UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

CITIZENS INDEPENDENT BANCORP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

April 3, 2014

To Our Shareholders:

You are cordially invited to attend the 2014 Annual Meeting of Shareholders (the “Annual Meeting”) of Citizens Independent Bancorp, Inc. (“Citizens” or the “Company”) to be held at Lee's Banquet Haus, 580 Radio Lane, Logan, Ohio on Tuesday, May 6th, 2014 at 7:00 p.m., local time.

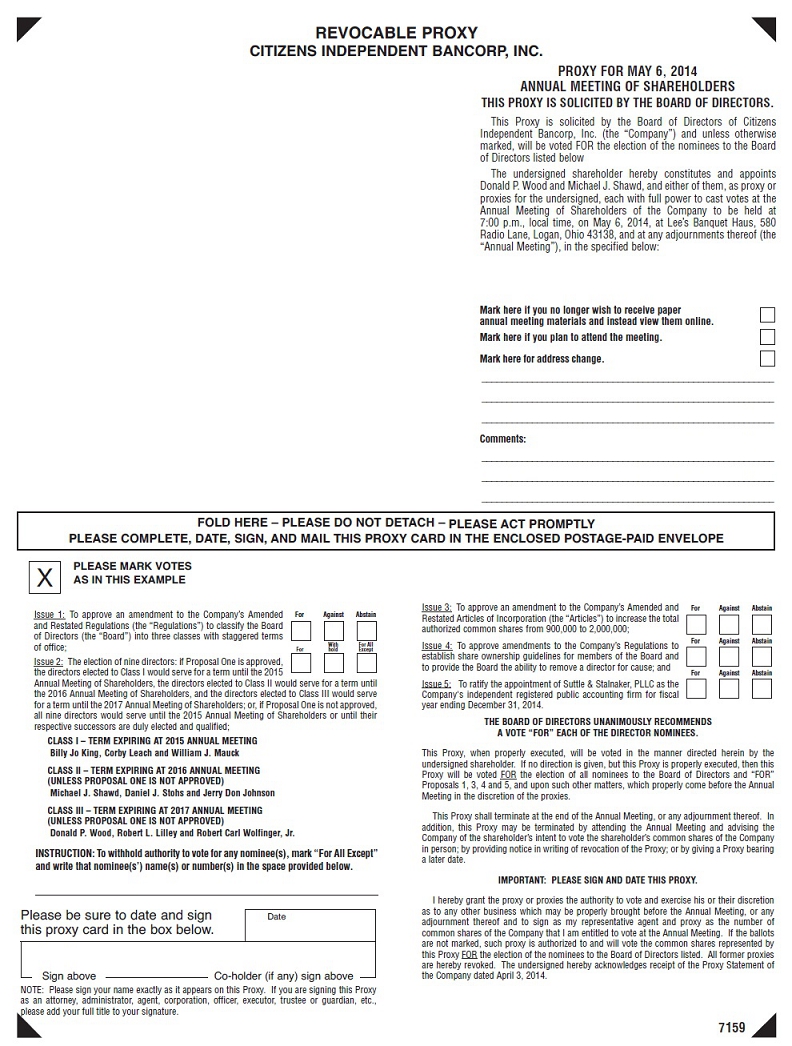

At the Annual Meeting you will be asked to vote on proposals to approve three amendments to the Company’s Amended and Restated Regulations (the “Regulations”), first, to classify the Board of Directors (the “Board”) of the Company into three classes with staggered terms of office, second, to establish share ownership guidelines for the members of the Board and third, to provide the Board the ability to remove a director for cause. You will also be asked to vote on a proposal to approve an amendment to the Company’s Amended and Restated Articles of Incorporation (the “Articles”) to increase the number of common shares we are authorized to issue from 900,000 to 2,000,000. In addition, you will be asked to ratify the Audit Committee's selection of Suttle & Stalnaker, PLLC as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2014. Finally, you will be asked to vote on the election of nine directors. If the proposal to classify the Board is approved, the directors elected to Class I would serve for a term until the 2015 Annual Meeting of Shareholders, the directors elected to Class II would serve for a term until the 2016 Annual Meeting of Shareholders, and the directors elected to Class III would serve for a term until the 2017 Annual Meeting of Shareholders; or, if the proposal to classify the Board is not approved, all nine directors would serve until the 2015 Annual Meeting of Shareholders or until their respective successors are duly elected and qualified.

On or about April 7, 2014, the Company will mail to shareholders a copy of the accompanying Proxy Statement, a form of proxy card, and the Company’s Annual Report to Shareholders for the fiscal year ended December 31, 2013.

Your vote on these matters is important, regardless of the number of shares you own, and all shareholders are cordially invited to attend the Annual Meeting in person. However, whether or not you plan to attend the Annual Meeting, it is important that your shares be represented. In order to ensure that your shares are represented, I urge you to execute and return the enclosed proxy as soon as possible.

| | | |

| | | |

|  | |

| | Donald P. Wood | |

| | Chairman of the Board of Directors | |

188 WEST MAIN STREET

LOGAN, OHIO 43138

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The 2014 Annual Meeting of Shareholders (the “Annual Meeting”) of Citizens Independent Bancorp, Inc. (“Citizens” or the “Company”) will be held at Lee's Banquet Haus, 580 Radio Lane, Logan, Ohio on Tuesday, May 6th, 2014 at 7:00 p.m., local time, for the following purposes:

| 1. | To approve an amendment to the Company’s Amended and Restated Regulations (the “Regulations”) to classify the Board of Directors (the “Board”) into three classes with staggered terms of office; |

| 2. | The election of nine directors: if Proposal One is approved, the directors elected to Class I would serve for a term until the 2015 Annual Meeting of Shareholders, the directors elected to Class II would serve for a term until the 2016 Annual Meeting of Shareholders, and the directors elected to Class III would serve for a term until the 2017 Annual Meeting of Shareholders; or, if Proposal One is not approved, all nine directors would serve until the 2015 Annual Meeting of Shareholders or until their respective successors are duly elected and qualified; |

| 3. | To approve an amendment to the Company’s Amended and Restated Articles of Incorporation (the “Articles”) to increase the total authorized common shares from 900,000 to 2,000,000; |

| 4. | To approve amendments to the Company’s Regulations to establish share ownership guidelines for members of the Board and to provide the Board the ability to remove a director for cause; |

| 5. | To ratify the appointment of Suttle & Stalnaker, PLLC as the Company's independent registered public accounting firm for fiscal year ending December 31, 2014; and |

| 6. | To transact such other business as may properly come before the meeting. |

As of the date of this Notice, the Board is not aware of any other business to come before the Annual Meeting.

The Board has fixed the close of business on March 15, 2014 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting. Your Board of Directors recommends that you vote“FOR” the approval of an amendment to our Regulations to classify the Board into three classes with staggered terms of office under “PROPOSAL ONE — AMENDMENT TO THE COMPANY'S AMENDED AND RESTATED REGULATIONS TO AUTHORIZE THE CLASSIFICATION OF THE BOARD OF DIRECTORS INTO THREE CLASSES WITH STAGGERED TERMS”, “FOR” the election of each of the director nominees listed in the proxy statement under “PROPOSAL TWO — ELECTION OF DIRECTORS”, “FOR” the approval of the amendment to our Articles to increase the authorized number of common shares under “PROPOSAL THREE — AMENDMENT TO THE COMPANY'S AMENDED AND RESTATED ARTICLES OF INCORPORATION TO INCREASE THE TOTAL NUMBER OF AUTHORIZED COMMON SHARES”, “FOR” the approval of an amendment to our Regulations to establish share ownership guidelines for members of the Board under “PROPOSAL FOUR — AMENDMENTS TO THE COMPANY'S AMENDED AND RESTATED REGULATIONS TO ESTABLISH DIRECTOR SHARE OWNERSHIP GUIDELINES AND TO PROVIDE THE BOARD THE ABILITY TO REMOVE A DIRECTOR FOR CAUSE” and “FOR” the ratification of Suttle & Stalnaker, PLLC under “PROPOSAL FIVE — RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM”.

In order to expedite the Annual Meeting, Lee's Banquet Haus will be open from 6:00 p.m. to 7:00 p.m. on May 6th, 2014, for advanced registration by shareholders attending the Annual Meeting. You are encouraged to utilize this procedure. This should prevent a delay in the start of the Annual Meeting.

It is important that your shares be represented and voted at the Annual Meeting. Voting instructions are printed on your proxy and included in the accompanying proxy statement.

| | By Order of the Board of Directors, | |

| | | |

| | | |

| |  | |

| | Donald P. Wood | |

| | Chairman of the Board of Directors | |

Logan, Ohio

April 3, 2014

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of Citizens Independent Bancorp, Inc. (“Citizens” or the “Company”), an Ohio corporation, of the accompanying proxy to be voted at the 2014 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Tuesday, May 6, 2014 at 7:00 p.m., local time, and at any adjournment thereof. The mailing address of the principal executive offices of Citizens is 188 West Main Street, Logan, Ohio 43138; telephone number (740) 385-8561. To obtain directions to attend the Annual Meeting, please contact Investor Relations at (740) 385-1450. This proxy statement, together with the related proxy and Citizens’ 2013 Annual Report to Shareholders, are being mailed to shareholders of the Company on or about April, 7 2014.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

When and Where will the Annual Meeting be Held?

The Annual Meeting will be held on Tuesday, May 6th, 2014 at 7:00 p.m., local time, at Lee's Banquet Haus, 580 Radio Lane, Logan, Ohio.

Why did I Receive these Proxy Materials?

You have received these proxy materials because the Board is soliciting a proxy to vote your shares at the Annual Meeting. This proxy statement contains information that Citizens is required to provide to you under the rules of the Securities and Exchange Commission (the “SEC”) and is intended to assist you in voting your shares.

Who may Vote at the Annual Meeting?

The Board has set March 15, 2014, as the “record date” for the Annual Meeting. This means that only shareholders of record at the close of business on that date are entitled to notice of, and to vote at, the Annual Meeting or any adjournment(s) or postponement(s) thereof. At the close of business on March 15, 2014, there were 556,733 common shares, no par value, outstanding. Each common share entitles the holder to one vote on each item to be voted upon at the Annual Meeting and there is no cumulative voting.

What is the Difference between Holding Common Shares as a “Shareholder of Record” and as a “Beneficial Owner?”

If your shares are registered directly in your name, you are considered the “shareholder of record” of those shares. Citizens has sent these proxy materials directly to all “shareholders of record.” Alternatively, if your shares are held in an account at a brokerage firm, bank, broker-dealer or other similar organization, which is sometimes called “street name,” then you are the “beneficial owner” of those shares, and these proxy materials were forwarded to you by that organization. The organization holding your shares is the shareholder of record for purposes of voting the shares at the Annual Meeting. As the beneficial owner, you have the right to direct that organization how to vote the common shares held in your account by following the voting instructions the organization provides to you.

How do I Vote?

Shareholders of record may vote on matters that are properly presented at the Annual Meeting in two ways: (i) by completing the accompanying proxy and returning it in the envelope provided; or (ii) by attending the Annual Meeting and casting your vote in person. If you hold your shares in street name, you should follow the voting instructions provided to you by the organization that holds your shares. If you plan to attend the Annual Meeting and vote in person, ballots will be available. If your shares are held in the name of your broker, bank or other shareholder of record, you must bring a legal proxy from the shareholder of record indicating that you were the beneficial owner of the shares on March 15, 2014 in order to vote in person.

How will My Shares be Voted?

Proxies solicited by the Board will be voted in accordance with the directions given therein. If you submit a valid proxy prior to the Annual Meeting, but do not complete the voting instructions, your shares will be voted:

| • | “FOR” the approval of an amendment to our Regulations to classify the Board under “PROPOSAL ONE — AMENDMENT TO THE COMPANY'S AMENDED AND RESTATED REGULATIONS TO AUTHORIZE THE CLASSIFICATION OF THE BOARD OF DIRECTORS INTO THREE CLASSES WITH STAGGERED TERMS”; |

| • | “FOR” the election of director nominees listed under “PROPOSAL TWO – ELECTION OF DIRECTORS”; |

| • | “FOR” the approval of the amendment to our Articles to increase the authorized number of common shares underPROPOSAL THREE — AMENDMENT TO THE COMPANY'S AMENDED AND RESTATED ARTICLES OF INCORPORATION TO INCREASE THE TOTAL NUMBER OF AUTHORIZED COMMON SHARES”; |

| • | “FOR” the approval of an amendments to our Regulations to establish share ownership guidelines for members of the Board and to provide the Board the ability to remove a director for cause under “PROPOSAL FOUR — AMENDMENT TO THE COMPANY'S AMENDED AND RESTATED REGULATIONS TO ESTABLISH DIRECTOR SHARE OWNERSHIP GUIDELINES AND TO PROVIDE THE BOARD THE ABILITY TO REMOVE A DIRECTOR FOR CAUSE”; and |

| • | “FOR” the ratification of Suttle & Stalnaker, PLLC as the Company's independent registered public accounting firm for fiscal year ending December 31, 2014 under “PROPOSAL FIVE — RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM”. |

Can Other Matters be Decided at the Annual Meeting?

On the date that this proxy statement was printed, Citizens did not know of any matters to be raised at the Annual Meeting other than those included in this proxy statement. If you submit a valid proxy and other matters are properly presented for consideration at the Annual Meeting, then the individuals appointed as proxies will have the discretion to vote on those matters for you.

May I Revoke or Change My Vote?

Yes, proxies may be revoked at any time before a vote is taken or the authority granted is otherwise exercised. Revocation may be accomplished by:

• the execution of a later dated proxy with respect to the same shares;

• giving notice in writing to Jim Lewis, Board Secretary, Citizens Independent Bancorp, Inc., 188 West Main Street, Logan, Ohio 43138; or

• notifying Jim Lewis in person at the Annual Meeting.

If your shares are held in street name and you wish to revoke your proxy, you should follow the instructions provided to you by the record holder of your shares. If you wish to revoke your proxy in person at the Annual Meeting, you must bring a legal proxy from the shareholder of record indicating that you were the beneficial owner of the shares on March 15, 2014. Attending the Annual Meeting will not, by itself, revoke your proxy.

Who Pays the Cost of Proxy Solicitation?

The accompanying proxy is solicited by and on behalf of the Board, whose notice of meeting is attached to this proxy statement, and the entire cost of such solicitation shall be borne by the Company. In addition to the use of the mail, proxies may be solicited by personal interview, telephone, facsimile and electronic mail by directors, officers and employees of Citizens. Arrangements will be made with brokerage houses and other custodians, nominees and fiduciaries for the forwarding of solicitation material to the beneficial owners of common shares held of record by such persons, and Citizens will reimburse them for reasonable out-of-pocket expenses incurred in connection therewith.

How Many Common Shares Must be Represented at the Annual Meeting in Order to Constitute a Quorum?

At least 283,367 common shares of Citizens must be represented at the Annual Meeting in person or by proxy in order to constitute a quorum for the transaction of business. Abstentions and “broker non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A “broker non-vote” occurs when a shareholder of record, such as a broker or bank, does not vote on a proposal because it has not received voting instructions from the beneficial owner and does not have discretionary authority to vote on that proposal. A broker may vote in accordance with management’s recommendation, without instructions from you, on routine matters, such as Proposal Five – Ratification of Independent Registered Public Accounting Firm.

What are the Voting Requirements for each Proposal?

| PROPOSALS ONE, THREE & FOUR | Under the Company’s Articles, any proposed amendment to the Articles or the Regulations shall require the approval of holders of at least a majority of the outstanding common shares of the Company. Shareholders may vote “FOR,” “AGAINST” or “ABSTAIN” from voting on these Proposals. Abstentions and broker non-votes will be counted as present and entitled to vote for purposes of these Proposals and, thus, will have the same effect as a vote against these Proposals. If the accompanying Proxy is signed and dated by the shareholder, but no vote is specified thereon, the common shares held by such shareholder will be voted “FOR” the adoption of the amendment to the Articles and “FOR” the amendments to the Regulations. |

| PROPOSAL TWO | Under the Articles, at all elections of directors, the candidates receiving the greatest number of votes shall be elected. Broker non-votes and proxies marked “WITHHOLD AUTHORITY” will not be counted toward the election of directors or toward the election of individual nominees specified in the proxy and, thus, will have no effect other than that they will be counted for establishing a quorum. If the accompanying Proxy is signed and dated by the shareholder, but no vote is specified thereon, the common shares held by such shareholder will be voted “FOR” the election of director nominees listed under this Proposal. |

| PROPOSAL FIVE | The proposal to ratify the appointment of the Company’s independent registered public accounting firm requires the affirmative vote of a majority of the common shares present, represented and entitled to vote at the Annual Meeting. Shareholders may vote “FOR,” “AGAINST” or “ABSTAIN” from voting on Proposal Five. Brokers may vote on Proposal Five in accordance with management’s recommendation without instructions from you. Abstentions will be counted as present and entitled to vote for purposes of Proposal Five and, thus, will have the same effect as a vote against Proposal Five. If the accompanying Proxy is signed and dated by the shareholder, but no vote is specified thereon, the common shares held by such shareholder will be voted “FOR” Proposal Five. |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

SHAREHOLDER MEETING TO BE HELD ON MAY 6, 2014

This proxy statement, the Form 10-K for the year ended December 31, 2013 and the 2013 Annual Report to Shareholders are available at http://www.tcbol.com/investor_news.

PROPOSAL ONE - AMENDMENT TO THE COMPANY’S AMENDED AND

RESTATED REGULATIONS TO AUTHORIZE THE CLASSIFICATION OF THE

BOARD OF DIRECTORS INTO THREE CLASSES WITH STAGGERED TERMS

On December 16, 2013, our Board approved an amendment to Section 2.02(A) of our Regulations to classify the Board of Directors into three classes with staggered terms (“Classified Board Amendment”). The Board is now unanimously proposing and recommending that our shareholders adopt and approve the proposed amendment to Section 2.02(A). Currently, the Board consists of a single class of directors, all of whom are elected at each Annual Meeting of Shareholders. Ohio law permits provisions in a company’s Articles or Regulations approved by shareholders that provide for a classified board of directors. The Classified Board Amendment would classify the Board into three separate classes, as nearly equal in number as possible, with one class being elected each year to serve a staggered three-year term. The Company currently has nine directors, as permitted under our Regulations.

All of the directors will be elected at the Annual Meeting. The directors initially elected in Class I would serve until the 2015 Annual Meeting of Shareholders and the election and qualification of his or her successors. The directors initially elected in Class II would serve until the 2016 Annual Meeting of Shareholders and the election and qualification of his or her successors. The directors initially elected in Class III would serve until the 2017 Annual Meeting of Shareholders and the election and qualification of his or her successor. Beginning with the election of directors to be held at the 2015 Annual Meeting of Shareholders, and going forward, the class of directors to be elected in such year (Class I) would be elected for a three-year term, and at each successive Annual Meeting of Shareholders, the class of directors to be elected in such year would be elected for a three-year term, so that the term of office of one class of directors shall expire in each year. The directors in each class are identified in Proposal Two – Election of Directors.

This proposal was designed to assure continuity and stability in the Board’s leadership and policies. While the Board has not experienced any problems with such continuity in the past, it wishes to ensure that this experience will continue. The Board also believes that the classified Board proposal will assist the Board in protecting the interest of the Company’s shareholders in the event of an unsolicited offer for the Company. The proposed amendment to classify the Board will extend significantly the time required to effect a change in control of the Board and may discourage hostile takeover bids for the Company. Currently, changes in control of the Board can be made by shareholders holding a majority of the votes cast at a single annual meeting. If the Company implements a classified Board, it will take at least two annual meetings for a majority of shareholders to make a change in control of the Board, because only a minority of the directors will be elected at each meeting.

As a result of the additional time required to change control of the Board, this Board proposal will tend to perpetuate present management. Without the ability to obtain immediate control of the Board, a potential acquirer will not be able to take action to remove other impediments to its acquisition of the Company, including the anti-takeover provisions discussed in Proposal Three – Amendment to the Company’s Amended and Restated Articles of Incorporation to Increase the Total Number of Authorized Common Shares. A classified board will increase the amount of time required for a takeover bid to obtain control of the Company. Even if the takeover bidder were to acquire a majority of the Company’s outstanding stock, a classified board will tend to discourage certain tender offers, perhaps including some tender offers that shareholders may feel would be in their best interests. Despite the anti-takeover effect of the proposed Classified Board Amendment, this proposal is not in response to any current effort of which the Company is aware to obtain control of the Company. For a discussion of current anti-takeover provisions in our Articles and Regulations, please see Proposal Three – Amendment to the Company’s Amended and Restated Articles of Incorporation to Increase the Total Number of Authorized Common Shares.

The Board recommends the shareholders approve the Classified Board Amendment. Accordingly, the shareholders of the Company will be asked to approve the following resolution at the Annual Meeting:

RESOLVED, that Section 2.02(A) of the Company’s Amended and Restated Regulations be, and it hereby is, deleted in its entirety and replaced with the following new Section 2.02(A):

2.02(A). The Directors shall be divided into three classes as nearly equal in number as the then fixed number of directors permits, with the term of office of one class expiring each year. A separate election for each class of directors shall be held at the 2014 annual meeting of the shareholders. The directors elected to the first class shall hold office for a term expiring in 2015; the directors elected to the second class shall hold office for a term expiring in 2016; and the directors elected to the third class shall hold office for a term expiring in 2017. At each annual meeting of shareholders, successors to the class of directors whose term expires shall be elected to hold office for a three-year term. A director shall hold office until the annual meeting for the year in which his term expires and until his successor is duly elected and qualified, or until his earlier resignation, removal from office, or death. In the event of any increase in the number of directors of the corporation, the additional directors shall be similarly classified in such a manner that each class of directors shall be as equal in number as possible. In the event of any decrease in the number of directors of the corporation, such decrease shall be effected in such a manner that each class of directors shall be as equal in number as possible.

Any director appointed to fill a vacancy of a director that resigns, retires, is removed, or otherwise ceases to serve prior to the end of such director’s term in office, shall hold office until the next election of the class for which such director has been chosen, and until that director’s successor has been elected and qualified or until his or her earlier resignation, removal or death.

If the proposed amendment is adopted, it will become effective upon the filing of Certificate of Amendment to our Regulations with the State of Ohio, which we expect to file shortly after receiving shareholder approval.

The amendment to the Regulations requires the affirmative vote of a majority of the outstanding shares entitled to vote at the Annual Meeting. Shareholders may vote “FOR,” “AGAINST” or “ABSTAIN” from voting on Proposal One. Abstentions and broker non-votes will have the same effect as votes against Proposal One.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT

THE SHAREHOLDERS VOTE “FOR” PROPOSAL ONE.

PROPOSAL TWO – ELECTION OF DIRECTORS

As set forth above (see Proposal One), the Board is proposing to stagger the terms of the directors of the Company by classifying the Board into three separate classes. One class would hold office initially for a term expiring at the 2015 Annual Meeting of Shareholders; a second class would hold office initially for a term expiring at the 2016 Annual Meeting of Shareholders; and a third class would hold office initially for a term expiring at the 2017 Annual Meeting of Shareholders. At each Annual Meeting of Shareholders following this initial classification and election, the successors to the class of directors whose terms expire at that meeting would be elected for a term of office to expire at the third succeeding Annual Meeting of Shareholders after their election, and until their successors have been duly elected and qualified. Directors chosen to fill vacancies on the classified board would hold office for the remainder of the term of the class of directors in which the vacancy occurred and until such director’s successor is elected and qualified. Vacancies on the Board of Directors may be filled by persons elected by two-thirds of the directors then in office or four-fifths of the outstanding voting power of the Company, voting at a meeting of the shareholders called for such purpose. All directors of the Company also serve as members of the Board of Directors of our wholly-owned subsidiary, The Citizens Bank of Logan (the “Bank”).

If Proposal One is not approved, the nine director nominees, if elected, will serve a one-year term until the 2015 Annual Meeting of Shareholders and until their successors are duly elected and qualified.

If any nominee becomes unavailable for any reason, a situation which is not anticipated, a substitute nominee may be proposed by the Board, and any shares represented by proxy will be voted for the substitute nominee, unless the Board reduces the number of directors.

The following table sets forth certain information concerning the nominees for director:

| Name and Age | | | Position with Company & Bank | | Bank Director Since |

| Donald P. Wood (69) | | | Chairman of the Board | | 2012 |

| Jerry Don Johnson (47) | | | Director | | 2013 |

| Billy Jo King (67) | | | Director | | 2013 |

| Corby Leach (41) | | | Director | | 2014 |

| Robert Lilley (69) | | | Director | | 2013 |

| William J. Mauck (67) | | | Director | | 2013 |

| Michael Shawd (59) | | | Director | | 2013 |

| Daniel Stohs (63) | | | Director | | 2013 |

| Robert Carl Wolfinger, Jr.(63) | | | Director | | 2013 |

CLASS I – TERM EXPIRING AT 2015 ANNUAL MEETING

Billy Jo King,a director since November 25, 2013, retired after 41 years as manager of The King Lumber Co. in Logan. He is a Navy veteran and received a B.S. degree from The Ohio State University in marketing and industrial production. Mr. King served on the Kachelmacher Memorial Trust fund for 23 years and is an original board member of The Village Mountain Mission, which builds houses and conducts medical clinics in the Dominican Republic. He also serves on the board of the Hocking County Historical Society.

Corby Leach, a director since January 27, 2014, is a State Farm insurance agent of Corby Leach Insurance Agency, Inc. in Logan. He previously worked for five years as a State Farm auto claim representative. Mr. Leach is a second-term board member of the Logan-Hocking School District Board of Education. He has a Bachelor of Music Education from The Ohio State University and is a graduate of the Leadership Development Program, where he studied and developed leadership and accountability skills.

William J. Mauck, a director since May 28, 2013, is a General Electric retiree after 26 years of service, most recently as Logan Glass Plant manager and Circleville Lamp Plant manager. During his time with GE, he contributed in all areas of manufacturing including non-union and union relations, staffing, quality improvement programs, budgeting and compliance. He also is a Vietnam Army veteran and member of Hocking Hills United Methodist Church. He has a B.S. of Science from the University of Iowa. Mr. Mauck’s strong ties with the community and career in management provide enhanced understanding of general management concerns and valuable community relations for the Board.

CLASS II – TERM EXPIRING AT 2016 ANNUAL MEETING (UNLESS PROPOSAL ONE IS NOT APPROVED)

Michael J. Shawd, a director since April 22, 2013, is the owner of the Goddard-Shawd Insurance Agency of Barlow, Ohio. The independent insurance agency serves the local market in Washington County and adjoining counties. Mr. Shawd worked as a loan review officer for Bank One N.A., loan reviewer for J.S. Barefoot & Associates and as a bank examiner for the State of Ohio Division of Banks. He has a B.S./B.A. from The Ohio State University. Mr. Shawd’s experience in bank loan review and as a banking examiner provide critical banking oversight and compliance experience to the Board.

Daniel J. Stohs, a director since May 28, 2013, is a self-employed attorney and former accountant in the Logan area. He also is a managing member of Rempel Partner, LLC (operator of Midwest Glassware Outlet) and shareholder and board member of Olde Dutch Restaurant. He currently serves as a member of the City of Logan Board of Zoning Appeals. He has a B.A. of Social Sciences from The Ohio State University and is a graduate of The Ohio State University Moritz College of Law. Mr. Stohs’ long experience living and working in the area along with his professional expertise as a lawyer provide the Board with oversight skills, knowledge of the region and business experience.

Jerry Don Johnson,a director since November 25, 2013,is a retired local business owner of Fancy Plants landscaping from 1985-2010. He is currently a landscape designer and consultant for Southern Pines Nursery and manages his family farm. He has served on several local boards and clubs including the Hocking County Children Services, Logan-Hocking School District Advisory, Hocking Valley Community Hospital Foundation, Hocking County Community Improvement Corporation and Logan-Hocking Chamber of Commerce.

CLASS III – TERM EXPIRING AT 2017 ANNUAL MEETING (UNLESS PROPOSAL ONE IS NOT APPROVED)

Donald P. Wood,a director since November 1, 2012, has owned and operated his own business for 28 years. He is the chair and CEO of Don Wood, Inc., automobile businesses in the Logan and Athens areas. His 16 years of banking experience includes serving as the district president of Bank Ohio’s Cambridge/Zanesville area in 1983, before becoming lead assistant director for branch administration of Florida National Bank in 1985. He has served on a publicly-traded bank board for the past 10 years. Mr. Wood is a University of Rio Grande board member, past board chair and past president. He also served as the president of the Hocking College Foundation Board. He joined Citizens as Board of Directors Chairman, President and CEO in 2012. He has an advanced degree in banking from the American Institute of Banking. Mr. Wood received an honorary Masters Degree and honorary Doctorate from the University of Rio Grande. Mr. Wood’s experience as a senior level banking officer, a successful entrepreneur and a leader in various roles in regional institutions provides valuable banking and leadership knowledge for the Board.

Robert L. Lilley, a director since June 24, 2013, has had a private law practice in Logan since 1973. He has served as an assistant attorney general for the Ohio Attorney General’s Office, acting municipal court judge, the City of Logan law director and is an Army veteran. Mr. Lilley is a member of the Logan-Hocking Board of Health, Logan Rotary Club and member of the Brighten Your Future Foundation board. He is a graduate of The Ohio State University Moritz College of Law and has a B.F.A. from Ohio University. Mr. Lilley’s professional expertise and long term active involvement in the community are valuable assets to the Board.

Robert Carl Wolfinger,Jr.,a director since November 25, 2013,is the treasurer of the City of Lancaster and served as senior vice president of National City Bank, where he was employed for 36 years. He received his bachelor’s degree from Ohio University and is a banking school graduate of Rutgers University. He has served on several boards in the Fairfield County area, including Lancaster Festival, Inc., Fairfield County Economic Development Committee, Lancaster Port Authority, Fairfield Medical Center and Lancaster-Fairfield Chamber of Commerce.

There are no family relationships among any of the directors, nominees for election as directors, and executive officers of the Company. The nine nominees receiving the greatest number of votes will be elected to the Board of Directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR”

EACH OF THE DIRECTOR NOMINEES.

CORPORATE GOVERNANCE

The Board of Directors — Independence

The Board of Directors of the Company and the Bank are currently comprised of nine members, all of whom are nominees for election at the Annual Meeting. Additional information regarding each director nominee is set forth in Proposal Two – Election of Directors. In 2013, the Board of Directors affirmatively determined that all of the directors listed below are “independent directors” under the current listing standards of the NASDAQ.

| Jerry Don Johnson | William J. Mauck |

| Billy Jo King | Michael Shawd |

| Robert Lilley | Daniel Stohs |

| | Robert Carl Wolfinger, Jr. |

In addition, the Board has affirmatively determined that Corby Leach, who was appointed to the Board on January 27, 2014, is an “independent director” under NASDAQ listing standards.

The only current director of the Company who has not been deemed independent by the Board is Donald P. Wood.

In assessing the independence of directors, the Board of Directors considered the business relationships between Citizens and its directors or their affiliated businesses, other than ordinary banking relationships. Where business relationships other than ordinary banking relationships existed, the Board determined that none of the relationships between Citizens and their affiliated businesses impaired the directors’ independence because the amounts involved were immaterial to the directors or to those businesses when compared to their annual income or gross revenues.

Related Party Transactions

The Board is responsible for reviewing and overseeing the procedures designed to identify “related party” transactions that are material to the Company’s consolidated financial statements or otherwise require disclosure under applicable laws and rules adopted by the SEC and the Board has the authority to approve such “related party” transactions. In addition, as of December 31, 2013, each director and executive officer of the Company must complete a Director and Officer Questionnaire that requires disclosure of any transaction, arrangement or relationship with the Company or the Bank during the last fiscal year in which the director or executive officer, or any member of his or her immediate family, had a direct or indirect material interest. Any transaction, arrangement or relationship disclosed by a director or executive officer in the questionnaire is reviewed and considered by the Board in making independence determinations with respect to directors and resolving any conflicts of interest that may be implicated.

During the Company’s 2013 fiscal year, the Bank entered into banking-related transactions in the ordinary course of business with certain executive officers and directors of the Company (including certain executive officers of the Bank), members of their immediate families and corporations or organizations with which they are affiliated. It is expected that similar transactions will be entered into in the future. All loans made to directors and executive officers (i) were made in the ordinary course of business; (ii) were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans with persons not related to Bancorp; and (iii) did not involve more than the normal risk of collectability or present other unfavorable features. The outstanding principal balance of loans to directors, executive officers, and principal shareholders of the Company (including certain executive officers of the Bank) and their associates as a group at December 31, 2013, was $250,000. As of the date of this Proxy Statement, all of these loans were performing loans.

In addition, the Company executed a promissory note in which it borrowed $5.0 million from WLPM LLC, an Ohio limited liability company. Alan Stockmeister, a holder of over 5% of the Company’s outstanding stock and the brother-in-law of one of the Company’s current directors, Michael Shawd, is currently a managing member of WLPM LLC. The promissory note has an annual interest rate of 8.0%, a portion of which is paid by the Company each month. The note matures on December 31, 2015. The Company made a payment of $400,000 in interest for the year ended December 2013. As of March 2014 through the maturity date of the note, approximately $701,000 total interest and $5.0 million total principal remain outstanding on the note. Mr. Stockmeister’s approximate interest in the note, as managing member of WLPM LLC, is $2.3 million dollars. The Board reviewed this arrangement and concluded that it was not inconsistent with the Company’s best interests and did not constitute a conflict of interest.

Board Meetings; Annual Meeting Attendance

The Board oversees our business and affairs and monitors the performance of management.The Board of Directors of the Company met 15 times during 2013. Meetings of the Board of Directors of the Company and the Board of Directors of the Bank were held jointly on 15 of those occasions. Each director attended at least seventy-five percent (75%) of the total number of meetings of the Board of Directors since their appointments.

It is the policy of the Board to encourage all directors to attend the Annual Meeting of Shareholders. All of the Company’s directors serving at that time attended the 2013 Annual Meeting of Shareholders.

Board Leadership Structure and Oversight of Enterprise Risk

The Board has no policy regarding the need to separate or combine the offices of Chairman of the Board and Chief Executive Officer. Instead the Board of Directors remains free to make this determination from time to time in a manner that seems most appropriate for the Company. The positions of Chairman of the Board and Chief Executive Officer are currently held by different persons. The Board believes that having a separate Chairman allows the Chief Executive Officer, Mr. Reed, to focus on the day-to-day management of the Company while enabling the Board to maintain an independent perspective on the activities of the Company and executive management.The Chairman of the Board presides over meetings of the Board, presides over annual meetings of shareholders, consults and advises the Board and its committees on the business and affairs of Citizens, and performs other responsibilities as may be assigned by the Board from time to time.The Board believes that its leadership structure has created an environment of open, efficient communication between the Board and management, enabling the Board to maintain an active, informed role in risk management by being able to monitor and manage those matters that may present significant risks.

The Board is actively involved in the oversight and management of risks that could affect the Company. The Board regularly reviews reports from management on areas of material risk to the Company including operational, financial, legal, regulatory and strategic risks. While the Board of Directors has the ultimate oversight responsibility for the risk management process, various committees of both management and the Board also have responsibility for risk management.

Committees of the Board of Directors

The Board of Directors conducts its business through meetings of the Board and the following committees of the Company and the Bank: (i) Audit Committee; (ii) Executive Committee; (iii) Loan Committee; (iv) Compensation, Personnel/Corporate Governance and Nominating Committee; and (v) ALCO (Asset and Liabilities) Committee. Prior to December 16, 2013, the members of the Executive and Loan Committee met together as the Executive and Loan Committee. Each committee meets on a regular basis and reports its deliberations and actions to the full Board of Directors. Each of the committees has the authority to engage outside experts, advisors and counsel to the extent it considers appropriate to assist the committee in its work. The following table identifies the Company’s standing committees and their respective members as of December 16, 2013. All members of each committee, except Mr. Wood, are independent in accordance with NASDAQ listing standards .

| Director | | Executive Committee | | | Loan Committee | | | Audit Committee | | | Compensation, Personnel/ Corporate Governance and Nominating Committee | | | ALCO Committee | |

| | | | | | | | | | | | | | | | |

| Donald P. Wood | | X* | | | | | | | | | | | | | |

| Jerry Don Johnson | | | | | X | | | | | | X | | | | |

| Billy Jo King | | | | | | | | | | | X | | | X | |

| Corby Leach | | | | | | | | X | | | | | | X | |

| Robert Lilley | | X | | | | | | | | | X* | | | | |

| William J. Mauck | | | | | X | | | X | | | | | | | |

| Michael Shawd | | X | | | | | | X* | | | | | | | |

| Daniel Stohs | | | X | | | | | | | | | | | | | | | | X* | |

| Robert Carl Wolfinger, Jr. | | | X | | | | X* | | | | | | | | | | | | | |

| Number of Meetings in fiscal 2013 | | | 5 | | | | 2 | | | | 12 | | | | 0 | | | | 9 | |

* Denotes Chairman

Audit Committee

The Company has a separately designated Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The purpose of the Audit Committee is to assist the Board in its oversight of the Company’ financial statements and oversee compliance with legal and regulatory requirements. During the fiscal year ended December 31, 2013, the Audit Committee met periodically to examine and approve the audit report prepared by the Company’s independent registered public accounting firm, to review and appoint the independent registered public accounting firm to be engaged by the Company and to review the Company’s internal audit function. The Audit Committee also provides guidance on the Company’s risk management policies, including reporting, key credit risks, market risks, and steps taken by management to monitor and mitigate such risks. In addition, the Audit Committee oversees procedures for the receipt, retention and treatment of complaints on accounting and auditing. All committee members are deemed “independent,” as independence for audit committee members is defined under applicable NASDAQ listing standards. The Board of Directors has adopted a written charter for the Audit Committee, the Audit Committee and the Board of Directors review the charter periodically to ensure the scope of the charter is consistent with the Audit Committee’s expected role.

Executive Committee

The Executive Committee, previously the Executive and Loan Committee, consists of the Chairman of the Board and the Chairman from each of the Audit, ALCO, Loan and Compensation, Personnel/ Corporate Governance and Nominating committees. The purpose of the Executive Committee is to exercise, during the intervals between the meetings of the Board, and except as otherwise provided in the Company’s Regulations, all the power and authority of the Board in the management of the property, affairs and business of the Company. On December 16, 2013, in order to focus on executive and loan issues more efficiently, the Executive and Loan Committee separated into two committees, the Executive Committee and the Loan Committee.

Loan Committee

The Loan Committee was established on December 16, 2013, as a result of the Board’s decision to separate the Executive and Loan Committee into two distinct committees. The Loan Committee is responsible for approving, denying or revising proposal for loans or amendments to loans that are above the authority of the Officers Loan Committee, advising the Board in setting the strategic direction for the Bank’s lending operations and assisting the Board in fulfilling its oversight functions as it pertains to lending, credit and loan servicing programs. In addition, the Loan Committee fulfills such other responsibilities as assigned by the Board.

Compensation, Personnel/ Corporate Governance and Nominating Committee

The Compensation, Personnel/Corporate Governance and Nominating Committee (the “Compensation and Nominating Committee”) is responsible for establishing and administering policies governing (a) the Board’s organization, membership and function, (b) procedures and criteria for evaluating the suitability of director nominees, (c) committee structure, membership and operations, (d) succession planning for executive officers of the Company, (e) the Company’s Corporate Governance Policy, (f) compensation of the Company’s named executive officers, (g) oversight of personnel matters and (h) other matters relating to compensation, personnel, corporate governance and the rights and interests of the Company’s shareholders. The Compensation and Nominating Committee operates under a written charter that establishes the Committee’s responsibilities. The Compensation and Nominating Committee and the Board review the charter periodically to ensure the scope of the charter is consistent with the Compensation and Nominating Committee’s expected role.

The Compensation and Nominating Committee nominates directors to be voted on at the annual meeting and recommends nominees to fill any vacancies on the Board of Directors. Individuals who are nominated for election to the Board must possess certain minimum qualities, including personal integrity, demonstrated achievement, and a general appreciation and understanding of the major issues facing financial companies of a size and operational scope similar to the Company.

The Compensation and Nominating Committee believes that each nominee and current member of the Board possesses a strong and unique set of skills, qualities, and experiences, which gives the Board as a whole, competence and experience in a wide range of areas, including banking industry experience, executive management, accounting and finance, government and community experience and leadership, corporate governance, and board service.

It is the policy of the Compensation and Nominating Committee to consider director candidates recommended by shareholders who appear to be qualified to serve on the Board of Directors. The Board may choose not to consider an unsolicited recommendation if no vacancy exists on the Board and the Board does not perceive a need to increase in size. In order to avoid the unnecessary use of the Board of Directors’ resources, the Board will consider only those director candidates recommended in accordance with the procedures set forth in Section 2.03 of the Regulations. Pursuant to this section, nominations for the election of directors at an annual meeting, other than those made by or on behalf of the existing Board of Directors of the Company, must be made in writing and must be received by the President of the Company not less than 14 days nor more than 50 days prior to any meeting of shareholders called for the election of directors; provided, however, that if less than 21 days’ notice of the meeting is given to shareholders, such nomination shall be delivered to the President of the Company not later than the close of business on the seventh day following the day on which the notice of meeting was mailed. Such notification must contain the following information:

| • | the name and address of each nominee; |

| • | the principal occupation of each nominee; |

| • | the total number of shares of capital stock of the Company that will be voted for each proposed nominee; |

| • | the name and residence address of the notifying shareholder; and |

| • | the number of shares of capital stock of the Company beneficially owned by the notifying shareholder. |

All director nominees for the Company are subject to approval by the Federal Reserve Bank of Cleveland. All directors for the Bank are subject to the approval of the Federal Deposit Insurance Corporation and the Ohio Division of Financial Institutions.

ALCO Committee

The ALCO (asset liability) committee is responsible for overseeing the asset/liability (interest rate risk) position, liquidity and funds management as well as investment portfolio functions of the Bank. The committee members are familiar with the regulatory environment of the Bank and the Chairman of the committee has financial expertise. The committee performs any tasks as it determines necessary and appropriate to fulfill their responsibilities. The qualifications of persons to serve on the committee are determined by the Board.

Directors’ Compensation

Meetings of the Board of the Company and the Board of the Bank are held regularly each month. The directors of the Bank are paid $12,000 per year in cash for their service as directors. Directors of the Company are not compensated. Directors are not paid additional fees for committee participation or special assignments.

The following table sets forth for the year ended 2013 certain information as to the total compensation we paid to the Company’s directors other than Mr. Wood. Compensation paid to Mr. Wood for his services as a director is included in “Executive Compensation—Summary Compensation Table.”

| Name | | | Fees Earned or Paid in Cash($) | | | | Total($) | |

| Jerry Don Johnson | | | 2,000 | | | | 2,000 | |

| Billy Jo King | | | 2,000 | | | | 2,000 | |

| Robert Lilley | | | 9,000 | | | | 9,000 | |

| William J. Mauck | | | 9,000 | | | | 9,000 | |

| Michael Shawd | | | 9,000 | | | | 9,000 | |

| Daniel Stohs | | | 9,000 | | | | 9,000 | |

| Robert Carl Wolfinger, Jr. | | | 2,000 | | | | 2,000 | |

| Corby Leach | | | 2,000 | | | | 2,000 | |

| Larry Willard1 | | | 6,000 | | | | 6,000 | |

| Richard Johnson1 | | | 3,000 | | | | 3,000 | |

| Ron Rutter1 | | | 3,000 | | | | 3,000 | |

| Steve Harden1 | | | 6,000 | | | | 6,000 | |

| Tom Kokensparger1 | | | 5,000 | | | | 5,000 | |

| David Wilhem1 | | | 3,000 | | | | 3,000 | |

| | | | | | | | | |

1 Messrs. Willard, Johnson, Rutter, Harden, Kokensparger and Wilhelm’s service on the Board of Directors ended in 2013.

Code of Ethics

We have adopted a Code of Ethics that applies to all directors, officers and employees’ of the Company and its subsidiaries.

Communications with the Board of Directors

The Board of Directors provides a process for shareholders to send written communications to the Board or any of the directors. Shareholders should address such written communications to the Board of Directors (or an individual director), c/o Jim Lewis, Secretary, Citizens Independent Bancorp, Inc., 188 West Main Street, Logan, Ohio 43138. All written communications will be forwarded by the Secretary of the Company to the Board or the individual directors, as applicable, without any screening.

EXECUTIVE OFFICERS

The executive officers of the Company are elected by the Board of Directors of the Company at the annual meeting of the Board of Directors and hold office until the next annual meeting of the Board of Directors or until their successors are chosen and qualify. The following information is supplied for certain of the Company’s and the Bank's current executive officers.

| Name and Age | Position with Bank | Position with Company | Executive Officer Since |

| Ronald R. Reed (67) | President & CEO | President & CEO | 2013 |

| James V. Livesay (61) | Chief Financial and Accounting Officer | Chief Financial Officer | 2013 |

| Michael Knuchel (44) | Chief Lending Officer | | 2013 |

Ronald R. Reed has served as the President and Chief Executive Officer of Citizens and the Bank since March 2013. Mr. Reed previously was employed as the President and CEO of Century Bank and Trust in Coldwater, Michigan from January 2010 to December 2012, as Chief Lending Officer at Monarch Bank and Trust in Coldwater, Michigan, as President and CEO of Lakeside Community Bank in Sterling Heights, Michigan from February 2009 to August 2010 and as President & CEO of Community Central Bank in Mt. Clemens, Michigan from September 2000 to July 2007. Mr. Reed earned a Bachelor of Business Administration degree from Oakland University and a Masters of Business Administration degree from the University of Michigan.

James V. Livesay was appointed Chief Financial and Accounting Officer of the Bank in September 2013 and Chief Financial Officer of the Company in November 2013. Prior to joining the Bank, Mr. Livesay previously was Controller at United Midwest Savings Bank near Columbus, Ohio for a period of nearly nine years. Previous assignments included Manager of Investment Operations at Fifth Third Bank in Cincinnati, Ohio from January 2002 to April 2003 and Vice President and Manager of Finance and Accounting of the Treasury Division at Huntington Banks in Columbus, Ohio from 1987 to January 2002. A CPA, Mr. Livesay earned a Bachelor of Mechanical Engineering at The Ohio State University and a Masters degree in Finance and Accounting at the University of Chicago.

Michael Knuchel was appointed Chief Lending Officer of the Bank in September 2013. Prior to joining the Bank, Mr. Knuchel was Vice President and Chief Lending Officer at Commodore Bank in Somerset, Ohio from September 2010 to August 2013. Previous employment included Managing Officer/CEO of Woodsfield Savings Bank in Woodsfield, Ohio from December 1998 to September 2010. Mr. Knuchel earned a Bachelor of Business Administration degree and Masters of Business Administration degree from Ohio University.

Compensation of Executive Officers

Compensation of Employees. The named executive officers were compensated by the Bank for their positions as officers of the Bank. Officers and employees of the Bank are compensated based on a number of merit-based factors. Our executive officers also received other benefits, such as reimbursement of certain fees and expenses. We do not maintain any equity based compensation plans.

Base Salary. Base salary represents the primary component of annual compensation paid to the Bank’s executive officers. When recommending an executive officer’s salary within the pay range established by peer group comparison data, the Compensation and Nominating Committee primarily considers the executive officer’s job performance and contribution to the objectives of the Company. These factors are determined in the subjective judgment of the Compensation and Nominating Committee for the Chief Executive Officer and with the benefit of performance reviews and salary recommendations by the Chief Executive Officer for other executive officers of the Company and the Bank. In addition, the Compensation and Nominating Committee also considers local and national economic conditions and future business prospects of the Bank in setting base salary levels.

Discretionary Bonuses. The Bank occasionally awards discretionary cash bonuses to its executive officers to attract new executive officers, to reward exceptional job performance, or to address special circumstances. Discretionary bonuses are awarded on a limited basis and are not contemplated or anticipated when setting annual compensation for the Bank’s executive officers.

Compensation Pursuant to Employee Benefit Plans. We maintain a 401(k) plan that matches 50% of the first 4% contributed. We also maintain health, life and accidental death & dismemberment insurance as well as long term disability insurance. Further, the Company has purchased life insurance policies on certain key executives. The Company owned life insurance is recorded at its cash surrender value, or the amount that can be realized.

Employment Agreement. The Bank entered into an employment agreement with Mr. John Demmler in February 2011 to serve as the Bank’s Senior Vice President and Chief Risk Administration and Lending Officer. The employment agreement terminated on February 12, 2013 when Mr. Demmler’s employment ended.

The employment agreement provided for an annual base salary of $130,000, subject to review and modification by the Bank. The employment agreement also provided for a $7,000 signing bonus, subject to a pro rata clawback if Mr. Demmler ended his employment within one year of the agreement. In addition, the agreement provided other benefits and privileges including, but not limited to, health insurance, disability insurance, vacation, sick leave and retirement savings plan.

Mr. Demmler’s employment agreement contained a severance provision upon termination without cause in which he is entitled to receive a payment amount equal to the six months period following the date of termination in accordance with the standard payroll policies of the Bank. In addition, Mr. Demmler’s employment agreement contained a severance provision upon termination or resignation following a material change of ownership of the Bank.

The employment agreement contained provisions restricting Mr. Demmler’s right to solicit the Bank’s employees during Mr. Demmler’s employment for a period of one year following termination, unless permission is obtained from the Bank upon written consent. In addition, following termination, the employment agreement contained provisions requiring Mr. Demmler to return all material documents, data and software to the Bank and to keep all confidential information obtained throughout his employment in the strictest confidence.

Pension Plan. The Company offered a defined benefit retirement plan to eligible personnel employed prior to December 2009, when the plan was frozen for both new participants and the accrual of additional benefits. As of December 31, 2013, 29 current and former employees are due benefits from the plan with a projected liability of $1.2 million and required additional funding of $528,730. Management believes that a plan has been put in place to ensure the pension plan is fully funded over the next ten years.

Consulting Agreements

The Company and Donald P. Wood entered into a consulting agreement dated May 1, 2013. The consulting agreement provided that Mr. Wood would assist with our stock offering by providing advice in the preparation of our Registration Statement (No. 333-191004) on Form S-1, identifying and meeting with potential investors, and ensuring all investor questions were answered. Mr. Wood received $10,000 per month and was reimbursed for all reasonable expenses incurred until the consulting agreement was concluded on January 31, 2014.

The Company and Ronald R. Reed entered into a consulting agreement dated January 28, 2013. Mr. Reed received $3,365 per week plus $500 a month as a vehicle allowance. The consulting agreement provided that Mr. Reed would advise both the Company and Bank’s Board of Directors on various banking industry matters. The contract terminated on March 18, 2013 when Mr. Reed began his position as President and CEO of the Company and the Bank.

Compensation Committee Interlocks and Insider Participation

There were no Compensation Committee interlocks or insider participation during 2013.

Tax Considerations

Under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), a limitation is placed on the tax deductibility of executive compensation paid by publicly-held corporations for individual compensation to certain executive officers in excess of $1,000,000 in any taxable year. No executive officer of the Company received compensation during the Company’s 2013 fiscal year that would be non-deductible under Section 162(m).

SUMMARY COMPENSATION TABLE

The following table summarizes compensation for the chief executive officer and two most highly compensated executive officers for the fiscal year ended December 31, 2013 and 2012 (the “named executive officers”).

Name & Principal Position | | | Year | | | | Salary ($) | | | | Bonus ($) | | | All Other Compensation ($) | | | Total ($) | |

| | | | | | | | | | | | | | | | | | | |

Ronald R. Reed President & Chief Executive Officer | | | 2013 2012 | | | | 135,735 0 | | | | 0 0 | | | 24,805(1) 0 | | | 160,540 0 | |

| | | | | | | | | | | | | | | | | | | |

Brian Starner President & Chief Executive Officer(2) | | | 2013 2012 | | | | 0 141,467 | | | | 0 0 | | | 0 32,790(3) | | | 0 174,257 | |

| | | | | | | | | | | | | | | | | | | |

Don Wood Chairman, Interim President & Chief Executive Officer | | | 2013 2012 | | | | 47,053(4) 6,154(4) | | | | 0 0 | | | 92,000(5) 3,000(6) | | | 139,053 9,154 | |

| | | | | | | | | | | | | | | | | | | |

James V. Livesay Chief Financial and Accounting Officer | | | 2013 2012 | | | | 29,617 0 | | | | 0 0 | | | 0

0 | | | 29,617 0 | |

| | | | | | | | | | | | | | | | | | | |

Michael Knuchel Chief Lending Officer | | | 2013 2012 | | | | 31,058 0 | | | | 0 0 | | | 0

0 | | | 31,058 0 | |

| | | | | | | | | | | | | | | | | | | |

John Demmler Executive Vice President/Chief Financial Officer & Chief Operating Officer(7) | | | 2013 2012 | | | | 115,055 129,042 | | | | 0 0 | | | 0

8,060 | | | 115,055 137,102 | |

| | | | | | | | | | | | | | | | | | | |

John Hock Senior Vice President(8) | | | 2013 2012 | | | | 35,821 125,000 | | | | 0 0 | | | 0

1,442 | | | 35,821 126,442 | |

| (1) | Mr. Reed was paid $24,805 for his services as a consultant, as described above, prior to his appointment as President & CEO. |

| (2) | Mr. Starner’s employment ended on September 17, 2012. |

| (3) | Includes $12,000 of Board fees earned during the year ended December 31, 2012. |

| (4) | Payments made in connection with Mr. Wood’s service as interim President and CEO beginning in November 2012 after Mr. Starner’s resignation until the hiring of Mr. Reed in March 2013. |

| (5) | Includes $12,000 in Board fees earned and $80,000 for his service as consultant during the year ended December 31, 2013, as described above. |

| (6) | Includes $3,000 in Board fees earned during the year ended December 31, 2012. |

| (7) | Mr. Demmler’s employment ended on February 12, 2013. |

| (8) | Mr. Hock’s employment ended on March 25, 2013. |

Other Compensation Table

Name | | | Year | | | | 401(k) Match ($) | | | Auto Allowance/Use of

Company Owned Vehicle ($) | | | Board Fees ($) | | | | Total ($) | |

| | | | | | | | | | | | | | | | | | | |

Ronald R. Reed President & Chief Executive Officer | | | 2013 2012 | | | | 0 0 | | | 1,250

0 | | | | | | | 1,250 0 | |

| | | | | | | | | | | | | | | | | | | |

Don Wood President & Chief Executive Officer | | | 2013 2012 | | | | 0 0 | | | 0

0 | | | 12,000 3,000 | | | | 12,000 3,000 | |

| | | | | | | | | | | | | | | | | | | |

James V. Livesay Chief Financial and Accounting Officer | | | 2013 2012 | | | | 0 | | | 0

0 | | | | | | | 0 0 | |

| | | | | | | | | | | | | | | | | | | |

Michael Knuchel Chief Lending Officer | | | 2013 2012 | | | | 0 0 | | | 0

0 | | | | | | | 0 0 | |

| | | | | | | | | | | | | | | | | | | |

Brian Starner President & Chief Executive Officer | | | 2013 2012 | | | | 0 2,378 | | | 0

18,412 | | |

12,000 | | | | 0 32,790 | |

| | | | | | | | | | | | | | | | | | | |

John Demmler Executive Vice President/Chief Financial Officer & Chief Operating Officer | | | 2013 2012 | | | | 0 2,581 | | | 0

5,479 | | | | | | | 0 8,060 | |

| | | | | | | | | | | | | | | | | | | |

John Hock Senior Vice President | | | 2013 2012 | | | | 0 1,442 | | | 0

0 | | | | | | | 0 1,442 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of our common shares by: (1) each of our directors, (2) each of our named executive officers, (3) all the directors and executive officers of the Company as a group as of March 14, 2014, and (4) each person, group or entity known to us to own beneficially more than 5% of our outstanding common shares.

Beneficial ownership is determined according to the rules of the SEC and generally includes any shares over which a person possesses sole or shared voting or investment power and options that are currently exercisable or exercisable within 60 days. The ownership information of each director and officer, as the case may be, is based upon our records with respect to beneficial ownership. Except as otherwise indicated in the footnotes to this table, we believe that the beneficial owners of common shares listed below have sole investment and voting power with respect to their shares.

The table lists applicable percentage ownership based on 556,733 common shares outstanding as of March 14, 2014. Unless otherwise noted, the address for each shareholder listed below is the same as our address.

| Name of Beneficial Owner | | Number of Shares | | | Percent of Class | |

| Donald P. Wood | | | 10,007 | | | | 1.80 | % |

| Jerry Don Johnson | | | 6,500 | (1) | | | 1.17 | % |

| Billy Jo King | | | 3,000 | (2) | | | * | |

| Michael Knuchel | | | 575 | (3) | | | * | |

| Corby Leach | | | 6,507 | (4) | | | 1.17 | % |

| Robert Lilley | | | 5,500 | (5) | | | 1.00 | % |

| James V. Livesay | | | 250 | | | | * | | |

| William J. Mauck | | | 2,001 | (6) | | | * | |

| Ronald R. Reed | | | 1,000 | (7) | | | * | |

| Michael Shawd | | | 1,966 | (8) | | | * | |

| Daniel Stohs | | | 7,001 | (9) | | | 1.26 | % |

| Robert Carl Wolfinger, Jr. | | | 2,000 | | | | * | |

| All current directors and executive officers as a group (13 persons) | | | 47,227 | | | | 8.48 | % |

| | | | | | | | | |

| Alan Stockmeiser | | | 28,968 | | | | 5.20 | % |

| 213 Redondo Drive | | | | | | | | |

| Jackson, Ohio 45640 | | | | | | | | |

* Less than 1% of the outstanding shares.

| (1) | All 6,500 shares are jointly held by Mr. Johnson and his spouse. |

| (2) | Includes 750 shares held by Mr. King directly, 750 shares held by his daughter and 1,500 shares held by his grandchildren. |

| (3) | All 575 shares are jointly held by Mr. Knuchel and his spouse. |

| (4) | Includes 10 shares jointly held by Mr. Leach and his spouse, 4,873 shares allocated to Mr. Leach’s Roth IRA and 1,624 shares allocated to his spouse’s Roth IRA. |

| (5) | Includes 4,250 shares held by Mr. Lilley directly and 1,250 shares held by his spouse. |

| (6) | Includes 1 share owned by Mr. Mauck directly and 2000 shares held jointly by Mr. Mauck and his spouse. |

| (7) | Includes 1,000 shares allocated to Mr. Reed’s Traditional IRA. |

| (8) | Includes 1 share held by Mr. Shawd directly and 1,965 allocated to his Traditional IRA. |

| (9) | Includes 1 share held by Mr. Stohs directly and 7,000 allocated to his Traditional IRA. |

PROPOSAL THREE – AMENDMENT TO THE COMPANY’S AMENDED AND

RESTATED ARTICLES OF INCORPORATION TO INCREASE THE TOTAL

NUMBER OF AUTHORIZED COMMON SHARES

On December 16, 2013, our Board approved an amendment to Article Fourth of the Articles in order to increase the number of authorized common shares by 1,100,000 from 900,000 to 2,000,0000. The Board is now unanimously proposing and recommending that our shareholders adopt and approve the proposed amendment to Article Fourth.

The Articles currently authorize 900,000 common shares, each without par value, and 100,000 preferred shares. The total number of currently authorized preferred shares will not change. As of March 15, 2014 there were 556,733 common shares issued and outstanding.

In considering the amendment, the Board concluded that it would be advisable for the additional common shares to be available for issuance at the discretion of the Board in connection with acquisitions, stock dividends, stock splits, and for any other purpose determined by the Board to be in the best interest of the Company, without the delay of obtaining shareholder approval prior to each issuance. Where approval by shareholders is otherwise required for the issuance of common shares, whether by Ohio law or other applicable requirement, such approval by shareholders will be requested. There are no present plans to issue any of the additional common shares requested to be authorized by the proposed amendment to Article Fourth, and the Board will not issue any additional common shares except on terms which it considers to be in the best interests of the Company. The additional common shares requested to be authorized by the amendment will have rights identical to the currently issued and outstanding common shares of the Company. Holders of the Company’s shares do not have preemptive rights.

The proposed increase in the number of authorized common shares could be deemed to have an anti-takeover effect by discouraging an attempt by a third party to acquire control of the Company since the Company could issue the additional authorized common shares in an effort to dilute the common share ownership of the person seeking to obtain control or increase the voting power of persons who would support the Board in opposing the takeover attempt. However, the proposal to increase the authorized number of common shares is not in response to any current effort of which the Company is aware to obtain control of the Company.

The proposed amendment is generally not part of a plan by the Company to adopt other measures having potential anti-takeover effects. The Articles and Regulations of the Company currently include, however, the following provisions which may be considered to have anti-takeover effects: (a) the elimination of cumulative voting in the election of directors; (b) the requirement that shareholder nominations for election to the Board of Directors be made in writing and delivered or mailed to the president of the Company within specified timeframes; (c) the requirement that directors may be removed only by the affirmative vote of holders of not less than 80% of the voting power of the Company entitled to vote at an election of directors; (d) the requirements that certain business combinations be approved by at least 80 percent of the voting power of the Company, depending on the nature of the recommendation of the Board of Directors with regard to the relevant acquisition; and (e) the lack of a provision opting out of application of the Ohio Merger Moratorium statute and its restrictions on persons who become the beneficial owner of ten percent or more of the shares of the Company. In addition, if Proposal One is approved, the classification of the Board into three classes with staggered terms will have an anti-takeover effect as previously outlined in Proposal One – Amendment to the Company’s Amended and Restated Regulations to Authorize the Classification of the Board of Directors Into Three Classes with Staggered Terms.

Based on the determination that the increase in authorized common shares from 900,000 to 2,000,000 will enable the Company to meet future business and financial needs, the Board recommends the shareholders approve the amendment. Accordingly, the shareholders of the Company will be asked to approve the following resolution at the Annual Meeting:

RESOLVED, that the first paragraph of Article Fourth of the Amended and Restated Articles of Incorporation be, and it hereby is, deleted in its entirety and replaced with the following new first paragraph of Article Fourth:

FOURTH. The authorized number of shares of the corporation shall be 2,100,000, which shares shall be divided into two classes, one class of which shall consist of 2,000,000 shares designated as common shares, each without par value, and one class of which shall consist of 100,0000 share designated as preferred share, each without par value.

If the proposed amendment is adopted, it will become effective upon the filing of Certificate of Amendment to our Articles with the State of Ohio, which we expect to file shortly after receiving shareholder approval.

The amendment to the Articles requires the affirmative vote of a majority of the outstanding shares entitled to vote at the Annual Meeting.Shareholders may vote “FOR,” “AGAINST” or “ABSTAIN” from voting on Proposal Three. Abstentions and broker non-votes will have the same effect as votes against Proposal Three.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT

THE SHAREHOLDERS VOTE “FOR” PROPOSAL THREE.

PROPOSAL FOUR - AMENDMENT TO THE COMPANY’S AMENDED AND

RESTATED REGULATIONS TO ESTABLISH DIRECTOR SHARE OWNERSHIP GUIDELINES AND TO PROVIDE THE BOARD THE ABILITY TO REMOVE A DIRECTOR FOR CAUSE

On December 16, 2013, our Board approved an amendment to Section 2.01 of our Regulations to establish share ownership guidelines for directors (the “Share Ownership Guidelines”). The Board is now unanimously proposing and recommending that our shareholders adopt and approve the proposed amendment to Section 2.01.

The Board believes that it is important for its directors to maintain an appropriate level of equity ownership in the Company. The Share Ownership Guidelines are designed to align the interests of directors serving on the Board with those of our shareholders, to support sound corporate governance, and to demonstrate a commitment to the Company. The Board believes that it is in the best interests of the Company for the Board to be able to adjust the required level of equity ownership of directors, depending on various factors such as changes to the market price of our equity securities, without the need to wait for a meeting of shareholders in order to amend the Regulations. For these reasons, the Board has determined it is in the best interests of the Company to amend our Regulations to provide that the Board will establish Share Ownership Guidelines for members of the Board. A copy of the Share Ownership Guidelines is attached as Annex A to this proxy statement.

In addition, on March 3, 2014, our Board approved an amendment to Section 2.04 of our Regulations to provide the Board with the ability to remove a director for cause (the “Removal Provision”). The Board is now unanimously proposing and recommending that our shareholders adopt and approve the proposed amendment to Section 2.04.

Currently, under our Regulations, our shareholders may remove a director from office, with or without cause, only by a supermajority vote of 80% of the voting power of the Company. This is consistent with anti-takeover provisions of our Articles and Regulations which insulate management and make the accomplishment of certain transactions involving the potential change of control of the Company more difficult. While the current provision limits the ability to change the composition of the Board, it does not provide the flexibility the Company needs in order to ensure that the members of the Board meet the standards and qualifications required by the Company under the Articles and Regulations. Under the Ohio Revised Code § 1701.58, directors may be removed from the Board, including if the director does not acquire the qualifications specified in the organizational documents of the company, including for our purposes, the Shareholder Ownership Guidelines, if approved. Providing the Board the ability to remove a director for cause ensures that directors meet the standards and qualifications required under the Articles and Regulations and increases the authority of the Board in enforcing these standards and qualifications.

If the Share Ownership Guidelines and the Removal Provision amendments are adopted, the amendments will become effective upon the filing of Certificate of Amendment to our Regulations with the State of Ohio, which we expect to file shortly after receiving shareholder approval.

The Board recommends the shareholders approve the amendments to the Regulations. Accordingly, the shareholders of the Company will be asked to approve the following resolution at the Annual Meeting:

RESOLVED, that Section 2.01 and Section 2.04 of the Company’s Amended and Restated Regulations be, and it hereby is, deleted in its entirety and replaced with the following new Section 2.01: