Exhibit 99.1 First Northwest Bancorp NASDAQ: FNWB Investor Meeting Sandler O”Neill & Partners, LP Seattle, WA June 14, 2018

Safe Harbor Statement Forward-Looking Statements When used in this presentation the words or phrases “believes,” “expects,” “anticipates,” “estimates” or similar expressions are intended to identify forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Additional forward looking statements may be made in the question and answer period following this presentation. These forward-looking statements relate to, among other things, expectations of the business environment in which we operate, projections of future performance, perceived opportunities in the market, potential future credit experience, and statements regarding our mission and vision. These forward-looking statements are based upon current management expectations and may, therefore, involve risks and uncertainties. Our actual results, performance, or achievements may differ materially from those suggested, expressed, or implied by forward-looking statements as a result of a wide variety or range of factors including, but not limited to: increased competitive pressures; changes in the interest rate environment; the credit risks of lending activities; changes in general economic conditions and conditions within the securities markets; legislative and regulatory changes; and other factors described in First Northwest Bancorp’s (“Company”) latest Annual Report on Form 10-K and other filings with the Securities and Exchange Commission (“SEC”) which are available on our website at www.ourfirstfed.com and on the SEC’s website at www.sec.gov. Any of the forward-looking statements that we discuss today may turn out to be incorrect because of the inaccurate assumptions we might make, because of the factors illustrated above or because of other factors that we cannot foresee. Any forward-looking statements are based upon management’s beliefs and assumptions at the time they are made. Because of these and other uncertainties, our actual future results may be materially different from those expressed or implied in any forward-looking statements made by or on our behalf and the Company's operating and stock price performance may be negatively affected. Therefore, these factors should be considered in evaluating the forward-looking statements, and undue reliance should not be placed on such statements. We do not undertake and specifically disclaim any obligation to revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of the forward-looking statements. 2

Strategic Plan and Performance 2017 Accomplishments • Geographic diversification • Earning asset diversification • Company performance • Share repurchases 2018 Challenges • Continuing to improve earnings and efficiency • Managing excess liquidity and capital • Continuing product and geographic diversification • Managing costs associated with our geographic expansion and keeping pace with technology and the regulatory environment 3

Leadership Board of Directors Name Board Title Director Since1 Steven E. Oliver Chairman of the Board 2001 David A. Blake Vice Chairman of the Board 2005 David T. Flodstrom Director 2002 Larry Hueth Director and President and Chief Executive Officer 2010 Jennifer Zaccardo Director 2011 Cindy H. Finnie Director 2012 Norman J. Tonina Jr. Director 2013 Craig A. Curtis Director 2014 Dana D. Behar Director 2015 1 Includes service on First Federal Savings & Loan Association Board of Directors. 4

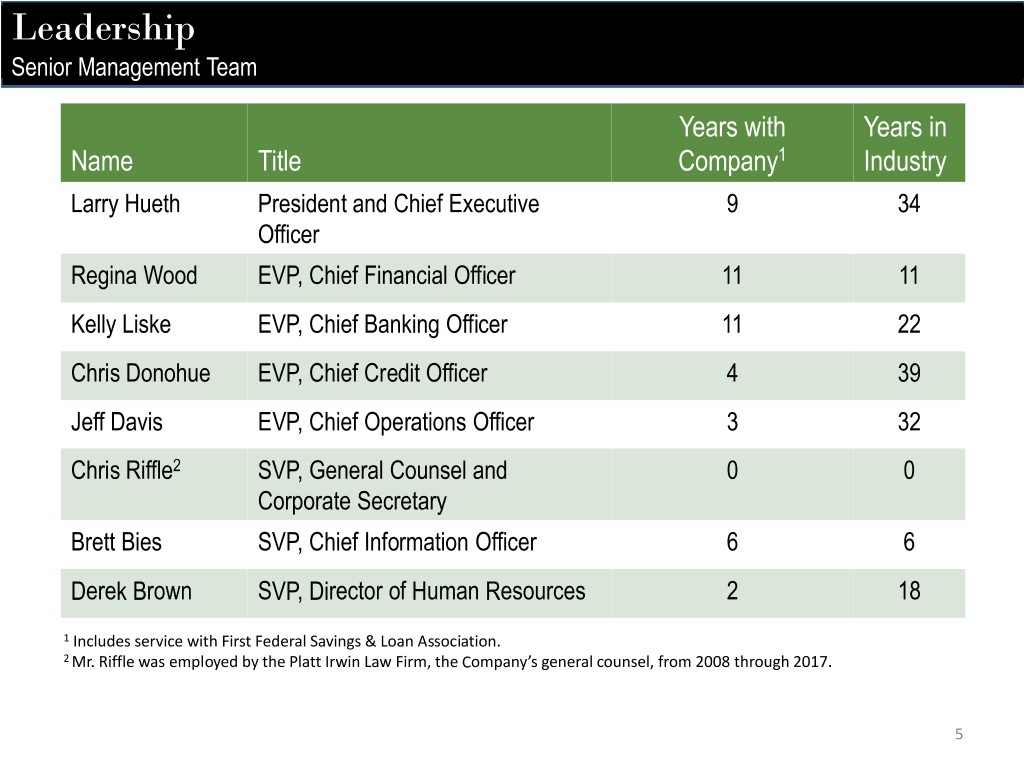

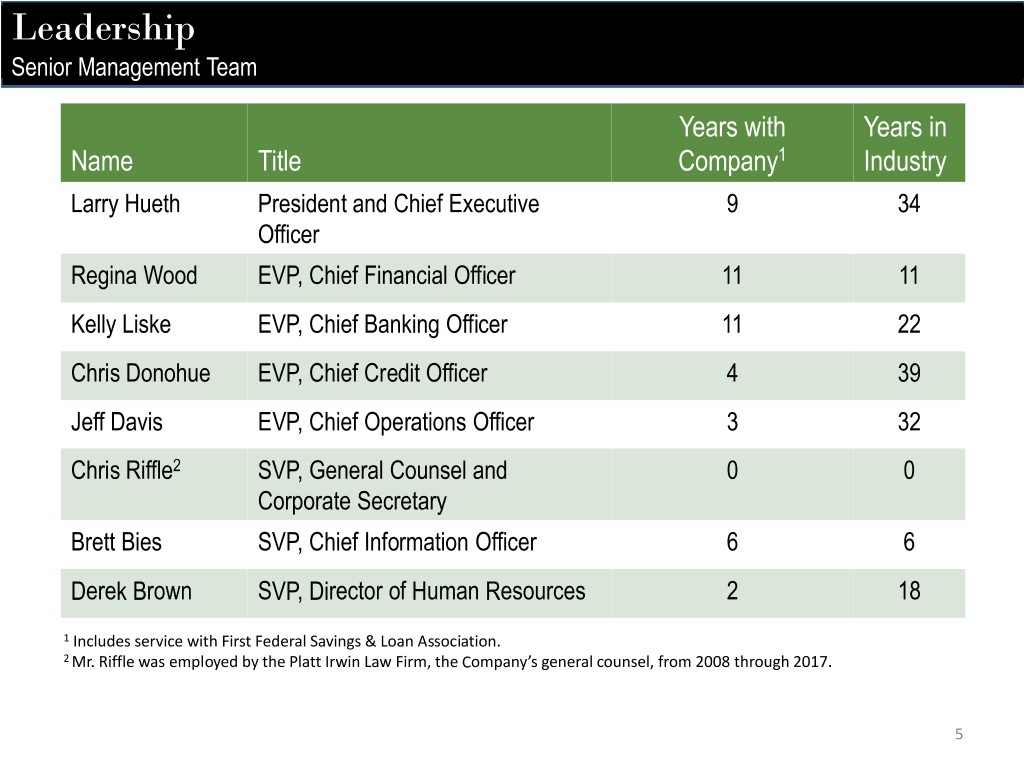

Leadership Senior Management Team Years with Years in Name Title Company1 Industry Larry Hueth President and Chief Executive 9 34 Officer Regina Wood EVP, Chief Financial Officer 11 11 Kelly Liske EVP, Chief Banking Officer 11 22 Chris Donohue EVP, Chief Credit Officer 4 39 Jeff Davis EVP, Chief Operations Officer 3 32 Chris Riffle2 SVP, General Counsel and 0 0 Corporate Secretary Brett Bies SVP, Chief Information Officer 6 6 Derek Brown SVP, Director of Human Resources 2 18 1 Includes service with First Federal Savings & Loan Association. 2 Mr. Riffle was employed by the Platt Irwin Law Firm, the Company’s general counsel, from 2008 through 2017. 5

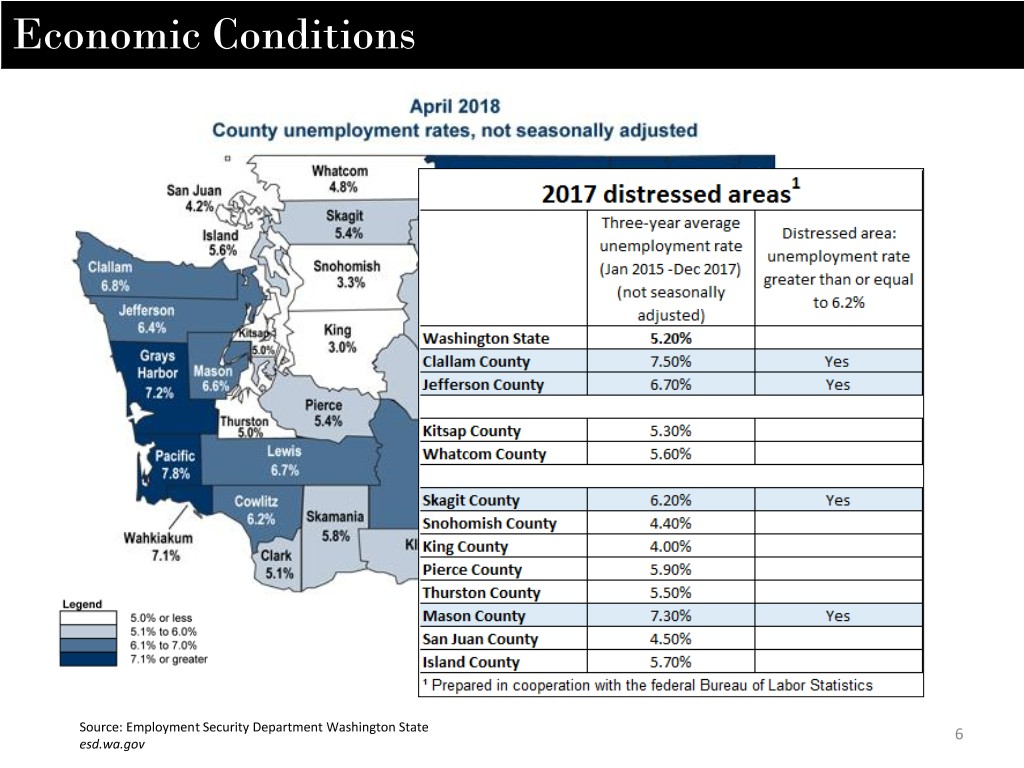

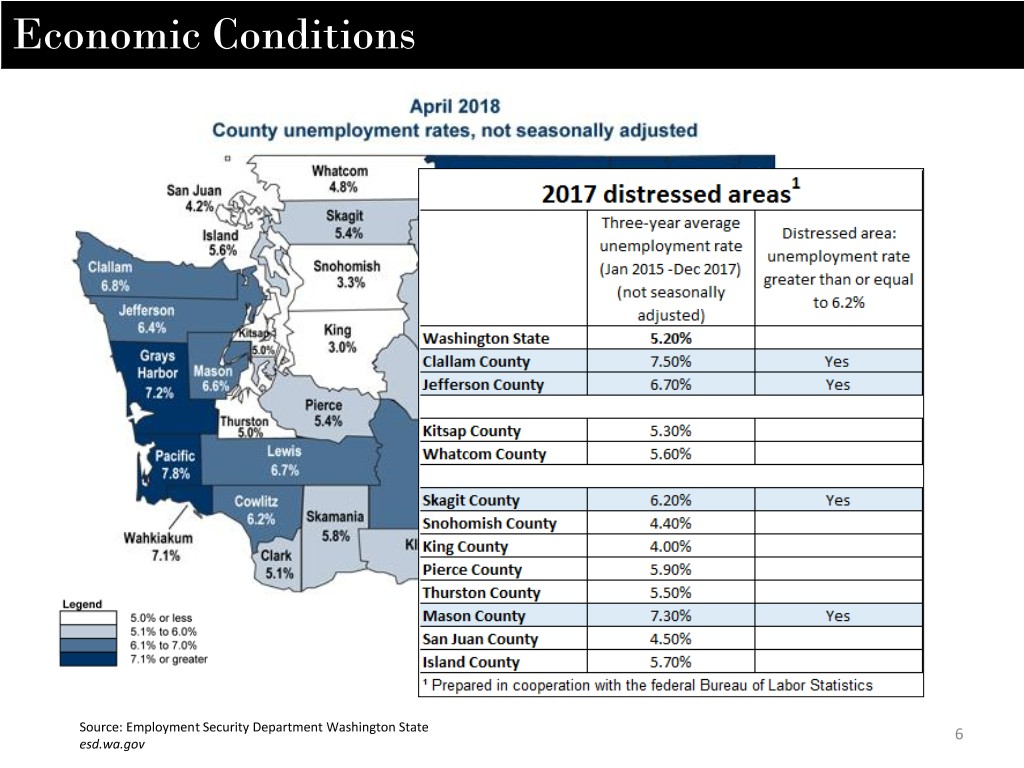

Economic Conditions Source: Employment Security Department Washington State 6 esd.wa.gov

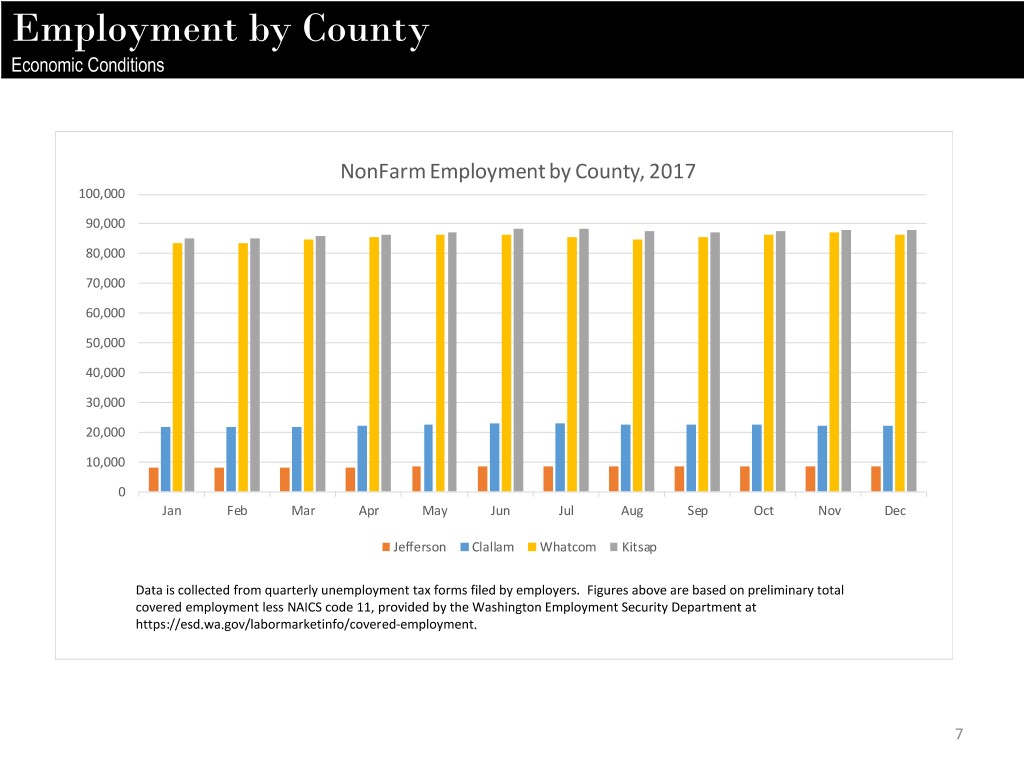

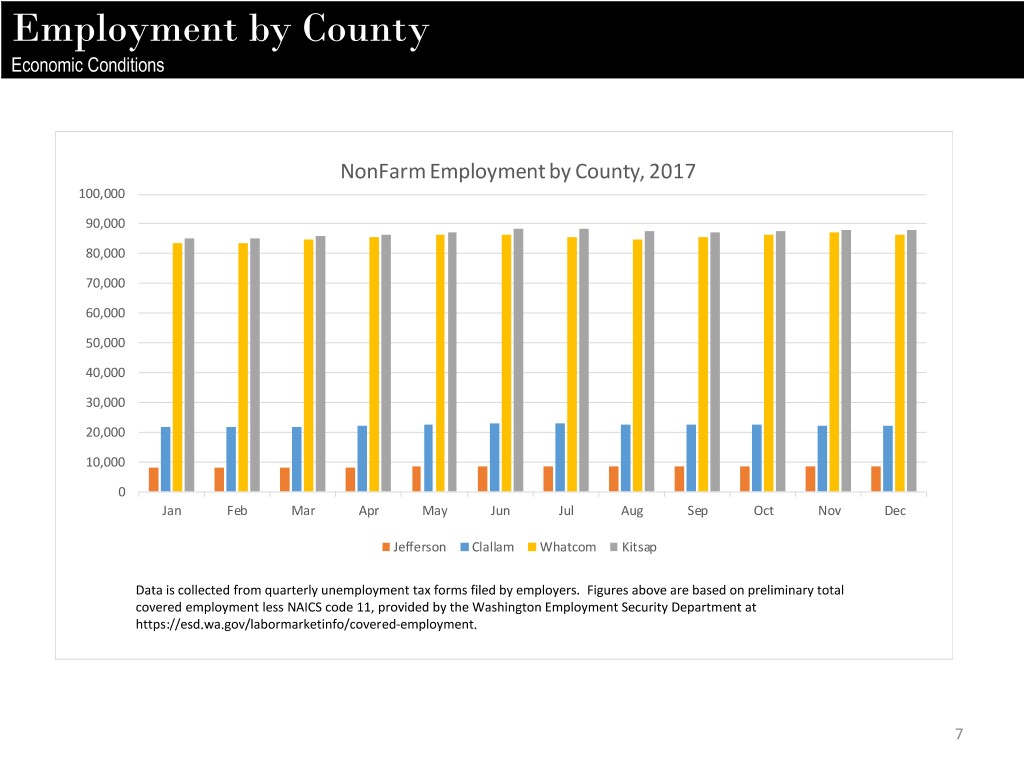

Employment by County Economic Conditions NonFarm Employment by County, 2017 100,000 90,000 80,000 70,000 60,000 50,000 40,000 30,000 20,000 10,000 0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jefferson Clallam Whatcom Kitsap Data is collected from quarterly unemployment tax forms filed by employers. Figures above are based on preliminary total covered employment less NAICS code 11, provided by the Washington Employment Security Department at https://esd.wa.gov/labormarketinfo/covered-employment. 7

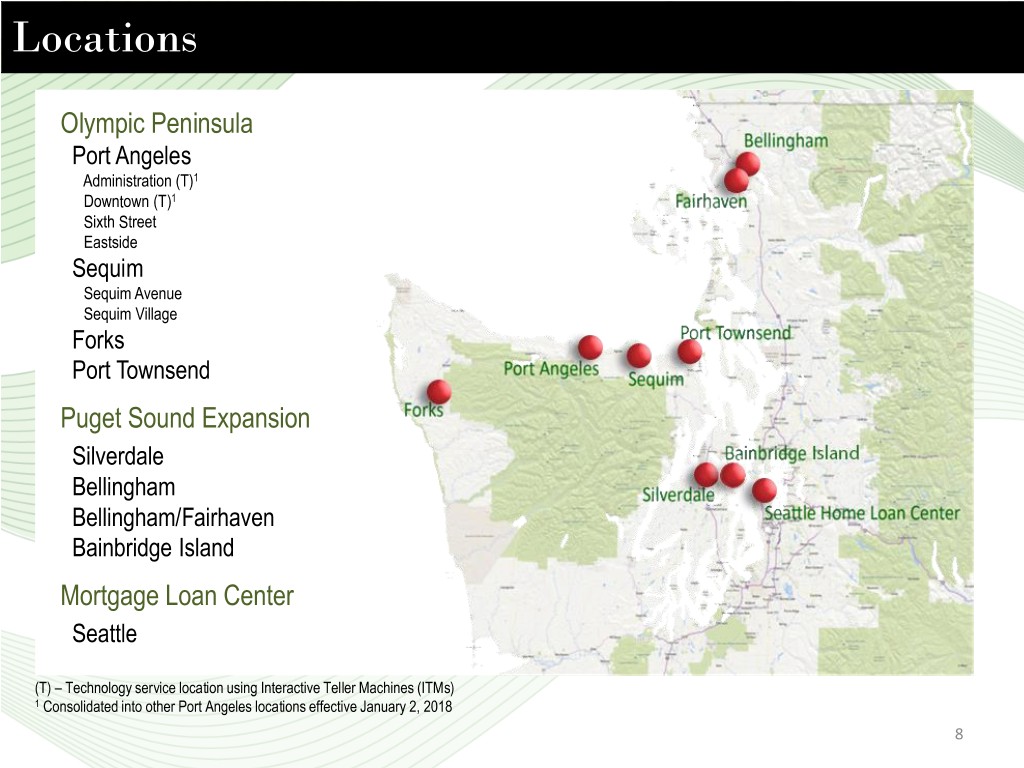

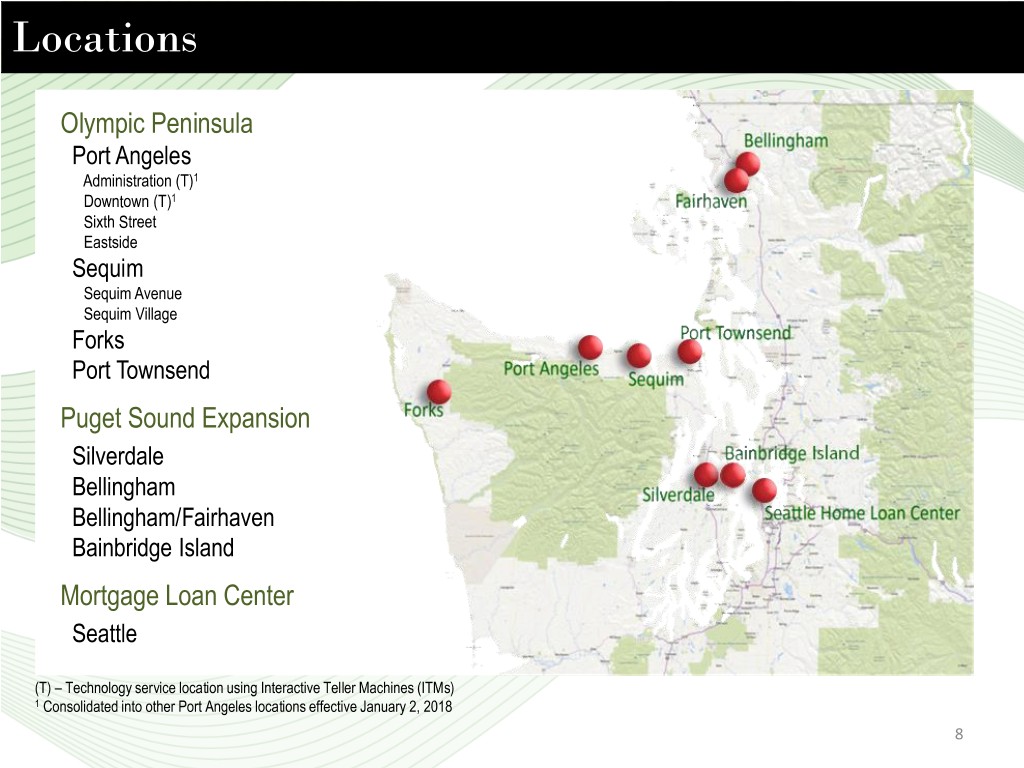

Locations Olympic Peninsula Port Angeles Administration (T)1 P Downtown (T)1 P Sixth Street Eastside Sequim Sequim Avenue Sequim Village Forks Port Townsend Puget Sound Expansion Silverdale Bellingham Bellingham/Fairhaven P Bainbridge Island P Mortgage Loan Center Seattle (T) – Technology service location using Interactive Teller Machines (ITMs) 1 Consolidated into other Port Angeles locations effective January 2, 2018 8

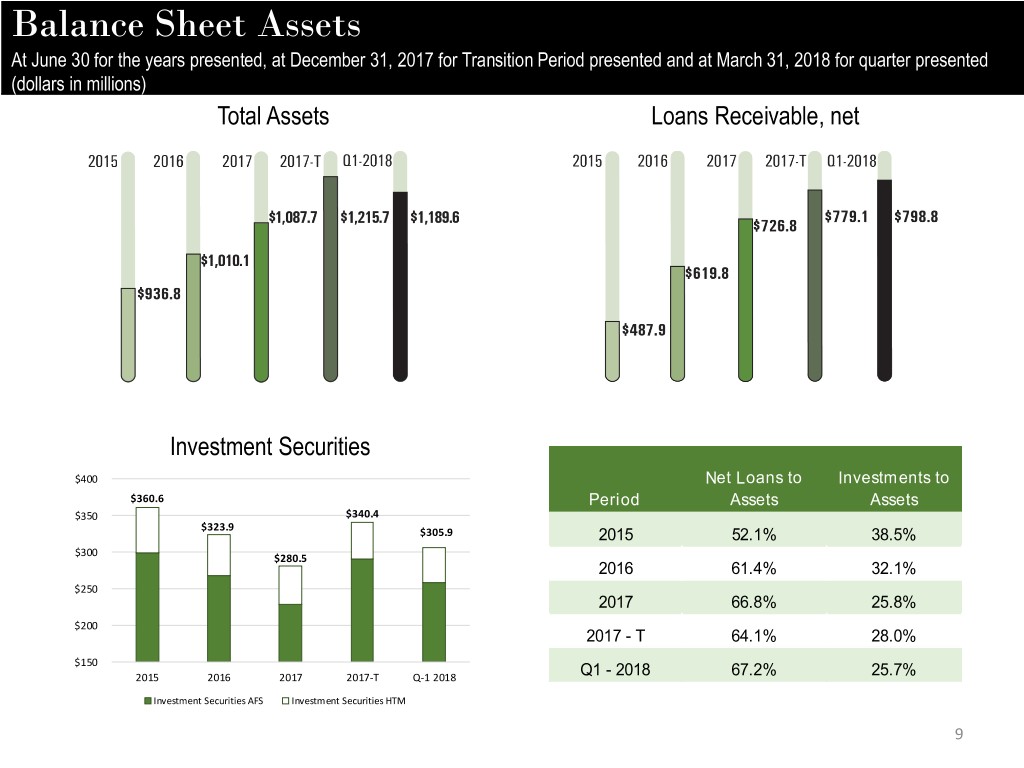

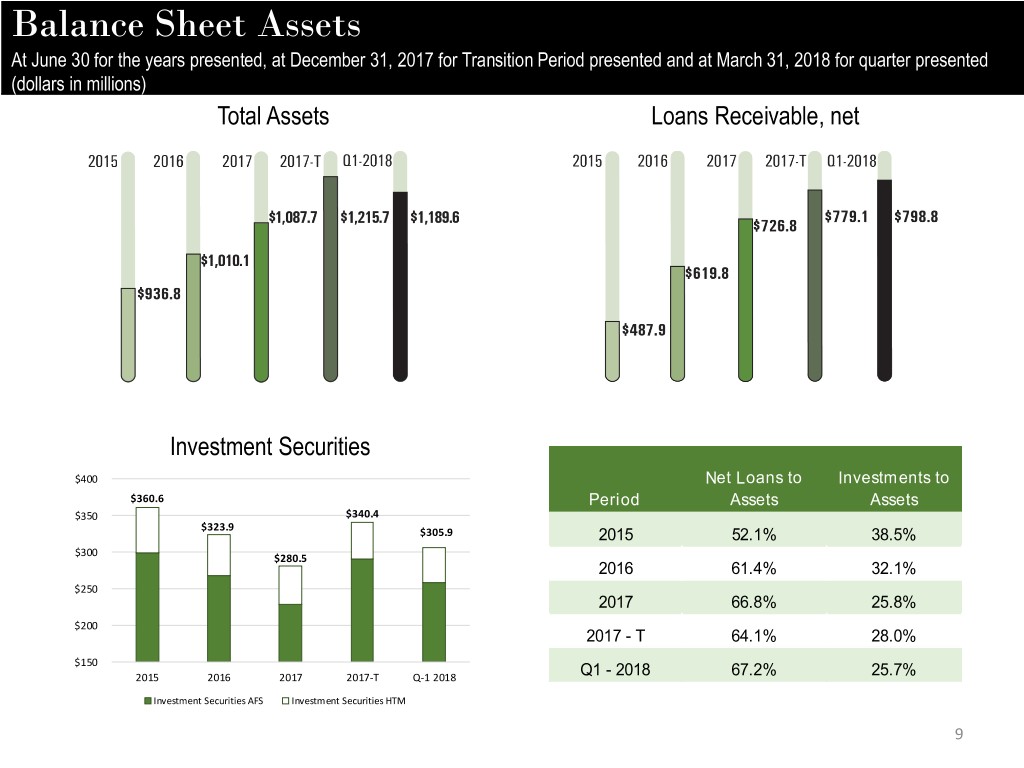

Balance Sheet Assets At June 30 for the years presented, at December 31, 2017 for Transition Period presented and at March 31, 2018 for quarter presented (dollars in millions) Total Assets Loans Receivable, net Investment Securities $400 Net Loans to Investments to $360.6 Period Assets Assets $350 $340.4 $323.9 $305.9 2015 52.1% 38.5% $300 $280.5 2016 61.4% 32.1% $250 2017 66.8% 25.8% $200 2017 - T 64.1% 28.0% $150 2015 2016 2017 2017-T Q-1 2018 Q1 - 2018 67.2% 25.7% Investment Securities AFS Investment Securities HTM 9

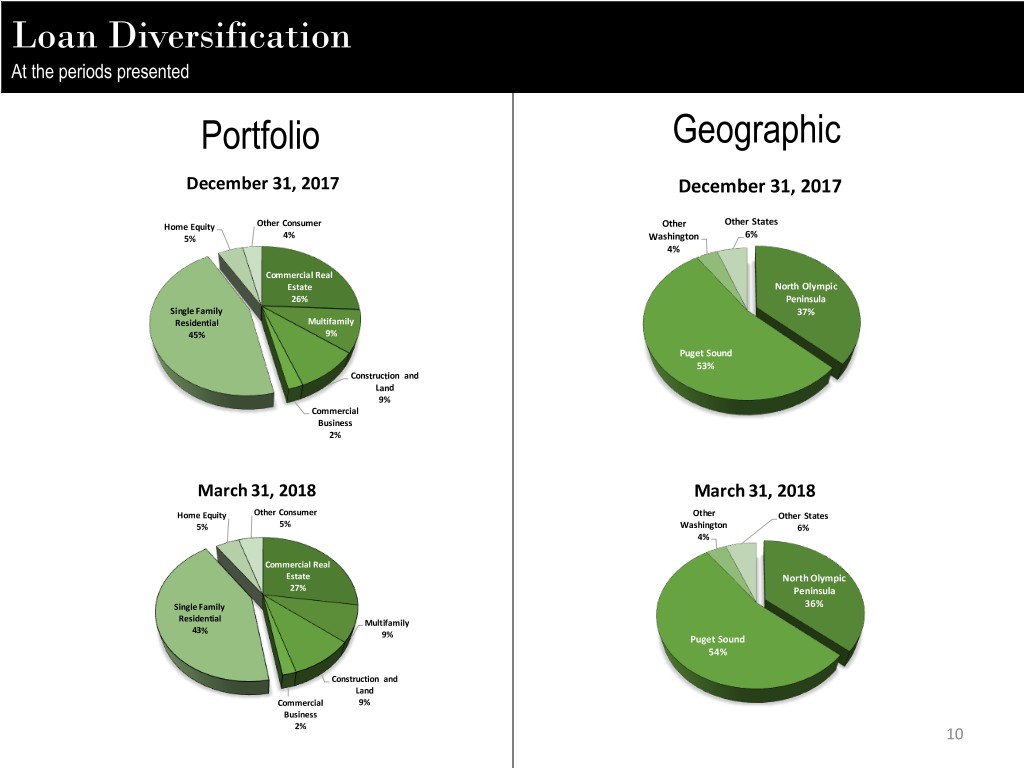

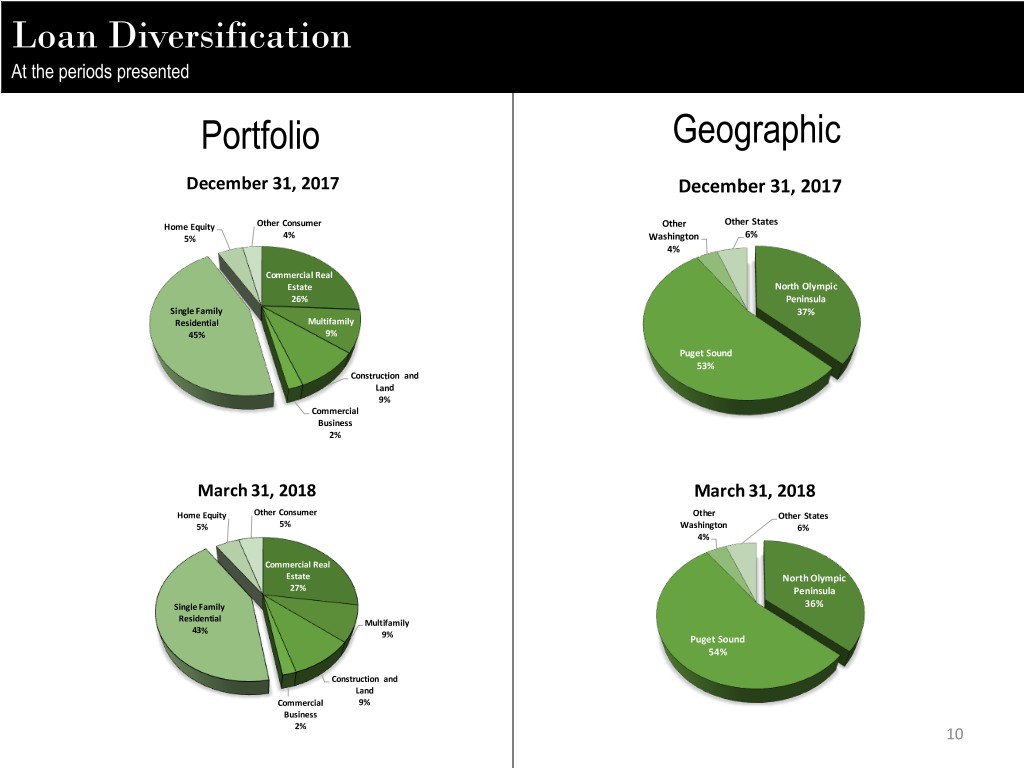

Loan Diversification At the periods presented Portfolio Geographic December 31, 2017 December 31, 2017 Other States Home Equity Other Consumer Other 5% 4% Washington 6% 4% Commercial Real Estate North Olympic 26% Peninsula Single Family 37% Residential Multifamily 45% 9% Puget Sound 53% Construction and Land 9% Commercial Business 2% March 31, 2018 March 31, 2018 Home Equity Other Consumer Other Other States 5% 5% Washington 6% 4% Commercial Real Estate North Olympic 27% Peninsula Single Family 36% Residential Multifamily 43% 9% Puget Sound 54% Construction and Land Commercial 9% Business 2% 10

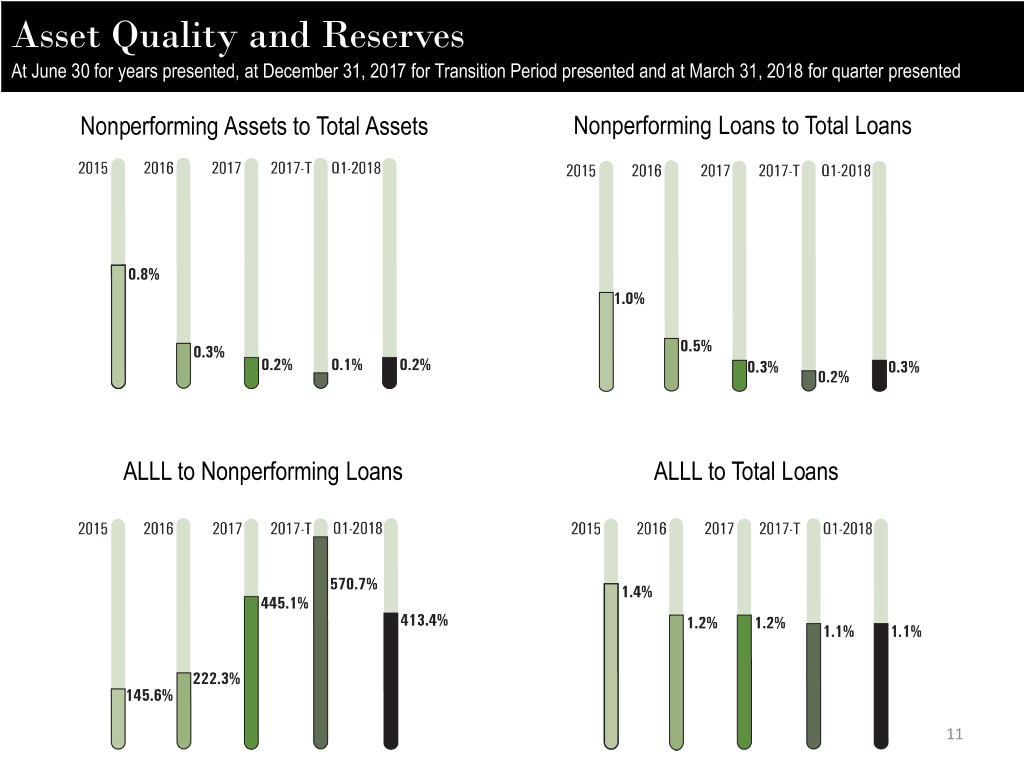

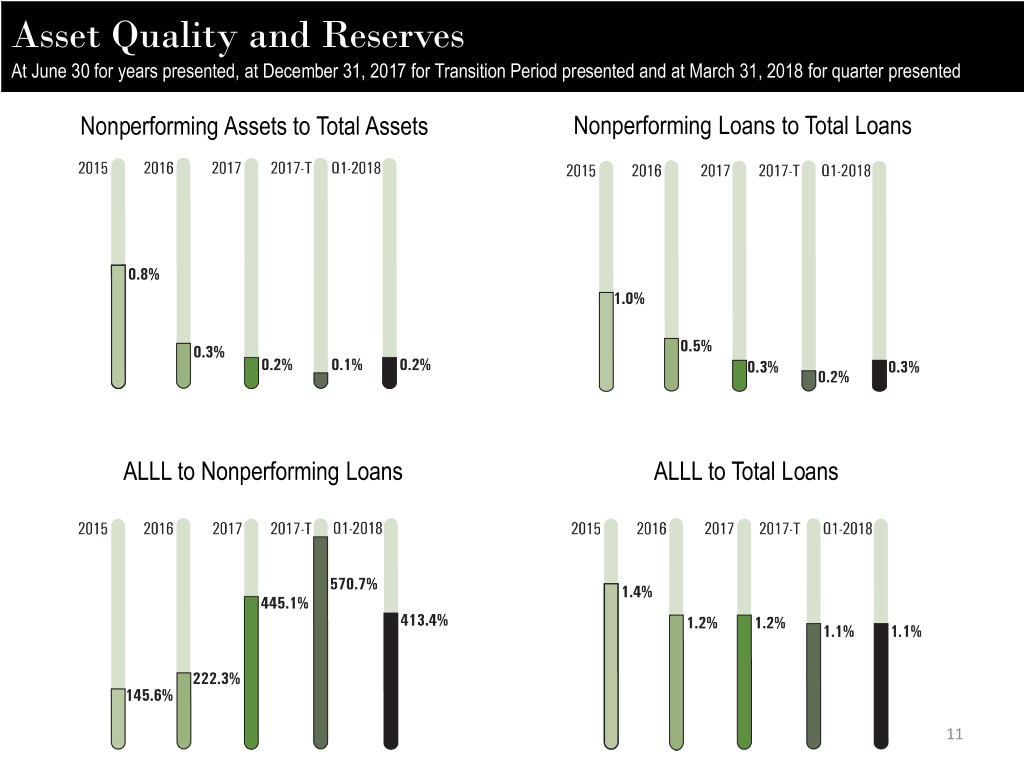

Asset Quality and Reserves At June 30 for years presented, at December 31, 2017 for Transition Period presented and at March 31, 2018 for quarter presented Nonperforming Assets to Total Assets Nonperforming Loans to Total Loans ALLL to Nonperforming Loans ALLL to Total Loans 11

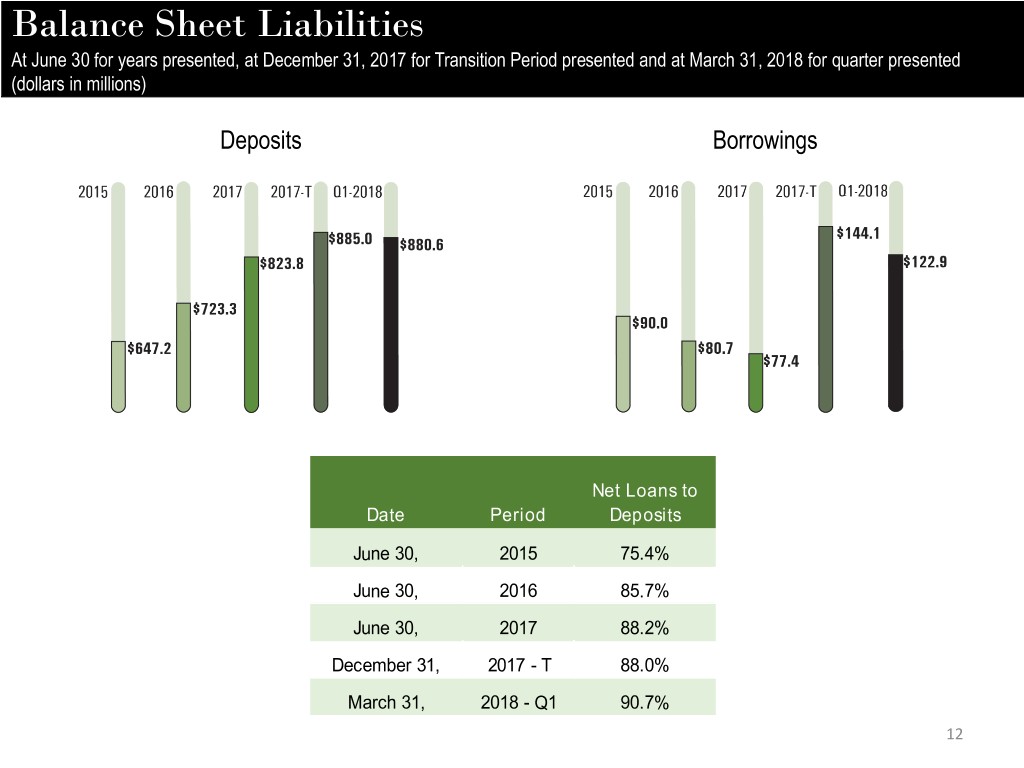

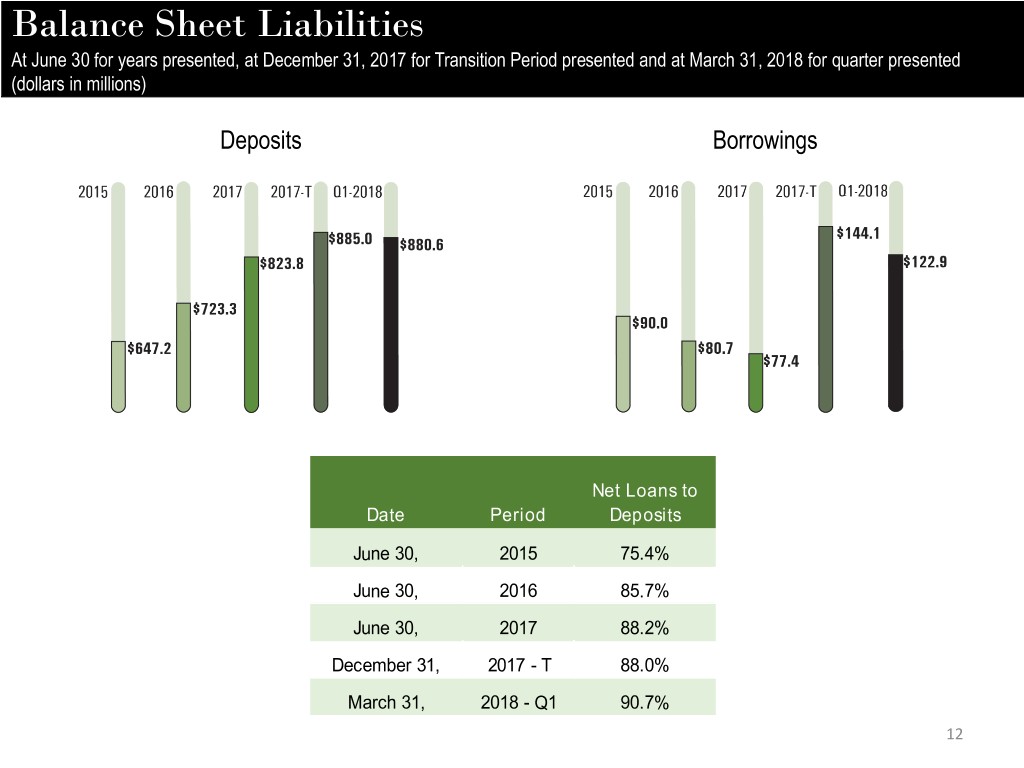

Balance Sheet Liabilities At June 30 for years presented, at December 31, 2017 for Transition Period presented and at March 31, 2018 for quarter presented (dollars in millions) Deposits Borrowings Net Loans to Date Period Deposits June 30, 2015 75.4% June 30, 2016 85.7% June 30, 2017 88.2% December 31, 2017 - T 88.0% March 31, 2018 - Q1 90.7% 12

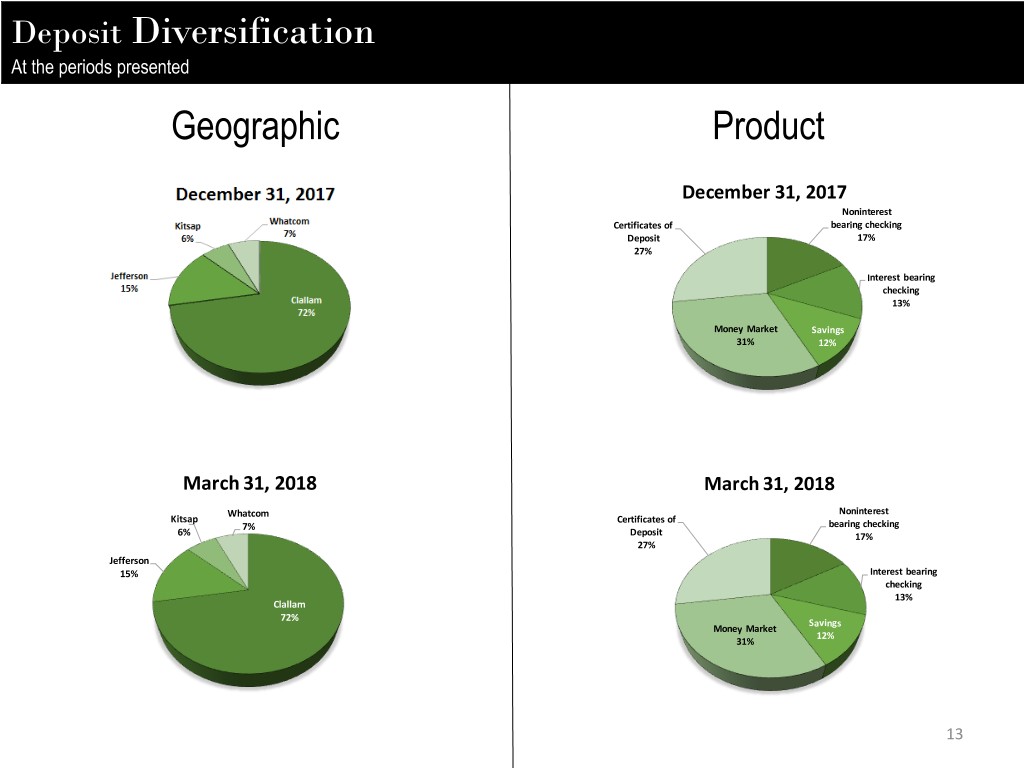

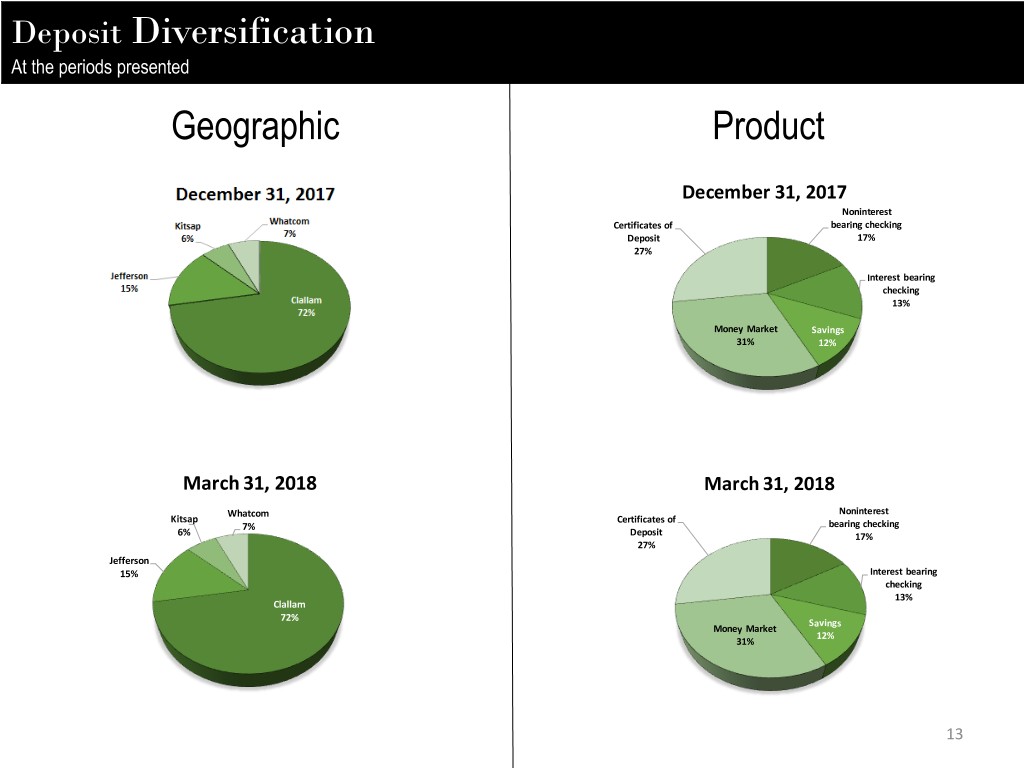

Deposit Diversification At the periods presented Geographic Product December 31, 2017 Noninterest Certificates of bearing checking Deposit 17% 27% Interest bearing checking 13% Money Market Savings 31% 12% March 31, 2018 March 31, 2018 Whatcom Noninterest Kitsap Certificates of 7% bearing checking 6% Deposit 17% 27% Jefferson 15% Interest bearing checking 13% Clallam 72% Savings Money Market 12% 31% 13

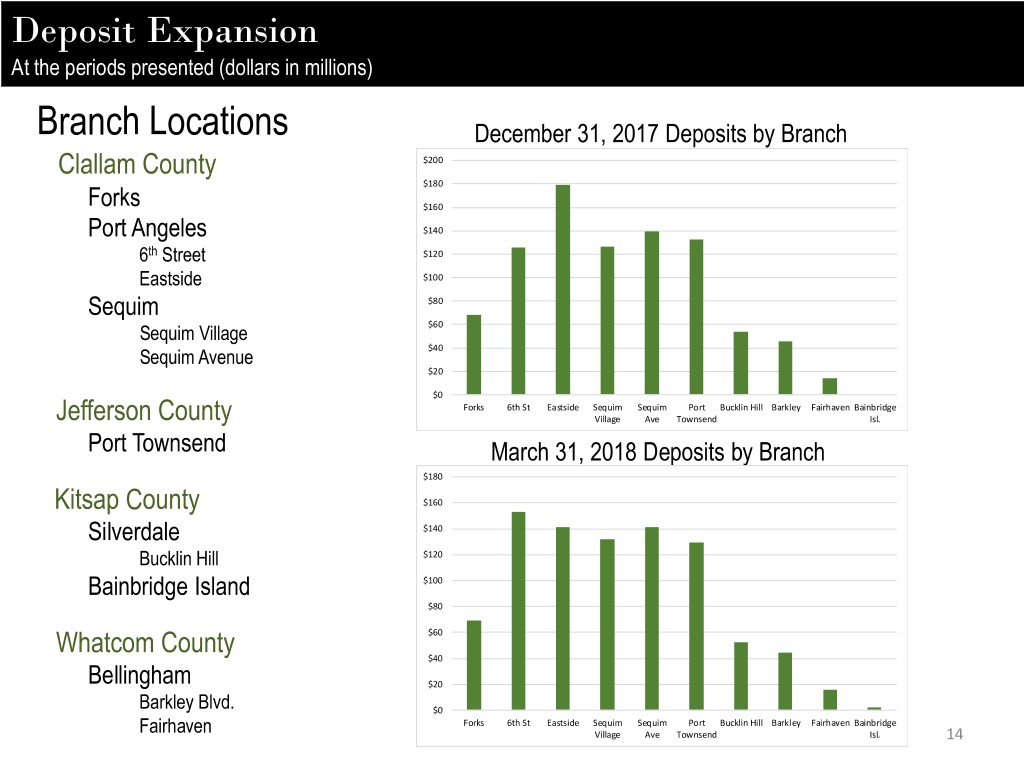

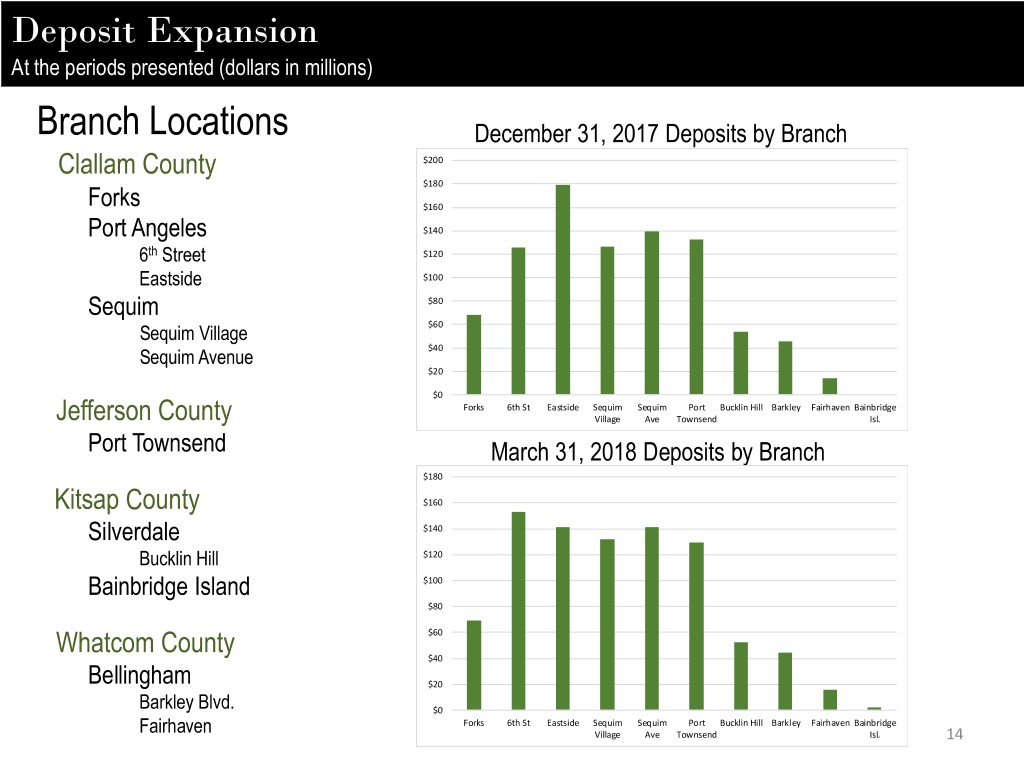

Deposit Expansion At the periods presented (dollars in millions) Branch Locations December 31, 2017 Deposits by Branch Clallam County $200 $180 Forks $160 Port Angeles $140 6th Street $120 Eastside $100 Sequim $80 Sequim Village $60 Sequim Avenue $40 $20 $0 Forks 6th St Eastside Sequim Sequim Port Bucklin Hill Barkley Fairhaven Bainbridge Jefferson County Village Ave Townsend Isl. Port Townsend March 31, 2018 Deposits by Branch $180 Kitsap County $160 Silverdale $140 Bucklin Hill $120 Bainbridge Island $100 $80 Whatcom County $60 $40 Bellingham $20 Barkley Blvd. $0 Fairhaven Forks 6th St Eastside Sequim Sequim Port Bucklin Hill Barkley Fairhaven Bainbridge Village Ave Townsend Isl. 14

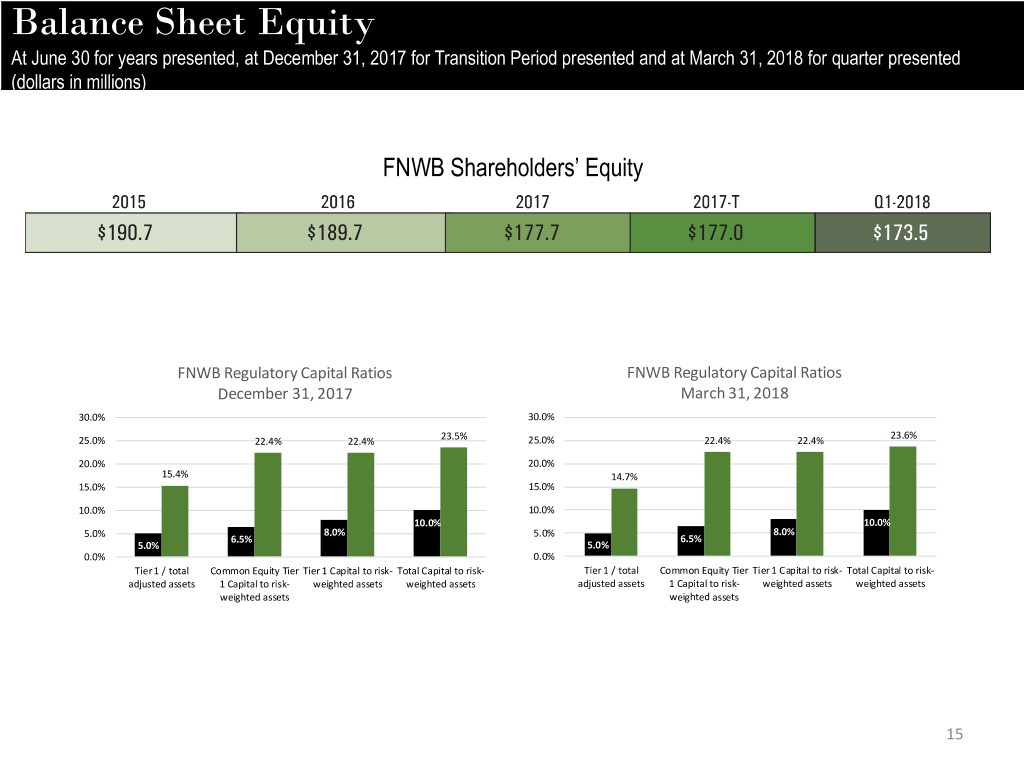

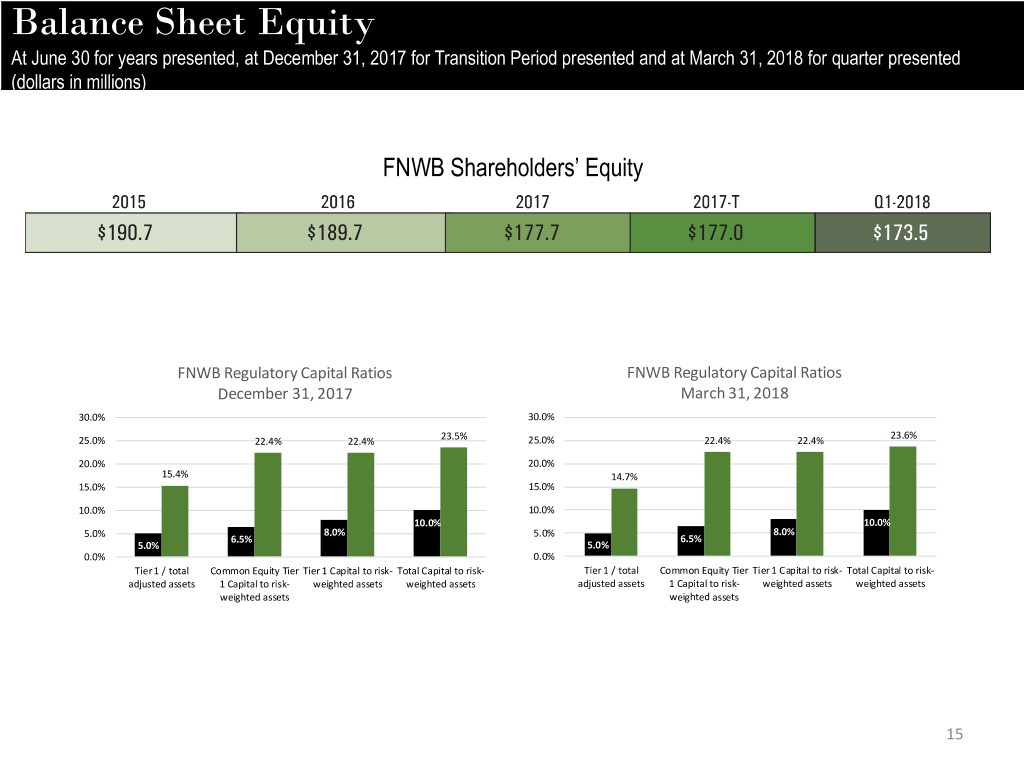

Balance Sheet Equity At June 30 for years presented, at December 31, 2017 for Transition Period presented and at March 31, 2018 for quarter presented (dollars in millions) FNWB Shareholders’ Equity FNWB Regulatory Capital Ratios FNWB Regulatory Capital Ratios December 31, 2017 March 31, 2018 30.0% 30.0% 23.6% 25.0% 22.4% 22.4% 23.5% 25.0% 22.4% 22.4% 20.0% 20.0% 15.4% 14.7% 15.0% 15.0% 10.0% 10.0% 10.0% 10.0% 5.0% 8.0% 5.0% 8.0% 6.5% 6.5% 5.0% 5.0% 0.0% 0.0% Tier 1 / total Common Equity Tier Tier 1 Capital to risk- Total Capital to risk- Tier 1 / total Common Equity Tier Tier 1 Capital to risk- Total Capital to risk- adjusted assets 1 Capital to risk- weighted assets weighted assets adjusted assets 1 Capital to risk- weighted assets weighted assets weighted assets weighted assets 15

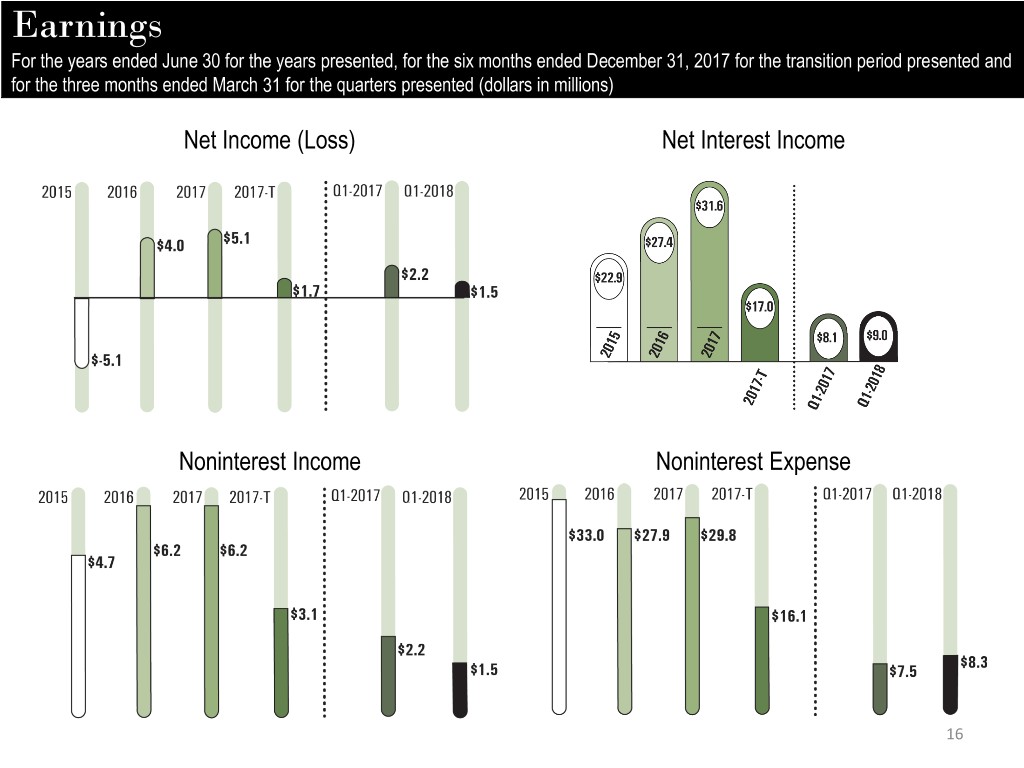

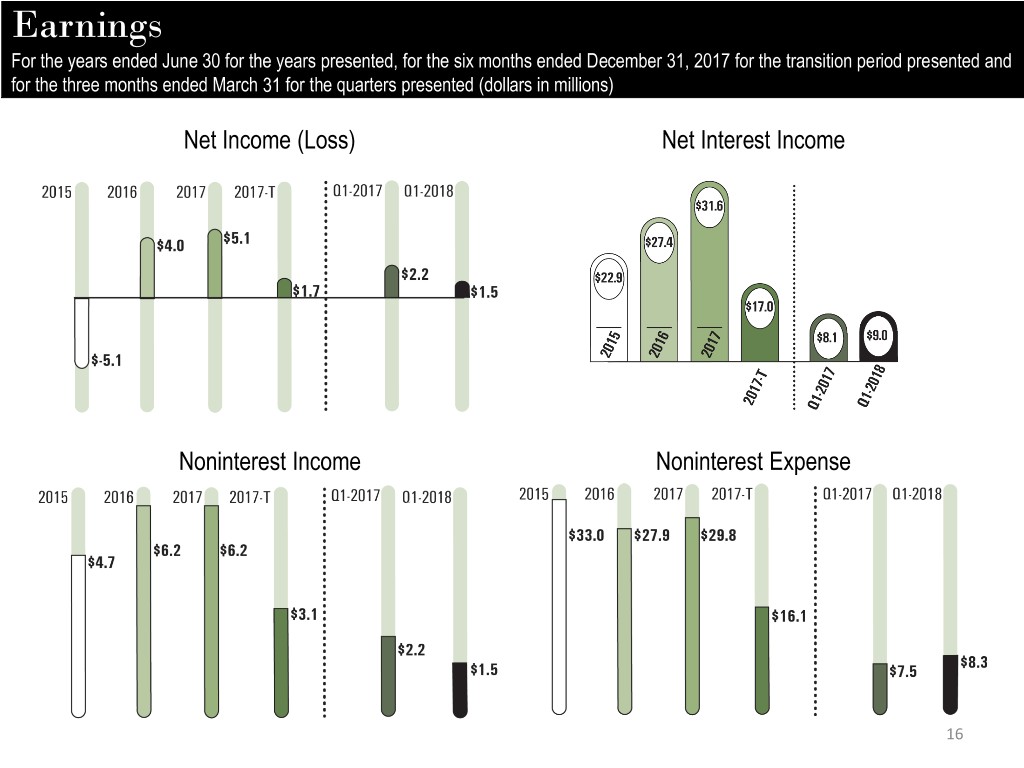

Earnings For the years ended June 30 for the years presented, for the six months ended December 31, 2017 for the transition period presented and for the three months ended March 31 for the quarters presented (dollars in millions) Net Income (Loss) Net Interest Income Noninterest Income Noninterest Expense 16

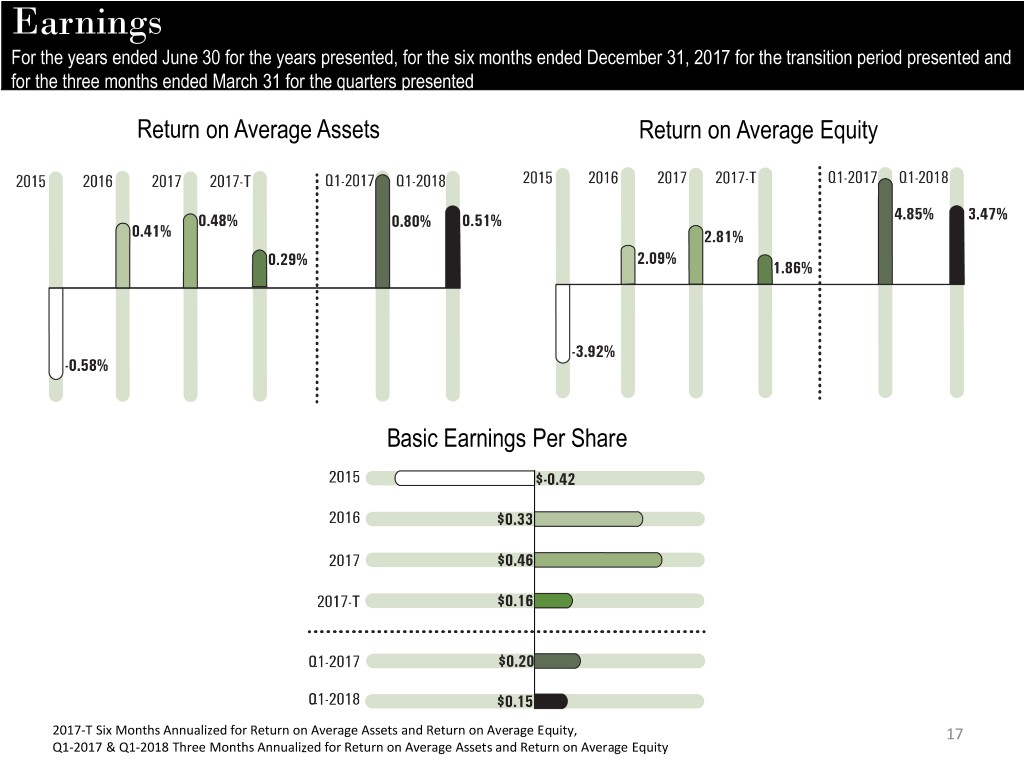

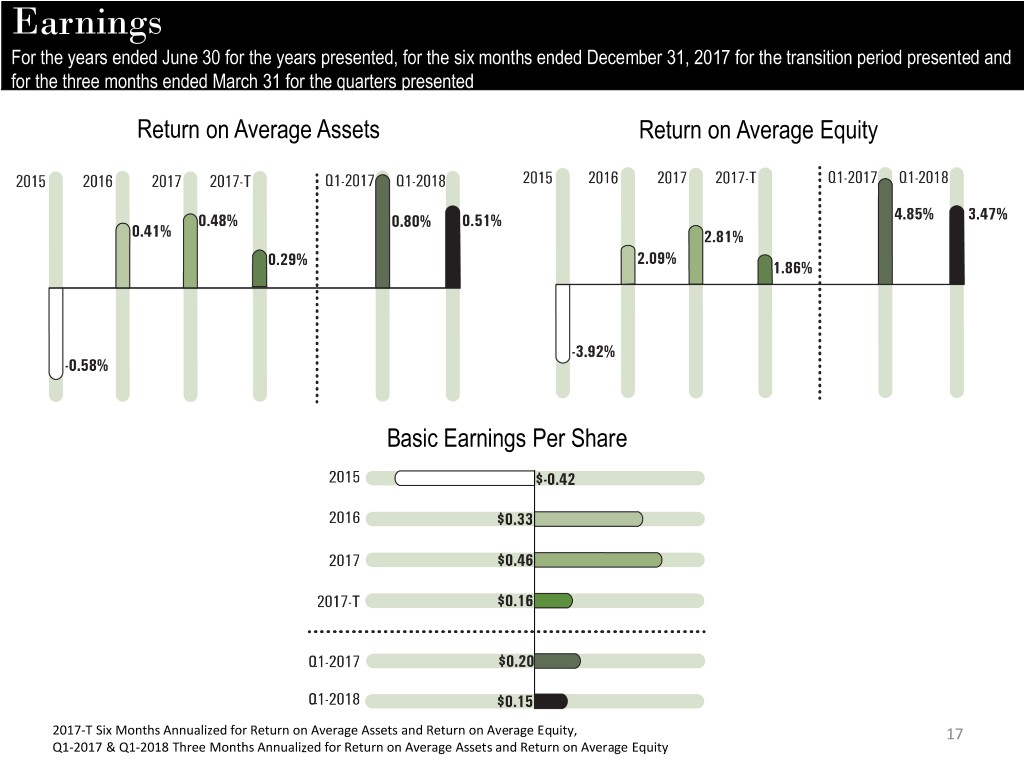

Earnings For the years ended June 30 for the years presented, for the six months ended December 31, 2017 for the transition period presented and for the three months ended March 31 for the quarters presented Return on Average Assets Return on Average Equity Basic Earnings Per Share 2017-T Six Months Annualized for Return on Average Assets and Return on Average Equity, 17 Q1-2017 & Q1-2018 Three Months Annualized for Return on Average Assets and Return on Average Equity

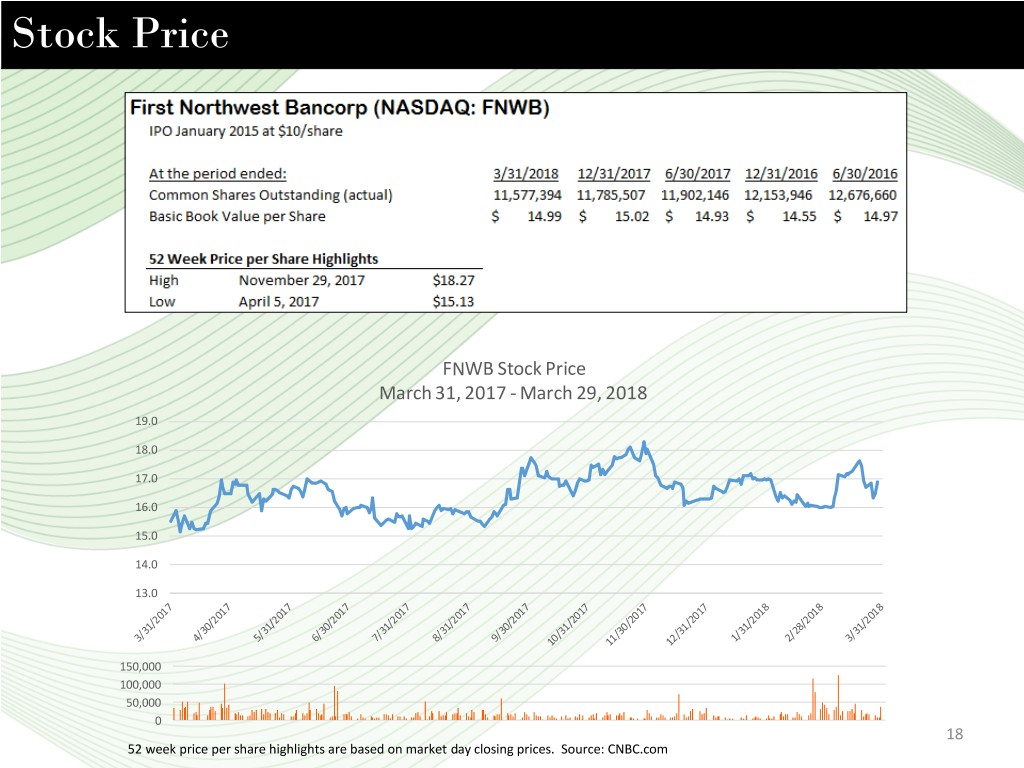

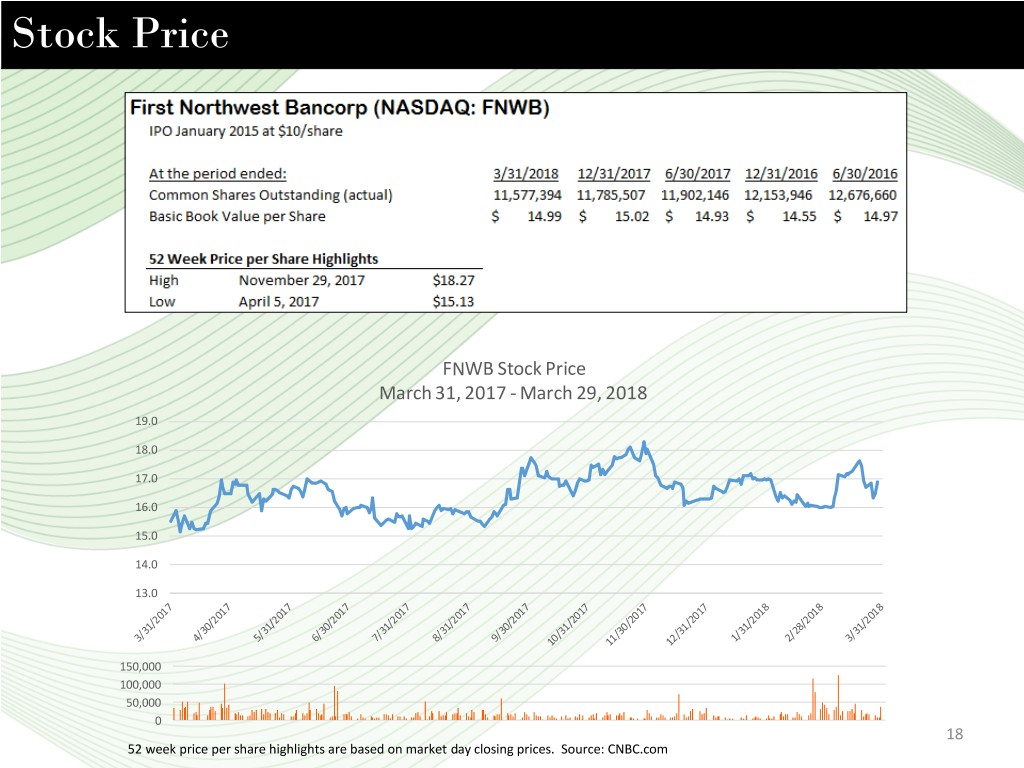

Stock Price FNWB Stock Price March 31, 2017 - March 29, 2018 19.0 18.0 17.0 16.0 15.0 14.0 13.0 150,000 100,000 50,000 0 18 52 week price per share highlights are based on market day closing prices. Source: CNBC.com

Thank You 19