | | (1,530 | ) | | | (1,682 | ) | | | (1,745 | ) | | | (2,354 | ) |

Below-market ground lease amortization | | | 1,958 | | | | 1,958 | | | | 1,957 | | | | 1,958 | | | | 1,958 | |

| | | | | | | | | | | | | | | | | | | | |

Total same store property cash NOI—excluding lease termination fees | | | 58,951 | | | | 60,886 | | | | 56,654 | | | | 56,147 | | | | 54,821 | |

Lease termination fees | | | 159 | | | | 995 | | | | 835 | | | | 301 | | | | 326 | |

| | | | | | | | | | | | | | | | | | | | |

Total same store property cash NOI | | $ | 59,110 | | | $ | 61,881 | | | $ | 57,489 | | | $ | 56,448 | | | $ | 55,147 | |

| | | | | | | | | | | | | | | | | | | | |

Same Store Greater New York Metropolitan Area Office Portfolio | | | | | | | | | | | | | | | | | | | | |

Revenues | | $ | 16,915 | | | $ | 18,771 | | | $ | 18,137 | | | $ | 17,798 | | | $ | 18,045 | |

Operating expenses | | | (8,479 | ) | | | (8,663 | ) | | | (9,373 | ) | | | (8,784 | ) | | | (8,927 | ) |

| | | | | | | | | | | | | | | | | | | | |

Same store property NOI | | | 8,436 | | | | 10,108 | | | | 8,764 | | | | 9,014 | | | | 9,118 | |

Straight-line rent | | | 12 | | | | 285 | | | | (42 | ) | | | 655 | | | | (124 | ) |

Above/below-market rent revenue amortization | | | — | | | | — | | | | — | | | | — | | | | — | |

Below-market ground lease amortization | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total same store property cash NOI—excluding lease termination fees | | | 8,448 | | | | 10,393 | | | | 8,722 | | | | 9,669 | | | | 8,994 | |

Lease termination fees | | | 52 | | | | 245 | | | | 710 | | | | 62 | | | | 62 | |

| | | | | | | | | | | | | | | | | | | | |

Total same store property cash NOI | | $ | 8,500 | | | $ | 10,638 | | | $ | 9,432 | | | $ | 9,731 | | | $ | 9,056 | |

| | | | | | | | | | | | | | | | | | | | |

Same Store Standalone Retail Portfolio | | | | | | | | | | | | | | | | | | | | |

Revenues | | $ | 4,299 | | | $ | 4,221 | | | $ | 4,282 | | | $ | 4,608 | | | $ | 4,681 | |

Operating expenses | | | (1,904 | ) | | | (1,879 | ) | | | (1,935 | ) | | | (1,890 | ) | | | (1,926 | ) |

| | | | | | | | | | | | | | | | | | | | |

Same store property NOI | | | 2,395 | | | | 2,342 | | | | 2,347 | | | | 2,718 | | | | 2,755 | |

Straight-line rent | | | 133 | | | | 144 | | | | 187 | | | | 305 | | | | 128 | |

Above/below-market rent revenue amortization | | | — | | | | — | | | | — | | | | — | | | | — | |

Below-market ground lease amortization | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total same store property cash NOI—excluding lease termination fees | | | 2,528 | | | | 2,486 | | | | 2,534 | | | | 3,023 | | | | 2,883 | |

Lease termination fees | | | — | | | | — | | | | 816 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total same store property cash NOI | | $ | 2,528 | | | $ | 2,486 | | | $ | 3,350 | | | $ | 3,023 | | | $ | 2,883 | |

| | | | | | | | | | | | | | | | | | | | |

Note:

Includes 509,244 rentable square feet of retail space in the Company’s nine Manhattan office properties.

Page 5

| | |

| | First Quarter 2020 Net Operating Income (“NOI”), Initial Free Rent Burn-Off and Signed Leases Not Commenced (unaudited and dollars in thousands) |

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | March 31,

2020 | | | December 31,

2019 | | | September 30,

2019 | | | June 30,

2019 | | | March 31,

2019 | |

Reconciliation of Net Income to NOI and Cash NOI | | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 8,288 | | | $ | 28,720 | | | $ | 26,784 | | | $ | 18,930 | | | $ | 9,856 | |

Add: | | | | | | | | | | | | | | | | | | | | |

General and administrative expenses | | | 15,951 | | | | 16,618 | | | | 14,421 | | | | 15,998 | | | | 14,026 | |

Depreciation and amortization | | | 46,093 | | | | 46,409 | | | | 44,260 | | | | 44,821 | | | | 46,098 | |

Interest expense | | | 19,704 | | | | 18,534 | | | | 19,426 | | | | 20,597 | | | | 20,689 | |

Income tax expense (benefit) | | | (382 | ) | | | 1,210 | | | | 1,338 | | | | 611 | | | | (730 | ) |

Less: | | | | | | | | | | | | | | | | | | | | |

Third-party management and other fees | | | (346 | ) | | | (299 | ) | | | (304 | ) | | | (331 | ) | | | (320 | ) |

Interest income | | | (637 | ) | | | (1,352 | ) | | | (2,269 | ) | | | (3,899 | ) | | | (3,739 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net operating income | | | 88,671 | | | | 109,840 | | | | 103,656 | | | | 96,727 | | | | 85,880 | |

Straight-line rent | | | (8,193 | ) | | | (6,276 | ) | | | (5,174 | ) | | | (3,203 | ) | | | (5,404 | ) |

Above/below-market rent revenue amortization | | | (908 | ) | | | (1,530 | ) | | | (1,682 | ) | | | (1,745 | ) | | | (2,354 | ) |

Below-market ground lease amortization | | | 1,958 | | | | 1,958 | | | | 1,957 | | | | 1,958 | | | | 1,958 | |

| | | | | | | | | | | | | | | | | | | | |

Total cash NOI—including Observatory and lease termination income | | | 81,528 | | | | 103,992 | | | | 98,757 | | | | 93,737 | | | | 80,080 | |

Less: Observatory NOI | | | (11,390 | ) | | | (28,987 | ) | | | (28,486 | ) | | | (24,535 | ) | | | (12,994 | ) |

Less: lease termination income | | | (211 | ) | | | (1,240 | ) | | | (2,361 | ) | | | (363 | ) | | | (388 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total property cash NOI—excluding Observatory and lease termination income | | $ | 69,927 | | | $ | 73,765 | | | $ | 67,910 | | | $ | 68,839 | | | $ | 66,698 | |

| | | | | | | | | | | | | | | | | | | | |

Burn-off of Free Rent and Signed Leases Not Commenced

| | | | | | | | | | | | | | | | | | | | |

| | | Incremental Annual | | | Base Cash Rent Contributing to Cash NOI in the Following Years | |

Total Portfolio | | Revenue | | | 2020 | | | 2021 | | | 2022 | | | 2023 | |

Commenced leases in free rent period | | $ | 27,570 | | | $ | 15,053 | | | $ | 27,508 | | | $ | 27,570 | | | $ | 27,570 | |

Signed leases not commenced | | | 22,190 | | | | 1,094 | | | | 11,028 | | | | 18,979 | | | | 19,705 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | $ | 49,760 | | | $ | 16,147 | | | $ | 38,536 | | | $ | 46,549 | | | $ | 47,275 | |

| | | | | | | | | | | | | | | | | | | | |

Commenced leases in free rent period

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Square | | | Cash | | | Incremental Annual | | | Base Cash Rent Contributing to Cash NOI in the Following Years | |

| | | Feet | | | Rent Date | | | Revenue | | | 2020 | | | 2021 | | | 2022 | | | 2023 | |

Second quarter 2020 - 27 leases | | | 408,164 | | | | Apr. 2020 - Jun. 2020 | | | $ | 18,898 | | | $ | 12,127 | (1) | | $ | 18,898 | | | $ | 18,898 | | | $ | 18,898 | |

Third quarter 2020 - 11 leases | | | 133,202 | | | | Jul. 2020 - Sept. 2020 | | | | 7,224 | | | | 2,791 | | | | 7,224 | | | | 7,224 | | | | 7,224 | |

Fourth quarter 2020 - 3 leases | | | 20,841 | | | | Oct. 2020 - Dec. 2020 | | | | 844 | | | | 135 | | | | 844 | | | | 844 | | | | 844 | |

First quarter 2021 - 1 lease | | | 2,652 | | | | Jan. 2021 - Mar. 2021 | | | | 604 | | | | — | | | | 542 | | | | 604 | | | | 604 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | $ | 27,570 | | | $ | 15,053 | | | $ | 27,508 | | | $ | 27,570 | | | $ | 27,570 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Signed leases not commenced (“SLNC”)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Square | | | Expected Base Rent

Commencement | | Incremental Annual | | | Base Cash Rent Contributing to Cash NOI in the Following Years | |

Tenant | | Feet | | | GAAP | | Cash | | Revenue(2) | | | 2020 | | | 2021 | | | 2022 | | | 2023 | |

Interpublic Group of Companies, Inc. | | | 15,086 | | | May. 2020 | | June 2020 | | $ | 1,060 | | | $ | 613 | | | $ | 1,060 | | | $ | 1,060 | | | $ | 1,060 | |

Uber Technologies, Inc. | | | 32,927 | | | Dec. 2020 | | Apr. 2021 | | | 2,300 | | | | — | | | | 1,722 | | | | 2,300 | | | | 2,300 | |

Concord Music Group, Inc. | | | 46,329 | | | Dec. 2020 | | Oct. 2021 | | | 2,870 | | | | — | | | | 635 | | | | 2,870 | | | | 2,870 | |

Kaplan Hecker & Fink LLP | | | 26,997 | | | Feb. 2021 | | Feb. 2021 | | | 2,000 | | | | — | | | | 1,743 | | | | 2,000 | | | | 2,000 | |

First Republic Bank | | | 14,430 | | | Jul. 2021 | | Jul. 2021 | | | 2,040 | | | | — | | | | 1,016 | | | | 2,040 | | | | 2,040 | |

LinkedIn Corporation: | | | | | | | | | | | | | | | | | | | | | | | | | |

LinkedIn Corporation | | | 52,939 | | | May 2021 | | Jan. 2022 | | | 1,000 | | | | — | | | | | | | | 994 | | | | 1,000 | |

LinkedIn Corporation | | | 52,666 | | | Nov. 2021 | | Nov. 2021 | | | 900 | | | | — | | | | 147 | | | | 900 | | | | 900 | |

LinkedIn Corporation | | | 52,574 | | | Jul. 2022 | | Jul. 2022 | | | 1,110 | | | | — | | | | — | | | | 555 | | | | 1,110 | |

LinkedIn Corporation | | | 30,283 | | | Dec. 2022 | | Oct. 2023 | | | 670 | | | | — | | | | — | | | | — | | | | 165 | |

Target | | | 32,579 | | | June 2024 | | Oct. 2024 | | | 1,980 | | | | — | | | | — | | | | — | | | | — | |

Other SLNC | | | 114,833 | | | Apr. 2020 - Dec. 2020 | | Jan. 2020 - Sept. 2021 | | | 6,260 | | | | 481 | | | | 4,705 | | | | 6,260 | | | | 6,260 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 471,643 | | | | | | | $ | 22,190 | | | $ | 1,094 | | | $ | 11,028 | | | $ | 18,979 | | | $ | 19,705 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Notes:

| (1) | As an example, the 2020 amount represents cash revenue contributing from the cash rent commencement date of April 2020 through December 2020. The full annual amount is realized in 2021. |

| (2) | Reflects new annual rent less annual rent from existing tenant in the space. |

| (3) | New York State mandate related to COVID-19 has stopped construction of tenant spaces. The above commencement dates assume that work will be allowed to resume by July 1, 2020. If the government moratorium on construction extends past July 1, 2020, the above commencement dates will change. |

Page 6

| | |

| | First Quarter 2020 Property Summary — Leasing Activity by Quarter (unaudited) |

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | March 31,

2020 | | | December 31,

2019 | | | September 30,

2019 | | | June 30,

2019 | | | March 31,

2019 | |

Total Portfolio | | | | | | | | | | | | | | | | | | | | |

Total leases executed | | | 35 | | | | 47 | | | | 25 | | | | 55 | | | | 34 | |

Weighted average lease term | | | 6.8 years | | | | 8.6 years | | | | 10.7 years | | | | 6.4 years | | | | 8.3 years | |

Average free rent period | | | 4.1 months | | | | 5.3 months | | | | 6.9 months | | | | 2.8 months | | | | 4.7 months | |

Office | | | | | | | | | | | | | | | | | | | | |

Total square footage executed | | | 117,481 | | | | 313,027 | | | | 374,256 | | | | 228,346 | | | | 300,408 | |

Average cash rent psf—leases executed | | $ | 57.29 | | | $ | 59.74 | | | $ | 62.83 | | | $ | 59.13 | | | $ | 61.79 | |

Previously escalated cash rents psf | | $ | 52.43 | | | $ | 54.02 | | | $ | 51.10 | | | $ | 51.72 | | | $ | 54.36 | |

Percentage of new cash rent over previously escalated rents | | | 9.3 | % | | | 10.6 | % | | | 23.0 | % | | | 14.3 | % | | | 13.7 | % |

Retail | | | | | | | | | | | | | | | | | | | | |

Total square footage executed | | | 31,662 | | | | 32,579 | | | | 14,430 | | | | 32,706 | | | | 7,643 | |

Average cash rent psf—leases executed | | $ | 101.03 | | | $ | 122.78 | | | $ | 141.68 | | | $ | 71.52 | | | $ | 109.54 | |

Previously escalated cash rents psf | | $ | 108.81 | | | $ | 60.79 | | | $ | 104.66 | | | $ | 72.08 | | | $ | 106.84 | |

Percentage of new cash rent over previously escalated rents | | | (7.1 | %) | | | 102.0 | % | | | 35.4 | % | | | (0.8 | %) | | | 2.5 | % |

Total Portfolio | | | | | | | | | | | | | | | | | | | | |

Total square footage executed | | | 149,143 | | | | 345,606 | | | | 388,686 | | | | 261,052 | | | | 308,051 | |

Average cash rent psf—leases executed | | $ | 66.58 | | | $ | 65.68 | | | $ | 65.76 | | | $ | 61.25 | | | $ | 63.90 | |

Previously escalated cash rents psf | | $ | 64.40 | | | $ | 54.66 | | | $ | 53.09 | | | $ | 54.58 | | | $ | 56.35 | |

Percentage of new cash rent over previously escalated rents | | | 3.4 | % | | | 20.2 | % | | | 23.9 | % | | | 12.2 | % | | | 13.4 | % |

Leasing commission costs per square foot | | $ | 20.19 | | | $ | 19.84 | | | $ | 23.75 | | | $ | 15.61 | | | $ | 15.00 | |

Tenant improvement costs per square foot | | | 100.79 | | | | 55.65 | | | | 65.59 | | | | 47.06 | | | | 55.09 | |

| | | | | | | | | | | | | | | | | | | | |

Total LC and TI per square foot(2) | | $ | 120.98 | | | $ | 75.49 | | | $ | 89.34 | | | $ | 62.67 | | | $ | 70.09 | |

| | | | | | | | | | | | | | | | | | | | |

Occupancy | | | 88.7 | % | | | 88.6 | % | | | 89.4 | % | | | 90.2 | % | | | 88.8 | % |

Manhattan Office Portfolio(1) | | | | | | | | | | | | | | | | | | | | |

Total leases executed | | | 26 | | | | 36 | | | | 18 | | | | 40 | | | | 30 | |

Office—New Leases | | | | | | | | | | | | | | | | | | | | |

Total square footage executed | | | 63,153 | | | | 170,247 | | | | 266,769 | | | | 119,235 | | | | 153,506 | |

Average cash rent psf—leases executed | | $ | 62.78 | | | $ | 64.82 | | | $ | 71.36 | | | $ | 65.08 | | | $ | 63.74 | |

Previously escalated cash rents psf | | $ | 52.56 | | | $ | 52.12 | | | $ | 53.83 | | | $ | 53.26 | | | $ | 52.65 | |

Percentage of new cash rent over previously escalated rents | | | 19.4 | % | | | 24.4 | % | | | 32.6 | % | | | 22.2 | % | | | 21.1 | % |

Office—Renewal Leases | | | | | | | | | | | | | | | | | | | | |

Total square footage executed | | | 30,712 | | | | 54,345 | | | | 18,826 | | | | 56,211 | | | | 131,304 | |

Average cash rent psf—leases executed | | $ | 60.20 | | | $ | 66.62 | | | $ | 53.83 | | | $ | 62.37 | | | $ | 62.51 | |

Previously escalated cash rents psf | | $ | 60.02 | | | $ | 66.27 | | | $ | 53.64 | | | $ | 55.88 | | | $ | 58.55 | |

Percentage of new cash rent over previously escalated rents | | | 0.3 | % | | | 0.5 | % | | | 0.4 | % | | | 11.6 | % | | | 6.8 | % |

Retail—New and Renewal Leases | | | | | | | | | | | | | | | | | | | | |

Total square footage executed | | | 26,432 | | | | — | | | | 14,430 | | | | 3,711 | | | | 1,998 | |

Average cash rent psf—leases executed | | $ | 76.73 | | | $ | — | | | $ | 141.68 | | | $ | 405.41 | | | $ | 80.00 | |

Previously escalated cash rents psf | | $ | 103.75 | | | $ | — | | | $ | 104.66 | | | $ | 317.25 | | | $ | 73.73 | |

Percentage of new cash rent over previously escalated rents | | | (26.0 | %) | | | — | | | | 35.4 | % | | | 27.8 | % | | | 8.5 | % |

Total Manhattan Office Portfolio | | | | | | | | | | | | | | | | | | | | |

Total square footage executed | | | 120,297 | | | | 224,592 | | | | 300,025 | | | | 179,157 | | | | 286,808 | |

Average cash rent psf—leases executed | | $ | 65.19 | | | $ | 65.26 | | | $ | 73.64 | | | $ | 71.28 | | | $ | 63.29 | |

Previously escalated cash rents psf | | $ | 65.71 | | | $ | 55.54 | | | $ | 56.26 | | | $ | 59.55 | | | $ | 55.50 | |

Percentage of new cash rent over previously escalated rents | | | (0.8 | %) | | | 17.5 | % | | | 30.9 | % | | | 19.7 | % | | | 14.0 | % |

Leasing commission costs per square foot | | $ | 20.57 | | | $ | 19.81 | | | $ | 28.93 | | | $ | 20.53 | | | $ | 14.50 | |

Tenant improvement costs per square foot | | | 107.77 | | | | 70.39 | | | | 78.31 | | | | 56.60 | | | | 54.18 | |

| | | | | | | | | | | | | | | | | | | | |

Total LC and TI per square foot(2) | | $ | 128.34 | | | $ | 90.20 | | | $ | 107.24 | | | $ | 77.13 | | | $ | 68.68 | |

| | | | | | | | | | | | | | | | | | | | |

Occupancy | | | 89.8 | % | | | 89.7 | % | | | 89.6 | % | | | 90.6 | % | | | 88.9 | % |

Page 7

| | |

| | First Quarter 2020 Property Summary—Leasing Activity by Quarter—(Continued) (unaudited) |

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | March 31,

2020 | | | December 31,

2019 | | | September 30,

2019 | | | June 30,

2019 | | | March 31,

2019 | |

Greater New York Metropolitan Area Office Portfolio | | | | | | | | | | | | | | | | | | | | |

Total leases executed | | | 7 | | | | 10 | | | | 7 | | | | 12 | | | | 3 | |

Total square footage executed | | | 23,616 | | | | 88,435 | | | | 88,661 | | | | 52,900 | | | | 15,598 | |

Average cash rent psf—leases executed | | $ | 38.85 | | | $ | 45.73 | | | $ | 39.08 | | | $ | 42.30 | | | $ | 36.60 | |

Previously escalated cash rents psf | | $ | 42.23 | | | $ | 50.15 | | | $ | 42.36 | | | $ | 43.82 | | | $ | 35.78 | |

Percentage of new cash rent over previously escalated rents | | | (8.0 | %) | | | (8.8 | %) | | | (7.7 | %) | | | (3.5 | %) | | | 2.3 | % |

Leasing commission costs per square foot | | $ | 7.34 | | | $ | 8.00 | | | $ | 6.22 | | | $ | 6.05 | | | $ | 15.32 | |

Tenant improvement costs per square foot | | | 51.56 | | | | 26.02 | | | | 22.53 | | | | 37.37 | | | | 77.21 | |

| | | | | | | | | | | | | | | | | | | | |

Total LC and TI per square foot(2) | | $ | 58.90 | | | $ | 34.02 | | | $ | 28.75 | | | $ | 43.42 | | | $ | 92.53 | |

| | | | | | | | | | | | | | | | | | | | |

Occupancy | | | 83.0 | % | | | 83.0 | % | | | 88.0 | % | | | 87.8 | % | | | 87.8 | % |

Standalone Retail Portfolio | | | | | | | | | | | | | | | | | | | | |

Total leases executed | | | 2 | | | | 1 | | | | — | | | | 3 | | | | 1 | |

Total square footage executed | | | 5,230 | | | | 32,579 | | | | — | | | | 28,995 | | | | 5,645 | |

Average cash rent psf—leases executed | | $ | 223.86 | | | $ | 122.78 | | | $ | — | | | $ | 28.78 | | | $ | 120.00 | |

Previously escalated cash rents psf | | $ | 134.41 | | | $ | 60.79 | | | $ | — | | | $ | 40.70 | | | $ | 118.56 | |

Percentage of new cash rent over previously escalated rents | | | 66.5 | % | | | 102.0 | % | | | — | | | | (29.3 | %)(3) | | | 1.2 | % |

Leasing commission costs per square foot | | $ | 69.53 | | | $ | 52.21 | | | $ | — | | | $ | 2.68 | | | $ | 39.08 | |

Tenant improvement costs per square foot | | | 162.60 | | | | 34.47 | | | | — | | | | 5.79 | | | | 40.00 | |

| | | | | | | | | | | | | | | | | | | | |

Total LC and TI per square foot(2) | | $ | 232.13 | | | $ | 86.68 | | | $ | — | | | $ | 8.47 | | | $ | 79.08 | |

| | | | | | | | | | | | | | | | | | | | |

Occupancy | | | 95.2 | % | | | 93.7 | % | | | 93.7 | % | | | 93.7 | % | | | 94.4 | % |

Notes:

| (1) | Includes 509,244 rentable square feet of retail space in the Company’s nine Manhattan office properties. |

| (2) | Presents all tenant improvement and leasing commission costs as if they were incurred in the period in which the lease was signed, which may be different than the period in which they were actually paid. |

| (3) | Includes the renewal of two parking garages comprising 27,143 of rentable square feet. These below grade spaces have market rents considerably lower than the Company’s typical street grade retail and drove the negative spread for the quarter. |

Page 8

| | |

| | First Quarter 2020 Total Portfolio Expirations and Vacates Summary (unaudited and in square feet) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | | | | | |

| | | Actual | | | Forecast (1) | | | Forecast (1) | | | Forecast (1) | | | Forecast(1) | | | Full Year | |

| | | March 31,

2020 | | | June 30,

2020 | | | September 30,

2020 | | | December 31,

2020 | | | Apr. to Dec.

2020 | | | 2021 | |

Total Portfolio(2) | | | | | | | | | | | | | | | | | | | | | | | | |

Total expirations | | | 92,373 | | | | 382,479 | | | | 137,859 | | | | 154,982 | | | | 675,320 | | | | 669,641 | |

Less: broadcasting | | | (906 | ) | | | (906 | ) | | | — | | | | (753 | ) | | | (1,659 | ) | | | (1,049 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Office and retail expirations | | | 91,467 | | | | 381,573 | | | | 137,859 | | | | 154,229 | | | | 673,661 | | | | 668,592 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Renewal & relocations (3) | | | 35,005 | | | | 68,471 | | | | 58,727 | | | | 48,726 | | | | 175,924 | | | | 161,865 | |

Short-term renewals (4) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

New leases (5) | | | 2,286 | | | | 171,863 | | | | 9,367 | | | | 10,562 | | | | 191,792 | | | | 44,755 | |

Tenant vacates (6) | | | 30,445 | | | | 98,112 | | | | 57,937 | | | | 35,256 | | | | 191,305 | | | | 252,657 | |

Intentional vacates (7) | | | 23,731 | | | | 36,255 | | | | 4,078 | | | | — | | | | 40,333 | | | | 42,348 | |

Holdover (8) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Unknown (9) | | | — | | | | 6,872 | | | | 7,750 | | | | 59,685 | | | | 74,307 | | | | 166,967 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Portfolio expirations and vacates | | | 91,467 | | | | 381,573 | | | | 137,859 | | | | 154,229 | | | | 673,661 | | | | 668,592 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Manhattan Office Portfolio | | | | | | | | | | | | | | | | | | | | | |

Total expirations | | | 53,312 | | | | 247,446 | | | | 125,968 | | | | 113,180 | | | | 486,594 | | | | 428,098 | |

Less: broadcasting | | | (906 | ) | | | (906 | ) | | | — | | | | (753 | ) | | | (1,659 | ) | | | (1,049 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Office expirations | | | 52,406 | | | | 246,540 | | | | 125,968 | | | | 112,427 | | | | 484,935 | | | | 427,049 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Renewal & relocations (3) | | | 16,958 | | | | 22,355 | | | | 51,978 | | | | 31,201 | | | | 105,534 | | | | 63,806 | |

Short-term renewals (4) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

New leases (5) | | | 2,286 | | | | 164,549 | | | | 9,367 | | | | 10,562 | | | | 184,478 | | | | 21,870 | |

Tenant vacates (6) | | | 27,106 | | | | 24,075 | | | | 52,795 | | | | 27,362 | | | | 104,232 | | | | 187,803 | |

Intentional vacates (7) | | | 6,056 | | | | 28,818 | | | | 4,078 | | | | — | | | | 32,896 | | | | 42,348 | |

Holdover (8) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Unknown (9) | | | — | | | | 6,743 | | | | 7,750 | | | | 43,302 | | | | 57,795 | | | | 111,222 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total expirations and vacates | | | 52,406 | | | | 246,540 | | | | 125,968 | | | | 112,427 | | | | 484,935 | | | | 427,049 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Greater New York Metropolitan Area Office Portfolio | | | | | | | | | | | | | | | | |

Office expirations | | | 17,148 | | | | 124,162 | | | | 8,391 | | | | 32,237 | | | | 164,790 | | | | 211,165 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Renewal & relocations (3) | | | 13,809 | | | | 42,811 | | | | 3,249 | | | | 17,525 | | | | 63,585 | | | | 79,727 | |

Short-term renewals (4) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

New leases (5) | | | — | | | | 7,314 | | | | — | | | | — | | | | 7,314 | | | | 22,885 | |

Tenant vacates (6) | | | 3,339 | | | | 74,037 | | | | 5,142 | | | | — | | | | 79,179 | | | | 56,455 | |

Intentional vacates (7) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Holdover (8) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Unknown (9) | | | — | | | | — | | | | — | | | | 14,712 | | | | 14,712 | | | | 52,098 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total expirations and vacates | | | 17,148 | | | | 124,162 | | | | 8,391 | | | | 32,237 | | | | 164,790 | | | | 211,165 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Retail Portfolio | | | | | | | | | | | | | | | | | | | | | |

Retail expirations | | | 21,913 | | | | 10,871 | | | | 3,500 | | | | 9,565 | | | | 23,936 | | | | 30,378 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Renewal & relocations (3) | | | 4,238 | | | | 3,305 | | | | 3,500 | | | | — | | | | 6,805 | | | | 18,332 | |

Short-term renewals (4) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

New leases (5) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Tenant vacates (6) | | | — | | | | — | | | | — | | | | 7,894 | | | | 7,894 | | | | 8,399 | |

Intentional vacates (7) | | | 17,675 | | | | 7,437 | | | | — | | | | — | | | | 7,437 | | | | — | |

Holdover (8) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Unknown (9) | | | — | | | | 129 | | | | — | | | | 1,671 | | | | 1,800 | | | | 3,647 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total expirations and vacates | | | 21,913 | | | | 10,871 | | | | 3,500 | | | | 9,565 | | | | 23,936 | | | | 30,378 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Notes:

| (1) | These forecasts, which are subject to change, are based on management’s expectations, including, among other things, discussions with and other information provided by tenants as well as management’s analyses of past historical trends. |

| (2) | Any lease on month to month or short-term will re-appear in “Actual” in each period until tenant has vacated or renewed, and thus it would be double counted if periods were cumulated. “Forecast” avoids double counting. |

| (3) | For forecasted periods, “Renewals” assume tenants renew their existing leases in all or a portion of their current spaces, and “Relocations” assume tenants move within a building or within the Company’s portfolio. |

| (4) | Represents tenants which signed renewal leases for a term of less than six months and reappear in forecast periods in 2020. |

| (5) | For forecasted periods, “New Leases” represents leases that have been signed with a new tenant, a subtenant who signed a direct lease or a tenant who expanded. The lease commencement dates are provided on page 6. There may be downtime between the lease expiration and the new lease commencement. |

| (6) | For forecasted periods, “Tenant Vacates” assumes a tenant elects not to renew at the end of their existing lease or exercises an early termination option. |

| (7) | For forecasted periods, “Intentional Vacates” assumes the Company decides not to renew tenant at the end of their existing lease due to anticipated future redevelopment or for other reasons. This also may include early lease terminations. |

| (8) | Holdover represents a tenant that remains in its space, paying rent after the expiration of its lease, but is not anticipated to continue doing so on a monthly basis. These tenants may reappear in forecast periods in 2020. |

| (9) | For forecasted periods, “Unknown” represents tenants’ existing leases which do not fall into any of the above categories: Renewals & Relocations, |

New Leases, Tenant Vacates or Intentional Vacates and tenants’ whose intention is unknown.

Page 9

| | |

| | First Quarter 2020 Property Detail (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | Annualized

Rent | | | | |

Property Name | | Location or Sub-Market | | Rentable

Square Feet (1) | | | Percent

Occupied (2) | | | Annualized

Rent (3) | | | per Occupied

Square Foot (4) | | | Number of

Leases(5) | |

Manhattan Office Properties—Office | | | | | | | | | | | | | | | | | | | | |

The Empire State Building(6) | | Penn Station —Times Sq. South | | | 2,710,823 | | | | 95.2 | % | | $ | 156,739,511 | | | $ | 60.75 | | | | 169 | |

One Grand Central Place | | Grand Central | | | 1,247,411 | | | | 88.1 | % | | | 65,065,885 | | | | 59.21 | | | | 186 | |

1400 Broadway(8) | | Penn Station —Times Sq. South | | | 916,834 | | | | 88.5 | % | | | 43,626,634 | | | | 53.80 | | | | 25 | |

111 West 33rd Street(9) | | Penn Station —Times Sq. South | | | 641,135 | | | | 97.6 | % | | | 38,289,310 | | | | 61.17 | | | | 24 | |

250 West 57th Street | | Columbus Circle—West Side | | | 474,047 | | | | 71.3 | % | | | 21,049,359 | | | | 62.30 | | | | 36 | |

501 Seventh Avenue | | Penn Station —Times Sq. South | | | 461,652 | | | | 82.8 | % | | | 18,890,710 | | | | 49.44 | | | | 30 | |

1359 Broadway | | Penn Station —Times Sq. South | | | 455,873 | | | | 96.4 | % | | | 24,245,005 | | | | 55.18 | | | | 31 | |

1350 Broadway(10) | | Penn Station —Times Sq. South | | | 372,778 | | | | 85.5 | % | | | 19,119,454 | | | | 60.01 | | | | 55 | |

1333 Broadway | | Penn Station —Times Sq. South | | | 292,835 | | | | 77.1 | % | | | 12,173,226 | | | | 53.89 | | | | 8 | |

| | | | | | | | | | | | | | | | | | | | | | |

Manhattan Office Properties—Office | | | 7,573,388 | | | | 90.0 | % | | | 399,199,093 | | | | 58.54 | | | | 564 | |

Manhattan Office Properties—Retail | | | | | | | | | | | | | | | | | | | | |

The Empire State Building(7) | | Penn Station -Times Sq. South | | | 102,364 | | | | 53.7 | % | | | 12,111,789 | | | | 220.44 | | | | 12 | |

One Grand Central Place | | Grand Central | | | 68,732 | | | | 79.0 | % | | | 6,439,115 | | | | 118.58 | | | | 13 | |

1400 Broadway(8) | | Penn Station —Times Sq. South | | | 20,176 | | | | 77.2 | % | | | 2,048,770 | | | | 131.58 | | | | 7 | |

112 West 34th Street(9) | | Penn Station —Times Sq. South | | | 90,132 | | | | 100.0 | % | | | 23,273,069 | | | | 258.21 | | | | 4 | |

250 West 57th Street | | Columbus Circle—West Side | | | 67,927 | | | | 100.0 | % | | | 10,316,195 | | | | 151.87 | | | | 8 | |

501 Seventh Avenue | | Penn Station —Times Sq. South | | | 33,632 | | | | 87.3 | % | | | 2,028,797 | | | | 69.11 | | | | 8 | |

1359 Broadway | | Penn Station —Times Sq. South | | | 27,506 | | | | 100.0 | % | | | 2,355,336 | | | | 85.63 | | | | 6 | |

1350 Broadway(10) | | Penn Station —Times Sq. South | | | 31,774 | | | | 95.6 | % | | | 7,238,797 | | | | 238.20 | | | | 5 | |

1333 Broadway | | Penn Station —Times Sq. South | | | 67,001 | | | | 100.0 | % | | | 9,330,744 | | | | 139.26 | | | | 4 | |

| | | | | | | | | | | | | | | | | | | | | | |

Manhattan Office Properties—Retail | | | 509,244 | | | | 85.8 | % | | | 75,142,611 | | | | 171.90 | | | | 67 | |

| | | | | | | | | | | | | | | | | | | | | | |

Sub-Total/Weighted AverageManhattan Office Properties—Office and Retail | | | 8,082,632 | | | | 89.8 | % | | | 474,341,705 | | | | 65.36 | | | | 631 | |

| | | | | | | | | | | | | | | | | | | | | | |

Greater New York Metropolitan Area Office Properties | | | | | | | | | | | | | | | | | | | | |

First Stamford Place(11) | | Stamford, CT | | | 779,098 | | | | 85.4 | % | | | 29,274,677 | | | | 44.00 | | | | 46 | |

Metro Center | | Stamford, CT | | | 287,975 | | | | 89.0 | % | | | 15,786,219 | | | | 61.58 | | | | 24 | |

383 Main Avenue | | Norwalk, CT | | | 260,546 | | | | 54.1 | % | | | 4,164,606 | | | | 29.53 | | | | 21 | |

500 Mamaroneck Avenue | | Harrison, NY | | | 287,157 | | | | 82.8 | % | | | 7,160,462 | | | | 30.13 | | | | 30 | |

10 Bank Street | | White Plains, NY | | | 232,517 | | | | 100.0 | % | | | 8,381,397 | | | | 36.05 | | | | 36 | |

| | | | | | | | | | | | | | | | | | | | | | |

Sub-Total/Weighted Average Greater New YorkMetropolitan Area Office Properties | | | 1,847,293 | | | | 83.0 | % | | | 64,767,361 | | | | 42.25 | | | | 157 | |

| | | | | | | | | | | | | | | | | | | | | | |

Standalone Retail Properties | | | | | | | | | | | | | | | | | | | | | | |

10 Union Square | | Union Square | | | 57,984 | | | | 94.7 | % | | | 6,652,084 | | | | 121.17 | | | | 11 | |

1542 Third Avenue | | Upper East Side | | | 56,250 | | | | 100.0 | % | | | 4,160,189 | | | | 73.96 | | | | 4 | |

1010 Third Avenue | | Upper East Side | | | 44,662 | | | | 100.0 | % | | | 3,612,691 | | | | 80.89 | | | | 2 | |

77 West 55th Street | | Midtown | | | 25,388 | | | | 100.0 | % | | | 2,824,593 | | | | 111.26 | | | | 3 | |

69-97 Main Street | | Westport, CT | | | 16,874 | | | | 59.7 | % | | | 1,143,384 | | | | 113.49 | | | | 3 | |

103-107 Main Street | | Westport, CT | | | 4,330 | | | | 100.0 | % | | | 776,442 | | | | 179.32 | | | | 1 | |

| | | | | | | | | | | | | | | | | | | | | | |

Sub-Total/Weighted Average StandaloneRetail Properties | | | 205,488 | | | | 95.2 | % | | | 19,169,382 | | | | 98.00 | | | | 24 | |

| | | | | | | | | | | | | | | | | | | | | | |

Portfolio Total | | | | | 10,135,413 | | | | 88.7 | % | | $ | 558,278,448 | | | $ | 62.13 | | | | 812 | |

| | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Average Office Properties | | | 9,420,681 | | | | 88.7 | % | | $ | 463,966,454 | | | $ | 55.55 | | | | 721 | |

Total/Weighted Average Retail Properties | | | 714,732 | | | | 88.5 | % | | | 94,311,993 | | | | 149.05 | | | | 91 | |

| | | | | | | | | | | | | | | | | | | | | | |

Portfolio Total | | | | | 10,135,413 | | | | 88.7 | % | | $ | 558,278,448 | | | $ | 62.13 | | | | 812 | |

| | | | | | | | | | | | | | | | | | | | | | |

Notes:

| (1) | Excludes (i) 193,510 square feet of space across the Company’s portfolio attributable to building management use and tenant amenities and (ii) 79,613 square feet of space attributable to the Company’s observatory. |

| (2) | Based on leases signed and commenced as of March 31, 2020. |

| (3) | Represents annualized base rent and current reimbursement for operating expenses and real estate taxes. |

| (4) | Represents annualized rent under leases commenced as of March 31, 2020 divided by occupied square feet. |

| (5) | Represents the number of leases at each property or on a portfolio basis. If a tenant has more than one lease, whether or not at the same property, but with different expirations, the number of leases is calculated equal to the number of leases with different expirations. |

| (6) | Includes 37,004 rentable square feet of space leased by the Company’s broadcasting tenants. |

| (7) | Includes 5,300 rentable square feet of space leased by WDFG North America, a licensee of the Company’s observatory. |

| (8) | Denotes a ground leasehold interest in the property with a remaining term, including unilateral extension rights available to the Company, of approximately 43 years (expiring December 31, 2063). |

| (9) | Denotes a ground leasehold interest in the property with a remaining term, including unilateral extension rights available to the Company, of approximately 57 years (expiring May 31, 2077). |

| (10) | Denotes a ground leasehold interest in the property with a remaining term, including unilateral extension rights available to the Company, of approximately 30 years (expiring July 31, 2050). |

| (11) | First Stamford Place consists of three buildings. |

Page 10

| | |

| | First Quarter 2020 Tenant Lease Expirations (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Lease Expirations | | Number

of Leases

Expiring (1) | | | Rentable

Square

Feet

Expiring(2) | | | Percent of

Portfolio

Rentable

Square Feet

Expiring | | | Annualized

Rent(3) | | | Percent of

Annualized

Rent | | | Annualized

Rent Per

Rentable

Square Foot | |

Available | | | — | | | | 901,697 | | | | 8.9 | % | | $ | — | | | | 0.0 | % | | $ | — | |

Signed leases not commenced | | | 21 | | | | 248,351 | | | | 2.5 | % | | | — | | | | 0.0 | % | | | — | |

1Q 2020(4) | | | 8 | | | | 20,108 | | | | 0.2 | % | | | 989,845 | | | | 0.2 | % | | | 49.23 | |

2Q 2020 | | | 37 | | | | 373,476 | | | | 3.7 | % | | | 20,233,336 | | | | 3.6 | % | | | 54.19 | |

3Q 2020 | | | 28 | | | | 137,859 | | | | 1.4 | % | | | 8,140,537 | | | | 1.5 | % | | | 59.05 | |

4Q 2020 | | | 25 | | | | 154,982 | | | | 1.5 | % | | | 8,778,265 | | | | 1.6 | % | | | 56.64 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total 2020 | | | 98 | | | | 686,425 | | | | 6.8 | % | | | 38,141,983 | | | | 6.8 | % | | | 55.57 | |

1Q 2021 | | | 29 | | | | 104,916 | | | | 1.0 | % | | | 7,227,565 | | | | 1.3 | % | | | 68.89 | |

2Q 2021 | | | 27 | | | | 192,371 | | | | 1.9 | % | | | 11,556,452 | | | | 2.1 | % | | | 60.07 | |

3Q 2021 | | | 26 | | | | 175,142 | | | | 1.7 | % | | | 10,193,906 | | | | 1.8 | % | | | 58.20 | |

4Q 2021 | | | 23 | | | | 197,212 | | | | 1.9 | % | | | 9,754,528 | | | | 1.7 | % | | | 49.46 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total 2021 | | | 105 | | | | 669,641 | | | | 6.6 | % | | | 38,732,451 | | | | 6.9 | % | | | 57.84 | |

2022 | | | 114 | | | | 576,655 | | | | 5.7 | % | | | 37,174,196 | | | | 6.7 | % | | | 64.47 | |

2023 | | | 94 | | | | 705,714 | | | | 7.0 | % | | | 44,229,743 | | | | 7.9 | % | | | 62.67 | |

2024 | | | 82 | | | | 791,680 | | | | 7.8 | % | | | 48,339,903 | | | | 8.7 | % | | | 61.06 | |

2025 | | | 78 | | | | 491,437 | | | | 4.8 | % | | | 36,536,513 | | | | 6.5 | % | | | 74.35 | |

2026 | | | 57 | | | | 734,737 | | | | 7.2 | % | | | 40,377,933 | | | | 7.2 | % | | | 54.96 | |

2027 | | | 51 | | | | 562,737 | | | | 5.6 | % | | | 33,596,727 | | | | 6.0 | % | | | 59.70 | |

2028 | | | 29 | | | | 1,031,308 | | | | 10.2 | % | | | 56,660,703 | | | | 10.1 | % | | | 54.94 | |

2029 | | | 35 | | | | 872,679 | | | | 8.6 | % | | | 61,690,892 | | | | 11.1 | % | | | 70.69 | |

2030 | | | 29 | | | | 677,029 | | | | 6.7 | % | | | 43,513,796 | | | | 7.8 | % | | | 64.27 | |

Thereafter | | | 40 | | | | 1,185,323 | | | | 11.6 | % | | | 79,283,607 | | | | 14.2 | % | | | 66.89 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 833 | | | | 10,135,413 | | | | 100.0 | % | | $ | 558,278,448 | | | | 100.0 | % | | $ | 62.13 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Manhattan Office Properties(5) | | | | | | | | | | | | | | | | | | |

Available | | | — | | | | 562,944 | | | | 7.4 | % | | $ | — | | | | 0.0 | % | | $ | — | |

Signed leases not commenced | | | 13 | | | | 190,724 | | | | 2.5 | % | | | — | | | | 0.0 | % | | | — | |

1Q 2020(4) | | | 5 | | | | 10,958 | | | | 0.1 | % | | | 626,486 | | | | 0.2 | % | | | 57.17 | |

2Q 2020 | | | 26 | | | | 245,593 | | | | 3.2 | % | | | 13,337,868 | | | | 3.3 | % | | | 54.31 | |

3Q 2020 | | | 22 | | | | 125,968 | | | | 1.7 | % | | | 7,095,202 | | | | 1.8 | % | | | 56.33 | |

4Q 2020 | | | 18 | | | | 113,180 | | | | 1.5 | % | | | 5,595,068 | | | | 1.4 | % | | | 49.44 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total 2020 | | | 71 | | | | 495,699 | | | | 6.5 | % | | | 26,654,624 | | | | 6.7 | % | | | 53.77 | |

1Q 2021 | | | 14 | | | | 41,948 | | | | 0.6 | % | | | 2,180,175 | | | | 0.5 | % | | | 51.97 | |

2Q 2021 | | | 21 | | | | 146,911 | | | | 1.9 | % | | | 8,086,408 | | | | 2.0 | % | | | 55.04 | |

3Q 2021 | | | 15 | | | | 115,569 | | | | 1.5 | % | | | 7,230,229 | | | | 1.8 | % | | | 62.56 | |

4Q 2021 | | | 16 | | | | 123,670 | | | | 1.6 | % | | | 6,823,145 | | | | 1.7 | % | | | 55.17 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total 2021 | | | 66 | | | | 428,098 | | | | 5.7 | % | | | 24,319,957 | | | | 6.1 | % | | | 56.81 | |

2022 | | | 83 | | | | 384,272 | | | | 5.1 | % | | | 22,896,842 | | | | 5.7 | % | | | 59.58 | |

2023 | | | 71 | | | | 531,176 | | | | 7.0 | % | | | 31,588,679 | | | | 7.9 | % | | | 59.47 | |

2024 | | | 60 | | | | 561,175 | | | | 7.4 | % | | | 33,299,153 | | | | 8.3 | % | | | 59.34 | |

2025 | | | 49 | | | | 320,138 | | | | 4.2 | % | | | 20,371,468 | | | | 5.1 | % | | | 63.63 | |

2026 | | | 36 | | | | 520,366 | | | | 6.9 | % | | | 29,930,349 | | | | 7.5 | % | | | 57.52 | |

2027 | | | 38 | | | | 433,014 | | | | 5.7 | % | | | 24,684,278 | | | | 6.2 | % | | | 57.01 | |

2028 | | | 19 | | | | 948,934 | | | | 12.5 | % | | | 52,754,296 | | | | 13.2 | % | | | 55.59 | |

2029 | | | 23 | | | | 629,599 | | | | 8.3 | % | | | 36,879,869 | | | | 9.2 | % | | | 58.58 | |

2030 | | | 18 | | | | 576,700 | | | | 7.6 | % | | | 34,542,113 | | | | 8.7 | % | | | 59.90 | |

Thereafter | | | 30 | | | | 990,549 | | | | 13.2 | % | | | 61,277,465 | | | | 15.4 | % | | | 61.86 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Manhattan office properties | | | 577 | | | | 7,573,388 | | | | 100.0 | % | | $ | 399,199,093 | | | | 100.0 | % | | $ | 58.54 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Notes:

| (1) | If a lease has two different expiration dates, it is considered to be two leases (for the purpose of lease count and square footage). |

| (2) | Excludes (i) 193,510 rentable square feet of space across the Company portfolio attributable to building management use and tenant amenities and (ii) 79,613 square feet of space attributable to the Company’s observatory. |

| (3) | Represents annualized base rent and current reimbursement for operating expenses and real estate taxes. |

| (4) | Represents leases that are included in occupancy as of March 31, 2020 and expire on March 31, 2020. |

| (5) | Excludes (i) retail space in the Company’s Manhattan office properties and (ii) the Empire State Building broadcasting licenses and observatory operations. |

Page 11

| | |

| | First Quarter 2020 Tenant Lease Expirations (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Greater New York Metropolitan Area Office Properties | | Number

of Leases

Expiring (1) | | | Rentable

Square

Feet

Expiring (2) | | | Percent of

Portfolio

Rentable

Square Feet

Expiring | | | Annualized

Rent(3) | | | Percent of

Annualized

Rent | | | Annualized

Rent Per

Rentable

Square Foot | |

Available | | | — | | | | 295,770 | | | | 16.0 | % | | $ | — | | | | 0.0 | % | | $ | — | |

Signed leases not commenced | | | 4 | | | | 18,612 | | | | 1.0 | % | | | — | | | | 0.0 | % | | | — | |

1Q 2020(4) | | | 3 | | | | 9,150 | | | | 0.5 | % | | | 363,359 | | | | 0.6 | % | | | 39.71 | |

2Q 2020 | | | 8 | | | | 117,012 | | | | 6.3 | % | | | 6,307,513 | | | | 9.7 | % | | | 53.90 | |

3Q 2020 | | | 4 | | | | 8,391 | | | | 0.5 | % | | | 399,028 | | | | 0.6 | % | | | 47.55 | |

4Q 2020 | | | 5 | | | | 32,237 | | | | 1.7 | % | | | 1,343,111 | | | | 2.1 | % | | | 41.66 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total 2020 | | | 20 | | | | 166,790 | | | | 9.0 | % | | | 8,413,011 | | | | 13.0 | % | | | 50.44 | |

1Q 2021 | | | 11 | | | | 49,650 | | | | 2.7 | % | | | 2,448,045 | | | | 3.8 | % | | | 49.31 | |

2Q 2021 | | | 3 | | | | 31,767 | | | | 1.7 | % | | | 1,526,572 | | | | 2.4 | % | | | 48.06 | |

3Q 2021 | | | 10 | | | | 56,504 | | | | 3.1 | % | | | 2,427,390 | | | | 3.7 | % | | | 42.96 | |

4Q 2021 | | | 7 | | | | 73,542 | | | | 4.0 | % | | | 2,931,383 | | | | 4.5 | % | | | 39.86 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total 2021 | | | 31 | | | | 211,463 | | | | 11.4 | % | | | 9,333,390 | | | | 14.4 | % | | | 44.14 | |

2022 | | | 22 | | | | 133,636 | | | | 7.2 | % | | | 5,130,047 | | | | 7.9 | % | | | 38.39 | |

2023 | | | 13 | | | | 119,834 | | | | 6.5 | % | | | 5,656,575 | | | | 8.7 | % | | | 47.20 | |

2024 | | | 12 | | | | 205,193 | | | | 11.1 | % | | | 9,248,851 | | | | 14.3 | % | | | 45.07 | |

2025 | | | 21 | | | | 133,974 | | | | 7.3 | % | | | 4,490,391 | | | | 6.9 | % | | | 33.52 | |

2026 | | | 13 | | | | 144,020 | | | | 7.8 | % | | | 5,831,011 | | | | 9.0 | % | | | 40.49 | |

2027 | | | 8 | | | | 73,457 | | | | 4.0 | % | | | 2,486,741 | | | | 3.8 | % | | | 33.85 | |

2028 | | | 6 | | | | 74,387 | | | | 4.0 | % | | | 2,676,163 | | | | 4.1 | % | | | 35.98 | |

2029 | | | 6 | | | | 144,998 | | | | 7.8 | % | | | 5,924,740 | | | | 9.1 | % | | | 40.86 | |

2030 | | | 4 | | | | 36,578 | | | | 2.0 | % | | | 1,794,318 | | | | 2.8 | % | | | 49.05 | |

Thereafter | | | 1 | | | | 88,581 | | | | 4.9 | % | | | 3,782,123 | | | | 6.0 | % | | | 42.70 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total greater New York metropolitan area office properties | | | 161 | | | | 1,847,293 | | | | 100.0 | % | | $ | 64,767,361 | | | | 100.0 | % | | $ | 42.25 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Retail Properties | | | | | | | | | | | | | | | | | | | | | | | | |

Available | | | — | | | | 42,983 | | | | 6.0 | % | | $ | — | | | | 0.0 | % | | $ | — | |

Signed leases not commenced | | | 4 | | | | 39,015 | | | | 5.5 | % | | | — | | | | 0.0 | % | | | — | |

1Q 2020(4) | | | — | | | | — | | | | 0.0 | % | | | — | | | | 0.0 | % | | | — | |

2Q 2020 | | | 3 | | | | 10,871 | | | | 1.5 | % | | | 587,955 | | | | 0.6 | % | | | 54.08 | |

3Q 2020 | | | 2 | | | | 3,500 | | | | 0.5 | % | | | 646,307 | | | | 0.7 | % | | | 184.66 | |

4Q 2020 | | | 2 | | | | 9,565 | | | | 1.3 | % | | | 1,840,086 | | | | 2.0 | % | | | 192.38 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total 2020 | | | 7 | | | | 23,936 | | | | 3.3 | % | | | 3,074,348 | | | | 3.3 | % | | | 128.44 | |

1Q 2021 | | | 4 | | | | 13,318 | | | | 1.9 | % | | | 2,599,345 | | | | 2.8 | % | | | 195.18 | |

2Q 2021 | | | 3 | | | | 13,693 | | | | 1.9 | % | | | 1,943,472 | | | | 2.1 | % | | | 141.93 | |

3Q 2021 | | | 1 | | | | 3,069 | | | | 0.4 | % | | | 536,287 | | | | 0.6 | % | | | 174.74 | |

4Q 2021 | | | — | | | | — | | | | 0.0 | % | | | — | | | | 0.0 | % | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total 2021 | | | 8 | | | | 30,080 | | | | 4.2 | % | | | 5,079,104 | | | | 5.4 | % | | | 168.85 | |

2022 | | | 9 | | | | 58,747 | | | | 8.2 | % | | | 9,147,307 | | | | 9.7 | % | | | 155.71 | |

2023 | | | 10 | | | | 54,704 | | | | 7.7 | % | | | 6,984,489 | | | | 7.4 | % | | | 127.68 | |

2024 | | | 10 | | | | 25,312 | | | | 3.5 | % | | | 5,791,899 | | | | 6.1 | % | | | 228.82 | |

2025 | | | 8 | | | | 37,325 | | | | 5.2 | % | | | 11,674,654 | | | | 12.4 | % | | | 312.78 | |

2026 | | | 8 | | | | 70,351 | | | | 9.8 | % | | | 4,616,573 | | | | 4.9 | % | | | 65.62 | |

2027 | | | 5 | | | | 56,266 | | | | 7.9 | % | | | 6,425,708 | | | | 6.8 | % | | | 114.20 | |

2028 | | | 4 | | | | 7,987 | | | | 1.1 | % | | | 1,230,244 | | | | 1.3 | % | | | 154.03 | |

2029 | | | 6 | | | | 98,082 | | | | 13.7 | % | | | 18,886,283 | | | | 20.0 | % | | | 192.56 | |

2030 | | | 7 | | | | 63,751 | | | | 8.9 | % | | | 7,177,365 | | | | 7.6 | % | | | 112.58 | |

Thereafter | | | 9 | | | | 106,193 | | | | 15.0 | % | | | 14,224,019 | | | | 15.1 | % | | | 133.94 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total retail properties | | | 95 | | | | 714,732 | | | | 100.0 | % | | $ | 94,311,993 | | | | 100.0 | % | | $ | 149.05 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Notes:

| (1) | If a lease has two different expiration dates, it is considered to be two leases (for the purpose of lease count and square footage). |

| (2) | Excludes (i) 193,510 rentable square feet of space across the Company portfolio attributable to building management use and tenant amenities and (ii) 79,613 square feet of space attributable to the Company’s observatory. |

| (3) | Represents annualized base rent and current reimbursement for operating expenses and real estate taxes. |

| (4) | Represents leases that are included in occupancy as of March 31, 2020 and expire on March 31, 2020. |

| (5) | Represents two license agreements. |

Page 12

| | |

| | First Quarter 2020 Tenant Lease Expirations (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Empire State Building Office(1) | | Number

of Leases

Expiring (2) | | | Rentable

Square

Feet

Expiring (3) | | | Percent of

Portfolio

Rentable

Square

Feet

Expiring | | | Annualized

Rent (4) (5) | | | Percent of

Annualized

Rent | | | Annualized

Rent Per

Rentable

Square

Foot | |

Available | | | — | | | | 103,689 | | | | 3.8 | % | | $ | — | | | | 0.0 | % | | $ | — | |

Signed leases not commenced | | | 1 | | | | 26,997 | | | | 1.0 | % | | | — | | | | 0.0 | % | | | — | |

1Q 2020(6) | | | 2 | | | | 1,853 | | | | 0.1 | % | | | 41,203 | | | | 0.0 | % | | | 22.24 | |

2Q 2020 | | | 6 | | | | 192,735 | | | | 7.1 | % | | | 10,276,235 | | | | 6.6 | % | | | 53.32 | |

3Q 2020 | | | 5 | | | | 24,519 | | | | 0.9 | % | | | 1,560,771 | | | | 1.0 | % | | | 63.66 | |

4Q 2020 | | | 6 | | | | 37,592 | | | | 1.4 | % | | | 1,997,379 | | | | 1.3 | % | | | 53.13 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total 2020 | | | 19 | | | | 256,699 | | | | 9.5 | % | | | 13,875,588 | | | | 8.9 | % | | | 54.05 | |

1Q 2021 | | | 1 | | | | 2,488 | | | | 0.1 | % | | | 210,663 | | | | 0.1 | % | | | 84.67 | |

2Q 2021 | | | 13 | | | | 81,328 | | | | 3.0 | % | | | 4,362,809 | | | | 2.8 | % | | | 53.64 | |

3Q 2021 | | | 3 | | | | 16,066 | | | | 0.6 | % | | | 1,158,610 | | | | 0.7 | % | | | 72.12 | |

4Q 2021 | | | 2 | | | | 7,903 | | | | 0.3 | % | | | 505,720 | | | | 0.3 | % | | | 63.99 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total 2021 | | | 19 | | | | 107,785 | | | | 4.0 | % | | | 6,237,802 | | | | 4.0 | % | | | 57.87 | |

2022 | | | 24 | | | | 122,863 | | | | 4.5 | % | | | 7,832,660 | | | | 5.0 | % | | | 63.75 | |

2023 | | | 25 | | | | 112,852 | | | | 4.2 | % | | | 7,588,787 | | | | 4.8 | % | | | 67.25 | |

2024 | | | 18 | | | | 227,351 | | | | 8.4 | % | | | 14,880,657 | | | | 9.5 | % | | | 65.45 | |

2025 | | | 14 | | | | 106,823 | | | | 3.9 | % | | | 7,214,570 | | | | 4.6 | % | | | 67.54 | |

2026 | | | 9 | | | | 122,685 | | | | 4.5 | % | | | 7,673,978 | | | | 4.9 | % | | | 62.55 | |

2027 | | | 8 | | | | 29,184 | | | | 1.1 | % | | | 1,762,316 | | | | 1.1 | % | | | 60.39 | |

2028 | | | 4 | | | | 545,713 | | | | 20.1 | % | | | 30,765,416 | | | | 19.6 | % | | | 56.38 | |

2029 | | | 7 | | | | 282,020 | | | | 10.4 | % | | | 17,327,003 | | | | 11.1 | % | | | 61.44 | |

2030 | | | 5 | | | | 204,740 | | | | 7.6 | % | | | 12,072,670 | | | | 7.7 | % | | | 58.97 | |

Thereafter | | | 17 | | | | 461,422 | | | | 17.0 | % | | | 29,508,064 | | | | 18.8 | % | | | 63.95 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Empire State Building office | | | 170 | | | | 2,710,823 | | | | 100.0 | % | | $ | 156,739,511 | | | | 100.0 | % | | $ | 60.75 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | |

Empire State Building Broadcasting Licenses and Leases | | Annualized

Base Rent(7) | | | Annualized

Expense

Reimbursements | | | Annualized

Rent (4) | | | Percent of

Annualized

Rent | |

1Q 2020(6) | | $ | 31,710 | | | $ | 12,618 | | | $ | 44,328 | | | | 0.3 | % |

2Q 2020 | | | — | | | | — | | | | — | | | | 0.0 | % |

3Q 2020 | | | — | | | | — | | | | — | | | | 0.0 | % |

4Q 2020 | | | 99,320 | | | | 31,588 | | | | 130,908 | | | | 0.9 | % |

| | | | | | | | | | | | | | | | |

Total 2020 | | | 131,030 | | | | 44,206 | | | | 175,236 | | | | 1.2 | % |

1Q 2021 | | | — | | | | — | | | | — | | | | 0.0 | % |

2Q 2021 | | | — | | | | — | | | | — | | | | 0.0 | % |

3Q 2021 | | | — | | | | — | | | | — | | | | 0.0 | % |

4Q 2021 | | | — | | | | — | | | | — | | | | 0.0 | % |

| | | | | | | | | | | | | | | | |

Total 2021 | | | — | | | | — | | | | — | | | | 0.0 | % |

2022 | | | 1,727,808 | | | | 414,711 | | | | 2,142,519 | | | | 15.2 | % |

2023 | | | 219,668 | | | | 49,169 | | | | 268,837 | | | | 1.9 | % |

2024 | | | 65,000 | | | | 21,278 | | | | 86,278 | | | | 0.6 | % |

2025 | | | 1,571,830 | | | | 176,869 | | | | 1,748,699 | | | | 12.4 | % |

2026 | | | 807,668 | | | | 63,727 | | | | 871,395 | | | | 6.2 | % |

2027 | | | 787,969 | | | | 70,312 | | | | 858,281 | | | | 6.1 | % |

2028 | | | 248,614 | | | | 7,964 | | | | 256,578 | | | | 1.8 | % |

2029 | | | — | | | | — | | | | — | | | | 0.0 | % |

2030 | | | 463,507 | | | | 88,346 | | | | 551,853 | | | | 3.9 | % |

Thereafter | | | 6,398,955 | | | | 719,840 | | | | 7,118,795 | | | | 50.7 | % |

| | | | | | | | | | | | | | | | |

Total Empire State Building broadcasting licenses and leases | | $ | 12,422,049 | | | $ | 1,656,422 | | | $ | 14,078,471 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | |

Notes:

| (1) | Excludes retail space, broadcasting licenses and observatory operations |

| (2) | If a lease has two different expiration dates, it is considered to be two leases (for the purpose of lease count and square footage). |

| (3) | Excludes 52,508 rentable square feet of space attributable to building management use. |

| (4) | Represents annualized base rent and current reimbursement for operating expenses and real estate taxes. |

| (5) | Includes approximately $6.0 million of annualized rent related to physical space occupied by broadcasting tenants for their broadcasting operations. Does not include license fees charged to broadcasting tenants. |

| (6) | Represents leases that are included in occupancy as of March 31, 2020 and expire on March 31, 2020. |

| (7) | Represents license fees for the use of the Empire State Building mast and base rent for physical space occupied by broadcasting tenants. |

Page 13

| | |

| | First Quarter 2020 20 Largest Tenants and Portfolio Tenant Diversification by Industry (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | |

20 Largest Tenants | | Property | | Lease Expiration (1) | | Weighted Average Remaining Lease Term(2) | | Total

Occupied

Square

Feet (3) | | | Percent of

Portfolio

Rentable

Square

Feet (4) | | | Annualized

Rent (5) | | | Percent of

Portfolio

Annualized

Rent (6) | |

1. Global Brands Group | | ESB, 1333 B’Way | | Oct. 2023 - Oct. 2028 | | 7.8 years | | | 668,942 | | | | 6.6 | % | | $ | 36,579,857 | | | | 6.6 | % |

2. LinkedIn | | ESB | | Aug. 2036 | | 16.4 years | | | 312,947 | | | | 3.1 | % | | | 18,434,225 | | | | 3.3 | % |

3. Coty | | ESB | | Apr. 2020 - Jan. 2030 | | 5.1 years | | | 312,471 | | | | 3.1 | % | | | 17,712,823 | | | | 3.2 | % |

4. PVH Corp. | | 501 Seventh Avenue | | Oct. 2028 | | 8.6 years | | | 237,281 | | | | 2.3 | % | | | 11,716,228 | | | | 2.1 | % |

5. Sephora | | 112 West 34th Street | | Jan. 2029 | | 8.8 years | | | 11,334 | | | | 0.1 | % | | | 10,468,996 | | | | 1.9 | % |

6. Macy’s | | 111 West 33rd Street | | May 2030 | | 10.2 years | | | 131,117 | | | | 1.3 | % | | | 7,813,096 | | | | 1.4 | % |

7. Li & Fung | | 1359 Broadway | | Oct. 2021 - Oct. 2027 | | 4.0 years | | | 149,436 | | | | 1.5 | % | | | 7,701,934 | | | | 1.4 | % |

8. Signature Bank | | 1333 & 1400 Broadway | | Jul. 2030 - Apr. 2035 | | 14.6 years | | | 124,884 | | | | 1.2 | % | | | 7,540,459 | | | | 1.4 | % |

9. Federal Deposit Insurance Corp. | | ESB | | Dec. 2024 | | 4.8 years | | | 119,226 | | | | 1.2 | % | | | 7,511,238 | | | | 1.3 | % |

10. Urban Outfitters | | 1333 Broadway | | Sept. 2029 | | 9.5 years | | | 56,730 | | | | 0.6 | % | | | 7,367,374 | | | | 1.3 | % |

11. Footlocker | | 112 West 34th Street | | Sept. 2031 | | 11.5 years | | | 34,192 | | | | 0.3 | % | | | 6,898,262 | | | | 1.2 | % |

12. Duane Reade/Walgreen’s | | ESB, 1350 B’Way, 250 West 57th | | Feb. 2021 - Sept. 2027 | | 4.7 years | | | 47,541 | | | | 0.5 | % | | | 6,704,508 | | | | 1.2 | % |

13. HNTB Corporation | | ESB | | Feb. 2029 | | 8.9 years | | | 105,143 | | | | 1.0 | % | | | 6,666,632 | | | | 1.2 | % |

14. The Interpublic Group of Co’s, Inc. | | 111 West 33rd St & 1400 B’way | | Jul. 2024 - Feb. 2025 | | 4.5 years | | | 117,278 | | | | 1.2 | % | | | 6,443,584 | | | | 1.2 | % |

15. Legg Mason | | First Stamford Place | | Sept. 2024 | | 4.5 years | | | 137,583 | | | | 1.4 | % | | | 6,407,814 | | | | 1.1 | % |

16. WDFG North America | | ESB | | Dec. 2025 | | 5.8 years | | | 5,300 | | | | 0.1 | % | | | 6,037,484 | | | | 1.1 | % |

17. Shutterstock | | ESB | | Apr. 2029 | | 9.1 years | | | 104,386 | | | | 1.0 | % | | | 5,953,855 | | | | 1.1 | % |

18. Fragomen | | 1400 Broadway | | Feb. 2035 | | 14.9 years | | | 107,680 | | | | 1.1 | % | | | 5,922,400 | | | | 1.1 | % |

19. The Michael J. Fox Foundation | | 111 West 33rd Street | | Nov. 2029 | | 9.7 years | | | 86,492 | | | | 0.9 | % | | | 5,390,818 | | | | 1.0 | % |

20. ASCAP | | 250 West 57th Street | | Aug. 2034 | | 14.4 years | | | 87,943 | | | | 0.9 | % | | | 5,345,814 | | | | 1.0 | % |

| | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | | | 2,957,906 | | | | 29.4 | % | | $ | 194,617,401 | | | | 35.1 | % |

| | | | | | | | | | | | | | | | | | | | | | |

Notes:

| (1) | Expiration dates are per lease and do not assume exercise of renewal or extension options. For tenants with more than two leases, the lease expiration is shown as a range. |

| (2) | Represents the weighted average lease term, based on annualized rent. |

| (3) | Based on leases signed and commenced as of March 31, 2020. |

| (4) | Represents the percentage of rentable square feet of the Company’s office and retail portfolios in the aggregate. |

| (5) | Represents annualized base rent and current reimbursement for operating expenses and real estate taxes. |

| (6) | Represents the percentage of annualized rent of the Company’s office and retail portfolios in the aggregate. |

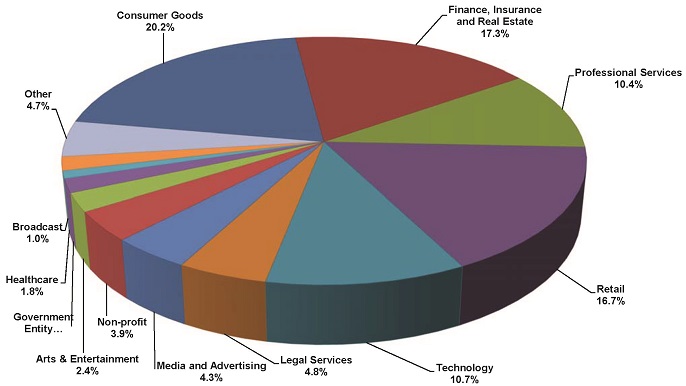

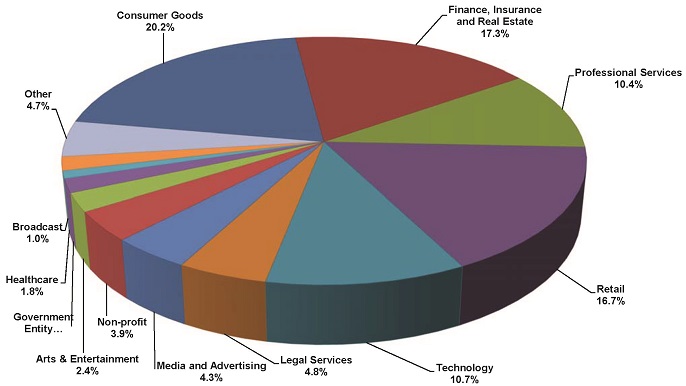

Portfolio Tenant Diversification by Industry (based on annualized rent)

Page 14

| | |

| | First Quarter 2020 Capital Expenditures and Redevelopment Program and Leasing Opportunity (unaudited and dollars in thousands) |

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| Capital expenditures | | March 31,

2020 | | | December 31,

2019 | | | September 30,

2019 | | | June 30,

2019 | | | March 31,

2019 | |

Tenant improvements—first generation | | $ | 4,913 | | | $ | 22,479 | | | $ | 17,639 | | | $ | 17,255 | | | $ | 19,142 | |

Tenant improvements—second generation | | | 8,151 | | | | 12,581 | | | | 8,734 | | | | 10,513 | | | | 9,028 | |

Leasing commissions—first generation | | | 4,001 | | | | 578 | | | | 574 | | | | 4,742 | | | | 1,276 | |

Leasing commissions—second generation | | | 3,347 | | | | 13,244 | | | | 2,651 | | | | 3,016 | | | | 1,869 | |

Building improvements—first generation | | | 8,379 | | | | 14,457 | | | | 10,988 | | | | 12,910 | | | | 11,022 | |

Building improvements—second generation | | | 3,846 | | | | 6,556 | | | | 4,931 | | | | 6,296 | | | | 4,840 | |

Observatory capital project(1) | | | 1,175 | | | | 17,574 | | | | 18,185 | | | | 14,539 | | | | 13,789 | |

Development(2) | | | 811 | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total | | $ | 34,623 | | | $ | 87,469 | | | $ | 63,702 | | | $ | 69,271 | | | $ | 60,966 | |