- THRY Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Thryv (THRY) DEF 14ADefinitive proxy

Filed: 29 Apr 24, 3:02pm

| | | 2200 West Airfield Drive, P.O. Box 619810, DFW Airport, Texas 75261 |

| |  | | | Elect three Class I directors of Thryv Holdings, Inc., each to serve a three-year term expiring at the 2027 annual meeting of stockholders and until such director’s successor is duly elected and qualified. | |

| |  | | | Ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. | |

| |  | | | Approve, on a non-binding advisory basis, the compensation of our named executive officers. | |

| |  | | | Transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. | |

| Thryv Holdings, Inc. | | | 1 | | | 2024 Proxy Statement |

| | Proposal | | | | | Board Recommendation | | |

| |  | | | The election of three Class I directors named in this Proxy Statement | | | For All Nominees | |

| |  | | | The ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 | | | For | |

| |  | | | Non-binding advisory vote on the compensation of our named executive officers | | | For | |

| Thryv Holdings, Inc. | | | 2 | | | 2024 Proxy Statement |

| | | Vote by Internet at the Annual Meeting You may vote via the virtual meeting website—any stockholder can attend the Annual Meeting by visiting https://www.virtualshareholder meeting.com/THRY2024, where stockholders may vote during the meeting. The meeting starts at 10 a.m. Central Time. Please have your 16-Digit Control Number to join the Annual Meeting. Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.proxyvote.com. | | |  | | | Vote by Telephone or Internet You may vote by telephone or through the Internet—in order to do so, please follow the instructions shown on your proxy card. | | |  | | | Vote by Mail You may vote by mail—if you request or receive a paper proxy card and voting instructions by mail, simply complete, sign, and date the enclosed proxy card and promptly return it in the envelope provided or, if the envelope is missing, please mail your completed proxy card to Vote Processing, c/o Broadridge Financial Solutions, Inc., 51 Mercedes Way, Edgewood, New York 11717. Your completed, signed, and dated proxy card must be received prior to the Annual Meeting. |

| Thryv Holdings, Inc. | | | 3 | | | 2024 Proxy Statement |

| • | delivering to our Chief Legal Officer & Human Resources and Executive Vice President, Chief Compliance Officer and Secretary by mail a written notice stating that the proxy is revoked; |

| • | signing and delivering a proxy bearing a later date; |

| • | voting again by telephone or through the Internet; or |

| • | attending virtually and voting during the Annual Meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy). |

| Thryv Holdings, Inc. | | | 4 | | | 2024 Proxy Statement |

| Thryv Holdings, Inc. | | | 5 | | | 2024 Proxy Statement |

| | | | Committees | | ||||||||||||||||

| | Name | | | Age | | | Director Since | | | Independent(1) | | | Audit | | | Compensation | | | Nominating and Corporate Governance | |

| | Joseph A. Walsh Chairman and CEO | | | 61 | | | 2014 | | | | ||||||||||

| | Amer Akhtar  Director | | | 54 | | | 2020 | | |  | | |  | | | | |  | | |

| | Bonnie Kintzer Director | | | 62 | | | 2020 | | |  | | | | |  | | | | ||

| | Ryan O’Hara Director | | | 55 | | | 2020 | | |  | | | | | | |  | | ||

| | John Slater  Lead Independent Director | | | 51 | | | 2016 | | |  | | |  | | |  | | | | |

| | Lauren Vaccarello Director | | | 40 | | | 2020 | | |  | | | | |  | | |  | | |

| | Heather Zynczak  Director | | | 52 | | | 2020 | | |  | | |  | | | | | | ||

= Chairperson = Chairperson | | |  = Member = Member | | |  = Financial Expert = Financial Expert |

| Thryv Holdings, Inc. | | | 6 | | | 2024 Proxy Statement |

| • | audits of our financial statements; |

| • | the integrity of our financial statements; |

| • | our process relating to risk management and the conduct and systems of internal control over financial reporting and disclosure controls and procedures; |

| • | the qualifications, engagement, compensation, independence, and performance of our independent auditor; and |

| • | the performance of our internal audit function. |

| • | determining and approving the compensation of our executive officers; and |

| • | producing an annual report regarding the Compensation Discussion and Analysis included in the Company’s proxy statement and annual report on Form 10-K. |

| • | making recommendations to the board of directors regarding nomination of individuals as members of the board of directors and its committees; |

| • | assisting the board of directors with identifying individuals qualified to become board of directors members; and |

| • | determining corporate governance practices and related matters. |

| Thryv Holdings, Inc. | | | 7 | | | 2024 Proxy Statement |

| Thryv Holdings, Inc. | | | 8 | | | 2024 Proxy Statement |

| • | Client Devoted |

| • | DONE3 (Make a Clear Commitment, Deliver on Your Commitment, and Follow-Up to Ensure Satisfaction) |

| • | Act Like You Own the Place |

| • | Invest in Our People |

| • | Under Promise, Over Deliver |

| • | Making Money is a Byproduct of Helping People |

| • | Think Long-Term; Act with Passion and Integrity |

| • | Emerging Leaders Program is designed to identify and develop future leaders. Once identified, Emerging Leaders are provided focused leadership and management skill development programs – instructor-led, online and on-the-job. |

| • | Likewise, New Manager Training Program is provided to newly promoted managers to develop and enhance their people management and leadership skills. This program aims to set up newly promoted people managers for success while developing a network of colleagues from which to draw support and counsel. |

| Thryv Holdings, Inc. | | | 9 | | | 2024 Proxy Statement |

| • | The AU leadership team launched a 2024 series of learning and networking sessions to enhance growth opportunities while investing in key AU leaders. |

| • | All employees enjoy the opportunity to participate in numerous Lunch and Learn sessions each month. Varying in topics from personal well-being to diversity & inclusion to emotional and mental health to work habits – these sessions have been key to enhancing culture, connect and career at Thryv. In a full remote work environment, employees connect on a different level during these interesting learning sessions. |

| Thryv Holdings, Inc. | | | 10 | | | 2024 Proxy Statement |

| Thryv Holdings, Inc. | | | 11 | | | 2024 Proxy Statement |

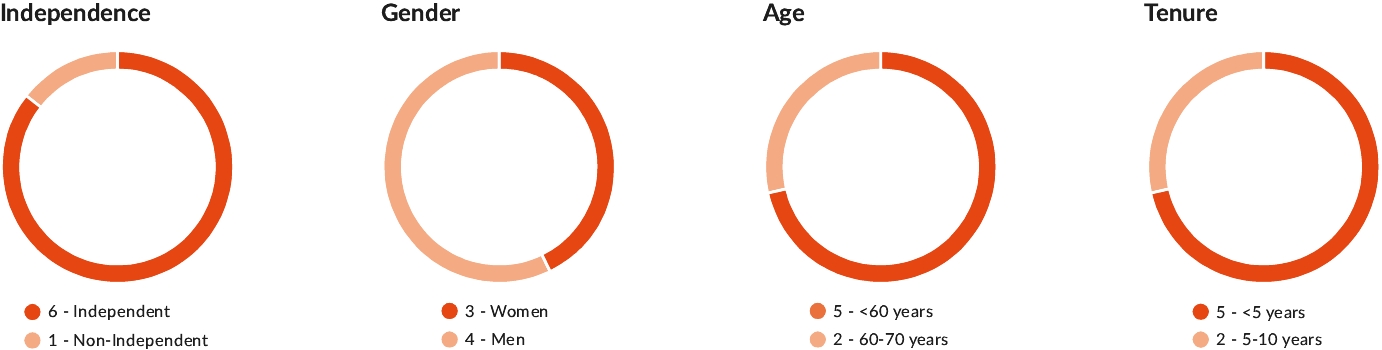

| | Board Diversity Matrix (as of April 16, 2024) | | ||||||||||||

| | Total Number of Directors | | | 7 | | |||||||||

| | | | Female | | | Male | | | Non-Binary | | | Did Not Disclose Gender | | |

| | Part I: Gender Identity | | | | | | | | | | ||||

| | Directors | | | 3 | | | 4 | | | 0 | | | 0 | |

| | Part II: Demographic Background | | | | | | | | | | ||||

| | African American or Black | | | 0 | | | 0 | | | 0 | | | 0 | |

| | Alaskan Native or Native American | | | 0 | | | 0 | | | 0 | | | 0 | |

| | Asian | | | 0 | | | 1 | | | 0 | | | 0 | |

| | Hispanic or Latinx | | | 0 | | | 0 | | | 0 | | | 0 | |

| | Native Hawaiian or Pacific Islander | | | 0 | | | 0 | | | 0 | | | 0 | |

| | White | | | 3 | | | 3 | | | 0 | | | 0 | |

| | Two or More Races or Ethnicities | | | 0 | | | 0 | | | 0 | | | 0 | |

| | LGBTQ+ | | | 0 | | |||||||||

| | Did Not Disclose Demographic Background | | | 0 | | |||||||||

| Thryv Holdings, Inc. | | | 12 | | | 2024 Proxy Statement |

| Thryv Holdings, Inc. | | | 13 | | | 2024 Proxy Statement |

Amer Akhtar Class I Director AGE: 54 DIRECTOR SINCE: 2020 | | | Mr. Akhtar currently serves as Chief Executive Officer of iTrade Network Inc., a provider of supply chain software. He previously served as the Chief Executive Officer of Celential.ai Inc., a venture-funded provider of AI-based recruiting solutions from January 2020 to January 2022. From April 2019 to October 2019, Mr. Akhtar served as the Chief Revenue Officer of DeepMap Inc., a high-definition mapping software provider for autonomous driving. From April 2016 to March 2019, Mr. Akhtar was the Chief Operating Officer, Head of U.S. and advisor to the CEO of XPT Inc., or XPT, a division of the electric vehicle company NIO, Inc. Prior to joining XPT, from November 2014 to April 2016, Mr. Akhtar was VP and General Manager of Yahoo Small Business, a technology business focused on e-commerce and online presence. Mr. Akhtar has also served as a board member of Zeuss Inc. from 2014 to 2019 and as an advisory board member of PayActiv Inc., a financial wellness platform, since 2014. Mr. Akhtar also spent almost a decade at Automatic Data Processing, Inc., or ADP, including from 2009 to 2013, in which he was Managing Director and Country President for ADP in Shanghai, China. Mr. Akhtar graduated from Amos Tuck School of Business at Dartmouth College. We believe that Mr. Akhtar is qualified to serve on our board of directors because of his technology and software expertise, and his deep experience with SMBs. |

Bonnie Kintzer Class I Director AGE: 62 DIRECTOR SINCE: 2020 | | | Ms. Kintzer has served as the President and Chief Executive Officer of Trusted Media Brands, Inc., a media and direct marketing company since April 2014. Ms. Kintzer has also served as a director of Trusted Media Brands, Inc. since April 2014. Previously, Ms. Kintzer served as Chief Executive Officer for Women’s Marketing Inc. from April 2010 to March 2014, where she also served as a director from September 2009 to December 2015. Ms. Kintzer served as Chairperson of the Reader’s Digest Foundation until March 2022, as a director of Union Savings Bank from October 2020 to March 2022, a director of SilverSPAC from September 2021 to September 2023, and currently serves as Chairperson of the 40 Million Story Campaign for United Through Reading. Ms. Kintzer served as a member of the board of directors for the Children’s Learning Center of Fairfield County from September 2017 to April 2022 and the Chair of the MPA – The Association of Magazine Media from April 2021 to June 2022. Ms. Kintzer holds a Master of Business Administration from Harvard Business School and a Bachelor of Arts degree from Clark University. We believe that Ms. Kintzer is qualified to serve on our board of directors due to her relevant leadership experience in the digital marketing arena, and, more specifically, with the rebranding of the Reader’s Digest Association into a digital-first company. |

| Thryv Holdings, Inc. | | | 14 | | | 2024 Proxy Statement |

Lauren Vaccarello Class I Director AGE: 40 DIRECTOR SINCE: 2020 | | | Ms. Vaccarello currently serves as an Executive in Residence for Scale Venture Partners. She previously served as Chief Marketing Officer of Salesloft, the provider of a leading sales engagement platform from May 2022 to June 2023 and the Chief Marketing Officer of Talend S.A., a data integration and data integrity company, from July 2019 to October 2021. Previously, Ms. Vaccarello served as the Vice President of Customer Engagement and Vice President of Marketing at Box, Inc., a cloud content management company, from July 2015 to October 2018. From August 2014 to July 2015, Ms. Vaccarello served as the Senior Vice President of Marketing of Sysomos Inc. Ms. Vaccarello has also held executive leadership roles at the AdRoll Group and Salesforce.com, Inc. Ms. Vaccarello has served as a director of SalesHood Inc. from July 2019 to August 2022. Ms. Vaccarello holds a Bachelor of Science degree in Marketing from Emerson College. We believe that Ms. Vaccarello is qualified to serve on our board of directors because of her expertise in digital marketing and her success in growing several SaaS companies. |

| Thryv Holdings, Inc. | | | 15 | | | 2024 Proxy Statement |

Ryan O’Hara Class II Director AGE: 55 DIRECTOR SINCE: 2020 | | | Mr. O’Hara currently serves as the Chief Executive Officer of 210 Home Buyers Warranty, a home warranty and insurance company. He previously served as an advisor to Apollo Global Management in the technology and media sectors from January 2020 until December 2022. From June to December 2019, Mr. O’Hara served as the Chief Executive Officer of Shutterfly, Inc., where he also served as a director from June to October 2019. Previously, from January 2015 to June 2019, Mr. O’Hara served as the Chief Executive Officer of Move Inc./Realtor.com. Prior to 2015, Mr. O’Hara also served in senior management roles at the Madison Square Garden Company and Gemstar–TV Guide International, Inc., and worked at Nestlé S.A., Fox Cable Networks, British Sky Broadcasting Group, and PricewaterhouseCoopers LLP. Mr. O’Hara currently serves on the board of Offerpad and as a board observer of Inside Real Estate, and previously served on the board of TKB Critical Technologies until August 2023, the board of REA Group Limited from June 2017 to April 2019, and the advisory council for the Stanford University Center on Longevity from August 2020 through January 2024. Mr. O’Hara holds a Bachelor of Arts degree in Economics from Stanford University, a Master of Business Administration from Harvard Business School and the Director Certificate from Harvard Business School. We believe Mr. O’Hara is qualified to serve on our board of directors because of his significant experience with technology and recurring revenue models, and his deep experience serving on the board of directors of both public and private companies. |

John Slater Class III Director AGE: 51 DIRECTOR SINCE: 2016 | | | Mr. Slater has served as Lead Independent Director since December 2021. He has served as the Chief Investment Officer for Hum Capital Inc. since September 2021. Mr. Slater previously served on our board of directors from 2013 to 2015. Mr. Slater served as Managing Director, Head of Credit at GPI Capital L.P. from January 2020 to December 2020. From 2009 to November 2019, Mr. Slater was a partner at Paulson, focusing on investments in the media, telecom and technology sectors. Prior to Paulson, Mr. Slater served as Vice President at Lehman Brothers Holdings, Inc. in the Global Trading Strategies Group and as a senior director of finance at NextSet Software, Inc. Mr. Slater holds both his Bachelor and Master of Arts degrees from the University of Cambridge and his Master of Business Administration from INSEAD, France. We believe Mr. Slater is qualified to serve on our board of directors because of his extensive background in accounting, technology sector investing and operations, and capital markets, and his board level experience. |

| Thryv Holdings, Inc. | | | 16 | | | 2024 Proxy Statement |

Joseph A. Walsh Class III Director AGE: 61 DIRECTOR SINCE: 2014 | | | Mr. Walsh has served as Chairman since December 2021, and as Chief Executive Officer and a Director since October 2014. Mr. Walsh also serves as the Chief Executive Officer and Chairman of Walsh Partners, a private company focused on investments and advisory services, from January 2012 and has served as the Chairman of Cambium Learning Group, a leading educational technology company, from June 2012 to December 2018. Mr. Walsh also previously served as President and CEO of Yellowbook, Inc. We believe Mr. Walsh is qualified to serve on our board of directors because he brings a wealth of leadership experience, particularly in the areas of SaaS software, small and medium sized business (“SMB”) marketing and strategic direction, and because of the operational expertise and continuity that he brings to our board of directors as our Chief Executive Officer. |

Heather Zynczak Class II Director AGE: 52 DIRECTOR SINCE: 2020 | | | Ms. Zynczak currently serves as the Chief Marketing Officer for AlphaSense, a market intelligence platform. Previously, Ms. Zynczak served as the Chief Marketing Officer of Pluralsight, Inc., a technology learning platform for enterprises from August 2016 to October 2020 and the Chief Marketing Officer of Domo Inc., a cloud operating system for businesses, from 2012 to 2016. Ms. Zynczak also held executive positions at enterprise technology companies, including SAP SE and Oracle Corporation, and she served as a business consultant for Accenture plc, The Boston Consulting Group and Booz Allen Hamilton Inc. Ms. Zynczak has served as a director of Demandbase since March 2021, a director of D2L since January 2023, a director of Lendio since July 2023 and a director of Vasion since August 2023. She previously served as a director of Digital Transformation Opportunities from March 2021 to September 2023, a director of Arkose Labs from July 2022 to January 2024, a director of SaltStack, Inc. from October 2018 to October 2020 and a director of ExpertVoice from March 2021 to September 2022. Ms. Zynczak holds a Bachelor of Business Administration degree in Finance from The University of Texas at Austin and holds a Master of Business Administration from The Wharton School at the University of Pennsylvania. We believe that Ms. Zynczak is qualified to serve on our board of directors because of her substantial digital marketing and technology experience, including key roles in building successful SaaS companies, and her board level experience. |

| Thryv Holdings, Inc. | | | 17 | | | 2024 Proxy Statement |

| | Director Compensation – Fiscal Year 2023 | | ||||||||||||

| | Name | | | Fees Earned or Paid in Cash ($) | | | Stock Awards(1) ($) | | | All Other Compensation ($) | | | Total ($) | |

| | Amer Akhtar | | | 110,000 | | | 140,000 | | | — | | | 250,000 | |

| | Bonnie Kintzer | | | 120,000 | | | 140,000 | | | — | | | 260,000 | |

| | Ryan O’Hara | | | 120,000 | | | 140,000 | | | — | | | 260,000 | |

| | John Slater | | | 155,000 | | | 140,000 | | | — | | | 295,000 | |

| | Lauren Vaccarello | | | 110,000 | | | 140,000 | | | — | | | 250,000 | |

| | Heather Zynczak | | | 100,000 | | | 140,000 | | | — | | | 240,000 | |

| 1. | Consists of an award of RSUs granted pursuant to the Thryv Holdings, Inc. 2020 Incentive Award Plan (the “2020 Plan”) to each director on June 13, 2023. Pursuant to the 2020 Stock Plan, each outside director is to receive an automatic grant of RSUs on the date of the annual stockholders meeting equal to the number of shares of common stock having an aggregate fair market value of $140,000. The amounts shown were not actually paid to the directors. Rather, as required by the rules of the SEC, the amounts represent the aggregate grant date fair value of the RSUs awarded to each of them in fiscal year 2023. These values were determined in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“FASB ASC Topic 718”). The aggregate grant date fair value of the RSUs is equal to the closing price of the common stock on the date of grant multiplied by the number of shares granted. On June 13, 2023, the date of grant for all directors, the closing price of our common stock on the Nasdaq was $25.09 per share. The amounts reported do not include any reduction in the value of the awards for the possibility of forfeiture. The awards were issued on June 13, 2023. |

| Thryv Holdings, Inc. | | | 18 | | | 2024 Proxy Statement |

| Thryv Holdings, Inc. | | | 19 | | | 2024 Proxy Statement |

| | | | Fiscal Year Ended December 31, 2022 ($ in thousands) | | | Fiscal Year Ended December 31, 2023 ($ in thousands) | | |

| | Audit Fees(1) | | | 2,856 | | | 3,082 | |

| | Audit-Related Fees(2) | | | — | | | — | |

| | Tax Fees(3) | | | — | | | 22 | |

| | All Other Fees(4) | | | — | | | 59 | |

| | Total Fees | | | 2,856 | | | 3,162 | |

| 1. | “Audit fees” include fees billed for professional services rendered for the integrated audit of our annual consolidated financial statements, reviews of our quarterly condensed consolidated financial statements, consents, and services that are normally provided in connection with regulatory filings or requirements. Audit fees also include accounting consultations and research related to the integrated audit. |

| 2. | “Audit-related fees” include fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit Fees.” These include services related to the preparation for compliance with section 404 of the Sarbanes-Oxley Act of 2002 and accounting matters in connection with acquisitions. |

| 3. | “Tax fees” include fees billed for tax compliance, consultation and planning services. |

| 4. | “All other fees” includes fees billed for publications and online subscriptions. |

| Thryv Holdings, Inc. | | | 20 | | | 2024 Proxy Statement |

| Thryv Holdings, Inc. | | | 21 | | | 2024 Proxy Statement |

| • | reviewed and discussed the audited financial statements of the Company for the fiscal year ended December 31, 2023 with management and Grant Thornton LLP; |

| • | discussed with Grant Thornton LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC; and |

| • | received the written disclosures and the letter from Grant Thornton LLP required by applicable requirements of the PCAOB regarding the independent accountant’s communications with our audit committee concerning independence and has discussed with Grant Thornton LLP its independence. |

| Thryv Holdings, Inc. | | | 22 | | | 2024 Proxy Statement |

| | Name | | | Age | | | Title | |

| | Joseph A. Walsh | | | 61 | | | Chairman and Chief Executive Officer | |

| | Paul D. Rouse | | | 65 | | | Chief Financial Officer, Executive Vice President and Treasurer | |

| | Grant Freeman | | | 45 | | | President | |

| | James McCusker | | | 61 | | | Chief Revenue Officer and Executive Vice President | |

| | John Wholey | | | 59 | | | Chief Operations & Information Officer and Executive Vice President | |

| | Lesley Bolger | | | 45 | | | Chief Legal Officer & Human Resources and Executive Vice President, Chief Compliance Officer and Secretary | |

| Thryv Holdings, Inc. | | | 23 | | | 2024 Proxy Statement |

| Thryv Holdings, Inc. | | | 24 | | | 2024 Proxy Statement |

| | Name of Beneficial Owner | | | Number of Shares (#) | | | Shares that may be Acquired within 60 Days (#) | | | Number of Shares Beneficially Owned (#) | | | Percentage of Outstanding Shares (%) | |

| | 5% Stockholders: | | ||||||||||||

| | BlackRock, Inc.(1) | | | 6,296,123 | | | — | | | 6,296,123 | | | 17.6 | |

| | FMR LLC(2) | | | 5,274,752 | | | — | | | 5,274,752 | | | 14.7 | |

| | The Vanguard Group(3) | | | 2,278,064 | | | — | | | 2,278,064 | | | 6.4 | |

| | Affiliates of Paulson(4) | | | 2,000,000 | | | — | | | 2,000,000 | | | 5.6 | |

| | SamJo Management, LLC(5) | | | 1,880,450 | | | — | | | 1,880,450 | | | 5.3 | |

| | Named Executive Officers and Directors: | | ||||||||||||

| | Joseph A. Walsh(6) | | | 2,016,043 | | | 1,054,643 | | | 3,070,686 | | | 8.3 | |

| | Paul D. Rouse(7) | | | 58,821 | | | 205,595 | | | 264,416 | | | * | |

| | Gordon Henry(8) | | | 30,324 | | | 265,882 | | | 296,206 | | | * | |

| Thryv Holdings, Inc. | | | 25 | | | 2024 Proxy Statement |

| | Name of Beneficial Owner | | | Number of Shares (#) | | | Shares that may be Acquired within 60 Days (#) | | | Number of Shares Beneficially Owned (#) | | | Percentage of Outstanding Shares (%) | |

| | James McCusker(9) | | | 33,781 | | | 261,632 | | | 295,413 | | | * | |

| | John Wholey(10) | | | 121,448 | | | 173,632 | | | 295,080 | | | * | |

| | Amer Akhtar(11) | | | 6,392 | | | 47,246 | | | 53,638 | | | * | |

| | Bonnie Kintzer(12) | | | 6,229 | | | 47,246 | | | 53,475 | | | * | |

| | Ryan O’Hara(13) | | | 7,642 | | | 47,246 | | | 54,880 | | | * | |

| | John Slater(14) | | | 6,392 | | | 47,246 | | | 53,638 | | | * | |

| | Lauren Vaccarello(15) | | | 5,392 | | | 47,246 | | | 52,638 | | | * | |

| | Heather Zynczak(16) | | | 6,232 | | | 47,246 | | | 53,478 | | | * | |

| | Directors and Executive Officers as a Group (12 persons)(17) | | | 2,316,796 | | | 2,136,715 | | | 4,453,511 | | | 11.7 | |

| * | Represents beneficial ownership of less than 1% of total shares of common stock outstanding. |

| 1. | The business address for BlackRock, Inc. (“Blackrock”) is 55 East 52nd Street, New York, NY 10055. Share ownership is based on Amendment No. 3 to Schedule 13G/A dated January 19, 2024, which discloses that Blackrock has sole voting power with respect to 6,043,960 shares of common stock and sole dispositive power with respect to 6,296,123 shares of Common Stock. |

| 2. | The business address for FMR LLC is 245 Summer Street, Boston, Massachusetts 02210. Share ownership is based on Amendment No. 3 to Schedule 13G/A dated February 9, 2024, which indicates that Abigail P. Johnson has sole dispositive power over 5,274,752 shares of common stock. |

| 3. | The business address for The Vanguard Group (“Vanguard” is 100 Vanguard Blvd., Malvern, PA 19355. Share ownership is based upon Amendment No.1 to Schedule 13G dated February 13, 2024, which indicates that Vanguard has sole voting power over 0 shares of common stock, shared voting power over 36,052 shares of common stock, sole dispositive power over 2,278,064 shares of common stock, and shared dispositive power over 66,746 shares of common stock. |

| 4. | Consists of 2,000,000 shares of common stock held of record by funds affiliated with Paulson & Co. Inc. (“Paulson”). Paulson manages the funds. In its role as manager, Paulson possesses voting and investment power over the securities that are owned by the funds. John Paulson is the controlling person of Paulson. Each of Paulson and John Paulson may be deemed to indirectly beneficially own the securities directly owned by the funds. The address of each of the entities and individuals is c/o Paulson & Co. Inc., 1133 Avenue of the Americas, New York, NY 10036. Share ownership is based on Form 13F dated February 14, 2024. |

| 5. | The business address for SamJo Management LLC (“SamJo”) is 880 Third Avenue, 16th Floor, New York, New York 10022. Share ownership is based upon Schedule 13G dated February 9, 2024 , which disclosed that SamJo and Andrew N. Wiener have shared voting power with respect to 869,900 shares of common stock and shared dispositive power with respect to 1,880,450 shares of common stock. |

| 6. | Consists of 1,625,206 shares held by a trust over which Mr. Walsh has sole voting power, 390,837 shares owned directly by Mr. Walsh, 1,049,383 shares issuable pursuant to options that are exercisable within 60 days of April 16, 2024 and 5,260 RSUs that will vest within 60 days of April 16, 2024. |

| 7. | Consists of 58,821 shares owned directly by Mr. Rouse and 205,595 shares issuable pursuant to options that are exercisable within 60 days of April 16, 2024. |

| 8. | Consists of 30,324 shares owned directly by Mr. Henry and 265,882 shares issuable pursuant to options that are exercisable within 60 days of April 16, 2024. Mr. Henry previously served as Chief Strategy Officer and Executive Vice President until March 22, 2024. |

| 9. | Consists of 33,781 shares owned directly by Mr. McCusker and 261,632 issuable pursuant to options that are exercisable within 60 days of April 16, 2024. |

| 10. | Consists of 121,448 shares owned directly by Mr. Wholey and 173,632 shares issuable pursuant to options that are exercisable within 60 days of April 16, 2024. |

| 11. | Consists of 6,392 shares owned directly by Mr. Akhtar, 41,667 shares issuable pursuant to options that are exercisable within 60 days of April 16, 2024 and 5,579 RSUs that will vest within 60 days of April 16, 2024. |

| 12. | Consists of 6,229 shares owned directly by Ms. Kintzer, 41,667 shares issuable pursuant to options that are exercisable within 60 days of April 16, 2024 and 5,579 RSUs that will vest within 60 days of April 16, 2024. |

| 13. | Consists of 7,642 shares owned directly by Mr. O’Hara, 41,667 shares issuable pursuant to options that are exercisable within 60 days of April 16, 2024 and 5,579 RSUs that will vest within 60 days of April 16, 2024. |

| 14. | Consists of 6,392 shares owned by Mr. Slater, 41,667 shares issuable pursuant to options that are exercisable within 60 days of April 16, 2024 and 5,579 RSUs that will vest within 60 days of April 16, 2024. |

| 15. | Consists of 5,392 shares owned by Ms. Vaccarello, 41,667 shares issuable pursuant to options that are exercisable within 60 days of April 16, 2024 and 5,579 RSUs that will vest within 60 days of April 16, 2024. |

| 16. | Consists of 6,232 shares owned by Ms. Zynczak, 41,667 shares issuable pursuant to options that are exercisable within 60 days of April 16, 2024 and 5,579 RSUs that will vest within 60 days of April 16, 2024. |

| 17. | Includes ownership of 22,150 shares owned directly by executive officer Lesley Bolger, Chief Legal Officer & Human Resources and Executive Vice President, Chief Compliance Officer and Secretary and 82,181 shares issuable pursuant to options that are exercisable within 60 days of April 16, 2024 and 26,274 shares owned directly by executive officer Grant Freeman, President, and 75,556 shares issuable pursuant to options that are exercisable within 60 days of April 16, 2024. |

| Thryv Holdings, Inc. | | | 26 | | | 2024 Proxy Statement |

| Thryv Holdings, Inc. | | | 27 | | | 2024 Proxy Statement |

| • | Joseph A. Walsh, who serves as Chairman and Chief Executive Officer; |

| • | Paul D. Rouse, who serves as Chief Financial Officer and Treasurer; |

| • | Gordon Henry, who served as Chief Strategy Officer and Executive Vice President until March 22, 2024; |

| • | James McCusker, who serves as Chief Revenue Officer and Executive Vice President; and |

| • | John Wholey, who serves as Chief Operations & Information Officer and Executive Vice President. |

| Thryv Holdings, Inc. | | | 28 | | | 2024 Proxy Statement |

| • | the performance of our NEOs in prior years; |

| • | the roles and responsibilities of our NEOs; |

| • | the individual experience and skills of our NEOs; |

| • | for each named executive officer, other than our Chief Executive Officer, the evaluations and recommendations of our Chief Executive Officer; |

| • | the amounts of compensation being paid to our other NEOs; and |

| • | internal equity. |

| | | | What it Does-How it Works | | | 2023 Plan Metrics-Weighting | | |

| | Base Salary | | | • Fixed annual cash amount that provides a regular source of income at competitive levels. • Influences annual target incentive value(base salary × target annual incentive %). | | | Not applicable. | |

| | Short-Term Incentive Plan: Cash | | | • Performance-based compensation element with a variable payout potential based on corporate and individual performance. • Intended to motivate and reward executive officers for the achievement of annual (short-term) business objectives. | | | • EBITDA-25% • Free Cash Flow-25% • SaaS Net Revenues-25% • Individual Performance-25% | |

| | Over Performance Plan: Cash | | | • Incremental cash incentive plan designed as an overachievement program to our Short-Term Incentive Plan. Only begins to pay once maximum goal is achieved under the Short-Term Incentive Plan. • Performance-based compensation element with variable payout potential based on company financial performance. • Intended to motivate and reward executive officers for the overachievement of annual business objectives. | | | • EBITDA-30% • Free Cash Flow-40% • SaaS Net Revenues-30% | |

| Thryv Holdings, Inc. | | | 29 | | | 2024 Proxy Statement |

| | | | What it Does-How it Works | | | 2023 Plan Metrics-Weighting | | |

| | Long-Term Equity Incentive Compensation | | | • Equity awards consisting of time-based restricted stock units (“RSUs”) and performance stock units (“PSUs”) awarded under the 2020 Stock Plan. The RSUs vest ratably, annually on each of the first three anniversaries of grant, and the PSUs cliff-vest at the conclusion of a three-year performance period, subject to the achievement of pre-established performance goals. • Designed to retain executives and align their interests with those of the Company’s stockholders. | | | • Relative TSR-30% • Absolute TSR-30% • SaaS Revenue CAGR-40% | |

| | Employee Stock Purchase Plan | | | • We have an employee stock purchase plan that permits all eligible employees to elect to contribute up to 15% of their eligible compensation (up to the IRS maximum) to purchase Company shares at a 15% discount of the fair market value of shares in the Company. | | | Not applicable. | |

| | Executive Physical | | | • Executive officers receive annual reimbursement for a comprehensive medical examination up to $4,000 for EVP and the actual cost of the executive physical for the Chief Executive Officer. | | | Not applicable. | |

| | Retirement Benefits | | | • A 401(k) retirement savings plan enables all employees, including executive officers, to contribute a portion of their compensation with a company matching contribution. | | | Not applicable. | |

| | Employment and Severance Benefits | | | • CEO Employment Agreement provides for salary, incentive opportunities and severance benefits. • Thryv, Inc. Severance Plan-Executive Vice Presidents and Above (“EVP Severance Plan”) provides for severance benefits equal to a multiple of salary and target short-term incentive award in the event of certain qualifying terminations of employment. | | | Not applicable. | |

| Thryv Holdings, Inc. | | | 30 | | | 2024 Proxy Statement |

| | Criteo S.A. | | | Alteryx, Inc. | | | Anaplan, Inc. | | | Clear Channel Outdoor Holdings, Inc. | | | Digital Turbine, Inc. | |

| | Five9, Inc. | | | HubSpot, Inc. | | | MicroStrategy Incorporated | | | Paycom Software, Inc. | | | Paylocity Holding Corporation | |

| | Pegasystems Inc. | | | Perion Network Ltd. | | | Stagwell Inc. | | | Verint Systems Inc. | | | Workiva Inc. | |

| | Yelp Inc. | | | Yext, Inc. | | | | | |

| Thryv Holdings, Inc. | | | 31 | | | 2024 Proxy Statement |

| | Named Executive Officers | | | 2023 Base Salary ($) | |

| | Joseph A. Walsh | | | 1,060,900 | |

| | Paul D. Rouse | | | 521,673 | |

| | Gordon Henry | | | 425,000 | |

| | James McCusker | | | 425,000 | |

| | John Wholey | | | 425,000 | |

| | Named Executive Officers | | | Target Annual Incentive (STI) (%) | |

| | Joseph A. Walsh | | | 100 | |

| | Paul D. Rouse | | | 70 | |

| | Gordon Henry | | | 70 | |

| | James McCusker | | | 70 | |

| | John Wholey | | | 70 | |

| 1. | EBITDA (25%). This performance metric supports our focus on maintaining margin trends. EBITDA is a non-GAAP financial metric defined as earnings before interest, tax, depreciation and amortization. |

| Thryv Holdings, Inc. | | | 32 | | | 2024 Proxy Statement |

2. | Free Cash Flow (“FCF”) (25%). This performance metric supports our goal of generating value for our stockholders. FCF is a non-GAAP financial metric defined as net cash provided by operating activities less capital expenditures. FCF does not include certain tax liabilities, settlement of liability stock option awards and certain investments in growth opportunities, including merger and acquisitions. |

3. | Reported SaaS Net Revenue (25%). This performance metric supports our goal of transitioning to a SaaS business. |

4. | Individual Performance (25%). This performance metric supports our goal of pay for performance. Individual annual goals (which are designed to propel Company performance and objectives) are determined by our Chief Executive Officer for all NEOs other than himself. The Chief Executive Officer’s individual annual goals are determined by the compensation committee. The attainment of each NEO’s annual goals is based on an individual performance assessment by our Chief Executive Officer (for all NEOs other than himself) and ratified by the compensation committee and the attainment of our Chief Executive Officer’s individual goals is based on an individual performance assessment by our compensation committee. In fiscal year 2023, the Company established a minimum EBITDA threshold (or gate) of $155 million for any payouts under the individual performance metric to be funded. That is, if EBITDA for fiscal year 2023 was below $155 million, no payouts would be earned for the individual performance metric and the 25% of the STI attributable to individual performance would be forfeited regardless of individual performance achievement. |

| | EBITDA (in millions) ($) | | | | | | | EBITDA Component Payout (%) | | | FCF (in millions) ($) | | | FCF Component Payout (%) | | | Reported SaaS Net Revenue (in millions) ($) | | | SaaS Net Revenue Component Payout (%) | | ||

| | 171.00 | | | | | | | 10 Threshold | | | 88.00 | | | 10 | | | 246.50 | | | 10 | | ||

| | 172.00 | | | | | | | 20 | | | 89.00 | | | 20 | | | 247.50 | | | 15 | | ||

| | 173.00 | | | | | | | 30 | | | 90.00 | | | 30 | | | 248.50 | | | 23 | | ||

| | 174.00 | | | | | | | 40 | | | 91.00 | | | 40 | | | 249.50 | | | 30 | | ||

| | 175.00 | | | | | | | 50 | | | 92.00 | | | 50 | | | 250.50 | | | 38 | | ||

| | 176.00 | | | | | | | 60 | | | 93.00 | | | 60 | | | 251.50 | | | 45 | | ||

| | 177.00 | | | | | | | 70 | | | 94.00 | | | 70 | | | 252.50 | | | 53 | | ||

| | 178.00 | | | | | | | 80 | | | 95.00 | | | 80 | | | 253.50 | | | 60 | | ||

| | 179.00 | | | | | | | 90 | | | 96.00 | | | 90 | | | 254.50 | | | 68 | | ||

| | 180.00 | | | | | | | 100 Target | | | 97.00 | | | 100 | | | 255.50 | | | 100 | | ||

| | 181.50 | | | | | | | 105 | | | 98.00 | | | 105 | | | 256.50 | | | 105 | | ||

| | 183.00 | | | | | | | 110 | | | 99.00 | | | 110 | | | 257.50 | | | 110 | | ||

| | 184.50 | | | | | | | 115 | | | 100.00 | | | 115 | | | 258.50 | | | 115 | | ||

| | 186.00 | | | | | | | 120 | | | 101.00 | | | 120 | | | 259.50 | | | 120 | | ||

| | 187.50 | | | | | | | 125 Maximum | | | 102.00 | | | 125 | | | 260.50 | | | 125 | |

| Thryv Holdings, Inc. | | | 33 | | | 2024 Proxy Statement |

| | Named Executive Officers | | | 2023 STI ($) | |

| | Joseph A. Walsh | | | 1,259,819 | |

| | Paul D. Rouse | | | 433,641 | |

| | Gordon Henry | | | 353,281 | |

| | James McCusker | | | 353,281 | |

| | John Wholey | | | 353,281 | |

| | Named Executive Officers | | | Target Annual Incentive (OPP) (%) | |

| | Joseph A. Walsh | | | 100 | |

| | Paul D. Rouse | | | 70 | |

| | Gordon Henry | | | 70 | |

| | James McCusker | | | 70 | |

| | John Wholey | | | 70 | |

| Thryv Holdings, Inc. | | | 34 | | | 2024 Proxy Statement |

| 1. | EBITDA (30%) |

| 2. | Free Cash Flow (40%) |

| 3. | Reported SaaS Net Revenue (30%) |

| | EBITDA (in millions) ($) | | | | | EBITDA Component Payout (%) | | | FCF (in millions) ($) | | | FCF Component Payout (%) | | | Reported SaaS Net Revenue (in millions) ($) | | | SaaS Net Revenue Component Payout (%) | | |

| | 187.50 | | | | | Threshold | | | 102.00 | | | | | 260.50 | | | | |||

| | 189.00 | | | | | 10 | | | 103.50 | | | 10 | | | 262.00 | | | 10 | | |

| | 190.50 | | | | | 20 | | | 105.00 | | | 20 | | | 263.50 | | | 20 | | |

| | 192.00 | | | | | 30 | | | 106.50 | | | 30 | | | 265.00 | | | 30 | | |

| | 193.50 | | | | | 40 | | | 108.00 | | | 40 | | | 266.50 | | | 40 | | |

| | 195.00 | | | | | 50 | | | 109.50 | | | 50 | | | 268.00 | | | 50 | | |

| | 196.50 | | | | | 60 | | | 111.00 | | | 60 | | | 269.50 | | | 60 | | |

| | 198.00 | | | | | 70 | | | 112.50 | | | 70 | | | 271.00 | | | 70 | | |

| | 199.50 | | | | | 80 | | | 114.00 | | | 80 | | | 272.50 | | | 80 | | |

| | 201.00 | | | | | 90 | | | 115.50 | | | 90 | | | 274.00 | | | 90 | | |

| | 202.50 | | | | | 100 | | | 117.00 | | | 100 | | | 275.50 | | | 100 | |

| Thryv Holdings, Inc. | | | 35 | | | 2024 Proxy Statement |

| | Named Executive Officers | | | 2023 OPP ($) | |

| | Joseph A. Walsh | | | 437,091 | |

| | Paul D. Rouse | | | 150,450 | |

| | Gordon Henry | | | 122,570 | |

| | James McCusker | | | 122,570 | |

| | John Wholey | | | 122,570 | |

| | NEO | | | Total Grant Date Value | | | PSUs (# of units) | | | RSUs (# of units) | |

| | Joseph A. Walsh | | | $3,000,000 | | | 101,140 | | | 54,460 | |

| | Paul D. Rouse | | | $2,500,000 | | | 84,284 | | | 45,383 | |

| | Gordon Henry | | | $1,750,000 | | | 58,998 | | | 31,768 | |

| | James McCusker | | | $1,750,000 | | | 58,998 | | | 31,768 | |

| | John Wholey | | | $1,750,000 | | | 58,998 | | | 31,768 | |

| Thryv Holdings, Inc. | | | 36 | | | 2024 Proxy Statement |

| | Measure | | | Weight | | | Threshold | | | Target | | | Maximum | |

| | | | | | | | Performance (as a % of Target) | | | | ||||

| | Relative TSR (“rTSR”) | | | 30% | | | 40th Percentile | | | 50th Percentile | | | 65th Percentile | |

| | Absolute TSR (“aTSR”) | | | 30% | | | 8.0% | | | 10.0% | | | 12.5% | |

| | SaaS Revenue CAGR | | | 40% | | | 15% | | | 18% | | | 22% | |

| | | | | | | | Payout (as a % of Target) | | | | ||||

| | Payout | | | N/A | | | 50% | | | 100% | | | 150% | |

| | Blackbaud, Inc. | | | Box, Inc. | | | Constellation Software Inc, | | | Datadog, Inc. | | | Digital Turbine, Inc. | |

| | Domo, Inc. | | | Dynatrace, Inc. | | | EverCommerce Inc. | | | Five9, Inc. | | | GoDaddy, Inc. | |

| | HubSpot, Inc. | | | Informatica Inc. | | | Lightspeed Commerce Inc. | | | Pegasystems Inc. | | | Sprout Social, Inc. | |

| | Squarespace, Inc. | | | Verint Systems Inc. | | | Wix.com Ltd. | | | | | |

| | Title | | | Ownership Threshold | |

| | Chief Executive Officer | | | Six Times Base Salary | |

| | Executive Committee | | | Three Times Base Salary | |

| | Vice Presidents | | | One Times Base Salary | |

| | Non-Employee Director | | | Three Times Annual Retainer | |

| Thryv Holdings, Inc. | | | 37 | | | 2024 Proxy Statement |

| Thryv Holdings, Inc. | | | 38 | | | 2024 Proxy Statement |

| Thryv Holdings, Inc. | | | 39 | | | 2024 Proxy Statement |

| | Name and Principal Position | | | Fiscal Year | | | Salary ($)(1) | | | Non-Equity Incentive Plan Compensation ($)(2) | | | Equity Awards ($)(3) | | | All Other Compensation ($)(4) | | | Total ($) | |

| | Joseph A. Walsh Chairman and CEO | | | 2023 | | | 1,060,900 | | | 1,696,910 | | | 3,000,000 | | | 53,317 | | | 5,811,127 | |

| | 2022 | | | 1,056,820 | | | 2,442,723 | | | 3,000,000 | | | 51,638 | | | 6,551,181 | | |||

| | 2021 | | | 1,052,581 | | | 2,166,225 | | | — | | | 49,905 | | | 3,268,711 | | |||

| | Paul D. Rouse Chief Financial Officer, EVP and Treasurer | | | 2023 | | | 521,673 | | | 584,091 | | | 2,500,000 | | | 18,590 | | | 3,624,354 | |

| | 2022 | | | 521,673 | | | 840,807 | | | 2,500,000 | | | 14,640 | | | 3,877,120 | | |||

| | 2021 | | | 517,582 | | | 745,634 | | | | | 16,920 | | | 1,280,136 | | ||||

| | Gordon Henry Former Chief Strategy Officer and EVP(5) | | | 2023 | | | 425,000 | | | 475,851 | | | 1,750,000 | | | 15,840 | | | 2,666,691 | |

| | 2022 | | | 422,937 | | | 684,994 | | | 1,750,000 | | | 17,510 | | | 2,875,441 | | |||

| | 2021 | | | 414,065 | | | 596,506 | | | — | | | 16,920 | | | 1,027,491 | | |||

| | James McCusker Chief Revenue Officer and EVP | | | 2023 | | | 425,000 | | | 475,851 | | | 1,750,000 | | | 18,390 | | | 2,669,241 | |

| | 2022 | | | 422,937 | | | 684,994 | | | 1,750,000 | | | 17,640 | | | 2,875,571 | | |||

| | 2021 | | | 414,066 | | | 596,506 | | | — | | | 16,920 | | | 1,027,492 | | |||

| | John Wholey Chief Operations and Information Officer and EVP | | | 2023 | | | 425,000 | | | 475,851 | | | 1,750,000 | | | 19,840 | | | 2,670,691 | |

| | 2022 | | | 419,615 | | | 684,994 | | | 1,750,000 | | | 14,640 | | | 2,869,249 | | |||

| | 2021 | | | 398,989 | | | 578,872 | | | — | | | 13,920 | | | 991,781 | |

| 1. | Amounts reported in this column represent the actual salary earned by each of our NEOs for fiscal years 2021, 2022 and 2023. NEOs did not receive any guaranteed, non-performance based bonuses in 2023. |

| 2. | Amounts reported in this column represent the cash incentive awards actually paid under our STI and OPP for fiscal years 2021, 2022 and 2023. See “Short-Term Incentive Plan – Cash Incentive” and “Over Performance Plan – Cash Incentive” in our Compensation Discussion and Analysis for further detail. |

| 3. | The amounts shown were not actually paid to the NEOs. Rather, as required by the rules of the SEC, the amounts represent the aggregate grant date fair value of RSUs and PSUs awarded to each of them in fiscal year 2023. These values were determined in accordance with FASB ASC Topic 718. The grant date fair value of the PSUs is based on our estimate on the grant date of the probable outcome of meeting the performance conditions of these awards. The aggregate grant date fair value of the RSUs is equal to the closing stock price of our common stock on the date of grant multiplied by the number of shares granted. The following are the aggregate grant date fair values of the PSUs granted in 2023 assuming we meet the highest level of the performance conditions of these awards as described in footnote (2) to the Grants of Plan-Based Awards Table Fiscal 2023: Mr. Walsh $1,950,000, Mr. Rouse $1,625,000, Mr. Henry $1,137,500, Mr. McCusker $1,137,500 and Mr. Wholey $1,137,500. The amounts reported do not include any reduction in the value of the awards for the possibility of forfeiture. We did not grant any equity-based awards to the NEOs in 2021. |

| Thryv Holdings, Inc. | | | 40 | | | 2024 Proxy Statement |

| 4. | All Other Compensation for fiscal year 2023 consisted of the following (all amounts in dollars): |

| | Name | | | 401(k) Matching Contributions ($)(a) | | | Allowance ($)(b) | | | Executive Physicals ($)(c) | | | Total ($) | |

| | Joseph A. Walsh | | | 15,840 | | | 30,000 | | | 7,477 | | | 53,317 | |

| | Paul D. Rouse | | | 15,840 | | | — | | | 2,750 | | | 18,590 | |

| | Gordon Henry | | | 15,840 | | | — | | | — | | | 15,840 | |

| | James McCusker | | | 15,840 | | | — | | | 2,550 | | | 18,390 | |

| | John Wholey | | | 15,840 | | | — | | | 4,000 | | | 19,840 | |

| a. | Amounts reported in this column represent the matching contribution made by the Company under the Company’s tax-qualified 401(k) retirement plan in 2023. |

| b. | For Mr. Walsh, amount includes an expense allowance of $30,000 for the maintenance of a remote office and miscellaneous expenses incurred. |

| c. | Executive officers receive annual reimbursement for a comprehensive medical examination up to $4,000 for EVPs and the actual cost of the physical for the Chief Executive Officer. |

| 5. | Mr. Henry departed the Company on March 22, 2024. |

| Thryv Holdings, Inc. | | | 41 | | | 2024 Proxy Statement |

| | | | | | | | Estimated Future Payouts Under Non-Equity Incentive Plan Awards | | | Estimated Future Payouts Under Equity Incentive Plans | | | | | | |||||||||||||||||

| | Name | | | Type | | | Grant Date | | | Threshold ($)(1) | | | Target ($)(1) | | | Maximum ($)(1) | | | Threshold (#)(2) | | | Target #(2) | | | Maximum (#)(2) | | | All Other Stock Awards: Number of Shares of Stock or Units (#)(3) | | | Grant Date Fair Market Value of Stock and Option Awards ($) | |

| | Joseph A. Walsh | | | STI | | | 1/1/2023 | | | 344,793 | | | 1,060,900 | | | 1,392,431 | | | — | | | — | | | — | | | — | | | — | |

| | OPP | | | 1/1/2023 | | | 106,090 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | |||

| | RSU | | | 1/5/2023 | | | — | | | — | | | — | | | — | | | — | | | — | | | 54,460 | | | 1,050,000 | | |||

| | PSU | | | 1/5/2023 | | | — | | | — | | | — | | | 50,570 | | | 101,140 | | | 151,710 | | | — | | | 1,950,000 | | |||

| | Paul D. Rouse | | | STI | | | 1/1/2023 | | | 118,681 | | | 365,171 | | | 479,287 | | | — | | | — | | | — | | | — | | | — | |

| | OPP | | | 1/1/2023 | | | 36,517 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | |||

| | RSU | | | 1/5/2023 | | | — | | | — | | | — | | | — | | | — | | | — | | | 45,383 | | | 875,000 | | |||

| | PSU | | | 1/5/2023 | | | — | | | — | | | — | | | 42,142 | | | 84,284 | | | 126,426 | | | — | | | 1,625,000 | | |||

| | Gordon Henry | | | STI | | | 1/1/2023 | | | 96,688 | | | 297,500 | | | 390,469 | | | — | | | — | | | — | | | — | | | — | |

| | OPP | | | 1/1/2023 | | | 29,750 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | |||

| | RSU | | | 1/5/2023 | | | — | | | — | | | — | | | — | | | — | | | — | | | 31,768 | | | 612,500 | | |||

| | PSU | | | 1/5/2023 | | | — | | | — | | | — | | | 29,499 | | | 58,998 | | | 88,497 | | | — | | | 1,137,500 | | |||

| | James McCusker | | | STI | | | 1/1/2023 | | | 96,688 | | | 297,500 | | | 390,469 | | | — | | | — | | | — | | | — | | | — | |

| | OPP | | | 1/1/2023 | | | 29,750 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | |||

| | RSU | | | 1/5/2023 | | | — | | | — | | | — | | | — | | | — | | | — | | | 31,768 | | | 612,500 | | |||

| | PSU | | | 1/5/2023 | | | — | | | — | | | — | | | 29,499 | | | 58,998 | | | 88,497 | | | — | | | 1,137,500 | | |||

| | John Wholey | | | STI | | | 1/1/2023 | | | 96,688 | | | 297,500 | | | 390,469 | | | — | | | — | | | — | | | — | | | — | |

| | OPP | | | 1/1/2023 | | | 29,750 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | |||

| | RSU | | | 1/5/2023 | | | — | | | — | | | — | | | — | | | — | | | — | | | 31,768 | | | 612,500 | | |||

| | PSU | | | 1/5/2023 | | | — | | | — | | | — | | | 29,499 | | | 58,998 | | | 88,497 | | | — | | | 1,137,500 | | |||

| 1. | For 2023 we continued the four components of the STI consisting of EBITDA, FCF, SaaS Revenue and individual performance equally weighted at 25%. The OPP is a self-funded plan and an incremental incentive plan to the STI to bridge the gap between the STI maximum and typical market maximums for senior leadership and only funds after the STI achieves maximum payout. The OPP individual financial payout scales are not capped; however, the overall payment is capped at 125%, i.e. the individual earning potential is capped at 200% the participant’s STI award at target. For fiscal year 2023, an award would only be paid out pursuant to our OPP if EBITDA exceeded $187.50 million, FCF exceeded $102.00 million or SaaS Revenue exceeded $260.50 million. |

| 2. | The amounts shown are potential payments of PSUs to the NEOs. Final payments of these awards can range from 0% to 150% of the shares originally granted. The PSUs vest January 5, 2026 after a three-year performance period from January 2023 to December 2025 based on achieved performance. |

| 3. | Consists of RSUs awarded pursuant to the 2020 Plan. The RSUs vest one-third over three years for Messrs. Rouse, Henry, McCusker and Wholey. The RSUs granted to Mr. Walsh vest in thirds over three years, with the first one-third cliff vesting at the end of the first year and 1/36th of the RSUs vesting on the 3rd of each month thereafter. |

| Thryv Holdings, Inc. | | | 42 | | | 2024 Proxy Statement |

| | | | | | Option Awards | | | | | | | Stock Awards | | ||||||||||||||||

| | Name | | | Grant Date(1) | | | Number of Securities Underlying Unexercised Options (#) Exercisable | | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | | Option Exercise Price ($)(6) | | | Option Expiration Date | | | Number of Shares or Units of Stock That Have Not Vested (#) | | | Market Value of Shares or Units of Stock That Have Not Vested ($) | | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) | |

| | Joseph A. Walsh | | | 11/18/2019(2) | | | 1,018,519 | | | 30,864 | | | 13.82 | | | 11/18/2029 | | | — | | | — | | | — | | | — | |

| | 5/03/2022(3) | | | — | | | — | | | — | | | — | | | 14,534 | | | 295,767 | | | 74,742 | | | 1,521,000 | | |||

| | 1/5/2023(7) | | | — | | | — | | | — | | | — | | | 54,460 | | | 1,108,261 | | | 101,140 | | | 2,058,199 | | |||

| | Paul D. Rouse | | | 11/14/2016(4) | | | 131,521 | | | 0 | | | 3.68 | | | 11/14/2026 | | | — | | | — | | | — | | | — | |

| | 11/18/2019(5) | | | 74,074 | | | 37,037 | | | 13.82 | | | 11/18/2029 | | | — | | | — | | | — | | | — | | |||

| | 5/03/2022(3) | | | — | | | — | | | — | | | — | | | 22,359 | | | 455,006 | | | 62,285 | | | 1,267,500 | | |||

| | 1/5/2023(7) | | | — | | | — | | | — | | | — | | | 45,383 | | | 923,544 | | | 84,284 | | | 1,715,179 | | |||

| | Gordon Henry | | | 9/26/2016(4) | | | 154,771 | | | 0 | | | 3.68 | | | 9/26/2026 | | | — | | | — | | | — | | | — | |

| | 11/18/2019(5) | | | 74,074 | | | 37,037 | | | 13.82 | | | 11/18/2029 | | | — | | | — | | | — | | | — | | |||

| | 5/03/2022(3) | | | — | | | — | | | — | | | — | | | 15,651 | | | 318,498 | | | 43,600 | | | 887,260 | | |||

| | 1/5/2023(7) | | | — | | | — | | | — | | | — | | | 31,768 | | | 646,479 | | | 58,998 | | | 1,200,609 | | |||

| | James McCusker | | | 9/26/2016(4) | | | 150,521 | | | 0 | | | 3.68 | | | 9/26/2026 | | | — | | | — | | | — | | | — | |

| | 11/18/2019(5) | | | 74,074 | | | 37,037 | | | 13.82 | | | 11/18/2029 | | | — | | | — | | | — | | | — | | |||

| | 5/03/2022(3) | | | — | | | — | | | — | | | — | | | 15,651 | | | 318,498 | | | 43,600 | | | 887,260 | | |||

| | 1/5/2023(7) | | | — | | | — | | | — | | | — | | | 31,768 | | | 646,479 | | | 58,998 | | | 1,200,609 | | |||

| | John Wholey | | | 9/26/2016(4) | | | 62,521 | | | 0 | | | 3.68 | | | 9/26/2026 | | | — | | | — | | | — | | | — | |

| | 11/18/2019(5) | | | 74,074 | | | 37,037 | | | 13.82 | | | 11/18/2029 | | | — | | | — | | | — | | | — | | |||

| | 5/03/2022(3) | | | — | | | — | | | — | | | — | | | 15,651 | | | 318,498 | | | 43,600 | | | 887,260 | | |||

| | 1/5/2023(7) | | | — | | | — | | | — | | | — | | | 31,768 | | | 646,479 | | | 58,998 | | | 1,200,609 | | |||

| 1. | We elected not to award grants of equity to our NEOs in 2020 or 2021 due to their significant equity stake from 2019 non-qualified stock option awards. Starting in 2022, we began annual grants of a combination of RSUs and PSUs to align with other SaaS companies and our peer group. See “Compensation Discussion and Analysis” for further information. |

| 2. | Stock options granted to Mr. Walsh on November 18, 2019 vested in equal monthly installments over a three-year period beginning January 1, 2020. On November 23, 2020, the board of directors and compensation committee approved a one-time stock option repricing for outstanding stock options granted November 18, 2019 to allow for the officers, contingent upon each officer’s written consent, a one-time stock repricing from $16.20 to $13.82 and a delayed vesting scheduled for those options granted in 2019. Mr. Walsh consented to the stock option repricing and subsequently restarting the vesting schedule beginning January 1, 2021. |

| 3. | Represents unvested and outstanding PSUs and RSUs as of December 31, 2023 granted on May 3, 2022 to our NEOs. As approved by the compensation committee, 65% of the total award value is in the form of PSUs and 35% is in the form of RSUs. The RSUs vest one-third over three years for Messrs. Rouse, Henry, McCusker and Wholey and for Mr. Walsh vest one-third over three years with the first tranche cliff-vesting January 3, 2023 at the end of the first year and 1/36th of the RSUs vesting on the 3rd of each month thereafter. The PSUs vest January 3, 2025 after a three-year performance period from January 2022 to December 2024, based on achieved performance. See “Grants of Plan Based Awards” table for more information. |

| Thryv Holdings, Inc. | | | 43 | | | 2024 Proxy Statement |

| 4. | Stock options granted to Mr. Rouse on November 14, 2016 and stock option grants to Messrs. Henry, McCusker and Wholey on September 26, 2016 vested in three equal installments on each of January 1, 2018, January 1, 2019 and January 1, 2020. |

| 5. | Stock option grants originally awarded to Messrs. Rouse, Henry, McCusker and Wholey on November 18, 2019 vested in three equal installments on each of January 1, 2021, January 1, 2022 and January 1, 2023. On November 23, 2020, the board of directors and compensation committee approved a one-time stock option repricing for outstanding stock granted November 18, 2019 to allow for the officers, contingent upon each officer’s written consent, a one-time stock repricing from $16.20 to $13.82 and a delayed vesting scheduled for those options granted in 2019. All NEOs consented to the stock option repricing and subsequently the vesting schedule was amended to vest in three equal installments on each of January 1, 2022, January 1, 2023 and January 1, 2024. |

| 6. | For applicable grants, reflects the revised exercise price of $13.82 pursuant to the option repricing. |

| 7. | Represents unvested and outstanding PSUs and RSUs as of December 31, 2023 granted January 5, 2023 to our NEOs. As approved by the Compensation Committee, 65% of the total award value is in the form of PSUs and 35% is in the form of RSUs. The total equity grant value was $3,000,000 for Mr. Walsh, $2,500,000 for Mr. Rouse and $1,750,000 for each of Messrs. Henry, McCusker and Wholey for fiscal year 2023. The RSUs vest one-third over three years for Messrs. Rouse, Henry, McCusker and Wholey and vest one-third over three year with the first tranche cliff-vesting on the 1st anniversary of the grant date and 1/36 of the RSUs vesting on the 3rd of each month thereafter for Mr. Walsh. The PSUs granted in 2023 vest January 5, 2026 after a three-year performance period January 2023 to December 2025 based on achieved performance. See “Grants of Plan Based Awards” table for more information. |

| | | | Option Awards | | | Stock Awards | | |||||||

| | Name | | | Number of Shares Acquired on Exercise (#)(1) | | | Value Realized on Exercise ($) | | | Number of Shares Acquired on Vesting (#)(2) | | | Value Realized on Vesting ($) | |

| | Joseph A. Walsh | | | — | | | — | | | 25,711 | | | 531,780 | |

| | Paul D. Rouse | | | — | | | — | | | 11,179 | | | 216,761 | |

| | Gordon Henry | | | — | | | — | | | 7,825 | | | 151,727 | |

| | James McCusker | | | — | | | — | | | 7,825 | | | 151,727 | |

| | John Wholey | | | — | | | — | | | 7,825 | | | 151,727 | |

| 1. | None of our NEOs exercised options during fiscal year 2023. |

| 2. | The number of shares acquired on vesting are pre-tax and do not account for shares sold or withheld to pay taxes. |

| Thryv Holdings, Inc. | | | 44 | | | 2024 Proxy Statement |

| | Name & Event | | | Cash Severance ($) | | | STI Awards ($)(3) | | | Benefits continuation ($)(4) | | | Accelerated Vesting of Stock Options(5) ($) | | | Vesting of RSUs(6) | | | Vesting of PSUs(7) | | | Outplacement ($)(8) | | | Total ($) | |

| | Joseph A. Walsh | | | | | | | | | | | | | | | | | | ||||||||

| | Resignation without Good Reason or Termination for Cause | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | Resignation for Good Reason or Termination without Cause(1) | | | 2,121,800 | | | 1,259,819 | | | — | | | — | | | 364,353 | | | | | — | | | 3,745,972 | | |

| | Death(1) | | | 2,121,800 | | | 1,259,819 | | | — | | | — | | | 364,353 | | | | | — | | | 3,745,972 | | |

| | Disability(1) | | | 2,121,800 | | | 1,259,819 | | | — | | | — | | | 364,353 | | | | | — | | | 3,745,972 | | |

| | Resignation for Good Reason, Termination without Cause in connection with a Change in Control(1) | | | 4,243,600 | | | 1,259,819 | | | — | | | 6,852,471 | | | 1,108,261 | | | 2,058,199 | | | — | | | 15,522,350 | |

| | Paul D. Rouse | | | | | | | | | | | | | | | | | | ||||||||

| | Resignation without Good Reason or Termination for Cause | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | Resignation for Good Reason or Termination without Cause(2) | | | 1,330,266 | | | 433,641 | | | 1,427 | | | — | | | 303,618 | | | 563,895 | | | 7,250 | | | 2,640,097 | |

| | Death | | | — | | | — | | | — | | | — | | | 303,618 | | | 563,895 | | | — | | | 867,512 | |

| | Disability | | | — | | | — | | | — | | | — | | | 303,618 | | | 563,895 | | | — | | | 867,512 | |

| | Resignation for Good Reason, Termination without Cause in connection with a Change in Control(2) | | | 1,773,688 | | | 433,641 | | | 1,427 | | | — | | | 923,544 | | | 1,715,179 | | | 7,250 | | | 4,854,730 | |

| | Gordon Henry | | | | | | | | | | | | | | | | | | ||||||||

| | Resignation without Good Reason or Termination for Cause | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | Resignation for Good Reason or Termination without Cause(2) | | | 1,083,750 | | | 353,281 | | | 1,163 | | | — | | | 212,534 | | | 394,721 | | | 7,250 | | | 2,052,699 | |

| | Death | | | — | | | — | | | — | | | — | | | 212,534 | | | 394,721 | | | — | | | 607,255 | |

| | Disability | | | — | | | — | | | — | | | — | | | 212,534 | | | 394,721 | | | — | | | 607,255 | |

| | Resignation for Good Reason, Termination without Cause in connection with a Change in Control(2) | | | 1,445,000 | | | 353,281 | | | 1,163 | | | — | | | 646,479 | | | 1,200,609 | | | 7,250 | | | 3,653,782 | |

| | James McCusker | | | | | | | | | | | | | | | | | | ||||||||

| | Resignation without Good Reason or Termination for Cause | | | | | | | | | — | | | — | | | — | | | — | | | — | | |||

| | Resignation for Good Reason or Termination without Cause(2) | | | 1,083,750 | | | 353,281 | | | 1,163 | | | — | | | 212,534 | | | 394,721 | | | 7,250 | | | 2,052,699 | |

| | Death | | | — | | | — | | | — | | | — | | | 212,534 | | | 394,721 | | | — | | | 607,255 | |

| | Disability | | | — | | | — | | | — | | | — | | | 212,534 | | | 394,721 | | | — | | | 607,255 | |

| | Resignation for Good Reason, Termination without Cause in connection with a Change in Control(2) | | | 1,445,000 | | | 353,281 | | | 1,163 | | | — | | | 646,479 | | | 1,200,609 | | | 7,250 | | | 3,653,782 | |

| Thryv Holdings, Inc. | | | 45 | | | 2024 Proxy Statement |

| | Name & Event | | | Cash Severance ($) | | | STI Awards ($)(3) | | | Benefits continuation ($)(4) | | | Accelerated Vesting of Stock Options(5) ($) | | | Vesting of RSUs(6) | | | Vesting of PSUs(7) | | | Outplacement ($)(8) | | | Total ($) | |

| | John Wholey | | | | | | | | | | | | | | | | | | ||||||||

| | Resignation without Good Reason or Termination for Cause | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | Resignation for Good Reason or Termination without Cause(2) | | | 1,083,750 | | | 353,281 | | | 1,163 | | | — | | | 212,534 | | | 394,721 | | | 7,250 | | | 2,052,699 | |

| | Death | | | — | | | — | | | — | | | — | | | 212,534 | | | 394,721 | | | — | | | 607,255 | |

| | Disability | | | — | | | — | | | — | | | — | | | 212,534 | | | 394,721 | | | — | | | 607,255 | |

| | Resignation for Good Reason, Termination without Cause in connection with a Change in Control(2) | | | 1,445,000 | | | 353,281 | | | 1,163 | | | — | | | 646,479 | | | 1,200,609 | | | 7,250 | | | 3,653,782 | |

| 1. | Pursuant to the Walsh Employment Agreement, in the event that Mr. Walsh’s employment is terminated by the Company without cause, by reason of Mr. Walsh’s resignation for good reason, by reason of Mr. Walsh’s death or disability, or as a result of the Company’s non-renewal of the employment term, Mr. Walsh is entitled to a lump sum cash severance amount equal to one times (1x) the sum of his annual base salary and target STI award. Mr. Walsh would also be entitled to a pro-rated STI award for the year in which his employment terminates (based on actual performance). In the event that Mr. Walsh’s employment is terminated by the Company without cause, by reason of his resignation for good reason, or as a result of the Company’s non-renewal of the employment term, in each case, within 6 months prior to and 12 months following a change in control, his lump sum cash severance amount would be increased to two times (2x) the sum of his annual base salary and target STI award. |

| 2. | Pursuant to the EVP Severance Plan, in the event that Messrs. Rouse’s, Henry’s, McCusker’s or Wholey’s employment is terminated by the Company without cause or by reason of their resignation for good reason, they would be entitled to a cash severance amount equal to (i) 78 weeks’ of base pay, payable in equal installments on the Company’s regular payroll schedule over the 78 weeks, and (ii) one and one-half (1.5) times their target STI award payable in equal installments on the Company’s regular payroll over a period of 78 weeks. They would also be entitled to a pro-rated STI award for the year in which their employment terminates (based on actual performance). In the event that Messrs. Rouse’s, Henry’s, McCusker’s or Wholey’s employment is terminated by the Company without cause or by reason of their resignation for good reason, in each case, within 2 years following a change in control, their cash severance amount would be increased to (i) 104 weeks’ of base pay, payable in equal installments on the Company’s regular payroll schedule over 104 weeks, and (ii) two (2) times their target STI award payable in equal installments on the Company’s regular payroll period over a period of 104 weeks. |

| 3. | Amounts reported in this column were calculated on the basis of short-term cash incentive awards paid under our STI for 2023 performance, which were approved on February 14, 2024 and paid on February 23, 2024. |

| 4. | For Messrs. Rouse, Henry, McCusker, and Wholey, represents continuation of Company-paid life insurance coverage for up to 18 months in the event that their employment is terminated by the Company without cause or by reason of their resignation for good reason, pursuant to the terms of the EVP Severance Program. |

| 5. | Pursuant to the term of Mr. Walsh’s stock option grants, in the event that Mr. Walsh’s employment is terminated by the Company without cause, or Mr. Walsh resigns for good reason, in either case within six months prior to or 12 months following a “change in control”, all outstanding unvested stock options held by Mr. Walsh will immediately vest and become exercisable as of the date of such termination (or change in control, if later). |

| 6. | For Messrs. Walsh, Rouse, Henry, McCusker and Wholey, represents a prorated portion of the unvested RSUs that otherwise would have vested on or before the next anniversary of the Grant Date that will become immediately vested. The prorated number of shares is determined by taking the number of days elapsed from the Grant Date through the date of termination divided by 365. Upon termination without cause or resignation for a good reason in connection with a change in control, all unvested RSUs will vest immediately. |

| 7. | For Messrs. Walsh, Rouse, Henry, McCusker and Wholey, represents a prorated portion of the unvested PSUs remaining in force and eligible to vest at the end of the Performance period based on the achievement against goal(s). The prorated number of shares is determined by taking the number of days elapsed from the first day of the applicable performance period through the date of termination divided by 365. The amounts represent the number of shares at target. In the event of a change in control together with termination without cause or resignation for good reason, the unvested PSUs will immediately vest at target. |

| 8. | For Messrs. Rouse, Henry, McCusker and Wholey, represents 12 months of Company-paid outplacement benefits in the event their employment is terminated by the Company without cause or by reason of their resignation for good reason pursuant to the terms of the EVP Severance Program. |

| Thryv Holdings, Inc. | | | 46 | | | 2024 Proxy Statement |

| Thryv Holdings, Inc. | | | 47 | | | 2024 Proxy Statement |

| Thryv Holdings, Inc. | | | 48 | | | 2024 Proxy Statement |

| • | We selected December 31, 2023, the last day of our 2023 fiscal year, as the determination date for purposes of identifying our median employee. |

| • | We selected our median employee based on 2,942 full-time and part-time U.S., Dominican Republic and Australian employees who were actively employed as of the determination date. |

| • | We identified our median employee using 2023 gross payroll earnings, excluding our CEO. Such compensation was annualized for employees who did not work the entire fiscal year. All employees, except for our CEO, were ranked from lowest to highest with the median employee determined from this list. |

| • | We excluded approximately 78 employees of Yellow New Zealand, which was acquired by Thryv on April 1, 2023 based on the acquisition exception under the SEC rules, and approximately 24 employees from Thryv Canada Ltd., which began operating in 2023 under the de minimus exception. Of the Company’s 3,044 employees, 2,035 are US employees and 1,009 are non-US employees. |

| Thryv Holdings, Inc. | | | 49 | | | 2024 Proxy Statement |

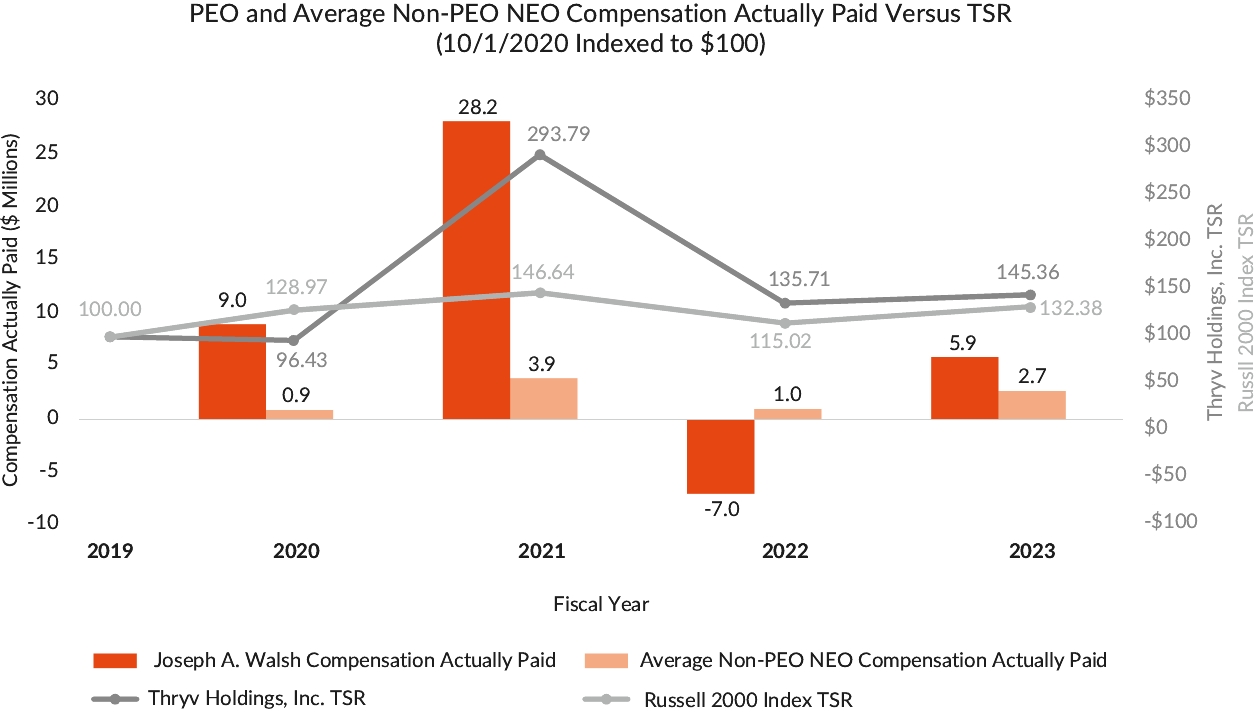

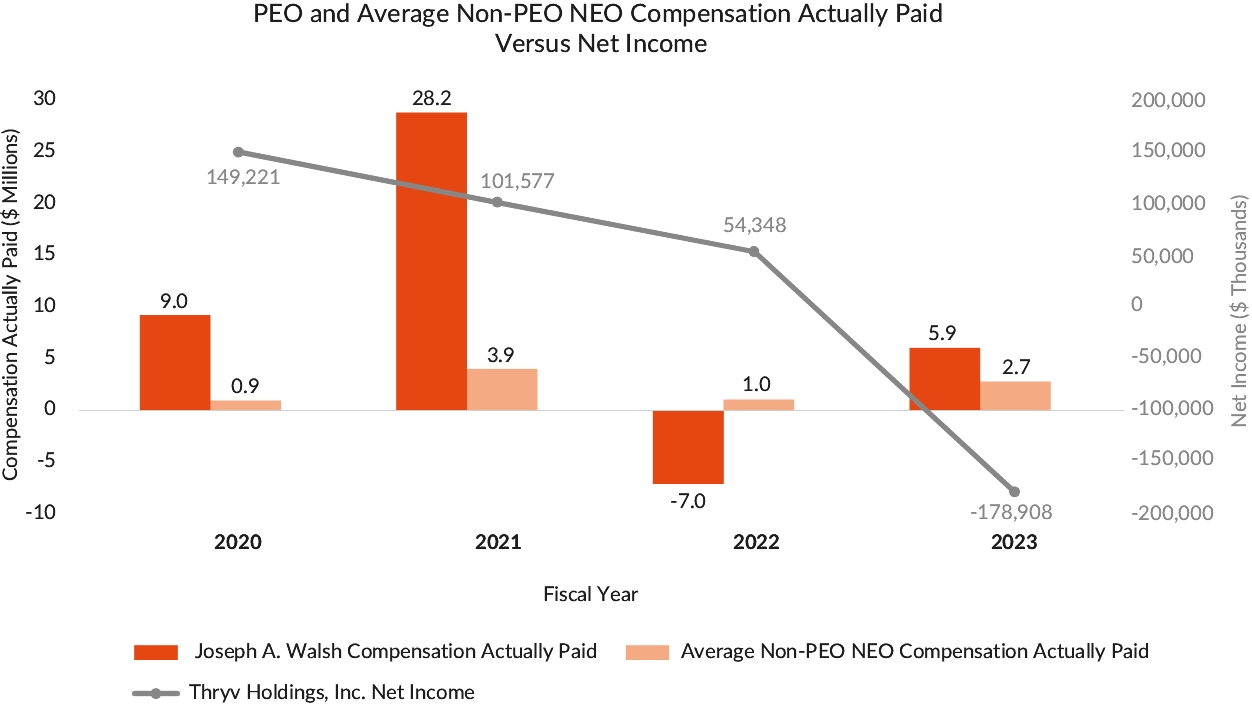

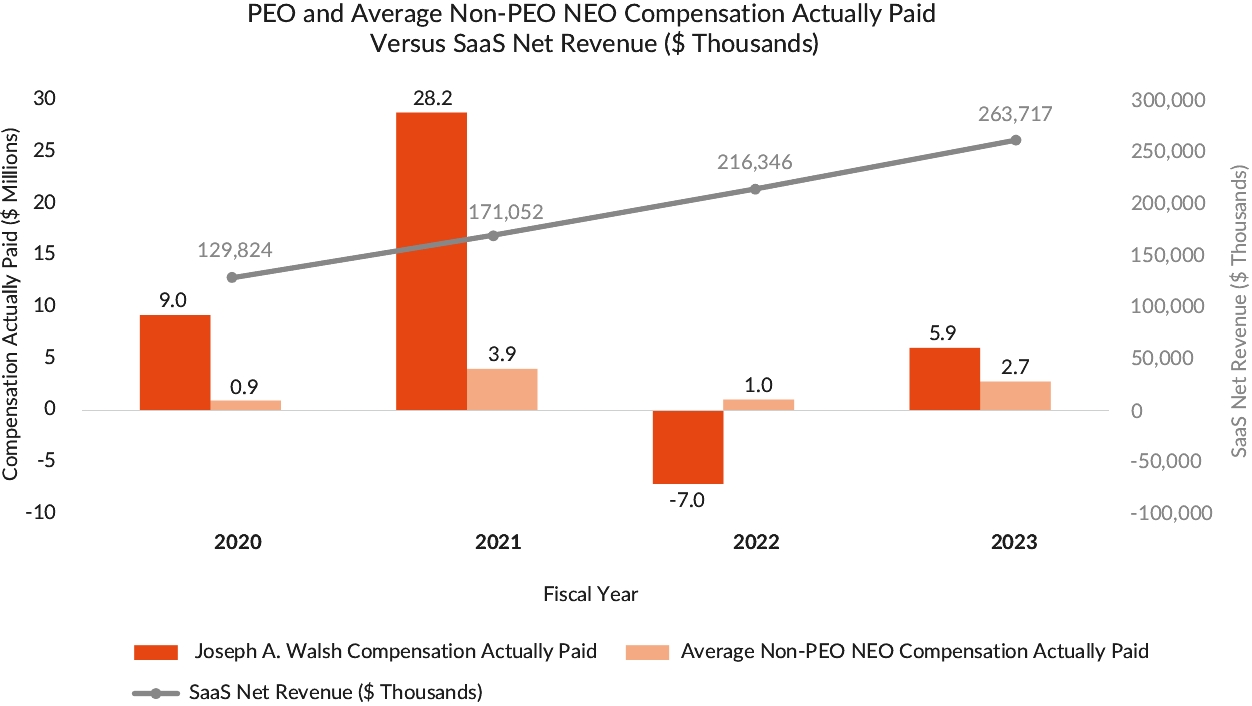

| | Year | | | Summary Compensation Table Total for PEO1 ($) | | | Compensation Actually Paid to PEO1,2,3, ($) | | | Average Summary Compensation Table Total for Non-PEO NEOs1 ($) | | | Average Compensation Actually Paid to Non-PEO NEOs1,2,3 ($) | | | Value of Initial Fixed $100 Investment based on:4 | | | Net Income ($ Thousands) | | | SaaS Revenue5 ($ Thousands) | | |||

| | TSR ($) | | | Peer Group TSR ($) | | |||||||||||||||||||||

| | (a) | | | (b) | | | (c) | | | (d) | | | (e) | | | (f) | | | (g) | | | (h) | | | (i) | |

| | 2023 | | | 5,809,005 | | | 5,868,820 | | | 2,907,115 | | | 2,741,138 | | | 145.36 | | | 132.38 | | | (178,908) | | | 263,717 | |

| | 2022 | | | 6,551,181 | | | (7,012,128) | | | 3,124,345 | | | 1,023,686 | | | 135.71 | | | 115.02 | | | 54,348 | | | 216,346 | |

| | 2021 | | | 3,268,711 | | | 28,174,803 | | | 1,081,725 | | | 3,917,477 | | | 293.79 | | | 146.64 | | | 101,577 | | | 171,052 | |

| | 2020 | | | 4,080,411 | | | 9,014,189 | | | 1,248,390 | | | 888,951 | | | 96.43 | | | 128.97 | | | 149,221 | | | 129,824 | |

| 1. | Joseph A. Walsh was our PEO for each year presented. The individuals comprising the non-PEO NEOs for each year presented are listed below. |

| | 2020 | | | 2021 | | | 2022 | | | 2023 | |

| | Paul D. Rouse | | | Paul D. Rouse | | | Paul D. Rouse | | | Paul D. Rouse | |

| | Gordon Henry | | | Gordon Henry | | | Gordon Henry | | | Gordon Henry | |

| | James McCusker | | | James McCusker | | | James McCusker | | | James McCusker | |

| | John Wholey | | | John Wholey | | | John Wholey | | | John Wholey | |

| | Debra A. Ryan | | | | | | | |

| 2. | The amounts shown for Compensation Actually Paid have been calculated in accordance with Item 402(v) of Regulation S-K and do not reflect compensation actually earned, realized, or received by the Company’s NEOs. These amounts reflect the Summary Compensation Table Total with certain adjustments required under Item 402(v). (For 2023, the adjustments are described in footnote 3 below.) |

| 3. | For the 2023, amounts in this column represent the Compensation Actually Paid to the PEO and, on an average basis, the non-PEO NEOs, based on their total compensation reported in the Summary Compensation Table for that fiscal year and adjusted as set forth below. Equity values are calculated in accordance with FASB ASC Topic 718. |

| | Year | | | Reported Summary Compensation Table Total for the PEO ($) | | | Subtract Reported Value of Stock Awards and Option Awards for the PEO ($) | | | Add/Subtract Equity Award Adjustments(a) for the PEO ($) | | | Compensation Actually Paid to the PEO ($) | |

| | 2023 | | | 5,809,005 | | | (3,000,000) | | | 3,059,815 | | | 5,868,820 | |

| Thryv Holdings, Inc. | | | 50 | | | 2024 Proxy Statement |

| | Year | | | Average Summary Compensation Table Total for Non-PEO NEOs ($) | | | Subtract Average Reported Value of Stock Awards and Option Awards for Non-PEO NEOs ($) | | | Add/Subtract Equity Award Adjustment for Non-PEO NEOs(a) ($) | | | Average Compensation Actually Paid to Non-PEO NEOs ($) | |

| | 2023 | | | 2,907,115 | | | (1,937,500) | | | 1,771,523 | | | 2,741,138 | |

| (a) | The equity award adjustments include the addition (or subtraction, as applicable) of the following: |

| (i) | the year-end fair value of any equity awards granted in the applicable year that are outstanding and unvested as of the end of the year |

| (ii) | the amount of change in fair value as of the end of the applicable year (from the end of the prior fiscal year) of any awards granted in prior years that are outstanding and unvested as of the end of the applicable year |

| (iii) | for awards that are granted and vest in same applicable year, the fair value as of the vesting date |

| (iv) | for awards granted in prior years that vest in the applicable year, the amount equal to the change in fair value as of the vesting date (from the end of the prior fiscal year); |

| (v) | for awards granted in prior years that are determined to fail to meet the applicable vesting conditions during the applicable year, a deduction for the amount equal to the fair value at the end of the prior fiscal year; and |

| (vi) | the value of any dividends or other earnings paid on awards prior to the vesting date that are not otherwise included in the total compensation for the applicable year. |

| | Year | | | Year-End Fair Value of Equity Awards Granted During Year That Remained Unvested as of Last Day of Year for PEO ($) | | | Change in Fair Value from Last Day of Prior Year to Last Day of Year of Unvested Equity Awards for PEO ($) | | | Vesting-Date Fair Value of Equity Awards Granted During Year that Vested During Year for PEO ($) | | | Change in Fair Value from Last Day of Prior Year to Vesting Date of Unvested Equity Awards that Vested During Year for PEO ($) | | | Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for PEO ($) | | | Value of Dividends or Other Earnings Paid on Equity Awards During the Year prior to Vesting for PEO ($) | | | Total - Inclusion of Equity Values for PEO ($) | |

| | 2023 | | | 3,150,181 | | | (406,102) | | | — | | | 315,739 | | | — | | | — | | | 3,059,815 | |

| | Year | | | Average Year-End Fair Value of Equity Awards Granted During Year That Remained Unvested as of Last Day of Year for Non-PEO NEOs ($) | | | Average Change in Fair Value from Last Day of Prior Year to Last Day of Year of Unvested Equity Awards for Non-PEO NEOs ($) | | | Average Vesting-Date Fair Value of Equity Awards Granted During Year that Vested During Year for Non- PEO NEOs ($) | | | Average Change in Fair Value from Last Day of Prior Year to Vesting Date of Unvested Equity Awards that Vested During Year for Non-PEO NEOs ($) | | | Average Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for Non-PEO NEOs ($) | | | Value of Dividends or Other Earnings Paid on Equity Awards During the Year prior to Vesting for Non-PEO NEOs ($) | | | Total - Average Inclusion of Equity Values for Non-PEO NEOs ($) | |

| | 2023 | | | 2,034,483 | | | (274,277) | | | — | | | 11,316 | | | — | | | — | | | 1,771,523 | |

| 4. | The Peer Group TSR set forth in this table utilizes the Russell 2000 Index, which we also utilize in the stock performance graph required by Item 201(e) of Regulation S-K included in our Annual Report for the year ended December 31, 2023. The comparison assumes $100 was invested for the period starting October 1, 2020, the date our common stock commenced trading on Nasdaq after our direct listing, through the end of the listed year in the Company and in the Russell 2000 Index, respectively. Historical stock performance is not necessarily indicative of future stock performance. For 2023, we removed the Nasdaq Computer Index from our10-K Performance Graph and added the Russell 2000 Index, as we were added to the Russell 2000 Index. The peer group TSR performance for the peer group disclosed in our 2023 Proxy filing, the Nasdaq Computer Index, would have been, for the years ending 12/31/2020, 12/31/2021, 12/31/2022, and 12/31/2023, respectively: $112.08, $154.51, $99.23, and $165.14. |

| 5. | We determined SaaS Net Revenue to be the most important financial performance measure used to link Company performance to Compensation Actually Paid to our PEO and Non-PEO NEOs in 2023. More information on SaaS Net Revenue can be found at the “Short-Term Incentive Plan - Cash Incentive” section of the CD&A. This performance measure may not have been the most important financial performance measure for prior years, and we may determine a different financial performance measure to be the most important financial performance measure in future years. |

| Thryv Holdings, Inc. | | | 51 | | | 2024 Proxy Statement |

| Thryv Holdings, Inc. | | | 52 | | | 2024 Proxy Statement |

| Thryv Holdings, Inc. | | | 53 | | | 2024 Proxy Statement |

| | Plan Category | | | Number of Securities to Be Issued Upon Exercise of Outstanding Options (a) | | | Weighted-Average Exercise Price of Outstanding Options (b) | | | Number of Options Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) (c) | |

| | Equity compensation plans approved by security holders | | | 5,432,465 | | | 8.70 | | | 4,860,517 | |