SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 18-K/A

For Foreign Governments and Political Subdivisions Thereof

AMENDMENT NO. 1

to

ANNUAL REPORT

of

FMS WERTMANAGEMENT

(Name of Registrant)

Date of end of last fiscal year: December 31, 2016

SECURITIES REGISTERED

(As of the close of the fiscal year)*

| | | | |

| TITLE OF ISSUE | | AMOUNT AS TO

WHICH REGISTRATION IS

EFFECTIVE | | NAMES OF EXCHANGES

ON WHICH REGISTERED |

| N/A | | N/A | | N/A |

| * | The registrant files annual reports on Form 18-K on a voluntary basis. |

Name and address of person authorized to receive notices

and communications from the Securities and Exchange Commission:

KRYSTIAN CZERNIECKI

Sullivan & Cromwell LLP

Neue Mainzer Strasse 52

60311 Frankfurt am Main, Germany

The undersigned registrant hereby amends its Annual Report on Form 18-K for the fiscal year ended December 31, 2016 as follows:

| | - | Exhibit (d) is hereby amended by adding the text under the caption “Exchange Rate Information” on page 1 hereof to the “Exchange Rate Information” section; |

| | - | Exhibit (d) is hereby amended by adding the text under the caption “Recent Developments—FMS Wertmanagement” on pages 2 and 3 hereof to the “Recent Developments” section; |

| | - | Exhibit (d) is hereby amended by replacing the text in “Recent Developments—The Federal Republic of Germany” section with the text under the caption “Recent Developments—The Federal Republic of Germany” on pages 4 to 7 hereof. |

This report is intended to be incorporated by reference into FMS Wertmanagement’s prospectus dated January 13, 2017, and any future prospectus filed by FMS Wertmanagement with the Securities and Exchange Commission to the extent such prospectus states that it incorporates by reference this report.

TABLE OF CONTENTS

EXCHANGE RATE INFORMATION

FMS-WM files reports with the U.S. Securities and Exchange Commission giving financial and economic data expressed in euro.

The following table shows the high and low noon buying rates for euro, expressed as U.S. dollars per EUR 1.00, for each month from June 2017 through November 2017, as reported by the Federal Reserve Bank of New York.

| | | | | | | | |

2017 | | High | | | Low | |

June | | | 1.1420 | | | | 1.1124 | |

July | | | 1.1826 | | | | 1.1336 | |

August | | | 1.2025 | | | | 1.1703 | |

September | | | 1.2041 | | | | 1.1747 | |

October | | | 1.1580 | | | | 1.1847 | |

November | | | 1.1936 | | | | 1.1577 | |

No representation is made that the euro or U.S. dollar amounts referred to herein could have been or could be converted into U.S. dollars or euro, as the case may be, at any particular rate.

1

RECENT DEVELOPMENTS

FMS WERTMANAGEMENT

FMS Wertmanagement’s Results for the Six Months Ended June 30, 2017

FMS-WM is not required to publish interim financial statements in conformity with German GAAP. Nevertheless, FMS-WM does prepare selected interim financial information for the six months ended June 30 in accordance with German GAAP applicable to interim financial reporting. The following information is based on this selected unaudited interim financial information. This information is not necessarily indicative of FMS-WM’s figures for the full year ending December 31, 2017.

FMS-WM generated a positive result from ordinary activities of EUR 298 million in the six months ended June 30, 2017 compared to EUR 200 million in the six months ended June 30, 2016. After taxes, net income for the six months ended June 30, 2017 was EUR 267 million compared to EUR 165 million for the six months ended June 30, 2016.

Total assets of FMS-WM amounted to EUR 165.9 billion as of June 30, 2017 compared to EUR 177.2 billion as of December 31, 2016.

The nominal volume of the portfolio decreased by 8.0% in the six months ended June 30, 2017 to EUR 81.7 billion, compared to a decrease of 8.1% in the six months ended June 30, 2016.

The result for the first six months ended June 30, 2017, was affected considerably by a capital repayment and profit distribution by Hypo Real Estate Capital Corporation, a US-based fully-owned subsidiary of FMS-WM.

With EUR 295 million, net interest income in the six months ended June 30, 2017, has basically remained unchanged as compared to EUR 294 million in the six months ended June 30, 2016. This results mainly from one-off effects due to the financial compensation for contract adjustments of credit support annexes for derivatives. Net commission income amounted to EUR 9 million in the six months ended June 30, 2017 compared to EUR 23 million in the six months ended June 30, 2016.

General and administrative expenses decreased by 13.5% to EUR 77 million in the six months ended June 30, 2017 compared to EUR 89 million in the six months ended June 30, 2016.

On FMS-WM’s funding side, the total new issuance volume across all capital market instruments in the six months ended June 30, 2017 amounted to EUR 14.1 billion compared to EUR 10.5 billion in the six months ended June 30, 2016. FMS-WM already managed to place a funding volume of EUR 15.4 billion with the capital market by the end of July 2017. Given the favorable market conditions, the original volume of around EUR 12 billion planned for the full 2017 fiscal year has been raised to a target of EUR 19.0 billion.

At the Depfa Group, which was transferred from the HRE Group to FMS-WM in December 2014 and is not consolidated in FMS-WM’s financial statements, loss before taxes was reduced significantly from EUR 54 million as of June 30, 2016 to EUR 3 million as of June 30, 2017.

Overall, FMS-WM had Depfa Group loans with a nominal value of EUR 2.0 billion in its portfolio as of June 30, 2017. Additional measures are planned for the second half of 2017 to continuously reduce Depfa Group’s total assets and further advance the wind-up of the Irish banking group.

Based on the successful first half of 2017, FMS-WM again expects a positive result from ordinary activities for the entire year 2017.

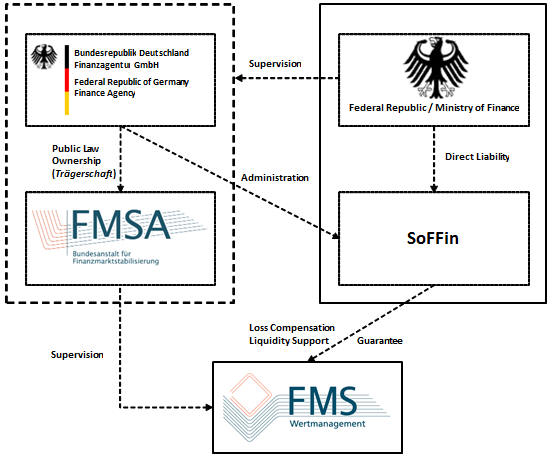

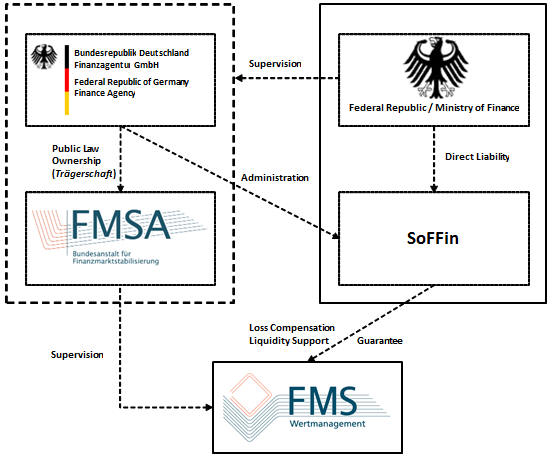

Reorganization of FMSA and Relationship with the Federal Republic of Germany

As previously disclosed, in December 2016, the German parliament passed a law for the reorganization of FMSA, under which Germany’s national resolution authority is being integrated into the Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht) and FMSA is being integrated into the Federal Republic of Germany – Finance Agency (Bundesrepublik Deutschland – Finanzagentur GmbH). The administration and management of SoFFin, for which FMSA is currently responsible, will be assumed by the

2

Federal Republic of Germany – Finance Agency while FMSA will remain responsible for the German wind-up institutions FMS-WM and Erste Abwicklungsanstalt. The reorganization is expected to be completed with effect as of January 1, 2018.

Accordingly, as previously disclosed, the reorganization of FMSA entails certain changes in the supervision of FMSA and the administration of SoFFin. However, the legal relationship between FMS-WM and each of the SoFFin and the FMSA, and therefore the Federal Republic, remains unchanged. The following chart provides an overview of the relationship between FMS-WM and the Federal Republic, including the SoFFin, the FMSA and the Federal Republic of Germany – Finance Agency, as it will be in effect as of January 1, 2018 upon completion of the reorganization:

3

THE FEDERAL REPUBLIC OF GERMANY

Overview of Key Economic Figures

The following economic information regarding the Federal Republic is derived from the public official documents cited below. Certain of the information is preliminary.

Gross Domestic Product (GDP)

GROSS DOMESTIC PRODUCT

| | | | |

(adjusted for price, seasonal and calendar effects) (1) |

Reference period | | Percentage change on previous quarter | | Percentage change on the same quarter in previous year |

3rd quarter 2016 | | 0.3 | | 1.8 |

4th quarter 2016 | | 0.4 | | 1.8 |

1st quarter 2017 | | 0.9 | | 2.1 |

2nd quarter 2017 | | 0.6 | | 2.3 |

3rd quarter 2017 | | 0.8 | | 2.8 |

| (1) | Adjustment for seasonal and calendar effects according to the Census X-12-ARIMA method. |

Germany’s gross domestic product (“GDP”) increased by 0.8% after price, seasonal and calendar adjustments in the third quarter of 2017 compared to the second quarter of 2017. Compared to the previous quarter, positive contributions came from foreign trade. Exports of goods and services increased by 1.7% compared to the second quarter of 2017. Imports in the third quarter of 2017 increased less markedly (+0.9%) than exports compared to the second quarter of 2017. Arithmetically, the balance of exports and imports thus had a positive effect on the gross domestic product growth. The final consumption expenditure of households (-0.1%) and of general government (-0.0%) remained rather stable at the level of the second quarter of 2017. In addition, capital formation showed a positive development (+0.4%) compared with the previous quarter. While gross fixed capital formation was up especially in machinery and equipment (+1.5%), it fell slightly in construction (–0.4%) compared with the second quarter of 2017, respectively.

In a year-on-year comparison, the German economy recorded positive growth. GDP in the third quarter of 2017 increased by 2.8% in price and calendar-adjusted terms compared to the corresponding period in 2016, following an increase of 2.3% in the second quarter of 2017 and 2.1% in the first quarter of 2017.

Source: Statistisches Bundesamt, Detailed gross domestic product results for the 3rd quarter of 2017, press release of November 23, 2017 (https://www.destatis.de/EN/PressServices/Press/pr/2017/11/PE17_422_811.html).

4

Inflation Rate

INFLATION RATE

| | | | |

| (based on overall consumer price index) |

| | |

Reference period | | Percentage change on

previous month | | Percentage change on the same month in

previous year |

October 2016 | | 0.2 | | 0.8 |

November 2016 | | 0.1 | | 0.8 |

December 2016 | | 0.7 | | 1.7 |

January 2017 | | -0.6 | | 1.9 |

February 2017 | | 0.6 | | 2.2 |

March 2017 | | 0.2 | | 1.6 |

April 2017 | | 0.0 | | 2.0 |

May 2017 | | -0.2 | | 1.5 |

June 2017 | | 0.2 | | 1.6 |

July 2017 | | 0.4 | | 1.7 |

August 2017 | | 0.1 | | 1.8 |

September 2017 | | 0.1 | | 1.8 |

October 2017 | | 0.0 | | 1.6 |

Consumer prices in Germany were 1.6% higher in October 2017 compared to October 2016. The prices of energy products were up 1.2% year on year, while in September 2017, the rate of energy price increase had been +2.7%. The upward effect of energy prices on the overall inflation rate diminished markedly. Prices of motor fuels and of household energy each rose by 1.2% in October 2017 compared to October 2016. Among the household energy products, price increases were recorded for heating oil (+3.8%), electricity (+1.9%) and charges for central and district heating (+0.8%). In contrast, gas prices decreased by 1.7% compared to October 2016. Excluding energy prices, the inflation rate in October 2017 would have been +1.6% too. Food prices in October 2017 rose 4.3% year on year and had a marked upward effect on the overall inflation rate. The year-on-year increase in food prices has accelerated continuously since July 2017 (July 2017: +2.7%; August 2017: +3.0%; September 2017: +3.6%). Prices increased in particular for edible fats and oils (+27.9%; butter +54.0%). Consumers also had to pay markedly more (+15.2%) for dairy products in general. Excluding energy and food prices, the inflation rate would have been +1.2% in October 2017. Prices of goods (total) rose 1.9% from October 2016 to October 2017, whereas prices of services (total) rose by 1.2%. A major factor contributing to the increase in service prices was the development of net rents exclusive of heating expenses (+1.6% on October 2016), as households spend a large part of their consumption expenditure on this item. Even larger price increases were observed, for example, for in-patient health services (+3.5%). In contrast, the prices of some services declined considerably, for instance services of social facilities (–7.6%); this was due to the implementation of Act II on Strengthening Long-Term Care in January 2017.

Compared to September 2017, the consumer price index remained unchanged in October 2017. In October 2017, there were seasonal price decreases especially for package holidays (–7.1%). Energy prices decreased slightly (–0.1%) compared to September 2017 and consumers paid 0.8% less for motor fuels. However, the prices of individual motor fuels showed partly diverging trends (for instance, supergrade petrol: –1.6%, whereas diesel fuel: +1.6%). Marked price increases were observed for heating oil (+2.2%). Food prices (total) were up 0.8% in October 2017 compared with the previous month. Prices rose especially for vegetables (+2.9%) and fruit (+2.4%).

Source: Statistisches Bundesamt, Consumer prices in October 2017: +1.6% on October 2016, press release of November 14, 2017 (https://www.destatis.de/EN/PressServices/Press/pr/2017/11/PE17_403_611.html).

5

Unemployment Rate

UNEMPLOYMENT RATE

| | | | |

(percent of unemployed persons in the total labor force according to the

International Labour Organization (ILO) definition) (1) |

| | |

Reference period | | Original percentages | | Adjusted percentages (2) |

October 2016 | | 3.9 | | 4.0 |

November 2016 | | 3.9 | | 3.9 |

December 2016 | | 3.5 | | 3.9 |

January 2017 | | 4.0 | | 3.9 |

February 2017 | | 4.3 | | 3.9 |

March 2017 | | 4.0 | | 3.9 |

April 2017 | | 4.1 | | 3.9 |

May 2017 | | 3.6 | | 3.8 |

June 2017 | | 3.6 | | 3.8 |

July 2017 | | 3.6 | | 3.7 |

August 2017 | | 3.7 | | 3.7 |

September 2017 | | 3.5 | | 3.6 |

October 2017 | | 3.7 | | 3.6 |

| (1) | The time series on unemployment are based on the German Labour Force Survey. |

| (2) | Adjusted for seasonal and irregular effects (trend cycle component) using the X-12-ARIMA method. |

The number of employed persons increased by approximately 650,000 persons, or 1.5%, from October 2016 to October 2017. Compared to September 2017, the number of employed persons increased by approximately 42,000, or 0.1%, after adjustment for seasonal fluctuations.

In October 2017, the number of unemployed persons decreased by approximately 92,000 compared to October 2016. Adjusted for seasonal and irregular effects (trend cycle component), the number of unemployed persons in October 2017 stood at 1.55 million, which was a decline of roughly 12,000 compared to September 2017.

Sources: Statistisches Bundesamt, Constant high growth in number of persons in employment in October 2017, press release of November 30, 2017 (https://www.destatis.de/EN/PressServices/Press/pr/2017/11/PE17_435_132.html); Statistisches Bundesamt, Genesis-Online Datenbank, Tabelle 13231 0001, Erwerbslose, Erwerbstätige, Erwerbspersonen, Erwerbslosenquote: Deutschland, Monate, Original- und bereinigte Daten (https://www-genesis.destatis.de/genesis/online/logon?sequenz=tabelleErgebnis&selectionname=13231-0001&zeitscheiben=2&leerzeilen=false).

Current Account and Foreign Trade

CURRENT ACCOUNT AND FOREIGN TRADE

| | | | |

| (balance in EUR billion) (1) |

| | |

Item | | January to September 2017 | | January to September 2016 |

Trade in goods, including supplementary trade items | | 202.7 | | 207.5 |

Services | | -18.4 | | -19.1 |

Primary income | | 37.0 | | 31.0 |

Secondary income | | -37.7 | | -28.4 |

| | | | |

Current account | | 183.6 | | 191.1 |

| | | | |

| (1) | Figures may not add up due to rounding. |

Source: Statistisches Bundesamt, German exports in September 2017: +4.6% on September 2016, press release of November 9, 2017 (https://www.destatis.de/EN/PressServices/Press/pr/2017/11/PE17_394_51.html).

6

Germany’s General Government Deficit/Surplus and General Government Gross Debt

The Federal Government has forecast that the German general government surplus for full year 2017 will be 0.8% of GDP, following a surplus of 0.8% of GDP in 2016. The general government gross debt ratio is forecast to be 65.5% in 2017.

Source: Eurostat, EDP Notification Tables, October 2017, Germany (http://ec.europa.eu/eurostat/documents/1015035/8338804/DE-2017-10.pdf).

Other Recent Developments

German general elections for the Bundestag

On September 24, 2017, general elections for the Bundestag (one of the two Houses of Parliament in Germany) were held, with the following final results:

| | | | |

| | | % of Votes | | Seats |

CDU | | 26.8 | | 200 |

SPD | | 20.5 | | 153 |

AfD | | 12.6 | | 94 |

FDP | | 10.7 | | 80 |

DIE LINKE | | 9.2 | | 69 |

GRÜNE | | 8.9 | | 67 |

CSU | | 6.2 | | 46 |

Others | | 5.0 | | — |

| | | | |

Total | | 100.0 | | 709 |

| | | | |

The coalition negotiations to form a new government have not yet been concluded. Federal President (Bundespräsident) Frank-Walter Steinmeier announced that he will seek a dialogue with those parties and their respective chairpersons, whose political agendas overlap to an extent that does not exclude the formation of a government with each other, with a view to encouraging a successful formation of government in the near future. Pending a conclusion of the coalition negotiations, the pre-electoral federal government has reconvened as an Acting Federal Government to ensure continuity between governments pursuant to Article 69 section 3 of the German basic constitutional law (Grundgesetz).

Sources: The Federal Returning Officer, Final results of the 2017 Bundestag Election, press release of October 12, 2017 (https://www.bundeswahlleiter.de/info/presse/mitteilungen/bundestagswahl-2017/34_17_endgueltiges_ergebnis.html); Bundespräsidialamt, Erklärung von Bundespräsident Steinmeier zur Regierungsbildung, press release of November 20, 2017 (http://www.bundespraesident.de/SharedDocs/Downloads/DE/Reden/2017/11/171120-Statement-Regierungsbildung.pdf?__blob=publicationFile); Bundesregierung, Fragen und Antworten zur Regierungsbildung, Article of November 20, 2017 (https://www.bundesregierung.de/Content/DE/Artikel/2017/10/2017-10-24-faq-regierungsbildung.html?nn=694676#doc2273622bodyText4).

Independence referendum in Catalonia

On October 1, 2017, Catalonia, a region in northern Spain that includes Barcelona and accounted for 19% of Spain’s GDP in 2016, held a vote on its independence in a referendum that has been declared unconstitutional by Spain’s constitutional court. According to the Catalan regional government, approximately 90% of the votes cast favored independence with an overall turnout of less than half of eligible voters. On October 27, 2017, Catalonia’s regional parliament voted to formally declare independence from Spain. On the same day, the extraordinary Council of Ministers approved initial measures provided for in application of article 155 of the Spanish constitution to recover legality in Catalonia and to restore its self-governance. These measures include, among other things, the removal of the Catalan regional government, the dissolution of the regional parliament as well as the calling of regional elections to be held on December 21, 2017. The German government does not recognize the unilateral declaration of independence by Catalonia’s regional parliament and supports the position of the Spanish government. For the European Commission, this is an internal matter for Spain that has to be dealt with in line with the constitutional order of Spain.

Sources: Bundesregierung, Nach “Referendum” in Katalonien, Bundesregierung hofft auf Deeskalation, press release of October 4, 2017 (https://www.bundesregierung.de/Content/DE/Artikel/2017/10/2017-10-04-katalonien.html); Instituto Nacional des Estadística, Spanish Regional Accounts - Base 2010, Table 1 (http://www.ine.es/en/daco/daco42/cre00/b2010/c17m_cre_en.xls); Bundesregierung, Nach “Referendum” in Katalonien, Merkel dringt auf verfassungskonforme Lösung, press release of October 19, 2017 (https://www.bundesregierung.de/Content/DE/Artikel/2017/10/2017-10-11-katalonien.html); Council of Ministers, “Neither the autonomy nor self-governance in Catalonia will be suspended”; but legality will be recovered, says Mariano Rajoy, Moncloa Palace, press release of October 21, 2017 (http://www.lamoncloa.gob.es/lang/en/gobierno/councilministers/Paginas/2017/20171021_councilministers.aspx); Bundesregierung, After the “referendum” in Catalonia, German government hopes for dialogue, press release of October 11, 2017 (https://www.bundesregierung.de/Content/EN/Artikel/2017/10_en/2017-10-11-katalonien_en.html); Extraordinary Council of Ministers, Government approves initial measures provided for in application of Article 155 of the Constitution, press release of October 27, 2017 (http://www.lamoncloa.gob.es/lang/en/gobierno/councilministers/Paginas/2017/20171028_councilmextra.aspx); Bundesregierung, Katalonien erklärt Unabhängigkeit, Seibert: Sorge über erneuten Verfassungsbruch, press release of October 30, 2017 (https://www.bundesregierung.de/Content/DE/Artikel/2017/10/2017-10-27-katalonien-unabhaengigkeit.html); European Commission - Statement, Statement on the events in Catalonia, press release of October 2, 2017 (http://europa.eu/rapid/press-release_STATEMENT-17-3626_en.htm).

7

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant FMS Wertmanagement has duly caused this amendment to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| FMS Wertmanagement |

| |

| By: | | /S/ TIM ARMBRUSTER |

| | Name: | | Tim Armbruster |

| | Title: | | Head of Group Treasury |

| |

| By: | | /S/ DR. RÜDIGER HANSEL |

| | Name: | | Dr. Rüdiger Hansel |

| | Title: | | Legal Counsel |

Date: December 6, 2017

8