UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2021

Or

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______ to _______

Commission file number: 0-55402

Rocky Mountain Industrials, Inc. (formerly RMR Industrials, Inc.)

(Exact name of registrant as specified in its charter)

Nevada | 46-0750094 |

(State or other jurisdiction of | (I.R.S. Employer |

|

|

4601 DTC Blvd., Suite 130 | 80237 |

(Address of principal executive office) | (Zip Code) |

(720) 614-5213

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

| | | | |

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

None | | N/A | | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Class B Common Stock, par value $0.001 per share

(Title of each class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ◻ No ⌧

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ◻ No ⌧

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ◻ No ⌧

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ◻ No ⌧

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ◻ | Accelerated filer | ◻ |

Non-accelerated filer | ⌧ | Smaller reporting company | ⌧ |

Emerging growth company | ⌧ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ◻ No ⌧

The aggregate market value of the voting common stock held by non-affiliates of the registrant, based upon the closing sale price of the Common Stock on December 15, 2021 was N/A.

As of December 15, 2021, the Company had 35,785,858 Shares of Class A Common Stock and 4,822,332 Shares of Class B Common Stock, and 118.47 preferred shares outstanding.

Table of Contents

|

| |

| |

| | | | |

| | 1 | ||

| | 5 | ||

| | 10 | ||

| | 10 | ||

| | 14 | ||

| | 15 | ||

| | | | |

| | | | |

| | | | |

| | 17 | ||

| | 17 | ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 17 | |

| | 23 | ||

| | 23 | ||

| Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | | 23 | |

| | 23 | ||

| | 25 | ||

| | | | |

| | | | |

| | | | |

| | 26 | ||

| | 29 | ||

| Security Ownership of Certain Beneficial Owners and Management and Related Stockholders Matters | | 31 | |

| Certain Relationships and Related Transactions, and Director Independence | | 34 | |

| | 35 | ||

| | | | |

| | | | |

| | | | |

| | 36 | ||

| | | | |

| | | 38 |

i

ROCKY MOUNTAIN INDUSTRIALS, INC.

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in this Annual Report on Form 10-K that are not historical facts are “forward-looking statements.” Forward-looking statements may include our statements regarding our goals, beliefs, strategies, objectives, plan, including product and service developments, future financial conditions, results or projections or current expectations. Such forward-looking statements may be identified by, among other things, the use of forward-looking terminology such as “believes,” “estimates,” “intends,” “plan” “expects,” “may,” “will,” “should,” “predicts,” “anticipates,” “continues,” or “potential,” or the negative thereof or other variations thereon or comparable terminology, and similar expressions are intended to identify forward-looking statements. We remind readers that forward-looking statements are merely predictions and therefore inherently subject to uncertainties and other factors and involve known and unknown risks that could cause the actual results, performance, levels of activity, or our achievements, or industry results, to be materially different from any future results, performance, levels of activity, achievements, or industry results, expressed or implied by such forward-looking statements. Such uncertainties and risks include those discussed in the “Risk Factors” and similar sections of this Report on and our other filings with the Securities and Exchange Commission, all of which are incorporated by reference herein. Forward-looking statements appear in Item 2 – “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as elsewhere in this Quarterly Report.

Our management has included projections and estimates in this Report, which are based primarily on management’s experience in the industry, assessments of our results of operations, discussions and negotiations with third parties and a review of information filed by our competitors with the SEC or otherwise publicly available. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events except as otherwise required by law.

Unless otherwise specified or required by context, as used in this Report, the terms “we,” “our,” “us” and the “Company” refers collectively to Rocky Mountain Industrials, Inc., (“RMI”) formerly known as RMR Industrials, Inc., and its wholly/majority-owned subsidiaries, RMR Aggregates, Inc., RMR Logistics, Inc., and Rail Land Company, LLC. Unless otherwise indicated, the term “common stock” refers to shares of our Class A Common Stock and Class B Common Stock.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States generally accepted accounting principles (U.S. GAAP).

ii

CAUTIONARY NOTE REGARDING EXPLORATION STAGE STATUS

AND USE OF CERTAIN MINING TERMS

We are considered an “exploration stage” company under the U.S. Securities and Exchange Commission (“SEC”) Industry Guide 7, Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations (“Guide 7”), because we do not have reserves as defined under Guide 7. Reserves are defined in Guide 7 as that part of a mineral deposit which can be economically and legally extracted or produced at the time of the reserve determination. The establishment of reserves under Guide 7 requires, among other things, certain spacing of exploratory drill holes to establish the required continuity of mineralization and the completion of a detailed cost or feasibility study. Since we have no reserves as defined in Guide 7, we have not exited the exploration stage and continue to report our financial information as an exploration stage entity as required under relevant accounting principles. We will remain an exploration stage company under Guide 7 until such time as we demonstrate reserves in accordance with the criteria in Guide 7.

Since we have no reserves, we will expense all mine construction costs, even though these expenditures are expected to have a future economic benefit in excess of one year. We will also expense our reclamation and remediation costs at the time the obligation is incurred. Companies that have reserves and have exited the exploration stage typically capitalize these costs, and subsequently amortize them on a units-of-production basis as reserves are mined, with the resulting depletion charge allocated to inventory, and then to cost of sales as the inventory is sold. As a result of these and other differences, our financial statements will not be comparable to the financial statements of mining companies that have established reserves and have exited the exploration stage.

We use certain terms in this report such as “production,” “mining or processing activities,” and “mine construction.” Production means the estimated quantities (tonnage) delivered or shipped to our customers, which may result in disclosure of related limestone and dolomite sales. Mining or processing activities means the process of extracting limestone and dolomite from the earth and treating that material. Mine construction means work carried out to access areas in the mine containing limestone and dolomite, which principally includes road construction, ramp construction and ancillary activities. We use these terms in this report since we believe they are necessary and helpful for the reader to understand our business and operations. However, we caution you that we do not have reserves and therefore have not exited the exploration stage as defined in Guide 7, and our use of the terminology described above is not intended to indicate that we have established reserves or have exited the exploration stage for purposes of Guide 7. Furthermore, since we do not have reserves, we cannot provide any indication or assurance as to how long we will likely continue mining activities at our mine site or whether such activities will be profitable.

iii

PART I

Item 1. Business

Overview

RMI’s predecessor entity was incorporated in August 2012 as a Nevada corporation. We are an exploration stage company dedicated to operating industrial assets in the United States (U.S.) including minerals, materials and services. Our strategy is to become a key provider of industrial materials and services in the Rocky Mountain region. We utilize differentiated operational capabilities, which we believe will allow us to outperform conventional operators through diverse markets.

We have a strategy to own, operate, develop, acquire and vertically integrate complementary industrial businesses. The experienced management team of RMI has a multi-cycle track record of operating industrial resource businesses.

We operate the Mid-Continent Quarry in Garfield County, Colorado, producing chemical-grade calcium carbonate that currently services local and regional customers in a variety of end markets, including but not limited to mining, manufacturing, construction, and agriculture. The Mid-Continent Quarry, which is located outside the city of Glenwood Springs, consists of 44 unpatented mining claims owned by the Bureau of Land Management and controlled by RMI. The operation currently serves Arch Coal, local construction firms, and various city and county government construction projects. The quarry is currently undergoing an expansion and modernization effort. For the years ended March 31, 2021 and 2020, we produced and sold 16,232 and 25,474 tons of high-calcium limestone, respectively, from the Mid-Continent Quarry. Please reference “Cautionary Note Regarding Exploration Stage Status and Use of Certain Mining Terms” for disclosure concerning the current stage of our mineral explorations.

We are also actively developing Rocky Mountain Rail Park (the “Rail Park”), a dedicated rail-served industrial business park serving the greater Denver market. In February 2018, we acquired approximately 470 acres of land in Bennett, Colorado which serves as the foundation for the Rail Park. In July 2018, we exercised our option to acquire an additional approximately 150 acres for a total of 620 acres. The Company’s development of the Rail Park is intended to expand the customer base for our products by utilizing rail freight capabilities to reach customers in the greater Denver area and by expanding our business to include rail transportation solutions and services. We intend to be the permanent owner and operator of the Rail Park and once operational, the facility will seek to establish a new industrial hub for rail transportation and related services serving Adams County, Colorado and the greater Denver metropolitan area. Purchaser interest has been strong after the unanimous approval by the Adams County Board of County Commissioners of the Final Development Plan and Final Plat in September 2020. Additionally, the Rail Park sold an 83 acre lot in January 2021, which has further positively impacted the interest in the property’s remaining southern lots.

Rail freight capabilities will allow the Mid-Continent Quarry’s products to access the Denver market, where demand for calcium carbonate is currently strong and supply is relatively limited. The market opportunity is primarily centered on front range infrastructure demands, but also includes fertilizer, animal feed, and multiple other industrial applications. According to the USGS Natural Aggregates Statistics and information Colorado demand in 2020 for construction aggregate was approximately 51.8 million metric tons per year, comprised of 33.6 million metric tons of sand and gravel and 18.2 million metric tons of crushed stone. The area experiences supply shortages in peak seasons, creating a natural market for our products. We believe we are well-positioned to benefit from this market environment.

In addition to developing and expanding our existing assets, we expect to supplement our growth with strategic acquisitions of related business and the integration these businesses to achieve economies of scale and synergies. We target companies in various sectors directed towards industrial and/or infrastructure applications, including but not limited to construction materials, industrial minerals, industrial resources, logistics solutions, and transportation.

1

Competitive Strengths

Our management team has extensive experience in investing in and operating natural resource assets. We believe our potential competitive strengths to be the following:

Application of Management Expertise. Our team has expertise in engineering, operations, finance and general management within the industrials resource sector.

Management Operating and Investing Experience. Over the course of their careers, the members of our management team have developed a broad international network of contacts and corporate relationships which we believe will serve as a useful source of investment opportunities. The management team has applied its deep understanding of historical precedents in the natural resource markets to the development of our business and strategy. Some of our management team members have been working together for the last ten years, and over that time have assembled a team of industrial resources and investment professionals to pursue investments across the industry.

Revenues and Customers

For the year ended March 31, 2021, approximately 84% of our consolidated revenue was from one customer. At March 31, 2021, approximately 43% of our accounts receivable were due from the same customer.

Industry and Competition

Limestone

Limestone, or calcium carbonate is used in a variety of applications including coal mining, coal fired power plants, construction aggregates, glass bottle and steel manufacturing, and agriculture. Regional competitors include Pete Lien & Sons, Inc., and United States Lime & Minerals, Inc.

Construction Aggregates

Aggregates are key material components used in the production of cement, ready-mixed concrete and asphalt paving mixes for the residential, nonresidential and public infrastructure markets and are also widely used for various applications and products, such as road and building foundations, railroad ballast, erosion control, filtration, roofing granules and in solutions for snow and ice control. Generally extracted from the earth using surface or underground mining methods, aggregates are produced from natural deposits of various materials such as limestone, sand and gravel, granite and trap rock.

Markets are typically local due to high transport costs and are generally fragmented, with numerous participants operating in localized markets. According to the 2019 U.S. Geological Survey, the U.S. market for these products was estimated at approximately 2.47 billion tons in 2019, an increase of 5% vs. 2018. Aggregates consumption is more heavily weighted towards public infrastructure and maintenance repair. However, the mix of end uses can vary widely by geographic location, based on the nature of construction activity in each market. Typically, three to six competitors comprise the majority market share in each local market because of constraints around the availability of natural resources and transportation. Regional competitors for construction aggregates in Colorado include Martin Marietta Materials, Inc., Albert Frei & Sons, Inc., Aggregate Industries, Brannan Sand & Gravel Co., LLC, L.G. Everist, Inc., and BURNCO.

Environmental and Government Regulation

Our operations are and will be subject to extensive federal, state and local laws, regulations and ordinances in the United States and abroad relating to the protection of the environment and human health and to safety, including those pertaining to chemical manufacture and distribution, waste generation, storage and disposal, discharges to waterways, and air emissions and various other health and safety matters. Governmental authorities have the power to enforce compliance with their regulations, and violators may be subject to civil, criminal and administrative penalties, injunctions or both. We

2

will devote significant financial resources to ensure compliance. We believe that we are in substantial compliance with all the applicable laws and regulations.

We anticipate that the regulation of our business operations under federal, state and local environmental laws in the United States and abroad will increase and become more stringent over time. We cannot estimate the impact of increased and more stringent regulation on our operations, future capital expenditure requirements or the cost of compliance.

United States Regulation. Statutory programs relating to protection of the environment and human health and to safety in the United States include, among others, the following.

CERCLA. The Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended, also known as “CERCLA” and “Superfund”, and comparable state laws generally impose joint and several liability for costs of investigation and remediation and for natural resource damages, without regard to fault or the legality of the original conduct, on certain classes of persons with respect to the release into the environment of specified substances, including under CERCLA those designated as “hazardous substances.” These “potentially responsible parties” include the present and certain former owners or operators of the site where the release occurred and those that disposed or arranged for the disposal of the hazardous substance at the site. These liabilities can arise in association with the properties where operations were conducted, as well as disposal facilities where wastes were sent. Many states have adopted comparable or more stringent state statutes. In the course of our operations, we have generated materials that fall within CERCLA’s definition of hazardous substances. We may also be the owner or operator of sites on which hazardous substances have been released and may have generated hazardous substances that have been transported to or otherwise released upon offsite facilities. We may be responsible under CERCLA for all or part of the costs to clean up facilities at which such substances have been released by previous owners or operators and offsite facilities to which our wastes were transported and for associated damages to natural resources.

Resource Conservation and Recovery Act. The federal Resource Conservation and Recovery Act, as amended (“RCRA”) and comparable state laws regulate the treatment, storage, disposal, remediation and transportation of wastes, specifically under RCRA those designated as “hazardous wastes.” The EPA and various state agencies have limited the disposal options for these wastes and impose numerous regulations upon the treatment, storage, disposal, remediation and transportation of them. Our operations generate wastes that are subject to RCRA and comparable state statutes. Furthermore, wastes generated by our operations that are currently exempt from treatment as hazardous wastes may be designated in the future as hazardous wastes under RCRA or other applicable statutes and, therefore, may be subject to more rigorous and costly treatment, storage and disposal requirements. Governmental agencies (and in the case of civil suits, private parties in certain circumstances) can bring actions for failure to comply with RCRA requirements, seeking administrative, civil, or criminal penalties and injunctive relief, to compel us to abate a solid or hazardous waste situation that presents an imminent or substantial endangerment to health or the environment.

Clean Water Act. The federal Clean Water Act imposes restrictions and strict controls regarding the discharge of pollutants, including dredged and fill materials into waters of the United States. Under the Clean Water Act, and comparable state laws, the government (and in the case of civil suits, private parties in certain circumstances) can bring actions for failure to comply with Clean Water Act requirements and enforce compliance through civil, criminal and administrative penalties for unauthorized discharges of hazardous substances and of other pollutants. In the event of an unauthorized discharge of pollutants, we may be liable for penalties and subject to injunctive relief.

Clean Air Act. The federal Clean Air Act (CAA), as amended and comparable state and local laws restrict the emission of air pollutants from many sources and also impose various monitoring and reporting requirements. These laws may require us to obtain pre-approval for the construction or modification of certain projects or facilities expected to produce or significantly increase air emissions, obtain and strictly comply with air permit requirements or utilize specific equipment or technologies to control emissions. Governmental agencies (and in the case of civil suits, private parties in certain circumstances) can bring actions for failure to strictly comply with air pollution regulations or permits and generally enforce compliance through administrative, civil or criminal enforcement actions, resulting in fines, injunctive relief (which could include requiring us to forego construction, modification or operation of sources of air pollutants) and imprisonment. While we may be required to incur certain capital expenditures for air pollution control equipment or other air emissions-related issues, we do not believe that such requirements will have a material adverse effect on our operations.

3

Greenhouse Gas Regulation. More stringent laws and regulations relating to climate change and greenhouse gases (GHGs) may be adopted in the future and could cause us to incur material expenses in complying with them. The EPA has begun to regulate GHGs as pollutants under the CAA. The EPA adopted rules to permit GHG emissions from stationary sources under the Prevention of Significant Deterioration and Title V permitting programs including the “Prevention of Significant Deterioration and Title V Greenhouse Gas Tailoring Rule,” requiring that the largest sources first obtain permits for GHG emissions. The United States Supreme Court, however, ruled in 2014 that the EPA did not have the authority to require permits for GHG emissions and also did not have the authority to adopt that rule. The EPA may not treat GHGs as an air pollutant for purposes of determining whether a source is a major source that is required to obtain a Prevention of Significant Deterioration or Title V permit. The Court did hold that if a source required a permit under the program because of other pollutants, the EPA had the authority to require that the source demonstrate that it would use the best available control technology to minimize GHG emissions that exceeded a minimal amount.

Because of the lack of any comprehensive legislation program addressing GHGs, the EPA is using its existing regulatory authority to promulgate regulations requiring reduction in GHG emissions from various categories of sources, starting with fossil fuel-fired power plants. Specifically, in June 2019, the EPA issued the final Affordable Clean Energy (“ACE”) rule, which, among other things, establishes emission guidelines for states to develop plans to address GHG emissions from existing coal-fired power plants. The ACE rule replaces the Clean Power Plan that the EPA had issued in 2015. There is a great deal of uncertainty as to how and when additional federal regulation of GHGs might take place. Some members of Congress have expressed the intention to promote legislation to curb the EPA’s authority to regulate GHGs. In addition to federal regulation, a number of states, individually and regionally, and localities also are considering implementing or have implemented GHG regulatory programs. These regional and state initiatives may result in so–called cap–and–trade programs, under which overall GHG emissions are limited and GHG emission “allowances” are then allocated and sold to and between persons subject to the program. These and possibly other regulatory requirements could result in our incurring material expenses to comply, for example by being required to purchase or to surrender allowances for GHGs resulting from other operations or otherwise being required to control or reduce emissions.

Health and Safety. Our operations are also governed by laws and regulations relating to workplace safety and worker health, principally regulations and requirements from the Occupational Safety and Health Administration (OSHA) and Mine Safety and Health Administration (“MSHA”). The OSHA hazard communication standard, the EPA’s community right-to-know regulations and similar state programs may require us to organize and/or disclose information about hazardous materials used or produced in our operations. Failure to comply with requirements from these laws and regulations can result in sanctions such as fines and penalties and claims for personal injury and property damage. These requirements may also result in increased operating and capital costs in the future. We believe that we are in substantial compliance with these requirements to extent applicable.

Licenses, Permits and Product Registrations. Certain licenses, permits and product registrations are required for our products and operations in the United States. The licenses, permits and product registrations are subject to revocation, modification and renewal by governmental authorities. In the United States in particular, producers and distributors of chemicals such as penta and creosote are subject to registration and notification requirements under federal law (including under the Federal Insecticide, Fungicide and Rodenticide Act (“FIFRA”) and the Toxic Substances Control Act, and comparable state law) in order to sell those products in the United States. Compliance with these laws has had, and in the future will continue to have, a material effect on our business, financial condition and results of operations. Under FIFRA, the law’s registration system requires an ongoing submission to the EPA of substantial scientific research and testing data regarding the chemistry and toxicology of pesticide products by manufacturers.

Available Information

We maintain a website at http://rockymountainindustrials.com/ that contains additional information about our Company.

Employees

We currently have 12 full-time employees.

4

Item 1A. Risk Factors

Risks Relating to Our Business

We have incurred losses in prior periods and may incur losses in the future.

We may not achieve or sustain profitability on a quarterly or annual basis in the future. Our operations are subject to the risks and competition inherent in the establishment of a business enterprise. There can be no assurance that future operations will be profitable. We may not achieve our business objectives and the failure to achieve such goals would have an adverse impact on us.

Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, we may have to cease our activities and investors could lose their entire investment.

There is no assurance that we will operate profitably or generate positive cash flow in the future. We will require additional financing in order to proceed with our business plan and acquire existing businesses that manufacture and distribute chemicals and minerals. We will also require additional financing to sustain our business operations if we are not successful in earning revenues. We may not be able to obtain financing on commercially reasonable terms or terms that are acceptable to us when required. Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, our business could fail and investors could lose their entire investment.

Our business may fail, and investors may lose all of their investment in our Company.

We are a company with a limited operating history and our future profitability is uncertain. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. If our business plan is not successful and we are not able to operate profitably, then our stock may become worthless and investors may lose all of their investment in our Company.

We anticipate that we will incur increased operating expenses prior to realizing significant revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that, if we are unable to generate significant revenues from the sale of our products in the future, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide no assurance that we will generate any revenues or ever achieve profitability. If we are unsuccessful in addressing these risks, our business will fail, and investors may lose all of their investment in our Company.

Our limited operating history makes evaluating our business and future prospects difficult and may increase the risk of your investment.

Our limited operating history may not provide a meaningful basis on which to evaluate our business. We will continue to encounter risks and difficulties frequently experienced by companies at a similar stage of development, including our potential failure to:

| ● | expand our product offerings and maintain the high quality of products offered; |

| ● | manage our expanding operations, including the integration of any future acquisitions; |

| ● | obtain sufficient working capital to support our expansion and to fill customers’ orders on time; |

| ● | maintain adequate control of our expenses; |

| ● | implement our product development, marketing, sales, and acquisition strategies and adapt and modify them as needed; and |

5

| ● | anticipate and adapt to changing conditions in the markets in which we operate as well as the impact of any changes in government regulation, mergers and acquisitions involving our competitors, technological developments, and other significant competitive and market dynamics. |

If we are not successful in addressing any or all of these risks, then our business may be materially and adversely affected.

If we are unable to identify, fund and execute new acquisitions, we will not be able to execute a key element of our business strategy.

Our strategy is to grow primarily by acquiring additional businesses and product lines. We cannot give any assurance that we will be able to identify, acquire or profitably manage additional businesses and product lines. Financing for acquisitions may not be available, or may be available only at a cost or on terms and conditions that are unacceptable to us. Further, acquisitions may involve a number of special risks or effects, including diversion of management’s attention, failure to retain key acquired personnel, unanticipated events or circumstances, legal liabilities, impairment of acquired intangible assets and other one-time or ongoing acquisition-related expenses. Some or all of these special risks or effects could have a material adverse effect on our financial and operating results. In addition, we cannot assure you that acquired businesses or product lines, if any, will achieve anticipated revenues and earnings, or that we will not assume unanticipated liabilities.

In addition, we may not be able to successfully or profitably integrate, operate, maintain and manage our newly acquired operations or their employees. We may not be able to maintain uniform standards, controls, procedures and policies, which may lead to operational inefficiencies.

We may be unable to sell rail park lots when appropriate or at all because real estate is not as liquid as certain other types of assets.

Real estate investments generally cannot be sold quickly, which could limit our ability to adjust our response to changes in economic conditions and affect the timing of sales or leases of rail park lots. This could adversely affect our financial condition and our ability to service debt

Loss of key members of our management team could disrupt our business.

We depend on the continued employment and performance of our senior executives and other key members of our management team. If any of these individuals resigns or becomes unable to continue in his or her present role and is not adequately replaced, our business operations and our ability to implement our growth strategies could be materially disrupted.

The industries in which we compete are highly competitive, and we may not be able to compete effectively with our competitors that have greater financial resources, which could have a material adverse effect on our business, results of operations and financial condition.

The industries in which we operate are highly competitive. Among our competitors are some of the world’s largest chemical companies that have their own raw material resources. Changes in the competitive landscape could make it difficult for us to retain our competitive position. In addition, some of the companies with whom we compete may be able to produce products more economically than we can. Furthermore, most of our competitors have greater financial resources, which may enable them to invest significant capital into their businesses, including expenditures for research and development.

Increases in the price of our primary raw materials may decrease our profitability and adversely affect our liquidity, cash flow, financial condition and results of operations.

The prices we pay for raw materials in our businesses may increase significantly, and we may not always be able to pass those increases through to our customers fully and timely. In the future, we may be unable to pass on increases in our raw material costs, and raw material price increases may erode the profitability of our products by reducing our gross profit. Price increases for raw materials may also increase our working capital needs, which could adversely affect our liquidity

6

and cash flow. For these reasons, we cannot assure you that raw material cost increases in our businesses would not have a material adverse effect on our financial condition and results of operations.

The Company will operate in competitive environment which gives rise to operating and market risk exposure.

The Company expects to sell a broad range of products and services in a competitive environment, and to compete for sales on the basis of product quality, price, technology and customer service. Increased levels of competition could result in lower prices or lower sales volume, which could have a negative impact on the Company’s results of operations.

Economic conditions around the world, and in certain industries in which the Company does business, also impact sales prices and volume. As a result, market uncertainty or an economic downturn in the geographic areas or industries in which we sell our products could reduce demand for these products and result in decreased sales volume, which could have a negative impact on our results of operations.

In addition, volatility and disruption of financial markets could limit customers’ ability to obtain adequate financing to maintain operations, which could result in a decrease in sales volume and have a negative impact on our results of operations. The Company’s business operations may also give rise to market risk exposure related to changes in interest rates, commodity prices and other market factors such as equity prices.

Disruptions in production at our processing facilities, both planned and unplanned, may have a material impact on our business, results of operations and/or financial condition.

Manufacturing and mining facilities in our industry are subject to planned and unplanned production shutdowns and outages. Unplanned production disruptions may occur for external reasons including natural disasters, weather, disease, strikes, transportation interruption, government regulation, political unrest or terrorism, or internal reasons, such as fire, unplanned maintenance or other problems. Alternative facilities with sufficient capacity may not be available, may cost substantially more or may take a significant time to increase production or qualify with our customers, each of which could negatively impact our business, results of operations and/or financial condition. Long-term production disruptions may cause our customers to seek alternative supply which could further adversely affect our profitability.

We will expend large amounts of money for environmental compliance in connection with our operations.

We are subject to stringent regulations under numerous U.S. federal, state, local and foreign environmental, health and safety laws and regulations relating to, among other things, the generation, storage, handling, discharge, disposition and stewardship of hazardous wastes and other materials. We will expend substantial funds to comply with such laws and regulations and have established a policy intended to minimize our emissions to the environment. Nevertheless, legislative, regulatory and economic uncertainties (including existing and potential laws and regulations pertaining to climate change) make it difficult for us to project future spending for these purposes and if there are changes to applicable regulatory requirements, we may be required to expend substantial additional funds to remain in compliance.

We are subject to environmental clean-up costs, fines, penalties and damage claims that have been and continue to be costly.

We are subject to the risk of lawsuits and regulatory actions in connection with current and former operations (including divested businesses) for breaches of environmental laws or regulations or in connection with clean-up obligations. Lawsuits and investigations may be initiated by public or private parties under various environmental laws, including with respect to off-site disposal at facilities where we have been identified as a potentially responsible party under the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended, commonly referred to as CERCLA, or similar laws.

7

Increased concerns regarding the safe use of chemicals in commerce and their potential impact on the environment have resulted in more restrictive regulations from local, state and federal governments and could lead to new regulations.

Concerns regarding the safe use of chemicals in commerce and their potential impact on health and the environment reflect a growing trend in societal demands for increasing levels of product safety and environmental protection. These concerns could manifest themselves in stockholder proposals, preferred purchasing and continued pressure for more stringent regulatory intervention. These concerns could also influence public perceptions, the viability of the Company’s products, the Company’s reputation and the cost to comply with regulations. In addition, terrorist attacks and natural disasters have increased concerns about the security and safety of chemical production and distribution. These concerns could have a negative impact on the Company’s results of operations.

Local, state and federal governments continue to propose new regulations related to the security of chemical plant locations and the transportation of hazardous chemicals, which could result in higher operating costs.

We work with dangerous materials that can injure our employees, damage our facilities and disrupt our operations.

Some of our operations involve the handling of hazardous materials that may pose a risk of fire, explosion, or the release of hazardous substances. Such events could result from terrorist attacks, natural disasters, or operational failures, and might cause injury or loss of life to our employees and others, environmental contamination, and property damage. These events could lead a temporary shutdown of an affected plant, or portion thereof, and we could be subject to penalties or claims as a result. A disruption of our operations caused by these or other events could have a material adverse effect on our results of operations.

Our ability to operate and/or expand our mining operations may be affected by our ability to secure proper permits.

Environmental and zoning regulations have made it increasingly difficult for the aggregates industry to expand existing quarries and to develop new quarry operations. Our mining operations could be materially impacted from being unable to maintain existing permits to operate the quarry or being unable to secure new permits to support the expansion of the quarry.

We may be subject to claims of infringement of the intellectual property rights of others, which could hurt our business.

From time to time, we expect to face infringement claims from our competitors or others alleging that our processes or products infringe on their proprietary technologies. Any claims that our products or processes infringe the intellectual property rights of others, regardless of the merit or resolution of the claims, could cause us to incur significant costs in responding to, defending and resolving the claims, and may divert the efforts and attention of our management and technical personnel from our business. If we are found to be infringing on the proprietary technology of others, we may be liable for damages, and we may be required to change our processes, redesign our products, pay others to use the technology or stop using the technology or producing the infringing product. Even if we ultimately prevail, the existence of the lawsuit could prompt our customers to switch to products that are not the subject of infringement suits.

Risks Related to Our Common Stock and Our Status as a Public Company

We will be required to incur significant costs and require significant management resources to evaluate our internal control over financial reporting as required under Section 404 of the Sarbanes-Oxley Act, and any failure to comply or any adverse result from such evaluation may have an adverse effect on our stock price.

As a reporting company under the Securities Exchange Act of 1934, as amended, we are required to evaluate our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”). Section 404 requires us to include an internal control report with the Annual Report on Form 10-K. This report must include management’s assessment of the effectiveness of our internal control over financial reporting as of the end of the fiscal year. This report

8

must also include disclosure of any material weaknesses in internal control over financial reporting that we have identified. Failure to comply, or any adverse results from such evaluation could result in a loss of investor confidence in our financial reports and have an adverse effect on the trading price of our equity securities.

Achieving continued compliance with Section 404 may require us to incur significant costs and expend significant time and management resources. We cannot assure you that we will be able to fully comply with Section 404. As a result, investors could lose confidence in our reported financial information, which could have an adverse effect on the trading price of our securities, as well as subject us to civil or criminal investigations and penalties.

Our founder and directors have voting control over the Company.

Our founders, who are also directors of the Company, have significant ownership of the Company, including a majority of our voting stock. This gives them the ability to control most, if not all, Company decisions.

Our founders as a group own, directly or indirectly, approximately 57% of the Company Class A Common Stock (the Company’s voting capital stock), effectively giving them voting control over most, if not all, decisions submitted to a shareholder vote, including the election of our directors and mergers and other major transactions. Such concentration of ownership and control could have the effect of delaying, deferring or preventing a change in control of the Company even when such a change of control would be in the best interests of the Company’s other shareholders. Accordingly, other investors will have little voice in our management decisions and will exercise very little control over us. In addition, the applicable sections of the Nevada Revised Statutes provide that certain actions must be approved by a specified percentage of shareholders. In the event that the requisite approval of shareholders is obtained, dissenting shareholders would be bound by such vote. Accordingly, no persons should purchase any shares unless they are willing to entrust all aspects of control to our management.

Indemnification rights held by our directors, officers and employees may result in substantial expenditures by our Company and may discourage lawsuits against our directors, officers, and employees.

The indemnification obligations provided in our articles of incorporation and our bylaws to our directors and officers could result in the Company incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which we may be unable to recoup. These provisions and resulting costs may also discourage us from bringing a lawsuit against directors and officers for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors and officers even though such actions, if successful, might otherwise benefit us and our shareholders. We may also provide indemnification rights to our employees with similar results.

Trading in our stock is subject to regulatory restrictions that limit a shareholder’s ability to buy and sell our stock.

There is currently no active trading market for our stock, and applicable SEC and other rules may prevent such a market from developing. For example:

| ● | Our stock is categorized as a “penny stock” under applicable SEC rules. SEC rules impose certain sales practice requirements on broker-dealers who sell penny stocks that do not apply to other securities, including a requirement that a broker-dealer deliver a standardized risk disclosure document prior to completing a transaction in a penny stock. Similarly, FINRA places certain restrictions on transactions involving low-priced securities, including our common stock. Our common stock is not listed on any national securities exchange, and it does not currently qualify for listing on any major exchange, including the New York Stock Exchange or Nasdaq. |

| ● | We have not timely filed all reports required to be filed by the rules of the SEC, which limits the ability of shareholders to sell our common stock in unregistered transactions in reliance on SEC Rule 144. |

Each of these factors limits liquidity in the market for our common stock and may therefore make it more difficult for our shareholders to sell their stock. The lack of trading in our stock may in turn make it more difficult for us to raise capital

9

through issuances of stock, as potential investors may be reluctant to invest given the difficulties they may face if they later choose to sell the stock they purchase.

To date, we have not paid any cash dividends and no cash dividends will be paid in the foreseeable future.

We do not anticipate paying cash dividends on our common stock in the foreseeable future and we may not have sufficient funds legally available to pay dividends. Even if the funds are legally available for distribution, we may nevertheless decide not to pay any dividends. We presently intend to retain all earnings for our operations.

If we issue additional shares in the future, it will result in the dilution of our existing shareholders.

Our articles of incorporation authorize the issuance of up 2,150,000,000 shares, of which 2,000,000,000 are shares of Class A Common Stock, par value $0.001 per share, 100,000,000 are shares of Class B Common Stock, par value $0.001 per share, and 50,000,000 are shares of Preferred Stock, par value $0.001 per share. Our Board of Directors may choose to issue some or all of such shares to acquire one or more companies or properties and to fund our overhead and general operating requirements. The issuance of any such shares may reduce the book value per share and may contribute to a reduction in the market price of the outstanding shares of our common stock. If we issue any such additional shares, such issuance will reduce the proportionate ownership and voting power of all current shareholders. Further, such issuance may result in a change of control of our Company.

We are an “emerging growth company” under the JOBS Act of 2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are choosing to take advantage of the extended transition period for complying with new or revised accounting standards. As a result, our financial statements may not be comparable to those of companies that comply with public company effective dates.

We will remain an “emerging growth company” for up to five years, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any May 30.

Item 1B. Unresolved Staff Comments

Not applicable

Item 2. Properties – Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations

Our principal executive offices are located in Denver, Colorado where we lease approximately 4,648 square feet under an arrangement that expires in February 2022. In Beverly Hills, California we lease approximately 2,238 square feet of office space for management, sales and support staff under an arrangement that expires in January 2022. The Company feels that

10

this space is sufficient until the Company significantly expands operations. The Company through its subsidiary Rail Land Company, LLC, owns an approximate 620-acre parcel of real property located in Bennett, Colorado. The Company’s development of the Rail Park is intended to expand the customer base for our products by utilizing rail freight capabilities to reach customers in the greater Denver area and by expanding our business to include rail transportation solutions and services

Please reference “Cautionary Note Regarding Exploration Stage Status and Use of Certain Mining Terms” in Item 1 related to stage of our mineral explorations, all of which are without reserves, as defined by Guide 7.

Background

RMI, through its subsidiary, RMR Aggregates, Inc., owns 44 mining claims on Bureau of Land Management (BLM) property in Garfield County, Colorado. The mining claims encompass 880 acres (20 acres each) and are for chemical grade limestone found within the Leadville Limestone formation. RMI purchased the mining claims and the associated mining facilities and equipment from CalX Minerals in October of 2016.

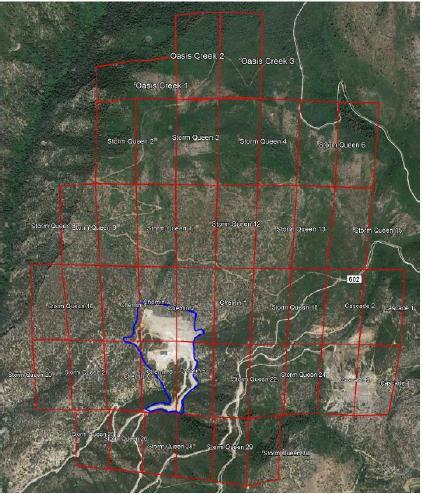

The mineral rights are controlled through unpatented mining claims, the extents of which are shown on Figure 1. RMI has the legal right to enter through the provisions of the 1872 Mining Law. The claims grant RMI the right to remove the minerals within each claim under a Plan of Operations which must be approved by the BLM. RMI does not have any surface rights or surface ownership with the claims. However, RMI may conduct surface activities and install structures on the surface so long as the approved Plan of Operations allows. There is no set duration or term to the mining claims. RMI retains the rights to the mining claims through the payment of claim renewal fees, to the BLM, in September of each year. Each of the 44 claims requires an annual renewal fee payment of $165 per claim. RMI is responsible for paying these claim renewal fees each year. All claims are listed below in Table 1.

11

There are no active plans for future exploration.

| | | | | | | | | | | | |

|

| Claim No. |

| |

| |

| |

| |

| |

Claim Name | | (CMC-) | | Loc. Date | | Township | | Range | | Sec. | | Description |

Cascade No. 1 |

| 251537 |

| 5/10/2001 |

| 5 South |

| 88 West |

| 31 |

| E/2NE/4SW/4 |

Cascade No. 2 |

| 251538 |

| 5/10/2001 |

| 5 South |

| 88 West |

| 31 |

| W/2NE/4SW/4 |

Cascade No. 3 |

| 251539 |

| 5/10/2001 |

| 5 South |

| 88 West |

| 31 |

| W/2SE/4SW/4 |

Cascade No. 4 |

| 251540 |

| 5/10/2001 |

| 5 South |

| 88 West |

| 31 |

| E/2SE/4SW/4 |

Chemin No. 1 |

| 251541 |

| 5/10/2001 |

| 5 South |

| 89 West |

| 36 |

| E/2NE/4SE/4 |

Chemin No. 2 |

| 251542 |

| 5/10/2001 |

| 5 South |

| 89 West |

| 36 |

| W/2NE/4SE/4 |

Chemin No. 3 |

| 251543 |

| 5/10/2001 |

| 5 South |

| 89 West |

| 36 |

| E/2NW/4SE/4 |

Chemin No. 4 |

| 251544 |

| 5/10/2001 |

| 5 South |

| 89 West |

| 36 |

| W/2NW/4SE/4 |

Chemin No. 5 |

| 251545 |

| 5/10/2001 |

| 5 South |

| 89 West |

| 36 |

| W/2SE/4SE/4 |

Chemin No. 6 |

| 251546 |

| 5/10/2001 |

| 5 South |

| 89 West |

| 36 |

| E/2SW/4SE/4 |

Chemin No. 7 |

| 251547 |

| 5/10/2001 |

| 5 South |

| 89 West |

| 36 |

| W/2SW/4SE/4 |

Storm Queen No. 1 |

| 276917 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 36 |

| W/2NW/4NE/4 |

Storm Queen No. 2 |

| 276918 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 36 |

| E/2NW/4NE/4 |

Storm Queen No. 3 |

| 276919 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 36 |

| W/2NE/4NE/4 |

Storm Queen No. 4 |

| 276920 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 36 |

| E/2NE/4NE/4 |

Storm Queen No. 5 |

| 276921 |

| 12/15/2008 |

| 5 South |

| 88 West |

| 31 |

| W/2NW/4NW/4 |

Storm Queen No. 6 |

| 276922 |

| 12/15/2008 |

| 5 South |

| 88 West |

| 31 |

| E/2NW/4NW/4 |

Storm Queen No. 7 |

| 276923 |

| 12/15/2008 |

| 5 South |

| 88 West |

| 31 |

| W/2NE/4NW/4 |

Storm Queen No. 8 |

| 276924 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 36 |

| E/2SE/4NW/4 |

Storm Queen No. 9 |

| 276925 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 36 |

| W/2SW/4NE/4 |

Storm Queen No. 10 |

| 276926 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 36 |

| E/2SW/4NE/4 |

Storm Queen No. 11 |

| 276927 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 36 |

| W/2SE/4NE/4 |

Storm Queen No. 12 |

| 276928 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 36 |

| E/2SE/4NE/4 |

Storm Queen No. 13 |

| 276929 |

| 12/15/2008 |

| 5 South |

| 88 West |

| 31 |

| W/2SW/4NW/4 |

Storm Queen No. 14 |

| 276930 |

| 12/15/2008 |

| 5 South |

| 88 West |

| 31 |

| E/2SW/4NW/4 |

Storm Queen No. 15 |

| 276931 |

| 12/15/2008 |

| 5 South |

| 88 West |

| 31 |

| W/2SE/4NW/4 |

Storm Queen No. 16 |

| 276932 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 36 |

| W/2NE/4SW/4 |

Storm Queen No. 17 |

| 276933 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 36 |

| E/2NE/4SW/4 |

Storm Queen No. 18 |

| 276934 |

| 12/15/2008 |

| 5 South |

| 88 West |

| 31 |

| W/2NW/4SW/4 |

Storm Queen No. 19 |

| 276935 |

| 12/15/2008 |

| 5 South |

| 88 West |

| 31 |

| E/2NW/4SW/4 |

Storm Queen No. 20 |

| 276936 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 36 |

| W/2SE/4SW/4 |

Storm Queen No. 21 |

| 276937 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 36 |

| E/2SE/4SW/4 |

Storm Queen No. 22 |

| 276938 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 36 |

| E/2ES/4SE/4 |

Storm Queen No. 23 |

| 276939 |

| 12/15/2008 |

| 5 South |

| 88 West |

| 31 |

| W/2SW/4SW/4 |

Storm Queen No. 24 |

| 276940 |

| 12/15/2008 |

| 5 South |

| 88 West |

| 31 |

| E/2SW/4SW/4 |

Storm Queen No. 25 |

| 276941 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 4 |

| W/2NW/4NE/4 |

Storm Queen No. 26 |

| 276942 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 4 |

| E/2NW/4NE/4 |

Storm Queen No. 27 |

| 276943 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 4 |

| W/2NE/4NE/4 |

Storm Queen No. 28 |

| 276944 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 4 |

| E/2NE/4NE/4 |

Storm Queen No. 29 |

| 276945 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 3 |

| W/2NW/4NW/4 |

Storm Queen No. 30 |

| 276946 |

| 12/15/2008 |

| 5 South |

| 89 West |

| 3 |

| E/2NW/4NW/4 |

Oasis No. 1 |

| 290391 |

| 4/5/2018 |

| 5 South |

| 89 West |

| 24 |

| S/2NE/4NW/4 |

Oasis No. 2 |

| 290392 |

| 4/5/2018 |

| 5 South |

| 89 West |

| 24 |

| W/2NW/4NW/4 |

Oasis No. 3 |

| 290393 |

| 4/5/2018 |

| 5 South |

| 89 West |

| 24 |

| E/2NW/4NW/4 |

Table 1 – RMI mining claims

RMI operates the Mid-Continent Quarry on 6 of the 44 BLM mining claims it owns. RMI is permitted by the BLM and Colorado Division of Reclamation Mining and Safety (the “DRMS”) to operate and extract limestone from the six claims

12

in which the Mid-Continent Quarry is located. The six claims cover a total of 120 acres. RMI operates the quarry within a 38-acre boundary stipulated by its CO DRMS permit.

Additionally, RMI has additional exploration property consisting of the remaining 38 mining claims (760 acres) not currently included with the Mid-Continent Quarry. This property surrounds the Mid-Continent Quarry property with the majority of the acreage existing to the north and east of the Mid-Continent Limestone Quarry property (see Figure 1).

The boundaries of the Mid-Continent Quarry and the exploration property follow the boundaries of the mining claims on which they are located.

Figure 1 - Mid-Continent Quarry area map with mining claims

Location and Access

The Mid-Continent Quarry is located about 1 mile north of the city of Glenwood Springs in Garfield County, Colorado. Access to the quarry is provided by a BLM dirt road called Transfer Trail.

The terrain of the location is dominated by a hillside with a slope that ranges between 2H:1V and 3H:1V. Vegetation is mostly composed of sparse grasses, shrubs, and evergreen trees.

13

Geology and Mineralization

The quarry area is located in the Leadville Limestone formation and is bound by an unnamed fault to the north and the West Glenwood Fault to the south. The limestone outcrops to the east and to the west creating a natural boundary for the edges of the deposit. The deposit is roughly tabular in nature, with a west-northwest to east-southeast strike and 10-30° dip to the south-southwest. The Leadville Limestone formation ranges from approximately 150-175 feet thick in the quarry area.

Facilities

RMI owns a limestone milling facility located within the 38-acre mining boundary. Additionally, RMI owns and operates various pieces of crushing, screening, and heavy mobile equipment used for extracting and sizing the limestone in the quarry.

Current Status

Shortly after RMI purchased the property, extensive site cleanup was performed. RMI performs daily activities related to the production of limestone. This work includes blasting rock, transporting rock with excavators and front-end loaders and crushing and screening rock into usable sized pieces. To perform these activities, RMI has incurred costs, and will continue to incur costs. These costs include payment for supplies, equipment, labor, and other associated expenses related to the extraction of limestone.

The power at the site is provided by Glenwood Springs Utilities. RMI does not have a direct water connect and utilizes water transported to the site and purchased from nearby locations for all water needs. The quarry is currently in excellent working condition.

Exploration of Property

RMI has not performed any exploration drilling of its own on the property outside of the quarry. RMI has performed surface sampling of the limestone on sections of this property. Testing results from the surface sampling have shown the limestone in this property to be nearly identical in nature to the chemical grade limestone found in the quarry.

Historical exploration drilling, occurring between 1958-1976, took place over large sections of the property outside of the quarry. Testing results from this drilling show the existence of chemical grade limestone like the limestone found in the quarry. There are no active plans for future exploration.

The costs associated with our properties can be found in Note F to our consolidated financial statements.

Item 3. Legal Proceedings

Rocky Mountain Industrials, Inc. and its wholly owned subsidiary RMR Aggregates, Inc. has a filed a lawsuit pending in the District Court of Garfield County, Colorado. The defendants include Garfield County and also the City of Glenwood Springs which voluntarily intervened. The claims include a request for judicial review of two Notices of Violation issued by Garfield County in 2019 and 2020 and the related decision of the Board of County Commissioners (“BOCC”) at a public meeting on April 22, 2019. RMI had also asserted related claims in federal court for violation of its Constitutional rights to procedural and substantive due process under 42 U.S.C. Sec. 1983 and for declaratory and injunctive relief due to preemption under federal law (the “Federal Claims”). By stipulation of the parties, the federal court lawsuit was dismissed, and all of the Federal Claims were added to the state lawsuit in Garfield County District Court. RMI is not presently seeking monetary damages because Garfield County has thus far not sought to enforce its Notices of Violation, but RMI has reserved the right to seek monetary damages in the future.

14

Item 4. Mine Safety Disclosures

The operation of the Mid-Continent Quarry is subject to regulation by MSHA under the Federal Mine Safety and Health Act of 1977 (the “Mine Act”). MSHA inspects the quarry on a regular basis and issues various citations and orders when it believes a violation has occurred under the Mine Act. Whenever MSHA issues a citation or order, it also generally proposes a civil penalty, or fine, related to the alleged violation. Citations or orders can be contested and appealed, and as part of that process, are often reduced in severity and amount, and are sometimes dismissed.

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the Dodd-Frank Act), the Company is required to present information regarding certain mining safety and health citations which MSHA has issued with respect to its aggregates mining operations in its periodic reports filed with the SEC. In evaluating this information, consideration should be given to factors such as: (i) the number of citations and orders will vary depending on the size of the quarry or mine and type of operations (underground or surface), (ii) the number of citations issued will vary from inspector to inspector and location to location, and (iii) citations and orders can be contested and appealed, and in that process, may be reduced in severity and amount, and are sometimes dismissed.

The Company presents the following items regarding certain mining safety and health matters for the fiscal year ended March 31, 2021:

15

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| |

| |

| |

| |

| |

| |

| | |

| |

| Received |

| Received |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | Notice of | | Notice of | | Citation | | | | |

| | | | | | | | | | | | | | | | | Total | | Pattern | | Potential | | Contests | | | | |

| | | | | | | | Section | | | | | | Total | | Number | | of | | to have | | Pending | | Citation | | Citation | |

| | | | | | | | 104(d) | | | | | | Dollar | | of | | Violation | | Pattern | | as of | | Contests | | Contests | |

| | | | Section | | Section | | Citations | | Section | | Section | | Value of | | Mining | | Under | | under | | Last | | Instituted | | Resolved | |

| | | | 104 S&S | | 104(b) | | and | | 110(b)(2) | | 107(a) | | MSHA | | Related | | Section | | Section | | Day of | | During | | During | |

| | MSHA | | Citations | | Orders | | Orders | | Violations | | Orders | | Assessment/ | | Fatalities | | 104(e) | | 104(e) | | Period | | Period | | Period | |

Location | | ID | | (#) | | (#) | | (#) | | (#) | | (#) | | $Proposed | | (#) | | (yes/no) | | (yes/no) | | (#) | | (#) | | (#) | |

Mid-Continent Quarry |

| 0504954 |

| — |

| — |

| — |

| — |

| — | | $ | 123 |

| — |

| no |

| no |

| — |

|

|

|

|

16

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our Class B Common Stock is currently quoted on the Over the Counter Market under the symbol “RMRI”. No shares of Class B Common Stock have traded on the Over the Counter Market to date.

Dividends

We plan to retain any earnings for the foreseeable future for our operations. We have never paid any dividends on our common stock and do not anticipate paying any cash dividends in the foreseeable future. Any future determination to pay cash dividends on common stock will be at the discretion of our board of directors and will depend on our financial condition, operating results, capital requirements and such other factors as our board of directors deems relevant. The Company has outstanding Series A-1 and A-2 Preferred Stock that accrue dividends.

Recent Issuance of Unregistered Securities

We issued the following unregistered securities during the year ended March 31, 2021:

| ● | Conversion of 338,343 shares of Class B Common Stock for 50.75 shares of Series A-3 Preferred Stock |

| ● | We issued 444,456 shares of Class B Common Stock for compensation |

| ● | We issued 5 shares of Series A-1 Preferred Stock for services |

| ● | We issued 19.45 shares of Series A-2 Preferred Stock, 2 of those 19.45 shares to settle Preferred shares debt, and 2.5 of the 19.45 shares to settle an outstanding notes payable |

| ● | We issued 40,300 shares of Class B Common Stock for services, and issued 60,000 shares of Class B Common Stock upon exercise of warrants, and issued 24,000 shares of Class B Common Stock for Board compensation |

We relied on an exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”) pursuant to Section 4(a)(2) of the Securities Act with respect to the foregoing issuance.

Item 6. Selected Financial Data

Not applicable.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Forward-Looking Statements

All statements in this report other than statements of historical fact are “forward-looking statements”. Such forward-looking statements include, but are not limited to, those relating to the following: our ability to secure necessary financing; fluctuations in interest rates; our ability to continue to grow and implement growth strategies, and future cash needs and operations and our business plans.

When used in this document, the words “anticipate,” “estimate,” “expect,” “may,” “plans,” “project,” and similar expressions are intended to be among the statements that identify forward-looking statements. Our results may differ significantly from the results discussed in the forward-looking statements. Such statements involve risks and uncertainties,

17

including, but not limited to, those relating to costs, delays and difficulties related to our ability to attract and retain skilled managers and other personnel; the intense competition within our industry; the uncertainty of our ability to manage and continue our growth and implement our business strategy; our vulnerability to general economic conditions; accuracy of accounting and other estimates; our future financial and operating results, cash needs and demand for services; and our ability to maintain and comply with permits and licenses; as well as other risk factors described in this Report. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those projected.

Overview

We were incorporated in the State of Nevada in August 2012 under the name “Online Yearbook” with the principal business objective of developing and marketing online yearbooks for schools, companies and government agencies.

In November 2014, Rocky Mountain Resource Holdings, Inc. (“RMRH”) became our majority shareholder by acquiring 5,200,000 shares of our common stock (the “Shares”), or 69.06% of the then issued and outstanding shares, pursuant to stock purchase agreements with Messrs. El Maraana and Salah Blal, our former officers and directors. The Shares were acquired for an aggregate purchase price of $357,670.

In December 2014, we changed our name to “RMR Industrials, Inc.” and on January 1, 2020, the Company changed its name from RMR Industrials, Inc. to Rocky Mountain Industrials, Inc.

In February 2015, (the “Closing Date”), we entered into and consummated a merger transaction pursuant to an Agreement and Plan of Merger (the “Merger Agreement”) by and among the Company, OLYB Acquisition Corporation, a Nevada corporation and wholly owned subsidiary of the Company (“Merger Sub”) and RMR IP, Inc., a Nevada corporation (“RMR IP”). In accordance with the terms of Merger Agreement, on the Closing Date, Merger Sub merged with and into RMR IP (the “Merger”), with RMR IP surviving the Merger as our wholly owned subsidiary. Chad Brownstein and Gregory M. Dangler are directors of the Company and co-owners of RMRH, which was the majority shareholder of the Company prior to the Merger. Additionally, Messrs. Brownstein and Dangler were indirect controlling shareholders and directors of RMR IP prior to the Merger. As such, the Merger was among entities under the common control of Messrs. Brownstein and Dangler.

In July 2016, we formed RMR Aggregates, Inc., a Colorado corporation (“RMR Aggregates”), as our wholly-owned subsidiary. RMR Aggregates was formed to hold assets whose primary focus is the mining and processing of industrial minerals for the manufacturing, construction and agriculture sectors. These minerals include limestone, aggregates, marble, silica, barite and sand.

In October 2016, pursuant to an Asset Purchase Agreement with CalX Minerals, LLC, a Colorado limited liability company (“CalX”), RMR Aggregates completed the purchase of substantially all of the assets associated with the Mid-Continent Quarry on 41 BLM unpatented placer mining claims in Garfield County, Colorado. CalX assets include the mining claims, improvements, access rights, water rights, equipment, inventory, contracts, permits, certain intellectual property rights, and other tangible and intangible assets associated with the limestone mining operation.

In January 2018, the Company formed Rail Land Company, LLC (“Rail Land Company”) as a wholly-owned subsidiary to acquire and develop a rail terminal and services facility (the “Rail Park”). Rail Land Company purchased an approximately 470-acre parcel of real property located in Bennett, Colorado in February, 2018. In July 2018 we exercised our option to acquire an additional approximately 150 acres for a total of 620 acres. The Company’s development of the Rail Park is intended to expand the customer base for our products by utilizing rail freight capabilities to reach customers in the greater Denver area and by expanding our business to include rail transportation solutions and services.

On April 26, 2019, RMR Logistics entered into an asset purchase agreement with H2K, LLC, a Colorado limited liability company (“the Seller”) pursuant to which RMR Logistics acquired the Seller’s trucking assets.

18

Critical Accounting Policies and Use of Estimates