Filed Pursuant to Rule 433 of the

Securities Act of 1933

Issuer Free Writing Prospectus dated

November 1, 2016

Registration No. 333-209702

RedHill Biopharma Ltd. (“RDHL”) Corporate Presentation November 2016 Filed Pursuantto Rule 433 of the SecuritiesActof1933 IssuerFreeWritingProspectusdated November1,2016 RegistrationNo.333-209702

DisclaimerandForwardLookingStatements 2 Statementsinthispresentationthatarenothistoricalfacts(includingstatementscontaining"believes,""anticipates,""plans,""expects," "may,""will,""would,""intends,""estimates"andsimilarexpressions)areforward-lookingstatementswithinthemeaningoftheU.S. PrivateSecuritiesLitigationReformActof1995.Thesestatementsarenotguaranteesoffutureperformance,arebasedoncurrent expectationsoffutureeventsandaresubjecttorisksanduncertaintiesthatcouldcauseactualresultstodiffermateriallyfromthose expressedorimpliedbysuchstatements,includingrisksthatwewillnothavesufficientworkingcapital,thattherewillbedelaysin obtaining,orwewillbeunabletoobtain,FDAorotherregulatoryapprovalsforourproducts,unabletoestablishcollaborations,orthat ourproductswillnotbecommerciallyviable,amongotherrisks.Additionalinformationabouttheriskfactorsthatmayaffectthe realizationofforward-lookingstatementsissetforthintheCompany’sfilingswithSecuritiesandExchangeCommission,includingthe Company’sAnnualReportonForm20-FfiledonFebruary25,2016.Ifoneormoreofthesefactorsmaterialize,orifanyunderlying assumptionsproveincorrect,ouractualresults,performanceorachievementsmayvarymateriallyfromanyfutureresults,performance orachievementsexpressedorimpliedbytheseforward-lookingstatements.Youshouldnotplaceunduerelianceonforward-looking statementsasapredictionofactualresults. Allforward-lookingstatementsincludedinthispresentationaremadeonlyasofthedateofthispresentation.Weassumenoobligation toupdateanywrittenororalforward-lookingstatementmadebyusoronourbehalfasaresultofnewinformation,futureeventsor otherfactors. AshelfregistrationstatementrelatingtotheshareswasfiledwiththeSECandiseffective.Wehavefiledaprospectussupplementwith theSECfortheofferingtowhichthiscommunicationrelates.Beforeyouinvest,youshouldreadtheprospectusinthatregistration statement,theprospectussupplement,andotherdocumentstheissuerhasfiledwiththeSECformorecompleteinformationaboutthe issuerandthisoffering.YoumaygetthesedocumentsforfreebyvisitingEDGARontheSECwebsiteatwww.sec.gov.Alternatively,the issuer,anyunderwriter,oranydealerparticipatingintheofferingwillarrangetosendyoutheprospectusifyourequestitbycontacting RothCapitalPartners,Attention:EquityCapitalMarkets,888SanClementeDrive,NewportBeach,CA92660,orbytelephoneat800- 678-9147,orFBR,Attention:SyndicateProspectusDepartment,1300North17thStreet,Suite1400,Arlington,VA22209,orby telephoneat703-312-9726,orbyemailatprospectuses@fbr.com.

This presentation highlights basic information about RedHill Biopharma, Ltd. and the offering. RedHill Biopharma, Ltd. has filed a shelf registration statement on Form F-3 (Registration No. 333-209702) (including a base prospectus) with the U.S. Securities and Exchange Commission (the ?SEC?) which is effective. RedHill Biopharma, Ltd. has filed a prospectus supplement with the SEC for the offering to which this presentation relates. Before you invest, you should read the prospectus in that registration statement, the prospectus supplement (including, among other things, risk factors described therein or incorporated by reference) and other documents RedHill Biopharma, Ltd. has filed with the SEC for more complete information about RedHill Biopharma, Ltd. and this offering. The preliminary prospectus supplement dated November 1, 2016, and subsequent amendments or supplements are available at the SEC website. You may get these documents for free by visiting EDGAR on the SEC. website at www.sec.gov. Alternatively, the issuer, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus if you request it by contacting Roth Capital Partners, Attention: Equity Capital Market team, 888 San Clemente, Newport Beach, CA 92660, or by telephone at 800-678-9147.

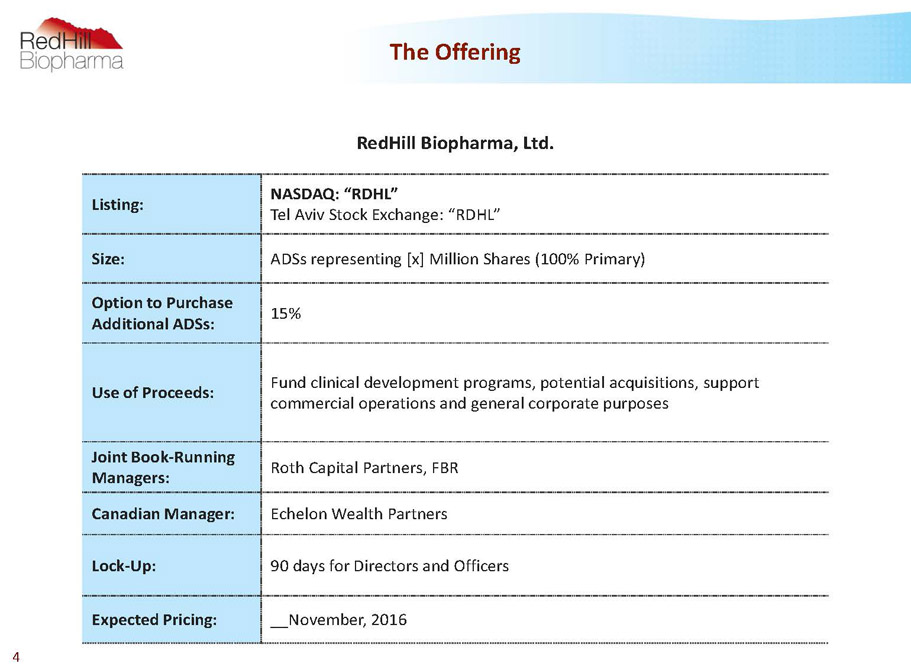

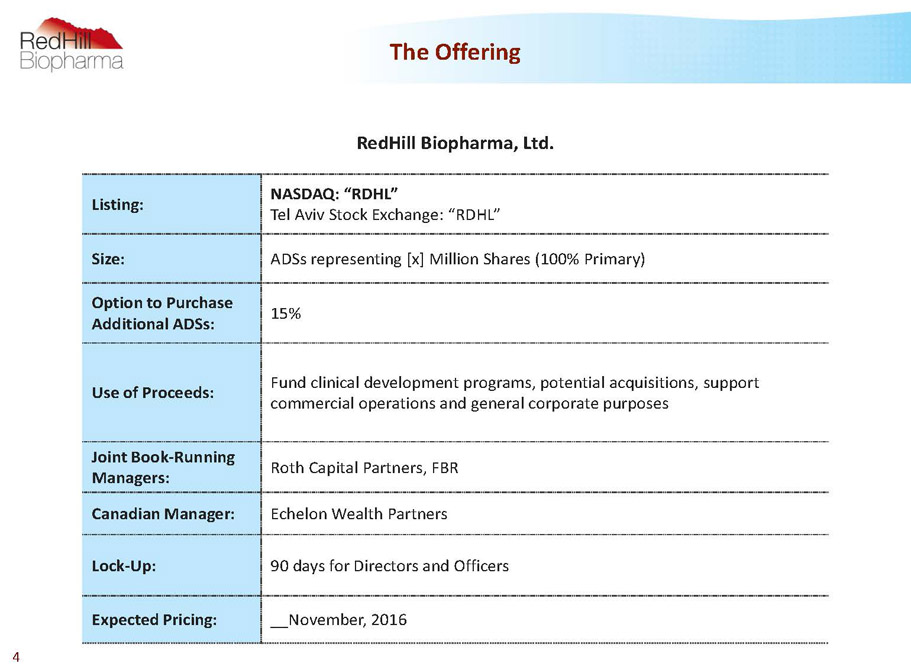

RedHill Biopharma, Ltd. Listing: NASDAQ:“RDHL” TelAviv Stock Exchange:“RDHL” Size: ADSs representing[x] MillionShares (100% Primary) Option to Purchase Additional ADSs: 15% Use ofProceeds: Fund clinicaldevelopment programs, potential acquisitions, support commercial operations andgeneral corporate purposes Joint Book-Running Managers: Roth Capital Partners, FBR Canadian Manager: Echelon Wealth Partners Lock-Up: 90 days for Directors and Officers Expected Pricing: __November, 2016 The Offering 4

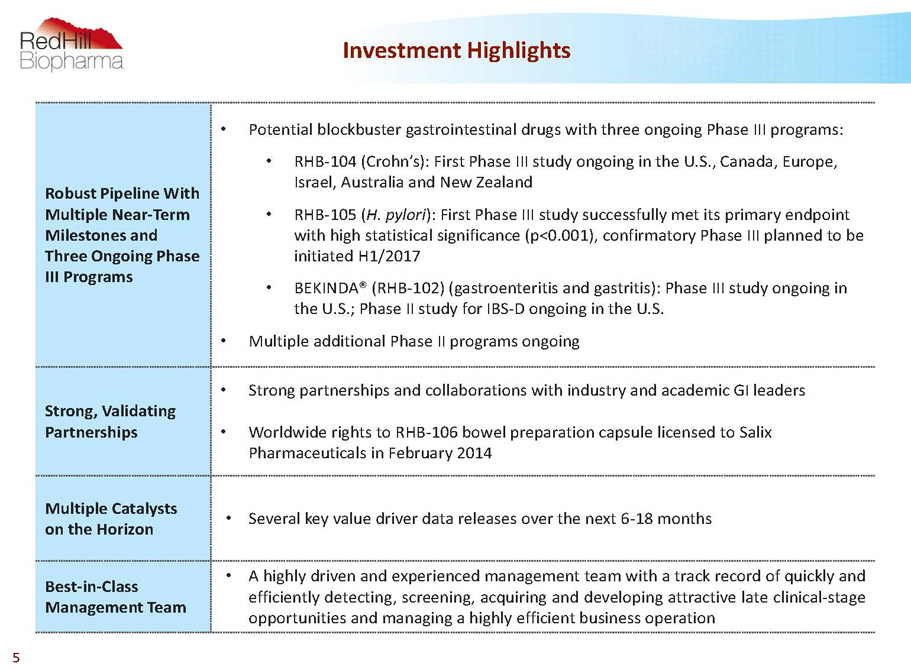

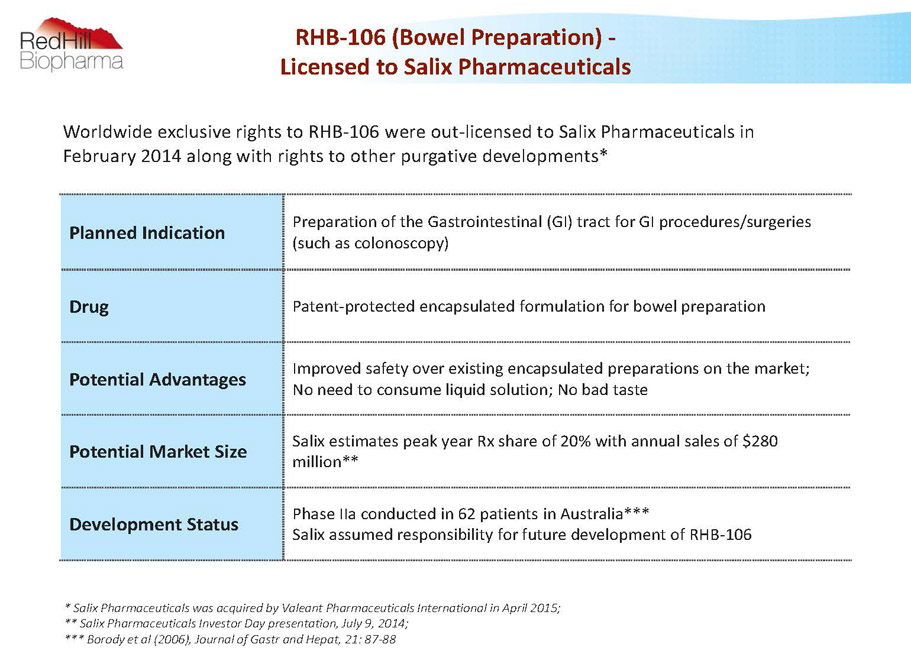

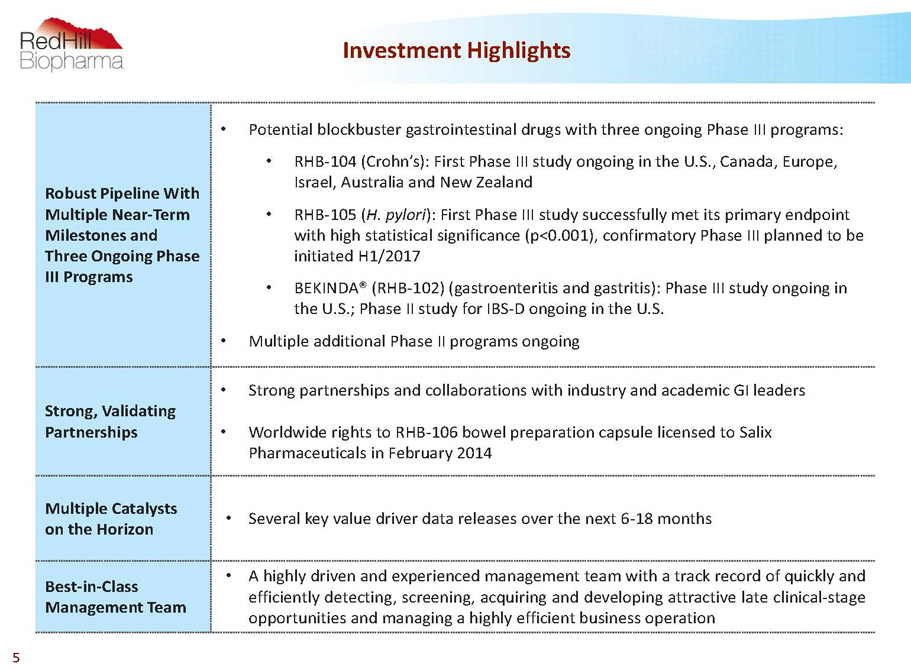

Robust Pipeline With Multiple Near-Term Milestones and Three Ongoing Phase III Programs • Potential blockbuster gastrointestinal drugs with three ongoing Phase III programs: • RHB-104 (Crohn’s): First Phase III study ongoing in the U.S., Canada, Europe, Israel, Australia and New Zealand • RHB-105 (H. pylori): First Phase III study successfully met its primary endpoint with high statistical significance (p<0.001), confirmatory Phase III planned to be initiated H1/2017 • BEKINDA® (RHB-102) (gastroenteritis and gastritis): Phase III study ongoing in the U.S.; Phase II study for IBS-D ongoing in the U.S. • Multiple additional Phase II programs ongoing Strong, Validating Partnerships • Strong partnerships and collaborations with industry and academic GI leaders • Worldwide rights to RHB-106 bowel preparation capsule licensed to Salix Pharmaceuticals in February 2014 Multiple Catalysts on the Horizon • Severalkeyvaluedriverdatareleasesoverthenext6-18months Best-in-Class Management Team • Ahighlydrivenandexperiencedmanagementteamwithatrackrecordofquicklyand efficientlydetecting,screening,acquiringanddevelopingattractivelateclinical-stage opportunitiesandmanagingahighlyefficientbusinessoperation Investment Highlights 5

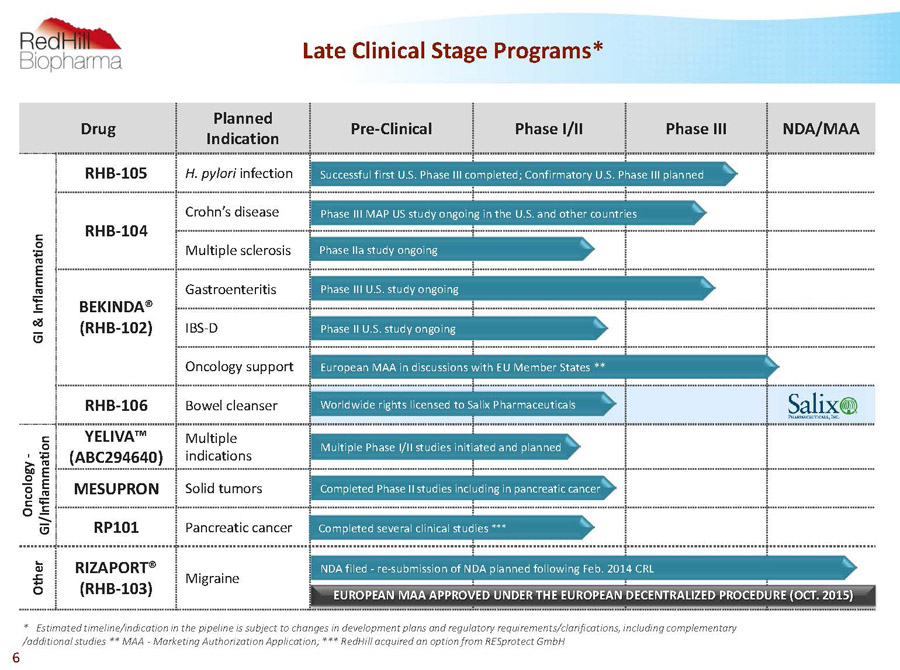

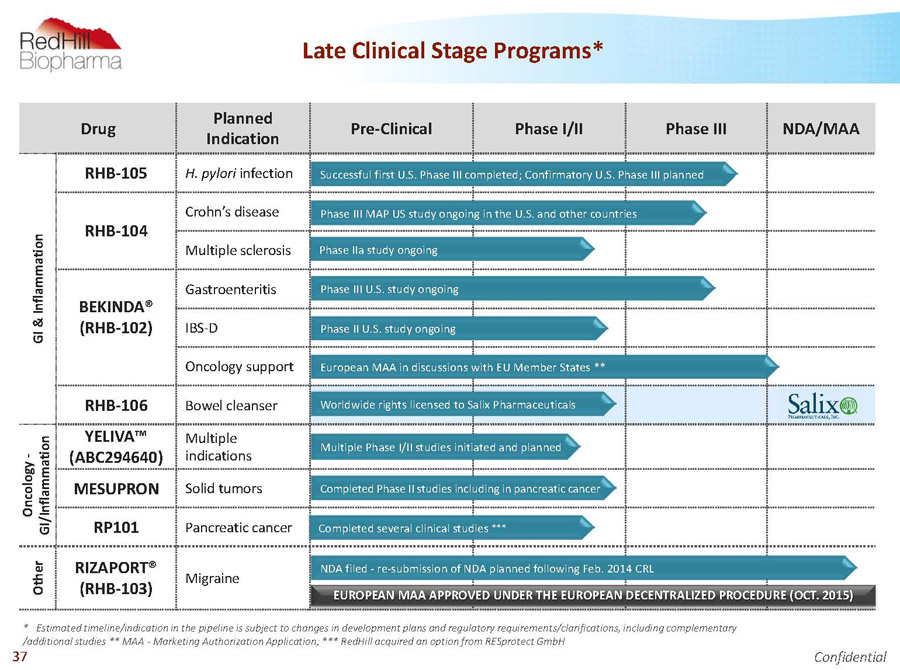

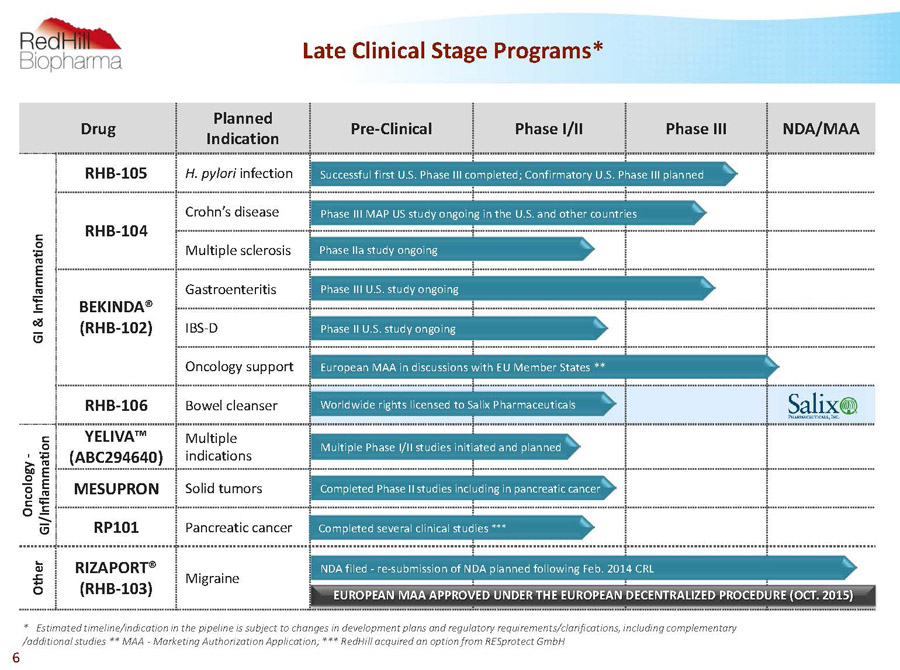

Drug Planned Indication Pre-Clinical Phase I/II Phase III NDA/MAA G I & I n f l a m m a t i o n RHB-105 H. pylori infection RHB-104 Crohn’s disease Multiple sclerosis BEKINDA® (RHB-102) Gastroenteritis IBS-D Oncology support RHB-106 Bowel cleanser O n c o l o g y - G I / I n f l a m m a t i o n YELIVA™ (ABC294640) Multiple indications MESUPRON Solid tumors RP101 Pancreatic cancer O t h e r RIZAPORT® (RHB-103) Migraine Worldwide rights licensed to Salix Pharmaceuticals Successful first U.S. Phase III completed; Confirmatory U.S. Phase III planned Phase III MAP US study ongoing in the U.S. and other countries Phase IIa study ongoing NDA filed -re-submission of NDA planned following Feb. 2014 CRL Phase III U.S. study ongoing Completed Phase II studies including in pancreatic cancer Completed several clinical studies *** European MAA in discussions with EU Member States ** * Estimated timeline/indication in the pipeline is subject to changes in development plans and regulatory requirements/clarifications, including complementary /additional studies ** MAA -Marketing Authorization Application; *** RedHillacquired an option from RESprotectGmbH Multiple Phase I/II studies initiated and planned 6 Late Clinical Stage Programs* Phase II U.S. study ongoing EUROPEAN MAA APPROVED UNDER THE EUROPEAN DECENTRALIZED PROCEDURE (OCT. 2015)

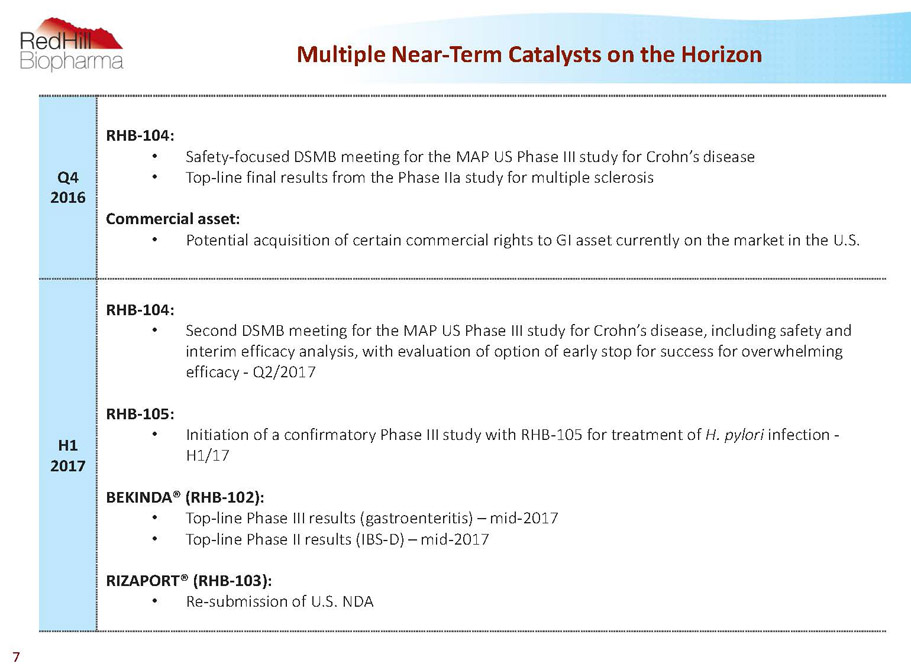

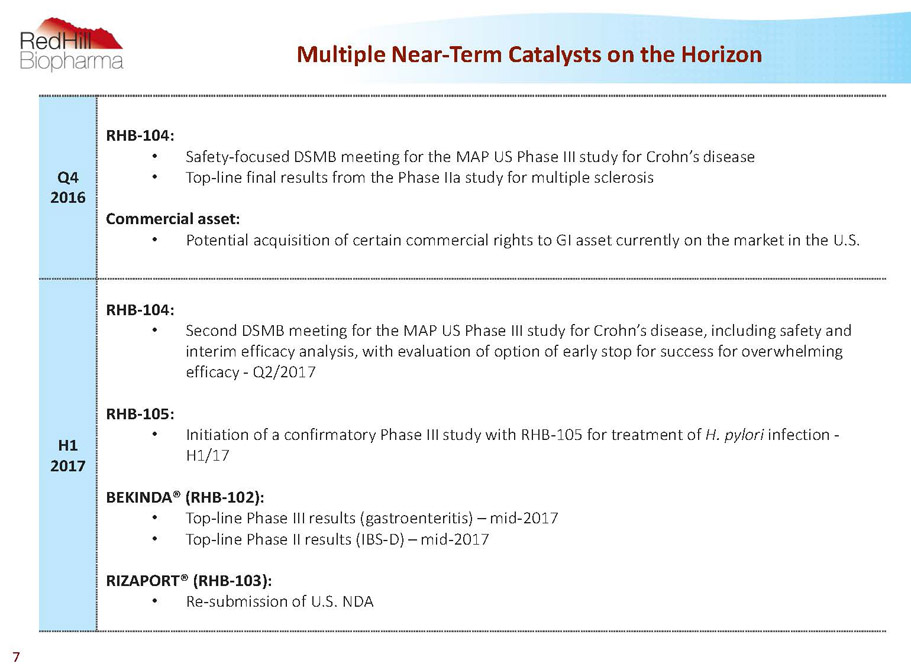

Multiple Near-Term Catalysts on the Horizon 7 Q4 2016 RHB-104: • Safety-focused DSMB meeting for the MAP US Phase III study for Crohn’s disease • Top-line final results from the Phase IIastudy for multiple sclerosis Commercial asset: • Potential acquisition of certain commercial rights to GI asset currently on the market in the U.S. H1 2017 RHB-104: • Second DSMB meeting for the MAP US Phase III study for Crohn’s disease, including safety and interim efficacy analysis, with evaluation of option of early stop for success for overwhelming efficacy -Q2/2017 RHB-105: • Initiation of a confirmatory Phase III study with RHB-105 for treatment of H. pylori infection - H1/17 BEKINDA®(RHB-102): • Top-line Phase III results (gastroenteritis) –mid-2017 • Top-line Phase II results (IBS-D) –mid-2017 RIZAPORT®(RHB-103): • Re-submission of U.S. NDA

Experienced Leadership Team 8 DrorBen-Asher,CEO P.C.M.I. Ltd. AdiFrish, Senior VP Business Development & Licensing Y. Ben-Dror, MediGus Reza FathiPhD, Senior VP R&D XTL,PharmaGenics,Harvard Inst. of Chem. & Cell Biology Ira KalfusMD, Medical Director Lev Pharmaceuticals, Aetna/US Healthcare Terry F. PlasseMD, Medical Director Rhone Poulenc-Rorer, Cytokine PharmaSciences Aida Bibliowicz, VP Clinical Affairs Europe MSc Technion, MBA TAU, Cato ResearchIsrael Gilead Raday, Chief Operating Officer MSc Neurology, MBE Cambridge, Sepal Pharma Guy Goldberg, Chief Business Officer Eagle Pharma, ProQuest, Mckinsey Micha Ben Chorin, Chief Financial Officer GVT, Pyramid Analytics, StarhomeB.V. Shani Maurice, VP Business Development & Communications Prime Minister’s Office Clara Fehrmann, Director Clinical Operations Merck Canada, SantheraPharmaceuticals, ICON Danielle Abramson, PhD, Director Intellectual Property & Research PhD Medical Sciences Brown, Patent Agent Greenberg Traurig * Personal background relates to selected former and current positions and education Executive Management*

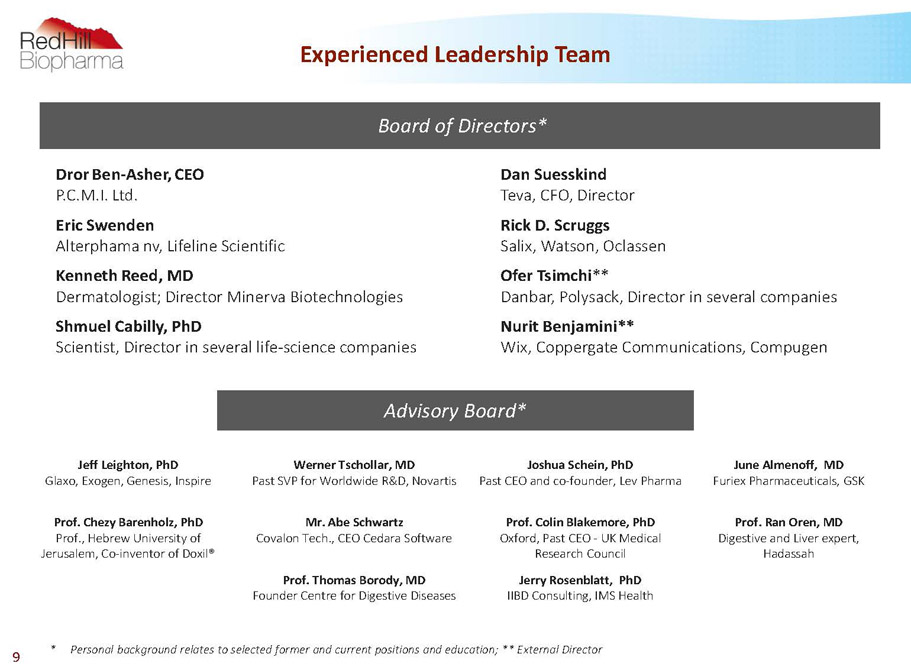

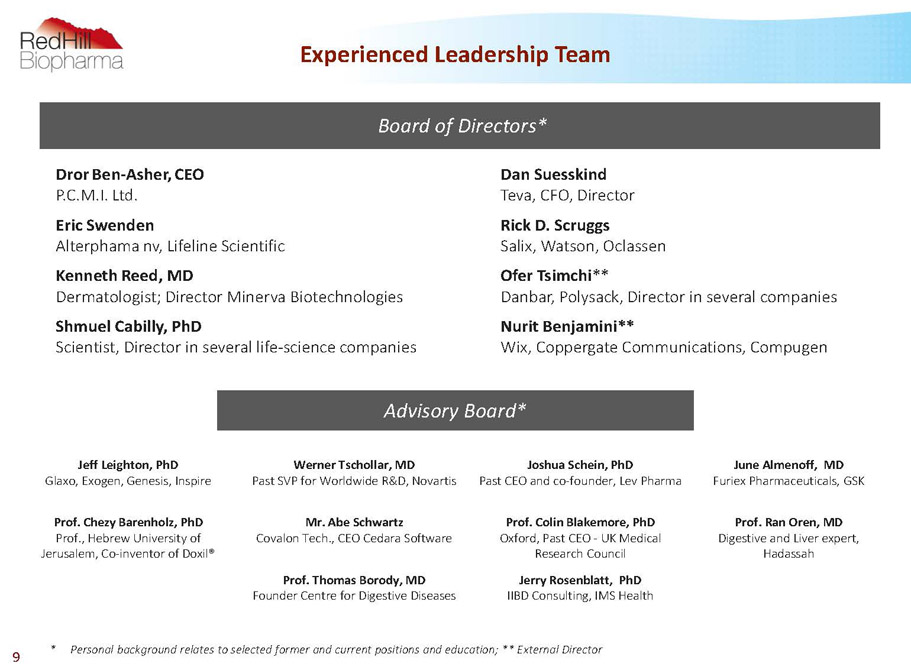

Jeff Leighton, PhD Glaxo, Exogen, Genesis, Inspire Werner Tschollar,MD Past SVP for Worldwide R&D, Novartis Joshua Schein, PhD Past CEO and co-founder, Lev Pharma June Almenoff,MD FuriexPharmaceuticals, GSK Prof. ChezyBarenholz,PhD Prof., Hebrew University of Jerusalem, Co-inventor of Doxil® Mr. Abe Schwartz Covalon Tech., CEO Cedara Software Prof. Colin Blakemore, PhD Oxford, Past CEO -UK Medical Research Council Prof. Ran Oren, MD Digestive and Liver expert, Hadassah Prof. Thomas Borody,MD Founder Centre for Digestive Diseases Jerry Rosenblatt,PhD IIBD Consulting, IMS Health Experienced Leadership Team 9 DrorBen-Asher,CEO P.C.M.I. Ltd. Eric Swenden Alterphama nv, Lifeline Scientific Kenneth Reed, MD Dermatologist; Director Minerva Biotechnologies Shmuel Cabilly, PhD Scientist, Director in several life-science companies Dan Suesskind Teva, CFO, Director Rick D. Scruggs Salix, Watson, Oclassen OferTsimchi** Danbar, Polysack, Director in several companies NuritBenjamini** Wix, CoppergateCommunications, Compugen * Personal background relates to selected former and current positions and education; ** External Director Board of Directors* Advisory Board*

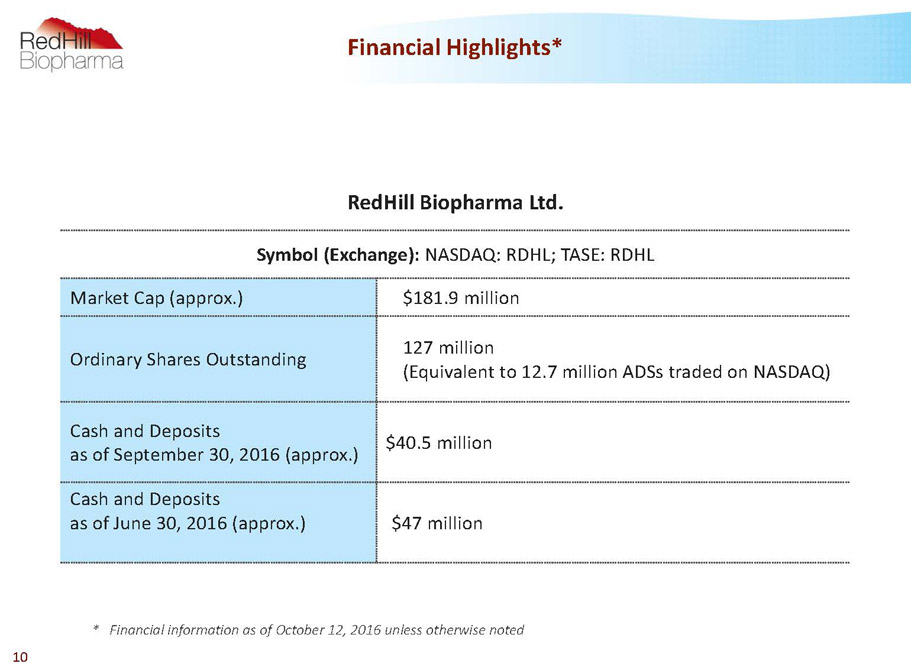

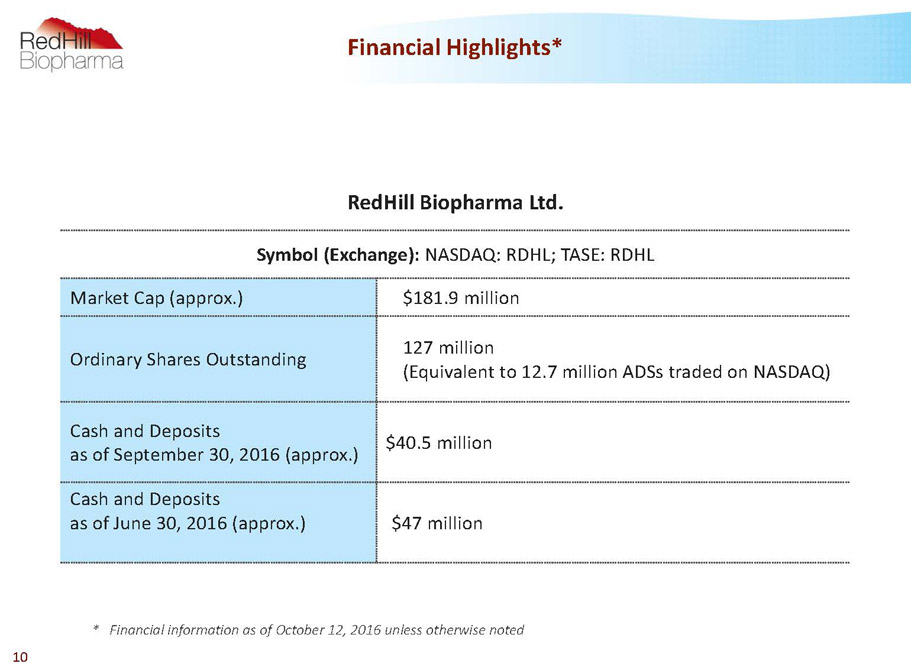

Financial Highlights* 10 RedHillBiopharma Ltd. Symbol (Exchange): NASDAQ:RDHL; TASE: RDHL Market Cap (approx.) $181.9 million Ordinary Shares Outstanding 127 million (Equivalentto 12.7 million ADSs traded on NASDAQ) Cash and Deposits as of September 30, 2016 (approx.) $40.5 million Cash and Deposits as of June 30, 2016 (approx.) $47 million * Financial information as of October 12, 2016 unless otherwise noted

RedHill’s GI Focus: Treating Inflammatory Disease “Where There is Inflammation –Look for Infection” 11 • The Emerging Microbiome Revolution: growing awareness that the microbiome plays a critical role in gastrointestinal illnesses • Lead products RHB-104 (Crohn’s disease) and RHB-105 (H. pylori) focus on restoring the gut microbiome • Strong knowledge base of the human microbiome • Experienced management and Board of Directors • Advisory Board includes Thomas Borody, MD, a key innovator in gastrointestinal (GI) tract diseases, who originally developed RHB-104 (Crohn’s disease) and RHB-105 (H. pylori)

RHB-104 Groundbreaking combination therapy targeting MAP bacteria for treatment of Crohn’s disease and potentially other autoimmune diseases First Phase III Ongoing in Crohn’s Disease Encouraging Top-Line Interim Results from Ongoing Phase IIaStudy in MS 12

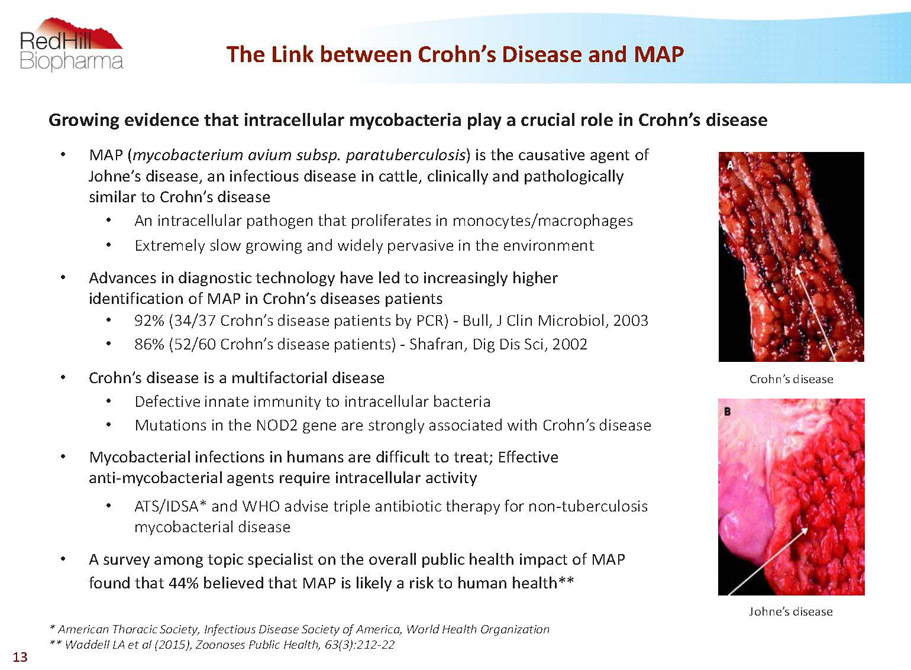

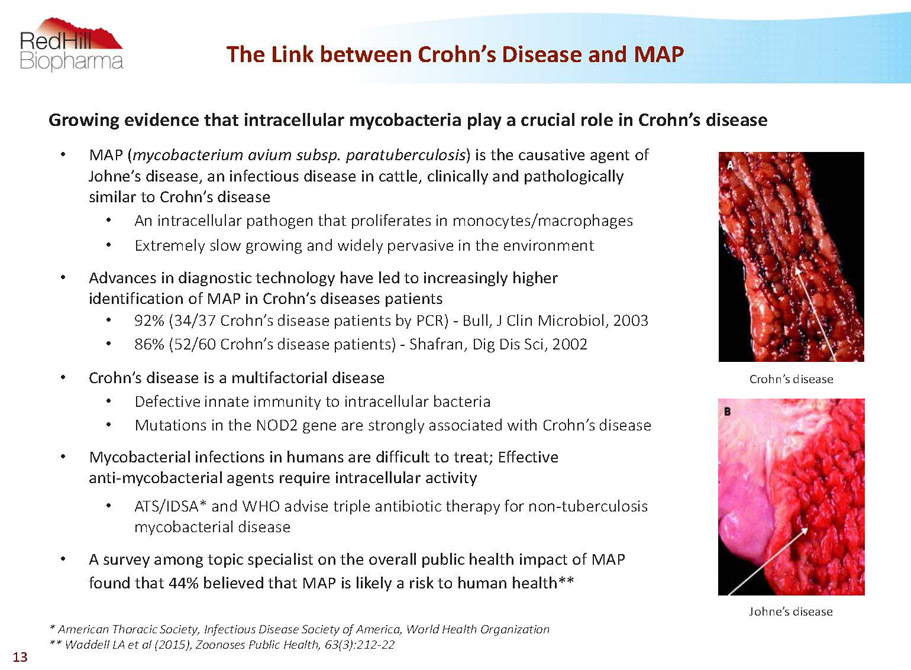

The Link between Crohn’s Disease and MAP 13 • MAP (mycobacterium aviumsubsp. paratuberculosis) is the causative agent of Johne’s disease, an infectious disease in cattle, clinically and pathologically similar to Crohn’s disease • An intracellular pathogen that proliferates in monocytes/macrophages • Extremely slow growing and widely pervasive in the environment • Advances in diagnostic technology have led to increasingly higher identification of MAP in Crohn’s diseases patients • 92% (34/37 Crohn’s disease patients by PCR) -Bull, J Clin Microbiol, 2003 • 86% (52/60 Crohn’s disease patients) -Shafran, Dig Dis Sci, 2002 • Crohn’s disease is a multifactorial disease • Defective innate immunity to intracellular bacteria • Mutations in the NOD2 gene are strongly associated with Crohn’s disease • Mycobacterial infections in humans are difficult to treat; Effective anti-mycobacterial agents require intracellular activity • ATS/IDSA* and WHO advise triple antibiotic therapy for non-tuberculosis mycobacterial disease • A survey among topic specialist on the overall public health impact of MAP found that 44% believed that MAP is likely a risk to human health** * American Thoracic Society, Infectious Disease Society of America, World Health Organization ** Waddell LA et al (2015), ZoonosesPublic Health, 63(3):212-22 Johne’s disease Crohn’s disease Growing evidence that intracellular mycobacteria play a crucial role in Crohn’s disease

RHB-104 (Crohn’s) -The UnmetNeed • Existing drugs treat symptoms, are associated with numerous side effects and are widely considered to have limited efficacy in the long term • Significant failure rate with current standard of care -Remicade® Phase III trial * • 42% of enrolled patients in infliximab (Remicade®) Phase III trial failed to qualify as “responders” • On intent-to-treat basis, only 23-26% in remission at 30 weeks • Increasing number of safety issues reported to FDA for infliximab (Remicade®) ** • Black box warning related to serious infections and malignancy • Costs of current anti-TNF? drug treatments are approximately $29-44k / year *** • Infliximab (Remicade®) has been shown to have anti-MAP activity * Hanauer at al (2002), Lancet InfectiousDiseases359:1541-1549 ** Moore et al (2007), Arch Intern Med 167:1752-1759 *** EvaluatePharma, 2015 14

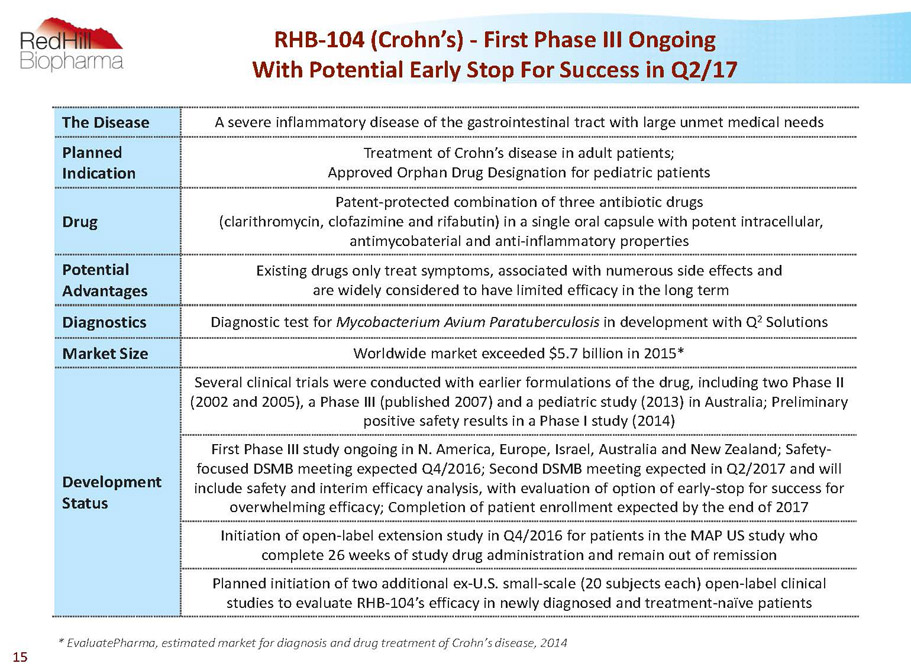

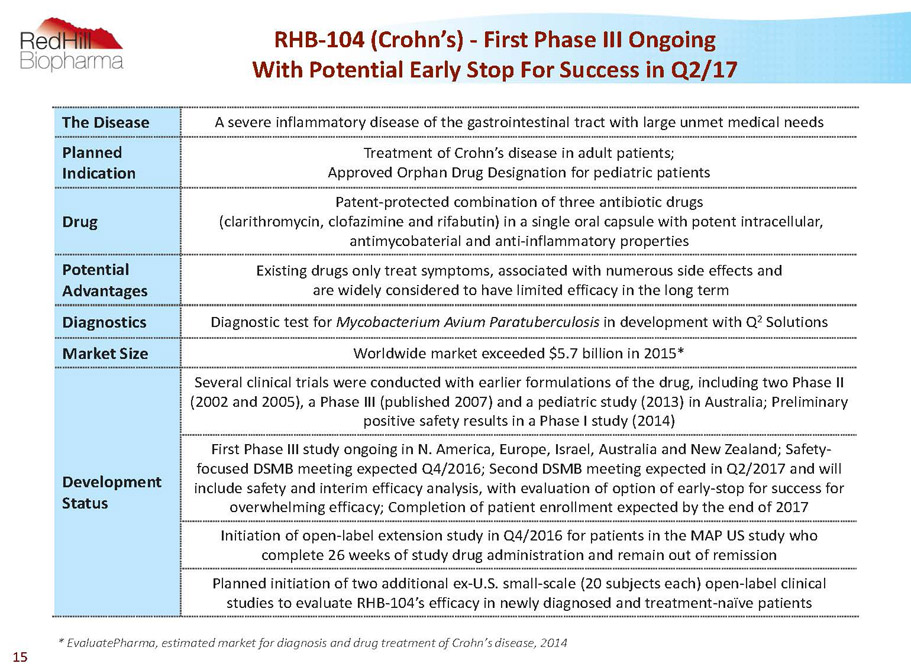

RHB-104 (Crohn’s) -First Phase III Ongoing With Potential Early Stop For Success in Q2/17 The Disease A severe inflammatory disease of the gastrointestinal tract with large unmet medical needs Planned Indication Treatment of Crohn’s disease in adult patients; Approved Orphan Drug Designation for pediatric patients Drug Patent-protected combination of three antibiotic drugs (clarithromycin, clofazimineand rifabutin) in a single oral capsule with potent intracellular, antimycobaterialand anti-inflammatory properties Potential Advantages Existing drugs only treat symptoms, associated with numerous side effects and are widely considered to have limited efficacy in the long term Diagnostics Diagnostic test for Mycobacterium AviumParatuberculosisin development with Q 2 Solutions Market Size Worldwide market exceeded $5.7 billion in 2015* Development Status Several clinical trials were conducted with earlier formulations of the drug, including two Phase II (2002 and 2005), a Phase III (published 2007) and a pediatric study (2013) in Australia; Preliminary positive safety results in a Phase I study (2014) First Phase III study ongoing in N. America, Europe, Israel, Australia and New Zealand; Safety- focused DSMB meeting expected Q4/2016; Second DSMB meeting expected in Q2/2017 and will include safety and interim efficacy analysis, with evaluation of option of early-stop for success for overwhelming efficacy; Completion of patient enrollment expected by the end of 2017 Initiation of open-label extension study in Q4/2016 for patients in the MAP US study who complete 26 weeks of study drug administration and remain out of remission Planned initiation of two additional ex-U.S. small-scale (20 subjects each) open-label clinical studies to evaluate RHB-104’s efficacy in newly diagnosed and treatment-naïve patients * EvaluatePharma, estimated market for diagnosis and drug treatment of Crohn’s disease, 2014 15

Multi-center, randomized, double-blind, placebo-controlled, parallel group study (the “MAP US Study”) to assess the efficacy and safety of fixed-dose combination RHB-104 in subjects with moderately to severely active Crohn’s disease Initiated September 30, 2013 Number of Subjects 410 Sites Up to 150 sites in the U.S., Canada, Europe, Australia, New Zealand and Israel Primary Endpoint State of remission at week 26 Secondary and Exploratory Endpoints -State of response at 26 weeks -Maintenance of remission through week 52 -Efficacy outcome measures in relation to presence of MAP infection -Safety Development Status - 1 st safety-focused DSMB meeting expected in Q4/2016 - 2 nd DSMB meeting expected in Q2/2017 will include safety and interim efficacy analysis with evaluation of an early-stop for success, once 50% of subject completed 26 weeks of study participation - 3rd safety-focused DSMB meeting expected once 75% of subjects complete 26 weeks of study participation - Completion of patient enrollment expected by the end of 2017 Extension Study Open-label extension study to be initiated -All subjects with CDAI>150 at 26 weeks eligible for up to one year of treatment with RHB-104 16 RHB-104 (Crohn’s) -First Phase III Study Ongoing

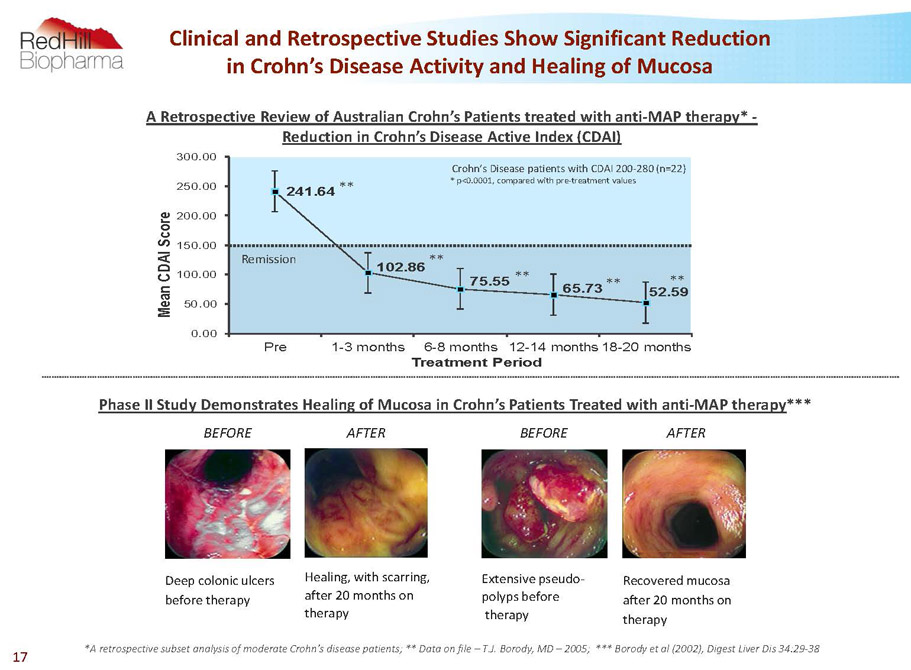

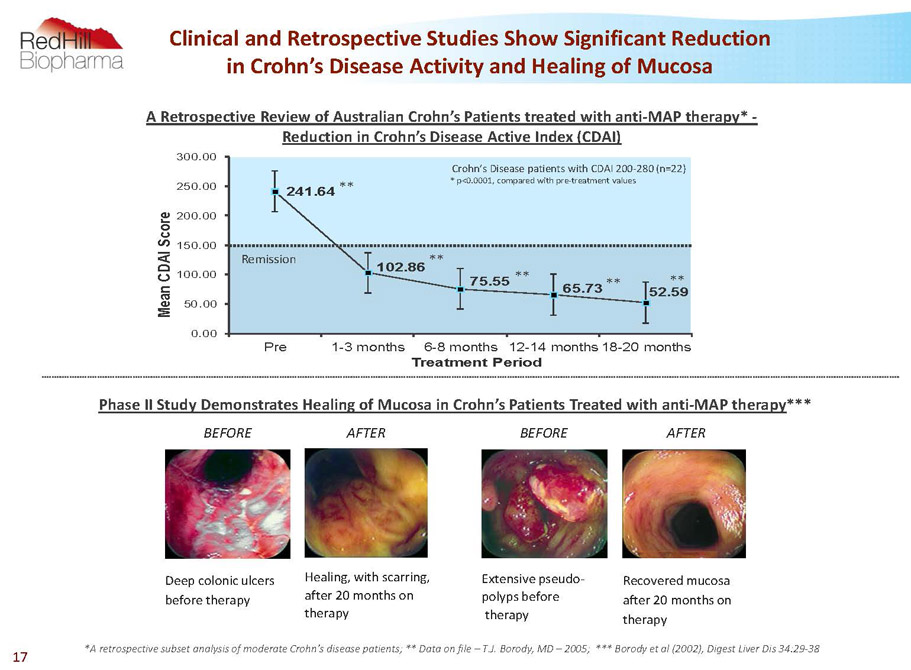

BEFORE Deep colonic ulcers before therapy AFTER Healing, with scarring, after 20 months on therapy Recovered mucosa after 20 months on therapy AFTER BEFORE Extensive pseudo- polyps before therapy 17 A retrospective subset analysis of moderate Crohn’s disease patients; ** Data on file –T.J. Borody, MD –2005; *** Borodyet al (2002), Digest Liver Dis 34:29-38 PhaseII Study Demonstrates Healing of Mucosa in Crohn’s Patients Treated with anti-MAP therapy*** Clinical and Retrospective Studies Show Significant Reduction in Crohn’s Disease Activity and Healing of Mucosa 241.64 102.86 75.55 65.73 52.59 0.00 50.00 100.00 150.00 200.00 250.00 300.00 Pre 1-3 months 6-8 months 12-14 months 18-20 months M e a n C D A I S c o r e Treatment Period * p<0.0001, compared with pre-treatment values Crohn’s Disease patients with CDAI 200-280 (n=22) Remission ** ** ** ** ** A Retrospective Review of Australian Crohn’s Patients treated with anti-MAP therapy* - Reduction in Crohn’s Disease Active Index (CDAI)

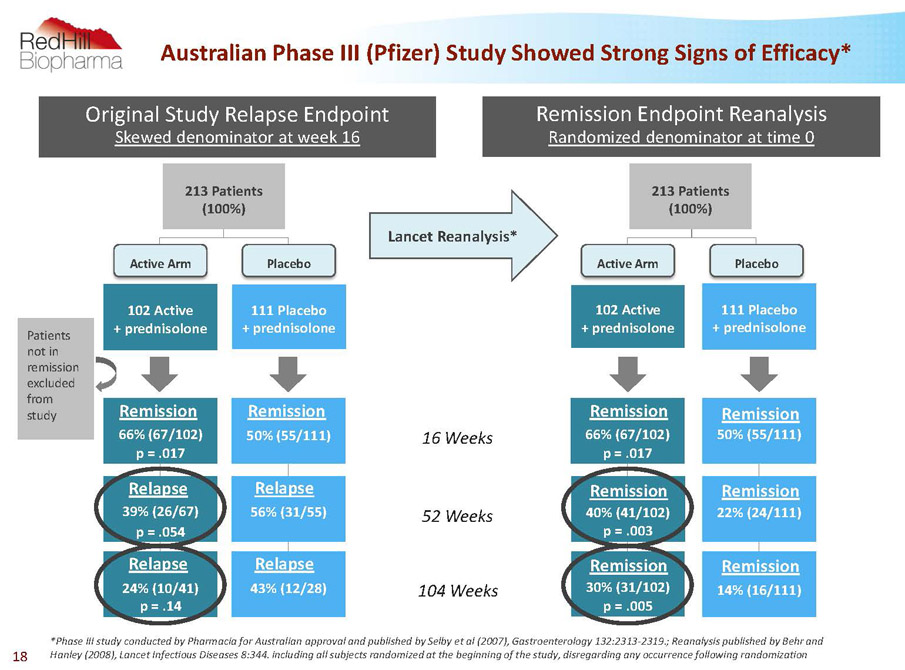

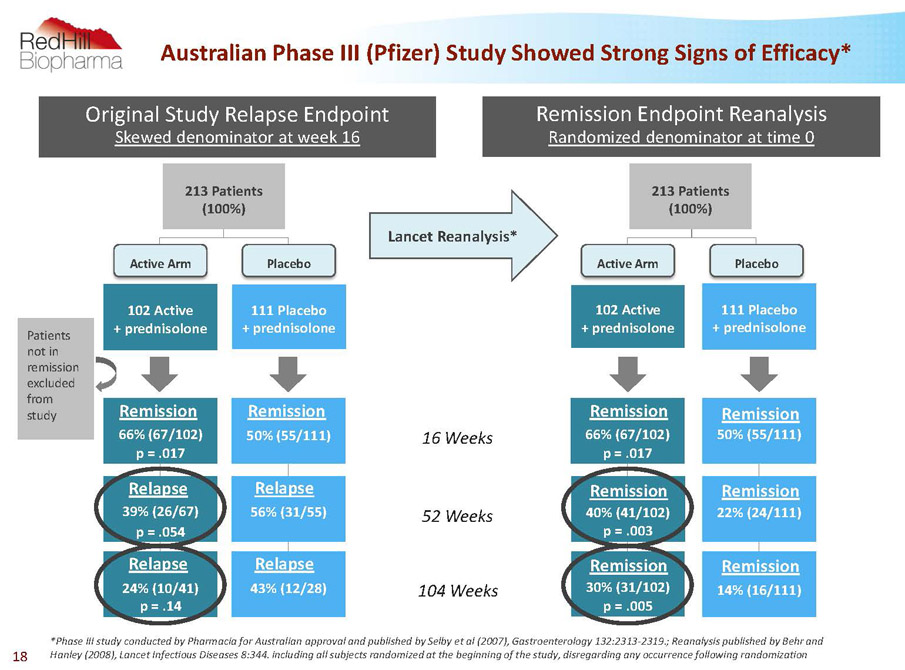

66% (67/102) p = .017 40% (41/102) p = .003 30% (31/102) p = .005 14% (16/111) 22% (24/111) 50% (55/111) 111 Placebo + prednisolone 102 Active + prednisolone Remission Endpoint Reanalysis Randomized denominator at time 0 66% (67/102) p = .017 39% (26/67) p = .054 24% (10/41) p = .14 43% (12/28) 56% (31/55) 50% (55/111) 111 Placebo + prednisolone 102 Active + prednisolone Original Study Relapse Endpoint Skewed denominator at week 16 *Phase III study conducted by Pharmacia for Australian approval and published by Selby et al (2007), Gastroenterology 132:2313-2319.; Reanalysis published by Behr and Hanley (2008), Lancet Infectious Diseases 8:344. including all subjects randomized at the beginning of the study, disregarding any occurrence following randomization 16 Weeks 52 Weeks 104 Weeks Lancet Reanalysis* Patients not in remission excluded from study 213 Patients (100%) Placebo Active Arm Active Arm Placebo 213 Patients (100%) Remission Relapse Remission Relapse Relapse Relapse Remission Remission Remission Remission Remission Remission Australian Phase III (Pfizer) Study ShowedStrong Signs of Efficacy* 18

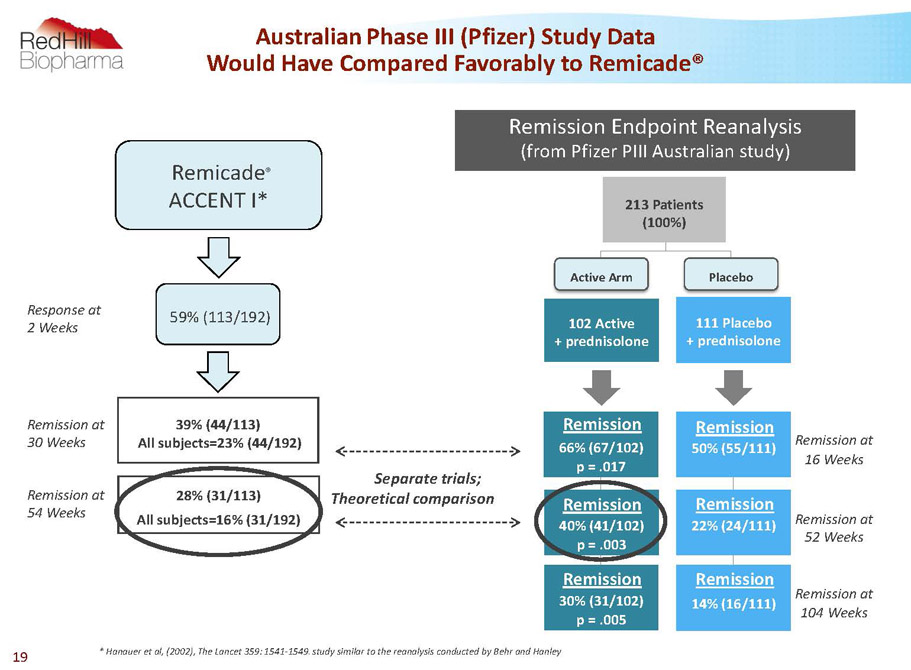

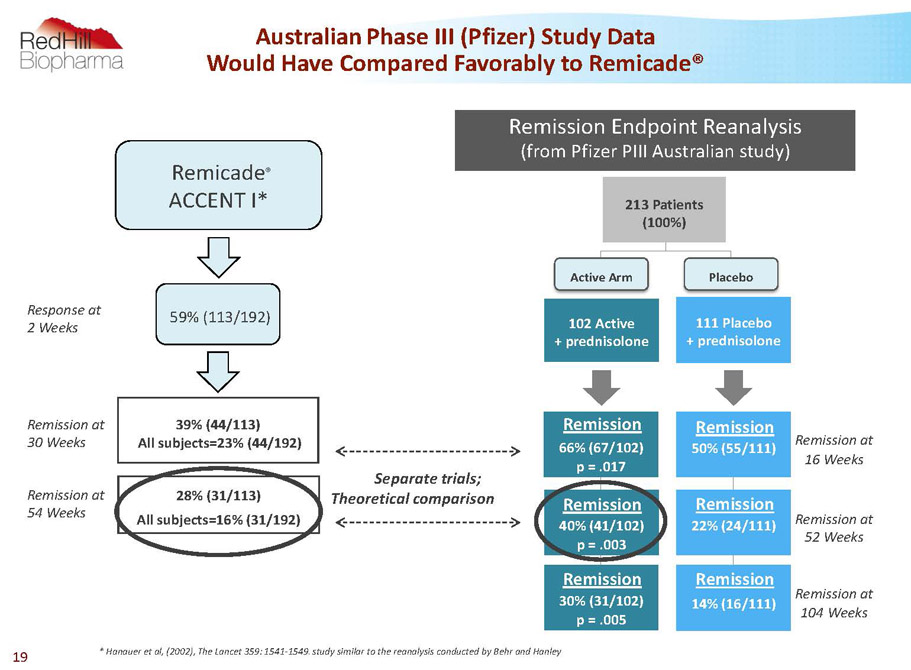

AustralianPhase III (Pfizer) Study Data Would Have Compared Favorably to Remicade® 39% (44/113) All subjects=23% (44/192) 28% (31/113) All subjects=16% (31/192) * Hanauer et al, (2002), The Lancet 359: 1541-1549. study similar to the reanalysis conducted by Behr and Hanley Remission at 54Weeks Remission at 30 Weeks Separate trials; Theoretical comparison Response at 2 Weeks Remicade ® ACCENT I* 59% (113/192) 66% (67/102) p = .017 40% (41/102) p = .003 30% (31/102) p = .005 14% (16/111) 22% (24/111) 50% (55/111) 111 Placebo + prednisolone 102 Active + prednisolone Remission Endpoint Reanalysis (from Pfizer PIII Australian study) Active Arm Placebo 213 Patients (100%) Remission Remission Remission Remission Remission Remission Remission at 16Weeks Remission at 52 Weeks Remission at 104Weeks 19

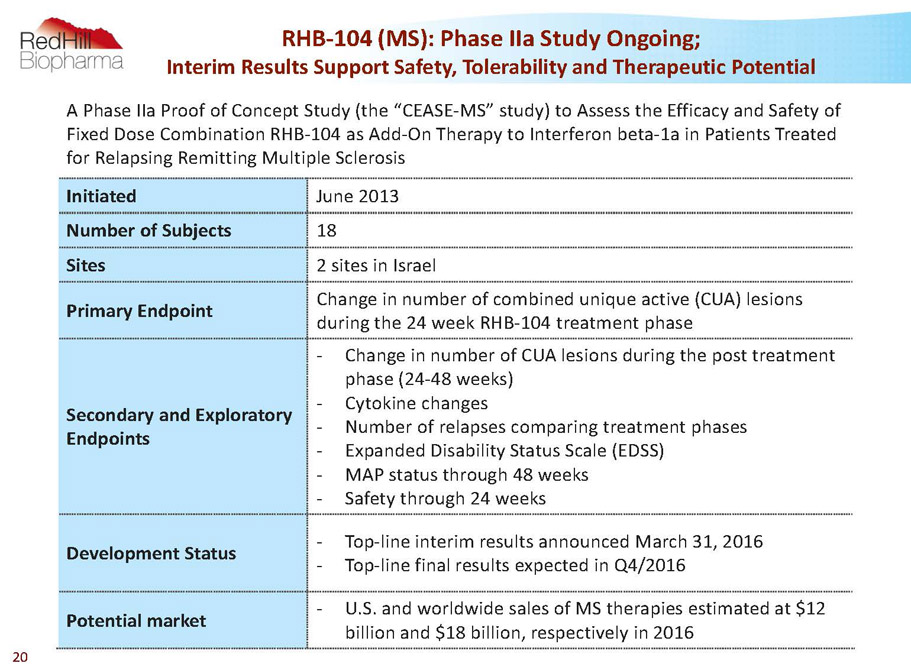

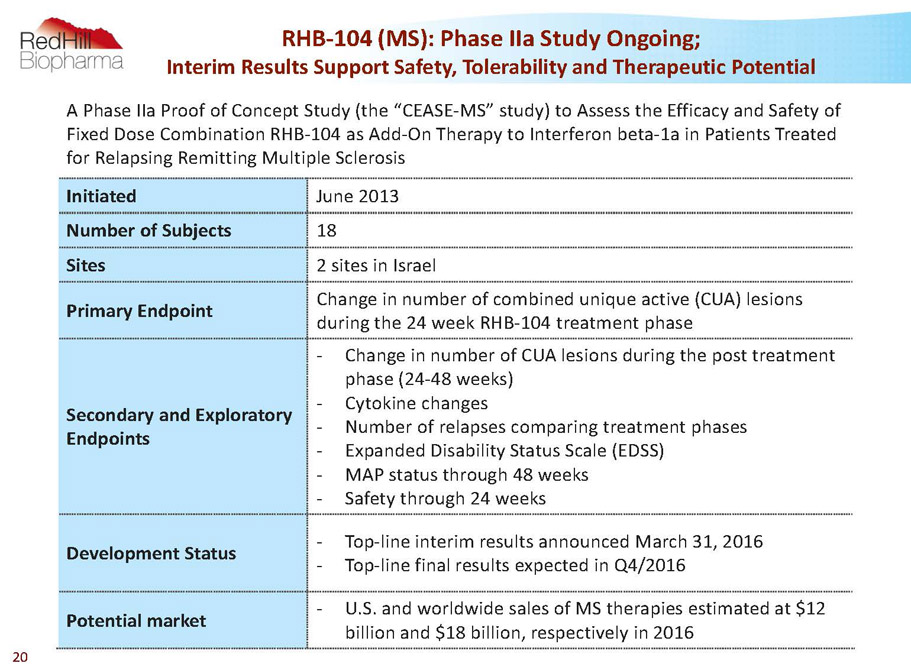

A Phase IIa Proof of Concept Study (the “CEASE-MS” study) to Assess the Efficacy and Safety of Fixed Dose Combination RHB-104 as Add-On Therapy to Interferon beta-1a in Patients Treated for Relapsing Remitting Multiple Sclerosis Initiated June 2013 Number of Subjects 18 Sites 2 sites in Israel Primary Endpoint Change in number of combined unique active (CUA) lesions during the 24 week RHB-104 treatment phase Secondary and Exploratory Endpoints - Change in number of CUA lesions during the post treatment phase (24-48 weeks) - Cytokine changes - Number of relapses comparing treatment phases - Expanded Disability Status Scale (EDSS) - MAP status through 48 weeks - Safety through 24 weeks Development Status - Top-line interim results announced March 31, 2016 - Top-line final results expected in Q4/2016 Potential market - U.S. and worldwide sales of MS therapies estimated at $12 billion and $18 billion, respectively in 2016 RHB-104 (MS): Phase IIaStudy Ongoing; Interim Results Support Safety, Tolerability and Therapeutic Potential 20

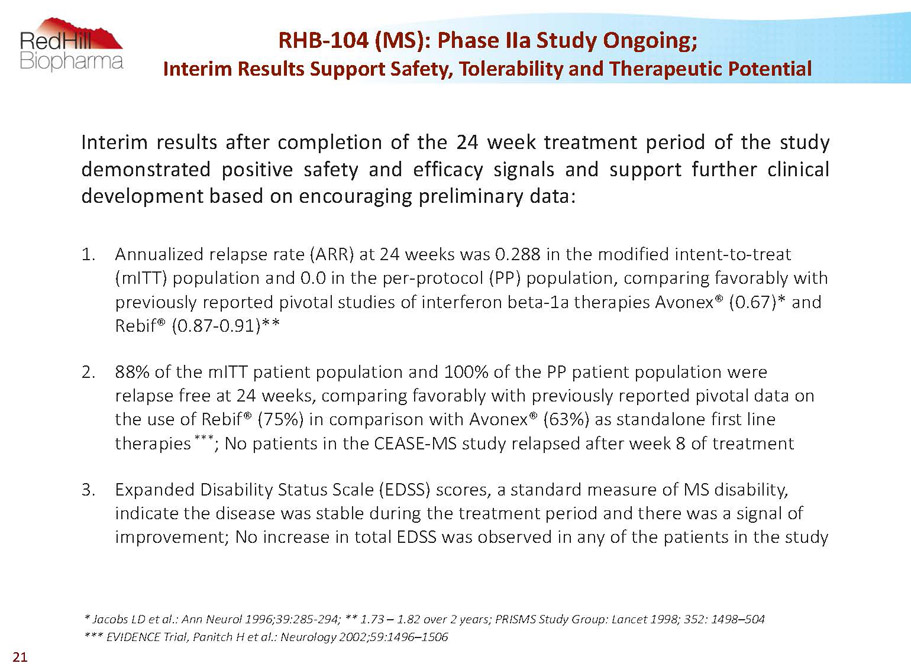

Interimresultsaftercompletionofthe24weektreatmentperiodofthestudy demonstratedpositivesafetyandefficacysignalsandsupportfurtherclinical developmentbasedonencouragingpreliminarydata: 1. Annualized relapse rate (ARR) at 24 weeks was 0.288 in the modified intent-to-treat (mITT) population and 0.0 in the per-protocol (PP) population, comparing favorably with previously reported pivotal studies of interferon beta-1a therapies Avonex® (0.67)* and Rebif® (0.87-0.91)** 2. 88% of the mITTpatient population and 100% of the PP patient population were relapse free at 24 weeks, comparing favorably with previously reported pivotal data on the use of Rebif® (75%) in comparison with Avonex® (63%) as standalone first line therapies *** ; No patients in the CEASE-MS study relapsed after week 8 of treatment 3. Expanded Disability Status Scale (EDSS) scores, a standard measure of MS disability, indicate the disease was stable during the treatment period and there was a signal of improvement; No increase in total EDSS was observed in any of the patients in the study * Jacobs LD et al.: Ann Neurol1996;39:285-294; **1.73 –1.82 over 2 years; PRISMS Study Group: Lancet 1998; 352: 1498–504 *** EVIDENCE Trial, PanitchH et al.: Neurology 2002;59:1496–1506 RHB-104 (MS): Phase IIaStudy Ongoing; Interim Results Support Safety, Tolerability and Therapeutic Potential 21

* Cohen J A et al.: Oral Fingolimodor Intramuscular Interferon for Relapsing Remitting Multiple Sclerosis. NEJM. 2010, 362: 402-15 ** Cohen J A et al.: Alemtuzumabversus Interferon Beta 1a as First-Line Treatment for Patients with Relapsing-Remitting Multiple Sclerosis: a RandomisedControlled Phase 3 Trial. The Lancet. 2012, 380: 1819-28 4. With only a single active T1 post gadolinium lesion noted among all patients followed, combined unique active lesions (CUAs) -the primary outcome measure in the study -were almost entirely MRI T2 lesions; Although not powered for efficacy, a reduction in total MRI T2 lesion volume was observed at 24 weeks as compared to baseline, suggesting a decreased burden of disease and comparing favorably with previously reported Avonex®* and Rebif®** data 5. No clinically significant change was observed for total CUA lesions at week 24, which is supportive of a stable disease state 6. RHB-104 was found to be safe and well tolerated, with no drug-related serious adverse events or other clinically relevant or unexpected adverse events 7. Patients are now completing their 24 week follow up treatment period and final results of the completed 48 week study are expected during H2/2016 Continued -RHB-104 (MS): Phase IIaStudy Ongoing; Interim Results Support Safety, Tolerability and Therapeutic Potential 22

RHB-105 A new combination therapy for treatment of H. pylori infection -with QIDP designation, including Fast-Track development status Successful First Phase III Study Completed - Met Primary Endpoint with High Statistical Significance Preparations for Confirmatory Phase III Study 23

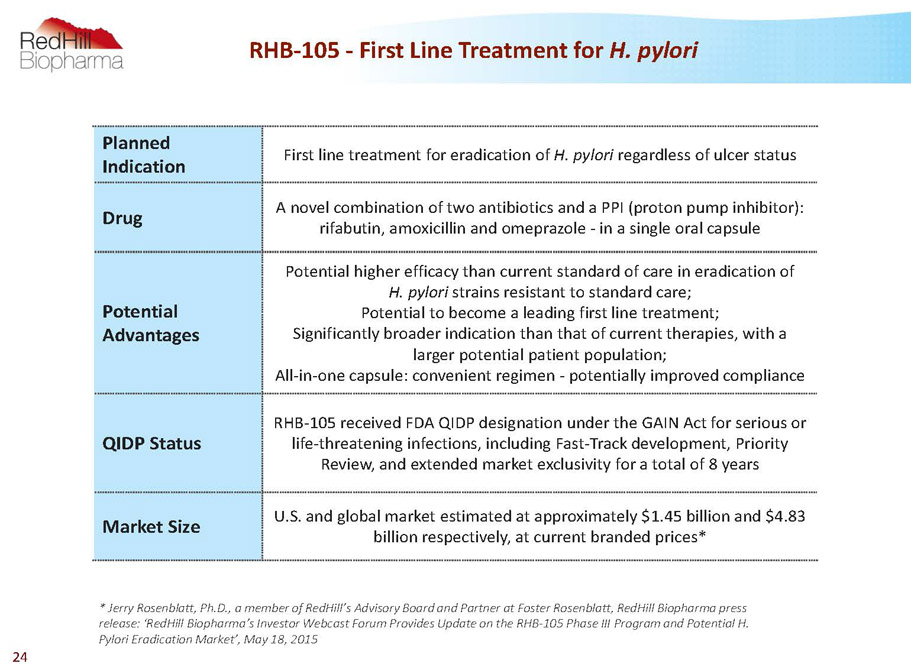

RHB-105 -First Line Treatment for H. pylori Planned Indication First line treatment for eradication of H. pylori regardless of ulcer status Drug A novel combination of two antibiotics and a PPI (proton pump inhibitor): rifabutin, amoxicillin and omeprazole -in a single oral capsule Potential Advantages Potential higher efficacy than current standard of care in eradication of H. pylori strains resistant to standard care; Potential to become a leading first line treatment; Significantly broader indication than that of current therapies, with a larger potential patient population; All-in-one capsule: convenient regimen -potentially improved compliance QIDP Status RHB-105 received FDA QIDP designation under the GAIN Act for serious or life-threatening infections, including Fast-Track development, Priority Review, and extended market exclusivity for a total of 8 years Market Size U.S. and global market estimated at approximately $1.45 billion and $4.83 billion respectively, at current branded prices* * Jerry Rosenblatt, Ph.D., a member of RedHill’sAdvisory Board and Partner at Foster Rosenblatt, RedHillBiopharma press release: ‘RedHillBiopharma’s Investor Webcast Forum Provides Update on the RHB-105 Phase III Program and PotentialH. PyloriEradication Market’, May 18, 2015 24

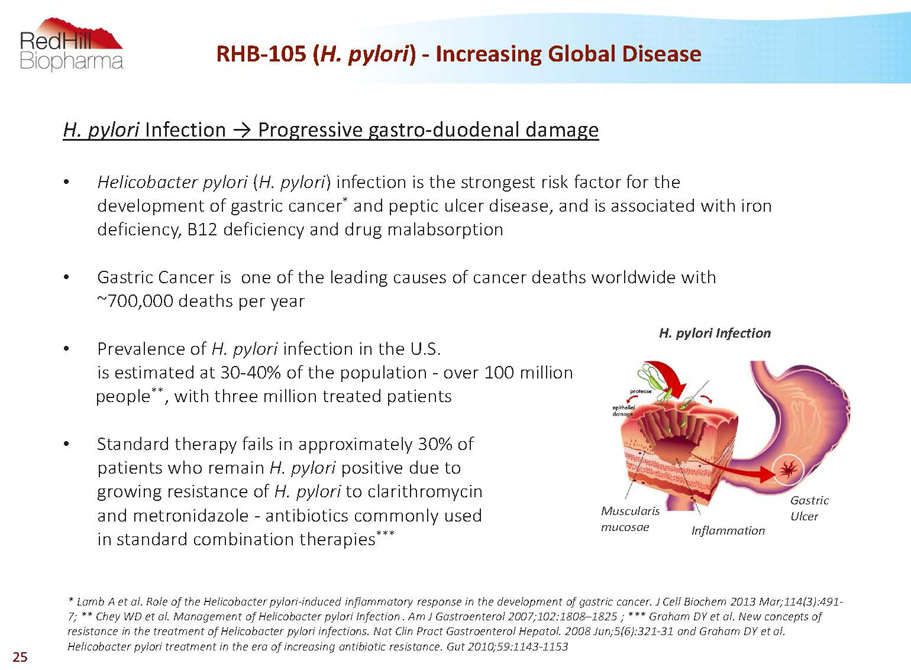

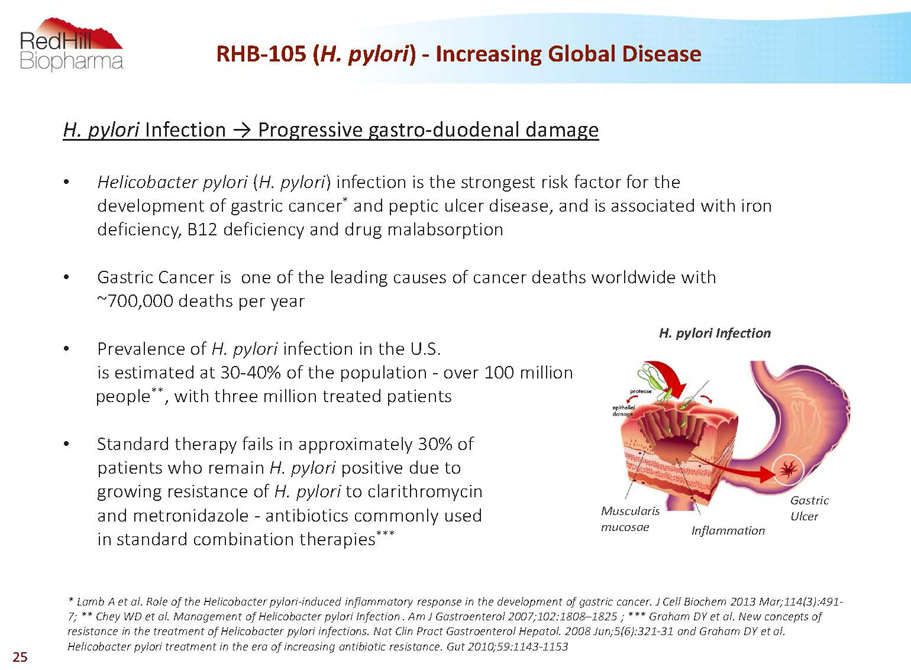

H. pylori Infection ? Progressive gastro-duodenal damage • Helicobacter pylori (H. pylori) infection is the strongest risk factor for the development of gastric cancer * and peptic ulcer disease, and is associated with iron deficiency, B12 deficiency and drug malabsorption • Gastric Cancer is one of the leading causes of cancer deaths worldwide with ~700,000 deaths per year • Prevalence of H. pylori infection in the U.S. is estimated at 30-40% of the population -over 100 million people ** , with three million treated patients • Standard therapy fails in approximately 30% of patients who remain H. pylori positive due to growing resistance of H. pylori to clarithromycin and metronidazole -antibiotics commonly used in standard combination therapies *** RHB-105 (H. pylori) -Increasing Global Disease H. pylori Infection Muscularis mucosae Inflammation Gastric Ulcer * Lamb A et al. Role of the Helicobacter pylori-induced inflammatory response in the development of gastric cancer. J Cell Biochem2013 Mar;114(3):491- 7; ** CheyWD et al. Management of Helicobacter pylori Infection. Am J Gastroenterol2007;102:1808–1825 ; *** Graham DY et al. New concepts of resistance in the treatment of Helicobacter pylori infections. Nat ClinPractGastroenterolHepatol.2008 Jun;5(6):321-31 and Graham DY et al. Helicobacter pylori treatment in the era of increasing antibiotic resistance. Gut 2010;59:1143-1153 25

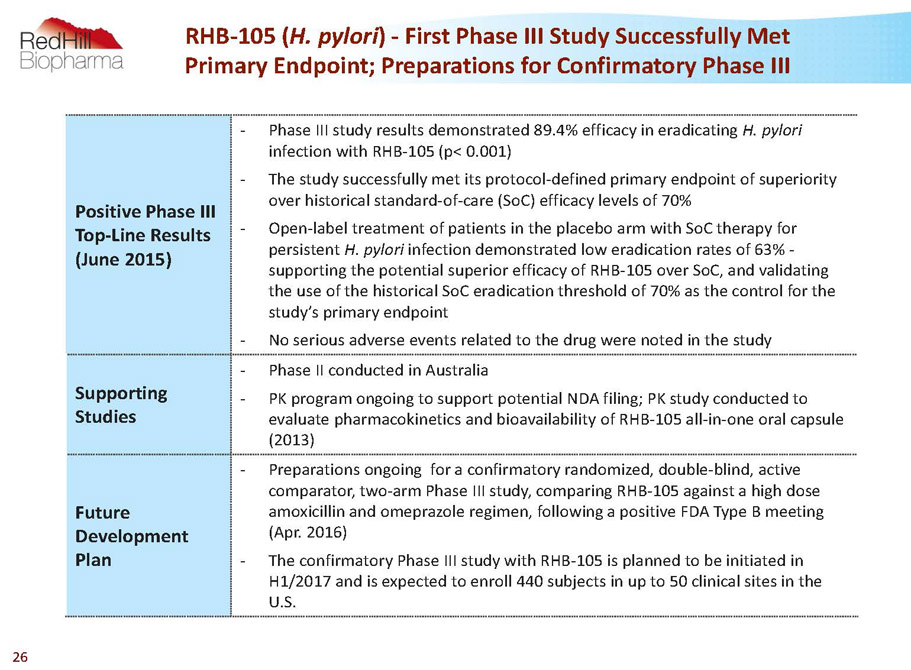

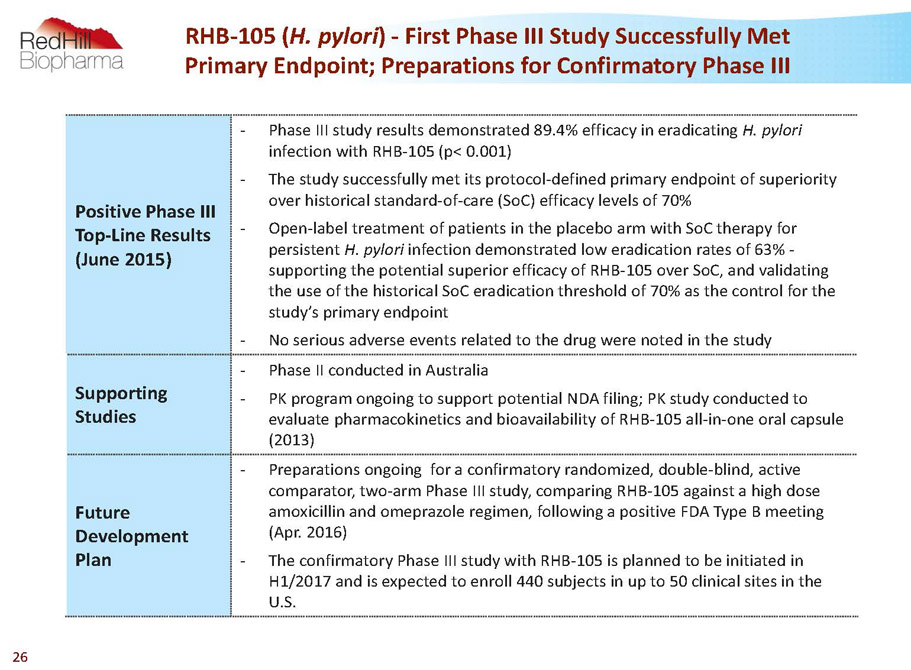

Positive Phase III Top-Line Results (June 2015) - Phase III study results demonstrated 89.4% efficacy in eradicating H. pylori infection with RHB-105 (p< 0.001) - The study successfully met its protocol-defined primary endpoint of superiority over historical standard-of-care (SoC) efficacy levels of 70% - Open-label treatment of patients in the placebo arm with SoCtherapy for persistent H. pylori infection demonstrated low eradication rates of 63% - supporting the potential superior efficacy of RHB-105 over SoC, and validating the use of the historical SoCeradication threshold of 70% as the control for the study’s primary endpoint - No serious adverse events related to the drug were noted in the study Supporting Studies - Phase II conducted in Australia - PK program ongoing to support potential NDA filing; PK study conducted to evaluate pharmacokinetics and bioavailability of RHB-105 all-in-one oral capsule (2013) Future Development Plan - Preparations ongoing for aconfirmatory randomized, double-blind, active comparator, two-arm Phase III study, comparing RHB-105 against a high dose amoxicillin and omeprazole regimen, following a positive FDA Type B meeting (Apr. 2016) - The confirmatory Phase III study with RHB-105 is planned to be initiated in H1/2017 and is expected to enroll 440 subjects in up to 50 clinical sites in the U.S. RHB-105 (H. pylori) -First Phase III Study Successfully Met Primary Endpoint; Preparations for Confirmatory Phase III 26

A Randomized Placebo-controlled Phase III Study (“ERADICATE Hp”) to Assess the Safety and Efficacy of RHB-105 in the Treatment of Confirmed H. pylori Infection in Dyspepsia Patients, Regardless of Ulcer Status Number of Subjects 118 Sites 13 sites in the U.S. Duration of Study Treatment 14 days Primary Endpoint - The occurrence of H. pylori eradication as confirmed via 13C Urea Breath Test (UBT) testing 28-35 days after completion of treatment - Superiority in eradication ofH. pyloriinfection over historical standard of care efficacy levels of 70% effectiveness Secondary and Exploratory Endpoints - Safety - Pharmacokinetics -The trough concentrations of amoxicillin, omeprazole, rifabutin, and the rifabutin metabolite 25-O-desacetyl- rifabutin on days 8 and 15 compared with baseline values - Patient reported outcome -Severity of Dyspepsia Assessment (SODA) score prior to and after treatment - Pharmacogenetic-cytochrome P450 (CYP) 2C19 status RHB-105 (H. pylori) -Successful First Phase III Study Completed 27

• BorodyTJ et al. Efficacy and safety of rifabutin-containing ‘rescue therapy’ for resistant Helicobacter pylori infection. Aliment PharmacolTher.2006;23:481–488 The Phase II study was designed to test the efficacy of a triple therapy regimen combining rifabutin, pantoprazole and amoxicillin as rescue therapy for patients in whom eradication of H. pylori had failed standard clarithromycin-based triple therapy* Study Description Prospective, two-arm, Phase II study in Australia Number of Subjects 130 (single site) Treatment 12 days with rifabutin 150 mg daily, amoxicillin 1g or 1.5g t.i.d and pantoprazole 80 mg t.i.d Results -ITT and per-protocol eradication rates = 90.8% in low-dose amoxicillin group (96.6% in high dose group) -Metronidazole or/and clarithromycin resistance had no significant impact on H. pylori eradication rates Side-effects Treatment is well tolerated; No serious adverse events Prior to the RHB-105 Phase III study, a Phase II Study Showed 90% Efficacy 28

BEKINDA®(RHB-102) A bi-modal extended release, once-daily, ondansetron Ongoing U.S. Phase III for Gastroenteritis/Gastritis Ongoing U.S. Phase II study for IBS-D European MAA for Oncology Support Indications in discussions with regulatory authorities 29

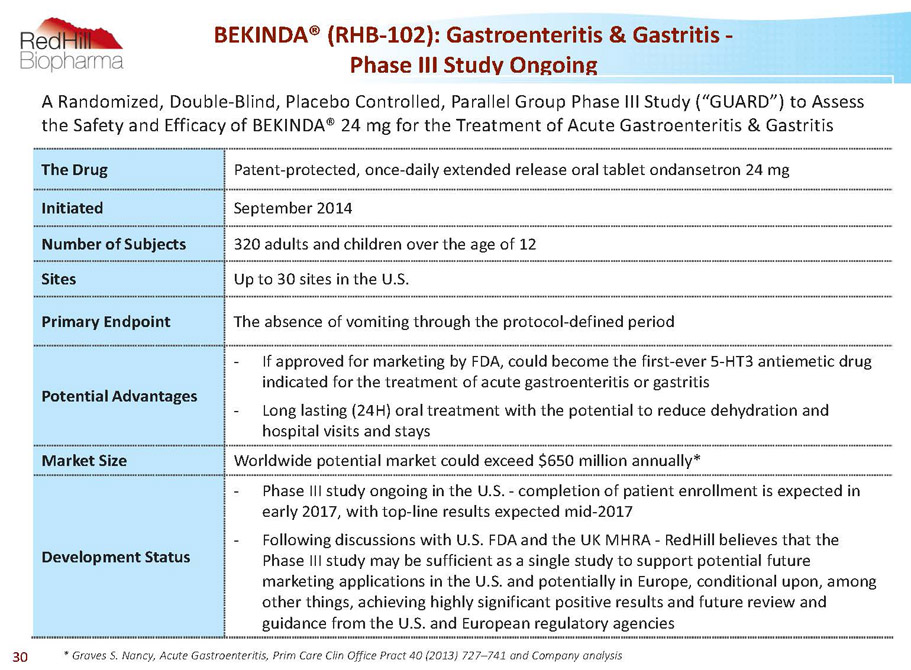

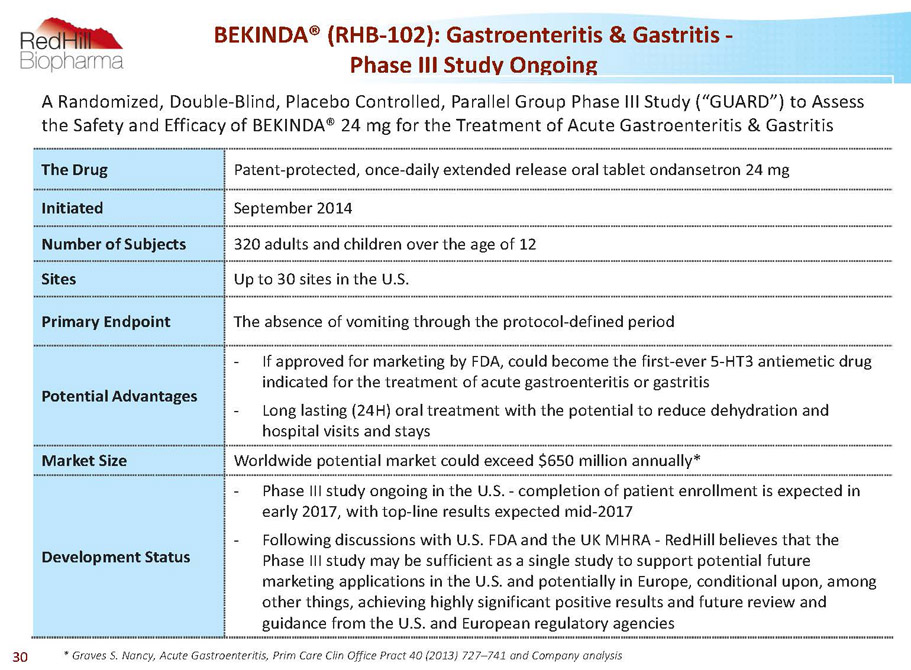

BEKINDA® (RHB-102): Gastroenteritis & Gastritis - Phase III Study Ongoing * Graves S. Nancy, Acute Gastroenteritis, Prim Care Clin Office Pract 40 (2013) 727–741 and Company analysis A Randomized, Double-Blind, Placebo Controlled, Parallel Group Phase III Study (“GUARD”) to Assess the Safety and Efficacy of BEKINDA® 24 mg for the Treatment of Acute Gastroenteritis & Gastritis The Drug Patent-protected, once-daily extended release oral tablet ondansetron 24 mg Initiated September 2014 Number of Subjects 320 adults and children over the age of 12 Sites Up to 30 sites in the U.S. Primary Endpoint The absence of vomiting through the protocol-defined period Potential Advantages - If approved for marketing by FDA, could become the first-ever 5-HT3 antiemetic drug indicated for the treatment of acute gastroenteritis or gastritis - Long lasting (24H) oral treatment with the potential to reduce dehydration and hospital visits and stays Market Size Worldwide potential market could exceed $650 million annually* Development Status - Phase III study ongoing in the U.S. -completion of patient enrollment is expected in early 2017, with top-line results expected mid-2017 - Following discussions with U.S. FDA and the UK MHRA -RedHillbelieves that the Phase III study may be sufficient as a single study to support potential future marketing applications in the U.S. and potentially in Europe, conditional upon, among other things, achieving highly significant positive results and future review and guidance from the U.S. and European regulatory agencies 30

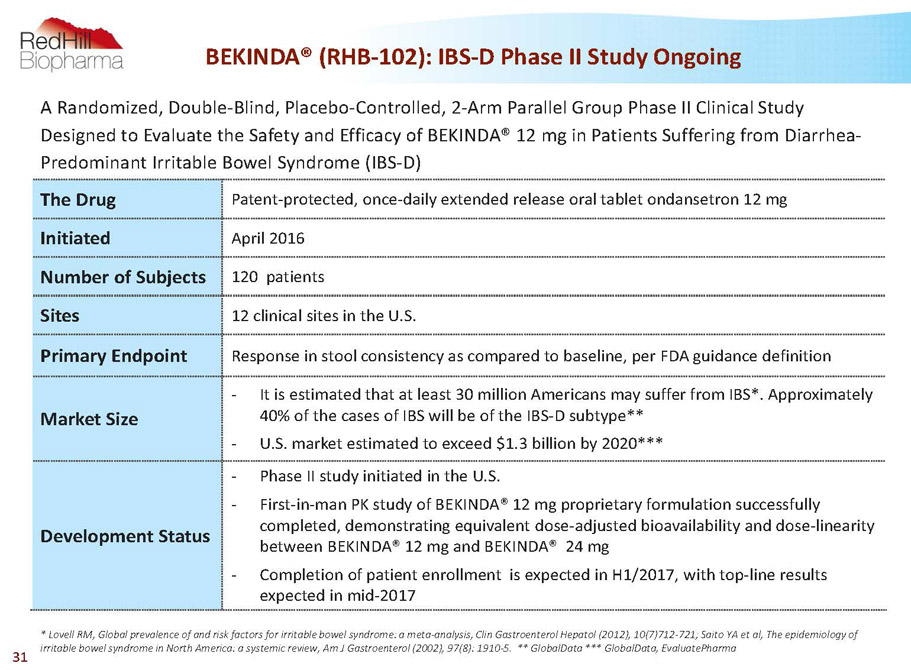

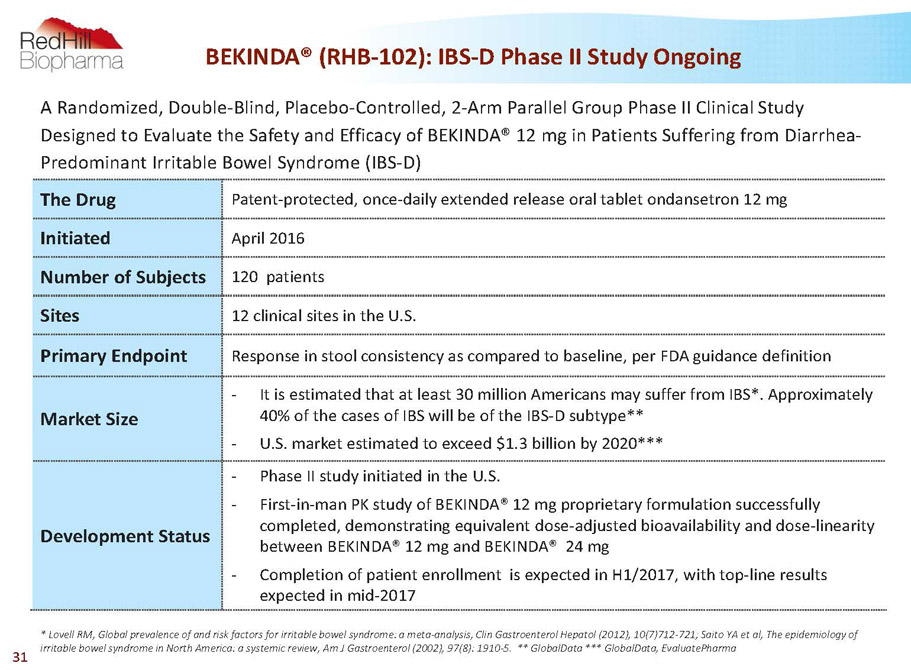

BEKINDA® (RHB-102): IBS-D Phase II Study Ongoing A Randomized, Double-Blind, Placebo-Controlled, 2-Arm Parallel Group Phase II Clinical Study Designed to Evaluate the Safety and Efficacy of BEKINDA®12 mg in Patients Suffering from Diarrhea- Predominant Irritable Bowel Syndrome (IBS-D) The Drug Patent-protected, once-daily extended release oral tablet ondansetron 12 mg Initiated April 2016 Number of Subjects 120 patients Sites 12 clinical sites in the U.S. Primary Endpoint Response in stool consistency as compared to baseline, per FDA guidance definition Market Size - It is estimated that at least 30 million Americans may suffer from IBS*. Approximately 40% of the cases of IBS will be of the IBS-D subtype** - U.S. market estimated to exceed $1.3 billion by 2020*** Development Status - Phase II study initiated in the U.S. - First-in-man PK study of BEKINDA®12 mg proprietary formulation successfully completed, demonstrating equivalent dose-adjusted bioavailability and dose-linearity between BEKINDA®12 mg and BEKINDA®24 mg - Completion of patient enrollment is expected in H1/2017, with top-line results expected in mid-2017 * Lovell RM, Global prevalence of and risk factors for irritable bowel syndrome: a meta-analysis, ClinGastroenterolHepatol(2012), 10(7)712-721; Saito YA et al, The epidemiology of irritable bowel syndrome in North America: a systemic review, Am J Gastroenterol(2002), 97(8): 1910-5. ** GlobalData *** GlobalData, EvaluatePharma 31

YELIVA™ (ABC294640) Phase II-stage first-in-class orally-administered sphingosine kinase-2 (SK2) inhibitor targeting multiple oncology, inflammatory and GI indications 32

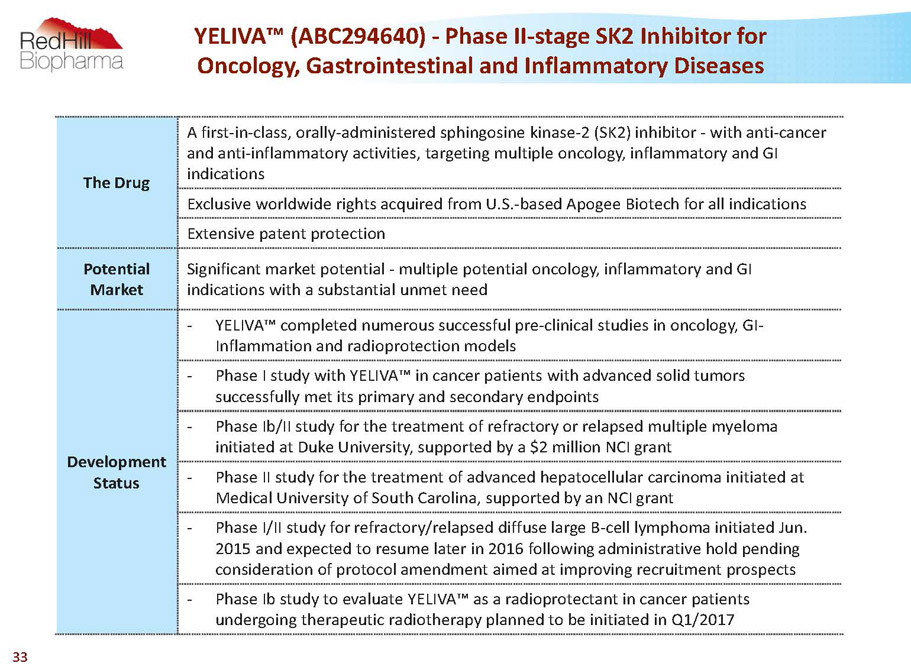

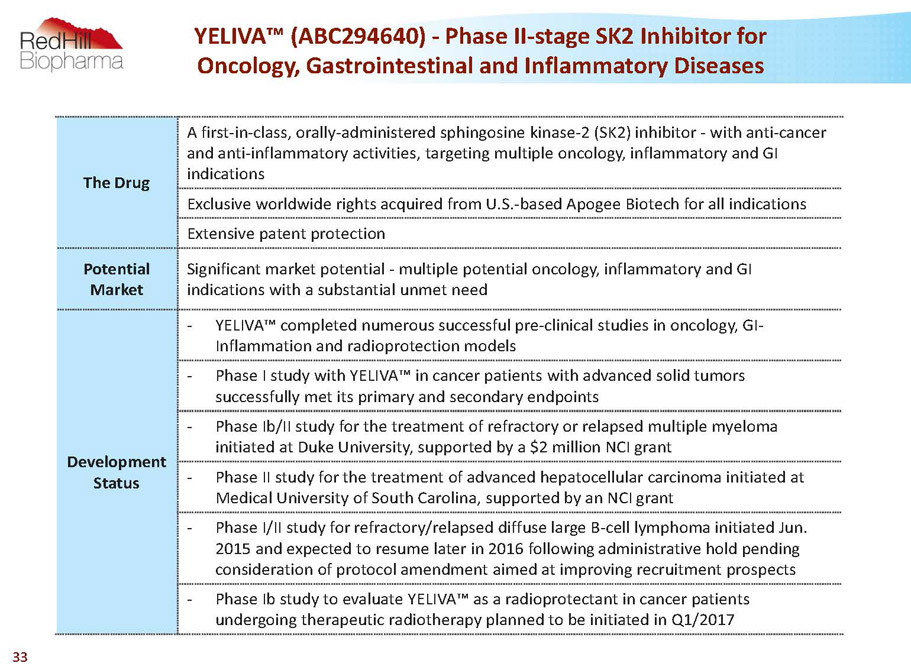

The Drug A first-in-class, orally-administered sphingosine kinase-2 (SK2) inhibitor -with anti-cancer and anti-inflammatory activities, targeting multiple oncology, inflammatory and GI indications Exclusive worldwide rights acquired from U.S.-based Apogee Biotech for all indications Extensive patent protection Potential Market Significant market potential -multiple potential oncology, inflammatory and GI indications with a substantial unmet need Development Status - YELIVA™ completed numerous successful pre-clinical studies in oncology, GI- Inflammation and radioprotection models - Phase I study with YELIVA™ in cancer patients with advanced solid tumors successfully met its primary and secondary endpoints - Phase Ib/II study for the treatment of refractory or relapsed multiple myeloma initiated at Duke University, supported by a $2 million NCI grant - Phase II study for the treatment of advanced hepatocellular carcinoma initiated at Medical University of South Carolina, supported by an NCI grant - Phase I/II study for refractory/relapsed diffuse large B-cell lymphoma initiated Jun. 2015 and expected to resume later in 2016 following administrative hold pending consideration of protocol amendment aimed at improving recruitment prospects - Phase Ibstudy to evaluate YELIVA™ as a radioprotectantin cancer patients undergoing therapeuticradiotherapy planned to be initiated in Q1/2017 YELIVA™ (ABC294640) -Phase II-stage SK2 Inhibitor for Oncology, Gastrointestinal and Inflammatory Diseases 33

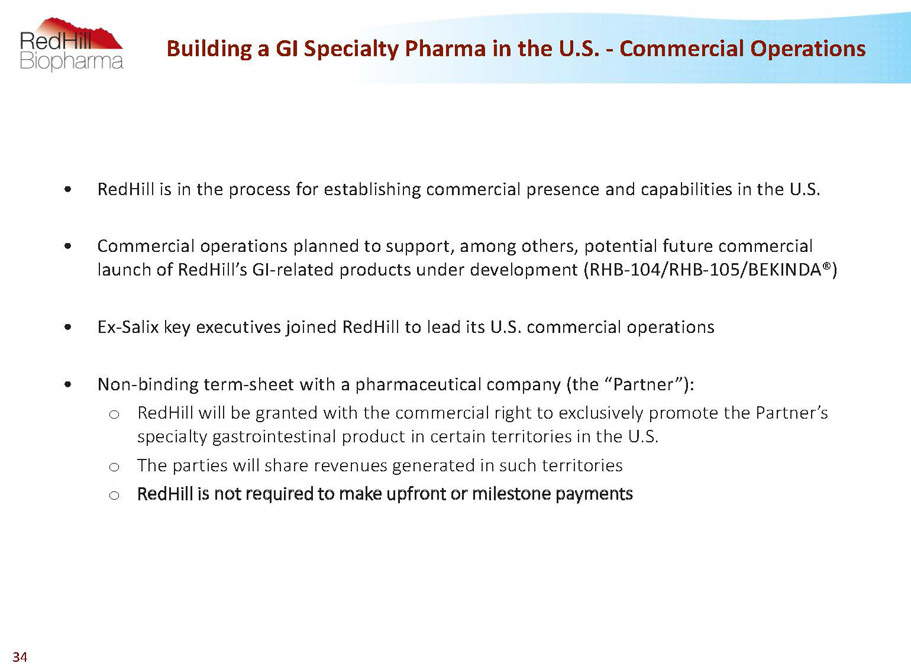

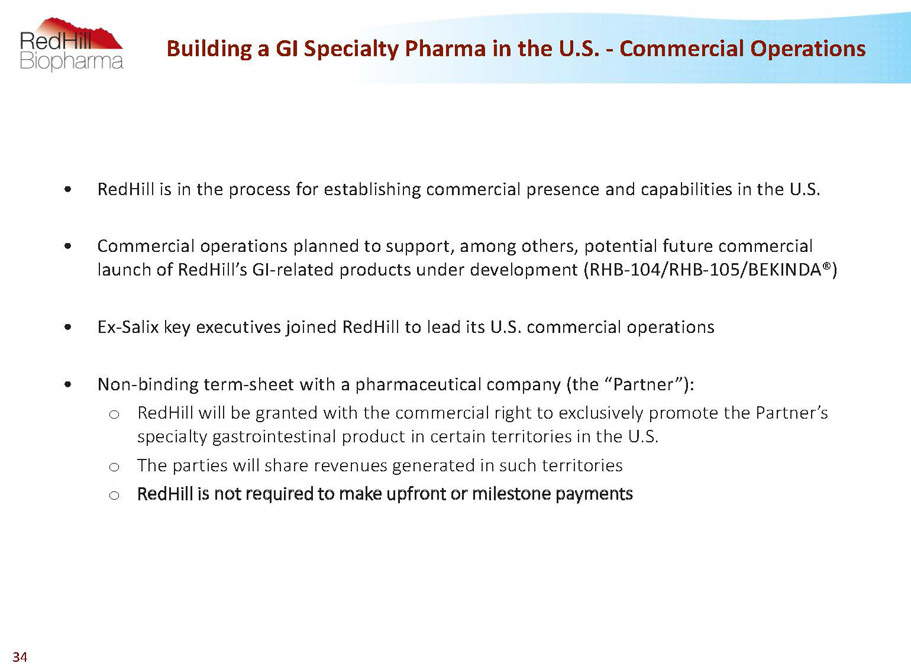

Building a GI Specialty Pharma in the U.S. -Commercial Operations • RedHill is in the process for establishing commercial presence and capabilities in the U.S. • Commercial operations planned to support, among others, potential future commercial launch of RedHill’sGI-related products under development (RHB-104/RHB-105/BEKINDA®) • Ex-Salix key executives joined RedHill to lead its U.S. commercial operations • Non-binding term-sheet with a pharmaceutical company (the “Partner”): o RedHill will be granted with the commercial right to exclusively promote the Partner’s specialty gastrointestinal product in certain territories in the U.S. o The parties will share revenues generated in such territories o RedHill is not required to make upfront or milestone payments 34

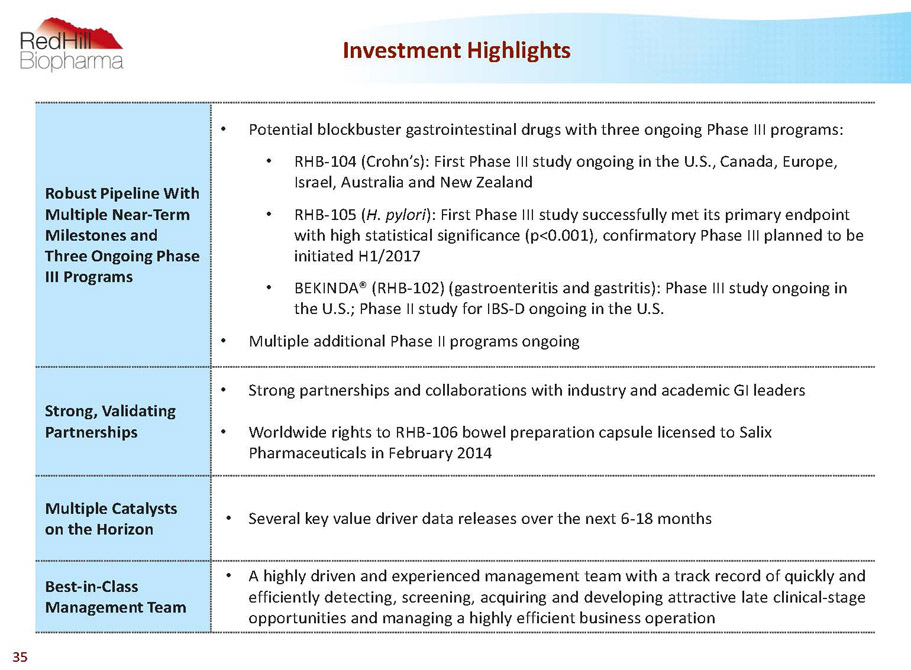

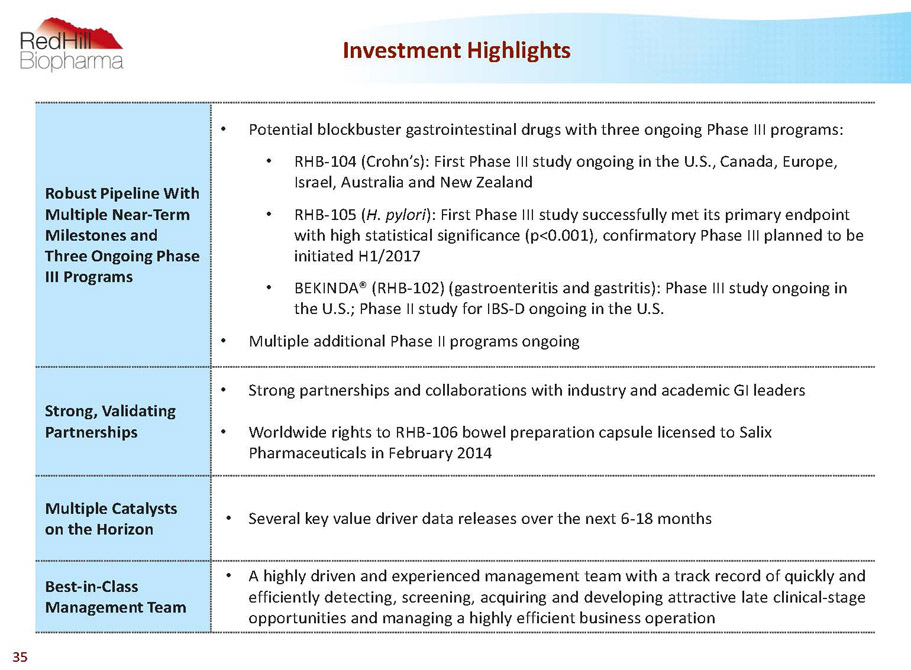

Robust Pipeline With Multiple Near-Term Milestones and Three Ongoing Phase III Programs • Potential blockbuster gastrointestinal drugs with three ongoing Phase III programs: • RHB-104 (Crohn’s): First Phase III study ongoing in the U.S., Canada, Europe, Israel, Australia and New Zealand • RHB-105 (H. pylori): First Phase III study successfully met its primary endpoint with high statistical significance (p<0.001), confirmatory Phase III planned to be initiated H1/2017 • BEKINDA® (RHB-102) (gastroenteritis and gastritis): Phase III study ongoing in the U.S.; Phase II study for IBS-D ongoing in the U.S. • Multiple additional Phase II programs ongoing Strong, Validating Partnerships • Strong partnerships and collaborations with industry and academic GI leaders • Worldwide rights to RHB-106 bowel preparation capsule licensed to Salix Pharmaceuticals in February 2014 Multiple Catalysts on the Horizon • Severalkeyvaluedriverdatareleasesoverthenext6-18months Best-in-Class Management Team • Ahighlydrivenandexperiencedmanagementteamwithatrackrecordofquicklyand efficientlydetecting,screening,acquiringanddevelopingattractivelateclinical-stage opportunitiesandmanagingahighlyefficientbusinessoperation Investment Highlights 35

Thank You! RedHill Biopharma Ltd. 21 Ha’arba’a St. Tel-Aviv, 6473921Israel Email: info@redhillbio.com Web: www.redhillbio.com Tel: +972-3-541-3131 36

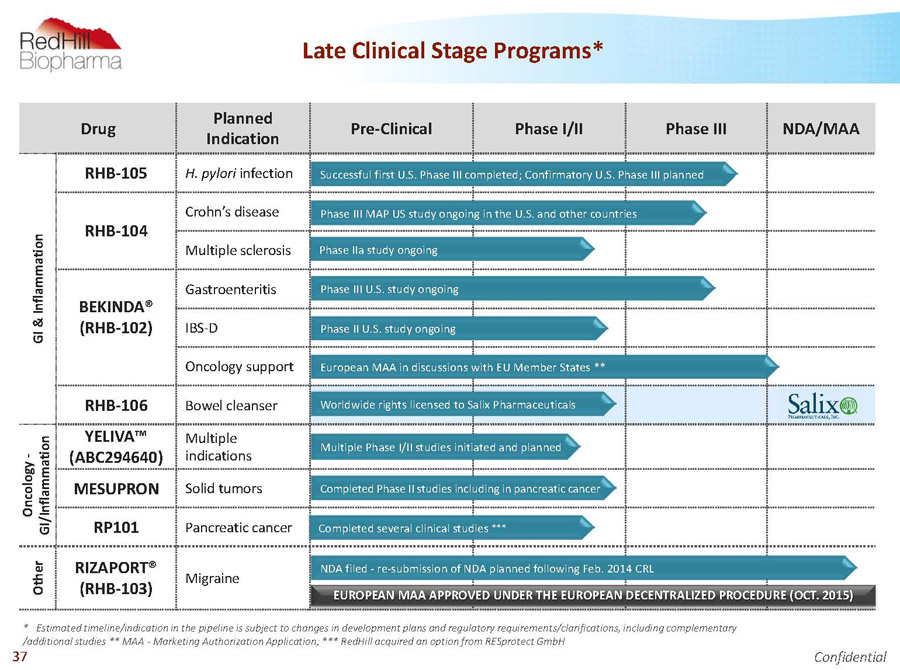

Drug Planned Indication Pre-Clinical Phase I/II Phase III NDA/MAA G I & I n f l a m m a t i o n RHB-105 H. pylori infection RHB-104 Crohn’s disease Multiple sclerosis BEKINDA® (RHB-102) Gastroenteritis IBS-D Oncology support RHB-106 Bowel cleanser O n c o l o g y - G I / I n f l a m m a t i o n YELIVA™ (ABC294640) Multiple indications MESUPRON Solid tumors RP101 Pancreatic cancer O t h e r RIZAPORT® (RHB-103) Migraine Worldwide rights licensed to Salix Pharmaceuticals Successful first U.S. Phase III completed; Confirmatory U.S. Phase III planned Phase III MAP US study ongoing in the U.S. and other countries Phase IIa study ongoing NDA filed -re-submission of NDA planned following Feb. 2014 CRL Phase III U.S. study ongoing Completed Phase II studies including in pancreatic cancer Completed several clinical studies *** European MAA in discussions with EU Member States ** * Estimated timeline/indication in the pipeline is subject to changes in development plans and regulatory requirements/clarifications, including complementary /additional studies ** MAA -Marketing Authorization Application; *** RedHillacquired an option from RESprotectGmbH Multiple Phase I/II studies initiated and planned Late Clinical Stage Programs* Phase II U.S. study ongoing EUROPEAN MAA APPROVED UNDER THE EUROPEAN DECENTRALIZED PROCEDURE (OCT. 2015) Confidential 37

Appendix 38

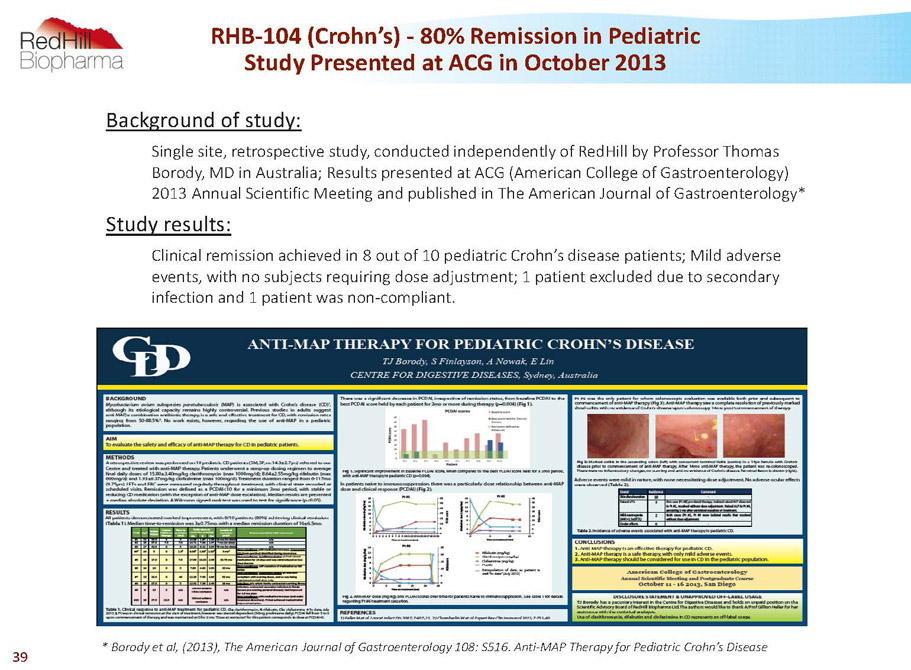

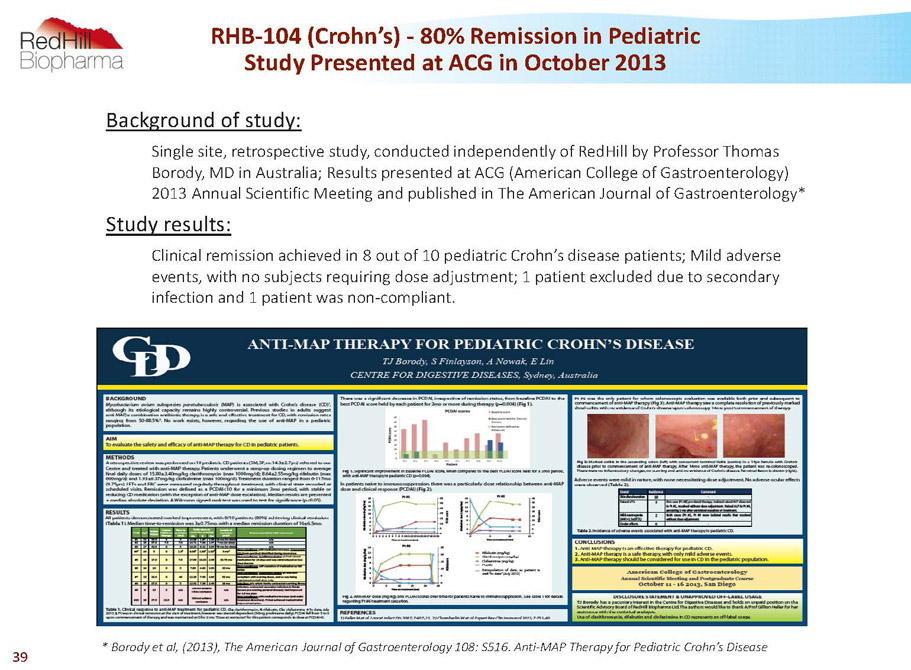

RHB-104 (Crohn’s) -80% Remission in Pediatric Study Presented at ACG in October 2013 Background of study: Single site, retrospective study, conducted independently of RedHillby Professor Thomas Borody, MD in Australia; Results presented at ACG (American College of Gastroenterology) 2013 Annual Scientific Meeting and published in The American Journal of Gastroenterology* Study results: Clinical remission achieved in 8 out of 10 pediatric Crohn’s disease patients; Mild adverse events, with no subjects requiring dose adjustment; 1 patient excluded due to secondary infection and 1 patient was non-compliant * Borodyet al, (2013), The AmericanJournal of Gastroenterology 108: S516. Anti-MAP Therapy for Pediatric Crohn’s Disease 39

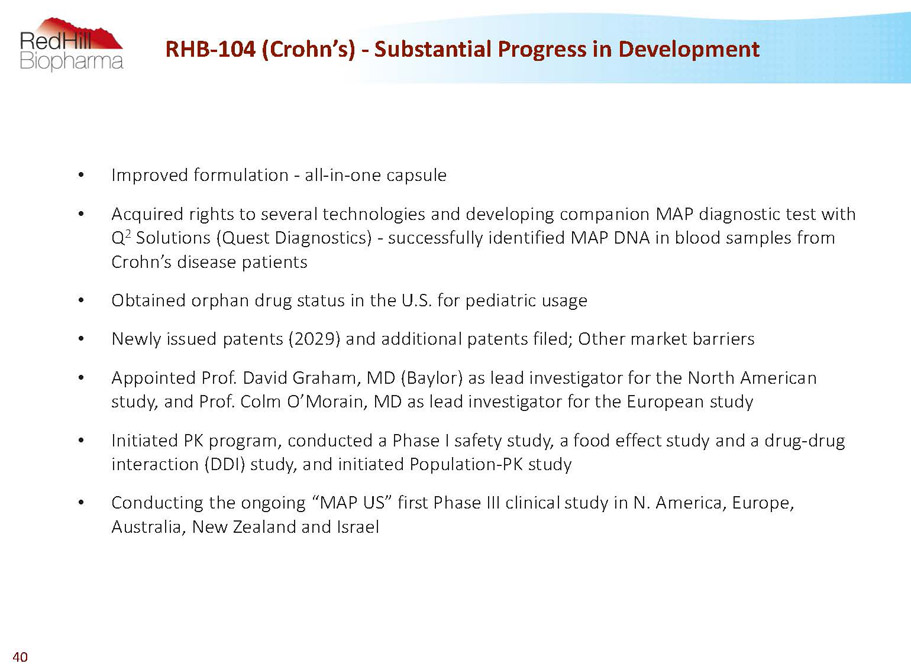

RHB-104 (Crohn’s) -Substantial Progress in Development • Improved formulation -all-in-one capsule • Acquired rights to several technologies and developing companion MAP diagnostic test with Q 2 Solutions (Quest Diagnostics) -successfully identified MAP DNA in blood samples from Crohn’s disease patients • Obtained orphan drug status in the U.S. for pediatric usage • Newly issued patents (2029) and additional patents filed; Other market barriers • Appointed Prof. David Graham, MD (Baylor) as lead investigator for the North American study, and Prof. Colm O’Morain, MD as lead investigator for the European study • Initiated PK program, conducted a Phase I safety study, a food effect study and a drug-drug interaction (DDI) study, and initiated Population-PK study • Conducting the ongoing “MAP US” first Phase III clinical study in N. America, Europe, Australia, New Zealand and Israel 40

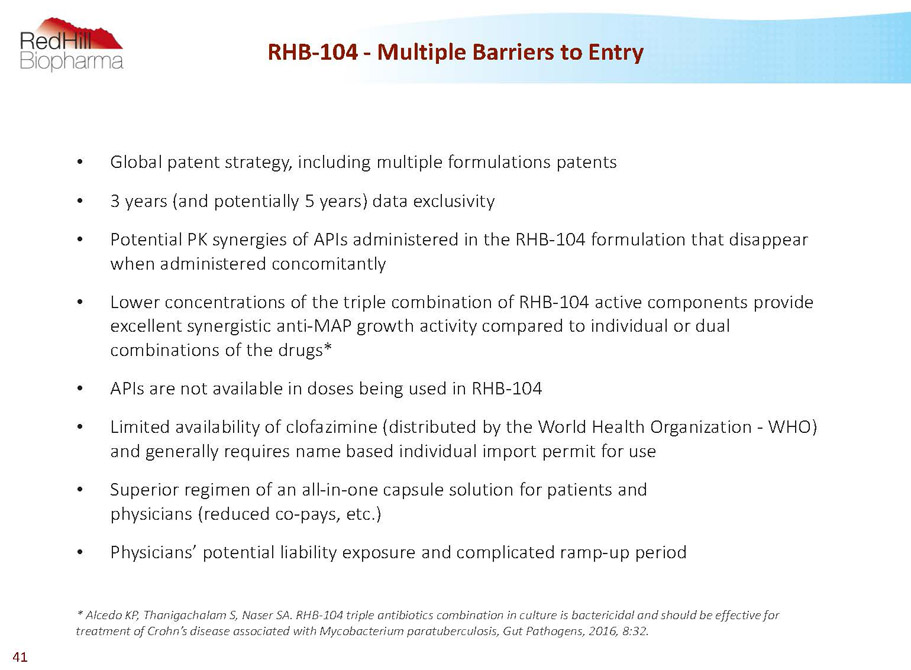

RHB-104 -Multiple Barriers to Entry • Global patent strategy, including multiple formulations patents • 3 years (and potentially 5 years) data exclusivity • Potential PK synergies of APIs administered in the RHB-104 formulation that disappear when administered concomitantly • Lower concentrations of the triple combination of RHB-104 active components provide excellent synergistic anti-MAP growth activity compared to individual or dual combinations of the drugs* • APIs are not available in doses being used in RHB-104 • Limited availability of clofazimine (distributed by the World Health Organization -WHO) and generally requires name based individual import permit for use • Superior regimen of an all-in-one capsule solution for patients and physicians (reduced co-pays, etc.) • Physicians’ potential liability exposure and complicated ramp-up period * AlcedoKP, ThanigachalamS, NaserSA. RHB-104 triple antibiotics combination in culture is bactericidal and should be effective for treatment of Crohn’s disease associated withMycobacterium paratuberculosis, Gut Pathogens, 2016, 8:32. 41

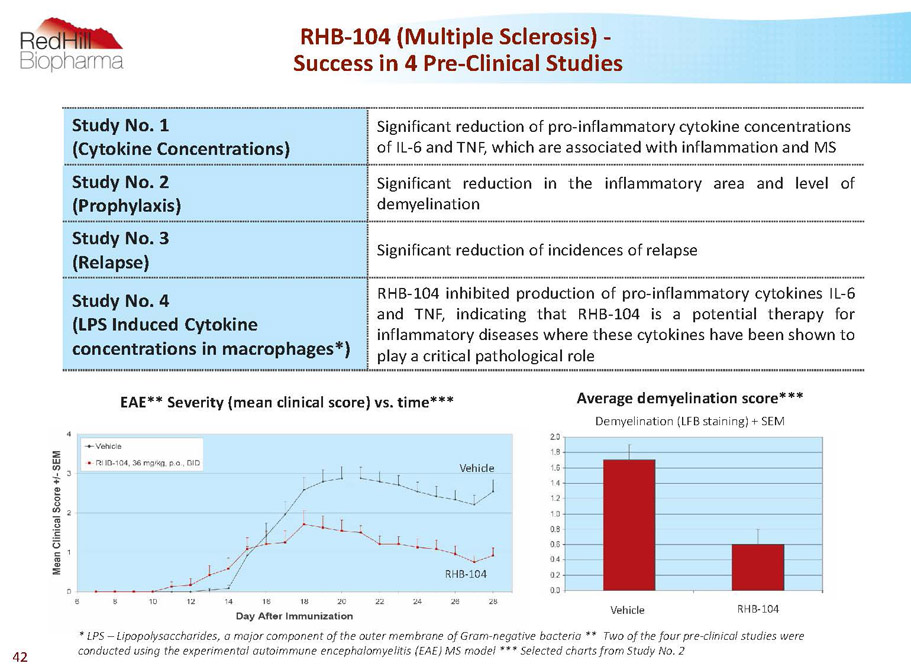

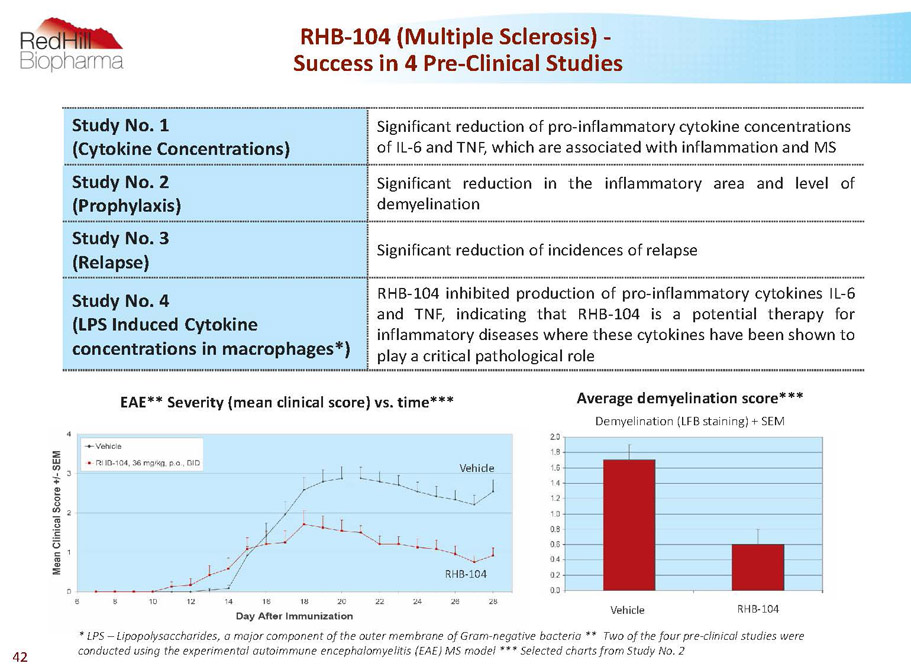

RHB-104 (Multiple Sclerosis) - Success in 4 Pre-Clinical Studies Study No. 1 (Cytokine Concentrations) Significant reduction of pro-inflammatory cytokine concentrations of IL-6 and TNF, which are associated with inflammation and MS Study No. 2 (Prophylaxis) Significant reduction in the inflammatory area and level of demyelination Study No. 3 (Relapse) Significantreductionofincidencesofrelapse Study No. 4 (LPS Induced Cytokine concentrations in macrophages*) RHB-104inhibitedproductionofpro-inflammatorycytokinesIL-6 and TNF,indicating that RHB-104 is a potential therapy for inflammatorydiseaseswherethesecytokineshavebeenshownto playacriticalpathologicalrole * LPS –Lipopolysaccharides, a major component of the outer membrane of Gram-negative bacteria** Two of the four pre-clinical studies were conducted using the experimental autoimmune encephalomyelitis (EAE) MS model *** Selected charts from Study No. 2 Average demyelination score*** Demyelination (LFB staining) + SEM EAE** Severity (mean clinical score) vs. time RHB-104 Vehicle Vehicle RHB-104 42

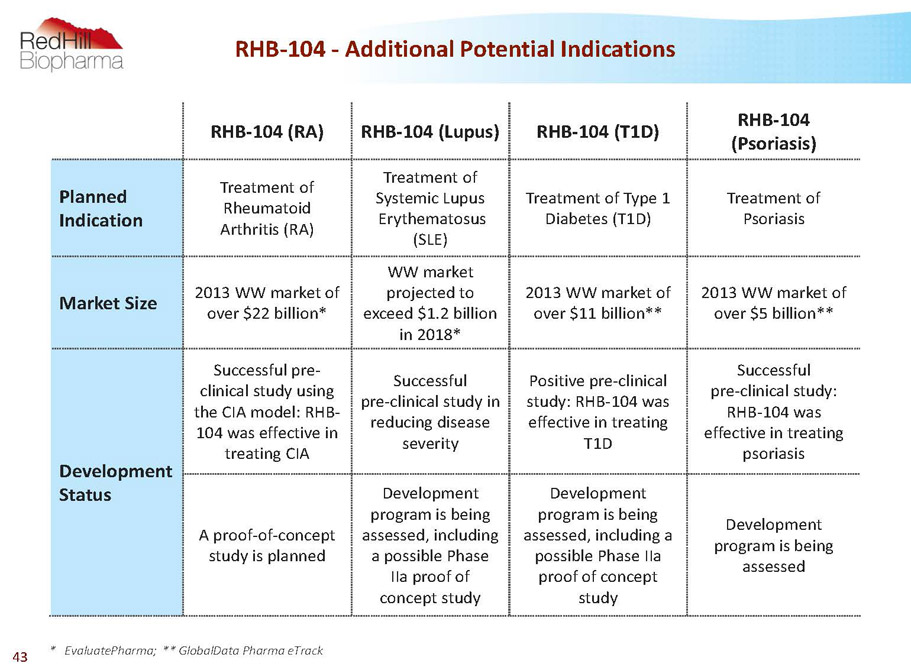

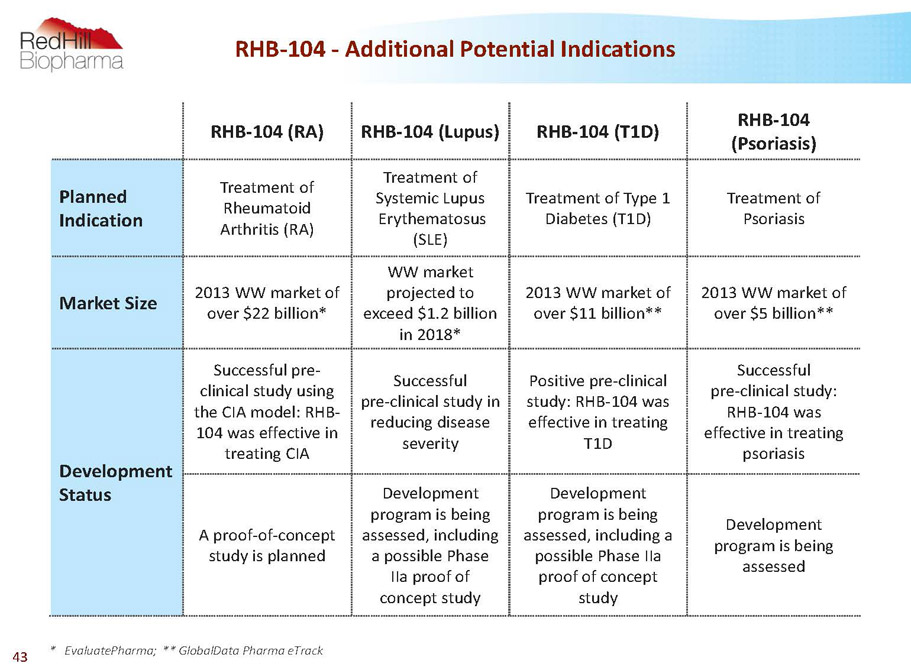

RHB-104 -Additional Potential Indications RHB-104 (RA) RHB-104 (Lupus) RHB-104 (T1D) RHB-104 (Psoriasis) Planned Indication Treatment of Rheumatoid Arthritis (RA) Treatment of Systemic Lupus Erythematosus (SLE) Treatment of Type 1 Diabetes (T1D) Treatment of Psoriasis MarketSize 2013 WW market of over $22 billion* WW market projected to exceed $1.2 billion in 2018* 2013 WW market of over $11 billion** 2013 WW market of over $5 billion** Development Status Successful pre- clinical study using the CIA model: RHB- 104 was effective in treating CIA Successful pre-clinical study in reducing disease severity Positive pre-clinical study: RHB-104 was effective in treating T1D Successful pre-clinical study: RHB-104 was effective in treating psoriasis A proof-of-concept study is planned Development program is being assessed, including a possible Phase IIa proof of concept study Development program is being assessed, including a possible Phase IIa proof of concept study Development program is being assessed * EvaluatePharma; ** GlobalData Pharma eTrack 43

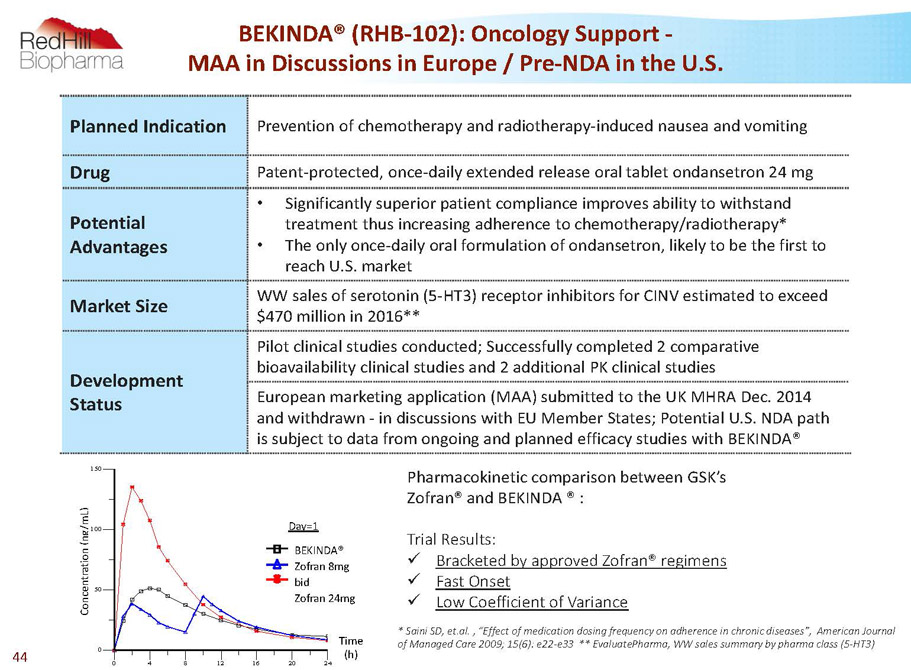

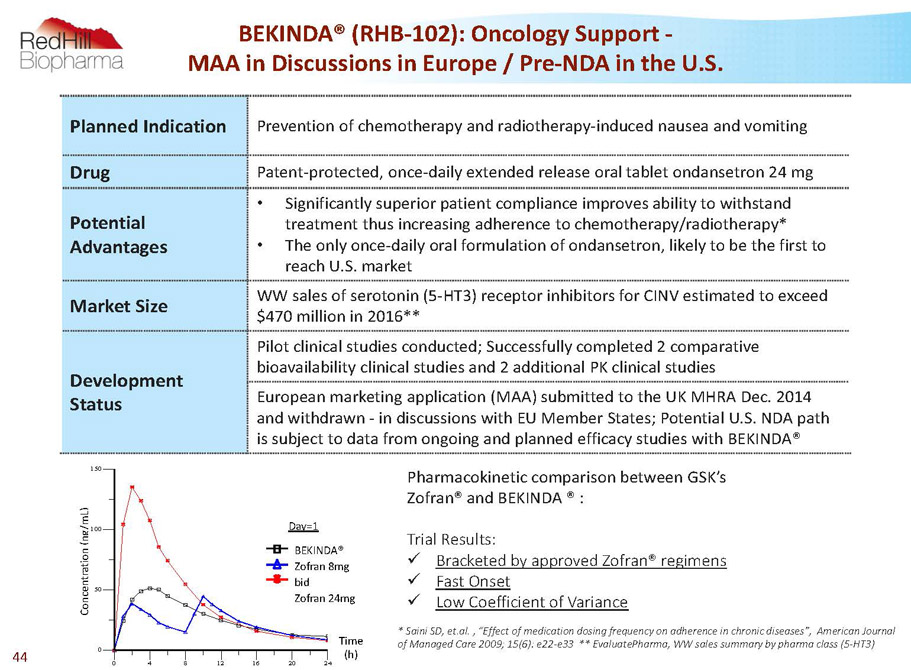

C o n c e n t r a t i o n ( n g / m L ) 0 50 100 150 C o n c e n t r a t i o n ( n g / m L ) 0 4 8 12 16 20 24 Time (h) Treatment-1 Treatment-2 Treatment-3 Day=1 BEKINDA® Zofran 8mg bid Zofran 24mg Day=1 Time (h) Planned Indication Prevention of chemotherapy and radiotherapy-induced nausea and vomiting Drug Patent-protected, once-daily extended release oral tablet ondansetron 24 mg Potential Advantages • Significantly superior patient compliance improves ability to withstand treatment thus increasing adherence to chemotherapy/radiotherapy* • The only once-daily oral formulation of ondansetron, likely to be the first to reach U.S. market Market Size WW sales of serotonin (5-HT3) receptor inhibitors for CINV estimated to exceed $470 million in 2016** Development Status Pilot clinical studies conducted; Successfully completed 2 comparative bioavailability clinical studies and 2 additional PK clinical studies European marketing application (MAA) submitted to the UK MHRA Dec. 2014 and withdrawn -in discussions with EU Member States; Potential U.S. NDA path is subject to data from ongoing and planned efficacy studies with BEKINDA® BEKINDA® (RHB-102): Oncology Support - MAA in Discussions in Europe / Pre-NDA in the U.S. Pharmacokinetic comparison between GSK’s Zofran® and BEKINDA® : TrialResults: x Bracketed by approved Zofran® regimens x FastOnset x LowCoefficientofVariance * Saini SD, et.al. , “Effect of medication dosing frequency on adherence in chronic diseases”, American Journal of Managed Care 2009; 15(6): e22-e33 ** EvaluatePharma, WW sales summary by pharma class (5-HT3) 44

BEKINDA® (RHB-102) -Market Opportunity 5-HT3 (serotonin) receptor antagonists are considered the most effective and significant class of drugs in prevention of nausea and vomiting Ondansetron: • The most prescribed first generation 5-HT3 inhibitor • Potentially attractive safety profile as indicated by prescription and reimbursement in broad off-label indications (primarily OB/GYN & GI) • Aloxi® (palonosetron) second generation 5-HT3 inhibitor is IV * (ambulatory use) and has a significantly higher price** • Akynzeo® (oral palonosetron& NK1) has a significantly higher price** BEKINDA®Potential Market: • Gastroenteritis and gastritis: WW potential market could exceed $650 million annually *** • IBS-D: U.S. market estimated to exceed $1.3 billion by 2020 • Oncology support: worldwide sales of serotonin (5-HT3) receptor inhibitors for CINV expected to exceed $470 million in 2016 **** • GSK’s branded generic (Zofran®) 2015 sales estimated at approx. $116 million ***** www.accessdata.fda.gov; ** www.GoodRx.com; *** Graves S. Nancy, Acute Gastroenteritis, Prim Care ClinOffice Pract40 (2013) 727–741 and Company analysis; **** EvaluatePharma,, WW sales summary by pharma class (5-HT3); *****EvaluatePharma,, WW sales of Zofran 45

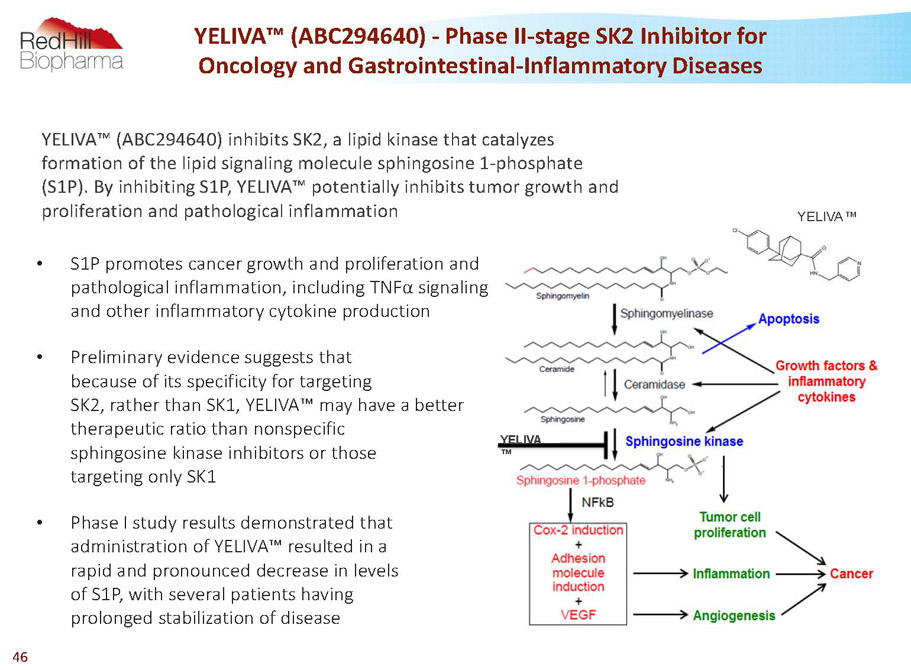

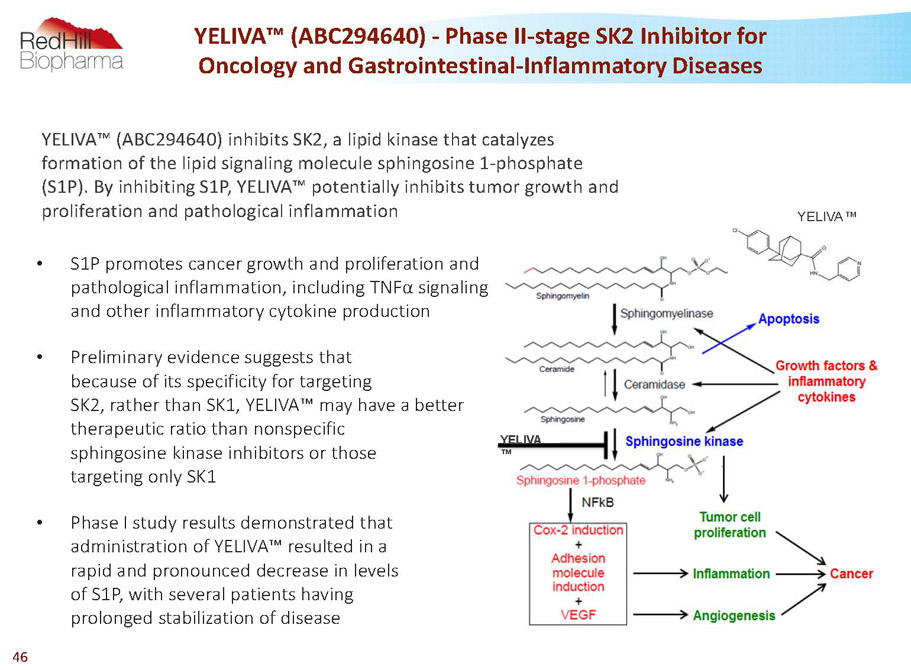

YELIVA ™ • S1P promotes cancer growth and proliferation and pathological inflammation, including TNFa signaling and other inflammatory cytokine production • Preliminary evidence suggests that because of its specificity for targeting SK2, rather than SK1, YELIVA™ may have a better therapeutic ratio than nonspecific sphingosine kinase inhibitors or those targeting only SK1 • Phase I study results demonstrated that administration of YELIVA™ resulted in a rapid and pronounced decrease in levels of S1P, with several patients having prolonged stabilization of disease YELIVA™ (ABC294640) -Phase II-stage SK2 Inhibitor for Oncology and Gastrointestinal-Inflammatory Diseases YELIVA™ YELIVA™ (ABC294640) inhibits SK2, a lipid kinase that catalyzes formation of the lipid signaling molecule sphingosine 1-phosphate (S1P). By inhibiting S1P, YELIVA™ potentially inhibits tumor growth and proliferation and pathological inflammation 46

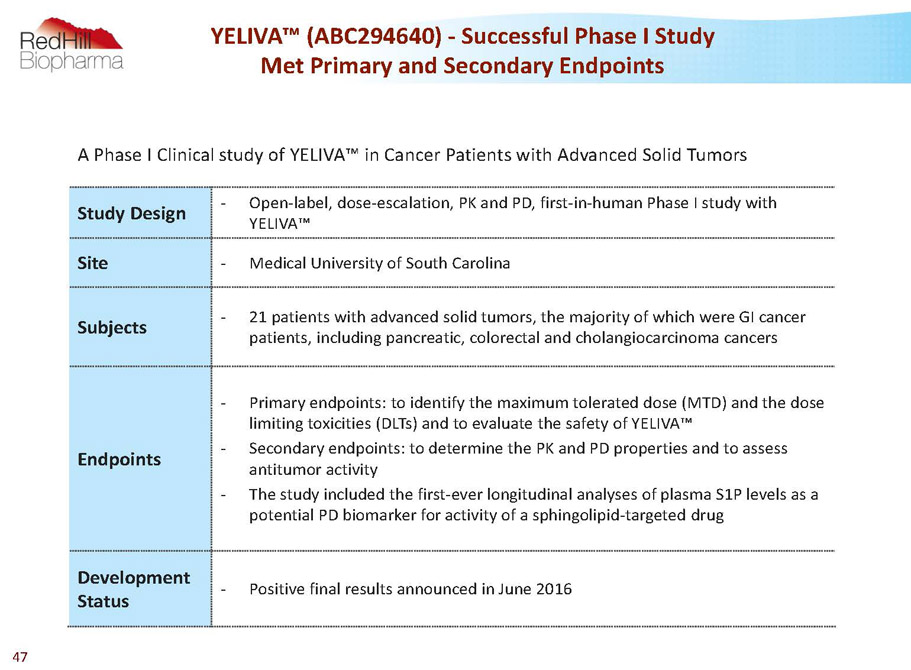

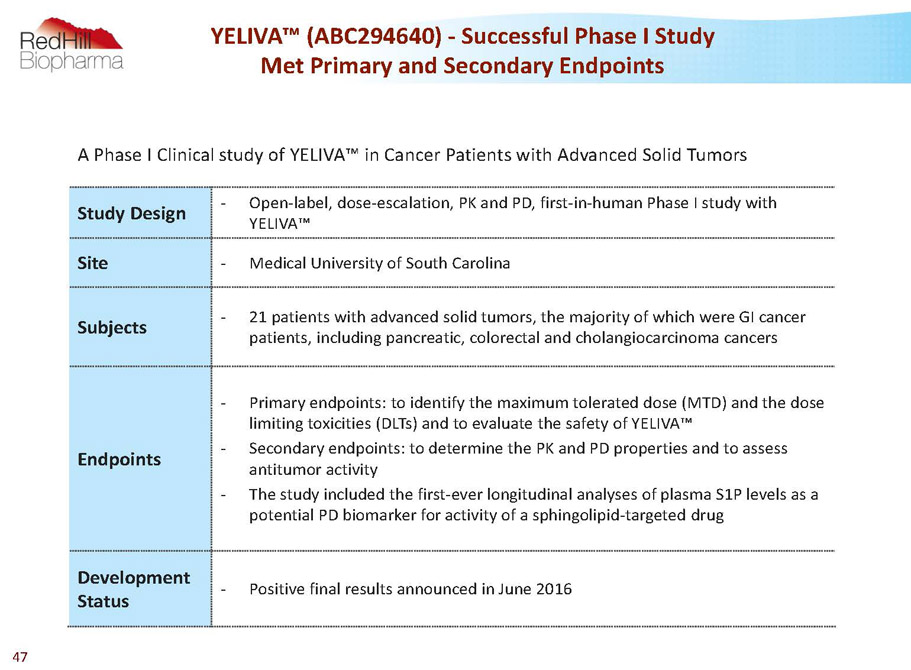

A Phase I Clinical study of YELIVA™ in Cancer Patients with Advanced Solid Tumors Study Design - Open-label, dose-escalation, PK and PD, first-in-human Phase I study with YELIVA™ Site - Medical University of South Carolina Subjects - 21 patients with advanced solid tumors, the majority of which were GI cancer patients, including pancreatic, colorectal and cholangiocarcinomacancers Endpoints - Primary endpoints: to identify the maximum tolerated dose (MTD) and the dose limiting toxicities (DLTs) and to evaluate the safety of YELIVA™ - Secondary endpoints: to determine the PK and PD properties and to assess antitumor activity - The study included the first-ever longitudinal analyses of plasma S1P levels as a potential PD biomarker for activity of a sphingolipid-targeted drug Development Status - Positive final results announced in June 2016 YELIVA™ (ABC294640) -Successful Phase I Study Met Primary and Secondary Endpoints 47

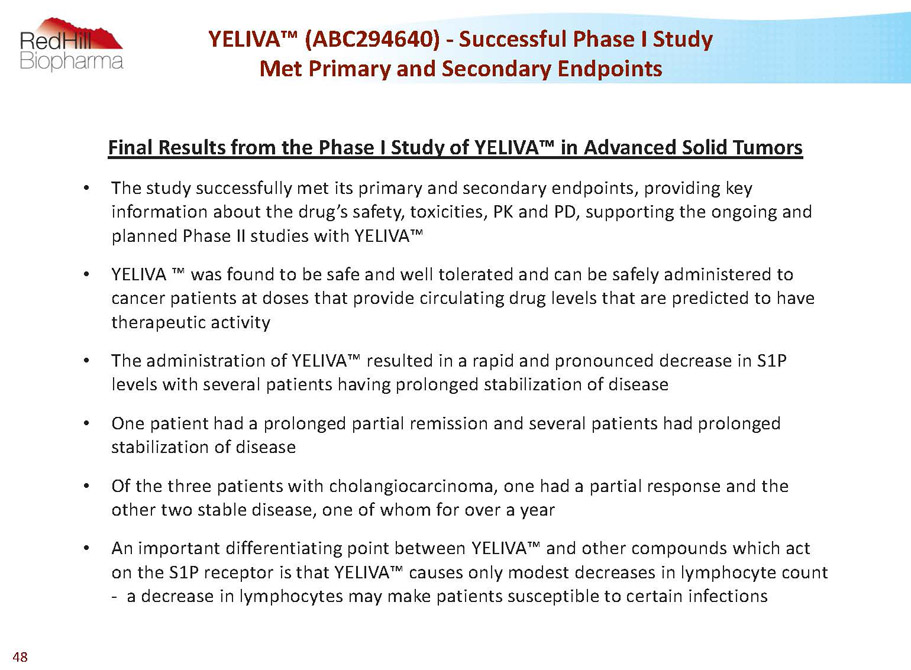

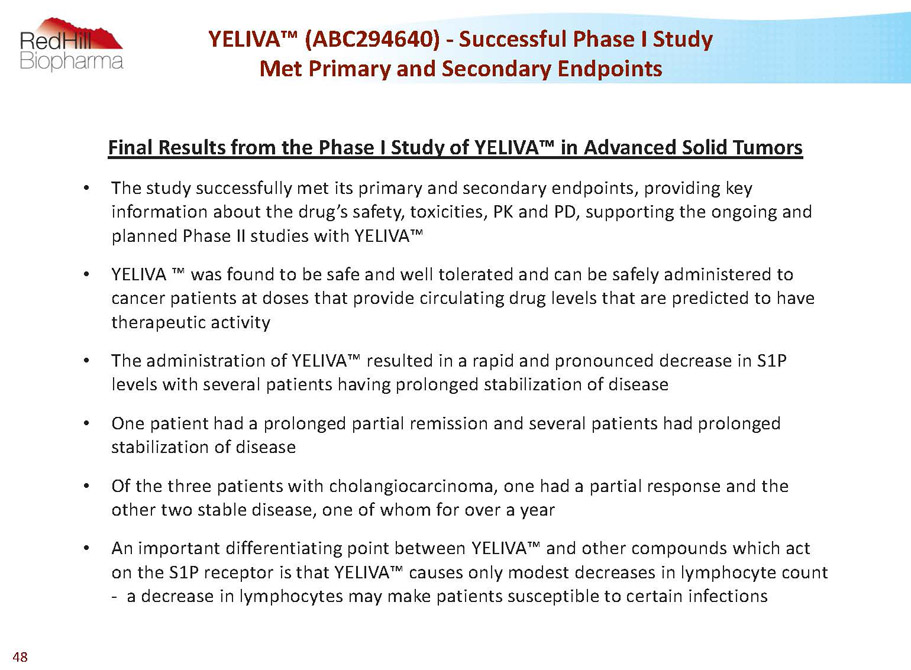

YELIVA™ (ABC294640) -Successful Phase I Study Met Primary and Secondary Endpoints Final Results from the Phase I Study of YELIVA™ in Advanced Solid Tumors • The study successfully met its primary and secondary endpoints, providing key information about the drug’s safety, toxicities, PK and PD, supporting the ongoing and planned Phase II studies with YELIVA™ • YELIVA ™ was found to be safe and well tolerated and can be safely administered to cancer patients at doses that provide circulating drug levels that are predicted to have therapeutic activity • The administration of YELIVA™ resulted in a rapid and pronounced decrease in S1P levels with several patients having prolonged stabilization of disease • One patient had a prolonged partial remission and several patients had prolonged stabilization of disease • Of the three patients with cholangiocarcinoma, one had a partial response and the other two stable disease, one of whom for over a year • An importantdifferentiating point between YELIVA™ and other compounds which act on the S1P receptor is that YELIVA™ causes only modest decreases in lymphocyte count -a decrease in lymphocytes may make patients susceptible to certain infections 48

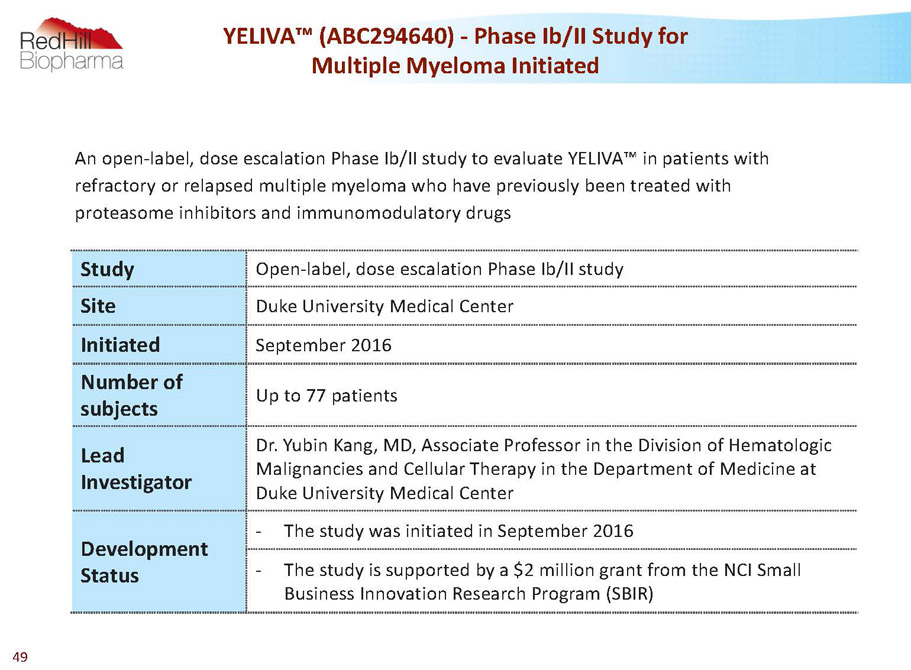

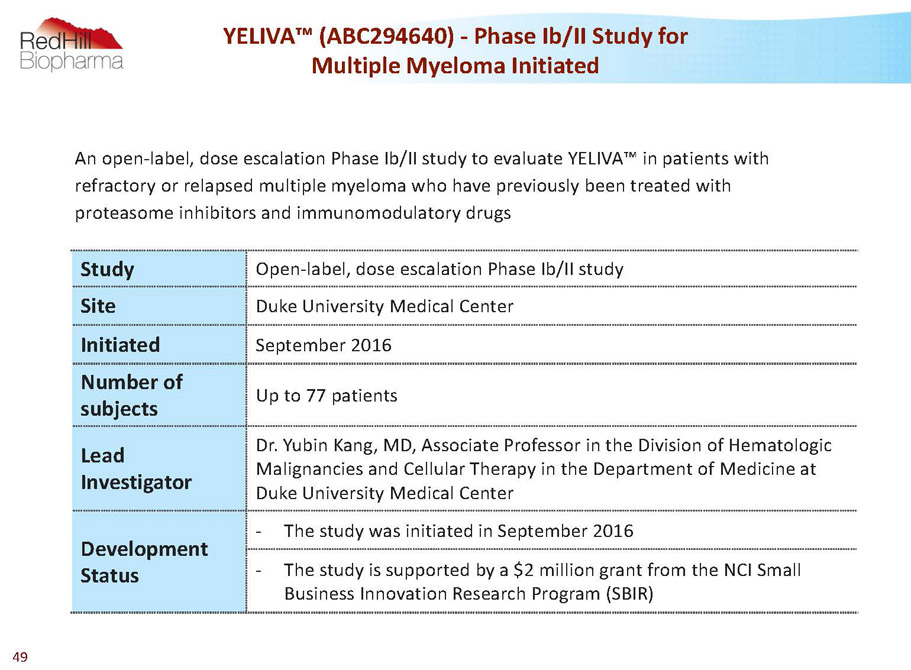

YELIVA™ (ABC294640) -Phase Ib/II Study for Multiple Myeloma Initiated Study Open-label, dose escalation Phase Ib/II study Site Duke University Medical Center Initiated September 2016 Number of subjects Up to 77 patients Lead Investigator Dr. YubinKang, MD, Associate Professor in the Division of Hematologic Malignancies and Cellular Therapy in the Department of Medicine at Duke University Medical Center Development Status - The study was initiated in September 2016 - The study is supported by a $2 million grant from the NCI Small Business Innovation Research Program (SBIR) An open-label, dose escalation Phase Ib/II study to evaluate YELIVA™ in patients with refractory or relapsed multiple myeloma who have previously been treated with proteasome inhibitors and immunomodulatorydrugs 49

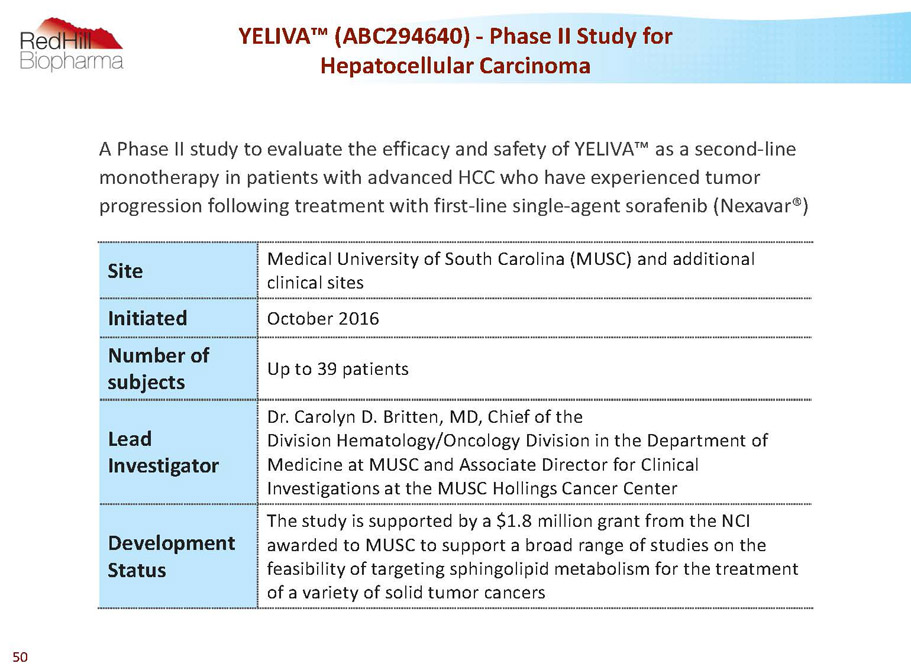

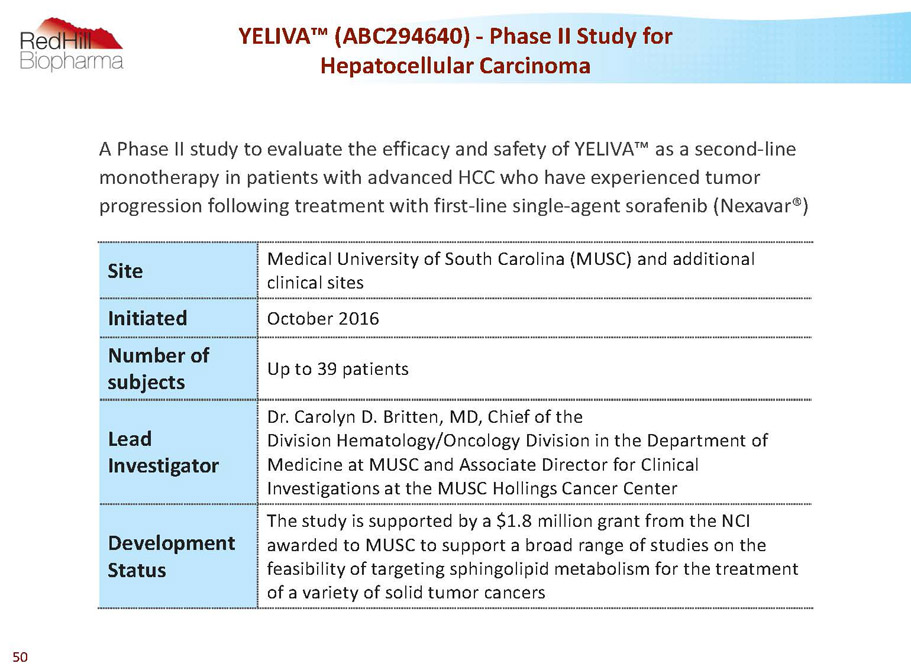

YELIVA™ (ABC294640) -Phase II Study for Hepatocellular Carcinoma Site Medical University of South Carolina (MUSC)and additional clinical sites Initiated October 2016 Number of subjects Up to 39 patients Lead Investigator Dr. Carolyn D. Britten, MD, Chief of the DivisionHematology/Oncology Division in the Department of Medicine at MUSC and Associate Director for Clinical Investigations at the MUSC Hollings Cancer Center Development Status The study is supported by a $1.8 million grant from the NCI awarded to MUSC to support a broad range of studies on the feasibility of targeting sphingolipid metabolism for the treatment of a variety of solid tumor cancers A Phase II study to evaluate the efficacy and safety of YELIVA™as a second-line monotherapy in patients with advanced HCC who have experienced tumor progression following treatment with first-line single-agent sorafenib(Nexavar®) 50

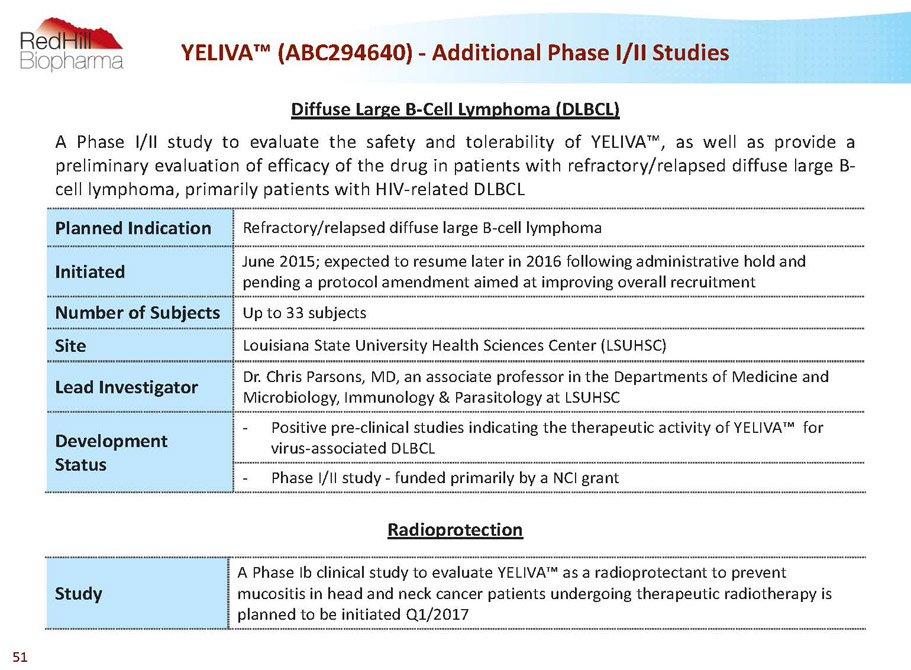

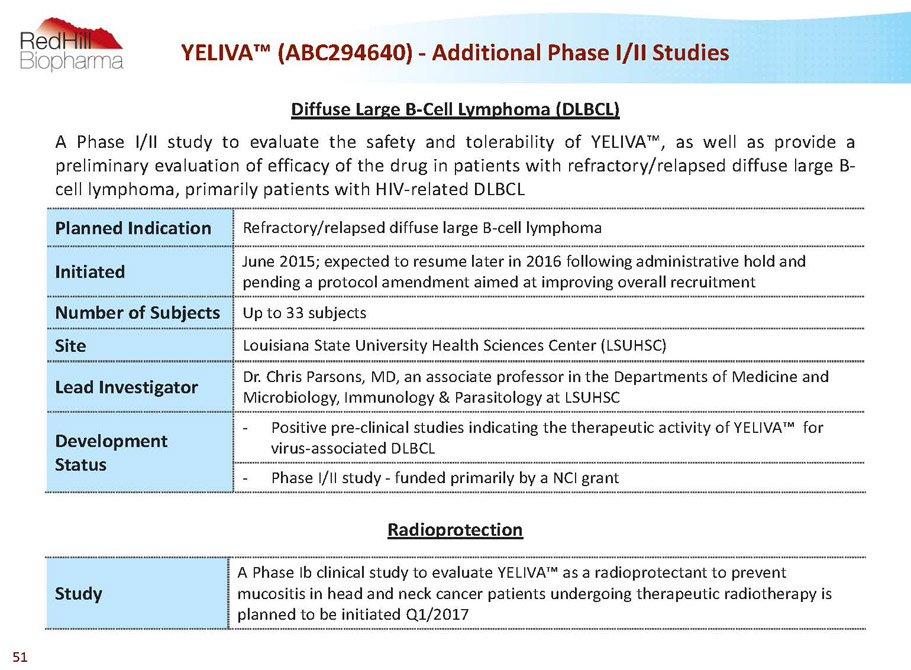

Diffuse Large B-Cell Lymphoma (DLBCL) APhaseI/IIstudytoevaluatethesafetyandtolerabilityofYELIVA™,aswellasprovidea preliminaryevaluationofefficacyofthedruginpatientswithrefractory/relapseddiffuselargeB- celllymphoma,primarilypatientswithHIV-relatedDLBCL Planned Indication Refractory/relapsed diffuse large B-cell lymphoma Initiated June 2015; expected to resume later in 2016 following administrative hold and pending a protocol amendment aimed at improving overall recruitment Number of Subjects Up to 33 subjects Site Louisiana State University Health Sciences Center (LSUHSC) Lead Investigator Dr. Chris Parsons, MD, an associate professor in the Departments of Medicine and Microbiology, Immunology & Parasitology at LSUHSC Development Status - Positive pre-clinical studies indicating the therapeutic activity of YELIVA™ for virus-associated DLBCL - Phase I/II study -funded primarily by a NCI grant YELIVA™ (ABC294640) -Additional Phase I/II Studies Radioprotection Study A Phase Ibclinical study to evaluate YELIVA™as a radioprotectantto prevent mucositisin head and neck cancer patients undergoing therapeutic radiotherapyis planned to be initiated Q1/2017 51

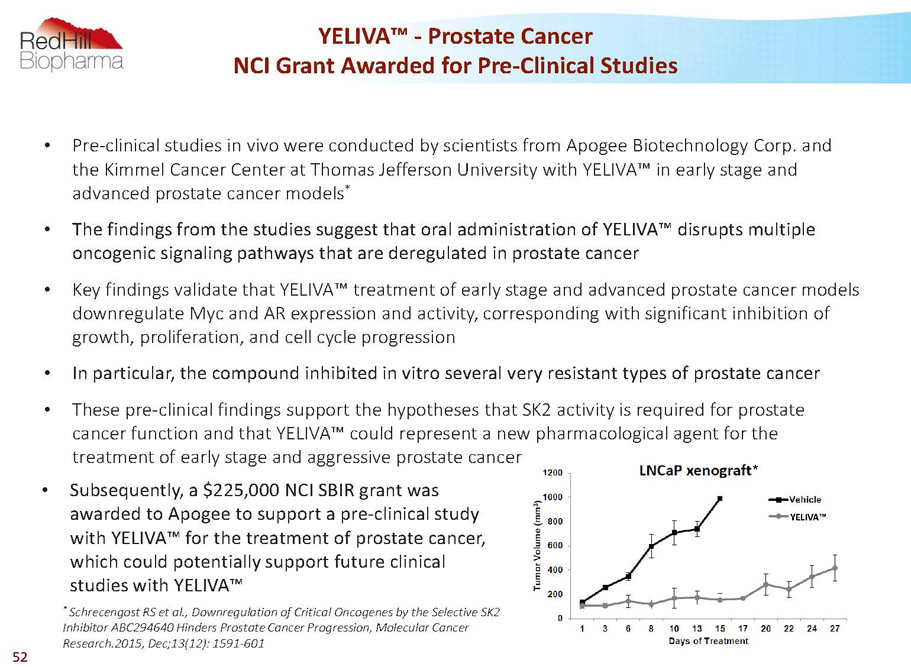

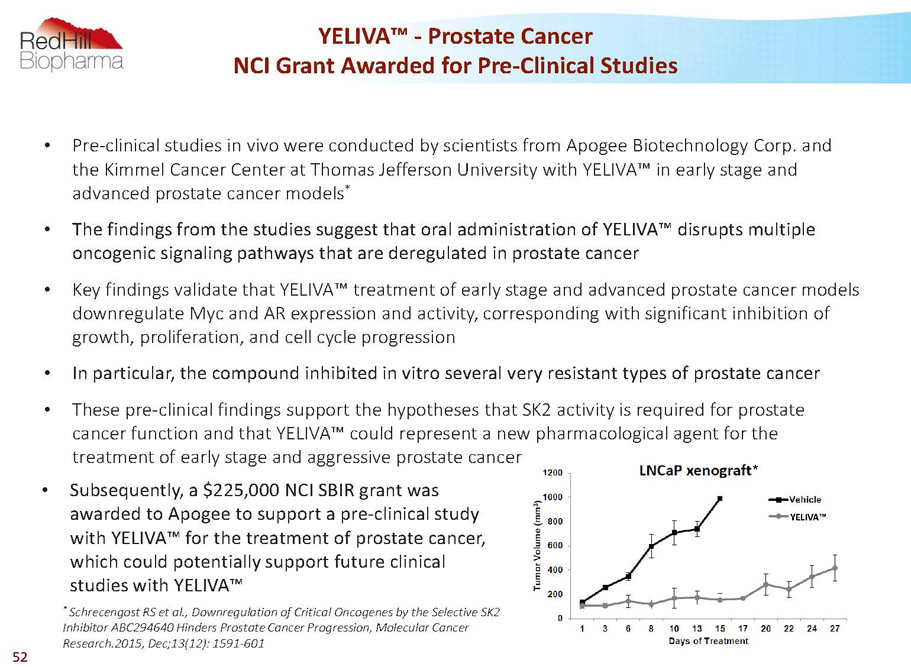

YELIVA™ * YELIVA™ -Prostate Cancer NCI Grant Awarded for Pre-Clinical Studies • Pre-clinical studies in vivo were conducted by scientists from Apogee Biotechnology Corp. and the Kimmel Cancer Center at Thomas Jefferson University with YELIVA™ in early stage and advanced prostate cancer models * • The findings from the studies suggest that oral administration of YELIVA™ disrupts multiple oncogenic signaling pathways that are deregulated in prostate cancer • Key findings validate that YELIVA™ treatment of early stage and advanced prostate cancer models downregulate Mycand AR expression and activity, corresponding with significant inhibition of growth, proliferation, and cell cycle progression • In particular, the compound inhibited in vitro several very resistant types of prostate cancer • These pre-clinical findings support the hypotheses that SK2 activity is required for prostate cancer function and that YELIVA™ could represent a new pharmacological agent for the treatment of early stage and aggressive prostate cancer * SchrecengostRS et al., Downregulation of Critical Oncogenes by the Selective SK2 Inhibitor ABC294640 Hinders Prostate Cancer Progression, Molecular Cancer Research.2015, Dec;13(12): 1591-601 • Subsequently, a $225,000 NCI SBIR grant was awarded to Apogee to support a pre-clinical study with YELIVA™ for the treatment of prostate cancer, which could potentially support future clinical studies with YELIVA™ 52

RHB-106 Bowel preparation capsule Out-licensed to Salix Pharmaceuticals 53

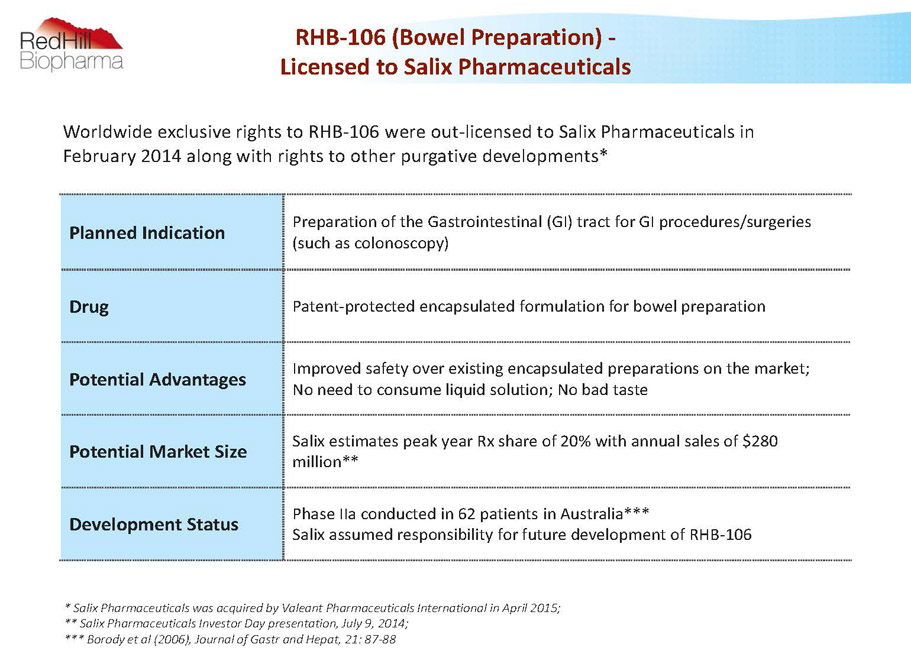

RHB-106 (Bowel Preparation) - Licensed to Salix Pharmaceuticals Planned Indication Preparation of the Gastrointestinal (GI) tract for GI procedures/surgeries (such as colonoscopy) Drug Patent-protected encapsulated formulation for bowel preparation Potential Advantages Improved safety over existing encapsulated preparations on the market; No need to consume liquid solution; No bad taste Potential Market Size Salix estimates peak year Rx share of 20% with annual sales of $280 million** Development Status Phase IIa conducted in 62 patients in Australia*** Salix assumed responsibility for future development of RHB-106 * Salix Pharmaceuticals was acquired by Valeant Pharmaceuticals International in April 2015; ** Salix Pharmaceuticals Investor Daypresentation, July 9, 2014; *** Borody et al (2006), Journal of Gastr and Hepat, 21: 87-88 Worldwide exclusive rights to RHB-106 were out-licensed to Salix Pharmaceuticals in February 2014 along with rights to other purgative developments* 54

MESUPRON & RP101 Phase II-stage first-in-class small molecules targeting multiple oncology indications 55

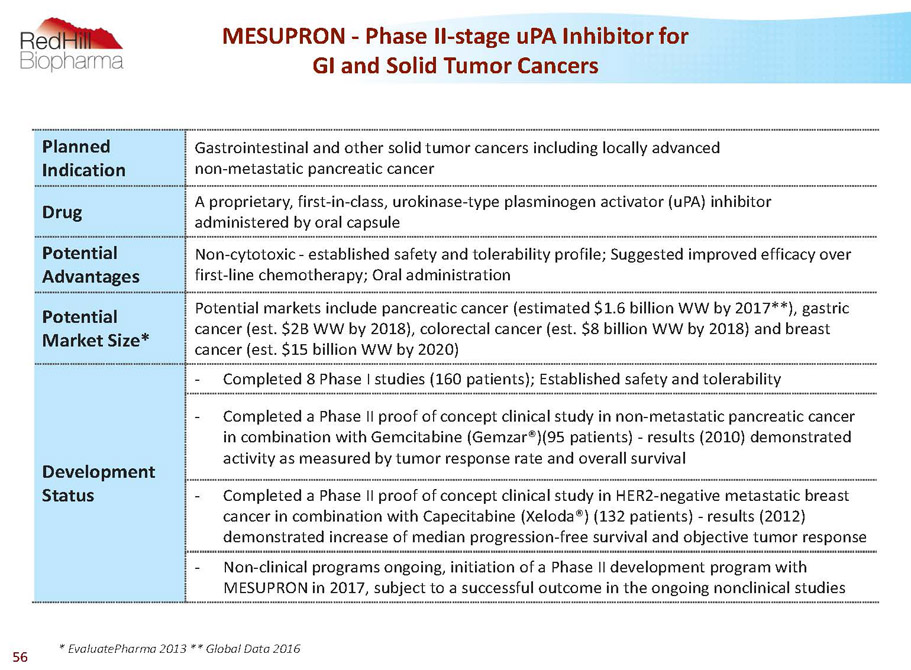

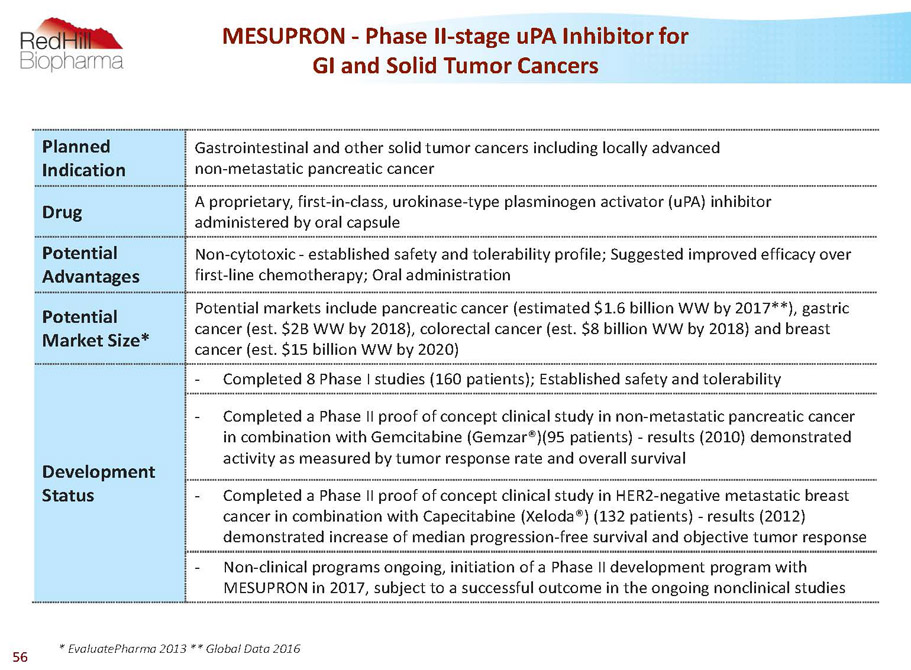

Planned Indication Gastrointestinal and other solid tumor cancers including locally advanced non-metastatic pancreatic cancer Drug A proprietary, first-in-class, urokinase-type plasminogen activator (uPA) inhibitor administered by oral capsule Potential Advantages Non-cytotoxic -established safety and tolerability profile; Suggested improved efficacy over first-line chemotherapy; Oral administration Potential Market Size* Potential markets include pancreatic cancer (estimated $1.6 billion WW by 2017**), gastric cancer (est. $2B WW by 2018), colorectal cancer (est. $8 billion WW by 2018) and breast cancer (est. $15 billion WW by 2020) Development Status - Completed 8 Phase I studies (160 patients); Established safety and tolerability - Completed a Phase II proof of concept clinical study in non-metastatic pancreatic cancer in combination with Gemcitabine (Gemzar®)(95 patients) -results (2010) demonstrated activity as measured by tumor response rate and overall survival - Completed a Phase II proof of concept clinical study in HER2-negative metastatic breast cancer in combination with Capecitabine (Xeloda®) (132 patients) -results (2012) demonstrated increase of median progression-free survival and objective tumor response - Non-clinical programs ongoing, initiation of a Phase II development program with MESUPRON in 2017, subject to a successful outcome in the ongoing nonclinical studies MESUPRON -Phase II-stage uPA Inhibitor for GI and Solid Tumor Cancers * EvaluatePharma2013 ** Global Data 2016 56

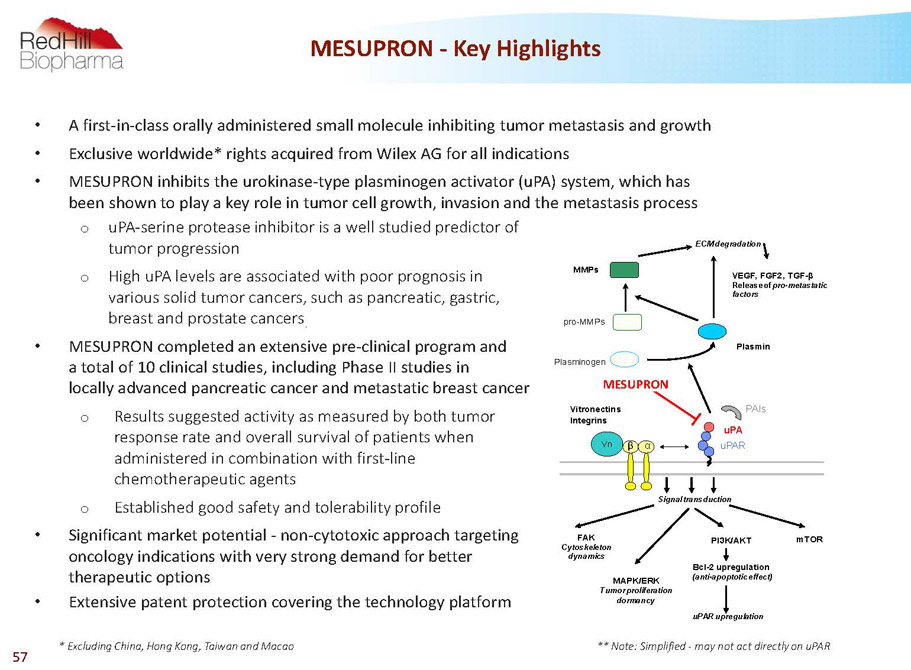

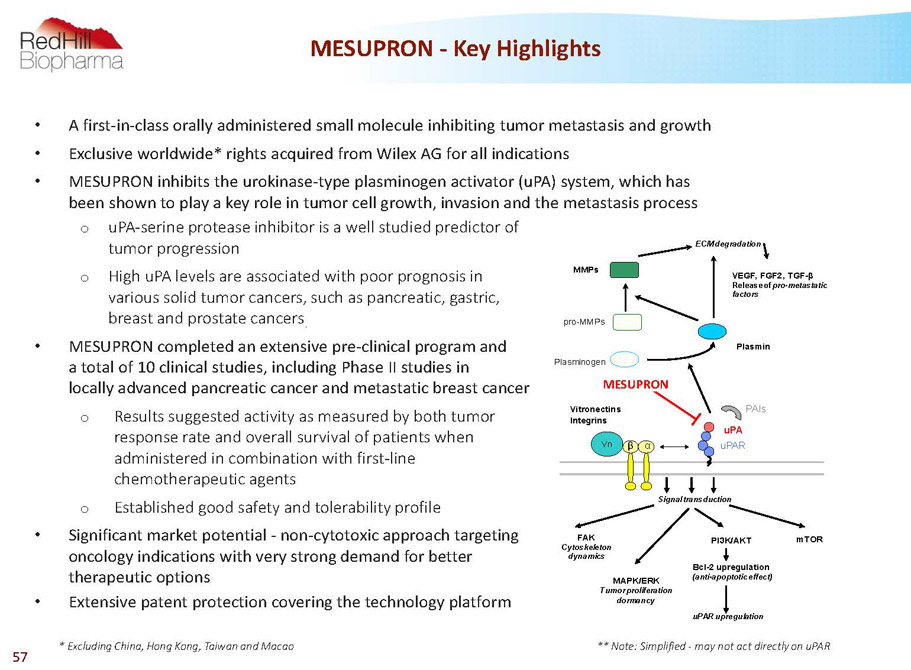

• A first-in-class orally administered small molecule inhibiting tumor metastasis and growth • Exclusive worldwide* rights acquired from Wilex AG for all indications • MESUPRON inhibits the urokinase-type plasminogen activator (uPA) system, which has been shown to play a key role in tumor cell growth, invasion and the metastasis process o uPA-serine protease inhibitor is a well studied predictor of tumor progression o High uPA levels are associated with poor prognosis in various solid tumor cancers, such as pancreatic, gastric, breast and prostate cancers . • MESUPRON completed an extensive pre-clinical program and a total of 10 clinical studies, including Phase II studies in locally advanced pancreatic cancer and metastatic breast cancer o Results suggested activity as measured by both tumor response rate and overall survival of patients when administered in combination with first-line chemotherapeutic agents o Established good safety and tolerability profile • Significant market potential -non-cytotoxic approach targeting oncology indications with very strong demand for better therapeutic options • Extensive patent protection covering the technology platform MESUPRON -Key Highlights * Excluding China, Hong Kong, Taiwan and Macao FAK Cytoskeleton dynamics Signal transduction MAPK/ERK Tumor proliferation dormancy PI3K/AKT mTOR Bcl-2 upregulation (anti-apoptotic effect) uPAR upregulation uPAR uPA ß a Vn Plasminogen Plasmin ECM degradation pro-MMPs MMPs WX-UK1 Vitronectins Integrins PAIs VEGF, FGF2, TGF-ß Release of pro-metastatic factors MESUPRON ** Note: Simplified -may not act directly on uPAR 57

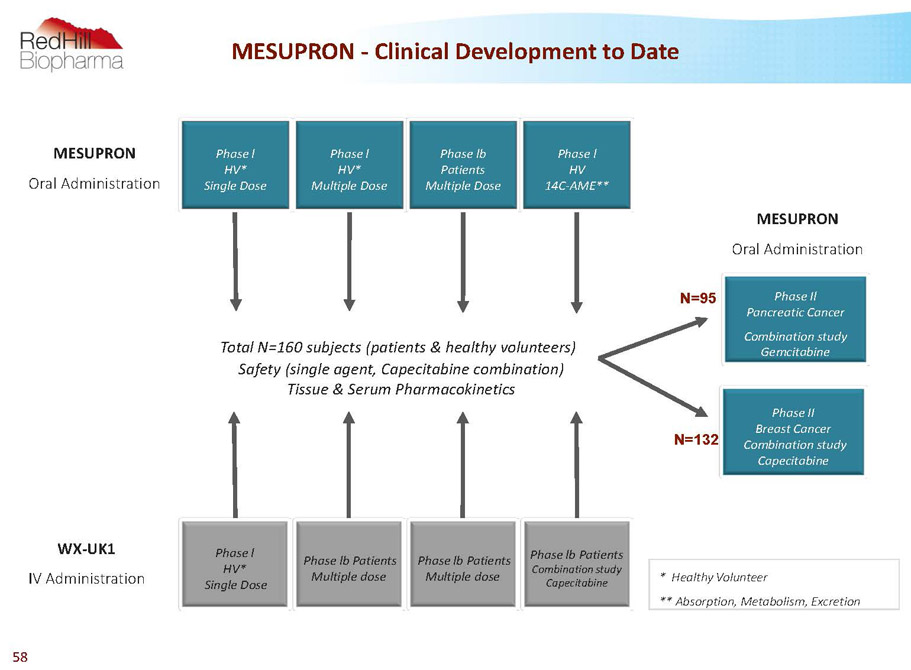

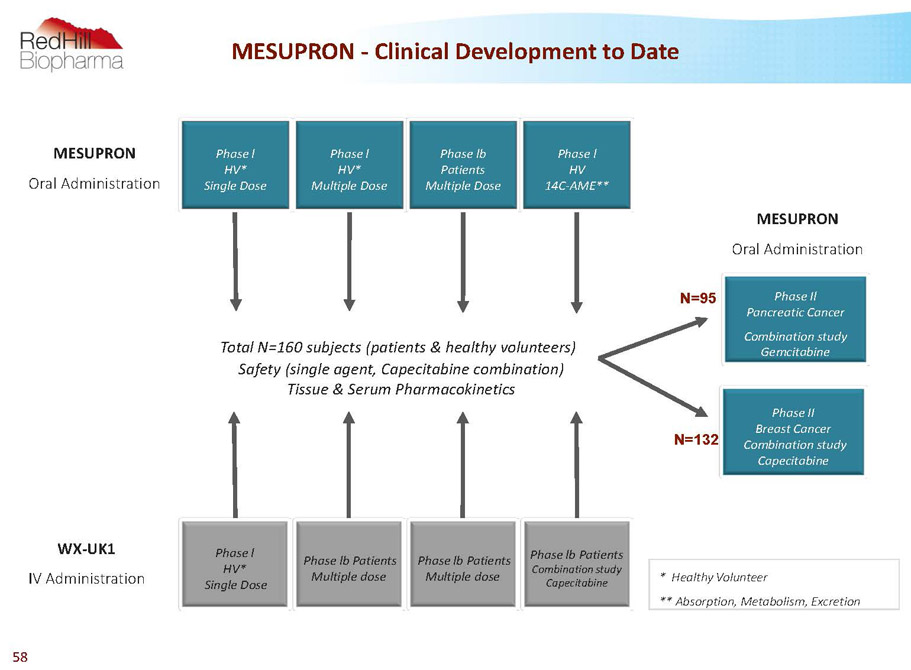

MESUPRON -Clinical Development to Date WX-UK1 IV Administration Total N=160 subjects (patients & healthy volunteers) Safety (single agent, Capecitabine combination) Tissue & Serum Pharmacokinetics Phase II Breast Cancer Combination study Capecitabine Phase Il Pancreatic Cancer Combination study Gemcitabine MESUPRON Oral Administration MESUPRON Oral Administration * Healthy Volunteer ** Absorption, Metabolism, Excretion Phase l HV* Multiple Dose Phase lb Patients Multiple Dose Phase l HV 14C-AME** N=95 N=132 Phase lb Patients Multiple dose Phase l HV* Single Dose Phase lb Patients Multiple dose Phase lb Patients Combination study Capecitabine Phase l HV* Single Dose 58

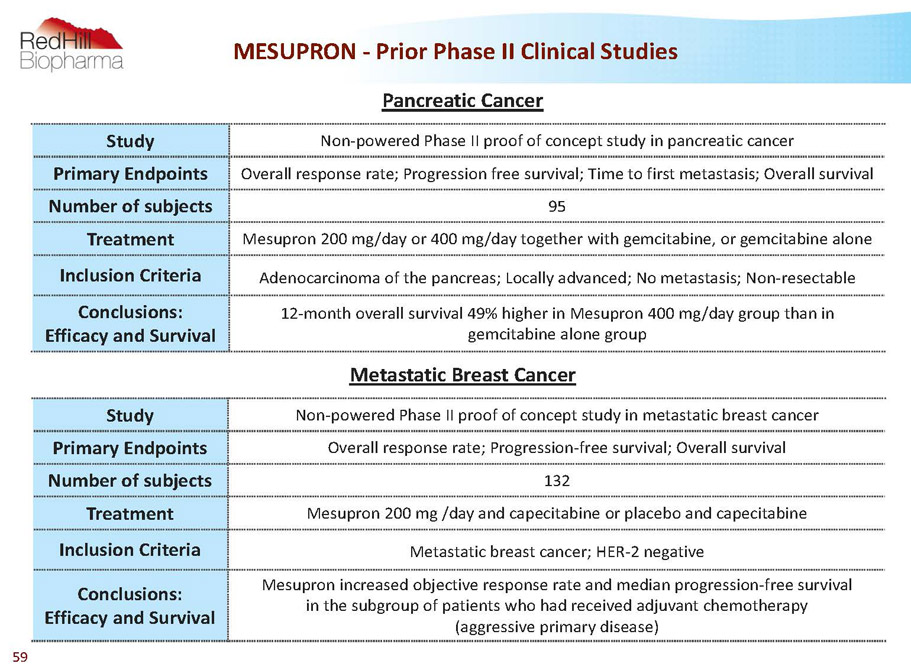

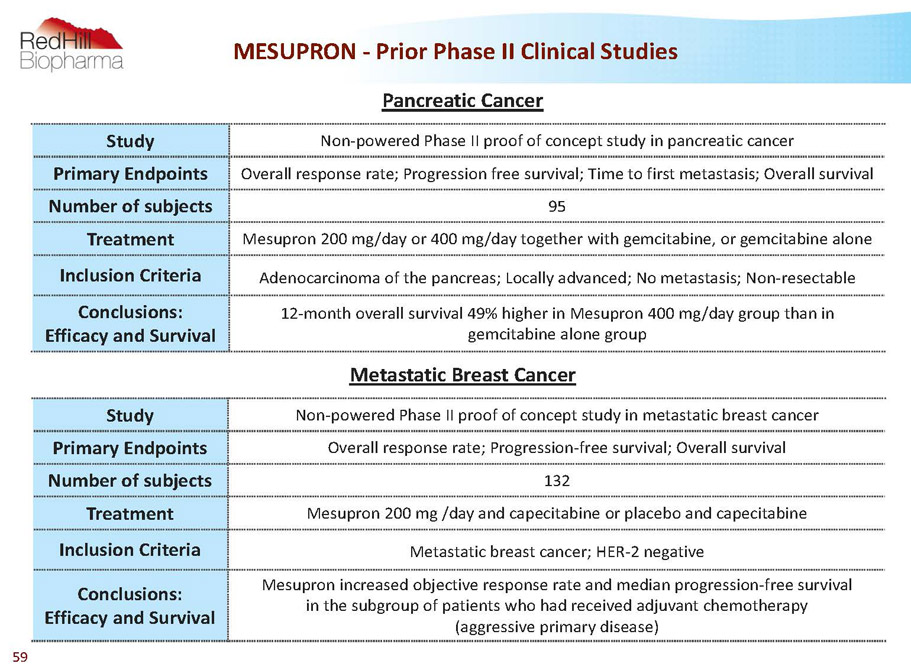

MESUPRON -PriorPhase II Clinical Studies Study Non-powered Phase II proof of concept study in pancreatic cancer Primary Endpoints Overall response rate; Progression free survival; Time to first metastasis; Overall survival Number of subjects 95 Treatment Mesupron200 mg/day or 400 mg/day together with gemcitabine, or gemcitabine alone Inclusion Criteria Adenocarcinoma of the pancreas; Locally advanced; No metastasis; Non-resectable Conclusions: Efficacy and Survival 12-month overall survival 49% higher in Mesupron400 mg/day group than in gemcitabine alone group Study Non-powered Phase II proof of concept study in metastatic breast cancer Primary Endpoints Overall response rate; Progression-free survival; Overall survival Number of subjects 132 Treatment Mesupron200 mg /day and capecitabine or placebo and capecitabine Inclusion Criteria Metastatic breast cancer; HER-2 negative Conclusions: Efficacy and Survival Mesupronincreased objective response rate and median progression-free survival in the subgroup of patients who had received adjuvant chemotherapy (aggressive primary disease) Pancreatic Cancer Metastatic Breast Cancer 59

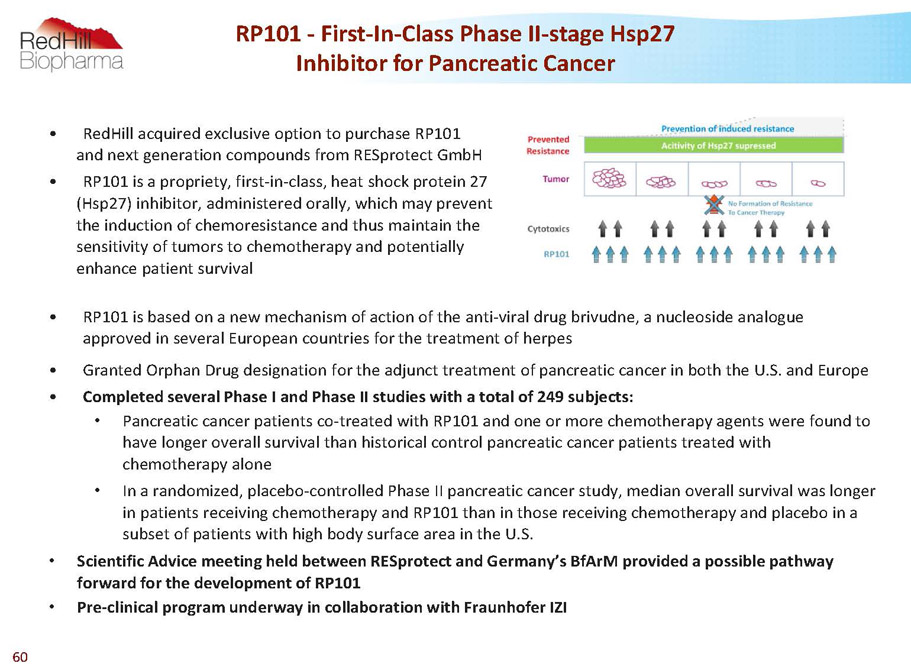

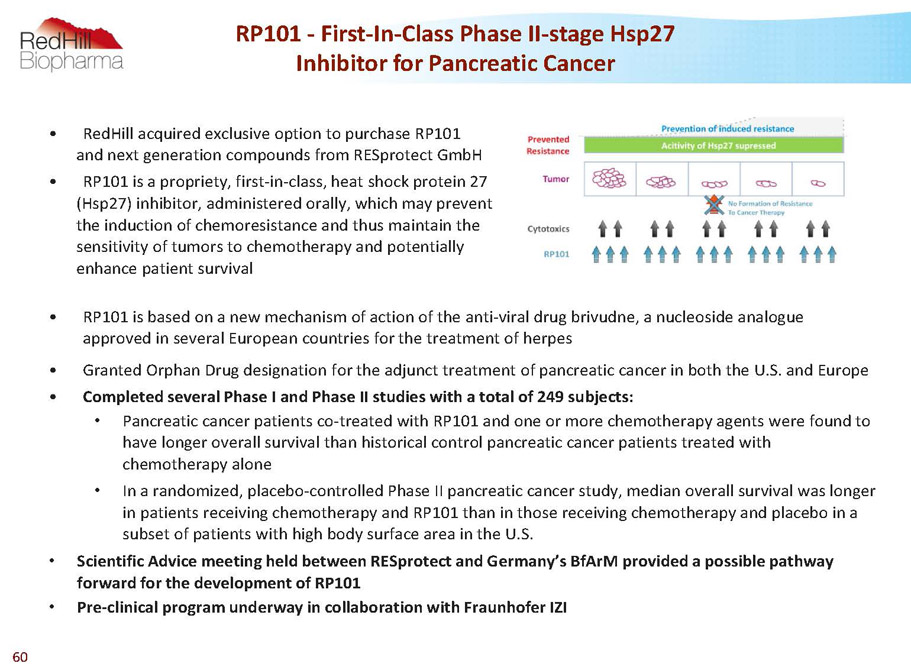

RP101 -First-In-Class Phase II-stage Hsp27 Inhibitor for Pancreatic Cancer • RedHill acquired exclusive option to purchase RP101 and next generation compounds from RESprotectGmbH • RP101 is a propriety, first-in-class, heat shock protein 27 (Hsp27) inhibitor, administered orally, which may prevent the induction of chemoresistance and thus maintain the sensitivity of tumors to chemotherapy and potentially enhance patient survival • RP101 is based on a new mechanism of action of the anti-viral drug brivudne, a nucleoside analogue approved in several European countries for the treatment of herpes • Granted Orphan Drug designation for the adjunct treatment of pancreatic cancer in both the U.S. and Europe • Completed several Phase I and Phase II studies with a total of 249 subjects: • Pancreatic cancer patients co-treated with RP101 and one or more chemotherapy agents were found to have longer overall survival than historical control pancreatic cancer patients treated with chemotherapy alone • In a randomized, placebo-controlled Phase II pancreatic cancer study, median overall survival was longer in patients receiving chemotherapy and RP101 than in those receiving chemotherapy and placebo in a subset of patients with high body surface area in the U.S. • Scientific Advice meeting held between RESprotect and Germany’s BfArM provided a possible pathway forward for the development of RP101 • Pre-clinical program underway in collaboration with FraunhoferIZI 60

RIZAPORT® Oral Thin-Film Rizatriptanfor Acute Migraines European MAA Approved Under the European Decentralized Procedure; U.S. NDA Submitted 61

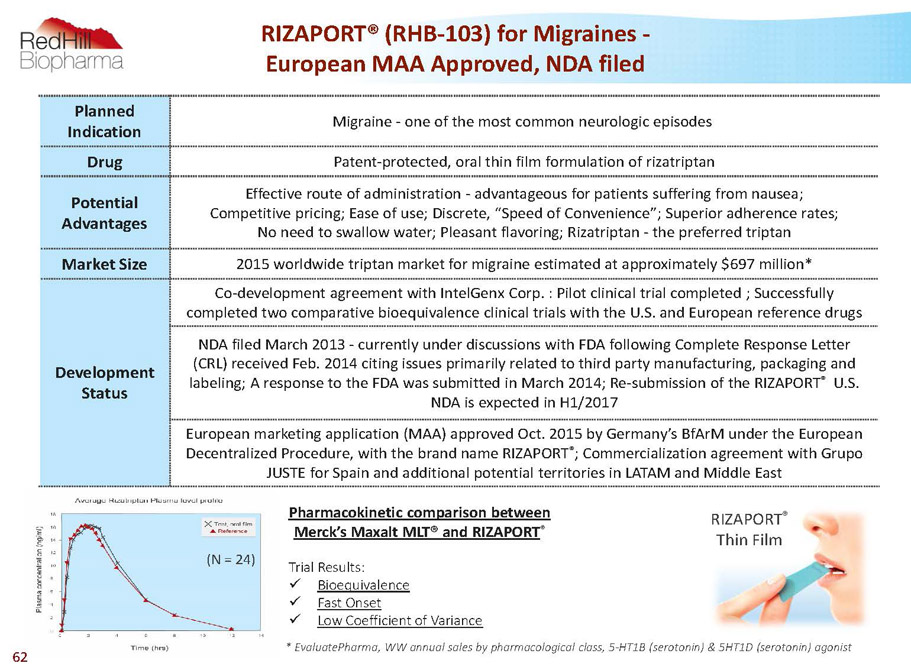

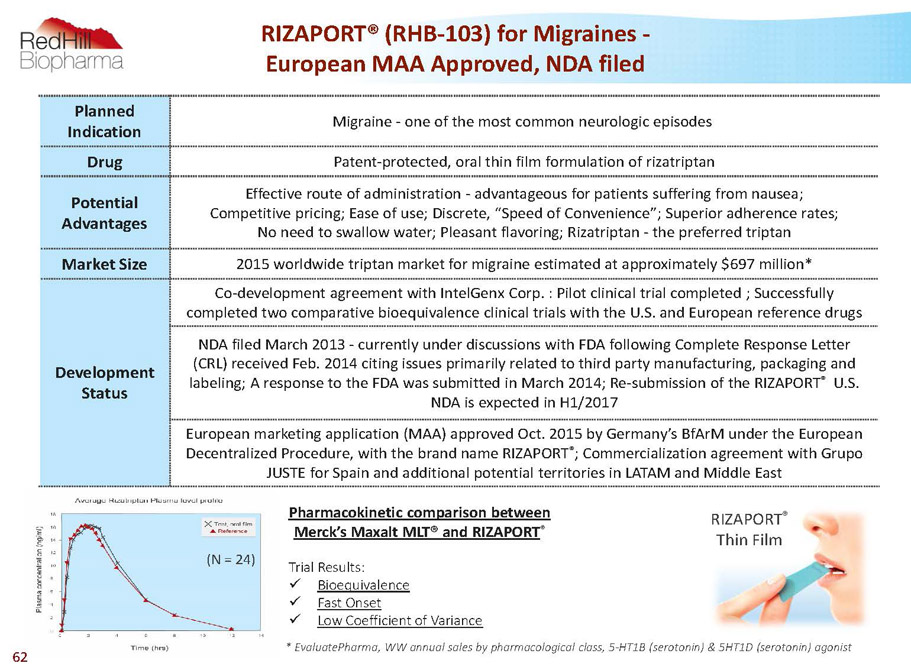

RIZAPORT® (RHB-103) for Migraines - European MAA Approved, NDA filed Planned Indication Migraine -one of the most common neurologic episodes Drug Patent-protected, oral thin film formulation of rizatriptan Potential Advantages Effective route of administration -advantageous for patients suffering from nausea; Competitive pricing; Ease of use; Discrete, “Speed of Convenience”; Superior adherence rates; No need to swallow water; Pleasant flavoring; Rizatriptan -the preferred triptan Market Size 2015 worldwide triptan market for migraine estimated at approximately $697 million* Development Status Co-development agreement with IntelGenxCorp. : Pilot clinical trial completed ; Successfully completed two comparative bioequivalence clinical trials with the U.S. and European reference drugs NDA filed March 2013 -currently under discussions with FDA following Complete Response Letter (CRL) received Feb. 2014 citing issues primarily related to third party manufacturing, packaging and labeling; A response to the FDA was submitted in March 2014; Re-submission of the RIZAPORT ® U.S. NDA is expected in H1/2017 European marketing application (MAA) approved Oct. 2015 by Germany’s BfArMunder the European Decentralized Procedure, with the brand name RIZAPORT ® ; Commercialization agreement with Grupo JUSTE for Spain and additional potential territories in LATAM and Middle East TrialResults: x Bioequivalence x FastOnset x LowCoefficientofVariance *EvaluatePharma,WWannualsalesbypharmacologicalclass,5-HT1B(serotonin)&5HT1D(serotonin)agonist (N = 24) Pharmacokinetic comparison between Merck’s Maxalt MLT® and RIZAPORT ® RIZAPORT ® Thin Film 62

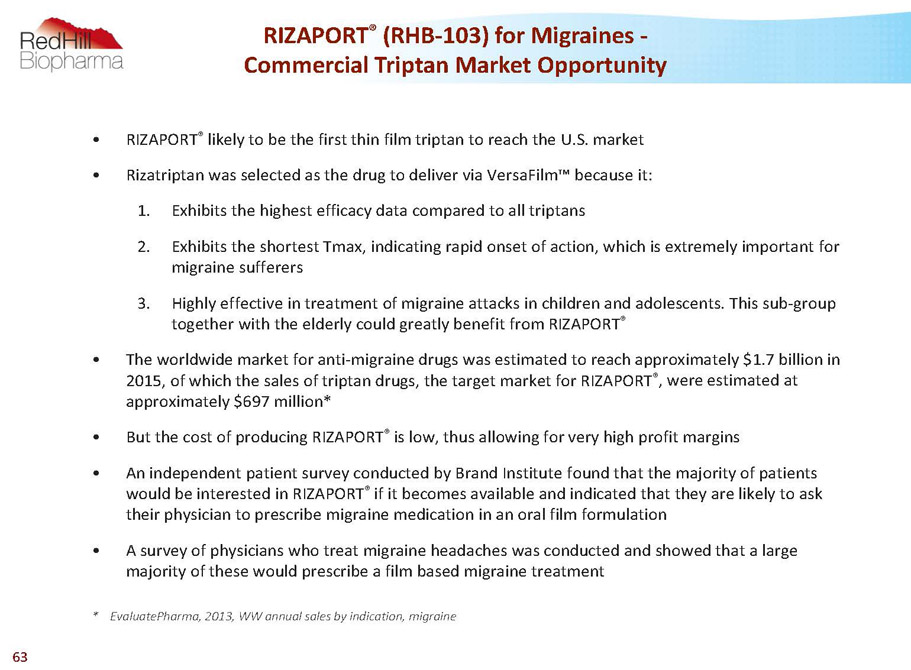

RIZAPORT ® (RHB-103) for Migraines - Commercial Triptan Market Opportunity * EvaluatePharma, 2013, WW annual sales by indication, migraine • RIZAPORT ® likely to be the first thin film triptan to reach the U.S. market • Rizatriptan was selected as the drug to deliver via VersaFilm��� because it: 1. Exhibits the highest efficacy data compared to all triptans 2. Exhibits the shortestTmax, indicating rapid onset of action, which is extremely important for migraine sufferers 3. Highly effective in treatment of migraine attacks in children and adolescents. This sub-group together with the elderly could greatly benefit from RIZAPORT ® • The worldwide market for anti-migraine drugs was estimated to reach approximately $1.7 billion in 2015, of which the sales of triptan drugs, the target market for RIZAPORT ® , were estimated at approximately $697 million* • But the cost of producing RIZAPORT ® is low, thus allowing for very high profit margins • An independent patient survey conducted by Brand Institute found that the majority of patients would be interested in RIZAPORT ® if it becomes available and indicated that they are likely to ask their physician to prescribe migraine medication in an oral film formulation • A survey of physicians who treat migraine headaches was conducted and showed that a large majority of these would prescribe a film based migraine treatment 63

RHB-101 Once-Daily Carvedilol for Hypertension & Congestive Heart Failure 64

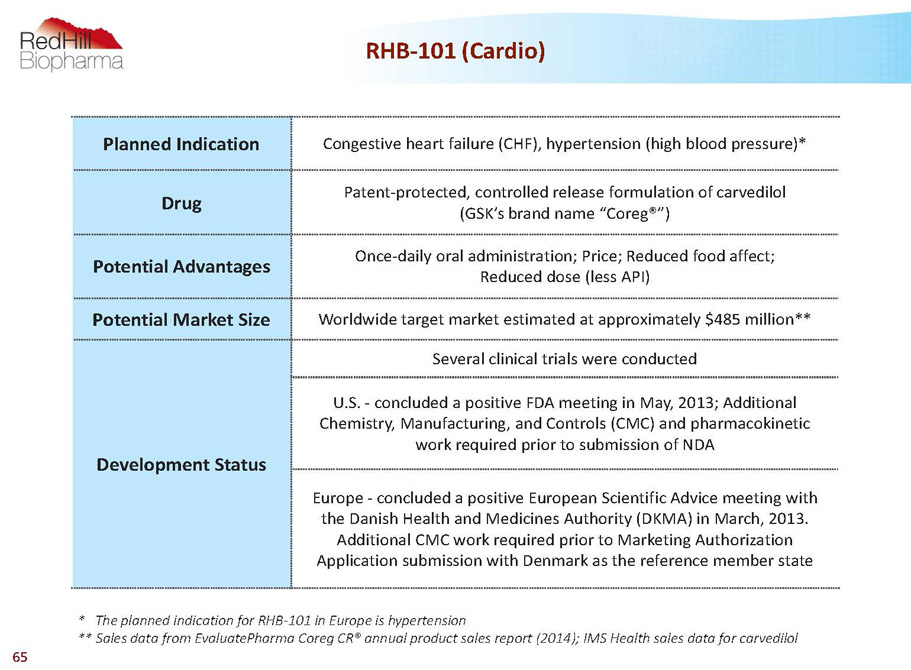

RHB-101 (Cardio) Planned Indication Congestive heart failure (CHF), hypertension (high blood pressure)* Drug Patent-protected, controlled release formulation of carvedilol (GSK’s brand name “Coreg®”) Potential Advantages Once-daily oral administration; Price; Reduced food affect; Reduced dose (less API) Potential Market Size Worldwide target market estimated at approximately $485 million** Development Status Several clinical trials were conducted U.S. -concluded a positive FDA meeting in May, 2013; Additional Chemistry, Manufacturing, and Controls (CMC) and pharmacokinetic work required prior to submission of NDA Europe -concluded a positive European Scientific Advice meeting with the Danish Health and Medicines Authority (DKMA)in March, 2013. Additional CMC work required prior to Marketing Authorization Applicationsubmission with Denmark as the reference member state * The planned indication for RHB-101 in Europe is hypertension ** Sales data from EvaluatePharmaCoreg CR® annual product sales report (2014); IMS Health sales data for carvedilol 65