UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-22746

American Funds Inflation Linked Bond Fund

(Exact Name of Registrant as Specified in Charter)

6455 Irvine Center Drive

Irvine, California 92618

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (949) 975-5000

Date of fiscal year end: November 30

Date of reporting period: November 30, 2019

Brian C. Janssen

American Funds Inflation Linked Bond Fund

6455 Irvine Center Drive

Irvine, California 92618

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

American Funds Inflation

Linked Bond Fund® Annual report

for the year ended

November 30, 2019 |  |

Invest with the

goal of preserving

purchasing power

Beginning January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, we intend to no longer mail paper copies of the fund’s shareholder reports, unless specifically requested from American Funds or your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Capital Group website (capitalgroup.com); you will be notified by mail and provided with a website link to access the report each time a report is posted. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. If you prefer to receive shareholder reports and other communications electronically, you may update your mailing preferences with your financial intermediary, or enroll in e-delivery at capitalgroup.com (for accounts held directly with the fund).

You may elect to receive paper copies of all future reports free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the fund, you may inform American Funds that you wish to continue receiving paper copies of your shareholder reports by contacting us at (800) 421-4225. Your election to receive paper reports will apply to all funds held with American Funds or through your financial intermediary.

American Funds Inflation Linked Bond Fund seeks to provide inflation protection and income consistent with investment in inflation linked securities.

This fund is one of more than 40 offered by Capital Group, home of American Funds, one of the nation’s largest mutual fund families. For more than 85 years, Capital Group has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class A shares at net asset value. If a sales charge (maximum 2.50%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, visit capitalgroup.com.

Here are the total returns on a $1,000 investment with all distributions reinvested for the period ended December 31, 2019 (the most recent calendar quarter-end):

| Class A shares | | 1 year | | 5 years | | Lifetime

(since 12/14/12) |

| | | | | | | |

| Reflecting 2.50% maximum sales charge | | 3.90% | | 1.72% | | 0.66% |

The total annual fund operating expense ratio is 0.73% for Class A shares as of the prospectus dated February 1, 2020 (unaudited). The expense ratio is restated to reflect current fees.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers and expense reimbursements, without which results would have been lower.

The fund’s 30-day yield for Class A shares as of December 31, 2019, reflecting the 2.50% maximum sales charge and calculated in accordance with the U.S. Securities and Exchange Commission formula, was 2.09%.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. The values of inflation-linked bonds generally fluctuate in response to changes in real interest rates. Inflation-linked bonds may experience greater losses than other debt securities with similar durations. There can be no assurance that the value of inflation-linked securities will be directly correlated to changes in interest rates. Refer to the fund prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the fund.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Contents

Fellow investors

Inflation expectations initially climbed before trending lower during the 12-month period ended November 30, 2019. At the same time, bond yields (which move inversely to prices) declined dramatically, helping the inflation-linked bond market to notch gains.

Over the same period, American Funds Inflation Linked Bond Fund generated a 6.43% return. The unmanaged Bloomberg Barclays U.S. Treasury Inflation-Protected Securities (TIPS) Index — a measure of the market in which the fund primarily invests — gained 8.61%.

The values of TIPS (issued by the United States Treasury Department) are directly linked to the U.S. Consumer Price Index (CPI) for All Urban Consumers. The Lipper Inflation Protected Bond Funds Average, a peer group measure, rose 6.87%.

Fund investors who reinvested dividends of just over 20 cents a share (paid in December 2018) earned an income return of 2.20%, the same as those who took dividends in cash. A capital gain of over 3 cents a share was also paid in December 2018.

The portfolio’s overall positioning in regard to interest rates detracted from results relative to the benchmark. The fund’s curve positioning (emphasizing bonds of particular maturities) and interest rate swap spread positioning were among the larger negative factors.

Market overview

Shortly after the start of fund’s fiscal year, significant equity volatility and relatively modest inflation prompted the Federal Reserve to recalibrate its policy stance.

In January 2019, the Fed hit the pause button on hikes — holding the federal funds target rate range steady at 2.25%–2.50%. This was followed by quarter percentage point rate cuts in July, September and October. In December 2019 the Fed left rates unchanged, at a range of 1.50%–1.75%.

Annualized core CPI — the inflation measure that strips out volatile food and energy prices — bottomed out in May 2019; it has climbed above 2.3% in recent months.

Earlier in the period, inflation prospects appeared decent thanks to solid economic data. By the third quarter of 2019, however, growth had moderated to 2.1% on an annualized basis. Unemployment stood at 3.5% in November — matching the 50-year low recorded in September.

The price of oil — another important source of inflation — peaked at $66 a barrel in

Results at a glance

For periods ended November 30, 2019, with all distributions reinvested

| | | Cumulative

total returns | | Average annual total returns |

| | | 6 months | | | 1 year | | | 3 years | | | 5 years | | | Lifetime

(since 12/14/12) |

| | | | | | | | | | | |

| American Funds Inflation Linked Bond Fund (Class A shares) | | | 0.82 | % | | | 6.43 | % | | | 2.36 | % | | | 1.94 | % | | | 0.95 | % |

| Bloomberg Barclays U.S. Treasury Inflation-Protected Securities (TIPS) Index* | | | 2.63 | | | | 8.61 | | | | 3.15 | | | | 2.31 | | | | 0.95 | |

| Lipper Inflation Protected Bond Funds Average† | | | 1.94 | | | | 6.87 | | | | 2.49 | | | | 1.64 | | | | 0.42 | |

| * | The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. |

| † | Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Source: Thomson Reuters Lipper. Lipper categories are dynamic and averages may have few funds, especially over longer periods. To see the number of funds included in the Lipper category for each fund’s lifetime, please see the Quarterly Statistical Update, available on our website. |

| American Funds Inflation Linked Bond Fund | 1 |

April 2019; it has mostly traded in a range of between $50 and $60 in the interim. Inflation expectations fared similarly, falling sharply at the end of 2018, climbing through April 2019, and remaining subdued since May.

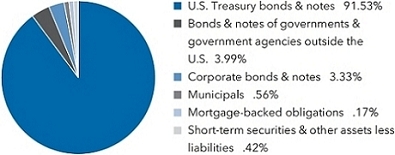

Inside the portfolio

As of November 30, 2019, 91.2% of the fund’s net assets were invested in inflation-linked government bonds, mostly U.S. TIPS. The portfolio’s modest investment in nominal Treasuries increased. Holdings of government bonds from the Eurozone and Japan were among the portfolio’s relatively small non-U.S. exposure.

Investments in corporate bonds accounted for 3.3% of the fund’s assets as of November 30, 2019. Informed by insights from our macroeconomic and fundamental credit analysts, managers recently added to holdings of bonds from energy-related industries; we also found opportunities to invest in firms from the utilities sector.

Consistent with the fund’s investment guidelines, we have made careful use of derivatives. For example, when used in conjunction with bonds, interest rate swaps can help the fund to gain more precisely targeted exposures to inflation and interest rates. A complete list of fund holdings can be found beginning on page 4.

Looking forward

While the past year was a period in which results relative to the benchmark were disappointing, we are pleased to have delivered solid returns (that far outpaced inflation) for fund investors on an absolute basis.

Furthermore, we remain confident that we are appropriately-positioned for an economic cycle that is in its latter stages — especially when you consider recent valuations. With the Fed seemingly likely to be on pause in 2020, we think monetary policy will offer a supportive backdrop for the fund’s portfolio.

And, if market confidence cracks (due to lackluster growth, or an escalation in the U.S.-China trade dispute, for example), then we believe that the fund could be a source of relative resilience for investors. Markets could also be unsettled by political developments in the run up to the 2020 presidential election.

The outlook for inflation appears finely balanced. Rising wages and low unemployment suggest there could be upward pressure on the general level of prices for goods and services. On the other hand, structural developments such as weak growth in the number of people working (or seeking work) could weigh on inflation in the longer term. That said, we are positive on the TIPS asset class, given valuations.

Regardless of how inflation evolves from here, it’s worth underscoring the important role that an investment in this fund can play for investors. It can act as a complement to other bond investments that may not hold up well in an inflationary environment — and provide diversification to equity-heavy portfolios.

We look forward to reporting to you again in six months.

Cordially,

Ritchie R. Tuazon

President

January 15, 2020

For current information about the fund, visit capitalgroup.com.

| 2 | American Funds Inflation Linked Bond Fund |

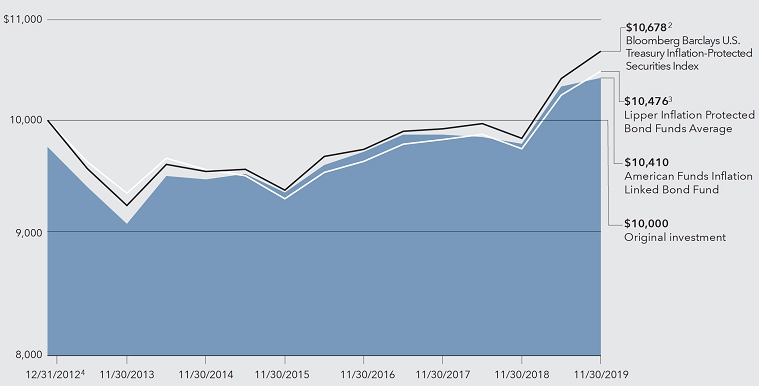

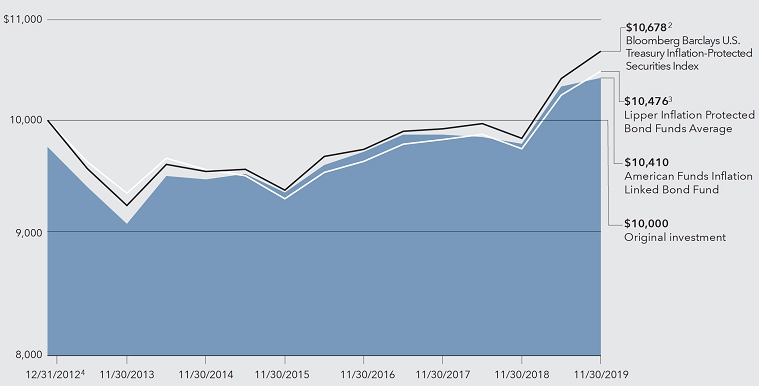

The value of a $10,000 investment

How a $10,000 investment has grown (for the period December 14, 2012, to November 30, 2019, with all distributions reinvested.

Fund results shown, unless otherwise indicated, reflect deduction of the maximum sales charge of 2.50% on the $10,000 investment.1 Thus, the net amount invested was $9,750.

| 1 | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $500,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| 2 | The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. |

| 3 | Results of the Lipper Inflation Protected Bond Funds Average do not reflect any sales charges. Source: Thomson Reuters Lipper. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) with in a given category. Lipper categories are dynamic and averages may have few funds, especially over longer periods. To see the number of funds included in the Lipper category for each fund’s lifetime, please see the Quarterly Statistical Update, available on our website. |

| 4 | For the period December 14, 2012, commencement of operations, through December 31, 2012. |

Past results are not predictive of results for future periods. The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment(for periods ended November 30, 2019)*

| | | Cumulative total return | | Average annual total return |

| | | 1 year | | 5 Years | | Lifetime (since 12/14/12) |

| | | | | | | |

| Class A shares | | 3.82% | | 1.42% | | 0.58% |

| * | Assumes reinvestment of all distributions and payment of the maximum 2.50% sales charge. |

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers and expense reimbursements, without which results would have been lower.

| American Funds Inflation Linked Bond Fund | 3 |

Investment portfolio November 30, 2019

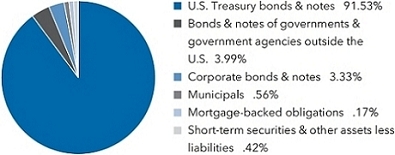

| Portfolio by type of security | Percent of net assets |

| Portfolio quality summary* | | Percent of

net assets |

| U.S. Treasury and agency† | | | 91.53 | % |

| AAA/Aaa | | | .67 | |

| AA/Aa | | | 1.43 | |

| A/A | | | 4.09 | |

| BBB/Baa | | | 1.86 | |

| Short-term securities & other assets less liabilities | | | .42 | |

| | |

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| † | These securities are guaranteed by the full faith and credit of the U.S. government. |

| Bonds, notes & other debt instruments 99.58% | Principal amount

(000) | | | Value

(000) | |

| U.S. Treasury bonds & notes 91.53% | | | | | | |

| U.S. Treasury inflation-protected securities 89.93% | | | | | | | | |

| U.S. Treasury Inflation-Protected Security 1.375% 20201 | | $ | 30,870 | | | $ | 30,905 | |

| U.S. Treasury Inflation-Protected Security 0.125% 20211,2 | | | 31,416 | | | | 31,224 | |

| U.S. Treasury Inflation-Protected Security 0.625% 20211,2 | | | 222,140 | | | | 223,765 | |

| U.S. Treasury Inflation-Protected Security 1.125% 20211 | | | 41,080 | | | | 41,370 | |

| U.S. Treasury Inflation-Protected Security 0.125% 20221 | | | 270,692 | | | | 268,904 | |

| U.S. Treasury Inflation-Protected Security 0.125% 20221 | | | 108,448 | | | | 107,873 | |

| U.S. Treasury Inflation-Protected Security 0.125% 20221 | | | 17,752 | | | | 17,736 | |

| U.S. Treasury Inflation-Protected Security 0.125% 20231 | | | 33,315 | | | | 33,138 | |

| U.S. Treasury Inflation-Protected Security 0.375% 20231 | | | 29,789 | | | | 30,056 | |

| U.S. Treasury Inflation-Protected Security 0.125% 20241 | | | 280,492 | | | | 280,652 | |

| U.S. Treasury Inflation-Protected Security 0.125% 20241 | | | 243,177 | | | | 243,411 | |

| U.S. Treasury Inflation-Protected Security 0.50% 20241 | | | 52,326 | | | | 52,957 | |

| U.S. Treasury Inflation-Protected Security 0.625% 20241 | | | 105,636 | | | | 107,401 | |

| U.S. Treasury Inflation-Protected Security 0.25% 20251 | | | 268,943 | | | | 269,925 | |

| U.S. Treasury Inflation-Protected Security 0.375% 20251,2 | | | 477,791 | | | | 484,595 | |

| U.S. Treasury Inflation-Protected Security 2.375% 20251,2 | | | 31,941 | | | | 35,471 | |

| U.S. Treasury Inflation-Protected Security 0.125% 20261 | | | 134,962 | | | | 134,994 | |

| U.S. Treasury Inflation-Protected Security 0.625% 20261 | | | 177,752 | | | | 182,581 | |

| U.S. Treasury Inflation-Protected Security 2.00% 20261,2 | | | 134,535 | | | | 149,250 | |

| U.S. Treasury Inflation-Protected Security 0.375% 20271 | | | 205,722 | | | | 209,485 | |

| U.S. Treasury Inflation-Protected Security 0.375% 20271 | | | 105,865 | | | | 107,297 | |

| U.S. Treasury Inflation-Protected Security 2.375% 20271,2 | | | 193,776 | | | | 223,539 | |

| U.S. Treasury Inflation-Protected Security 0.50% 20281 | | | 238,780 | | | | 244,875 | |

| U.S. Treasury Inflation-Protected Security 1.75% 20281 | | | 74,760 | | | | 84,042 | |

| U.S. Treasury Inflation-Protected Security 0.25% 20291,2 | | | 689,576 | | | | 695,572 | |

| U.S. Treasury Inflation-Protected Security 0.875% 20291 | | | 69,551 | | | | 73,919 | |

| U.S. Treasury Inflation-Protected Security 2.50% 20291 | | | 2,392 | | | | 2,888 | |

| U.S. Treasury Inflation-Protected Security 2.125% 20401,2 | | | 53,456 | | | | 71,031 | |

| U.S. Treasury Inflation-Protected Security 2.125% 20411,2 | | | 51,001 | | | | 68,434 | |

| U.S. Treasury Inflation-Protected Security 0.75% 20421,2 | | | 56,814 | | | | 60,298 | |

| U.S. Treasury Inflation-Protected Security 0.625% 20431 | | | 11,168 | | | | 11,550 | |

| U.S. Treasury Inflation-Protected Security 1.375% 20441,2 | | | 71,718 | | | | 86,458 | |

| | |

| 4 | American Funds Inflation Linked Bond Fund |

| | Principal amount

(000) | | | Value

(000) | |

| U.S. Treasury Inflation-Protected Security 0.75% 20451,2 | | $ | 122,117 | | | $ | 129,632 | |

| U.S. Treasury Inflation-Protected Security 1.00% 20461,2 | | | 104,941 | | | | 118,070 | |

| U.S. Treasury Inflation-Protected Security 0.875% 20471,2 | | | 174,754 | | | | 191,490 | |

| U.S. Treasury Inflation-Protected Security 1.00% 20481,2 | | | 262,898 | | | | 297,573 | |

| U.S. Treasury Inflation-Protected Security 1.00% 20491,2 | | | 55,200 | | | | 62,857 | |

| | | | | | | | 5,465,218 | |

| | | | | | | | | |

| U.S. Treasury 1.60% | | | | | | | | |

| U.S. Treasury 1.875% 20192 | | | 1,000 | | | | 1,000 | |

| U.S. Treasury 1.25% 2024 | | | 2,000 | | | | 1,966 | |

| U.S. Treasury 1.625% 2026 | | | 85,000 | | | | 84,436 | |

| U.S. Treasury 1.625% 2026 | | | 10,000 | | | | 9,933 | |

| | | | | | | | 97,335 | |

| | | | | | | | | |

| Total U.S. Treasury bonds & notes | | | | | | | 5,562,553 | |

| | | | | | | | | |

| Bonds & notes of governments & government agencies outside the U.S. 3.99% | | | |

| Colombia (Republic of) 5.00% 2045 | | | 600 | | | | 688 | |

| European Stability Mechanism 2.125% 20223 | | | 40,000 | | | | 40,495 | |

| Japan, Series 18, 0.10% 20241 | | ¥ | 2,242,450 | | | | 20,815 | |

| Japan, Series 20, 0.10% 20251 | | | 4,318,000 | | | | 40,278 | |

| South Africa (Republic of), Series R-197, 5.50% 20231 | | ZAR | 755 | | | | 57 | |

| Spain (Kingdom of) 0.25% 2024 | | € | 106,400 | | | | 119,114 | |

| United Kingdom 0.125% 20411 | | £ | 8,354 | | | | 17,020 | |

| Uruguay (Oriental Republic of) 8.50% 2028 | | UYU | 172,200 | | | | 3,930 | |

| | | | | | | | | |

| Total bonds & notes of governments & government agencies outside the U.S. | | | | 242,397 | |

| | | | | | | | | |

| Corporate bonds & notes 3.33% | | | | | | | | |

| Energy 1.26% | | | | | | | | |

| Energy Transfer Partners, LP 6.00% 2048 | | $ | 10,000 | | | | 11,418 | |

| Equinor ASA 3.625% 2028 | | | 13,165 | | | | 14,562 | |

| MPLX LP 4.00% 2028 | | | 2,430 | | | | 2,491 | |

| MPLX LP 4.70% 2048 | | | 10,000 | | | | 9,924 | |

| Occidental Petroleum Corp. 2.60% 2021 | | | 24,802 | | | | 24,928 | |

| Occidental Petroleum Corp. 2.90% 2024 | | | 10,841 | | | | 10,913 | |

| Petróleos Mexicanos 7.47% 2026 | | MXN | 30 | | | | 1 | |

| Sabine Pass Liquefaction, LLC 4.20% 2028 | | $ | 2,225 | | | | 2,344 | |

| | | | | | | | 76,581 | |

| | | | | | | | | |

| Utilities 0.91% | | | | | | | | |

| Consumers Energy Co. 4.05% 2048 | | | 8,570 | | | | 9,987 | |

| FirstEnergy Corp. 3.90% 2027 | | | 4,725 | | | | 5,068 | |

| FirstEnergy Corp. 4.85% 2047 | | | 4,890 | | | | 5,809 | |

| Mississippi Power Co. 4.25% 2042 | | | 1,660 | | | | 1,806 | |

| Public Service Enterprise Group Inc. 3.20% 2049 | | | 8,250 | | | | 8,522 | |

| Tampa Electric Co. 4.45% 2049 | | | 8,070 | | | | 9,757 | |

| Virginia Electric and Power Co. 3.80% 2028 | | | 7,925 | | | | 8,648 | |

| Virginia Electric and Power Co. 2.875% 2029 | | | 2,800 | | | | 2,869 | |

| Wisconsin Electric Power Co. 4.30% 2048 | | | 2,600 | | | | 3,124 | |

| | | | | | | | 55,590 | |

| | | | | | | | | |

| Consumer staples 0.39% | | | | | | | | |

| Conagra Brands, Inc. 4.85% 2028 | | | 6,400 | | | | 7,275 | |

| Keurig Dr Pepper Inc. 4.057% 2023 | | | 10,650 | | | | 11,267 | |

| Keurig Dr Pepper Inc. 5.085% 2048 | | | 4,291 | | | | 5,162 | |

| | | | | | | | 23,704 | |

| | | | | | | | | |

| Health care 0.28% | | | | | | | | |

| Becton, Dickinson and Co. 3.70% 2027 | | | 7,700 | | | | 8,250 | |

| Cigna Corp. 4.90% 2048 | | | 7,175 | | | | 8,529 | |

| | | | | | | | 16,779 | |

| | | | | | | | | |

| Industrials 0.22% | | | | | | | | |

| General Dynamics Corp. 3.75% 2028 | | | 8,650 | | | | 9,624 | |

| United Technologies Corp. 4.125% 2028 | | | 3,265 | | | | 3,679 | |

| | | | | | | | 13,303 | |

| | |

| American Funds Inflation Linked Bond Fund | 5 |

| Bonds, notes & other debt instruments (continued) | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds & notes (continued) | | | | | | |

| Consumer discretionary 0.14% | | | | | | | | |

| Boston University 4.061% 2048 | | $ | 2,075 | | | $ | 2,486 | |

| Home Depot, Inc. 4.50% 2048 | | | 4,639 | | | | 5,818 | |

| | | | | | | | 8,304 | |

| | | | | | | | | |

| Communication services 0.13% | | | | | | | | |

| Verizon Communications Inc. 4.50% 2033 | | | 7,000 | | | | 8,195 | |

| | | | | | | | | |

| Total corporate bonds & notes | | | | | | | 202,456 | |

| | | | | | | | | |

| Municipals 0.56% | | | | | | | | |

| California 0.56% | | | | | | | | |

| South Pasadena Unified School Dist., G.O. Bonds, 2016 Election, Series 2019-B, 3.404% 2049 | | | 29,960 | | | | 29,981 | |

| South Pasadena Unified School Dist., G.O. Bonds, 2016 Election, Series 2019-B, 5.00% 2039 | | | 3,545 | | | | 4,140 | |

| | | | | | | | | |

| Total municipals | | | | | | | 34,121 | |

| | | | | | | | | |

| Mortgage-backed obligations 0.17% | | | | | | | | |

| Collateralized mortgage-backed obligations 0.17% | | | | | | | | |

| Legacy Mortgage Asset Trust, Series 2019-GS5, Class A1, 3.20% 20593,4,5 | | | 10,221 | | | | 10,252 | |

| | | | | | | | | |

| Total mortgage-backed obligations | | | | | | | 10,252 | |

| | | | | | | | | |

| Total bonds, notes & other debt instruments(cost: $5,857,409,000) | | | | | | | 6,051,779 | |

| | | | | | | | | |

| Short-term securities 1.90% | | Shares | | | | | |

| Money market investments 1.90% | | | | | | | | |

| Capital Group Central Cash Fund 1.78%6 | | | 1,155,031 | | | | 115,503 | |

| | | | | | | | | |

| Total short-term securities(cost: $115,503,000) | | | | | | | 115,503 | |

| Total investment securities 101.48%(cost: $5,972,912,000) | | | | | | | 6,167,282 | |

| Other assets less liabilities (1.48)% | | | | | | | (90,071 | ) |

| | | | | | | | | |

| Net assets 100.00% | | | | | | $ | 6,077,211 | |

Futures contracts

| Contracts | | Type | | Number of

contracts | | | Expiration | | Notional

amount

(000) | 7

| | Value at

11/30/2019

(000) | 8

| Unrealized

(depreciation)

appreciation

at 11/30/2019

(000) | |

| 30 Day Federal Funds Futures | | Long | | | 3,045 | | | January 2020 | | $ | 1,268,852 | | | $ | 1,249,057 | | | $ | (893 | ) |

| 90 Day Euro Dollar Futures | | Long | | | 5,022 | | | March 2020 | | | 1,255,500 | | | | 1,233,905 | | | | 4,117 | |

| 90 Day Euro Dollar Futures | | Short | | | 547 | | | March 2021 | | | (136,750 | ) | | | (134,753 | ) | | | 271 | |

| 2 Year U.S. Treasury Note Futures | | Short | | | 3,825 | | | April 2020 | | | (765,000 | ) | | | (824,616 | ) | | | 182 | |

| 5 Year Euro-Bobl Futures | | Long | | | 638 | | | December 2019 | | € | 63,800 | | | | 94,411 | | | | (1,603 | ) |

| 5 Year U.S. Treasury Note Futures | | Long | | | 14,035 | | | April 2020 | | $ | 1,403,500 | | | | 1,669,726 | | | | (740 | ) |

| 10 Year Euro-Bund Futures | | Long | | | 305 | | | December 2019 | | € | 30,500 | | | | 57,483 | | | | (958 | ) |

| 10 Year U.S. Treasury Note Futures | | Long | | | 695 | | | March 2020 | | $ | 69,500 | | | | 89,905 | | | | (33 | ) |

| 10 Year Ultra U.S. Treasury Note Futures | | Short | | | 3,569 | | | March 2020 | | | (356,900 | ) | | | (507,579 | ) | | | 629 | |

| 20 Year U.S. Treasury Bond Futures | | Short | | | 187 | | | March 2020 | | | (18,700 | ) | | | (29,727 | ) | | | 139 | |

| 30 Year Euro-Buxl Futures | | Long | | | 270 | | | December 2019 | | € | 27,000 | | | | 61,955 | | | | (3,308 | ) |

| 30 Year Ultra U.S. Treasury Bond Futures | | Short | | | 2,254 | | | March 2020 | | $ | (225,400 | ) | | | (423,118 | ) | | | (954 | ) |

| | | | | | | | | | | | | | | | | | | $ | (3,151 | ) |

| | |

| 6 | American Funds Inflation Linked Bond Fund |

Forward currency contracts

| Contract amount | | | | | Unrealized

appreciation

(depreciation) | |

Purchases

(000) | | Sales

(000) | | Counterparty | | Settlement

date | at 11/30/2019

(000) | |

| USD9,830 | | MXN189,916 | | HSBC Bank | | 12/11/2019 | | $ | 134 | |

| USD4,397 | | CAD5,785 | | Bank of New York Mellon | | 12/11/2019 | | | 42 | |

| USD4,106 | | EUR3,700 | | Bank of New York Mellon | | 12/11/2019 | | | 26 | |

| JPY2,061,479 | | USD18,925 | | JPMorgan Chase | | 12/11/2019 | | | (75 | ) |

| USD10,365 | | SEK100,000 | | Citibank | | 12/11/2019 | | | (83 | ) |

| NZD23,540 | | USD14,994 | | Standard Chartered Bank | | 12/12/2019 | | | 117 | |

| USD11,409 | | MXN220,400 | | Citibank | | 12/13/2019 | | | 160 | |

| USD190 | | CAD250 | | JPMorgan Chase | | 12/13/2019 | | | 2 | |

| JPY1,466,000 | | USD13,474 | | Goldman Sachs | | 12/13/2019 | | | (65 | ) |

| JPY3,431,000 | | USD31,478 | | UBS AG | | 12/16/2019 | | | (87 | ) |

| USD13,508 | | GBP10,510 | | Bank of America, N.A. | | 12/16/2019 | | | (95 | ) |

| EUR21,658 | | MXN460,000 | | Citibank | | 12/17/2019 | | | 428 | |

| AUD14,700 | | USD10,089 | | UBS AG | | 12/17/2019 | | | (140 | ) |

| EUR59,300 | | USD65,794 | | Citibank | | 12/19/2019 | | | (359 | ) |

| USD120,006 | | EUR108,100 | | Citibank | | 12/20/2019 | | | 711 | |

| USD5,853 | | EUR5,300 | | Barclays Bank PLC | | 12/20/2019 | | | 4 | |

| EUR11,600 | | USD12,863 | | Morgan Stanley | | 12/20/2019 | | | (62 | ) |

| AUD23,900 | | USD16,278 | | JPMorgan Chase | | 12/20/2019 | | | (102 | ) |

| USD23,857 | | MXN466,000 | | Goldman Sachs | | 1/6/2020 | | | 153 | |

| CAD6,035 | | USD4,541 | | HSBC Bank | | 1/7/2020 | | | 4 | |

| MXN309,932 | | USD15,874 | | Barclays Bank PLC | | 1/7/2020 | | | (111 | ) |

| USD27,799 | | KRW32,489,550 | | Citibank | | 1/9/2020 | | | 261 | |

| COP38,740,000 | | USD11,214 | | Citibank | | 1/9/2020 | | | (226 | ) |

| | | | | | | | | $ | 637 | |

Swap contracts

Interest rate swaps

| Receive | | Pay | | Expiration

date | | Notional

(000) | | Value at

11/30/2019

(000) | | Upfront

payments/

receipts

(000) | | Unrealized

(depreciation)

appreciation

at 11/30/2019

(000) | |

| 1.555% | | U.S. EFFR | | 1/29/2020 | | $8,297,600 | | $ | (119 | ) | | $ | — | | | $ | (119 | ) |

| 1.5365% | | U.S. EFFR | | 1/29/2020 | | 5,475,600 | | | (216 | ) | | | — | | | | (216 | ) |

| 1.535% | | U.S. EFFR | | 1/29/2020 | | 5,744,700 | | | (239 | ) | | | — | | | | (239 | ) |

| 1.538% | | U.S. EFFR | | 1/29/2020 | | 8,123,000 | | | (304 | ) | | | — | | | | (304 | ) |

| 1.531% | | U.S. EFFR | | 3/18/2020 | | 3,613,900 | | | (20 | ) | | | — | | | | (20 | ) |

| 1.5305% | | U.S. EFFR | | 3/18/2020 | | 9,147,000 | | | (57 | ) | | | — | | | | (57 | ) |

| 1.515% | | U.S. EFFR | | 3/18/2020 | | 3,272,000 | | | (89 | ) | | | — | | | | (89 | ) |

| 1.5155% | | U.S. EFFR | | 3/18/2020 | | 6,918,200 | | | (184 | ) | | | — | | | | (184 | ) |

| 1.5135% | | U.S. EFFR | | 3/18/2020 | | 6,916,900 | | | (203 | ) | | | — | | | | (203 | ) |

| 7.14% | | 28-day MXN-TIIE | | 4/29/2020 | | MXN1,633,150 | | | (117 | ) | | | — | | | | (117 | ) |

| 7.87% | | 28-day MXN-TIIE | | 5/8/2020 | | 1,452,815 | | | 135 | | | | — | | | | 135 | |

| 7.84% | | 28-day MXN-TIIE | | 5/8/2020 | | 792,185 | | | 69 | | | | — | | | | 69 | |

| 6.78% | | 28-day MXN-TIIE | | 7/6/2020 | | 777,690 | | | (131 | ) | | | — | | | | (131 | ) |

| 2.37325% | | U.S. EFFR | | 3/6/2021 | | $ 566,100 | | | 6,111 | | | | — | | | | 6,111 | |

| 2.1125% | | U.S. EFFR | | 3/28/2021 | | 460,300 | | | 3,617 | | | | — | | | | 3,617 | |

| 2.103% | | U.S. EFFR | | 3/28/2021 | | 110,000 | | | 851 | | | | — | | | | 851 | |

| 3-month USD-LIBOR | | 2.367% | | 3/28/2021 | | 68,800 | | | (598 | ) | | | — | | | | (598 | ) |

| 2.19875% | | U.S. EFFR | | 5/7/2021 | | 483,100 | | | 4,829 | | | | — | | | | 4,829 | |

| 1.665% | | U.S. EFFR | | 6/20/2021 | | 737,000 | | | 2,271 | | | | — | | | | 2,271 | |

| 1.7775% | | 3-month USD-LIBOR | | 6/21/2021 | | 1,345,400 | | | 2,168 | | | | — | | | | 2,168 | |

| 1.355% | | U.S. EFFR | | 10/24/2021 | | 115,400 | | | (19 | ) | | | — | | | | (19 | ) |

| 1.3475% | | U.S. EFFR | | 10/24/2021 | | 312,500 | | | (95 | ) | | | — | | | | (95 | ) |

| 1.339% | | U.S. EFFR | | 10/24/2021 | | 209,800 | | | (97 | ) | | | — | | | | (97 | ) |

| 1.3065% | | U.S. EFFR | | 10/25/2021 | | 283,300 | | | (304 | ) | | | — | | | | (304 | ) |

| 1.305% | | U.S. EFFR | | 10/25/2021 | | 308,600 | | | (339 | ) | | | — | | | | (339 | ) |

| 1.39% | | U.S. EFFR | | 10/31/2021 | | 517,300 | | | 292 | | | | — | | | | 292 | |

| 1.3615% | | U.S. EFFR | | 11/1/2021 | | 258,600 | | | 9 | | | | — | | | | 9 | |

| | |

| American Funds Inflation Linked Bond Fund | 7 |

Swap contracts(continued)

Interest rate swaps (continued)

| Receive | | Pay | | Expiration

date | | Notional

(000) | | Value at

11/30/2019

(000) | | Upfront

payments/

receipts

(000) | | Unrealized

(depreciation)

appreciation

at 11/30/2019

(000) | |

| 1.332% | | U.S. EFFR | | 11/4/2021 | | $ 56,000 | | $ | (29 | ) | | $ | — | | | $ | (29 | ) |

| 1.281% | | U.S. EFFR | | 11/4/2021 | | 258,900 | | | (388 | ) | | | — | | | | (388 | ) |

| 1.411% | | U.S. EFFR | | 11/7/2021 | | 345,875 | | | 350 | | | | — | | | | 350 | |

| 1.3925% | | U.S. EFFR | | 11/7/2021 | | 345,875 | | | 226 | | | | — | | | | 226 | |

| 8.54% | | 28-day MXN-TIIE | | 1/6/2022 | | MXN813,614 | | | 1,451 | | | | — | | | | 1,451 | |

| 8.44% | | 28-day MXN-TIIE | | 1/7/2022 | | 916,386 | | | 1,544 | | | | — | | | | 1,544 | |

| 2.197% | | U.S. EFFR | | 4/18/2022 | | $ 489,000 | | | 9,161 | | | | — | | | | 9,161 | |

| 6.99% | | 28-day MXN-TIIE | | 6/17/2022 | | MXN480,000 | | | 151 | | | | — | | | | 151 | |

| 1.8475% | | 3-month USD-LIBOR | | 7/11/2022 | | $ 193,600 | | | 1,247 | | | | — | | | | 1,247 | |

| 2.80% | | 3-month USD-LIBOR | | 9/2/2022 | | 280,000 | | | 7,035 | | | | — | | | | 7,035 | |

| 2.75% | | 3-month USD-LIBOR | | 9/2/2022 | | 280,000 | | | 6,763 | | | | — | | | | 6,763 | |

| 1.5675% | | 3-month USD-LIBOR | | 8/17/2023 | | 270,000 | | | 250 | | | | — | | | | 250 | |

| 3-month USD-LIBOR | | 2.18075% | | 3/29/2024 | | 29,400 | | | (732 | ) | | | — | | | | (732 | ) |

| 3-month USD-LIBOR | | 2.194% | | 3/29/2024 | | 29,600 | | | (753 | ) | | | — | | | | (753 | ) |

| 3-month USD-LIBOR | | 2.21875% | | 3/29/2024 | | 31,000 | | | (821 | ) | | | — | | | | (821 | ) |

| 3-month USD-LIBOR | | 2.221% | | 4/1/2024 | | 23,000 | | | (611 | ) | | | — | | | | (611 | ) |

| 3-month USD-LIBOR | | 2.365% | | 5/2/2024 | | 428,700 | | | (14,316 | ) | | | — | | | | (14,316 | ) |

| 3-month USD-LIBOR | | 1.7935% | | 7/12/2024 | | 46,000 | | | (418 | ) | | | — | | | | (418 | ) |

| 2.319% | | 3-month USD-LIBOR | | 6/15/2025 | | 340,000 | | | 12,252 | | | | — | | | | 12,252 | |

| 3-month USD-LIBOR | | 1.867% | | 7/11/2025 | | 274,100 | | | (2,083 | ) | | | — | | | | (2,083 | ) |

| 2.344% | | 3-month USD-LIBOR | | 9/25/2025 | | 449,000 | | | 16,649 | | | | — | | | | 16,649 | |

| 6-month JPY-LIBOR | | 0.228% | | 2/8/2026 | | ¥4,250,000 | | | (619 | ) | | | — | | | | (619 | ) |

| 28-day MXN-TIIE | | 8.11% | | 1/11/2027 | | MXN800,000 | | | (3,122 | ) | | | — | | | | (3,122 | ) |

| 28-day MXN-TIIE | | 8.135% | | 1/14/2027 | | 453,000 | | | (1,803 | ) | | | — | | | | (1,803 | ) |

| 28-day MXN-TIIE | | 7.625% | | 5/20/2027 | | 385,000 | | | (966 | ) | | | — | | | | (966 | ) |

| U.S. EFFR | | 2.045% | | 11/2/2027 | | $ 290,000 | | | (14,160 | ) | | | — | | | | (14,160 | ) |

| 2.91% | | 3-month USD-LIBOR | | 2/1/2028 | | 70,300 | | | 3,937 | | | | — | | | | 3,937 | |

| 2.908% | | 3-month USD-LIBOR | | 2/1/2028 | | 70,300 | | | 3,931 | | | | — | | | | 3,931 | |

| 2.925% | | 3-month USD-LIBOR | | 2/1/2028 | | 56,200 | | | 3,186 | | | | — | | | | 3,186 | |

| 2.92% | | 3-month USD-LIBOR | | 2/2/2028 | | 53,200 | | | 3,003 | | | | — | | | | 3,003 | |

| 6-month GBP-LIBOR | | 1.6567% | | 9/28/2028 | | £ 44,000 | | | (3,745 | ) | | | — | | | | (3,745 | ) |

| 28-day MXN-TIIE | | 8.855% | | 12/28/2028 | | MXN511,419 | | | (3,617 | ) | | | — | | | | (3,617 | ) |

| 3-month USD-LIBOR | | 2.724% | | 2/5/2029 | | $ 219,770 | | | (19,710 | ) | | | — | | | | (19,710 | ) |

| 3-month USD-LIBOR | | 2.3665% | | 3/27/2029 | | 24,000 | | | (1,426 | ) | | | — | | | | (1,426 | ) |

| 3-month USD-LIBOR | | 1.9675% | | 6/21/2029 | | 288,900 | | | (7,070 | ) | | | — | | | | (7,070 | ) |

| 3-month USD-LIBOR | | 1.995% | | 7/19/2029 | | 76,400 | | | (2,063 | ) | | | — | | | | (2,063 | ) |

| 3-month USD-LIBOR | | 2.494% | | 6/15/2030 | | 180,000 | | | (13,022 | ) | | | — | | | | (13,022 | ) |

| 3-month USD-LIBOR | | 2.97125% | | 9/2/2030 | | 57,050 | | | (6,585 | ) | | | — | | | | (6,585 | ) |

| 3-month USD-LIBOR | | 3.005% | | 9/2/2030 | | 57,050 | | | (6,762 | ) | | | — | | | | (6,762 | ) |

| 3-month USD-LIBOR | | 2.507% | | 9/25/2030 | | 239,000 | | | (17,316 | ) | | | — | | | | (17,316 | ) |

| 3-month USD-LIBOR | | 1.83% | | 8/17/2031 | | 58,000 | | | (387 | ) | | | — | | | | (387 | ) |

| 3-month USD-LIBOR | | 2.986% | | 2/1/2038 | | 33,900 | | | (2,658 | ) | | | — | | | | (2,658 | ) |

| 3-month USD-LIBOR | | 2.9625% | | 2/1/2038 | | 42,100 | | | (3,221 | ) | | | — | | | | (3,221 | ) |

| 3-month USD-LIBOR | | 2.963% | | 2/1/2038 | | 42,200 | | | (3,230 | ) | | | — | | | | (3,230 | ) |

| 3-month USD-LIBOR | | 2.967% | | 2/2/2038 | | 32,800 | | | (2,521 | ) | | | — | | | | (2,521 | ) |

| 6-month GBP-LIBOR | | 1.5872% | | 2/5/2039 | | £ 3,600 | | | (483 | ) | | | — | | | | (483 | ) |

| 6-month GBP-LIBOR | | 1.5877% | | 2/5/2039 | | 6,100 | | | (819 | ) | | | — | | | | (819 | ) |

| 3-month USD-LIBOR | | 3.253% | | 10/29/2048 | | $ 4 | | | (1 | ) | | | — | | | | (1 | ) |

| 3-month USD-LIBOR | | 2.195% | | 6/24/2049 | | 127,200 | | | (9,613 | ) | | | — | | | | (9,613 | ) |

| | | | | | | | | | | | | $ | — | | | $ | (56,713 | ) |

Credit default swaps

Centrally cleared credit default swaps on credit indices — buy protection

| Receive | | Pay/

Payment frequency | | Expiration

date | | Notional

(000) | | Value at

11/30/2019

(000) | | Upfront

payments

(000) | | Unrealized

depreciation

at 11/30/2019

(000) | |

| CDX.NA.IG.33 | | 1.00%/Quarterly | | 12/20/2024 | | $1,145,000 | | $ | (27,582 | ) | | $ | (23,526 | ) | | $ | (4,056 | ) |

| | |

| 8 | American Funds Inflation Linked Bond Fund |

| 1 | Index-linked bond whose principal amount moves with a government price index. |

| 2 | All or a portion of this security was pledged as collateral. The total value of pledged collateral was $94,739,000, which represented 1.56% of the net assets of the fund. |

| 3 | Acquired in a transaction exempt from registration under Rule 144A of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities was $50,747,000, which represented .84% of the net assets of the fund. |

| 4 | Principal payments may be made periodically. Therefore, the effective maturity date may be earlier than the stated maturity date. |

| 5 | Coupon rate may change periodically. |

| 6 | Rate represents the seven-day yield at 11/30/2019. |

| 7 | Notional amount is calculated based on the number of contracts and notional contract size. |

| 8 | Value is calculated based on the notional amount and current market price. |

Key to abbreviations and symbols

AUD = Australian dollars

CAD = Canadian dollars

COP = Colombian pesos

Dist. = District

EFFR = Effective Federal Funds Rate

EUR/€ = Euros

G.O. = General Obligation

GBP/£ = British pounds

JPY/¥ = Japanese yen

KRW = South Korean won

LIBOR = London Interbank Offered Rate

MXN = Mexican pesos

NZD = New Zealand dollars

SEK = Swedish kronor

TIIE = Equilibrium Interbank Interest Rate

USD/$ = U.S. dollars

UYU = Uruguayan pesos

ZAR = South African rand

See notes to financial statements.

| American Funds Inflation Linked Bond Fund | 9 |

Financial statements

| Statement of assets and liabilities | | | | | | |

| at November 30, 2019 | | (dollars in thousands) | |

| | | | | | | | | |

| Assets: | | | | | | | | |

| Investment securities in unaffiliated issuers, at value (cost: $5,972,912) | | | | | | $ | 6,167,282 | |

| Cash | | | | | | | 1,022 | |

| Cash denominated in currencies other than U.S. dollars (cost: $1,792) | | | | | | | 1,792 | |

| Unrealized appreciation on open forward currency contracts | | | | | | | 2,042 | |

| Receivables for: | | | | | | | | |

| Sales of fund’s shares | | $ | 12,299 | | | | | |

| Dividends and interest | | | 13,830 | | | | | |

| Variation margin on futures contracts | | | 1,938 | | | | | |

| Variation margin on swap contracts | | | 8,269 | | | | 36,336 | |

| | | | | | | | 6,208,474 | |

| Liabilities: | | | | | | | | |

| Unrealized depreciation on open forward currency contracts | | | | | | | 1,405 | |

| Payables for: | | | | | | | | |

| Purchases of investments | | | 118,848 | | | | | |

| Repurchases of fund’s shares | | | 675 | | | | | |

| Investment advisory services | | | 1,371 | | | | | |

| Services provided by related parties | | | 386 | | | | | |

| Trustees’ deferred compensation | | | 29 | | | | | |

| Variation margin on futures contracts | | | 768 | | | | | |

| Variation margin on swap contracts | | | 7,770 | | | | | |

| Other | | | 11 | | | | 129,858 | |

| Net assets at November 30, 2019 | | | | | | $ | 6,077,211 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Capital paid in on shares of beneficial interest | | | | | | $ | 5,915,584 | |

| Total distributable earnings | | | | | | | 161,627 | |

| Net assets at November 30, 2019 | | | | | | $ | 6,077,211 | |

(dollars and shares in thousands, except per-share amounts)

Shares of beneficial interest issued and outstanding (no stated par value) —

unlimited shares authorized (611,030 total shares outstanding)

| | | Net assets | | | Shares

outstanding | | | Net asset

value per share | |

| Class A | | $ | 655,498 | | | | 66,289 | | | $ | 9.89 | |

| Class C | | | 11,192 | | | | 1,145 | | | | 9.78 | |

| Class T | | | 10 | | | | 1 | | | | 9.90 | |

| Class F-1 | | | 32,900 | | | | 3,325 | | | | 9.89 | |

| Class F-2 | | | 426,365 | | | | 42,891 | | | | 9.94 | |

| Class F-3 | | | 204,447 | | | | 20,598 | | | | 9.93 | |

| Class 529-A | | | 25,982 | | | | 2,627 | | | | 9.89 | |

| Class 529-C | | | 2,469 | | | | 252 | | | | 9.79 | |

| Class 529-E | | | 1,106 | | | | 112 | | | | 9.84 | |

| Class 529-T | | | 11 | | | | 1 | | | | 9.90 | |

| Class 529-F-1 | | | 4,902 | | | | 494 | | | | 9.92 | |

| Class R-1 | | | 351 | | | | 36 | | | | 9.80 | |

| Class R-2 | | | 5,372 | | | | 553 | | | | 9.72 | |

| Class R-2E | | | 1,626 | | | | 165 | | | | 9.85 | |

| Class R-3 | | | 9,806 | | | | 999 | | | | 9.81 | |

| Class R-4 | | | 8,335 | | | | 843 | | | | 9.89 | |

| Class R-5E | | | 3,920 | | | | 395 | | | | 9.91 | |

| Class R-5 | | | 3,419 | | | | 344 | | | | 9.95 | |

| Class R-6 | | | 4,679,500 | | | | 469,960 | | | | 9.96 | |

See notes to financial statements.

| 10 | American Funds Inflation Linked Bond Fund |

| Statement of operations | | | | | | |

| for the year ended November 30, 2019 | | (dollars in thousands) | |

| | | | | | | |

| Investment income: | | | | | | | | |

| Income: | | | | | | | | |

| Interest | | $ | 122,945 | | | | | |

| Dividends | | | 4,375 | | | $ | 127,320 | |

| Fees and expenses*: | | | | | | | | |

| Investment advisory services | | | 15,128 | | | | | |

| Distribution services | | | 2,334 | | | | | |

| Transfer agent services | | | 1,334 | | | | | |

| Administrative services | | | 2,062 | | | | | |

| Reports to shareholders | | | 104 | | | | | |

| Registration statement and prospectus | | | 460 | | | | | |

| Trustees’ compensation | | | 32 | | | | | |

| Auditing and legal | | | 56 | | | | | |

| Custodian | | | 49 | | | | | |

| Other | | | 56 | | | | | |

| Total fees and expenses before waiver | | | 21,615 | | | | | |

| Less transfer agent services waiver | | | 26 | | | | | |

| Total fees and expenses after waiver | | | | | | | 21,589 | |

| Net investment income | | | | | | | 105,731 | |

| | | | | | | | | |

| Net realized loss and unrealized appreciation: | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments in unaffiliated issuers | | | 56,205 | | | | | |

| Futures contracts | | | (36,797 | ) | | | | |

| Forward currency contracts | | | 397 | | | | | |

| Swap contracts | | | (70,482 | ) | | | | |

| Currency transactions | | | (188 | ) | | | (50,865 | ) |

| Net unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments in unaffiliated issuers | | | 356,393 | | | | | |

| Futures contracts | | | (4,605 | ) | | | | |

| Forward currency contracts | | | 404 | | | | | |

| Swap contracts | | | (63,467 | ) | | | 288,725 | |

| Net realized loss and unrealized appreciation | | | | | | | 237,860 | |

| | | | | | | | | |

| Net increase in net assets resulting from operations | | | | | | $ | 343,591 | |

| * | Additional information related to class-specific fees and expenses is included in the notes to financial statements. |

See notes to financial statements.

| American Funds Inflation Linked Bond Fund | 11 |

Statements of changes in net assets

| | | (dollars in thousands) | |

| | | | |

| | | Year ended November 30, | |

| | | 2019 | | | 2018 | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 105,731 | | | $ | 111,837 | |

| Net realized (loss) gain | | | (50,865 | ) | | | 13,521 | |

| Net unrealized appreciation (depreciation) | | | 288,725 | | | | (151,293 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 343,591 | | | | (25,935 | ) |

| | | | | | | | | |

| Distributions paid to shareholders | | | (139,150 | ) | | | (66,747 | ) |

| | | | | | | | | |

| Net capital share transactions | | | 1,075,116 | | | | 1,138,825 | |

| | | | | | | | | |

| Total increase in net assets | | | 1,279,557 | | | | 1,046,143 | |

| | | | | | | | | |

| Net assets: | | | | | | | | |

| Beginning of year | | | 4,797,654 | | | | 3,751,511 | |

| End of year | | $ | 6,077,211 | | | $ | 4,797,654 | |

See notes to financial statements.

| 12 | American Funds Inflation Linked Bond Fund |

Notes to financial statements

1. Organization

American Funds Inflation Linked Bond Fund (the “fund”) is registered under the Investment Company Act of 1940 as an open-end, diversified management investment company. The fund seeks to provide inflation protection and income consistent with investment in inflation linked securities.

The fund has 19 share classes consisting of six retail share classes (Classes A, C, T, F-1, F-2 and F-3), five 529 college savings plan share classes (Classes 529-A, 529-C, 529-E, 529-T and 529-F-1) and eight retirement plan share classes (Classes R-1, R-2, R-2E, R-3, R-4, R-5E, R-5 and R-6). The 529 college savings plan share classes can be used to save for college education. The retirement plan share classes are generally offered only through eligible employer-sponsored retirement plans. The fund’s share classes are described further in the following table:

| Share class | | Initial sales

charge | | Contingent deferred sales

charge upon redemption | | Conversion feature |

| Classes A and 529-A | | Up to 2.50% | | None (except 1% for certain redemptions within 18 months of purchase without an initial sales charge) | | None |

| Class C* | | None | | 1% for redemptions within one year of purchase | | Class C converts to Class F-1 after 10 years |

| Class 529-C* | | None | | 1% for redemptions within one year of purchase | | Class 529-C converts to Class 529-A after 10 years |

| Class 529-E | | None | | None | | None |

| Classes T and 529-T* | | Up to 2.50% | | None | | None |

| Classes F-1, F-2, F-3 and 529-F-1 | | None | | None | | None |

| Classes R-1, R-2, R-2E, R-3, R-4, R-5E, R-5 and R-6 | | None | | None | | None |

| * | Class C, T, 529-C and 529-T shares are not available for purchase. |

Holders of all share classes have equal pro rata rights to the assets, dividends and liquidation proceeds of the fund. Each share class has identical voting rights, except for the exclusive right to vote on matters affecting only its class. Share classes have different fees and expenses (“class-specific fees and expenses”), primarily due to different arrangements for distribution, transfer agent and administrative services. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different per-share dividends by each share class.

2. Significant accounting policies

The fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. The fund’s financial statements have been prepared to comply with U.S. generally accepted accounting principles (“U.S. GAAP”). These principles require the fund’s investment adviser to make estimates and assumptions that affect reported amounts and disclosures. Actual results could differ from those estimates. Subsequent events, if any, have been evaluated through the date of issuance in the preparation of the financial statements. The fund follows the significant accounting policies described in this section, as well as the valuation policies described in the next section on valuation.

Security transactions and related investment income — Security transactions are recorded by the fund as of the date the trades are executed with brokers. Realized gains and losses from security transactions are determined based on the specific identified cost of the securities. In the event a security is purchased with a delayed payment date, the fund will segregate liquid assets sufficient to meet its payment obligations. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Market discounts, premiums and original issue discounts on fixed-income securities are amortized daily over the expected life of the security.

Class allocations — Income, fees and expenses (other than class-specific fees and expenses) and realized and unrealized gains and losses are allocated daily among the various share classes based on their relative net assets. Class-specific fees and expenses, such as distribution, transfer agent and administrative services, are charged directly to the respective share class.

Distributions paid to shareholders — Income dividends and capital gain distributions are recorded on the ex-dividend date.

| American Funds Inflation Linked Bond Fund | 13 |

Currency translation — Assets and liabilities, including investment securities, denominated in currencies other than U.S. dollars are translated into U.S. dollars at the exchange rates supplied by one or more pricing vendors on the valuation date. Purchases and sales of investment securities and income and expenses are translated into U.S. dollars at the exchange rates on the dates of such transactions. The effects of changes in exchange rates on investment securities are included with the net realized gain or loss and net unrealized appreciation or depreciation on investments in the fund’s statement of operations. The realized gain or loss and unrealized appreciation or depreciation resulting from all other transactions denominated in currencies other than U.S. dollars are disclosed separately.

3. Valuation

Capital Research and Management Company (“CRMC”), the fund’s investment adviser, values the fund’s investments at fair value as defined by U.S. GAAP. The net asset value of each share class of the fund is generally determined as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open.

Methods and inputs — The fund’s investment adviser uses the following methods and inputs to establish the fair value of the fund’s assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Fixed-income securities, including short-term securities, are generally valued at prices obtained from one or more pricing vendors. Vendors value such securities based on one or more of the inputs described in the following table. The table provides examples of inputs that are commonly relevant for valuing particular classes of fixed-income securities in which the fund is authorized to invest. However, these classifications are not exclusive, and any of the inputs may be used to value any other class of fixed-income security.

| Fixed-income class | | Examples of standard inputs |

| All | | Benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data (collectively referred to as “standard inputs”) |

| Corporate bonds & notes; convertible securities | | Standard inputs and underlying equity of the issuer |

| Bonds & notes of governments & government agencies | | Standard inputs and interest rate volatilities |

| Mortgage-backed; asset-backed obligations | | Standard inputs and cash flows, prepayment information, default rates, delinquency and loss assumptions, collateral characteristics, credit enhancements and specific deal information |

When the fund’s investment adviser deems it appropriate to do so (such as when vendor prices are unavailable or deemed to be not representative), fixed-income securities will be valued in good faith at the mean quoted bid and ask prices that are reasonably and timely available (or bid prices, if ask prices are not available) or at prices for securities of comparable maturity, quality and type. The Capital Group Central Cash Fund (“CCF”), a fund within the Capital Group Central Fund Series (“Central Funds”), is valued based upon a floating net asset value, which fluctuates with changes in the value of CCF’s portfolio securities. The underlying securities are valued based on the policies and procedures in CCF’s statement of additional information.

Exchange-traded futures are generally valued at the official settlement price of the exchange or market on which such instruments are traded, as of the close of business on the day the futures are being valued. Forward currency contracts are valued at the mean of representative quoted bid and ask prices, generally based on prices supplied by one or more pricing vendors. Interest rate swaps and credit default swaps are generally valued by pricing vendors based on market inputs that include the index and term of index, reset frequency, payer/receiver, currency and pay frequency.

Securities and other assets for which representative market quotations are not readily available or are considered unreliable by the fund’s investment adviser are fair valued as determined in good faith under fair valuation guidelines adopted by authority of the fund’s board of trustees as further described. The investment adviser follows fair valuation guidelines, consistent with U.S. Securities and Exchange Commission rules and guidance, to consider relevant principles and factors when making fair value determinations. The investment adviser considers relevant indications of value that are reasonably and timely available to it in determining the fair value to be assigned to a particular security, such as the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. In addition, the closing prices of equity securities that trade in markets outside U.S. time zones may be adjusted to reflect significant events

| 14 | American Funds Inflation Linked Bond Fund |

that occur after the close of local trading but before the net asset value of each share class of the fund is determined. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations that would have been used had greater market activity occurred.

Processes and structure — The fund’s board of trustees has delegated authority to the fund’s investment adviser to make fair value determinations, subject to board oversight. The investment adviser has established a Joint Fair Valuation Committee (the “Fair Valuation Committee”) to administer, implement and oversee the fair valuation process, and to make fair value decisions. The Fair Valuation Committee regularly reviews its own fair value decisions, as well as decisions made under its standing instructions to the investment adviser’s valuation teams. The Fair Valuation Committee reviews changes in fair value measurements from period to period and may, as deemed appropriate, update the fair valuation guidelines to better reflect the results of back testing and address new or evolving issues. The Fair Valuation Committee reports any changes to the fair valuation guidelines to the board of trustees. The fund’s board and audit committee also regularly review reports that describe fair value determinations and methods.

The fund’s investment adviser has also established a Fixed-Income Pricing Review Group to administer and oversee the fixed-income valuation process, including the use of fixed-income pricing vendors. This group regularly reviews pricing vendor information and market data. Pricing decisions, processes and controls over security valuation are also subject to additional internal reviews, including an annual control self-evaluation program facilitated by the investment adviser’s compliance group.

Classifications — The fund’s investment adviser classifies the fund’s assets and liabilities into three levels based on the inputs used to value the assets or liabilities. Level 1 values are based on quoted prices in active markets for identical securities. Level 2 values are based on significant observable market inputs, such as quoted prices for similar securities and quoted prices in inactive markets. Certain securities trading outside the U.S. may transfer between Level 1 and Level 2 due to valuation adjustments resulting from significant market movements following the close of local trading. Level 3 values are based on significant unobservable inputs that reflect the investment adviser’s determination of assumptions that market participants might reasonably use in valuing the securities. The valuation levels are not necessarily an indication of the risk or liquidity associated with the underlying investment. For example, U.S. government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market. The following tables present the fund’s valuation levels as of November 30, 2019 (dollars in thousands):

| | | Investment securities | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets: | | | | | | | | | | | | | | | | |

| Bonds, notes & other debt instruments: | | | | | | | | | | | | | | | | |

| U.S. Treasury bonds & notes | | $ | — | | | $ | 5,562,553 | | | $ | — | | | $ | 5,562,553 | |

| Bonds & notes of governments & government agencies outside the U.S. | | | — | | | | 242,397 | | | | — | | | | 242,397 | |

| Corporate bonds & notes | | | — | | | | 202,456 | | | | — | | | | 202,456 | |

| Municipals | | | — | | | | 34,121 | | | | — | | | | 34,121 | |

| Mortgage-backed obligations | | | — | | | | 10,252 | | | | — | | | | 10,252 | |

| Short-term securities | | | 115,503 | | | | — | | | | — | | | | 115,503 | |

| Total | | $ | 115,503 | | | $ | 6,051,779 | | | $ | — | | | $ | 6,167,282 | |

| | | | | | | | | | | | | | | | | |

| | | Other investments* | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets: | | | | | | | | | | | | | | | | |

| Unrealized appreciation on futures contracts | | $ | 5,338 | | | $ | — | | | $ | — | | | $ | 5,338 | |

| Unrealized appreciation on open forward currency contracts | | | — | | | | 2,042 | | | | — | | | | 2,042 | |

| Unrealized appreciation on interest rate swaps | | | — | | | | 91,488 | | | | — | | | | 91,488 | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Unrealized depreciation on futures contracts | | | (8,489 | ) | | | — | | | | — | | | | (8,489 | ) |

| Unrealized depreciation on open forward currency contracts | | | — | | | | (1,405 | ) | | | — | | | | (1,405 | ) |

| Unrealized depreciation on interest rate swaps | | | — | | | | (148,201 | ) | | | — | | | | (148,201 | ) |

| Unrealized depreciation on credit default swaps | | | — | | | | (4,056 | ) | | | — | | | | (4,056 | ) |

| Total | | $ | (3,151 | ) | | $ | (60,132 | ) | | $ | — | | | $ | (63,283 | ) |

| * | Futures contracts, forward currency contracts, interest rate swaps and credit default swaps are not included in the investment portfolio. |

| American Funds Inflation Linked Bond Fund | 15 |

4. Risk factors

Investing in the fund may involve certain risks including, but not limited to, those described below.

Market conditions — The prices of, and the income generated by, the securities held by the fund may decline — sometimes rapidly or unpredictably — due to various factors, including events or conditions affecting the general economy or particular industries; overall market changes; local, regional or global political, social or economic instability; governmental, governmental agency or central bank responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

Issuer risks — The prices of, and the income generated by, securities held by the fund may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance, major litigation related to the issuer, changes in government regulations affecting the issuer or its competitive environment and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing in debt instruments — The prices of, and the income generated by, bonds and other debt securities held by the fund may be affected by changing interest rates and by changes in the effective maturities and credit ratings of these securities.

Rising interest rates will generally cause the prices of bonds and other debt securities to fall. A general rise in interest rates may cause investors to sell debt securities on a large scale, which could also adversely affect the price and liquidity of debt securities and could also result in increased redemptions from the fund. Falling interest rates may cause an issuer to redeem, call or refinance a debt security before its stated maturity, which may result in the fund failing to recoup the full amount of its initial investment and having to reinvest the proceeds in lower yielding securities. Longer maturity debt securities generally have greater sensitivity to changes in interest rates and may be subject to greater price fluctuations than shorter maturity debt securities.

Bonds and other debt securities are also subject to credit risk, which is the possibility that the credit strength of an issuer or guarantor will weaken or be perceived to be weaker, and/or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. A downgrade or default affecting any of the fund’s securities could cause the value of the fund’s shares to decrease. Lower quality debt securities generally have higher rates of interest and may be subject to greater price fluctuations than higher quality debt securities. Credit risk is gauged, in part, by the credit ratings of the debt securities in which the fund invests. However, ratings are only the opinions of the rating agencies issuing them and are not guarantees as to credit quality or an evaluation of market risk. The fund’s investment adviser relies on its own credit analysts to research issuers and issues in seeking to assess credit and default risks.

Investing in inflation-linked bonds — The values of inflation-linked bonds generally fluctuate in response to changes in real interest rates — i.e., rates of interest after factoring in inflation. A rise in real interest rates may cause the prices of inflation-linked securities to fall, while a decline in real interest rates may cause the prices to increase. Inflation-linked bonds may experience greater losses than other debt securities with similar durations when real interest rates rise faster than nominal interest rates. There can be no assurance that the value of an inflation-linked security will be directly correlated to changes in interest rates; for example, if interest rates rise for reasons other than inflation, the increase may not be reflected in the security’s inflation measure.

Investing in inflation-linked bonds may also reduce the fund’s distributable income during periods of deflation. If prices for goods and services decline throughout the economy, the principal and income on inflation-linked securities may decline and result in losses to the fund.

Investing in securities backed by the U.S. government — Securities backed by the U.S. Treasury or the full faith and credit of the U.S. government are guaranteed only as to the timely payment of interest and principal when held to maturity. Accordingly, the current market values for these securities will fluctuate with changes in interest rates and the credit rating of the U.S. government. Securities issued by government-sponsored entities and federal agencies and instrumentalities that are not backed by the full faith and credit of the U.S. government are neither issued nor guaranteed by the U.S. government.

Liquidity risk — Certain fund holdings may be or may become difficult or impossible to sell, particularly during times of market turmoil. Liquidity may be impacted by the lack of an active market for a holding, legal or contractual restrictions on resale, or the reduced number and capacity of market participants to make a market in such holding. Market prices for less liquid or illiquid holdings may be volatile, and reduced liquidity may have an adverse impact on the market price of such holdings. Additionally, the sale of less liquid or illiquid holdings may involve substantial delays (including delays in settlement) and additional costs and the fund may be unable to sell such holdings when necessary to meet its liquidity needs or may be forced to sell at a loss.

| 16 | American Funds Inflation Linked Bond Fund |

Investing in derivatives — The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional securities, such as stocks and bonds. Changes in the value of a derivative may not correlate perfectly with, and may be more sensitive to market events than, the underlying asset, rate or index, and a derivative instrument may expose the fund to losses in excess of its initial investment. Derivatives may be difficult to value, difficult for the fund to buy or sell at an opportune time or price and difficult, or even impossible, to terminate or otherwise offset. The fund’s use of derivatives may result in losses to the fund, and investing in derivatives may reduce the fund’s returns and increase the fund’s price volatility. The fund’s counterparty to a derivative transaction (including, if applicable, the fund’s clearing broker, the derivatives exchange or the clearinghouse) may be unable or unwilling to honor its financial obligations in respect of the transaction. In certain cases, the fund may be hindered or delayed in exercising remedies against or closing out derivative instruments with a counterparty, which may result in additional losses.

Investing outside the U.S. — Securities of issuers domiciled outside the U.S., or with significant operations or revenues outside the U.S., may lose value because of adverse political, social, economic or market developments (including social instability, regional conflicts, terrorism and war) in the countries or regions in which the issuers operate or generate revenue. These securities may also lose value due to changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries. Issuers of these securities may be more susceptible to actions of foreign governments, such as nationalization, currency blockage or the imposition of price controls or punitive taxes, each of which could adversely impact the value of these securities. Securities markets in certain countries may be more volatile and/or less liquid than those in the U.S. Investments outside the U.S. may also be subject to different accounting practices and different regulatory, legal and reporting standards and practices, and may be more difficult to value, than those in the U.S. In addition, the value of investments outside the U.S. may be reduced by foreign taxes, including foreign withholding taxes on interest and dividends. Further, there may be increased risks of delayed settlement of securities purchased or sold by the fund. The risks of investing outside the U.S. may be heightened in connection with investments in emerging markets.

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses, including models, tools and data, employed by the investment adviser in this process may be flawed or incorrect and may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives. Your investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, entity or person. You should consider how this fund fits into your overall investment program.

5. Certain investment techniques

Index-linked bonds — The fund has invested in index-linked bonds, which are fixed-income securities whose principal value is periodically adjusted to a government price index. Over the life of an index-linked bond, interest is paid on the adjusted principal value. Increases or decreases in the principal value of index-linked bonds are recorded as interest income in the fund’s statement of operations.

Futures contracts — The fund has entered into futures contracts, which provide for the future sale by one party and purchase by another party of a specified amount of a specific financial instrument for a specified price, date, time and place designated at the time the contract is made. Futures contracts are used to strategically manage the fund’s interest rate sensitivity by increasing or decreasing the duration of the fund or a portion of the fund’s portfolio.

Upon entering into futures contracts, and to maintain the fund’s open positions in futures contracts, the fund is required to deposit with a futures broker, known as a futures commission merchant (“FCM”), in a segregated account in the name of the FCM an amount of cash, U.S. government securities or other liquid securities, known as initial margin. The margin required for a particular futures contract is set by the exchange on which the contract is traded to serve as collateral, and may be significantly modified from time to time by the exchange during the term of the contract. Securities deposited as initial margin, if any, are disclosed in the investment portfolio and cash deposited as initial margin, if any, is reflected as cash pledged for futures contracts in the fund’s statement of assets and liabilities.

On a daily basis, the fund pays or receives variation margin based on the increase or decrease in the value of the futures contracts and records variation margin on futures contracts in the statement of assets and liabilities. In addition, the fund segregates liquid assets equivalent to the fund’s outstanding obligations under the contract in excess of the initial margin and variation margin, if any. Futures contracts may involve a risk of loss in excess of the variation margin shown on the fund’s statement of assets and liabilities. The fund records realized gains or losses at the time the futures contract is closed or expires. Net realized gains or losses and net unrealized appreciation or depreciation from futures contracts are recorded in the fund’s statement of operations. The average month-end notional amount of futures contracts while held was $6,715,450,000.

| American Funds Inflation Linked Bond Fund | 17 |

Forward currency contracts — The fund has entered into forward currency contracts, which represent agreements to exchange currencies on specific future dates at predetermined rates. The fund’s investment adviser uses forward currency contracts to manage the fund’s exposure to changes in exchange rates. Upon entering into these contracts, risks may arise from the potential inability of counterparties to meet the terms of their contracts and from possible movements in exchange rates.

On a daily basis, the fund’s investment adviser values forward currency contracts and records unrealized appreciation or depreciation for open forward currency contracts in the fund’s statement of assets and liabilities. Realized gains or losses are recorded at the time the forward currency contract is closed or offset by another contract with the same broker for the same settlement date and currency.

Closed forward currency contracts that have not reached their settlement date are included in the respective receivables or payables for closed forward currency contracts in the fund’s statement of assets and liabilities. Net realized gains or losses from closed forward currency contracts and net unrealized appreciation or depreciation from open forward currency contracts are recorded in the fund’s statement of operations. The average month-end notional amount of open forward currency contracts while held was $486,728,000.

Interest rate swaps — The fund has entered into interest rate swap contracts, which are agreements to exchange one stream of future interest payments for another based on a specified notional amount. Typically, interest rate swaps exchange a fixed interest rate for a payment that floats relative to a benchmark or vice versa. The fund’s investment adviser uses interest rate swaps to seek to manage the interest rate sensitivity of the fund by increasing or decreasing the duration of the fund or a portion of the fund’s portfolio. Risks may arise as a result of the fund’s investment adviser incorrectly anticipating changes in interest rates, increased volatility, reduced liquidity and the potential inability of counterparties to meet the terms of their agreements.

Upon entering into an interest rate swap contract, the fund is required to deposit cash, U.S. government securities or other liquid securities, which is known as initial margin. Generally, the initial margin required for a particular interest rate swap is set and held as collateral by the clearinghouse on which the contract is cleared. The amount of initial margin required may be significantly modified from time to time by the clearinghouse during the term of the contract.

On a daily basis, the fund’s investment adviser records daily interest accruals related to the exchange of future payments as a receivable and payable in the fund’s statement of assets and liabilities. The fund also pays or receives a variation margin based on the increase or decrease in the value of the interest rate swaps, including accrued interest, and records variation margin on interest rate swaps in the statement of assets and liabilities. The fund records realized gains and losses on both the net accrued interest and any gain or loss recognized at the time the interest rate swap is closed or expires. Net realized gains or losses, as well as any net unrealized appreciation or depreciation, from interest rate swaps are recorded in the fund’s statement of operations. The average month-end notional amount of interest rate swaps while held was $56,047,466,000.

Credit default swap indices — The fund has entered into centrally cleared credit default swap agreements on credit indices (“CDSI”) that involve one party (the protection buyer) making a stream of payments to another party (the protection seller) in exchange for the right to receive a specified return upon the occurrence of a credit event, such as a default or restructuring, with respect to any of the underlying issuers (reference obligations) in the referenced index. The fund’s investment adviser uses credit default swaps to assume exposure to a diversified portfolio of credits or to hedge against existing credit risks.