- ZTS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Zoetis (ZTS) DEF 14ADefinitive proxy

Filed: 31 Mar 17, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

Zoetis Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

NOTICE OF

ANNUAL MEETING

AND

PROXY STATEMENT

Zoetis Inc. 10 Sylvan Way Parsippany, NJ 07054 |  |

NOTICE OF 2017 ANNUAL MEETING OF SHAREHOLDERS

WHEN

Thursday, May 11, 2017 10:00 a.m. Eastern Time

WHERE

Hilton Short Hills 41 John F. Kennedy Parkway Short Hills, New Jersey 07078

RECORD DATE

Close of Business on March 17, 2017 | ITEMS OF BUSINESS

1. Election of Class I Directors until the 2020 Annual Meeting of Shareholders for a three-year term as set forth in this proxy statement

2. An advisory vote to approve the company’s executive compensation (Say on Pay)

3. Ratification of the appointment of KPMG LLP as the company’s independent registered public accounting firm for 2017

4. Such other business as may properly come before the Annual Meeting |

PROXY VOTING

Shareholders of record on the Record Date are entitled to vote by proxy in the following ways:

| ||||

|  |  | ||

By calling 1 (800) 652-8683 (toll free) in the United States or Canada | Online at www.envisionreports.com/ZTS | By returning a properly completed, signed and dated proxy card | ||

Sincerely yours,

Heidi C Chen

Executive Vice President,

General Counsel and Corporate Secretary

March 31, 2017

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2017 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 11, 2017:

| ||||

Zoetis Inc.’s Proxy Statement and Annual Report on Form 10-K for the year ended December 31, 2016 are available online at www.edocumentview.com/ZTS. We are furnishing proxy materials to our shareholders primarily via “Notice and Access” delivery. On or about March 31, 2017, we mailed to our shareholders a notice of Internet availability of proxy materials. This notice contains instructions on how to access our proxy statement and 2016 Annual Report and vote online.

|

| ZOETIS 2017 PROXY STATEMENT | ||

This summary highlights certain information in this proxy statement. As it is only a summary, please review the complete Zoetis Inc. (“we”, “us”, “our”, the “company” or “Zoetis”) Proxy Statement and 2016 Annual Report before you vote.

In 2016, our leadership team drove strong operating performance by building on the strength of our business model defined by our three interconnected capabilities that have been critical to our success since becoming a public company: direct customer relationships, innovative research and development and high-quality manufacturing and supply.

| ● | Business Review. We completed the review of our business operations that was launched in 2015, referred to as our “Business Review”, and made significant progress toward our Business Review’s goals of: (1) reducing complexity that does not add value for our customers or our business; (2) optimizing resource allocation and efficiency; and (3) better positioning Zoetis for long-term profitable growth. By the end of 2016, we exited or reduced our footprint in several markets; eliminated approximately 5,000 product stock keeping units from our product portfolio; and implemented organizational changes to create a more efficient, simple and flexible structure for our company. With the progress on our Business Review in 2016, we are on target to exceed our goal of achieving a $300 million reduction in our operating expense base by the end of 2017. |

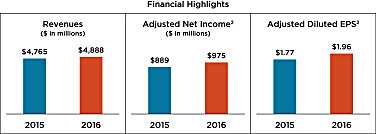

| ● | Financial Highlights. Our 2016 financial performance is highlighted below. |

(For more information please review the Company’s Annual Report on Form 10-K for fiscal year 2016 and this proxy statement.)

| ¡ | Revenues. For full year 2016, reported revenue was $4.888 billion, with revenue growth of 5% on an operational1 basis. We saw strong operational revenue growth in the United States, as well as in a number of our international markets, driven by our diverse portfolio and the successful launch of several new products, particularly in the companion animal business line. |

| ¡ | Adjusted Net Income. Net income for 2016 was $821 million and adjusted net income2 for 2016 was $975 million, reflecting an increase of 10% over 2015. In line with our long-term value proposition, we grew adjusted net income faster than revenue, demonstrating our focus on long-term profitable growth. |

| ¡ | Earnings Per Share (“EPS”). Reported diluted EPS for 2016 was $1.65 per diluted share, compared to $0.68 per diluted share reported in 2015. Adjusted diluted EPS2 for 2016 was $1.96 per diluted share, an increase of 11% over the 2015 amount of $1.77 per diluted share. |

Our 2016 financial performance as compared to 2015 is reflected in the chart below.

| 1 | Operational revenue growth (a non-GAAP financial measure) is defined as revenue growth excluding the impact of foreign exchange. |

| 2 | Adjusted net income and adjusted diluted EPS (non-GAAP financial measures) are defined as reported net income attributable to Zoetis and reported diluted EPS, excluding purchase accounting adjustments, acquisition-related costs and certain significant items such as costs associated with implementing organizational changes resulting from our Business Review and costs associated with becoming an independent public company. Pages 47 to 50 of our 2016 Annual Report on Form 10-K, filed with the SEC on February 16, 2017, contain a reconciliation of these non-GAAP financial measures to reported results under GAAP for 2016. |

| ZOETIS 2017 PROXY STATEMENT | 1 |

PROXY SUMMARY

| ● | Value-Added Investment Opportunities. Our Research & Development (“R&D”) team continued to increase long-term portfolio value in 2016. We received approval for more than 200 new and enhanced products and launched several new important products, including CytopointTM, the first monoclonal antibody licensed for dogs suffering from atopic dermatitis, and Simparica®, a chewable treatment for ticks and fleas in dogs. We also expanded our livestock and companion animal vaccine portfolios. |

| ● | Acquisitions. We executed on our strategy to deploy capital in acquisitions that strengthen our portfolio, including our acquisition of Scandinavian Micro Biodevices, a pioneer in the development and manufacturing of microfluidic “lab on a chip” diagnostic analyzers and tests for veterinary point-of-care services. |

Time and Date

|

Thursday, May 11, 2017, at 10:00 a.m. EDT

| |

Place

|

Hilton Short Hills 41 John F. Kennedy Parkway Short Hills, New Jersey 07078

| |

Record Date

|

Close of business on March 17, 2017

| |

Voting

|

Shareholders on the record date are entitled to one vote per share on each matter to be voted upon at the Annual Meeting.

| |

Admission |

We do not require tickets for admission to the meeting, but we do limit attendance to shareholders on the record date or their proxy holders. Please bring proof of your common share ownership, such as a current brokerage statement, and photo identification.

|

| ELECTION OF DIRECTORS

You are being asked to elect 3 directors – Gregory Norden, Louise M. Parent and Robert W. Scully – to hold office until the 2020 Annual Meeting of Shareholders and until their respective successors are duly elected and qualified, or until their earlier death, resignation or removal. |

| 2 | ZOETIS 2017 PROXY STATEMENT |

PROXY SUMMARY

SUMMARY INFORMATION ABOUT OUR DIRECTOR NOMINEES AND CONTINUING DIRECTORS

Committee Memberships(1) | Qualifications and Experience | |||||||||||||||||||||||

| Name, Occupation and Experience | Age | Director Since | A | C | CG | QI | Life Sciences | M&A | Global | Finance | Public Board | Diversity | ||||||||||||

Director Nominees

| ||||||||||||||||||||||||

Gregory Norden* Former Chief Financial Officer, Wyeth

| 59

| 2013

|

|

| ✓

| ✓

| ✓

| ✓

| ✓

| |||||||||||||||

Louise M. Parent* Former EVP and General Counsel, American Express Company

| 66

| 2013

|

|

| ✓

| ✓

| ✓

| ✓

| ||||||||||||||||

Robert W. Scully* Former Member of Office of Chairman, Morgan Stanley

| 67

| 2013

|

|

| ✓

| ✓

| ✓

| ✓

| ||||||||||||||||

Continuing Directors

| ||||||||||||||||||||||||

Juan Ramón Alaix CEO, Zoetis Inc.

| 65

| 2012

| ✓

| ✓

| ✓

| ✓

| ✓

| |||||||||||||||||

Paul M. Bisaro* President and CEO, Impax Laboratories, Inc.

| 56

| 2015

|

|

| ✓

| ✓

| ✓

| ✓

| ✓

| |||||||||||||||

Frank A. D’Amelio* EVP, Business Operations, and Chief Financial Officer, Pfizer Inc.

| 59

| 2012

| ✓

| ✓

| ✓

| ✓

| ✓

| |||||||||||||||||

Sanjay Khosla* Former EVP, Mondelēz International

| 65

| 2013

|

|

| ✓

| ✓

| ✓

| ✓

| ✓

| |||||||||||||||

Michael B. McCallister* (Board Chair) Former Chairman of the Board and CEO, Humana Inc.

| 64

| 2013

|

| ✓

| ✓

| ✓

| ✓

| |||||||||||||||||

Willie M. Reed* Dean of the College of Veterinary Medicine, Purdue University

| 62

| 2014

|

|

| ✓

| ✓

| ||||||||||||||||||

William C. Steere, Jr.* Chairman Emeritus, Pfizer Inc.

| 80

| 2013

|

|

| ✓

| ✓

| ✓

| ✓

| ✓

| |||||||||||||||

* Independent Director  Chair

Chair  Member

Member

| (1) | A – Audit Committee,C – Compensation Committee,CG – Corporate Governance Committee,QI – Quality and Innovation Committee |

ITEM 1 RECOMMENDATION: OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF MR. NORDEN, MS. PARENT AND MR. SCULLY AS DIRECTORS.

|

| ZOETIS 2017 PROXY STATEMENT | 3 |

PROXY SUMMARY

|

ADVISORY VOTE TO APPROVE OUR EXECUTIVE COMPENSATION (SAY ON PAY)

You are being asked to approve, on an advisory basis, our executive officer compensation program as described in this proxy statement. We believe that our program incentivizes and rewards our leadership for increasing shareholder value and aligns the interests of our leadership with those of our shareholders on an annual and long-term basis. |

The Compensation Committee took several actions in 2016, including:

| ● | Compensation-Related Actions Regarding Change in CFO. Mr. Paul S. Herendeen, Executive Vice President and CFO, resigned from the company effective August 18, 2016. The Board of Directors appointed Mr. Glenn C. David, Senior Vice President, Finance Operations, as the company’s new Executive Vice President and CFO, effective August 19, 2016. Mr. David previously served as the company’s interim CFO in 2014, prior to the hiring of Mr. Herendeen. The Compensation Committee took compensation-related actions in connection with Mr. David’s appointment which are disclosed in the Compensation Discussion and Analysis (“CD&A”) under “2016 Compensation Program and Decisions”. In accordance with applicable Securities and Exchange Commission (“SEC”) rules, the CD&A and the Executive Compensation Tables contained in this proxy statement include compensation information for both Mr. Herendeen and Mr. David. |

| ● | Restricted Stock Units (“RSUs”). For RSUs granted under the Zoetis Inc. 2013 Equity and Incentive Plan beginning in 2017, the Compensation Committee approved enhanced vesting for retirees who are at least age 65 with 10 or more years of service, providing full vesting on the original schedule (all other retirees will continue to receive pro-rata vesting at retirement). This enhancement, which applies to all Zoetis employees eligible to receive long-term incentives (including the Named Executive Officers), was made to recognize the long-term contributions of our full-career retirees by allowing them to retain an important part of their compensation and to better align our program with market practice. All awards are forfeited upon a retirement that occurs within one year after the grant date. |

ITEM 2 RECOMMENDATION: OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTEFOR THE APPROVAL OF OUR EXECUTIVE COMPENSATION.

|

| RATIFICATION OF APPOINTMENT OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2017

You are being asked to ratify our Audit Committee’s appointment of KPMG LLP (“KPMG”) as our independent registered public accounting firm for 2017. KPMG has been our auditor since 2013.

The fees paid to KPMG are detailed on page 57.

One or more representatives of KPMG will be present at the Annual Meeting. They will be given the opportunity to make a statement if they desire to do so, and they will be available to respond to appropriate questions. |

ITEM 3 RECOMMENDATION: OUR BOARD OF DIRECTORS RECOMMENDS THAT

|

| 4 | ZOETIS 2017 PROXY STATEMENT |

CORPORATE GOVERNANCE AT ZOETIS

| ELECTION OF DIRECTORS |

Our Board of Directors currently consists of ten directors divided into three classes. The directors hold office for staggered terms of three years (and until their successors are elected and qualified, or until their earlier death, resignation or removal). One of the three classes is elected each year to succeed the directors whose terms are expiring.

The directors in Class I, whose terms expire at the 2017 Annual Meeting of Shareholders, are Gregory Norden, Louise M. Parent and Robert W. Scully. Each of these directors has been nominated by the Board of Directors, upon the recommendation of its Corporate Governance Committee, to stand for election for a term expiring at the 2020 Annual Meeting of Shareholders. Each of these nominees has consented to being named in this proxy statement as a Board nominee and to serve if elected.

The Corporate Governance Committee considers a number of factors and principles in determining the slate of director nominees for election to the company’s Board, as discussed in the section titled “Director Nominations” below. The Corporate Governance Committee and the Board have evaluated each of Mr. Norden, Ms. Parent and Mr. Scully against the factors and principles Zoetis uses to select nominees for director. Based on this evaluation, the Corporate Governance Committee and the Board have concluded that it is in the best interests of Zoetis and its shareholders for each of Mr. Norden, Ms. Parent and Mr. Scully to continue to serve as a director of Zoetis.

The proxies appointed by the Board intend to vote for the election of Mr. Norden, Ms. Parent and Mr. Scully unless you indicate otherwise on your proxy card or voting instruction form. The Board of Directors has no reason to believe that any of its nominees will refuse or be unable to serve as a director if elected. However, if any nominee is not able to serve, the Board will designate a substitute nominee to serve in his or her place as a director. If any substitute nominee is designated, we will file an amended Proxy Statement and proxy card that, as applicable, identifies the substitute nominee, discloses that such nominee has consented to being named in the revised Proxy Statement and to serve if elected, and includes biographical and other information about such nominee as required by the rules of the SEC. In this situation, the proxies will be voted for such substitute nominee unless you indicate otherwise on your proxy card or voting instruction form.

In order to be elected, a nominee must receive more votes cast “For” than “Against” his or her election. Abstentions and broker non-votes will have no effect on the outcome of the vote. See “Corporate Governance Principles and Practices—Majority Voting Standard for Director Elections” for more information about our procedures if a nominee fails to receive a majority of the votes in an uncontested election.

Our Board of Directors recommends that you vote on your proxy card or voting instruction form “FOR” the election of each of the Board’s nominees for election – Gregory Norden, Louise M. Parent and Robert W. Scully – to serve as directors of Zoetis until our 2020 Annual Meeting and until their successors are elected and qualified, or until their earlier death, resignation or removal. The Board believes that these three nominees have a strong track record of being responsible stewards of shareholders’ interests and of bringing extraordinarily valuable insight, perspective and expertise to the Board. In each individual’s biography set forth on pages 7 and 8, we have highlighted specific experience, qualifications and skills that led the Board to conclude that each individual should continue to serve as a director of Zoetis.

ITEM 1 RECOMMENDATION: OUR BOARD OF DIRECTORS RECOMMENDS THAT AS DIRECTORS.

|

| ZOETIS 2017 PROXY STATEMENT | 5 |

CORPORATE GOVERNANCE AT ZOETIS

OUR DIRECTORS

The following table sets forth certain information regarding the director nominees and the directors of the company whose terms will continue after the Annual Meeting of Shareholders.

| Name | Age(1) | Position(s) with the Company | Term Expires | |||||||

Juan Ramón Alaix

|

| 65

|

| Chief Executive Officer and Director

|

| 2019

|

| |||

Paul M. Bisaro

|

| 56

|

| Director

|

| 2019

|

| |||

Frank A. D’Amelio

|

| 59

|

| Director

|

| 2019

|

| |||

Sanjay Khosla

|

| 65

|

| Director

|

| 2018

|

| |||

Michael B. McCallister

|

| 64

|

| Non-Executive Chair of the Board and Director

|

| 2019

|

| |||

Gregory Norden

|

| 59

|

| Director

|

| 2017

| (2)

| |||

Louise M. Parent

|

| 66

|

| Director

|

| 2017

| (2)

| |||

Willie M. Reed

|

| 62

|

| Director

|

| 2018

|

| |||

Robert W. Scully

|

| 67

|

| Director

|

| 2017

| (2)

| |||

William C. Steere, Jr.

|

| 80

|

| Director

|

| 2018

|

| |||

| (1) | As of March 31, 2017. |

| (2) | Nominee for re-election at the 2017 Annual Meeting for a term expiring in 2020. |

| 6 | ZOETIS 2017 PROXY STATEMENT |

CORPORATE GOVERNANCE AT ZOETIS

OUR DIRECTOR NOMINEES

| GREGORY NORDEN

Age 59 Director since January 2013 |

Former Chief Financial Officer of Wyeth. Prior to his role as Chief Financial Officer of Wyeth, Mr. Norden held various senior positions with Wyeth Pharmaceuticals and American Home Products. Prior to his affiliation with Wyeth, Mr. Norden served as Audit Manager at Arthur Andersen & Co. Mr. Norden currently serves on the boards of NanoString Technologies, a provider of life science tools for translational research and development of molecular diagnostic products; Royalty Pharma, a leader in the acquisition of revenue-producing intellectual property; and Univision, the leading media company serving Hispanic America. Mr. Norden is a former director of Welch Allyn, where he served until 2015; Lumara Health, where he served until 2014; and Human Genome Sciences, Inc., where he served until 2012. In addition, Mr. Norden is the Managing Director of G9 Capital Group LLC, which invests in early stage ventures and provides corporate finance advisory services. Mr. Norden’s background in finance and experience as a senior executive in the global healthcare and pharmaceutical industries make him a valuable member of our Board.

Specific qualifications, experience, skills and expertise:

| ● | Extensive experience in corporate finance, including as former Chief Financial Officer of Wyeth |

| ● | Experience in global healthcare and pharmaceutical industries |

| ● | Background in accounting as an audit manager at a major accounting firm |

| ● | Public company director experience |

| LOUISE M. PARENT

Age 66 Director since August 2013 |

Former Executive Vice President and General Counsel of American Express Company from 2003 to 2013. Since early 2014, Ms. Parent has served as Of Counsel at the law firm of Cleary Gottlieb Steen & Hamilton LLP. Ms. Parent brings deep experience in corporate governance and board matters, and in compliance and risk management, gained during her tenure with American Express, where she worked extensively with the Audit, Compensation and Nomination and Governance committees in her role as General Counsel. Ms. Parent also served on the operating committee and global management team of American Express from 2003 through 2013 and was a member of the board of American Express Centurion Bank through 2013. Ms. Parent currently serves on the Supervisory Board of Deutsche Bank AG. Ms. Parent holds a bachelor’s degree from Smith College and a law degree from Georgetown University Law Center. Ms. Parent’s experience in corporate governance, compliance and risk management and global management makes her a valuable member of our Board.

Specific qualifications, experience, skills and expertise:

| ● | Extensive experience in corporate governance and board matters |

| ● | Extensive experience in compliance and risk management |

| ● | Operating and senior management experience as former General Counsel of American Express |

| ● | Global business experience |

| ● | Legal background |

| ZOETIS 2017 PROXY STATEMENT | 7 |

CORPORATE GOVERNANCE AT ZOETIS

| ROBERT W. SCULLY

Age 67 Director since June 2013 |

Former member of the Office of the Chairman of Morgan Stanley. Mr. Scully has nearly 35 years of experience in the financial services industry. He served as a member of the Office of the Chairman of Morgan Stanley from 2007 until his retirement in January 2009, where he had previously been Co-President of the firm, Chairman of global capital markets and Vice Chairman of investment banking. Prior to joining Morgan Stanley in 1996, he served as a Managing Director at Lehman Brothers and at Salomon Brothers Inc. He currently serves on the boards of KKR & Co. LP, a private equity and asset management firm, and Chubb Limited (formerly ACE Limited), a global property and casualty company. Previously, he served as a director of Bank of America Corporation, GMAC Financial Services and MSCI Inc. and as a Public Governor of FINRA, the Financial Industry Regulatory Authority. Mr. Scully holds a bachelor’s degree from Princeton University and an MBA from Harvard Business School. Mr. Scully’s global management experience, financial acumen, business development knowledge and investor insights make him a valuable member of our Board.

Specific qualifications, experience, skills and expertise:

| ● | Extensive experience in financial services |

| ● | Mergers and acquisitions expertise |

| ● | Global management experience |

| ● | Public company director experience |

| 8 | ZOETIS 2017 PROXY STATEMENT |

CORPORATE GOVERNANCE AT ZOETIS

CONTINUING DIRECTORS

| JUAN RAMÓN ALAIX

Age 65 Director since July 2012 |

Chief Executive Officer of our companysince July 2012. From 2006 to 2012 he served as President of Pfizer Animal Health, and was responsible for its overall strategic direction and financial performance. Under his leadership, the company grew to become a $4.3 billion enterprise in 2012. Mr. Alaix has more than 35 years’ experience in finance and management, including 20 years in the pharmaceutical industry. He joined Pfizer in 2003 and held various positions, including Regional President of Central/Southern Europe for Pfizer’s pharmaceutical business. Prior to that, Mr. Alaix held various positions with Pharmacia, including as Country President of Spain, from 1998 until Pharmacia’s acquisition by Pfizer in 2003. Earlier in his career he served in general management with Rhône-Poulenc Rorer in Spain and Belgium. In 2013, Mr. Alaix completed a two-year term as President of the International Federation for Animal Health (“IFAH”), now known as HealthforAnimals, and he continues to serve as a member of its board and executive committee. HealthforAnimals represents manufacturers of veterinary medicines, vaccines and other animal health products in both developed and emerging markets. A native of Spain, Mr. Alaix received a graduate degree in economics from the Universidad de Madrid. Mr. Alaix’ experience, including his knowledge and leadership of our company, his business and management experience and his experience in the animal health industry make him a valuable member of our Board.

Specific qualifications, experience, skills and expertise:

| ● | Knowledge and leadership of our company as its current CEO and former President of Pfizer Animal Health |

| ● | Experience in animal health industry |

| ● | Global business experience |

| ● | Background in economics |

| PAUL M. BISARO

Age 56 Director since May 2015 |

President and Chief Executive Officer of Impax Laboratories, a specialty pharmaceutical company, since March 27, 2017. Mr. Bisaro was the Executive Chairman of the board of directors of Allergan plc (formerly Actavis plc) from July 2014 to October 2016. Until June 2014, Mr. Bisaro served as Board Chairman, President and Chief Executive Officer of Actavis (formerly Watson Pharmaceuticals). He was appointed President, Chief Executive Officer and a member of the board of Watson Pharmaceuticals in September 2007; and later appointed Chairman of the board of Watson Pharmaceuticals in October 2013. Prior to joining Watson, Mr. Bisaro was President, Chief Operating Officer and a member of the board of Barr Pharmaceuticals, Inc., a global specialty pharmaceutical company, from 1999 to 2007. Between 1992 and 1999, Mr. Bisaro served as General Counsel of Barr, and from 1997 to 1999 served in various additional capacities including Senior Vice President – Strategic Business Development. Prior to joining Barr, Mr. Bisaro was associated with the law firm Winston & Strawn and a predecessor firm, Bishop, Cook, Purcell and Reynolds from 1989 to 1992. Mr. Bisaro currently serves on the board of directors of Allergan plc, Impax Laboratories and Zimmer Biomet Holdings, Inc., a world leader in musculoskeletal health solutions, and on the Board of Visitors of The Catholic University of America’s Columbus School of Law. Mr. Bisaro holds an undergraduate degree in General Studies from the University of Michigan and a Juris Doctor from The Catholic University of America in Washington, D.C. Mr. Bisaro’s business, management and leadership experience; his understanding of the pharmaceutical industry; and his public company board service make him a valuable member of our Board.

Specific qualifications, experience, skills and expertise:

| ● | Extensive business, operations and senior management experience |

| ● | Experience in global healthcare and pharmaceutical industries |

| ● | Public company director experience |

| ZOETIS 2017 PROXY STATEMENT | 9 |

CORPORATE GOVERNANCE AT ZOETIS

| FRANK A. D’AMELIO

Age 59 Director since July 2012 |

Executive Vice President, Business Operations, and Chief Financial Officer of Pfizer since December 2010, where he serves as a member of Pfizer’s Senior Executive Leadership Team. Mr. D’Amelio joined Pfizer in September 2007 and held various positions, including Senior Vice President and Chief Financial Officer. From November 2006 to August 2007, Mr. D’Amelio held the position of Senior Executive Vice President of Integration and Chief Administrative Officer at Alcatel-Lucent, S.A., a global telecommunications equipment company. Prior to the merger of Alcatel and Lucent Technologies in 2006, Mr. D’Amelio was the Chief Operating Officer of Lucent Technologies, responsible for leading business operations, including sales, the product groups, the services business, the supply chain, information technology operations, human resources and labor relations. In 2001, he was appointed Executive Vice President, Administration and Chief Financial Officer of Lucent, where he helped lead the company through one of the most challenging periods in the telecom industry’s history and returned the company to profitability. In this role, Mr. D’Amelio was responsible for management and oversight of all financial, accounting, real estate and labor relations operations and the operational aspects of the legal and human resources organizations. Mr. D’Amelio currently serves as a member of the board of Humana Inc., a health care company that offers a wide range of insurance products and health and welfare services, and as chair of its audit committee. He also serves on the board of the Independent College Fund of New Jersey, and formerly served as a member of the National Advisory Board of JPMorgan Chase & Co. Mr. D’Amelio earned his MBA in Finance from St. John’s University and his bachelor’s degree in Accounting from St. Peter’s College. Mr. D’Amelio’s business, management and leadership experience and his experience serving on the board of another public company make him a valuable member of our Board.

Specific qualifications, experience, skills and expertise:

| ● | Extensive management experience |

| ● | Experience in finance and accounting |

| ● | Global business experience |

| ● | Public company director experience |

| SANJAY KHOSLA

Age 65 Director since June 2013 |

Former Executive Vice President of Mondelēz Internationalfrom 2007 to 2013. Mr. Khosla brings more than 35 years of international business experience from his career with food, beverage and consumer product leaders such as Mondelēz, Kraft and Unilever, where he managed various business units, particularly in developing markets. As President, Kraft Foods, Developing Markets (now Mondelēz International) from 2007 to 2013, Mr. Khosla transformed the $5 billion business into a $16 billion business, while significantly improving profitability. He also has animal health experience from his three-year tenure from 2004 to 2007 as Managing Director of Fonterra Brands and Food Service, a multinational dairy cooperative based in New Zealand. Mr. Khosla serves on the board of NIIT, Ltd., a company involved in technology-related educational services, and Iconix Brand Group, Inc., a company that licenses and markets a portfolio of consumer brands. From October 2008 until June 2015, he served on the board of Best Buy, Inc., a specialty retailer of consumer electronics, personal computers, entertainment software and appliances. Mr. Khosla holds a bachelor’s degree in electrical engineering from the Indian Institute of Technology in New Delhi. Mr. Khosla also completed the Advance Management Program at Harvard Business School. Mr. Khosla is currently a senior fellow and adjunct professor at the Kellogg School of Management, Northwestern University. Mr. Khosla’s international business and management experience and his public company board service make him a valuable member of our Board.

Specific qualifications, experience, skills and expertise:

| ● | Extensive international business and management experience |

| ● | Experience in animal health industry |

| ● | Global operational experience, including in developing markets |

| ● | Public company director experience |

| 10 | ZOETIS 2017 PROXY STATEMENT |

CORPORATE GOVERNANCE AT ZOETIS

| MICHAEL B. MCCALLISTER

Age 64 Director since January 2013; Board Chair since June 2013 |

Former Chairman of the Board and CEO of Humana Inc.from 2010 to 2013. Humana is a health care company that offers a wide range of insurance products and health and welfare services. Mr. McCallister joined Humana in 1974, and was its Chief Executive Officer from February 2000 until his retirement on December 31, 2012. During his tenure as CEO, Humana gained a reputation as one of the industry’s leading people-focused innovative companies, leveraging products, processes and technology to help individuals take control of their own health. Mr. McCallister served for many years on the board of the Business Roundtable and is past Chairman of its Health and Retirement Task Force. He is currently on the boards of AT&T, where he serves on the audit committee, Fifth Third Bank and Bellarmine University. Mr. McCallister holds a bachelor’s degree in accounting from Louisiana Tech University and an MBA from Pepperdine University. Mr. McCallister’s extensive business and management experience in the health care industry and public company board service make him a valuable member of our Board.

Specific qualifications, experience, skills and expertise:

| ● | Extensive business and senior management experience, including as former CEO of Humana |

| ● | Background in accounting |

| ● | Experience in corporate governance |

| ● | Public company director experience |

| WILLIE M. REED

Age 62 Director since March 2014 |

Dean of the College of Veterinary Medicine at Purdue University since 2007. Dr. Reed has more than 30 years of experience in animal health and veterinary medicine, gained during his tenure at Purdue University and Michigan State University, and as a Diplomate of the American College of Veterinary Pathologists and Charter Diplomate of the American College of Poultry Veterinarians. Dr. Reed has served as President of the Association of American Veterinary Medical Colleges, President of the American Association of Veterinary Laboratory Diagnosticians, President of the American Association of Avian Pathologists and Chair of the American Veterinary Medical Association Council on Research. He currently serves on the American Veterinary Medical Association’s Member Services Committee. Dr. Reed has a Doctor of Veterinary Medicine degree from Tuskegee University, and a Ph.D. in Veterinary Pathology from Purdue University. Dr. Reed’s medical expertise, his deep understanding of veterinary medicines and vaccines and his leadership experience in the animal health community make him a valuable member of our Board.

Specific qualifications, experience, skills and expertise:

| ● | Doctorate in veterinary medicine |

| ● | Expert in avian pathology, diagnostic medicine and infectious diseases |

| ● | Scientific understanding of veterinary medicines and vaccines |

| ● | Extensive leadership experience in the animal health community |

| ZOETIS 2017 PROXY STATEMENT | 11 |

CORPORATE GOVERNANCE AT ZOETIS

| WILLIAM C. STEERE, JR.

Age 80 Director since January 2013 |

Chairman Emeritus of Pfizer since July 2001. Mr. Steere joined Pfizer in 1959 and held various positions, including Chief Executive Officer from 1991 until 2000, Chairman of the board of directors from 1992 until 2001, and member of the board of directors until 2011. Mr. Steere also served on the boards of Dow Jones & Company, Inc. until 2007, MetLife, Inc. until 2010 and Health Management Associates, Inc. until 2014. Mr. Steere’s extensive business and management experience, his public company board service and his knowledge of the animal health business obtained through his service with Pfizer make him a valuable member of our Board.

Specific qualifications, experience, skills and expertise:

| ● | Extensive senior management experience, including as former CEO of Pfizer |

| ● | Knowledge of animal health business |

| ● | Global business experience |

| ● | Public company director experience |

| 12 | ZOETIS 2017 PROXY STATEMENT |

CORPORATE GOVERNANCE AT ZOETIS

KEY CORPORATE GOVERNANCE FEATURES

Board Independence and Expertise

| ◾ | All directors are independent other than our CEO |

| ◾ | Board consists of highly qualified, experienced and diverse directors with relevant expertise for overseeing our strategy and business |

Independent Board Chair

| ◾ | Board Chair is an independent director and elected by Board annually |

Board Committees

| ◾ | Four Board committees: Audit, Compensation, Corporate Governance and Quality and Innovation |

| ◾ | All four committees are composed entirely of independent directors |

Executive Sessions

| ◾ | Directors hold regularly scheduled executive sessions, at which directors can discuss matters without management present |

| ◾ | Independent Board Chair presides over all executive sessions of the Board |

Board Oversight of Risk

| ◾ | Risk oversight by full Board and committees |

Proxy Access

| ◾ | Adopted a proxy access right for shareholders |

Accountability

| ◾ | In uncontested director elections, our directors are elected by a majority of the votes cast |

| ◾ | Each share of common stock is entitled to one vote |

| ◾ | Processes in place to facilitate communication with shareholders and other stakeholders, and between our Board, including the Board and committee chairs, and management |

Director Stock Ownership

| ◾ | Each non-employee director is required to hold Zoetis stock worth at least USD $400,000 (including share equivalent units), to be acquired within five years of joining our Board |

Open Lines of Communication

| ◾ | Board promotes open and frank discussions with senior management |

| ◾ | Our directors have access to all members of management and other employees and are authorized to hire outside consultants or experts at the company’s expense |

Board Self-Evaluation

| ◾ | Our Board and each of its committees conduct an annual self-evaluation |

CORPORATE GOVERNANCE PRINCIPLES AND PRACTICES

DIRECTOR INDEPENDENCE

It is the policy of our company, and a requirement under New York Stock Exchange (“NYSE”) listing standards, that a majority of our Board consists of independent directors. To assist it in determining director independence, our Board has adopted categorical independence standards, referred to as our Director Qualification Standards, which meet the independence requirements of the NYSE. Our Director Qualification Standards can be found on our website at www.zoetis.com underAbout Us—Corporate Governance.

To be considered “independent” under our Director Qualification Standards, a director must be determined by our Board to have no material relationship with the company other than as a director. In addition, under our Director Qualification Standards, a director is not independent if the director is, or has been within the last three years, an employee of the company or an employee of a member of the company’s consolidated group for financial reporting.

From January 1, 2016 through May 11, 2016, our Board of Directors consisted of eleven directors, nine of whom were determined by our Board to be independent under our Director Qualification Standards and two of whom were not independent under those standards. The independent directors during this period were Paul M. Bisaro, William Doyle, Louise M. Parent, Willie M. Reed, Sanjay Khosla, Michael B. McCallister, Gregory Norden, Robert W. Scully and William

| ZOETIS 2017 PROXY STATEMENT | 13 |

CORPORATE GOVERNANCE AT ZOETIS

C. Steere, Jr. The non-independent directors during this period were Juan Ramón Alaix and Frank A. D’Amelio. Mr. Alaix is not an independent director because he is employed as the company’s CEO. Prior to June 24, 2016, the third anniversary of our separation from Pfizer, Mr. D’Amelio was considered a non-independent director under NYSE Listing Standards and our Director Qualification Standards. The Board subsequently determined that as of June 24, 2016, the third anniversary of our complete separation from Pfizer, Mr. D’Amelio was an independent director under our Director Qualification Standards and the NYSE listing standards.

On May 12, 2016, Mr. Doyle’s term of service on the Board ended pursuant to a letter agreement with Pershing Square Capital Management, L.P. (“Pershing Square”), Sachem Head Capital Management LP and certain of their respective affiliates, which was filed as an exhibit to our company’s Current Report on Form 8-K, filed with the SEC on February 4, 2015 (the “Letter Agreement”).

On February 14, 2017, our Board completed its annual review of director independence and affirmatively determined that Ms. Parent, Dr. Reed and Messrs. Bisaro, D’Amelio, Khosla, McCallister, Norden, Scully and Steere are independent under NYSE listing standards and our Director Qualification Standards.

BOARD LEADERSHIP STRUCTURE

Our Corporate Governance Principles, which can be found on our website at www.zoetis.com underAbout Us—Corporate Governance, provide the Board flexibility in determining its leadership structure. Currently, Juan Ramón Alaix serves as our CEO and Michael B. McCallister serves as Chair of our Board. The Board believes that this leadership structure, which separates the CEO and the Board Chair roles, is optimal at this time because it allows Mr. Alaix to focus on operating and managing our company, while Mr. McCallister can focus on the leadership of the Board. The Board Chair presides over all meetings of our shareholders and of the Board as a whole, including its executive sessions, and performs such other duties as may be designated in our By-laws or by the Board. The Board will periodically evaluate our leadership structure and determine whether continuing the separate roles of CEO and Board Chair is in the company’s best interest based on circumstances existing at the time.

DIRECTOR ATTENDANCE

During 2016, our Board met six times. Each of our directors attended at least 75% of the meetings of the Board and Board committees on which he or she served during 2016. All Board members are expected to attend our Annual Meeting unless an emergency prevents them from doing so. All of our directors attended our 2016 Annual Meeting.

BOARD COMMITTEE MEMBERSHIP

Our Board has a standing Audit Committee, Compensation Committee, Corporate Governance Committee and Quality and Innovation Committee. The written charter of each of our standing committees is available on our website at www.zoetis.com underAbout Us—Corporate Governance. Each committee has the authority to hire outside advisors at the company’s expense. All of the members of each of our committees are independent under NYSE listing standards and our Director Qualification Standards, and the members of our Audit Committee and Compensation Committee satisfy the additional NYSE independence requirements for members of audit and compensation committees.

| 14 | ZOETIS 2017 PROXY STATEMENT |

CORPORATE GOVERNANCE AT ZOETIS

The following table lists the Chair and current members of each committee and the number of meetings held in 2016.

| Committee | ||||||||||

Name | Independent | Audit | Compensation | Corporate Governance | Quality and Innovation | |||||

Juan Ramón Alaix

| no

| |||||||||

Paul M. Bisaro

| yes

|

|

| |||||||

Frank A. D’Amelio

| yes

| |||||||||

Sanjay Khosla

| yes

|

|

| |||||||

Michael B. McCallister

| yes

|

| ||||||||

Gregory Norden

| yes

|

|

| |||||||

Louise M. Parent

| yes

|

|

| |||||||

Willie M. Reed

| yes

|

|

| |||||||

Robert W. Scully

| yes

|

|

| |||||||

William C. Steere, Jr.

| yes

|

|

| |||||||

Number of Meetings in 2016

| 8

| 8

| 6

| 3

| ||||||

Chair

Chair  Member

Member

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The current members of the Compensation Committee are Robert W. Scully (Chair), Paul M. Bisaro, Sanjay Khosla, Gregory Norden and Louise M. Parent. All of the current members are independent under NYSE listing standards and our Director Qualification Standards. None of the current members is a former or current officer or employee of Zoetis or any of its subsidiaries. None of the current members has any relationship that is required to be disclosed under this caption under the rules of the SEC. During 2016, no executive officers of the company served on the compensation committee (or its equivalent) or board of directors of another entity whose executive officer served on the company’s Compensation Committee or Board.

| ZOETIS 2017 PROXY STATEMENT | 15 |

CORPORATE GOVERNANCE AT ZOETIS

PRIMARY RESPONSIBILITIES OF BOARD COMMITTEES

Board Committees

|

Responsibilities

| |||||

AUDIT COMMITTEE

All Members Independent

All Members Financially Literate

Each of Mr. Norden and Mr. Scully qualifies as an “audit committee financial expert” |

● Responsible for the oversight of the integrity of our financial statements and system of internal controls

● Sole authority and responsibility to select, determine the compensation of, evaluate and, when appropriate, replace our independent audit firm

● Oversees the performance of our internal audit function

● Reviews reports from management, legal counsel and third parties relating to the status of our compliance with laws, regulations and internal procedures

● Oversees our Enterprise Risk Management process

| |||||

COMPENSATION COMMITTEE

All Members Independent |

● Responsible for reviewing and approving our overall compensation philosophy

● Responsible for overseeing the administration of our compensation and benefit programs, policies and practices

● Annually establishes the corporate goals and objectives relevant to the compensation of our CEO, reviews the goals established by our CEO for our other executive officers and evaluates their performance in light of these goals

● Recommends to the Board the compensation of our CEO and approves the compensation of our other executive officers

● Administers our incentive and equity-based compensation plans and oversees the management of risks relating to our compensation plans and arrangements

| |||||

CORPORATE GOVERNANCE COMMITTEE

All Members Independent |

● Responsible for matters of corporate governance and matters relating to the practices, policies and procedures of our Board of Directors

● Identifies and recommends candidates for election to our Board and recommends the members and Chairs of Board committees

● Advises on and recommends director compensation for approval by the Board

● Recommends changes in our corporate governance documents

● Administers our policies and procedures regarding related person transactions

| |||||

QUALITY AND INNOVATION COMMITTEE

All Members Independent |

● Evaluates our strategy, activities, results and investment in research and development and innovation

● Responsible for the oversight of our compliance with systems and other legal and regulatory requirements related to manufacturing quality and environmental, health and safety (“EHS”) matters

● Reviews our manufacturing quality and EHS internal controls and programs and our organizational structure and qualifications of key personnel in supply chain, manufacturing quality and EHS functions

|

BOARD’S ROLE IN RISK OVERSIGHT

The Board of Directors as a whole and through its committees oversees the company’s risk management. Members of senior management regularly report to the Board on areas of material risk to the company. The Board regularly reviews information regarding the company’s strategy, finances, operations, legal and regulatory developments, research and development, manufacturing quality and competitive environment, as well as the risks related to these areas. The Audit Committee oversees our Enterprise Risk Management process, the management of risks related to financial reporting and monitors the annual internal audit risk assessment, which identifies and prioritizes risks related to the company’s internal controls in order to develop internal audit plans for future fiscal years. The Compensation Committee oversees the management of risks relating to our compensation plans and arrangements. The Corporate Governance Committee oversees risks associated with potential conflicts of interest and the management of risks associated with the independence of the Board, as well as the effectiveness of our Corporate Governance Principles and the Board’s compliance with our Code of Business Conduct and Ethics for Members of the Board. The Quality and Innovation Committee oversees risks related to manufacturing quality and environmental, health and safety matters and our strategy and investments in research and development and innovation initiatives. Each committee of the

| 16 | ZOETIS 2017 PROXY STATEMENT |

CORPORATE GOVERNANCE AT ZOETIS

Board provides periodic reports to the full Board regarding their areas of responsibility and oversight. We believe that our Board’s leadership and committee structures, allocation of responsibilities and practices support our efforts to oversee and manage areas of material risk to the company.

MAJORITY VOTING STANDARD FOR DIRECTOR ELECTIONS

Our By-laws contain a majority voting standard for all uncontested director elections. Under this standard, a director is elected only if the votes cast “for” his or her election exceed the votes cast “against” his or her election. Our Corporate Governance Principles provide that every nominee for director is required to agree to tender his or her resignation if he or she fails to receive the required majority vote in an uncontested director election. Our Corporate Governance Committee will recommend, and our Board of Directors will determine, whether or not to accept such resignation. The Board will publicly disclose its decision-making process and the reasons for its decision.

In the event of a contested election, the director nominees will be elected by the affirmative vote of a plurality of the votes cast. Under this standard, in a contested election the directors receiving the highest number of votes in favor of their election will be elected as directors.

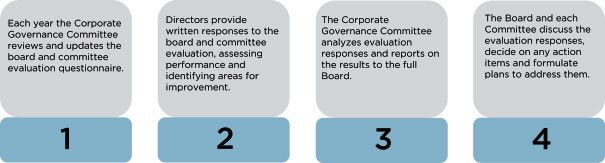

BOARD EVALUATION

Our Board conducts an annual self-evaluation to assess its effectiveness and to identify opportunities for improvement.

DIRECTOR NOMINATIONS

The Corporate Governance Committee considers and recommends the annual slate of director nominees for approval by the full Board. When evaluating director candidates, the Corporate Governance Committee considers, among other factors: the candidate’s integrity; independence; diversity; leadership and ability to exercise sound judgment; animal health or veterinary expertise; prior public company executive experience; significant operations, manufacturing or research and development experience; as well as other areas relevant to the company’s global business. The Corporate Governance Committee is responsible for considering the appropriate size and needs of the Board, and may develop and recommend to the Board additional criteria for Board membership. The company does not have a formal policy with respect to diversity, but diversity of experience among the various Board members is an important factor in the selection of directors.

The Corporate Governance Committee will consider director candidates recommended by shareholders. Recommendations should be sent to the Chair of the Corporate Governance Committee (in the manner described below) by November 18, 2017, to be considered for the following annual meeting. The Corporate Governance Committee evaluates candidates recommended by shareholders under the same criteria it uses for other director candidates. Shareholders may also submit nominees for election at an annual or special meeting of shareholders by following the procedures set forth in our By-laws, which are summarized on page 67.

Since the initial public offering of our stock in 2013, six directors have been elected to our Board: Sanjay Khosla, Robert W. Scully, Louise M. Parent, Willie M. Reed, William F. Doyle (director from February 3, 2015 through May 11, 2016) and Paul M. Bisaro.

| ZOETIS 2017 PROXY STATEMENT | 17 |

CORPORATE GOVERNANCE AT ZOETIS

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Under our Corporate Governance Principles, our CEO is responsible for establishing effective communications with the company’s stakeholder groups, including shareholders, customers, employees, communities, suppliers, creditors, governments, corporate partners and other interested parties. While it is our policy that management speaks for the company, non-employee directors, including the Board Chair, may meet with stakeholders, but in most circumstances such meetings will be held with management present.

Stakeholders and other interested parties may communicate with the following Board and committee Chairs at the following email addresses:

Board Chair

| BoardChair@zoetis.com

| |

Audit Committee Chair

| AuditChair@zoetis.com

| |

Compensation Committee Chair

| CompChair@zoetis.com

| |

Corporate Governance Committee Chair

| CorpGovChair@zoetis.com

| |

Quality and Innovation Committee Chair

| QandIChair@zoetis.com

| |

Stakeholders and other interested parties may also write to any of our outside directors, including the Board and committee Chairs, by directing the communication to Katherine H. Walden, Vice President, Chief Governance Counsel and Assistant Secretary, Zoetis Inc., 10 Sylvan Way, Parsippany, NJ 07054.

Communications are distributed to the Board, or to any individual director as appropriate, depending on the facts and circumstances outlined in the communication, but excluding spam, junk mail and mass mailings, product complaints, product inquiries, new product suggestions, job inquiries, surveys and business solicitations or advertisements. Material that is unduly hostile, threatening, illegal or similarly unsuitable will also be excluded. However, any communication that is filtered out under our policy will be made available to any non-management director upon his or her request.

We believe that it is important for directors to directly hear concerns expressed by stakeholders and other interested parties. It is our policy that all Board members are expected to attend the Annual Meeting. All Board members attended our 2016 Annual Meeting of Shareholders.

CODE OF ETHICS

All of our employees, including our CEO, Chief Financial Officer and Controller, are required to abide by our policies on business conduct to ensure that our business is conducted in a consistently legal and ethical manner. A copy of the Code of Conduct can be found on our website www.zoetis.com underAbout Us—Corporate Compliance. We have also adopted a separate Code of Business Conduct and Ethics for members of our Board of Directors, a copy of which can be found on our website www.zoetis.com underAbout Us—Corporate Governance. We will disclose any future amendments to, or waivers from, provisions of these Codes affecting our directors or executive officers on our website as required under applicable SEC and NYSE rules.

2016 COMPENSATION OF DIRECTORS

We provide competitive compensation to our non-employee directors that enables us to attract and retain high quality directors, provides them with compensation at a level that is consistent with our compensation objectives and encourages their ownership of our stock to further align their interests with those of our shareholders. Our directors who are our full-time employees receive no additional compensation for service as a member of our Board of Directors.

| 18 | ZOETIS 2017 PROXY STATEMENT |

CORPORATE GOVERNANCE AT ZOETIS

For 2016, our non-employee directors’ compensation consisted of an annual cash retainer for each non-employee director of $100,000 and an equity retainer to each non-employee director upon his or her first election as such and annually thereafter with a value of $170,000 on the date of grant, based upon the closing price of shares of Zoetis common stock on that date. The equity retainer is in the form of restricted stock units which are subject to three-year cliff vesting, remaining unvested until the third anniversary of the date of grant.

| 2016 Annual Director Compensation | 2016 Additional Director Compensation | |||

|

Board Chair: An additional $150,000 annual cash retainer | |||

Committee Chairs: An additional $25,000 annual cash retainer

| ||||

During 2016, we granted equity retainers in the form of restricted stock units, valued at $170,000 in the aggregate for each director on the date of grant, as follows:

| ● | To each of Ms. Parent, Dr. Reed and Messrs. Bisaro, D’Amelio, Khosla, Norden, McCallister, Scully and Steere, 4,064 restricted stock units valued at $41.83 per share. |

Each restricted stock unit earns dividend equivalents which are credited as additional restricted stock units. Each non-employee director has a right to receive the shares of Zoetis common stock underlying the restricted stock units on the third anniversary of the date of grant of the restricted stock units (or in the case of dividend equivalents, on the third anniversary of the date of grant of the underlying restricted stock units), subject to the director’s continued service through such vesting date and subject to earlier vesting and settlement upon certain specific events.

We have adopted share ownership guidelines applicable to non-employee directors, requiring the directors to hold Zoetis shares with a value of four times their annual cash retainer of $100,000. For purposes of satisfying these requirements, (a) a director’s holdings of the company’s stock shall include, in addition to shares held outright, units granted to the director as compensation for Board service and shares or units held under a deferral or similar plan, and (b) each such unit shall have the same value as a share of the company’s common stock. Each non-employee director has five years from (y) the date upon which the guidelines were established, or (z) if later, the date of his or her first election as a director, to achieve the share ownership requirement.

William F. Doyle was appointed to serve as a director of our company on February 3, 2015. Mr. Doyle’s appointment was pursuant to the Letter Agreement with Pershing Square. Prior to leaving the Board on May 12, 2016, Mr. Doyle was eligible to participate in our company’s non-employee director compensation program and he voluntarily waived any compensation from our company in respect of his services as a Board member. Mr. Doyle was a member of Pershing Square and was independently compensated by Pershing Square; the Letter Agreement provided that no compensation paid by Pershing Square to Mr. Doyle would depend directly or indirectly on the performance of our company or its stock price (although compensation arrangements based on the overall value of the funds Pershing Square manages will not be considered to be restricted arrangements unless the value of such funds depended primarily on the performance of our company or our stock price).

| ZOETIS 2017 PROXY STATEMENT | 19 |

CORPORATE GOVERNANCE AT ZOETIS

The following table summarizes the total compensation earned in 2016 by each of our directors who served as a non-employee director during 2016.

| Name | Fees Earned or Paid in Cash($)(1) | Stock Awards ($)(2)(3) | Option Awards($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Non- Qualified Deferred Compensation Earnings($) | All Other Compensation ($) | Total ($) | |||||||||||||

Paul M. Bisaro(4)

| $

| 112,500

|

| $

| 170,000

|

| –

| –

| –

| –

| $

| 282,500

|

| |||||||

Frank A. D’Amelio(5)

| $

| 100,000

|

| $

| 170,000

|

| –

| –

| –

| –

| $

| 270,000

|

| |||||||

Sanjay Khosla(5)

| $

| 100,000

|

| $

| 170,000

|

| –

| –

| –

| –

| $

| 270,000

|

| |||||||

Michael B. McCallister(6)

| $

| 275,000

|

| $

| 170,000

|

| –

| –

| –

| –

| $

| 445,000

|

| |||||||

Gregory Norden(7)

| $

| 125,000

|

| $

| 170,000

|

| –

| –

| –

| –

| $

| 295,000

|

| |||||||

Louise M. Parent(5)

| $

| 100,000

|

| $

| 170,000

|

| –

| –

| –

| –

| $

| 270,000

|

| |||||||

Willie M. Reed(5)

| $

| 100,000

|

| $

| 170,000

|

| –

| –

| –

| –

| $

| 270,000

|

| |||||||

Robert W. Scully(8)

| $

| 125,000

|

| $

| 170,000

|

| –

| –

| –

| –

| $

| 295,000

|

| |||||||

William C. Steere, Jr.(5)

| $

| 100,000

|

| $

| 170,000

|

| –

| –

| –

| –

| $

| 270,000

|

| |||||||

| (1) | Non-employee directors may defer the receipt of up to 100% of their annual cash retainer into a notional stock unit account under the Zoetis Non-Employee Director Deferred Compensation Plan. Any deferrals under this plan are credited as phantom stock units in the Zoetis stock fund, with each phantom unit representing one share of Zoetis common stock. Phantom units receive dividend equivalent rights but do not receive voting rights. Phantom stock units are settled in cash following the director’s separation from service and may be transferred into an alternate investment fund at any time, subject to the limitations described in the Zoetis Non-Employee Director Deferred Compensation Plan. During 2016, two directors, Ms. Parent and Mr. Steere, deferred all of their cash retainers into their respective Non-Employee Director Deferred Compensation Plan accounts. |

| (2) | The amounts in the Stock Awards column reflect the aggregate grant date value of restricted stock units granted to directors in 2016 calculated in accordance with FASB ASC Topic 718. The grant date fair value of each restricted stock unit granted to a non-employee director on February 19, 2016, was $41.83. Restricted stock units accrue dividend equivalents, the value of which is factored into the grant date fair value. Restricted stock units vest and are settled in shares of Zoetis common stock on the third anniversary of the date of grant, subject to the director’s continued service through such vesting date and subject to earlier vesting and settlement upon certain specified events. Dividend equivalents vest and are settled in shares of Zoetis common stock on the third anniversary of the date of grant of the underlying restricted stock units, subject to the director’s continued service through such vesting date and subject to earlier vesting and settlement upon certain specified events. At the end of 2016, the aggregate number of restricted stock units (including dividend equivalents) held by each current non-employee director was as follows: Mr. Bisaro, 7,943; Mr. D’Amelio, 7,826; Mr. Khosla, 7,826; Mr. McCallister, 7,826; Mr. Norden, 7,826; Ms. Parent, 7,826; Dr. Reed, 7,826; Mr. Scully, 7,826; and Mr. Steere, 7,826. |

| (3) | Prior to 2015, each non-employee director was granted an equity retainer in the form of deferred stock units upon his or her election to the Board and annually thereafter. Deferred stock units vest fully on the date of grant, accrue dividend equivalents and are settled in Zoetis common stock only upon the director’s separation from service with the company. At the end of 2016, the aggregate number of deferred stock units (including dividend equivalents) held by each current non-employee director was as follows: Mr. D’Amelio, 9,417; Mr. Khosla, 9,417; Mr. McCallister, 10,180; Mr. Norden, 10,180; Ms. Parent, 9,417; Dr. Reed, 4,631; Mr. Scully, 9,417; and Mr. Steere, 10,180. |

| (4) | Represents (a) a cash retainer of $100,000 for service to the Board as a non-employee director during 2016, (b) a prorated cash retainer of $12,500 for service as Chair of the Quality and Innovation Committee during the second half of 2016 and (c) an equity retainer of 4,064 restricted stock units granted on February 19, 2016. |

| (5) | Represents (a) a cash retainer of $100,000 for service to the Board as a non-employee director during 2016 and (b) an equity retainer of 4,064 restricted stock units granted on February 19, 2016. |

| (6) | Represents (a) a cash retainer of $100,000 for service to the Board as a non-employee director during 2016, (b) a cash retainer of $150,000 for service as Chair of the Board during 2016, (c) a cash retainer of $25,000 for service as Chair of the Corporate Governance Committee during 2016 and (d) an equity retainer of 4,064 restricted stock units granted on February 19, 2016. |

| (7) | Represents (a) a cash retainer of $100,000 for service to the Board as a non-employee director during 2016, (b) a cash retainer of $25,000 for service as Chair of the Audit Committee during 2016 and (c) an equity retainer of 4,064 restricted stock units granted on February 19, 2016. |

| (8) | Represents (a) a cash retainer of $100,000 for service to the Board as a non-employee director during 2016, (b) a cash retainer of $25,000 for service as Chair of the Compensation Committee during 2016 and (c) an equity retainer of 4,064 restricted stock units granted on February 19, 2016. |

| 20 | ZOETIS 2017 PROXY STATEMENT |

CORPORATE GOVERNANCE AT ZOETIS

DIRECTOR COMPENSATION DECISIONS FOR 2017

Effective January 1, 2017, our non-employee directors’ compensation will consist of the following:

| 2017 Annual Director Compensation | 2017 Additional Director Compensation | |||

|

Board Chair: An additional $150,000 annual cash retainer | |||

Committee Chairs: An additional $25,000 annual cash retainer

| ||||

For 2017, our non-employee directors’ compensation will consist of an annual cash retainer for each non-employee director of $100,000 and an equity retainer to each non-employee director upon his or her first election as such and annually thereafter with a value of $200,000 on the date of grant, based upon the closing price of shares of Zoetis common stock on that date. The equity retainer is in the form of restricted stock units which are subject to three-year cliff vesting, remaining unvested until the third anniversary of the date of grant.

| ZOETIS 2017 PROXY STATEMENT | 21 |

This page intentionally left blank.

| 22 | ZOETIS 2017 PROXY STATEMENT |

| ADVISORY VOTE TO APPROVE OUR EXECUTIVE COMPENSATION (SAY ON PAY) |

We are seeking your vote, on an advisory basis, on the compensation of our named executive officers as described in the Compensation Discussion and Analysis and the Executive Compensation Tables and accompanying narrative disclosure, as provided on pages 24 to 55 of this proxy statement. While the vote is not binding on the Board, the Compensation Committee will consider the outcome of the vote when making future executive compensation decisions.

For background, Section 14A of the Exchange Act of 1934 (the “Exchange Act”) requires an advisory vote on the frequency of shareholder votes on executive compensation. We conducted this advisory vote on frequency at our 2014 Annual Meeting of Shareholders. At that meeting, our shareholders agreed, and our Board subsequently approved, that the advisory vote on executive compensation be held on an annual basis.

Our Board of Directors believes that our executive compensation program incentivizes and rewards our leadership for increasing shareholder value and aligns the interests of our leadership with those of our shareholders on an annual and long-term basis.

ITEM 2 RECOMMENDATION: OUR BOARD OF DIRECTORS RECOMMENDS THAT

|

| ZOETIS 2017 PROXY STATEMENT | 23 |

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

EXECUTIVE SUMMARY

In this Compensation Discussion and Analysis (“CD&A”) we describe our executive compensation philosophy and programs and the compensation decisions made by the Compensation Committee of the Board of Directors of Zoetis Inc. (the “Committee”) regarding compensation of our named executive officers (“NEOs”) during 2016.

Zoetis’ executive compensation program is designed to incent and reward our leadership for increasing shareholder value and align the interests of leadership with those of our shareholders on an annual and long-term basis.

Our NEOs for 2016, whose compensation is discussed in this CD&A and shown in the Executive Compensation Tables below, are:

| NEO | Title | |

Juan Ramón Alaix

| Chief Executive Officer (“CEO”)

| |

Glenn C. David | Executive Vice President and Chief Financial Officer (“CFO”) since August 19, 2016

| |

Kristin C. Peck | Executive Vice President and President of U.S. Operations

| |

Clinton A. Lewis, Jr. | Executive Vice President and President of International Operations

| |

Catherine A. Knupp | Executive Vice President and President of Research and Development

| |

Paul S. Herendeen | Executive Vice President and CFO through August 18, 2016

| |

2016 BUSINESS HIGHLIGHTS

In 2016, our leadership team drove strong operating performance by building on the strength of our business model defined by our three interconnected capabilities that have been critical to our success since becoming a public company: direct customer relationships, innovative research and development and high-quality manufacturing and supply.

| ● | Business Review. We completed the review of our business operations that was launched in 2015, referred to as our “Business Review”, and made significant progress toward our Business Review’s goals of: (1) reducing complexity that does not add value for our customers or our business; (2) optimizing resource allocation and efficiency; and (3) better positioning Zoetis for long-term profitable growth. By the end of 2016, we: |

| ¡ | Completed the exit or reduction of our footprint in several markets; |

| ¡ | Eliminated approximately 5,000 product stock keeping units (“SKUs”) from our product portfolio; and |

| ¡ | Implemented organizational changes to create a more efficient, simple and flexible structure for our company. |

With the progress on our Business Review in 2016, we are on target to exceed our goal of achieving a $300 million reduction in our operating expense base by the end of 2017.

| ● | Financial Highlights. Our 2016 financial performance is highlighted below. |

(For more information please review the Company’s Annual Report on Form 10-K for fiscal year 2016 and this proxy statement.)

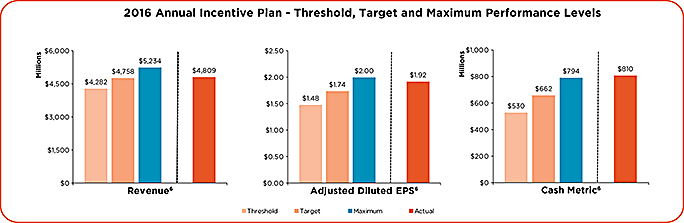

| ¡ | Revenues. For full year 2016, reported revenue was $4.888 billion, with revenue growth of 5% on an operational3 basis. We saw strong operational revenue growth in the United States, as well as in a number of our international markets, driven by our diverse portfolio and the successful launch of several new products, particularly in the companion animal business line. |

| 3 | Operational revenue growth (a non-GAAP financial measure) is defined as revenue growth excluding the impact of foreign exchange. |

| 24 | ZOETIS 2017 PROXY STATEMENT |

EXECUTIVE COMPENSATION

| ¡ | Adjusted Net Income. Net income for 2016 was $821 million and adjusted net income4 for 2016 was $975 million, reflecting an increase of 10% over 2015. In line with our long-term value proposition, we grew adjusted net income faster than revenue, demonstrating our focus on long-term profitable growth. |

| ¡ | Earnings Per Share(“EPS”). Reported diluted EPS for 2016 was $1.65 per diluted share, compared to $0.68 per diluted share reported in 2015. Adjusted diluted EPS4 for 2016 was $1.96 per diluted share, an increase of 11% over the 2015 amount of $1.77 per diluted share. |

Our 2016 financial performance as compared to 2015 is reflected in the chart below.

| ● | Value-Added Investment Opportunities. Our Research & Development (“R&D”) team continued to increase long-term portfolio value in 2016. We received approval for more than 200 new and enhanced products and launched several new important products, including CytopointTM, the first monoclonal antibody licensed for dogs suffering from atopic dermatitis, and Simparica®, a chewable treatment for ticks and fleas in dogs. We also expanded our livestock and companion animal vaccine portfolios. |

| ● | Acquisitions. We executed on our strategy to deploy capital in acquisitions that strengthen our portfolio, including our acquisition of Scandinavian Micro Biodevices, a pioneer in the development and manufacturing of microfluidic “lab on a chip” diagnostic analyzers and tests for veterinary point-of-care services. |

2016 COMPENSATION HIGHLIGHTS

The Committee took several actions in 2016, including:

| ● | Compensation-Related Actions Regarding Change in CFO. Mr. Paul S. Herendeen, Executive Vice President and CFO, resigned from the company effective August 18, 2016. The Board of Directors appointed Mr. Glenn C. David, Senior Vice President, Finance Operations, as the company’s new Executive Vice President and CFO, effective August 19, 2016. Mr. David previously served as the company’s interim CFO in 2014, prior to the hiring of Mr. Herendeen. The Committee took compensation-related actions in connection with Mr. David’s appointment which are disclosed below under “2016 Compensation Program and Decisions”. In accordance with applicable SEC rules, this CD&A and the Executive Compensation Tables contained in this proxy statement include compensation information for both Mr. Herendeen and Mr. David. |

| 4 | Adjusted net income and adjusted diluted EPS (non-GAAP financial measures) are defined as reported net income attributable to Zoetis and reported diluted EPS, excluding purchase accounting adjustments, acquisition-related costs and certain significant items such as costs associated with implementing organizational changes resulting from our Business Review and costs associated with becoming an independent public company. Pages 47 to 50 of our 2016 Annual Report on Form 10-K, filed with the SEC on February 16, 2017, contain a reconciliation of these non-GAAP financial measures to reported results under GAAP for 2016. |

| ZOETIS 2017 PROXY STATEMENT | 25 |

EXECUTIVE COMPENSATION

| ● | Restricted Stock Units (“RSUs”). For RSUs granted under the Zoetis Inc. 2013 Equity and Incentive Plan (the “Equity Plan”) beginning in 2017, the Committee approved enhanced vesting for retirees who are at least age 65 with 10 or more years of service, providing full vesting on the original schedule (all other retirees will continue to receive pro-rata vesting at retirement). This enhancement, which applies to all Zoetis employees eligible to receive long-term incentives (including our NEOs), was made to recognize the long-term contributions of our full-career retirees by allowing them to retain an important part of their compensation and to better align our program with market practice. All awards are forfeited upon a retirement that occurs within one year after the grant date. |

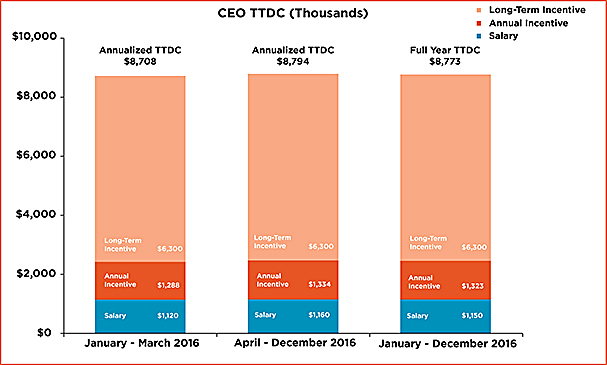

CEO COMPENSATION: AT A GLANCE

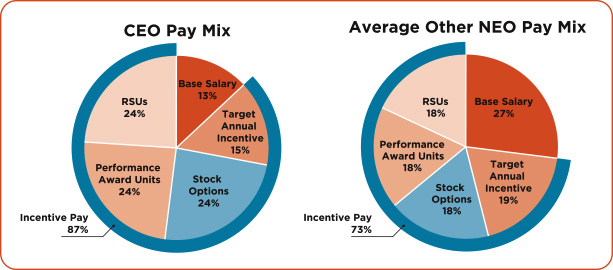

Components of CEO Target Total Direct Compensation

Mr. Alaix’ target total direct compensation is comprised of base salary, target annual incentive compensation opportunity and target long-term incentive compensation opportunity.

Base Salary and Annual Incentive

Mr. Alaix’ base salary for the first three months of 2016 was $1,120,000 and his target annual incentive opportunity for that three-month period was 115% of his base salary, providing for annualized target total cash compensation of $2,408,000.