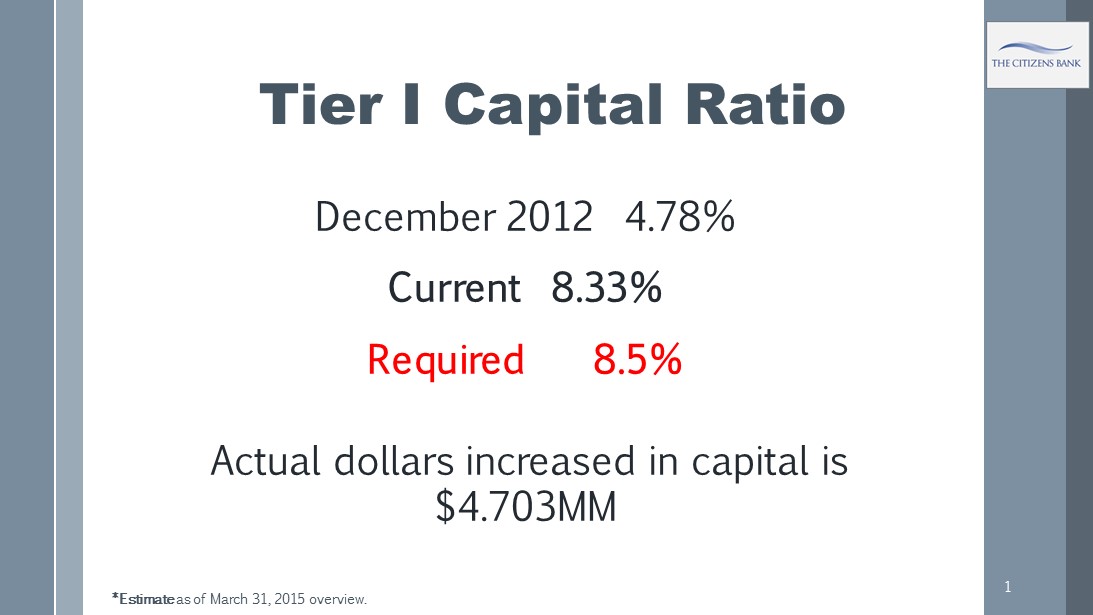

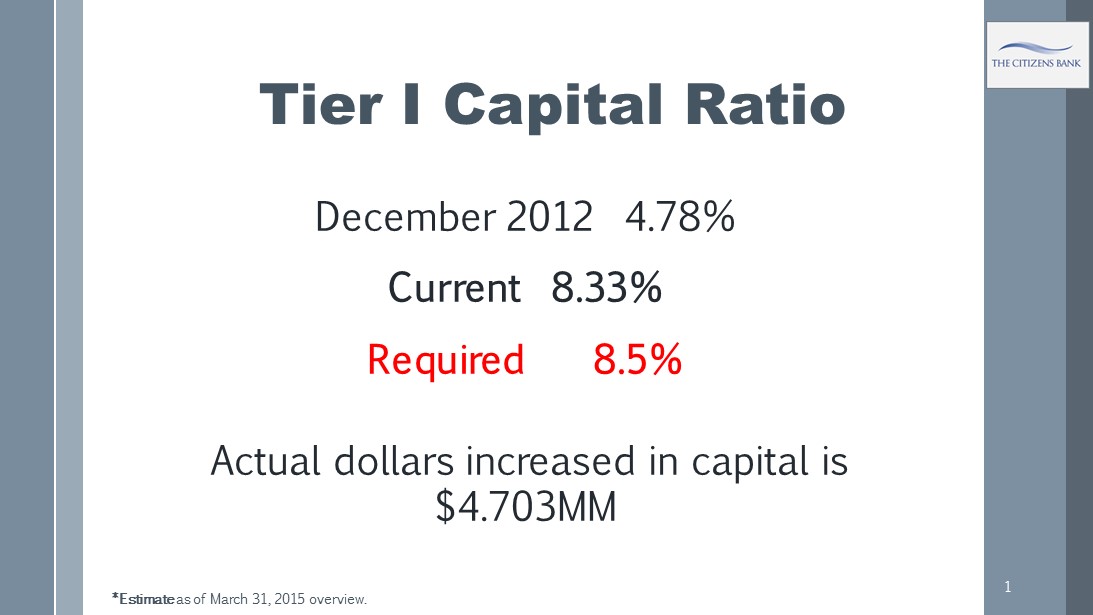

1 Tier I Capital Ratio December 2012 4.78% Current 8.33% Required 8.5% Actual dollars increased in capital is $4.703MM *Estimate as of March 31, 2015 overview.

2 Book value per share: as of December 31, 2013 was $16.95 Current book value per share: as of December 31, 2014 is $25.40

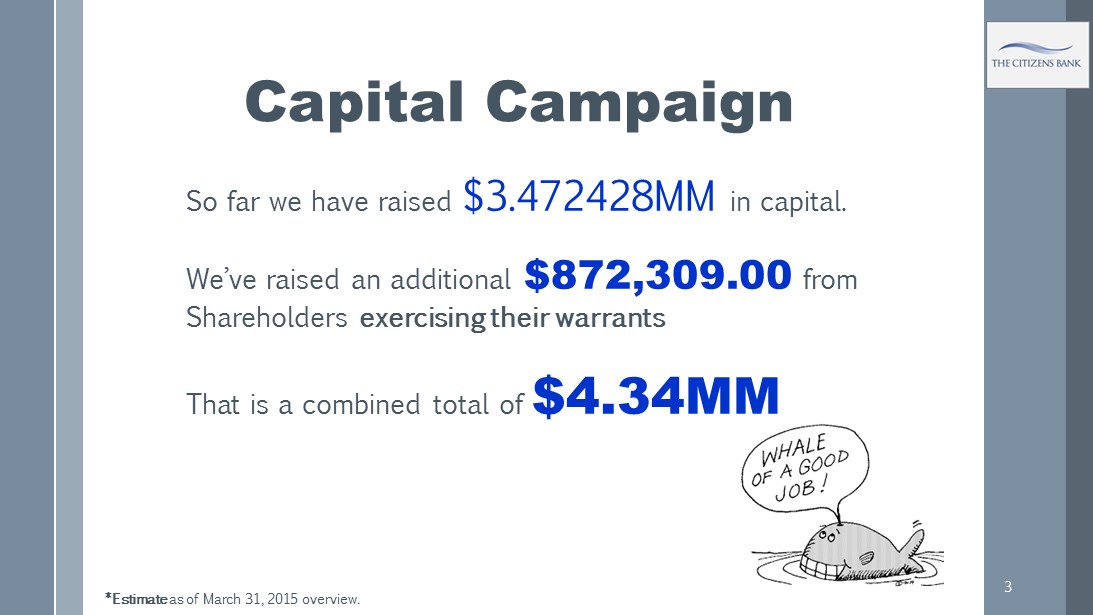

3 So far we have raised $3.472428MM in capital. We’ve raised an additional $872,309.00 from Shareholders exercising their warrants That is a combined total of $4.34MM Capital Campaign *Estimate as of March 31, 2015 overview.

$5MM Loan Holding Company Loan 4 • Loan made in 2010 to 4 partners of WLPM • Loan matures December 31, 2015 • Loan was split into 2 Notes: Note A and Note B

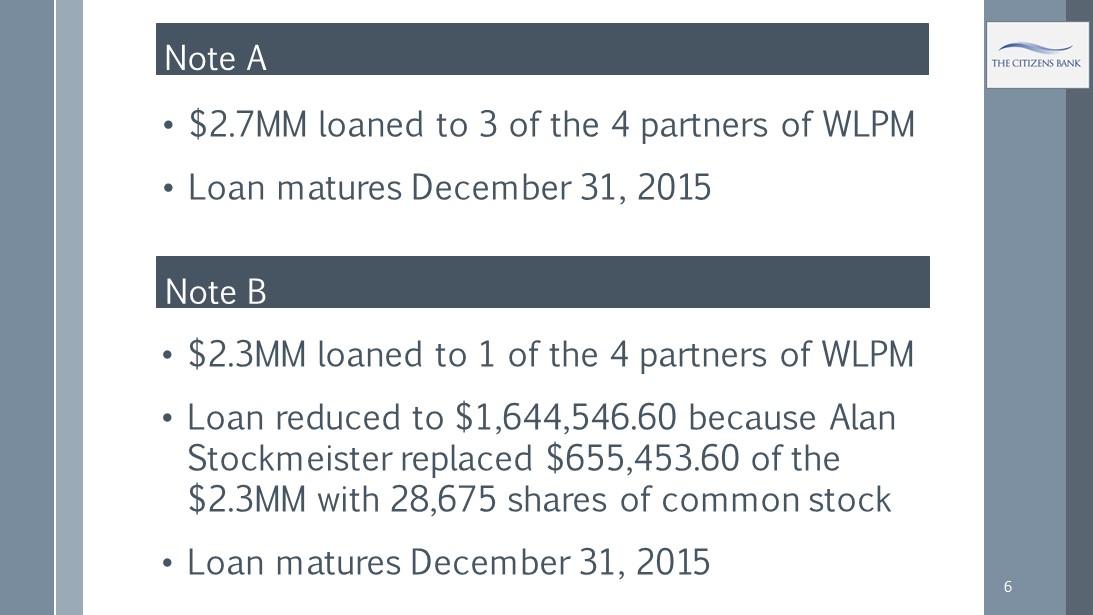

5 Note A • $2.7MM loaned to 3 of the 4 partners of WLPM • Loan matures December 31, 2015

6 Note A • $2.7MM loaned to 3 of the 4 partners of WLPM • Loan matures December 31, 2015 • $2.3MM loaned to 1 of the 4 partners of WLPM • Loan reduced to $1,644,546.60 because Alan Stockmeister replaced $655,453.60 of the $2.3MM with 28,675 shares of common stock • Loan matures December 31, 2015 Note B

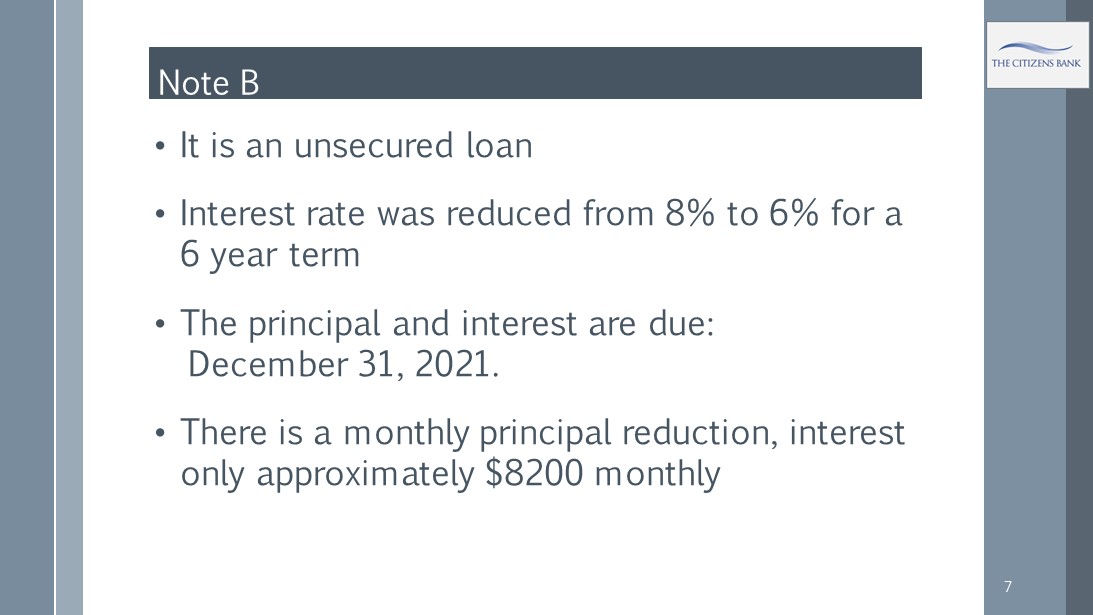

7 Note A • It is an unsecured loan • Interest rate was reduced from 8% to 6% for a 6 year term • The principal and interest are due: December 31, 2021. • There is a monthly principal reduction, interest only approximately $8200 monthly Note B

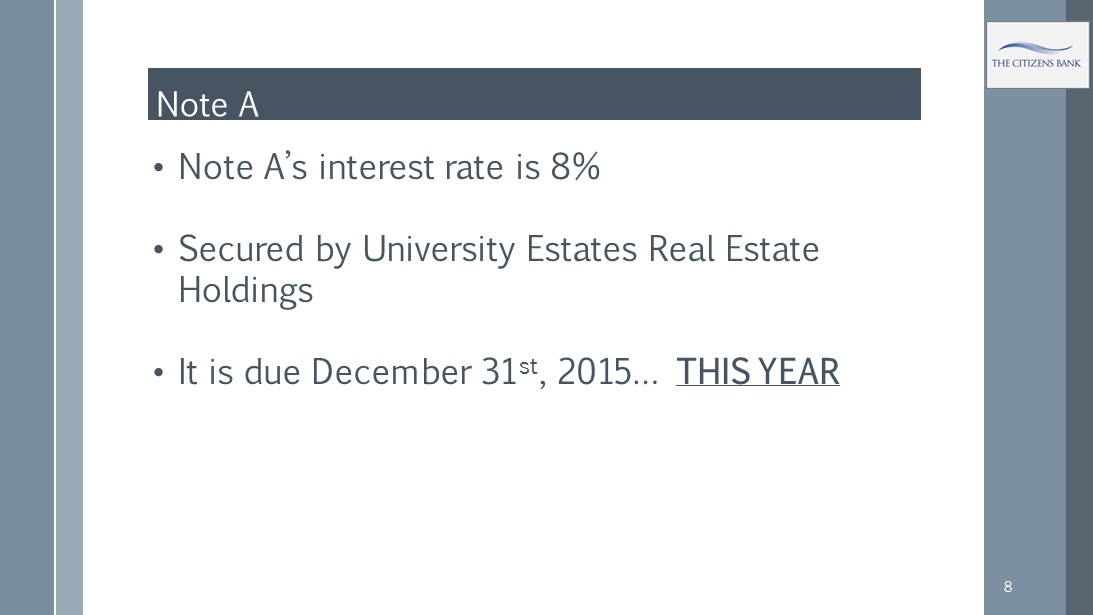

8 Note A • Note A’s interest rate is 8% • Secured by University Estates Real Estate Holdings • It is due December 31 st , 2015… THIS YEAR Note A

9 Note A A. $1.6MM cash available at Holding Company B. Anticipate raising additional funds from Shareholders exercising their warrants C. Additional $200M in cash from sale of a portion of University Estates property D. Normalized earnings between $800M to $900M Options to Eliminate Note A & Note B

10 Note A E. Refinance $1MM with another lending institution that can be paid with future profits F. IF we are relieved of our consent order we can rid ourselves of $1MM of this debt by future dividends to make monthly payments until maturity Options to Eliminate Note A & Note B (continued)

11 Note A G. A one time $1MM dividend upstreamed from the Bank to the Holding Company. Options to Eliminate Note A & Note B (continued)

12 Our Peer Group for Data Comparison Comprised of 52 Ohio banks Each with an asset size between $100MM to $300MM Our current asset size is $200MM

13 Book value per share: as of December 31, 2013 was $16.95 Year end book value per share: as of December 31, 2014 is $25.40

14 * Suttle & Stalnaker , PLLC March 2015

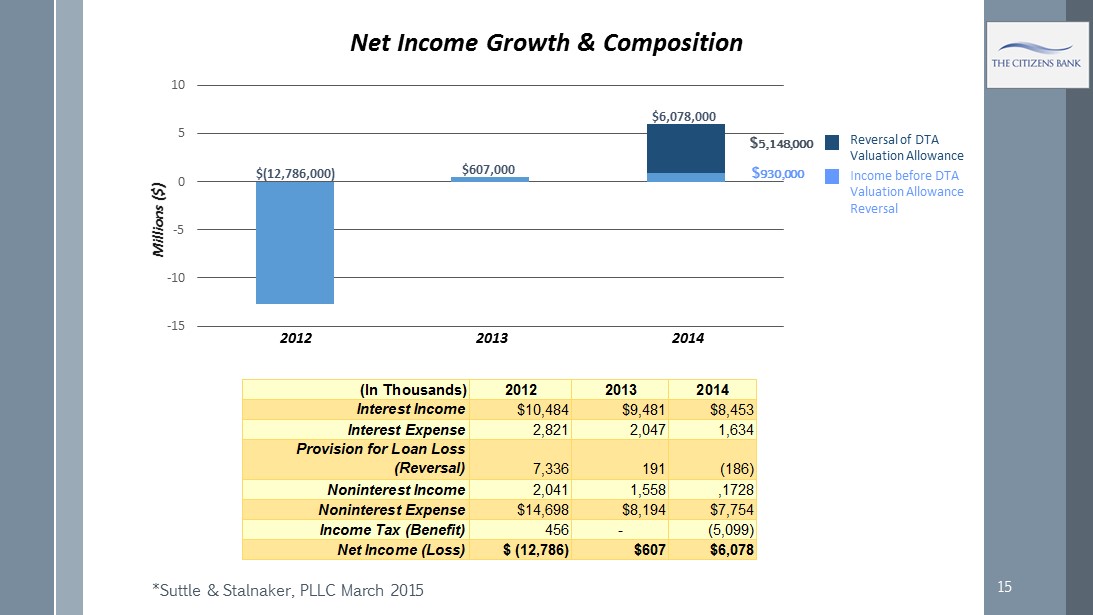

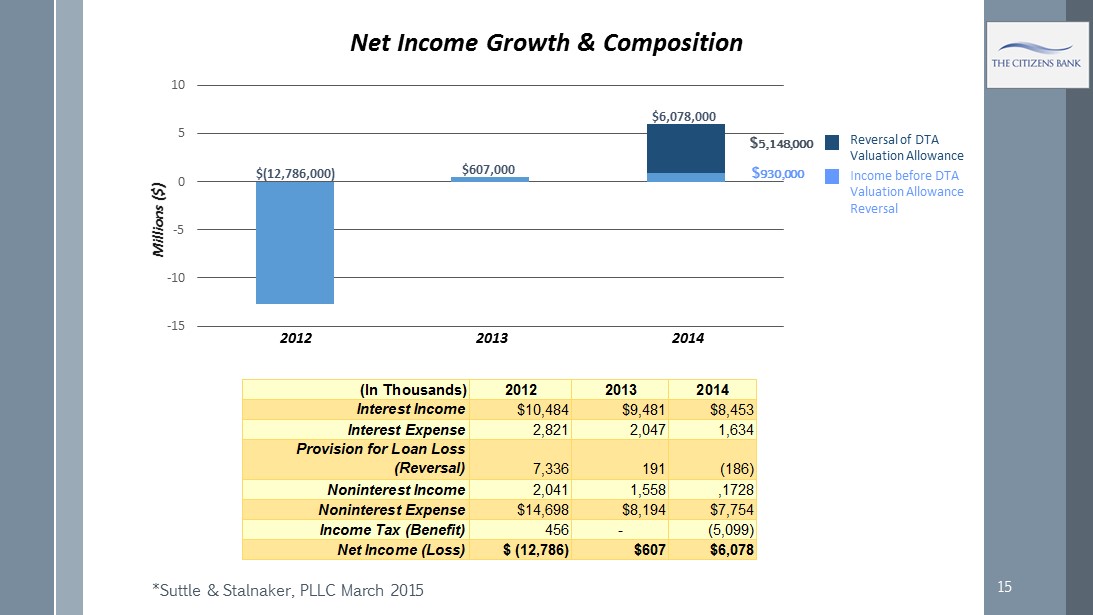

15 * Suttle & Stalnaker , PLLC March 2015 (In Thousands) 2012 2013 2014 Interest Income $10,484 $9,481 $8,453 Interest Expense 2,821 2,047 1,634 Provision for Loan Loss (Reversal) 7,336 191 (186) Noninterest Income 2,041 1,558 ,1728 Noninterest Expense $14,698 $8,194 $7,754 Income Tax (Benefit) 456 - (5,099) Net Income (Loss) $ (12,786) $607 $6,078 $(12,786,000) $607,000 $6,078,000 -15 -10 -5 0 5 10 Millions ($) 2012 2013 2014 Net Income Growth & Composition Reversal of DTA Valuation Allowance Income before DTA Valuation Allowance Reversal $ 930,000 $ 5,148,000

16 Only $445,000 needed to achieve the 8.5% minimum threshold Tier 1 Capital!

17 * Suttle & Stalnaker , PLLC March 2015

18 * Suttle & Stalnaker , PLLC March 2015

19 * Suttle & Stalnaker , PLLC March 2015