|

Exhibit 99.2

|

Investor day 2014

Agenda

2:00 pm Strategies for Value Creation

Fritz Henderson, Chairman & Chief Executive Officer

2:20 pm Operations Excellence: Maximizing Asset Productivity

Mike Thomson, President & Chief Operating Officer

2:50 pm Framing the Growth Opportunity

Jonathan Lock, Vice President, Strategy

3:10 pm Break

3:20 pm Restructuring and Capital Allocation

Mark Newman, Senior Vice President & Chief Financial Officer

3:50 pm Concluding Remarks

Fritz Henderson, Chairman & Chief Executive Officer

4:00 pm Q&A

5:00 pm Cocktail Reception

Investor Day 2014 2

Forward-Looking Statements

Some of the information included in this presentation constitutes “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All statements in this presentation that express opinions, expectations, beliefs, plans, objectives, assumptions or projections with respect to anticipated future performance of SunCoke or the Partnership, in contrast with statements of historical facts, are forward-looking statements. Such forward-looking statements are based on management’s beliefs and assumptions and on information currently available. Forward-looking statements include information concerning possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance improvements, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and may be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “will,” “should” or the negative of these terms or similar expressions.

Although management believes that its plans, intentions and expectations reflected in or suggested by the forward-looking statements made in this presentation are reasonable, no assurance can be given that these plans, intentions or expectations will be achieved when anticipated or at all. Moreover, such statements are subject to a number of assumptions, risks and uncertainties. Many of these risks are beyond the control of SunCoke and the Partnership, and may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Each of SunCoke and the Partnership has included in its filings with the Securities and Exchange Commission cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement. For more information concerning these factors, see the Securities and Exchange Commission filings of SunCoke and the Partnership. All forward-looking statements included in this presentation are expressly qualified in their entirety by such cautionary statements. Although forward-looking statements are based on current beliefs and expectations, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date hereof. SunCoke and the Partnership do not have any intention or obligation to update publicly any forward-looking statement (or its associated cautionary language) whether as a result of new information or future events or after the date of this presentation, except as required by applicable law.

This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of the presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in the Appendix.

Investor Day 2014 3

Fritz Henderson

Chairman and

Chief Executive Officer

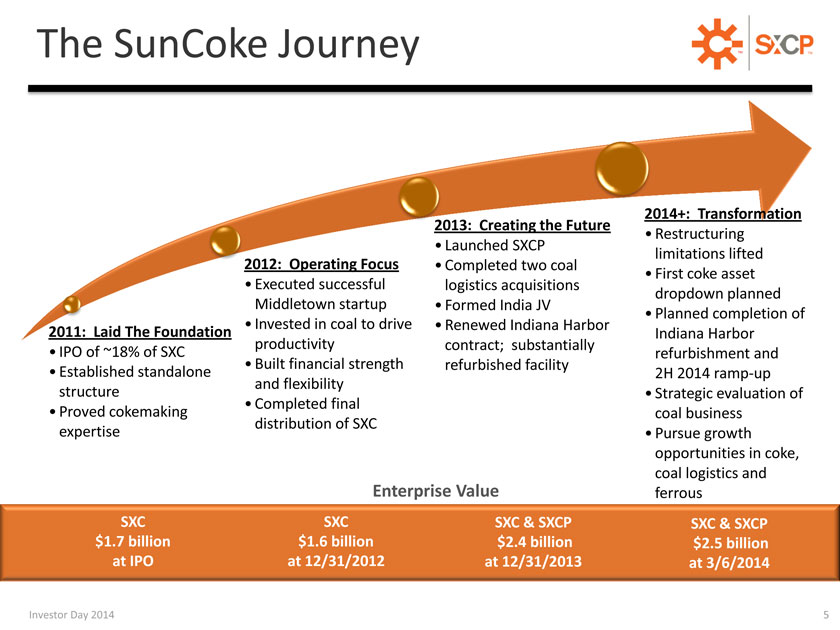

The SunCoke Journey

2011: Laid The Foundation

IPO of ~18% of SXC

Established standalone structure

Proved cokemaking expertise

2012: Operating Focus

Executed successful Middletown startup

Invested in coal to drive productivity

Built financial strength and flexibility

Completed final distribution of SXC

2013: Creating the Future

Launched SXCP

Completed two coal logistics acquisitions

Formed India JV

Renewed Indiana Harbor contract; substantially refurbished facility

2014+: Transformation

Restructuring limitations lifted

First coke asset dropdown planned

Planned completion of Indiana Harbor refurbishment and

2H 2014 ramp-up

Strategic evaluation of coal business

Pursue growth opportunities in coke, coal logistics and ferrous

Enterprise Value

SXC SXC SXC & SXCP SXC & SXCP $1.7 billion $1.6 billion $2.4 billion $2.5 billion at IPO at 12/31/2012 at 12/31/2013 at 3/6/2014

Investor Day 2014 5

5

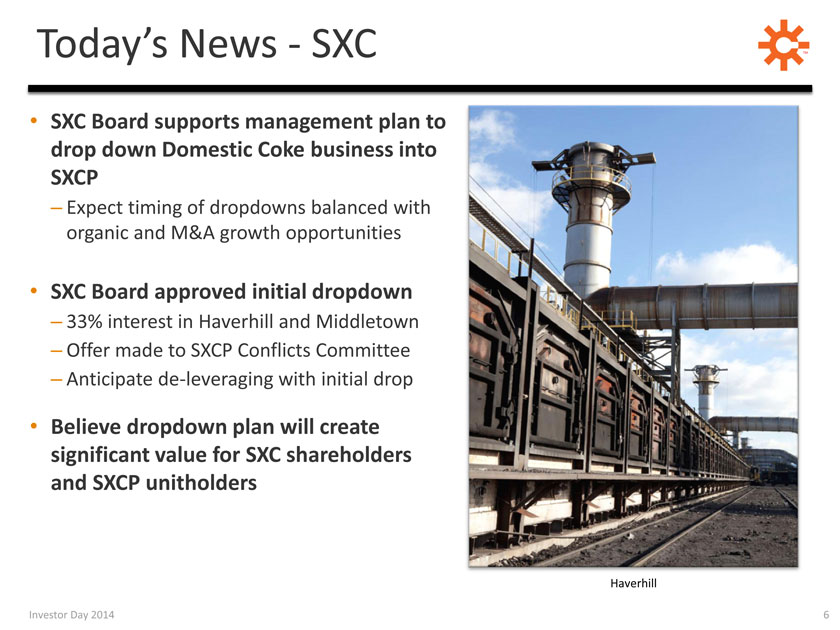

Today’s News—SXC

• SXC Board supports management plan to drop down Domestic Coke business into SXCP

– Expect timing of dropdowns balanced with organic and M&A growth opportunities

• SXC Board approved initial dropdown

– 33% interest in Haverhill and Middletown

– Offer made to SXCP Conflicts Committee

– Anticipate de-leveraging with initial drop

• Believe dropdown plan will create significant value for SXC shareholders and SXCP unitholders

Haverhill

Investor Day 2014 6

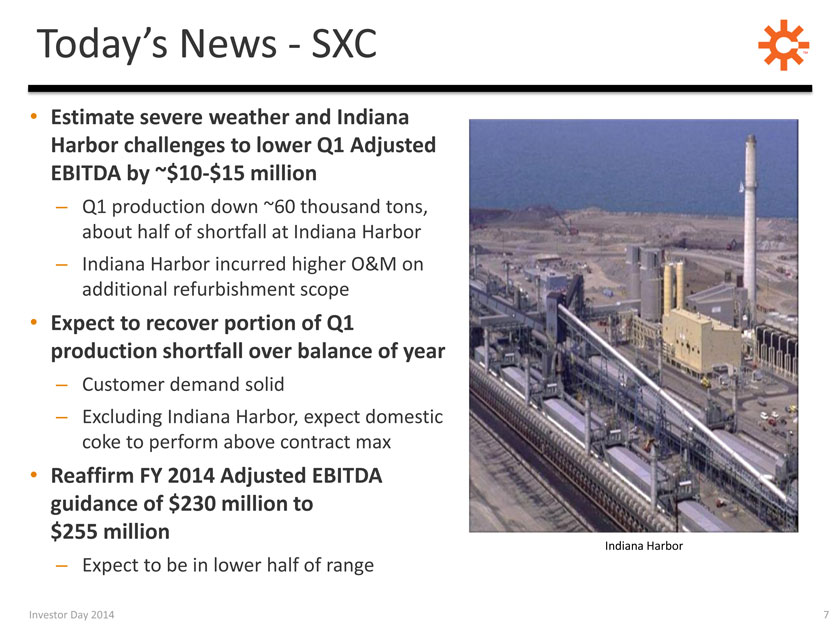

Today’s News—SXC

• Estimate severe weather and Indiana Harbor challenges to lower Q1 Adjusted EBITDA by ~$10-$15 million

– Q1 production down ~60 thousand tons, about half of shortfall at Indiana Harbor

– Indiana Harbor incurred higher O&M on additional refurbishment scope

• Expect to recover portion of Q1 production shortfall over balance of year

– Customer demand solid

– Excluding Indiana Harbor, expect domestic coke to perform above contract max

• Reaffirm FY 2014 Adjusted EBITDA guidance of $230 million to $255 million

– Expect to be in lower half of range

Indiana Harbor

Investor Day 2014 7

Coal Business Strategic Evaluation

Developing strategic exit plan

Retained advisors to assist with restructuring plan

– Have significant structuring flexibility and will evaluate all options

– Preferred option is potential sale but will consider other alternatives including joint ventures, partnerships or further downsizing

New prep plant part of evaluation

– Generates MLP qualifying income

– Willing to invest to optimize potential exit transaction

Key transaction objectives include

– Ensure reliable, cost-effective supply of coal to Jewell Coke

– Enable standalone Jewell Coke operation

– Create value for SXC shareholders

Investor Day 2014 8

SXC Priorities

Given domestic coke dropdown plan and coal business restructuring, evaluating strategic alternatives for SXC

Focus on maximizing value of SXC by

– Increasing value of SXC’s ownership of SXCP & GP interest

– Maximizing cash flow from remaining SXC level assets

– Deploying capital in projects delivering attractive risk-adjusted returns

Expect SXC to become a flexible recycler of capital

– Focus on investing to drive productivity in existing assets and incubate projects for SXCP

Plan to review capital allocation priorities with Board after first drop

Investor Day 2014 9

Today’s News—SXCP

• Intend to raise per unit cash distribution 5.3% to $0.50 for Q1 2014 payment

– Expect to be above 1.15x annual cash coverage ratio on existing operations

• Initial drop expected to add

~$38 million annually to distributable cash flow (pre-financing) (1)

– Supports additional future increases to per unit cash distribution rate

• Assessing optimal dropdown funding structures

– Expect first dropdown financed by combination of SXCP equity and debt

Middletown

(1) Distributable Cash Flow (pre-financing) equal to EBITDA less ongoing capex and replacement capex accrual. Does not include interest expense related to potential debt financing.

Investor Day 2014 10

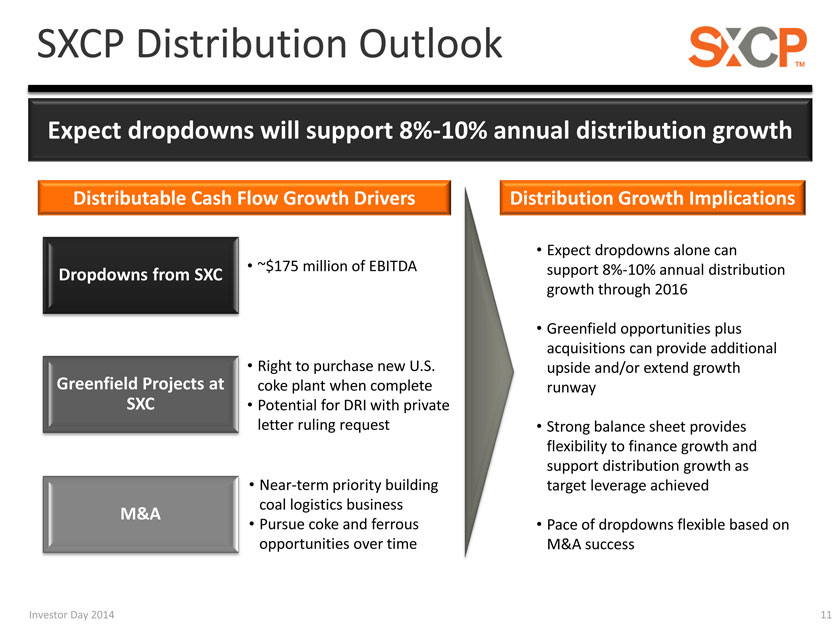

SXCP Distribution Outlook

Expect dropdowns will support 8%-10% annual distribution growth

Distributable Cash Flow Growth Drivers

Dropdowns from SXC

~$175 million of EBITDA

Greenfield Projects at SXC

Right to purchase new U.S. coke plant when complete

Potential for DRI with private letter ruling request

M&A

Near-term priority building coal logistics business

Pursue coke and ferrous opportunities over time

Distribution Growth Implications

Expect dropdowns alone can support 8%-10% annual distribution growth through 2016

Greenfield opportunities plus acquisitions can provide additional upside and/or extend growth runway

Strong balance sheet provides flexibility to finance growth and support distribution growth as target leverage achieved

Pace of dropdowns flexible based on M&A success

Investor Day 2014 11

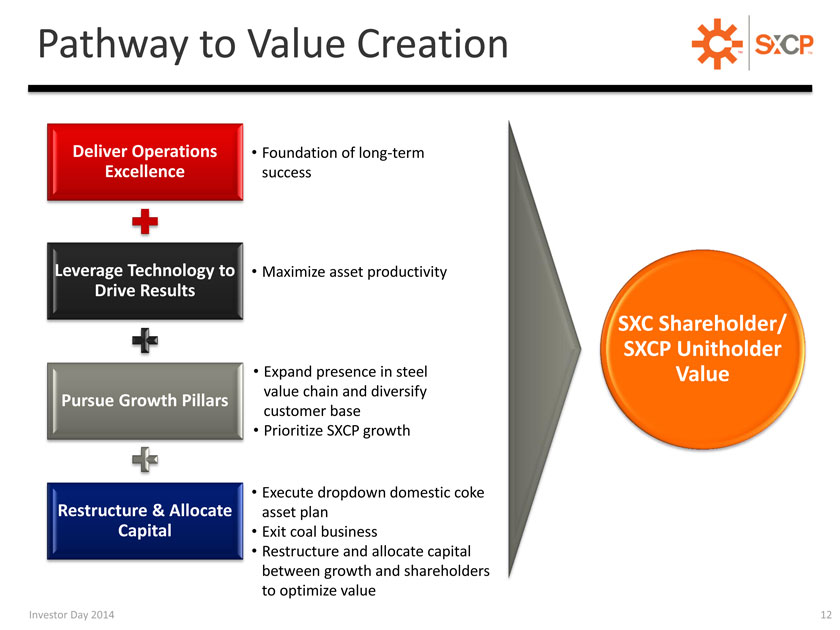

Pathway to Value Creation

Deliver Operations Excellence

Foundation of long-term success

Leverage Technology to Drive Results

Maximize asset productivity

Pursue Growth Pillars

Expand presence in steel value chain and diversify customer base

Prioritize SXCP growth

Restructure & Allocate Capital

Execute dropdown domestic coke asset plan

Exit coal business

Restructure and allocate capital between growth and shareholders to optimize value

SXC Shareholder/ SXCP Unitholder Value

Investor Day 2014 12

Mike Thomson

President and

Chief Operating Officer

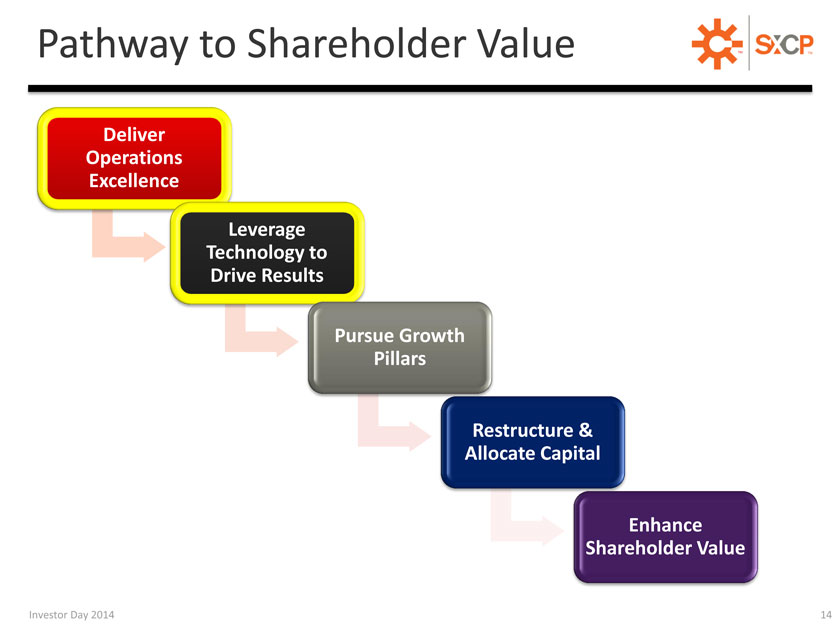

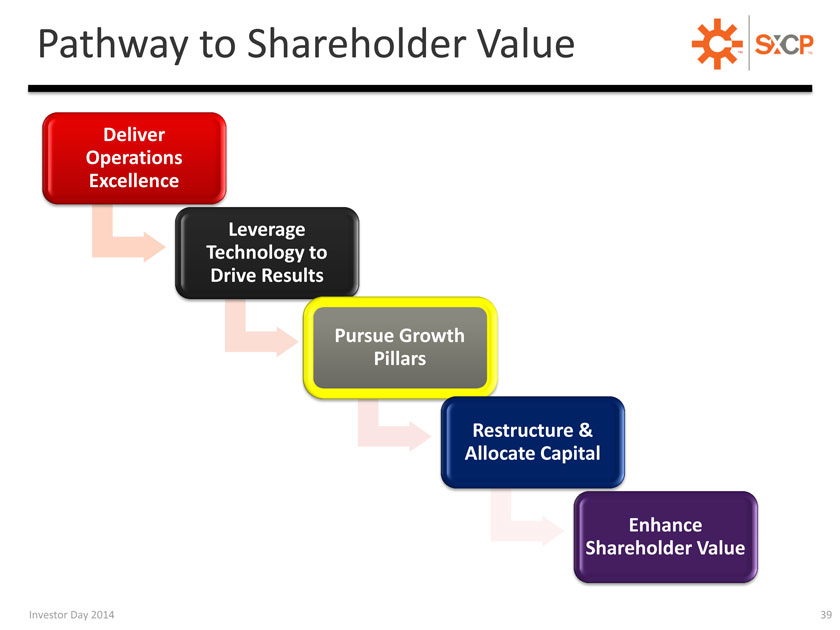

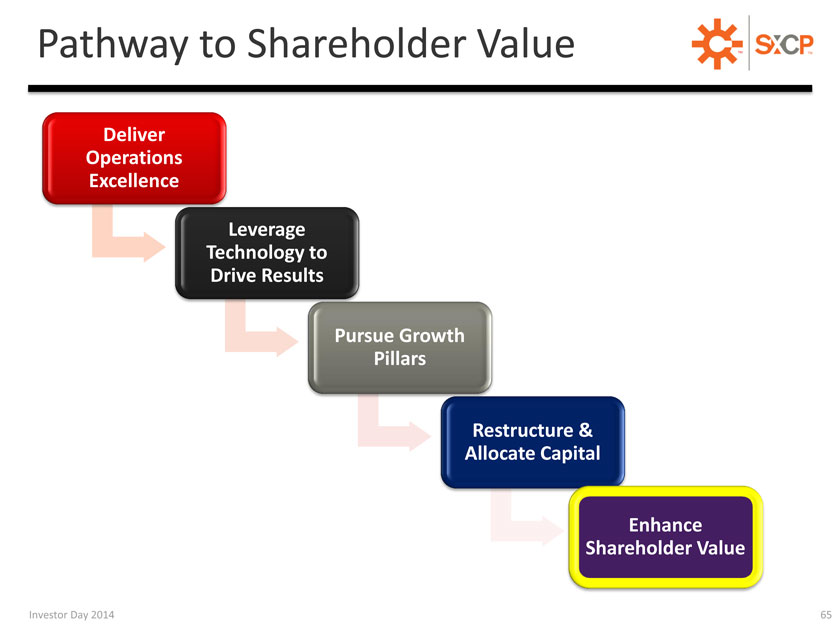

Pathway to Shareholder Value

Deliver Operations Excellence

Leverage

Technology to Drive Results

Pursue Growth

Pillars

Restructure & Allocate Capital

Enhance

Shareholder Value

Investor Day 2014 14

Deliver Operations Excellence

Focus of The SunCoke Way

Financial Performance

Productivity

Execution

Safety & Environmental

Leverage operating know-how and technology to continuously improve yields, operating and maintenance costs

Rigorous discipline around systems and processes of coke and coal mining operations

Sustain and enhance top quartile safety performance

Meet and exceed environmental standards

Investor Day 2014 15

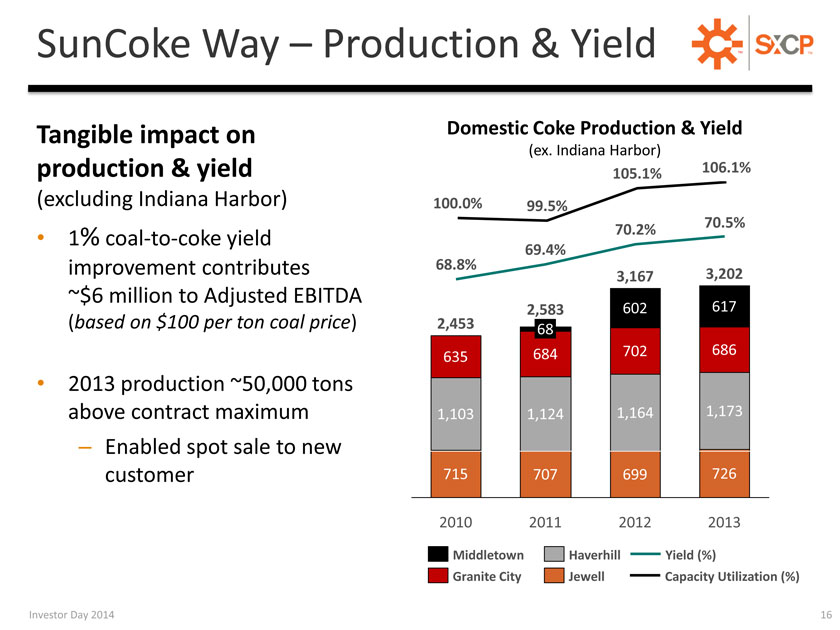

SunCoke Way – Production & Yield

Tangible impact on production & yield

(excluding Indiana Harbor)

1% coal-to-coke yield improvement contributes

~$6 million to Adjusted EBITDA

(based on $100 per ton coal price)

2013 production ~50,000 tons above contract maximum

– Enabled spot sale to new customer

Domestic Coke Production & Yield

(ex. Indiana Harbor)

105.1% 106.1% 100.0% 99.5% 70.5% 70.2% 69.4% 68.8% 3,167 3,202

2,583 602 617

2,453 68

684 702 686 635

1,103 1,124 1,164 1,173

715 707 699 726

2010 2011 2012 2013

Middletown Haverhill Yield (%)

Granite City Jewell Capacity Utilization (%)

Investor Day 2014 16

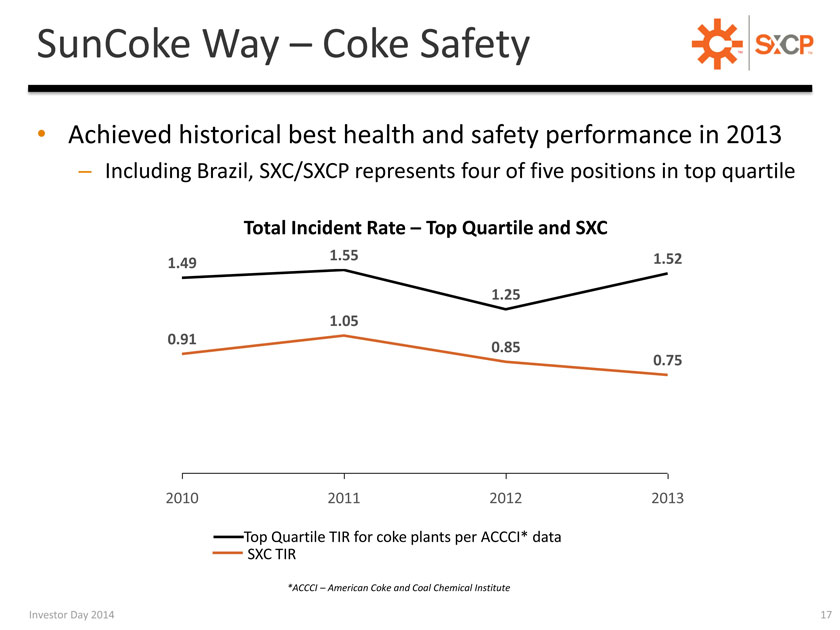

SunCoke Way – Coke Safety

Achieved historical best health and safety performance in 2013

– Including Brazil, SXC/SXCP represents four of five positions in top quartile

Total Incident Rate – Top Quartile and SXC

1.55 1.52

1.49

1.25

1.05

0.91

0.85

0.75

2010 2011 2012 2013

Top Quartile TIR for coke plants per ACCCI* data SXC TIR

*ACCCI – American Coke and Coal Chemical Institute

Investor Day 2014 17

International Coke

Brazil Coke

Demonstrated exceptional flexibility operating at ~50% utilization

2013 Adj. EBITDA of $16 million on 876 thousand tons

Expect improvement in 2014 on higher volumes

VISA SunCoke

Strong operating performance

Merchant market experiencing margin compression due to slower economic growth, import pricing pressure and high inventories

Anticipate contribution of ~$3 million to 2014E Adj. EBITDA

Brazil Coke

VISA SunCoke

Investor Day 2014 18

Coal Mining Business

Continued focus on decreasing cash costs per ton on productivity gains and reduced royalty rates

Maintaining focus on top quartile safety and compliance performance

Preserve assets and capabilities to maximize strategic flexibility

Investor Day 2014 19

LEVERAGE TECHNOLOGY

Investor Day 2014 20

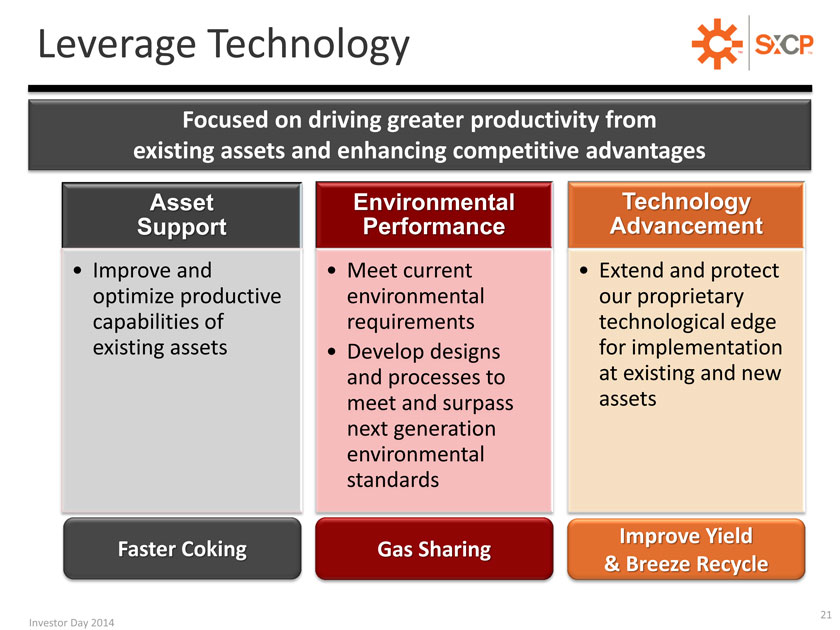

Leverage Technology

Focused on driving greater productivity from existing assets and enhancing competitive advantages

Asset Support

Improve and

optimize productive

capabilities of

existing assets

Faster Coking

Environmental Performance

Meet current environmental requirements

Develop designs and processes to meet and surpass next generation environmental standards

Gas Sharing

Technology

Advancement

Extend and protect our proprietary technological edge for implementation at existing and new assets

Improve Yield

& Breeze Recycle

21 Investor Day 2014

Investor Day 2014 21

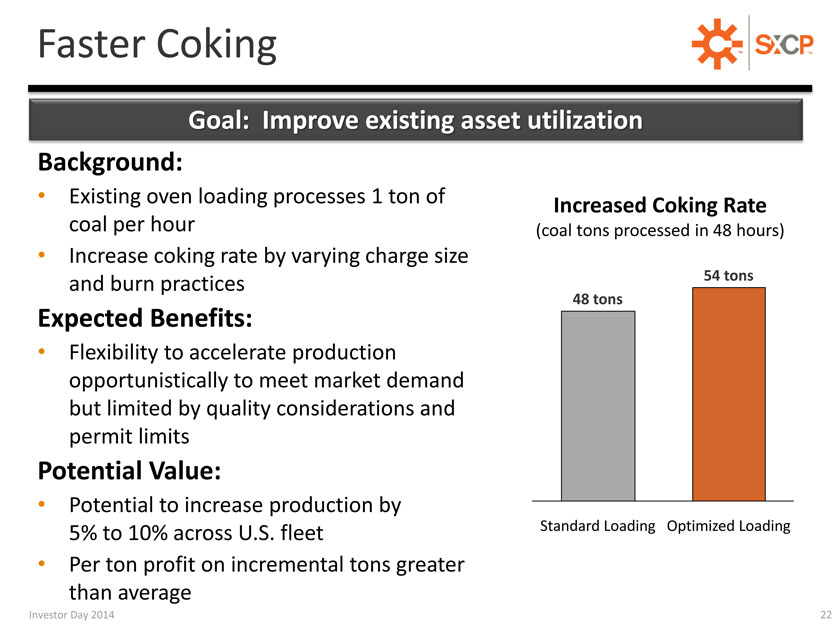

Faster Coking

Goal: Improve existing asset utilization

Existing oven loading processes 1 ton of coal per hour

Increase coking rate by varying charge size and burn practices

Expected Benefits:

Flexibility to accelerate production opportunistically to meet market demand but limited by quality considerations and permit limits

Potential Value:

Potential to increase production by 5% to 10% across U.S. fleet

Per ton profit on incremental tons greater than average

Increased Coking Rate

(coal tons processed in 48 hours)

48 tons

54 tons

Standard Loading Optimized Loading

Investor Day 2014 22

Gas Sharing

Goal: Develop and implement new technology to minimize venting

Background:

Address NOVs at Haverhill and Granite City as part of U.S. EPA Consent Decree

Expected Benefits:

Substantially reduces venting

Sets new emission standard for cokemaking

Capital Investment:

Estimated cap ex $120 million to be invested 2012 – 2016

– $33 million in 2012-2013; $41 million planned in 2014

Investor Day 2014 23

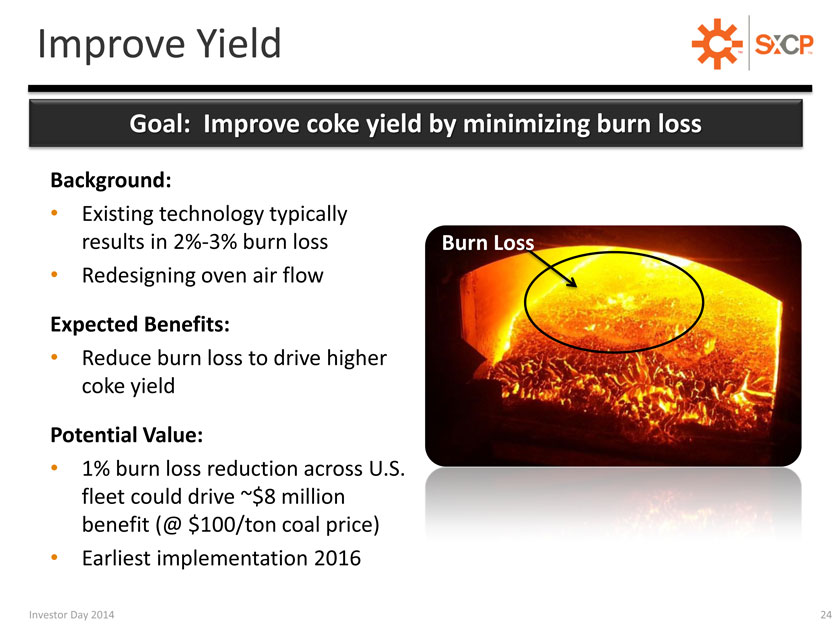

Improve Yield

Goal: Improve coke yield by minimizing burn losts

Background:

Existing technology typically results in 2%-3% burn loss

Redesigning oven air flow

Expected Benefits:

Reduce burn loss to drive higher coke yield

Potential Value:

1% burn loss reduction across U.S. fleet could drive ~$8 million benefit (@ $100/ton coal price)

Earliest implementation 2016

Burn Loss

Investor Day 2014 24

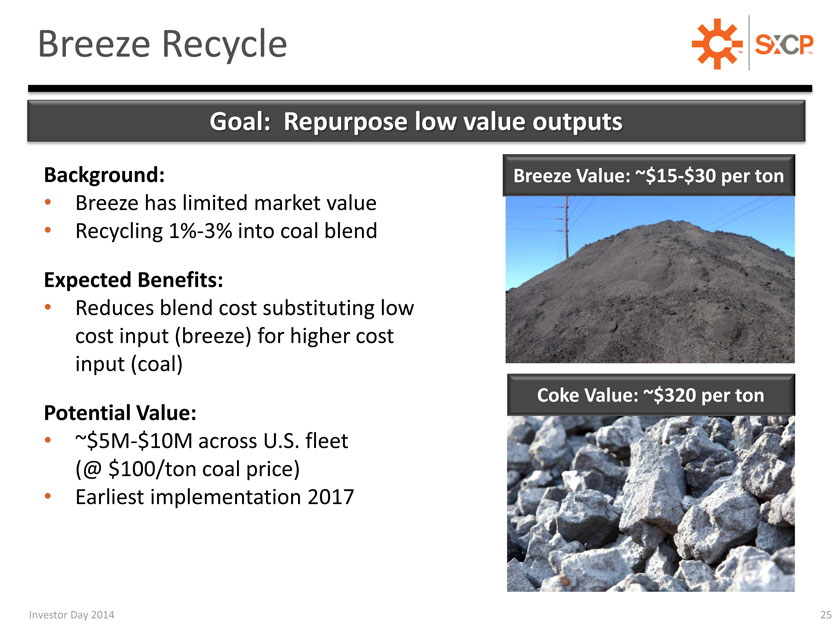

Breeze Recycle

Goal: Repurpose low value outpu

Background:

Breeze has limited market value

Recycling 1%-3% into coal blend

Expected Benefits:

Reduces blend cost substituting low cost input (breeze) for higher cost input (coal)

Potential Value:

~$5M-$10M across U.S. fleet

(@ $100/ton coal price)

Earliest implementation 2017

Breeze Value: ~$15-$30 per ton

Coke Value: ~$320 per ton

Investor Day 2014 25

INDIANA HARBOR REFURBISHMENT

Investor Day 2014 26

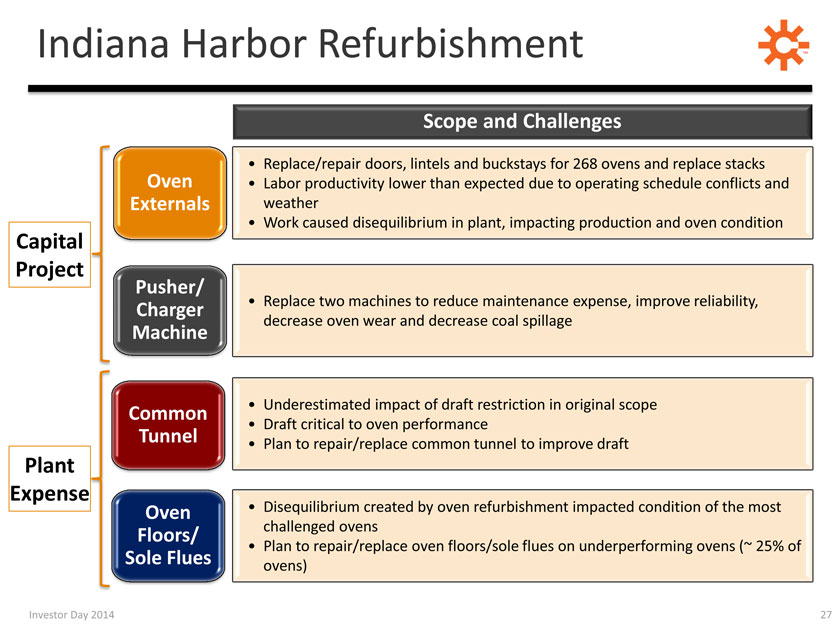

Indiana Harbor Refurbishment

Capital Project

Plant

Expense

Oven Externals

Pusher/ Charger Machine

Common Tunnel

Oven

Floors/

Sole Flues

Scope and Challenges

Replace/repair doors, lintels and buckstays for 268 ovens and replace stacks

Labor productivity lower than expected due to operating schedule conflicts and weather

Work caused disequilibrium in plant, impacting production and oven condition

Replace two machines to reduce maintenance expense, improve reliability, decrease oven wear and decrease coal spillage

Underestimated impact of draft restriction in original scope

Draft critical to oven performance

Plan to repair/replace common tunnel to improve draft

Disequilibrium created by oven refurbishment impacted condition of the most challenged ovens

Plan to repair/replace oven floors/sole flues on underperforming ovens (~ 25% of ovens)

Investor Day 2014 27

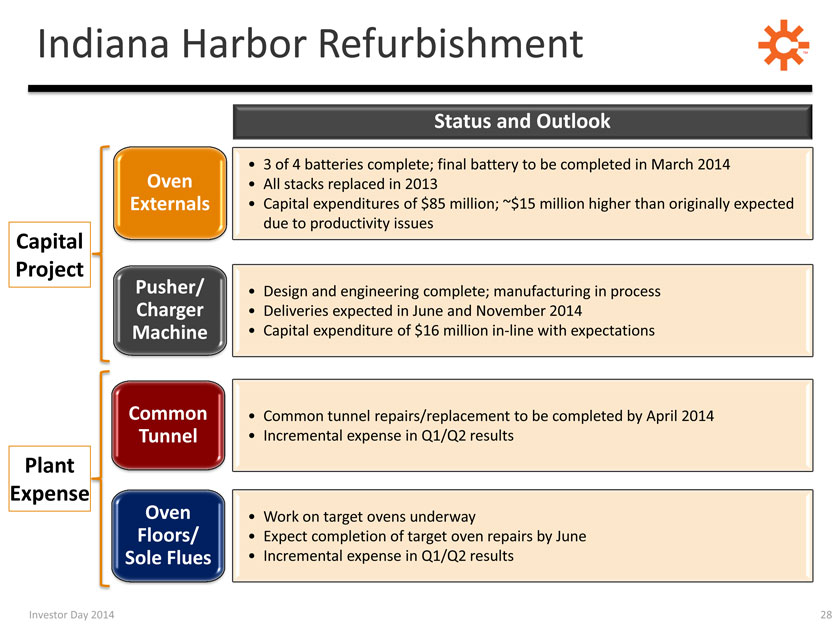

Indiana Harbor Refurbishment

Capital Project Plant Expense

Oven Externals

Pusher/ Charger Machine

Common Tunnel

Oven

Floors/

Sole Flues

Status and Outlook

3 of 4 batteries complete; final battery to be completed in March 2014

All stacks replaced in 2013

Capital expenditures of $85 million; ~$15 million higher than originally expected due to productivity issues

Design and engineering complete; manufacturing in process

Deliveries expected in June and November 2014

Capital expenditure of $16 million in-line with expectations

Common tunnel repairs/replacement to be completed by April 2014

Incremental expense in Q1/Q2 results

Work on target ovens underway

Expect completion of target oven repairs by June

Incremental expense in Q1/Q2 results

Investor Day 2014 28

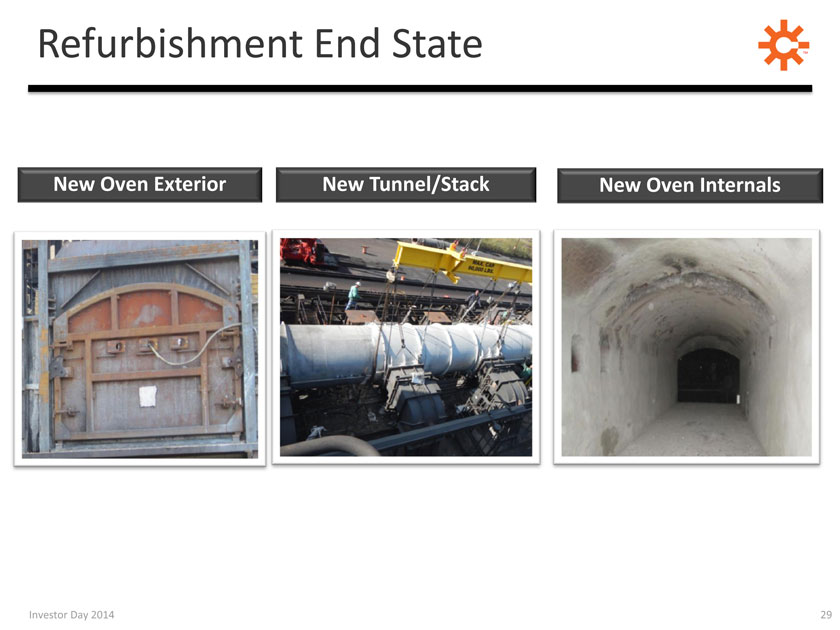

Refurbishment End State

New Oven Exterior New Tunnel/Stack New Oven Internals

Investor Day 2014 29

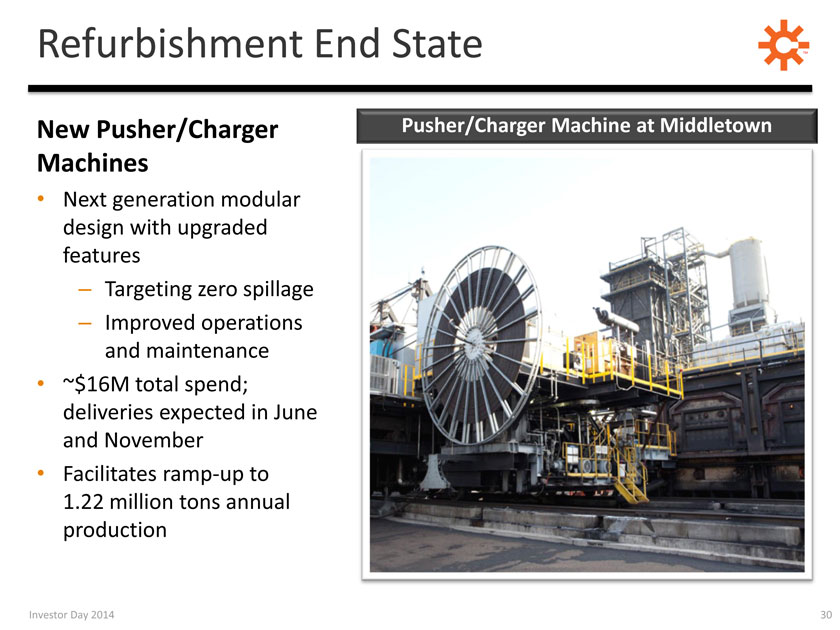

Refurbishment End State

New Pusher/Charger Pusher/Charger Machine at Middletown

Machines

Next generation modular design with upgraded features

– Targeting zero spillage

– Improved operations and maintenance

~$16M total spend; deliveries expected in June and November

Facilitates ramp-up to 1.22 million tons annual production

Investor Day 2014 30

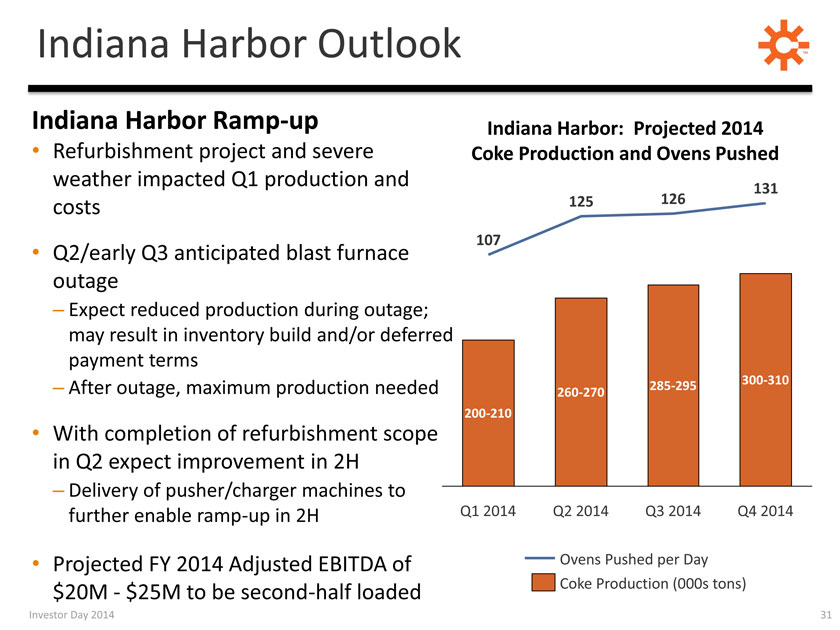

Indiana Harbor Outlook TM

Indiana Harbor Ramp-up Indiana Harbor: Projected 2014

Refurbishment project and severe Coke Production and Ovens Pushed weather impacted Q1 production and costs

131

Q2/early Q3 anticipated blast furnace outage

– Expect reduced production during outage; may result in inventory build and/or deferred payment terms

300-310

– After outage, maximum production needed 285-295

260-270 200-210

With completion of refurbishment scope in Q2 expect improvement in 2H

– Delivery of pusher/charger machines to further enable ramp-up in 2H Q1 2014 Q2 2014 Q3 2014 Q4 2014

Projected FY 2014 Adjusted EBITDA of Ovens Pushed per Day $20M—$ 25M to be Coke Production (000s tons) second-half loaded

Investor Day 2014 31

POTENTIAL NEW COKE PLANT

Investor Day 2014 32

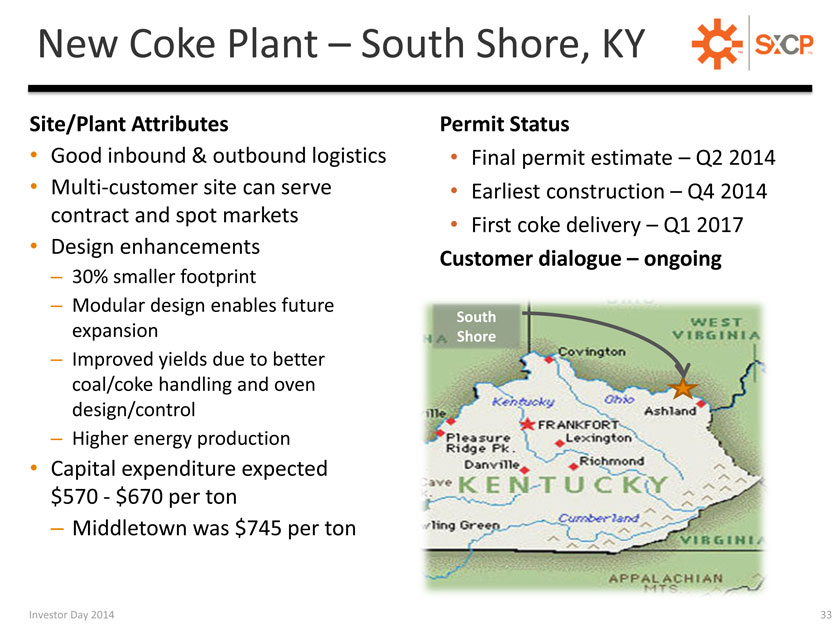

New Coke Plant – South Shore, KY TM

Site/Plant Attributes Permit Status

Good inbound & outbound logistics Final permit estimate – Q2 2014

Multi-customer site can serve Earliest construction – Q4 2014 contract and spot markets

First coke delivery – Q1 2017

Design enhancements

Customer dialogue – ongoing

– 30% smaller footprint

– Modular design enables future

South

expansion Shore

– Improved yields due to better coal/coke handling and oven design/control

– Higher energy production

Capital expenditure expected $570—$670 per ton

– Middletown was $745 per ton

Investor Day 2014 33

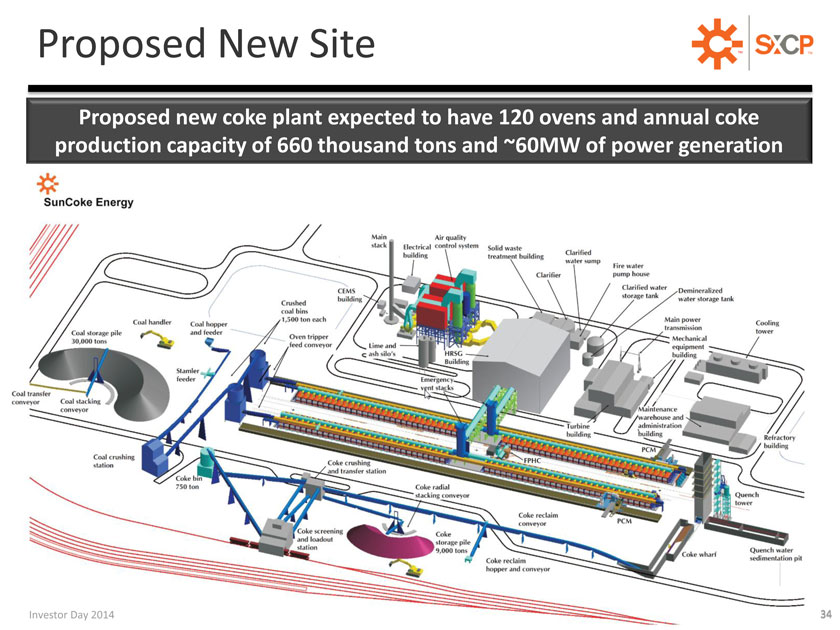

Proposed New Site TM

Proposed new coke plant expected to have 120 ovens and annual coke production capacity of 660 thousand tons and ~60MW of power generation

Investor Day 2014 34

COAL LOGISTICS

Investor Day 2014 35

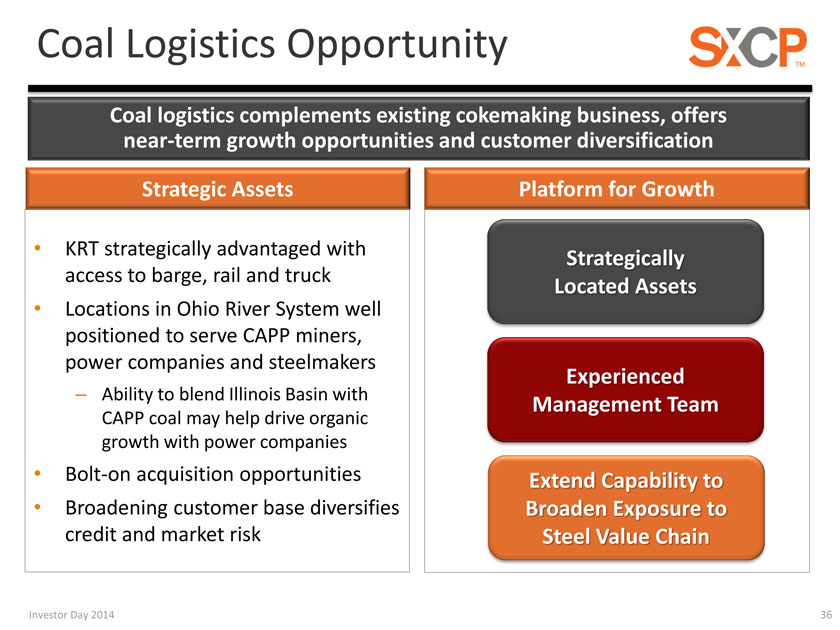

Coal Logistics Opportunity

Coal logistics complements existing cokemaking business, offers near-term growth opportunities and customer diversification

Strategic Assets

KRT strategically advantaged with access to barge, rail and truck

Locations in Ohio River System well positioned to serve CAPP miners, power companies and steelmakers

– Ability to blend Illinois Basin with CAPP coal may help drive organic growth with power companies

Bolt-on acquisition opportunities

Broadening customer base diversifies credit and market risk

Platform for Growth

Strategically Located Assets

Experienced Management Team

Extend Capability to Broaden Exposure to Steel Value Chain

Investor Day 2014 36

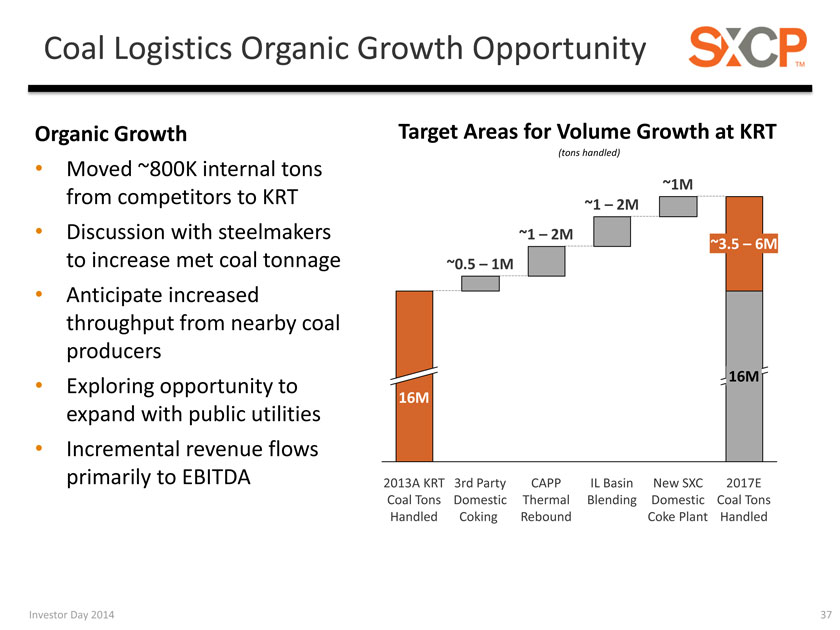

Coal Logistics Organic Growth Opportunity

Organic Growth Target Areas for Volume Growth at KRT

(tons handled)

Moved ~800K internal tons

~1M

from competitors to KRT ~1 – 2M

• Discussion with steelmakers ~1 – 2M

~3.5 – 6M

to increase met coal tonnage ~0.5 – 1M

Anticipate increased throughput from nearby coal producers

16M

Exploring opportunity to

16M

expand with public utilities

Incremental revenue flows

primarily to EBITDA 2013A KRT 3rd Party CAPP IL Basin New SXC 2017E Coal Tons Domestic Thermal Blending Domestic Coal Tons Handled Coking Rebound Coke Plant Handled

Investor Day 2014 37

Jonathan Lock

Vice President—

Strategy

Pathway to Shareholder Value

Deliver Operations Excellence

Leverage

Technology to Drive Results

Pursue Growth

Pillars

Restructure & Allocate Capital

Enhance

Shareholder Value

Investor Day 2014 39

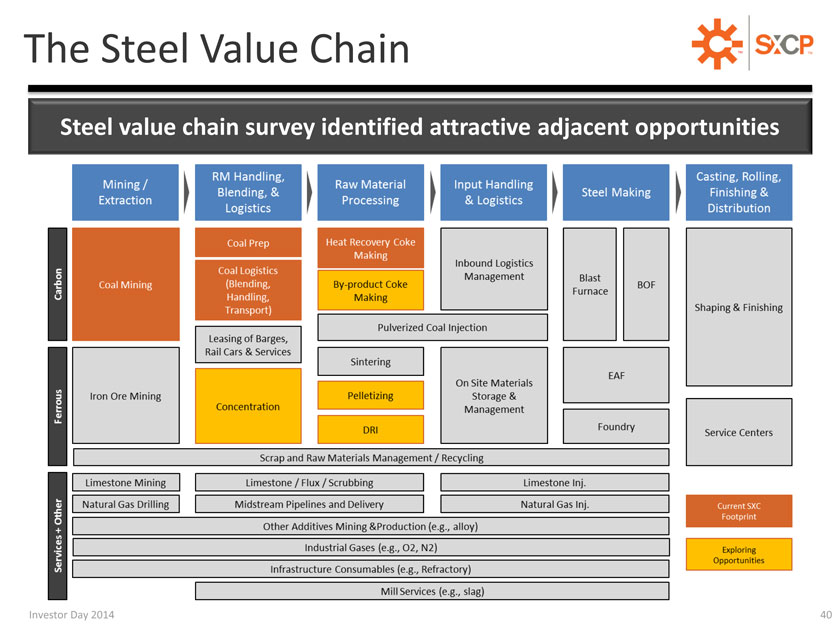

The Steel Value Chain TM

Steel value chain survey identified attractive adjacent opportunities

Investor Day 2014 40

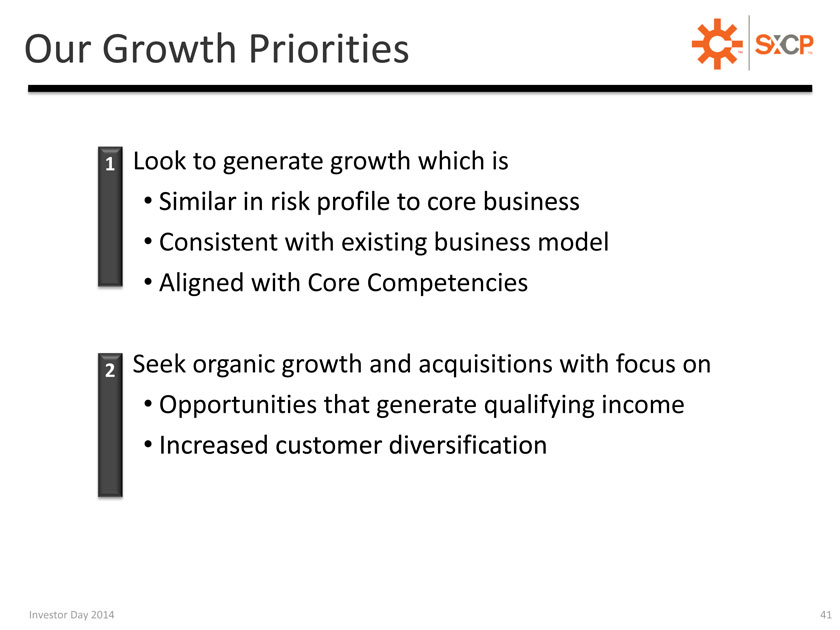

Our Growth Priorities TM

1 Look to generate growth which is

Similar in risk profile to core business

Consistent with existing business model

Aligned with Core Competencies

2 Seek organic growth and acquisitions with focus on

Opportunities that generate qualifying income

Increased customer diversification

Investor Day 2014 41

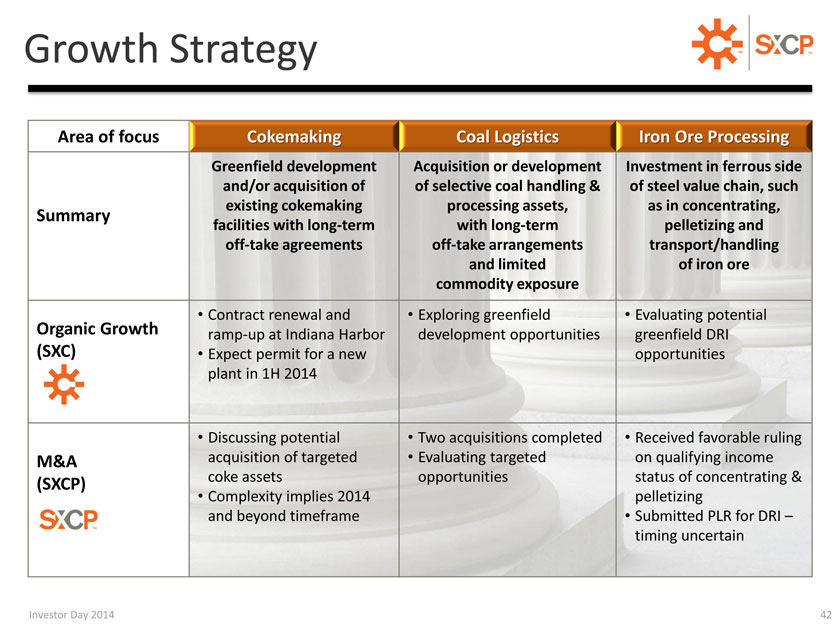

Growth Strategy TM

Area of focus Cokemaking Coal Logistics Iron Ore Processing

Greenfield development Acquisition or development Investment in ferrous side and/or acquisition of of selective coal handling & of steel value chain, such existing cokemaking processing assets, as in concentrating,

Summary facilities with long-term with long-term pelletizing and off-take agreements off-take arrangements transport/handling and limited of iron ore commodity exposure

Contract renewal and Exploring greenfield Evaluating potential Organic Growth ramp-up at Indiana Harbor development opportunities greenfield DRI (SXC) Expect permit for a new opportunities plant in 1H 2014

• Discussing potential • Two acquisitions completed • Received favorable ruling M&A acquisition of targeted • Evaluating targeted on qualifying income coke assets opportunities status of concentrating & (SXCP) implies

Complexity 2014 pelletizing and beyond timeframe Submitted PLR for DRI – timing uncertain

Investor Day 2014 42

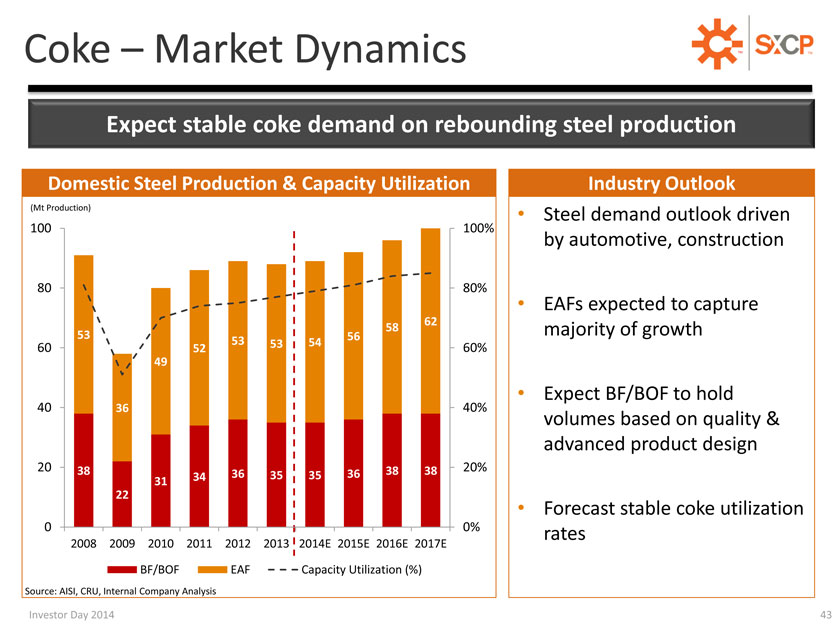

Coke – Market Dynamics TM

Expect stable coke demand on rebounding steel production

Domestic Steel Production & Capacity Utilization Industry Outlook

(Mt Production) • Steel demand outlook driven

100 100%

by automotive, construction

80 80%

EAFs expected to capture

62

58 majority of growth

53 56 62

53 53 54

60 52 60%

49

Expect BF/BOF to hold

40 36 40%

volumes based on quality & advanced product design 38

20 38 38 38 20%

34 36 35 35 36 31 22

Forecast stable coke utilization

0 0% rates

2008 2009 2010 2011 2012 2013 2014E 2015E 2016E 2017E

BF/BOF EAF Capacity Utilization (%)

Source: AISI, CRU, Internal Company Analysis

Investor Day 2014 43

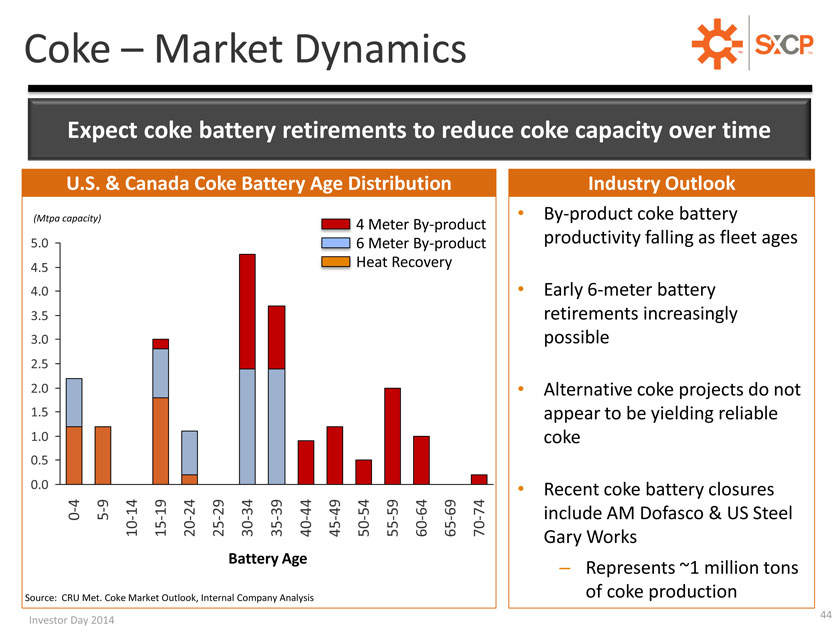

Coke – Market Dynamics

Expect coke battery retirements to reduce coke capacity over time

U.S. & Canada Coke Battery Age Distribution

(Mtpa capacity) 4 Meter By-product 5.0 6 Meter By-product 4.5 Heat Recovery

4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5

0.0

49

— 14 19 24 29 34 39 44 49 54 59 64 69 74

0 5 10—15—20 — 25—30—35—40—45—50 55—60 — 65 70 -

Battery Age

Source: CRU Met. Coke Market Outlook, Internal Company Analysis

Industry Outlook

By-product coke battery productivity falling as fleet ages

Early 6-meter battery retirements increasingly possible

Alternative coke projects do not appear to be yielding reliable coke

Recent coke battery closures include AM Dofasco & US Steel Gary Works

– Represents ~1 million tons of coke production

44 Investor Day 2014

Investor Day 2014 44

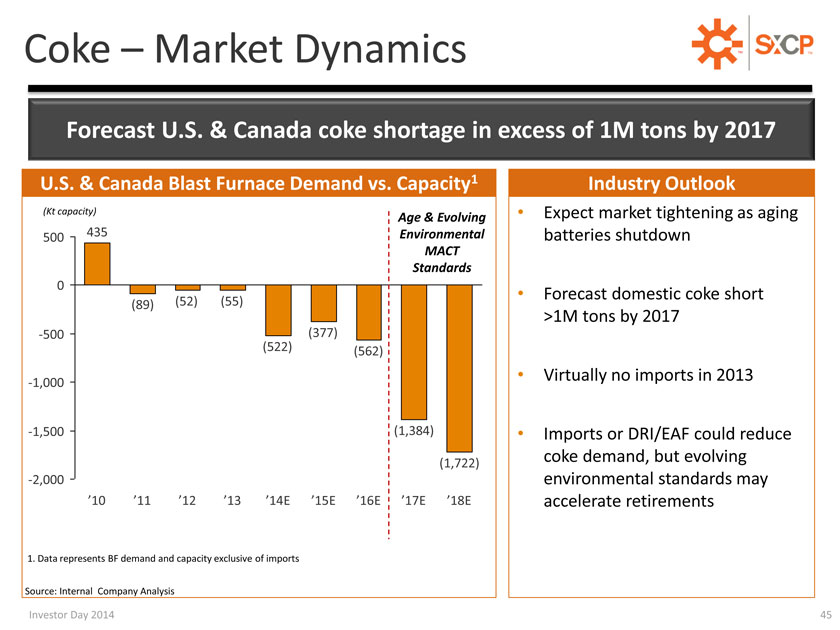

Coke – Market Dynamics TM

Forecast U.S. & Canada coke shortage in excess of 1M tons by 2017

U.S. & Canada Blast Furnace Demand vs. Capacity1 Industry Outlook

(Kt capacity) • Expect market tightening as aging

Age & Evolving

500 435 Environmental batteries shutdown

MACT

Standards

0

Forecast domestic coke short

(89) (52) (55)

>1M tons by 2017

-500 (377)

(522) (562)

Virtually no imports in 2013

-1,000

-1,500 (1,384) • Imports or DRI/EAF could reduce coke demand, but evolving

(1,722)

-2,000 environmental standards may

’10 ’11 ’12 ’13 ’14E ’15E ’16E ’17E ’18E accelerate retirements

1. Data represents BF demand and capacity exclusive of imports

Source: Internal Company Analysis

Investor Day 2014 45

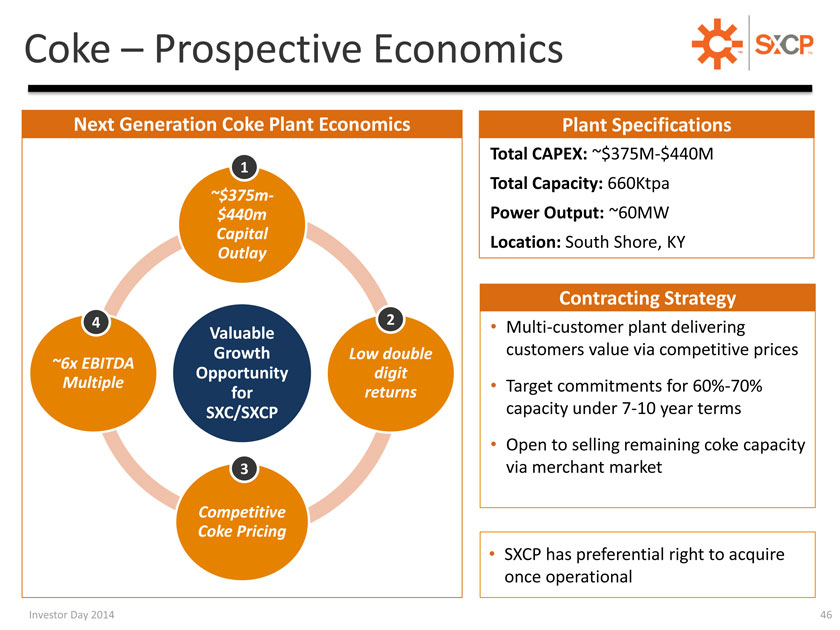

Coke – Prospective Economics TM

Next Generation Coke Plant Economics Plant Specifications

Total CAPEX: ~$375M-$440M

1

Total Capacity: 660Ktpa

~$375m-$440m Power Output: ~60MW

Capital

Location: South Shore, KY

Outlay

Contracting Strategy

4 2

Valuable • Multi-customer plant delivering ~6x EBITDA Growth Low double customers value via competitive prices

Opportunity digit

Multiple • Target commitments for 60%-70% for returns

SXC/SXCP capacity under 7-10 year terms

Open to selling remaining coke capacity 3 via merchant market

Competitive Coke Pricing

SXCP has preferential right to acquire once operational

Investor Day 2014 46

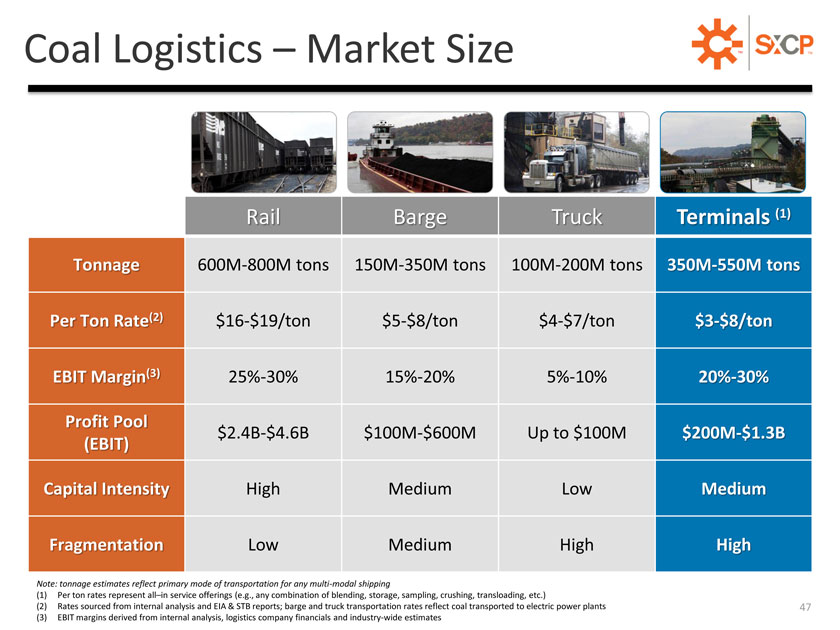

Coal Logistics – Market Size TM

Rail Barge Truck Terminals (1)

Tonnage 600M-800M tons 150M-350M tons 100M-200M tons 350M-550M tons Per Ton Rate(2) $16-$19/ton $5-$8/ton $4-$7/ton $3-$8/ton EBIT Margin(3) 25%-30% 15%-20% 5%-10% 20%-30%

Profit Pool $2.4B-$4.6B $100M-$600M Up to $100M $200M-$1.3B

(EBIT)

Capital Intensity High Medium Low Medium

Fragmentation Low Medium High High

Note: tonnage estimates reflect primary mode of transportation for any multi-modal shipping

(1) Per ton rates represent all–in service offerings (e.g., any combination of blending, storage, sampling, crushing, transloading, etc.)

(2) Rates sourced from internal analysis and EIA & STB reports; barge and truck transportation rates reflect coal transported to electric power plants 47 (3) EBIT margins derived from internal analysis, logistics company financials and industry-wide estimates

Investor Day 2014 47

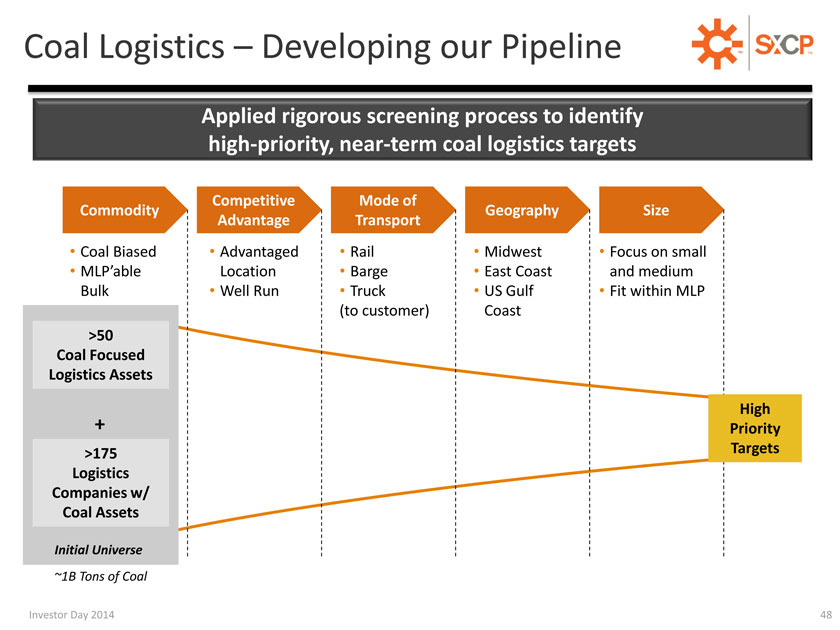

Coal Logistics – Developing our Pipeline TM

Applied rigorous screening process to identify high-priority, near-term coal logistics targets

Competitive Mode of

Commodity Geography Size Advantage Transport

Coal Biased Advantaged Rail Midwest Focus on small

MLP’able Location Barge East Coast and medium Bulk Well Run Truck US Gulf Fit within MLP

(to customer) Coast

>50 Coal Focused Logistics Assets

High

+ Priority >175 Targets Logistics Companies w/ Coal Assets

Initial Universe

~1B Tons of Coal

Investor Day 2014 48

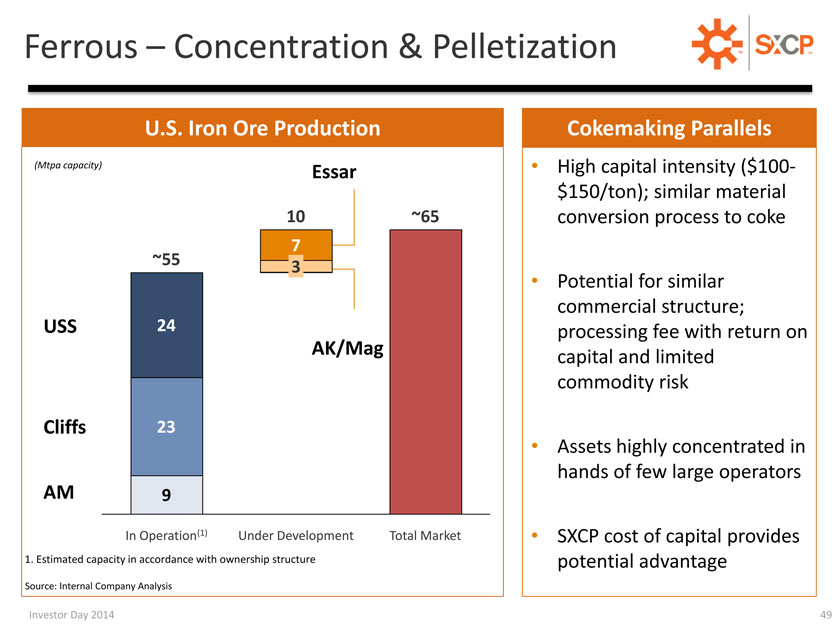

Ferrous – Concentration & Pelletization TM

U.S. Iron Ore Production Cokemaking Parallels

(Mtpa capacity) Essar • High capital intensity ($100- $150/ton); similar material

10 ~65 conversion process to coke

~55 7 3

Potential for similar commercial structure;

USS 24 processing fee with return on

AK/Mag capital and limited commodity risk

Cliffs 23

• Assets highly concentrated in hands of few large operators

AM 9

In Operation(1) Under Development Total Market • SXCP cost of capital provides

1. Estimated capacity in accordance with ownership structure potential advantage

Source: Internal Company Analysis

Investor Day 2014 49

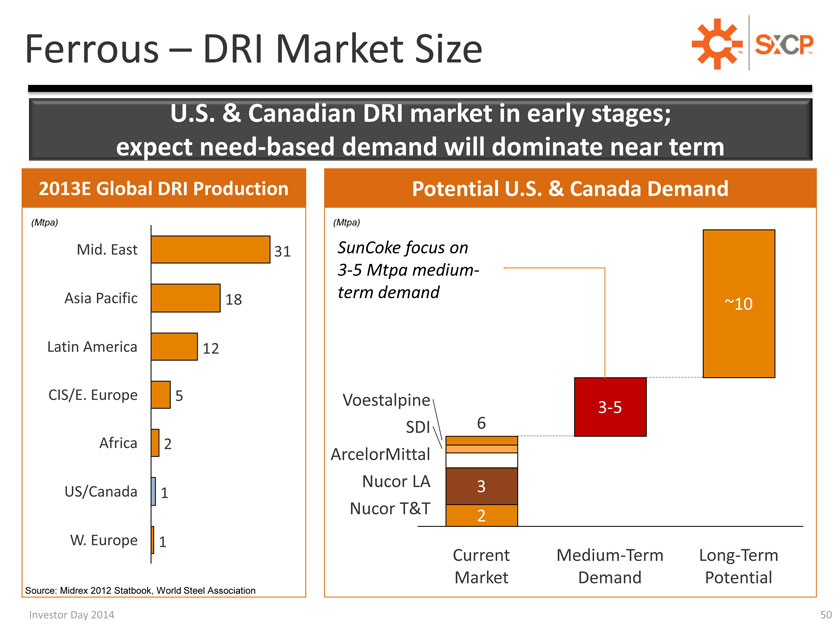

Ferrous – DRI Market Size TM

U.S. & Canadian DRI market in early stages; expect need-based demand will dominate near term

2013E Global DRI Production Potential U.S. & Canada Demand

(Mtpa) (Mtpa)

Mid. East 31 SunCoke focus on 3-5 Mtpa medium-

Asia Pacific term demand 6 -9

18 ~10

Latin America 12

CIS/E. Europe 5 Voestalpine

3-5 SDI 6

Africa 2

ArcelorMittal Nucor LA 3

US/Canada 1

Nucor T&T 2

W. Europe 1

Current Medium-Term Long-Term Market Demand Potential

Source: Midrex 2012 Statbook, World Steel Association

Investor Day 2014 50

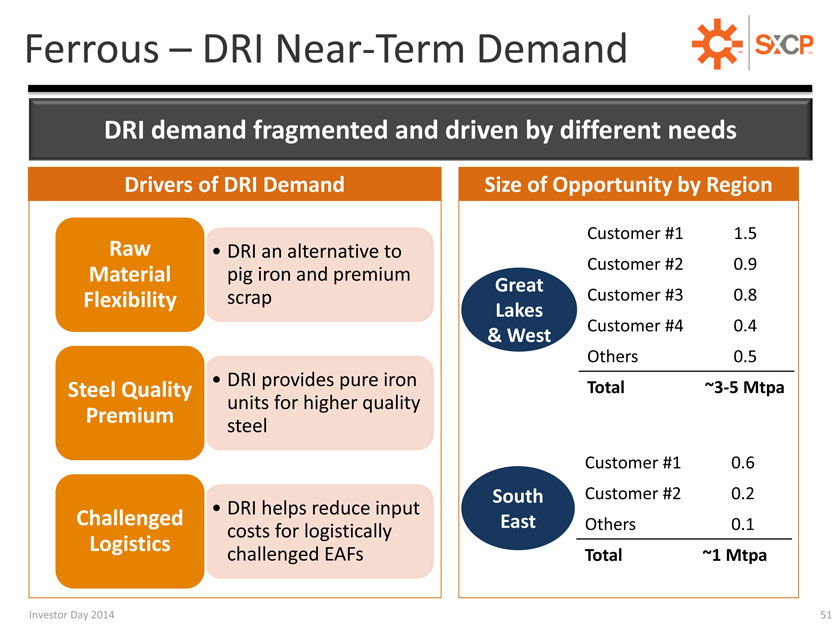

Ferrous – DRI Near-Term Demand TM

DRI demand fragmented and driven by different needs

Drivers of DRI Demand Size of Opportunity by Region

Customer #1 1.5

Raw • DRI an alternative to Customer #2 0.9 Material pig iron and premium

Great

Flexibility scrap Lakes Customer #3 0.8 Customer #4 0.4

& West

Others 0.5

• DRI provides pure iron Total ~3-5 Mtpa

Steel Quality

units for higher quality

Premium

steel

Customer #1 0

.6

DRI helps reduce input South Customer #2 0.2

Challenged East Others 0.1

costs for logistically

Logistics

challenged EAFs Total ~1 Mtpa

Investor Day 2014 51

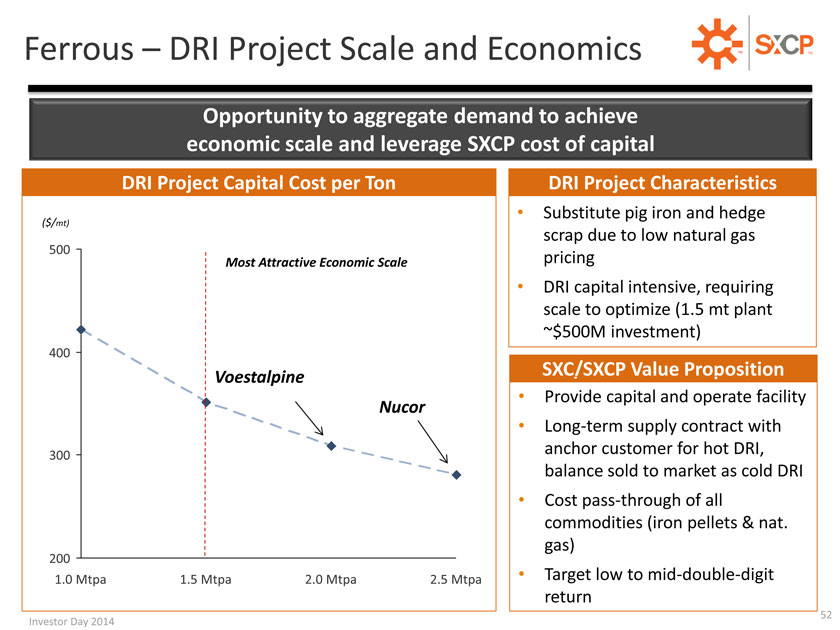

Ferrous – DRI Project Scale and Economics TM

Opportunity to aggregate demand to achieve economic scale and leverage SXCP cost of capital

DRI Project Capital Cost per Ton DRI Project Characteristics

Substitute pig iron and hedge

($/mt)

scrap due to low natural gas

500

Most Attractive Economic Scale pricing

DRI capital intensive, requiring scale to optimize (1.5 mt plant

~$500M investment)

400

SXC/SXCP Value Proposition

Voestalpine

Provide capital and operate facility

Nucor

Long-term supply contract with anchor customer for hot DRI,

300

balance sold to market as cold DRI

Cost pass-through of

all commodities (iron pellets & nat. gas)

200

1.0 Mtpa 1.5 Mtpa 2.0 Mtpa 2.5 Mtpa • Target low to mid-double-digit return

52 Investor Day 2014

Investor Day 2014 52

Mark Newman

Senior Vice President &

Chief Financial Officer

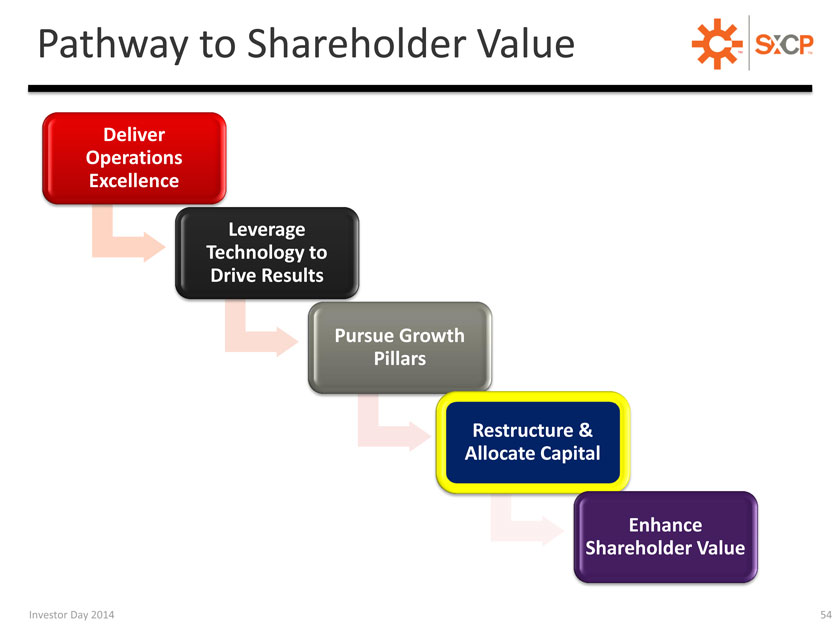

Pathway to Shareholder Value TM

Deliver Operations Excellence

Leverage

Technology to Drive Results

Pursue Growth

Pillars

Restructure & Allocate Capital

Enhance

Shareholder Value

Investor Day 2014 54

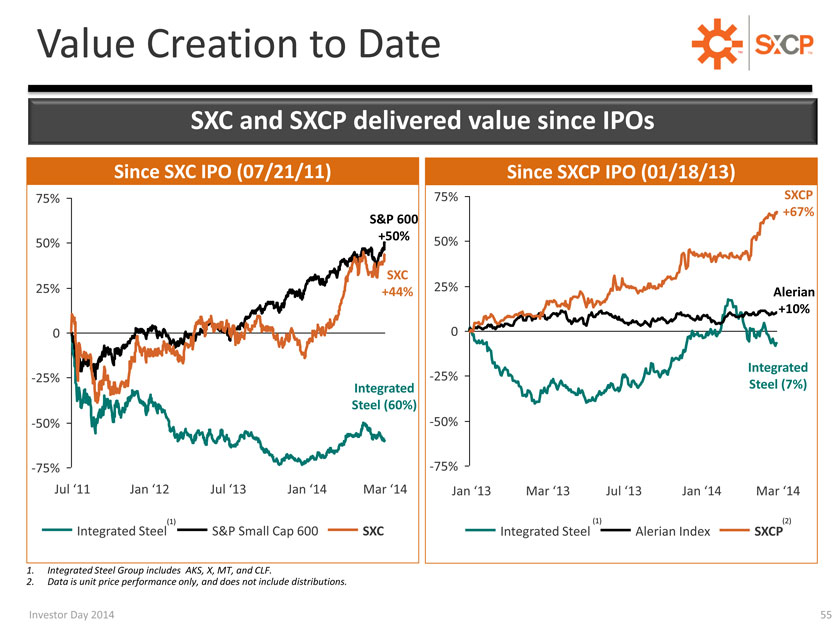

Value Creation to Date TM

SXC and SXCP delivered value since IPOs

Since SXC IPO (07/21/11) Since SXCP IPO (01/18/13)

75% 75% SXCP +67% S&P 600 +50%

50% 50%

SXC

25% +44% 25% Alerian +10%

0 0

Integrated

-25% -25%

Integrated Steel (7%) Steel (60%)

-50% -50%

-75% -75%

Jul ‘11 Jan ‘12 Jul ‘13 Jan ‘14 Mar ‘14 Jan ‘13 Mar ‘13 Jul ‘13 Jan ‘14 Mar ‘14

(1) (1) (2)

Integrated Steel S&P Small Cap 600 SXC Integrated Steel Alerian Index SXCP

1. Integrated Steel Group includes AKS, X, MT, and CLF.

2. Data is unit price performance only, and does not include distributions.

Investor Day 2014 55

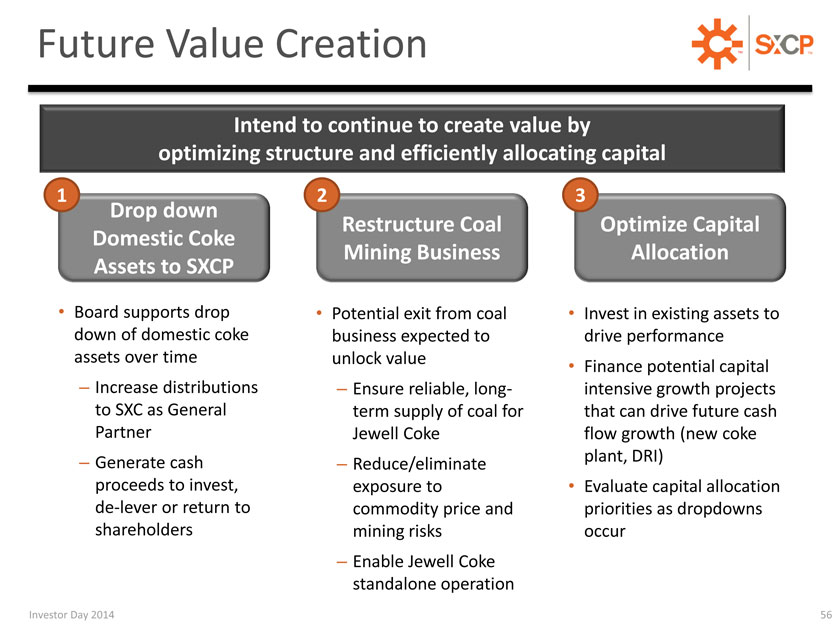

Future Value Creation TM

Intend to continue to create value by optimizing structure and efficiently allocating capital

1 2 3

Drop down

Restructure Coal Optimize Capital Domestic Coke Mining Business Allocation Assets to SXCP

Board supports drop Potential exit from coal Invest in existing assets to down of domestic coke business expected to drive performance assets over time unlock value

Finance potential capital

– Increase distributions – Ensure reliable, long- intensive growth projects to SXC as General term supply of coal for that can drive future cash Partner Jewell Coke flow growth (new coke

– Generate cash plant, DRI)

– Reduce/eliminate proceeds to invest, exposure to • Evaluate capital allocation de-lever or return to commodity price and priorities as dropdowns shareholders mining risks occur

– Enable Jewell Coke standalone operation

Investor Day 2014 56

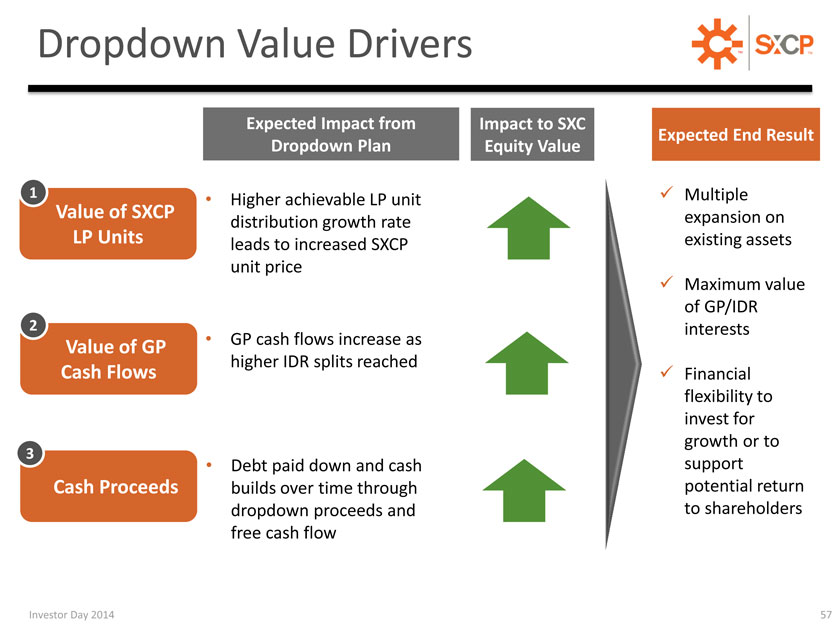

Dropdown Value Drivers TM

Expected Impact from Impact to SXC

Expected End Result Dropdown Plan Equity Value

1 • Higher achievable LP unit ??Multiple

Value of SXCP expansion on

LP Units distribution growth rate leads to increased SXCP existing assets unit price ??Maximum value of GP/IDR

2 GP cash flows increase interests • as Value of GP higher IDR splits reached

Cash Flows ??Financial

fl

exibility to invest for 3 growth or to

Debt paid down and cash support Cash Proceeds builds over time through potential return dropdown proceeds and to shareholders free cash flow

Investor Day 2014 57

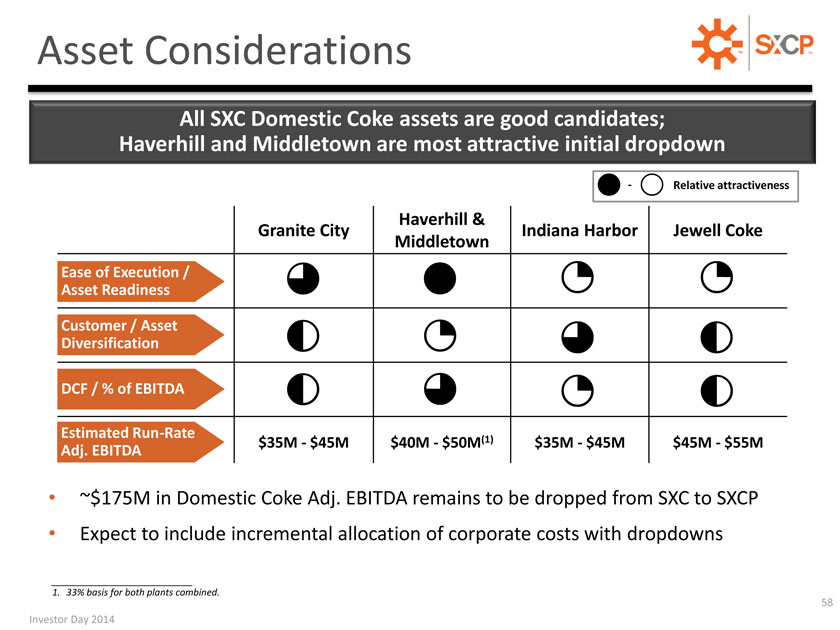

Asset Considerations TM

All SXC Domestic Coke assets are good candidates; Haverhill and Middletown are most attractive initial dropdown

- Relative attractiveness

Haverhill &

Granite City Indiana Harbor Jewell Coke Middletown

Ease of Execution / Asset Readiness

Customer / Asset Diversification

DCF / % of EBITDA

Estimated Run-Rate

Adj. EBITDA $35M—$45M $40M—$50M(1) $35M—$45M $45M—$55M

~$175M in Domestic Coke Adj. EBITDA remains to be dropped from SXC to SXCP

• Expect to include incremental allocation of corporate costs with dropdowns

1. 33% basis for both plants combined.

58 I

nvestor Day 2014

Investor Day 2014 58

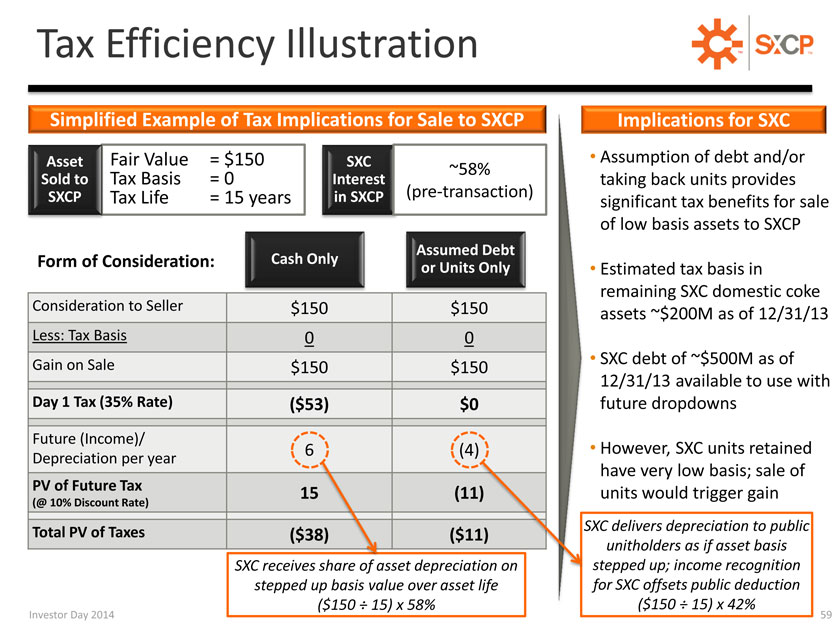

Tax Efficiency Illustration TM

Simplified Example of Tax Implications for Sale to SXCP Implications for SXC

Asset Fair Value = $150 SXC • Assumption of debt and/or ~58% Sold to Tax Basis = 0 Interest taking back units provides

SXCP Tax Life = 15 years in SXCP (pre-transaction) significant tax benefits for sale of low basis assets to SXCP

Cash Only Assumed Debt

Form of Consideration: or Units Only •

Estimated tax basis in remaining SXC domestic coke

Consideration to Seller $150 $150 assets ~$200M as of 12/31/13

Less: Tax Basis 0 0

Gain on Sale • SXC debt of ~$500M as of $150 $150 12/31/13 available to use with

Day 1 Tax (35% Rate) ($53) $0 future dropdowns

Future (Income)/

6 (4) • However, SXC units retained

Depreciation per year have very low basis; sale of

PV of Future Tax

15 (11) units would trigger gain

(@ 10% Discount Rate)

XC delivers depreciation to public

Total PV of Taxes ($38) ($11) unitholders as if asset basis SXC receives et depreciation on stepped up; income recognition stepped up basis value over asset life for SXC offsets public deduction Investor Day 2014 ($150 ÷ 15) x 58% ($150 ÷ 15) x 42% 59

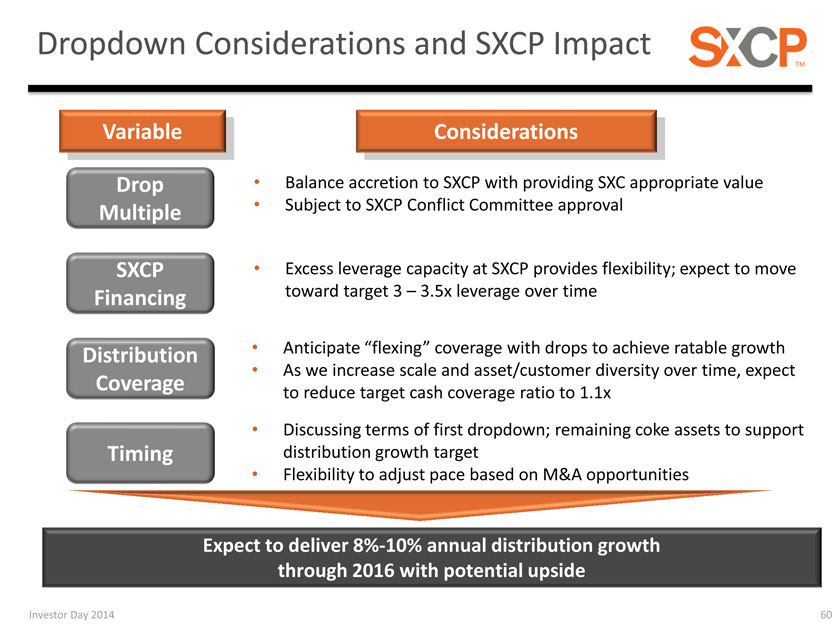

Dropdown Considerations and SXCP Impact

Variable Considerations

Drop • Balance accretion to SXCP with providing SXC appropriate value Multiple • Subject to SXCP Conflict Committee approval

SXCP • Excess leverage capacity at SXCP provides flexibility; expect to move Financing toward target 3 – 3.5x leverage over time

Distribution • Anticipate “flexing” coverage with drops to achieve ratable growth

As we increase scale and asset/customer diversity over time, expect

Coverage

to reduce target cash coverage ratio to 1.1x

Discussing terms of first dropdown; remaining coke assets to support Timing distribution growth target

Flexibility to adjust pace based on M&A opportunities

Expect to deliver 8%-10% annual distribution growth through 2016 with potential upside

Investor Day 2014 60

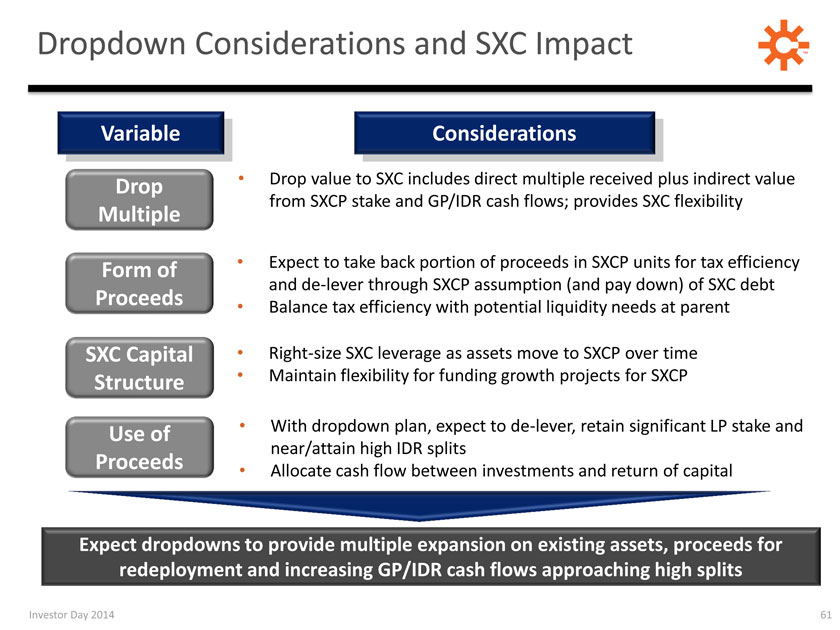

Dropdown Considerations and SXC Impact TM

Variable Considerations

Drop • Drop value to SXC includes direct multiple received plus indirect value from SXCP stake and GP/IDR cash flows; provides SXC flexibility

Multiple

Form of • Expect to take back portion of proceeds in SXCP units for tax efficiency and de-lever through SXCP assumption (and pay down) of SXC debt

Proceeds

Balance tax efficiency with potential liquidity needs at parent

SXC Capital • Right-size SXC leverage as assets move to SXCP over time Structure • Maintain flexibility for funding growth projects for SXCP

Use of • With dropdown plan, expect to de-lever, retain significant LP stake and near/attain high IDR splits

Proceeds

Allocate cash flow between investments and return of capital

Expect dropdowns to provide multiple expansion on existing assets, proceeds for redeployment and increasing GP/IDR cash flows approaching high splits

Investor Day 2014 61

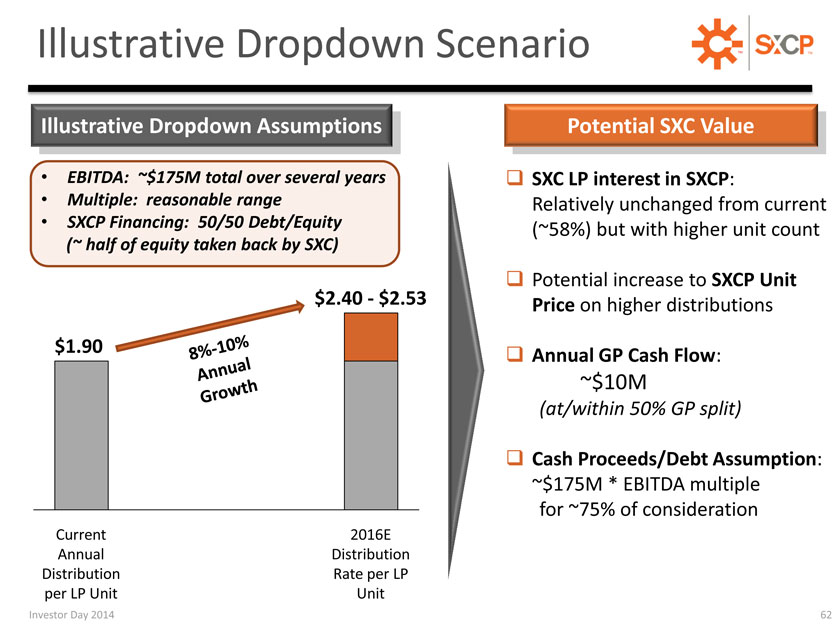

Illustrative Dropdown Scenario TM

Illustrative Dropdown Assumptions Potential SXC Value

EBITDA: ~$175M total over several years ??SXC LP interest in SXCP:

Multiple: reasonable range Relatively unchanged from current

• SXCP Financing: 50/50 Debt/Equity

(~ half of equity taken back by SXC) (~58%) but with higher unit count

??Potential increase to SXCP Unit $2.40—$2.53 Price on higher distributions $1.90 ??Annual GP Cash Flow:

~$10M

(at/within 50% GP split)

??Cash Proceeds/Debt Assumption:

~$175M * EBITDA multiple for ~75% of consideration

Current 2016E Annual Distribution Distribution Rate per LP per LP Unit Unit

Investor Day 2014 62

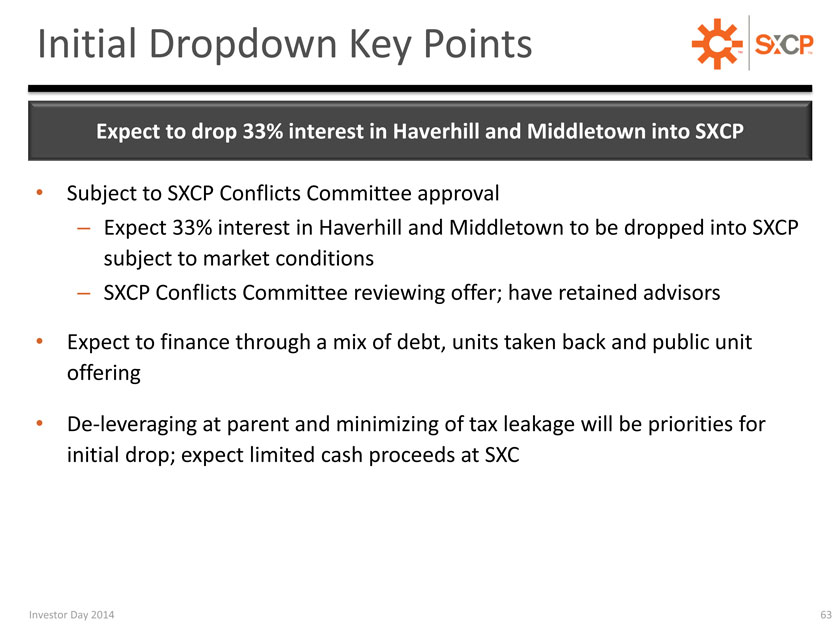

Initial Dropdown Key Points TM

Expect to drop 33% interest in Haverhill and Middletown into SXCP

Subject to SXCP Conflicts Committee approval

– Expect 33% interest in Haverhill and Middletown to be dropped into SXCP subject to market conditions

– SXCP Conflicts Committee reviewing offer; have retained advisors

Expect to finance through a mix of debt, units taken back and public unit offering

De-leveraging at parent and minimizing of tax leakage will be priorities for initial drop; expect limited cash proceeds at SXC

Investor Day 2014 63

Fritz Henderson

Chairman &

Chief Executive Officer

Pathway to Shareholder Value TM

Deliver Operations Excellence

Leverage

Technology to Drive Results

Pursue Growth

Pillars

Restructure & Allocate Capital

Enhance

Shareholder Value

Investor Day 2014 65

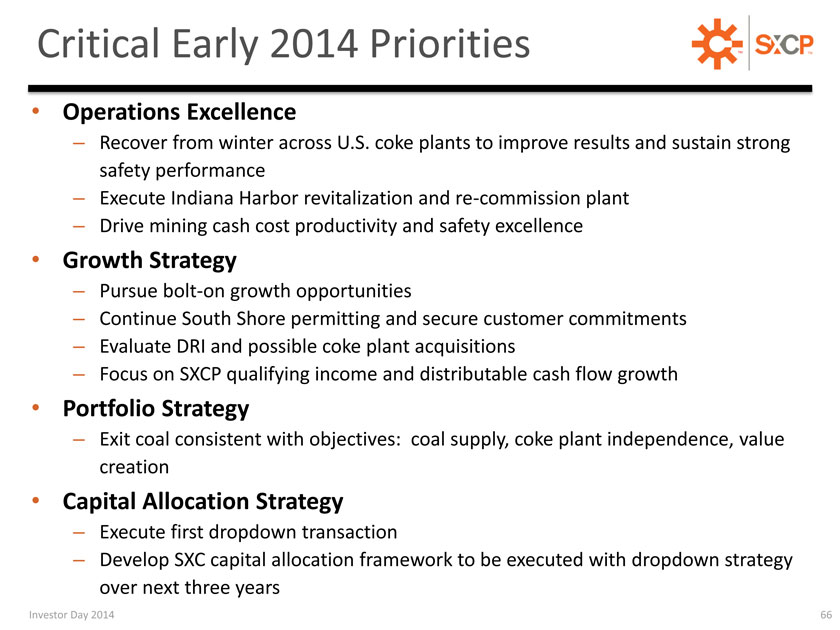

Critical Early 2014 Priorities TM

• Operations Excellence

– Recover from winter across U.S. coke plants to improve results and sustain strong safety performance

– Execute Indiana Harbor revitalization and re-commission plant

– Drive mining cash cost productivity and safety excellence

• Growth Strategy

– Pursue bolt-on growth opportunities

– Continue South Shore permitting and secure customer commitments

– Evaluate DRI and possible coke plant acquisitions

– Focus on SXCP qualifying income and distributable cash flow growth

• Portfolio Strategy

– Exit coal consistent with objectives: coal supply, coke plant independence, value creation

• Capital Allocation Strategy

– Execute first dropdown transaction

– Develop SXC capital allocation framework to be executed with dropdown strategy over next three years

Investor Day 2014 66

APPENDIX

Investor Day 2014 67

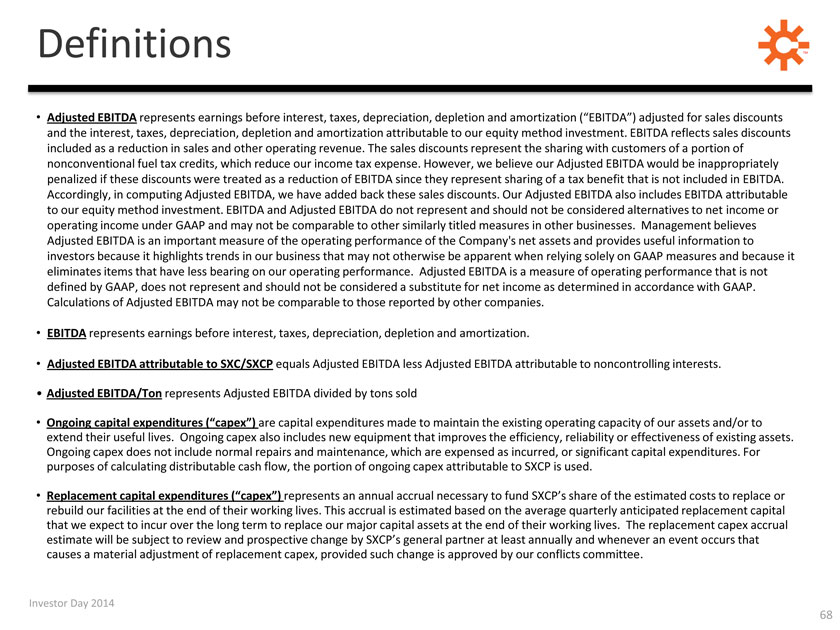

Definitions

Adjusted EBITDA represents earnings before interest, taxes, depreciation, depletion and amortization (“EBITDA”) adjusted for sales discounts and the interest, taxes, depreciation, depletion and amortization attributable to our equity method investment. EBITDA reflects sales discounts included as a reduction in sales and other operating revenue. The sales discounts represent the sharing with customers of a portion of nonconventional fuel tax credits, which reduce our income tax expense. However, we believe our Adjusted EBITDA would be inappropriately penalized if these discounts were treated as a reduction of EBITDA since they represent sharing of a tax benefit that is not included in EBITDA. Accordingly, in computing Adjusted EBITDA, we have added back these sales discounts. Our Adjusted EBITDA also includes EBITDA attributable to our equity method investment. EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure of the operating performance of the Company’s net assets and provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance. Adjusted EBITDA is a measure of operating performance that is not defined by GAAP, does not represent and should not be considered a substitute for net income as determined in accordance with GAAP. Calculations of Adjusted EBITDA may not be comparable to those reported by other companies.

EBITDA represents earnings before interest, taxes, depreciation, depletion and amortization.

• Adjusted EBITDA attributable to SXC/SXCP equals Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests.

Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold

Ongoing capital expenditures (“capex”) are capital expenditures made to maintain the existing operating capacity of our assets and/or to extend their useful lives. Ongoing capex also includes new equipment that improves the efficiency, reliability or effectiveness of existing assets. Ongoing capex does not include normal repairs and maintenance, which are expensed as incurred, or significant capital expenditures. For purposes of calculating distributable cash flow, the portion of ongoing capex attributable to SXCP is used.

Replacement capital expenditures (“capex”) represents an annual accrual necessary to fund SXCP’s share of the estimated costs to replace or rebuild our facilities at the end of their working lives. This accrual is estimated based on the average quarterly anticipated replacement capital that we expect to incur over the long term to replace our major capital assets at the end of their working lives. The replacement capex accrual estimate will be subject to review and prospective change by SXCP’s general partner at least annually and whenever an event occurs that causes a material adjustment of replacement capex, provided such change is approved by our conflicts committee.

Investor Day 2014 68

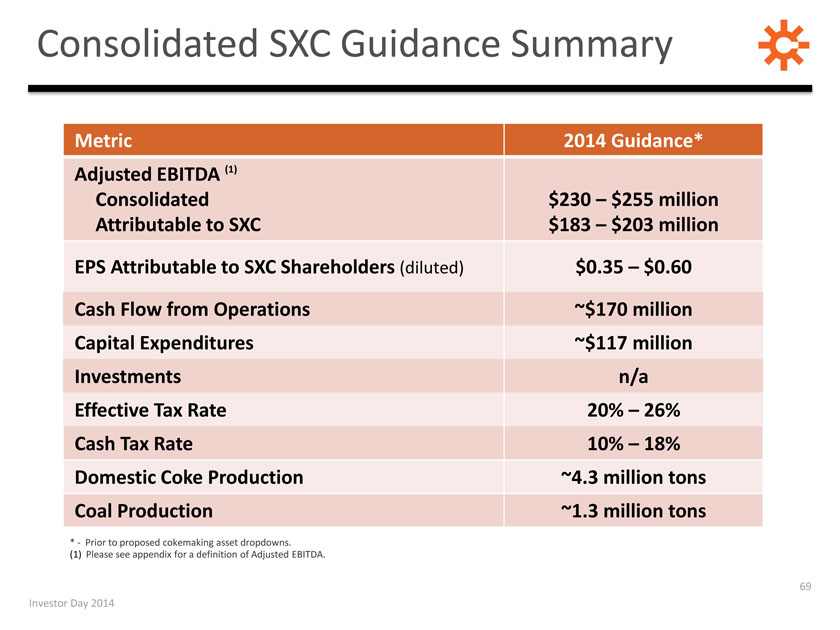

Consolidated SXC Guidance Summary

Metric 2014 Guidance*

Adjusted EBITDA (1)

Consolidated $230 – $255 million Attributable to SXC $183 – $203 million

EPS Attributable to SXC Shareholders (diluted) $0.35 – $0.60

Cash Flow from Operations ~$170 million

Capital Expenditures ~$117 million Investments n/a Effective Tax Rate 20% – 26% Cash Tax Rate 10% – 18% Domestic Coke Production ~4.3 million tons Coal Production ~1.3 million tons

*— Prior to proposed cokemaking asset dropdowns.

(1) Please see appendix for a definition of Adjusted EBITDA.

Investor Day 2014 69

69 Investor Day 2014

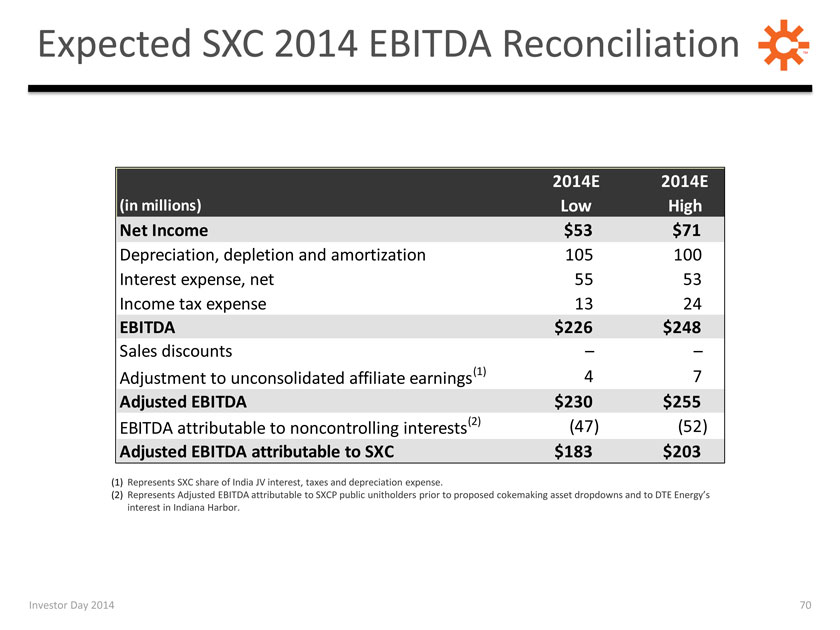

Expected SXC 2014 EBITDA Reconciliation

2014E 2014E (in millions) Low High Net Income $53 $71

Depreciation, depletion and amortization 105 100 Interest expense, net 55 53 Income tax expense 13 24

EBITDA $226 $248

Sales discounts – –Adjustment to unconsolidated affiliate earnings(1) 4 7

Adjusted EBITDA $230 $255

EBITDA attributable to noncontrolling interests(2) (47) (52)

Adjusted EBITDA attributable to SXC $183 $203

(1) Represents SXC share of India JV interest, taxes and depreciation expense.

(2) Represents Adjusted EBITDA attributable to SXCP public unitholders prior to proposed cokemaking asset dropdowns and to DTE Energy’s interest in Indiana Harbor.

Investor Day 2014 70

SXCP Adjusted EBITDA and Distributable Cash Flow Reconciliations

FY 2014 Guidance*

($ in Millions) Low High

Net income $ 94 $ 107

Add:

Depreciation 43 41 Interest expense, net 18 17 Income tax expense — 1 Sales discounts — -

Adjusted EBITDA $ 155 $ 166

Adjusted EBITDA attributable to NCI (50) (54)

Adjusted EBITDA attributable to Predecessor/SXCP $ 105 $ 112

Less:

Ongoing capex (SXCP share) (12) (12) Replacement capex accrual (4) (4) Cash interest accrual (15) (15)

Distributable cash flow $ 74 $ 81

* Before proposed dropdown transaction

Investor Day 2014 71

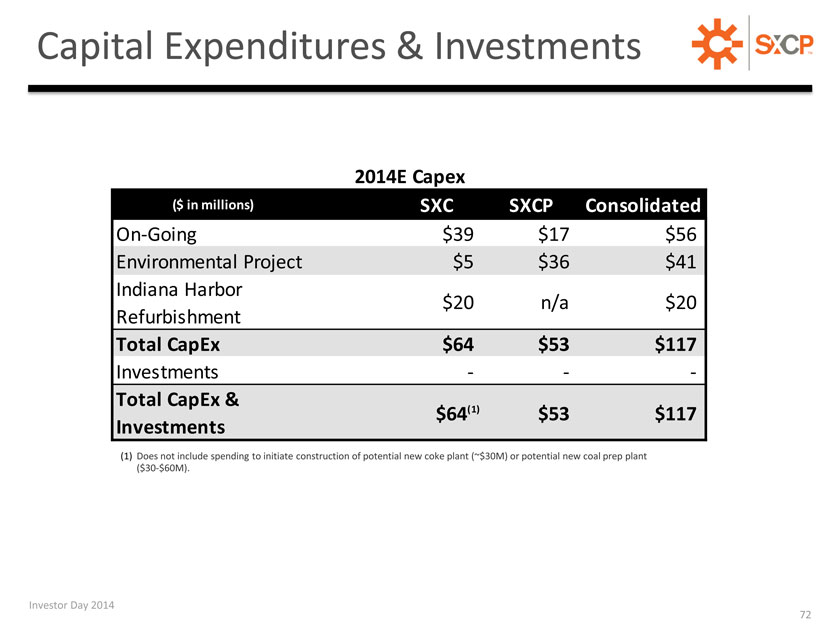

Capital Expenditures & Investments

2014E Capex

($ in millions) SXC SXCP Consolidated

On-Going $39 $17 $56 Environmental Project $5 $36 $41 Indiana Harbor $20 n/a $20 Refurbishment

Total CapEx $64 $53 $117

Investments — — -

Total CapEx &

$64(1) $53 $117 Investments

(1) Does not include spending to initiate construction of potential new coke plant (~$30M) or potential new coal prep plant

($30-$60M).

Investor Day 2014 72