UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-22746

American Funds Inflation Linked Bond Fund

(Exact Name of Registrant as Specified in Charter)

6455 Irvine Center Drive

Irvine, California 92618

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (949) 975-5000

Date of fiscal year end: November 30

Date of reporting period: May 31, 2014

Courtney R. Taylor

American Funds Inflation Linked Bond Fund

6455 Irvine Center Drive

Irvine, California 92618

(Name and Address of Agent for Service)

Copies to:

Michael Glazer

Bingham McCutchen LLP

355 South Grand Avenue, Suite 4400

Los Angeles, California 90071

(Counsel for the Registrant)

ITEM 1 – Reports to Stockholders

| American Funds Inflation |

| Linked Bond FundSM |

| |

| Semi-annual report |

| for the six months ended |

| May 31, 2014 |

American Funds Inflation Linked Bond Fund seeks to provide inflation protection and income consistent with investment in inflation linked securities.

This fund is one of more than 40 offered by one of the nation’s largest mutual fund families, American Funds, from Capital Group. For more than 80 years, Capital has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class A shares at net asset value. If a sales charge (maximum 2.50%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Here are total returns on a $1,000 investment with all distributions reinvested for the periods ended June 30, 2014 (the most recent calendar quarter-end):

| | | Cumulative

total return | | Average annual

total return |

| Class A shares | | 1 year | | Lifetime

(since 12/14/12) |

| | | | | |

| Reflecting 2.50% maximum sales charge | | | 3.09 | % | | | -3.17 | % |

The fund’s estimated gross expense ratio for Class A shares was 0.79% as of the prospectus dated February 1, 2014.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. The investment adviser is currently reimbursing a portion of other expenses for each share class. This reimbursement will be in effect through at least January 31, 2015, unless modified or terminated by the fund’s board. The adviser may elect at its discretion to extend, modify or terminate the reimbursement at that time. Investment results shown reflect the reimbursement, without which the results would have been lower. Refer to the fund’s most recent prospectus for details.

Although the fund has plans of distribution for some share classes, fees for distribution services are not paid by the fund on amounts invested in the fund by the fund’s investment adviser. Expenses shown assume fees for distribution services were charged on these assets. However, because fees for distribution services were not charged on these assets, actual fund expenses were lower and total return was higher. See the “Plans of distribution” section of the prospectus for information on the distribution service fees permitted to be charged by the fund.

The fund’s 30-day yield for Class A shares as of June 30, 2014, reflecting the 2.50% maximum sales charge and calculated in accordance with the U.S. Securities and Exchange Commission formula, was -0.03%.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. The values of inflation linked bonds generally fluctuate in response to changes in real interest rates. Inflation linked bonds may experience greater losses than other debt securities with similar durations. There can be no assurance that the value of inflation linked securities will be directly correlated to changes in interest rates. Refer to the fund prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the fund.

Invest with the

goal of preserving

purchasing power.

Fellow investors:

During the first half of American Funds Inflation Linked Bond Fund’s fiscal year, issues with longer maturities and lower credit quality generally recorded the highest returns among U.S. bonds. Total returns for inflation-linked issues were helped by declines in longer maturity U.S. Treasury yields (which move inversely to prices), as well as a pickup in inflation expectations.

Against this supportive backdrop, the fund produced a total return of 4.65% for the six months ended May 31, 2014. The unmanaged Barclays U.S. Treasury Inflation Protected Securities (TIPS) Index — a broad measure of the market in which the fund primarily invests — returned 3.96%. Issued by the U.S. Treasury, the values of TIPS are directly linked to the U.S. Consumer Price Index for All Urban Consumers. Meanwhile, the Lipper Inflation-Protected Bond Funds Average (a peer group measure) recorded a 3.34% return over the same period.

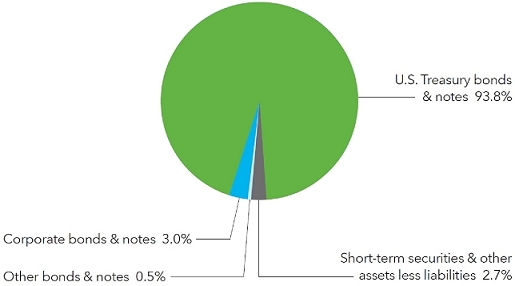

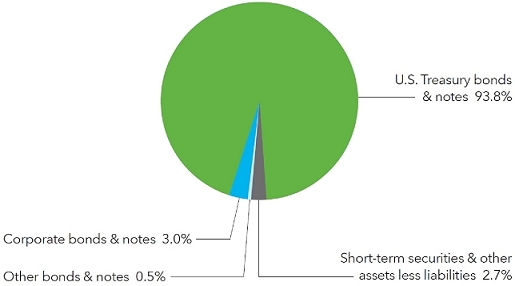

Inside the portfolio

As of May 31, 2014, 93.8% of the fund’s portfolio was invested in inflation-linked government bonds — mostly U.S. TIPS. Other fund investments included a variety of corporate issues, such as floating-rate notes — issues that pay bond investors a variable interest rate. A range of

Results at a glance

For periods ended May 31, 2014, with all distributions reinvested

| | | Cumulative total returns | | Average annual

total returns |

| | | 6 months | | 1 year | | Lifetime

(since 12/14/12) |

| | | | | | | |

| American Funds Inflation Linked Bond Fund (Class A shares) | | | 4.65 | % | | | 1.06 | % | | | -1.84 | % |

| Barclays U.S. Treasury Inflation Protected Securities (TIPS) Index* | | | 3.96 | | | | 0.40 | | | | -2.82 | |

| Lipper Inflation-Protected Bond Funds Average | | | 3.34 | | | | 0.15 | | | | -2.58 | |

| * | The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. |

| American Funds Inflation Linked Bond Fund | 1 |

corporate sectors are reflected in these holdings, including issues by health care, energy and financials companies.

Consistent with the fund’s investment guidelines, the portfolio managers have made careful and limited use of interest-rate swaps. Used alongside investments in inflation-linked bonds, these financial instruments have, for example, helped the fund to gain more precisely targeted exposures to inflation. A complete list of fund holdings can be found beginning on page 3.

Looking forward

Market expectations about the possible timing of a rise in the target federal funds rate have shifted in the wake of recent official comments, and the release of significant economic data. Consequently, bond yields have proven volatile on occasion.

We remain mindful of the possibility of further bouts of market turbulence as the Federal Reserve seeks to move away from unconventional monetary policy: first tapering its asset purchase, then eventually reducing its bond holdings and raising the official short-term interest rate. In terms of tapering, the Fed appears on course to end its buying activity before year-end; in January it began reducing monthly bond purchases by $10 billion each month.

The fund’s investment approach is designed to preserve purchasing power — an objective that may hold particular appeal for investors as inflation picks up. Signs of increases in wages, food prices and rents are just a few of the factors that suggest upward pressure on the broad cost of living as the recovery progresses.

In our view, inflation over the next few months could exceed current expectations. Likewise, our analysis suggests that U.S. economic growth during 2014 should be faster than is widely anticipated. Overall, the fund’s investment professionals continue to have a fairly positive outlook for the return potential of U.S. TIPS.

We thank you for making the fund part of your portfolio and look forward to reporting to you again in six months.

Cordially,

David A. Hoag

President

July 16, 2014

For current information about the fund, visit americanfunds.com.

| 2 | American Funds Inflation Linked Bond Fund |

| Investment portfolio May 31, 2014 | unaudited |

| Investment mix by security type | Percent of net assets |

|

| Portfolio quality summary* | | Percent of net assets |

| U.S. Treasury and agency† | | | 93.8 | % |

| Aaa/AAA | | | 0.4 | |

| Aa/AA | | | 0.1 | |

| A/A | | | 0.3 | |

| Baa/BBB | | | 2.7 | |

| Short-term securities & other assets less liabilities | | | 2.7 | |

| * | Bond ratings, which typically range from Aaa/AAA (highest) to D (lowest), are assigned by credit rating agencies such as Moody’s, Standard & Poor’s and/or Fitch as an indication of an issuer’s creditworthiness. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. |

| † | These securities are guaranteed by the full faith and credit of the United States government. |

| Bonds, notes & other debt instruments 97.29% | | Principal amount

(000) | | | | Value

(000) | | | | Percent of

net assets | |

| U.S. Treasury bonds & notes 93.76% | | | | | | | | | | | | |

| U.S. Treasury inflation-protected securities1 93.76% | | | | | | | | | | | | |

| U.S. Treasury Inflation-Protected Security 0.50% 2015 | | $ | 8,198 | | | $ | 8,329 | | | | | |

| U.S. Treasury Inflation-Protected Security 0.125% 2017 | | | 104 | | | | 107 | | | | | |

| U.S. Treasury Inflation-Protected Security 0.125% 20182 | | | 5,723 | | | | 5,915 | | | | | |

| U.S. Treasury Inflation-Protected Security 0.125% 2019 | | | 50,915 | | | | 52,391 | | | | | |

| U.S. Treasury Inflation-Protected Security 1.375% 2020 | | | 28,404 | | | | 31,164 | | | | | |

| U.S. Treasury Inflation-Protected Security 0.625% 2021 | | | 15,723 | | | | 16,576 | | | | | |

| U.S. Treasury Inflation-Protected Security 0.125% 2022 | | | 16,334 | | | | 16,451 | | | | 93.76 | % |

| U.S. Treasury Inflation-Protected Security 0.125% 2023 | | | 7,113 | | | | 7,099 | | | | | |

| U.S. Treasury Inflation-Protected Security 0.375% 2023 | | | 10,499 | | | | 10,725 | | | | | |

| U.S. Treasury Inflation-Protected Security 0.625% 2024 | | | 64,799 | | | | 67,240 | | | | | |

| U.S. Treasury Inflation-Protected Security 2.375% 2025 | | | 439 | | | | 534 | | | | | |

| U.S. Treasury Inflation-Protected Security 2.00% 2026 | | | 27,376 | | | | 32,398 | | | | | |

| U.S. Treasury Inflation-Protected Security 1.375% 2044 | | | 24,886 | | | | 27,184 | | | | | |

| | | | | | | | 276,113 | | | | 93.76 | |

| | | | | | | | | | | | | |

| Corporate bonds & notes 3.03% | | | | | | | | | | | | |

| Health care 1.50% | | | | | | | | | | | | |

| Celgene Corp 4.625% 2044 | | | 2,065 | | | | 2,063 | | | | .70 | |

| McKesson Corp. 3.796% 2024 | | | 2,000 | | | | 2,048 | | | | .70 | |

| Pfizer Inc. 0.533% 20183 | | | 300 | | | | 301 | | | | .10 | |

| | | | | | | | 4,412 | | | | 1.50 | |

| | | | | | | | | | | | | |

| Energy 1.29% | | | | | | | | | | | | |

| Enable Midstream Partners, LP 5.00% 20444 | | | 3,000 | | | | 3,042 | | | | 1.03 | |

| ECOPETROL SA 5.875% 2045 | | | 725 | | | | 751 | | | | .26 | |

| | | | | | | | 3,793 | | | | 1.29 | |

| American Funds Inflation Linked Bond Fund | 3 |

| | | Principal amount | | | Value | | | Percent of | |

| | | (000) | | | (000) | | | net assets | |

| Industrials 0.14% | | | | | | | | | | | | |

| Burlington Northern Santa Fe LLC 3.75% 2024 | | $ | 395 | | | $ | 410 | | | | .14 | % |

| | | | | | | | | | | | | |

| Financials 0.10% | | | | | | | | | | | | |

| American Express Co. 0.818% 20183 | | | 300 | | | | 303 | | | | .10 | |

| | | | | | | | | | | | | |

| Total corporate bonds & notes | | | | | | | 8,918 | | | | 3.03 | |

| | | | | | | | | | | | | |

| Mortgage-backed obligations5 0.48% | | | | | | | | | | | | |

| Hilton USA Trust, Series 2013-HLF-AFX, 2.662% 20304 | | | 1,000 | | | | 1,015 | | | | .34 | |

| CS First Boston Mortgage Securities Corp., Series 2007-C2, Class A-M, 5.612% 20493 | | | 200 | | | | 219 | | | | .08 | |

| Greenwich Capital Commercial Funding Corp., Series 2007-GG11, Class A-M, 5.867% 20493 | | | 156 | | | | 173 | | | | .06 | |

| | | | | | | | 1,407 | | | | .48 | |

| | | | | | | | | | | | | |

| Bonds & notes of governments outside the U.S. 0.02% | | | | | | | | | | | | |

| South Africa (Republic of), Series 197, 5.50% 20231 | | ZAR | 575 | | | | 73 | | | | .02 | |

| | | | | | | | | | | | | |

| Total bonds, notes & other debt instruments (cost: $278,250,000) | | | | | | | 286,511 | | | | 97.29 | |

| | | | | | | | | | | | | |

| Short-term securities 1.63% | | | | | | | | | | | | |

| General Electric Co. 0.06% due 6/2/2014 | | $ | 3,000 | | | | 3,000 | | | | 1.02 | |

| Federal Home Loan Bank 0.063% due 8/29/2014 | | | 1,800 | | | | 1,800 | | | | .61 | |

| | | | | | | | | | | | | |

| Total short-term securities (cost: $4,800,000) | | | | | | | 4,800 | | | | 1.63 | |

| Total investment securities (cost: $283,050,000) | | | | | | | 291,311 | | | | 98.92 | |

| Other assets less liabilities | | | | | | | 3,188 | | | | 1.08 | |

| | | | | | | | | | | | | |

| Net assets | | | | | | $ | 294,499 | | | | 100.00 | % |

| 4 | American Funds Inflation Linked Bond Fund |

Interest rate swaps

The fund has entered into interest rate swaps as shown in the following table. The average notional amount of interest rate swaps was $209,520,000 over the prior 10-month period.

Pay/receive

floating rate | | Floating rate index | | Fixed rate | | | Expiration date | | Notional

amount

(000) | | | Unrealized

appreciation

(depreciation)

at 5/31/2014

(000) | |

| Pay | | 3-month USD-LIBOR | | | 0.31 | % | | 1/3/2015 | | $ | 20,000 | | | $ | 8 | |

| Pay | | 3-month USD-LIBOR | | | 0.3265 | | | 3/17/2015 | | | 200,000 | | | | 126 | |

| Pay | | 3-month USD-LIBOR | | | 0.461 | | | 2/14/2016 | | | 1,000 | | | | 1 | |

| Pay | | 6-month EUR-LIBOR | | | 0.441 | | | 2/18/2016 | | | 1,000 | | | | 2 | |

| Pay | | 3-month USD-LIBOR | | | 1.565 | | | 6/2/2019 | | | 12,000 | | | | (33 | ) |

| Pay | | 3-month USD-LIBOR | | | 1.5655 | | | 6/2/2019 | | | 10,000 | | | | (25 | ) |

| Receive | | 3-month USD-LIBOR | | | 2.824 | | | 2/20/2024 | | | 1,500 | | | | (37 | ) |

| Receive | | 3-month USD-LIBOR | | | 2.812 | | | 3/6/2024 | | | 1,440 | | | | (34 | ) |

| Receive | | 3-month USD-LIBOR | | | 2.8965 | | | 3/11/2024 | | | 2,000 | | | | (62 | ) |

| Receive | | 3-month USD-LIBOR | | | 2.671 | | | 5/12/2024 | | | 5,500 | | | | (50 | ) |

| Receive | | 3-month USD-LIBOR | | | 2.636 | | | 5/23/2024 | | | 4,000 | | | | (22 | ) |

| Receive | | 3-month USD-LIBOR | | | 2.647 | | | 5/27/2024 | | | 13,000 | | | | (83 | ) |

| Receive | | 3-month USD-LIBOR | | | 2.625 | | | 5/29/2024 | | | 13,200 | | | | (59 | ) |

| Receive | | 3-month USD-LIBOR | | | 2.541 | | | 5/30/2024 | | | 8,000 | | | | 26 | |

| Receive | | 3-month USD-LIBOR | | | 3.3045 | | | 5/19/2044 | | | 2,000 | | | | — | |

| Receive | | 3-month USD-LIBOR | | | 3.362 | | | 5/21/2044 | | | 3,000 | | | | (35 | ) |

| Receive | | 3-month USD-LIBOR | | | 3.26 | | | 6/2/2044 | | | 2,000 | | | | 18 | |

| | | | | | | | | | | | | | | $ | (259 | ) |

| 1 | Index-linked bond whose principal amount moves with a government price index. |

| 2 | A portion of this security was pledged as collateral. The total value of pledged collateral was $2,991,000, which represented 1.02% of the net assets of the fund. |

| 3 | Coupon rate may change periodically. |

| 4 | Acquired in a transaction exempt from registration under Rule 144A of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities was $4,057,000, which represented 1.38% of the net assets of the fund. |

| 5 | Principal payments may be made periodically. Therefore, the effective maturity date may be earlier than the stated maturity date. |

Key to abbreviation

ZAR = South African rand

See Notes to Financial Statements

| American Funds Inflation Linked Bond Fund | 5 |

Financial statements

| Statement of assets and liabilities | | | | | unaudited |

| at May 31, 2014 | | (dollars in thousands) |

| | | | | | | | | |

| Assets: | | | | | | | | |

| Investment securities, at value (cost: $283,050) | | | | | | $ | 291,311 | |

| Cash denominated in currencies other than U.S. dollars (cost: $177) | | | | | | | 173 | |

| Cash | | | | | | | 393 | |

| Receivables for: | | | | | | | | |

| Sales of investments | | $ | 57,075 | | | | | |

| Interest | | | 883 | | | | 57,958 | |

| | | | | | | | 349,835 | |

| Liabilities: | | | | | | | | |

| Payables for: | | | | | | | | |

| Purchases of investments | | | 54,970 | | | | | |

| Investment advisory services | | | 88 | | | | | |

| Services provided by related parties | | | 12 | | | | | |

| Trustees’ deferred compensation | | | — | * | | | | |

| Variation margin on interest rate swaps | | | 264 | | | | | |

| Other | | | 2 | | | | 55,336 | |

| Net assets at May 31, 2014 | | | | | | $ | 294,499 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Capital paid in on shares of beneficial interest | | | | | | $ | 284,478 | |

| Undistributed net investment income | | | | | | | 2,154 | |

| Accumulated net realized loss | | | | | | | (132 | ) |

| Net unrealized appreciation | | | | | | | 7,999 | |

| Net assets at May 31, 2014 | | | | | | $ | 294,499 | |

(dollars and shares in thousands, except per-share amounts)

Shares of beneficial interest issued and outstanding (no stated par value) —

unlimited shares authorized (30,286 total shares outstanding)

| | | | | | Shares | | | | Net asset value | |

| | | Net assets | | | outstanding | | | | per share | |

| Class A | | $ | 2,946 | | | | 303 | | | $ | 9.73 | |

| Class R-6 | | | 291,553 | | | | 29,983 | | | | 9.72 | |

*Amount less than one thousand.

See Notes to Financial Statements

| 6 | American Funds Inflation Linked Bond Fund |

| Statement of operations | | | | | unaudited |

| for the six months ended May 31, 2014 | �� | (dollars in thousands) |

| | | | | | | | | |

| Investment income: | | | | | | | | |

| Income: | | | | | | | | |

| Interest | | | | | | $ | 2,755 | |

| Fees and expenses*: | | | | | | | | |

| Investment advisory services | | $ | 445 | | | | | |

| Transfer agent services | | | — | † | | | | |

| Administrative services | | | 61 | | | | | |

| Reports to shareholders | | | 7 | | | | | |

| Registration statement and prospectus | | | 36 | | | | | |

| Trustees’ compensation | | | — | † | | | | |

| Auditing and legal | | | 7 | | | | | |

| Custodian | | | 1 | | | | | |

| Other | | | 63 | | | | | |

| Total fees and expenses before reimbursement | | | 620 | | | | | |

| Less reimbursement of fees and expenses | | | 39 | | | | | |

| Total fees and expenses after reimbursements | | | | | | | 581 | |

| Net investment income | | | | | | | 2,174 | |

| | | | | | | | | |

Net realized gain and unrealized appreciation on investments, forward currency contracts,

interest rate swaps and currency: | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments | | | 1,601 | | | | | |

| Forward currency contracts | | | (368 | ) | | | | |

| Interest rate swaps | | | (263 | ) | | | | |

| Currency transactions | | | 59 | | | | 1,029 | |

| Net unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | | 9,615 | | | | | |

| Interest rate swaps | | | (299 | ) | | | | |

| Currency translations | | | (3 | ) | | | 9,313 | |

| Net realized gain and unrealized appreciation on investments, forward currency contracts, interest rate swaps and currency | | | | | | | 10,342 | |

| | | | | | | | | |

| Net increase in net assets resulting from operations | | | | | | $ | 12,516 | |

| | |

| * | Additional information related to class-specific fees and expenses is included in the Notes to Financial Statements. |

| † | Amount less than one thousand. |

See Notes to Financial Statements

| American Funds Inflation Linked Bond Fund | 7 |

Statements of changes in net assets

(dollars in thousands)

| | | Six months

ended

May 31, 2014* | | | For the period

December 14, 2012†

to November 30, 2013 | |

| | | | | | | |

| Operations: | | | | | | | | |

| Net investment income (loss) | | $ | 2,174 | | | $ | (80 | ) |

| Net realized gain (loss) on investments, forward currency contracts, interest rate swaps and currency transactions | | | 1,029 | | | | (1,054 | ) |

| Net unrealized appreciation (depreciation) on investments, forward currency contracts, interest rate swaps and currency translations | | | 9,313 | | | | (1,314 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 12,516 | | | | (2,448 | ) |

| | | | | | | | | |

| Dividends paid to shareholders from net investment income | | | (46 | ) | | | — | |

| | | | | | | | | |

| Net capital share transactions | | | 75,143 | | | | 209,334 | |

| | | | | | | | | |

| Total increase in net assets | | | 87,613 | | | | 206,886 | |

| | | | | | | | | |

| Net assets: | | | | | | | | |

| Beginning of period | | | 206,886 | | | | — | |

End of period (including undistributed net investment income:

$2,154 and $26, respectively) | | $ | 294,499 | | | $ | 206,886 | |

| | |

| * | Unaudited. |

| † | Commencement of operations. |

See Notes to Financial Statements

| 8 | American Funds Inflation Linked Bond Fund |

| Notes to financial statements | unaudited |

1. Organization

American Funds Inflation Linked Bond Fund (the “fund”) is registered under the Investment Company Act of 1940 as an open-end, diversified management investment company. The fund seeks to provide inflation protection and income consistent with investment in inflation linked securities.

The fund has 16 share classes consisting of five retail share classes (Classes A, B and C, as well as two F share classes, F-1 and F-2), five 529 college savings plan share classes (Classes 529-A, 529-B, 529-C, 529-E and 529-F-1) and six retirement plan share classes (Classes R-1, R-2, R-3, R-4, R-5 and R-6). The 529 college savings plan share classes can be used to save for college education. The retirement plan share classes are generally offered only through eligible employer-sponsored retirement plans. The fund’s share classes are further described:

| Share class | | Initial sales charge | | Contingent deferred sales charge upon redemption | | Conversion feature |

| Classes A and 529-A | | Up to 2.50% | | None (except 1% for certain redemptions within one year of purchase without an initial sales charge) | | None |

| Classes B and 529-B* | | None | | Declines from 5% to 0% for redemptions within six years of purchase | | Classes B and 529-B convert to Classes A and 529-A, respectively, after eight years |

| Class C | | None | | 1% for redemptions within one year of purchase | | Class C converts to Class F-1 after 10 years |

| Class 529-C | | None | | 1% for redemptions within one year of purchase | | None |

| Class 529-E | | None | | None | | None |

Classes F-1, F-2

and 529-F-1 | | None | | None | | None |

Classes R-1, R-2, R-3,

R-4, R-5 and R-6 | | None | | None | | None |

*Class B and 529-B shares of the fund are not available for purchase.

Holders of all share classes have equal pro rata rights to assets, dividends and liquidation proceeds. Each share class has identical voting rights, except for the exclusive right to vote on matters affecting only its class. Share classes have different fees and expenses (“class-specific fees and expenses”), primarily due to different arrangements for distribution, administrative and shareholder services. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different per-share dividends by each share class.

2. Significant accounting policies

The financial statements have been prepared to comply with accounting principles generally accepted in the United States of America. These principles require management to make estimates and assumptions that affect reported amounts and disclosures. Actual results could differ from those estimates. The fund follows the significant accounting policies described in this section, as well as the valuation policies described in the next section on valuation.

Security transactions and related investment income — Security transactions are recorded by the fund as of the date the trades are executed with brokers. Realized gains and losses from security transactions are determined based on the specific identified cost of the securities. In the event a security is purchased with a delayed payment date, the fund will segregate liquid assets sufficient to meet its payment obligations. Interest income is recognized on an accrual basis. Market discounts, premiums and original issue discounts on fixed-income securities are amortized daily over the expected life of the security.

Class allocations — Income, fees and expenses (other than class-specific fees and expenses) and realized and unrealized gains and losses are allocated daily among the various share classes based on their relative net assets. Class-specific fees and expenses, such as distribution, administrative and shareholder services, are charged directly to the respective share class.

Dividends and distributions to shareholders — Dividends and distributions to shareholders are recorded on the ex-dividend date.

| American Funds Inflation Linked Bond Fund | 9 |

Currency translation — Assets and liabilities, including investment securities, denominated in currencies other than U.S. dollars are translated into U.S. dollars at the exchange rates supplied by one or more pricing vendors on the valuation date. Purchases and sales of investment securities and income and expenses are translated into U.S. dollars at the exchange rates on the dates of such transactions. The effects of changes in exchange rates on investment securities are included with the net realized gain or loss and net unrealized appreciation or depreciation on investments in the fund’s statement of operations. The realized gain or loss and unrealized appreciation or depreciation resulting from all other transactions denominated in currencies other than U.S. dollars are disclosed separately.

3. Valuation

Capital Research and Management Company (“CRMC”), the fund’s investment adviser, values the fund’s investments at fair value as defined by accounting principles generally accepted in the United States of America. The net asset value of each share class of the fund is generally determined as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open.

Methods and inputs — The fund’s investment adviser uses the following methods and inputs to establish the fair value of the fund’s assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Fixed-income securities, including short-term securities purchased with more than 60 days left to maturity, are generally valued at prices obtained from one or more pricing vendors. Vendors value such securities based on one or more of the inputs described in the following table. The table provides examples of inputs that are commonly relevant for valuing particular classes of fixed-income securities in which the fund is authorized to invest. However, these classifications are not exclusive, and any of the inputs may be used to value any other class of fixed-income security.

| Fixed-income class | Examples of standard inputs |

| All | Benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data (collectively referred to as “standard inputs”) |

| Bonds & notes of governments & government agencies | Standard inputs and interest rate volatilities |

| Mortgage-backed; asset-backed obligations | Standard inputs and cash flows, prepayment information, default rates, delinquency and loss assumptions, collateral characteristics, credit enhancements and specific deal information |

When the fund’s investment adviser deems it appropriate to do so (such as when vendor prices are unavailable or not deemed to be representative), fixed-income securities will be valued in good faith at the mean quoted bid and ask prices that are reasonably and timely available (or bid prices, if ask prices are not available) or at prices for securities of comparable maturity, quality and type.

Short-term securities purchased within 60 days to maturity are valued at amortized cost, which approximates fair value. The value of short-term securities originally purchased with maturities greater than 60 days is determined based on an amortized value to par when they reach 60 days. Forward currency contracts are valued at the mean of representative quoted bid and ask prices, generally based on prices supplied by one or more pricing vendors. Interest rate swaps are generally valued by pricing vendors based on market inputs that include the index and term of index, reset frequency, payer/receiver, currency and pay frequency.

Securities and other assets for which representative market quotations are not readily available or are considered unreliable by the fund’s investment adviser are fair valued as determined in good faith under fair valuation guidelines adopted by authority of the fund’s board of trustees as further described. The investment adviser follows fair valuation guidelines, consistent with U.S. Securities and Exchange Commission rules and guidance, to consider relevant principles and factors when making fair value determinations. The investment adviser considers relevant indications of value that are reasonably and timely available to it in determining the fair value to be assigned to a particular security, such as the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations that would have been used had greater market activity occurred.

| 10 | American Funds Inflation Linked Bond Fund |

Processes and structure — The fund’s board of trustees has delegated authority to the fund’s investment adviser to make fair value determinations, subject to board oversight. The investment adviser has established a Joint Fair Valuation Committee (the “Fair Valuation Committee”) to administer, implement and oversee the fair valuation process, and to make fair value decisions. The Fair Valuation Committee regularly reviews its own fair value decisions, as well as decisions made under its standing instructions to the investment adviser’s valuation teams. The Fair Valuation Committee reviews changes in fair value measurements from period to period and may, as deemed appropriate, update the fair valuation guidelines to better reflect the results of back testing and address new or evolving issues. The Fair Valuation Committee reports any changes to the fair valuation guidelines to the board of trustees with supplemental information to support the changes. The fund’s board and audit committee also regularly review reports that describe fair value determinations and methods.

The fund’s investment adviser has also established a Fixed-Income Pricing Review Group to administer and oversee the fixed-income valuation process, including the use of fixed-income pricing vendors. This group regularly reviews pricing vendor information and market data. Pricing decisions, processes and controls over security valuation are also subject to additional internal reviews, including an annual control self-evaluation program facilitated by the investment adviser’s compliance group.

Classifications — The fund’s investment adviser classifies the fund’s assets and liabilities into three levels based on the inputs used to value the assets or liabilities. Level 1 values are based on quoted prices in active markets for identical securities. Level 2 values are based on significant observable market inputs, such as quoted prices for similar securities and quoted prices in inactive markets. Level 3 values are based on significant unobservable inputs that reflect the investment adviser’s determination of assumptions that market participants might reasonably use in valuing the securities. The valuation levels are not necessarily an indication of the risk or liquidity associated with the underlying investment. For example, U.S. government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market. At May 31, 2014, all of the fund’s investments were classified as Level 2.

4. Risk factors

Investing in the fund may involve certain risks including, but not limited to, those described below.

Market conditions — The prices of, and the income generated by, the securities held by the fund may decline due to market conditions and other factors, including those directly involving the issuers of securities held by the fund.

Investing in bonds — Rising interest rates will generally cause the prices of bonds and other debt securities to fall. Longer maturity debt securities may be subject to greater price fluctuations than shorter maturity debt securities. In addition, falling interest rates may cause an issuer to redeem, call or refinance a debt security before its stated maturity, which may result in the fund having to reinvest the proceeds in lower yielding securities.

Bonds and other debt securities are subject to credit risk, which is the possibility that the credit strength of an issuer will weaken and/or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. Lower quality debt securities generally have higher rates of interest and may be subject to greater price fluctuations than higher quality debt securities. Credit risk is gauged, in part, by the credit ratings of the securities in which the fund invests. However, ratings are only the opinions of the rating agencies issuing them and are not guarantees as to credit quality or an evaluation of market risk. The fund’s investment adviser relies on its own credit analysts to research issuers and issues in seeking to mitigate various credit and default risks.

Investing in inflation linked bonds — The values of inflation linked bonds generally fluctuate in response to changes in real interest rates — the rates of interest one expects to receive after factoring in inflation. A rise in real interest rates may cause the prices of inflation linked securities to fall, while a decline in real interest rates may cause the prices to increase. Inflation linked bonds may experience greater losses than other debt securities with similar durations when real interest rates rise faster than nominal interest rates. There can be no assurance that the value of inflation linked securities will be directly correlated to changes in interest rates; for example, if interest rates rise for reasons other than inflation, the increase may not be reflected in the security’s inflation measure.

Investing in inflation linked bonds may also mean that during periods of extreme deflation, the fund may have reduced income to distribute. If prices for goods and services decline throughout the economy, the principal and income on inflation linked securities may decline and result in losses to the fund.

| American Funds Inflation Linked Bond Fund | 11 |

Investing in securities backed by the U.S. government — Securities backed by the U.S. Treasury or the full faith and credit of the U.S. government are guaranteed only as to the timely payment of interest and principal when held to maturity. Accordingly, the current market values for these securities will fluctuate with changes in interest rates. Securities issued by government-sponsored entities and federal agencies and instrumentalities that are not backed by the full faith and credit of the U.S. government are neither issued nor guaranteed by the U.S. government.

Investing in interest rate swaps — The use of interest rate swaps involves the risk that anticipated changes in interest rates will not be accurately predicted, which may result in losses to the fund. Interest rate swaps also involve the possible failure of a counterparty to perform in accordance with the terms of the swap agreement. If a counterparty defaults on its obligations under a swap agreement, the fund may lose any amount it expected to receive from the counterparty, potentially including amounts in excess of the fund’s initial investment.

Thinly traded securities — There may be little trading in the secondary market for particular bonds or other debt securities, which may make them more difficult to value, acquire or sell.

Investing outside the U.S. — Securities of issuers domiciled outside the U.S., or with significant operations outside the U.S., may lose value because of adverse political, social, economic or market developments in the countries or regions in which the issuers operate. These securities may also lose value due to changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries. Securities markets in certain countries may be more volatile and/or less liquid than those in the U.S. Investments outside the U.S. may also be subject to different settlement and accounting practices and different regulatory, legal and reporting standards, and may be more difficult to value, than those in the U.S. The risks of investing outside the U.S. may be heightened in connection with investments in emerging markets.

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses employed by the investment adviser in this process may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

5. Certain investment techniques

Forward currency contracts — The fund has entered into forward currency contracts, which represent agreements to exchange currencies on specific future dates at predetermined rates. The fund’s investment adviser uses forward currency contracts to manage the fund’s exposure to changes in exchange rates. Upon entering into these contracts, risks may arise from the potential inability of counterparties to meet the terms of their contracts and from possible movements in exchange rates.

On a daily basis, the fund’s investment adviser values forward currency contracts and records unrealized appreciation or depreciation for open forward currency contracts in the fund’s statement of assets and liabilities. Realized gains or losses are recorded at the time the forward currency contract is closed or offset by another contract with the same broker for the same settlement date and currency.

Closed forward currency contracts that have not reached their settlement date are included in the respective receivables or payables for closed forward currency contracts in the fund’s statement of assets and liabilities. Net realized gains or losses from closed forward currency contracts and net unrealized appreciation or depreciation from open forward currency contracts are recorded in the fund’s statement of operations. As of May 31, 2014, the fund did not have any open forward currency contracts.

Interest rate swaps — The fund has entered into interest rate swaps, which are agreements to exchange one stream of future interest payments for another based on a specified notional amount. Typically, interest rate swaps exchange a fixed interest rate for a payment that floats relative to a benchmark or vice versa. The fund’s investment adviser uses interest rate swaps to manage the interest rate sensitivity of the fund by increasing or decreasing the duration of the fund or a portion of the fund’s portfolio. Risks may arise as a result of the fund’s investment adviser incorrectly anticipating changes in interest rates, increased volatility, reduced liquidity and the potential inability of counterparties to meet the terms of their agreements.

Upon entering into an interest rate swap contract, the fund is required to deposit cash, U.S. government securities or other liquid securities, which is known as “initial margin.” Generally, the initial margin required for a particular interest rate swap is set and held as collateral by the clearinghouse on which the contract is cleared. The amount of initial margin required may be significantly modified from time to time by the clearinghouse during the term of the contract.

| 12 | American Funds Inflation Linked Bond Fund |

On a daily basis, the fund’s investment adviser records daily interest accruals related to the exchange of future payments as a receivable and payable in the fund’s statement of assets and liabilities. The fund also pays or receives a “variation margin” based on the increase or decrease in the value of the interest rate swaps, including accrued interest, and records variation margin on interest rate swaps in the statement of assets and liabilities. The fund records realized gains and losses on both the net accrued interest and any gain or loss recognized at the time the interest rate swap is closed or expires. Net realized gains or losses, as well as any net unrealized appreciation or depreciation, from interest rate swaps are recorded in the fund’s statement of operations.

The following tables present the financial statement impacts resulting from the fund’s use of forward currency contracts and interest rate swaps as of May 31, 2014 (dollars in thousands):

| | | Asset | | | | | Liability | | | |

| Contract | | Location on statement of

assets and liabilities | | Value | | | Location on statement of

assets and liabilities | | Value | |

| Interest rate swaps | | Variation margin on interest rate swaps | | $ | — | | | Variation margin on interest rate swaps | | $ | 264 | |

| | | | | | | | | | | | | |

| | | Net realized loss | | | | | | Net unrealized depreciation | | | | |

| Contract | | Location on statement of

operations | | Value | | | Location on statement of

operations | | Value | |

| Forward currency | | Net realized loss on forward currency contracts | | $ | (368 | ) | | Net unrealized depreciation on forward currency contracts | | $ | — | |

| Interest rate swaps | | Net realized loss on interest rate swaps | | | (263 | ) | | Net unrealized depreciation on interest rate swaps | | | (299 | ) |

| | | | | $ | (631 | ) | | | | $ | (299 | ) |

Collateral — The fund has entered into a collateral program due to its use of forward currency contracts and interest rate swaps. For forward currency contracts, the program calls for the fund to either receive or pledge collateral based on the net gain or loss on unsettled forward currency contracts by counterparty. For interest rate swaps, the program calls for the fund to pledge collateral for initial and variation margin by contract. The purpose of the collateral is to cover potential losses that could occur in the event that either party cannot meet its contractual obligations.

6. Taxation and distributions

Federal income taxation — The fund complies with the requirements under Subchapter M of the Internal Revenue Code applicable to mutual funds and intends to distribute substantially all of its net taxable income and net capital each year. The fund is not subject to income taxes to the extent such distributions are made. Therefore, no federal income tax provision is required.

As of and during the period ended May 31, 2014, the fund did not have a liability for any unrecognized tax benefits. The fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the period, the fund did not incur any interest or penalties.

The fund is not subject to examination by U.S. federal and state tax authorities for tax years before 2012, the year the fund commenced operations.

Non-U.S. taxation — Interest income is recorded net of non-U.S. taxes paid.

Distributions — Distributions paid to shareholders are based on net investment income and net realized gains determined on a tax basis, which may differ from net investment income and net realized gains for financial reporting purposes. These differences are due primarily to different treatment for items such as currency gains and losses; short-term capital gains and losses; capital losses related to sales of certain securities within 30 days of purchase; cost of investments sold; net capital losses; and income on certain investments.

| American Funds Inflation Linked Bond Fund | 13 |

The components of distributable earnings on a tax basis are reported as of the fund’s most recent year-end. As of November 30, 2013, the components of distributable earnings on a tax basis were as follows (dollars in thousands):

| Undistributed ordinary income | | $ | 46 | |

| Capital loss carryforward* | | | (846 | ) |

| * | The capital loss carryforward will be used to offset any capital gains realized by the fund in the current year or subsequent years. The fund will not make distributions from capital gains while a capital loss carryforward remains. |

As of May 31, 2014, the tax basis unrealized appreciation (depreciation) and cost of investment securities were as follows (dollars in thousands):

| Gross unrealized appreciation on investment securities | | $ | 7,702 | |

| Gross unrealized depreciation on investment securities | | | (4 | ) |

| Net unrealized appreciation on investment securities | | | 7,698 | |

| Cost of investment securities | | | 283,613 | |

No distributions were paid to shareholders during the year ended November 30, 2013. Tax-basis distributions paid or accrued to shareholders from ordinary income were as follows (dollars in thousands):

| Share class | | Six months ended

May 31, 2014 | |

| Class A | | $ | 1 | |

| Class R-6 | | | 45 | |

| Total | | $ | 46 | |

7. Fees and transactions with related parties

CRMC, the fund’s investment adviser, is the parent company of American Funds Distributors,® Inc. (“AFD”), the principal underwriter of the fund’s shares, and American Funds Service Company® (“AFS”), the fund’s transfer agent. CRMC, AFD and AFS are considered related parties to the fund.

Investment advisory services — The fund has an investment advisory and service agreement with CRMC that provides for monthly fees accrued daily. These fees are based on an annual rate of 0.360% of average daily net assets. For the six months ended May 31, 2014, the investment advisory services fee was $445,000.

CRMC has agreed to reimburse a portion of the fees and expenses of the fund during its startup period. This reimbursement may be adjusted or discontinued by CRMC, subject to any restrictions in the fund’s prospectus. For the six months ended May 31, 2014, total fees and expenses reimbursed by CRMC were $39,000. Fees and expenses in the statement of operations are presented gross of any reimbursements from CRMC.

Class-specific fees and expenses — Expenses that are specific to individual share classes are accrued directly to the respective share class. The principal class-specific fees and expenses are described below:

Distribution services — The fund has plans of distribution for all share classes, except Class F-2, R-5 and R-6 shares. Under the plans, the board of trustees approves certain categories of expenses that are used to finance activities primarily intended to sell fund shares and service existing accounts. The plans provide for payments, based on an annualized percentage of average daily net assets, 0.30% to 1.00% as noted in this section. In some cases, the board of trustees has limited the amounts that may be paid to less than the maximum allowed by the plans. All share classes with a plan may use up to 0.25% of average daily net assets to pay service fees, or to compensate AFD for paying service fees, to firms that have entered into agreements with AFD to provide certain shareholder services. The remaining amounts available to be paid under each plan are paid to dealers to compensate them for their sales activities.

| 14 | American Funds Inflation Linked Bond Fund |

For Class A and 529-A shares, distribution-related expenses include the reimbursement of dealer and wholesaler commissions paid by AFD for certain shares sold without a sales charge. These share classes reimburse AFD for amounts billed within the prior 15 months but only to the extent that the overall annual expense limit of 0.30% is not exceeded. As of May 31, 2014, there were no unreimbursed expenses subject to reimbursement for Class A or 529-A shares.

| Share class | | Currently approved limits | | Plan limits |

| Class A | | | 0.30 | % | | | 0.30 | % |

| Class 529-A | | | 0.25 | | | | 0.50 | |

| Classes B and 529-B | | | 1.00 | | | | 1.00 | |

| Classes C, 529-C and R-1 | | | 1.00 | | | | 1.00 | |

| Class R-2 | | | 0.75 | | | | 1.00 | |

| Classes 529-E and R-3 | | | 0.50 | | | | 0.75 | |

| Classes F-1, 529-F-1 and R-4 | | | 0.25 | | | | 0.50 | |

Transfer agent services — The fund has a shareholder services agreement with AFS under which the fund compensates AFS for providing transfer agent services to each of the fund’s share classes. These services include recordkeeping, shareholder communications and transaction processing. In addition, the fund reimburses AFS for amounts paid to third parties for performing transfer agent services on behalf of fund shareholders.

Administrative services — The fund has an administrative services agreement with CRMC under which the fund compensates CRMC for providing administrative services to Class A, C, F, 529 and R shares. These services include, but are not limited to, coordinating, monitoring, assisting and overseeing third parties that provide services to fund shareholders. Under the agreement, Class A shares pay an annual fee of 0.01% and Class C, F, 529 and R shares pay an annual fee of 0.05% of their respective average daily net assets.

529 plan services — Each 529 share class is subject to service fees to compensate the Commonwealth of Virginia for the maintenance of the 529 college savings plan. During the period November 1, 2013 to March 31, 2014, the quarterly fee was based on a series of decreasing annual rates beginning with 0.10% on the first $30 billion of the net assets invested in Class 529 shares of the American Funds and decreasing to 0.06% on such assets between $120 billion and $150 billion. Effective April 1, 2014, the quarterly fee was amended to provide for reduced annual rates of 0.07%, 0.06% and 0.05% over $30 billion, $50 billion and $70 billion, respectively, of the net assets invested in Class 529 shares of the American Funds. The fee for any given calendar quarter is accrued and calculated on the basis of the average net assets of Class 529 shares of the American Funds for the last month of the prior calendar quarter. The fee is included in other expenses in the fund’s statement of operations. The Commonwealth of Virginia is not considered a related party.

For the six months ended May 31, 2014, class-specific expenses under the agreements were as follows (dollars in thousands):

| Share class | | Distribution

services | | Transfer agent

services | | | Administrative

services | | | 529 plan

services | |

| Class A | | $— | | $— | * | | $— | * | | Not applicable | |

| Class R-6 | | | Not applicable | | | — | * | | | 61 | | | | Not applicable | |

| Total class-specific expenses | | | $— | | | $— | * | | | $61 | | | | Not applicable | |

| * | Amount less than one thousand. |

Trustees’ deferred compensation — Trustees who are unaffiliated with CRMC may elect to defer the cash payment of part or all of their compensation. These deferred amounts, which remain as liabilities of the fund, are treated as if invested in shares of the fund or other American Funds. These amounts represent general, unsecured liabilities of the fund and vary according to the total returns of the selected funds. Trustees’ compensation in the fund’s statement of operations includes the current fees (either paid in cash or deferred) and the net increase or decrease in the value of the deferred amounts.

Affiliated officers and trustees — Officers and certain trustees of the fund are or may be considered to be affiliated with CRMC, AFD and AFS. No affiliated officers or trustees received any compensation directly from the fund.

| American Funds Inflation Linked Bond Fund | 15 |

8. Capital share transactions

Capital share transactions in the fund were as follows (dollars and shares in thousands):

| | | Sales | | | Reinvestments of dividends | | | Repurchases | | | Net increase |

| Share class | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended May 31, 2014 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | $ | — | | | | — | | | $ | — | | | | — | | | $ | — | | | | — | | | $ | — | | | | — | |

| Class R-6 | | | 78,590 | | | | 8,397 | | | | 45 | | | | 5 | | | | (3,492 | ) | | | (374 | ) | | | 75,143 | | | | 8,028 | |

| Total net increase (decrease) | | $ | 78,590 | | | | 8,397 | | | $ | 45 | | | | 5 | | | $ | (3,492 | ) | | | (374 | ) | | $ | 75,143 | | | | 8,028 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the period December 14, 2012* to November 30, 2013 | | | | | | | | | | | | | | | | | | |

| Class A | | $ | 25,000 | | | | 2,500 | | | $ | — | | | | — | | | $ | (20,500 | ) | | | (2,197 | ) | | $ | 4,500 | | | | 303 | |

| Class R-6† | | | 205,132 | | | | 21,987 | | | | — | | | | — | | | | (298 | ) | | | (32 | ) | | | 204,834 | | | | 21,955 | |

| Total net increase (decrease) | | $ | 230,132 | | | | 24,487 | | | $ | — | | | | — | | | $ | (20,798 | ) | | | (2,229 | ) | | $ | 209,334 | | | | 22,258 | |

| * | Commencement of operations. |

| † | Class R-6 shares were offered beginning November 1, 2013. |

9. Investment transactions and other disclosures

The fund made purchases and sales of investment securities, excluding short-term securities and U.S. government obligations, if any, of $89,711,000 and $98,805,000, respectively, during the six months ended May 31, 2014.

10. Ownership concentration

At May 31, 2014, CRMC held all of the fund’s Class A outstanding shares. The ownership represents the seed money invested in the fund when it began operations on December 14, 2012.

At May 31, 2014, the fund’s Class R-6 shares had four shareholders: American Funds 2010 Target Date Retirement Fund, American Funds 2015 Target Date Retirement Fund, American Funds 2020 Target Date Retirement Fund and American Funds 2025 Target Date Retirement Fund. Aggregate ownership of the fund’s Class R-6 outstanding shares was 23%, 17%, 37% and 23%, respectively. CRMC is the investment adviser to these four target date funds.

| 16 | American Funds Inflation Linked Bond Fund |

Financial highlights

| | | | | Income (loss) from investment operations1 | | | | | | | | | | | | | | | | | | | | |

| | | Net asset

value,

beginning

of period | | Net

investment

income

(loss) | | | Net gains

(losses)

on securities

(both realized

and unrealized) | | | Total from

investment

operations | | | Dividends

(from net

investment

income) | | | Net asset

value, end

of period | | Total

return2,3 | | | Net assets,

end of

period (in

thousands) | | Ratio of

expenses to

average net

assets before

reimbursement | | | Ratio of

expenses to

average net

assets after

reimbursement3 | | | Ratio of

net income

(loss) to

average

net assets3 | |

| Class A: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended 5/31/20144,5 | | $ | 9.30 | | $ | .07 | | | $ | .36 | | | $ | .43 | | | $ | — | 6 | | $ | 9.73 | | | 4.65 | %7 | | $ | 2,946 | | | .46 | %7,8 | | | .43 | %7,8 | | | 1.55 | %7,8 |

| Period from 12/14/2012 to 11/30/20134,9 | | | 10.00 | | | (.03 | ) | | | (.67 | ) | | | (.70 | ) | | | — | | | | 9.30 | | | (7.00 | )7 | | | 2,816 | | | .61 | 7,8 | | | .43 | 7,8 | | | (.36 | )7,8 |

| Class R-6: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended 5/31/20144,5 | | | 9.29 | | | .08 | | | | .35 | | | | .43 | | | | — | 6 | | | 9.72 | | | 4.65 | | | | 291,553 | | | .50 | 8 | | | .47 | 8 | | | 1.76 | 8 |

| Period from 11/1/2013 to 11/30/20134,10 | | | 9.33 | | | — | 6 | | | (.04 | ) | | | (.04 | ) | | | — | | | | 9.29 | | | (.43 | ) | | | 204,070 | | | .03 | | | | .03 | | | | — | 11 |

| | | Six months ended | | Period ended |

| | | May 31, 20144,5 | | November 30, 20134,9 |

| Portfolio turnover rate for all share classes | | | 339 | % | | | 543 | % |

| 1 | Based on average shares outstanding. |

| 2 | Total returns exclude any applicable sales charges, including contingent deferred sales charges. |

| 3 | This column reflects the impact of a reimbursement from CRMC. During the periods shown, CRMC reimbursed other fees and expenses. |

| 4 | Based on operations for the period shown and, accordingly, is not representative of a full year. |

| 5 | Unaudited. |

| 6 | Amount less than $.01. |

| 7 | Although the fund has a plan of distribution for Class A shares, fees for distribution services are not paid by the fund on amounts invested in the fund by CRMC and/or its affiliates. If fees for distribution services were charged on these assets, fund expenses would have been higher and net income and total return would have been lower. |

| 8 | Annualized. |

| 9 | For the period December 14, 2012, commencement of operations, through November 30, 2013. |

| 10 | Class R-6 shares were offered beginning November 1, 2013. |

| 11 | Amount less than .01%. |

See Notes to Financial Statements

| American Funds Inflation Linked Bond Fund | 17 |

As a fund shareholder, you incur two types of costs: (1) transaction costs, such as initial sales charges on purchase payments and contingent deferred sales charges on redemptions (loads), and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund so you can compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period (December 1, 2013, through May 31, 2014).

Actual expenses:

The first line of each share class in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses paid during period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes:

The second line of each share class in the table below provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio for the share class and an assumed rate of return of 5.00% per year before expenses, which is not the actual return of the share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5.00% hypothetical example with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Notes:

Retirement plan participants may be subject to certain fees charged by the plan sponsor, and Class F-1, F-2 and 529-F-1 shareholders may be subject to fees charged by financial intermediaries, typically ranging from 0.75% to 1.50% of assets annually depending on services offered. You can estimate the impact of these fees by adding the amount of the fees to the total estimated expenses you paid on your account during the period as calculated above. In addition, your ending account value would be lower by the amount of these fees.

Note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

account value

12/1/2013 | | | Ending

account value

5/31/2014 | | | Expenses paid

during period* | | | Annualized

expense ratio | |

| Class A — actual return | | $ | 1,000.00 | | | $ | 1,046.46 | | | $ | 2.19 | | | | .43 | % |

| Class A — assumed 5% return | | | 1,000.00 | | | | 1,022.79 | | | | 2.17 | | | | .43 | |

| Class R-6 — actual return | | | 1,000.00 | | | | 1,046.52 | | | | 2.40 | | | | .47 | |

| Class R-6 — assumed 5% return | | | 1,000.00 | | | | 1,022.59 | | | | 2.37 | | | | .47 | |

| * | The “expenses paid during period” are equal to the “annualized expense ratio,” multiplied by the average account value over the period, multiplied by the number of days in the period, and divided by 365 (to reflect the one-half year period). |

| 18 | American Funds Inflation Linked Bond Fund |

Approval of Investment Advisory and Service Agreement

The American Funds Inflation Linked Bond Fund’s board has approved the fund’s Investment Advisory and Service Agreement (the “agreement”) with Capital Research and Management Company (“CRMC”) for an additional one-year term through March 31, 2015. The board approved the agreement following the recommendation of the fund’s Contracts Committee (the “committee”), which is composed of all of the fund’s independent board members. The board and the committee determined that the fund’s advisory fee structure was fair and reasonable in relation to the services provided and that approving the agreement was in the best interests of the fund and its shareholders.

In reaching this decision, the board and the committee took into account information furnished to them throughout the year and otherwise provided to them, as well as information prepared specifically in connection with their review of the agreement, and were advised by their independent counsel. They considered the following factors, among others, but did not identify any single issue or particular piece of information that, in isolation, was the controlling factor, and each board and committee member did not necessarily attribute the same weight to each factor.

1. Nature, extent and quality of services

The board and the committee considered the depth and quality of CRMC’s investment management process, including its global research capabilities; the experience, capability and integrity of its senior management and other personnel; the low turnover rates of its key personnel; the overall financial strength and stability of its organization; and the ongoing evolution of CRMC’s organizational structure designed to maintain and strengthen these qualities. The board and the committee also considered the nature, extent and quality of administrative, compliance and shareholder services provided by CRMC to the fund under the agreement and other agreements, as well as the benefits to fund shareholders from investing in a fund that is part of a large family of funds. The board and the committee concluded that the nature, extent and quality of the services provided by CRMC have benefited and should continue to benefit the fund and its shareholders.

2. Investment results

The board and the committee considered the investment results of the fund in light of its objective of providing, over the long term, a high level of total return largely comprised of current income. They compared the fund’s investment results with those of other relevant funds (including funds that form the basis of the Lipper index for the category in which the fund is included), and data such as relevant market and fund indexes, over various periods through September 30, 2013. This report, including the letter to shareholders and related disclosures, contains certain information about the fund’s investment results. The board and the committee reviewed the fund’s investment results measured against the Lipper Inflation Protected Bond Funds Average and the Barclays U.S. TIPS Index. They noted the fund’s short history and that the investment results of the fund were above the results of the Barclays index for the nine-month and lifetime periods. The board and committee further noted that the fund’s results were above the results of the Lipper average for the nine-month period, but below those of the Lipper average for the fund’s short lifetime period. The board and the committee concluded that the fund’s investment results have been satisfactory and that CRMC’s record in managing the fund indicated that its continued management should benefit the fund and its shareholders.

3. Advisory fees and total expenses

The board and the committee reviewed the advisory fees and total expense levels of the fund. They observed that the fund’s advisory fees were at the median level of other inflation protected funds when it commenced operation. They also noted the limited usefulness of comparative expense data because the fund was not yet available to the public. In addition, they reviewed information regarding the effective advisory fees charged to non-mutual fund clients by CRMC and its affiliates. They noted that, to the extent there were differences between the advisory fees paid by the fund and the advisory fees paid by those clients, the differences appropriately reflected the investment, operational and regulatory differences between advising the fund and the other clients. The board and the committee concluded that the fund’s cost structure was fair and reasonable in relation to the services provided, and that the fund’s shareholders receive reasonable value in return for the advisory fees and other amounts paid to CRMC by the fund.

| American Funds Inflation Linked Bond Fund | 19 |

4. Ancillary benefits

The board and the committee considered a variety of other benefits that CRMC and its affiliates receive as a result of CRMC’s relationship with the fund and the other American Funds, including fees for administrative services provided to certain share classes; fees paid to CRMC’s affiliated transfer agent; sales charges and distribution fees received and retained by the fund’s principal underwriter, an affiliate of CRMC; and possible ancillary benefits to CRMC and its institutional management affiliates in managing other investment vehicles. The board and the committee reviewed CRMC’s portfolio trading practices, noting that while CRMC receives the benefit of research provided by broker-dealers executing portfolio transactions on behalf of the fund, it does not obtain third-party research or other services in return for allocating brokerage to such broker-dealers. The board and the committee took these ancillary benefits into account in evaluating the reasonableness of the advisory fees and other amounts paid to CRMC by the fund.

5. Adviser financial information

The board and the committee reviewed information regarding CRMC’s costs of providing services to the American Funds, including personnel, systems and resources of investment, compliance, trading, accounting and other administrative operations. They considered CRMC’s costs and willingness to invest in technology, infrastructure and staff to maintain and expand services and capabilities, respond to industry and regulatory developments, and attract and retain qualified personnel. They noted information regarding the compensation structure for CRMC’s investment professionals. The board and the committee also compared CRMC’s profitability and compensation data to the reported results and data of several large, publicly held investment management companies. The board and the committee noted the competitiveness and cyclicality of both the mutual fund industry and the capital markets, and the importance in that environment of CRMC’s long-term profitability for maintaining its independence, company culture and management continuity. They further considered the breakpoint discounts in the fund’s advisory fee structure. The board and the committee concluded that the fund’s advisory fee structure reflected a reasonable sharing of benefits between CRMC and the fund’s shareholders.

| 20 | American Funds Inflation Linked Bond Fund |

Offices of the fund and of the investment adviser

Capital Research and Management Company

333 South Hope Street

Los Angeles, CA 90071-1406

6455 Irvine Center Drive

Irvine, CA 92618-4518

Transfer agent for shareholder accounts

American Funds Service Company

(Write to the address near you.)

P.O. Box 6007

Indianapolis, IN 46206-6007

P.O. Box 2280

Norfolk, VA 23501-2280

Custodian of assets

Bank of New York Mellon

One Wall Street

New York, NY 10286

Counsel

Bingham McCutchen LLP

355 South Grand Avenue, Suite 4400

Los Angeles, CA 90071-3106

Independent registered public accounting firm

PricewaterhouseCoopers LLP

601 South Figueroa Street

Los Angeles, CA 90017-3874

Principal underwriter

American Funds Distributors, Inc.

333 South Hope Street

Los Angeles, CA 90071-1406

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectus and summary prospectus, which can be obtained from your financial professional and should be read carefully before investing. You may also call American Funds Service Company (AFS) at (800) 421-4225 or visit the American Funds website at americanfunds.com.

“American Funds Proxy Voting Procedures and Principles” — which describes how we vote proxies relating to portfolio securities — is available on the American Funds website or upon request by calling AFS. The fund files its proxy voting record with the U.S. Securities and Exchange Commission (SEC) for the 12 months ended June 30 by August 31. The proxy voting record is available free of charge on the SEC website at sec.gov and on the American Funds website.

American Funds Inflation Linked Bond Fund files a complete list of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. This filing is available free of charge on the SEC website. You may also review or, for a fee, copy this filing at the SEC’s Public Reference Room in Washington, D.C. Additional information regarding the operation of the Public Reference Room may be obtained by calling the SEC’s Office of Investor Education and Advocacy at (800) SEC-0330. Additionally, the list of portfolio holdings is available by calling AFS.

This report is for the information of shareholders of American Funds Inflation Linked Bond Fund, but it also may be used as sales literature when preceded or accompanied by the current prospectus or summary prospectus, which gives details about charges, expenses, investment objectives and operating policies of the fund. If used as sales material after September 30, 2014, this report must be accompanied by an American Funds statistical update for the most recently completed calendar quarter.

| American Funds Inflation Linked Bond Fund | 21 |

The American Funds Advantage

Since 1931, American Funds, part of Capital Group, has helped investors pursue long-term investment success. Our consistent approach — in combination with The Capital SystemSM — has resulted in a superior long-term track record.

| | Aligned with investor success |

| | We base our decisions on a long-term perspective, which we believe aligns our goals with the interests of our clients. Our portfolio managers average 26 years of investment experience, including 21 years at our company, reflecting a career commitment to our long-term approach.1 |

| | |

| | The Capital SystemSM |

| | Our investment process, The Capital System, combines individual accountability with teamwork. Each fund is divided into portions that are managed independently by investment professionals with diverse backgrounds, ages and investment approaches. An extensive global research effort is the backbone of our system. |

| | |

| | Superior long-term track record |

| | Our equity funds have beaten their Lipper peer indexes in 90% of 10-year periods and 96% of 20-year periods. Our fixed-income funds have beaten their Lipper indexes in 56% of 10-year periods and 57% of 20-year periods.2 Our fund management fees have been among the lowest in the industry.3 |

| | 1 | Portfolio manager experience as of December 31, 2013. |

| | 2 | Based on Class A share results for rolling periods through December 31, 2013. Periods covered are the shorter of the fund’s lifetime or since the comparable Lipper index inception date (except SMALLCAP World Fund, for which the Lipper average was used). |

| | 3 | Based on management fees for the 20-year period ended December 31, 2013, versus comparable Lipper categories, excluding funds of funds. |

Lit. No. MFGESRX-060-0714O Litho in USA CT/10280-S41522

ITEM 2 – Code of Ethics

Not applicable for filing of semi-annual reports to shareholders.

ITEM 3 – Audit Committee Financial Expert

Not applicable for filing of semi-annual reports to shareholders.

ITEM 4 – Principal Accountant Fees and Services

Not applicable for filing of semi-annual reports to shareholders.

ITEM 5 – Audit Committee of Listed Registrants

Not applicable to this Registrant, insofar as the Registrant is not a listed issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934.

ITEM 6 – Schedule of Investments

Not applicable insofar as the schedule is included as part of the report to shareholders filed under Item 1 of this Form.

ITEM 7 – Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable to this Registrant, insofar as the Registrant is not a closed-end management investment company.

ITEM 8 – Portfolio Managers of Closed-End Management Investment Companies

Not applicable to this Registrant, insofar as the Registrant is not a closed-end management investment company.

ITEM 9 – Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

Not applicable to this Registrant, insofar as the Registrant is not a closed-end management investment company.

ITEM 10 – Submission of Matters to a Vote of Security Holders