Exhibit 99

CITIZENS INDEPENDENT BANCORP

AND

THE CITIZENS BANK OF LOGAN

SHAREHOLDER LUNCHEON

OCTOBER 29, 2015

CITIZENS INDEPENDENT BANCORP

Year Over Year Pretax Net Income

Thru September 30

($000's)

| 2015 | 2014 | |||||||

| 1. Net Income Before Tax | 583 | 702 | ||||||

| 2. Non-recurring Items | (131 | ) | (477 | ) | ||||

| 5. Baseline Income | $ | 452 | $ | 225 | ||||

THE CITIZENS BANK OF LOGAN

CITIZENS LOGAN vs OHIO PEERS

Selected Performance Ratios

| NAME | CITY | Assets | Earning Asset Yield | Cost of Funds | Net Interest Margin | Noncurr Assets +ORE to Assets | Noncurr Loans to Loans | Loan to Deposit | Core Leverage Capital |

| Ohio Peers $100 million - $300 million June 30, 2015 | Average | 172,388 | 4.11 | 0.49 | 3.61 | 1.16 | 1.54 | 82.02 | 12.36 |

| Median | 152,922 | 4.09 | 0.48 | 3.53 | 0.82 | 0.95 | 81.12 | 10.59 | |

| Citizens Bank of Logan | 09/30/14 | 198,091 | 4.34 | 0.65 | 3.80 | 4.41 | 5.15 | 79.50 | 7.42 |

| 06/30/15 | 191,483 | 4.47 | 3.95 | 1.12 | 1.24 | 82.66 | 8.47 | ||

| 09/30/15 | 189,928 | 4.52 | 0.61 | 4.01 | 0.92 | 0.95 | 85.40 | 8.61 |

THE CITIZENS BANK OF LOGAN

SEVERAL WAYS TO LOOK AT OUR LOAN HISTORY

THE CITIZENS BANK OF LOGAN

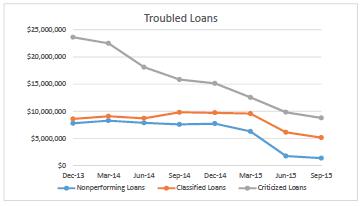

A HISTORY OF OUR LOAN QUALITY ISSUES

| 12/31/13 | 03/31/14 | 06/30/14 | 09/30/14 | 12/31/14 | 03/31/15 | 06/30/15 | 09/30/15 | |

| Nonperforming Loans | $ 7,788,344 | $ 8,272,331 | $ 7,864,446 | $ 7,588,398 | $ 7,729,408 | $ 6,302,763 | $ 1,765,783 | $ 1,365,429 |

| Classified Loans (6/7) | $ 8,600,169 | $ 9,090,976 | $ 8,717,321 | $ 9,815,300 | $ 9,725,106 | $ 9,591,242 | $ 6,130,992 | $ 5,158,757 |

| Criticized Loans (5/6/7) | $ 23,627,542 | $ 22,508,076 | $ 18,119,064 | $ 15,854,107 | $ 15,154,407 | $ 12,565,475 | $ 9,828,158 | $ 8,775,339 |

Nonperforming Loan - a loan that is in default or close to being in default.

Classified Loan - Any bank loan that is in danger of default. Classified loans have unpaid interest and principal outstanding, and it is unclear whether the bank will be able to recoup the loan proceeds from the borrower.

Criticized Loans - loans with payments in arrears and those for which payment is considered uncertain. Criticized loans include classified loans.

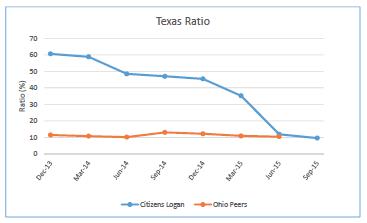

| Texas Ratio | ||||||||

| 12/31/13 | 03/31/14 | 06/30/14 | 09/30/14 | 12/31/14 | 03/31/15 | 06/30/15 | 09/30/15 | |

| Citizens Bank of Logan | 60.6% | 58.8% | 48.4% | 47.0% | 45.4% | 35.2% | 11.9% | 9.6% |

| Peer Group | 11.4% | 10.7% | 10.2% | 13.0% | 12.2% | 10.9% | 10.4% |

Texas Ratio is Non-performing Assets + OREO divided by Loan Loss Reserve + Equity

Texas ratio is a measure of a bank's credit troubles. The higher the Texas ratio, the more severe the credit troubles

CITIZENS INDEDPENDENT BANCORP

The Holding Company Has Debts to Pay

Where we were last year

| December 31, 2014 | ||||||

| Principal | Rate | Maturity | ||||

| $ 5,000,000 | 8.00% | 12/29/15 | Note AB | |||

| 485,132 | 4.25% | 06/25/19 | Note S | |||

| 662,370 | 4.75% | 11/21/19 | Note M | |||

| $ 6,147,502 | ||||||

Where we are now

| September 30, 2015 | ||||||

| Principal | Rate | Maturity | ||||

| $ 1,626,109 | 8.00% | 12/29/15 | Note A | |||

| 410,214 | 4.25% | 06/25/19 | Note S | |||

| 571,032 | 4.75% | 11/21/19 | Note M | |||

| $ 1,644,547 | 6.00% | 08/04/21 | Note B | |||

| $ 4,251,902 | ||||||

Where we plan to be

| December 31, 2015 | ||||||

| Principal | Rate | Maturity | ||||

| 385,038 | 4.25% | 06/25/19 | Note S | |||

| 540,324 | 4.75% | 11/21/19 | Note M | |||

| $ 1,644,547 | 6.00% | 08/04/21 | Note B | |||

| $ 2,569,909 | ||||||