Exhibit 99.2

Exhibit 99.2

NAPTP 2013 MLP

Investor Conference

May 22, 2013

Mark Newman

Senior Vice President and

Chief Financial Officer

Forward-Looking Statements

Some of the information included in this presentation constitutes “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All statements in this presentation that express opinions, expectations, beliefs, plans, objectives, assumptions or projections with respect to anticipated future performance of SunCoke Energy, Inc. (“SunCoke”) or SunCoke Energy Partners, L.P. (“Partnership”), in contrast with statements of historical facts, are forward-looking statements. Such forward-looking statements are based on management’s beliefs and assumptions and on information currently available. Forward-looking statements include information concerning possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance improvements, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and may be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “will,” “should” or the negative of these terms or similar expressions.

Although management believes that its plans, intentions and expectations reflected in or suggested by the forward-looking statements made in this presentation are reasonable, no assurance can be given that these plans, intentions or expectations will be achieved when anticipated or at all. Moreover, such statements are subject to a number of assumptions, risks and uncertainties. Many of these risks are beyond the control of SunCoke and the Partnership, and may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Each of SunCoke and the Partnership has included in its filings with the Securities and Exchange Commission (including, in the case of the Partnership, its Form S-1) cautionary language identifying important factors ( factors) that could cause actual results to differ materially from those expressed in any forward-looking statement. For more information concerning these factors, see the Securities and Exchange Commission filings of SunCoke and the Partnership. All forward-looking statements included in this presentation are expressly qualified in their entirety by such cautionary statements. Although forward-looking statements are based on current beliefs and expectations, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date hereof. Neither SunCoke nor the Partnership has any intention or obligation to update publicly any forward-looking statement (or its associated cautionary language) whether events or after the date of this presentation, except as required by applicable law.

This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of the presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in the Appendix.

NAPTP 2013 MLP Annual Investor Conference

3

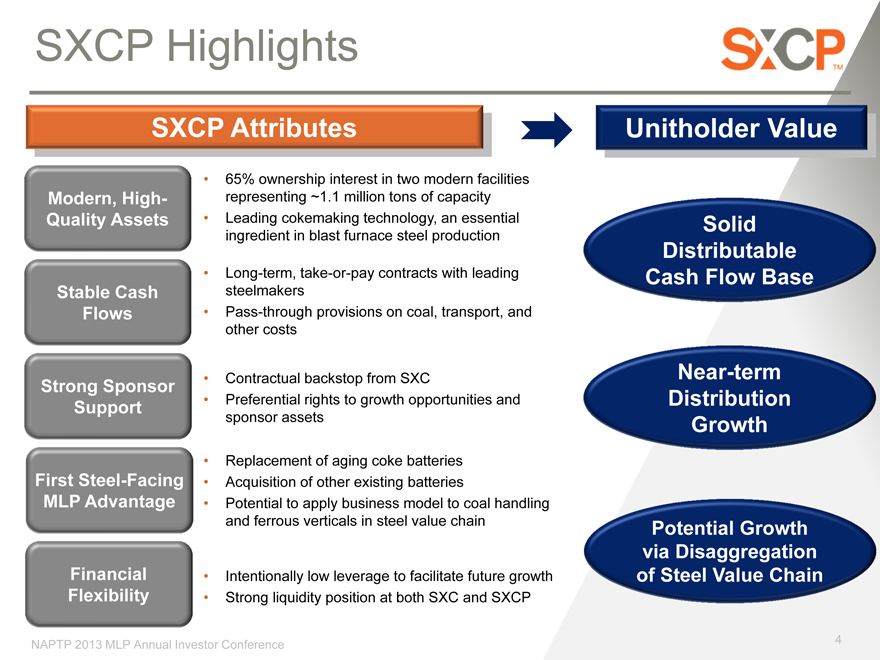

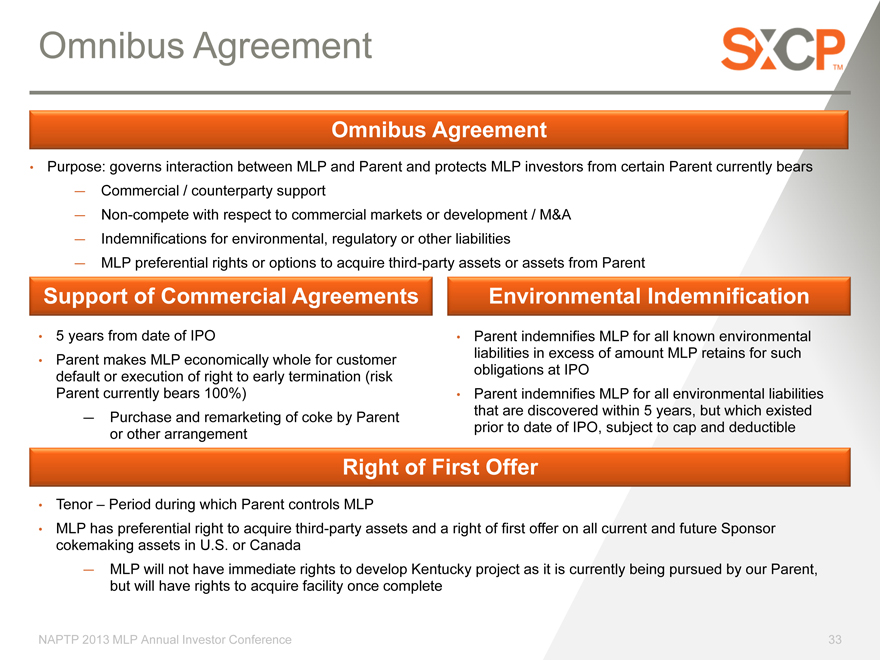

SXCP Highlights

SXCP Attributes

Modern, High-Quality Assets

Stable Cash Flows

Strong Sponsor Support

First Steel-Facing MLP Advantage

Financial Flexibility

65% ownership interest in two modern facilities representing ~1.1 million tons of capacity

Leading cokemaking technology, an essential ingredient in blast furnace steel production

Long-term, take-or-pay contracts with leading steelmakers

Pass-through provisions on coal, transport, and other costs

Contractual backstop from SXC

Preferential rights to growth opportunities and sponsor assets

Replacement of aging coke batteries

Acquisition of other existing batteries

Potential to apply business model to coal handling and ferrous verticals in steel value chain

Intentionally low leverage to facilitate future growth

Strong liquidity position at both SXC and SXCP

Unitholder Value

Solid Distributable Cash Flow Base

Near-term Distribution Growth

Potential Growth via Disaggregation of Steel Value Chain

NAPTP 2013 MLP Annual Investor Conference

4

Video: This is SXCP

The “This is SXCP” video is available for viewing on the SunCoke Energy Partners, L.P. website:

http://www.sxcpartners.com/phoenix.zhtml c=251513&p=index

NAPTP 2013 MLP Annual Investor Conference

5

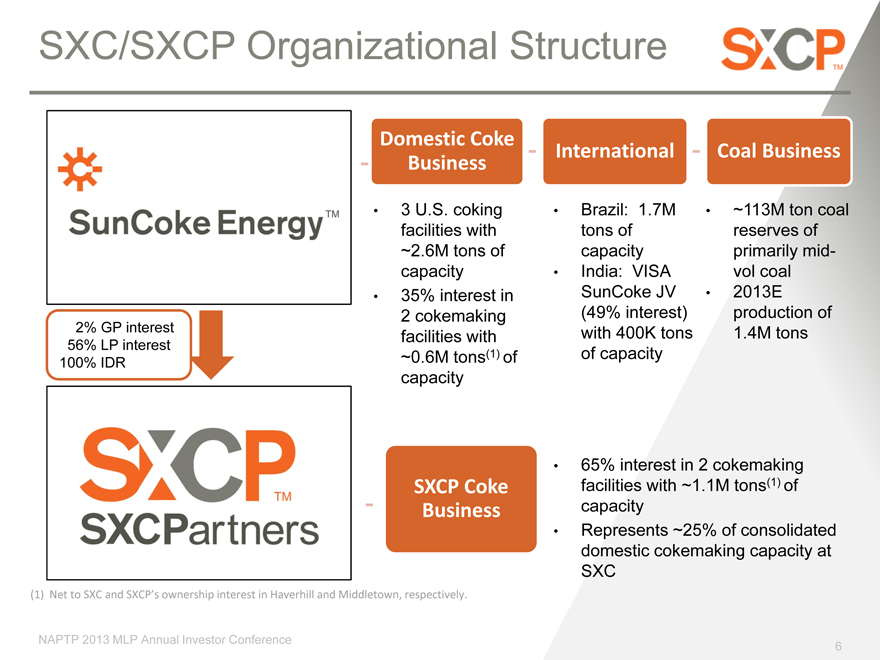

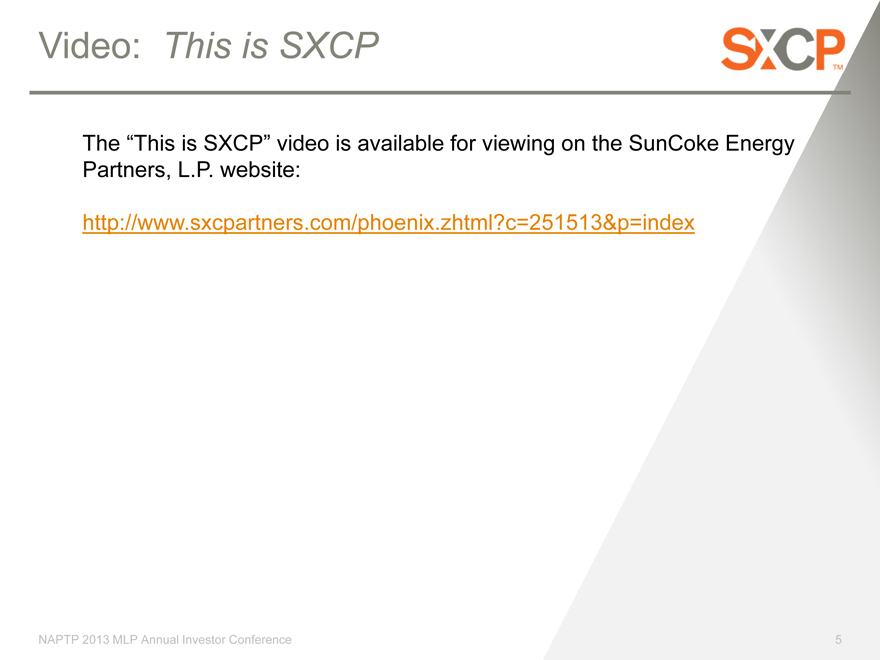

SXC/SXCP Organizational Structure

2% GP interest 56% LP interest 100% IDR

Domestic Coke

Business

• 3 U.S. coking

facilities with

~2.6M tons of

capacity

• 35% interest in

2 cokemaking

facilities with

~0.6M tons(1) of

capacity

International

• Brazil: 1.7M

tons of

capacity

• India: VISA

SunCoke JV

(49% interest)

with 400K tons

of capacity

Coal Business

~113M ton coal

reserves of

primarily mid-

vol coal

2013E

production of

1.4M tons

SXCP Coke Business

65% interest in 2 cokemaking facilities with ~1.1M tons(1) of capacity

Represents ~25% of consolidated domestic cokemaking capacity at SXC

(1) Net to SXC and SXCP’s ownership interest in Haverhill and Middletown, respectively.

NAPTP 2013 MLP Annual Investor Conference

6

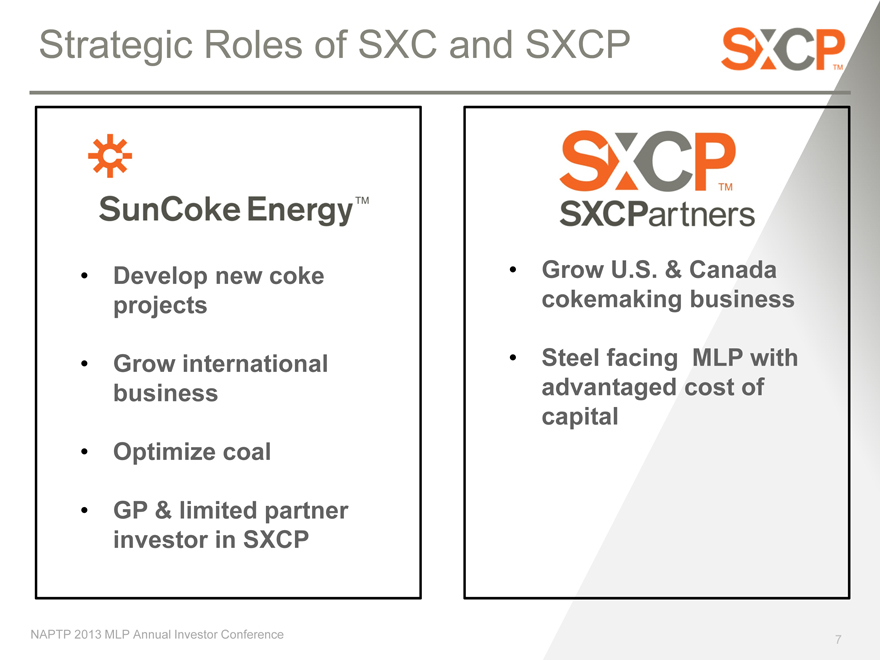

Strategic Roles of SXC and SXCP

Develop new coke projects

Grow international business

Optimize coal

GP & limited partner investor in SXCP

Grow U.S. & Canada cokemaking business

Steel facing MLP with advantaged cost of capital

NAPTP 2013 MLP Annual Investor Conference

7

SUNCOKE’S COKEMAKING TECHNOLOGY

& DOMESTIC BUSINESS MODEL

NAPTP 2013 MLP Annual Investor Conference

8

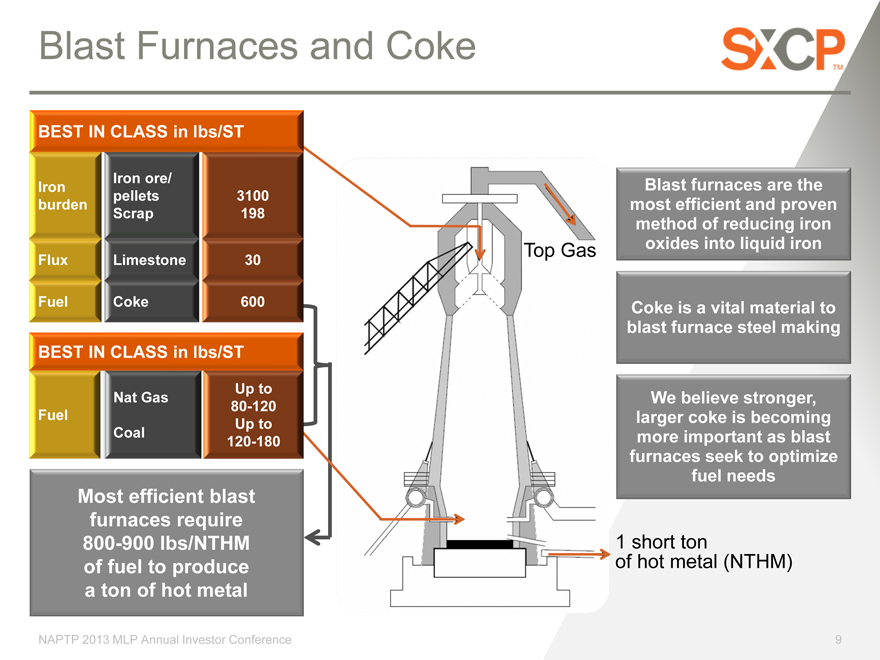

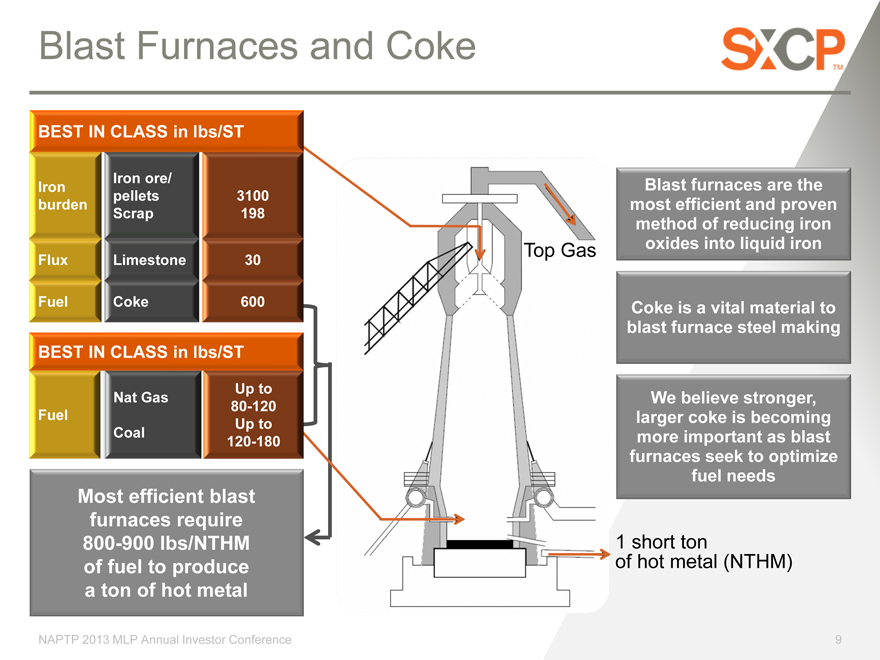

Blast Furnaces and Coke

BEST IN CLASS in lbs/ST

Iron ore/

Iron pellets 3100

burden Scrap 198

Flux Limestone 30

Fuel okeCoke 600

BEST IN CLASS in lbs/ST

Nat Gas Up to

Fuel 80-120

Up to

Coal 120-180

Most efficient blast furnaces require 800-900 lbs/NTHM of fuel to produce a ton of hot metal

Top Gas

Blast furnaces are the most efficient and proven method of reducing iron oxides into liquid iron

Coke is a vital material to blast furnace steel making

We believe stronger, larger coke is becoming more important as blast furnaces seek to optimize fuel needs

1 short ton of hot metal (NTHM)

NAPTP 2013 MLP Annual Investor Conference

9

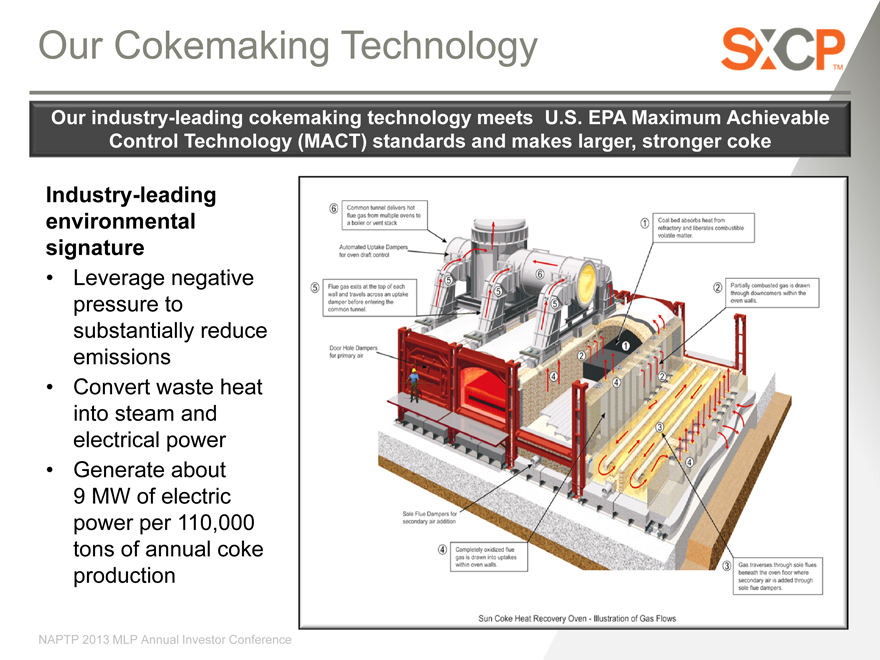

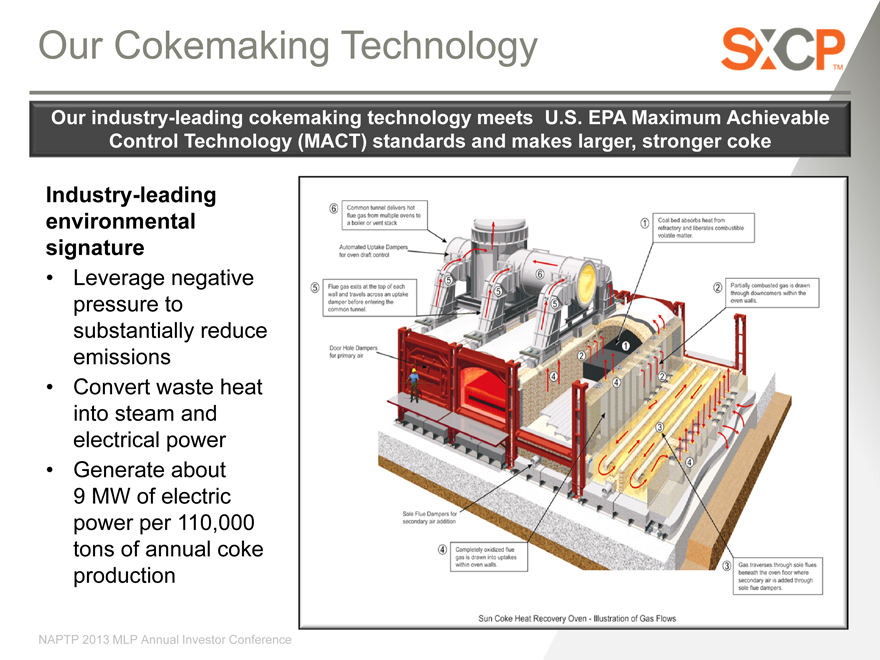

Our Cokemaking Technology

Our industry-leading cokemaking technology meets U.S. EPA Maximum Achievable Control Technology (MACT) standards and makes larger, stronger coke

Industry-leading

environmental

signature

• Leverage negative

pressure to

substantially reduce

emissions

• Convert waste heat

into steam and

electrical power

• Generate about

9 MW of electric

power per 110,000

tons of annual coke

production

NAPTP 2013 MLP Annual Investor Conference

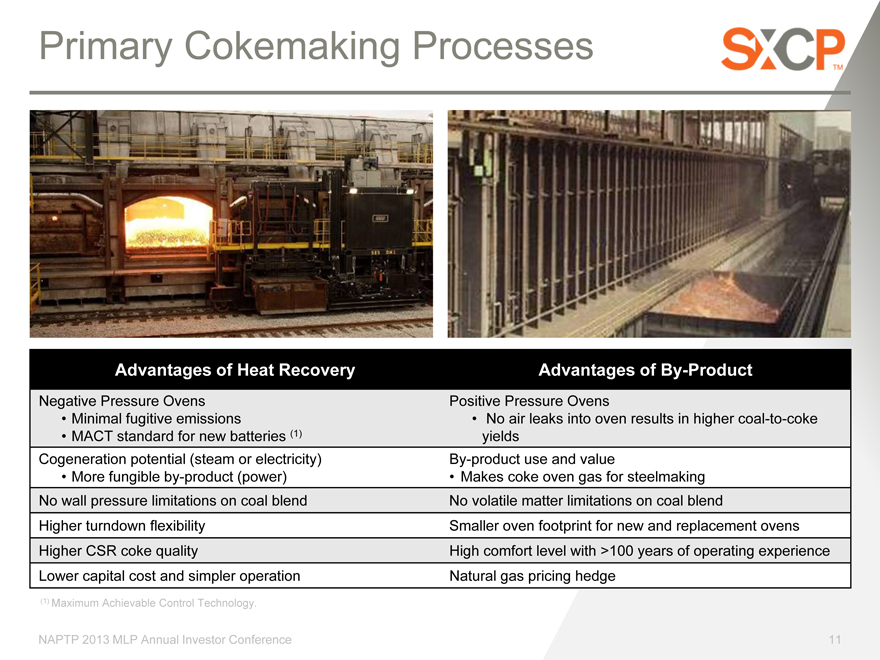

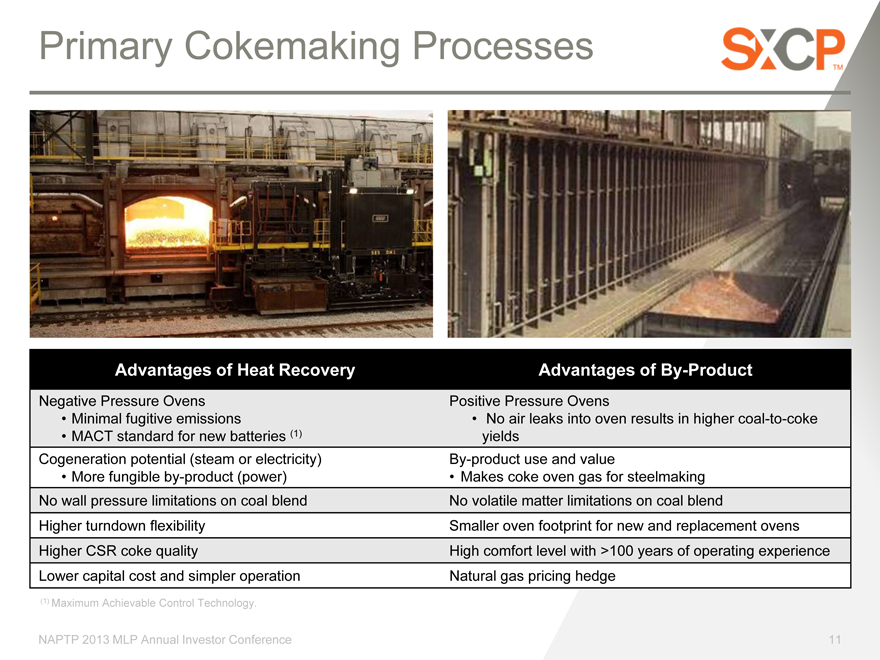

Primary Cokemaking Processes

Advantages of Heat Recovery

Negative Pressure Ovens

•

Minimal fugitive emissions

•

MACT standard for new batteries (1)

Cogeneration potential (steam or electricity)

•

More fungible by-product (power)

No wall pressure limitations on coal blend

Higher turndown flexibility

Higher CSR coke quality

Lower capital cost and simpler operation

Advantages of By-Product

Positive Pressure Ovens

• No air leaks into oven results in higher coal-to-coke

yields

By-product use and value

• Makes coke oven gas for steelmaking

No volatile matter limitations on coal blend

Smaller oven footprint for new and replacement ovens

High comfort level with >100 years of operating experience

Natural gas pricing hedge

(1) Maximum Achievable Control Technology.

NAPTP 2013 MLP Annual Investor Conference

11

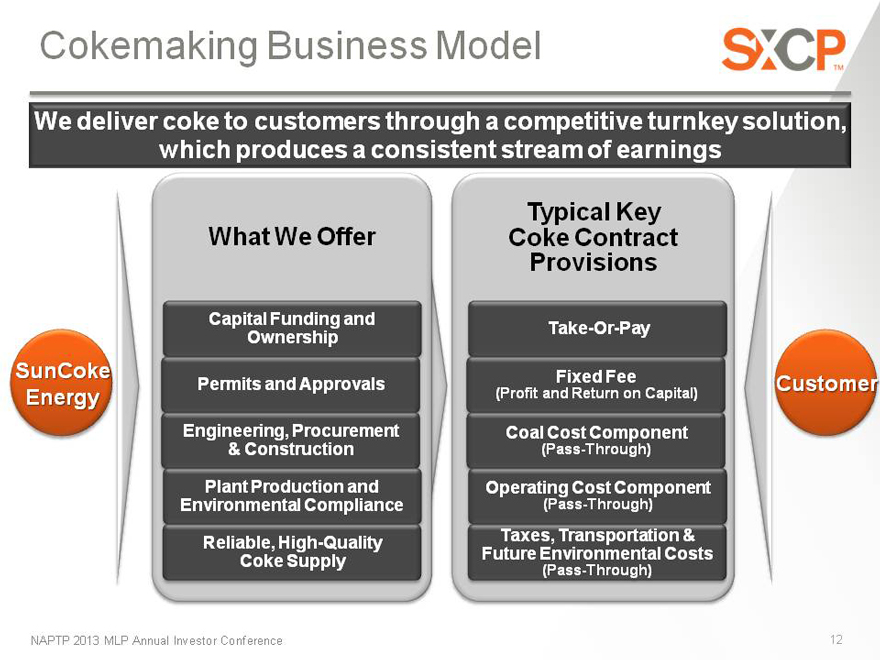

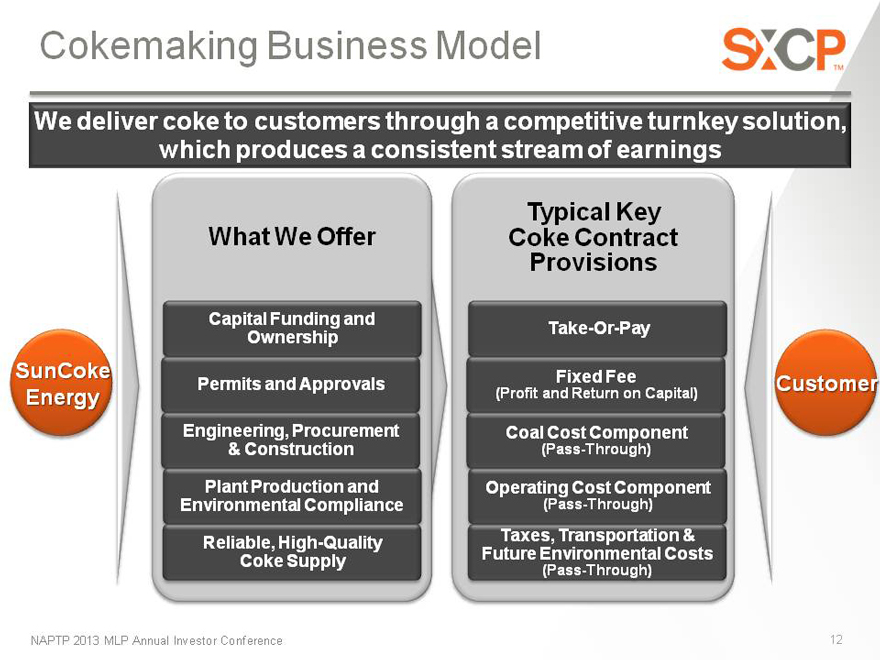

Cokemaking Business Model

We deliver coke to customers through a competitive turnkey solution, which produces a consistent stream of earnings

What We Offer

Capital Funding and

Ownership

Permits and Approvals

Engineering, Procurement

& Construction

Plant Production and

Environmental Compliance

Reliable, High-Quality

Coke Supply

Typical Key

Coke Contract

Provisions

Take-Or-Pay

Fixed Fee

(Profit and Return on Capital)

Coal Cost Component

(Pass-Through)

Operating Cost Component

(Pass-Through)

Taxes, Transportation &

Future Environmental Costs

(Pass-Through)

SunCoke Energy

Customer

NAPTP 2013 MLP Annual Investor Conference

12

OUR MARKET OPPORTUNITY

NAPTP 2013 MLP Annual Investor Conference

13

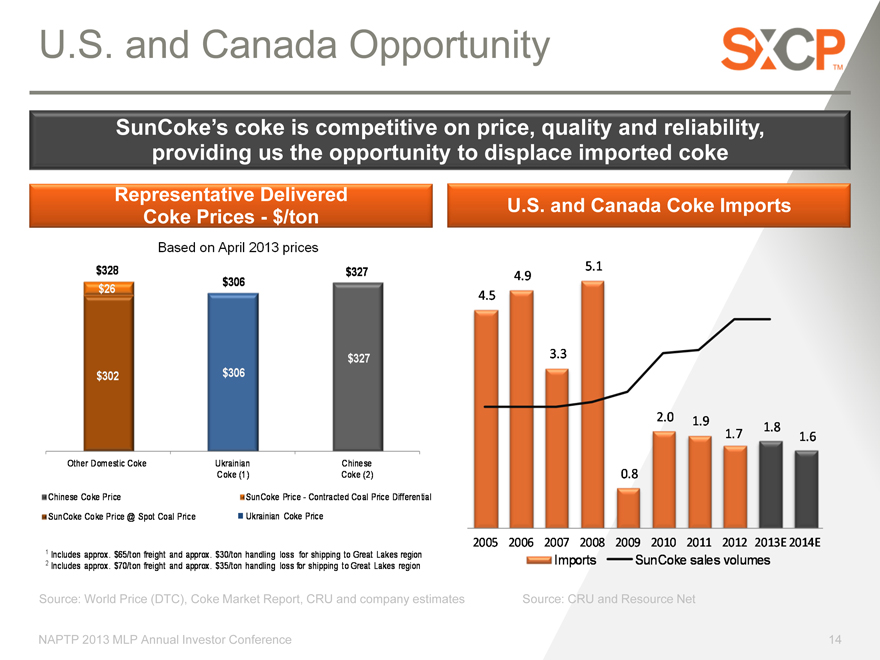

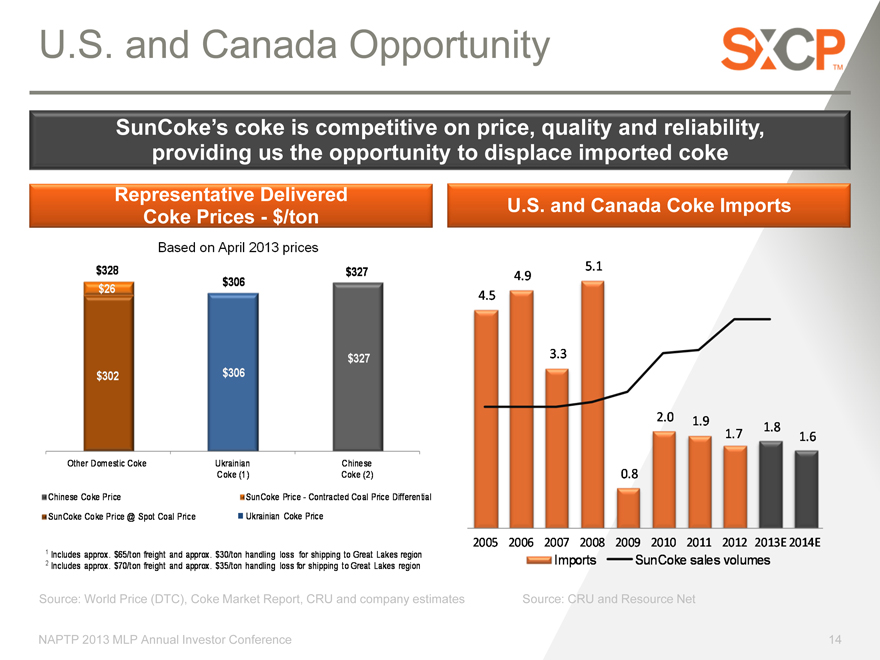

U.S. and Canada Opportunity

SunCoke’s coke is competitive on price, quality and reliability, providing us the opportunity to displace imported coke

Representative Delivered Coke Prices—$/ton n

Based on April 2013 prices

$328 $327 $306 $26

$327 $302 $306

Other Domestic Coke Ukrainian Chinese Coke (1) Coke (2)

Chinese Coke Price SunCoke Price—Contracted Coal Price Differential

SunCoke Coke Price @ Spot Coal Price „ Ukrainian Coke Price

Includes approx. $65/ton freight and approx. $30/ton handling loss for shipping to Great Lakes region

Includes approx. $70/ton freight and approx. $35/ton handling loss for shipping to Great Lakes region

U.S. and Canada Coke Imports

5.1

4.9

4.5

3.3

2.0 1.9 1.8

1.7 1.6

0.8

2005 2006 2007 2008 2009 2010 2011 2012 2013E 2014E

Imports SunCoke sales volumes

Source: World Price (DTC), Coke Market Report, CRU and company estimates

Source: CRU and Resource Net

NAPTP 2013 MLP Annual Investor Conference

14

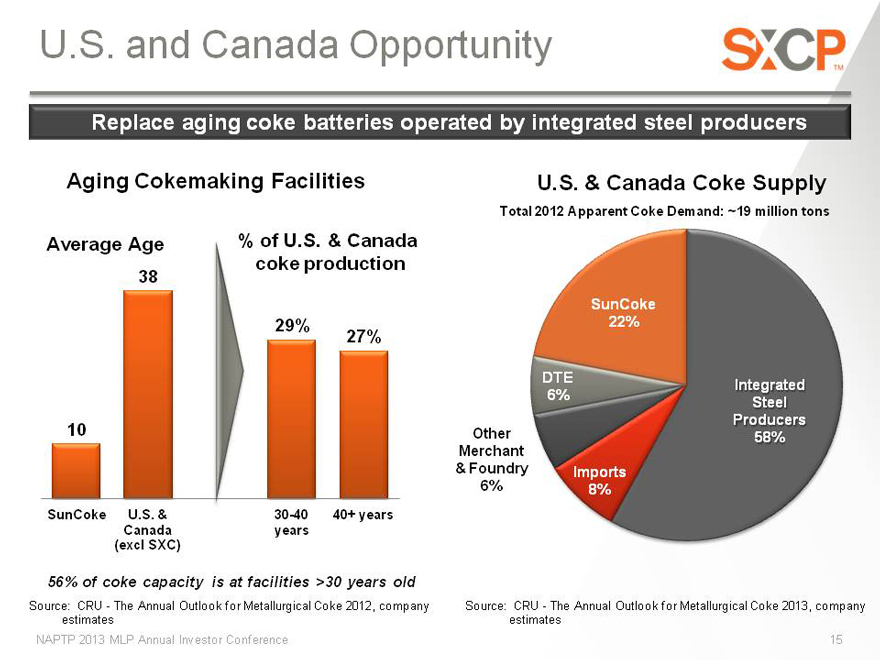

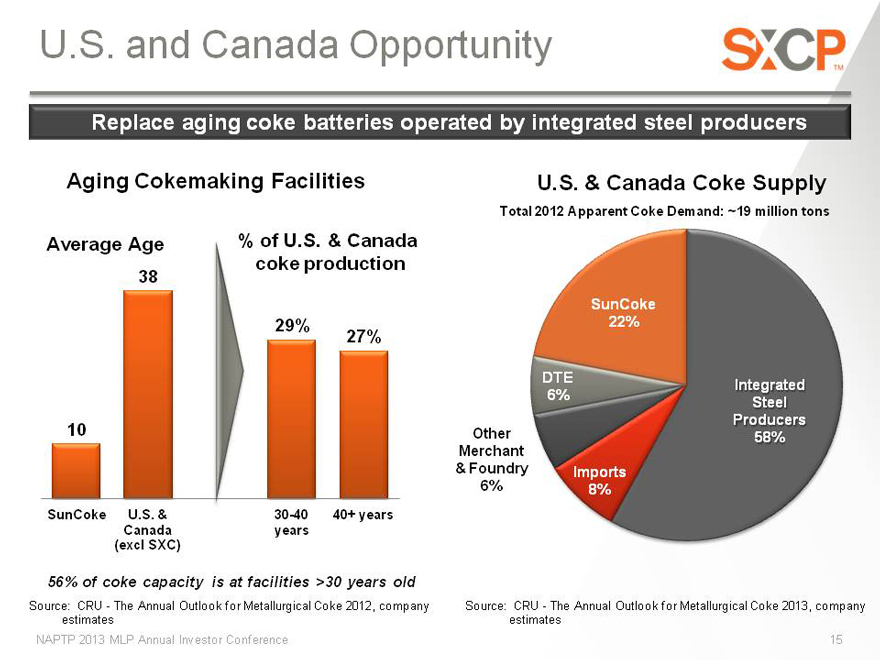

U.S. and Canada Opportunity

Replace aging coke batteries operated by integrated steel producers

Aging Cokemaking Facilities

Average Age

% of U.S. & Canada coke production

38

29%

27%

10

SunCoke U.S. & 30-40 40+ years Canada years (excl SXC)

56% of coke capacity is at facilities >30 years old

Source: CRU—The Annual Outlook for Metallurgical Coke 2012, company estimates

U.S. & Canada Coke Supply

Total 2012 Apparent Coke Demand: ~19 million tons

Other Merchant

& Foundry 6%

SunCoke 22%

DTE

Integrated 6% Steel Producers 58%

Imports 8%

Source: CRU—The Annual Outlook for Metallurgical Coke 2013, company estimates

NAPTP 2013 MLP Annual Investor Conference

15

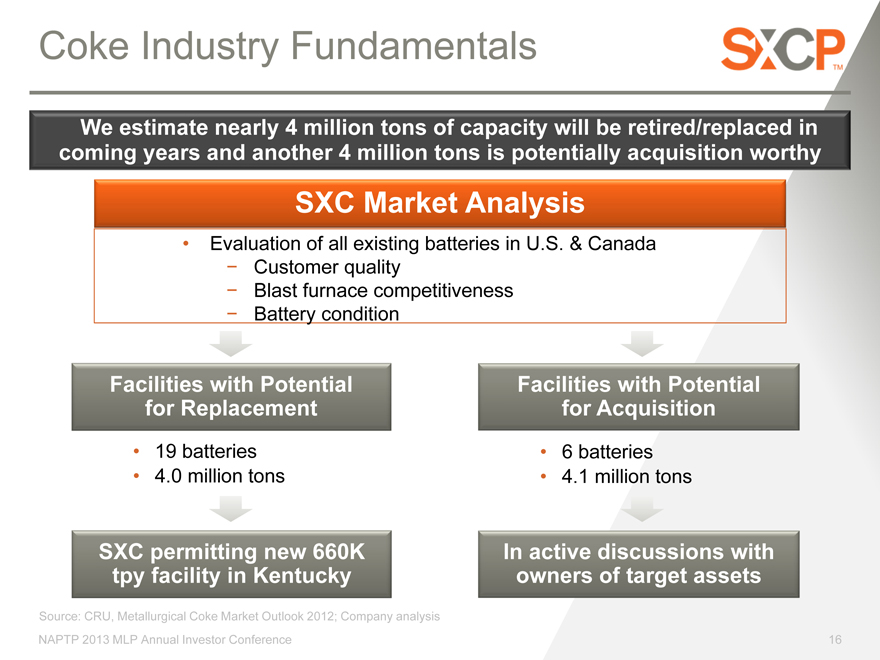

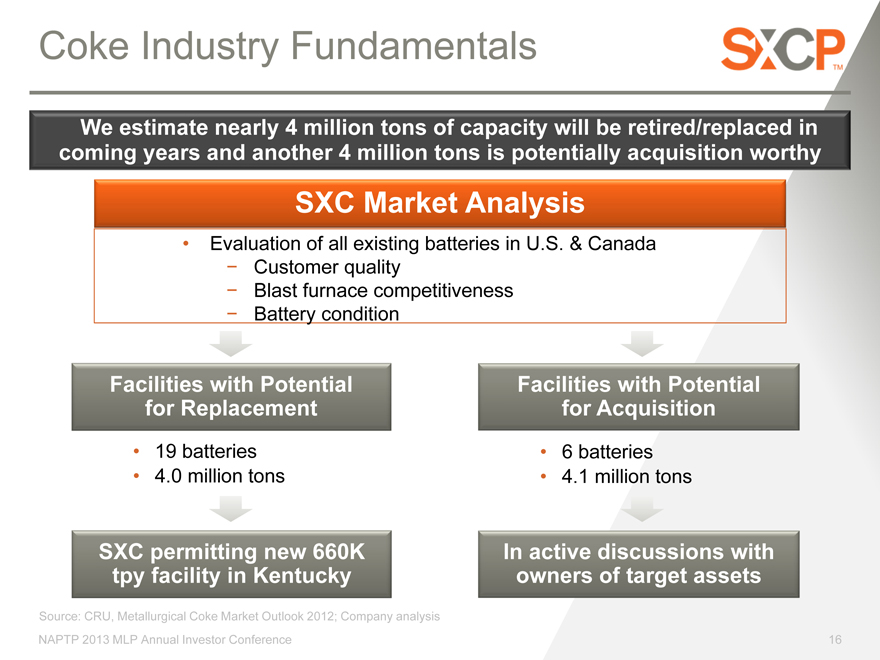

Coke Industry Fundamentals

We estimate nearly 4 million tons of capacity will be retired/replaced in coming years and another 4 million tons is potentially acquisition worthy

SXC Market Analysis

• Evaluation of all existing batteries in U.S. & Canada

- Customer quality

- Blast furnace competitiveness

- Battery condition

Facilities with Potential for Replacement

• 19 batteries

• 4.0 million tons

Facilities with Potential for Acquisition

• 6 batteries

• 4.1 million tons

SXC permitting new 660K tpy facility in Kentucky

Source: CRU, Metallurgical Coke Market Outlook 2012; Company analysis NAPTP 2013 MLP Annual Investor Conference

In active discussions with owners of target assets

16

North America M&A Growth Strategy

Opportunistic Evaluation for First priority for acquisitions of future value core business adjacent assets chain expansion

Cokemaking

FOCUS

Acquisition of existing cokemaking facilities with long-term off take agreements

In active discussion with owners of targeted assets

Degree of integration in steel operations and environmental issues will impact complexity and timing of transaction

Customer concentration likely to remain high

Coal Handling /

Iron Ore Processing Processing

FOCUS FOCUS

Selective acquisition of met Investment in ferrous side of coal related handling and steel value chain processing assets, with long- (concentrating, pelletizing, term off take agreements and transport/handling) limited commodity exposure

Initiated discussions with Researching qualifying potential parties income status and market opportunity

Current opportunities available

Potential to deploy tolling/pass and less complex assets through model implies potentially shorter deal cycle Potential to diversify customer

Potential to add value to core base and enhance value-add business and diversify to steel industry customer base

NAPTP 2013 MLP Annual Investor Conference

17

1Q 2013 PERFORMANCE

& FINANCIAL POSITION

NAPTP 2013 MLP Annual Investor Conference

18

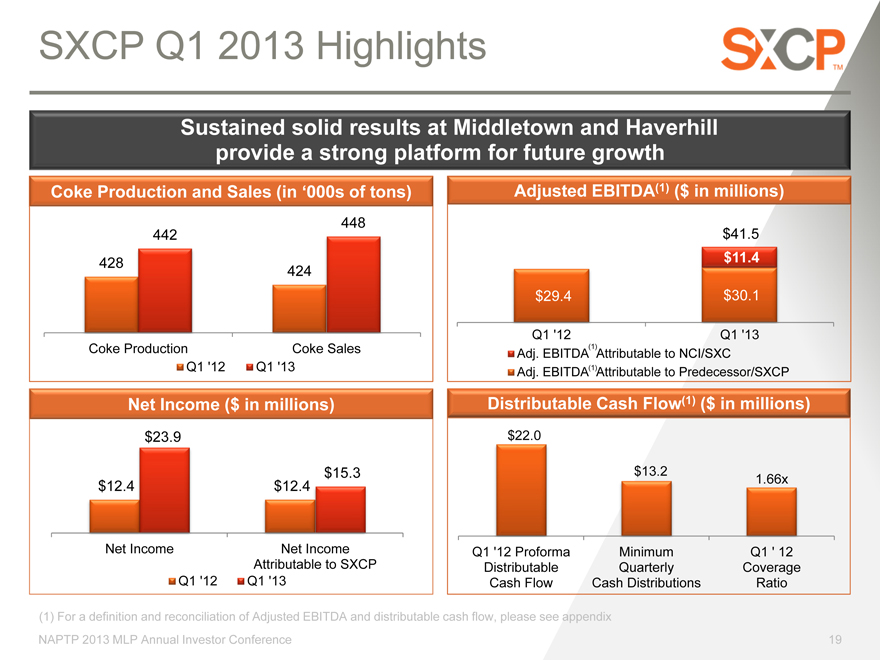

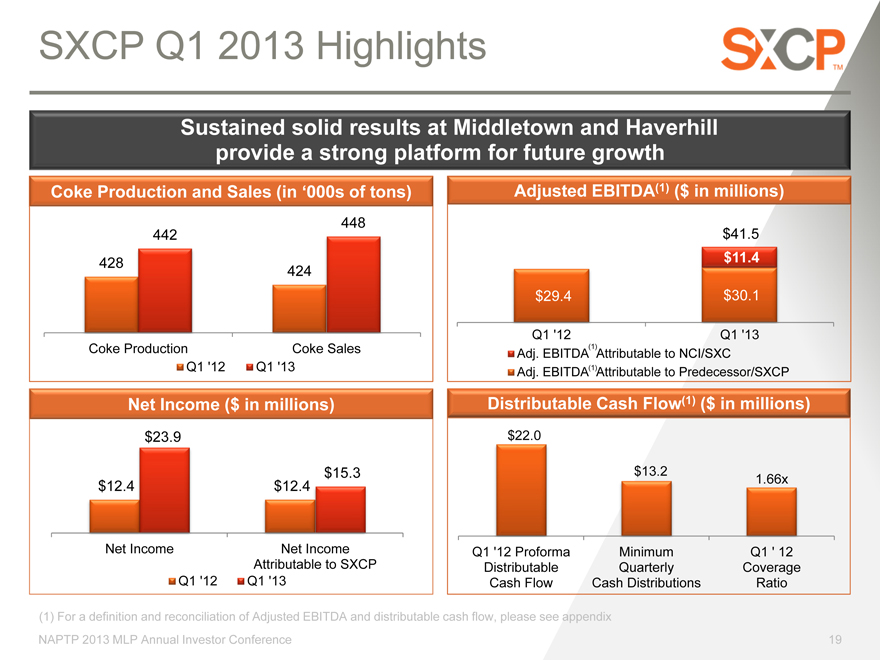

SXCP Q1 2013 Highlights

Sustained solid results at Middletown and Haverhill provide a strong platform for future growth

Coke Production and Sales (in ‘000s of tons)

448

442

428 424

Coke Production Coke Sales

Q1 ‘12 Q1 ‘13

Adjusted EBITDA(1) ($ in millions)

$ 41.5

$11.4

$29.4 $30.1

Q1 ‘12 Q1 ‘13

Adj. EBITDA(1) Attributable to Predecessor/SXCP

Adj. EBITDA(1)Attributable to NCI/SXC

Net Income ($ in millions)

$23.9

$15.3

$12.4 $12.4

Net Income Net Income

Attributable to SXCP

Q1 ‘12 Q1 ‘13

Distributable Cash Flow(1) ($ in millions)

$22.0

$13.2 1.66x

Q1 ‘12 Proforma Minimum Q1 ‘ 12

Distributable Quarterly Coverage

Cash Flow Cash Distributions Ratio

(1) For a definition and reconciliation of Adjusted EBITDA and distributable cash flow, please see appendix

NAPTP 2013 MLP Annual Investor Conference

19

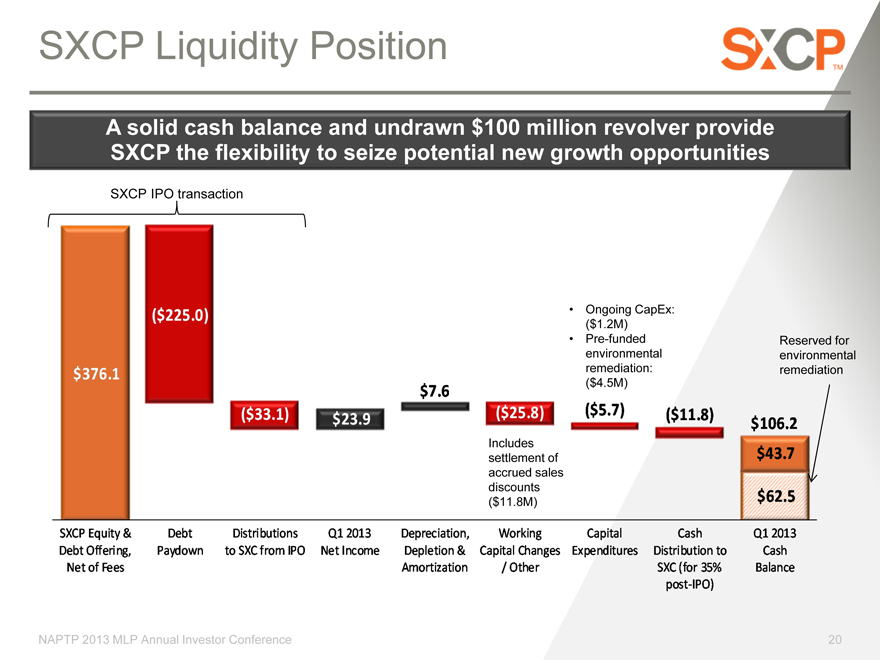

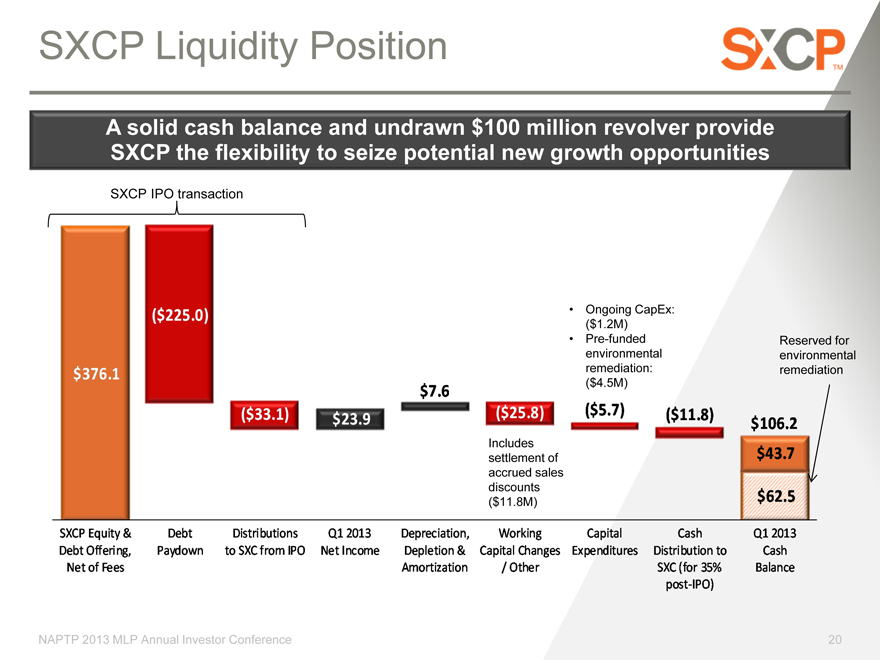

SXCP Liquidity Position

A solid cash balance and undrawn $100 million revolver provide SXCP the flexibility to seize potential new growth opportunities

SXCP IPO transaction

($225.0) Ongoing CapEx:

($1.2M)

Pre-funded Reserved for

environmental environmental

$376.1 remediation: remediation

($4.5M)

$7.6

($33.1) ($25.8) ($5.7) ($11.8)

$23.9 $106.2

Includes

settlement of $43.7

accrued sales

discounts

($11.8M) $62.5

SXCP Equity & Debt Distributions Q1 2013 Depreciation, Working Capital Cash Q1 2013

Debt Offering, Paydown to SXC from IPO Net Income Depletion & Capital Changes Expenditures Distribution to Cash

Net of Fees Amortization / Other SXC (for 35% Balance

NAPTP 2013 MLP Annual Investor Conference

20

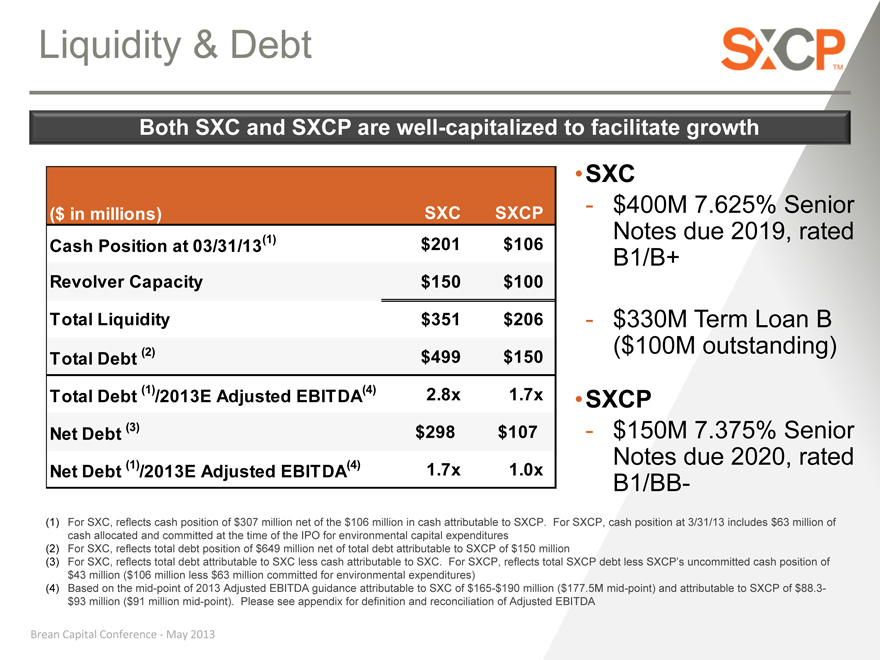

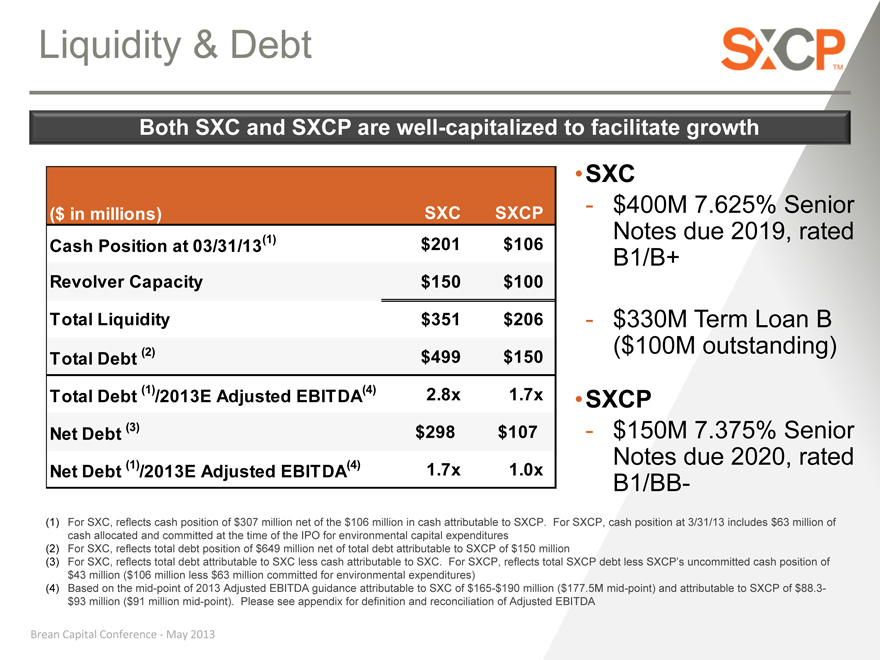

Liquidity & Debt

Both SXC and SXCP are well-capitalized to facilitate growth

($ in millions) SXC SXCP

Cash Position at 03/31/13(1) $201 $106

Revolver Capacity $150 $100

Total Liquidity $351 $206

Total Debt (2) $499 $150

Total Debt (1) /2013E Adjusted EBITDA(4) 2.8x 1.7x

Net Debt (3) $298 $107

Net Debt (1) /2013E Adjusted EBITDA(4) 1.7x 1.0x

SXC

$400M 7.625% Senior Notes due 2019, rated B1/B+

$330M Term Loan B

($100M outstanding)

SXCP

$150M 7.375% Senior Notes due 2020, rated B1/BB-

(1) For SXC, reflects cash position of $307 million net of the $106 million in cash attributable to SXCP. For SXCP, cash position at 3/31/13 includes $63 million of cash allocated and committed at the time of the IPO for environmental capital expenditures (2) For SXC, reflects total debt position of $649 million net of total debt attributable to SXCP of $150 million (3) For SXC, reflects total debt attributable to SXC less cash attributable to SXC. For SXCP, reflects total SXCP debt less SXCP’s uncommitted cash position of $43 million ($106 million less $63 million committed for environmental expenditures) (4) Based on the mid-point of 2013 Adjusted EBITDA guidance attributable to SXC of $165-$190 million ($177.5M mid-point) and attributable to SXCP of $88.3-$93 million ($91 million mid-point). Please see appendix for definition and reconciliation of Adjusted EBITDA

Brean Capital Conference—May 2013

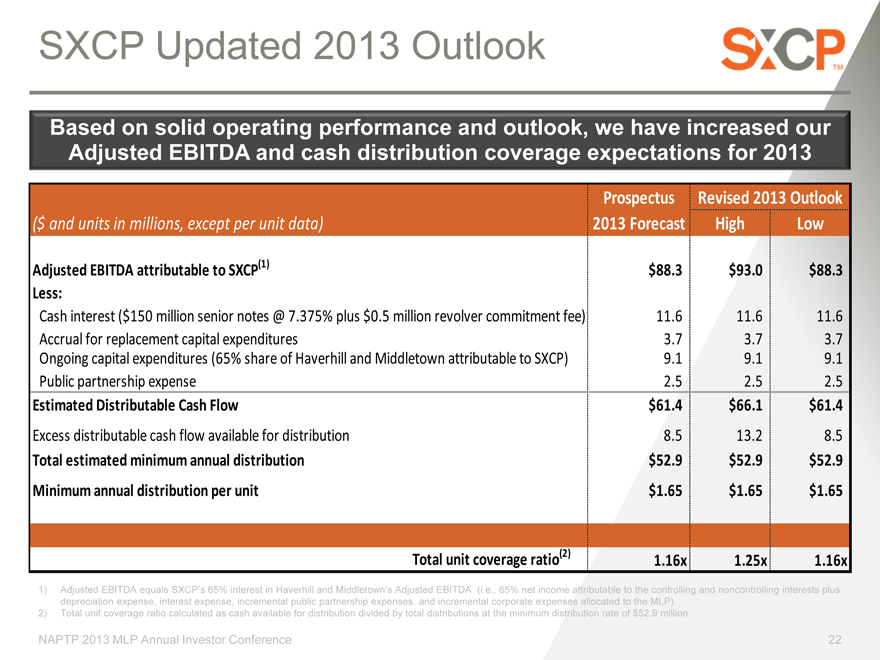

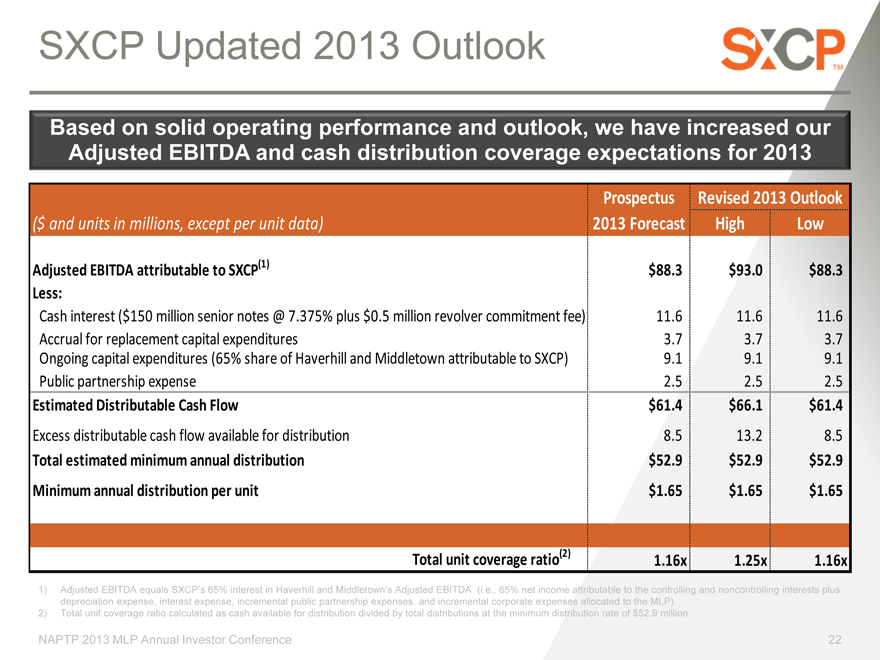

SXCP Updated 2013 Outlook

Based on solid operating performance and outlook, we have increased our Adjusted EBITDA and cash distribution coverage expectations for 2013

Prospectus Revised 2013 Outlook

($ and units in millions, except per unit data) 2013 Forecast High Low

Adjusted EBITDA attributable to SXCP(1) $ 88.3 $93.0 $ 88.3

Less:

Cash interest ($150 million senior notes @ 7.375% plus $0.5 million revolver commitment fee) 11.6 11.6 11.6

Accrual for replacement capital expenditures 3.7 3.7 3.7

Ongoing capital expenditures (65% share of Haverhill and Middletown attributable to SXCP) 9.1 9.1 9.1

Public partnership expense 2.5 2.5 2.5

Estimated Distributable Cash Flow $ 61.4 $66.1 $ 61.4

Excess distributable cash flow available for distribution 8.5 13.2 8.5

Total estimated minimum annual distribution $ 52.9 $52.9 $ 52.9

Minimum annual distribution per unit $ 1.65 $1.65 $ 1.65

Total unit coverage ratio(2) 1.16x 1.25x 1.16x

1) Adjusted EBITDA equals SXCP’s 65% interest in Haverhill and Middletown’s Adjusted EBITDA (i.e., 65% net income attributable to the controlling and noncontrolling interests plus depreciation expense, interest expense, incremental public partnership expenses, and incremental corporate expenses allocated to the MLP).

2) Total unit coverage ratio calculated as cash available for distribution divided by total distributions at the minimum distribution rate of $52.9 million.

NAPTP 2013 MLP Annual Investor Conference

22

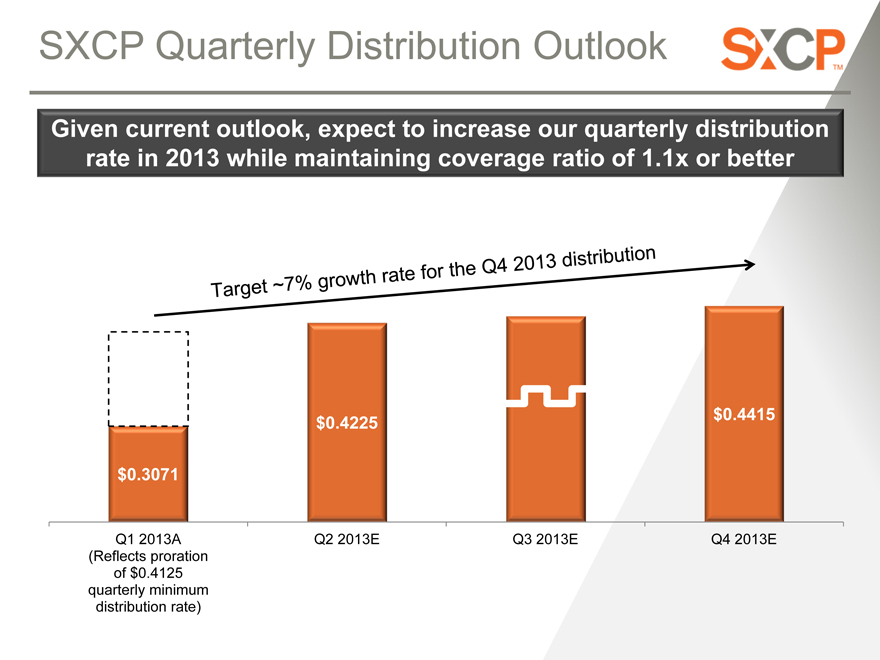

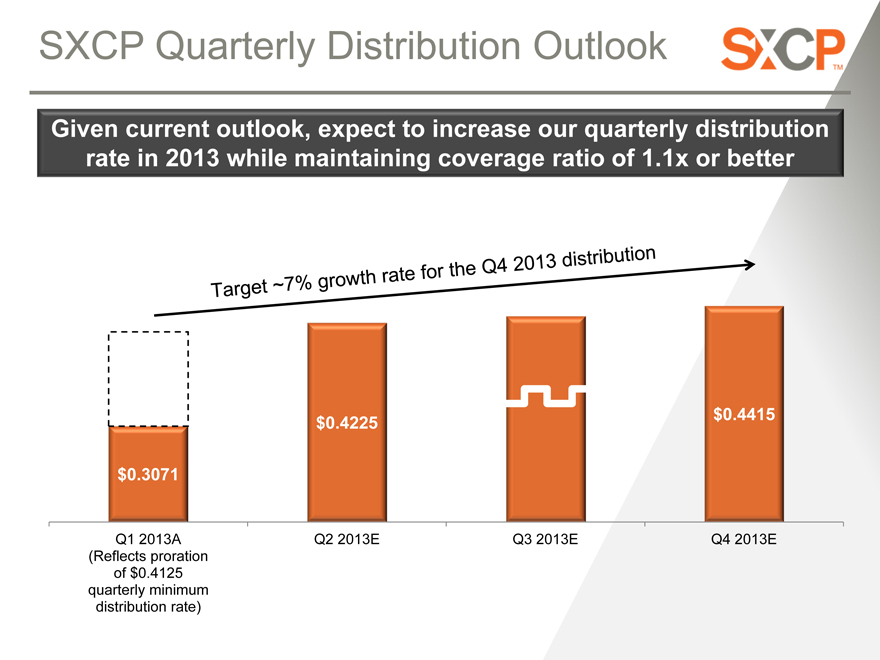

SXCP Quarterly Distribution Outlook

Given current outlook, expect to increase our quarterly distribution rate in 2013 while maintaining coverage ratio of 1.1x or better

$0.4225 $0.4415

$0.3071

Q1 2013A Q2 2013E Q3 2013E Q4 2013E

(Reflects proration

of $0.4125

quarterly minimum

distribution rate)

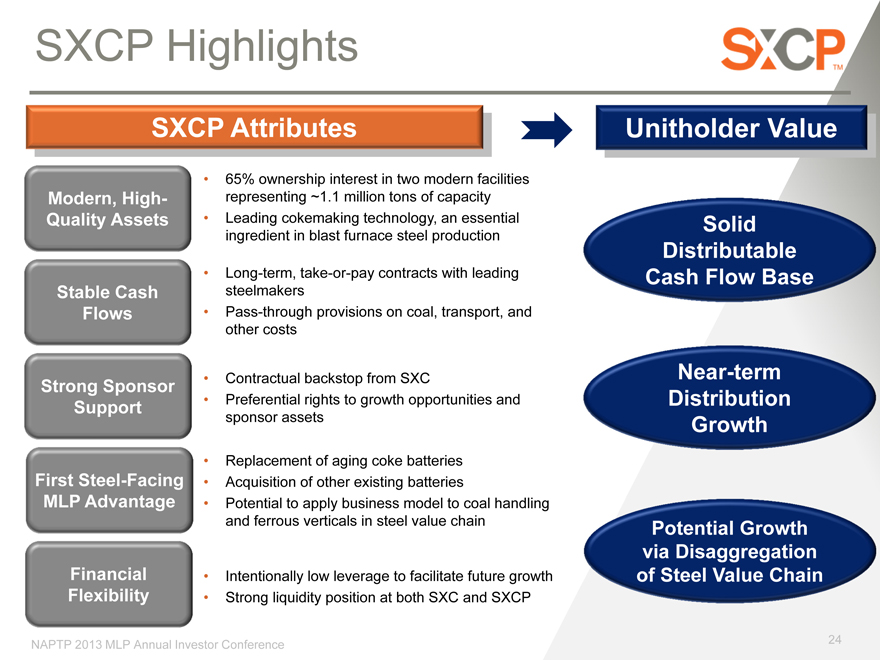

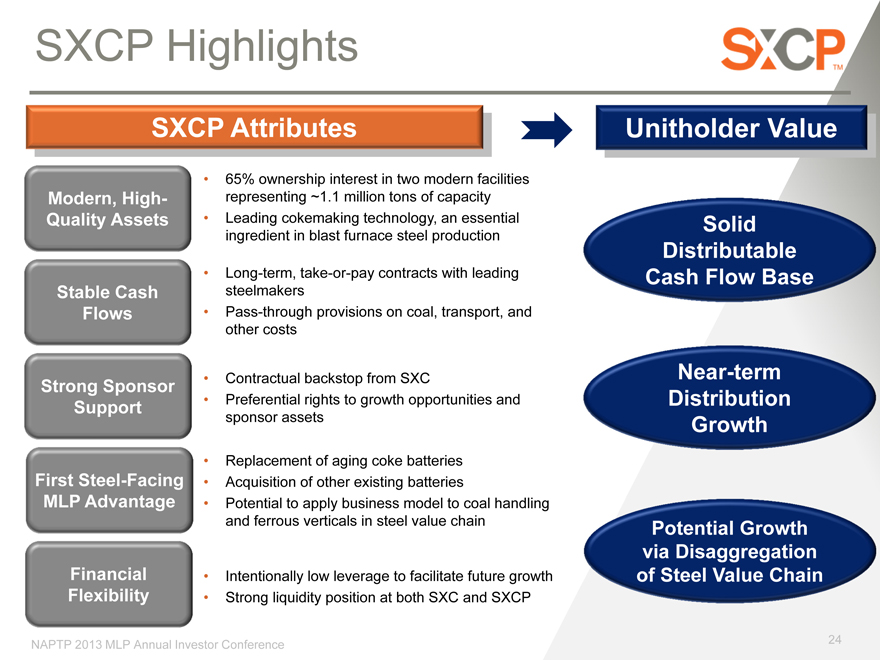

SXCP Highlights

SXCP Attributes

65% ownership interest in two modern facilities Modern, High- representing ~1.1 million tons of capacity Quality Assets • Leading cokemaking technology, an essential ingredient in blast furnace steel production

Long-term, take-or-pay contracts with leading

Stable Cash steelmakers

Flows Pass-through provisions on coal, transport, and other costs

Strong Sponsor Contractual backstop from SXC

Support Preferential rights to growth opportunities and sponsor assets

Replacement of aging coke batteries First Steel-Facing Acquisition of other existing batteries

MLP Advantage Potential to apply business model to coal handling and ferrous verticals in steel value chain

Financial Intentionally low leverage to facilitate future growth Flexibility Strong liquidity position at both SXC and SXCP

Unitholder Value

Solid Distributable Cash Flow Base

Near-term Distribution Growth

Potential Growth via Disaggregation of Steel Value Chain

NAPTP 2013 MLP Annual Investor Conference

24

QUESTIONS

NAPTP 2013 MLP Annual Investor Conference

25

Investor Relations: 630-824-1987 www.suncoke.com

APPENDIX

NAPTP 2013 MLP Annual Investor Conference

27

Definitions

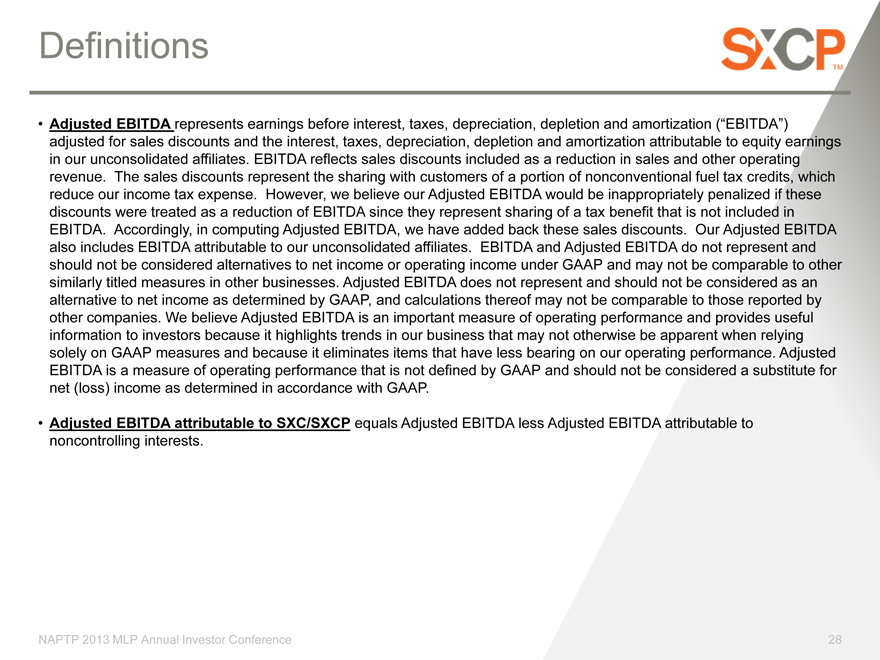

Adjusted EBITDA represents earnings before interest, taxes, depreciation, depletion and amortization (“EBITDA”) adjusted for sales discounts and the interest, taxes, depreciation, depletion and amortization attributable to equity earnings in our unconsolidated affiliates. EBITDA reflects sales discounts included as a reduction in sales and other operating revenue. The sales discounts represent the sharing with customers of a portion of nonconventional fuel tax credits, which reduce our income tax expense. However, we believe our Adjusted EBITDA would be inappropriately penalized if these discounts were treated as a reduction of EBITDA since they represent sharing of a tax benefit that is not included in EBITDA. Accordingly, in computing Adjusted EBITDA, we have added back these sales discounts. Our Adjusted EBITDA also includes EBITDA attributable to our unconsolidated affiliates. EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Adjusted EBITDA does not represent and should not alternative to net income as determined by GAAP, and calculations thereof may not be comparable to those reported by other companies. We believe Adjusted EBITDA is an important measure of operating performance and provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance. Adjusted EBITDA is a measure of operating performance that is not defined by GAAP and should not be considered a substitute for net (loss) income as determined in accordance with GAAP.

Adjusted EBITDA attributable to SXC/SXCP equals Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests.

NAPTP 2013 MLP Annual Investor Conference

28

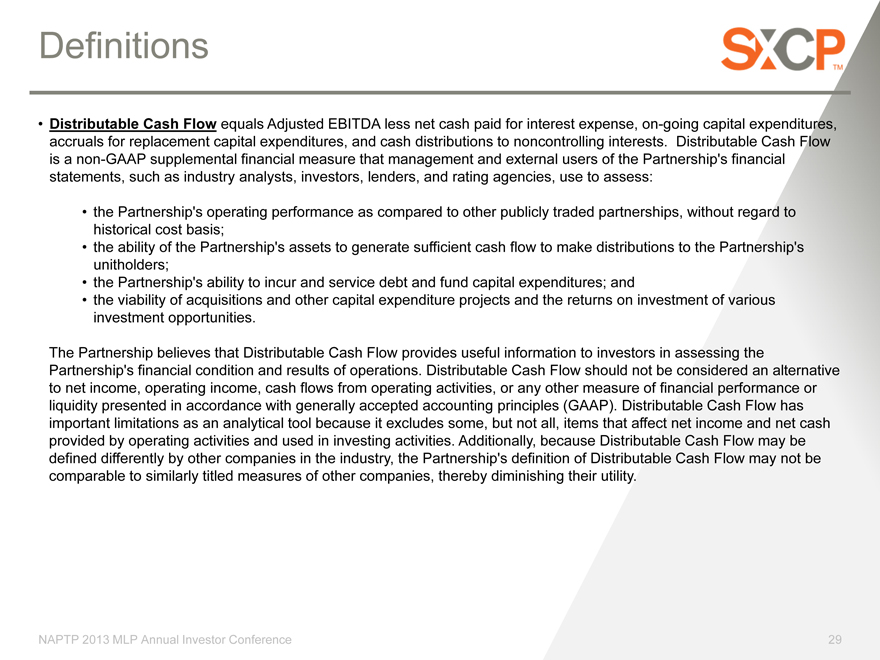

Definitions

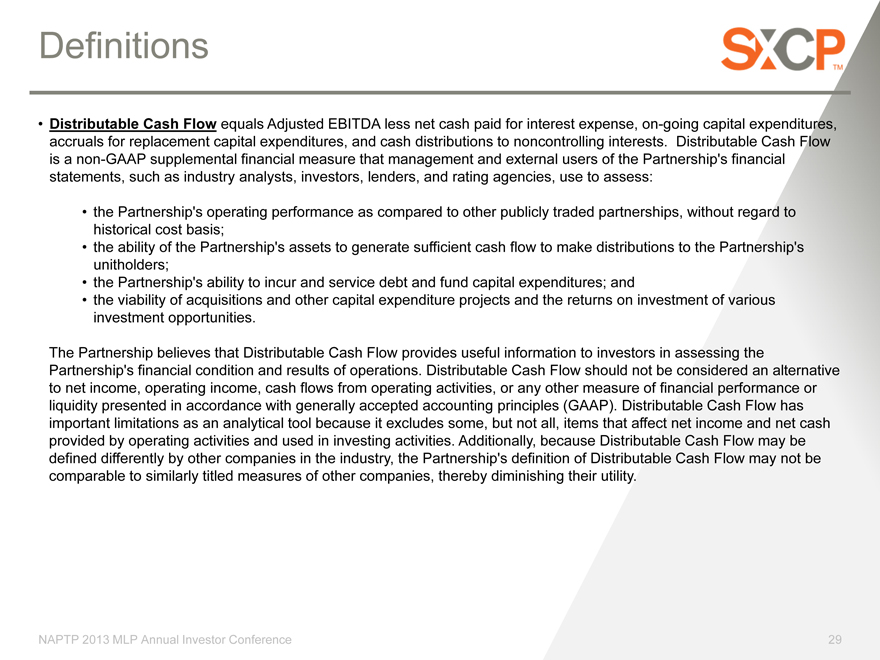

Distributable Cash Flow equals Adjusted EBITDA less net cash paid for interest expense, on-going capital expenditures, accruals for replacement capital expenditures, and cash distributions to noncontrolling interests. Distributable Cash Flow is a non-GAAP supplemental financial measure that management and external users of the Partnership’s financial statements, such as industry analysts, investors, lenders, and rating agencies, use to assess:

the Partnership’s operating performance as compared to other publicly traded partnerships, without regard to historical cost basis; • the ability of the Partnership’s assets to generate sufficient cash flow to make distributions to the Partnership’s unitholders; • the Partnership’s ability to incur and service debt and fund capital expenditures; and • the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities.

The Partnership believes that Distributable Cash Flow provides useful information to investors in assessing the

Partnership’s financial condition and results of operations. Distributable Cash Flow should not be considered an alternative to net income, operating income, cash flows from operating activities, or any other measure of financial performance or liquidity presented in accordance with generally accepted accounting principles (GAAP). Distributable Cash Flow has important limitations as an analytical tool because it excludes some, but not all, items that affect net income and net cash provided by operating activities and used in investing activities. Additionally, because Distributable Cash Flow may be defined differently by other companies in the industry, the Partnership’s definition of Distributable Cash Flow may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

NAPTP 2013 MLP Annual Investor Conference

29

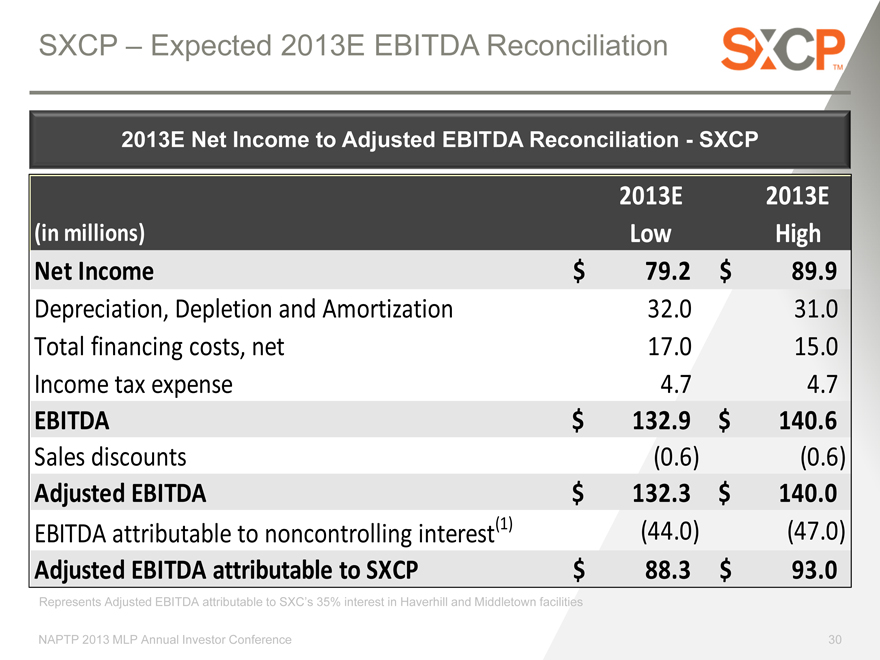

SXCP – Expected 2013E EBITDA Reconciliation

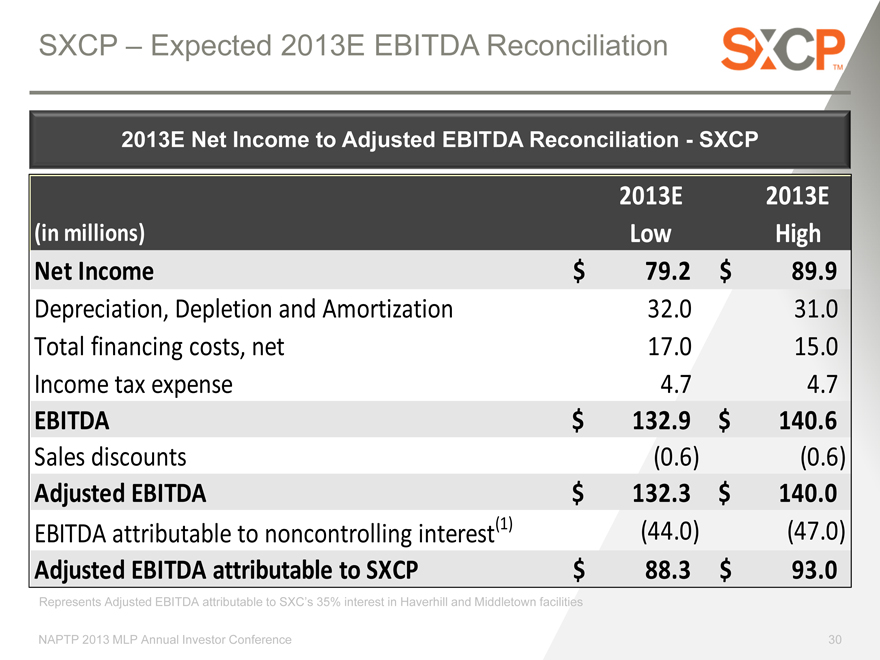

2013E Net Income to Adjusted EBITDA Reconciliation—SXCP

2013E 2013E

(in millions) Low High

Net Income $ 79.2 $ 89.9

Depreciation, Depletion and Amortization 32.0 31.0

Total financing costs, net 17.0 15.0

Income tax expense 4.7 4.7

EBITDA $ 132.9 $ 140.6

Sales discounts (0.6) (0.6)

Adjusted EBITDA $ 132.3 $ 140.0

EBITDA attributable to noncontrolling interest(1) (44.0) (47.0)

Adjusted EBITDA attributable to SXCP $ 88.3 $ 93.0

Represents Adjusted EBITDA attributable to SXC’s 35% interest in Haverhill and Middletown facilities

NAPTP 2013 MLP Annual Investor Conference

30

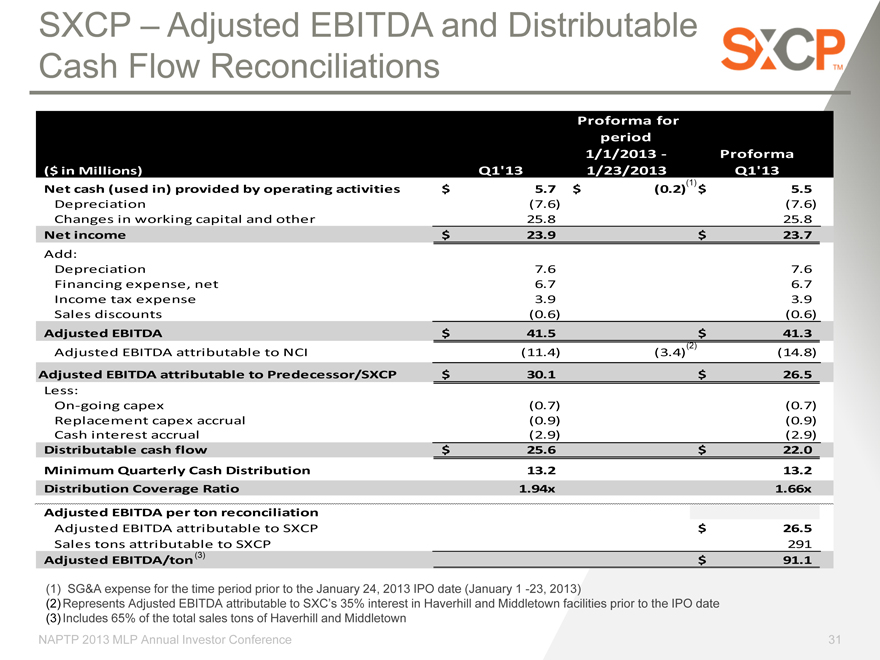

SXCP – Adjusted EBITDA and Distributable Cash Flow Reconciliations

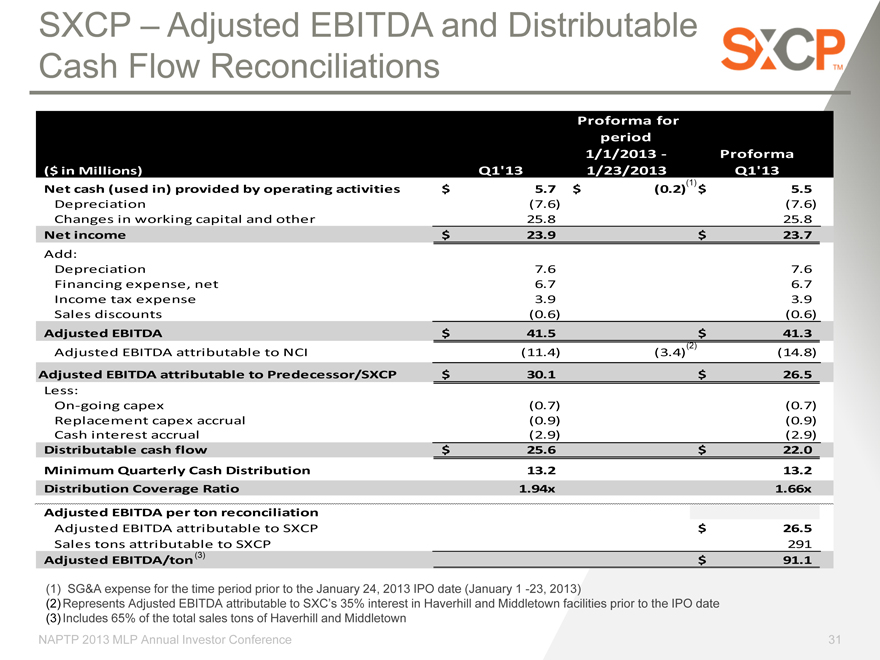

Proforma for

period

1/1/2013— Proforma

($ in Millions) Q1’13 1/23/2013 Q1’13

Net cash (used in) provided by operating activities $ 5.7 $ (0.2)(1) $ .

Depreciation (7.6) (7.6)

Changes in working capital and other 25.8 25.8

Net income $ 23.9 $ 23.7

Add:

Depreciation 7.6 7.6

Financing expense, net 6.7 6.7

Income tax expense 3.9 3.9

Sales discounts (0.6) (0.6)

Adjusted EBITDA $ 41.5 $ 41.3

Adjusted EBITDA attributable to NCI (11.4) (3.4) (2) (14.8)

Adjusted EBITDA attributable to Predecessor/SXCP $ 30.1 $ 26.5

Less:

On-going capex (0.7) (0.7)

Replacement capex accrual (0.9) (0.9)

Cash interest accrual (2.9) (2.9)

Distributable cash flow $ 25.6 $ 22.0

Minimum Quarterly Cash Distribution 13.2 .

Distribution Coverage Ratio 1.94x 1.66x

Adjusted EBITDA per ton reconciliation

Adjusted EBITDA attributable to SXCP $ 26.5

Sales tons attributable to SXCP 291

Adjusted EBITDA/ton (3) $ 91.1

(1) SG&A expense for the time period prior to the January 24, 2013 IPO date (January 1 -23, 2013)

(2) Represents Adjusted EBITDA attributable to SXC’s 35% interest in Haverhill and Middletown facilities prior to the IPO date

(3) Includes 65% of the total sales tons of Haverhill and Middletown

NAPTP 2013 MLP Annual Investor Conference

31

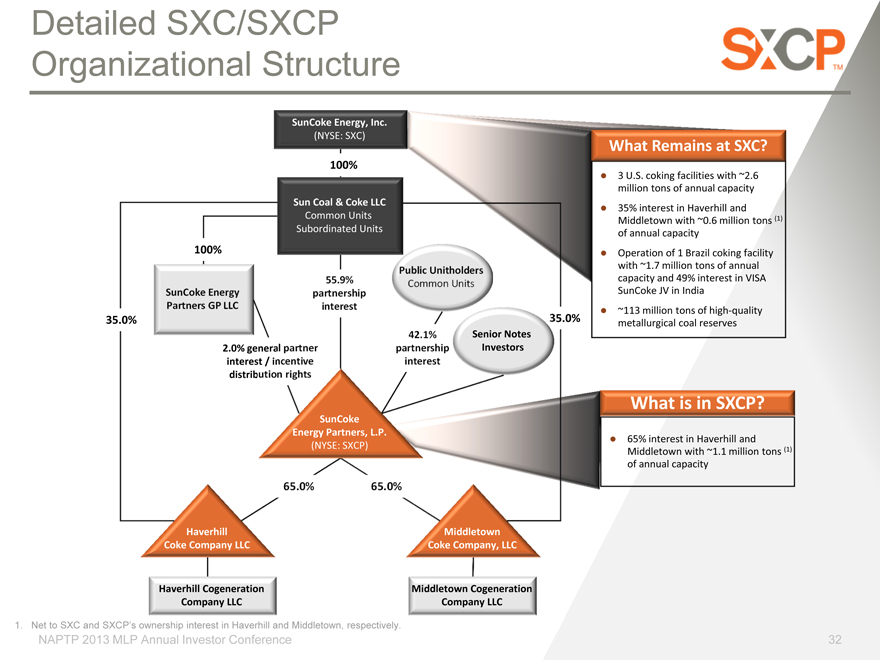

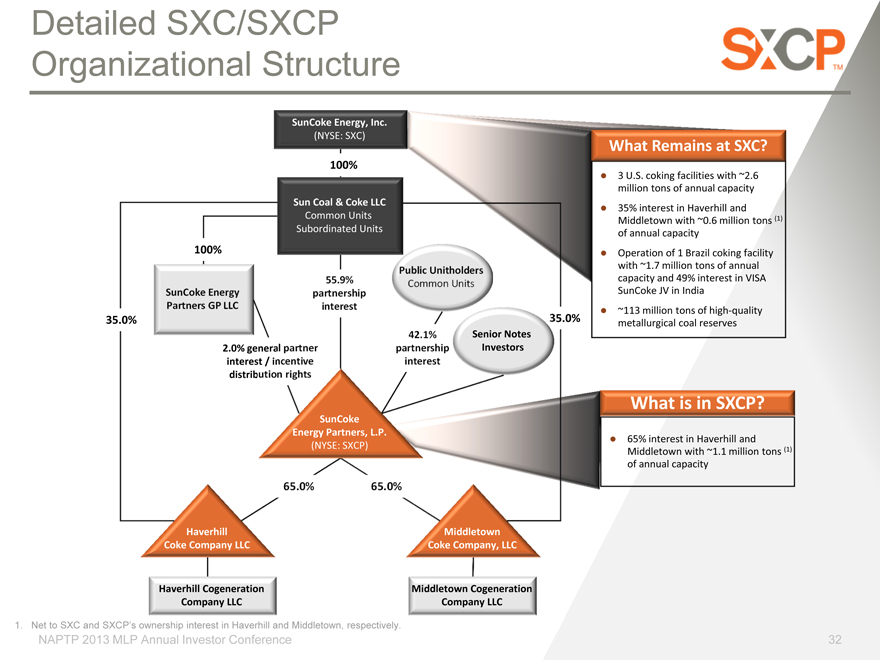

Detailed SXC/SXCP Organizational Structure

SunCoke Energy, Inc.

(NYSE: SXC)

What Remains at SXC

100%

z 3 U.S. coking facilities with ~2.6

million tons of annual capacity

Sun Coal & Coke LLC z 35% interest in Haverhill and

Common Units Middletown with ~0.6 million tons (1)

Subordinated Units of annual capacity

100% z Operation of 1 Brazil coking facility

Public Unitholders with ~1.7 million tons of annual

55.9% Common Units capacity and 49% interest in VISA

partnership SunCoke JV in India

interest z ~113 million tons of high-quality

35.0% 35.0% metallurgical coal reserves

42.1% Senior Notes

2.0% general partner partnership Investors

interest / incentive interest

distribution rights

What is in SXCP

SunCoke

Energy Partners, L.P.

z 65% interest in Haverhill and

(NYSE: SXCP) Middletown with ~1.1 million tons (1)

of annual capacity

65.0% 65.0%

Haverhill Middletown

Coke Company LLC Coke Company, LLC

Haverhill Cogeneration Middletown Cogeneration

Company LLC Company LLC

1. Net to SXC and SXCP’s ownership interest in Haverhill and Middletown, respectively.

NAPTP 2013 MLP Annual Investor Conference

32

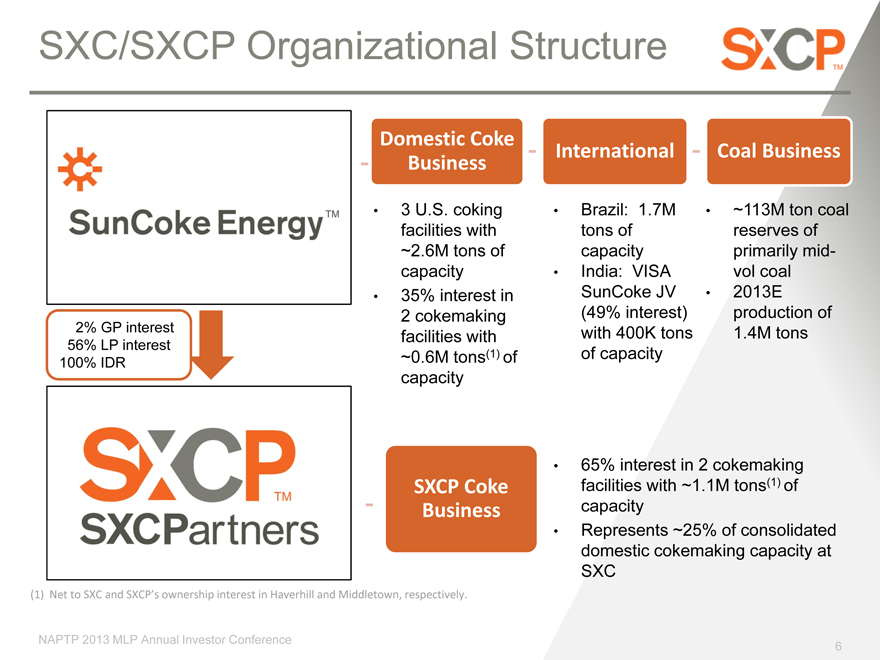

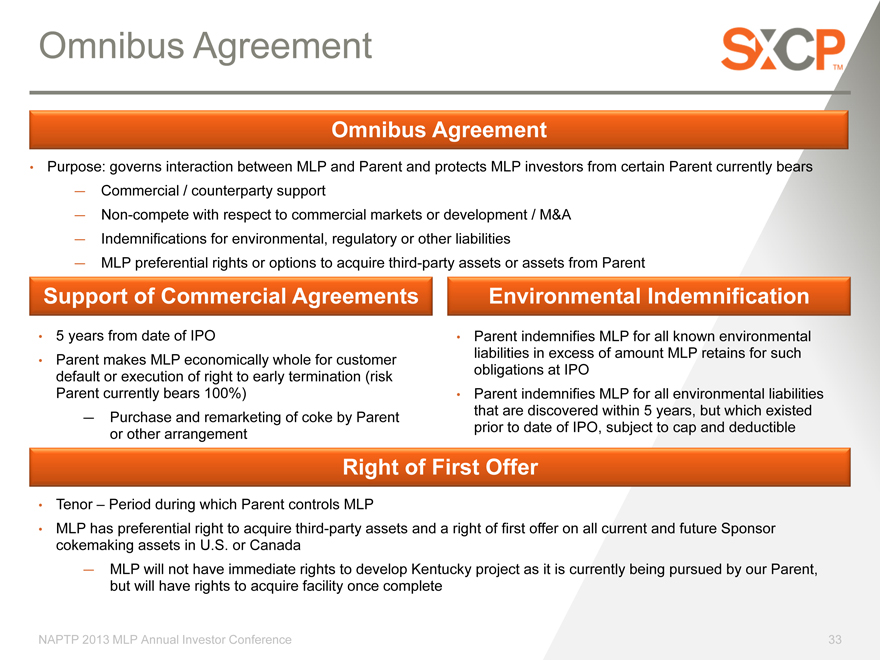

Omnibus Agreement

Omnibus Agreement

Purpose: governs interaction between MLP and Parent and protects MLP investors from certain Parent currently bears

Commercial / counterparty support

Non-compete with respect to commercial markets or development / M&A

Indemnifications for environmental, regulatory or other liabilities

MLP preferential rights or options to acquire third-party assets or assets from Parent

Support of Commercial Agreements Environmental Indemnification

5 years from date of IPO Parent indemnifies MLP for all known environmental liabilities in excess of amount MLP retains for such

Parent makes MLP economically whole for customer obligations at IPO default or execution of right to early termination (risk

Parent currently bears 100%) Parent indemnifies MLP for all environmental liabilities that are discovered within 5 years, but which existed

Purchase and remarketing of coke by Parent prior to date of IPO, subject to cap and deductible or other arrangement

Right of First Offer

Tenor – Period during which Parent controls MLP

MLP has preferential right to acquire third-party assets and a right of first offer on all current and future Sponsor cokemaking assets in U.S. or Canada

MLP will not have immediate rights to develop Kentucky project as it is currently being pursued by our Parent, but will have rights to acquire facility once complete

NAPTP 2013 MLP Annual Investor Conference

33