SunCoke Energy Partners, L.P. Q1 2017 Earnings Conference Call April 20, 2017 Exhibit 99.2

Forward-Looking Statements This slide presentation should be reviewed in conjunction with the First Quarter 2017 earnings release of SunCoke Energy Partners, L.P. (SXCP) and conference call held on April 20, 2017 at 10:00 a.m. ET. Some of the information included in this presentation constitutes “forward-looking statements.” All statements in this presentation that express opinions, expectations, beliefs, plans, objectives, assumptions or projections with respect to anticipated future performance of SunCoke Energy, Inc. (SXC) or SXCP, in contrast with statements of historical facts, are forward-looking statements. Such forward-looking statements are based on management’s beliefs and assumptions and on information currently available. Forward-looking statements include information concerning possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance improvements, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and may be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “will,” “should” or the negative of these terms or similar expressions. Although management believes that its plans, intentions and expectations reflected in or suggested by the forward-looking statements made in this presentation are reasonable, no assurance can be given that these plans, intentions or expectations will be achieved when anticipated or at all. Moreover, such statements are subject to a number of assumptions, risks and uncertainties. Many of these risks are beyond the control of SXC and SXCP, and may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Each of SXC and SXCP has included in its filings with the Securities and Exchange Commission cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement. For more information concerning these factors, see the Securities and Exchange Commission filings of SXC and SXCP. All forward-looking statements included in this presentation are expressly qualified in their entirety by such cautionary statements. Although forward-looking statements are based on current beliefs and expectations, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date hereof. SXC and SXCP do not have any intention or obligation to update publicly any forward-looking statement (or its associated cautionary language) whether as a result of new information or future events or after the date of this presentation, except as required by applicable law. This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of the presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in the Appendix. SXCP Q1 2017 Earnings Call

Simplification Transaction Update While unable to reach agreement on Simplification Transaction, fundamentals of coke and logistics businesses remain sound SXC and Conflicts Committee engaged in active dialogue regarding proposal Received input from variety of stakeholders throughout process While Conflicts Committee also sees benefits of combined enterprise, both parties unable to reach agreement – therefore process has been terminated Remain focused on executing FY 2017 objectives Deliver operational excellence, optimize asset base and execute GCO gas sharing project Achieve FY 2017 financial targets and deliver on commitments to unitholders Well positioned to leverage strong competitive advantages to capitalize on sustained coke and logistics industry dynamics Further steel recovery could lead to structural domestic coke shortage Continue to experience improvement in coal logistics as exports remain attractive Moving forward, formulating strategy post change in Qualifying Income regs. 10-year transition period provides time to evaluate and evolve structure SXCP Q1 2017 Earnings Call

Q1 2017 Highlights SXCP Q1 2017 Earnings Call Achieved solid safety and operating performance across coke and coal logistics fleet Initiated Granite City gas sharing capital project; remain on-track to complete by Q1 2019 Handled record coal export volume at CMT Delivered solid Q1 2017 Adj. EBITDA of $51.7M; remain well positioned to achieve FY guidance Declared quarterly distribution of $0.5940/unit; focused on optimizing capital deployment

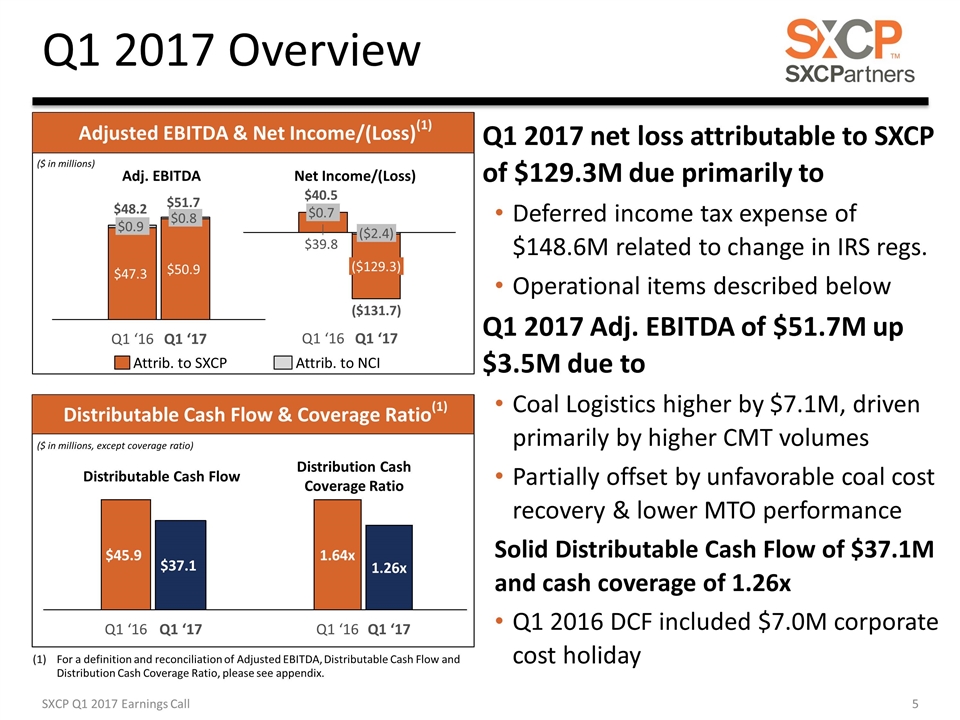

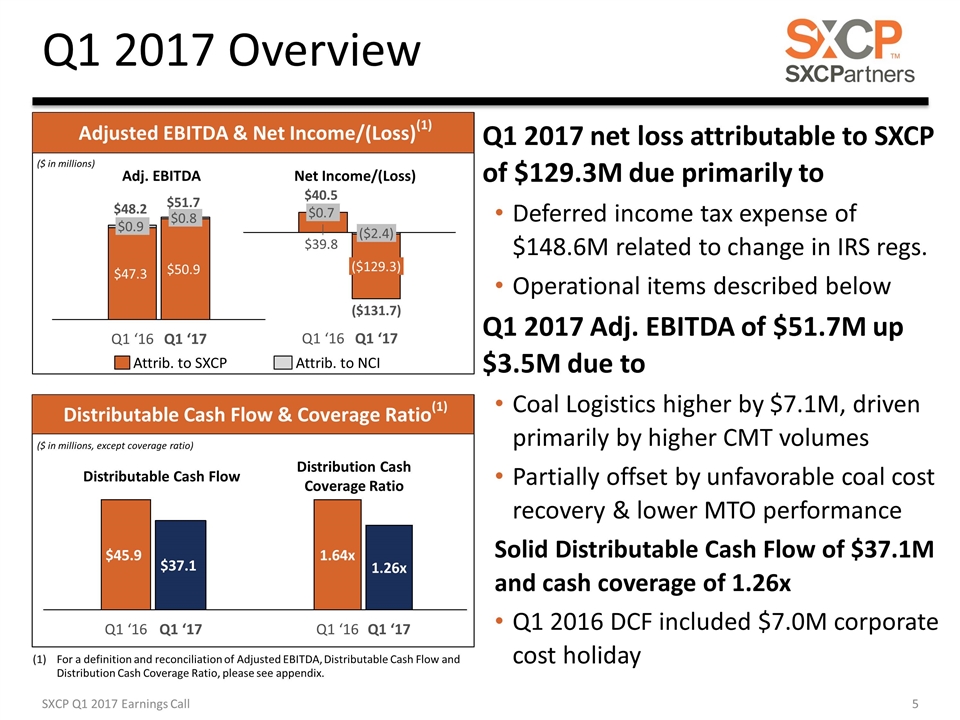

Q1 2017 Overview Q1 2017 net loss attributable to SXCP of $129.3M due primarily to Deferred income tax expense of $148.6M related to change in IRS regs. Operational items described below Q1 2017 Adj. EBITDA of $51.7M up $3.5M due to Coal Logistics higher by $7.1M, driven primarily by higher CMT volumes Partially offset by unfavorable coal cost recovery & lower MTO performance Solid Distributable Cash Flow of $37.1M and cash coverage of 1.26x Q1 2016 DCF included $7.0M corporate cost holiday For a definition and reconciliation of Adjusted EBITDA, Distributable Cash Flow and Distribution Cash Coverage Ratio, please see appendix. SXCP Q1 2017 Earnings Call ($ in millions, except coverage ratio) x x Distributable Cash Flow Distribution Cash Coverage Ratio ($ in millions) Adj. EBITDA Net Income/(Loss) Attrib. to NCI Attrib. to SXCP

Adj. EBITDA(1) – Q1 ‘16 to Q1 ‘17 ($ in millions) For a definition and reconciliation of Adjusted EBITDA, please see appendix. (1) (1) ($1.4M) – Unfavorable coal cost recovery ($1.2M) – Middletown return to run-rate performance $6.2M – Higher CMT volumes Q1 2017 Adjusted EBITDA improvement driven by significantly improved Coal Logistics volumes SXCP Q1 2017 Earnings Call

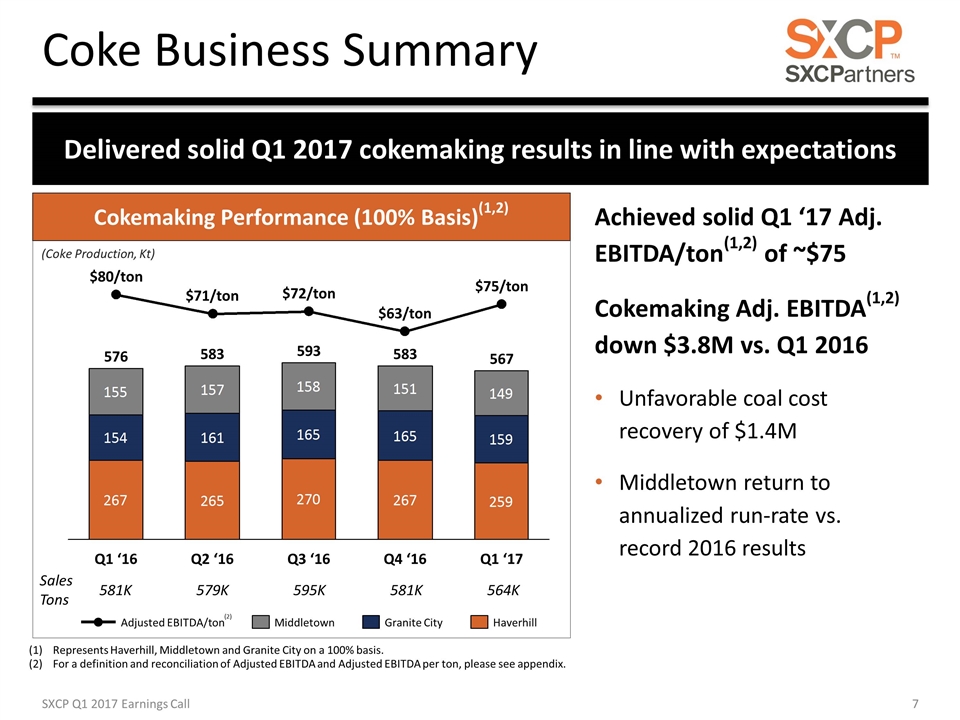

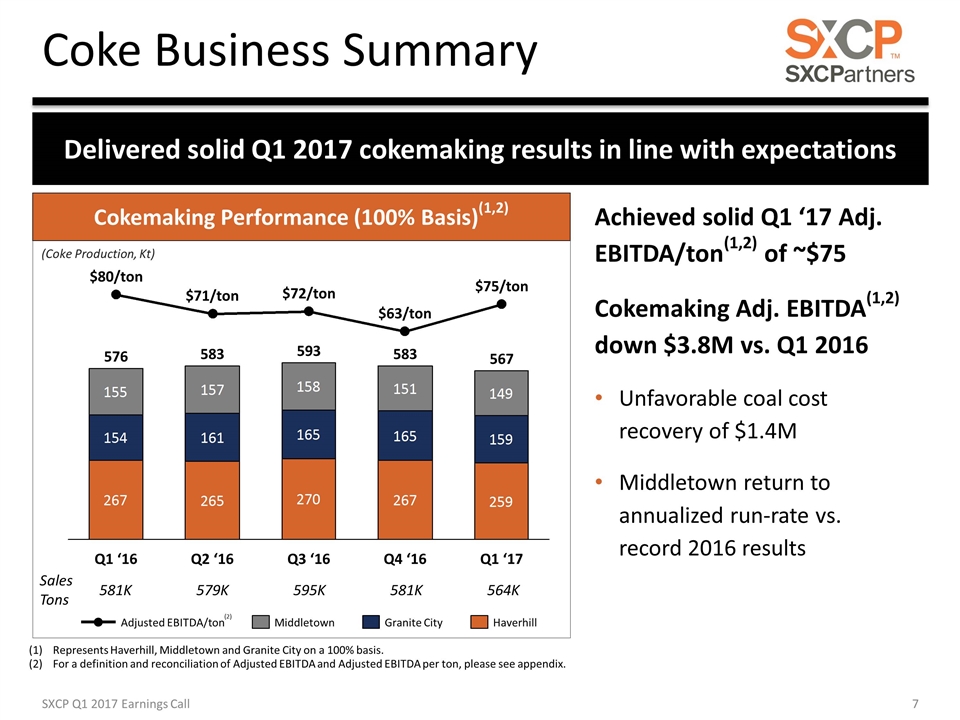

Coke Business Summary Delivered solid Q1 2017 cokemaking results in line with expectations Cokemaking Performance (100% Basis)(1,2) /ton /ton /ton /ton /ton 581K 579K 595K 581K Sales Tons 564K Represents Haverhill, Middletown and Granite City on a 100% basis. For a definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA per ton, please see appendix. Achieved solid Q1 ‘17 Adj. EBITDA/ton(1,2) of ~$75 Cokemaking Adj. EBITDA(1,2) down $3.8M vs. Q1 2016 Unfavorable coal cost recovery of $1.4M Middletown return to annualized run-rate vs. record 2016 results (2) SXCP Q1 2017 Earnings Call (Coke Production, Kt)

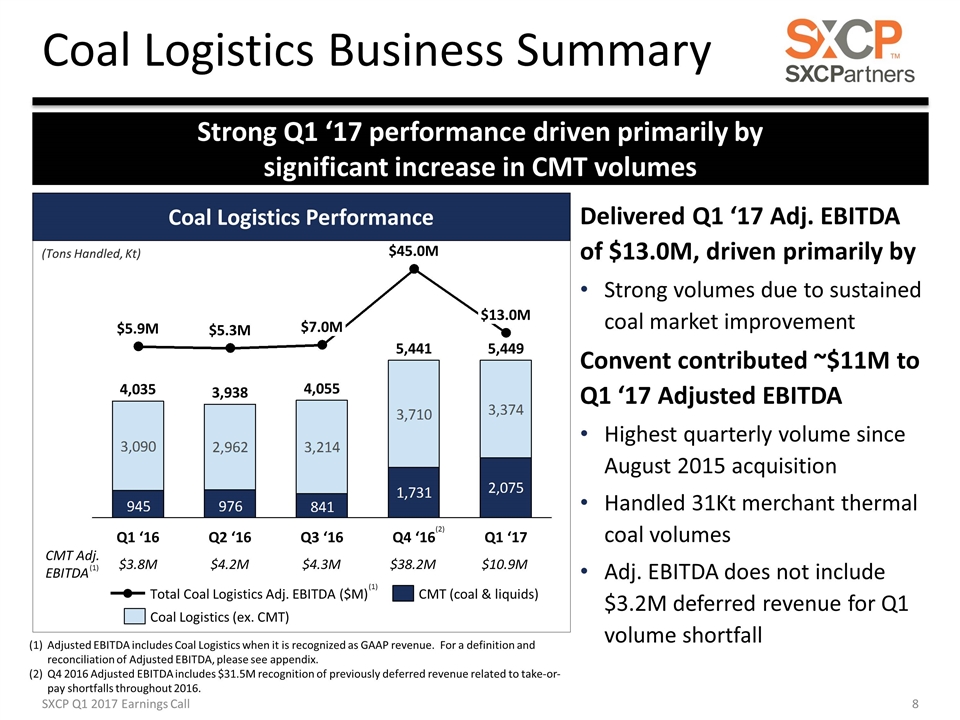

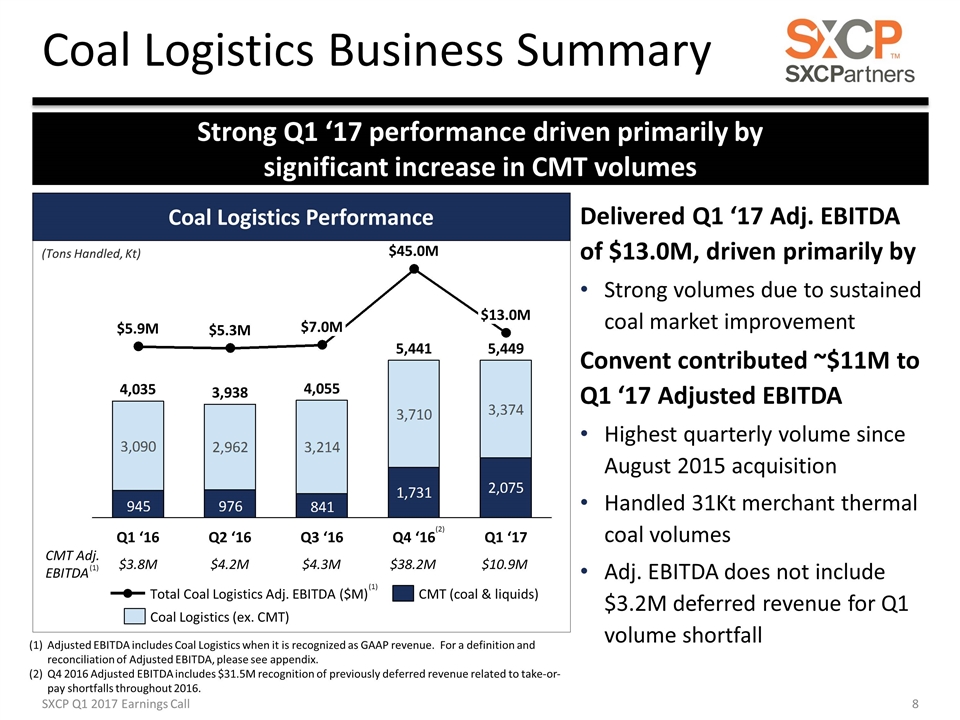

Coal Logistics Business Summary SXCP Q1 2017 Earnings Call Strong Q1 ‘17 performance driven primarily by significant increase in CMT volumes M M M M M (Tons Handled, Kt) Adjusted EBITDA includes Coal Logistics when it is recognized as GAAP revenue. For a definition and reconciliation of Adjusted EBITDA, please see appendix. Q4 2016 Adjusted EBITDA includes $31.5M recognition of previously deferred revenue related to take-or-pay shortfalls throughout 2016. $3.8M $4.2M $4.3M $38.2M CMT Adj. EBITDA $10.9M (1) (1) Coal Logistics Performance Delivered Q1 ‘17 Adj. EBITDA of $13.0M, driven primarily by Strong volumes due to sustained coal market improvement Convent contributed ~$11M to Q1 ‘17 Adjusted EBITDA Highest quarterly volume since August 2015 acquisition Handled 31Kt merchant thermal coal volumes Adj. EBITDA does not include $3.2M deferred revenue for Q1 volume shortfall (2)

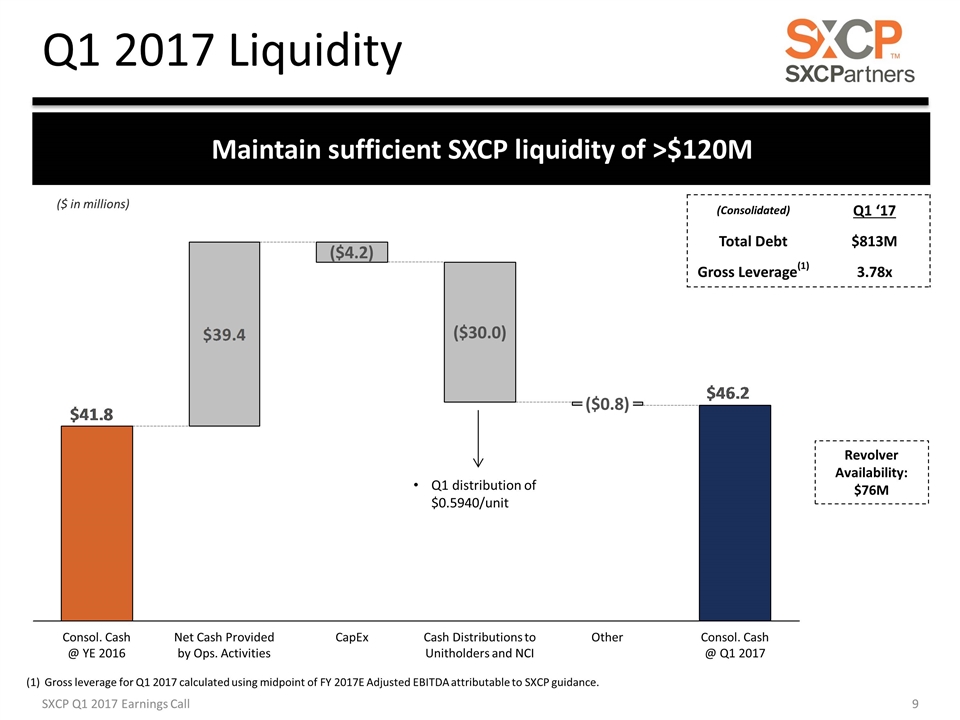

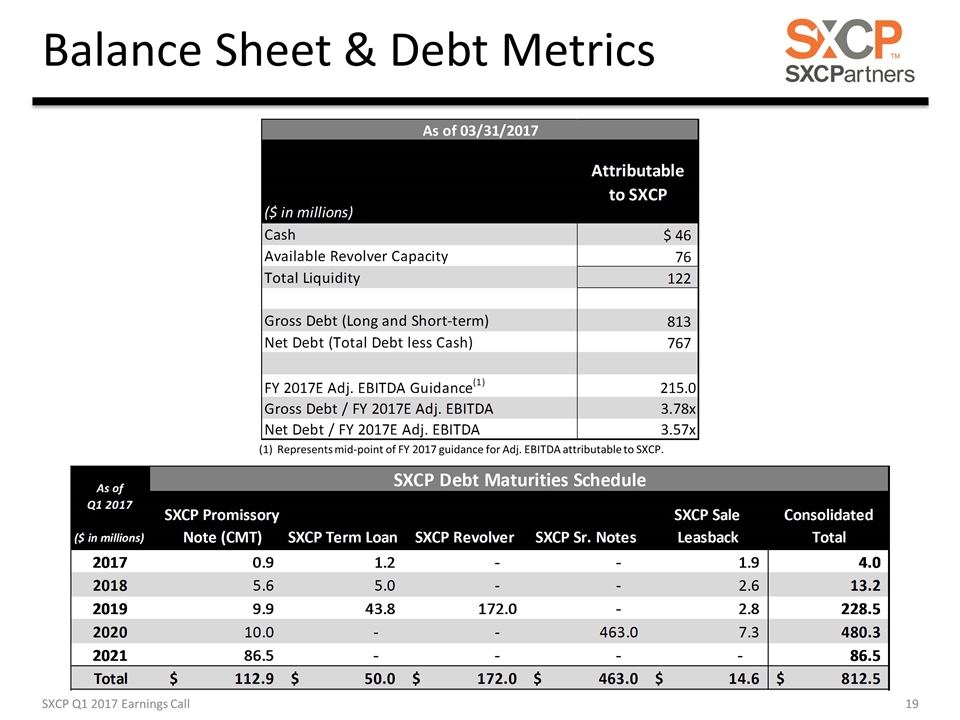

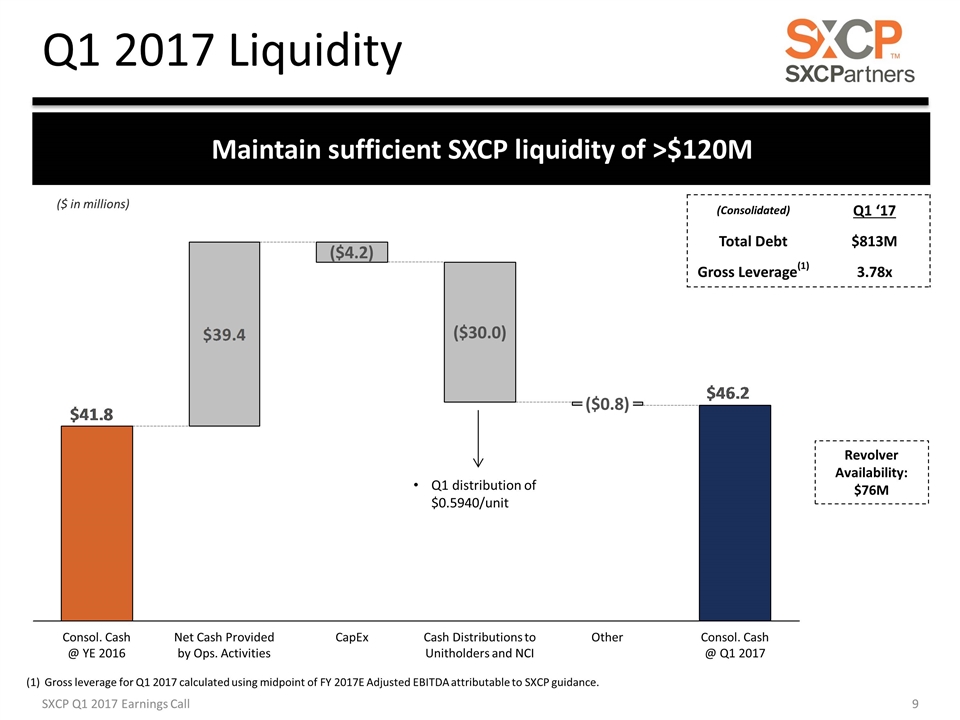

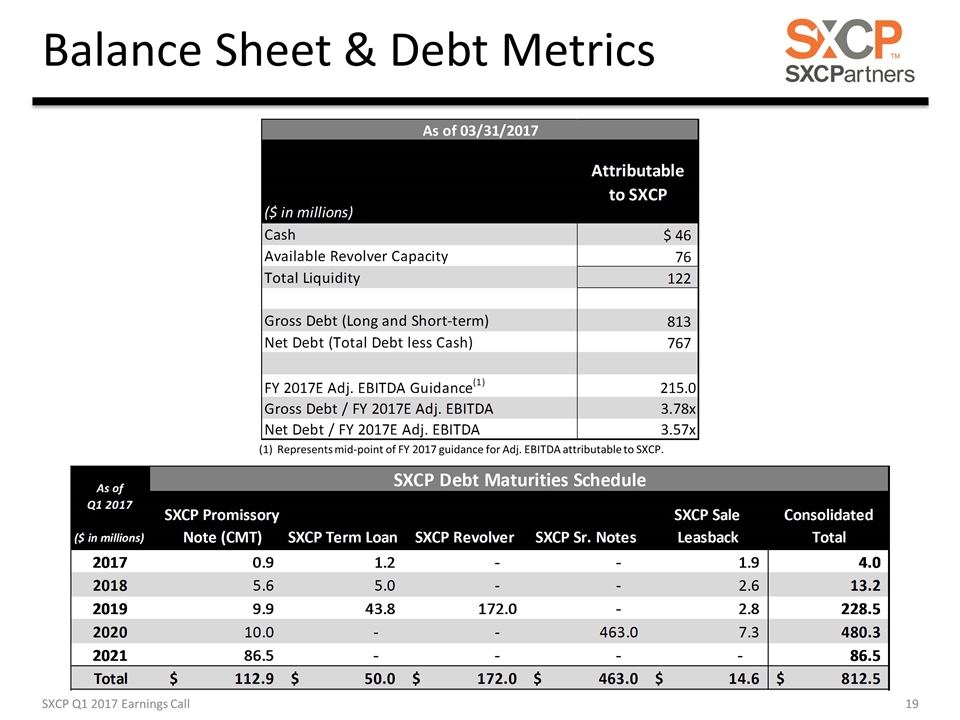

Q1 2017 Liquidity Strong cash flow generation from coke and coal logistics operations deployed primarily for de-levering, CapEx and SXCP distributions ($ in millions) Revolver Availability: $76M Maintain sufficient SXCP liquidity of >$120M SXCP Q1 2017 Earnings Call (Consolidated) Q1 ‘17 Total Debt $813M Gross Leverage(1) 3.78x Gross leverage for Q1 2017 calculated using midpoint of FY 2017E Adjusted EBITDA attributable to SXCP guidance. Q1 distribution of $0.5940/unit

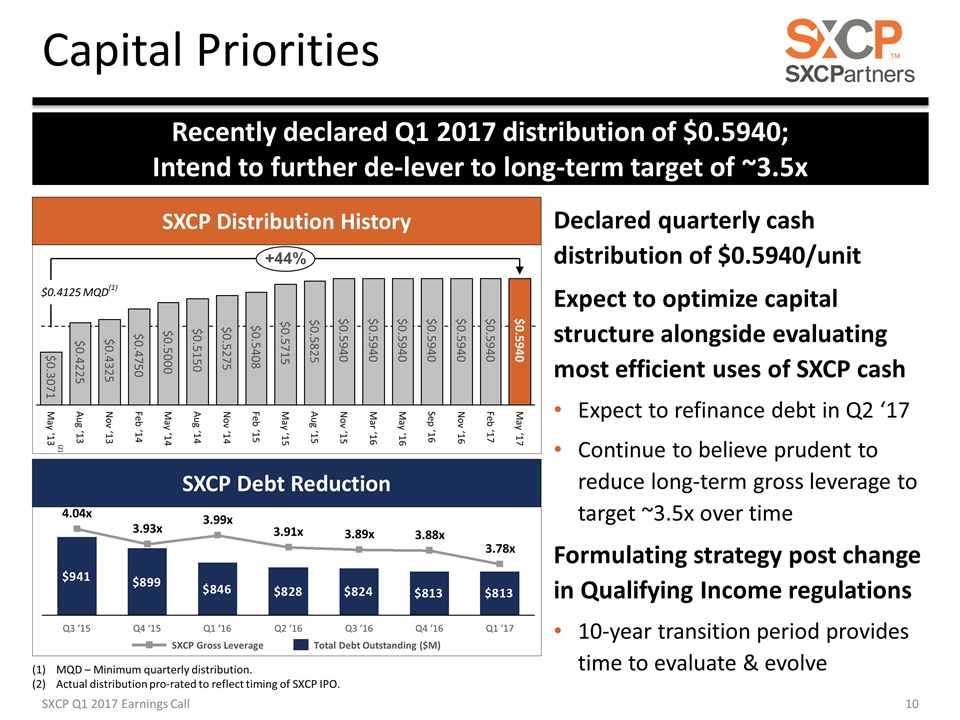

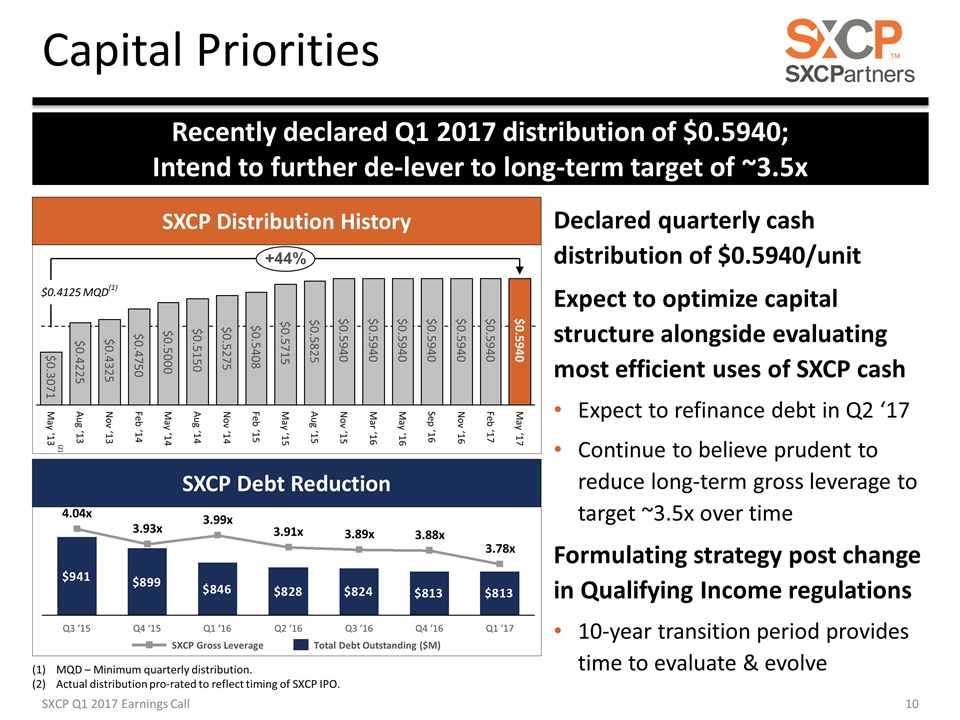

Capital Priorities +44% MQD – Minimum quarterly distribution. Actual distribution pro-rated to reflect timing of SXCP IPO. (2) Declared quarterly cash distribution of $0.5940/unit Expect to optimize capital structure alongside evaluating most efficient uses of SXCP cash Expect to refinance debt in Q2 ‘17 Continue to believe prudent to reduce long-term gross leverage to target ~3.5x over time Formulating strategy post change in Qualifying Income regulations 10-year transition period provides time to evaluate & evolve $0.4125 MQD(1) SXCP Distribution History Recently declared Q1 2017 distribution of $0.5940; Intend to further de-lever to long-term target of ~3.5x SXCP Q1 2017 Earnings Call x x x x x x x SXCP Debt Reduction

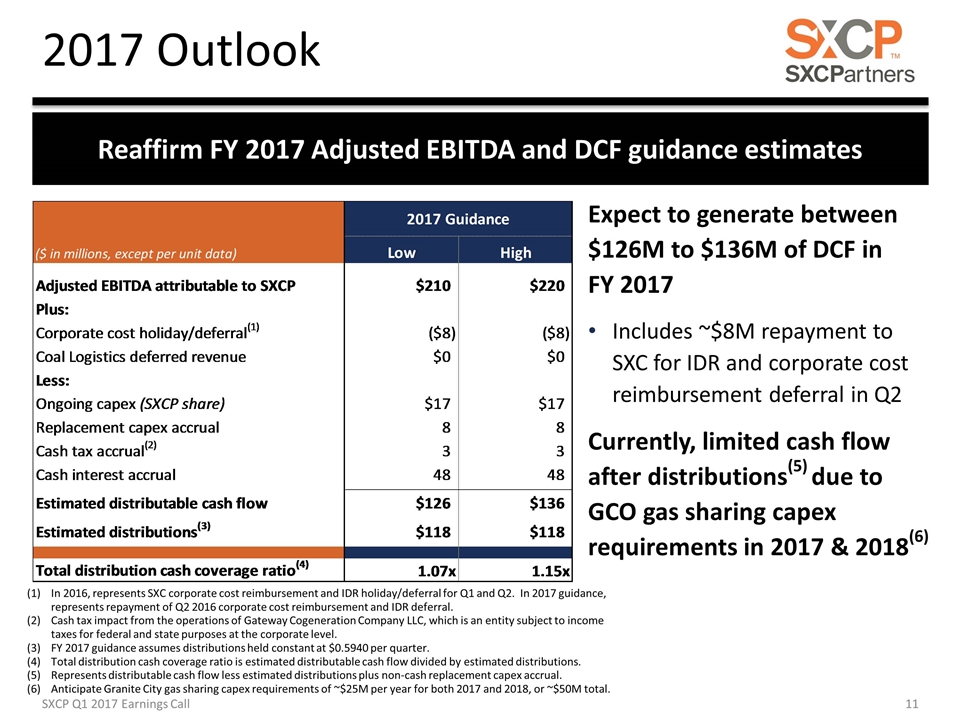

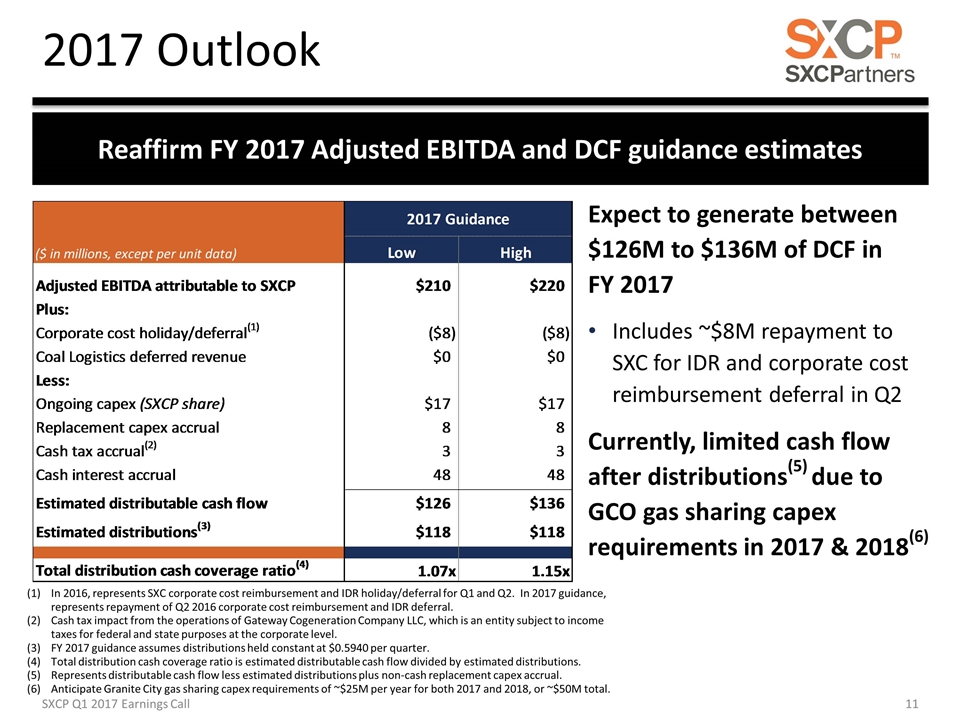

2017 Outlook In 2016, represents SXC corporate cost reimbursement and IDR holiday/deferral for Q1 and Q2. In 2017 guidance, represents repayment of Q2 2016 corporate cost reimbursement and IDR deferral. Cash tax impact from the operations of Gateway Cogeneration Company LLC, which is an entity subject to income taxes for federal and state purposes at the corporate level. FY 2017 guidance assumes distributions held constant at $0.5940 per quarter. Total distribution cash coverage ratio is estimated distributable cash flow divided by estimated distributions. Represents distributable cash flow less estimated distributions plus non-cash replacement capex accrual. Anticipate Granite City gas sharing capex requirements of ~$25M per year for both 2017 and 2018, or ~$50M total. Reaffirm FY 2017 Adjusted EBITDA and DCF guidance estimates Expect to generate between $126M to $136M of DCF in FY 2017 Includes ~$8M repayment to SXC for IDR and corporate cost reimbursement deferral in Q2 Currently, limited cash flow after distributions(5) due to GCO gas sharing capex requirements in 2017 & 2018(6) SXCP Q1 2017 Earnings Call

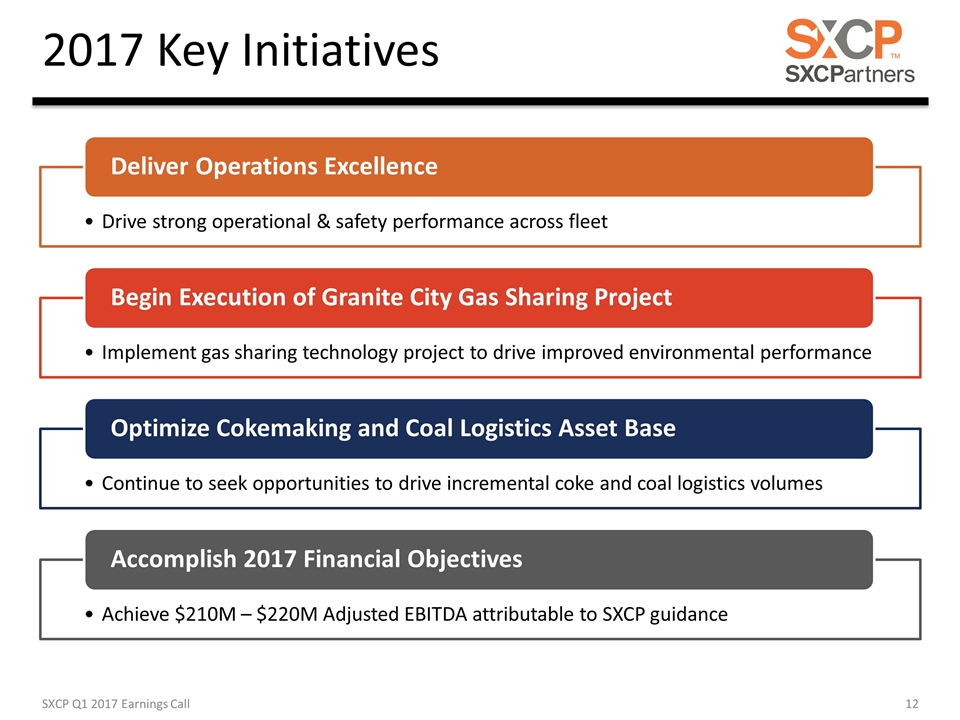

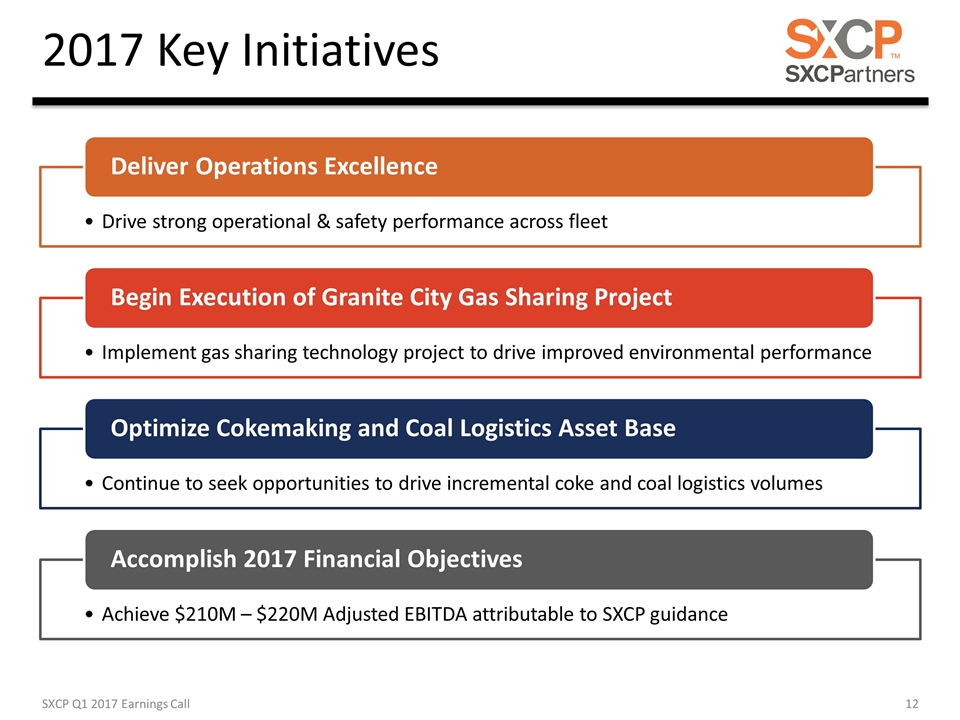

2017 Key Initiatives Drive strong operational & safety performance across fleet Deliver Operations Excellence Implement gas sharing technology project to drive improved environmental performance Begin Execution of Granite City Gas Sharing Project Continue to seek opportunities to drive incremental coke and coal logistics volumes Optimize Cokemaking and Coal Logistics Asset Base Achieve $210M – $220M Adjusted EBITDA attributable to SXCP guidance Accomplish 2017 Financial Objectives SXCP Q1 2017 Earnings Call

Questions

Investor Relations 630-824-1987 www.suncoke.com

Appendix

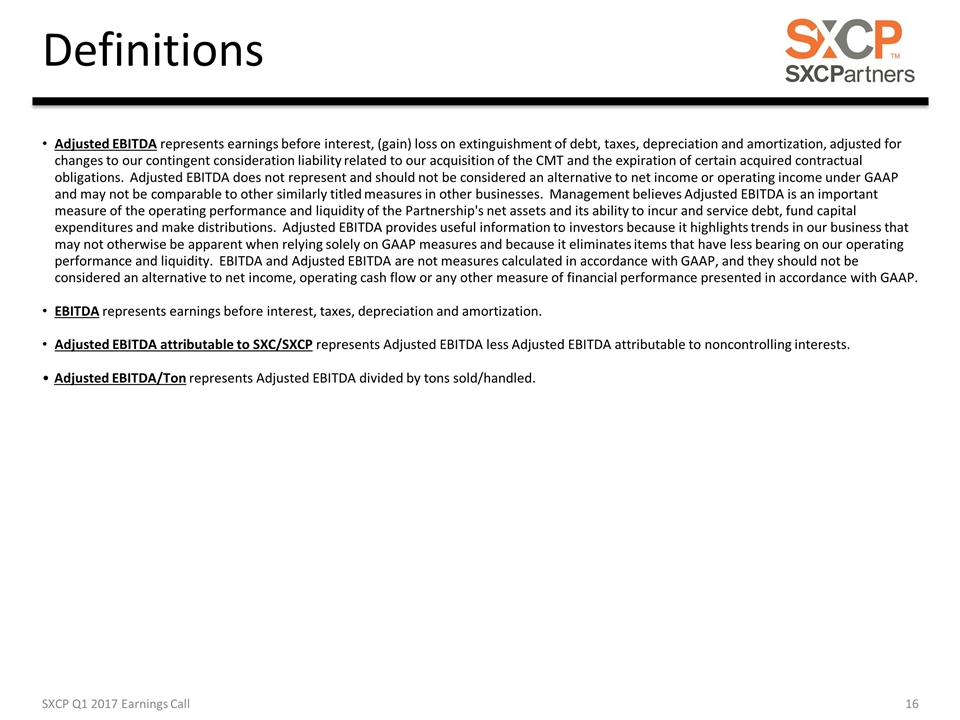

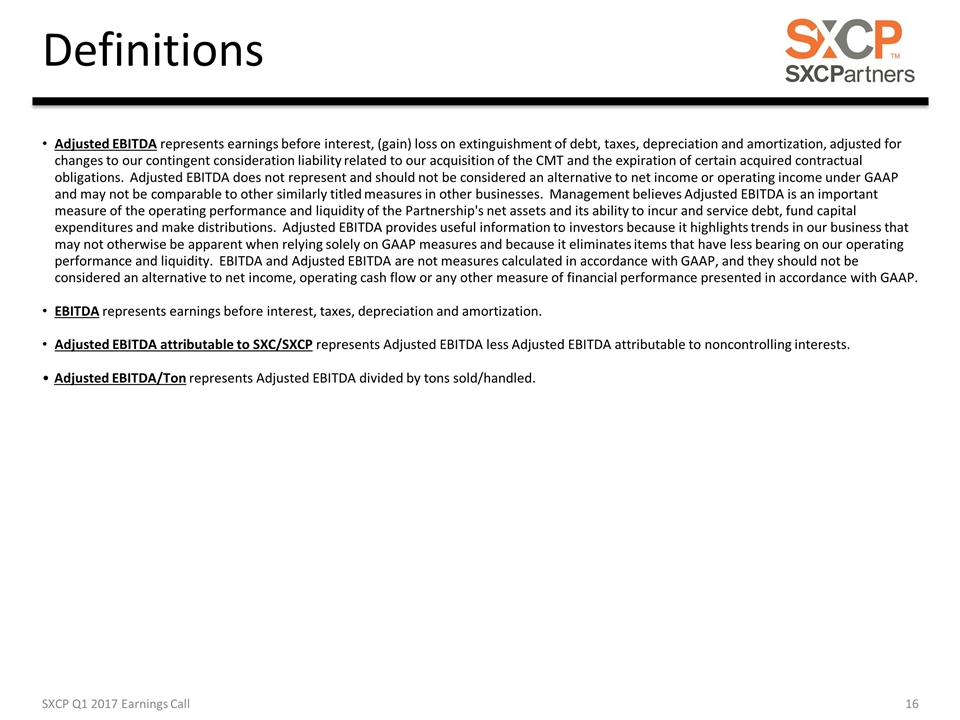

Definitions Adjusted EBITDA represents earnings before interest, (gain) loss on extinguishment of debt, taxes, depreciation and amortization, adjusted for changes to our contingent consideration liability related to our acquisition of the CMT and the expiration of certain acquired contractual obligations. Adjusted EBITDA does not represent and should not be considered an alternative to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure of the operating performance and liquidity of the Partnership's net assets and its ability to incur and service debt, fund capital expenditures and make distributions. Adjusted EBITDA provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance and liquidity. EBITDA and Adjusted EBITDA are not measures calculated in accordance with GAAP, and they should not be considered an alternative to net income, operating cash flow or any other measure of financial performance presented in accordance with GAAP. EBITDA represents earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA attributable to SXC/SXCP represents Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests. •Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold/handled. SXCP Q1 2017 Earnings Call

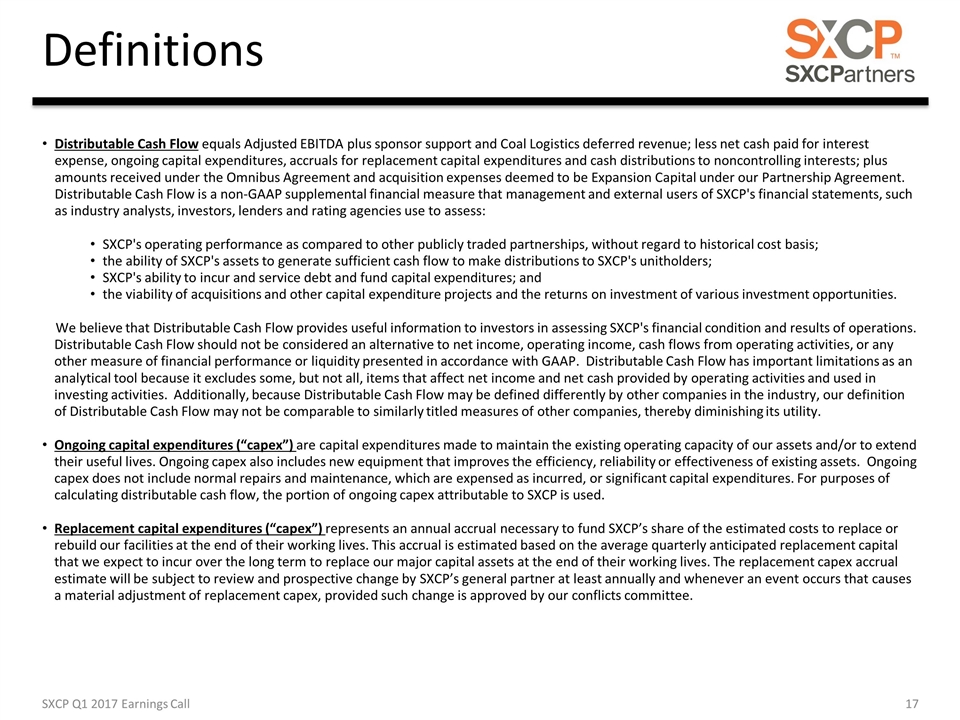

Definitions Distributable Cash Flow equals Adjusted EBITDA plus sponsor support and Coal Logistics deferred revenue; less net cash paid for interest expense, ongoing capital expenditures, accruals for replacement capital expenditures and cash distributions to noncontrolling interests; plus amounts received under the Omnibus Agreement and acquisition expenses deemed to be Expansion Capital under our Partnership Agreement. Distributable Cash Flow is a non-GAAP supplemental financial measure that management and external users of SXCP's financial statements, such as industry analysts, investors, lenders and rating agencies use to assess: SXCP's operating performance as compared to other publicly traded partnerships, without regard to historical cost basis; the ability of SXCP's assets to generate sufficient cash flow to make distributions to SXCP's unitholders; SXCP's ability to incur and service debt and fund capital expenditures; and the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities. We believe that Distributable Cash Flow provides useful information to investors in assessing SXCP's financial condition and results of operations. Distributable Cash Flow should not be considered an alternative to net income, operating income, cash flows from operating activities, or any other measure of financial performance or liquidity presented in accordance with GAAP. Distributable Cash Flow has important limitations as an analytical tool because it excludes some, but not all, items that affect net income and net cash provided by operating activities and used in investing activities. Additionally, because Distributable Cash Flow may be defined differently by other companies in the industry, our definition of Distributable Cash Flow may not be comparable to similarly titled measures of other companies, thereby diminishing its utility. Ongoing capital expenditures (“capex”) are capital expenditures made to maintain the existing operating capacity of our assets and/or to extend their useful lives. Ongoing capex also includes new equipment that improves the efficiency, reliability or effectiveness of existing assets. Ongoing capex does not include normal repairs and maintenance, which are expensed as incurred, or significant capital expenditures. For purposes of calculating distributable cash flow, the portion of ongoing capex attributable to SXCP is used. Replacement capital expenditures (“capex”) represents an annual accrual necessary to fund SXCP’s share of the estimated costs to replace or rebuild our facilities at the end of their working lives. This accrual is estimated based on the average quarterly anticipated replacement capital that we expect to incur over the long term to replace our major capital assets at the end of their working lives. The replacement capex accrual estimate will be subject to review and prospective change by SXCP’s general partner at least annually and whenever an event occurs that causes a material adjustment of replacement capex, provided such change is approved by our conflicts committee. SXCP Q1 2017 Earnings Call

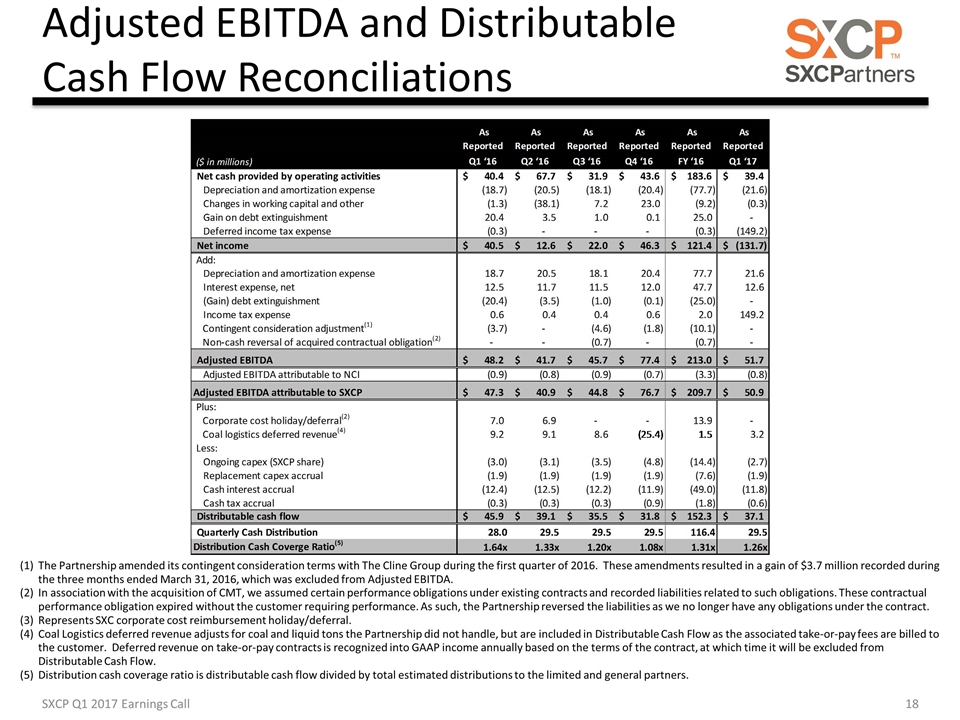

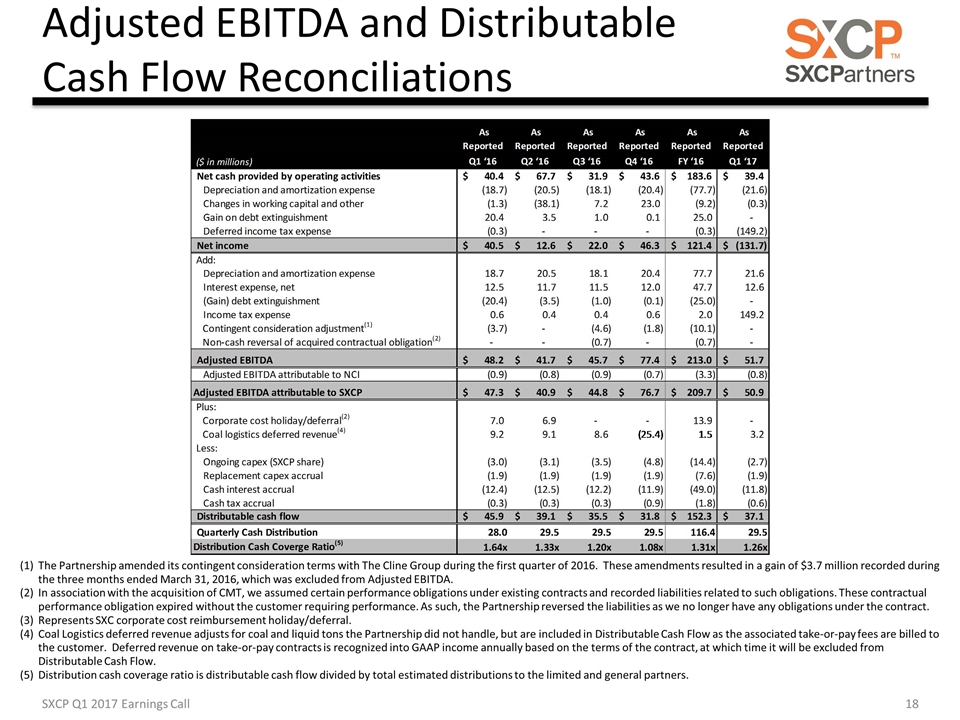

Adjusted EBITDA and Distributable Cash Flow Reconciliations The Partnership amended its contingent consideration terms with The Cline Group during the first quarter of 2016. These amendments resulted in a gain of $3.7 million recorded during the three months ended March 31, 2016, which was excluded from Adjusted EBITDA. In association with the acquisition of CMT, we assumed certain performance obligations under existing contracts and recorded liabilities related to such obligations. These contractual performance obligation expired without the customer requiring performance. As such, the Partnership reversed the liabilities as we no longer have any obligations under the contract. Represents SXC corporate cost reimbursement holiday/deferral. Coal Logistics deferred revenue adjusts for coal and liquid tons the Partnership did not handle, but are included in Distributable Cash Flow as the associated take-or-pay fees are billed to the customer. Deferred revenue on take-or-pay contracts is recognized into GAAP income annually based on the terms of the contract, at which time it will be excluded from Distributable Cash Flow. Distribution cash coverage ratio is distributable cash flow divided by total estimated distributions to the limited and general partners. SXCP Q1 2017 Earnings Call

Balance Sheet & Debt Metrics SXCP Q1 2017 Earnings Call Represents mid-point of FY 2017 guidance for Adj. EBITDA attributable to SXCP.

Expected 2017E EBITDA Reconciliation Adjusted EBITDA attributable to noncontrolling interest represents SXC’s 2% interest in Haverhill, Middletown and Granite City cokemaking facilities. Represents repayment of SXC corporate cost/IDR deferral from Q2 2016. Coal Logistics deferred revenue adjusts for coal and liquid tons the Partnership did not handle, but are included in Distributable Cash Flow as the associated take-or-pay fees are billed to the customer. Deferred revenue on take-or-pay contracts is recognized into GAAP income annually based on the terms of the contract. Cash tax impact from the operations of Gateway Cogeneration Company LLC, which is an entity subject to income taxes for federal and state purposes at the corporate level. SXCP Q1 2017 Earnings Call

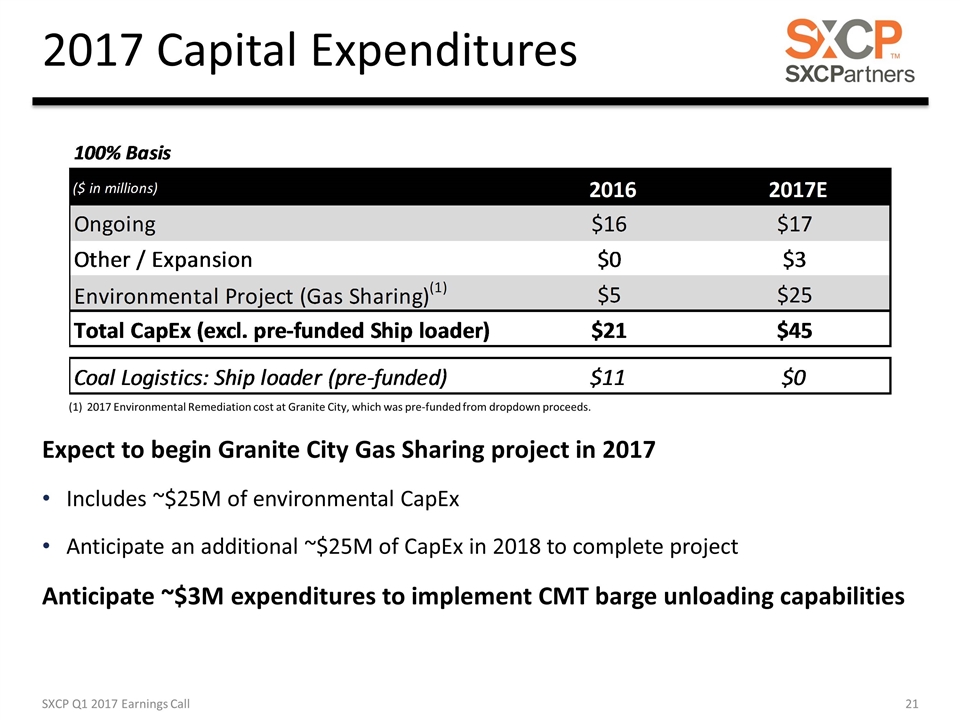

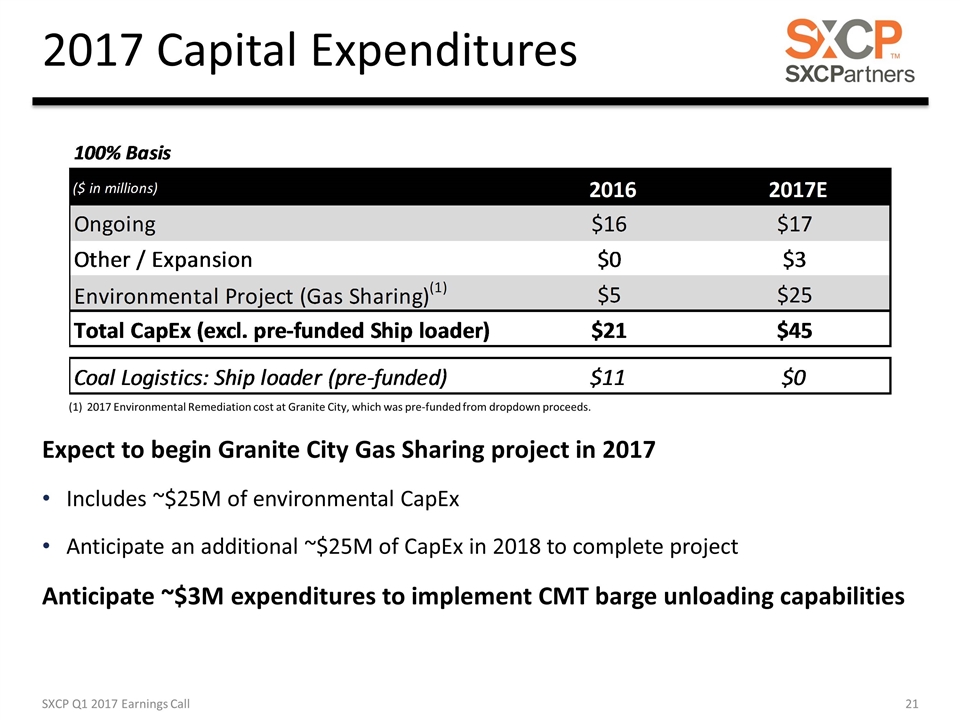

2017 Capital Expenditures 2017 Environmental Remediation cost at Granite City, which was pre-funded from dropdown proceeds. SXCP Q1 2017 Earnings Call Expect to begin Granite City Gas Sharing project in 2017 Includes ~$25M of environmental CapEx Anticipate an additional ~$25M of CapEx in 2018 to complete project Anticipate ~$3M expenditures to implement CMT barge unloading capabilities

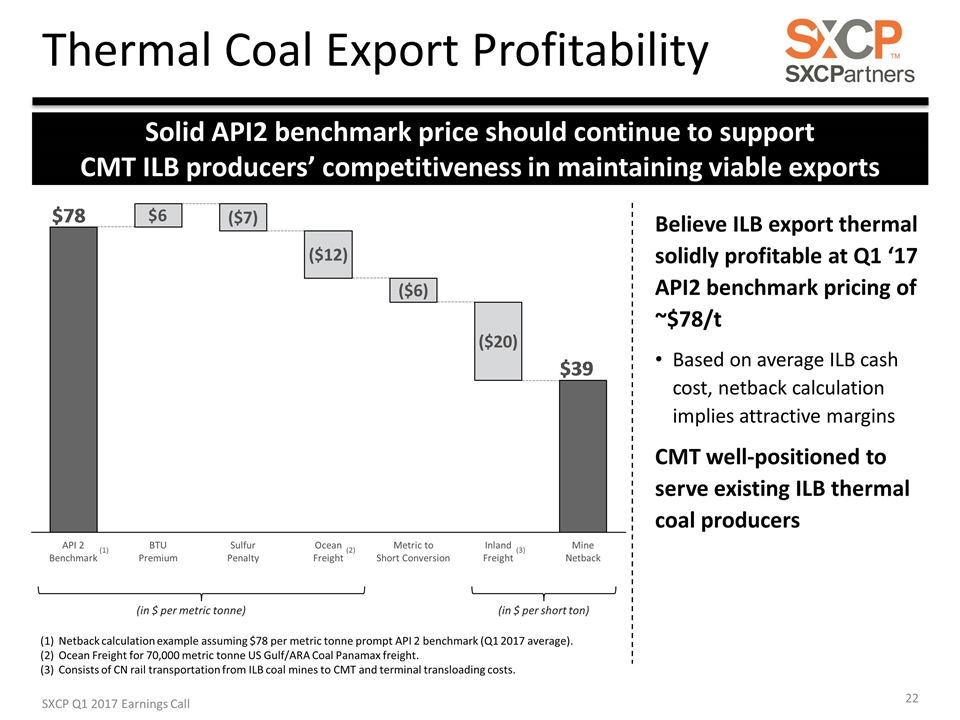

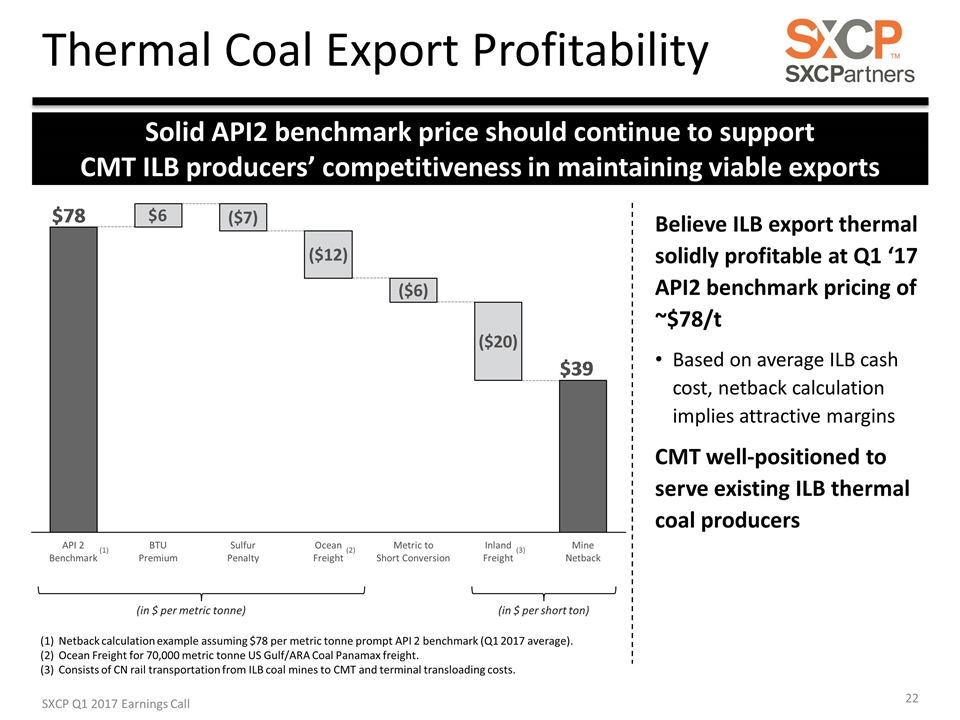

Thermal Coal Export Profitability (in $ per metric tonne) Solid API2 benchmark price should continue to support CMT ILB producers’ competitiveness in maintaining viable exports Netback calculation example assuming $78 per metric tonne prompt API 2 benchmark (Q1 2017 average). Ocean Freight for 70,000 metric tonne US Gulf/ARA Coal Panamax freight. Consists of CN rail transportation from ILB coal mines to CMT and terminal transloading costs. (1) (2) Believe ILB export thermal solidly profitable at Q1 ‘17 API2 benchmark pricing of ~$78/t Based on average ILB cash cost, netback calculation implies attractive margins CMT well-positioned to serve existing ILB thermal coal producers (in $ per short ton) (3) SXCP Q1 2017 Earnings Call