![[tealeafcorresp201211002.gif]](https://capedge.com/proxy/CORRESP/0001162044-12-001122/tealeafcorresp201211002.gif)

November9, 2012

VIA EDGAR TRANSMISSION

Bo J. Howell

Staff Attorney

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Re: Tea Leaf Management Investment Trust, File Nos. 333-183374 and 811-22737

Dear Mr. Howell:

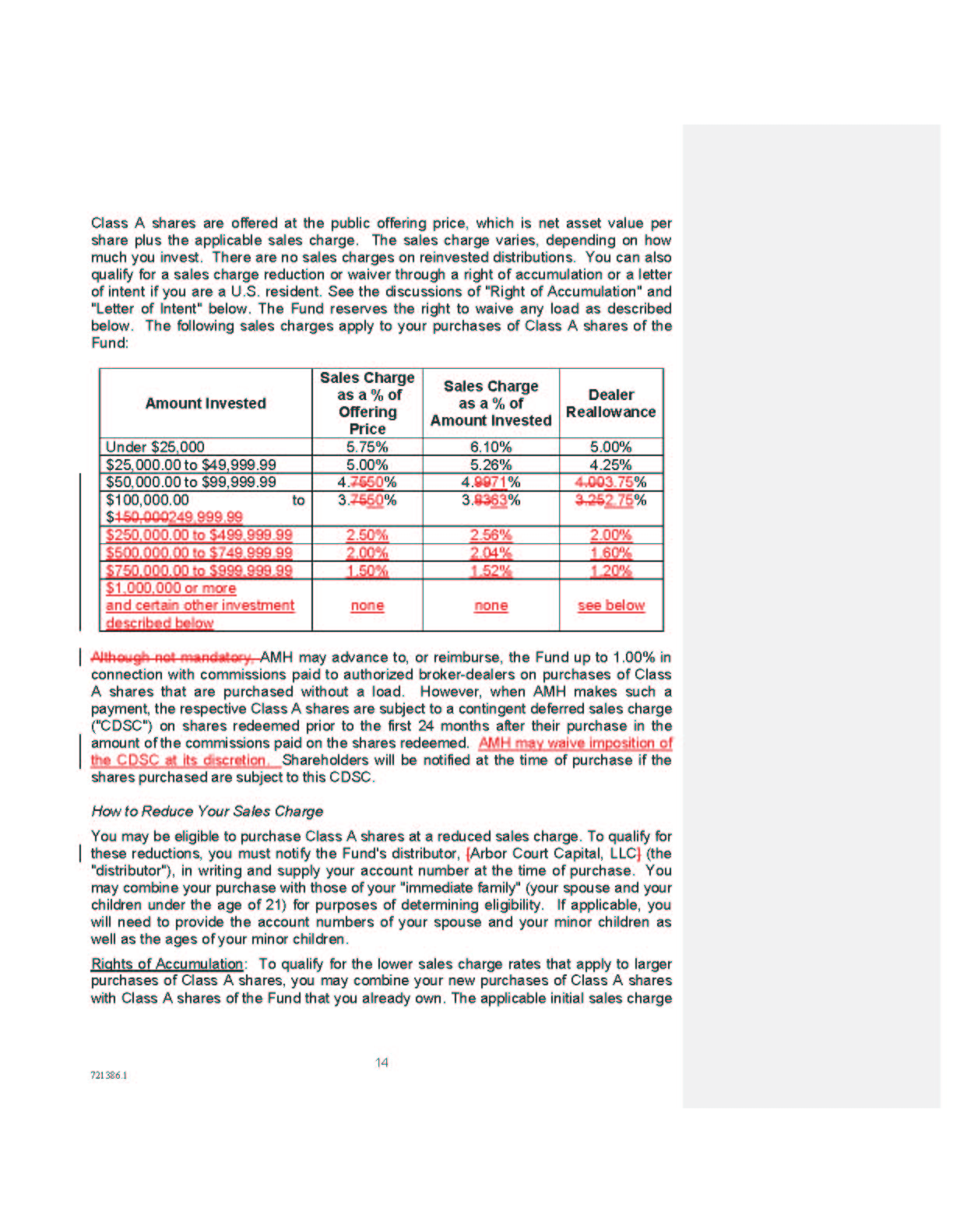

On August 17, 2012 Tea Leaf Management Investment Trust (the "Registrant"), on behalf of its sole series, Tea Leaf Long/Short Deep Value Fund (the "Fund"), filed a Registration Statement under the Securities Act of 1933 on Form N-1A. By letter dated September 13, 2012, you provided written comments to the Registration Statement. Please find below Registrant's responses to those comments, which the Registrant has authorized Thompson Hine LLP to make on behalf of the Registrant. A marked version of relevant portions of the Registration Statement are attached to aid in the review of the Registrant's responses.

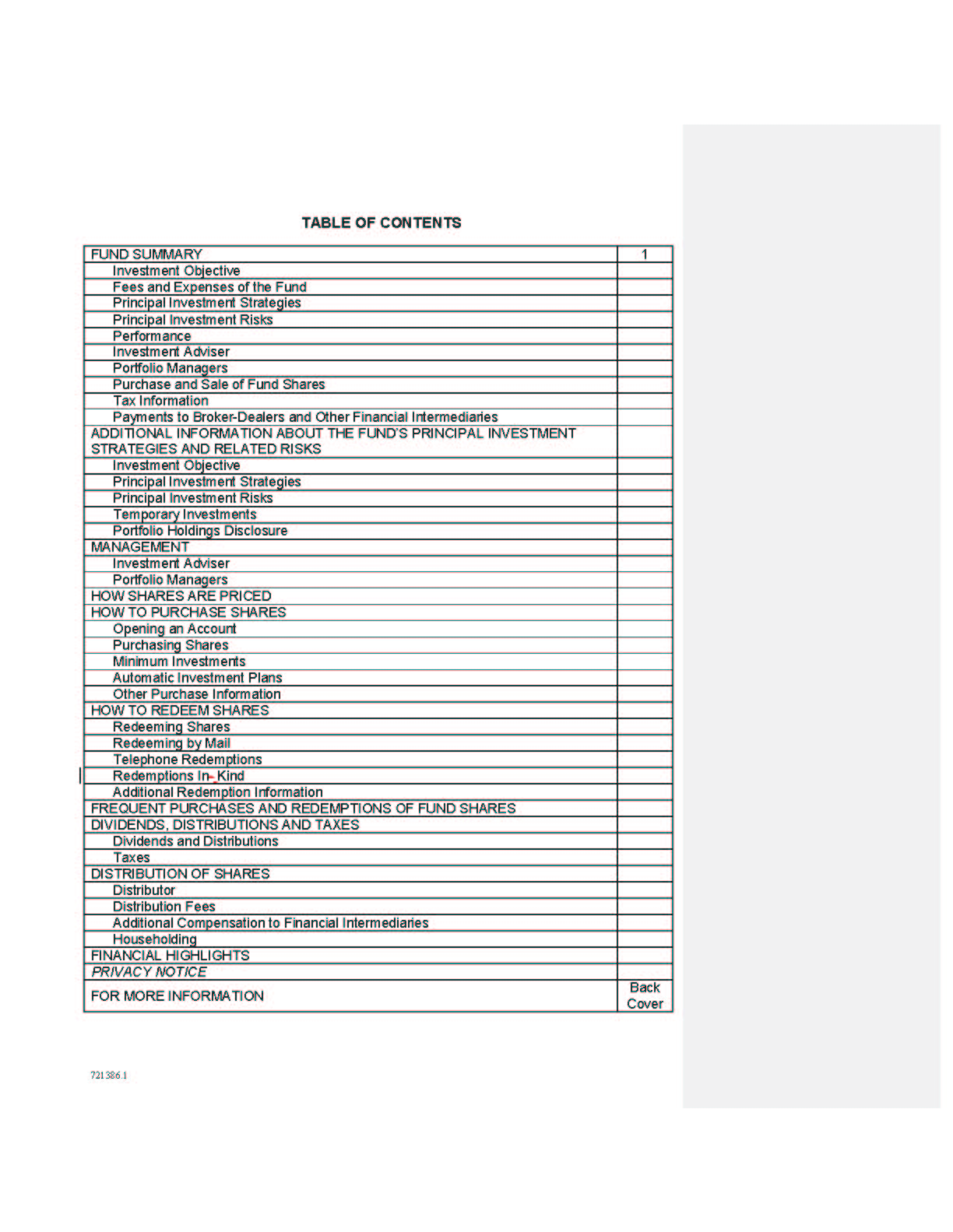

Fund Summary

Fees and Expenses of the Fund

Comment 1. Please disclose the $20 wire redemption fee as a line item underShareholder Fees.

Response. The Registrant has amended the fees and expenses table to include a redemption fee line item under Shareholder Fees.

Comment 2. Footnote 3 to the fee table refers to a fee waiver and expense reimbursement agreement.Please confirm that the Fund will include this agreement as an exhibit to the registrationstatement and disclose that the agreement will remain in effect for at least one year from theeffective date of the registration statement.SeeInstruction 3(e) to Item 3 of Form N-1A.

Response. The Registrant confirms that it will include the fee waiver and expense reimbursement agreement as an exhibit to the registration statement and will disclose that the agreement will remain in effect for at least one year from theeffective date of the Registration Statement.

Principal Investment Strategies

Comment 3. The first line of the first paragraph says the Fund will invest in "securities of North Americancompanies". Please define "North American companies".

Response. The Registrant has amended disclosures to refer to U.S. and Canadian companies rather thanNorth American companies.

Comment 4. In the second paragraph please include the Fund's definition of"smaller issuers", which theFund defines later in the prospectus as "companies with a market capitalization below $1.5billion at the time of investment."

Response. The Registrant has amended disclosures to include the Fund's definition of smaller issuers in the second paragraph.

Comment5. The third paragraph of this section states "that the Fund's gross exposure to equity securitieswill not exceed 150% of the Fund's net assets." Please describe "gross exposure" anddisclose the maximum percentage of assets that the Fund may hold in "long" and "short"positions.

Response. The Registrant has amended disclosures to include the Fund's definition of gross exposure and to state the maximum percentage of assets that the Fund may hold in "long" and "short"positions.

Principal Risks of Investing in the Fund

Comment6. Please provide separate principal risk items for the Fund's investment in inverse andleveraged exchange-traded funds ("ETFs").

Response. The Registrant has amended disclosures to provide a separate principal risk item for the Fund's investment in inverse and leveraged exchange-traded funds ("ETFs")

Management

Investment Adviser

Comment7. This section says "[a] discussion regarding the basis for the Board of Trustees' approval ofthe Management Agreement will be available in the Fund's first annual or semi-annualshareholder report." Please disclose the period covered by the relevant report.SeeItem10(a)(1)(iii) ofForm N-1A.

Response. The Registrant has provided the requested disclosure.

Prior Performance Information

Comment8. Disclosure in this section should state that the Leviticus Partners, L.P. and the separateaccount (collectively, the "Composite") are all of the accounts managed by the adviser thathave investment objectives policies and principal investment strategies substantially similarto the Fund.SeeNicholas-Applegate Mutual Funds (pub. avail. Aug. 6, 1996).

Response. The Registrant has decided to omit prior performance and has deleted relevant sections.

Comment9. Confirm supplementally that the adjusted fees used to calculate the prior performanceinformation include the maximum applicable sales load. Also, please explain to us whetherthe estimated fees and expenses of the Fund are lower than the actual fees and expenses ofthe Composite. Ifthe actual fees and expenses of the Composite are higher than the Fund'sestimated fees and expenses, then use the actual fees and expenses of the Composite. Theadjusted fees and expenses should not result in adjusted performance that is higher than theactual Composite performance.

Response. The Registrant has decided to omit prior performance and has deleted relevant sections.

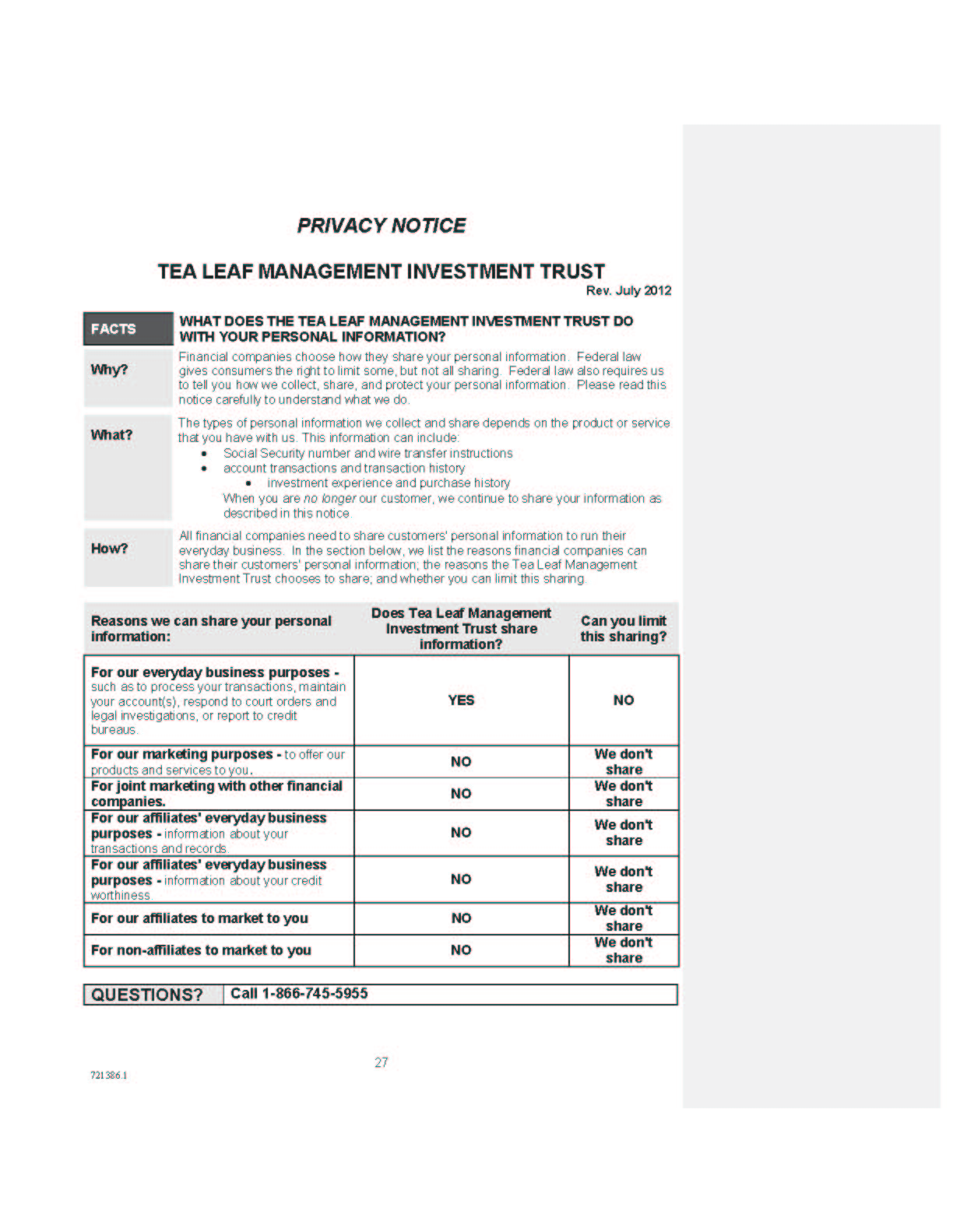

Distribution of Shares

Distribution Fees

Comment10. Please revise the last paragraph in this section to conform to Item 12(b)(2) of Form N-1A.

Response. The Registrant has amended last paragraph to conform to Item 12(b)(2) of Form N-1A.

For More Information

Comment11. Please change the last four digits of the Securities and Exchange Commission's zip code to"1520".

Response. The Registrant has amended last four digits of the Securities and Exchange Commission's zip code to 1520.

Statement of Additional Information

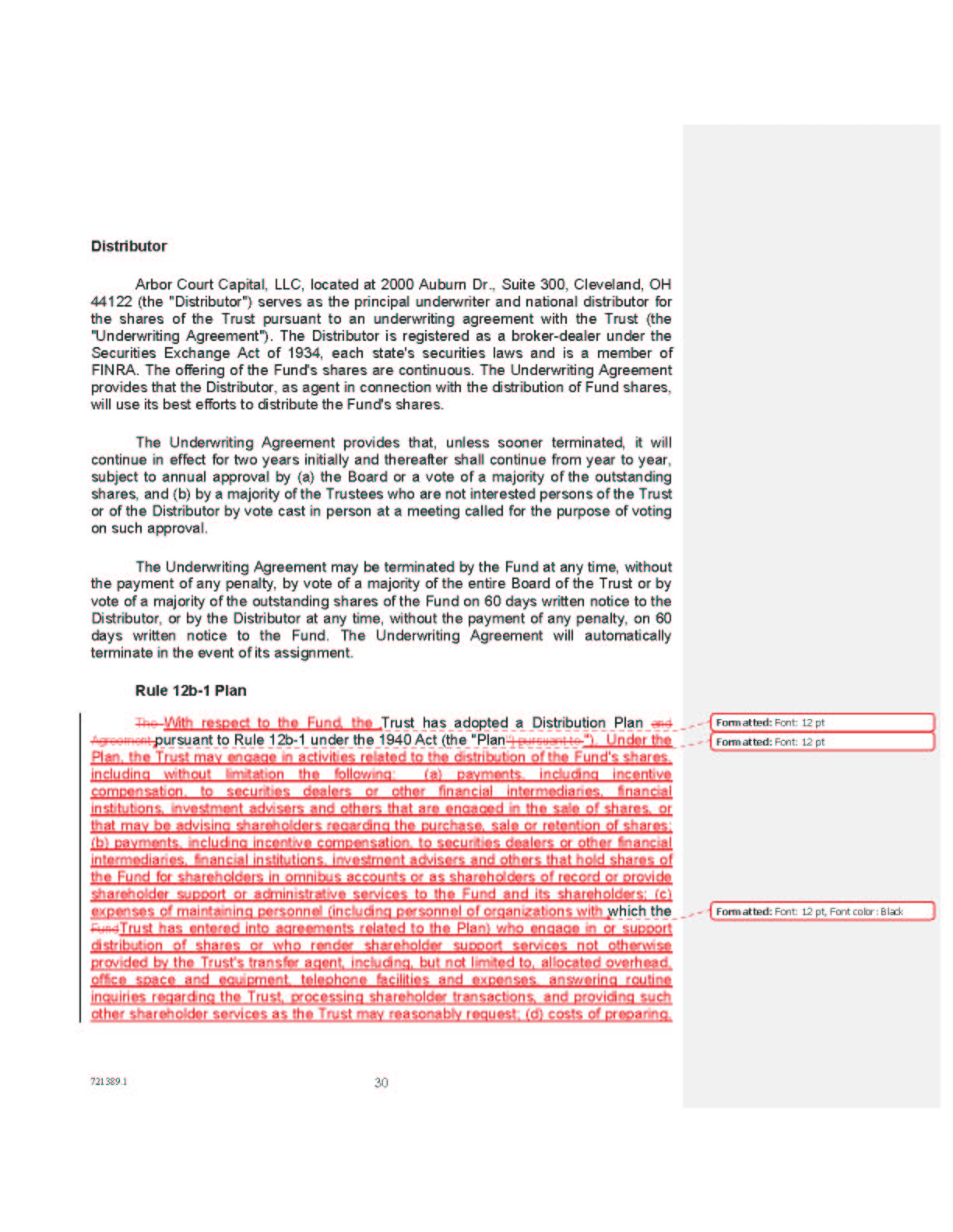

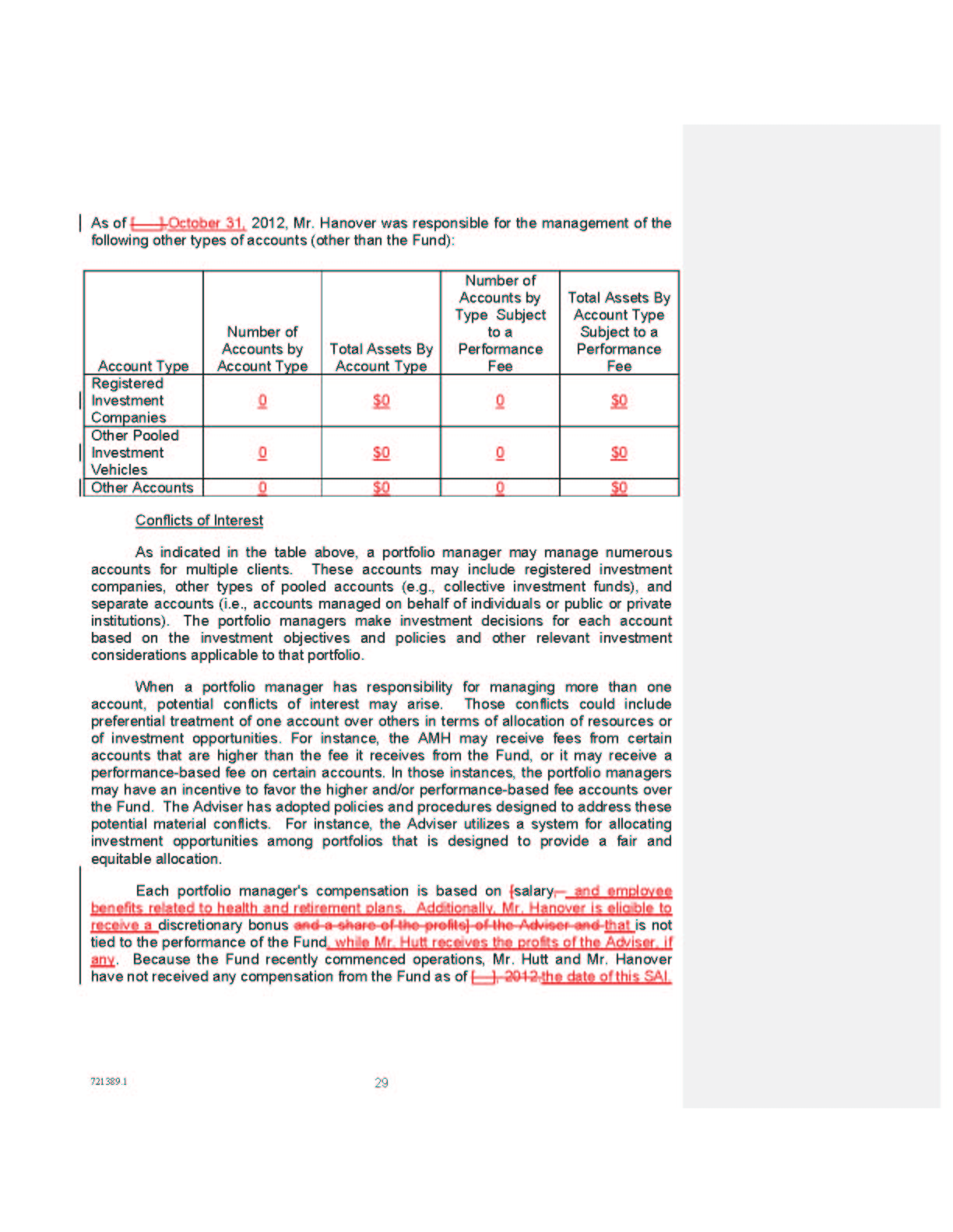

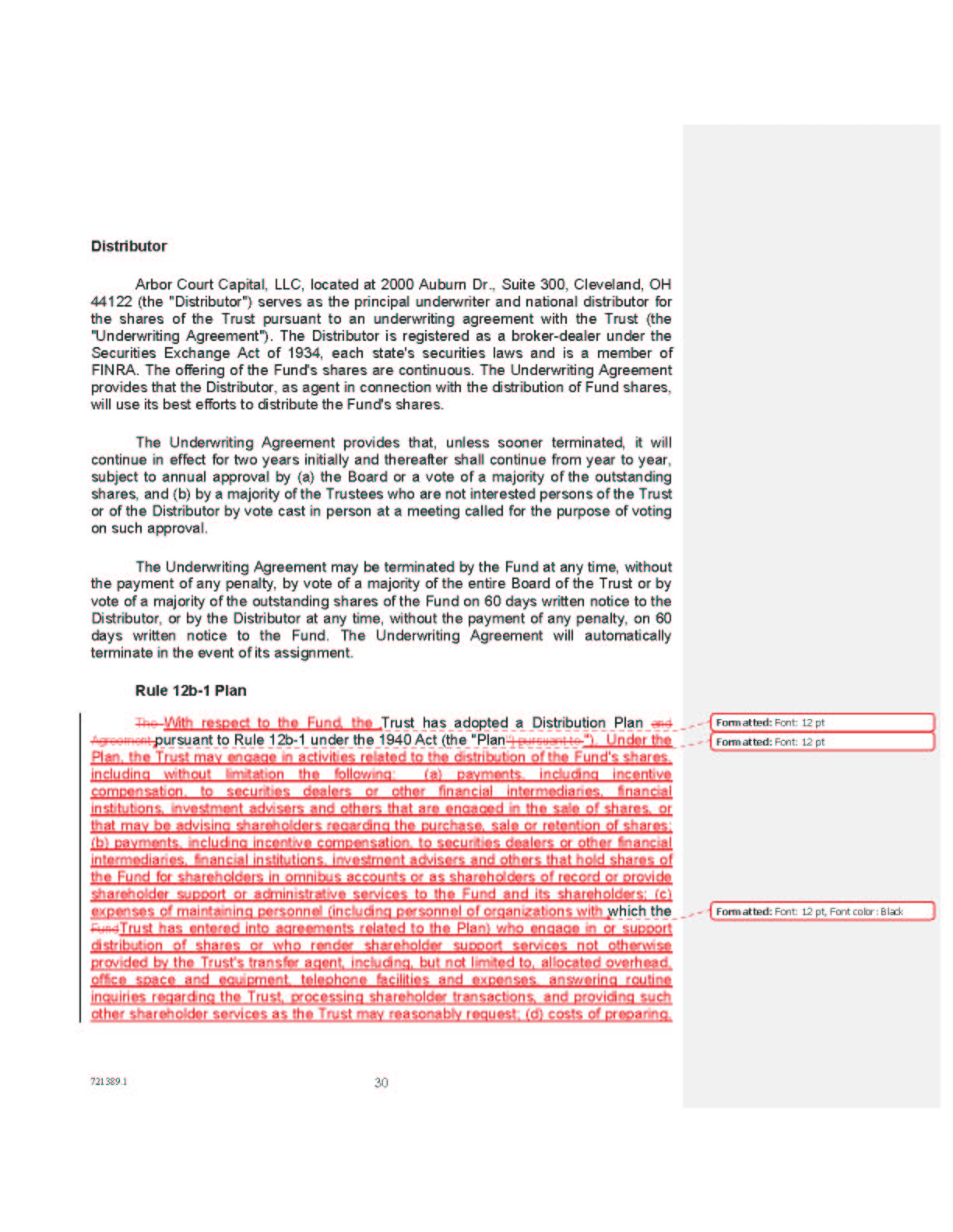

Conflicts of Interest

Comment12. Please revise the portfolio manager's compensation disclosure to provide the informationspecified in Item 20(b) and the related instructions.

Response. The Registranthas revised the portfolio manager's compensation disclosure to provide the information specified in Item 20(b)and the related instructions.

General Comments

Comment13. Where a comment is made in one location, it is applicable to all similar disclosure appearingelsewhere in the registration statement.

Response. The Registrant undertakes to assure relevant amendments are made throughout the Registration Statement.

Comment14. We note that portions of the filing are incomplete. We may have additional comments onsuch portions when you complete them in pre-effective amendments, on disclosures made inresponse to this letter, on information supplied supplementally, or on exhibits added in anypre-effective amendments.

Response. The Registrant acknowledges this comment.

Comment15. If you intend to omit certain information from the form of prospectus included with theregistration statement that is declared effective in reliance on Rule 430A under the SecuritiesAct of 1933 (the "Securities Act"), please identify the omitted information to ussupplementally, preferably before filing the final pre-effective amendment.

Response. The Registrant does not intend to omit prospectus information.

Comment 16. Please advise us if you have submitted or expect to submit exemptive applications or noactionrequests in connection with your registration statement. In addition, at the time theFund requests acceleration of effectiveness, please advise us whether FINRA has reviewedand cleared the filing.

Response. The Registrant has not submitted, nor does it expect to submit exemptive applications or noactionrequests in connection with its Registration Statement. The Registrant is not aware of any requirement that FINRA reviewand clear the filing.

Comment17. Response to this letter should be in the form of a pre-effective amendment filed pursuant toRule 472 under the Securities Act. Where no change will be made in the filing in response toa comment, please indicate this fact in a supplemental letter and briefly state the basis foryour position.

Response. The Registrant will file a pre-effective amendment pursuant toRule 472 and undertakes to note any instances where it proposes no changes in response to a comment.

Comment18. We urge all persons who are responsible for the accuracy and adequacy of the disclosure inthe filing reviewed by the staff to be certain that they have provided all information investorsrequire for an informed decision. Since the Fund and its management are in possession of allfacts relating to the Fund's disclosure, they are responsible for the accuracy and adequacy ofthe disclosures they have made.

Response. The Registrant acknowledges this comment.

Comment19. Notwithstanding our comments, in the event the Fund requests acceleration ofthe effectivedate of the pending registration statement, it should furnish a letter, at the time of suchrequest, acknowledging that:

·

should the Commission or the staff, acting pursuant to delegated authority, declare thefiling effective, it does not foreclose the Commission from taking any action with respectto the filing;

·

the action of the Commission or the staff, acting pursuant to delegated authority, indeclaring the filing effective, does not relieve the Fund from its full responsibility for theadequacy and accuracy of the disclosure in the filing; and

·

the Fund may not assert this action as a defense in any proceeding initiated by theCommission or any person under the federal securities laws of the United States.

Response. The Registrant acknowledges these comments and will furnish an effectiveness request letter including the representations described above.

In addition, with respect to the final paragraphs of your letter, the Registrant acknowledges that:

·

the Division of Enforcement has access to allinformation provided to the staff of the Division of Investment Management in connectionwith the review of the filing or in response to comments on the filing; and

·

when the Division of Investment Management considers a written request for acceleration of the effective date of the registrationstatement it will view such request as confirmation of the fact that those requesting acceleration are aware of theirrespective responsibilities; and

·

that the Division of Investment Management will act on the request and, pursuant to delegated authority, grantacceleration of the effective date.

If you have any questions or additional comments, please call Don Mendelsohn at (513) 352-6546 or Parker Bridgeport at (614) 469-3238.

Sincerely,

/s/ Thompson Hine LLP

![[tealeafcorresp201211002.gif]](https://capedge.com/proxy/CORRESP/0001162044-12-001122/tealeafcorresp201211002.gif)