NAREIT Presentation June 2018 George Ellison, CEO Robin Lowe, CFO home.welcome © 2018 Front Yard Residential. All rights reserved. 1

Forward-looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, regarding management’s beliefs, estimates, projections, anticipations and assumptions with respect to, among other things, Front Yard Residential Corporation’s (the “Company” or “Front Yard”) financial results, future operations, business plans and investment strategies as well as industry and market conditions. These statements may be identified by words such as “anticipate,” “intend,” “expect,” “may,” “could,” “should,” “would,” “plan,” “estimate,” “seek,” “believe” and other expressions or words of similar meaning. We caution that forward-looking statements are qualified by the existence of certain risks and uncertainties that could cause actual results and events to differ materially from what is contemplated by the forward-looking statements. Factors that could cause the Company's actual results to differ materially from these forward-looking statements may include, without limitation, our ability to implement our business strategy; our ability to make distributions to stockholders; our ability to complete potential transactions in accordance with anticipated terms and on a timely basis or at all; the Company's ability to integrate newly acquired rental assets into the portfolio; difficulties in identifying single-family properties to acquire; the impact of changes to the supply of, value of and the returns on single-family rental properties; the Company’s ability to acquire single-family rental properties generating attractive returns; the Company’s ability to sell residential mortgage assets or non-rental real estate owned on favorable terms or at all; the Company’s ability to predict costs; the Company’s ability to effectively compete with competitors; changes in interest rates; changes in the market value of single-family properties; the Company’s ability to obtain and access financing arrangements on favorable terms or at all; the Company’s ability to apply the net proceeds from financings or asset sales to acquire target assets in a timely manner or at all; the Company’s ability to retain the exclusive engagement of Altisource Asset Management Corporation; the failure of Altisource Portfolio Solutions S.A. and its affiliates to effectively perform their obligations under various agreements with the Company; the failure of Main Street Renewal, LLC to effectively perform under its property management agreement with the Company; the failure of the Company’s mortgage loan servicers to effectively perform their servicing obligations under their servicing agreements; the Company's failure to qualify or maintain qualification as a REIT; the Company’s failure to maintain its exemption from registration under the Investment Company Act of 1940, as amended; the impact of adverse real estate, mortgage or housing markets; the impact of adverse legislative or regulatory tax changes and other risks and uncertainties detailed in the "Risk Factors" and other sections described from time to time in the Company's current and future filings with the Securities and Exchange Commission. In addition, financial risks such as liquidity, interest rate and credit risks could influence future results. The foregoing list of factors should not be construed as exhaustive. The statements made in this presentation are current as of the date of this presentation only. The Company undertakes no obligation to publicly update or revise any forward-looking statements or any other information contained herein, whether as a result of new information, future events or otherwise. © 2018 Front Yard Residential. All rights reserved. 2

Executive Summary Investment Highlights . Favorable economic tailwinds . Growing renter demand for Single Family homes . Rising interest rates and tightened lending standards make purchasing homes less affordable . Aggregation opportunity in a fragmented market . Only 1% of rented homes are managed institutionally Front Yard is an industry leader in . Potentially large acquisition run‐way at Front Yard’s price providing quality, affordable rental point homes to America’s families. Our homes offer exceptional value in a . Unique model in Single Family Rental industry variety of suburban communities . Focus on affordable housing market which have easy accessibility to . Price point drives attractive yields metropolitan areas. Front Yard's tenants enjoy the space and comfort . Tenants less likely to leave to purchase a home that is unique to single‐family housing, . Proven operating ability at reasonable prices. Our mission is to provide our tenants with houses they . Acquired over 10,000 rental properties since 2015 are proud to call home. Additional . Multiple quarters of positive trends in key metrics information is available at . Strategic initiatives continue to drive long‐term value www.frontyardresidential.com. . Liquidity available to acquire up to 3,500 additional homes Ticker: RESI without equity raise Established: 2012 Market Cap1: $566 million Number of homes1: 11,954 1. Approximate Market Cap calculated at close of market 5/30/2018. Rental homes owned as of 03/31/2018. Source: Federal Reserve Economic Data, St. Louis Fed, SEC filings © 2018 Front Yard Residential. All rights reserved. 3

Strong Fundamentals and Opportunity in Affordable Housing © 2018 Front Yard Residential. All rights reserved. 4

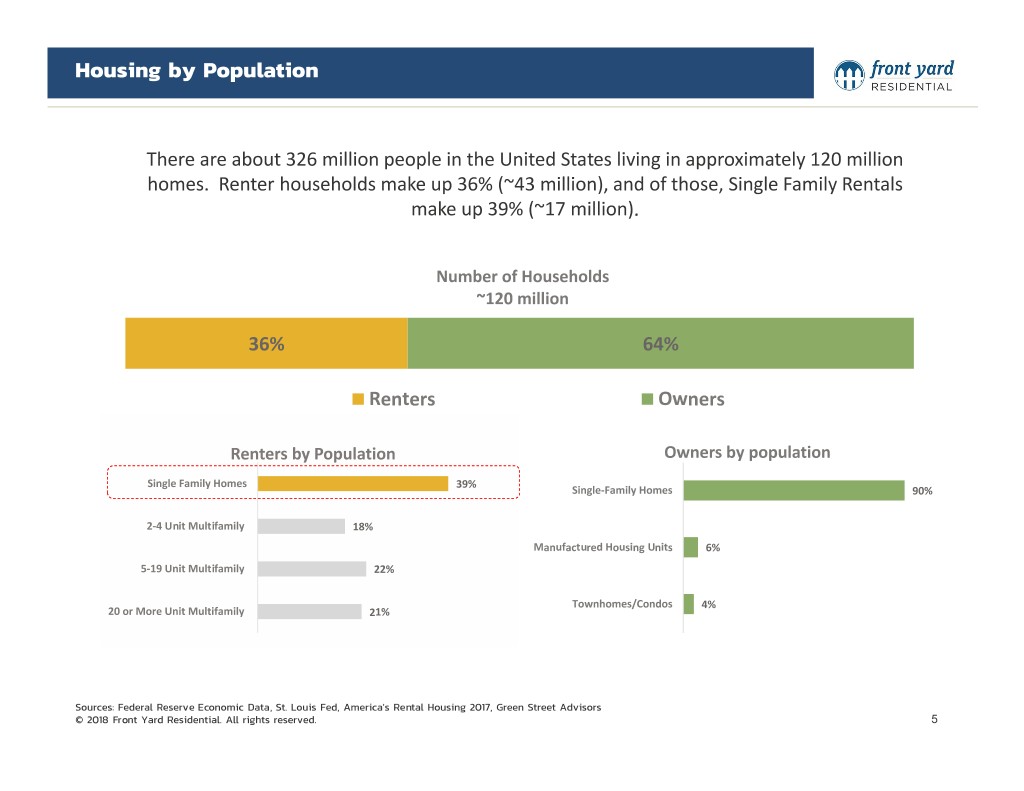

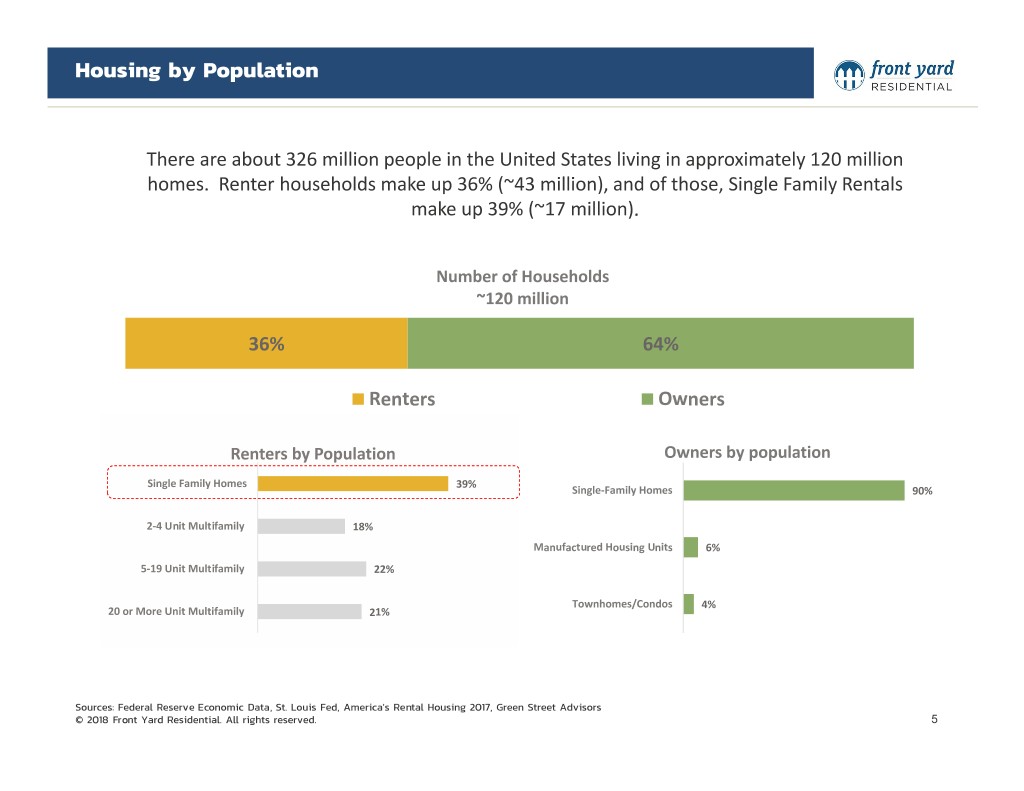

Housing by Population There are about 326 million people in the United States living in approximately 120 million homes. Renter households make up 36% (~43 million), and of those, Single Family Rentals make up 39% (~17 million). Number of Households ~120 million 36% 64% Renters Owners Renters by Population Owners by population Single Family Homes 39% Single‐Family Homes 90% 2‐4 Unit Multifamily 18% Manufactured Housing Units 6% 5‐19 Unit Multifamily 22% Townhomes/Condos 4% 20 or More Unit Multifamily 21% Sources: Federal Reserve Economic Data, St. Louis Fed, America's Rental Housing 2017, Green Street Advisors © 2018 Front Yard Residential. All rights reserved. 5

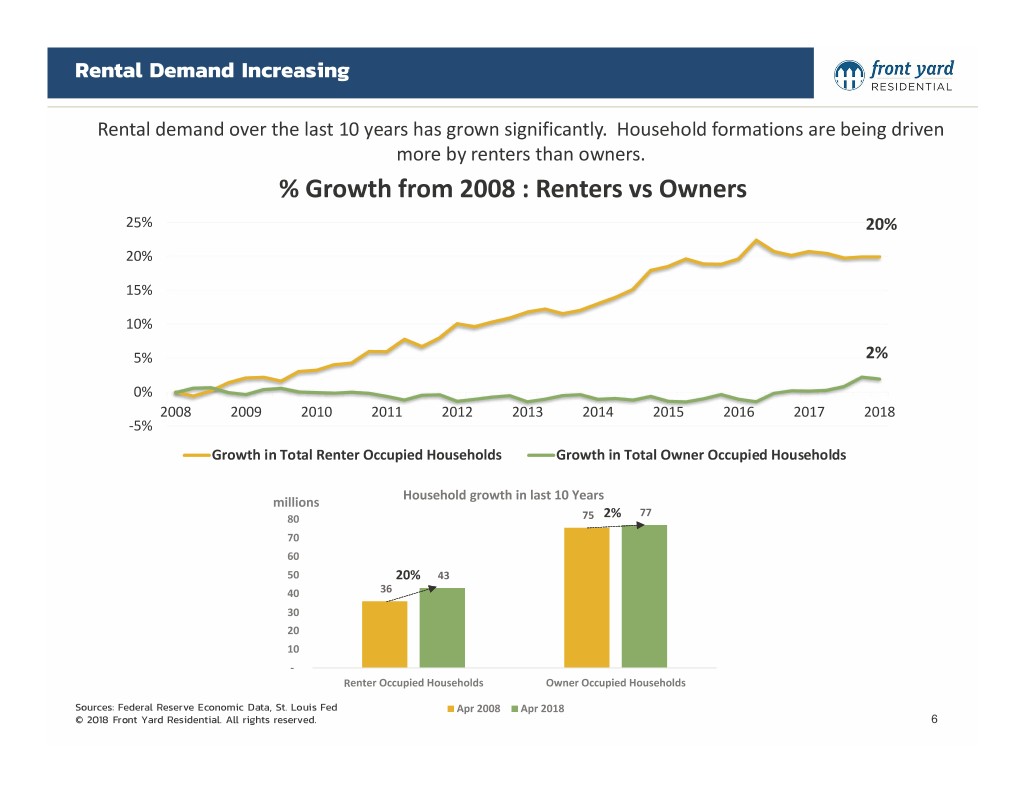

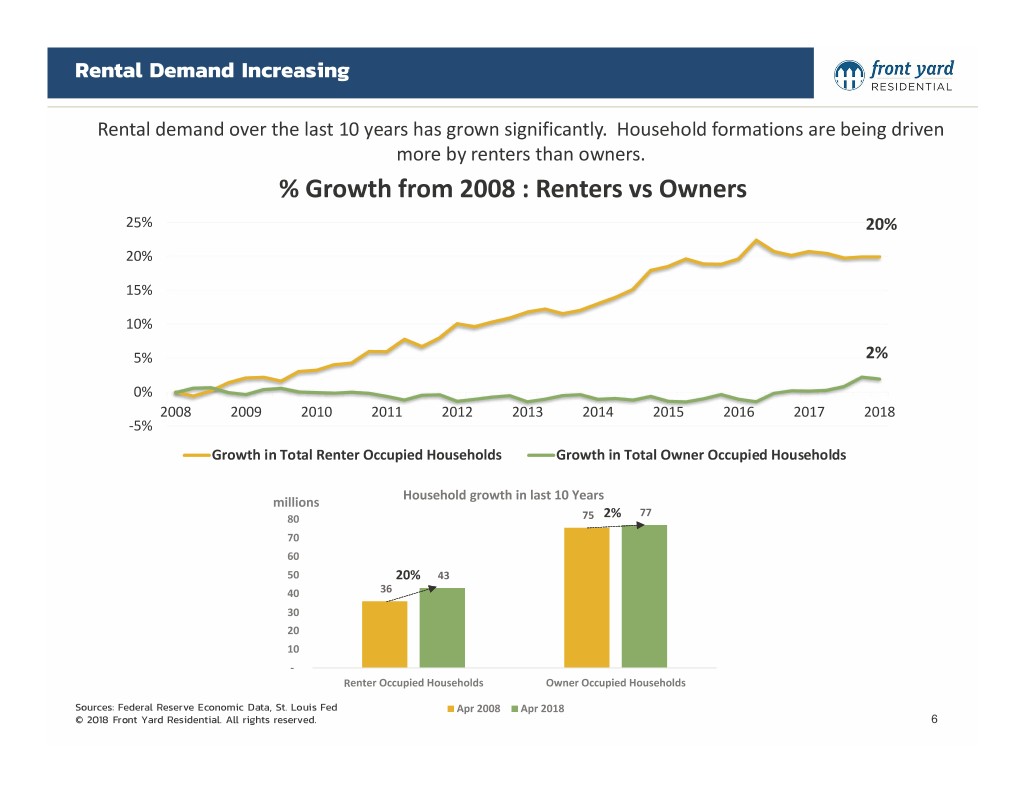

Rental Demand Increasing Rental demand over the last 10 years has grown significantly. Household formations are being driven more by renters than owners. % Growth from 2008 : Renters vs Owners 25% 20% 20% 15% 10% 5% 2% 0% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 ‐5% Growth in Total Renter Occupied Households Growth in Total Owner Occupied Households Household growth in last 10 Years millions 77 80 75 2% 70 60 50 20% 43 40 36 30 20 10 ‐ Renter Occupied Households Owner Occupied Households Sources: Federal Reserve Economic Data, St. Louis Fed Apr 2008 Apr 2018 © 2018 Front Yard Residential. All rights reserved. 6

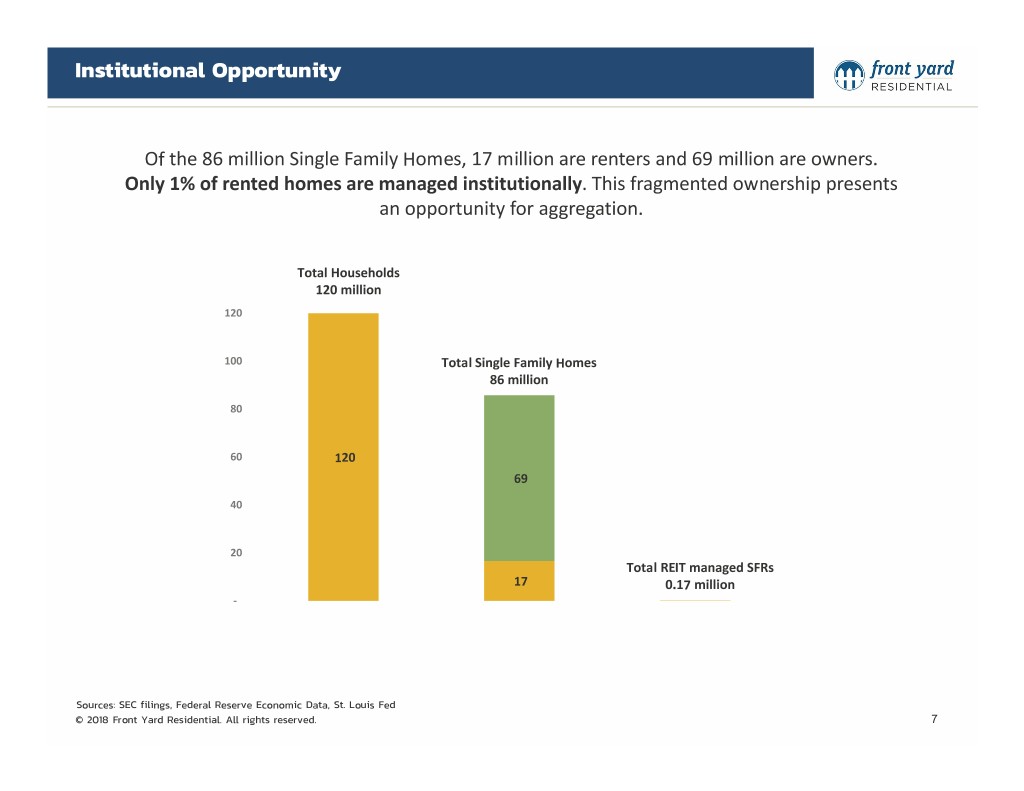

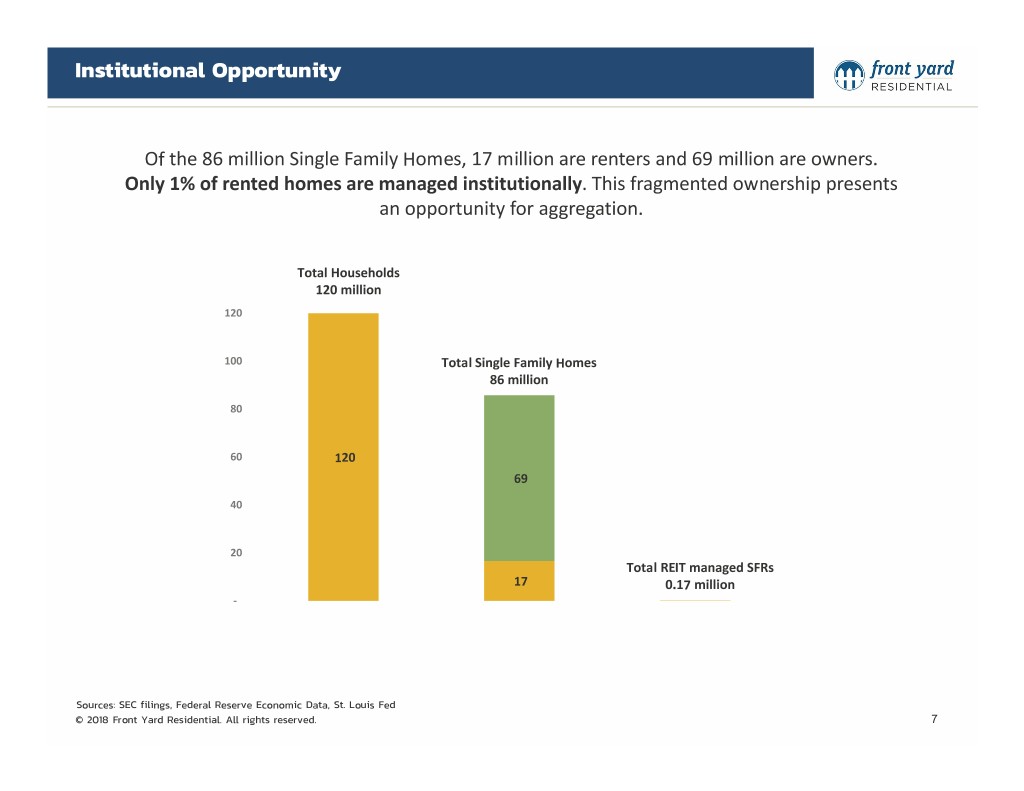

Institutional Opportunity Of the 86 million Single Family Homes, 17 million are renters and 69 million are owners. Only 1% of rented homes are managed institutionally. This fragmented ownership presents an opportunity for aggregation. Total Households 120 million 120 100 Total Single Family Homes 86 million 80 60 120 69 40 20 Total REIT managed SFRs 17 0.17 million0.17 ‐ Sources: SEC filings, Federal Reserve Economic Data, St. Louis Fed © 2018 Front Yard Residential. All rights reserved. 7

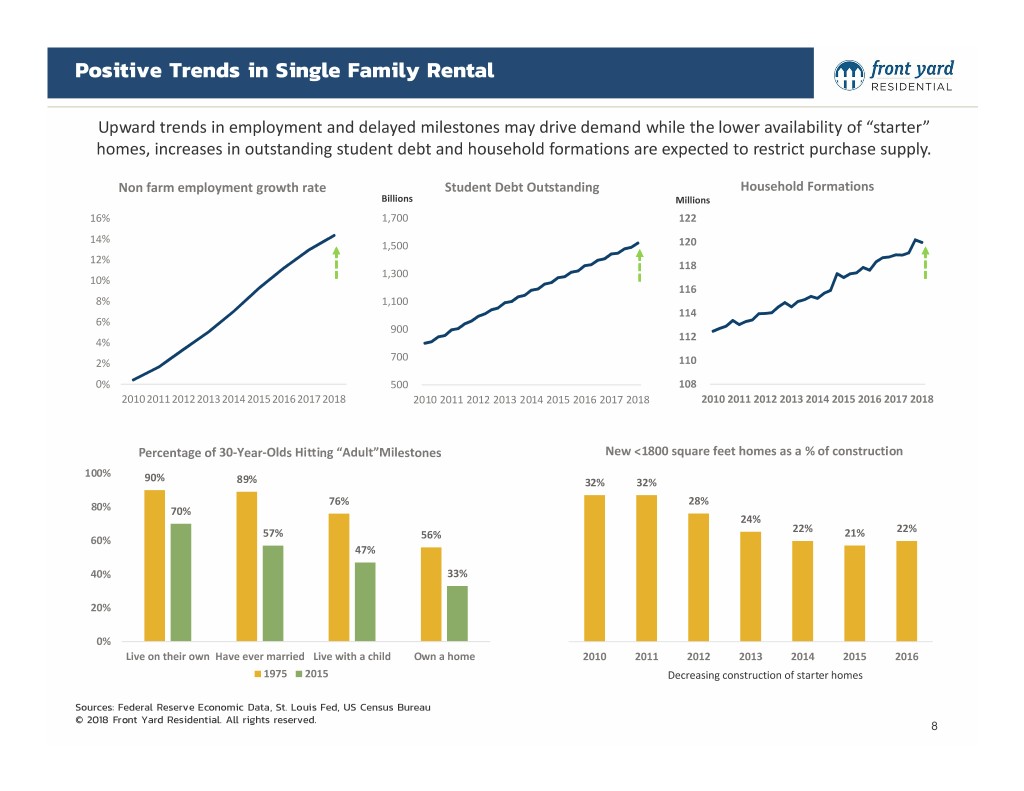

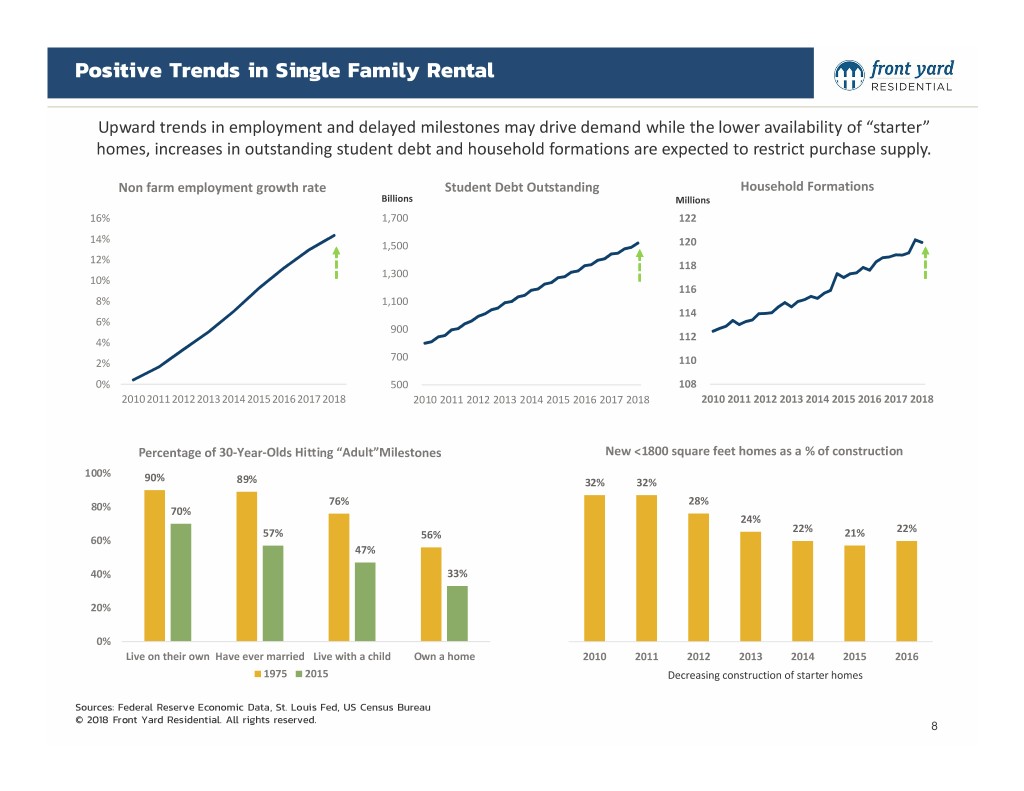

Positive Trends in Single Family Rental Upward trends in employment and delayed milestones may drive demand while the lower availability of “starter” homes, increases in outstanding student debt and household formations are expected to restrict purchase supply. Non farm employment growth rate Student Debt Outstanding Household Formations Billions Millions 16% 1,700 122 14% 1,500 120 12% 118 1,300 10% 116 8% 1,100 114 6% 900 112 4% 700 2% 110 0% 500 108 20102011 201220132014 201520162017 2018 2010 2011 2012 2013 2014 2015 2016 2017 2018 2010 2011 2012 2013 2014 2015 2016 2017 2018 Percentage of 30‐Year‐Olds Hitting “Adult”Milestones New <1800 square feet homes as a % of construction 100% 90% 89% 32% 32% 76% 28% 80% 70% 24% 57% 22% 21% 22% 60% 56% 47% 40% 33% 20% 0% Live on their own Have ever married Live with a child Own a home 2010 2011 2012 2013 2014 2015 2016 1975 2015 Decreasing construction of starter homes Sources: Federal Reserve Economic Data, St. Louis Fed, US Census Bureau © 2018 Front Yard Residential. All rights reserved. 8

Renter Household Growth Supply Deficit of Housing Units Post crisis, total households have grown at a 2010 2018 faster rate compared to total housing units, 137 4% resulting in a supply deficit. 132 With decreased supply and upward price movement, the choice to rent may be more 120 attractive, especially to those without the 7% ability for large down payments or who cannot 112 afford costly repairs associated with home ownership. The more affordable housing segment of the population may find ownership even more Households Growth (Millions) Housing Units Growth (Millions) difficult. Months’ Supply of Houses in the United States months thousands US New Single‐Family Home Average Sales Price 9.0 8.1 $450 8.0 407 7.0 $400 6.0 $350 5.0 4.0 4.8 $300 283 3.0 2.0 $250 1.0 0.0 $200 2011 2012 2013 2014 2015 2016 2017 2018 2010 2011 2012 2013 2014 2015 2016 2017 2018 Sources: Federal Reserve Economic Data, St. Louis Fed © 2018 Front Yard Residential. All rights reserved. 9

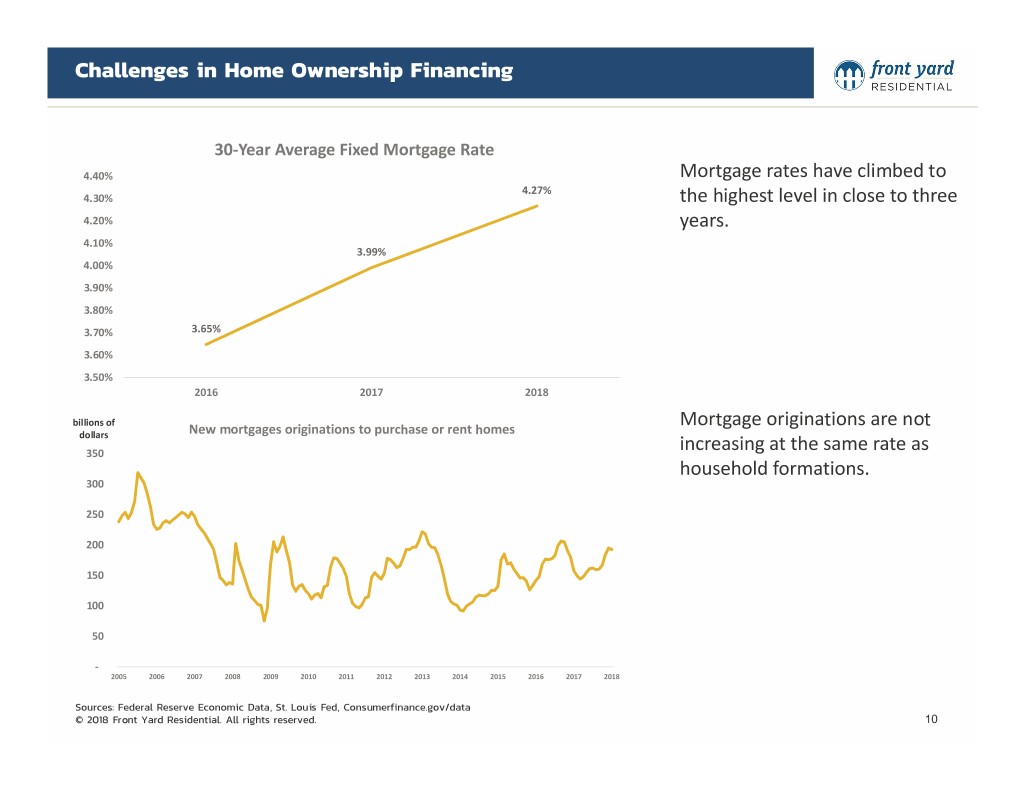

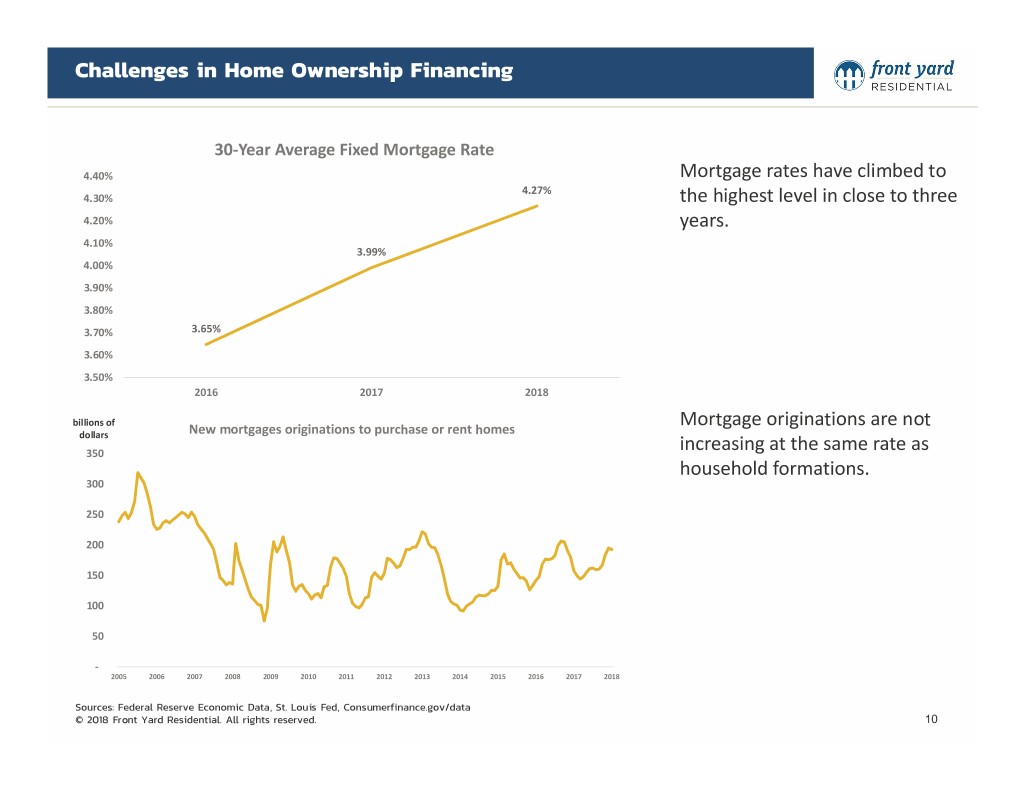

Challenges in Home Ownership Financing 30‐Year Average Fixed Mortgage Rate 4.40% Mortgage rates have climbed to 4.27% 4.30% the highest level in close to three 4.20% years. 4.10% 3.99% 4.00% 3.90% 3.80% 3.70% 3.65% 3.60% 3.50% 2016 2017 2018 billions of 2 Mortgage originations are not dollars New mortgages originations to purchase or rent homes 350 increasing at the same rate as household formations. 300 250 200 150 100 50 ‐ 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Sources: Federal Reserve Economic Data, St. Louis Fed, Consumerfinance.gov/data © 2018 Front Yard Residential. All rights reserved. 10

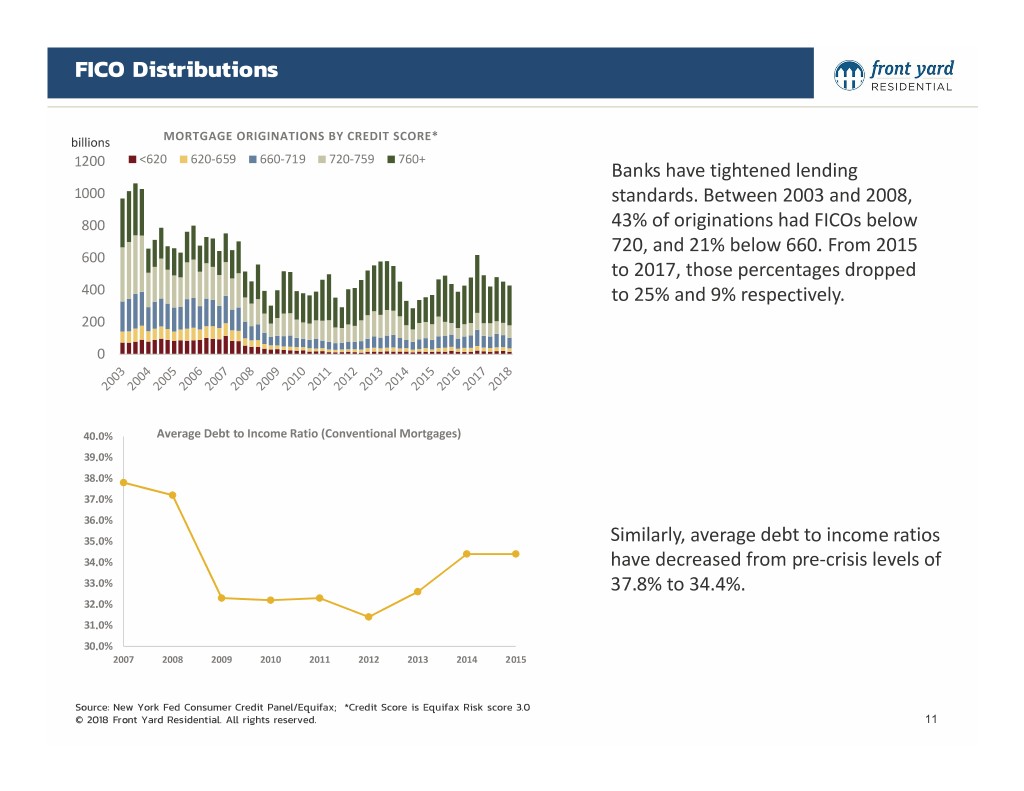

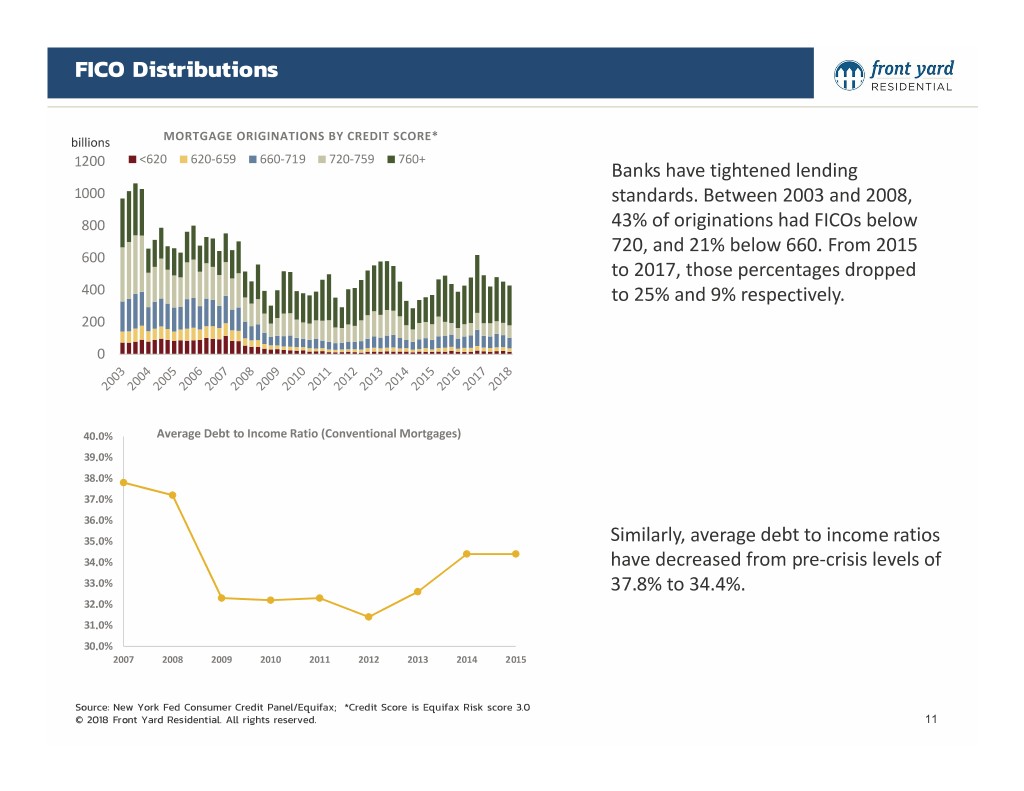

FICO Distributions billions MORTGAGE ORIGINATIONS BY CREDIT SCORE* <620 620‐659 660‐719 720‐759 760+ 1200 Banks have tightened lending 1000 standards. Between 2003 and 2008, 800 43% of originations had FICOs below 720, and 21% below 660. From 2015 600 to 2017, those percentages dropped 400 to 25% and 9% respectively. 200 0 40.0% Average Debt to Income Ratio (Conventional Mortgages) 39.0% 38.0% 37.0% 36.0% 35.0% Similarly, average debt to income ratios 34.0% have decreased from pre‐crisis levels of 33.0% 37.8% to 34.4%. 32.0% 31.0% 30.0% 2007 2008 2009 2010 2011 2012 2013 2014 2015 Source: New York Fed Consumer Credit Panel/Equifax; *Credit Score is Equifax Risk score 3.0 © 2018 Front Yard Residential. All rights reserved. 11

Strong Growth and Operational Performance © 2018 Front Yard Residential. All rights reserved. 12

Mission Statement Front Yard Residential is an industry leader in providing quality, affordable rental homes to America’s families. Our homes offer exceptional value in a variety of suburban communities across the US with access to quality education and jobs. We renovate each property to bring it up to our exacting standards while maintaining reasonable rents. In addition to offering a great place to live, we aim to provide a great experience for our tenants. Our property managers provide a nationwide network that ensures our tenants receive excellent service. At Front Yard Residential, we invite you to make one of our houses your home. © 2018 Front Yard Residential. All rights reserved. 13

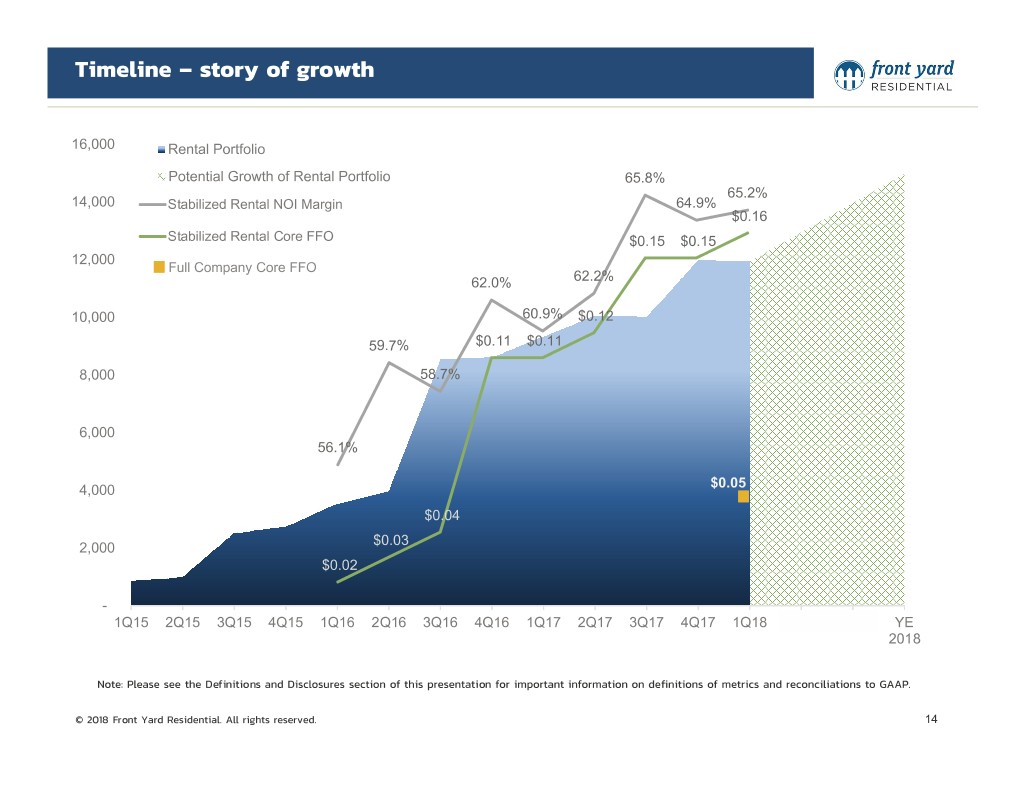

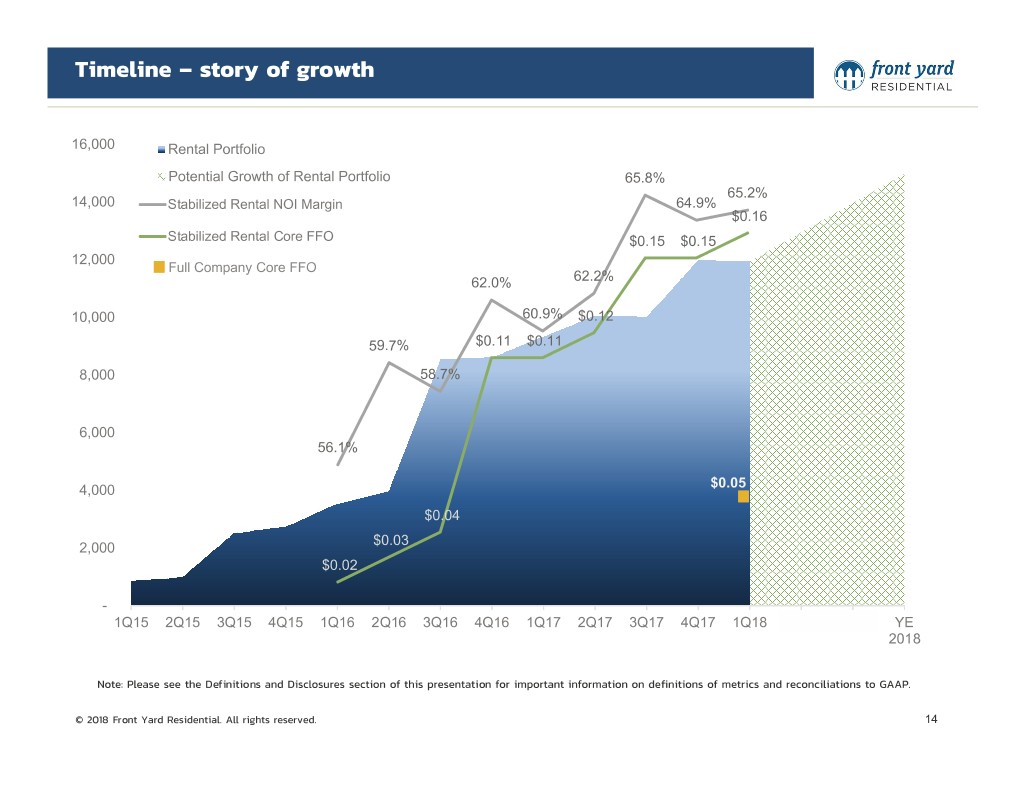

Timeline – story of growth 0.68 0.2 16,000 Rental Portfolio Potential Growth of Rental Portfolio 65.8% 0.18 0.66 65.2% 14,000 Stabilized Rental NOI Margin 64.9% $0.16 Stabilized Rental Core FFO 0.16 0.64 $0.15 $0.15 12,000 Full Company Core FFO 62.0% 62.2% 0.14 0.62 10,000 60.9% $0.12 0.12 59.7% $0.11 $0.11 0.6 8,000 58.7% 0.1 0.58 6,000 0.08 56.1% 0.56 $0.05 0.06 4,000 0.54 $0.04 0.04 $0.03 2,000 $0.02 0.52 0.02 - 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 YE 0.5 0 2018 Note: Please see the Definitions and Disclosures section of this presentation for important information on definitions of metrics and reconciliations to GAAP. © 2018 Front Yard Residential. All rights reserved. 14

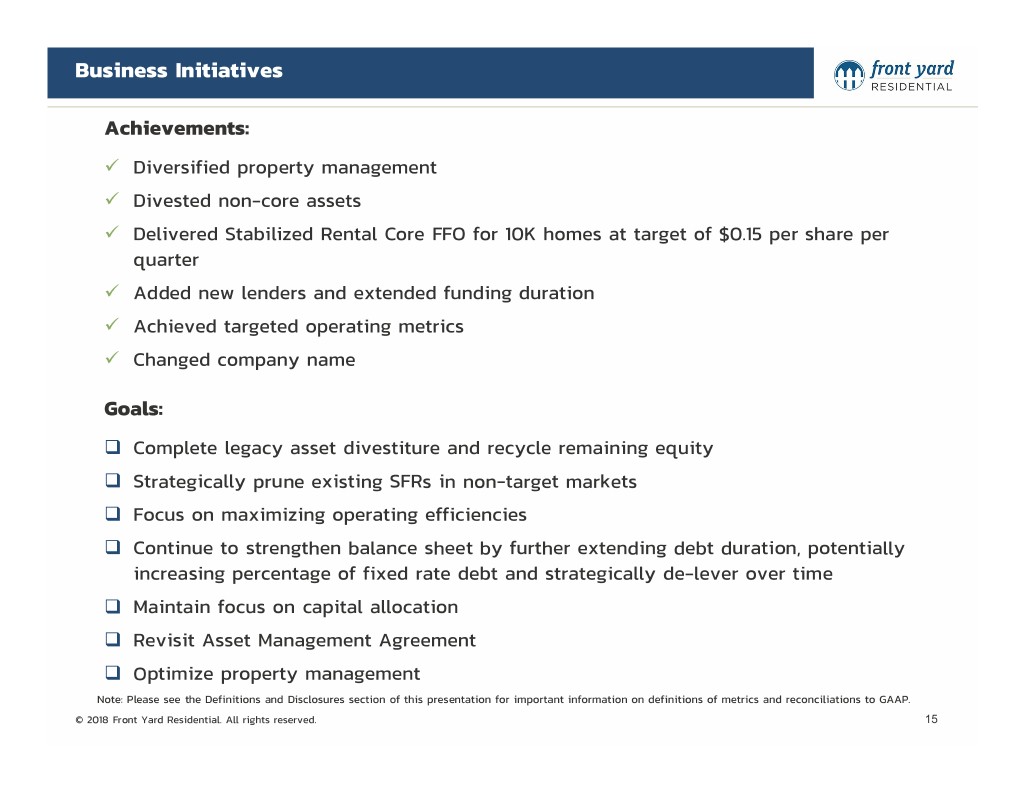

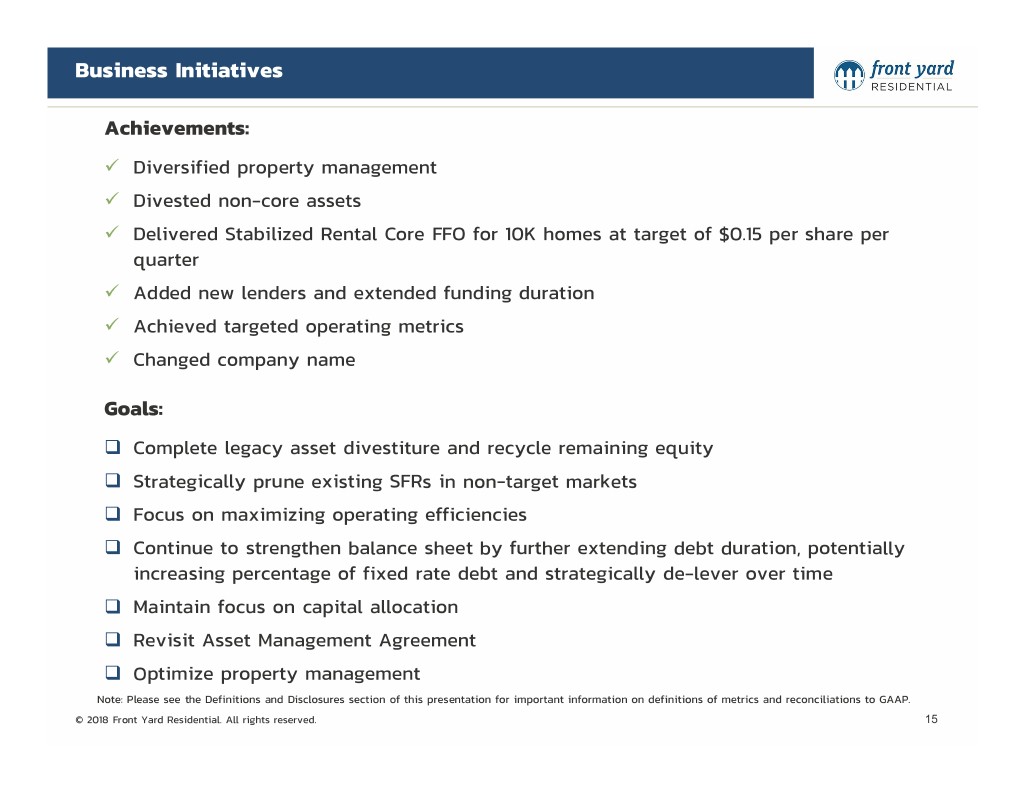

Business Initiatives Achievements: Diversified property management Divested non-core assets Delivered Stabilized Rental Core FFO for 10K homes at target of $0.15 per share per quarter Added new lenders and extended funding duration Achieved targeted operating metrics Changed company name Goals: Complete legacy asset divestiture and recycle remaining equity Strategically prune existing SFRs in non-target markets Focus on maximizing operating efficiencies Continue to strengthen balance sheet by further extending debt duration, potentially increasing percentage of fixed rate debt and strategically de-lever over time Maintain focus on capital allocation Revisit Asset Management Agreement Optimize property management Note: Please see the Definitions and Disclosures section of this presentation for important information on definitions of metrics and reconciliations to GAAP. © 2018 Front Yard Residential. All rights reserved. 15

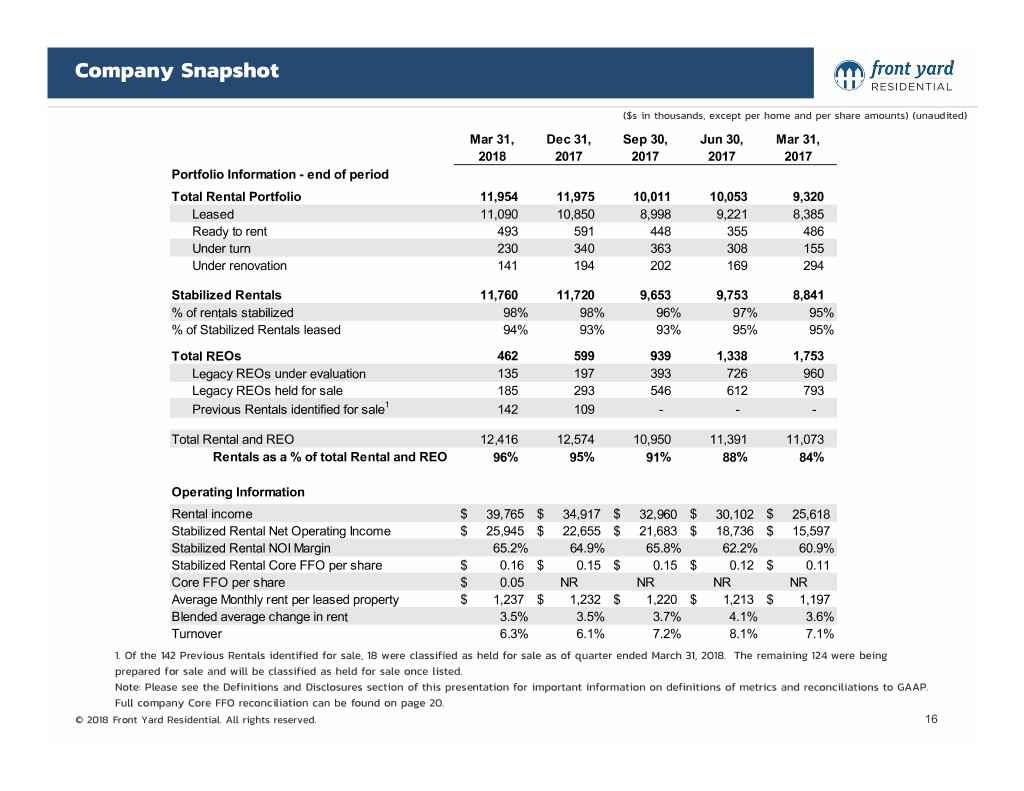

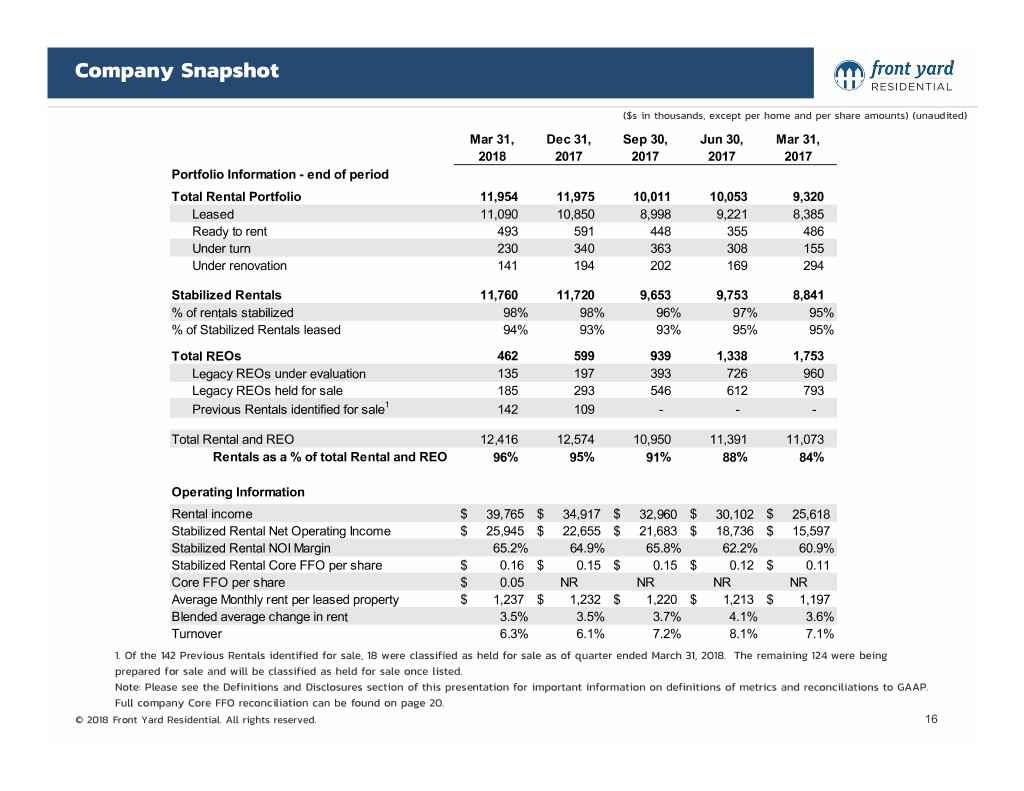

Company Snapshot ($s in thousands, except per home and per share amounts) (unaudited) Mar 31, Dec 31, Sep 30, Jun 30, Mar 31, 2018 2017 2017 2017 2017 Portfolio Information - end of period Total Rental Portfolio 11,954 11,975 10,011 10,053 9,320 Leased 11,090 10,850 8,998 9,221 8,385 Ready to rent 493 591 448 355 486 Under turn 230 340 363 308 155 Under renovation 141 194 202 169 294 Stabilized Rentals 11,760 11,720 9,653 9,753 8,841 % of rentals stabilized 98% 98% 96% 97% 95% % of Stabilized Rentals leased 94% 93% 93% 95% 95% Total REOs 462 599 939 1,338 1,753 Legacy REOs under evaluation 135 197 393 726 960 Legacy REOs held for sale 185 293 546 612 793 Previous Rentals identified for sale1 142 109 - - - Total Rental and REO 12,416 12,574 10,950 11,391 11,073 Rentals as a % of total Rental and REO 96% 95% 91% 88% 84% Operating Information Rental income$ 39,765 $ 34,917 $ 32,960 $ 30,102 $ 25,618 Stabilized Rental Net Operating Income$ 25,945 $ 22,655 $ 21,683 $ 18,736 $ 15,597 Stabilized Rental NOI Margin 65.2% 64.9% 65.8% 62.2% 60.9% Stabilized Rental Core FFO per share$ 0.16 $ 0.15 $ 0.15 $ 0.12 $ 0.11 Core FFO per share$ 0.05 NR NR NR NR Average Monthly rent per leased property$ 1,237 $ 1,232 $ 1,220 $ 1,213 $ 1,197 Blended average change in rent 3.5% 3.5% 3.7% 4.1% 3.6% Turnover 6.3% 6.1% 7.2% 8.1% 7.1% 1. Of the 142 Previous Rentals identified for sale, 18 were classified as held for sale as of quarter ended March 31, 2018. The remaining 124 were being prepared for sale and will be classified as held for sale once listed. Note: Please see the Definitions and Disclosures section of this presentation for important information on definitions of metrics and reconciliations to GAAP. Full company Core FFO reconciliation can be found on page 20. © 2018 Front Yard Residential. All rights reserved. 16

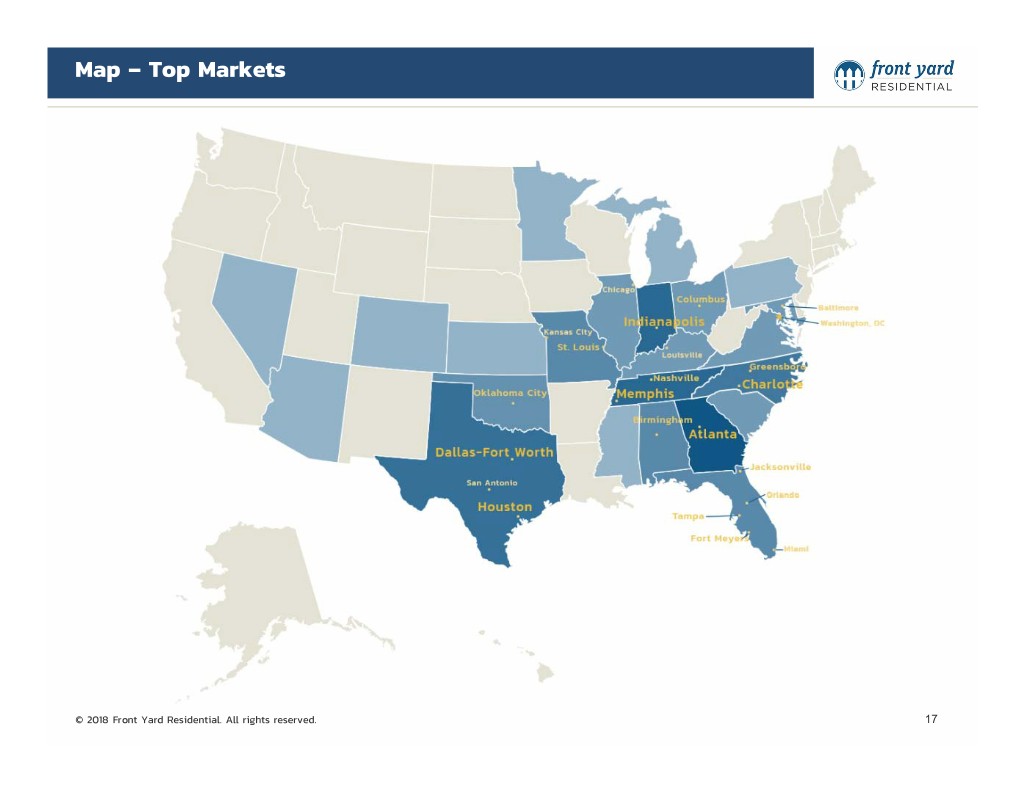

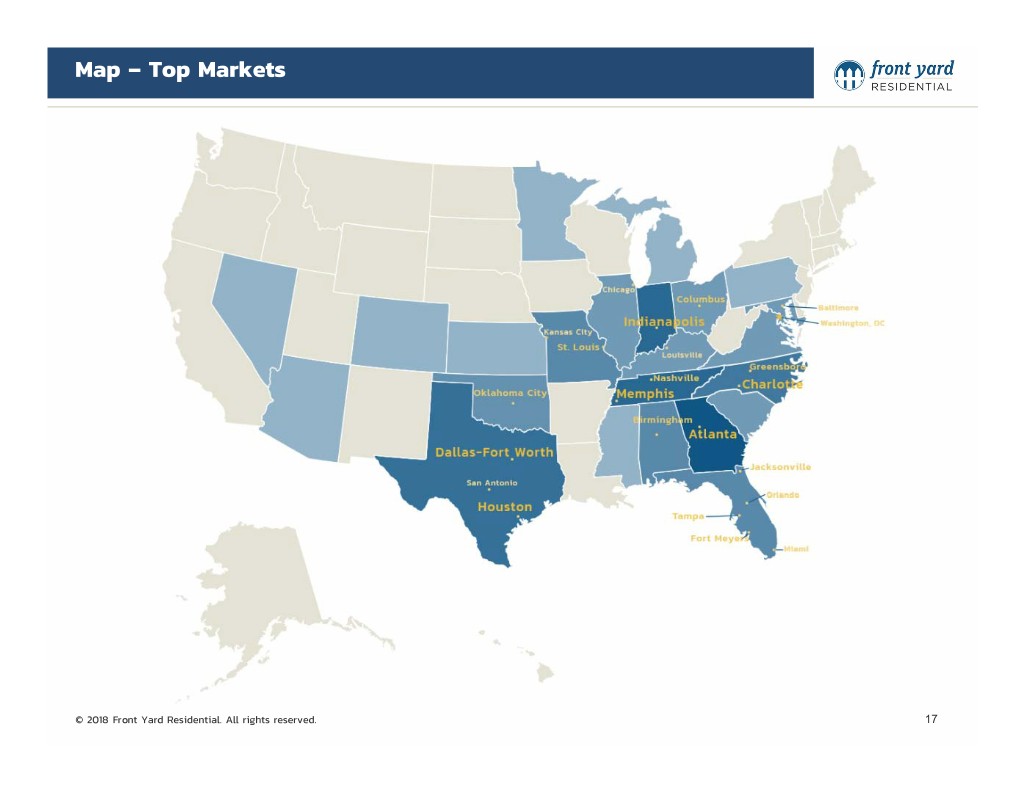

Map – Top Markets © 2018 Front Yard Residential. All rights reserved. 17

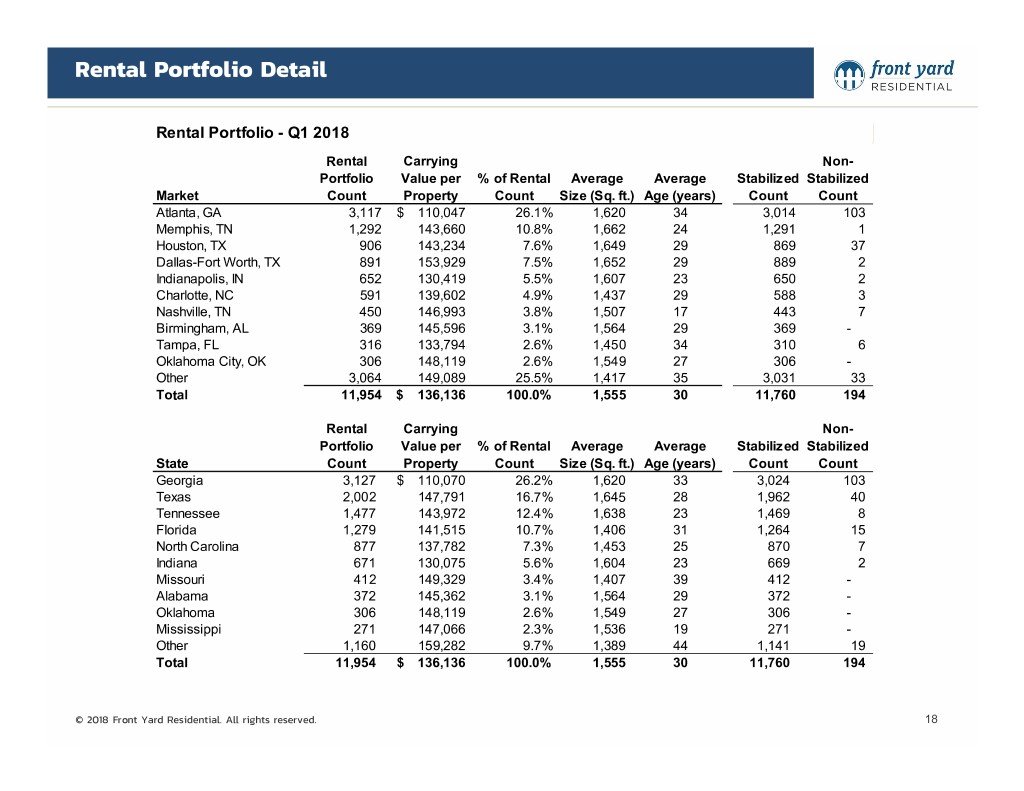

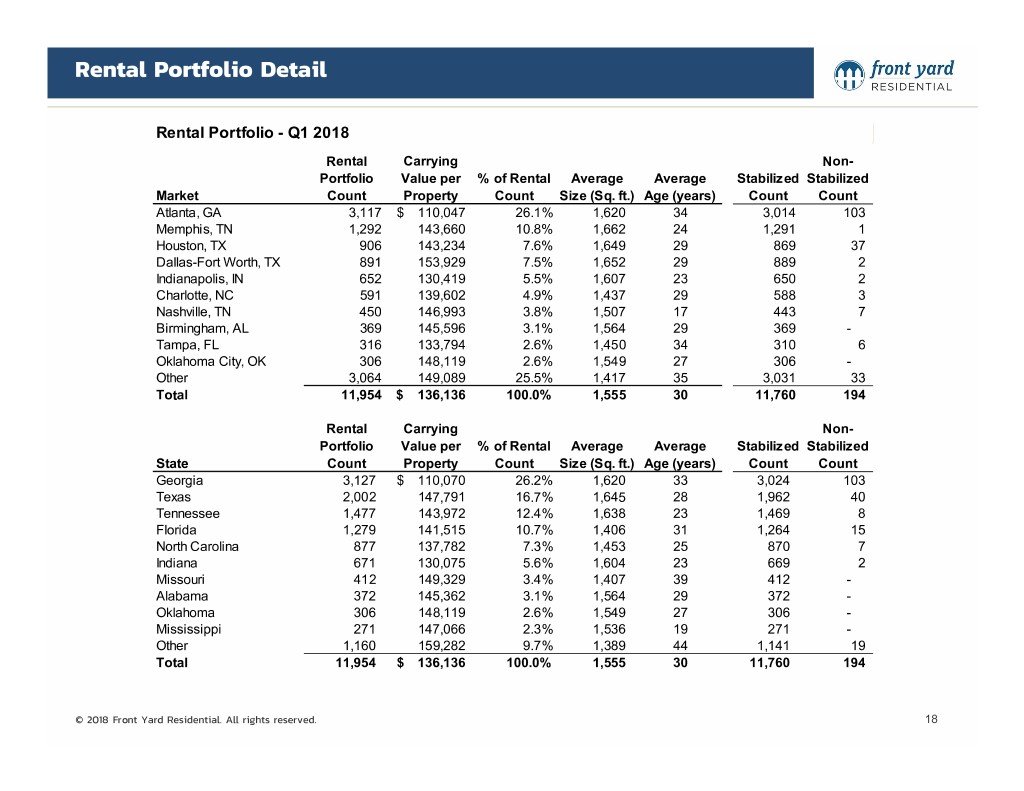

Rental Portfolio Detail Rental Portfolio - Q1 2018 Rental Carrying Non- Portfolio Value per % of Rental Average Average Stabilized Stabilized Market Count Property Count Size (Sq. ft.) Age (years) Count Count Atlanta, GA 3,117 $ 110,047 26.1% 1,620 34 3,014 103 Memphis, TN 1,292 143,660 10.8% 1,662 24 1,291 1 Houston, TX 906 143,234 7.6% 1,649 29 869 37 Dallas-Fort Worth, TX 891 153,929 7.5% 1,652 29 889 2 Indianapolis, IN 652 130,419 5.5% 1,607 23 650 2 Charlotte, NC 591 139,602 4.9% 1,437 29 588 3 Nashville, TN 450 146,993 3.8% 1,507 17 443 7 Birmingham, AL 369 145,596 3.1% 1,564 29 369 - Tampa, FL 316 133,794 2.6% 1,450 34 310 6 Oklahoma City, OK 306 148,119 2.6% 1,549 27 306 - Other 3,064 149,089 25.5% 1,417 35 3,031 33 Total 11,954 $ 136,136 100.0% 1,555 30 11,760 194 Rental Carrying Non- Portfolio Value per % of Rental Average Average Stabilized Stabilized State Count Property Count Size (Sq. ft.) Age (years) Count Count Georgia 3,127$ 110,070 26.2% 1,620 33 3,024 103 Texas 2,002 147,791 16.7% 1,645 28 1,962 40 Tennessee 1,477 143,972 12.4% 1,638 23 1,469 8 Florida 1,279 141,515 10.7% 1,406 31 1,264 15 North Carolina 877 137,782 7.3% 1,453 25 870 7 Indiana 671 130,075 5.6% 1,604 23 669 2 Missouri 412 149,329 3.4% 1,407 39 412 - Alabama 372 145,362 3.1% 1,564 29 372 - Oklahoma 306 148,119 2.6% 1,549 27 306 - Mississippi 271 147,066 2.3% 1,536 19 271 - Other 1,160 159,282 9.7% 1,389 44 1,141 19 Total 11,954$ 136,136 100.0% 1,555 30 11,760 194 © 2018 Front Yard Residential. All rights reserved. 18

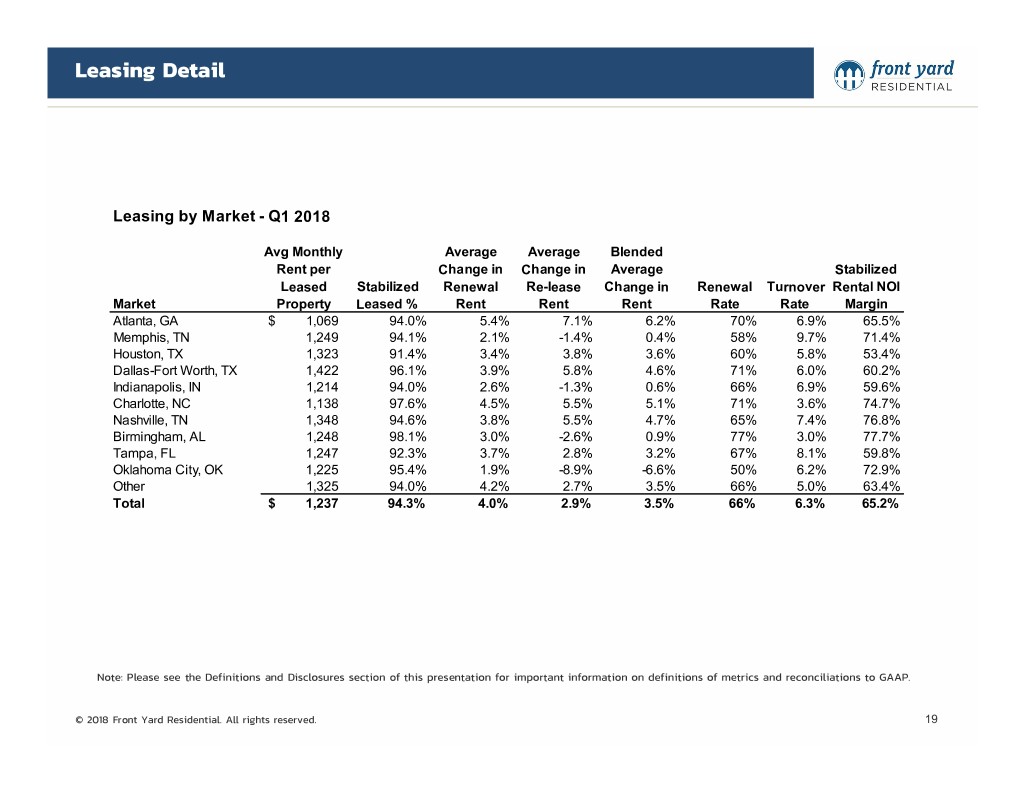

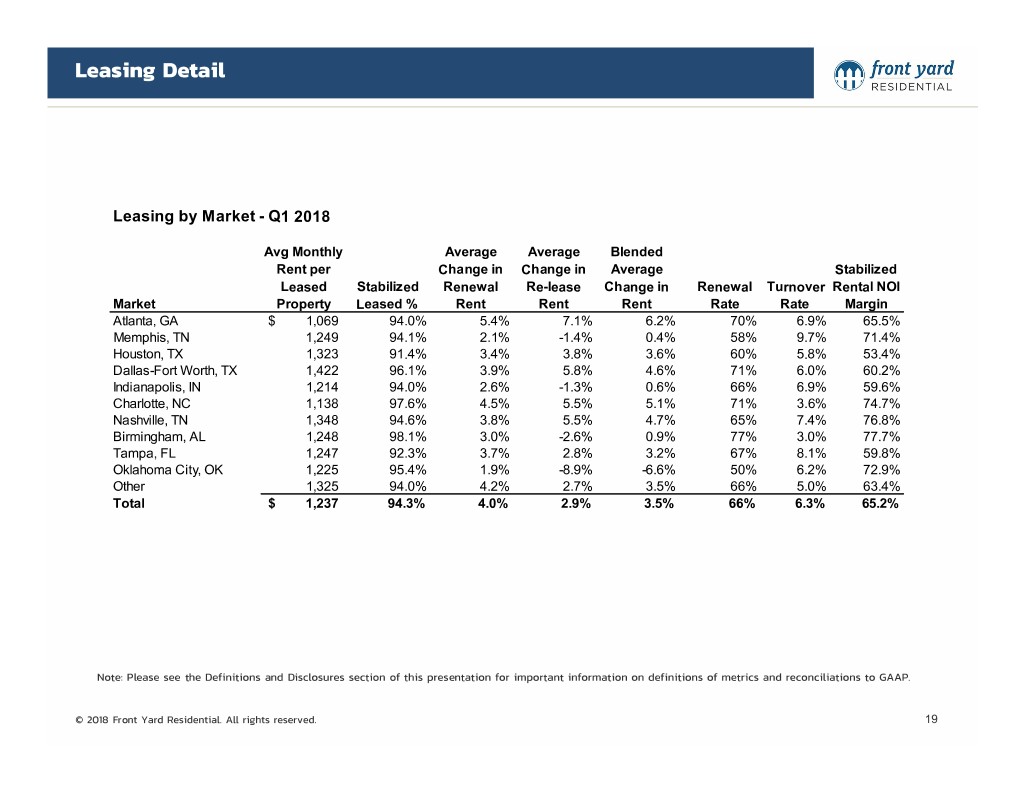

Leasing Detail Leasing by Market - Q1 2018 Avg Monthly Average Average Blended Rent per Change in Change in Average Stabilized Leased Stabilized Renewal Re-lease Change in Renewal Turnover Rental NOI Market Property Leased % Rent Rent Rent Rate Rate Margin Atlanta, GA$ 1,069 94.0% 5.4% 7.1% 6.2% 70% 6.9% 65.5% Memphis, TN 1,249 94.1% 2.1% -1.4% 0.4% 58% 9.7% 71.4% Houston, TX 1,323 91.4% 3.4% 3.8% 3.6% 60% 5.8% 53.4% Dallas-Fort Worth, TX 1,422 96.1% 3.9% 5.8% 4.6% 71% 6.0% 60.2% Indianapolis, IN 1,214 94.0% 2.6% -1.3% 0.6% 66% 6.9% 59.6% Charlotte, NC 1,138 97.6% 4.5% 5.5% 5.1% 71% 3.6% 74.7% Nashville, TN 1,348 94.6% 3.8% 5.5% 4.7% 65% 7.4% 76.8% Birmingham, AL 1,248 98.1% 3.0% -2.6% 0.9% 77% 3.0% 77.7% Tampa, FL 1,247 92.3% 3.7% 2.8% 3.2% 67% 8.1% 59.8% Oklahoma City, OK 1,225 95.4% 1.9% -8.9% -6.6% 50% 6.2% 72.9% Other 1,325 94.0% 4.2% 2.7% 3.5% 66% 5.0% 63.4% Total$ 1,237 94.3% 4.0% 2.9% 3.5% 66% 6.3% 65.2% Note: Please see the Definitions and Disclosures section of this presentation for important information on definitions of metrics and reconciliations to GAAP. © 2018 Front Yard Residential. All rights reserved. 19

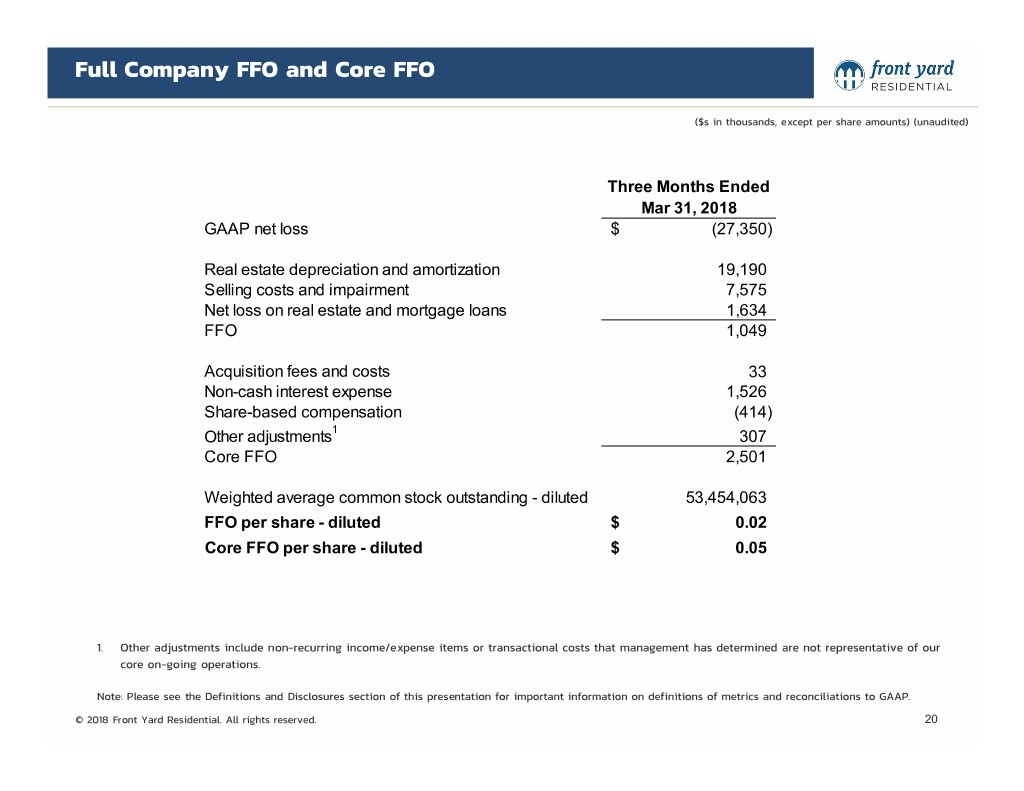

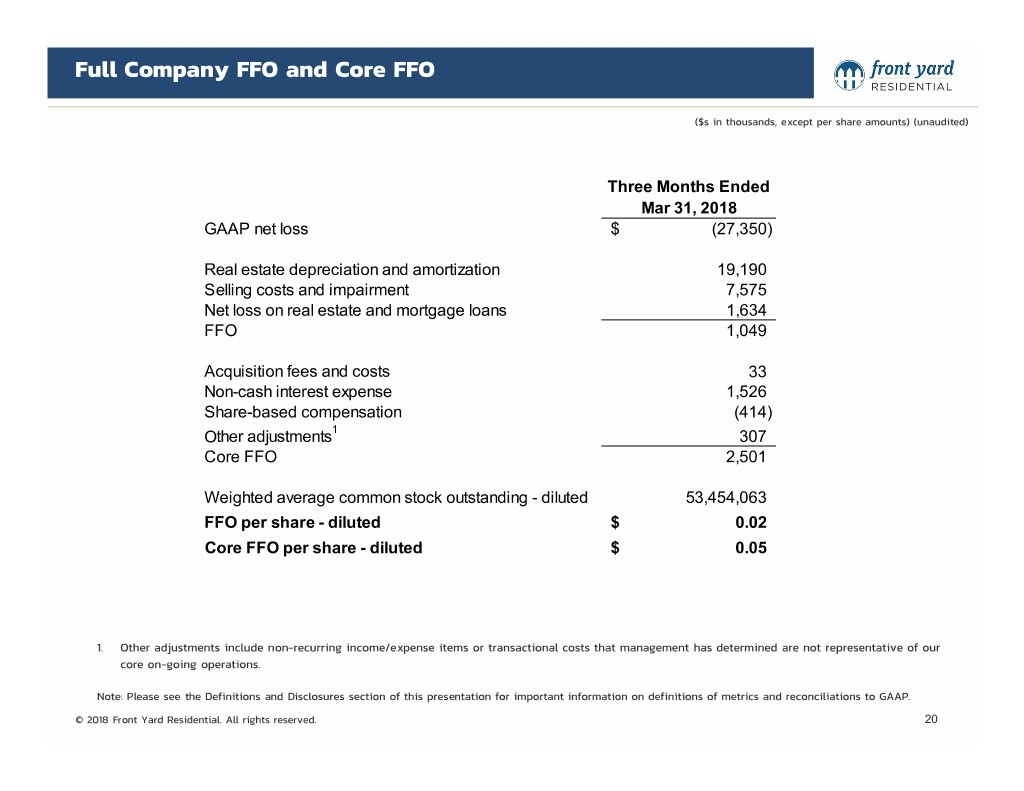

Full Company FFO and Core FFO ($s in thousands, except per share amounts) (unaudited) Three Months Ended Mar 31, 2018 GAAP net loss$ (27,350) Real estate depreciation and amortization 19,190 Selling costs and impairment 7,575 Net loss on real estate and mortgage loans 1,634 FFO 1,049 Acquisition fees and costs 33 Non-cash interest expense 1,526 Share-based compensation (414) Other adjustments1 307 Core FFO 2,501 Weighted average common stock outstanding - diluted 53,454,063 FFO per share - diluted$ 0.02 Core FFO per share - diluted$ 0.05 1. Other adjustments include non-recurring income/expense items or transactional costs that management has determined are not representative of our core on-going operations. Note: Please see the Definitions and Disclosures section of this presentation for important information on definitions of metrics and reconciliations to GAAP. © 2018 Front Yard Residential. All rights reserved. 20

Definitions and Disclosures © 2018 Front Yard Residential. All rights reserved. 21

Definitions and Disclosures Definitions: Average change in renewal rent: Average percentage change in rent on all non-month-to-month lease renewals during the quarter, compared to previous lease rent. Average change in re-lease rent: Average percentage change in rent for new leases starting in the quarter compared to previous annual contractual rent. Average monthly rent per leased property: Contractual rent on all properties leased at quarter end. Blended average change in rent: Total average percentage change in rent for both renewals and re-leases in the quarter. Renewal Rate: Renewal rate is calculated as the number of renewed leases in a given period divided by total leases expired excluding early terminations and leases transitioning to month-to-month in the period. Rental Portfolio: We define Rental Portfolio as properties that are leased, listed and ready to rent, or under renovation or turn where that property is expected to become leased to qualified tenants. Stabilized Rental: We define a property as stabilized once it has been renovated and then initially leased or available for rent for a period greater than 90 days. All other homes are considered non‐stabilized. Homes are considered stabilized even after subsequent resident turnover. However, homes may be removed from the stabilized home portfolio and placed in the non-stabilized home portfolio due to renovation during the home lifecycle or because it is identified for sale. © 2018 Front Yard Residential. All rights reserved. 22

Definitions and Disclosures FFO, Core FFO, Stabilized Rental FFO and Stabilized Rental Core FFO: Funds from Operations (“FFO”) is a supplemental performance measure of an equity real estate investment trust (“REIT”) used by industry analysts and investors in order to facilitate meaningful comparisons between periods and among peer companies. FFO is defined by the National Association of Real Estate Investment Trusts (“NAREIT”) as GAAP net income or loss excluding gains or losses from sales of property, impairment charges on real estate and depreciation and amortization on real estate assets adjusted for unconsolidated partnerships and jointly owned investments. We believe that FFO of our total operations and of our stabilized rental portfolio (“Stabilized Rental FFO”) is a meaningful supplemental measure of our overall operating performance and the operating performance of our stabilized rental portfolio, respectively, because historical cost accounting for real estate assets in accordance with GAAP assumes that the value of real estate assets diminishes predictably over time, as reflected through depreciation. Because real estate values have historically risen or fallen with market conditions, management considers FFO and Stabilized Rental FFO an appropriate supplemental performance measure because it excludes historical cost depreciation, impairment charges and gains or losses related to sales of previously depreciated homes from GAAP net income. By excluding depreciation, impairment and gains or losses on sales of real estate, FFO and Stabilized Rental FFO provide measures of our returns on our investments in real estate assets. However, because both FFO and Stabilized Rental FFO exclude depreciation and amortization and capture neither the changes in the value of the homes that result from use or market conditions nor the level of capital expenditures to maintain the operating performance of the homes, all of which have real economic effect andcould materially affect our results from operations, the utility of FFO and Stabilized Rental FFO as measures of our performance is limited. Our Core FFO and Stabilized Rental Core FFO begin with FFO and Stabilized Rental FFO, respectively, and are adjusted for share-based compensation; acquisition fees and costs; non-cash interest expense related to deferred debt issuance costs, amortization of loan discounts and mark-to-market adjustments on interest rate derivatives and other non-comparable items, as applicable. We believe that Core FFO and Stabilized Rental Core FFO, when used in conjunction with the results of operations under GAAP, are meaningful supplemental measures of our operating performance for the same reasons as FFO and Stabilized Rental FFO and are further helpfulas they provide a consistent measurement of our performance across reporting periods by removing the impact of certain items that are not comparable from period to period. Although management believes that FFO, Core FFO, Stabilized Rental FFO and Stabilized Rental Core FFO increase our comparabilitywith other companies, these measures may not be comparable to the FFO or Core FFO of other companies because 1) other companies may adopt a definition of FFO other than the NAREIT definition, may apply a different method of determining Core FFO or may utilize metrics other than or in addition to Core FFO and 2) in the case of Stabilized Rental FFO and Stabilized Rental Core FFO, we base these measures only on our stabilized rental portfolio. © 2018 Front Yard Residential. All rights reserved. 23

Definitions and Disclosures Stabilized Rental Net Operating Income (“Stabilized Rental NOI”) and Stabilized Rental NOI Margin: Stabilized Rental NOI is a non- GAAP supplemental measure that we define as rental revenues less residential property operating expenses of the stabilized rental properties in our rental portfolio. We define Stabilized Rental NOI Margin as Stabilized Rental NOI divided by rental revenues. We consider Stabilized Rental NOI and Stabilized Rental NOI Margin to be meaningful supplemental measures of operating performance because they reflect the operating performance of our stabilized properties without allocation of corporate level overhead or general and administrative costs, acquisition fees and other similar costs and provide insight to the ongoing operations of our business. These measures should be used only as supplements to and not substitutes for net income or loss or net cash flows from operating activities as determined in accordance with GAAP. These net operating income measures should not be used as indicators of funds available to fund cash needs, including distributions and dividends. Although we may use these non-GAAP measures to compare our performance to other REITs, not all REITs may calculate these non-GAAP measures in the same way, and there is no assurance that our calculation is comparable with that of other REITs. While management believes that our calculations are reasonable, there is no standard calculation methodology for Stabilized Rental NOI Margin, and different methodologies could produce materially different results. Turnover Rate: Total number of properties vacated including move-outs and early terminations during the quarter as a percentage of the stabilized rental portfolio. © 2018 Front Yard Residential. All rights reserved. 24

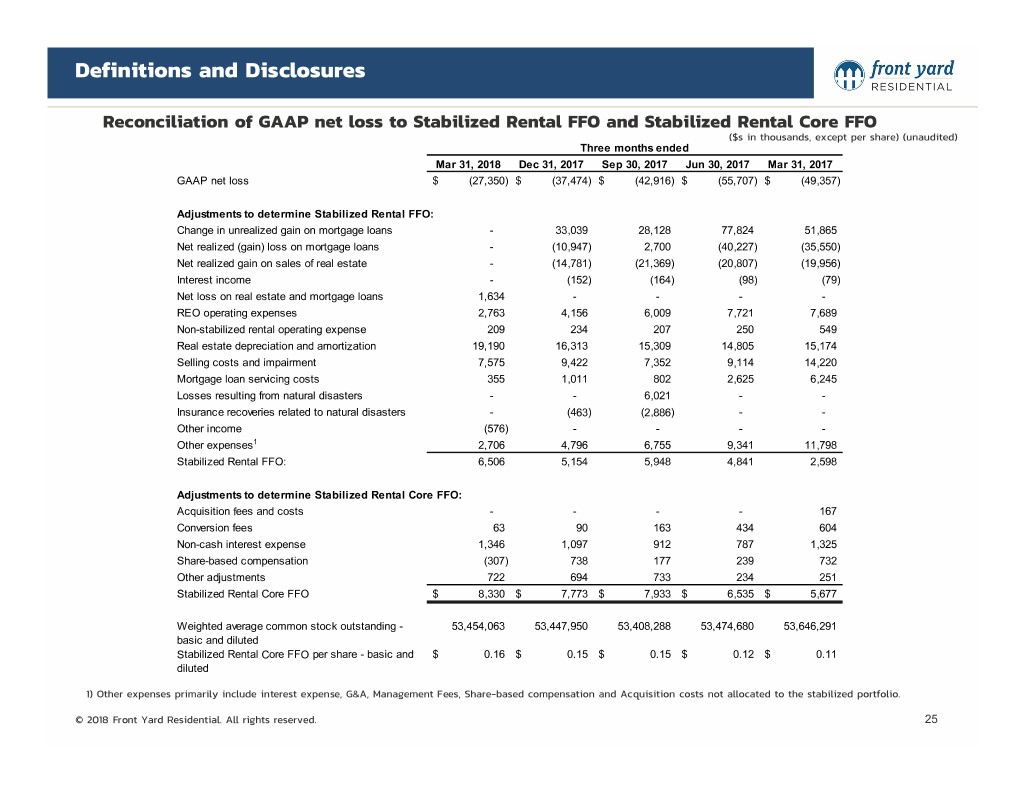

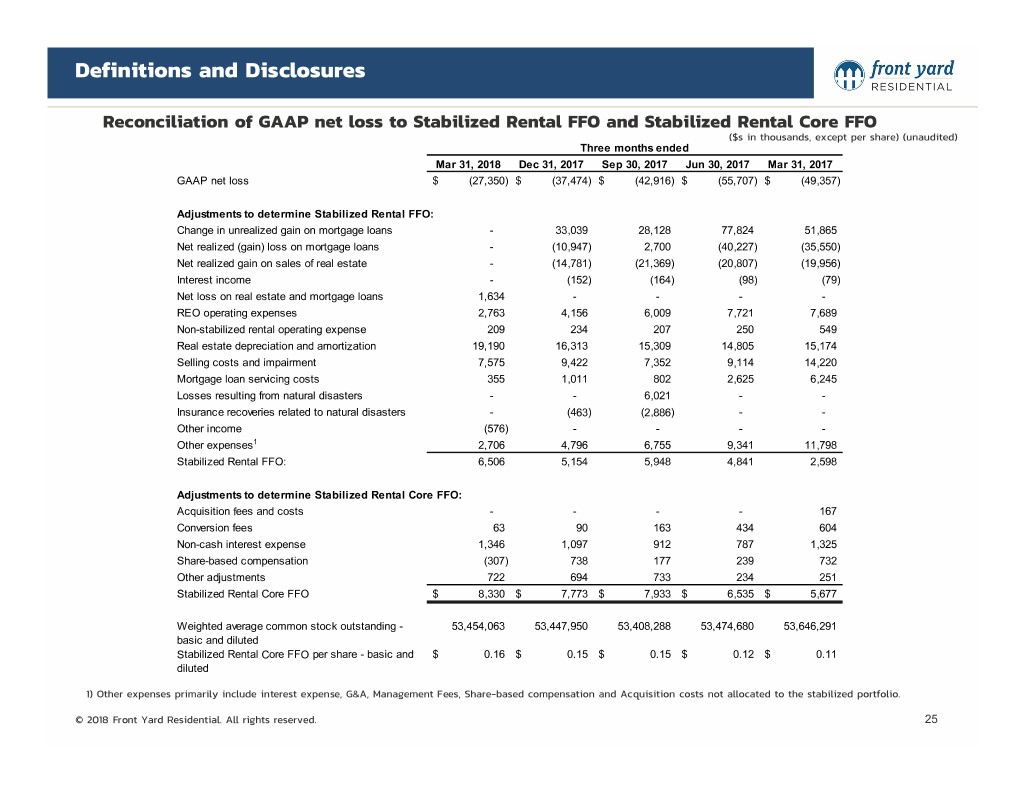

Definitions and Disclosures Reconciliation of GAAP net loss to Stabilized Rental FFO and Stabilized Rental Core FFO ($s in thousands, except per share) (unaudited) Three months ended Mar 31, 2018 Dec 31, 2017 Sep 30, 2017 Jun 30, 2017 Mar 31, 2017 GAAP net loss$ (27,350) $ (37,474) $ (42,916) $ (55,707) $ (49,357) Adjustments to determine Stabilized Rental FFO: Change in unrealized gain on mortgage loans - 33,039 28,128 77,824 51,865 Net realized (gain) loss on mortgage loans - (10,947) 2,700 (40,227) (35,550) Net realized gain on sales of real estate - (14,781) (21,369) (20,807) (19,956) Interest income - (152) (164) (98) (79) Net loss on real estate and mortgage loans 1,634 - - - - REO operating expenses 2,763 4,156 6,009 7,721 7,689 Non-stabilized rental operating expense 209 234 207 250 549 Real estate depreciation and amortization 19,190 16,313 15,309 14,805 15,174 Selling costs and impairment 7,575 9,422 7,352 9,114 14,220 Mortgage loan servicing costs 355 1,011 802 2,625 6,245 Losses resulting from natural disasters - - 6,021 - - Insurance recoveries related to natural disasters - (463) (2,886) - - Other income (576) - - - - Other expenses1 2,706 4,796 6,755 9,341 11,798 Stabilized Rental FFO: 6,506 5,154 5,948 4,841 2,598 Adjustments to determine Stabilized Rental Core FFO: Acquisition fees and costs - - - - 167 Conversion fees 63 90 163 434 604 Non-cash interest expense 1,346 1,097 912 787 1,325 Share-based compensation (307) 738 177 239 732 Other adjustments 722 694 733 234 251 Stabilized Rental Core FFO$ 8,330 $ 7,773 $ 7,933 $ 6,535 $ 5,677 Weighted average common stock outstanding - 53,454,063 53,447,950 53,408,288 53,474,680 53,646,291 basic and diluted Stabilized Rental Core FFO per share - basic and $ 0.16 $ 0.15 $ 0.15 $ 0.12 $ 0.11 diluted 1) Other expenses primarily include interest expense, G&A, Management Fees, Share-based compensation and Acquisition costs not allocated to the stabilized portfolio. © 2018 Front Yard Residential. All rights reserved. 25

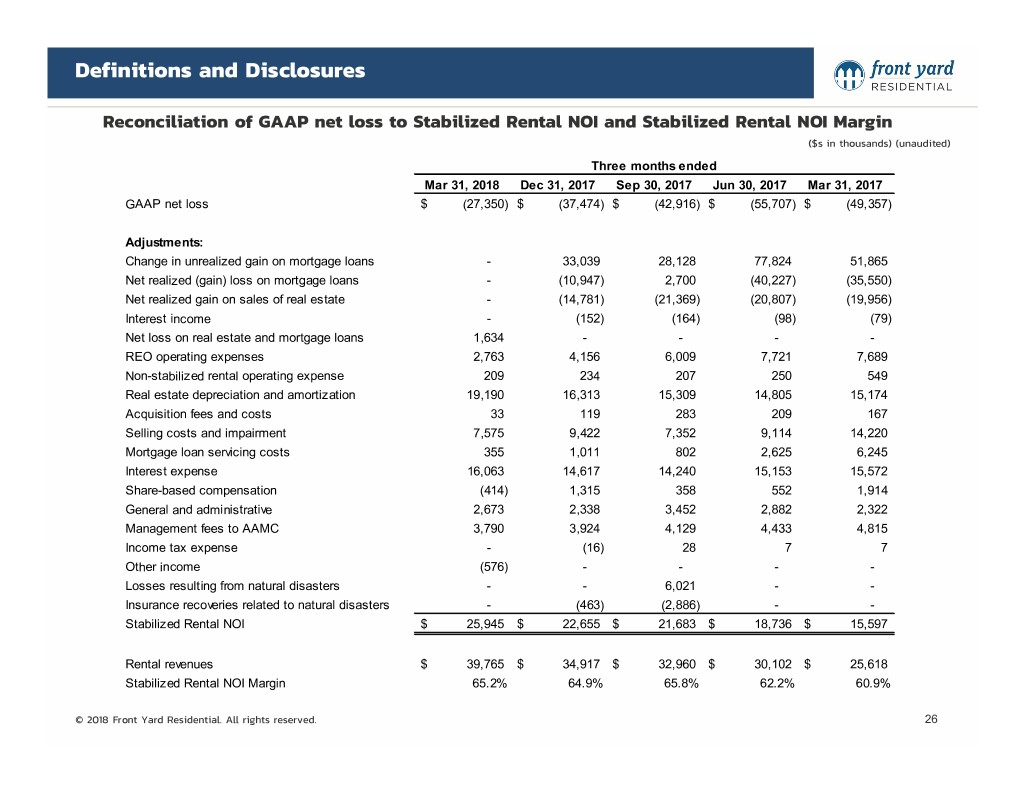

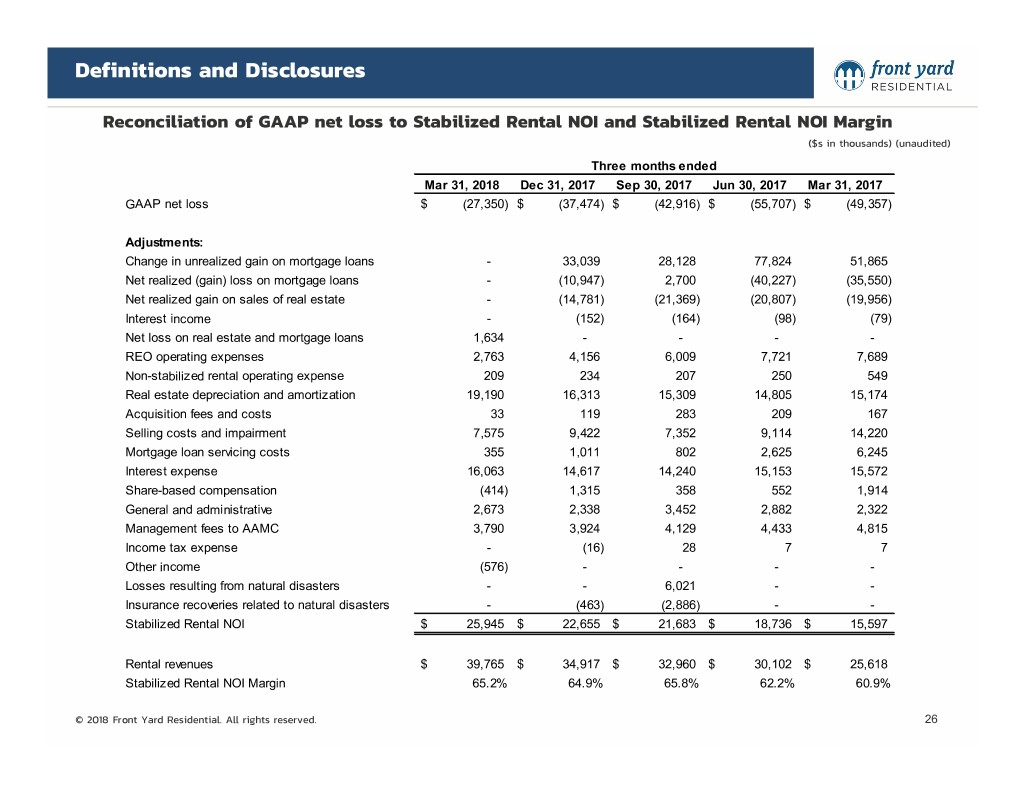

Definitions and Disclosures Reconciliation of GAAP net loss to Stabilized Rental NOI and Stabilized Rental NOI Margin ($s in thousands) (unaudited) Three months ended Mar 31, 2018 Dec 31, 2017 Sep 30, 2017 Jun 30, 2017 Mar 31, 2017 GAAP net loss$ (27,350) $ (37,474) $ (42,916) $ (55,707) $ (49,357) Adjustme nts: Change in unrealized gain on mortgage loans - 33,039 28,128 77,824 51,865 Net realized (gain) loss on mortgage loans - (10,947) 2,700 (40,227) (35,550) Net realized gain on sales of real estate - (14,781) (21,369) (20,807) (19,956) Interest income - (152) (164) (98) (79) Net loss on real estate and mortgage loans 1,634 - - - - REO operating expenses 2,763 4,156 6,009 7,721 7,689 Non-stabilized rental operating expense 209 234 207 250 549 Real estate depreciation and amortization 19,190 16,313 15,309 14,805 15,174 Acquisition fees and costs 33 119 283 209 167 Selling costs and impairment 7,575 9,422 7,352 9,114 14,220 Mortgage loan servicing costs 355 1,011 802 2,625 6,245 Interest expense 16,063 14,617 14,240 15,153 15,572 Share-based compensation (414) 1,315 358 552 1,914 General and administrative 2,673 2,338 3,452 2,882 2,322 Management fees to AAMC 3,790 3,924 4,129 4,433 4,815 Income tax expense - (16) 28 7 7 Other income (576) - - - - Losses resulting from natural disasters - - 6,021 - - Insurance recoveries related to natural disasters - (463) (2,886) - - Stabilized Rental NOI$ 25,945 $ 22,655 $ 21,683 $ 18,736 $ 15,597 Rental revenues$ 39,765 $ 34,917 $ 32,960 $ 30,102 $ 25,618 Stabilized Rental NOI Margin 65.2% 64.9% 65.8% 62.2% 60.9% © 2018 Front Yard Residential. All rights reserved. 26

Thank you. © 2018 Front Yard Residential. All rights reserved. 27