|

Exhibit 99.3

|

Exhibit 99.3

SunCoke Energy Partners, L.P.

Q2 2015 Earnings and

M&A Announcement

Conference Call

July 21, 2015

Forward-Looking Statements

This slide presentation should be reviewed in conjunction with the Second Quarter 2015 earnings release of SunCoke Energy Partners, L.P. (SXCP) and the conference call held on July 21, 2015 at 8:30 a.m. ET.

Some of the information included in this presentation constitutes “forward-looking statements.” All statements in this presentation that express opinions, expectations, beliefs, plans, objectives, assumptions or projections with respect to anticipated future performance of SunCoke Energy, Inc. (SXC) or SXCP, in contrast with statements of historical facts, are forward-looking statements. Such forward-looking statements are based on management’s beliefs and assumptions and on information currently available. Forward-looking statements include information concerning possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance improvements, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and may be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “will,” “should” or the negative of these terms or similar expressions.

Although management believes that its plans, intentions and expectations reflected in or suggested by the forward-looking statements made in this presentation are reasonable, no assurance can be given that these plans, intentions or expectations will be achieved when anticipated or at all. Moreover, such statements are subject to a number of assumptions, risks and uncertainties. Many of these risks are beyond the control of SXC and SXCP, and may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Each of SXC and SXCP has included in its filings with the Securities and Exchange Commission cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement. For more information concerning these factors, see the Securities and Exchange Commission filings of SXC and SXCP. All forward-looking statements included in this presentation are expressly qualified in their entirety by such cautionary statements. Although forward-looking statements are based on current beliefs and expectations, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date hereof. SXC and SXCP do not have any intention or obligation to update publicly any forward-looking statement (or its associated cautionary language) whether as a result of new information or future events or after the date of this presentation, except as required by applicable law.

This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of the presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in the Appendix.

SXCP Q2 2015 Earnings and M&A Announcement Call

1

Management Overview

Achieved solid quarterly results, supporting FY 2015E Adjusted EBITDA and Distributable Cash Flow guidance outlook(1,2)

Increased cash distribution for 9th consecutive quarter

Executed against growth strategy with highly accretive Convent Marine Terminal acquisition

Authorized $50M unit repurchase program, reflecting attractive investment opportunity at current trading levels

Reached agreement on Granite City 23% dropdown at 7.2x multiple(3)

(1) For a definition and reconciliation of Adjusted EBITDA and Distributable Cash Flow, please see appendix. (2) Excludes expected benefits of Convent Marine Terminal acquisition and Granite City 23% dropdown.

(3) Based on $67M transaction value over ~$9.3M EBITDA run-rate for 23% interest in Granite City. This transaction is expected to close in the third quarter 2015, concurrently with the execution of long-term financing related to the Convent Marine Terminal acquisition.

SXCP Q2 2015 Earnings and M&A Announcement Call

2

Q2 ‘15 Overview

Adjusted EBITDA (1,2) (2) & Net Income

($ in millions)

$11.7

$5.8

$30.8

$23.

$44.7

$2.6

$42.1

Adj. EBITDA

$48.3

Net Income

$18.1

$1.1

$17.0

$5.0

$4.6 $1.2

$10.8

Q2 ‘14 Q2 ‘15

Q2 ‘14 Q2 ‘15

Attrib. to SXCP

Attrib. to NCI

Attrib. to Predecessor

($ in millions, except coverage ratio)

Distributable Cash Flow & Coverage Ratio

Distributable Cash Flow (DCF)

Distribution Cash Coverage Ratio

$19.4

$23.8

$36.3

$53.1

0.98x

0.98x

0.93x

1.10x

Q2 ‘14 Q2 ‘15 YTD ‘14 YTD ‘15

Q2 ‘14 Q2 ‘15 YTD ‘14 YTD ‘15

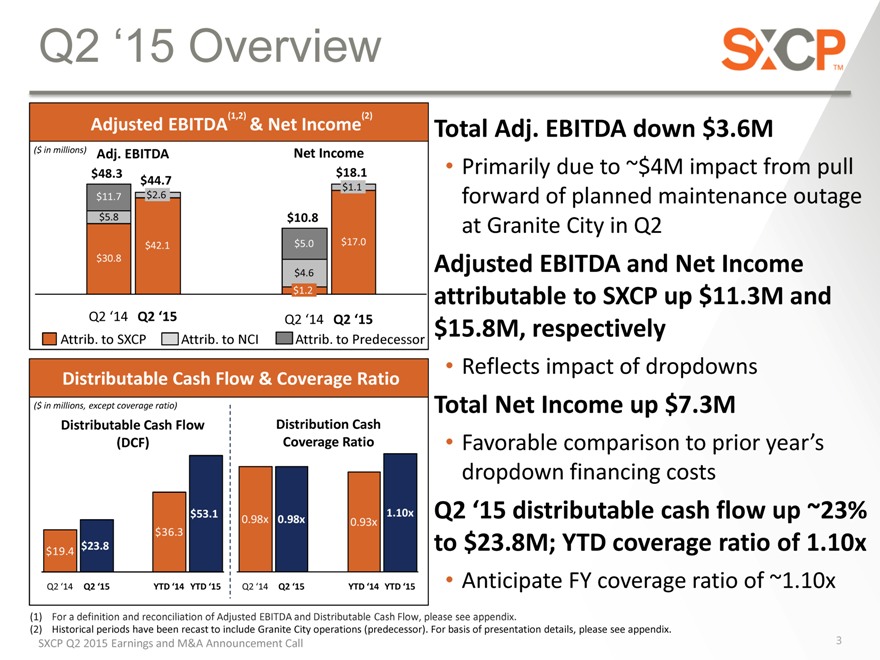

Total Adj. EBITDA down $3.6M

Primarily due to ~$4M impact from pull forward of planned maintenance outage at Granite City in Q2

Adjusted EBITDA and Net Income attributable to SXCP up $11.3M and

$15.8M, respectively

Reflects impact of dropdowns

Total Net Income up $7.3M

Favorable comparison to prior year’s dropdown financing costs

Q2 ‘15 distributable cash flow up ~23% to $23.8M; YTD coverage ratio of 1.10x

Anticipate FY coverage ratio of ~1.10x

(1) For a definition and reconciliation of Adjusted EBITDA and Distributable Cash Flow, please see appendix.

(2) Historical periods have been recast to include Granite City operations (predecessor). For basis of presentation details, please see appendix.

SXCP Q2 2015 Earnings and M&A Announcement Call

3

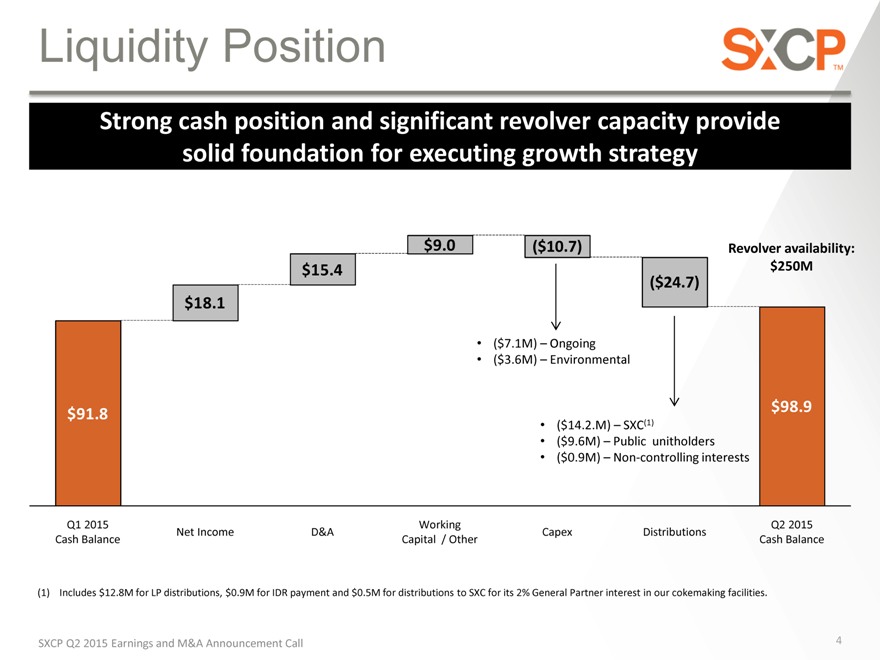

Liquidity Position

Strong cash position and significant revolver capacity provide solid foundation for executing growth strategy

$91.8

$18.1

$15.4

$9.0

($10.7)

($24.7)

Revolver availability: $250M

($7.1M) – Ongoing

($3.6M) – Environmental

($14.2.M) – SXC(1)

($9.6M) – Public unitholders

($0.9M) – Non-controlling interests

$98.9

Q1 2015 Working Q2 2015 Net Income D&A Capex Distributions Cash Balance Capital / Other Cash Balance

(1) Includes $12.8M for LP distributions, $0.9M for IDR payment and $0.5M for distributions to SXC for its 2% General Partner interest in our cokemaking facilities.

SXCP Q2 2015 Earnings and M&A Announcement Call

4

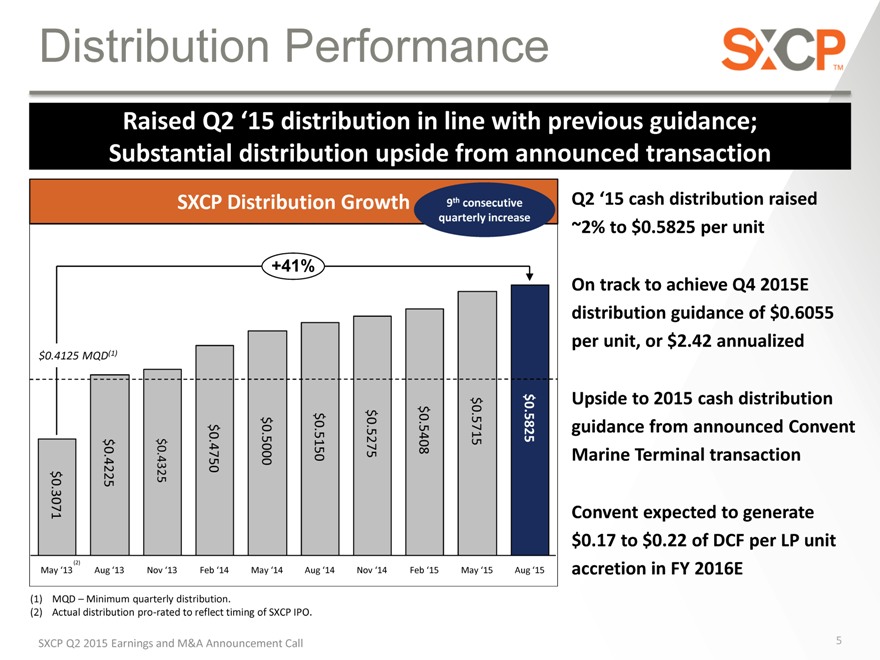

Distribution Performance

Raised Q2 ‘15 distribution in line with previous guidance;

Substantial distribution upside from announced transaction

SXCP Distribution Growth

9th consecutive quarterly increase

+41%

$0.4125 MQD(1)

$0.3071

$0.4225

$0.4325

$0.4750

$0.5000

$0.5150

$0.5275

$0.5408

$0.5715

$0.5825

May ‘13 (2) Aug ‘13 Nov ‘13 Feb ‘14 May ‘14 Aug ‘14 Nov ‘14 Feb ‘15 May ‘15 Aug ‘15

(1) MQD – Minimum quarterly distribution.

(2) Actual distribution pro-rated to reflect timing of SXCP IPO.

Q2 ‘15 cash distribution raised

~2% to $0.5825 per unit

On track to achieve Q4 2015E distribution guidance of $0.6055 per unit, or $2.42 annualized

Upside to 2015 cash distribution guidance from announced Convent Marine Terminal transaction

Convent expected to generate $0.17 to $0.22 of DCF per LP unit accretion in FY 2016E

SXCP Q2 2015 Earnings and M&A Announcement Call

5

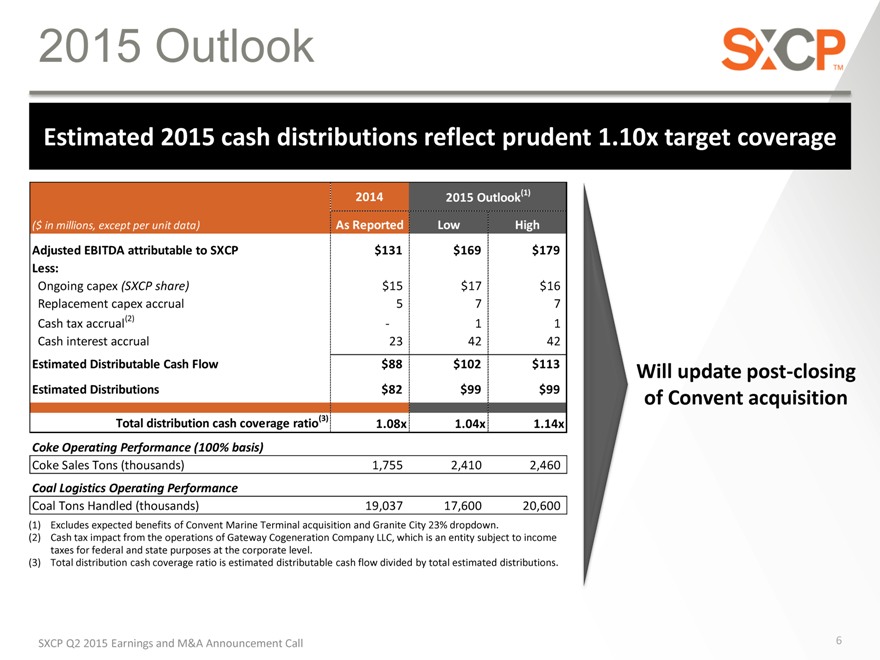

2015 Outlook

Estimated 2015 cash distributions reflect prudent 1.10x target coverage

($ in millions, except per unit data)

2014

As Reported

2015 Outlook(1)

Low

High

Adjusted EBITDA attributable to SXCP Less:

Ongoing capex (SXCP share) Replacement capex accrual Cash tax accrual(2) Cash interest accrual

Estimated Distributable Cash Flow

Estimated Distributions

$131

$15 5 -23

$88

$82

$169

$17

7

1

42

$102

$99

$179

$16

7

1

42

$113

$99

Total distribution cash coverage ratio(3)

1.08x 1.04x 1.14x

Coke Operating Performance (100% basis)

Coke Sales Tons (thousands)

1,755

2,410

2,460

Coal Logistics Operating Performance

Coal Tons Handled (thousands)

19,037

17,600

20,600

(1) Excludes expected benefits of Convent Marine Terminal acquisition and Granite City 23% dropdown.

(2) Cash tax impact from the operations of Gateway Cogeneration Company LLC, which is an entity subject to income taxes for federal and state purposes at the corporate level.

(3) Total distribution cash coverage ratio is estimated distributable cash flow divided by total estimated distributions.

SXCP Q2 2015 Earnings and M&A Announcement Call

Will update post-closing of Convent acquisition

6

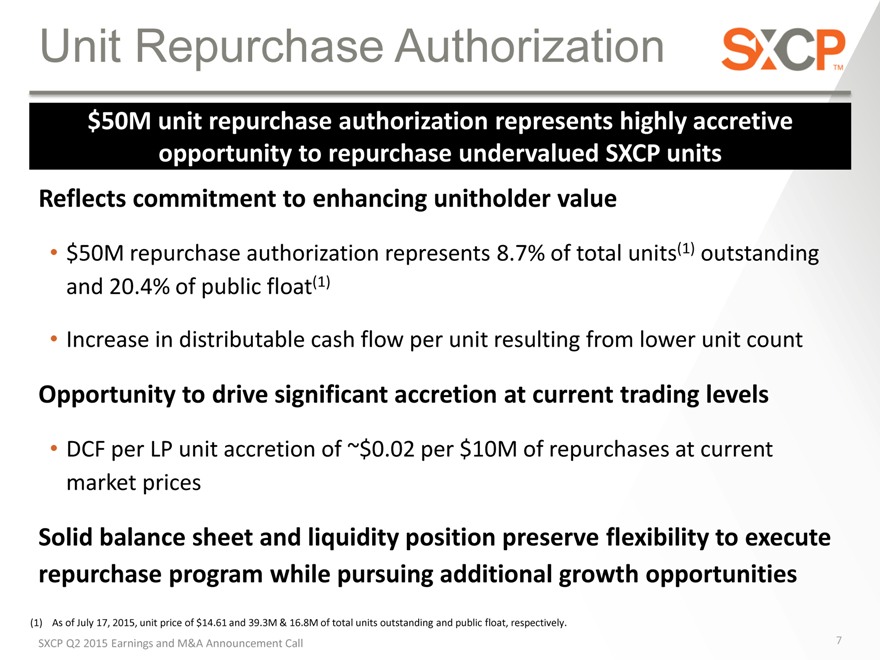

Unit Repurchase Authorization

$50M unit repurchase authorization represents highly accretive opportunity to repurchase undervalued SXCP units

Reflects commitment to enhancing unitholder value

$50M repurchase authorization represents 8.7% of total units(1) outstanding and 20.4% of public float(1)

Increase in distributable cash flow per unit resulting from lower unit count

Opportunity to drive significant accretion at current trading levels

DCF per LP unit accretion of ~$0.02 per $10M of repurchases at current market prices

Solid balance sheet and liquidity position preserve flexibility to execute repurchase program while pursuing additional growth opportunities

(1) As of July 17, 2015, unit price of $14.61 and 39.3M & 16.8M of total units outstanding and public float, respectively.

SXCP Q2 2015 Earnings and M&A Announcement Call

7

CONVENT MARINE TERMINAL (CMT) ACQUISITION OVERVIEW

SXCP Q2 2015 Earnings and M&A Announcement Call

8

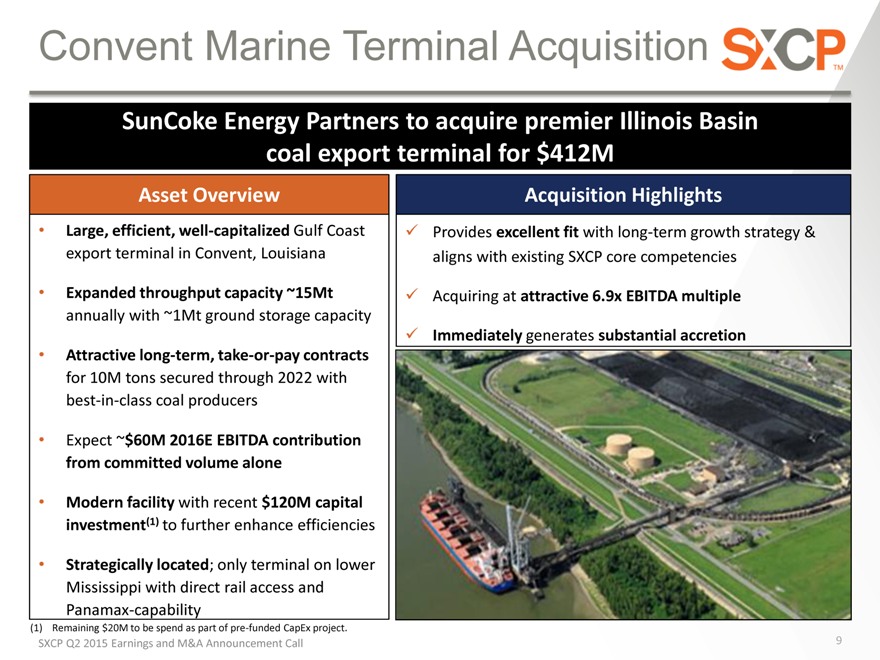

Convent Marine Terminal Acquisition

SunCoke Energy Partners to acquire premier Illinois Basin coal export terminal for $412M

Large, efficient, well-capitalized Gulf Coast export terminal in Convent, Louisiana

Expanded throughput capacity ~15Mt annually with ~1Mt ground storage capacity

Attractive long-term, take-or-pay contracts for 10M tons secured through 2022 with best-in-class coal producers

Expect ~$60M 2016E EBITDA contribution from committed volume alone

Modern facility with recent $120M capital investment(1) to further enhance efficiencies

Strategically located; only terminal on lower Mississippi with direct rail access and Panamax-capability

Provides excellent fit with long-term growth strategy & aligns with existing SXCP core competencies

Acquiring at attractive 6.9x EBITDA multiple

Immediately generates substantial accretion

(1) Remaining $20M to be spend as part of pre-funded CapEx project.

SXCP Q2 2015 Earnings and M&A Announcement Call

9

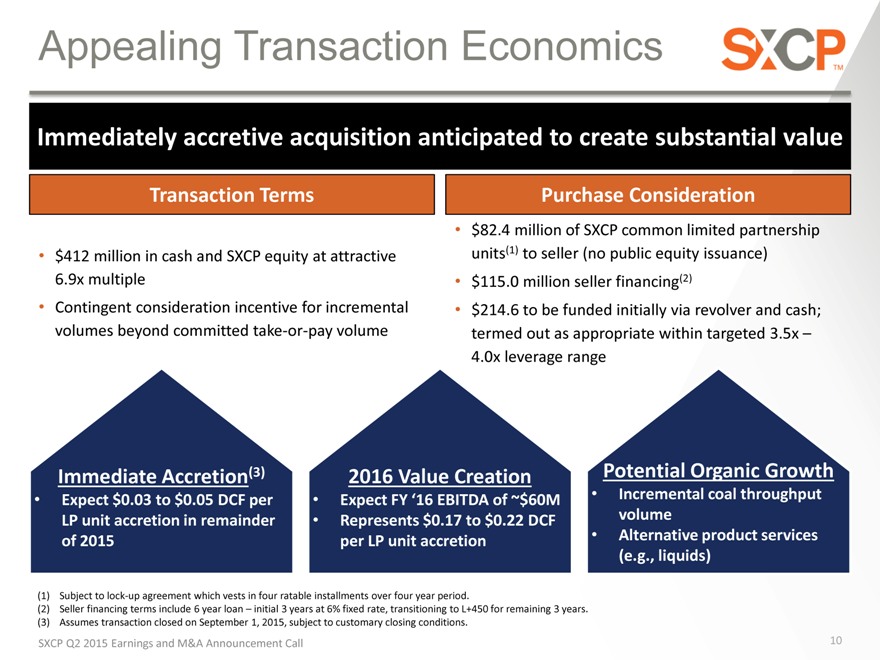

Appealing Transaction Economics

Immediately accretive acquisition anticipated to create substantial value

Transaction Terms

$412 million in cash and SXCP equity at attractive 6.9x multiple Contingent consideration incentive for incremental volumes beyond committed take-or-pay volume

Purchase Consideration

$82.4 million of SXCP common limited partnership units(1) to seller (no public equity issuance) $115.0 million seller financing(2) $214.6 to be funded initially via revolver and cash; termed out as appropriate within targeted 3.5x – 4.0x leverage range

Immediate Accretion(3)

Expect $0.03 to $0.05 DCF per LP unit accretion in remainder of 2015

2016 Value Creation

Expect FY ‘16 EBITDA of ~$60M

Represents $0.17 to $0.22 DCF per LP unit accretion

Potential Organic Growth

Incremental coal throughput volume

Alternative product services (e.g., liquids)

(1) Subject to lock-up agreement which vests in four ratable installments over four year period.

(2) Seller financing terms include 6 year loan – initial 3 years at 6% fixed rate, transitioning to L+450 for remaining 3 years. (3) Assumes transaction closed on September 1, 2015, subject to customary closing conditions.

SXCP Q2 2015 Earnings and M&A Announcement Call

10

Advantaged Customers & Contract Structure

Convent throughput volumes contracted with lowest-cost ILB producers via attractive long-term, take-or-pay contracts

Lowest Cost ILB Coal Producer Base

Advantaged Contract Structure

Foresight Energy, LLC

Premier ILB coal producer

Among lowest-cost coal ILB coal producers

Highly efficient longwall miner

Solid credit profile with stable B+ credit rating

Murray Energy Corporation(1)

Largest privately-owned US coal mining company

Among lowest-cost ILB coal producers

Diversified across NAPP, ILB and Uinta Basins

Solid credit profile with stable B+ credit rating

Contract Terms Thru 2022 Total Take-or-Pay Volume 10Mtpa Annual Contract Escalator ? Termination Rights None Force Majeure Typical Provisions

(1) Contract with Murray American Coal Inc., a subsidiary of Murray Energy Corporation

SXCP Q2 2015 Earnings and M&A Announcement Call

11

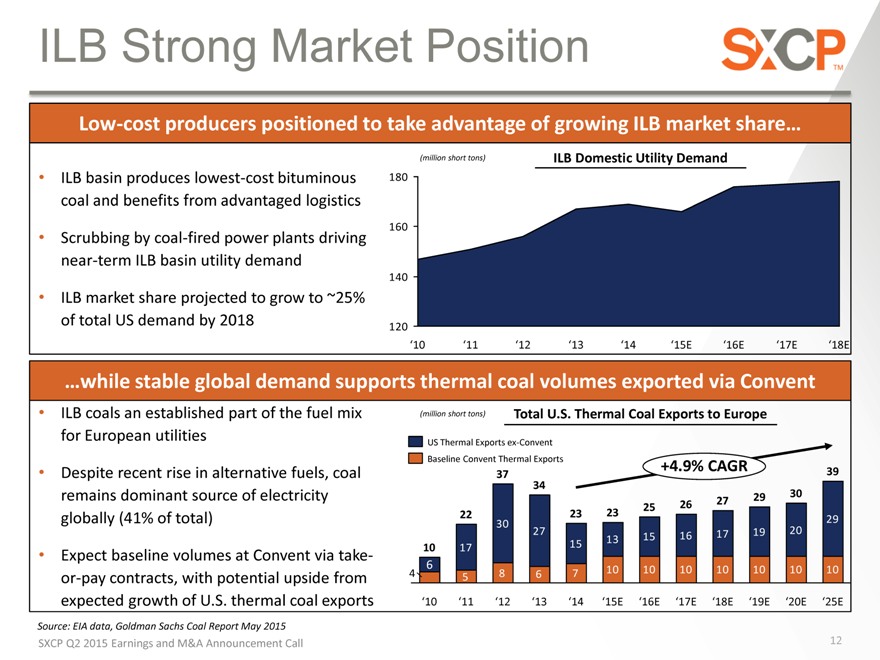

ILB Strong Market Position

Low-cost producers positioned to take advantage of growing ILB market share…

ILB basin produces lowest-cost bituminous coal and benefits from advantaged logistics

Scrubbing by coal-fired power plants driving near-term ILB basin utility demand

ILB market share projected to grow to ~25% of total US demand by 2018

(million short tons)

ILB Domestic Utility Demand

180

160

140

120

‘11

‘12

‘13

‘14

‘15E

‘16E

‘17E

‘18E

…while stable global demand supports thermal coal volumes exported via Convent

ILB coals an established part of the fuel mix for European utilities

Despite recent rise in alternative fuels, coal remains dominant source of electricity globally (41% of total)

Expect baseline volumes at Convent via take-or-pay contracts, with potential upside from expected growth of U.S. thermal coal exports

(million short tons)

Total U.S. Thermal Coal Exports to Europe

US Thermal Exports ex-Convent

Baseline Convent Thermal Exports

+4.9% CAGR

37

39

34

29

30

26

27

25

22

23

23

29

30

27

17

19

20

13

15

16

10

17

15

6

4

8

7

10

10

10

10

10

10

10

5

6

‘10 ‘11 ‘12 ‘13 ‘14 ‘15E ‘16E ‘17E ‘18E ‘19E ‘20E ‘25E

Source: EIA data, Goldman Sachs Coal Report May 2015

SXCP Q2 2015 Earnings and M&A Announcement Call

12

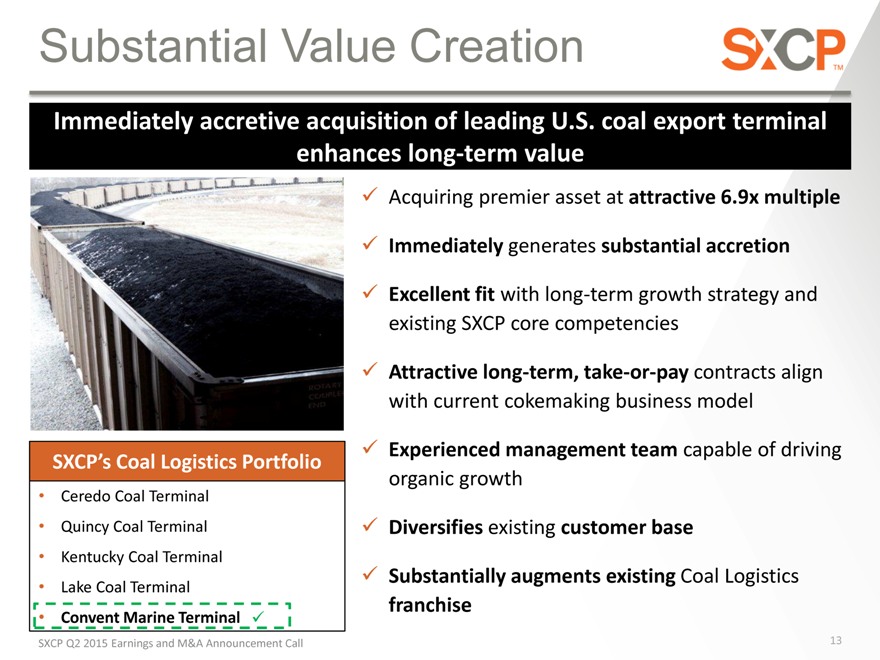

Substantial Value Creation

Immediately accretive acquisition of leading U.S. coal export terminal enhances long-term value

Acquiring premier asset at attractive 6.9x multiple

Immediately generates substantial accretion

Excellent fit with long-term growth strategy and existing SXCP core competencies

Attractive long-term, take-or-pay contracts align with current cokemaking business model

Experienced management team capable of driving organic growth

Diversifies existing customer base

Substantially augments existing Coal Logistics franchise

SXCP’s Coal Logistics Portfolio

Ceredo Coal Terminal Quincy Coal Terminal Kentucky Coal Terminal Lake Coal Terminal

Convent Marine Terminal

SXCP Q2 2015 Earnings and M&A Announcement Call

13

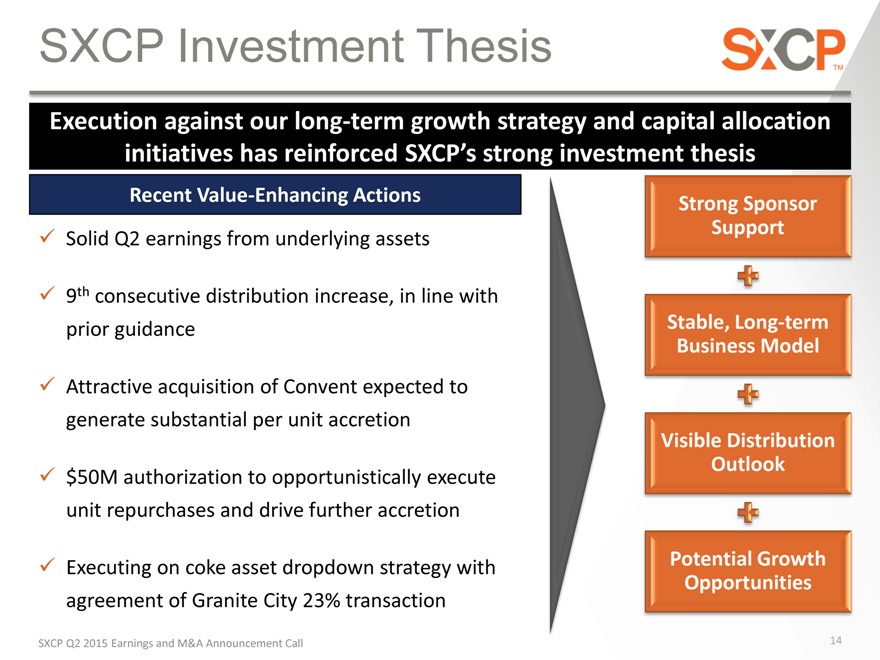

SXCP Investment Thesis

Execution against our long-term growth strategy and capital allocation initiatives has reinforced SXCP’s strong investment thesis

Solid Q2 earnings from underlying assets

9th consecutive distribution increase, in line with prior guidance

Attractive acquisition of Convent expected to generate substantial per unit accretion

$50M authorization to opportunistically execute unit repurchases and drive further accretion

Executing on coke asset dropdown strategy with agreement of Granite City 23% transaction

Strong Sponsor Support

Stable, Long-term Business Model

Visible Distribution Outlook

Potential Growth Opportunities

SXCP Q2 2015 Earnings and M&A Announcement Call

14

QUESTIONS

SXCP Q2 2015 Earnings and M&A Announcement Call

15

Investor Relations 630-824-1987 www.sxcpartners.com

APPENDIX – CONVENT MARINE TERMINAL ACQUISITION UPDATE

SXCP Q2 2015 Earnings and M&A Announcement Call

17

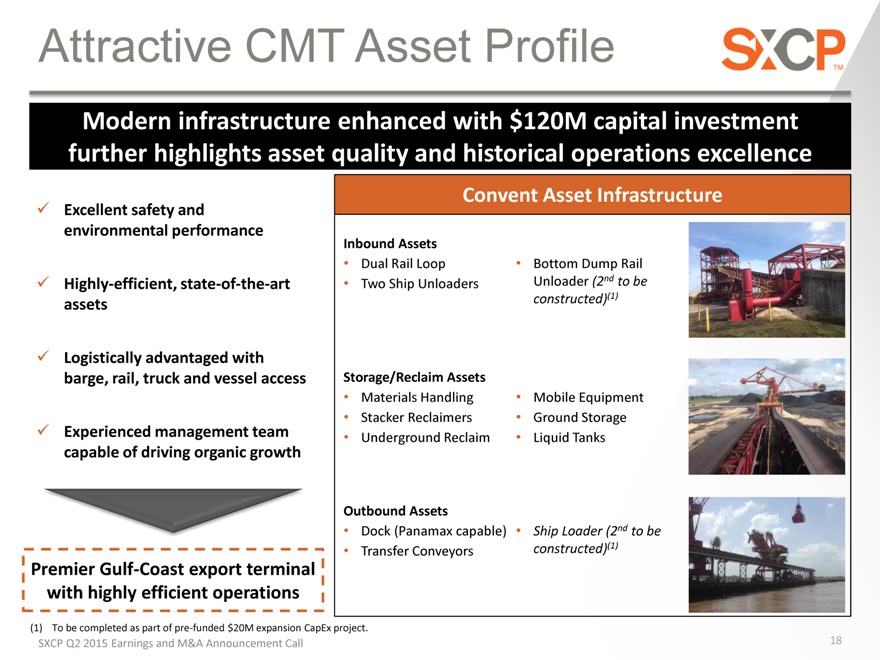

Attractive CMT Asset Profile

Modern infrastructure enhanced with $120M capital investment further highlights asset quality and historical operations excellence

Excellent safety and environmental performance

Highly-efficient, state-of-the-art assets

Logistically advantaged with barge, rail, truck and vessel access

Experienced management team capable of driving organic growth

Convent Asset Infrastructure

Inbound Assets

Dual Rail Loop Bottom Dump Rail

Two Ship Unloaders Unloader (2nd to be constructed)(1)

Storage/Reclaim Assets

Materials Handling Mobile Equipment

Stacker Reclaimers Ground Storage

Underground Reclaim Liquid Tanks

Outbound Assets

Dock (Panamax capable) • Ship Loader (2nd to be

Transfer Conveyors constructed)(1)

Premier Gulf-Coast export terminal with highly efficient operations

(1) To be completed as part of pre-funded $20M expansion CapEx project.

SXCP Q2 2015 Earnings and M&A Announcement Call

18

FINANCIAL RECONCILIATIONS

SXCP Q2 2015 Earnings and M&A Announcement Call

19

Basis of Presentation & Definitions

BASIS OF PRESENTATION

On January 13, 2015, SunCoke Energy Partners, L.P. acquired a 75 percent interest in the Granite City cokemaking facility from SunCoke. Because this was a transfer between entities under common control, all historical financial results of Granite City prior to the dropdown are included in our financial results and presented on an “Attributable to Predecessor” basis. Prior year information has been recast to reflect this required accounting treatment.

DEFINITIONS

Adjusted EBITDA represents earnings before interest, taxes, depreciation and amortization. Prior to the expiration of our nonconventional fuel tax credits in 2013, Adjusted EBITDA included an add-back of sales discounts related to the sharing of these credits with our customers. Any adjustments to these amounts subsequent to 2013 have been included in Adjusted EBITDA. Adjusted EBITDA does not represent and should not be considered an alternative to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure of the operating performance and liquidity of the Partnership’s net assets and its ability to incur and service debt, fund capital expenditures and make distributions. Adjusted EBITDA provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance and liquidity. EBITDA and Adjusted EBITDA are not measures calculated in accordance with GAAP, as they should not be considered an alternative to net income, operating cash flow or any other measure of financial performance presented in accordance with GAAP.

EBITDA represents earnings before interest, taxes, depreciation and amortization.

Adjusted EBITDA attributable to SXC/SXCP represents Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests.

Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold/handled.

SXCP Q2 2015 Earnings and M&A Announcement Call

20

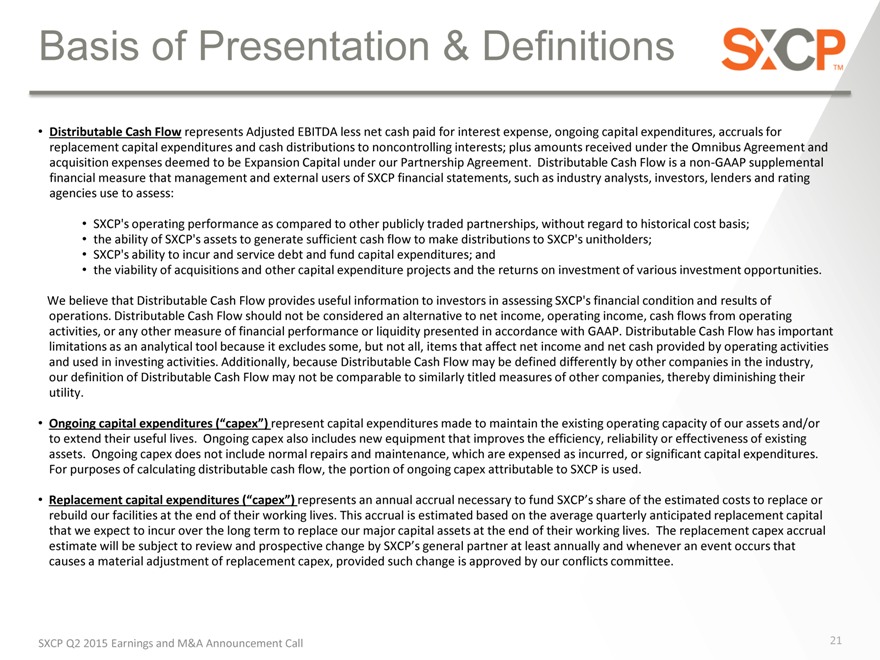

Basis of Presentation & Definitions

Distributable Cash Flow represents Adjusted EBITDA less net cash paid for interest expense, ongoing capital expenditures, accruals for replacement capital expenditures and cash distributions to noncontrolling interests; plus amounts received under the Omnibus Agreement and acquisition expenses deemed to be Expansion Capital under our Partnership Agreement. Distributable Cash Flow is a non-GAAP supplemental financial measure that management and external users of SXCP financial statements, such as industry analysts, investors, lenders and rating agencies use to assess:

SXCP’s operating performance as compared to other publicly traded partnerships, without regard to historical cost basis; the ability of SXCP’s assets to generate sufficient cash flow to make distributions to SXCP’s unitholders;

SXCP’s ability to incur and service debt and fund capital expenditures; and

the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities.

We believe that Distributable Cash Flow provides useful information to investors in assessing SXCP’s financial condition and results of operations. Distributable Cash Flow should not be considered an alternative to net income, operating income, cash flows from operating activities, or any other measure of financial performance or liquidity presented in accordance with GAAP. Distributable Cash Flow has important limitations as an analytical tool because it excludes some, but not all, items that affect net income and net cash provided by operating activities and used in investing activities. Additionally, because Distributable Cash Flow may be defined differently by other companies in the industry, our definition of Distributable Cash Flow may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

Ongoing capital expenditures (“capex”) represent capital expenditures made to maintain the existing operating capacity of our assets and/or to extend their useful lives. Ongoing capex also includes new equipment that improves the efficiency, reliability or effectiveness of existing assets. Ongoing capex does not include normal repairs and maintenance, which are expensed as incurred, or significant capital expenditures. For purposes of calculating distributable cash flow, the portion of ongoing capex attributable to SXCP is used.

Replacement capital expenditures (“capex”) represents an annual accrual necessary to fund SXCP’s share of the estimated costs to replace or rebuild our facilities at the end of their working lives. This accrual is estimated based on the average quarterly anticipated replacement capital that we expect to incur over the long term to replace our major capital assets at the end of their working lives. The replacement capex accrual estimate will be subject to review and prospective change by SXCP’s general partner at least annually and whenever an event occurs that causes a material adjustment of replacement capex, provided such change is approved by our conflicts committee.

SXCP Q2 2015 Earnings and M&A Announcement Call

21

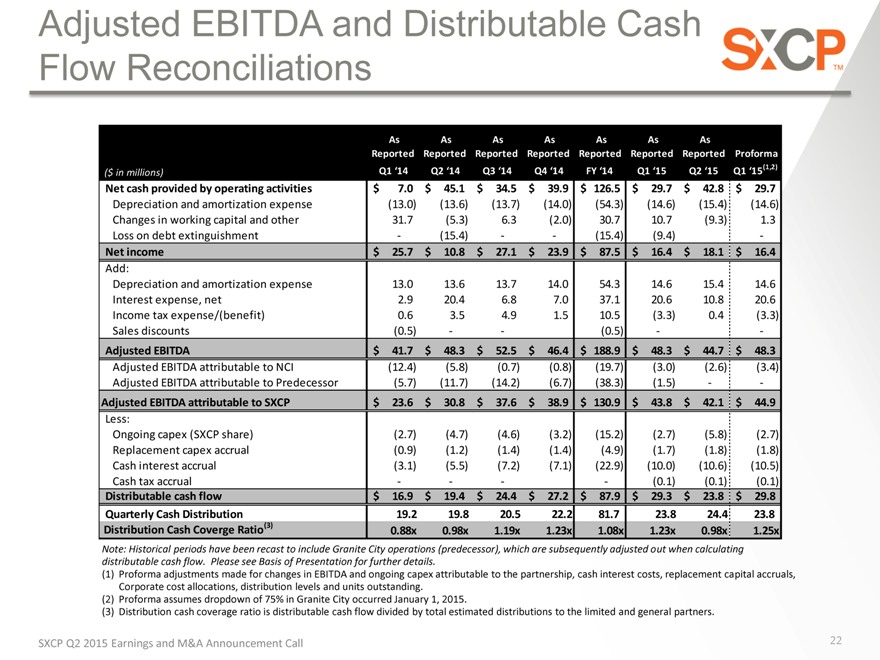

Adjusted EBITDA and Distributable Cash Flow Reconciliations

As Reported

As Reported

As Reported

As Reported

As Reported

As Reported

As Reported

Proforma

($ in millions) Q1 ‘14 Q2 ‘14 Q3 ‘14 Q4 ‘14 FY ‘14 Q1 ‘15 Q2 ‘15 Q1 ‘15(1,2)

Net cash provided by operating activities $ 7.0 $ 45.1 $ 34.5 $ 39.9 $ 126.5 $ 29.7 $ 42.8 $ 29.7

Depreciation and amortization expense (13.0) (13.6) (13.7) (14.0) (54.3) (14.6) (15.4) (14.6)

Changes in working capital and other 31.7 (5.3) 6.3 (2.0) 30.7 10.7 (9.3) 1.3

Loss on debt extinguishment - (15.4) — (15.4) (9.4) -

Net income $ 25.7 $ 10.8 $ 27.1 $ 23.9 $ 87.5 $ 16.4 $ 18.1 $ 16.4

Add:

Depreciation and amortization expense 13.0 13.6 13.7 14.0 54.3 14.6 15.4 14.6

Interest expense, net 2.9 20.4 6.8 7.0 37.1 20.6 10.8 20.6

Income tax expense/(benefit) 0.6 3.5 4.9 1.5 10.5(3.3) 0.4(3.3)

Sales discounts (0.5) — (0.5) —

Adjusted EBITDA $ 41.7 $ 48.3 $ 52.5 $ 46.4 $ 188.9 $ 48.3 $ 44.7 $ 48.3

Adjusted EBITDA attributable to NCI (12.4) (5.8) (0.7) (0.8) (19.7) (3.0) (2.6) (3.4)

Adjusted EBITDA attributable to Predecessor (5.7) (11.7) (14.2) (6.7) (38.3) (1.5) —

Adjusted EBITDA attributable to SXCP $ 23.6 $ 30.8 $ 37.6 $ 38.9 $ 130.9 $ 43.8 $ 42.1 $ 44.9

Less:

Ongoing capex (SXCP share) (2.7) (4.7) (4.6) (3.2) (15.2) (2.7) (5.8) (2.7)

Replacement capex accrual (0.9) (1.2) (1.4) (1.4) (4.9) (1.7) (1.8) (1.8)

Cash interest accrual (3.1) (5.5) (7.2) (7.1) (22.9) (10.0) (10.6) (10.5)

Cash tax accrual — — (0.1) (0.1) (0.1)

Distributable cash flow $ 16.9 $ 19.4 $ 24.4 $ 27.2 $ 87.9 $ 29.3 $ 23.8 $ 29.8

Quarterly Cash Distribution 19.2 19.8 20.5 22.2 81.7 23.8 24.4 23.8

Distribution Cash Coverge Ratio(3) 0.88x 0.98x 1.19x 1.23x 1.08x 1.23x 0.98x 1.25x

Note: Historical periods have been recast to include Granite City operations (predecessor), which are subsequently adjusted out when calculating distributable cash flow. Please see Basis of Presentation for further details.

(1) Proforma adjustments made for changes in EBITDA and ongoing capex attributable to the partnership, cash interest costs, replacement capital accruals, Corporate cost allocations, distribution levels and units outstanding.

(2) Proforma assumes dropdown of 75% in Granite City occurred January 1, 2015.

(3) Distribution cash coverage ratio is distributable cash flow divided by total estimated distributions to the limited and general partners.

SXCP Q2 2015 Earnings and M&A Announcement Call

22

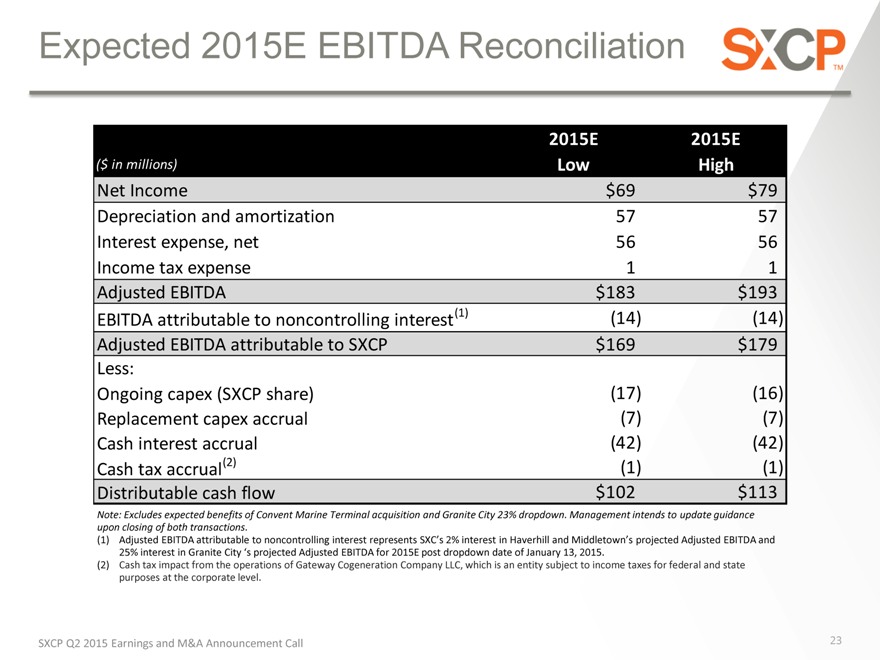

Expected 2015E EBITDA Reconciliation

($ in millions)

2015E

2015E

Low

High

Net Income

Depreciation and amortization Interest expense, net Income tax expense Adjusted EBITDA

EBITDA attributable to noncontrolling interest(1) Adjusted EBITDA attributable to SXCP

Less:

Ongoing capex (SXCP share) Replacement capex accrual Cash interest accrual Cash tax accrual(2) Distributable cash flow

$69

57

56

1

$183

(14)

$169

(17)

(7)

(42)

(1)

$102

$79

57

56

1

$193

(14)

$179

(16)

(7)

(42)

(1)

$113

Note: Excludes expected benefits of Convent Marine Terminal acquisition and Granite City 23% dropdown. Management intends to update guidance upon closing of both transactions.

(1) Adjusted EBITDA attributable to noncontrolling interest represents SXC’s 2% interest in Haverhill and Middletown’s projected Adjusted EBITDA and 25% interest in Granite City ‘s projected Adjusted EBITDA for 2015E post dropdown date of January 13, 2015.

(2) Cash tax impact from the operations of Gateway Cogeneration Company LLC, which is an entity subject to income taxes for federal and state purposes at the corporate level.

SXCP Q2 2015 Earnings and M&A Announcement Call

23

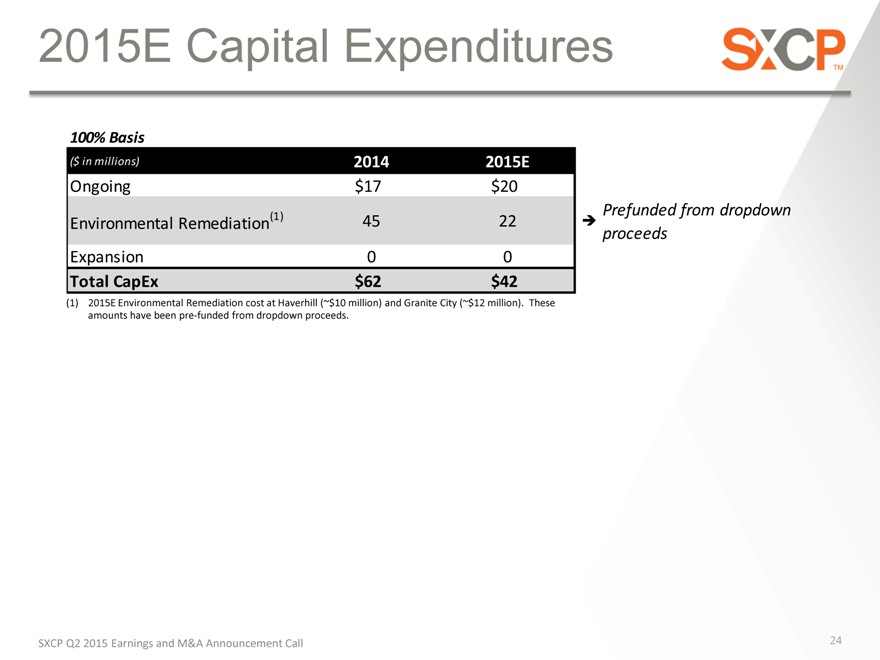

2015E Capital Expenditures

($ in millions)

100% Basis

2014

$17

45

0

$62

2015E

$20

22

0

$42

Prefunded from dropdown proceeds

(1) 2015E Environmental Remediation cost at Haverhill (~$10 million) and Granite City (~$12 million). These amounts have been pre-funded from dropdown proceeds.

SXCP Q2 2015 Earnings and M&A Announcement Call

24