Filed Pursuant to Rule 424(b)(5)

Registration No. 333-209702

PROSPECTUS SUPPLEMENT

(to Prospectus dated March 11, 2016)

2,250,000 American Depositary Shares Representing 22,500,000 Ordinary Shares

Warrants to Purchase 1,125,000 American Depositary Shares

RedHill Biopharma Ltd.

Weare offering 2,250,000 American Depositary Shares (“ADSs”) representing 22,500,000 of our ordinary shares, par value NIS 0.01 per share (“Ordinary Shares”), and warrants to purchase 1,125,000 ADSs. Each ADS represents 10 Ordinary Shares. The ADSs and warrants will be issued separately, but the ADSs and warrants will be sold in a fixed combination of one ADS and a warrant to purchase 0.5 of an ADS, for the combined purchase price of $10.25. The warrants may only be exercised to purchase whole ADSs at an exercise price of $13.33 per ADS and will expire three years from the date of issuance. Echelon Wealth Partners, the Canadian Manager, will only be offering the ADSs and warrants to investors in Canada.

Our ADSs are listed on The NASDAQ Capital Market (“The NASDAQ”) under the symbol “RDHL.” On December 20, 2016, the last reported sale price of our ADSs on The NASDAQ was $10.80 per ADS. Our Ordinary Shares are also listed on the Tel Aviv Stock Exchange (the “TASE”) under the symbol “RDHL.” On December 20, 2016, the last reported sale price of our Ordinary Shares on the TASE was NIS 4.23, or $1.10 per Ordinary Share (based on the exchange rate reported by the Bank of Israel on such date). There is no established trading market for the warrants, and we do not expect a market to develop. In addition, we do not intend to list the warrants on The NASDAQ, the TASE or any other national securities exchange or any other recognized trading system.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and may elect to comply with certain reduced public company reporting requirements for future filings.

Investing in our securities involves a high degree of risk. Please read “Risk Factors” beginning on page S-11 of this prospectus supplement, on page 3 of the accompanying prospectus and in the documents incorporated by reference into this prospectus supplement.

None of the United States Securities and Exchange Commission, the Israeli Securities Authority, any state securities commission or any other regulatory body, has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

| | | PER ADS(3) | | TOTAL |

| Public Offering Price | | $ | 10.250 | | | $ | 23,062,500 | |

| Underwriting Discounts and Commissions (1) | | $ | 0.615 | | | $ | 1,383,750 | |

| Proceeds to Us, before Expenses (2) | | $ | 9.635 | | | $ | 21,678,750 | |

| (1) | We have agreed to reimburse the underwriters for certain offering-related expenses. In addition, we may also elect to pay certain of the underwriters a discretionary fee of up to $115,313. See “Underwriting.” |

| (2) | Does not include proceeds from the exercise of the warrants in cash, if any. |

| (3) | Per ADS price represents the offering price for one ADS and a warrant to purchase 0.5 of one ADS. |

Aninvestor has agreed to purchase 1,463,415 ADSs and warrants to purchase 731,708 ADSs at the public offering price in a concurrent registered direct offering.

One of our directors has agreed to purchase 95,000 ADSs and warrants to purchase 47,500 ADSs in this offering. The underwriters will receive the same underwriting discount on any ADSs and warrants purchased by this person as they will on the other ADSs and warrants sold to the public in this offering.

Delivery of the ADSs and warrants is expected to be made on or about December 27, 2016. We have granted the underwriters an option for a period of 30 days to purchase up to an additional 337,500 ADSs representing 3,375,000 Ordinary Shares and warrants to purchase 168,750 additional ADSs, in any combination thereof, at the public offering price if each ADS is purchased in combination with a warrant, otherwise at a price of $10.25 per ADS and $0.005 per warrant, in each case, less underwriting discounts and commissions. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be $1.59 million, before reimbursement of expenses and payment of any discretionary fee, and the total proceeds to us, before expenses, will be $24.93 million, assuming that none of the warrants issued in this offering is exercised.

| | Sole Book-Running Manager | |

| | | |

| | Roth Capital Partners | |

| | | |

| | Canadian Manager | |

| | | |

| | Echelon Wealth Partners | |

Prospectus Supplement dated December 21, 2016.

Table Of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

You should rely only on the information provided in this prospectus supplement and the accompanying prospectus, all information incorporated by reference herein and therein, as well as the additional information described under “Incorporation of Information by Reference” on page S-59 of this prospectus supplement. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus supplement and the accompanying prospectus do not constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered by this prospectus supplement and the accompanying prospectus in any jurisdiction where it is unlawful to make such offer or solicitation. You should not assume that the information contained in this prospectus supplement or the accompanying prospectus, or any document incorporated by reference in this prospectus supplement or the accompanying prospectus, is accurate as of any date other than the date on the front cover of the applicable document. Neither the delivery of this prospectus supplement nor any distribution of securities pursuant to this prospectus supplement shall, under any circumstances, create any implication that there has been no change in the information set forth or incorporated by reference into this prospectus supplement or in our affairs since the date of this prospectus supplement. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus supplement and the accompanying prospectus are part of a registration statement (No. 333-209702) that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. This document comprises two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference herein, in addition to information concerning the option to purchase additional ADSs and warrants to purchase additional ADSs, or any combination thereof, granted by us to the underwriters. The second part, the accompanying prospectus, gives more general information, some of which may not apply to this offering. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. If the description of the offering varies between this prospectus supplement and the accompanying prospectus or the documents incorporated herein by reference filed prior to the date of this prospectus supplement, you should rely on the information contained in this prospectus supplement. However, if any statement in one of these documents is inconsistent with a statement in another document having a later date — for example, a document incorporated by reference in the accompanying prospectus — the statement in the document having the later date modifies or supersedes the earlier statement.

Before purchasing any securities, you should carefully read both this prospectus supplement and the accompanying prospectus, together with the additional information described under the headings, “Where You Can Find More Information” and “Incorporation of Information by Reference,” onpage S-59 of this prospectus supplement.

Unless the context otherwise requires, all references to “RedHill,” “we,” “us,” “our,” the “Company” and similar designations refer to RedHill Biopharma Ltd. The term “NIS” refers to New Israeli Shekels, the lawful currency of the State of Israel, the terms “dollar,” “US$” or “$” refer to U.S. dollars, the lawful currency of the United States (“U.S.”). Our functional and presentation currency is the U.S. dollar. Foreign currency transactions in currencies other than the U.S. dollar are translated in this prospectus supplement into U.S. dollars using exchange rates in effect at the date of the transactions.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We are offering to sell, and seeking offers to buy, ADSs representing our Ordinary Shares and warrants to purchase ADSs only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the ADSs and warrants in certain jurisdictions may be restricted by law. Persons outside the U.S. who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the ADSs and warrants and the distribution of this prospectus supplement and the accompanying prospectus outside the U.S. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus, and the information incorporated by reference herein and therein may include forward looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms including “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would,” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. In addition, certain sections of this prospectus supplement, the accompanying prospectus, and the information incorporated by reference herein contain information obtained from independent industry and other sources that we have not independently verified. You should not put undue reliance on any forward-looking statements. Unless we are required to do so under U.S. federal securities laws or other applicable laws, we do not intend to update or revise any forward-looking statements.

Our ability to predict our operating results or the effects of various events on our operating results is inherently uncertain. Therefore, we caution you to consider carefully the matters described under the caption “Risk Factors” onpage S-11 of this prospectus supplement, and certain other matters discussed in this prospectus supplement, the accompanying prospectus, and the information incorporated by reference herein and therein, and other publicly available sources. Such factors and many other factors beyond our control could cause our actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by the forward-looking statements.

Factors that could cause our actual results to differ materially from those expressed or implied in such forward-looking statements include, but are not limited to:

| • | the initiation, timing, progress and results of our research, manufacturing, preclinical studies, clinical trials, and other therapeutic candidate development efforts, as well as the extent and number of additional studies that we may be required to conduct; |

| • | our ability to advance our therapeutic candidates into clinical trials or to successfully complete our preclinical studies or clinical trials; |

| • | our receipt of regulatory clarity and approvals for our therapeutic candidates, and the timing of other regulatory filings and approvals; |

| • | the research, manufacturing, clinical development, commercialization, and market acceptance of our therapeutic candidates; |

| • | our ability to establish and maintain corporate collaborations; |

| • | our ability to acquire products approved for marketing in the U.S. that achieve commercial success and build our own marketing and commercialization capabilities; |

| • | the interpretation of the properties and characteristics of our therapeutic candidates and of the results obtained with our therapeutic candidates in research, preclinical studies or clinical trials; |

| • | the implementation of our business model, strategic plans for our business and therapeutic candidates; |

| • | the scope of protection we are able to establish and maintain for intellectual property rights covering our therapeutic candidates and our ability to operate our business without infringing the intellectual property rights of others; |

| • | estimates of our expenses, future revenues, capital requirements and our needs for additional financing; |

| • | parties from whom we license our intellectual property defaulting in their obligations towards us; |

| • | the impact of competitive companies and technologies within our industry; and |

| • | the impact of the political and security situation in Israel and in the U.S. on our business. |

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information about us, this offering and information contained in greater detail elsewhere in this prospectus supplement, the accompanying prospectus, any free writing prospectus that we have been authorized to use, and in the documents incorporated by reference. This summary is not complete and does not contain all of the information that you should consider before investing in our ADSs and warrants. You should carefully read and consider this entire prospectus supplement, the accompanying prospectus and the documents, including financial statements and related notes, and information incorporated by reference into this prospectus supplement, including the financial statements and “Risk Factors” startingon page S-11 of this prospectus supplement, before making an investment decision. If you invest in our securities, you are assuming a high degree of risk.

Our Business

We are a biopharmaceutical company primarily focused on the development of late clinical-stage, proprietary, orally-administered, small-molecule drugs for the treatment of gastrointestinal (“GI”) and inflammatory diseases and cancer.

Depending on the specific development program, our therapeutic candidates are designed to exhibit greater efficacy and provide improvements over existing drugs by improving their safety profile, reducing side effects, reducing the number of administrations, using a more convenient administration form and/or providing a cost advantage.

In addition to our primary focus on the development of clinical-stage GI products, we are in the process of establishing commercial presence and capabilities in the U.S. to support potential future launch of our GI-related therapeutic candidates currently under development in the U.S. We are also seeking to acquire commercial rights and promote other GI products, as part of our vertical integration strategy to become a specialty GI pharmaceutical company in the U.S.

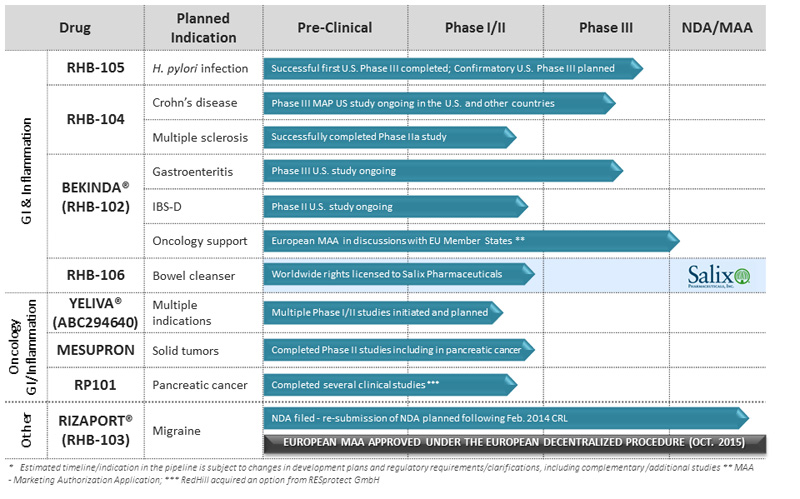

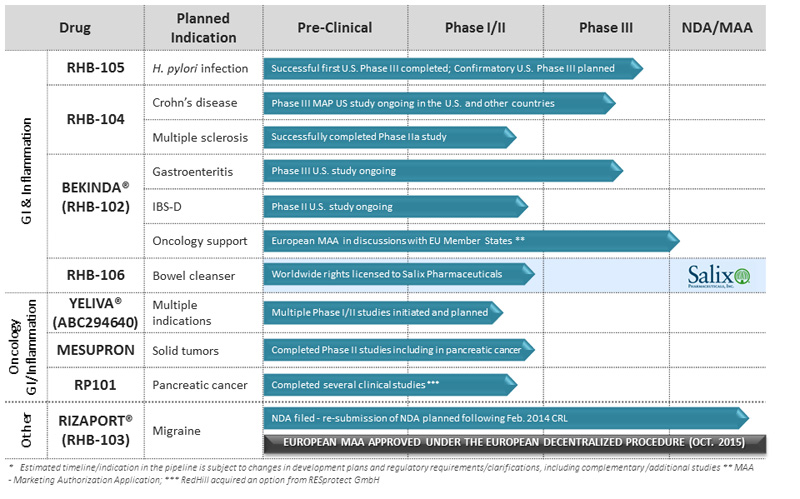

Product Pipeline

The table below summarizes our current pipeline of products and product candidates, as well as the target indication.

Recent Developments

RHB-105

We met with the U.S. Food and Drug Administration (“FDA”) in April 2016 to discuss the successful results of the ERADICATE Hp Phase III study and the proposed design of the confirmatory Phase III study for the treatment of Helicobacter pylori(“H. pylori”) infection. In light of the feedback received from the FDA, we expect to initiate a confirmatory Phase III randomized, double-blind, active comparator, two-arm clinical study, comparing RHB-105 against a high dose amoxicillin and omeprazole regimen, in the first half of 2017.

As per a recommendation from the FDA, we intend to complete a supportive pharmacokinetic (“PK”) program prior to initiating the confirmatory Phase III study, by end of the first quarter of 2017. Subject to their successful outcome, the confirmatory Phase III study and the supportive PK program are expected to complete the clinical package required for a submission of a New Drug Application (“NDA”) for RHB-105.

RHB-104

Crohn’s Disease

We are currently conducting a randomized, double-blind, placebo-controlled first Phase III study with RHB-104 for Crohn’s disease (the “MAP US” study).The MAP US study is expected to enroll 410 patients with moderately to severely active Crohn’s disease at up to 150 clinical sites in the U.S., Canada, Europe, Israel, Australia and New Zealand. Patients are randomized 1:1 to receive either RHB-104 or a placebo for 52 weeks and are evaluated for the primary endpoint of remission (Crohn’s disease active index (“CDAI”) <150) at week 26 of treatment.

We plan to initiate, in the fourth quarter of 2016, an open-label extension study for all patients who have completed 26 weeks of treatment in the MAP US study and failed to achieve remission at week 26. Patients with a CDAI score of greater than 150 at week 26 will be offered the opportunity to receive treatment with RHB-104 for a 52-week period. This study is considered separate from the MAP US study, and the data collected from the open-label extension study will be supplemental to the MAP US study data.

Following a pre-planned review of safety data, an independent interim Data and Safety Monitoring Board (“DSMB”) unanimously recommended in December 2016 that the MAP US study continue as planned, without any modifications. Two additional DSMB meetings are expected to take place after 50% and after 75% of the 410 patients planned to be enrolled in the study complete the 26 weeks of study participation. Over half of the patients have already been enrolled in the MAP US study, with the 205th patient enrolled in August 2016. As a result, we expect the second independent DSMB meeting to be held in the second quarter of 2017, after the first 205 patients complete 26 weeks of study participation. The second DSMB meeting will include safety and interim efficacy analysis and will evaluate the option of an early stop for success, according to a pre-specified statistical significance threshold for analysis requiring overwhelming efficacy of RHB-104 versus placebo in the primary endpoint (two sided p-value <0.003). Assuming that the study is not stopped early for success or inefficacy following the second DSMB meeting, we expect to complete the recruitment of all 410 subjects planned to enroll for the study by the end of 2017. Additional studies will be required to support a U.S. NDA for RHB-104.

We also intend to initiate in the coming months two additional ex-U.S. small-scale open-label clinical studies with RHB-104, each with up to 20 Crohn’s disease patients, to provide additional supportive clinical data for potential future marketing applications, as well as to evaluate RHB-104’s efficacy in newly diagnosed and treatment-naïve Crohn’s disease patients and as an add-on therapy to current standard of care.

Multiple Sclerosis (“MS”)

We have completed a Phase IIa proof-of-concept study with RHB-104 for relapsing remitting multiple sclerosis (“RRMS”) (the “CEASE MS” study) at two clinical sites in Israel, with top-line final results (48 weeks) announced on December 12, 2016. The top-line final results (48 weeks) were consistent with the interim results (24 weeks) suggesting meaningful positive safety and clinical signals upon 24 weeks of treatment with RHB-104 as an add-on therapy, including an encouraging relapse-free rate, Expanded Disability Status Scale scores and MRI results, which support further clinical development.

BEKINDA®(RHB-102)

Acute Gastroenteritis and Gastritis

We have initiated a randomized, double-blind, placebo controlled, parallel group Phase III study (the “GUARD” study) that is being conducted at up to 30 clinical sites in the U.S. and is expected to enroll 320 adults and children over the age of 12 who suffer from acute gastroenteritis and gastritis. Patients are randomized to receive either BEKINDA®or a placebo. The primary endpoint for the study is the absence of vomiting and the need for rescue medications or intravenous hydration after 30 minutes and through 24 hours after the first dose of the study medication. Secondary endpoints include, among others, frequency of vomiting, severity and time to resolution of nausea and time to resumption of normal activities. We implemented a protocol amendment to the ongoing GUARD study to increase the safety data collected, so that the study results may support a potential NDA filing, as recommended by the FDA. The study protocol now requires patients to remain in the emergency room for a longer follow-up period and be subject to an electrocardiogram at the end of the follow-up period before the patient is discharged. In light of this amendment, we expect top-line results from the GUARD study in mid-2017.

Irritable Bowel Syndrome with Diarrhea (“IBS-D”)

We are conducting a randomized, double-blind, placebo controlled Phase II study to evaluate the safety and efficacy of BEKINDA®12 mg with patients with IBS-D. The study is expected to enroll 120 adults over the age of 18 who suffer from IBS-D, at up to 12 clinical sites in the U.S. Patients are randomized to receive either BEKINDA®12 mg once daily or a placebo. Top-line results are expected in mid-2017.

YELIVA®(ABC294640)

A Phase Ib/II study with YELIVA®, for the treatment of refractory or relapsed multiple myeloma was initiated earlier this year at Duke University Medical Center. The study is supported by a $2 million grant from the National Cancer Institute (“NCI”), with additional support from us.

The initiation of a Phase II study with YELIVA® for the treatment of advanced hepatocellular carcinoma (“HCC”) was announced in October 2016. The study is being conducted at the Medical University of South Carolina (“MUSC”) Hollings Cancer Center and additional clinical centers in the U.S. The study is supported by a $1.8 million grant from the NCI awarded to MUSC, which is intended to fund a broad range of studies on the feasibility of targeting sphingolipid metabolism for the treatment of a variety of solid tumor cancers, including the Phase II study with YELIVA® for the treatment of HCC. The Phase II HCC study is supported by additional funding from us.

A Phase I/II clinical study evaluating YELIVA® in patients with refractory/relapsed diffuse large B-cell lymphoma was initiated at the Louisiana State University Health Sciences Center in New Orleans in June 2015 and was put on administrative hold and recently amended to address the overall recruitment prospects. The study, which will now also include Kaposi sarcoma patients, is expected to resume in the first quarter of 2017, pending regulatory approval. The study is supported by a grant from the NCI, as well as additional support from us.

A Phase Ib clinical study to evaluate YELIVA® as a radioprotectant to prevent mucositis in head and neck cancer patients undergoing therapeutic radiotherapy is planned to be initiated in the first half of 2017.

Following the successful completion of a Phase I study with YELIVA® in cancer patients with advanced solid tumors, and in light of the drug’s mechanism of action, we are evaluating potential clinical studies for additional oncology and inflammatory indications for YELIVA®, as well as potential collaboration opportunities to evaluate YELIVA® as an add-on therapy.

RIZAPORT®(RHB-103)

In July 2016, we, together with IntelGenx Corp., entered into an exclusive license agreement with Grupo JUSTE S.A.Q.F (“Grupo JUSTE”), pursuant to which Grupo JUSTE was granted an exclusive license to commercialize RIZAPORT®in Spain and a right of first refusal for the commercialization rights in certain additional territories. Under the terms of the agreement, we granted Grupo JUSTE the exclusive rights to register and commercialize RIZAPORT®in Spain and a right of first refusal for a predetermined term for the territories of Belize, the Caribbean, Chile, Colombia, Costa Rica, Dominican Republic, El Salvador, Guatemala, Honduras, Mexico, Nicaragua, Panama, the Middle East and Morocco. An upfront payment has been paid by Group JUSTE, and we and IntelGenx Corp. are entitled to receive additional milestone payments upon the achievement of certain predefined regulatory and commercial targets, as well as tiered royalties. The initial term of the agreement is for ten years from the date of the first commercial sale and shall automatically renew for an additional two-year term. Commercial launch of RIZAPORT® in Spain is expected to take place in the second half of 2017.

On December 13, 2016, we, together with IntelGenx Corp., entered into an exclusive license agreement with Pharmatronic Co., pursuant to which Pharmatronic Co. was granted an exclusive license to commercialize RIZAPORT® in the Republic of Korea (South Korea). Under the terms of the agreement, we and IntelGenx Corp. are entitled to receive an upfront payment and are entitled to receive additional milestone payments upon the achievement of certain predetermined regulatory and commercial targets, as well as tiered royalties. The initial term of the agreement is for ten years from the date of the first commercial sale and shall automatically renew for an additional two-year term. Commercial launch of RIZAPORT® in South Korea is expected to take place in the first quarter of 2019.

Following the receipt of a complete response letter from the FDA as announced on February 4, 2014, we, together with IntelGenx Corp., expect to re-submit the NDA for RIZAPORT®to the FDA in the first half of 2017 and subsequently receive a new Prescription Drug User Fee Act date.

Ebola Virus Disease Therapy

We expect to initiate a nonclinical research collaboration with the U.S. National Institute of Allergy and Infectious Diseases, part of the National Institutes of Health, in the first quarter of 2017. The study is intended to evaluate our proprietary experimental therapy for the treatment of the Ebola virus disease. Top-line results from the nonclinical research are expected in 2017.

Potential Commercial Activities in the U.S.

We are in the process of establishing commercial presence and capabilities in the U.S., and we plan to leverage such presence and capabilities to support, among others, potential future commercial launch of our GI-related products under development (RHB-104, RHB-105 and BEKINDA®) in the U.S.

On October 3, 2016, we entered into a non-binding term sheet with a pharmaceutical company, as part of our strategic vertical integration plan to build a U.S. specialty pharmaceutical company by establishing a commercial presence and capabilities. Under the term sheet, we would be granted the right to exclusively promote a specialty GI product in certain territories in the U.S. The parties would share revenues generated in such territories, based on an agreeable split between the parties. We are not required to make any upfront or milestone payments under the term sheet. Although our goal is to complete the transaction pertaining to the commercial asset in the fourth quarter of 2016, the term sheet is non-binding and there is no certainty as to the execution and timing of the execution of a definitive agreement between us and our potential partner. There is no assurance that satisfactory due diligence will be completed or the parties will obtain all necessary corporate approvals.

Corporate Information

We were incorporated as a limited liability company under the laws of the State of Israel on August 3, 2009. Our principal executive offices are located at 21 Ha’arba’a Street, Tel Aviv, Israel and our telephone number is +972 (3) 541-3131. Our web site address is http://www.redhillbio.com. The information on our web site does not constitute part of this prospectus. Our registered agent in the U.S. is Puglisi & Associates. The address of Puglisi & Associates is 850 Library Avenue, Suite 204, Newark Delaware 19715.

THE OFFERING

ADSs offered by us in the offering Warrants offered by us | | 2,250,000 ADSs representing 22,500,000 Ordinary Shares (2,587,500 ADSs representing 25,875,000 Ordinary Shares if the underwriters exercise their option to purchase additional ADSs and warrants in full). Warrants to purchase 1,125,000 ADSs. Each warrant will have a per ADS exercise price of $13.33 and will be exercisable upon issuance and will expire three years from the date of issuance. The ADSs and warrants will be issued separately, but the ADSs and warrants will be issued and sold to purchasers in a fixed combination of one ADS and one warrant to purchase 0.5 of an ADS. The warrants may only be exercised to purchase whole ADSs. |

| | | |

| Total Ordinary Shares outstanding immediately after this offering and the concurrent registered direct offering | | 164,974,234 Ordinary Shares, or 183,541,314 Ordinary Shares if the warrants offered in this offering and the concurrent registered direct offering are exercised in full. If the underwriters exercise their option in full and all warrants offered in this offering and the concurrent registered direct offering are exercised in full, the total Ordinary Shares outstanding immediately after this offering and the concurrent registered direct offering will be 188,603,814 Ordinary Shares. |

| | | |

| The ADSs | | Each ADS represents 10 Ordinary Shares. The ADSs initially will be evidenced by American Depositary Receipts (“ADRs”), executed and delivered by The Bank of New York Mellon, as depositary (the “Depositary”). The Depositary, as depositary, will be the holder of the Ordinary Shares underlying your ADSs and you will have rights as provided in the Deposit Agreement dated as of December 26, 2012, among us, The Bank of New York Mellon, as Depositary, and all owners and holders from time to time of ADSs issued thereunder (the “Deposit Agreement”), a form of which has been filed as Exhibit 1 to the Registration Statement on Form F-6 filed by the Depositary with the SEC on December 6, 2012. Subject to compliance with the relevant requirements set out in the prospectus, you may turn in your ADSs to the Depositary in exchange for Ordinary Shares underlying your ADSs. The Depositary will charge you fees for such exchanges pursuant to the Deposit Agreement. You should carefully read the “Description of American Depositary Shares” section of the accompanying prospectus and the Deposit Agreement to better understand the terms of the ADSs. |

| | | |

| Offering Price | | The public offering price and the price in the concurrent registered direct offering is $10.25 per a fixed combination of one ADS and one warrant to purchase 0.5 of an ADS. |

| | | |

| Option to purchase additional ADSs | | We have granted the underwriters an option to purchase up to an additional 337,500 ADSs representing 3,375,000 Ordinary Shares and warrants to purchase 168,750 ADSs, in any combination thereof. |

Right to Nominate Director | | We offered to any investor purchasing in the offering or the concurrent registered direct offering, together with its affiliates, as such term is defined in Rule 405 of the Securities Act of 1933, as amended (the “Securities Act”), at least $15 million of ADSs and warrants in this offering (or the concurrent registered direct offering, excluding the proceeds, if any, from the exercise of warrants) the right to nominate one person for election to our board of directors at our next annual meeting of shareholders ("upcoming shareholder meeting"), subject to meeting applicable legal and stock exchange requirements and subject to the consent of our board of directors, which consent shall, subject to our directors’ fiduciary duties under applicable law, not be unreasonably withheld. The nomination right is also subject to shareholder approval of amendments to our articles of association, the approval of which amendments shall be recommended to our shareholders by our board of directors, (i) increasing the maximum number of directors that may serve on our board of directors and (ii) providing that the term of office of any director elected to our board of directors, and originally nominated for election by an investor by virtue of the nomination right in this prospectus, shall automatically expire at the first annual meeting of shareholders following the upcoming shareholder meeting unless such investor, at least 75 days prior to such first following annual meeting of shareholders evidences to us its beneficial ownership, together with its affiliates, of at least 4% of our outstanding shares. If not so expired at the first annual meeting following the upcoming shareholder meeting, the term of office of such director shall automatically expire at the second annual meeting of shareholders following the upcoming shareholder meeting unless such investor, at least 75 days prior to such second annual meeting following this offering, evidences to us its beneficial ownership, together with its affiliates, of at least 4% of our outstanding shares. In any event, the term of office of such director shall automatically expire at the third annual meeting of shareholders following the upcoming shareholder meeting unless re-elected by our shareholders. There is no guarantee that our shareholders will approve such amendments. Upon the selection of this director nominee, and the approval of this director nominee by our board of directors, our board shall recommend to our shareholders the election of the director nominee to our board of directors. EMC2 FUND LTD., the purchaser in our concurrent registered direct offering, has agreed to purchase $15 million of our ADSs and warrants. Such investor will therefore have the right to nominate a director upon the closing of the registered direct offering. |

Use of Proceeds | | We currently intend to use the net proceeds from the sale of our ADSs and warrants in this offering and the concurrent registered direct offering and any proceeds from the exercise of the warrants to fund clinical development programs, for potential acquisitions, to support commercial operations and for general corporate purposes. See “Use of Proceeds” for additional information. |

| | | |

| Listing | | Our ADSs are listed on The NASDAQ under the symbol “RDHL” and our Ordinary Shares currently trade on the TASE in Israel under the symbol “RDHL”. There is no established trading market for the warrants, and we do not expect a market to develop. In addition, we do not intend to list the warrants on The NASDAQ, the TASE or any other national securities exchange or any other recognized trading system. Warrant holders are prohibited from listing any warrants on any such exchange or trading system or on any other trading platform. |

| | | |

| Risk factors | | Before deciding to invest in our ADSs and warrants, you should carefully consider the risks related to our business, the offering and our securities, and our location in Israel. See “Risk Factors” onpage S-11 of this prospectus supplement. |

| | | |

| Concurrent registered direct offering | | Concurrently with this offering, we are offering 1,463,415 ADSs and warrants to purchase 731,708 ADSs to an investor in a concurrent registered direct offering, which we refer to herein as our concurrent registered direct offering. The concurrent registered direct offering is being conducted as a separate offering by means of a separate prospectus supplement. This offering is not contingent upon the completion of the concurrent registered direct offering and the concurrent registered direct offering is not contingent upon the completion of this offering. |

| | | |

| Dividend Policy | | We have never declared or paid any cash dividends to our shareholders, and we currently do not expect to declare or pay any cash dividends in the foreseeable future. See “Dividend Policy.” |

| | | |

| Depositary | | The Bank of New York Mellon |

The number of Ordinary Shares to be outstanding immediately after the offering and the concurrent registered direct offering as shown above is based on 127,840,084 Ordinary Shares outstanding as of December 20, 2016, and excludes, as of such date (i) 22,065,548 Ordinary Shares issuable upon the exercise of outstanding options to purchase 22,065,548 Ordinary Shares at a weighted average exercise price of $0.95 per share (equivalent to 2,206,554 ADSs at a weighted average exercise price of $9.50 per ADS), (ii) 4,183,496 Ordinary Shares issuable upon the exercise of outstanding non-tradable warrants to purchase 4,183,496 Ordinary Shares at an exercise price of $1.40 per share (equivalent to 418,349 ADSs at an exercise price of $14.00 per ADS), and (iii)3,578,960 Ordinary Shares issuable upon the exercise of outstanding non-tradable warrants to purchase3,578,960 Ordinary Shares at an exercise price of $1.10 per share (equivalent to 357,896 ADSs at an exercise price of $11.00 per ADS).

Unless otherwise stated, outstanding share information throughout this prospectus supplement excludes such outstanding securities. Except as otherwise indicated, all information in this prospectus supplement assumes no exercise by the underwriters of their option to purchase an additional 337,500 ADSs or warrants to purchase 168,750 ADSs, or any combination thereof, and no exercise of the warrants issued in this offering or in the concurrent registered direct offering.

One of our directors has agreed to purchase 95,000 ADSs and warrants to purchase 47,500 ADSs in this offering. The underwriters will receive the same underwriting discount on any ADSs and warrants purchased by this person as they will on the other ADSs and warrants sold to the public in this offering.

SUMMARY FINANCIAL DATA

We derived the summary financial statement data for the years ended December 31, 2013, 2014 and 2015 set forth below from our audited financial statements and related notes incorporated by reference in this prospectus supplement and the accompanying prospectus. We derived the summary financial statement data as of September 30, 2016 and for the nine months ended September 30, 2015 and 2016 from our unaudited condensed interim financial statements and related notes incorporated by reference in this prospectus supplement and the accompanying prospectus. Our results for interim periods are not necessarily indicative of the results that may be expected for the entire year. You should read the information presented below together with our financial statements, the notes to those statements and the other financial information incorporated by reference in this prospectus supplement and the accompanying prospectus.

| | | Year Ended December 31, | | Nine Months ended September 30, |

| | | 2013 | | 2014 | | 2015 | | 2015 | | 2016 |

| | | | | | | | | (unaudited) |

| | | | | (U.S. Dollars, in thousands, except per share and weighted average shares data) | | |

| Statement of Comprehensive Loss | | | | | | |

| Revenues | | | 12 | | | | 7,014 | | | | 3 | | | | 3 | | | | 1 | |

| Cost of Revenues | | | - | | | | 1,050 | | | | - | | | | - | | | | - | |

| Research and development expenses, net | | | (8,100 | ) | | | (12,700 | ) | | | (17,771 | ) | | | (12,820 | ) | | | (17,745 | ) |

| General and administrative expenses | | | (2,684 | ) | | | (4,011 | ) | | | (4,134 | ) | | | (2,420 | ) | | | (3,807 | ) |

| Other income | | | - | | | | 100 | | | | 100 | | | | - | | | | - | |

| Operating loss | | | (10,772 | ) | | | (10,647 | ) | | | (22,002 | ) | | | (15,237 | ) | | | (21,551 | ) |

| Financial income | | | 158 | | | | 319 | | | | 1,124 | | | | 889 | | | | 548 | |

| Financial expenses | | | (14 | ) | | | (383 | ) | | | (212 | ) | | | (182 | ) | | | (17 | ) |

| Financial expenses, net | | | (144 | ) | | | (64 | ) | | | (912 | ) | | | (707 | ) | | | (531 | ) |

| Loss and comprehensive loss | | | (10,628 | ) | | | (10,711 | ) | | | (21,090 | ) | | | (14,530 | ) | | | (21,020 | ) |

| Loss per ordinary share (in U.S. dollars): | | | | | | | | | | | | | | | | | | | | |

| Basic - | | | (0.17 | ) | | | (0.12 | ) | | | (0.19 | ) | | | (0.14 | ) | | | (0.17 | ) |

| Diluted - | | | (0.17 | ) | | | (0.13 | ) | | | (0.19 | ) | | | (0.14 | ) | | | (0.17 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Number of Ordinary Shares used in computing Loss per ordinary share (in thousands): | | | | | | | | | | | | | | | | | | | | |

| Basic - | | | 62,379 | | | | 86,610 | | | | 110,814 | | | | 105,328 | | | | 127,317 | |

| Diluted - | | | 62,379 | | | | 87,222 | | | | 111,715 | | | | 106,334 | | | | 127,615 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | As of September 30, 2016 |

| | | Actual | | As Adjusted |

| | | (unaudited) |

| | | (U.S. Dollars, in thousands) |

| Balance Sheet Data | | | | | | | | |

| Cash and short term investments | | | 40,503 | | | | 75,921 | |

| Working capital | | | 35,245 | | | | 70,663 | |

| Total assets | | | 48,880 | | | | 84,298 | |

| Total liabilities | | | 8,395 | | | | 14,465 | |

| Accumulated deficit | | | 81,646 | | | | 82,067 | |

| Equity | | | 40,485 | | | | 69,833 | |

______________________

(1) See Note 2(P) of the notes to the financial statements incorporated by reference in this prospectus supplement and the accompanying prospectus for an explanation of the determination of the number of shares used to compute basic and dilutive per share amounts for the years ended December 31, 2013, 2014 and 2015 and the nine months ended September 30, 2015 and 2016. Due to the anti-dilutive effect, basic loss per share was equal to diluted loss per share for the year ended December 31, 2013.

The as adjusted balance sheet data above reflects the application of the net proceeds from the sale of 3,713,415 ADSs representing 37,134,150 Ordinary Shares and the sale of warrants to purchase ADSs from this offering and the concurrent registered direct offering, assuming that none of the warrants issued in this offering and the concurrent registered direct offering is exercised, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us in connection with this offering and placement agent fees and estimated offering expenses payable by us in connection with the concurrent registered direct offering.

RISK FACTORS

You should carefully consider the risks described below and in our annual report on Form 20-F for the year ended December 31, 2015, as well as the other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus, including our financial statements and the related notes, before you decide to buy our securities. The risks and uncertainties described below and incorporated by reference in this prospectus supplement are not the only risks facing us. We may face additional risks and uncertainties not currently known to us or that we currently deem to be immaterial. Any of the risks described below or incorporated by reference in this prospectus supplement, and any such additional risks, could materially adversely affect our business, financial condition or results of operations. In such case, you may lose all or part of your original investment.

Risks Related to Our Financial Condition and Capital Requirements

We are a clinical development-stage biopharmaceutical company with a history of operating losses. We expect to incur additional losses in the future and may never be profitable.

We are a clinical development-stage biopharmaceutical company. Since our incorporation in 2009, we have been focused primarily on the development and acquisition of late clinical-stage therapeutic candidates. All of our therapeutic candidates are in the clinical development stage, and, except for RIZAPORT® which has been approved for marketing in Germany but has yet to be marketed, none has been approved for marketing or is being marketed or commercialized. Most of our therapeutic candidates require additional clinical trials before we can obtain the regulatory approvals in order to initiate commercial sales. We have incurred losses since inception, principally as a result of research and development and general and administrative expenses in support of our operations. We experienced net losses of approximately $21.1 million in 2015 and $10.7 million in 2014. As of September 30, 2016, we had an accumulated deficit of approximately $81.6 million. We may incur significant additional losses as we continue to focus our resources on prioritizing, selecting and advancing our therapeutic candidates. Our ability to generate revenue and achieve profitability depends mainly upon our ability, alone or with others, to successfully develop our therapeutic candidates, obtain the required regulatory approvals in various territories and commercialize our therapeutic candidates. We may be unable to achieve any or all of these goals with regard to our therapeutic candidates. As a result, we may never be profitable or achieve significant and/or sustained revenues.

Our limited operating history makes it difficult to evaluate our business and prospects.

We have a limited operating history and our operations to date have been limited primarily to acquiring and in-licensing therapeutic candidates, research and development, raising capital and recruiting scientific and management personnel and third party partners. Except with respect to RHB-106 and related rights, which is out-licensed to Valeant Pharmaceutical International, Inc. (“Valeant”), and with respect to RIZAPORT®, for which we have received marketing approval in Germany and which was out-licensed in July 2016 to Grupo JUSTE for the commercialization in Spain, and a right of first refusal for additional territories, and which was out-licensed in December 2016 to Pharmatronic Co. for commercialization in South Korea, we have not yet demonstrated an ability to commercialize or obtain regulatory approval for any of our therapeutic candidates. Consequently, any predictions about our future performance may not be accurate, and you may not be able to fully assess our ability to complete development and/or commercialize our therapeutic candidates, obtain regulatory approvals, or achieve market acceptance or favorable pricing for our therapeutic candidates.

Our current working capital is not sufficient to complete our research and development with respect to all of our therapeutic candidates. We will need to raise additional capital to achieve our strategic objectives of acquiring, developing and commercializing therapeutic candidates, and our failure to raise sufficient capital would significantly impair our ability to fund our operations, develop our therapeutic candidates, attract development and/or commercial partners and retain key personnel.

We have funded our operations primarily through public and private offerings of our securities. We plan to fund our future operations through commercialization and out-licensing of our therapeutic candidates and raising additional capital. As of September 30, 2016, we had cash and short-term investments of approximately $40.5 million, and as of December 31, 2015, we had cash and short-term investments of approximately $58.1 million. These amounts are not sufficient to complete the research and development of all of our therapeutic candidates, and accordingly we may need to raise additional capital in the coming year.

To date, our business generated limited revenues. As we plan to continue expending substantial funds in research and development, including clinical trials, as well as to acquire additional products, we will need to raise additional capital in the future through either debt or equity financing or pursuant to development or commercialization agreements with third parties with respect to particular therapeutic candidates. However, we cannot be certain that we will be able to raise capital on commercially reasonable terms or at all, or that our actual cash requirements will not be greater than anticipated. We may have difficulty raising needed capital or securing a development or commercialization partner in the future as a result of, among other factors, our lack of revenues from commercialization of the therapeutic candidates, as well as the inherent business risks associated with our company, our therapeutic candidates and present and future market conditions. In addition, global and local economic conditions may make it more difficult for us to raise needed capital or secure a development or commercialization partner in the future and may impact our liquidity. If we are unable to obtain future financing or obtain sufficient future financing, we may be forced to delay, reduce the scope of, or eliminate one or more of our research, development or commercialization programs for our therapeutic candidates, any of which may have material adverse effect on our business, financial condition and results of operations. Moreover, to the extent we are able to raise capital through the issuance of debt or equity securities, it could result in substantial dilution to existing shareholders.

Our long term capital requirements are subject to numerous risks.

Our long term capital requirements are expected to depend on many potential factors, including:

| · | the number of therapeutic candidates in development; |

| · | the regulatory clarity and path of each of our therapeutic candidates; |

| · | the progress, success and cost of our clinical trials and research and development programs including manufacturing; |

| · | the identification and acquisition of additional therapeutic candidates; |

| · | the costs, timing and outcome of regulatory review and obtaining regulatory clarity and approval of our therapeutic candidates and addressing regulatory and other issues that may arise post-approval; |

| · | the costs of enforcing our issued patents and defending intellectual property-related claims; |

| · | the costs of manufacturing, developing sales, marketing and distribution channels; |

| · | our ability to successfully commercialize our therapeutic candidates, including through securing commercialization agreements with third parties and favorable pricing and market share or through securing our own commercialization capabilities; and |

| | |

| · | our consumption of available resources more rapidly than currently anticipated, resulting in the need for additional funding sooner than anticipated. |

Risks Related to Our Business and Regulatory Matters

If we and/or our commercialization partners are unable to obtain FDA and/or other foreign regulatory authority clearance and approval for our therapeutic candidates, we and/or our commercialization partners will be unable to commercialize our therapeutic candidates.

To date, we have not marketed, distributed or sold any therapeutic candidate or other product. Currently, we have eight therapeutic candidates, which include one therapeutic candidate (RP101) for which we have an option to acquire, in various programs and clinical development stages, RHB-105 for the eradication ofH. pylori infection; RHB-104 for the treatment of Crohn’s disease and potentially other diseases; RHB-106 (out-licensed to Valeant) for bowel preparation; BEKINDA® (RHB-102) for acute gastroenteritis and gastritis, IBS-D and for the prevention of chemotherapy and radiotherapy induced nausea and vomiting; YELIVA® (ABC294640), a sphingosine kinase-2 selective inhibitor targeting multiple oncology, GI and inflammatory indications; MESUPRON targeting GI and other solid tumor cancers; RP101 (currently subject to an option-to-acquire by us) targeting pancreatic and other GI cancers; and RIZAPORT® (RHB-103) for the treatment of acute migraine headaches. Our therapeutic candidates are subject to extensive governmental laws, regulations and guidelines relating to development, clinical trials, manufacturing and commercialization of drugs. Other than RIZAPORT® which has received marketing approval to date only in Germany, we may not be able to obtain marketing approval for any of our therapeutic candidates in a timely manner or at all.

Any material delay in obtaining, or the failure to obtain, required regulatory clarity and approvals will increase our costs and materially and adversely affect our ability to generate future revenues. Any regulatory approval to market a therapeutic candidate may be subject to limitations on the indicated uses for marketing the therapeutic candidate or may impose restrictive conditions of use, including cautionary information, thereby limiting the size of the market for the therapeutic candidate. We also are, and will be, subject to numerous regulatory requirements from both the FDA and foreign state agencies that govern the conduct of clinical trials, manufacturing and marketing authorization, pricing and third-party reimbursement. Moreover, approval by one regulatory authority does not ensure approval by other regulatory authorities in separate jurisdictions. Each jurisdiction may have different approval processes and may impose additional testing, development and manufacturing requirements for our therapeutic candidates than other jurisdictions. Additionally, the FDA or other foreign regulatory bodies may change their approval policies or adopt new laws, regulations or guidelines in a manner that materially delays or impairs our ability to obtain the necessary regulatory approvals or our ability to commercialize our therapeutic candidates.

Clinical trials and related non-clinical studies may involve a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results. We and/or commercialization partners will not be able to commercialize our therapeutic candidates without completing such trials.

We have limited experience in conducting and managing the clinical trials that are required to commence commercial sales of our therapeutic candidates. Clinical trials and related non-clinical studies are expensive, complex, can take many years and have uncertain outcomes. We cannot predict whether we, independently or through third parties, will encounter problems with any of the completed, ongoing or planned clinical trials that will cause delays, including suspension of a clinical trial, delay of data analysis or release of the final report. The clinical trials of our therapeutic candidates may take significantly longer to complete than is estimated. Failure can occur at any stage of the testing and we may experience numerous unforeseen events during, or as a result of, the clinical trial process that could materially delay or prevent commercialization of our current or future therapeutic candidates.

In connection with the clinical trials for our therapeutic candidates and other therapeutic candidates that we may seek to develop in the future, either on our own or through licensing or partnering agreements, we face various risks and uncertainties, including but not limited to:

| · | delays in securing clinical investigators or trial sites for the clinical trials; |

| · | delays in receiving import or other government approvals to ensure appropriate drug supply; |

| · | delays in obtaining institutional review board and other regulatory approvals to commence a clinical trial; |

| · | expiration of clinical trial material before or during our trials as a result of degradation of, or other damage to, the clinical trial material; |

| · | negative or inconclusive results from clinical trials; |

| · | the FDA or other foreign regulatory authorities may disagree with the number, design, size, conduct or implementation of our clinical studies; |

| · | the FDA or other foreign regulatory authorities may require us to conduct additional clinical trials and/or studies; |

| · | inability to monitor patients adequately during or after treatment; |

| · | problems with investigator or patient compliance with the trial protocols; |

| · | a therapeutic candidate may not prove safe or efficacious; there may be unexpected or even serious adverse events and side effects from the use of a therapeutic candidate; |

| · | the results with respect to any therapeutic candidate may not confirm the positive results from earlier preclinical studies or clinical trials; |

| · | the results may not meet the level of statistical significance required by the FDA or other foreign regulatory authorities; |

| · | the results may justify only limited and/or restrictive uses, including the inclusion of warnings and contraindications, which could significantly limit the marketability and profitability of a therapeutic candidate; |

| · | the clinical trials may be delayed or not completed due to the failure to recruit suitable candidates or if there is a lower rate of suitable candidates than anticipated or if there is a delay in recruiting suitable candidates; and |

| · | changes to the current regulatory requirements related to clinical trials which can delay, hinder or lead to unexpected costs in connection with our receiving the applicable regulatory approvals. |

A number of companies in the pharmaceutical and biotechnology industries, including those with greater resources and experience than us, have suffered significant setbacks in advanced clinical trials, even after seeing promising results in earlier clinical trials. As such, despite the results reported in earlier clinical trials of our therapeutic candidates, we do not know if the clinical trials we conduct will demonstrate adequate efficacy and safety sufficient to obtain regulatory approval to market our therapeutic candidates. If any of the clinical trials of any therapeutic candidate do not produce favorable results, our ability to obtain regulatory approval for the therapeutic candidate may be adversely impacted, which will have a material adverse effect on our business, financial condition and results of operations.

If we do not establish collaborations for our therapeutic candidates or otherwise raise substantial additional capital, we will likely need to alter our development and any commercialization plans.

Our drug development programs and the potential commercialization of our therapeutic candidates will require additional cash to fund expenses. As such, our strategy includes either selectively partnering or collaborating with multiple pharmaceutical and biotechnology companies to assist us in furthering development and/or potential commercialization of our therapeutic candidates, in whole or in part, in some or all jurisdictions or through securing our own commercialization capabilities. Although we are currently aware of numerous potential new third party partners for the development or commercialization of our therapeutic candidates, we may not be successful in entering into new collaborations with third parties on acceptable terms, or at all. In addition, if we fail to negotiate and maintain suitable development and/or commercialization agreements or otherwise raise substantial additional capital to secure our own commercialization capabilities, we may have to limit the size or scope of our activities or we may have to delay one or more of our development or commercialization programs. Any failure to enter into development or commercialization agreements with respect to the development, marketing and commercialization of any therapeutic candidate or failure to develop, market and commercialize such therapeutic candidate independently will have an adverse effect on our business, financial condition and results of operations.

Any collaborative arrangements that we have established or may establish may not be successful or we may otherwise not realize the anticipated benefits from these collaborations, including our out-license of RHB-106. We do not control third parties with whom we have or may have collaborative arrangements, and we rely on them to achieve results which may be significant to us. In addition, any future collaborative arrangements may place the development and commercialization of our therapeutic candidates outside our control, may require us to relinquish important rights or may otherwise be on terms unfavorable to us.

Each of our collaborative arrangements requires us to rely on external consultants, advisors, and experts for assistance in several key functions, including clinical development, manufacturing, regulatory, market research, intellectual property and commercialization. We do not control these third parties, but we rely on them to achieve results which may be significant to us. To date, we have out-licensed one of our therapeutic candidates, RHB-106 and related rights to Valeant. We do not control Valeant, but we rely on Valeant to clinically develop and commercialize the product based on the license agreement.

Relying upon collaborative arrangements to develop and commercialize our therapeutic candidates, such as our out-license of RHB-106 and related rights, subjects us to a number of risks, including but not limited to:

| · | we may not be able to control the amount and timing of resources that our collaborators may devote to our therapeutic candidates; |

| · | should a collaborator fail to comply with applicable laws, rules, or regulations when performing services for us, we could be held liable for such violations; |

| · | our collaborators may experience financial difficulties or changes in business focus; |

| · | our collaborators’ partners may fail to secure adequate commercial supplies of our therapeutic candidates upon marketing approval, if at all; |

| · | our collaborators’ partners may have a shortage of qualified personnel; |

| · | we may be required to relinquish important rights, such as marketing and distribution rights; |

| · | business combinations or significant changes in a collaborator’s business or business strategy may adversely affect a collaborator’s willingness or ability to complete its obligations under any arrangement; |

| · | under certain circumstances, a collaborator could move forward with a competing therapeutic candidate developed either independently or in collaboration with others, including our competitors; and |

| · | collaborative arrangements are often terminated or allowed to expire, which could delay the development and may increase the cost of developing our therapeutic candidates. |

If any of these scenarios materialize, they could have an adverse effect on our business, financial condition or results of operations.

We may not be successful in acquiring products and/or companies that own the rights to FDA-approved products (approved for marketing in the U.S.) that achieve commercial success or building our own marketing and commercialization capabilities.

Part of our strategy is to identify and acquire rights to products that have been approved for marketing in the U.S. Specifically, we seek to acquire rights to products that are already commercialized in the U.S., which would enable us to commercialize such products independently and build our own marketing and commercialization capabilities. However, there can be no assurance as to our ability to identify and acquire rights to such products, in particular those with a therapeutic focus on GI, inflammation and/or cancer. If we are not successful in acquiring any such products, we may not be able to build our own marketing and commercialization capabilities. This may limit our ability to commercialize our products on our own or require us to contract with third party commercialization partners which may not be on commercially favorable terms and which may result in additional commercialization and marketing expenses.

In addition, there can be no assurance as to our ability to accurately or consistently identify products approved for marketing in the U.S. that will achieve commercial success or that we will successfully commercialize these products in the U.S.

We may encounter difficulties successfully expanding our operations to build our own marketing and commercialization capabilities.

To build our own marketing and commercialization capabilities, we would need to expand our development, regulatory, manufacturing, marketing and sales capabilities and to increase our personnel to accommodate sales, including establishing a direct sales force and a complete commercial team. Expanding our operations would also impose significant added responsibilities on our management. We must be able to manage our independent commercialization efforts effectively; hire, train and integrate additional management, development, administrative and sales and marketing personnel; improve our managerial, development, operational and finance systems, all of which may impose a strain on our administrative and operational infrastructure and adversely affect our research and development activities. We may also not have sufficient funds to finance the hiring of the additional personnel and the expansion of our marketing and commercialization activities. If we are not able to effectively expand our operations to build our own marketing and commercialization capabilities, our revenues and growth may be adversely affected, which will have a material adverse effect on our business, financial condition and results of operations.

We have no history of independently commercializing therapeutic candidates and may have difficulty commercializing products on our own.

We have no prior experience in commercializing therapeutic candidates on our own, which may materially increase marketing and sales expenses. There can be no assurance we will successfully commercialize our products or the products we acquire.

In addition, many companies, both public and private, including well-known pharmaceutical companies and smaller niche-focused companies, are currently distributing drug products that directly compete with the therapeutic candidates that we may seek to commercialize. Many of these companies have significantly greater financial, marketing and sales experience and resources than us. As a result, our competitors may be more successful than we are in commercializing their products to consumers.

We rely on third parties to conduct our clinical trials and related non-clinical studies and those third parties may not perform satisfactorily, including but not limited to failing to meet established deadlines for the completion of such clinical trials.

We currently do not have the ability to independently conduct clinical trials and related non-clinical studies for our therapeutic candidates, and we rely on third parties, such as contract research organizations, medical institutions, contract laboratories, development and commercialization partners, clinical investigators and independent study monitors to perform these functions. Our reliance on these third parties for clinical development activities reduces our control over these activities. Furthermore, these third parties may also have relationships with other entities, some of which may be our competitors. Although we have, in the ordinary course of business, entered into agreements with such third parties, other than with respect to RHB-106 and related rights, which we have out-licensed to Valeant, we continue to be responsible for confirming that each of our clinical trials is conducted in accordance with its general investigational plan and protocol. Moreover, the FDA requires us to comply with regulations and standards, commonly referred to as good clinical practices, for conducting, recording and reporting the results of clinical trials to assure that data and reported results are credible and accurate and that the trial participants are adequately protected. Our reliance on third parties does not relieve us of these responsibilities and requirements. To date, we believe our contract research organizations and other similar entities with which we are working have performed well. However, if these third parties do not successfully carry out their contractual duties or meet expected deadlines, we may be required to replace them or perform such functions independently. Although we believe that there are a number of other third-party contractors we could engage to continue these activities, it may result in a delay of the affected trial and additional costs. Accordingly, we may be materially delayed in obtaining regulatory approvals for our therapeutic candidates and may be materially delayed in our efforts to successfully commercialize our therapeutic candidates for targeted diseases.

In addition, our ability to bring our therapeutic candidates to market depends on the quality and integrity of data that we present to regulatory authorities in order to obtain marketing authorizations. Although we attempt to audit and control the quality of third party data, we cannot guarantee the authenticity or accuracy of such data, nor can we be certain that such data has not been fraudulently generated.

If third parties do not manufacture our therapeutic candidates with sufficient quality, in sufficient quantities, in the required timeframe, and at an acceptable cost, clinical development and commercialization of our therapeutic candidates would be delayed.

We do not currently own or operate manufacturing facilities, and we rely, and expect to continue to rely, on third parties to manufacture clinical and commercial quantities of our therapeutic candidates. Our reliance on third parties includes our reliance on them for quality assurance related to regulatory compliance. Our current and anticipated future reliance upon others for the manufacture of our therapeutic candidates may adversely affect our future profit margins, if any, and our ability to develop therapeutic candidates and commercialize any therapeutic candidates on a timely and competitive basis.

We may not be able to maintain our existing or future third-party manufacturing arrangements on acceptable terms, if at all. If for some reason our manufacturers do not perform as agreed or expected, we may be required to replace them. Although we are not substantially dependent upon our existing manufacturing agreements since we could replace them with other third party manufacturers, we may incur added costs and delays in identifying, engaging, qualifying and training any such replacements.

We rely on third-party-contract vendors to manufacture and supply us with high quality active pharmaceutical ingredients in the quantities we require on a timely basis.

We currently do not manufacture any active pharmaceutical ingredients ourselves. Instead, we rely on third-party vendors for the manufacture and supply of our active pharmaceutical ingredients that are used to formulate our therapeutic candidates. While there are many potential active pharmaceutical ingredient suppliers in the market, if these suppliers are incapable or unwilling to meet our current or future needs on acceptable terms or at all, we could experience a delay in obtaining regulatory approval for our therapeutic candidates or conducting additional clinical trials of our therapeutic candidates and incur additional costs.

For example, our supplier of raw materials for RIZAPORT® has been sending updates to the FDA regarding progress of corrective actions in regard to compliance issues at its manufacturing facility and subsequently invited the FDA for re-inspection, which are independent of us and not specific to RIZAPORT®. Although we were informed that the supplier recently resolved these compliance issues and although we have been working to ensure continued supply of the necessary raw materials for RIZAPORT® from an alternative supplier, our ability to obtain FDA approval for RIZAPORT® may be delayed until we are able to successfully manufacture new batches with the new active pharmaceutical ingredient secured from a compliant source of active pharmaceutical ingredient.

While there may be several alternative suppliers of active pharmaceutical ingredient on the market, we have yet to conclude extensive investigations into the quality or availability of their active pharmaceutical ingredients. As a result, we can provide no assurances that supply sources will not be interrupted from time to time. Changing active pharmaceutical ingredient suppliers or finding and qualifying new active pharmaceutical ingredient suppliers can be costly and take a significant amount of time. Many active pharmaceutical ingredients require significant lead time to manufacture. There can also be challenges in maintaining similar quality or technical standards from one manufacturing batch to the next.

If we are not able to find stable, affordable, high quality, or reliable supplies of our active pharmaceutical ingredients, we may not be able to produce enough supplies of our therapeutic candidates, which could materially adversely affect our business, financial condition or results of operations.

We anticipate continued reliance on third-party manufacturers if we are successful in obtaining marketing approval from the FDA and other regulatory agencies for any of our therapeutic candidates.

To date, our therapeutic candidates have been manufactured in relatively small quantities for preclinical testing and clinical trials as well as for other regulatory purposes by third-party manufacturers. If the FDA or other regulatory agencies approve any of our therapeutic candidates for commercial sale, we expect that we would continue to rely, at least initially, on third-party manufacturers to produce commercial quantities of our approved therapeutic candidates. These manufacturers may not be able to successfully increase the manufacturing capacity for any of our approved therapeutic candidates in a timely or economic manner, or at all. Significant scale-up of manufacturing may require additional validation studies, which the FDA or other foreign regulatory agencies must review and approve. If they are unable to successfully increase the manufacturing capacity for a therapeutic candidate, or we are unable to establish our own manufacturing capabilities or secure replacement manufacturers, the commercial launch of any approved products may be delayed or there may be a shortage in supply.

We and our third-party manufacturers are, and will be, subject to regulations of the FDA and other foreign regulatory authorities.

We and our contract manufacturers are, and will be, required to adhere to laws, regulations and guidelines of the FDA or other foreign regulatory authorities setting forth current good manufacturing practices. These laws, regulations and guidelines cover all aspects of the manufacturing, testing, quality control and recordkeeping relating to our therapeutic candidates. We and our manufacturers may not be able to comply with applicable laws, regulations and guidelines. We and our manufacturers are and will be subject to unannounced inspections by the FDA, state regulators and similar foreign regulatory authorities outside the U.S. Our failure, or the failure of our third-party manufacturers, to comply with applicable laws, regulations and guidelines could result in the imposition of sanctions on us, including fines, injunctions, civil penalties, failure of regulatory authorities to grant marketing approval of our therapeutic candidates, delays, suspension or withdrawal of approvals, license revocation, seizures or recalls of our therapeutic candidates, operating restrictions and criminal prosecutions, any of which could significantly and adversely affect regulatory approval and supplies of our therapeutic candidates, and materially and adversely affect our business, financial condition and results of operations.

Even if we obtain regulatory approvals, our therapeutic candidates will be subject to ongoing regulatory review. If we fail to comply with continuing U.S. and applicable foreign laws, regulations and guidelines, we could lose those approvals, and our business may be seriously harmed.