As confidentially submitted to the Securities and Exchange Commission on May 11, 2020

This draft registration statement has not been publicly filed with the Securities and Exchange Commission and all information herein remains strictly confidential.

Delaware | | | 7374 | | | 13-2740040 |

(State or Other Jurisdiction of Incorporation or Organization) | | | (Primary Standard Industrial Classification Code Number) | | | (I.R.S. Employer Identification Number) |

Alexander D. Lynch Corey R. Chivers Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, New York 10153 (212) 310-8000 (Phone) (212) 310-8007 (Fax) | | | Lesley Bolger Thryv Holdings, Inc. 2200 West Airfield Drive P.O. Box 619810 DFW Airport, Texas 75261 (972) 453-7000 |

Large accelerated filer | | | ☐ | | | Accelerated filer | | | ☐ |

Non-accelerated filer | | | ☒ | | | Smaller reporting company | | | ☐ |

| | | | | Emerging growth company | | | ☐ |

Title of Each Class of Securities to be Registered | | | Amount to be Registered | | | Proposed Maximum Offering Price Per Share | | | Proposed Maximum Aggregate Offering Price(1) | | | Amount of Registration Fee |

Common Stock, $0.01 par value per share | | | | | Not applicable | | | $ | | | $ |

| (1) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(a) of the Securities Act. Given that there is no proposed maximum offering price per share of common stock, the Registrant calculated the proposed maximum aggregate offering price by analogy to Rule 457(f)(2), based on the book value of $0.45 per share of the common stock the Registrant registered, which was calculated from its audited balance sheet as of December 31, 2019. Given that the Registrant’s common stock is not traded on an exchange or over-the-counter on a recent or sustained basis, the Registrant did not use the market prices of its common stock in accordance with Rule 457(c). |

| | | Page | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

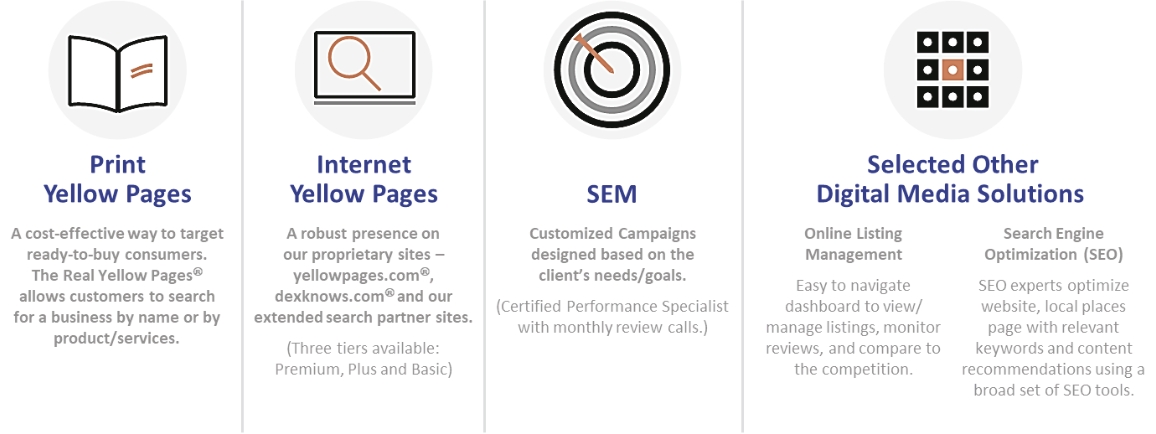

| • | Print Yellow Pages. Print marketing solutions through our owned and operated Print Yellow Pages (“PYPs”), which carry “The Real Yellow Pages” tagline; |

| • | Internet Yellow Pages. Digital marketing solutions through our proprietary Internet Yellow Pages (“IYPs”), including Yellowpages.com, Superpages.com and Dexknows.com; |

| • | Search Engine Marketing. Search engine marketing (“SEM”) solutions that deliver business leads from Google, Yahoo!, Bing, Yelp and other major engines and directories; and |

| • | Other Digital Media Solutions. Other digital media solutions, which include stand-alone websites, online display and social advertising, online presence and video and search engine optimization (“SEO”) tools. |

| | | Years Ended December 31, | |||||||

| | | 2019 | | | 2018 | | | 2017 | |

| | | (in thousands) | |||||||

Marketing Services | | | | | | | |||

PYP | | | $604,417 | | | $798,838 | | | $542,745 |

IYP | | | 340,257 | | | 379,687 | | | 259,526 |

SEM | | | 232,084 | | | 328,814 | | | 288,161 |

Other | | | 115,459 | | | 152,447 | | | 152,582 |

Total Marketing Services | | | $1,292,217 | | | $1,659,786 | | | $1,243,014 |

| • | Thryv®. Thryv® our Thryv platform is our flagship SMB business management platform. Our Thryv platform capabilities include customer relationship management (“CRM”), email and text, appointment bookings, estimates, invoices, online presence, social media, reputation management and bill payment. The platform also helps SMBs to find and retain customers using online listings management and social media; and |

| • | Thryv Leads® and add-ons. Thryv Leads is our integrated lead management solution, and we offer a range of add-ons that can be purchased in conjunction with our Thryv platform including, but not limited to, website development and SEO tools. |

| | | Years Ended December 31, | |||||||

| | | 2019 | | | 2018 | | | 2017 | |

| | | (in thousands) | |||||||

SaaS | | | | | | | |||

Thryv platform | | | $96,887 | | | $111,875 | | | $72,755 |

Thryv Leads and add-ons | | | 32,270 | | | 12,740 | | | 2,397 |

Total SaaS | | | $129,157 | | | $ 124,615 | | | $ 75,152 |

| • | Rising Expectations of the Digital Consumer. Consumers have grown accustomed to sophisticated web platforms and mobile applications that deliver modern solutions. Large enterprises have optimized experiences such as one-click e-commerce, instant ride-sharing, and food delivery applications. Many SMBs are challenged to create these “frictionless” customer experiences by themselves. |

| • | Increasingly Fragmented Consumer Marketplace. As a growing majority of consumers turn to digital platforms and applications for information, SMBs face challenges in finding ways to connect with their customers. Meanwhile, a subset of consumers still prefers traditional forms of media, such as print. We believe it is increasingly difficult for SMBs to target both of these consumer segments with a coherent strategy. |

| • | Businesses Are Challenged to Determine Which Advertising Is Effective. The old John Wanamaker adage, “Half the money I spend on advertising is wasted; the trouble is, I don’t know which half,” is still true. We believe the print and digital advertising choices for SMBs have become overwhelming and that many SMBs benefit from assistance in identifying the most advantageous advertising medium. |

| • | your ability to sell your common stock at or above the price you bought them for due to (i) our listing not having the same safeguards as an underwritten initial public offering, which may result in the public price of our shares of common stock being volatile and declining significantly and rapidly upon listing, or (ii) the failure of an active, liquid, and orderly market for our shares of common stock to develop or be sustained; |

| • | none of our stockholders are party to any contractual lock-up agreement or other contractual restrictions on transfer. Following our listing, sales of substantial amounts of our common stock in the public markets or the perception that sales might occur, could cause the market price of our common stock to decline; |

| • | significant competition for our Marketing Services solutions and SaaS offerings which include companies who use components of our SaaS offerings provided by third parties; |

| • | we may not maintain profitability; |

| • | we may not manage our growth effectively; |

| • | we may not be able to transition our Marketing Services clients to our Thryv platform, sell our platform into new markets or further penetrate existing markets; |

| • | the effect of COVID-19 (as defined below) on our business, including the measures to reduce its spread, and the impact on the economy and demand for our services, which may precipitate or exacerbate other risks and uncertainties; |

| • | we may not maintain our strategic relationships with third-party service providers; |

| • | internet search engines and portals potentially terminating or materially altering their agreements with us; |

| • | we may not keep pace with rapid technological changes and evolving industry standards; |

| • | our SMB clients potentially opting not to renew their agreements with us or renewing at lower spend; |

| • | potential system interruptions or failures, including cyber-security breaches, identity theft, data loss, unauthorized access to data or other disruptions that could compromise our information; |

| • | our potential failure in identifying and acquiring suitable acquisition candidates; and |

| • | the potential loss of one or more key employees or our inability to attract and to retain highly skilled employees. |

| | | Years Ended December 31, | |||||||

| | | 2019(1)(2) | | | 2018(1)(2) | | | 2017(2) | |

| | | (in thousands, except share and per share data) | |||||||

Revenue | | | $1,421,374 | | | $1,784,401 | | | $1,318,166 |

Operating expenses: | | | | | | ||||

Cost of services (exclusive of depreciation and amortization) | | | 476,355 | | | 647,288 | | | 553,293 |

Sales and marketing | | | 352,740 | | | 469,238 | | | 370,548 |

General and administrative | | | 179,956 | | | 238,554 | | | 223,887 |

Depreciation and amortization | | | 206,270 | | | 266,975 | | | 301,435 |

Total operating expenses | | | 1,215,321 | | | 1,622,055 | | | 1,449,163 |

Operating income (loss) | | | 206,053 | | | 162,346 | | | (130,997) |

Other income (expense): | | | | | | | |||

Interest expense | | | (92,951) | | | (82,697) | | | (67,815) |

Other components of net periodic pension costs | | | (53,161) | | | (516) | | | (40,804) |

(Loss) gain on early extinguishment of debt | | | (6,375) | | | (18,375) | | | 751 |

Income (loss) before (provision) benefit for income taxes | | | 53,566 | | | 60,758 | | | (238,865) |

(Provision) benefit for income taxes | | | (18,062) | | | (8,487) | | | 67,541 |

Net income (loss) | | | $35,504 | | | $52,271 | | | $(171,324) |

Net income (loss) per common share: | | | | | | ||||

Basic | | | $0.48 | | | $0.51 | | | $(1.69) |

Diluted | | | $0.45 | | | $0.49 | | | $(1.69) |

Weighted-average shares used in computing basic and diluted net income (loss) per common share: | | | | | | | |||

Basic | | | 73,521,230 | | | 103,196,920 | | | 101,586,026 |

Diluted | | | 78,221,765 | | | 107,336,152 | | | 101,586,026 |

| | | Years Ended December 31, | |||||||

| | | 2019 | | | 2018 | | | 2017 | |

| | | (in thousands) | |||||||

Other Financial Data: | | | | | | | |||

Adjusted EBITDA(3) | | | $ 480,498 | | | $ 546,714 | | | $ 253,256 |

Free Cash Flow(3) | | | 244,534 | | | 319,632 | | | 220,801 |

| | | As of December 31, | ||||

| | | 2019(1) | | | 2018(1) | |

| | | (in thousands) | ||||

Cash and cash equivalents | | | $1,912 | | | $34,169 |

Adjusted working capital(4) | | | 221,128 | | | 321,714 |

Total assets(5) | | | 1,388,292 | | | 1,653,488 |

Long-term debt obligations | | | 714,392 | | | 545,861 |

Financing obligations | | | 56,117 | | | 57,343 |

Total liabilities(5) | | | 1,361,032 | | | 1,225,148 |

Total stockholders’ equity | | | 27,260 | | | 428,340 |

| (1) | The Company’s operating results and financial position for the years ended December 31, 2019 and 2018 were impacted by the adoption of Accounting Standards Codification 606, Revenue from Contracts with Customers, (“ASC 606”). The Company used the modified retrospective method of adoption. Results for reporting periods beginning January 1, 2018 are presented under ASC 606, while prior period amounts are not adjusted and continue to be reported in accordance with the historical accounting guidance under Accounting Standards Codification 605, Revenue Recognition, (“ASC 605”). The adoption of ASC 606 resulted in a decrease to revenues of $8.6 million for the year ended December 31, 2018. See Note 1, Description of Business and Summary of Significant Accounting Policies, and Note 2, Revenue Recognition, to our consolidated financial statements included elsewhere in this prospectus for more information. |

| (2) | The Company’s operating results for the years ended December 31, 2019, 2018 and 2017 are impacted by the YP Acquisition, which occurred on June 30, 2017. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In addition, see Note 3, Acquisitions, to our consolidated financial statements included elsewhere in this prospectus for more information. |

| (3) | Adjusted EBITDA and Free Cash Flow are non-GAAP financial measures. We define Adjusted EBITDA as Net income (loss) plus Interest expense, Provision (benefit) for income taxes, Depreciation and amortization expense, Loss/(gain) on early extinguishment of debt, Restructuring and integration charges, Stock-based compensation expense, Other components of net periodic pension cost, Non-cash gain from remeasurement of indemnification asset and certain unusual and non-recurring charges that might have been incurred. We define Free Cash Flow as Net cash provided by operating activities less cash expenditures for additions to fixed assets and capitalized software. For a discussion of Adjusted EBITDA and Free Cash Flow, please refer to “Non-GAAP Financial Measures” and “Selected Historical Consolidated Financial Data and Other Data – Non-GAAP Financial Measures,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The following is the reconciliation of Adjusted EBITDA to its most directly comparable GAAP measure, net income: |

| | | Years Ended December 31, | |||||||

| | | 2019 | | | 2018 | | | 2017 | |

| | | (in thousands) | |||||||

Reconciliation of Adjusted EBITDA | | | | | | | |||

Net income (loss) | | | $ 35,504 | | | $ 52,271 | | | $ (171,324) |

Interest expense | | | 92,951 | | | 82,697 | | | 67,815 |

Provision (benefit) for income taxes | | | 18,062 | | | 8,487 | | | (67,541) |

Depreciation and amortization expense | | | 206,270 | | | 266,975 | | | 301,435 |

Loss (gains) on early extinguishment of debt | | | 6,375 | | | 18,375 | | | (751) |

Restructuring and integration charges(a) | | | 45,960 | | | 87,307 | | | 65,645 |

Direct listing expenses(b) | | | 4,003 | | | — | | | — |

Stock-based compensation expense | | | 14,119 | | | 39,604 | | | 23,364 |

Other components of net periodic pension cost(c) | | | 53,161 | | | 516 | | | 40,804 |

Non-cash gain from remeasurement of indemnification asset(d) | | | 4,093 | | | (9,518) | | | (6,191) |

Adjusted EBITDA | | | $480,498 | | | $546,714 | | | $253,256 |

| (a) | Restructuring and other integration charges include severance benefits, facility exit costs, system consolidation and integration costs, and professional consulting and advisory services costs related to the YP Acquisition. See Note 6, Restructuring and Integration Expenses, to our consolidated financial statements included elsewhere in this prospectus for more information. |

| (b) | The Company incurred $4.0 million of expenses related to its direct listing, including accounting, legal, printing and other fees. |

| (c) | Other components of net periodic pension cost is from our non-contributory defined benefit pension plans that are currently frozen and incur no additional service costs. The most significant component of other components of net periodic pension cost relates to the annual mark to market pension remeasurement. The Company recorded a remeasurement loss of $45.4 million during the year ended December 31, 2019, a remeasurement gain of $3.5 million during the year ended December 31, 2018 and a remeasurement loss of $40.3 million during the year ended December 31, 2017. See Note 12, Pensions, to our consolidated financial statements included elsewhere in this prospectus for more information. |

| (d) | In connection with the YP Acquisition, the seller provided the Company indemnity for future potential losses associated with certain federal and state tax positions taken in tax returns filed by the seller prior to the Acquisition Date. The indemnity covers potential losses in excess of $8.0 million and is capped at an amount equal to the lesser of the uncertain tax position (“UTP”) liability or the current fair value of the 3,248,487 shares of the Company's common stock issued to the seller as part of the purchase consideration (the “Shares”). See Note 3, Acquisitions, to our consolidated financial statements included elsewhere in this prospectus for more information. |

| | | Years Ended December 31, | |||||||

| | | 2019 | | | 2018 | | | 2017 | |

| | | (in thousands) | |||||||

Reconciliation of Free Cash Flow | | | | | | | |||

Net cash provided by operating activities | | | $ 270,599 | | | $ 347,061 | | | $ 240,793 |

Cash expenditures for additions to fixed assets and capitalized software | | | (26,065) | | | (27,429) | | | (19,992) |

Free Cash Flow | | | $244,534 | | | $319,632 | | | $220,801 |

| (4) | Adjusted working capital is defined as current assets minus current liabilities excluding current maturities of long-term debt obligations, as applicable. |

| (5) | The Company’s financial position for the year ended December 31, 2019 was impacted by the adoption of Accounting Standards Codification 842, Leases (“ASC 842”). The Company used the modified retrospective method of adoption. For reporting periods beginning January 1, 2019, leases are presented under ASC 842, while prior period amounts are not adjusted and continue to be reported in accordance with the historical accounting guidance under Accounting Standards Codification 840, Leases (“ASC 840”). As of December 31, 2019, the consolidated balance sheet included an operating lease liability of $38.4 million and right-of-use assets of $39.0 million. See Note 1, Description of Business and Summary of Significant Accounting Policies and Note 10, Leases, to our consolidated financial statements included elsewhere in this prospectus for more information. |

| • | other print media companies; |

| • | cloud-based business automation providers; |

| • | email marketing software vendors; |

| • | sales force automation and CRM software vendors; |

| • | website builders and providers of other digital tools, including low cost, less experienced do-it-yourself providers; |

| • | marketing agencies and other providers of SEM, SEO, display and social advertising and other digital marketing services; and |

| • | large-scale SaaS enterprise suites who are moving down market and targeting SMBs. |

| • | changes due to rapid technological advances; |

| • | additional qualification requirements related to technological challenges; and |

| • | evolving industry standards and changes in the regulatory and legislative environment. |

| • | difficulties in converting the clients of the acquired business onto our Thryv platform; |

| • | difficulties in converting the clients of the acquired business to our Marketing Services offerings or to our contract terms; |

| • | diversion of management’s attention; |

| • | incurrence of significant amounts of additional debt; |

| • | creation of significant contingent earn-out obligations or other financial liabilities; |

| • | difficulties in the integration of acquired operations, including the integration of data and information solutions or other technologies; |

| • | and retention of personnel; |

| • | entry into unfamiliar segments; |

| • | adverse effects to our existing business relationships with business partners and clients as a result of the acquisition; |

| • | retaining key employees and maintaining the key business and client relationships of the businesses we acquire; |

| • | cultural challenges associated with integrating employees from the acquired company into our organization; |

| • | unanticipated problems or legal liabilities; and |

| • | tax and accounting issues. |

| • | loss or delayed market acceptance and sales; |

| • | breach of warranty or other contractual claims for damages incurred by clients; |

| • | loss of clients; |

| • | diversion of development and client service resources; and |

| • | injury to our reputation; |

| • | prepare and distribute periodic public reports and other stockholder communications in compliance with our obligations under the federal securities laws and applicable stock exchange rules; |

| • | create or expand the roles and duties of our Board and committees of the Board; |

| • | institute more comprehensive financial reporting and disclosure compliance functions; |

| • | enhance our investor relations function; and |

| • | involve and retain to a greater degree outside counsel and accountants in the activities listed above. |

| • | our ability to attract new clients; |

| • | our ability to manage our declining Marketing Services revenue; |

| • | the timing of recognition of revenues; |

| • | the amount and timing of operating expenses related to the maintenance and expansion of our business, operations and infrastructure; |

| • | network outages or security breaches; |

| • | general economic, industry and market conditions; |

| • | client renewals; |

| • | increases or decreases in the number of elements of our services or pricing changes upon any renewals of client agreements; |

| • | changes in our pricing policies or those of our competitors; |

| • | seasonal variations in our client subscriptions; |

| • | fluctuation in market interest rates, which impacts debt interest expense; |

| • | any changes in the competitive dynamics of our industry, including consolidation among competitors, clients, or strategic partners; and |

| • | the impact of new accounting rules. |

| • | increase our vulnerability to adverse changes in general economic and industry conditions and competitive pressures; |

| • | require us to dedicate a substantial portion of our cash flow from operations to make payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures and other general corporate purposes; |

| • | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| • | restrict us from pursuing business opportunities as they arise or from successfully carrying out plans to expand our business; |

| • | make it more difficult to satisfy our financial obligations, including payments on our indebtedness; |

| • | place us at a disadvantage compared to our competitors that have less debt; and |

| • | limit our ability to borrow additional funds for working capital, capital expenditures, acquisitions, debt service requirements, execution of our business strategy or other general corporate purposes. |

| • | incur additional indebtedness; |

| • | issue preferred stock; |

| • | create, incur, assume or permit liens; |

| • | consolidate, merge, liquidate, wind up or dissolve; |

| • | make, purchase, hold or acquire investments, including acquisitions, loans and advances; |

| • | pay dividends or make other distributions in respect of equity; |

| • | make payments in respect of junior lien or subordinated debt; |

| • | sell, transfer, lease, license or sublease or otherwise dispose of assets; |

| • | enter into any sale and leaseback transactions; |

| • | enter into any swap transactions; |

| • | engage in transactions with affiliates; |

| • | enter into any restrictive agreement; |

| • | materially alter the business that we conduct; |

| • | change our fiscal year for accounting and financial reporting purposes; |

| • | permit any subsidiary to, make or commit to make any capital expenditure; and |

| • | amend or otherwise change the terms of the documentation governing certain restricted debt. |

| • | There are no underwriters. Consequently, prior to the opening of trading on Nasdaq, there will be no book building process and no price at which underwriters initially sold shares to the public to help inform efficient and sufficient price discovery with respect to the opening trades on Nasdaq. Therefore, buy and sell orders submitted prior to and at the opening of trading of our common stock on Nasdaq will not have the benefit of being informed by a published price range or a price at which the underwriters initially sold shares to the public, as would be the case in an underwritten initial public offering. Moreover, there will be no underwriters assuming risk in connection with the initial resale of shares of our common stock. In an underwritten initial public offering, the underwriters may engage in “covered” short sales in an amount of shares representing the underwriters’ option to purchase additional shares. To close a covered short position, the underwriters purchase shares in the open market or exercise the underwriters’ option to purchase additional shares. In determining the source of shares to close the covered short position, the underwriters typically consider, among other things, the price of shares available for purchase in the open market as compared to the price at which they may purchase shares through the underwriters’ option to purchase additional shares. Purchases in the open market to cover short positions, as well as other purchases underwriters may undertake for their own accounts, may have the effect of preventing a decline in the market price of shares. Given that there will be no underwriters’ option to purchase additional shares and no underwriters engaging in stabilizing transactions, there could be greater volatility in the public price of our common stock during the period immediately following the listing. See also “— Our shares of common stock have no prior public market, an active trading market may not develop or continue to be liquid and the market price of our shares of common stock may be volatile.” |

| • | There is not a fixed or determined number of shares of common stock available for sale in connection with the registration and the listing. Therefore, there can be no assurance that any Registered Stockholders or other existing stockholders will sell any of their shares of common stock and there may initially be a lack of supply of, or demand for, shares of common stock on Nasdaq. Alternatively, we may have a large number of Registered Stockholders or other existing stockholders, who choose to sell their shares of common stock in the near term, resulting in potential oversupply of our common stock, which could adversely impact the public price of our common stock once listed on Nasdaq. |

| • | None of our Registered Stockholders or other existing stockholders has entered into contractual lock-up agreements or other contractual restrictions on transfer. In an underwritten initial public offering, it is customary for an issuer’s officers, directors and most or all of its other stockholders to enter into a 180-day contractual lock-up arrangement with the underwriters to help promote orderly trading immediately after such initial public offering. Consequently, any of our stockholders, including our directors and officers who own our common stock and other significant stockholders, may sell any or all of their shares of common stock at any time (subject to any restrictions under applicable law), including immediately upon listing. If such sales were to occur in a significant volume in a short period of time following the listing, it may result in an oversupply of our common stock in the market, which |

| • | We will not conduct a traditional “roadshow” with underwriters prior to the opening of trading of our common stock on Nasdaq. Instead, we intend to host an investor day and engage in certain other investor education meetings without our financial advisor. In advance of the investor day, we will announce the date for such day over financial news outlets in a manner consistent with typical corporate outreach to investors. We intend to prepare an electronic presentation for this investor day, which will have content similar to a traditional roadshow presentation and to make the presentation publicly available, without restrictions, on our website. There can be no guarantee that the investor day and other investor education meetings will have the same impact on investor education as a traditional “roadshow” conducted in connection with an underwritten initial public offering. As a result, there may not be efficient or sufficient price discovery with respect to our common stock or sufficient demand among potential investors immediately after our listing, which could result in a more volatile public price of our common stock. |

| • | Such differences from an underwritten initial public offering could result in a volatile market price for our common stock and uncertain trading volume, which may adversely affect your ability to sell any shares of common stock that you may purchase. |

| • | the number of shares of our common stock publicly owned and available for trading; |

| • | overall performance of the equity markets and/or publicly-listed companies that offer marketing services and SaaS solutions; |

| • | actual or anticipated fluctuations in our revenue or other operating metrics; |

| • | our actual or anticipated operating performance and the operating performance of our competitors; |

| • | changes in the financial projections we provide to the public or our failure to meet these projections; |

| • | failure of securities analysts to initiate or maintain coverage of us, changes in financial estimates by any securities analysts who follow our company, or our failure to meet the estimates or the expectations of investors; |

| • | any major change in our Board, management, or key personnel; |

| • | the economy as a whole and market conditions in our industry; |

| • | rumors and market speculation involving us or other companies in our industry; |

| • | announcements by us or our competitors of significant innovations, new products, services, features, integrations or capabilities, acquisitions, strategic investments, partnerships, joint ventures, or capital commitments; |

| • | new laws or regulations or new interpretations of existing laws or regulations applicable to our business, including those related to data privacy and cyber-security in the U.S. or globally; |

| • | lawsuits threatened or filed against us; |

| • | other events or factors, including those resulting from war, incidents of terrorism, or responses to these events; and |

| • | sales or expected sales of our common stock by us and our officers, directors and principal stockholders. |

| • | provide for a classified Board with staggered three-year terms; |

| • | do not permit cumulative voting in the election of directors, which would otherwise allow less than a majority of stockholders to elect director candidates; |

| • | delegate the sole power of a majority of the Board to fix the number of directors; |

| • | provide the power of our Board to fill any vacancy on our Board, whether such vacancy occurs as a result of an increase in the number of directors or otherwise; |

| • | eliminate the ability of stockholders to call special meetings of stockholders; and |

| • | establish advance notice requirements for nominations for election to our Board or for proposing matters that can be acted on by stockholders at stockholder meetings. |

| • | significant competition for our Marketing Services solutions and SaaS offerings which include companies who use components of our SaaS offerings provided by third parties; |

| • | we may not maintain profitability; |

| • | we may not manage our growth effectively; |

| • | we may not be able to transition our Marketing Services clients to our Thryv platform, sell our platform into new markets or further penetrate existing markets; |

| • | the effect of COVID-19 on our business, including the measures to reduce its spread, and the impact on the economy and demand for our services, which may precipitate or exacerbate other risks and uncertainties; |

| • | we may not maintain our strategic relationships with third-party service providers; |

| • | internet search engines and portals potentially terminating or materially altering their agreements with us; |

| • | we may not keep pace with rapid technological changes and evolving industry standards; |

| • | our SMB clients potentially opting not to renew their agreements with us or renewing at lower spend; |

| • | potential system interruptions or failures, including cyber-security breaches, identity theft, data loss, unauthorized access to data or other disruptions that could compromise our information; |

| • | our potential failure in identifying and acquiring suitable acquisition candidates; |

| • | the potential loss of one or more key employees or our inability to attract and to retain highly skilled employees; |

| • | we may not maintain the compatibility of our Thryv platform with third-party applications; |

| • | we may not successfully expand our current offerings into new markets or further penetrate existing markets; |

| • | our potential failure to provide new or enhanced functionality and features; |

| • | our potential failure to comply with applicable privacy, security and data laws, regulations and standards; |

| • | potential changes in regulations governing privacy concerns and laws or other domestic or foreign data protection regulations; |

| • | our potential failure to meet service level commitments under our client contracts; |

| • | our potential failure to offer high-quality or technical support services; |

| • | our Thryv platform and add-ons potentially failing to perform properly; |

| • | the potential impact of future labor negotiations; and |

| • | we may not protect our intellectual property rights, proprietary technology, information, processes, and know-how. |

| | | As of December 31, 2019 | |

| | | (in thousands) | |

Cash and cash equivalents | | | $1,912 |

| | | ||

Total debt(1) | | | $714,392 |

Stockholders’ equity: | | | |

Common stock - $0.01 par value per share, 250,000,000 shares authorized; 103,397,908 shares issued and 60,282,947 outstanding at December 31, 2019 | | | 1,034 |

Additional paid-in capital | | | 1,008,241 |

Treasury stock - $0.01 par value per share, 43,114,961 shares at December 31, 2019 | | | (437,962) |

Accumulated (deficit) | | | (544,053) |

Total stockholders’ equity | | | $27,260 |

Total capitalization | | | $741,652 |

| (1) | For a discussion of our existing indebtedness, see “Description of Material Indebtedness” and Note 11, Debt Obligations, to our consolidated financial statements included elsewhere in this prospectus. |

| | | Successor | | | Predecessor | |||||||||||||

| | | Years Ended December 31, | | | Five Months Ended December 31, 2016 | | | Seven Months Ended July 31, 2016 | | | Year Ended December 31, 2015 | |||||||

| | | 2019(1)(2) | | | 2018(1)(2) | | | 2017(2) | | |||||||||

| | | (in thousands, except share and per share data) | ||||||||||||||||

Revenue | | | $1,421,374 | | | $1,784,401 | | | $1,318,166 | | | $230,341 | | | $712,628 | | | $1,498,074 |

Operating expenses: | | | | | | | | | | | | | ||||||

Cost of services (exclusive of depreciation and amortization) | | | 476,355 | | | 647,288 | | | 553,293 | | | 135,546 | | | 267,330 | | | 510,994 |

Sales and marketing | | | 352,740 | | | 469,238 | | | 370,548 | | | 87,429 | | | 176,954 | | | 345,630 |

General and administrative | | | 179,956 | | | 238,554 | | | 223,887 | | | 12,633 | | | 87,558 | | | 165,792 |

Depreciation and amortization | | | 206,270 | | | 266,975 | | | 301,435 | | | 128,947 | | | 150,454 | | | 410,415 |

Impairment charge(3) | | | — | | | — | | | — | | | 712,795 | | | — | | | — |

Total operating expenses | | | 1,215,321 | | | 1,622,055 | | | 1,449,163 | | | 1,077,350 | | | 682,296 | | | 1,432,831 |

Operating income (loss) | | | 206,053 | | | 162,346 | | | (130,997) | | | (847,009) | | | 30,332 | | | 65,243 |

Other income (expense): | | | | | | | | | | | | | ||||||

Interest expense | | | (92,951) | | | (82,697) | | | (67,815) | | | (27,584) | | | (134,753) | | | (354,612) |

Other components of net periodic pension cost | | | (53,161) | | | (516) | | | (40,804) | | | (35,702) | | | (1,475) | | | (14,961) |

(Loss) gain on early extinguishment of debt | | | (6,375) | | | (18,375) | | | 751 | | | 1,056 | | | — | | | 1,250 |

Reorganization items and fresh start adjustments, net(4) | | | — | | | — | | | — | | | — | | | 1,843,991 | | | — |

Income (loss) before (provision) benefit for income taxes | | | 53,566 | | | 60,758 | | | (238,865) | | | (909,239) | | | 1,738,095 | | | (303,080) |

(Provision) benefit for income taxes | | | (18,062) | | | (8,487) | | | 67,541 | | | 286,724 | | | (441,500) | | | 39,617 |

Net income (loss) | | | $35,504 | | | $52,271 | | | $(171,324) | | | $(622,515) | | | $1,296,595 | | | $(263,463) |

Net income (loss) per common share: | | | | | | | | | | | | | ||||||

Basic | | | $0.48 | | | $0.51 | | | $(1.69) | | | $(6.23) | | | $74.01 | | | $(14.98) |

Diluted | | | $0.45 | | | $0.49 | | | $(1.69) | | | $(6.23) | | | $74.01 | | | $(14.98) |

Weighted-average shares used in computing basic and diluted net income (loss) per common share: | | | | | | | | | | | | | ||||||

Basic | | | 73,521,230 | | | 103,196,920 | | | 101,586,026 | | | 99,948,433 | | | 17,518,888 | | | 17,584,843 |

Diluted | | | 78,221,765 | | | 107,336,152 | | | 101,586,026 | | | 99,948,433 | | | 17,518,888 | | | 17,584,843 |

| | | Successor | | | Predecessor | ||||||||||

| | | As of December 31, | | | As of December 31, | ||||||||||

| | | 2019(1)(2) | | | 2018(1)(2) | | | 2017(2) | | | 2016(3)(4) | | | 2015 | |

| | | (in thousands) | |||||||||||||

Cash and cash equivalents | | | $1,912 | | | $34,169 | | | $2,038 | | | $41,409 | | | $175,057 |

Adjusted working capital(5) | | | 221,128 | | | 321,714 | | | 69,906 | | | 204,958 | | | 260,406 |

Total assets(6) | | | 1,388,292 | | | 1,653,488 | | | 1,747,928 | | | 1,253,096 | | | 1,267,565 |

Current maturities of long-term debt | | | — | | | — | | | — | | | — | | | 2,301,167 |

Long-term debt obligations | | | 714,392 | | | 545,861 | | | 812,012 | | | 481,287 | | | |

Financing obligations | | | 56,117 | | | 57,343 | | | 60,460 | | | — | | | — |

Total liabilities(6) | | | 1,361,032 | | | 1,225,148 | | | 1,534,372 | | | 886,389 | | | 2,648,668 |

Total stockholders’ equity (deficit) | | | 27,260 | | | 428,340 | | | 213,556 | | | 366,707 | | | (1,381,103) |

| (1) | The Company’s operating results and financial position for the years ended December 31, 2019 and 2018 were impacted by the adoption of ASC 606. The Company used the modified retrospective method of adoption. Results for reporting periods beginning January 1, 2018 are presented under ASC 606, while prior period amounts were not adjusted and continue to be reported in accordance with the historical accounting guidance under ASC 605. The adoption of ASC 606 resulted in a decrease to revenues of $8.6 million for the year ended December 31, 2018. See Note 1, Description of Business and Summary of Significant Accounting Policies, and Note 2, Revenue Recognition, to our consolidated financial statements included elsewhere in this prospectus for more information. |

| (2) | The Company’s operating results and financial position for the years ended December 31, 2019, 2018 and 2017 were impacted by the YP Acquisition, which occurred on June 30, 2017. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In addition, see Note 3, Acquisitions, to our consolidated financial statements included elsewhere in this prospectus for more information. |

| (3) | During the five months ended December 31, 2016, the Company recorded a goodwill impairment charge of $712.8 million. |

| (4) | In July 2016, the Predecessor successfully emerged from bankruptcy. As a result of fresh start accounting, the Company recorded a pre-tax net gain of $1,844.0 million for reorganization items, including pre-emergence gains of $630.2 million associated with the discharge of liabilities and $1,299.9 million associated with fresh start adjustments, offset by a charge of $86.1 million. |

| (5) | Adjusted working capital is defined as current assets minus current liabilities excluding current maturities of long-term debt obligations, as applicable. |

| (6) | The Company’s financial position for the year ended December 31, 2019 was impacted by the adoption of ASC 842. The Company used the modified retrospective method of adoption. For reporting periods beginning January 1, 2019, leases are presented under ASC 842, while prior period amounts are not adjusted and continue to be reported in accordance with the historical accounting guidance under ASC 840. As of December 31, 2019, the consolidated balance sheet included an operating lease liability of $38.4 million and right-of-use assets of $39.0 million. See Note 1, Description of Business and Summary of Significant Accounting Policies and Note 10, Leases, to our consolidated financial statements included elsewhere in this prospectus for more information. |

| | | As of and for Years Ended December 31, | |||||||

| | | 2019 | | | 2018 | | | 2017 | |

| | | (in thousands, except for dollars) | |||||||

Clients: | | | | | | | |||

Marketing Services | | | 387 | | | 467 | | | 579 |

SaaS | | | 47 | | | 54 | | | 36 |

Total(1) | | | 403 | | | 484 | | | 589 |

ARPU (Monthly): | | | | | | | |||

Marketing Services | | | $ 235 | | | $ 250 | | | $ 262 |

SaaS | | | 219 | | | 201 | | | 210 |

Total(2) | | | $252 | | | $262 | | | $269 |

Monthly Active Users - SaaS (“MAUs”)(3) | | | 22 | | | 22 | | | — |

| (1) | Marketing Services clients plus SaaS clients are greater than Total clients since clients that purchase both Marketing Services and SaaS are considered only one client in the Total client count when the accounts are managed by the same business entity or individual. |

| (2) | Total monthly ARPU is higher than the individual monthly ARPUs for Marketing Services and SaaS due to clients that purchase both Marketing Services and SaaS solutions. |

| (3) | We began tracking MAUs starting with our upgraded platform in 2018. |

| | | Years Ended December 31, | |||||||

| | | 2019 | | | 2018 | | | 2017 | |

| | | (in thousands) | |||||||

Reconciliation of Adjusted EBITDA | | | | | | | |||

Net income (loss) | | | $ 35,504 | | | $ 52,271 | | | $ (171,324) |

Interest expense | | | 92,951 | | | 82,697 | | | 67,815 |

Provision (benefit) for income taxes | | | 18,062 | | | 8,487 | | | (67,541) |

Depreciation and amortization expense | | | 206,270 | | | 266,975 | | | 301,435 |

Loss (gains) on early extinguishment of debt | | | 6,375 | | | 18,375 | | | (751) |

Restructuring and integration charges(a) | | | 45,960 | | | 87,307 | | | 65,645 |

Direct listing expenses(b) | | | 4,003 | | | — | | | — |

Stock-based compensation expense | | | 14,119 | | | 39,604 | | | 23,364 |

Other components of net periodic pension cost(c) | | | 53,161 | | | 516 | | | 40,804 |

Non-cash loss (gain) from remeasurement of indemnification asset(d) | | | 4,093 | | | (9,518) | | | (6,191) |

| | | | | | | ||||

Adjusted EBITDA | | | $480,498 | | | $546,714 | | | $253,256 |

| (a) | Restructuring and other integration charges include severance benefits, facility exit costs, system consolidation and integration costs, and professional consulting and advisory services costs related to the YP Acquisition. See Note 6, Restructuring and Integration Expenses, to our consolidated financial statements included elsewhere in this prospectus for more information. |

| (b) | The Company incurred $4.0 million of expenses related to its direct listing, including accounting, legal, printing and other fees. |

| (c) | Other components of net periodic pension cost is from our non-contributory defined benefit pension plans that are currently frozen and incur no additional service costs. The increase in components of net periodic pension cost for the year ended December 31, 2019 was primarily due to a mark to market pension remeasurement loss of $45.4 million during the year ended December 31, 2019 compared to a pension remeasurement gain of $3.5 million during the year ended December 31, 2018. The decrease in components of net periodic pension cost for the year ended December 31, 2018 was primarily due to a mark to market pension remeasurement gain of $3.5 million during the year ended December 31, 2018 compared to a pension remeasurement loss of $40.3 million during the year ended December 31, 2017. See Note 12, Pensions, to our consolidated financial statements included elsewhere in this prospectus for more information. |

| (d) | In connection with the YP Acquisition, the seller provided the Company indemnity for future potential losses associated with certain federal and state tax positions taken in tax returns filed by the seller prior to the Acquisition Date. The indemnity covers potential losses in excess of $8.0 million and is capped at an amount equal to the lesser of the UTP Liability or the current fair value of the 3,248,487 Shares. See Note 3, Acquisitions, to our consolidated financial statements included elsewhere in this prospectus for more information. |

| | | Years Ended December 31, | |||||||

| | | 2019 | | | 2018 | | | 2017 | |

| | | (in thousands) | |||||||

Reconciliation of Free Cash Flow | | | | | | | |||

Net cash provided by operating activities | | | $270,599 | | | $347,061 | | | $240,793 |

Cash expenditures for additions to fixed assets and capitalized software | | | (26,065) | | | (27,429) | | | (19,992) |

Free Cash Flow | | | $ 244,534 | | | $ 319,632 | | | $ 220,801 |

| | | As of December 31, | |||||||

| | | 2019 | | | 2018 | | | 2017 | |

| | | (in thousands) | |||||||

Clients | | | | | | | |||

Marketing Services | | | 387 | | | 467 | | | 579 |

SaaS | | | 47 | | | 54 | | | 36 |

Total(1) | | | 403 | | | 484 | | | 589 |

| (1) | Marketing Services clients plus SaaS clients are greater than Total clients since clients that purchase both Marketing Services and SaaS are considered only one client in the Total client count when the accounts are managed by the same business entity or individual. |

| | | Years Ended December 31, | |||||||

| | | 2019 | | | 2018 | | | 2017 | |

ARPU (Monthly) | | | | | | | |||

Marketing Services | | | $235 | | | $250 | | | $262 |

SaaS | | | 219 | | | 201 | | | 210 |

Total(1) | | | $252 | | | $262 | | | $269 |

| (1) | Total monthly ARPU is higher than the individual monthly ARPUs for Marketing Services and SaaS due to clients that purchase both Marketing Services and SaaS solutions. |

| | | December 31, | |||||||

| | | 2019 | | | 2018 | | | 2017 | |

| | | (in thousands) | |||||||

Monthly Active Users – SaaS(1) | | | 22 | | | 22 | | | — |

| (1) | We began tracking MAUs starting with our upgraded platform in 2018. |

| | | Years Ended December 31, | ||||||||||||||||

| | | 2019 | | | 2018 | | | 2017 | ||||||||||

| | | (in thousands) | ||||||||||||||||

| | | Amount | | | % of Revenue | | | Amount | | | % of Revenue | | | Amount | | | % of Revenue | |

Revenue | | | $1,421,374 | | | 100% | | | $1,784,401 | | | 100% | | | $1,318,166 | | | 100% |

Operating expenses: | | | | | | | | | | | | | ||||||

Cost of services (exclusive of depreciation and amortization) | | | 476,355 | | | 33.5 | | | 647,288 | | | 36.3 | | | 553,293 | | | 42.0 |

Sales and marketing | | | 352,740 | | | 24.8 | | | 469,238 | | | 26.3 | | | 370,548 | | | 28.1 |

General and administrative | | | 179,956 | | | 12.7 | | | 238,554 | | | 13.4 | | | 223,887 | | | 17.0 |

Depreciation and amortization | | | 206,270 | | | 14.5 | | | 266,975 | | | 15.0 | | | 301,435 | | | 22.9 |

Total operating expenses | | | 1,215,321 | | | 85.5 | | | 1,622,055 | | | 90.9 | | | 1,449,163 | | | 109.9 |

Operating income (loss) | | | 206,053 | | | 14.5 | | | 162,346 | | | 9.1 | | | (130,997) | | | (9.9) |

Other income (expense) | | | | | | | | | | | | | ||||||

Interest expense | | | (92,951) | | | (6.5) | | | (82,697) | | | (4.6) | | | (67,815) | | | (5.1) |

Other components of net periodic pension cost | | | (53,161) | | | (3.7) | | | (516) | | | — | | | (40,804) | | | (3.1) |

(Loss) / gain on early extinguishment of debt | | | (6,375) | | | (0.4) | | | (18,375) | | | (1.0) | | | 751 | | | — |

Income (loss) before (provision) benefit for income taxes | | | 53,566 | | | 3.8 | | | 60,758 | | | 3.4 | | | (238,865) | | | (18.1) |

(Provision) benefit for income taxes | | | (18,062) | | | (1.3) | | | (8,487) | | | (0.5) | | | 67,541 | | | 5.1 |

Net income (loss) | | | $35,504 | | | 2.5% | | | $52,271 | | | 2.9% | | | $(171,324) | | | (13.0)% |

Other Financial Data: | | | | | | | | | | |||||||||

Adjusted EBITDA | | | $ 480,498 | | | | | $ 546,714 | | | | | $ 253,256 | | | |||

| | | Years Ended December 31, | | | Change | |||||||

| | | 2019 | | | 2018 | | | Amount | | | % | |

| | | (in thousands) | ||||||||||

Marketing Services | | | $1,292,217 | | | $1,659,786 | | | $(367,569) | | | (22.1)% |

SaaS | | | 129,157 | | | 124,615 | | | 4,542 | | | 3.6 |

Total revenues | | | $1,421,374 | | | $1,784,401 | | | $(363,027) | | | (20.3)% |

| | | Years Ended December 31, | | | Change | |||||||

| | | 2018 | | | 2017 | | | Amount | | | % | |

| | | (in thousands) | ||||||||||

Marketing Services | | | $1,659,786 | | | $1,243,014 | | | $416,772 | | | 33.5% |

SaaS | | | 124,615 | | | 75,152 | | | 49,463 | | | 65.8 |

Total revenues | | | $1,784,401 | | | $1,318,166 | | | $466,235 | | | 35.4% |

| | | Years Ended December 31, | |||||||

| | | 2019 | | | 2018 | | | 2017 | |

| | | (in thousands) | |||||||

Cash flows provided by (used in): | | | | | | | |||

Operating activites | | | $270,599 | | | $347,061 | | | $240,793 |

Investing activities | | | (25,365) | | | (28,662) | | | (600,394) |

Financing activities | | | (277,491) | | | (286,268) | | | 320,230 |

(Decrease) increase in Cash and cash equivalents | | | $(32,257) | | | $32,131 | | | $(39,371) |

| | | Total | | | Less than 1 Year | | | 1-3 Years | | | 3-5 Years | | | More than 5 Years | |

| | | (in thousands) | |||||||||||||

Senior Term Loan | | | $609,407 | | | $— | | | $— | | | $609,407 | | | $— |

ABL Facility | | | 104,985 | | | — | | | — | | | 104,985 | | | — |

Interest payments(1) | | | 296,581 | | | 74,439 | | | 148,099 | | | 74,043 | | | — |

Operating leases(2) | | | 48,091 | | | 12,439 | | | 14,974 | | | 13,777 | | | 6,901 |

Other financing obligations(3) | | | 1,441 | | | 580 | | | 861 | | | — | | | — |

Purchase commitments(4) | | | 715 | | | 715 | | | — | | | — | | | — |

Unrecognized tax benefits(5) | | | 53,111 | | | 53,111 | | | — | | | — | | | — |

Total contractual obligations | | | $1,114,331 | | | $141,284 | | | $163,934 | | | $802,212 | | | $6,901 |

| (1) | Represents the estimated interest payments associated with the amounts outstanding on our Senior Term Loan and ABL Facility as of December 31, 2019, assuming current interest rates and the amount of debt outstanding in the periods indicated in the table above. Refer to Note 11—Debt Obligations in the notes to our consolidated financial statements that are included in this filing. |

| (2) | Represents the undiscounted future minimum lease payments under non-cancelable operating leases. |

| (3) | Represents future minimum lease payments under financing obligations related to a failed sale-leaseback liability associated with property in Tucker, Georgia. |

| (4) | Represents future purchase commitments from third-party service providers. Reasonable estimates of the period of cash outflows related to purchase commitments beyond one year cannot be made. |

| (5) | In connection with the YP Acquisition, the Company recorded a UTP liability relating to certain federal and state tax positions regarding credits, deductions, and other apportionment items associated with income tax returns filed by the seller prior to the acquisition date. The seller provided the Company indemnity for future potential losses in excess of $8 million. The indemnity is capped at an amount equal to the lesser of the UTP liability or the current fair value of shares of the Company’s company stock issued to the seller as part of purchase consideration. The seller may elect to pay such amounts in cash and/or shares. The recorded value of the UTP liability, including interest and penalties, and the related indemnification asset were $53.1 million and $29.8 million, respectively, at December 31, 2019. See Note 3, Acquisitions, and Note 16, Contingent Liabilities. Additionally, for approximately $1.8 million of our unrecognized tax benefits, we are unable to reasonably estimate the timing of the cash outflow due to uncertainties in the timing of the effective settlement of tax positions. |

| • | Print Yellow Pages. Print marketing solutions through our owned and operated PYPs, which carry “The Real Yellow Pages” tagline; |

| • | Internet Yellow Pages. Digital marketing solutions through our proprietary IYPs, including Yellowpages.com, Superpages.com and Dexknows.com; |

| • | Search Engine Marketing. SEM solutions that deliver business leads from Google, Yahoo!, Bing, Yelp and other major engines and directories; and |

| • | Other Digital Media Solutions. Other digital media solutions, which include stand-alone websites, online display and social advertising, online presence and video and SEO tools. |

| | | Years Ended December 31, | |||||||

| | | 2019 | | | 2018 | | | 2017 | |

| | | (in thousands) | |||||||

Marketing Services | | | | | | | |||

PYP | | | $604,417 | | | $798,838 | | | $542,745 |

IYP | | | 340,257 | | | 379,687 | | | 259,526 |

SEM | | | 232,084 | | | 328,814 | | | 288,161 |

Other | | | 115,459 | | | 152,447 | | | 152,582 |

Total Marketing Services | | | $1,292,217 | | | $1,659,786 | | | $1,243,014 |

| • | Thryv®. Thryv®, our Thryv platform is our flagship SMB business management platform. Our Thryv platform capabilities include CRM, email and text, appointment bookings, estimates, invoices, online presence, social media, reputation management and bill payment. The platform also helps SMBs to find and retain customers using online listings management and social media; and |

| • | Thryv Leads® and add-ons. Thryv Leads is our integrated lead management solution, and we offer a range of add-ons that can be purchased in conjunction with our Thryv platform including, but not limited to, website development and SEO tools. |

| | | Years Ended December 31, | |||||||

| | | 2019 | | | 2018 | | | 2017 | |

| | | (in thousands) | |||||||

SaaS | | | | | | | |||

Thryv platform | | | $96,887 | | | $111,875 | | | $72,755 |

Thryv Leads and add-ons | | | 32,270 | | | 12,740 | | | 2,397 |

Total SaaS | | | $ 129,157 | | | $ 124,615 | | | $ 75,152 |

| • | Rising Expectations of the Digital Consumer. Consumers have grown accustomed to sophisticated web platforms and mobile applications that deliver modern solutions. Large enterprises have optimized experiences such as one-click e-commerce, instant ride-sharing, and food delivery applications. Many SMBs are challenged to create these “frictionless” customer experiences by themselves. |

| • | Increasingly Fragmented Consumer Marketplace. As a growing majority of consumers turn to digital platforms and applications for information, SMBs face challenges in finding ways to connect with their customers. Meanwhile, a subset of consumers still prefers traditional forms of media, such as print. We believe it is increasingly difficult for SMBs to target both of these consumer segments with a coherent strategy. |

| • | Businesses Are Challenged to Determine Which Advertising Is Effective. The old John Wanamaker adage, “Half the money I spend on advertising is wasted; the trouble is, I don’t know which half,” is still true. We believe the print and digital advertising choices for SMBs have become overwhelming and that many SMBs benefit from assistance in identifying the most advantageous advertising medium. |

| • | the advertiser’s bid price, and |

| • | click-through rate (the rate at which users click through to the ad). |

| • | Websites: Our websites leverage a third-party platform that we view as best-in-class and captivate our client’s audience through photos and personalized content. Our offering allows our clients to make an impactful online first impression by telling their company’s story through professionally designed and interactive pages. |

| • | Online Display and Social Advertising: We enable our clients to promote their company’s image through online advertising that drives leads and brand recognition. |

| • | Online Presence and Video: We help our client’s business look vibrant and engaging. We record videos on-site using a partner that we view as best-in-class, allowing clients to appeal to different audiences on different platforms. |

| • | SEO: Works to improve rankings within search engines like Google, Yahoo! and Bing. We make our client’s website more visible and prominent. |

| • | Acquire New Customers. Thryv Leads allows SMBs to acquire new customers by simply indicating how many new customers per month they want to reach. SMBs decide on the number of business leads per month that they need, and Thryv Leads recommends a budget based on the costs in the client’s category and geographical area. Thryv Leads then delineates the SMB’s spending across advertising solutions such as print, digital and social media allowing SMBs to avoid the confusion of determining a proper ad budget. |

| • | Simplify Lead Tracking. Thryv Leads tracks and attributes each business lead that the SMB receives. |

| • | Analyze Advertising Results. Thryv Leads provides the SMB with proof that the SMB’s advertising is effective and enables SMBs to leverage consumer respondent information by injecting data into the SMB’s Thryv platform, creating a usable database for SMBs. |

| • | Automatically Answer Calls. Thryv Leads provides call answering services to assist SMBs in maintaining communication with new and existing customers. |

| • | our nationwide, inside and outside sales forces; |

| • | inbound telephone, driven by direct mail, online advertising and other lead generation activities; |

| • | outbound mail channel; |

| • | resellers and agencies; |

| • | affiliates; and |

| • | corporate partnerships. |

| • | customized, integrated and tailored solution strategies; |

| • | flexible technology that is compatible with third-party applications and data sources; |

| • | quality; |

| • | pricing; |

| • | ease of use; |

| • | brand recognition and word-of-mouth referrals; |

| • | availability of onboarding programs and customer support; and |

| • | nationwide and extensive, inside and outside sales forces. |

| • | Point Solution Providers. We compete with single-point solution providers across many features. Many of these products are low-cost and some have been in the market longer than Thryv. |

| • | Vertical Solutions. Vertical solutions exist in many categories including Home Services, Health & Wellness, Animal Services, Professional Services and Educational Services. Competitors have studied these categories and customized their product for that category. These companies offer a tailored solution with targeted appeal. Some also have consumer-facing apps that create demand for the SMB. |

| • | All-In-One Competitors. Our most direct competitors are other all-in-one solutions. Several are priced above our price point or target larger companies with more employees. |

| • | trademark protection on brands, taglines and products; |

| • | proprietary roadmap and product stack with proprietary code; |

| • | machine learning algorithms and techniques; |

| • | notice of allowance on a patent related to systems and methods underlying Thryv Leads, which processes include the coordination among our lead estimator tool, lead scoring systems, budget allocation systems and the SMB’s CRM system; |

| • | strategic alliances; |

| • | branding via proprietary print and online assets; and |

| • | copyright protections on work product. |

| • | product features; |

| • | customer FAQs; |

| • | our ideal client profile; |

| • | website images and content; |

| • | vertical industry templates and taxonomy; |

| • | how-to videos; and |

| • | articles, blogs and guides on using and competing with digital marketing. |

Name | | | Age | | | Position |

Joseph A. Walsh | | | 56 | | | Chief Executive Officer, President and Director |

Paul D. Rouse | | | 61 | | | Chief Financial Officer, Executive Vice President and Treasurer |

Gordon Henry | | | 58 | | | Chief Strategy Officer and Executive Vice President |

James McCusker | | | 57 | | | Chief Revenue Officer and Executive Vice President |

Deb Ryan | | | 68 | | | Chief Human Resources Officer and Executive Vice President |

John Wholey | | | 55 | | | Executive Vice President of Operations |

Lesley Bolger | | | 41 | | | Chief Compliance Officer, Vice President of Corporate Counsel and Secretary |

Jason Mudrick | | | 45 | | | Chairman and Director |

Scott Galloway | | | 54 | | | Director |

Peter Glusker | | | 58 | | | Director |

Scott Kasen | | | 54 | | | Director |

Brian Kushner | | | 61 | | | Director |

Ross Levinsohn | | | 55 | | | Director |

John Slater | | | 46 | | | Director |

| • | audits of our financial statements; |

| • | the integrity of our financial statements; |

| • | our process relating to risk management and the conduct and systems of internal control over financial reporting and disclosure controls and procedures; |

| • | the qualifications, engagement, compensation, independence, and performance of our independent auditor; and |

| • | the performance of our internal audit function. |

| • | determining and approving the compensation of our executive officers; and |

| • | reviewing and approving incentive compensation and equity compensation policies and programs. |

| • | make recommendations to the Board regarding nomination of individuals as members of the Board and its committees; |

| • | assist the Board with identifying individuals qualified to become Board members; and |

| • | determine corporate governance practices and related matters. |

| • | Joseph A. Walsh, who serves as President and Chief Executive Officer; |

| • | Paul D. Rouse, who serves as Chief Financial Officer, Executive Vice President and Treasurer; |

| • | Gordon Henry, who serves as Chief Strategy Officer and Executive Vice President; |

| • | James McCusker, who serves as Chief Revenue Officer and Executive Vice President; and |

| • | John Wholey, who serves as Executive Vice President of Operations. |

| • | the performance of our NEOs in prior years; |

| • | the roles and responsibilities of our NEOs; |

| • | the individual experience and skills of our NEOs; |

| • | for each named executive officer, other than our Chief Executive Officer, the evaluations and recommendations of our Chief Executive Officer; and |

| • | the amounts of compensation being paid to our other NEOs. |

| | | What it Does—How it Works | | | 2019 Plan Metrics—Weighting | |||||||

Base Salary | | | • | | | Basic element of competitive pay. | | | Not applicable. | |||

| | | • | | | Influences annual incentive value (base salary × target annual incentive %). | | | | | |||

Short-Term Incentive Plan: Cash | | | • | | | Performance-based compensation element with a variable payout potential based on corporate and individual performance. | | | • | | | Adjusted EBITDA—50% |

| | • | | | Adjusted Free Cash Flow—25% | ||||||||

| | • | | | Individual Performance—25% | ||||||||

| | | • | | | Intended to motivate and reward executive officers for the achievement of annual (short-term) business objectives. | | | | | |||

Over Performance Plan: Cash | | | • | | | Incremental incentive plan designed as an overachievement program to our Short-Term Incentive Plan. | | | • | | | Adjusted EBITDA—50% |

| | • | | | Adjusted Free Cash Flow—50% | ||||||||

| | | • | | | Performance-based compensation element with variable payout potential based on company financial performance. | | | | | |||

| | | • | | | Intended to motivate and reward executive officers for the overachievement of annual business objectives. | | | | | |||

Stock Incentive Plan: Non-Qualified Stock Options | | | • | | | Options to acquire shares of stock that vest over a 3-year period beginning on January 1, 2020 for options granted in 2019. | | | Not applicable. | |||

| | | • | | | Designed to retain executives and align their interests with those of the Company’s stockholders. | | | | | |||

| | | What it Does—How it Works | | | 2019 Plan Metrics—Weighting | |||||||

Executive Physical | | | • | | | Executive officers receive annual reimbursement for a comprehensive medical examination up to $1,800 for EVP and the actual cost of the executive physical for the CEO. | | | Not applicable. | |||

Retirement Benefits | | | • | | | A 401(k) retirement savings plan enables all employees, including executive officers, to contribute a portion of their compensation with a company matching contribution. | | | Not applicable. | |||

Employment and Severance Benefits | | | • | | | CEO Employment Agreement provides for salary, incentive opportunities and severance benefits. | | | Not applicable. | |||

| | | • | | | Thryv, Inc. Severance Plan—Executive Vice Presidents and Above (“EVP Severance Plan”) provides for severance benefits equal to a multiple of salary and target short-term incentive award in the event of certain qualifying terminations of employment. | | | | | |||

Relocation Lump Sum | | | • | | | EVP NEOs who commute from another state to Texas are eligible for an annual lump sum payment each December for the upcoming year in lieu of all relocation benefits. | | | Not applicable. | |||

Stipend Allowance | | | • | | | A stipend allowance to cover cell phone expenses is paid out each payroll at $25 per pay period. | | | Not applicable. | |||

Named Executive Officers | | | Base Salary Prior to March 31, 2019 | | | Base Salary Following March 31, 2019 |

| | | | | |||

Joseph A. Walsh | | | $1,000,000 | | | $1,030,000 |

Paul D. Rouse | | | $491,727 | | | $506,479 |

Gordon Henry | | | $393,382 | | | $405,183 |

James McCusker | | | $393,382 | | | $405,183 |

John Wholey | | | $371,527 | | | $382,673 |

Named Executive Officers | | | Target Annual Incentive (STI) |

| | | ||

Joseph A. Walsh | | | 100% |

Paul D. Rouse | | | 70% |

Gordon Henry | | | 70% |

James McCusker | | | 70% |

John Wholey | | | 70% |

| 1. | Adjusted EBITDA (50%). This performance metric supports our focus on improving revenue trends and reflects the public budget released on February 26, 2019, which represents the budget guiding principles and financial projections of the Company for fiscal year 2019. Adjusted EBITDA is adjusted for certain investments in growth opportunities. |

| 2. | Adjusted Free Cash Flow (“Adjusted FCF”) (25%). This performance metric supports our goal of generating cash to build the business, while continuing to meet our debt requirements. Free Cash Flow has been adjusted to reflect the public budget release of February 26, 2019, which represents the budget guiding principles and financial projections of the Company for fiscal year 2019. Adjusted FCF does not include certain tax liabilities, settlement of liability stock option awards and certain investments in growth opportunities, including merger and acquisitions and relisting activities. |

| 3. | Individual Performance (25%). This performance metric supports our goal of pay for performance. It is determined based on individual performance assessment by our CEO. In fiscal year 2019, the Company established a minimum EBITDA threshold of $470 million for this performance metric. This means that if EBITDA for fiscal year 2019 was below $470 million, no incentive award would be earned for the Individual Performance metric (i.e. 25% of the STI payout opportunity would not be funded). |

EBITDA (in millions) | | | % of EBITDA Component Payout | | | | | Adjusted FCF (in millions) | | | % of Adjusted FCF Component Payout | |

$ 491.00 | | | 25% | | | Threshold | | | $211.00 | | | 25% |

$ 492.00 | | | 33% | | | | | $ 212.00 | | | 33% | |

$ 493.00 | | | 42% | | | | | $ 213.00 | | | 42% | |

$ 494.00 | | | 50% | | | | | $ 214.00 | | | 50% | |

$ 495.00 | | | 58% | | | | | $ 215.00 | | | 58% | |

$ 496.00 | | | 67% | | | | | $ 216.00 | | | 67% | |

$ 497.00 | | | 75% | | | | | $ 217.00 | | | 75% | |

$ 498.00 | | | 83% | | | | | $ 218.00 | | | 83% | |

$ 499.00 | | | 92% | | | | | $ 219.00 | | | 92% | |

$ 500.00 | | | 100% | | | Target | | | $ 220.00 | | | 100% |

$ 501.50 | | | 104% | | | | | $ 221.00 | | | 104% | |

$ 503.00 | | | 108% | | | | | $ 222.00 | | | 108% | |

$ 504.50 | | | 113% | | | | | $ 223.00 | | | 113% | |

$ 506.00 | | | 117% | | | | | $ 224.00 | | | 117% | |

$ 507.50 | | | 121% | | | | | $ 225.00 | | | 121% | |

$ 509.00 | | | 125% | | | Maximum | | | $ 226.00 | | | 125% |

| | | | | | | | |

Named Executive Officers | | | 2019 STI Paid on April 1, 2020 |

| | | ||

Joseph A. Walsh | | | $1,080,213 |

Paul D. Rouse | | | $371,819 |

Gordon Henry | | | $297,455 |

James McCusker | | | $297,455 |

John Wholey | | | $280,930 |

Named Executive Officers | | | Target Annual Incentive (OPP) |

| | | ||

Joseph A. Walsh | | | 100% |

Paul D. Rouse | | | 70% |

Gordon Henry | | | 70% |

James McCusker | | | 70% |

John Wholey | | | 70% |

| 1. | Adjusted EBITDA (50%). This performance metric supports our focus on improving revenue trends and reflects the public budget released on February 26, 2019, which represents the budget guiding principles and financial projections of the Company for fiscal year 2019. Adjusted EBITDA is adjusted for certain investments in growth opportunities. |

| 2. | Adjusted FCF (50%). This performance metric supports our goal of generating cash to build the business, while continuing to meet our debt requirements. Free Cash Flow has been adjusted to reflect the public budget release of February 26, 2019, which represents the budget guiding principles and financial projections of the Company for fiscal year 2019. Adjusted FCF does not include certain tax liabilities, settlement of liability stock option awards and certain investments in growth opportunities, including merger and acquisitions and relisting activities.. |

EBITDA (in millions) | | | % of EBITDA Component Payout | | | | | Adjusted FCF (in millions) | | | % of Adjusted FCF Component Payout | |

$ 509.00 | | | | | Threshold | | | $ 226.00 | | | ||

$ 511.00 | | | 10% | | | | | $228.00 | | | 10% | |

$ 513.00 | | | 20% | | | | | $230.00 | | | 20% | |

$ 515.00 | | | 30% | | | | | $ 232.00 | | | 30% | |

$ 517.00 | | | 40% | | | | | $ 234.00 | | | 40% | |

$ 519.00 | | | 50% | | | | | $ 236.00 | | | 50% | |

$ 521.00 | | | 60% | | | | | $ 238.00 | | | 60% | |

$ 523.00 | | | 70% | | | | | $ 240.00 | | | 70% | |

$ 525.00 | | | 80% | | | | | $ 242.00 | | | 80% | |

$ 527.00 | | | 90% | | | | | $ 244.00 | | | 90% | |

$ 529.00 | | | 100% | | | | | $ 246.00 | | | 100% | |

$ 531.00 | | | 110% | | | | | $ 248.00 | | | 110% | |

$ 533.00 | | | 120% | | | | | $ 250.00 | | | 120% | |

$ 535.00 | | | 130% | | | | | $ 252.00 | | | 130% | |

$ 537.00 | | | 140% | | | | | $ 254.00 | | | 140% | |

$ 539.00+ | | | 150%+ | | | No Cap | | | $256.00+ | | | 150%+ |

Named Executive Officers | | | 2019 OPP Paid on April 1, 2020 |

| | | ||

Joseph A. Walsh | | | $581,950 |

Paul D. Rouse | | | $200,312 |

Gordon Henry | | | $160,250 |

James McCusker | | | $160,250 |

John Wholey | | | $151,347 |

Named Executive Officers | | | Stock Options(1) | | | Stock Options Grant Date Value ($)(2) |

| | | | | |||

Joseph A. Walsh | | | 2,000,000 | | | 10,793,400 |

Paul D. Rouse | | | 200,000 | | | 1,079,340 |

Gordon Henry | | | 200,000 | | | 1,079,340 |

James McCusker | | | 200,000 | | | 1,079,340 |

John Wholey | | | 200,000 | | | 1,079,340 |

| (1) | On November 18, 2019, Mr. Walsh received an award of stock options to acquire 2,000,000 shares of the Company’s common stock at an exercise price of $9.00, with vesting occurring in equal monthly installments over a three-year period beginning January 1, 2020. On November 18, 2019, Messrs. Rouse, Henry, McCusker and Wholey each received an award of stock options to acquire 200,000 shares of the Company’s common stock at an exercise price of $9.00, with one-third vesting each January 1, 2021, 2022 and 2023. |

| (2) | The fair market value of the November 18, 2019 grants, based on the Black-Scholes valuation model, is $5.3967. |

Name and Principal Position | | | Fiscal Year | | | Salary ($)(a) | | | Non-Equity Incentive Plan Compensation ($)(b) | | | Option Awards ($)(c) | | | All Other Compensation ($)(d) | | | Total ($) |

Joseph A. Walsh | | | 2019 | | | 1,021,923 | | | 1,662,163 | | | 10,793,400 | | | 16,869,514 | | | 30,347,000 |

President & CEO | | |||||||||||||||||

Paul D. Rouse | | | 2019 | | | 502,507 | | | 572,131 | | | 1,079,340 | | | 1,814,368 | | | 3,968,346 |

Chief Financial Officer, EVP & Treasurer | | |||||||||||||||||

Gordon Henry | | | 2019 | | | 402,006 | | | 457,705 | | | 1,079,340 | | | 1,696,790 | | | 3,635,841 |

Chief Strategy Officer & EVP | | |||||||||||||||||

James McCusker | | | 2019 | | | 402,006 | | | 457,705 | | | 1,079,340 | | | 1,696,790 | | | 3,635,841 |

Chief Revenue Officer & EVP | | |||||||||||||||||

John Wholey | | | 2019 | | | 379,672 | | | 432,277 | | | 1,079,340 | | | 1,696,790 | | | 3,588,079 |

EVP of Operations | | | | | | | | | | | | |

| (a) | Amounts reported in this column represent the actual salary earned by each of our NEOs during 2019, taking into account the increase in annual base salary rates for the NEOs, which was effective March 31, 2019. |

| (b) | Amounts reported in this column represent the cash incentive awards paid under our STI and OPP for 2019 performance, which were approved on March 3, 2020 and paid on April 1, 2020. |

| (c) | Amounts reported in this column reflect the grant date value of awards calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“FASB ASC Topic 718”) without regard to estimated forfeitures related to service-based vesting conditions. The assumptions used in calculating the grant date fair value are set forth in Note 4, Fair value measurements to our consolidated financial statements included elsewhere in this prospectus. |

| (d) | All Other Compensation for fiscal year 2019 consisted of the following (all amounts in dollars): |

Name | | | 401(k) Matching Contributions ($)(1) | | | Relocation Expenses (and Gross Up) ($)(2) | | | Allowance ($)(3) | | | Stock Option Tender Offer - Cash Payment ($)(4) | | | Total |

Joseph A. Walsh | | | 13,440 | | | — | | | 30,825 | | | 16,825,249 | | | 16,869,514 |

Paul D. Rouse | | | 13,440 | | | 117,578 | | | 825 | | | 1,682,525 | | | 1,814,368 |

Gordon Henry | | | 13,440 | | | — | | | 825 | | | 1,682,525 | | | 1,696,790 |

James McCusker | | | 13,440 | | | — | | | 825 | | | 1,682,525 | | | 1,696,790 |

John Wholey | | | 13,440 | | | — | | | 825 | | | 1,682,525 | | | 1,696,790 |

| (1) | Amounts reported in this column represent the matching contribution made by the Company under the Company’s tax-qualified 401(k) retirement plan. |

| (2) | Amount reported in this column reflects an annual lump sum allowance of $60,000 and a related tax gross-up payment of $57,578 made to Mr. Rouse in lieu of all relocation benefits for the upcoming fiscal year 2020 for expenses associated with his commute from New York to Texas. |

| (3) | Amounts reported in this column reflect a stipend to cover cell phone expenses of the NEOs. In addition to the cell phone stipend, Mr. Walsh receives an additional expense allowance of $30,000 for maintenance of a remote office and miscellaneous expenses incurred. |

| (4) | Represents a one-time cash payment that occurred as a result of a tender offer (the “Tender Offer”) made by the Company to all stockholders and option holders. Vested options were repurchased by the Company at $10.15 per option less the exercise price of $2.04 for a cash payment made on May 1, 2019. The Company purchased 62.239% of the NEOs’ vested options which equated to 2,074,630 options from Mr. Walsh and 207,463 options each from Messrs. Rouse, Henry, McCusker and Wholey. See “Certain Relationships and Related Party Transactions — Stock Repurchases.” |

| | | | | | | Estimated Future Payouts Under Non- Equity Incentive Plan Awards | | | All Other Option/ SAR Awards: Number of Securities Underlying Options/ SARs (#)(2) | | | Exercise or Base Price of Option/ SAR Awards ($/Share) (2) | | | Grant Date Fair Value of Stock and Option/ SAR Awards(2) | |||||||||

Name | | | | | Grant Date | | | Threshold ($)(1) | | | Target ($)(1) | | | Maximum ($)(1) | | |||||||||

Joseph A. Walsh | | | STI | | | 1/1/2019 | | | 450,625 | | | 1,030,000 | | | 1,351,875 | | | | | | | |||

| | OPP | | | 1/1/2019 | | | 51,500 | | | 1,030,000 | | | | | | | | | ||||||

| | SIP | | | 11/18/2019 | | | | | | | | | 2,000,000 | | | 5.397 | | | 10,793,400 | |||||

Paul D. Rouse | | | STI | | | 1/1/2019 | | | 155,109 | | | 354,535 | | | 465,328 | | | | | | | |||