![[eudoracorresp201211001.jpg]](https://capedge.com/proxy/CORRESP/0001162044-12-001204/eudoracorresp201211001.jpg)

November 27, 2012

Larry L. Greene

Senior Counsel

Division of Investment Management

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Re:

The Eudora Funds - File Numbers 811-22729 & 333-183018

Dear Mr. Greene:

On behalf of The Eudora Funds (the “Registrant”), we hereby submit, via electronic filing, Pre-Effective Amendment No. 2 to the Registrant’s Registration Statement. On August 2, 2012, the Registrant, on behalf of the Eudora Fund (the "Fund"), filed a registration statement on Form N -1 A, registering the Eudora Fund (the "Fund"). On August 28, 2012 you provided written comments to the Registration statement. By letter dated October 24, 2012, the Registrant provided responses to those comments along with the filing of Pre-Effective Amendment Number 1 to the Registrant’s Registration Statement. On November 19, 2012, you provided oral comments on the Amendment to Emily Little. Please find below responses to those comments, which the Registrant has authorized Thompson Hine LLP to make on behalf of Registrant. Redlined change pages are provided in certain portions of this letter and as an attachment to this letter to aid in your review. Further, all changes related to the Registrant’s responses to your comments, refining edits and supplemental information are marked in the Amendment.

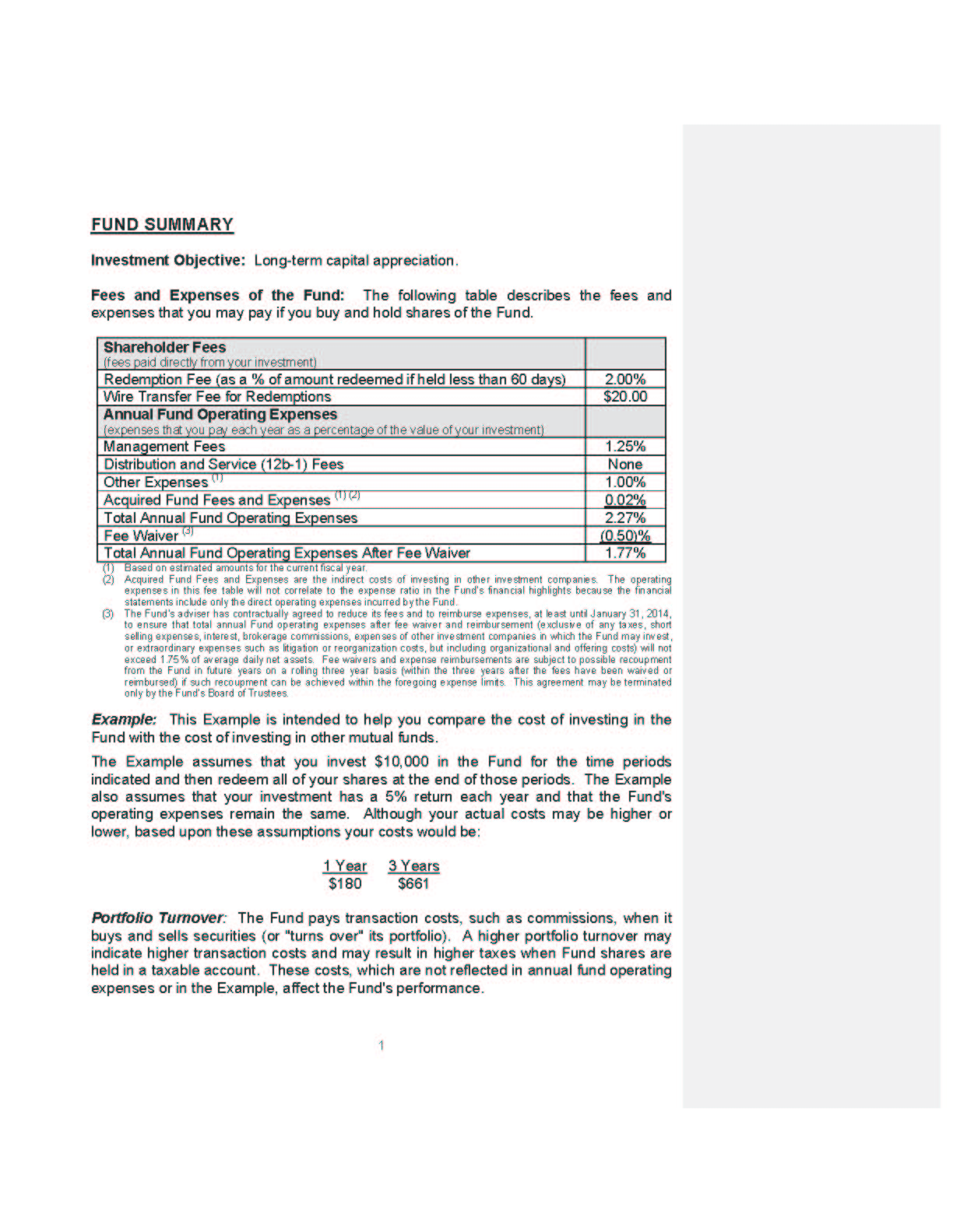

Comment 1. Please confirm that the AFFE charge shown in the fee table, 0.02%, is correct. Given that the Fund intends to invest in ETFs, please confirm that the amount shown is correct, or revise the disclosed AFFE charge as necessary.

Response. Registrant confirms that the amount shown is a good faith estimate of the AFFE to be incurred by the Fund in the first fiscal year.

Comment 2. With respect to the final elements in Comment 2 of the written comment letter of August 28, 2012, please amend disclosures to clarify that:

(i) the Fund “will sell options”, and

(ii) for what purposes (i.e. hedgingor other purposes)?

Additionally, please amend disclosures to clarify whether the Fund will invest in exchange-traded, over-the-counter or commodity options. Please indicate clearly, if appropriate, that the Fund will be investing in European style options.

Response.The Registrant notes that the prospectus disclosures have been amended to clarify that option selling (writing) may be used as part of the adviser’s three-prong options strategy. Specifically, the Fund may write options as (1) substitutes for reference assets, (2) to hedge against market declines and (3) to generate additional gains. Additionally, option-related disclosures have been revised to specify that the Fund uses exchange-traded options. However, the Fund does not employ commodity options and believes that a negative statement to that effect might tend to obscure the affirmative disclosuresin such a way as to cloud a prospective shareholder’s understanding of the Fund’s options-related strategies.

Additionally, with respect to European-style options, the Registrant notes that the Fund may invest in European-style options (those that may only be exercised on expiration date), which it acknowledges are different than American-style options (those that may be exercised on or before expiration date). The Registrant, however, reasonably believes that the distinction between American and European-style options is highly technical and further disclosure in the summary portion of the prospectus would not illuminate investors’ understanding of the Fund and its strategy.However, the Registrant has amended the statutory portion to describe American and European-style options and their differences.

Comment 3. The summary also discloses that the Fund will purchase and sell certain derivatives forhedging. In the disclosure, please clearly note that, with respect to derivatives, the Fund’s investment is potentially unlimited or up to 100% of the portfolio.

Response. The Registrant has amended the disclosure to indicate that derivatives may represent up to 100% of the Fund’s portfolio of investments. The revised disclosure reads as follows:

“Such derivatives, used for hedging purposes, may represent up to 100% of the Fund’s investment portfolio.”

Comment 4. In your response to Comment 3 of the written comment letter dated August 28, 2012, you indicated that “the Fund may write call options on securities it does not own.” Please confirm that the Fund will comply with Investment Company Act Rel. No. 10666 (Apr. 18, 1979), (“Investment Company Act Rel. No. 10666”), which requires the use of segregated accounts in order to avoid the possible creation of a senior security, and willsegregate assets accordingly.

Response.The Registrant confirms that it will comply with Investment Company Act Rel. No. 10666.

Comment 5. Please define “fixed income securities” to specifically identify what types of fixed income securities the Fund will invest in.

Response.The Registrant hasrevised disclosures to enumerate the types of fixed income securities in which the Fund will primarily invest.The revised disclosure reads as follows:

“The Fund's adviser seeks to achieve the Fund's investment objective by investing primarily in (1) common stocks, (2) fixed income securities(i.e., high yield bonds (commonly referred to as “junk bonds”), investment grade corporate bonds and government issued bonds), (3) exchange-traded funds ("ETFs") that invest primarily in common stocks or fixed income securities and (4) options on common stocks, equity index sector ETFs and equity indexes.”

Comment 6. In your response to Comment 6 of the written comment letter dated August 28, 2012, you indicate that, “[t]he Fund will invest primarily in index sector-based ETFs…” Please explain how this is consistent with the disclosure in the “Principal Investment Strategies” sections of the prospectus. If it is not consistent, please revise the disclosure accordingly.

Response. The Registrant has amended ETF-related to disclosures to specify that the Fund will focus its ETF investments in index sector-based ETFs.

Comment 7. In your response to Comment 7 of the written comment letter date August 28, 2012, you indicate that“that the adviser estimates fixed income portfolio duration is expected to be less than 10.” Please confirm that the prospectus includes explanatory disclosure explaining the “duration concept.” An example would be helpful to investors. If the prospectus currently includes such disclosure, please confirm as much in your response.

Response. The Registrant has revised the disclosure to include the following explanation and example of the duration concept.

“Duration is a measure of a fixed income security’s average life that reflects the present value of the security’s cash flow, and accordingly, is a measure of price sensitivity to interest rate changes. Duration is expressed in years, like maturity, but it is a better indicator of price sensitivity than maturity because it takes into account the time value of cash flows generated over the security’s life. Future interest and principal payments are discounted to reflect their present value and then are multiplied by the number of years they will be received to produce a value expressed in years. You can estimate the effect of interest rates on a fixed income fund’s share price by multiplying the fund’s duration by an expected change in interest rates. For example, the share price of a fixed income fund with a duration of three years would be expected to fall approximately 3% if interest rates rose by one percentage point.”

Comment 8. Reiterating a portion of Comment 10 of the written comment letter dated August 28, 2012: [D]isclose that, when the Fund writes a call option covered by a security it holds, the Fund gives up potential capital appreciation in exchange for current income. Please disclose how writing options furthers the Fund's investment objective of capital appreciation.

Response. The Registrant has amended the Principal Investment Strategies summary disclosure and Options Risk summary disclosure as follows to so state:

Principal Investment Strategies

“The adviser selects securities that it believes will produce income from dividends and produce capital appreciation. Additionally, the Fund writes stock index and single stock options to generate what is commonly referred to as income (although premiums received are classified as a capital transaction for accounting and tax purposes and thus as source of capital appreciation) and to reduce exposure to stock market price declines, to the extent of the call option premium received.”

Option Risk

Purchased options may expire worthless and may have imperfect correlation to the value of the hedged asset. Written call options expose the Fund to potential large losses, including potentially unlimited losses when the Fund does not own the reference asset. Written call options on portfolio securitiesthat the Fund holdswill prevent the Fund from participating in gains, including potential capital appreciation, on the reference asset, in exchange for current income. Written options may also have imperfect correlation to the value of assets they are intended to hedge.

Comment 9. In your response to Comment 14 to the written comment letter dated August 28, 2012, you indicated that the Registrant has “disclosed prior performance information of the [Eudora Strategy A]ccountsusing the actual returns…” Please confirm that “actual returns” refers to “actual expenses.” Also, please confirm that the returns reflected in the table reflects gross and not net expenses.

Response. The Registrant confirms that “actual returns” refers to “actual expenses,” and that the returns reflected in the table reflect gross expenses.

Comment 10. Comment 18 of the written comment letter dated August 28, 2012 asked the Registrant to “[p]lease disclose why, and the limits on the amount of assets it may, lend through repurchase agreements.” Please consider responding to this portion of the Comment.

Response. Registrant has reviewed its disclosure and notes that it has disclosed that there is no express limitation in place on repurchase agreements other than that such agreements are limited to counterparties with assets of $1 billion or more and registered securities dealers determined by the adviser to be creditworthy, and that the Fund may not enter into a repurchase agreement with a term of more than seven days if, as a result, more than 15% of the value of its net assets would then be invested in such repurchase agreements and other illiquid investments.

Comment 11. To the extent known, please identify and describe the people who are a part of the Fund’s on-going arrangements to disclose non-public portfolio holding information, including the specific identity of such persons receiving the information. See Item 16(f)(2) on Form N-1A.

Response. The Registrant has revised the disclosure to include the following disclosure and accompanying table:

Other than the Adviser for the express purpose of furthering the investment objective and strategies of the Fund, each entity entering into such arrangements has agreed to maintain Fund non-public holdings information in confidence and not to trade portfolio securities based on the non-public holdings information. The nature of these arrangements is reflected in the chart below:

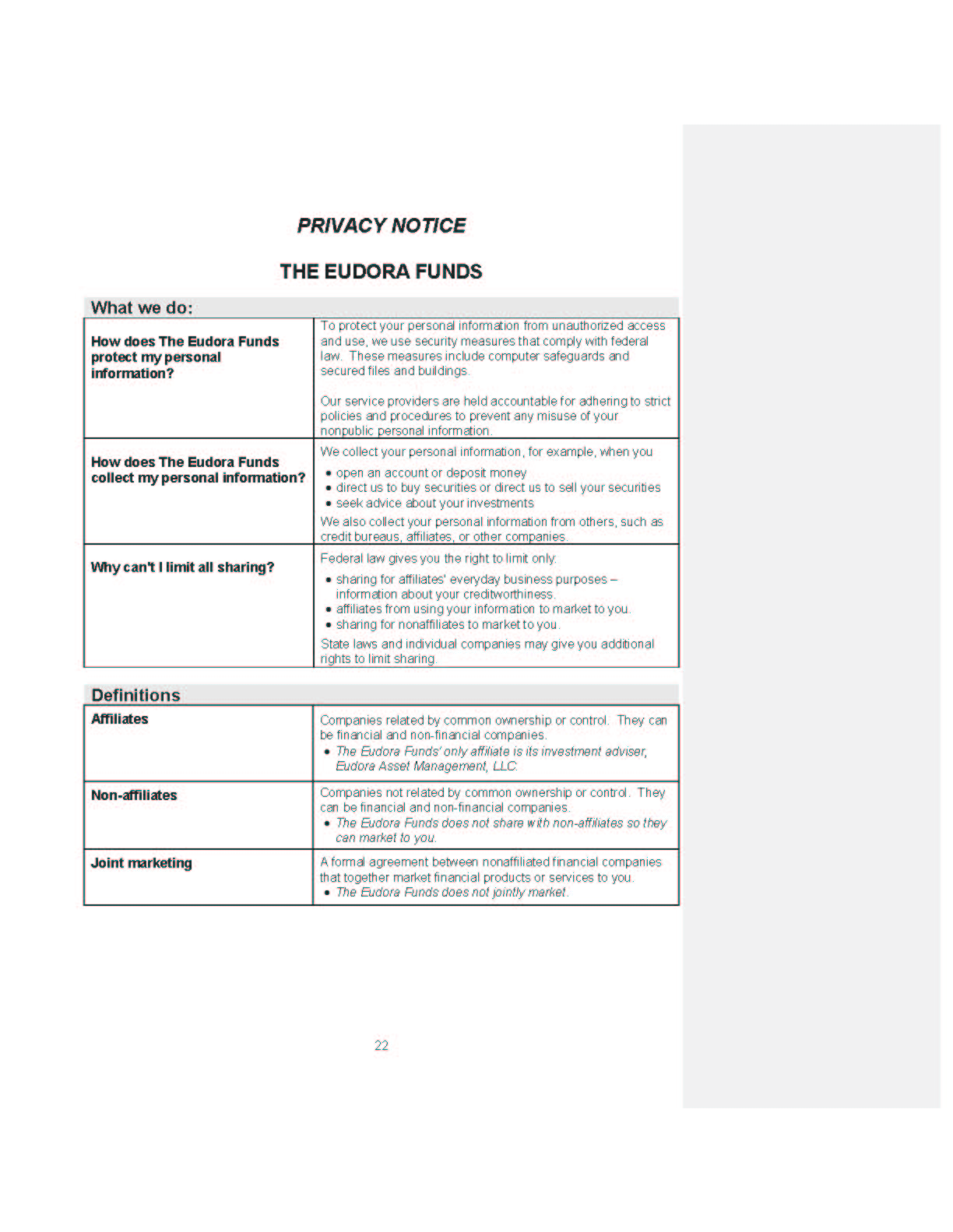

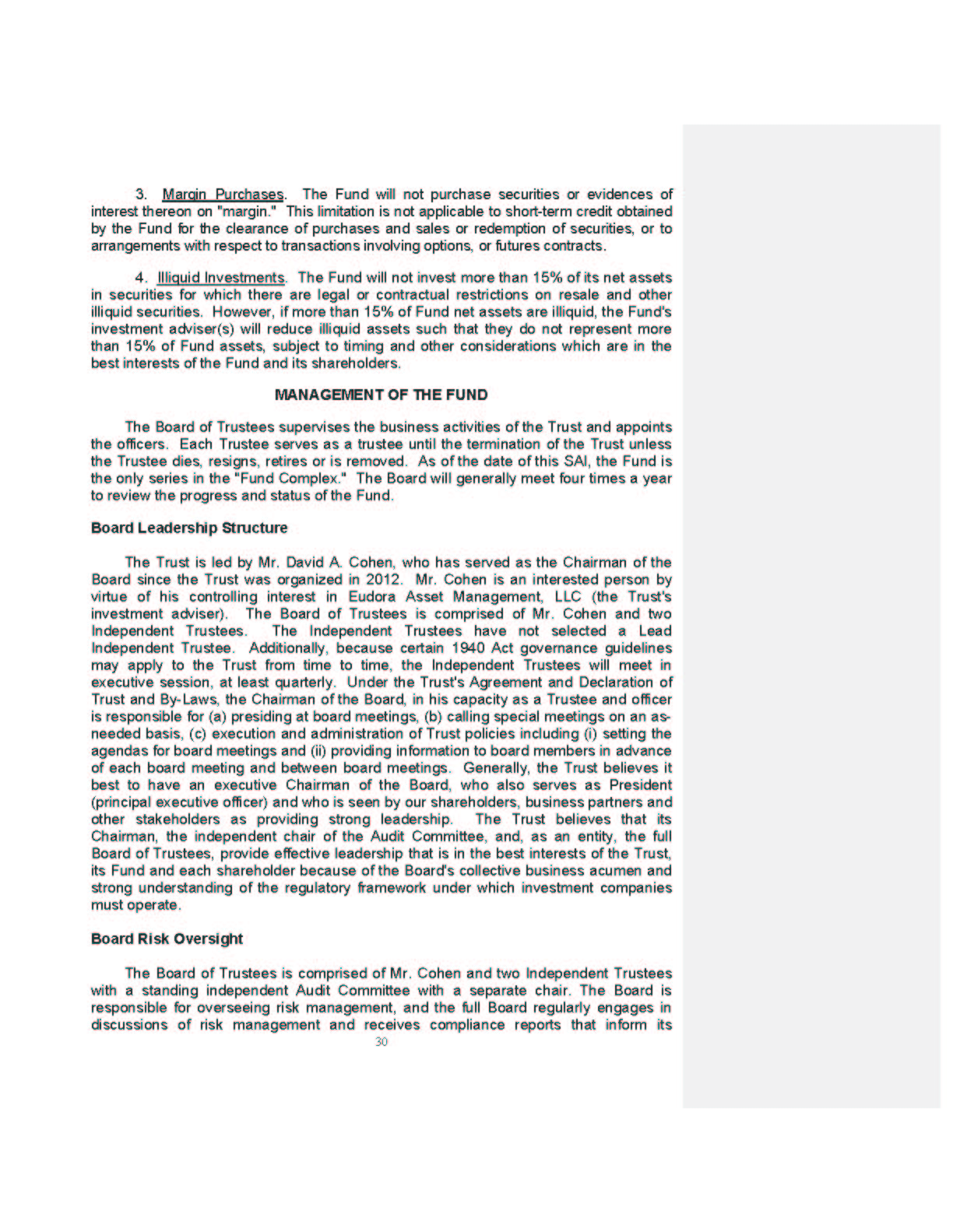

Name/Service Provider | Information Disclosed | Frequency | Lag Time |

Gemini Fund Services, LLC | Complete Portfolio Holdings | Daily Basis | Information will typically be provided on a real time basis or as soon thereafter as possible. |

Eudora Asset Management, LLC | Complete Portfolio Holdings | Daily Basis | Information will typically be provided on a real time basis or as soon thereafter as possible. |

The Huntington National Bank | Complete Portfolio Holdings | Monthly and quarterly basis, and from time to time as needed | At least one day after month/quarter end |

Thompson Hine LLP | Complete Portfolio Holdings | As Needed | Information will typically be provided on a real time basis or as soon thereafter as possible. |

* * * * *

On behalf of the Registrant, we hereby request that the Commission accelerate the effective date of the Pre-Effective Amendment to the Registrant's Registration Statement on the date submitted or, in the alternative, acceleration to the earliest possible time after the date submitted.

The Registrant notes is has not submitted nor expects to submit an exceptive application or no-action request in connection with its registration statement.

The Registrant has authorized me to convey to you that the Registrant acknowledges the following:

·

the Fund is responsible for the adequacy and accuracy of the disclosure in the filing;

·

should the Commission or the staff, acting pursuant to delegated authority, declare the filing effective, it does not foreclose the Commission from taking any action with respect to the filing;

·

the action of the Commission or the staff, acting pursuant to delegated authority, in declaring the filing effective, does not relieve the Fund from its full responsibility for the adequacy and accuracy of the disclosure in the filing; and

·

the Fund may not assert this action as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

If you have any questions or additional comments, please call JoAnn Strasser at (614) 469-3265 or Parker Bridgeport at (614) 469-3238.

Sincerely,

/s/Thompson Hine LLP

Attachment