|

Exhibit 99.1

|

Investor Meetings

SXCP Partners

March 2015

Forward-Looking Statements

Some of the information included in this presentation constitutes “forward-looking statements.” All statements in this presentation that express opinions, expectations, beliefs, plans, objectives, assumptions or projections with respect to anticipated future performance of SunCoke Energy, Inc. (SXC) or SunCoke Energy Partners, L.P. (SXCP), in contrast with statements of historical facts, are forward-looking statements. Such forward-looking statements are based on management’s beliefs and assumptions and on information currently available. Forward-looking statements include information concerning possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance improvements, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and may be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “will,” “should” or the negative of these terms or similar expressions.

Although management believes that its plans, intentions and expectations reflected in or suggested by the forward-looking statements made in this presentation are reasonable, no assurance can be given that these plans, intentions or expectations will be achieved when anticipated or at all. Moreover, such statements are subject to a number of assumptions, risks and uncertainties. Many of these risks are beyond the control of SXC and SXCP, and may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Each of SXC and SXCP has included in its filings with the Securities and Exchange Commission cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement. For more information concerning these factors, see the Securities and Exchange Commission filings of SXC and SXCP. All forward-looking statements included in this presentation are expressly qualified in their entirety by such cautionary statements. Although forward-looking statements are based on current beliefs and expectations, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date hereof. SXC and SXCP do not have any intention or obligation to update publicly any forward-looking statement (or its associated cautionary language) after the date of this presentation whether as a result of new information or future events or otherwise, except as required by applicable law.

This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of the presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in the Appendix.

Investor Meetings – March 2015

SXC and SXCP

Investor Meetings – March 2015

WHO WE ARE

Investor Meetings – March 2015

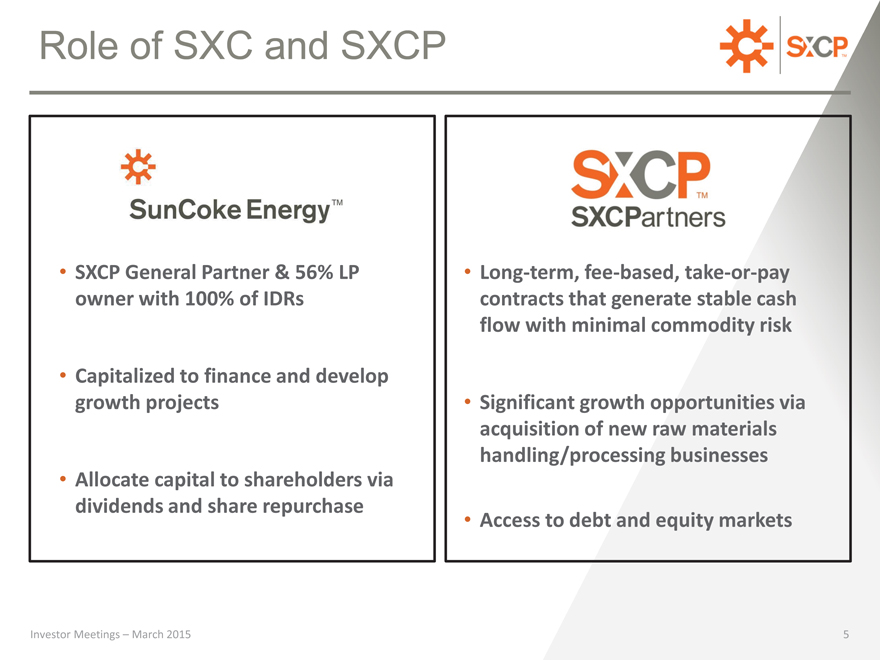

Role of SXC and SXCP

SXCP General Partner & 56% LP owner with 100% of IDRs

Capitalized to finance and develop growth projects

Allocate capital to shareholders via dividends and share repurchase

Long-term, fee-based, take-or-pay contracts that generate stable cash flow with minimal commodity risk

Significant growth opportunities via acquisition of new raw materials handling/processing businesses

Access to debt and equity markets

Investor Meetings – March 2015

5

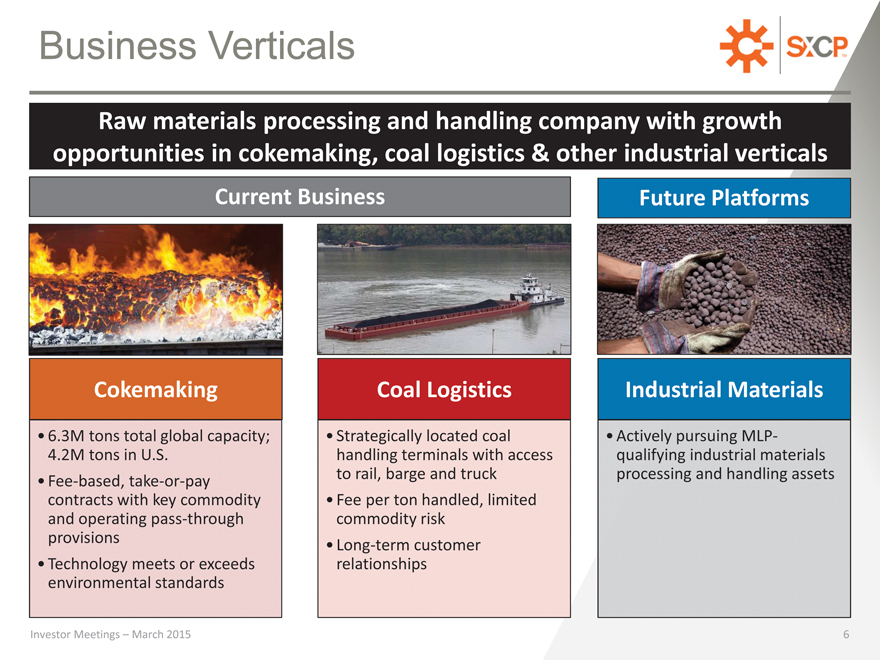

Business Verticals

Raw materials processing and handling company with growth opportunities in cokemaking, coal logistics & other industrial verticals

Current Business Future Platforms

Cokemaking Coal Logistics Industrial Materials

6.3M tons total global capacity;

4.2M tons in U.S.

Fee-based, take-or-pay contracts with key commodity and operating pass-through provisions

Technology meets or exceeds environmental standards

Strategically located coal handling terminals with access to rail, barge and truck

Fee per ton handled, limited commodity risk

Long-term customer relationships

Actively pursuing MLP-qualifying industrial materials processing and handling assets

Investor Meetings – March 2015

6

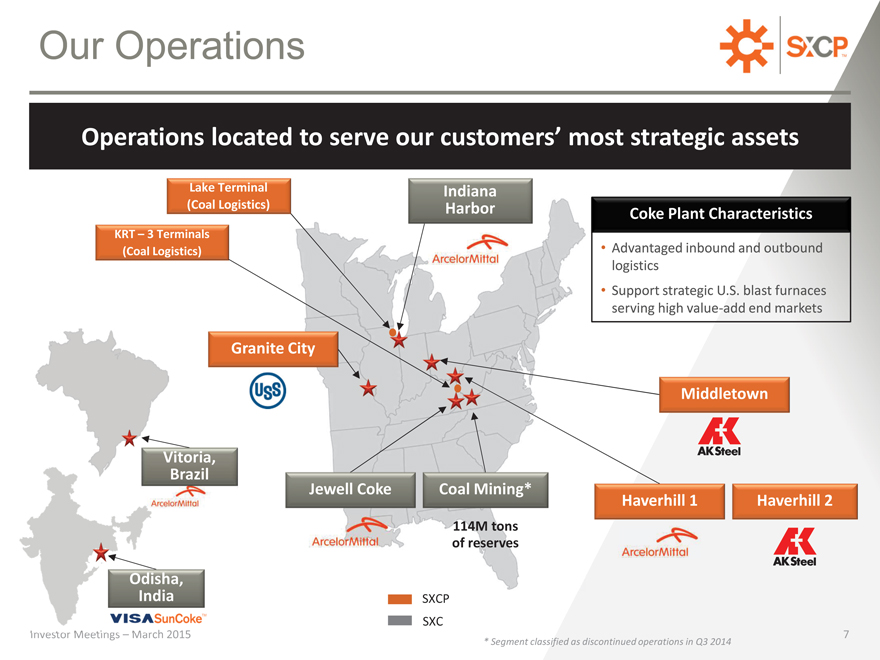

Our Operations

Operations located to serve our customers’ most strategic assets

Lake Terminal (Coal Logistics)

KRT – 3 Terminals (Coal Logistics)

Granite City

Vitoria, Brazil

Jewell Coke

Odisha, India

Investor Meetings – March 2015

Indiana

Harbor Coke Plant Characteristics

Advantaged inbound and outbound logistics

Support strategic U.S. blast furnaces serving high value-add end markets

Middletown

Coal Mining*

Haverhill 1 Haverhill 2

114M tons of reserves

SXCP

SXC

7

* Segment classified as discontinued operations in Q3 2014

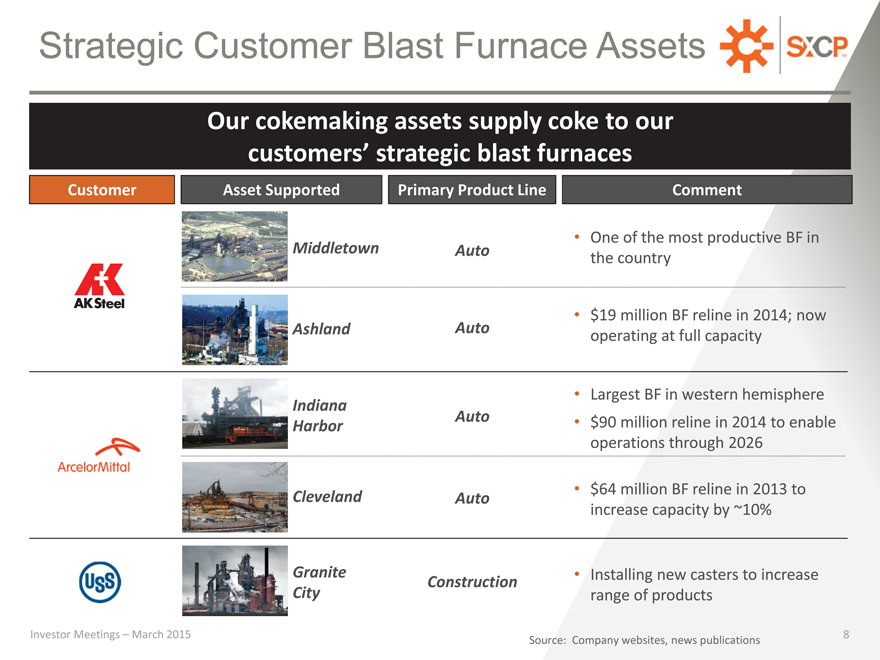

Strategic Customer Blast Furnace Assets

Our cokemaking assets supply coke to our customers’ strategic blast furnaces

Customer Asset Supported Primary Product Line Comment

One of the most productive BF in

Middletown Auto the country

$19 million BF reline in 2014; now

Ashland Auto operating at full capacity

Largest BF in western hemisphere

Indiana

Auto • $90 million reline in 2014 to enable

Harbor operations through 2026

$64 million BF reline in 2013 to Cleveland Auto increase capacity by ~10%

Granite • Installing new casters to increase

Construction

City range of products

Investor Meetings – March 2015 8 Source: Company websites, news publications

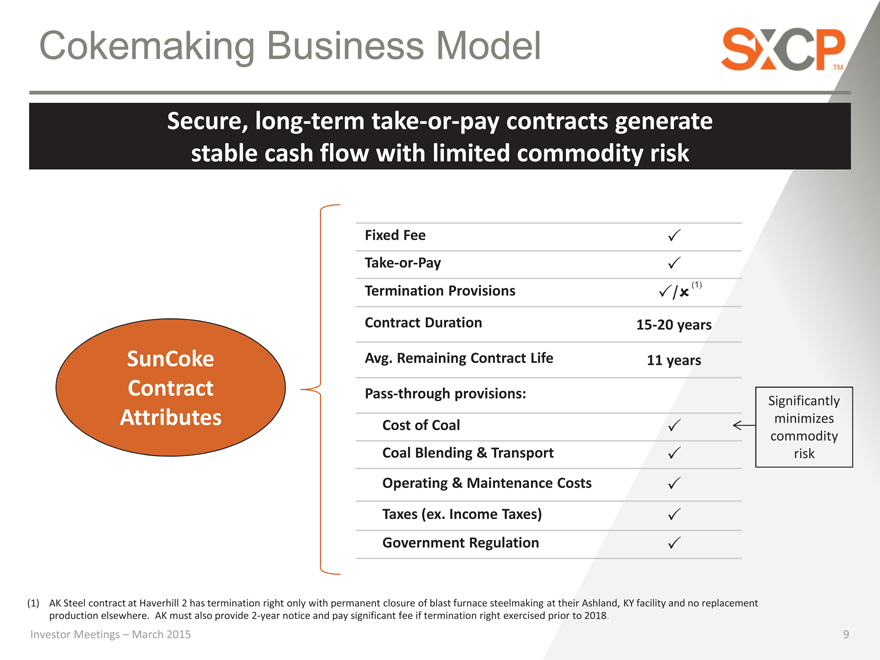

Cokemaking Business Model

Secure, long-term take-or-pay contracts generate stable cash flow with limited commodity risk

Fixed Fee _ Take-or-Pay _ Termination Provisions (1)

_/_

Contract Duration 15-20 years

SunCoke Avg. Remaining Contract Life 11 years Contract Pass-through provisions:

Significantly

Attributes minimizes

Cost of Coal _ commodity Coal Blending & Transport _ risk Operating & Maintenance Costs _ Taxes (ex. Income Taxes) _ Government Regulation _

(1) AK Steel contract at Haverhill 2 has termination right only with permanent closure of blast furnace steelmaking at their Ashland, KY facility and no replacement production elsewhere. AK must also provide 2-year notice and pay significant fee if termination right exercised prior to 2018.

Investor Meetings – March 2015

9

Coal Logistics

Coal Logistics complements our cokemaking business and broadens exposure to industrial customers

Platform for Growth

Strategically located assets with access to barge, rail and truck

Experienced management team capable of driving growth

Broadening customer base diversifies credit and market risk

Investor Meetings – March 2015

10

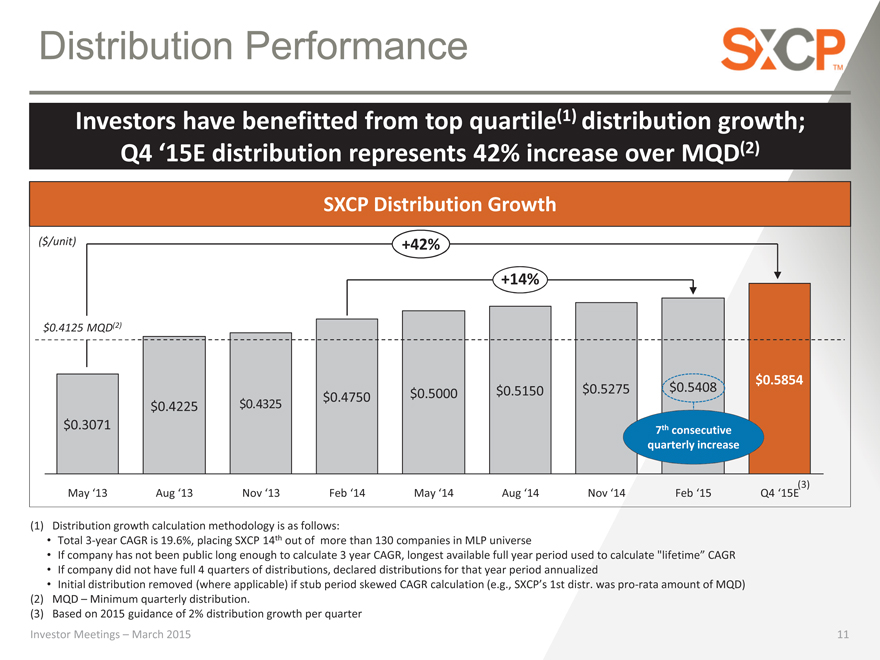

Distribution Performance

Investors have benefitted from top quartile(1) distribution growth; Q4 ‘15E distribution represents 42% increase over MQD(2)

SXCP Distribution Growth

($/unit) +42%

+14%

$0.4125 MQD(2)

$0.5854

$0.5150 $0.5275 $0.5408 $0.4325 $0.4750 $0.5000

$0.4225

$0.3071 th

7 consecutive quarterly increase

May ‘13 Aug ‘13 Nov ‘13 Feb ‘14 May ‘14 Aug ‘14 Nov ‘14 Feb ‘15 Q4 ‘15E(3)

(1) Distribution growth calculation methodology is as follows:

Total 3-year CAGR is 19.6%, placing SXCP 14th out of more than 130 companies in MLP universe

If company has not been public long enough to calculate 3 year CAGR, longest available full year period used to calculate “lifetime” CAGR

If company did not have full 4 quarters of distributions, declared distributions for that year period annualized

Initial distribution removed (where applicable) if stub period skewed CAGR calculation (e.g., SXCP’s 1st distr. was pro-rata amount of MQD) (2) MQD – Minimum quarterly distribution.

(3) Based on 2015 guidance of 2% distribution growth per quarter

Investor Meetings – March 2015

11

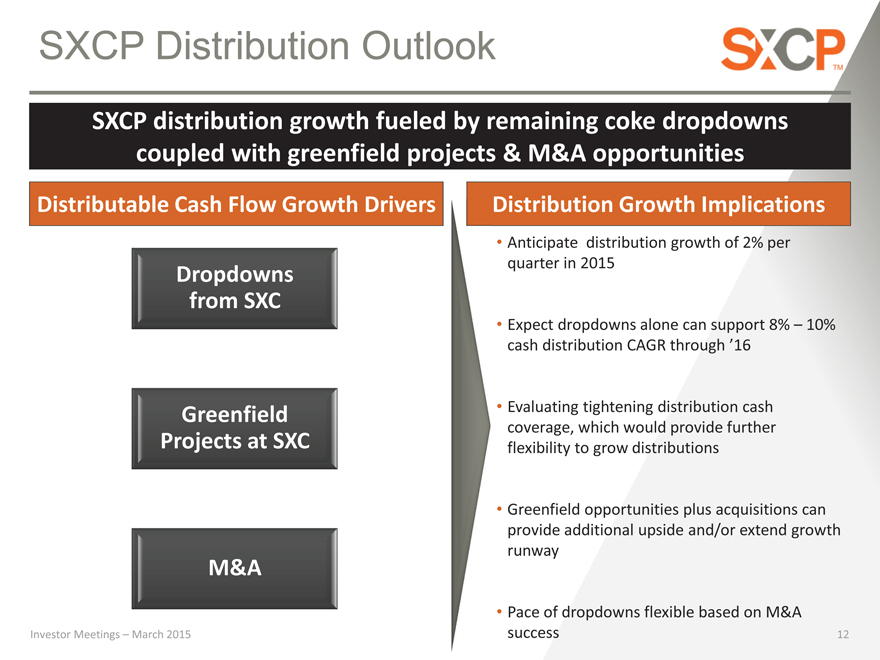

SXCP Distribution Outlook

SXCP distribution growth fueled by remaining coke dropdowns coupled with greenfield projects & M&A opportunities

Distributable Cash Flow Growth Drivers Distribution Growth Implications

Anticipate distribution growth of 2% per quarter in 2015

Dropdowns from SXC

Expect dropdowns alone can support 8% – 10% cash distribution CAGR through ’16

Greenfield • Evaluating tightening distribution cash coverage, which would provide further Projects at SXC flexibility to grow distributions

Greenfield opportunities plus acquisitions can provide additional upside and/or extend growth runway

M&A

Pace of dropdowns flexible based on M&A

Investor Meetings – March 2015

success

12

GROWTH STRATEGY

Investor Meetings – March 2015

13

Transformational Strategy

Capitalize Leading raw Fuel our on strengths in Replicate materials steel customers raw materials business processing with coke and processing and model and handling power handling company

Investor Meetings – March 2015 14

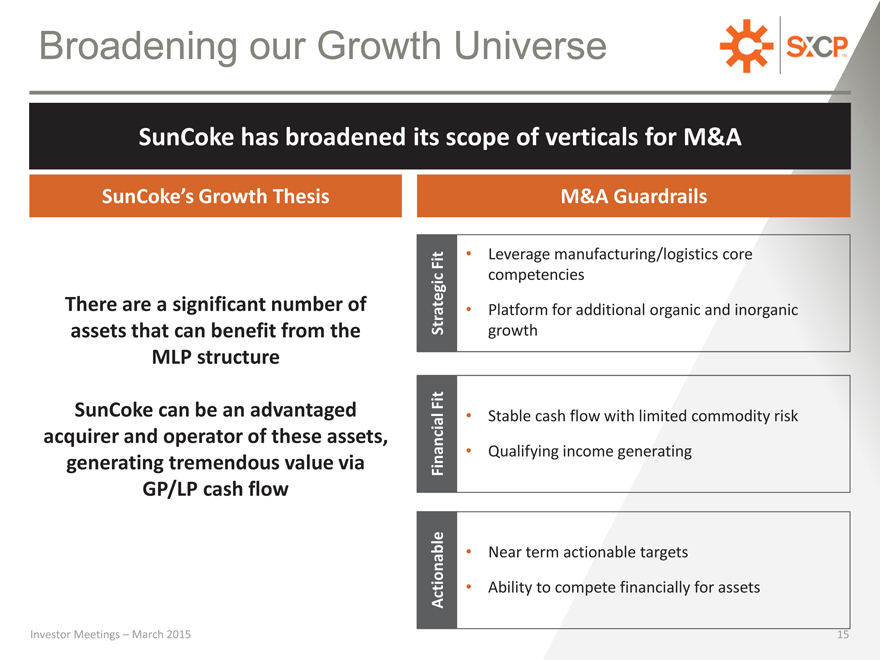

Broadening our Growth Universe

SunCoke has broadened its scope of verticals for M&A

SunCoke’s Growth Thesis M&A Guardrails

Fit • Leverage manufacturing/logistics core competencies There are a significant number of Strategic • Platform for additional organic and inorganic

assets that can benefit from the growth MLP structure

SunCoke can be an advantaged Fit • Stable cash flow with limited commodity risk

acquirer and operator of these assets,

Qualifying income generating

generating tremendous value via Financial GP/LP cash flow

Near term actionable targets

Actionable • Ability to compete financially for assets

Investor Meetings – March 2015

15

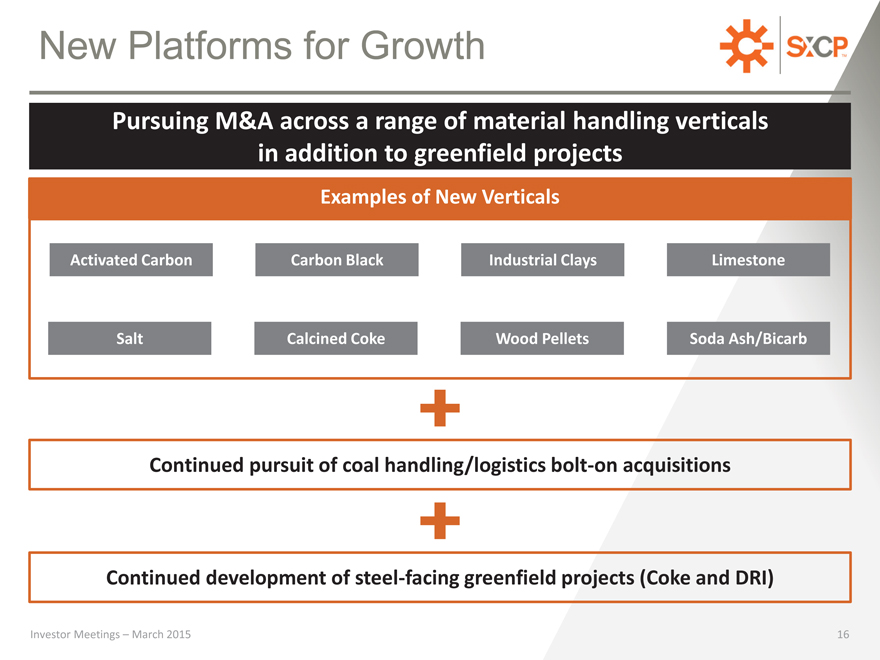

New Platforms for Growth

Pursuing M&A across a range of material handling verticals in addition to greenfield projects

Examples of New Verticals

Activated Carbon Carbon Black Industrial Clays Limestone

Salt Calcined Coke Wood Pellets Soda Ash/Bicarb

Continued pursuit of coal handling/logistics bolt-on acquisitions

Continued development of steel-facing greenfield projects (Coke and DRI)

Investor Meetings – March 2015 16

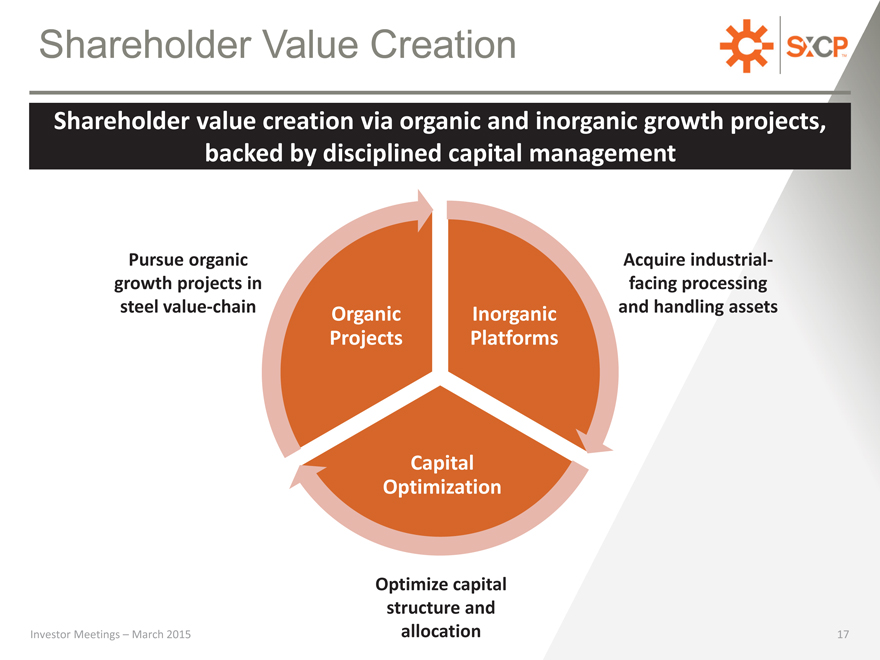

Shareholder Value Creation

Shareholder value creation via organic and inorganic growth projects, backed by disciplined capital management

Pursue organic Acquire industrial-growth projects in facing processing steel value-chain Organic Inorganic and handling assets

Projects Platforms

Capital Optimization

Optimize capital structure and

Investor Meetings – March 2015 allocation 17

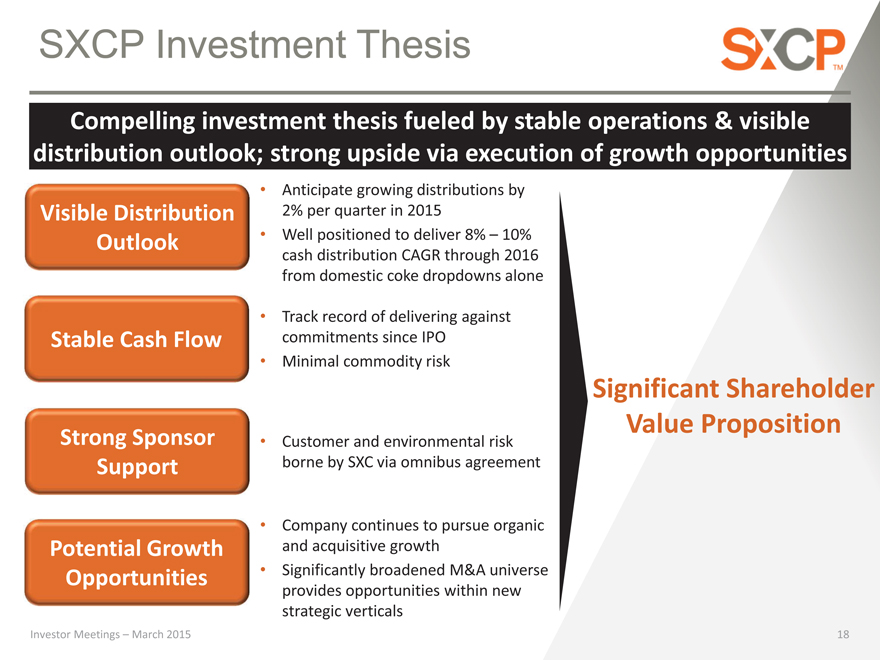

SXCP Investment Thesis

Compelling investment thesis fueled by stable operations & visible distribution outlook; strong upside via execution of growth opportunities

Anticipate growing distributions by

Visible Distribution 2% per quarter in 2015

Outlook • Well positioned to deliver 8% – 10% cash distribution CAGR through 2016 from domestic coke dropdowns alone

Track record of delivering against Stable Cash Flow commitments since IPO

Minimal commodity risk

Significant Shareholder Value Proposition

Strong Sponsor • Customer and environmental risk Support borne by SXC via omnibus agreement

Company continues to pursue organic Potential Growth and acquisitive growth Opportunities Significantly broadened M&A universe provides opportunities within new strategic verticals

Investor Meetings – March 2015 18

APPENDIX

Investor Meetings – March 2015

19

SXCP RECONCILIATIONS & 2015 GUIDANCE

Investor Meetings – March 2015

20

Definitions

Adjusted EBITDA represents earnings before interest, taxes, depreciation and amortization (“EBITDA”) adjusted for sales discounts. Prior to the expiration of our nonconventional fuel tax credits in June 2012, EBITDA reflects sales discounts included as a reduction in sales and other operating revenue. The sales discounts represent the sharing with customers of a portion of nonconventional fuel tax credits, which reduce our income tax expense. However, we believe our Adjusted EBITDA would be inappropriately penalized if these discounts were treated as a reduction of EBITDA since they represent sharing of a tax benefit that is not included in EBITDA. Accordingly, in computing Adjusted EBITDA, we have added back these sales discounts. EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure of the operating performance of the SXCP’s net assets and provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance. Adjusted EBITDA is a measure of operating performance that is not defined by GAAP, does not represent and should not be considered a substitute for net income as determined in accordance with GAAP. Calculations of Adjusted EBITDA may not be comparable to those reported by other companies.

EBITDA represents earnings before interest, taxes, depreciation and amortization.

Adjusted EBITDA attributable to SXC/SXCP equals Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests.

Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold.

Investor Meetings – March 2015

21

Definitions

Distributable Cash Flow equals Adjusted EBITDA less net cash paid for interest expense, ongoing capital expenditures, accruals for replacement capital expenditures, and cash distributions to noncontrolling interests; plus amounts received under the Omnibus Agreement and acquisition expenses deemed to be Expansion Capital under our Partnership Agreement. Distributable Cash Flow is a non-GAAP supplemental financial measure that management and external users of SXCP financial statements, such as industry analysts, investors, lenders and rating agencies use to assess:

SXCP’s operating performance as compared to other publicly traded partnerships, without regard to historical cost basis; the ability of SXCP’s assets to generate sufficient cash flow to make distributions to SXCP’s unitholders;

SXCP’s ability to incur and service debt and fund capital expenditures; and

the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities.

We believe that Distributable Cash Flow provides useful information to investors in assessing SXCP’s financial condition and results of operations. Distributable Cash Flow should not be considered an alternative to net income, operating income, cash flow from operating activities, or any other measure of financial performance or liquidity presented in accordance with generally accepted accounting principles (GAAP). Distributable Cash Flow has important limitations as an analytical tool because it excludes some, but not all, items that affect net income and net cash provided by operating activities and used in investing activities. Additionally, because Distributable Cash Flow may be defined differently by other companies in the industry, our definition of Distributable Cash Flow may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

Ongoing capital expenditures (“capex”) are capital expenditures made to maintain the existing operating capacity of our assets and/or to extend their useful lives. Ongoing capex also includes new equipment that improves the efficiency, reliability or effectiveness of existing assets. Ongoing capex does not include normal repairs and maintenance, which are expensed as incurred, or significant capital expenditures. For purposes of calculating distributable cash flow, the portion of ongoing capex attributable to SXCP is used.

Replacement capital expenditures (“capex”) represents an annual accrual necessary to fund SXCP’s share of the estimated costs to replace or rebuild our facilities at the end of their working lives. This accrual is estimated based on the average quarterly anticipated replacement capital that we expect to incur over the long term to replace our major capital assets at the end of their working lives. The replacement capex accrual estimate will be subject to review and prospective change by SXCP’s general partner at least annually and whenever an event occurs that causes a material adjustment of replacement capex, provided such change is approved by our conflicts committee.

Investor Meetings – March 2015

22

SXCP 2015 Outlook

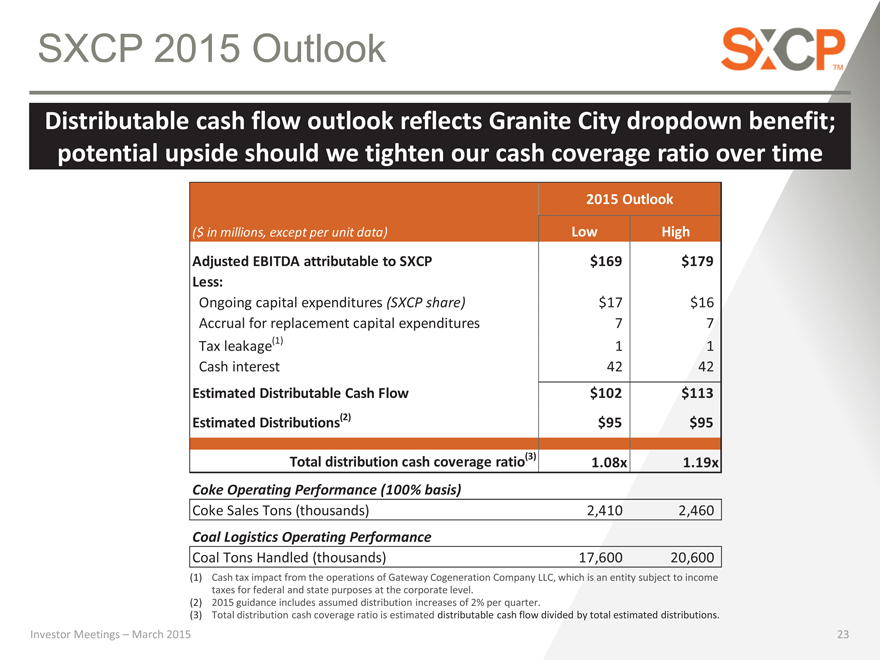

Distributable cash flow outlook reflects Granite City dropdown benefit; potential upside should we tighten our cash coverage ratio over time

2015 Outlook

($ in millions, except per unit data) Low High

Adjusted EBITDA attributable to SXCP $169 $179 Less:

Ongoing capital expenditures (SXCP share) $17 $16 Accrual for replacement capital expenditures 7 7 Tax leakage(1) 1 1 Cash interest 42 42

Estimated Distributable Cash Flow $102 $113

Estimated Distributions(2) $95 $95

Total distribution cash coverage ratio(3)

1.08x 1.19x

Coke Operating Performance (100% basis)

Coke Sales Tons (thousands) 2,410 2,460

Coal Logistics Operating Performance

Coal Tons Handled (thousands) 17,600 20,600

(1) Cash tax impact from the operations of Gateway Cogeneration Company LLC, which is an entity subject to income taxes for federal and state purposes at the corporate level.

(2) | | 2015 guidance includes assumed distribution increases of 2% per quarter. |

(3) Total distribution cash coverage ratio is estimated distributable cash flow divided by total estimated distributions.

Investor Meetings – March 2015

23

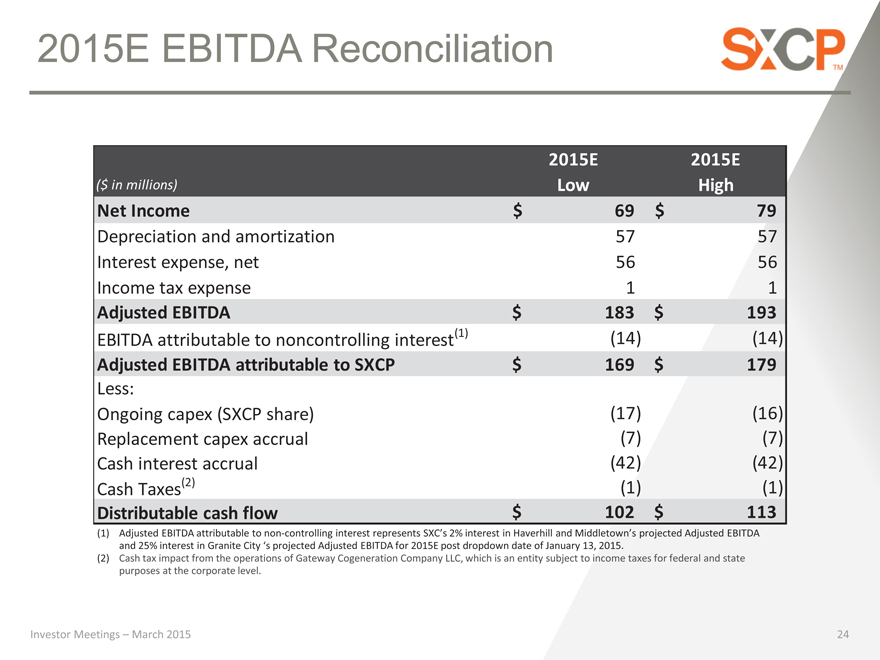

2015E EBITDA Reconciliation

2015E 2015E

($ in millions) Low High

Net Income $ 69 $ 79

Depreciation and amortization 57 57 Interest expense, net 56 56 Income tax expense 1 1

Adjusted EBITDA $ 183 $ 193

EBITDA attributable to noncontrolling interest(1) (14) (14)

Adjusted EBITDA attributable to SXCP $ 169 $ 179

Less:

Ongoing capex (SXCP share) (17) (16) Replacement capex accrual (7) (7) Cash interest accrual (42) (42) Cash Taxes(2) (1) (1)

Distributable cash flow $ 102 $ 113

(1) Adjusted EBITDA attributable to non-controlling interest represents SXC’s 2% interest in Haverhill and Middletown’s projected Adjusted EBITDA and 25% interest in Granite City ‘s projected Adjusted EBITDA for 2015E post dropdown date of January 13, 2015.

(2) Cash tax impact from the operations of Gateway Cogeneration Company LLC, which is an entity subject to income taxes for federal and state purposes at the corporate level.

Investor Meetings – March 2015

24

SXC RECONCILIATIONS & 2015 GUIDANCE

Investor Meetings – March 2015

25

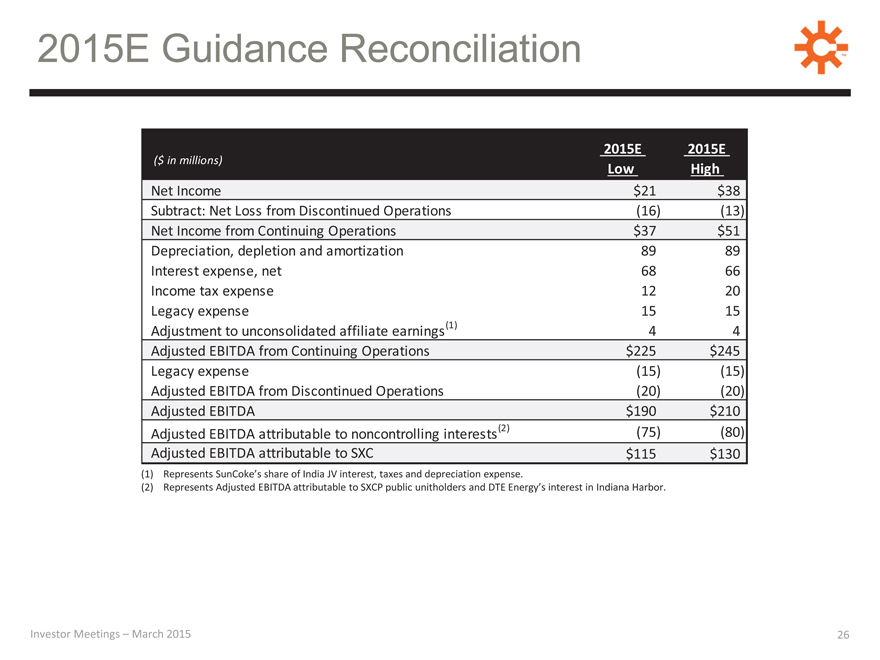

2015E Guidance Reconciliation

2015E 2015E

($ in millions)

Low High

Net Income $21 $38 Subtract: Net Loss from Discontinued Operations (16) (13) Net Income from Continuing Operations $37 $51 Depreciation, depletion and amortization 89 89 Interest expense, net 68 66 Income tax expense 12 20 Legacy expense 15 15

Adjustment to unconsolidated affiliate earnings 4 4 Adjusted EBITDA from Continuing Operations $225 $245 Legacy expense (15) (15) Adjusted EBITDA from Discontinued Operations (20) (20) Adjusted EBITDA $190 $210

(2) (75) (80) Adjusted EBITDA attributable to noncontrolling interests Adjusted EBITDA attributable to SXC $115 $130

(1) | | Represents SunCoke’s share of India JV interest, taxes and depreciation expense. |

(2) | | Represents Adjusted EBITDA attributable to SXCP public unitholders and DTE Energy’s interest in Indiana Harbor. |

Investor Meetings – March 2015

26

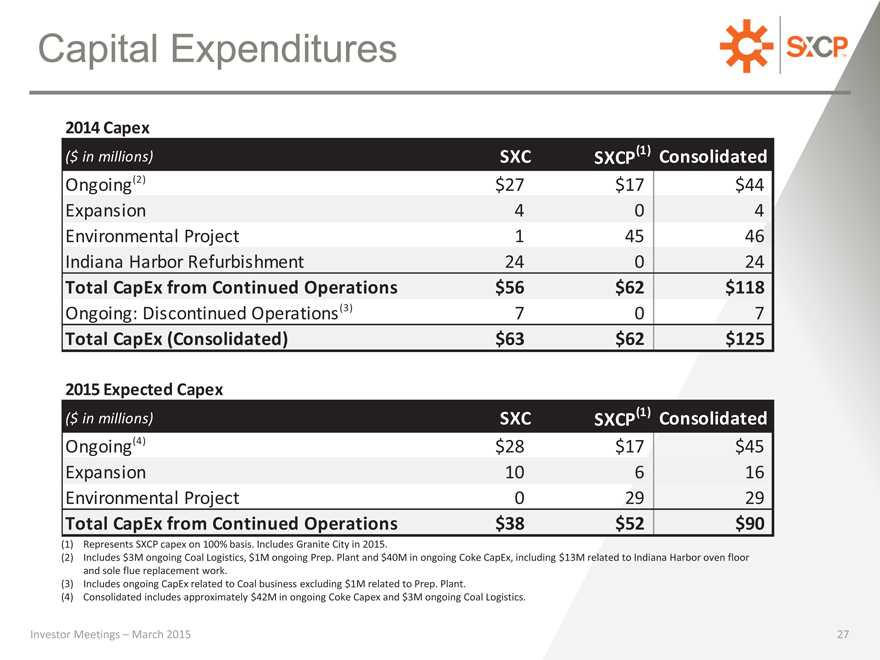

Capital Expenditures

2014 Capex

($ in millions) SXC SXCP Consolidated

Ongoing(2) $27 $17 $44 Expansion 4 0 4 Environmental Project 1 45 46 Indiana Harbor Refurbishment 24 0 24

Total CapEx from Continued Operations $56 $62 $118

Ongoing: Discontinued Operations(3) 7 0 7

Total CapEx (Consolidated) $63 $62 $125

2015 Expected Capex

($ in millions) SXC SXCP Consolidated

Ongoing(4) $28 $17 $45 Expansion 10 6 16 Environmental Project 0 29 29

Total CapEx from Continued Operations $38 $52 $90

(1) | | Represents SXCP capex on 100% basis. Includes Granite City in 2015. |

(2) Includes $3M ongoing Coal Logistics, $1M ongoing Prep. Plant and $40M in ongoing Coke CapEx, including $13M related to Indiana Harbor oven floor and sole flue replacement work.

(3) | | Includes ongoing CapEx related to Coal business excluding $1M related to Prep. Plant. |

(4) | | Consolidated includes approximately $42M in ongoing Coke Capex and $3M ongoing Coal Logistics. |

Investor Meetings – March 2015

27

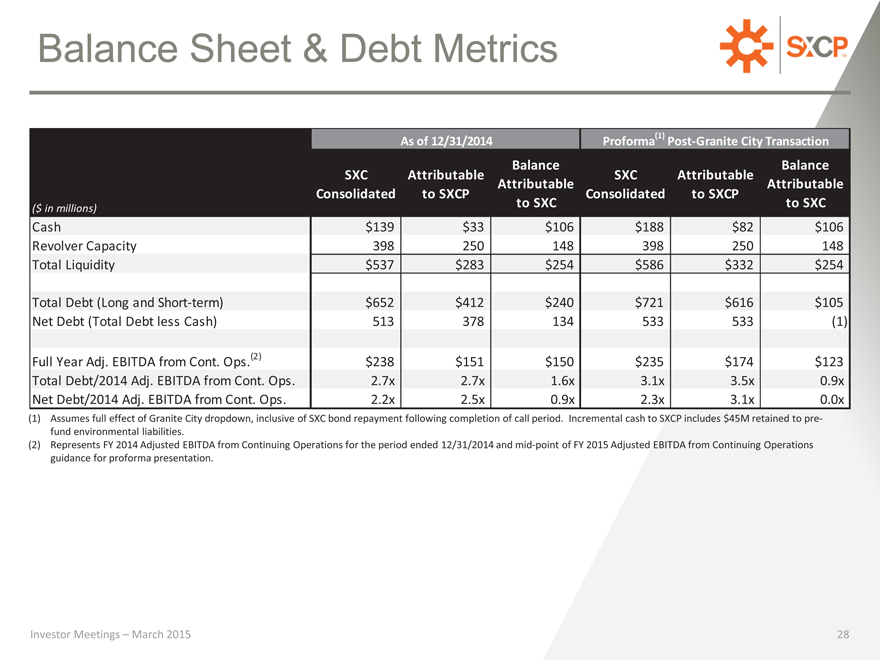

Balance Sheet & Debt Metrics

As of 12/31/2014 Proforma Post-Granite City Transaction

SXC Attributable Balance SXC Attributable Balance Consolidated to SXCP Attributable Consolidated to SXCP Attributable to SXC to SXC

($ in millions)

Cash $139 $33 $106 $188 $82 $106 Revolver Capacity 398 250 148 398 250 148 Total Liquidity $537 $283 $254 $586 $332 $254

Total Debt (Long and Short-term) $652 $412 $240 $721 $616 $105 Net Debt (Total Debt less Cash) 513 378 134 533 533 (1)

Full Year Adj. EBITDA from Cont. Ops. $238 $151 $150 $235 $174 $123 Total Debt/2014 Adj. EBITDA from Cont. Ops. 2.7x 2.7x 1.6x 3.1x 3.5x 0.9x Net Debt/2014 Adj. EBITDA from Cont. Ops. 2.2x 2.5x 0.9x 2.3x 3.1x 0.0x

(1) Assumes full effect of Granite City dropdown, inclusive of SXC bond repayment following completion of call period. Incremental cash to SXCP includes $45M retained to pre-fund environmental liabilities.

(2) Represents FY 2014 Adjusted EBITDA from Continuing Operations for the period ended 12/31/2014 and mid-point of FY 2015 Adjusted EBITDA from Continuing Operations guidance for proforma presentation.

Investor Meetings – March 2015

28

ADDITIONAL INFORMATION ABOUT SUNCOKE, OUR TECHNOLOGY

AND COKE DEMAND

Investor Meetings – March 2015

29

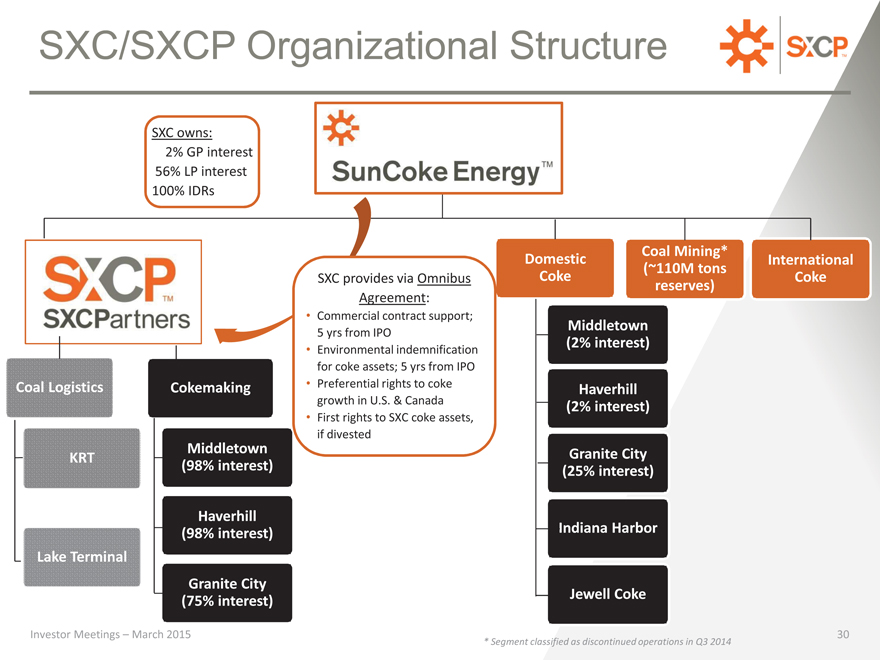

SXC/SXCP Organizational Structure

SXC owns:

2% GP interest

56% LP interest

100% IDRs

Coal Logistics Cokemaking

Middletown KRT

(98% interest)

Haverhill (98% interest) Lake Terminal

Granite City (75% interest)

Investor Meetings – March 2015

Coal Mining*

Domestic International (~110M tons

SXC provides via Omnibus Coke Coke reserves)

Agreement:

Commercial contract support;

Middletown

5 yrs from IPO

(2% interest)

Environmental indemnification for coke assets; 5 yrs from IPO

Preferential rights to coke Haverhill growth in U.S. & Canada

(2% interest)

First rights to SXC coke assets, if divested

Granite City

(25% interest)

Indiana Harbor

Jewell Coke

* Segment classified as discontinued operations in Q3 2014

30

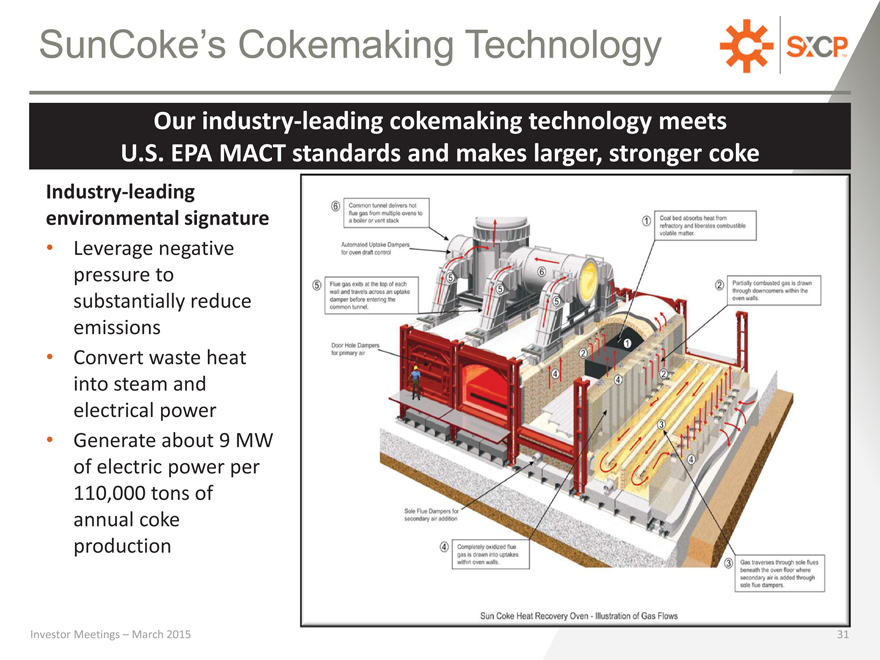

SunCoke’s Cokemaking Technology

Our industry-leading cokemaking technology meets U.S. EPA MACT standards and makes larger, stronger coke

Industry-leading

environmental signature

Leverage negative pressure to substantially reduce emissions

Convert waste heat into steam and electrical power

Generate about 9 MW of electric power per 110,000 tons of annual coke production

Investor Meetings – March 2015

31

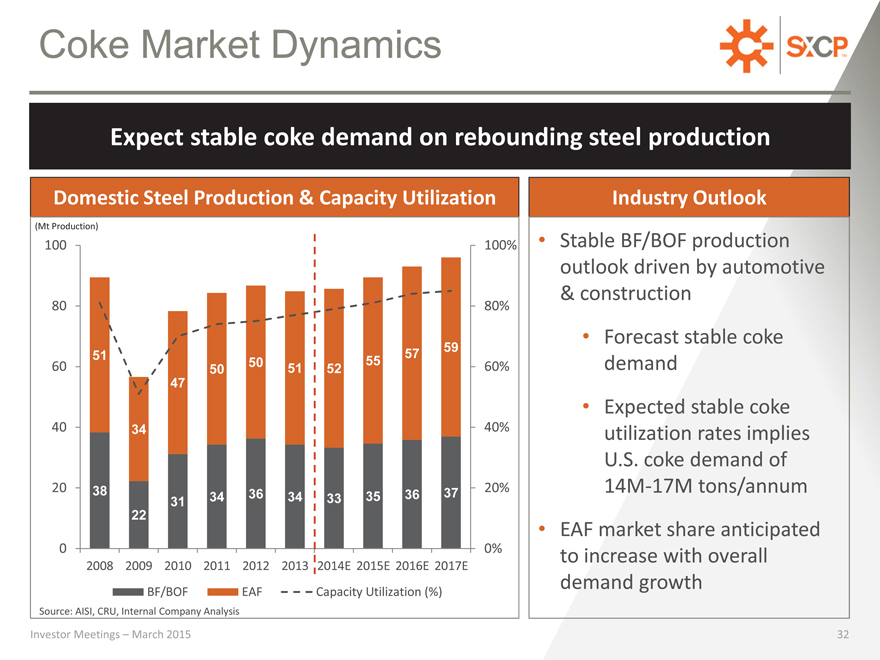

Coke Market Dynamics

Expect stable coke demand on rebounding steel production

Domestic Steel Production & Capacity Utilization

(Mt Production)

100 100%

80 80%

59

51 57

60 50 55 60%

50 51 52 47

40 34 40%

20 38 20%

34 36 34 35 36 37

31 33 22

0 0%

2008 2009 2010 2011 2012 2013 2014E 2015E 2016E 2017E

BF/BOF EAF Capacity Utilization (%)

Source: AISI, CRU, Internal Company Analysis

Investor Meetings – March 2015

Industry Outlook

Stable BF/BOF production outlook driven by automotive & construction

Forecast stable coke demand

Expected stable coke utilization rates implies U.S. coke demand of 14M-17M tons/annum

EAF market share anticipated to increase with overall demand growth

32

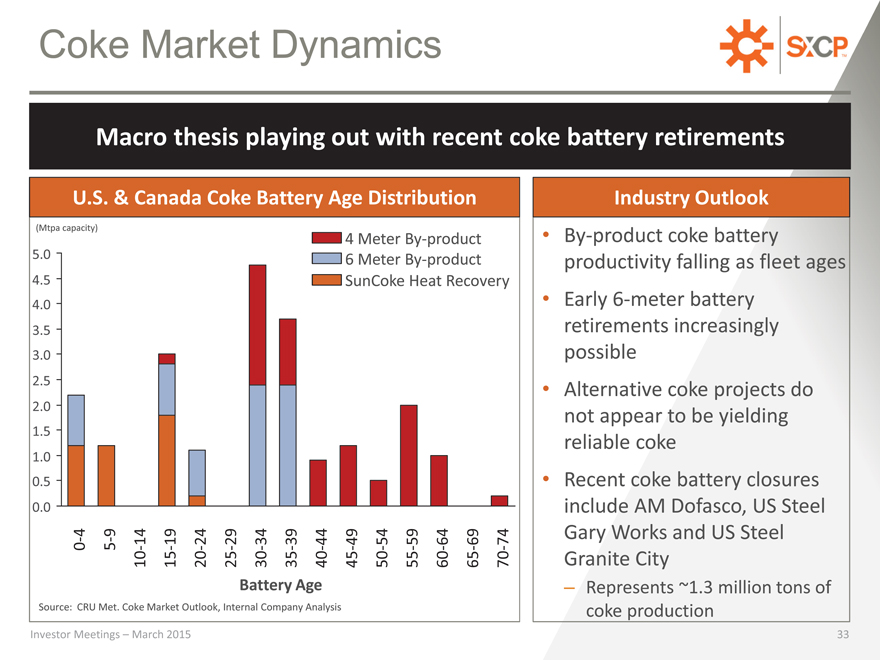

Coke Market Dynamics

Macro thesis playing out with recent coke battery retirements

U.S. & Canada Coke Battery Age Distribution

Industry Outlook

(Mtpa capacity)

5.0

4.5

4.0

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0.0

- 4 0

5-9

10-14

15-19

20-24

25-29

Battery 30-34

Age 35-39

40-44

Source: CRU Met. Coke Market Outlook, Internal Company Analysis

Investor Meetings – March 2015

4 Meter By-product

6 Meter By-product SunCoke Heat Recovery

45-49

50-54

55-59

60-64

65-69

70-74

By-product coke battery productivity falling as fleet ages

Early 6-meter battery retirements increasingly possible

Alternative coke projects do not appear to be yielding reliable coke

Recent coke battery closures include AM Dofasco, US Steel Gary Works and US Steel Granite City

– Represents ~1.3 million tons of coke production

33

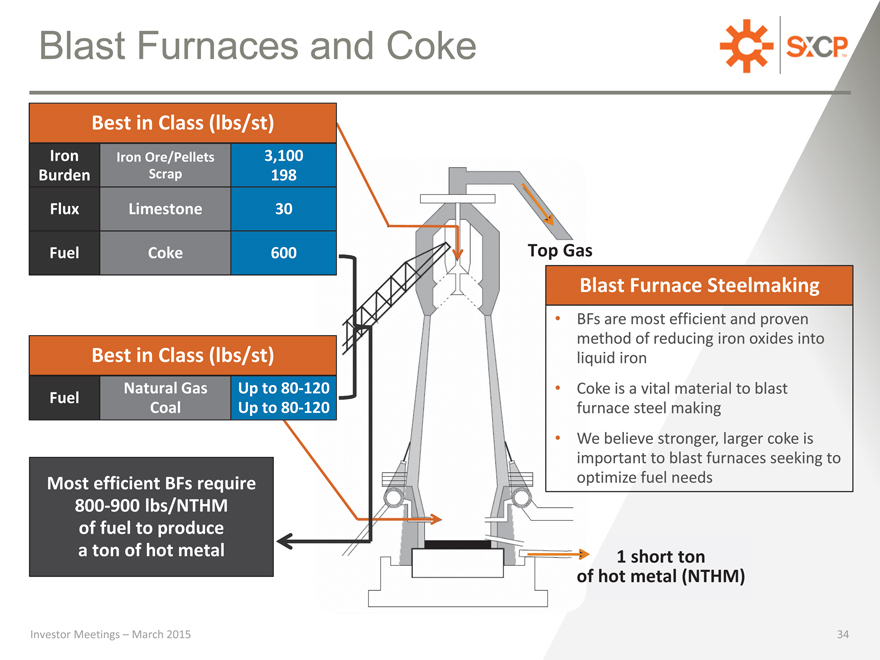

Blast Furnaces and Coke

Best in Class (lbs/st)

Iron Iron Ore/Pellets 3,100

Burden Scrap 198

Flux Limestone 30

Fuel Coke 600 Top Gas

Blast Furnace Steelmaking

Best in Class (lbs/st)

Natural Gas Up to 80-120 Fuel Coal Up to 80-120

Most efficient BFs require 800-900 lbs/NTHM of fuel to produce a ton of hot metal

BFs are most efficient and proven method of reducing iron oxides into liquid iron

Coke is a vital material to blast furnace steel making

We believe stronger, larger coke is important to blast furnaces seeking to optimize fuel needs

1 short ton

of hot metal (NTHM)

Investor Meetings – March 2015

34

Investor Relations: 630-824-1907 www.sxcpartners.com