- THRY Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Thryv (THRY) DEF 14ADefinitive proxy

Filed: 17 Apr 15, 12:00am

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| DEX MEDIA, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

![]()

April 17, 2015

Dear Stockholders:

I am pleased to invite you to attend the 2015 Annual Meeting of Stockholders ("Annual Meeting") of Dex Media, Inc. (the "Company" or "Dex Media"), which will be held at our D/FW headquarters, located at 2200 West Airfield Drive, P.O. Box 619810, D/FW Airport, Texas 75261, on Thursday, May 28, 2015, at 9 a.m. local time. The attached Notice of Annual Meeting of Stockholders and proxy statement will guide you through the items of business to be conducted at the Annual Meeting and provide details regarding the Annual Meeting.

During 2014, we made progress on many fronts—integrating corporate functions from our legacy companies, continuing to pay down our debt, expanding our telephone sales channel and adding more bundled, multi-platform marketing solutions to our product suite.

When I joined the Company in the fourth quarter as CEO, my mandate from the Board of Directors was clear—to accelerate the Company's transformation from a legacy print directory business into a full service digital media company. To achieve that mandate, I appointed a new executive team that is a mix of proven talent from the Company and from the industry.

Last December, we announced a number of transformative initiatives designed to reorganize the Company, achieve significant cost reductions and improve operational productivity. We also announced a number of revenue enhancement measures that will improve and upgrade our existing products, enhance the sales call and provide a more satisfying client experience. All of those efforts are now underway.

We are excited to see the many planned changes and enhancements come to life. With fiscal year 2014 behind us, we are now fully focused on reshaping the business and creating a sustainable future.

As we evolve our business, our processes and our product mix, our Board, executives and employees remain committed to strong corporate governance as the foundation for financial integrity and shareholder confidence. We value the ongoing input we receive from investors and other stakeholders.

Whether or not you plan to attend the Annual Meeting in person, we encourage you to vote promptly using the directions outlined in this proxy statement.

On behalf of the Board of Directors and the executive team, I would like to express our appreciation for your interest in Dex Media.

Sincerely,

Joseph A. Walsh

Chief Executive Officer

![]()

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on May 28, 2015

Dear Stockholders:

We are pleased to invite you to attend the 2015 Annual Meeting (the "Annual Meeting") of Stockholders of Dex Media, Inc. (the "Company," "Dex Media," "we," "us" or "our") to be held on Thursday, May 28, 2015, at 9:00 a.m., local time, at our headquarters at 2200 West Airfield Drive, P.O. Box 619810, D/FW Airport, Texas 75261. The meeting will be held for the following purposes:

Information concerning the matters to be voted upon at the Annual Meeting is set forth in the accompanying proxy statement. Holders of record of the Company's common stock as of the close of business on April 6, 2015 are entitled to notice of, and to vote at, the Annual Meeting. A list of such stockholders will be available at the Annual Meeting, and during the ten days prior to the Annual Meeting, at our headquarters located at the address above.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on May 28, 2015. We are furnishing proxy materials to our stockholders primarily over the Internet, instead of mailing printed copies of those materials to each stockholder. By doing so we provide you with the information you need while lowering the costs of delivery and reducing the environmental impact of our Annual Meeting. On or about April 17, 2015, we mailed a Notice of Internet Availability of Proxy Materials to our stockholders containing instructions on how to access the proxy statement and vote online, and made proxy materials available to our stockholders over the Internet. Instructions for requesting paper or e-mail copies of the proxy materials are contained in the Notice of Internet Availability of Proxy Materials.

Your vote is important. You are cordially invited to attend the Annual Meeting in person. Whether or not you plan to attend the Annual Meeting, we hope you will vote as promptly as possible.

| By Order of the Board of Directors, | ||

| Raymond R. Ferrell Executive Vice President, General Counsel and Corporate Secretary |

D/FW Airport, Texas

April 17, 2015

Your vote is important. Whether or not you plan to attend the Annual Meeting in person, we encourage you to read this proxy statement and vote promptly over the Internet, by telephone or, if you requested to receive printed proxy materials, by completing and mailing a proxy card or voting instruction form, so that your shares will be represented at the Annual Meeting. Please review the instructions on each of your voting options described in this proxy statement, as well as in the Notice of Internet Availability of Proxy Materials you received in the mail.

General Information about the Annual Meeting and Voting | 1 | |||

Proxy Summary | 2 | |||

Questions and Answers about the Annual Meeting and Voting | 7 | |||

Corporate Governance | 11 | |||

Board Composition, Responsibilities and Leadership Structure | 11 | |||

Director Independence | 11 | |||

Board Committees | 12 | |||

Corporate Governance Principles | 13 | |||

Risk Oversight | 13 | |||

Communications with the Board | 14 | |||

Code of Conduct | 14 | |||

Related Person Transactions | 14 | |||

Election of Directors (Item No. 1) | 16 | |||

Executive and Director Compensation | 20 | |||

Compensation Discussion and Analysis | 20 | |||

Section 1—Business Summary and Highlights | 20 | |||

Section 2—Chief Executive Officer Pay and Transition | 21 | |||

Section 3—Our Compensation Decision Making Process | 22 | |||

Section 4—Compensation Philosophy, Objectives and Programs | 24 | |||

Section 5—Executive Employment and Consulting Agreements | 33 | |||

Section 6—Other Compensation Related Items | 35 | |||

Compensation and Benefits Committee Report | 38 | |||

Executive Compensation Tables | 39 | |||

Summary Compensation Table | 39 | |||

Grants of Plan-Based Awards Table—Fiscal 2014 | 41 | |||

Additional Information Relating to Summary Compensation Table and Grants of Plan-Based Awards Table | 41 | |||

Outstanding Equity Awards at Fiscal Year-End—Fiscal 2014 | 43 | |||

Option Exercises and Stock Vested—Fiscal 2014 | 44 | |||

Pension Benefits—Fiscal 2014 | 44 | |||

Potential Payments Upon Termination or Change in Control | 45 | |||

Compensation and Benefits Committee Interlocks and Insider Participation | 51 | |||

Director Compensation | 51 | |||

Advisory Vote Approving the Company's Executive Compensation (Item No. 2) | 54 | |||

Stock Ownership Information | 55 | |||

Stock Ownership of Certain Beneficial Owners and Management | 55 | |||

Section 16(a) Beneficial Ownership Reporting Compliance | 56 | |||

Audit and Finance Committee | 57 | |||

Audit and Finance Committee Report | 57 | |||

Principal Accountant Fees and Services | 57 | |||

Ratification of Appointment of Independent Registered Public Accounting Firm for 2015(Item No. 3) | 59 | |||

Householding of Materials | 60 | |||

Other Information | 60 | |||

How to Raise a Matter at a Meeting or Nominate Members of the Board of Directors | 60 |

DEX MEDIA, INC.

P.O. Box 619810

2200 West Airfield Drive

D/FW Airport, Texas 75261

PROXY STATEMENT

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

This proxy statement provides information in connection with the solicitation of proxies by the Board of Directors (the "Board") of Dex Media, Inc. (the "Company," "Dex Media," "we," "us" or "our") for use at the Company's 2015 Annual Meeting of Stockholders or any postponement or adjournment thereof (the "Annual Meeting").

Holders of record of the Company's common stock as of the close of business on April 6, 2015, are entitled to vote at the Annual Meeting. Each holder of record as of April 6, 2015, is entitled to one vote for each share of common stock held. On April 6, 2015, there were 17,621,932 shares of common stock outstanding.

Pursuant to "notice and access" rules adopted by the Securities and Exchange Commission ("SEC"), the Company has elected to provide access to its proxy materials over the Internet. Accordingly, on or about April 17, 2015, materials for the Annual Meeting, including this proxy statement and the Company's 2014 Annual Report, are being made available to all stockholders entitled to vote at the Annual Meeting. We also mailed a Notice of Internet Availability of Proxy Materials (the "Notice") on or about April 17, 2015, to all stockholders entitled to vote at the Annual Meeting. This Notice includes (i) instructions on how to access our proxy materials electronically, (ii) the date, time and location of the Annual Meeting, (iii) a description of the matters intended to be acted upon at the Annual Meeting, (iv) a list of the materials being made available electronically, (v) instructions on how a stockholder can request to receive paper or e-mail copies of the proxy materials, (vi) any control/identification numbers that a stockholder needs to access the proxy, and (vii) information about attending the Annual Meeting and voting in person. We encourage our stockholders to take advantage of the availability of the proxy materials over the Internet to help lower the costs of delivery and reduce the environmental impact of our Annual Meeting.

No business can be conducted at the Annual Meeting unless a majority of all shares entitled to vote are either present in person or represented by proxy at the Annual Meeting. As far as we know, the only matters to be brought before the Annual Meeting are those referred to in this proxy statement. If any additional matters are presented at the Annual Meeting, the persons named as proxies may vote your shares in their discretion.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible. You may vote over the Internet, as well as by telephone, or, if you requested to receive printed proxy materials, by completing and mailing a proxy card or voting instruction form, so that your shares will be represented at the Annual Meeting. Please review the instructions on each of your voting options described in this proxy statement, as well as in the Notice you received in the mail.

Also, please let us know if you plan to attend the Annual Meeting by marking the appropriate box on the enclosed proxy card, if you requested to receive printed proxy materials, or, if you vote by telephone or over the Internet, by indicating your plans when prompted.

1

This summary includes highlights of our proxy materials for your reference. This summary does not include all of the information that you should consider, so please read our entire proxy statement before you vote.

2015 ANNUAL MEETING OF STOCKHOLDERS

Date: May 28, 2015

Time: 9:00 a.m., local time

Place: 2200 West Airfield Drive, P.O. Box 619810, D/FW Airport, Texas 75261

Record Date: Stockholders of record as of the close of business on April 6, 2015 are entitled to attend, and to vote at, the Annual Meeting.

Admission Requirements: You must provide proof of your ownership of our common stock and a form of personal identification for admission to the Annual Meeting. For more information about attendance and voting please see the "Questions and Answers About the Annual Meeting and Voting" beginning on page 7.

VOTING MATTERS AND BOARD RECOMMENDATIONS

The following table summarizes the proposals that will be considered at our Annual Meeting and also provides our Board of Directors' recommendations with respect to each proposal.

Proposals | Board Vote Recommendation | Page Reference (for full details) | ||||||

|---|---|---|---|---|---|---|---|---|

| Item 1 | Election of eight directors | FOR each nominee | 16 | |||||

Item 2 | Advisory vote to approve the Company's executive compensation | FOR | 54 | |||||

Item 3 | Ratification of the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm | FOR | 59 | |||||

Your vote is important. Whether or not you plan to attend the Annual Meeting in person, please promptly vote over the Internet, by telephone, or, if you requested to receive printed proxy materials, by completing and mailing a proxy card or voting instruction form, so that your shares will be represented at the Annual Meeting.

We believe that adherence to sound corporate governance principles and practices makes Dex Media a better business partner for our clients and also serves the best interests of our stockholders. Through its independent Corporate Governance Committee, our Board members play an active role in establishing our Corporate Governance Guidelines. The Board of Directors monitors developments in governance best practices to assure that it continues to meet its commitment to thoughtful and

2

independent representation of stockholder interests. The following table summarizes certain of our corporate governance practices and facts:

| ü | Seven out of eight director nominees are independent | ü | Executive sessions of independent directors held at each regularly scheduled Board meeting | |||

| ü | Annual election of all directors | ü | Stock ownership guidelines for directors and executive officers | |||

| ü | Independent Chairman of the Board | ü | Annual advisory vote on executive compensation | |||

| ü | Separate positions for Chairman and CEO | ü | Annual CEO performance review conducted by non-management directors | |||

| ü | Annual board and committee self-evaluations | ü | Engagement of independent advisors (reporting to the Board) to evaluate executive compensation practices |

The following table provides summary information about our directors who have been nominated to serve on our Board until the 2016 Annual Meeting of Stockholders. Please see "Election of Directors" beginning on page 16 for more information about the nominees.

Name | Dex Media Director Since: | Board Service with a Dex Media Predecessor:(1) | Position or Committee Memberships | Independent? | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

Jonathan B. Bulkeley | 2013 | 2010 | • Compensation and Benefits | Yes | ||||||

| • Corporate Governance | ||||||||||

Thomas D. Gardner | 2013 | 2009 | • Audit and Finance | Yes | ||||||

| • Compensation and Benefits (Chair) | ||||||||||

W. Kirk Liddell | 2013 | 2010 | • Audit and Finance (Chair) | Yes | ||||||

Thomas S. Rogers | 2013 | 2006 | • Compensation and Benefits | Yes | ||||||

Alan F. Schultz | 2013 | 2005 | • Chairman of the Board | Yes | ||||||

John Slater | 2013 | 2010 | • Audit and Finance | Yes | ||||||

| • Corporate Governance | ||||||||||

Joseph A. Walsh | 2014 | N/A | • President and CEO | No | ||||||

Douglas D. Wheat | 2013 | 2010 | • Corporate Governance (Chair) | Yes | ||||||

Our mission is to be the trusted marketing partner for small and medium-sized businesses. 2014 was the first full year of operation for our combined company following the merger of Dex One Corporation and SuperMedia Inc. in April 2013, and we made progress on many fronts. Our accomplishments in 2014 included:

3

CHANGES TO OUR EXECUTIVE MANAGEMENT TEAM

We appointed new executive leadership in 2014 and early 2015, beginning with our President and Chief Executive Officer ("CEO"), Joseph A. Walsh. As you will see in the table below, our leadership team brings a wealth of experience to Dex Media, from within our company as well as our industry. That experience will be critical to transforming the traditional print-based directory business to a digital and multi-product marketing service business.

The following table sets forth our current executive leadership team, along with some highlights of their past employment for your reference. For more narrative and a complete look at their biographies and work history, please see Item 1. "Business—Executive Officers of the Registrant" in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, filed with the SEC on March 16, 2015.

4

Name | Position | Joined Dex Media | Highlights: Prior Business Experience | ||||

|---|---|---|---|---|---|---|---|

Joseph A. Walsh | President and CEO | 2014 | • President and CEO, Board Member of Yellowbook Inc. • Co-founded IYP Publishing • Chairman of the Local Search Association | ||||

Del Humenik | EVP—Chief Revenue Officer | 2010 | • Chief Operating Officer, Dex Media • EVP, Sales and Marketing, Dex Media • EVP, Sales, SuperMedia Inc. • SVP, Sales and Marketing, Paychex Inc. • SVP and GM, RHDC | ||||

Paul D. Rouse | EVP—Chief Financial Officer and Treasurer | 2014 | • CFO, Apple and Eve, LLC • VP of Finance and Treasurer, Yellowbook Inc. • Public accounting, Ernst and Young LLP • Internal audit, JPMorgan | ||||

Gordon Henry | EVP—Chief Marketing Officer | 2014 | • Vice President and General Manager, Deluxe Corp. • Chief Marketing Officer, Yellowbook Inc. | ||||

Carleton G. Shaw | EVP—Chief Information Officer | 2014 | • Principal, Houstonian Partners, LLC • Global Chief Information Officer, Hibu plc • Chief Information Officer, Yellowbook • EVP Operations, Yellowbook | ||||

John F. Wholey | EVP—Operations and Client Services | 2015 | • Head of United States Operations, Hibu plc • Vice President, Operations, Hibu plc | ||||

Raymond R. Ferrell | EVP—General Counsel and Corporate Secretary | 2009 | • Vice President and Associate General Counsel, Commercial Operations, SuperMedia • Senior Counsel and Vice President, General Counsel's Office, American Express | ||||

Debra M. Ryan | EVP—Chief Human Resources Officer | 2012 | • EVP, Human Resources and Employee Administration, SuperMedia Inc. • VP, Franchise Development, Dex One • VP, Human Resources, RHDC | ||||

Michael N. Dunn | EVP—Chief Technology Officer | 2010 | • Vice President and CIO, SuperMedia • SVP, Information Technology and Business Process Management, Level 3 Communications | ||||

Mark Cairns | EVP—Integration and Client Experience | 2014 | • Principal, Treales, LLC • Head of Operations for the United States and United Kingdom, Hibu plc • Chief Publishing Officer, Yellow Book Inc. • Yell Group | ||||

EXECUTIVE COMPENSATION AND PAY-FOR-PERFORMANCE

Our push for business transformation creates an opportunity to align our compensation programs with longer-term goals for the Company. Starting with the hire of our current President and CEO, Joseph A. Walsh, in October 2014, the Compensation and Benefits Committee began working with management to craft a new executive compensation philosophy and a new approach to pay. The new philosophy allocates more of an executive's pay opportunity to performance-based annual and long-term incentives, and focuses less on base salary and perquisites; we explain more about this shift in the "Compensation Discussion and Analysis" beginning on page 20.

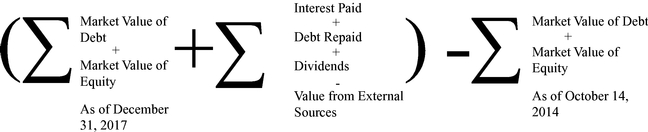

VALUE CREATION PROGRAM ("VCP")

One very important change that we made to long-term incentives in 2014 was the discontinuation of our 2013 - 2015 Cash Long-term Incentive Plan ("2013-2015 Cash LTIP") and the introduction of the Value Creation Program ("VCP"). The VCP rewards participants for the increase in value in the

5

total invested capital of the Company—total invested capital is the sum of the market value of the Company's equity and debt. We implemented the VCP in the fourth quarter of 2014. We did not grant any awards under the 2013-2015 Cash LTIP for the 2015 performance year, i.e., the performance periods for these plans do not overlap.

The VCP is a three-year plan that began on October 14, 2014 and ends on December 31, 2017; awards may be paid out in 2018 if value has been created per the plan terms. The VCP rewards participants for net value creation in the Company measured as the net change over the performance period in the fair market value of the Company's total invested capital, including equity securities, debt securities, and bank debt; plus cash dividends and cash payments (interest and principal) to debt, but reduced by any net value contributed from external sources, in each case as determined in the manner provided by the VCP. The formula for the value creation under the VCP is summarized below:

We describe the VCP in more detail in the "Compensation Discussion and Analysis" beginning on page 20.

DISCONTINUATION OF PERQUISITES

To further align our overall program with a stronger pay-for-performance mindset, management and the Compensation and Benefits Committee decided to discontinue two programs that fall into the category of perquisites:

We ended the Flexible Allowance program in December 2014. The Financial Planning program will end in May 2015 so that participants can work with their current advisors to complete their 2014 financial planning and tax preparation.

The Compensation and Benefits Committee and management agreed that it is in the best interests of both stockholders and our senior management team to keep the Physical Examination program, which provides eligible executives with a comprehensive medical examination once per year. The cost of this program to the Company is approximately $2,000 per year per participant; a valuable benefit with a relatively low cost.

6

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

What am I voting on at the Annual Meeting?

What does the Board of Directors recommend with respect to the matters to be presented at the Annual Meeting?

The Board of Directors recommends a vote:

You are entitled to vote at the Annual Meeting if you owned Company shares (directly in your name or in "street name," as defined below) as of the close of business on April 6, 2015, the record date for the Annual Meeting. On that date, 17,621,932 shares of our common stock were outstanding and entitled to vote at the Annual Meeting and no shares of our preferred stock were outstanding. Each share of common stock is entitled to one vote on each proposal to properly come before the Annual Meeting.

What is the difference between holding shares directly as a stockholder of record and holding shares in "street name"?

Most of our stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are differences between shares held of record and those held beneficially or in "street name."

Registered Stockholders. If your shares are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares, and a notice containing instructions on how to access our proxy statement and annual report online was sent directly to you. As the stockholder of record, you have the right to vote your shares as described herein.

Beneficial Stockholders. If your shares are held by a bank, broker or other agent as your nominee, you are considered the beneficial owner of shares held in "street name," and the notice containing instructions on how to access our proxy statement and annual report online was forwarded to you by your bank, broker or agent who is considered the stockholder of record with respect to those shares.

Registered Stockholders. If you hold shares in your own name you may vote in the following ways:

7

Beneficial Stockholders. If you are a beneficial owner of shares held in street name, you may vote in the following ways:

Even if you plan to attend the Annual Meeting, we recommend that you vote your shares in advance over the Internet, by telephone or, if you requested to receive printed proxy materials, by completing and mailing a proxy card or voting instruction form, so that your shares will be represented at the annual meeting, so that your vote will be counted if you later decide not to attend the Annual Meeting.

Can I change my vote or revoke my proxy?

You may change your vote or revoke your proxy at any time prior to the final vote at the Annual Meeting by voting again over the Internet or by telephone, by completing, signing, dating and returning a new proxy card or voting instruction form with a later date, or by attending the Annual Meeting and voting in person. Only your latest dated proxy we receive at or prior to the Annual Meeting will be counted. However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote again at the Annual Meeting and specifically request that your prior proxy be revoked by sending a written notice of revocation to the Corporate Secretary (at 2200 West Airfield Drive, P.O. Box 619810, D/FW Airport, Texas 75261) prior to the Annual Meeting.

Who will count the vote at the Annual Meeting?

Representatives of Broadridge Financial Solutions will tabulate the vote and serve as inspector of election at the Annual Meeting.

8

What vote is required to approve each proposal?

Item No. 1—Election of Directors. Each director will be elected by the vote of the majority of the votes cast when a quorum is present. A "majority of the votes cast" means that the number of votes cast "for" a director exceeds the number of votes cast "against" that director. "Votes cast" excludes abstentions and any votes withheld by banks and brokers in the absence of instructions from street name holders ("broker non-votes"). Your broker or nominee will not be permitted to vote on the election of directors without specific instructions as to how to vote from the beneficial owner. As a result, if you hold your shares through a broker or nominee, they will not be voted in the election of directors, unless you affirmatively vote your shares in accordance with the voting instructions provided by that institution.

Item No. 2—Advisory Vote on the Company's Executive Compensation and Item No. 3—Ratification of Appointment of Ernst & Young LLP. The affirmative vote of a majority of the shares present at the Annual Meeting in person or by proxy is required to: approve, on an advisory basis, the Company's executive compensation (Item No. 2); and ratify the appointment of our independent registered public accounting firm (Item No. 3). Abstentions have the same effect as votes cast against Item Nos. 2 and 3. Broker non-votes will be voted in and for Item No. 3, and will have no effect on the outcome of the vote on Item No. 2.

Although the advisory vote on Item No. 2 is non-binding as provided by law, our Board will review the results of the vote and, consistent with our record of stockholder engagement, will take them into account in making a determination concerning executive compensation.

Any other matter. Any other matter that properly comes before the Annual Meeting will require the approval of the majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting.

What constitutes a quorum for the Annual Meeting?

The presence of the holders of a majority of the outstanding shares of our common stock entitled to vote at the Annual Meeting, present in person or represented by proxy, is necessary to constitute a quorum. Abstentions and broker non-votes are counted as present and entitled to vote for purposes of determining a quorum.

What happens if I sign, date and return my proxy but do not specify how I want my shares voted on one or more of the proposals?

Regardless of your form of ownership, your proxy will be counted as a vote "FOR" all of the director nominees; and "FOR" Item Nos. 2 and 3.

What happens if I do not vote my shares?

Registered Stockholders. Your shares will not be voted at the Annual Meeting.

Beneficial Stockholders. Your broker or nominee may vote your shares only on those proposals on which it has discretion to vote. Your broker or nominee does not have discretion to vote your shares on non-routine matters such as the election of directors (Item No. 1) or advisory vote on the Company's executive compensation (Item No. 2). However, your broker or nominee does have discretion to vote your shares on routine matters such as ratification of appointment of Ernst & Young LLP (Item No. 3). To be sure your shares are voted in the manner you desire, you should instruct your broker or nominee how to vote your shares.

9

How is my proxy voted on matters not identified on the proxy form or in this Proxy Statement?

Other than the three items of business described in this Proxy Statement, our Board presently knows of no other matters to be presented for action at the Annual Meeting. Neither did we receive timely notice of any nomination for a director, nor did we receive timely notice of any other matter intended to be raised by any stockholder at the Annual Meeting. Accordingly, the proxy form confers upon the persons named on the proxy form authority to vote your shares in their discretion upon any other matter that may properly come before the Annual Meeting.

Who is bearing the cost of this proxy solicitation and how is the solicitation effected?

The Company is soliciting your proxy and is paying the cost of such solicitation, including preparing this proxy statement and the proxy card and the costs of any mailing. The Company may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of these proxy materials to their principals and to request authority for the execution of proxies. The Company may reimburse such persons for their expenses in so doing.

Under what circumstances can the Annual Meeting be adjourned?

Adjournments may be made for the purpose of, among other things, soliciting additional proxies. Any adjournment may be made from time to time by approval of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting (whether or not a quorum exists) without further notice other than by an announcement made at the Annual Meeting. We do not currently intend to seek an adjournment of the Annual Meeting.

Where can I find the voting results of the Annual Meeting?

We will disclose voting results on a Form 8-K filed with the SEC within four business days after the Annual Meeting.

When are stockholder proposals due for inclusion in the Company's proxy statement for the 2016 Annual Meeting of Stockholders?

In order to be considered for inclusion in the Company's proxy materials for the 2016 Annual Meeting of Stockholders, a stockholder proposal must be received in writing by our Company at Dex Media, Inc., 2200 West Airfield Drive, P.O. Box 619810, D/FW Airport, TX 75261, Attention: Corporate Secretary, no later than the close of business on December 21, 2015, and otherwise comply with Rule 14a-8 under the Securities Exchange Act of 1934.

Our Bylaws provide that stockholders may propose business to be conducted at an annual meeting of stockholders and/or nominate individuals to be elected to the Board of Directors at an annual meeting of stockholders if such proposal or nomination is made pursuant to timely notice in writing to the Secretary of the Company (at 2200 West Airfield Drive, P.O. Box 619810, D/FW Airport, Texas 75261). To be timely, a stockholder's notice shall be delivered to or mailed and received at our principal executive offices not less than 90 days nor more than 120 days in advance of the anniversary date of the immediately preceding annual meeting; provided, however, that in the event that the annual meeting is called for a date that is not within 30 days before or after such anniversary date, notice by the stockholder in order to be timely must be so received not later than the close of business on the 10th day following the day on which notice of the date of the annual meeting was first mailed or public disclosure of the date of the annual meeting was first made, whichever first occurs. Such stockholder's notice shall set forth all of the information described in Section 11 of our Bylaws. A copy of our Bylaws is available upon request by any of our stockholders from the Secretary of the Company.

10

BOARD COMPOSITION, RESPONSIBILITIES AND LEADERSHIP STRUCTURE

Our Board of Directors is responsible for overseeing the affairs of the Company. The Board currently consists of eight directors. Our Bylaws provide, however, that the Board may increase or decrease the size of the Board and fill any vacancies. The Board held 11 meetings during 2014. Each director attended at least 90% of the meetings of the Board and of the standing committees on which they served during 2014. Our Board of Directors appointed Mr. Walsh as President and Chief Executive Officer of the Company and elected him to the Company's Board of Directors, effective upon resignation of Mr. McDonald on October 14, 2014. Mr. Walsh attended both meetings of the Board held between October 14, 2014 and December 31, 2014.

As reflected in our Corporate Governance Guidelines, while the Board does not presently require all its members to attend annual meetings of stockholders, it does encourage its members to do so and the non-executive Chairman is expected to attend all meetings of stockholders. The Board is sensitive to stockholder access concerns and will periodically monitor and reassess this policy to ensure it remains open and available for stockholder communications. Seven of our directors attended the May 2014 annual stockholders meeting.

The Board has determined that the appropriate leadership structure for the Board at this time is for a non-management director to serve as non-executive Chairman of the Board. The Board reserves the right to review this policy from time to time to assess whether a non-executive Chairman continues to serve the best interests of the Company and our stockholders.

The non-executive Chairman is responsible for ensuring that the quality, quantity and timeliness of the flow of information between our management and the Board enables the Board to fulfill its functions and fiduciary duties in an efficient and effective manner. Our non-executive Chairman is elected annually by a majority of the independent directors upon a recommendation from the Corporate Governance Committee. Our non-executive Chairman presides over executive sessions of the non-employee directors following every regularly scheduled Board meeting (which sessions are not attended by management) and advises the Board, in consultation with the CEO and other independent directors, as to Board schedules and agendas. The Board has also determined that our non-executive Chairman shall be available to consult with stockholders and call meetings of the independent directors when appropriate. See our Corporate Governance Guidelines in the corporate governance section of our website at http://www.dexmedia.com/about/corporate/corporate-governance/ for additional information on the leadership structure of the Board.

Our Corporate Governance Guidelines state that the Board's objective is that at least two-thirds of the members of the Board be independent under applicable listing standards of The NASDAQ Stock Market LLC ("NASDAQ") and applicable law. To be considered "independent," the Board of Directors must make an affirmative determination, by a resolution of the Board as a whole, that the director being reviewed has no material relationship with the Company that interferes with the exercise of independent judgment in carrying out the duties of a director. In each case, the Board broadly considers all relevant facts and circumstances.

The Board has determined that seven of eight directors standing for re-election, Jonathan B. Bulkeley, Thomas D. Gardner, W. Kirk Liddell, Thomas S. Rogers, Alan F. Schultz, John Slater, and Douglas D. Wheat, are independent under applicable NASDAQ listing standards for membership on the Board. The Board has also determined, as further described below, that each of these directors is independent under applicable SEC rules and the NASDAQ listing standards for service on the

11

Committees of the Board on which they serve. Mr. Walsh is not an independent director because he is our President and Chief Executive Officer.

The Board maintains three standing committees—an Audit and Finance Committee, a Compensation and Benefits Committee and a Corporate Governance Committee. Each Committee operates under a charter that has been approved by the Board. A copy of each Committee charter is posted in the corporate governance section of our website at http://www.dexmedia.com/about/corporate/corporate-governance/. Each Committee may delegate the authority granted to it under its charter to a subcommittee, in order to ensure compliance with legal and regulatory obligations, timely decision making or for other purposes.

The following table below sets forth the composition of our Board committees in 2014.

| | Audit and Finance Committee | Compensation and Benefits Committee | Corporate Governance Committee | |||

|---|---|---|---|---|---|---|

| Jonathan B. Bulkeley | ü | ü | ||||

| Thomas D. Gardner | ü | ü(Chair) | ||||

| W. Kirk Liddell | ü(Chair) | |||||

| Thomas S. Rogers | ü | |||||

| John Slater | ü | ü | ||||

| Douglas D. Wheat | ü(Chair) | |||||

| Alan F. Schultz (Board Chair) |

The Audit and Finance Committee has overall responsibility for the integrity of our financial reporting process, including oversight of the preparation of financial statements and related financial information and the annual independent audit of such statements, as well as responsibility for our system of internal controls, internal audit process, risk assessment and management processes and compliance function. In addition, the Audit and Finance Committee has responsibility for reviewing proposed and existing financing arrangements (and compliance with governing documents) and for making recommendations to the Board regarding financing requirements for the Company and sources for such financing.

The Audit and Finance Committee also prepares the Audit and Finance Committee Report that the SEC rules require be included in our annual proxy statement. This report is on page 57 of this proxy statement.

The Board of Directors has unanimously determined that W. Kirk Liddell, a present Chair of the Audit and Finance Committee, qualifies as "audit committee financial expert" within the meaning of the SEC rules and satisfies financial sophistication requirements under the NASDAQ listing standards. In addition, the Board has unanimously determined that all present members of the Audit and Finance Committee are financially literate and independent within the meaning of applicable SEC rules and the NASDAQ listing standards.

The Audit and Finance Committee met eight times in 2014.

COMPENSATION AND BENEFITS COMMITTEE

The Compensation and Benefits Committee is responsible for the oversight of our executive and non-management director compensation practices and programs and the administration of our compensation and benefit plans for employees and non-management directors.

12

The Compensation and Benefits Committee is responsible for reviewing and approving all aspects of compensation paid to our CEO and our other executive officers as defined in Rule 16a-1(f) under the Securities Exchange Act of 1934. The Compensation and Benefits Committee also approves all executive employment contracts and other compensatory arrangements providing for the payment of benefits following a change of control of the Company or severance following a termination of employment. See "Compensation Discussion and Analysis—Section 3—Our Compensation Decision-Making Process—Role of the Compensation and Benefits Committee" on page 22 for further details.

The Compensation and Benefits Committee also prepares the Compensation and Benefits Committee Report that SEC rules require be included in our annual proxy statement. This report is on page 38 of this proxy statement.

The Board has determined that each member of the Compensation and Benefits Committee is an independent director within the meaning of the NASDAQ listing standards, an "outside director" under Section 162(m) of the U.S. Internal Revenue Code ("Section 162(m)") and a "nonemployee director" under Exchange Act Rule 16b-3.

The Compensation and Benefits Committee met 15 times in 2014.

CORPORATE GOVERNANCE COMMITTEE

The Corporate Governance Committee oversees the Board candidate selection, assessment and nomination process, makes recommendations to the Board regarding corporate governance policies, guidelines and procedures and in coordination with the Audit and Finance Committee, establishes and administers policies with respect to corporate responsibility and ethical business practices.

The Board has determined that each member of the Corporate Governance Committee is an independent director within the meaning of applicable NASDAQ listing standards.

The Corporate Governance Committee met nine times in 2014.

CORPORATE GOVERNANCE PRINCIPLES

The Board of Directors has adopted policies and procedures to ensure effective governance of the Company. Our corporate governance materials, including our Corporate Governance Guidelines, the charters of each of the standing Committees of the Board and our Code of Conduct for directors, finance employees and all employees, may be viewed in the corporate governance section of our website at http://www.dexmedia.com/about/corporate/corporate-governance/. We will also provide without charge copies of any of the foregoing information in print upon written request of our stockholders to the Office of the Corporate Secretary, Dex Media, Inc., P.O. Box 619810, 2200 West Airfield Drive, D/FW Airport, Texas 75261.

The Corporate Governance Committee reviews our Corporate Governance Guidelines on a regular basis and proposes modifications to the principles and other key governance practices as warranted for adoption by the Board.

Senior management is responsible for identifying and prioritizing enterprise risks facing the Company. The Board of Directors, in turn, is responsible for ensuring that material risks are managed appropriately. The Board of Directors as a whole has responsibility for risk oversight, with reviews of certain areas being conducted by the relevant Board committees. The Board and its committees regularly review material strategic, operational, financial and reporting, succession and compensation, and compliance risks with senior management. The Audit and Finance Committee is responsible for

13

discussing our overall risk assessment and risk management practices, as set forth in the Audit and Finance Committee's charter. The Audit and Finance Committee also performs a central oversight role with respect to financial and compliance risks, and periodically reports on its findings to the full Board. In addition, the Audit and Finance Committee is responsible for assessing risks related to our capital structure, significant financial exposures and our risk management and major insurance programs, and regularly evaluates financial risks associated with such programs. The Compensation and Benefits Committee considers risk in connection with its design of compensation programs for our executives.

Our Board welcomes communications from stockholders and other interested parties. Stockholders and other interested parties may contact the Board by writing to Joseph A. Walsh, President and Chief Executive Officer, c/o Dex Media, Inc., 2200 West Airfield Drive, P.O. Box 619810, D/FW Airport, Texas 75261. Stockholders and other interested parties may contact the independent members of our Board with any governance questions or other concerns by writing to Alan F. Schultz, Chairman of the Board, Dex Media, Inc., 2200 West Airfield Drive, P.O. Box 619810, D/FW Airport, Texas 75261. In addition, any questions or concerns regarding financial reporting, internal controls, accounting or other financial matters may be forwarded to W. Kirk Liddell, Chair of the Audit and Finance Committee, c/o Dex Media, Inc., 2200 West Airfield Drive, P.O. Box 619810, D/FW Airport, Texas 75261. All appropriate inquiries will be forwarded directly to the addressee. Persons wishing to submit anonymous, confidential inquiries or comments regarding the Company may do so through www.dexmedia.ethicspoint.com, our web-based reporting system, by simply following the instructions on that site. These procedures for communications between independent members of our Board and interested parties were approved by the independent and non-management members of our Board.

Our Board has adopted a Code of Conduct applicable to our directors, senior management including the principal executive officer, principal financial officer and principal accounting officer, and all other employees. The Code of Conduct is available on our website at http://www.dexmedia.com/about/corporate/corporate-governance/. Any waiver of any provision of the Code of Conduct made with respect to any director or executive officer of the Company will be promptly posted on our website at the same link as the Code of Conduct itself and will be disclosed in the next periodic report required to be filed with the SEC.

The Corporate Governance Committee, in consultation with the Audit and Finance Committee, is charged with the responsibility of reviewing, approving and overseeing all transactions with related persons (as defined in the SEC regulations). The Corporate Governance Committee and the Audit and Finance Committee periodically reassess any related-person transactions entered into by the Company to ensure their continued appropriateness.

The Corporate Governance Committee and the Audit and Finance Committee consider all relevant factors when determining whether to approve a related person transaction including, without limitation, the following:

14

under circumstances that are at least as favorable to the Company as would be available in comparable transactions with or involving unrelated third parties.

On October 14, 2014, we announced the appointment of Mr. Walsh, as President and Chief Executive Officer of the Company and his election to the Company's Board of Directors. During the period from March 7, 2014 to October 7, 2014 Mr. Walsh, through his wholly-owned consulting firm, Walsh Partners, was retained by the Company as a consultant to the Board of Directors. Mr. Walsh provided consulting services with respect to, among other things, the Company's current business and strategies, and was paid $490,000 for such consulting services. The consulting arrangement was approved by the Company's Board of Directors.

On September 9, 2014, certain subsidiaries of the Company commenced offers to repurchase bank debt below par. The offers expired on September 16, 2014 and the Company successfully repurchased bank debt at two of its operating subsidiaries and retired approximately $35 million in principal amount of bank debt for approximately $29 million in cash consideration. Franklin Resources, Inc. ("FRI") and Paulson & Co. ("Paulson"), entities known by the Company to beneficially own 5% or more of the Company's outstanding common stock, participated in the offers. FRI and Paulson tendered $15.0 million, and $18.1 million in bank debt, respectively. Mr. Slater, one of our directors, is an officer of Paulson. The bank debt repurchases were carried out in the ordinary course of business, pursuant to the terms of the Company's amended and restated credit facilities, approved by the Board of Directors, and were offered to debt holders on the same terms and conditions. The Corporate Governance Committee, in consultation with the Audit and Finance Committee, reviewed and approved these transactions.

15

ELECTION OF DIRECTORS (ITEM NO. 1)

The Company's by-laws provide that the number of directors will be determined by our Board of Directors from time to time, provided that the number of directors may not be less than three. The Board of Directors set the number of directors to serve on the Board after the Annual Meeting at eight directors.

Each of our current directors is serving a term that expires at the Annual Meeting. Each of the director nominees listed below will be elected if he receives the vote of the majority of the votes cast, meaning he will be elected if he receives more "For" votes than "Against" votes. Each nominee elected as a director will continue in office until the 2016 Annual Meeting of Stockholders and until his successor has been duly elected and qualified or until his earlier death, resignation or removal. If any nominee becomes unable to serve, proxies will be voted for the election of such other person as the Board of Directors may designate, unless the Board chooses to reduce the number of directors.

The Corporate Governance Committee of the Board of Directors is responsible for making recommendations to the Board concerning nominees for election as directors and nominees for Board vacancies. When assessing a director candidate's qualifications, the Corporate Governance Committee considers the candidate's expertise (including industry background), independence, and integrity, as well as skills relating to operations, finance, marketing and technology. In addition, the Committee looks at the overall composition of the Board and how a candidate would contribute to the overall synergy and collaborative process of the Board. The Committee has not established specific minimum eligibility requirements for candidates other than integrity, the commitment to act in the best interests of all stockholders and ensuring that a substantial majority of the Board remains independent. Our Corporate Governance Guidelines provide that the Corporate Governance Committee will consider director candidates recommended by stockholders provided such recommendations comply with our Bylaws and the process set forth in this proxy statement. In assessing such candidates, the Corporate Governance Committee will consider the same criteria described above. See our Corporate Governance Guidelines, which may be viewed in the corporate governance section of our website at http://www.dexmedia.com/about/corporate/corporate-governance/, for additional information on the selection of director candidates.

Each of the director nominees listed below is an incumbent director whose nomination to serve on the Board was recommended by the Corporate Governance Committee and approved by the Board. Each of the director nominees has indicated a willingness to serve as a director if elected.

Mr. Bulkeley, 54, has served on the Dex Media Board of Directors since April 2013; he previously served as a Director of Dex One Corporation ("Dex One") from January 2010 to April 2013, and was non-executive Chairman of the Dex One Board of Directors from September 2010 to August 2011. He currently serves as a member of the Compensation and Benefits Committee and the Corporate Governance Committee of Dex Media. Mr. Bulkeley also serves as the Chief Executive Officer at RealMatch Inc., a leader in the online recruitment industry selling through hundreds of local media partners. Mr. Bulkeley founded Blue Square Capital Management LLC, which operates the Blue Square Small Cap Value Fund, a hedge fund investing in global small and micro cap equities, in March 2009 and served as its Chief Investment Officer until November 2014. Mr. Bulkeley also served as Chief Executive Officer of Scanbuy Inc., a global leader in visual navigation for the wireless industry, from March 2006 to August 2010. Mr. Bulkeley also previously has served as Chief Executive Officer of barnesandnoble.com, and Chairman and Chief Executive Officer of Lifeminders, an online direct marketing company. Mr. Bulkeley currently serves on the Board of Jones, Lang, LaSalle Income Property Trust.

16

Mr. Bulkeley brings to the Board investing, board and operational experience with companies in all phases of growth. In particular, he has deep experience in overseeing and managing digital media and local digital media businesses.

Mr. Gardner, 57, has served on the Dex Media Board of Directors since April 2013; he previously served as a Director of SuperMedia Inc. ("SuperMedia") from December 2009 to April 2013. He currently serves as the Chairman of the Compensation and Benefits Committee and as a member of the Audit and Finance Committee. He is a trustee for Guideposts, and previously served as a trustee for Northern Westchester Hospital and Reader's Digest Foundation. He served as executive vice president of Reader's Digest Association, Inc. from 2006 to 2007, and was president of Reader's Digest International from 2003 to 2007. Prior to holding those positions, he held numerous other positions with Reader's Digest Association, Inc. from 1992 to 2007, including president, North American Books and Home Entertainment; president, global marketing; senior vice president, corporate strategy and U.S. new business development; vice president, marketing, Reader's Digest USA; and director, corporate planning. From 1989 to 1992, Mr. Gardner was a management consultant for McKinsey & Co. Other experience includes time with General Foods Corporation in product management, desserts division, and with Yankelovich, Skelly and White, Inc., industrial and corporate communications division, in project management.

Mr. Gardner's experience in the publishing industries, including his several senior positions at Reader's Digest, gives him an understanding of the opportunities and challenges associated with our business. In addition, Mr. Gardner brings an understanding of financial issues to the Board and the Audit and Finance Committee.

Mr. Liddell, 65, has served on the Dex Media Board of Directors since April 2013; he previously served as a Director of Dex One from January 2010 to April 2013. Mr. Liddell previously served as interim Principal Executive Officer of Dex One, from May 2010 to September 2010. He currently serves as the Chairman of the Audit and Finance Committee. Mr. Liddell has served as President, Chief Executive Officer and Director of Irex Corporation, the parent corporation of a specialty contracting network serving commercial, industrial, marine and residential customers, since 1984. Prior to joining Irex Corporation, Mr. Liddell was an associate at Covington & Burling in Washington, D.C., where he practiced corporate law with a focus on bank regulation, securities and antitrust.

Mr. Liddell brings to the Board operational experience as the chief executive of a company directly interfacing with local businesses and consumers. In addition, Mr. Liddell brings an understanding of financial issues to the Board and the Audit and Finance Committee.

Mr. Rogers, 60, has served on the Dex Media Board of Directors since April 2013; he previously served as a Director of SuperMedia from 2006 to April 2013. He currently serves as a member of the Compensation and Benefits Committee. Mr. Rogers serves as President and Chief Executive officer of TiVo Inc., a provider of television-based interactive and entertainment services, a position he has held since July 2005. He also currently serves on the board of directors of TiVo Inc. Mr. Rogers previously served as Chairman of the board of Teleglobe International Holdings, Ltd., a provider of international voice, data, internet and mobile roaming services, from November 2004 to February 2006. He also has served as Chairman of TRget Media LLC, a media industry investment and operations advisory firm, since July 2003. Mr. Rogers served as the senior operating executive for media and entertainment for Cerberus Capital Management, a large private equity firm, from 2004 to July 2005. Prior to holding

17

that position, he served as Chairman and Chief Executive Officer of Primedia, Inc., a print, video and online media company, from October 1999 to April 2003. From January 1987 until October 1999, Mr. Rogers held positions with National Broadcast Company, Inc., including president of NBC Cable and executive vice president.

As a long-term member of the board of SuperMedia Mr. Rogers has a familiarity with our business that makes him uniquely qualified to serve as a director of Dex Media. As president and chief executive officer of a public company, Mr. Rogers has significant exposure to, and we benefit from his experiences related to, the opportunities and challenges associated with our business. Additionally, his service on other public company boards allows the Company to leverage his experiences with, among other things, appropriate oversight and corporate governance matters.

Mr. Schultz, 56, has served on the Dex Media Board of Directors since April 2013 and currently serves as the non-executive Chairman of the Board; he previously served as a Director of Dex One from 2005 to April 2013, and was non-executive Chairman of the Dex One Board of Directors from August 2011 to April 2013 and from June 2010 to September 2010. Mr. Schultz served as non-executive Chairman of the Board of Valassis Communications, Inc., a respected leader within the marketing services and promotional media industries, from January 1, 2012 to February 4, 2014, following his retirement as President and Chief Executive Officer effective December 31, 2011. From 1997 through December 2011, Mr. Schultz served as Chairman, President and Chief Executive Officer of Valassis. Prior to that, Mr. Schultz held numerous executive positions in sales, marketing, operations and finance with Valassis. He has served on the Board of Directors of the Ad Council and the American Advertising Federation. Mr. Schultz joined Valassis from Deloitte and Touche in 1984.

Mr. Schultz brings to the Board experience as the former chief executive officer of a publicly-held marketing services company servicing both national and local businesses. Mr. Schultz also has significant experience with the Company's business and industry.

Mr. Slater, 42, has served on the Dex Media Board of Directors since April 2013; he previously served as a Director of SuperMedia from January 2010 to April 2013. He currently serves as a member of the Audit and Finance Committee and the Corporate Governance Committee. Mr. Slater serves as a Senior Vice President at Paulson where he focuses on investments in the media, telecom and technology sectors. Mr. Slater joined Paulson in January 2009. Previously, he was a vice president at Lehman Brothers and Barclays Capital where he worked from 2004 to 2008 in the global trading strategies group, focusing on investments in the media and other sectors. Prior to Lehman Brothers and Barclays Capital, Mr. Slater was senior director, finance and strategy, at NextSet Software Inc., a financial trading systems software vendor. He started his career as an associate consultant at Burlington Consultants, a strategy consultancy based in London.

Mr. Slater brings leadership, financial experience and a background in the media, telecom and technology industries to the Board. Mr. Slater's exposure to companies in the media, telecom and technology industries provides valuable insight to the Board regarding industry trends that affect our Company. Mr. Slater also brings to the Board the perspective of large institutional investors.

Mr. Walsh, 51, has joined the Company as its President and Chief Executive Officer and a member of the Board of Directors in October 2014. Prior to joining the Company, Mr. Walsh was the Chairman and Chief Executive Officer of Walsh Partners, a private company founded in 2012 that has been focused on investments and advisory services. Mr. Walsh has also served as the Executive Chairman of

18

Cambium Learning Group, Inc., a leading educational solutions and services company, since March 2013. Mr. Walsh was previously employed by Yellowbook Inc., a digital and print marketing solutions company, from 1987 until 2011, and served as President and Chief Executive Officer and a member of its board of directors from 1993 until 2011. In 1982, Mr. Walsh co-founded IYP Publishing, a company sold in 1985 to DataNational Corporation, a leading provider for enterprise software and services. He served as Vice President of Sales at DataNational until joining Yellowbook in 1987. Mr. Walsh served as Chairman of the Local Search Association (LSA) and on the board of LSA's predecessor, the Yellow Pages Association. He was also Chairman and a long-term board member of the Association of Directory Publishers and served on the board of the Association of Directory Marketing.

Mr. Walsh possesses substantial executive, business and operational experience relating to yellow pages directory advertising and publication industry which gives him unique knowledge of the opportunities and challenges associated with our business. Mr. Walsh's familiarity with our business and industry and the various market participants provides invaluable insight and advice to our board.

Mr. Wheat, 64, has served on the Dex Media Board of Directors since April 2013; he previously served as the Chairman of the Board of Directors of SuperMedia from July 2010 to April 2013, including Executive Chairman from August 2010 to December 2010. He currently serves as the Chairman of the Corporate Governance Committee. Mr. Wheat serves as Chairman of AMN Healthcare Services, Inc., one of the leading temporary healthcare staffing companies in the world, and as the Chairman of the Board of Overseas Shipholding Group, Inc., a market leader in global energy transportation services. Mr. Wheat previously served as a director of Playtex Products, Inc. from 1995 to 2007 (including serving as its chairman from 2004 to 2006). Mr. Wheat has served as a member of the boards of directors of Dr. Pepper/Seven-Up Companies, Inc., Thermadyne Industries, Inc., Sybron International Corporation, Smarte Carte Corporation, Nebraska Book Corporation, and ALC Communications Corporation. Since 2008, he has served as Managing Partner of Southlake Equity Group (formerly Challenger Equity Group), a private investment firm. Prior to Southlake Equity Group, he served as president of Haas Wheat & Partners, a private investment firm specializing in strategic equity investments and leveraged buyouts of middle market companies from 1992 to 2006. Mr. Wheat also held various leadership and senior management positions at Grauer & Wheat and Donaldson Lufkin & Jenrette Securities Corporation earlier in his career.

Mr. Wheat's extensive experience serving on public company boards, including as chairman of three public boards, and his expertise in a variety of financial matters make him uniquely qualified to serve on our Board. Additionally, Mr. Wheat's experiences have provided him with critical knowledge with respect to, among other things, appropriate oversight and related actions utilized in the Board environment, including concerning corporate governance matters.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE "FOR"

THE ELECTION OF ALL OF THE DIRECTOR NOMINEES NAMED ABOVE

19

EXECUTIVE AND DIRECTOR COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis provides a description of our compensation philosophy, the objectives of our compensation programs for executive officers, and the process that the Compensation and Benefits Committee of the Board of Directors, referred to below as the "Committee," follows to make decisions regarding executive compensation arrangements.

This discussion and analysis should be read in conjunction with the accompanying tables and text disclosing the compensation awarded to, earned by, and paid to, our named executive officers, referred to herein as the "Named Executive Officers" or "NEOs." The "NEOs" for 2014 include: Joseph A. Walsh, President and Chief Executive Officer; Paul D. Rouse, Executive Vice President—Chief Financial Officer and Treasurer; Del Humenik, Executive Vice President—Chief Revenue Officer; Raymond R. Ferrell, Executive Vice President—General Counsel and Corporate Secretary; Debra M. Ryan, Executive Vice President—Chief Human Resources Officer; Peter J. McDonald, former President and Chief Executive Officer (resigned effective October 14, 2014); Samuel D. Jones, former Executive Vice President—Chief Financial Officer and Treasurer (resigned effective November 14, 2014); and Frank P. Gatto, former Executive Vice President—Operations (resigned effective October 31, 2014).

We have organized the discussion into the following sections:

SECTION 1—BUSINESS SUMMARY AND HIGHLIGHTS

SECTION 2—CHIEF EXECUTIVE OFFICER PAY AND TRANSITION

SECTION 3—OUR COMPENSATION DECISION-MAKING PROCESS

SECTION 4—COMPENSATION PHILOSOPHY, OBJECTIVES AND PROGRAMS

SECTION 5—EXECUTIVE EMPLOYMENT AND CONSULTING AGREEMENTS

SECTION 6—OTHER COMPENSATION RELATED ITEMS

SECTION 1—BUSINESS SUMMARY AND HIGHLIGHTS

Dex Media was formed on April 30, 2013 through the merger of Dex One and SuperMedia, two major providers of local, social, and mobile marketing solutions to businesses in communities across the United States. Our mission is to be the trusted marketing partner for local businesses. 2014 was the first full year of operation for our combined company following the merger, and we made progress on many fronts. Our accomplishments in 2014 included:

In December 2014, we started implementing an organizational restructuring program designed to reorganize and strategically refocus the Company and to transform Dex Media into a leaner, nimbler and more competitive organization positioned to be the leading multi-product marketing provider for small and medium-sized businesses. The program includes the launch of virtual sales offices, enabling

20

the Company to eliminate field sales offices, the automation of the sales process, integration to eliminate duplicative systems, product simplifications, introduction of new sales tools and workforce reductions.

SECTION 2—CHIEF EXECUTIVE OFFICER PAY AND TRANSITION

On October 14, 2014, we announced the retirement of Mr. McDonald, our then President and Chief Executive Officer, and the appointment of Mr. Walsh as our President and Chief Executive Officer and a Board member.

To ensure a smooth transition, our Board worked closely with Mr. McDonald in identifying and recruiting his successor. Further to this goal, the Board retained Mr. McDonald via a consulting agreement for a 12-month period beginning in October 2014 (see "Compensation Discussion and Analysis—Section 5—Executive Employment and Consulting Agreements" for further details). Before joining Dex Media as our President and Chief Executive Officer, Mr. Walsh provided consulting services to our Board with respect to the Company's business operations and strategy from March 2014 to October 2014, through his wholly-owned consulting firm, Walsh Partners.

Mr. Walsh's top priority is to accelerate the Company's transformation to the leading marketing services provider for small and medium-sized businesses. To help accomplish this goal, he assembled an experienced executive team combining talent from within our Company as well as some long-time colleagues from the industry. That experience will be critical to transforming the traditional print-based directory business to a digital and multi-product marketing service business (see "Proxy Summary—Changes to Our Executive Management Team" for further details). Some of the compensation strategy changes we made in 2014 are reflected in Mr. Walsh's own compensation package, which evidences heavy emphasis on performance-based compensation.

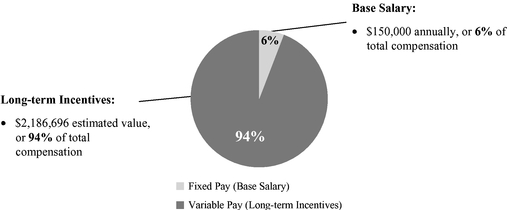

The compensation package for our current President and Chief Executive Officer, Mr. Walsh, comprises an annual base salary of $150,000 and long-term incentives valued as of their award date at $7,183,180. The long-term incentives have two components: (i) 271,000 stock options with an exercise price equal to their fair market value of the Company's common stock on the grant date of $7.54, having a total award value of $1,130,070 (using the Black-Scholes option pricing model), and (ii) 350,000 units in the Company's Value Creation Program (the "VCP") valued at $6,053,110, or $17.29 per unit, on the grant date (using a Monte Carlo simulation, a type of option pricing model). See Note 11 to the consolidated financial statements in the Company's annual report on Form 10-K for the year ended December 31, 2014, for a description of the assumptions used in the Monte Carlo simulation. The actual value to the CEO of the stock options and VCP will depend on actual results and could be higher or lower than the award value.

These long-term incentive awards are intended to cover performance from October 14, 2014, Mr. Walsh's hire date, through the time the awards vest. The stock options will vest on December 31, 2017, subject to the terms of the applicable award agreement. The performance period for the VCP units ends on December 31, 2017, and the value of those units, if any, will be paid out in equal one-third installments on each of March 31, 2018, June 30, 2018 and December 31, 2018. The Committee currently has no plans to award Mr. Walsh additional long-term incentives prior to December 31, 2017. The annualized award value for the stock options and VCP units awarded to Mr. Walsh for the period from October 14, 2014 to December 31, 2017 is $2,186,696.

Mr. Walsh's total compensation package is weighted heavily towards performance-based incentive awards, or pay "at risk." Below is an illustration of the fixed and variable proportions of Mr. Walsh's compensation package. For this illustration, we have annualized the expected value, based on the

21

estimated value at the time the awards were made, of both the stock options and VCP units that Mr. Walsh received on his hire date:

Proportion of Fixed vs. Variable

Compensation

See "Compensation Discussion and Analysis—Section 4—Compensation Philosophy, Objectives and Programs" and "Executive Compensation Tables—Grants of Plan-Based Awards" for further description of the stock option and VCP unit awards that comprise Mr. Walsh's performance-based incentives.

SECTION 3—OUR COMPENSATION DECISION-MAKING PROCESS

Stockholders Advisory Vote: "Say on Pay"

At the Company's annual meeting of stockholders held in May 2014, a substantial majority (90.86%) of the votes cast on the proposal to approve executive compensation, on an advisory basis, were voted in favor of the proposal. The Committee believes this affirms stockholders' support of the Company's approach to executive compensation.

Role of the Compensation and Benefits Committee

The Committee is responsible for reviewing and making individual compensation determinations including, but not limited to, salary, annual cash incentives, long-term incentive awards of cash or stock and any other awards made to the CEO and senior management (which includes all executive officers as defined in Rule 16a-1(f) under the Securities Exchange Act of 1934). The Committee annually reviews and approves the corporate goals, objectives, and other key measures relevant to compensation of the Company's executive officers. All key decisions are presented to the full Board for review and, in the case of the CEO, for ratification.

The Committee reviews and approves the Company's incentive compensation and equity-based compensation plans, including the performance measures to be applied in determining incentive awards. The Committee oversees the administration of the incentive compensation and equity-based compensation plans to ensure consistency with the Committee's compensation policies, objectives, and programs with respect to plan participation, including, but not limited to, approving general size of overall awards, designating eligible participants, approving awards, appointing and reviewing the performance of plan administrators, and imposing any limitations, restrictions and conditions upon awards. The Committee also reviews performance-based awards, such as those payable under our annual and long-term incentive plans, prior to any payout to ensure that performance under the plan is sufficient to merit an award, and payments are made in accordance with the plan terms.

22

The Committee works with management and the Committee's independent compensation consulting firm, Semler Brossy Consulting Group LLC ("Semler Brossy"), to make pay determinations and to ensure that our programs are competitive and meet our compensation objectives (see "Compensation Discussion and Analysis—Section 4—Compensation Philosophy, Objectives and Programs" for further details).

Role of the Committee's Compensation Adviser

As mentioned above, the Committee has selected Semler Brossy as its independent compensation adviser. Semler Brossy reports directly to the Committee and does not have any other consulting engagements with management or the Company. The Committee has assessed the independence of Semler Brossy and concluded that its engagement of Semler Brossy did not raise any conflict of interest with the Company or any of its directors or executive officers in 2014. In making this assessment, the Committee considered the independence factors enumerated in new Rule 10C-1(b) under the Securities Exchange Act of 1934, including the fact that Semler Brossy does not provide any other services to the Company, the level of fees received from the Company as a percentage of Semler Brossy's total revenue, policies and procedures employed by Semler Brossy to prevent conflicts of interest, and whether the individual Semler Brossy advisers to the Committee own any of the Company's stock or have any business or personal relationships with members of the Committee or our executive officers.

The Committee regularly seeks advice from Semler Brossy on current trends in compensation design, including overall levels of compensation, the appropriateness of peer group companies, the relative weightings of compensation elements and the value of particular performance measures on which to base compensation. Within this framework, Semler Brossy has been directed to work collaboratively with management to ensure sufficient understanding of the Company's business and compensation programs.

With respect to compensation for Dex Media's CEO, Semler Brossy provides competitive market CEO compensation data for the Committee's consideration. In accumulating these relevant data, Semler Brossy relies on its understanding of Dex Media's business and compensation programs and its independent research and analysis. Semler Brossy does not meet with the CEO with respect to his compensation.

For executive officers other than the CEO, our Chief Human Resources Officer works with the CEO to develop recommendations to the Committee. In developing these recommendations, the CEO considers the Company's overall performance, each individual's scope of responsibility, competitive market compensation data, individual performance, and the CEO's assessment of the individual's current and future potential contributions.

Executive Compensation Peer Group

Semler Brossy assists the Committee in determining an appropriate compensation benchmarking group for our executive officers. In 2014, the Committee reexamined the peer group and made changes that are reflected in the table below. The current peer group includes companies in the Advertising (GICS Industry 25401010) and Publishing (GICS Industry 25401040) subcategories of Media companies with trailing four quarter revenues between $1.0 billion and $2.5 billion that are comparable to Dex

23

Media. The peer group is used to provide market references in establishing the total compensation opportunity for our executive officers. For 2014, this group comprised:

| IAC/InterActiveCorp | John Wiley & Sons Inc. | |

Lamar Advertising Company | Meredith Corporation | |

Scholastic Corporation | The McClatchy Company | |

The New York Times Company |