Exhibit 99.2

2

3

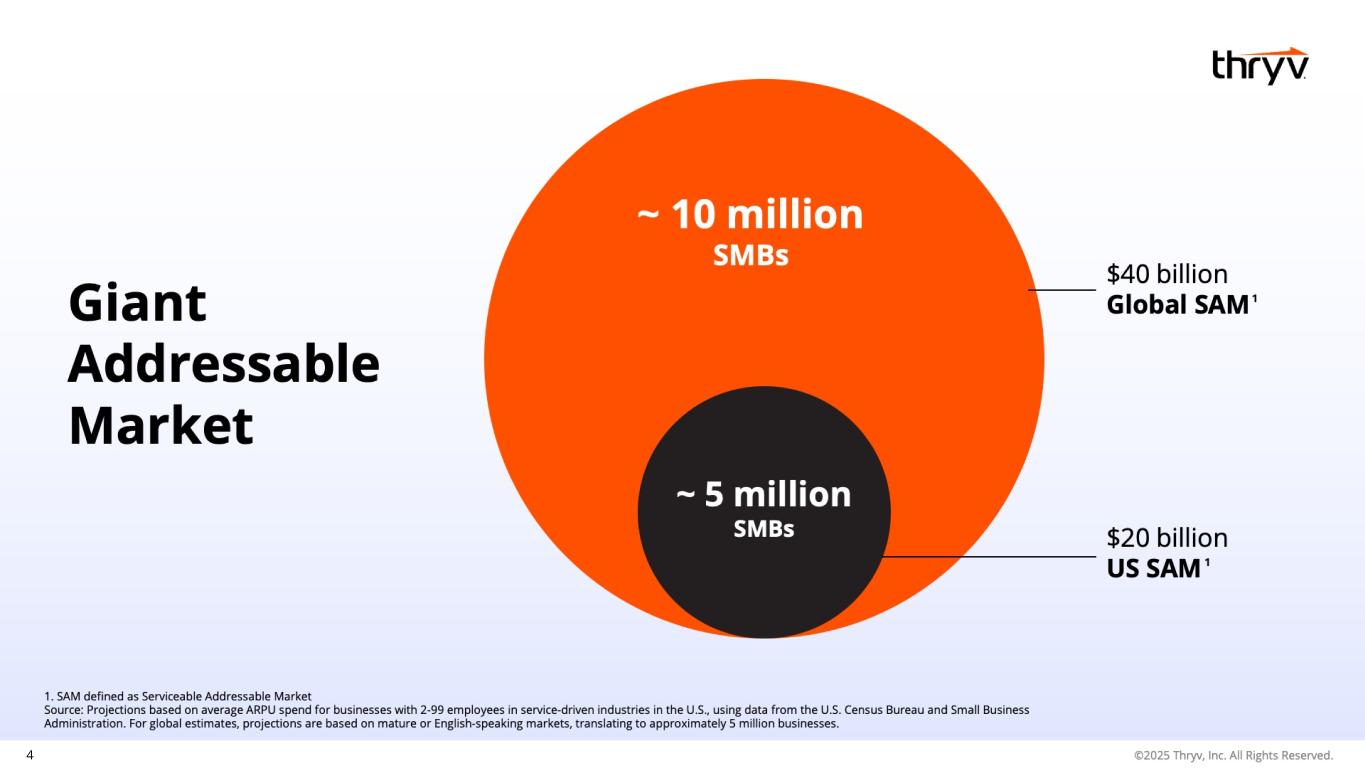

4

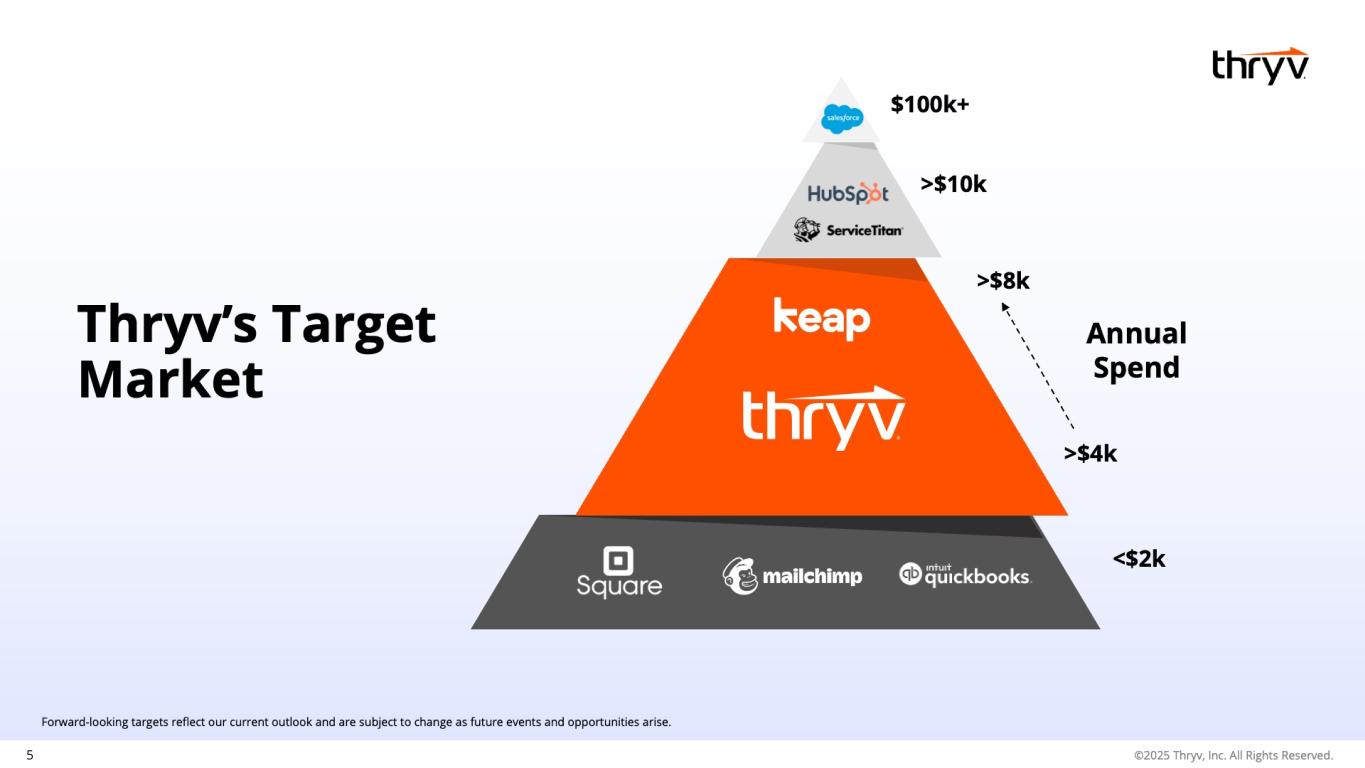

5

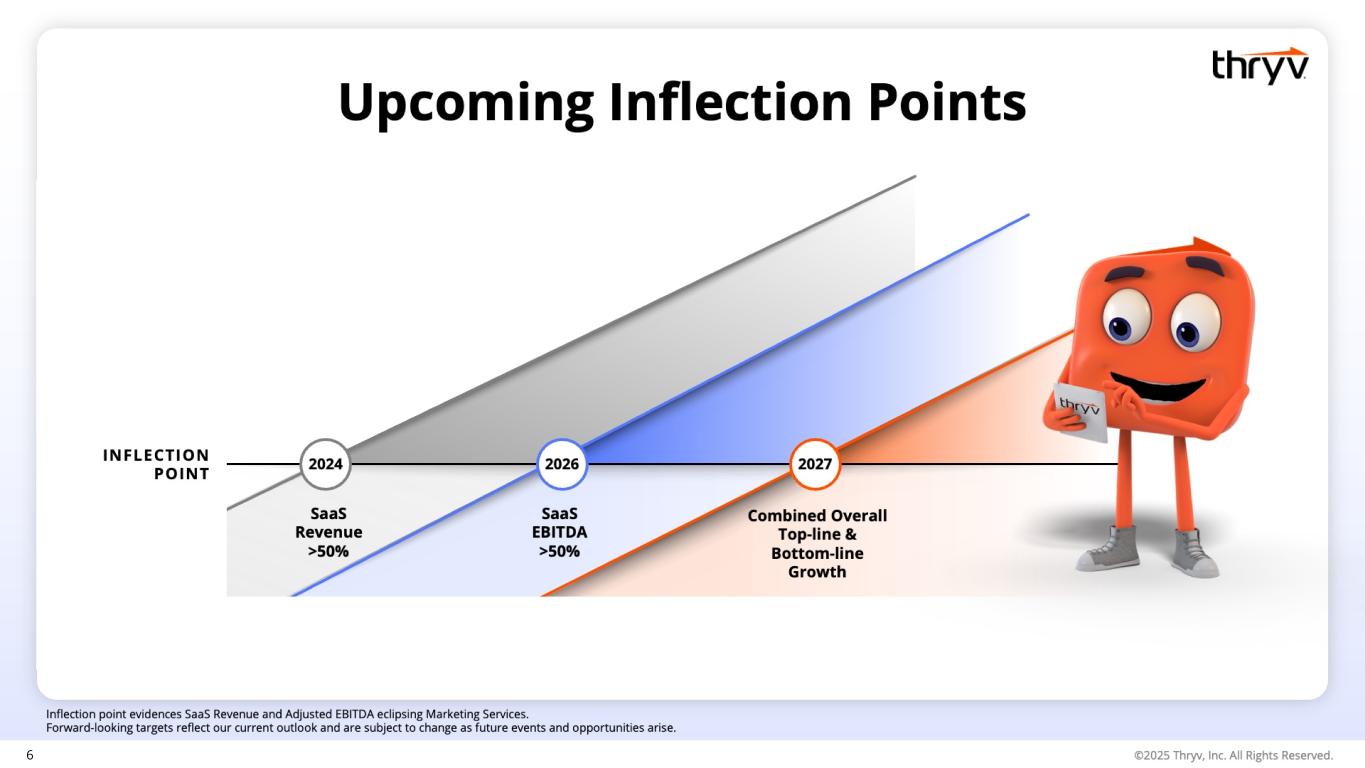

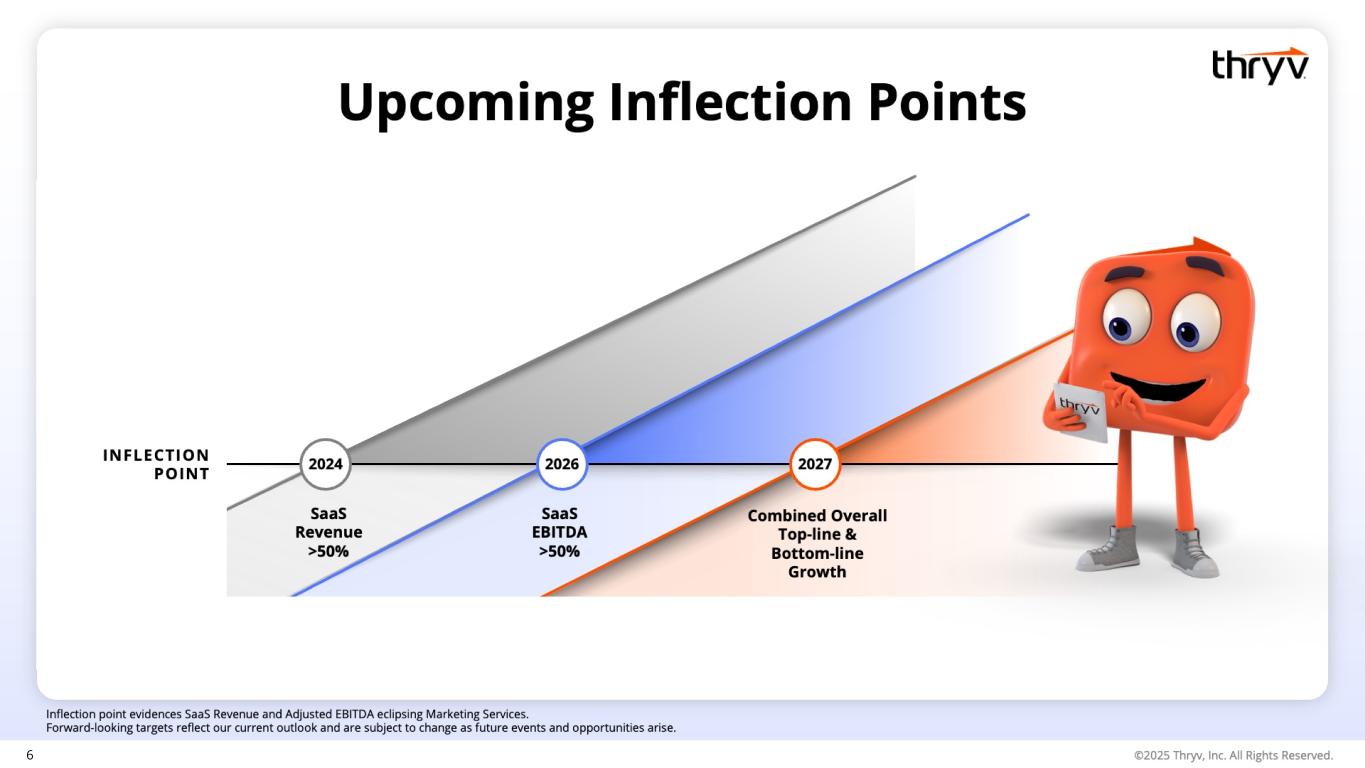

6

7

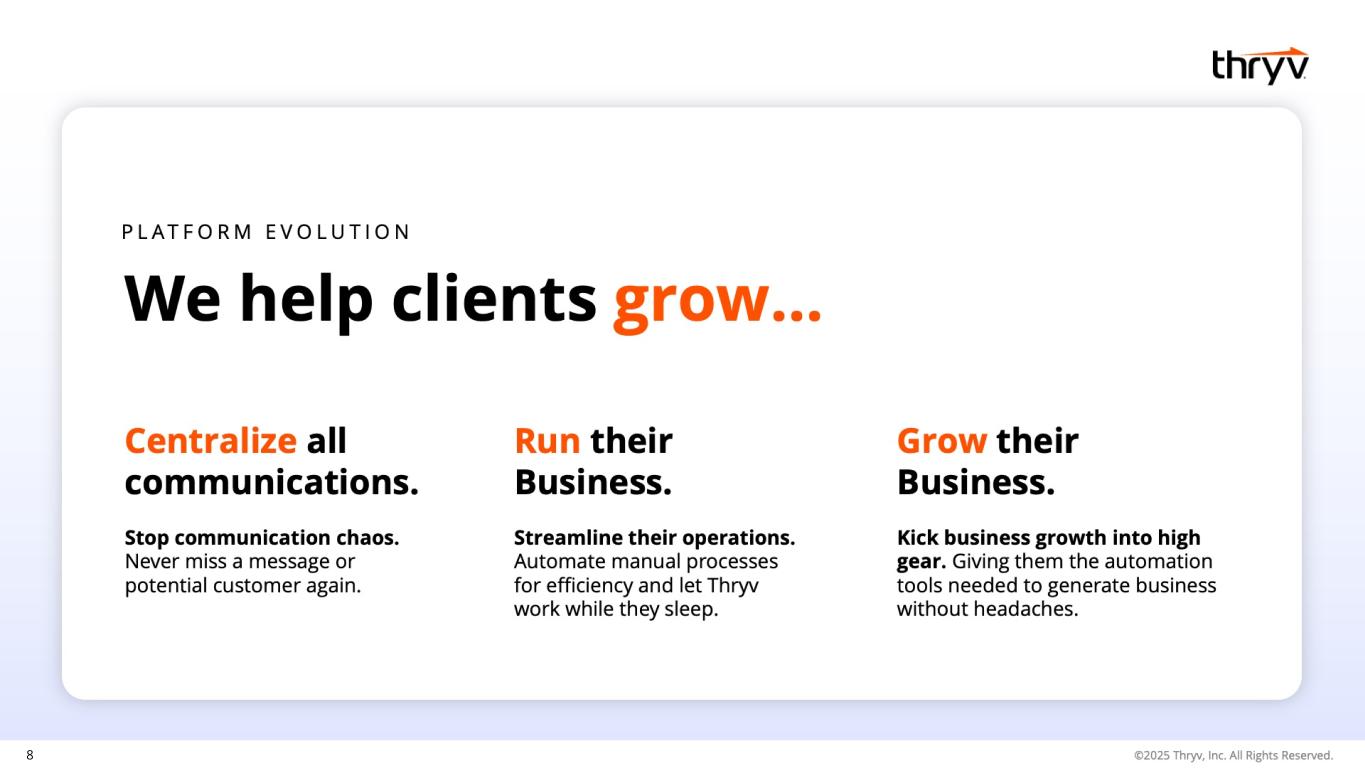

8

9

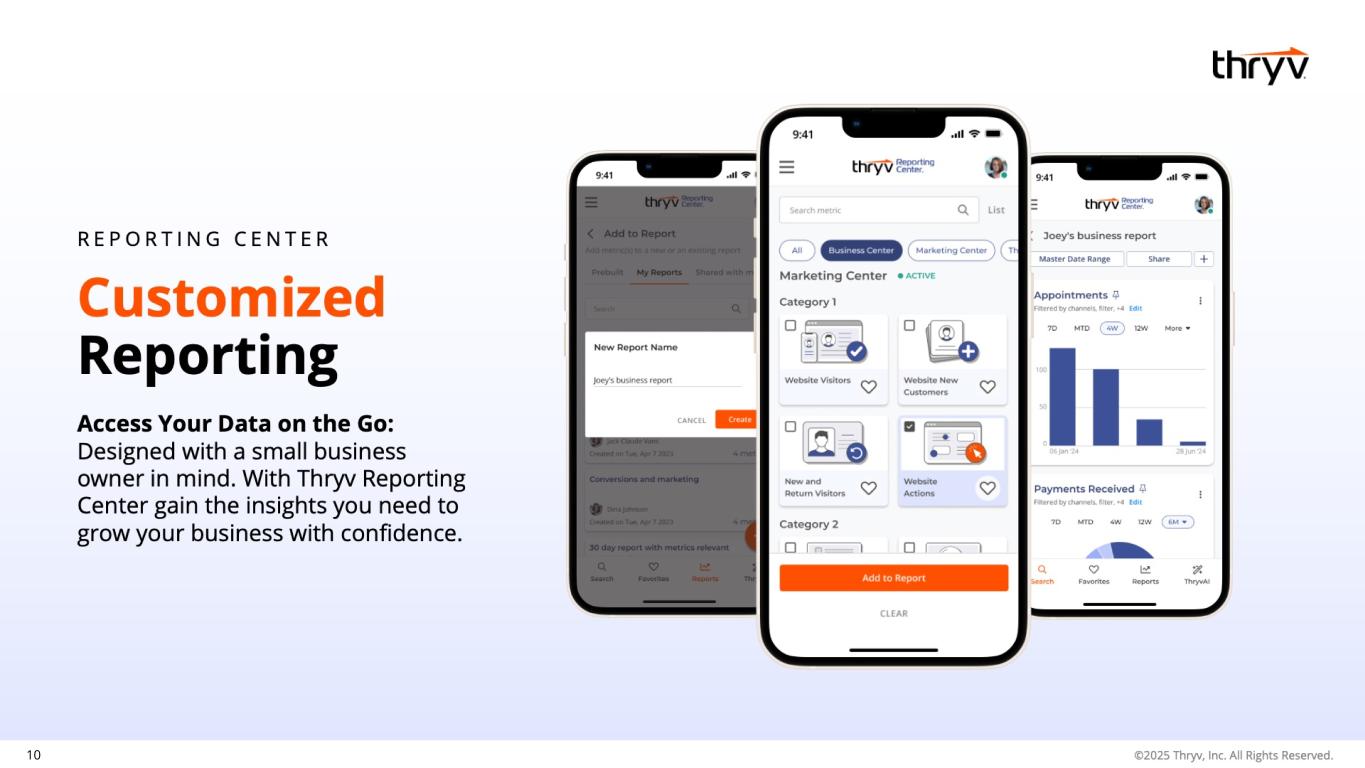

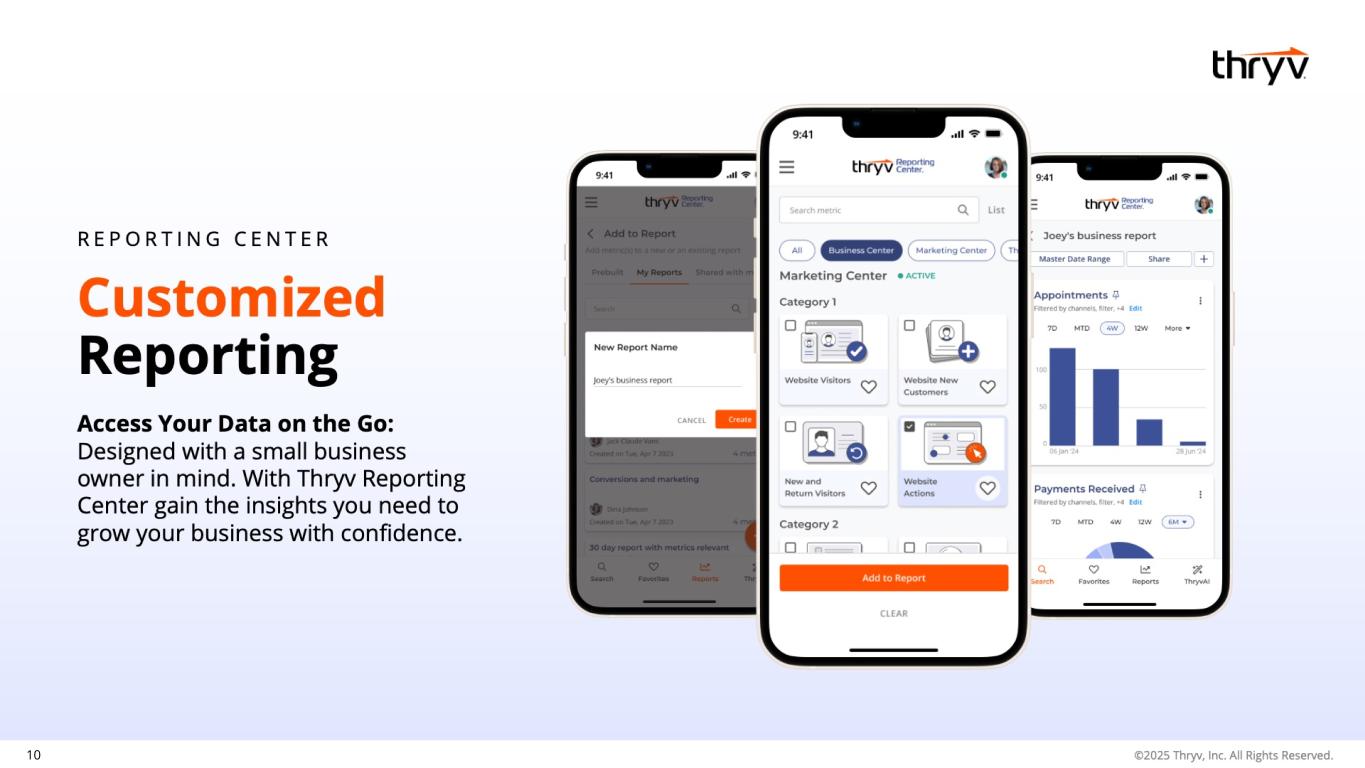

10

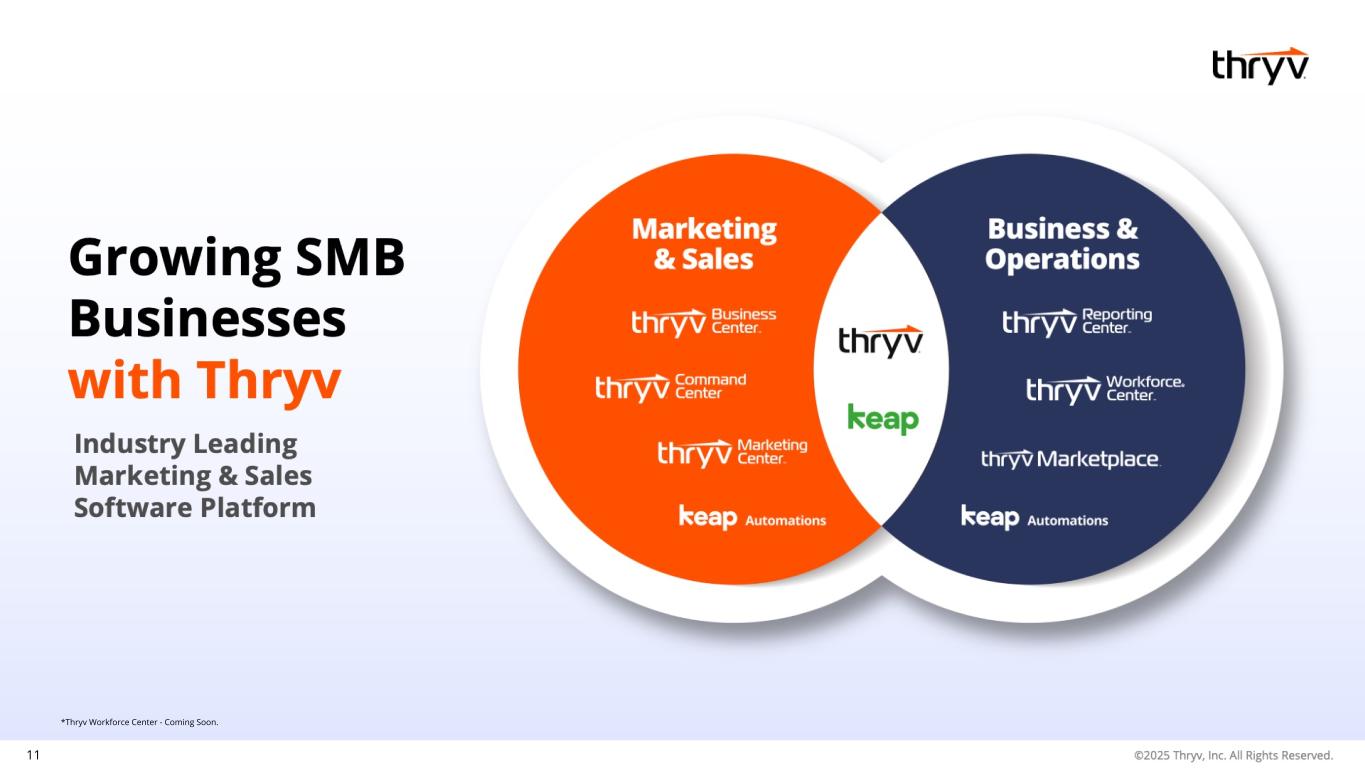

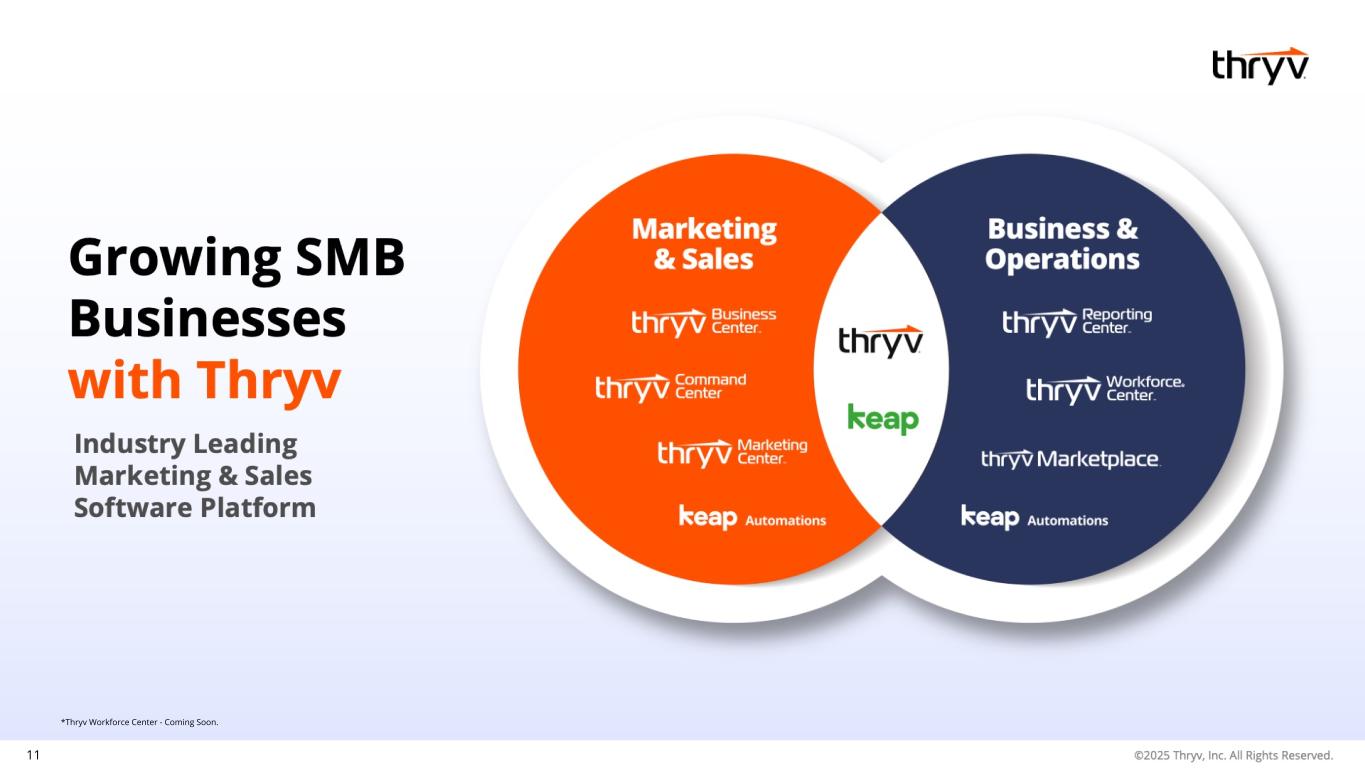

11 *Thryv Workforce Center - Coming Soon. *

12

13

14

15 Q4 2024

16 4th Quarter and FY 2024 Highlights 1Consolidated Adjusted EBITDA is equal to Total SaaS Adjusted EBITDA and Total Marketing Services Adjusted EBITDA. See the Appendix for a reconciliation to Net income (loss). 2 Equal to adjusted EBITDA divided by revenue. 4th Quarter Full Year $ in thousands 2024 2023 YoY% 2024 2023 YoY% Total SaaS Revenue $104,305 $73,970 41.0% $343,476 $263,717 30.2% Adjusted EBITDA1 17,276 6,503 41,190 12,025 Adjusted EBITDA Margin2 16.6% 8.8% 12.0% 4.6% Total Marketing Services Revenue $82,291 $162,193 (49.3)% $480,680 $653,244 (26.4)% Adjusted EBITDA1 12,104 45,773 $121,241 $175,490 Adjusted EBITDA Margin2 14.7% 28.2% 25.2% 26.9% Consolidated Revenue $186,596 $236,163 (21.0)% $824,156 $916,961 (10.1)% Net Income (Loss) 7,883 (257,541) (74,216) (259,295) Net Income (Loss) Margin 4.2% (109.1)% (9.0)% (28.3)% Adjusted EBITDA1 29,380 52,276 162,431 187,515 Adjusted EBITDA Margin2 15.7% 22.1% 19.7% 20.4%

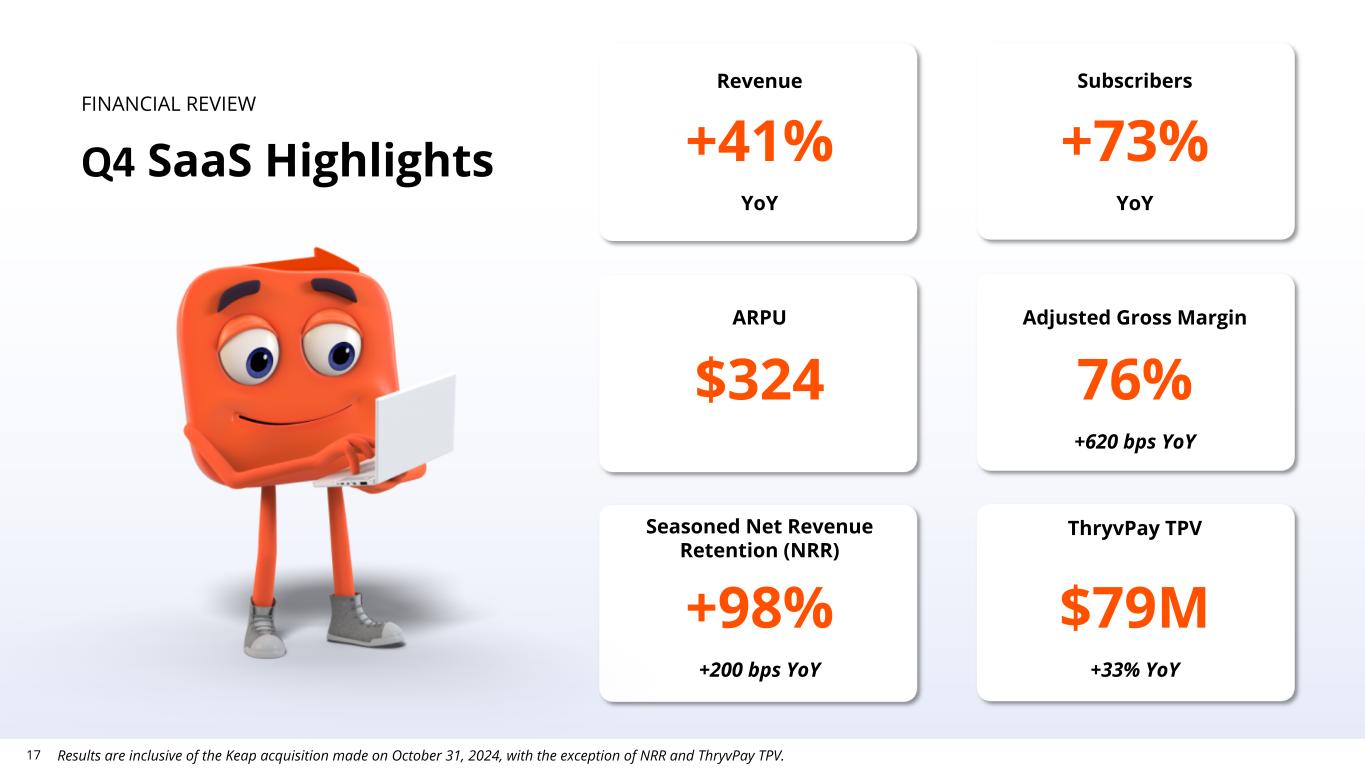

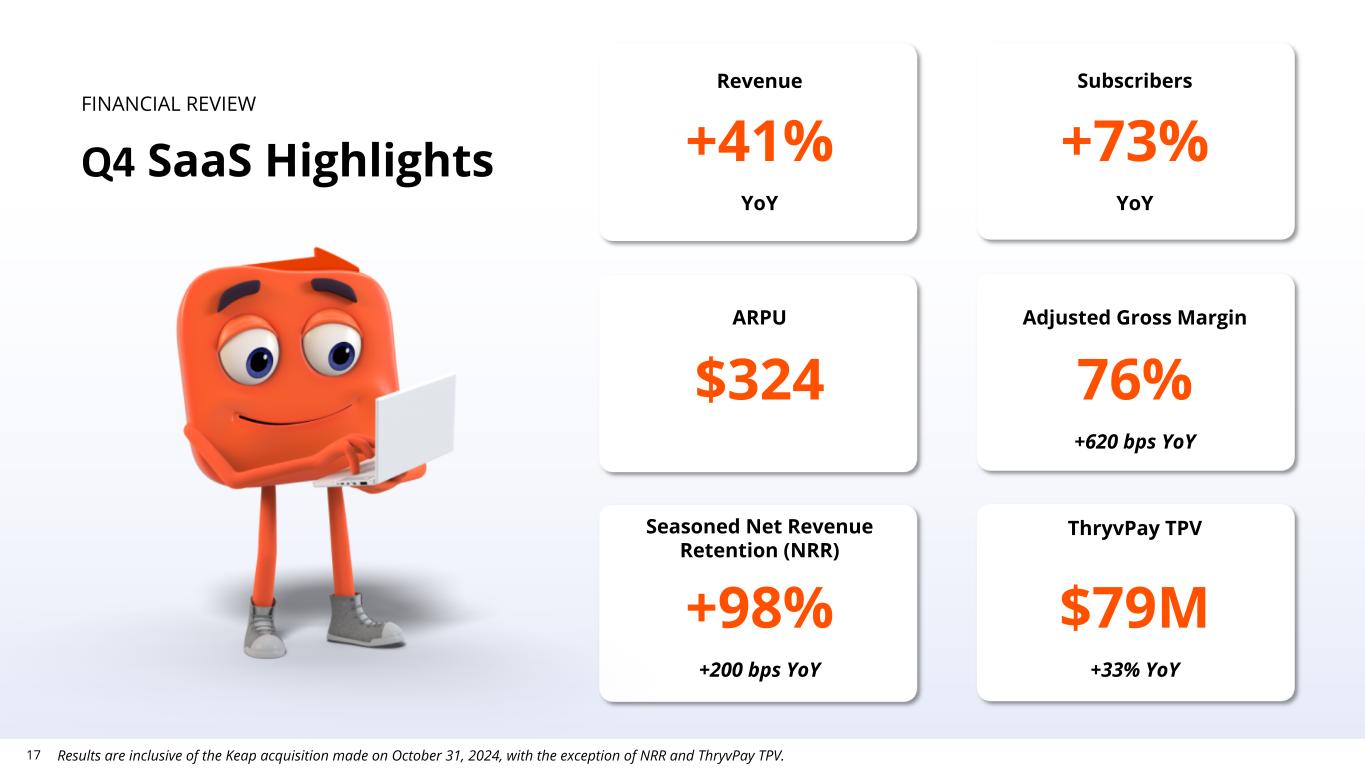

17 FINANCIAL REVIEW Q4 SaaS Highlights +41% YoY +73% YoY $324 $79M +33% YoY Revenue Subscribers ARPU ThryvPay TPVSeasoned Net Revenue Retention (NRR) 76% +620 bps YoY +98% +200 bps YoY Adjusted Gross Margin Results are inclusive of the Keap acquisition made on October 31, 2024, with the exception of NRR and ThryvPay TPV.

18 SaaS Highlights F I N A N C I A L R E V I E W Revenue $74.0 $104.3 Q4-23 Q4-24 Adjusted EBITDA $6.5 $17.3 Q4-23 Q4-24 Adjusted Gross Margin 69.7% 75.9% Q4-23 Q4-24 ($ in millions) Results are inclusive of the Keap acquisition made on October 31, 2024.

19 (1) (1) Denotes customer demand for paid products. Excludes 15,000 clients from the Keap acquisition made on October 31, 2024.

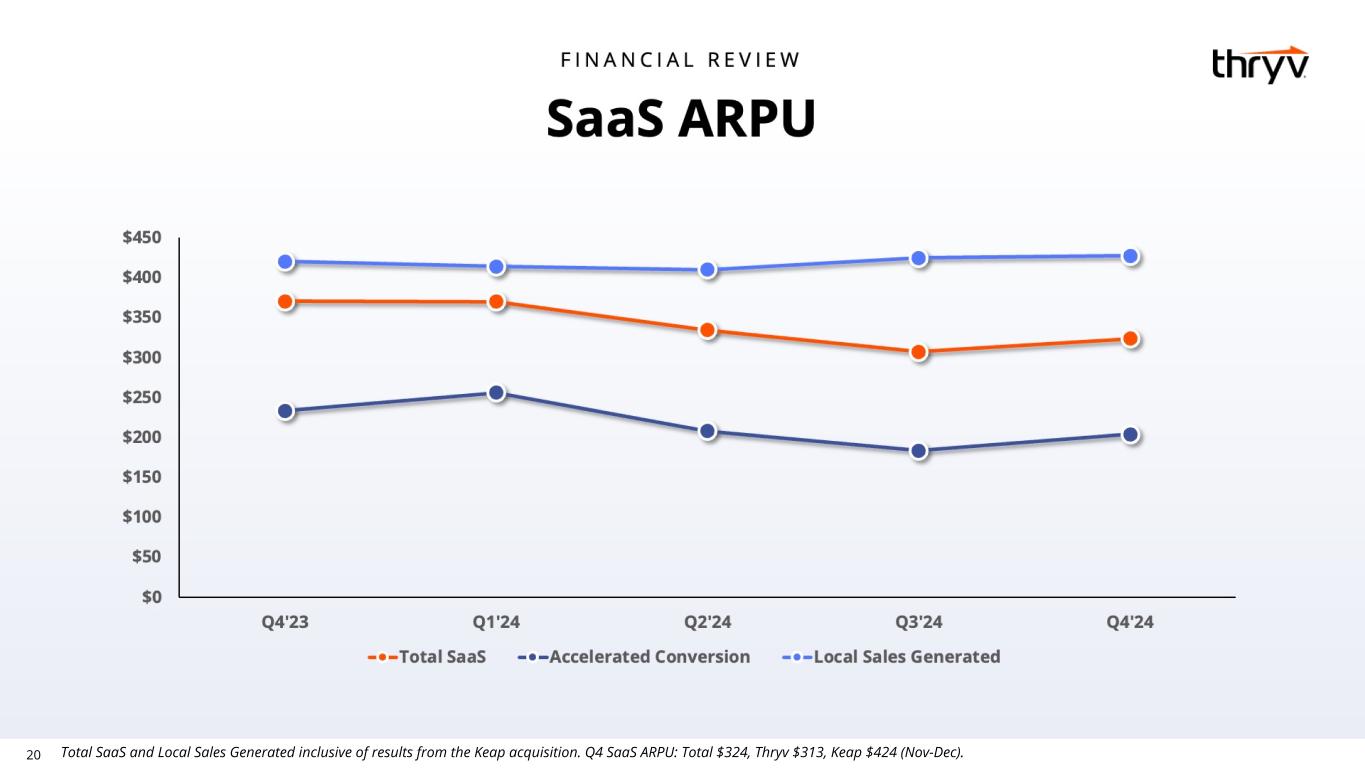

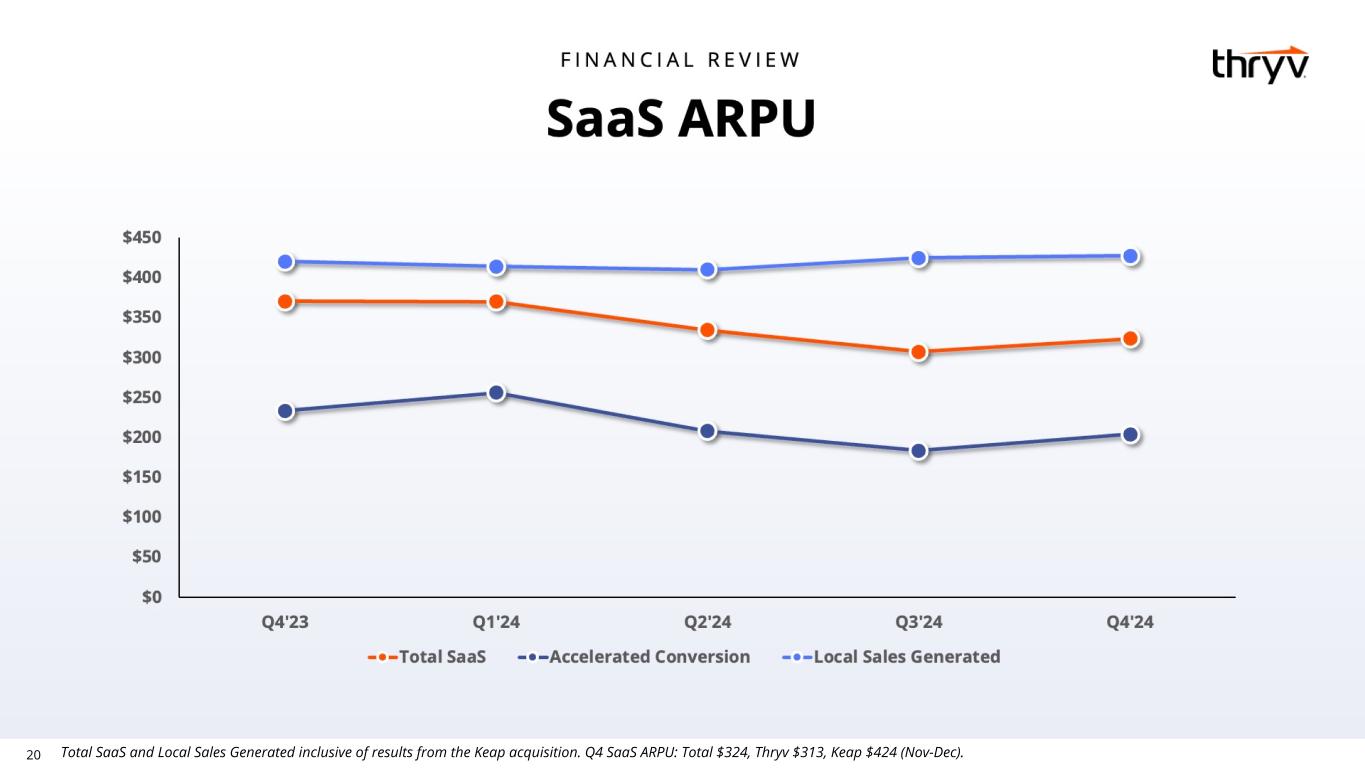

20 Total SaaS and Local Sales Generated inclusive of results from the Keap acquisition. Q4 SaaS ARPU: Total $324, Thryv $313, Keap $424 (Nov-Dec).

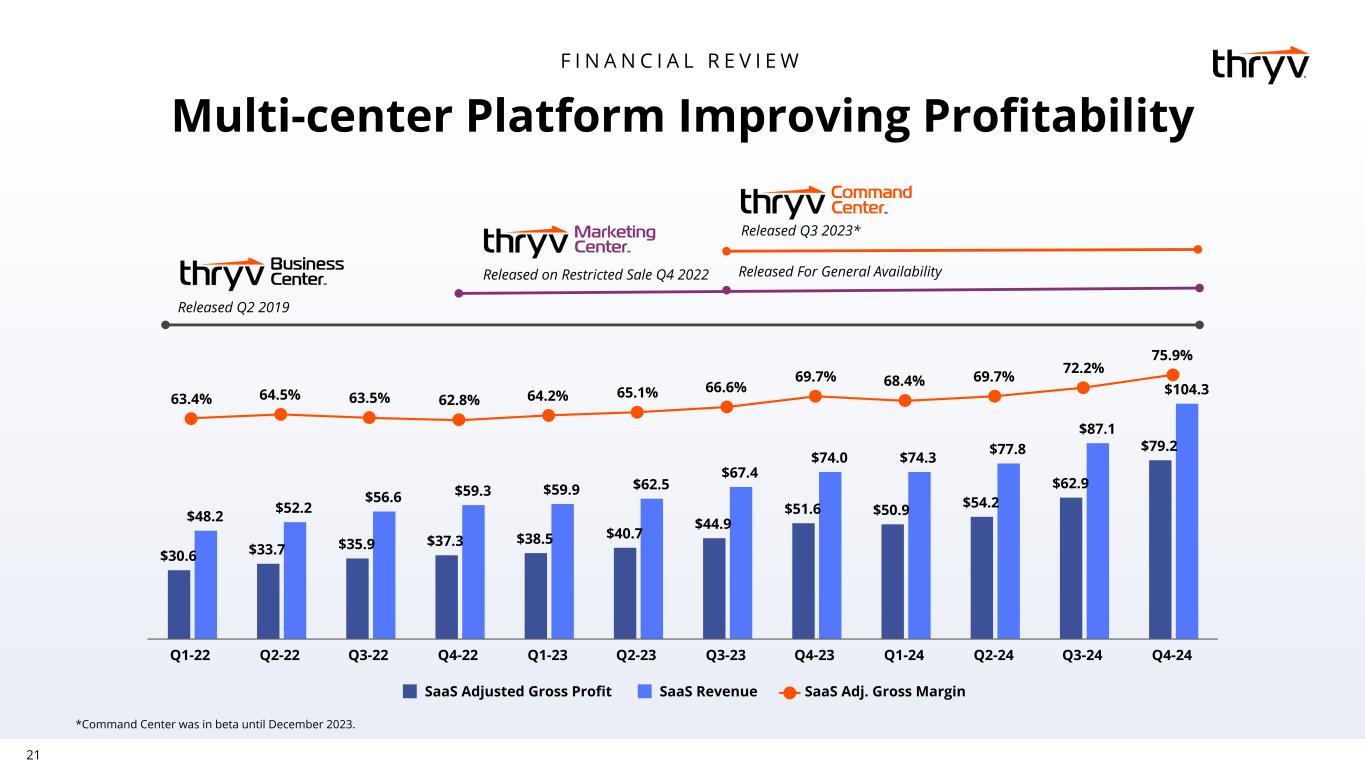

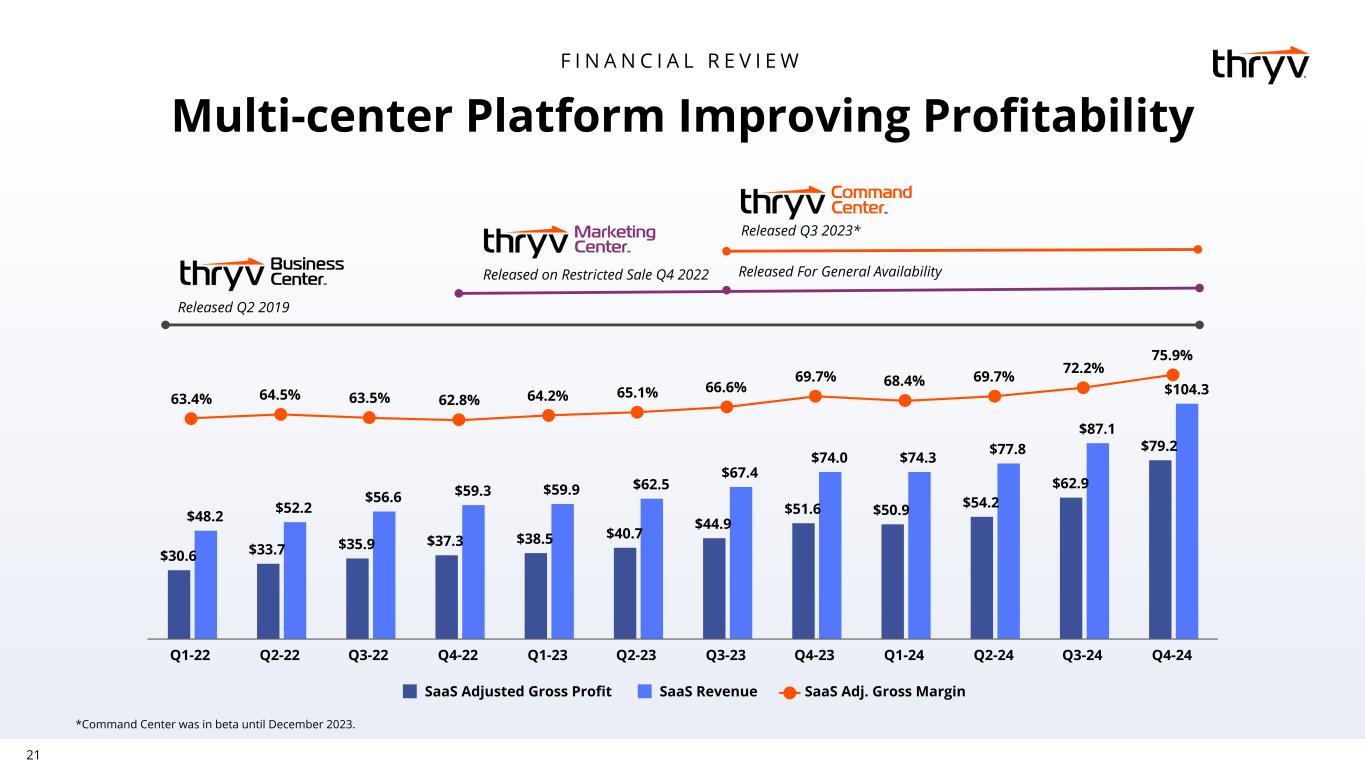

21 $30.6 $33.7 $35.9 $37.3 $38.5 $40.7 $44.9 $51.6 $50.9 $54.2 $62.9 $79.2 $48.2 $52.2 $56.6 $59.3 $59.9 $62.5 $67.4 $74.0 $74.3 $77.8 $87.1 $104.363.4% 64.5% 63.5% 62.8% 64.2% 65.1% 66.6% 69.7% 68.4% 69.7% 72.2% 75.9% SaaS Adjusted Gross Profit SaaS Revenue SaaS Adj. Gross Margin Q1-22 Q2-22 Q3-22 Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 Q2-24 Q3-24 Q4-24 F I N A N C I A L R E V I E W Released Q2 2019 Released on Restricted Sale Q4 2022 Released Q3 2023* Released For General Availability *Command Center was in beta until December 2023. Multi-center Platform Improving Profitability

22 Results are inclusive of the Keap acquisition made on October 31, 2024.

23 Q4-24 Q4-23 Marketing Services Billings (millions)(3) $91.7 $153.1 YoY % (40)% (23)% BILLINGS (YoY%) (19)% (17)% (20)% (17)% (19)% (22)% (19)% (23)% (24)% (28)% (35)% (40)% 21% 20% 24% 25% 24% 20% 13% 22% 22% 24% 32% 43% (14)% (12)% (13)% (9)% (12)% (14)% (12)% (12)% (12)% (14)% (16)% (13)% Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 Total Company Billings F I N A N C I A L R E V I E W Q4-24 Q4-23 SaaS Billings (millions)(1)(2) $105.0 $73.6 YoY % 43% 22% Q4-24 Q4-23 Total Company Billings (millions)(2) $196.7 $226.7 YoY % (13)% (12)% (1) SaaS Billings may differ from SaaS Revenue due to various U.S. GAAP accounting adjustments. (2) SaaS and Total Company Billings includes the effects of the Keap acquisition made on October 31, 2024. (3) Marketing Services Billings excludes Vivial Holdings run-off products. Figures may not foot due to rounding

24 Q1 and FY 2025 Outlook Company Issues Strong SaaS Guidance for FY 2025 (in millions, USD) Q1 2025 Q2 2025 Q3 2025 Q4 2025 FY 2025 MANAGEMENT COMMENTARY TOTAL MARKETING SERVICES REVENUE $65.0 to $66.0 $90.0 to $91.0 $83.0 to $84.0 $72.0 to $73.0 $310.0 to $314.0 • Company expects FY-25 MS revenue decline of ~35% Adjusted EBITDA $9.0 to $10.0 $77.5 to $78.5 • Company expects MS EBITDA margins in the mid-twenties for FY-25 (in millions, USD) Q1 2025 FY 2025 MANAGEMENT COMMENTARY TOTAL SAAS REVENUE $107.5 to $110.0 $464.5 to $474.0 • Company expects FY-25 increase of 35% to 38%. Keap is expected to contribute $75 to $78 million in FY-25 Adjusted EBITDA $9.0 to $9.5 $69.5 to $71.0 • Q1-25 SaaS EBITDA impacted by ~$2-3 million as lower print volumes shift additional cost allocations to SaaS

26 (in thousands) Q1-23 Q2-23 Q3-23 Q4-23 FY23 Q1-24 Q2-24 Q3-24 Q4-24 FY24 Net Income (Loss) $ 9,314 $ 15,978 $ (27,046) $ (257,541) $ (259,295) $ 8,424 $ 5,548 $ (96,071) $ 7,883 $ (74,216) Interest expense 16,488 16,292 15,131 13,817 61,728 13,359 12,175 11,514 9,723 46,771 Depreciation and amortization expense 15,431 15,667 15,842 16,311 63,251 14,553 14,072 12,519 11,645 52,789 Stock-based compensation expense 5,393 5,798 5,462 5,548 22,201 5,289 6,353 6,011 6,465 24,118 Restructuring and integration expenses 5,340 3,921 3,584 1,767 14,612 5,265 7,553 4,861 15,018 32,697 Income tax expense (benefit) 4,496 (3,428) (10,241) 7,924 (1,249) 5,397 6,618 (5,375) 1,578 8,218 Transaction costs 373 — — — 373 — — 1,706 3,439 5,145 Other components of net periodic pension cost (benefit) 121 1,865 1,902 (6,607) (2,719) 1,581 1,581 1,581 (29,549) (24,806) Loss on early extinguishment of debt — — — — — — 6,638 — — 6,638 (Gain) loss on remeasurement of indemnification asset (756) 11,490 — — 10,734 — — — — — Impairment charges — — — 268,846 268,846 — — 83,094 — 83,094 Other 2,269 1,856 2,697 2,211 9,033 246 (1,224) (217) 3,178 1,983 Adjusted EBITDA $ 58,469 $ 69,439 $ 7,331 $ 52,276 $ 187,515 $ 54,114 $ 59,314 $ 19,623 $ 29,380 $ 162,431 APPENDIX Non-GAAP Financial Reconciliation *Figures may not foot due to rounding.

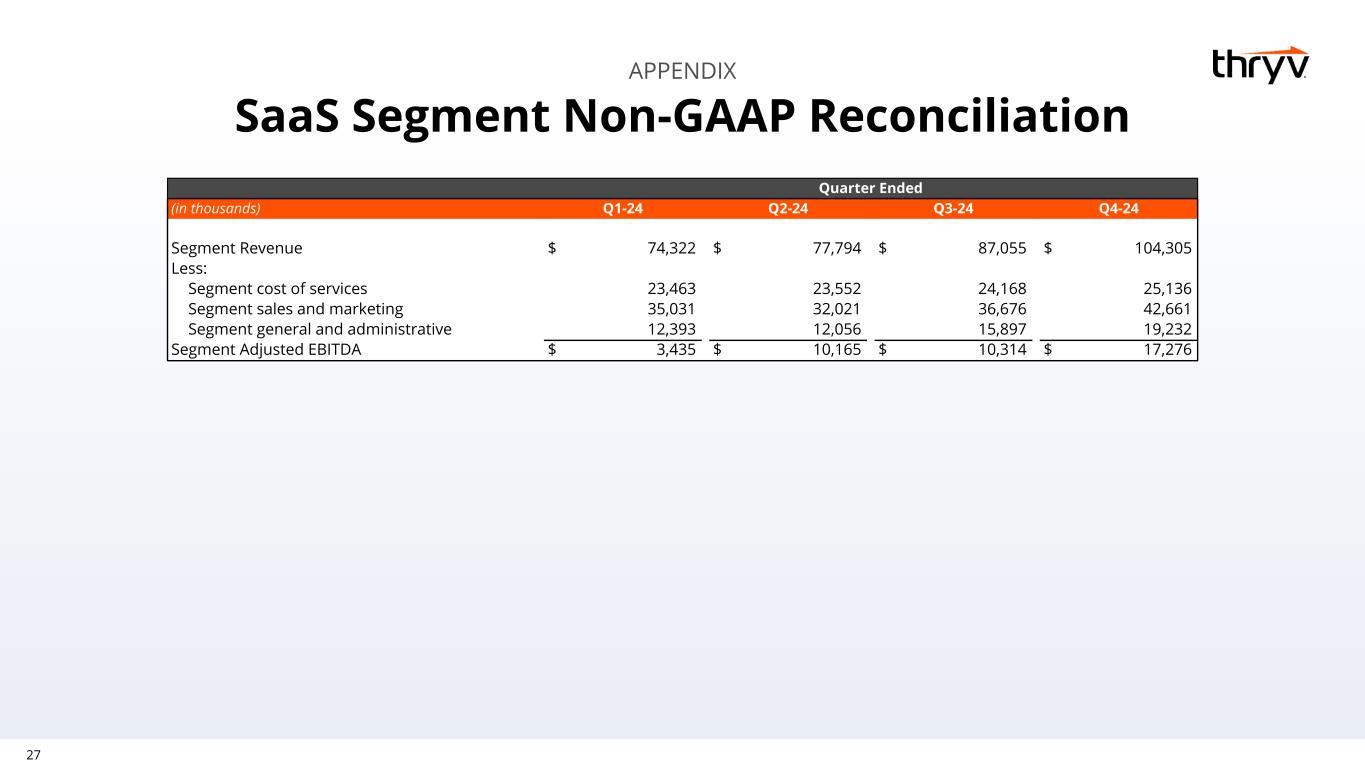

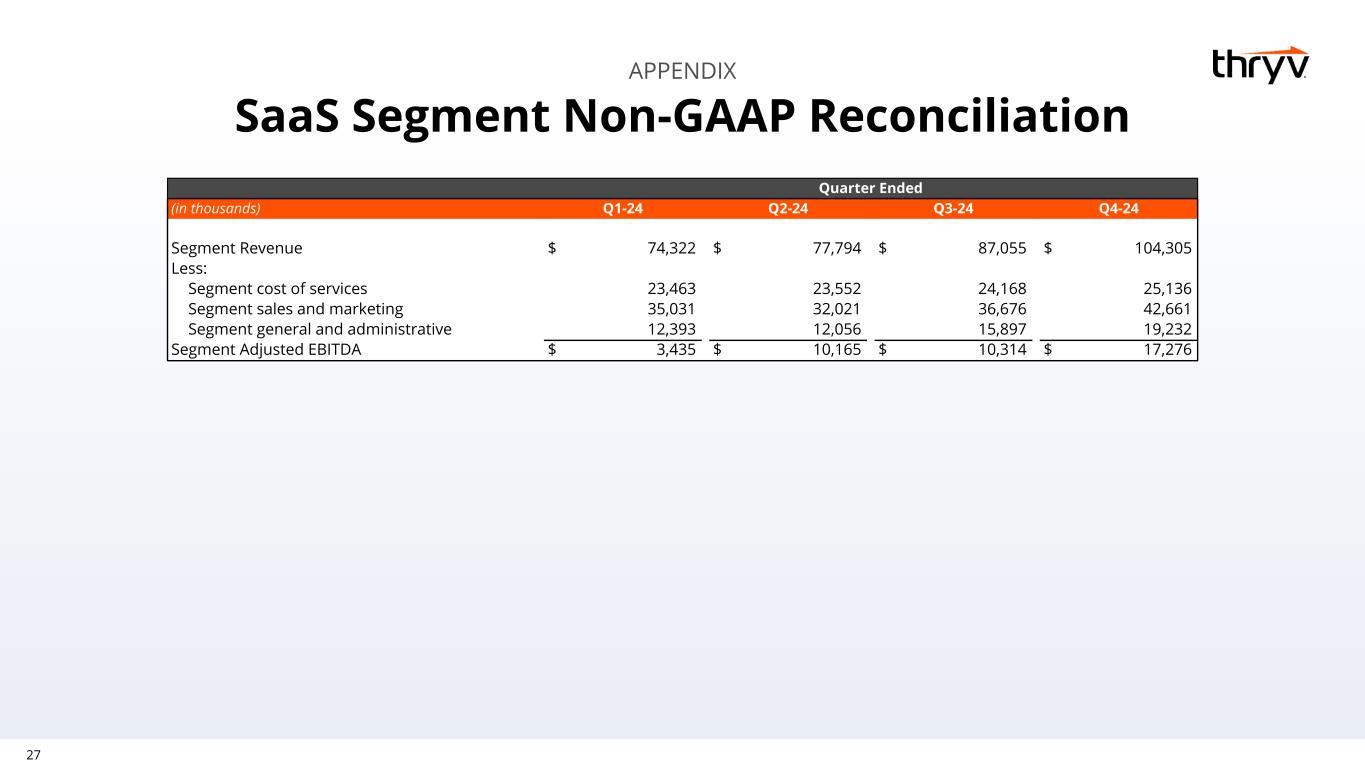

27 APPENDIX Quarter Ended (in thousands) Q1-24 Q2-24 Q3-24 Q4-24 Segment Revenue $ 74,322 $ 77,794 $ 87,055 $ 104,305 Less: Segment cost of services 23,463 23,552 24,168 25,136 Segment sales and marketing 35,031 32,021 36,676 42,661 Segment general and administrative 12,393 12,056 15,897 19,232 Segment Adjusted EBITDA $ 3,435 $ 10,165 $ 10,314 $ 17,276 SaaS Segment Non-GAAP Reconciliation

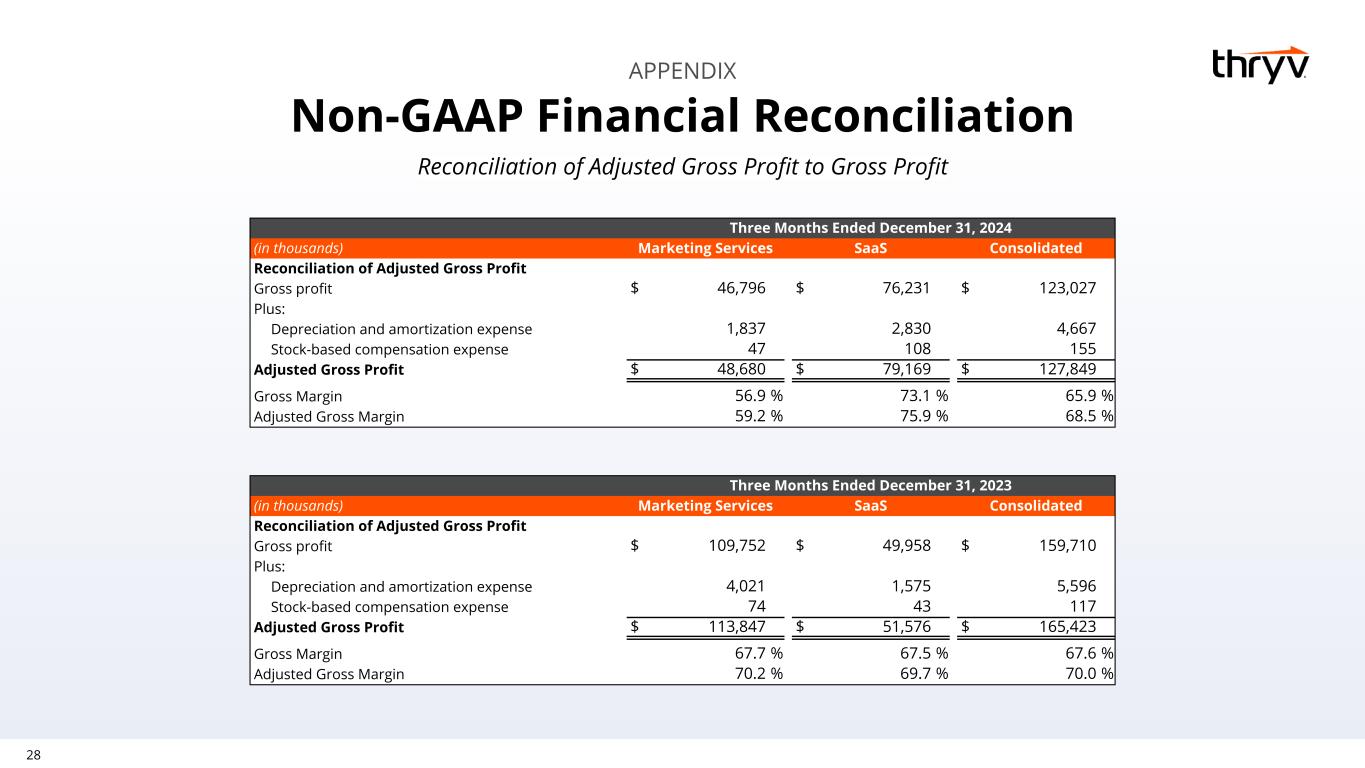

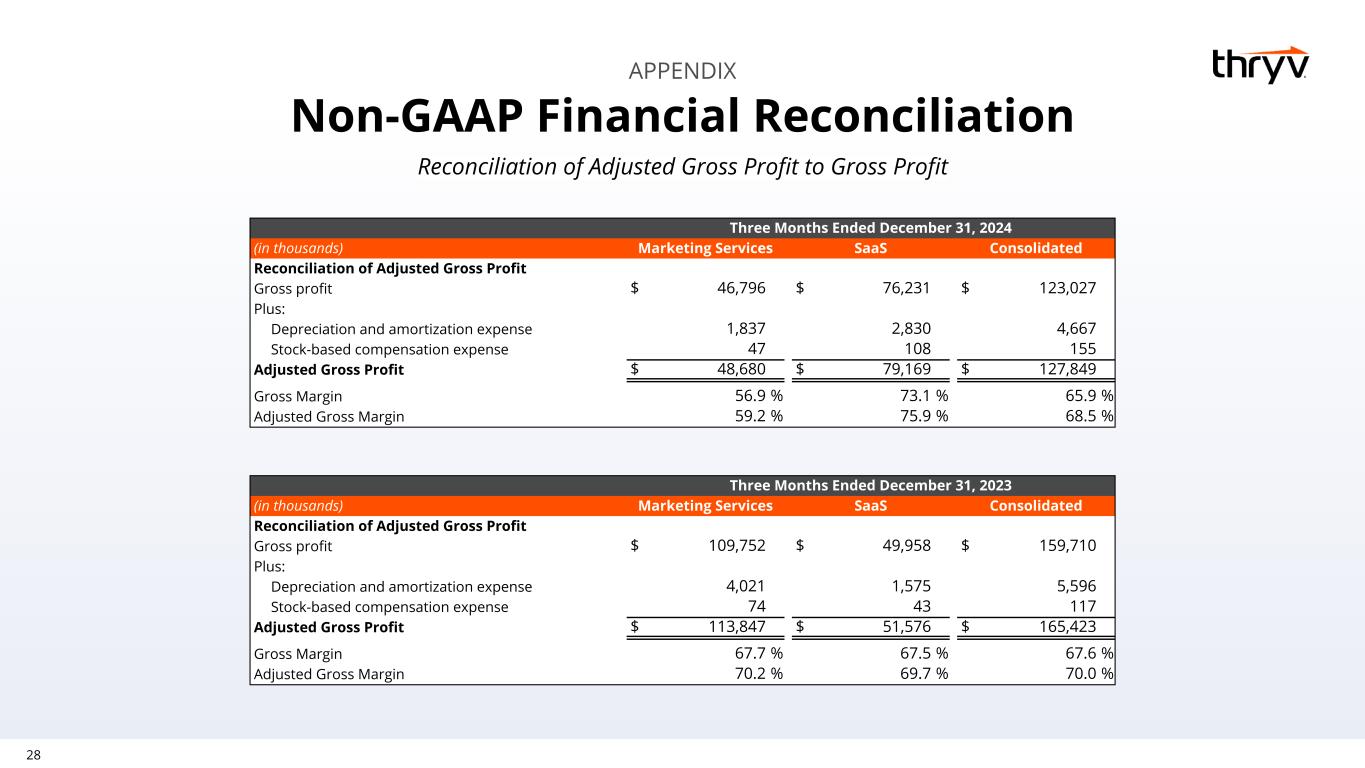

28 Reconciliation of Adjusted Gross Profit to Gross Profit APPENDIX Three Months Ended December 31, 2024 (in thousands) Marketing Services SaaS Consolidated Reconciliation of Adjusted Gross Profit Gross profit $ 46,796 $ 76,231 $ 123,027 Plus: Depreciation and amortization expense 1,837 2,830 4,667 Stock-based compensation expense 47 108 155 Adjusted Gross Profit $ 48,680 $ 79,169 $ 127,849 Gross Margin 56.9 % 73.1 % 65.9 % Adjusted Gross Margin 59.2 % 75.9 % 68.5 % Three Months Ended December 31, 2023 (in thousands) Marketing Services SaaS Consolidated Reconciliation of Adjusted Gross Profit Gross profit $ 109,752 $ 49,958 $ 159,710 Plus: Depreciation and amortization expense 4,021 1,575 5,596 Stock-based compensation expense 74 43 117 Adjusted Gross Profit $ 113,847 $ 51,576 $ 165,423 Gross Margin 67.7 % 67.5 % 67.6 % Adjusted Gross Margin 70.2 % 69.7 % 70.0 % Non-GAAP Financial Reconciliation

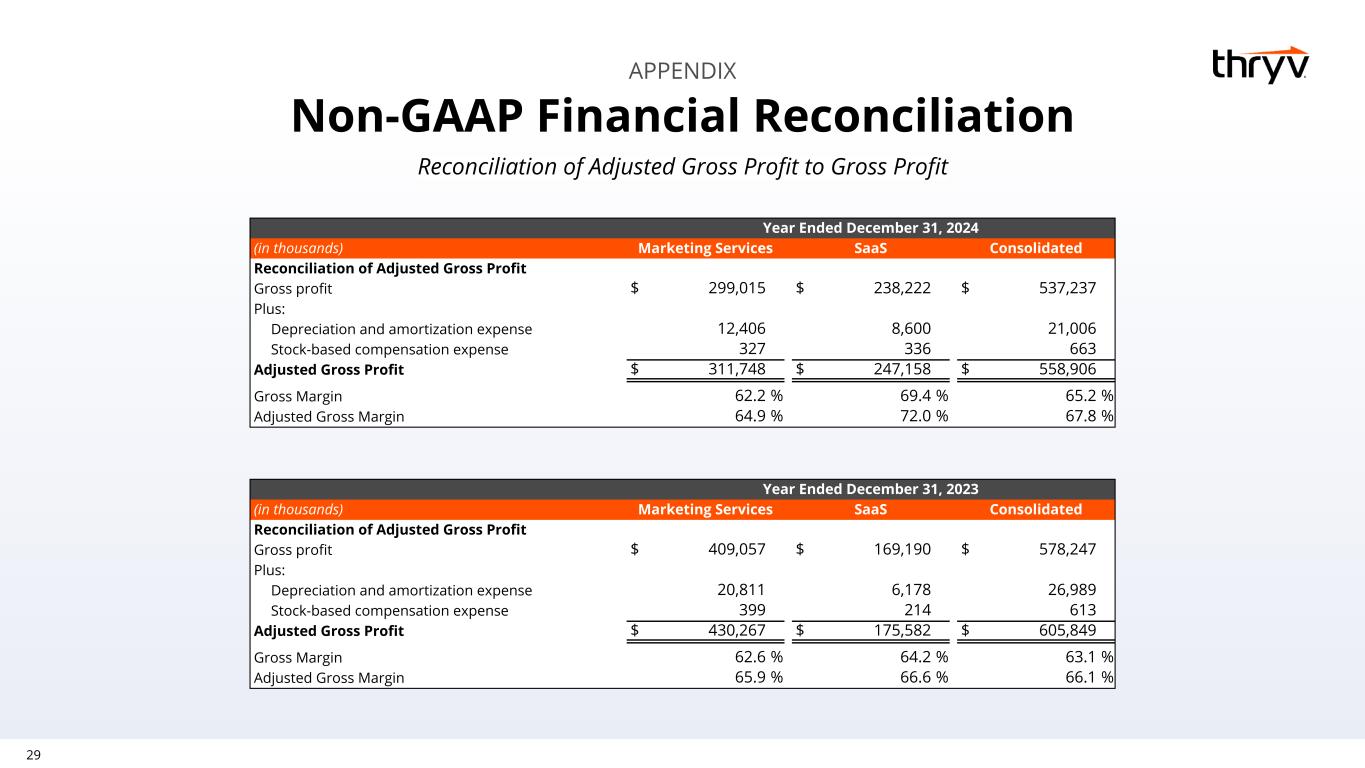

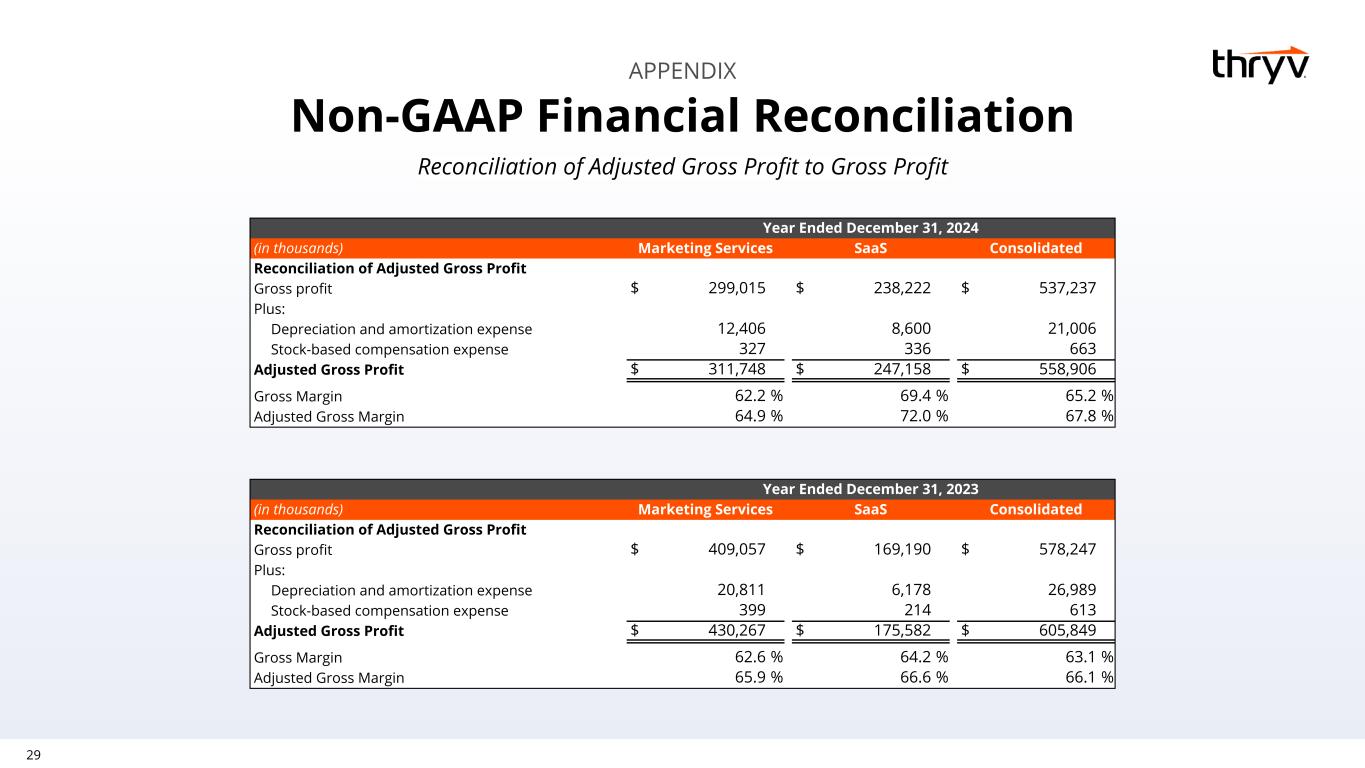

29 Reconciliation of Adjusted Gross Profit to Gross Profit APPENDIX Non-GAAP Financial Reconciliation Year Ended December 31, 2024 (in thousands) Marketing Services SaaS Consolidated Reconciliation of Adjusted Gross Profit Gross profit $ 299,015 $ 238,222 $ 537,237 Plus: Depreciation and amortization expense 12,406 8,600 21,006 Stock-based compensation expense 327 336 663 Adjusted Gross Profit $ 311,748 $ 247,158 $ 558,906 Gross Margin 62.2 % 69.4 % 65.2 % Adjusted Gross Margin 64.9 % 72.0 % 67.8 % Year Ended December 31, 2023 (in thousands) Marketing Services SaaS Consolidated Reconciliation of Adjusted Gross Profit Gross profit $ 409,057 $ 169,190 $ 578,247 Plus: Depreciation and amortization expense 20,811 6,178 26,989 Stock-based compensation expense 399 214 613 Adjusted Gross Profit $ 430,267 $ 175,582 $ 605,849 Gross Margin 62.6 % 64.2 % 63.1 % Adjusted Gross Margin 65.9 % 66.6 % 66.1 %

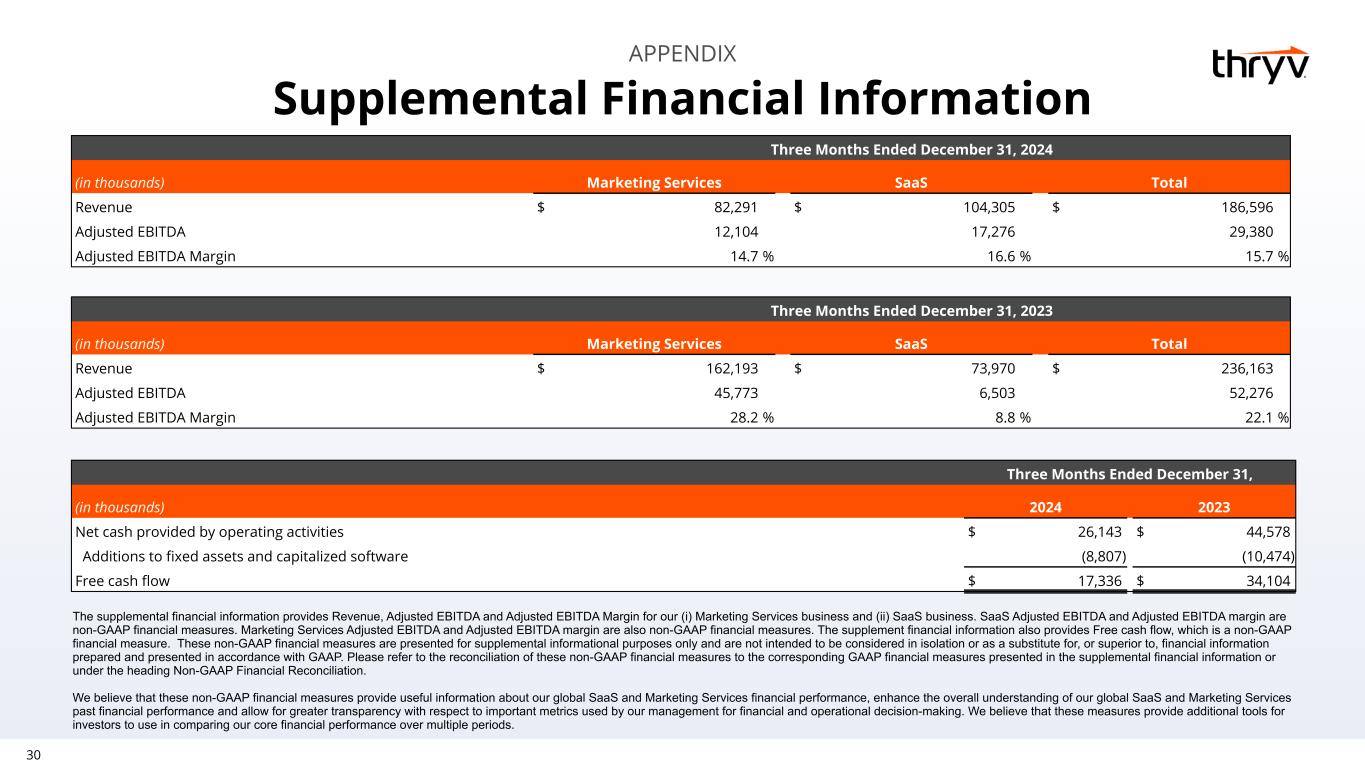

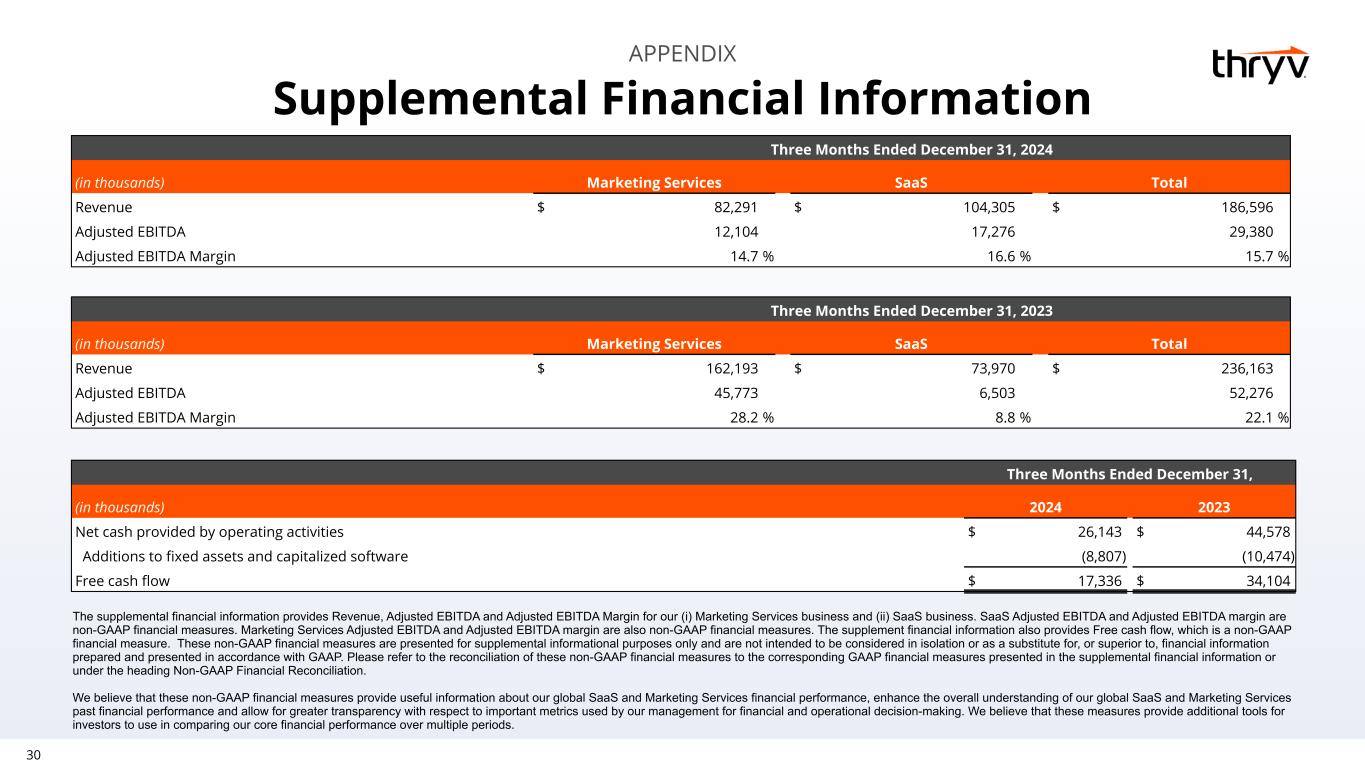

30 APPENDIX Supplemental Financial Information The supplemental financial information provides Revenue, Adjusted EBITDA and Adjusted EBITDA Margin for our (i) Marketing Services business and (ii) SaaS business. SaaS Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. Marketing Services Adjusted EBITDA and Adjusted EBITDA margin are also non-GAAP financial measures. The supplement financial information also provides Free cash flow, which is a non-GAAP financial measure. These non-GAAP financial measures are presented for supplemental informational purposes only and are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Please refer to the reconciliation of these non-GAAP financial measures to the corresponding GAAP financial measures presented in the supplemental financial information or under the heading Non-GAAP Financial Reconciliation. We believe that these non-GAAP financial measures provide useful information about our global SaaS and Marketing Services financial performance, enhance the overall understanding of our global SaaS and Marketing Services past financial performance and allow for greater transparency with respect to important metrics used by our management for financial and operational decision-making. We believe that these measures provide additional tools for investors to use in comparing our core financial performance over multiple periods. Three Months Ended December 31, 2024 (in thousands) Marketing Services SaaS Total Revenue $ 82,291 $ 104,305 $ 186,596 Adjusted EBITDA 12,104 17,276 29,380 Adjusted EBITDA Margin 14.7 % 16.6 % 15.7 % Three Months Ended December 31, (in thousands) 2024 2023 Net cash provided by operating activities $ 26,143 $ 44,578 Additions to fixed assets and capitalized software (8,807) (10,474) Free cash flow $ 17,336 $ 34,104 Three Months Ended December 31, 2023 (in thousands) Marketing Services SaaS Total Revenue $ 162,193 $ 73,970 $ 236,163 Adjusted EBITDA 45,773 6,503 52,276 Adjusted EBITDA Margin 28.2 % 8.8 % 22.1 %

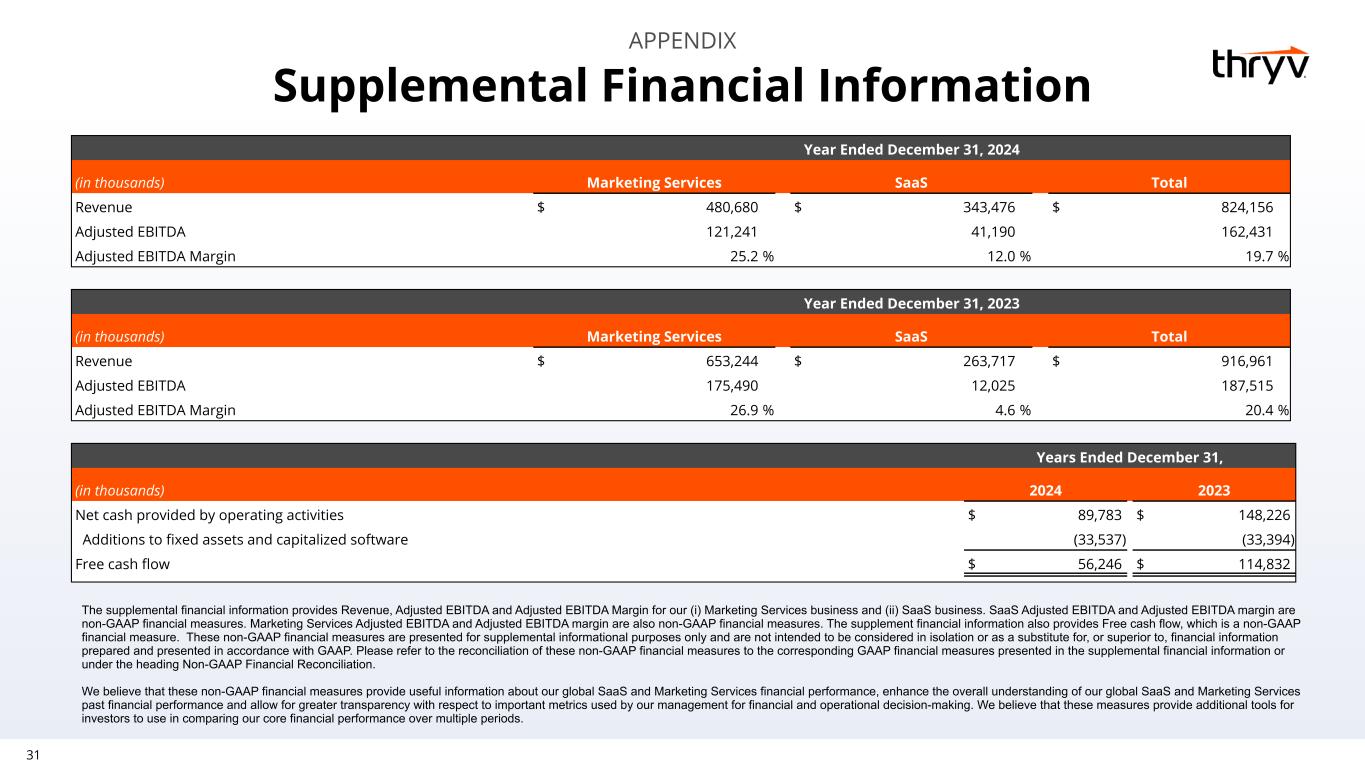

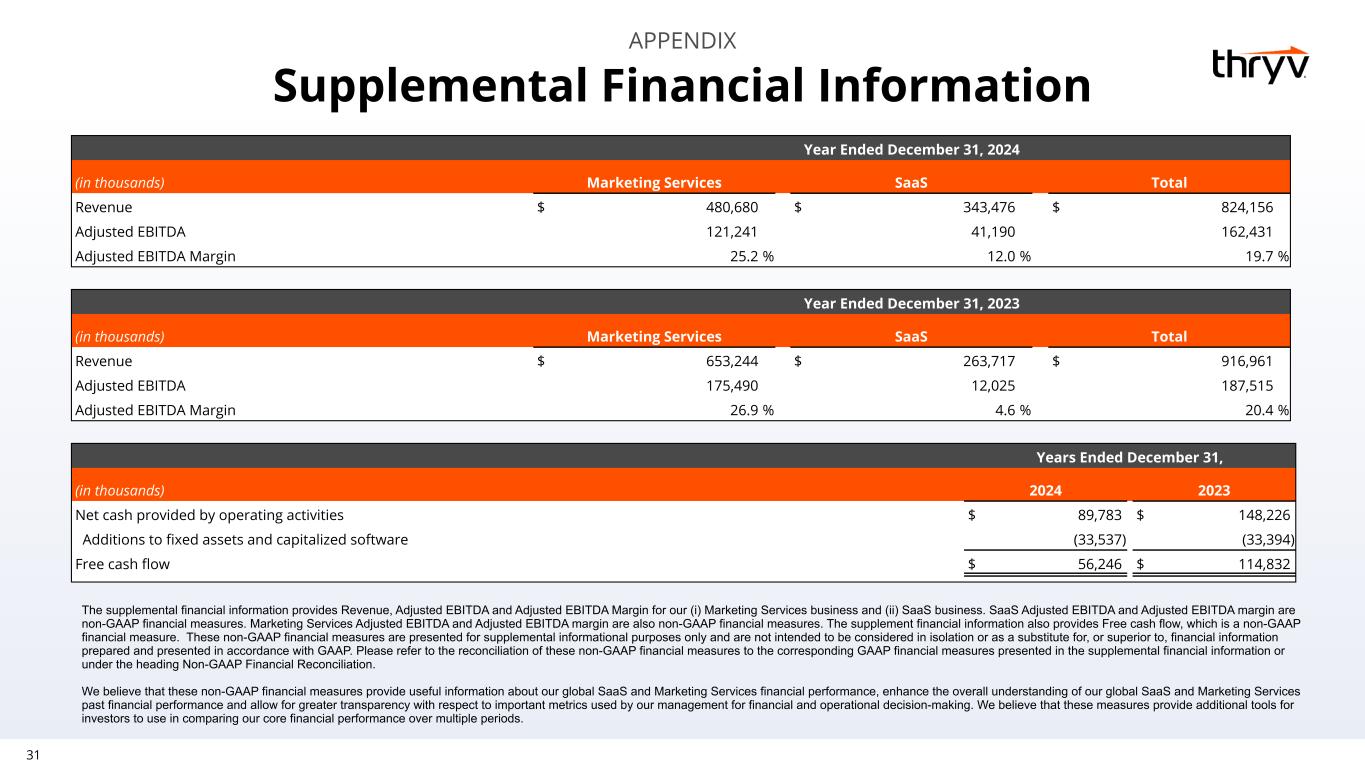

31 APPENDIX Years Ended December 31, (in thousands) 2024 2023 Net cash provided by operating activities $ 89,783 $ 148,226 Additions to fixed assets and capitalized software (33,537) (33,394) Free cash flow $ 56,246 $ 114,832 Supplemental Financial Information Year Ended December 31, 2024 (in thousands) Marketing Services SaaS Total Revenue $ 480,680 $ 343,476 $ 824,156 Adjusted EBITDA 121,241 41,190 162,431 Adjusted EBITDA Margin 25.2 % 12.0 % 19.7 % Year Ended December 31, 2023 (in thousands) Marketing Services SaaS Total Revenue $ 653,244 $ 263,717 $ 916,961 Adjusted EBITDA 175,490 12,025 187,515 Adjusted EBITDA Margin 26.9 % 4.6 % 20.4 % The supplemental financial information provides Revenue, Adjusted EBITDA and Adjusted EBITDA Margin for our (i) Marketing Services business and (ii) SaaS business. SaaS Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. Marketing Services Adjusted EBITDA and Adjusted EBITDA margin are also non-GAAP financial measures. The supplement financial information also provides Free cash flow, which is a non-GAAP financial measure. These non-GAAP financial measures are presented for supplemental informational purposes only and are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Please refer to the reconciliation of these non-GAAP financial measures to the corresponding GAAP financial measures presented in the supplemental financial information or under the heading Non-GAAP Financial Reconciliation. We believe that these non-GAAP financial measures provide useful information about our global SaaS and Marketing Services financial performance, enhance the overall understanding of our global SaaS and Marketing Services past financial performance and allow for greater transparency with respect to important metrics used by our management for financial and operational decision-making. We believe that these measures provide additional tools for investors to use in comparing our core financial performance over multiple periods.

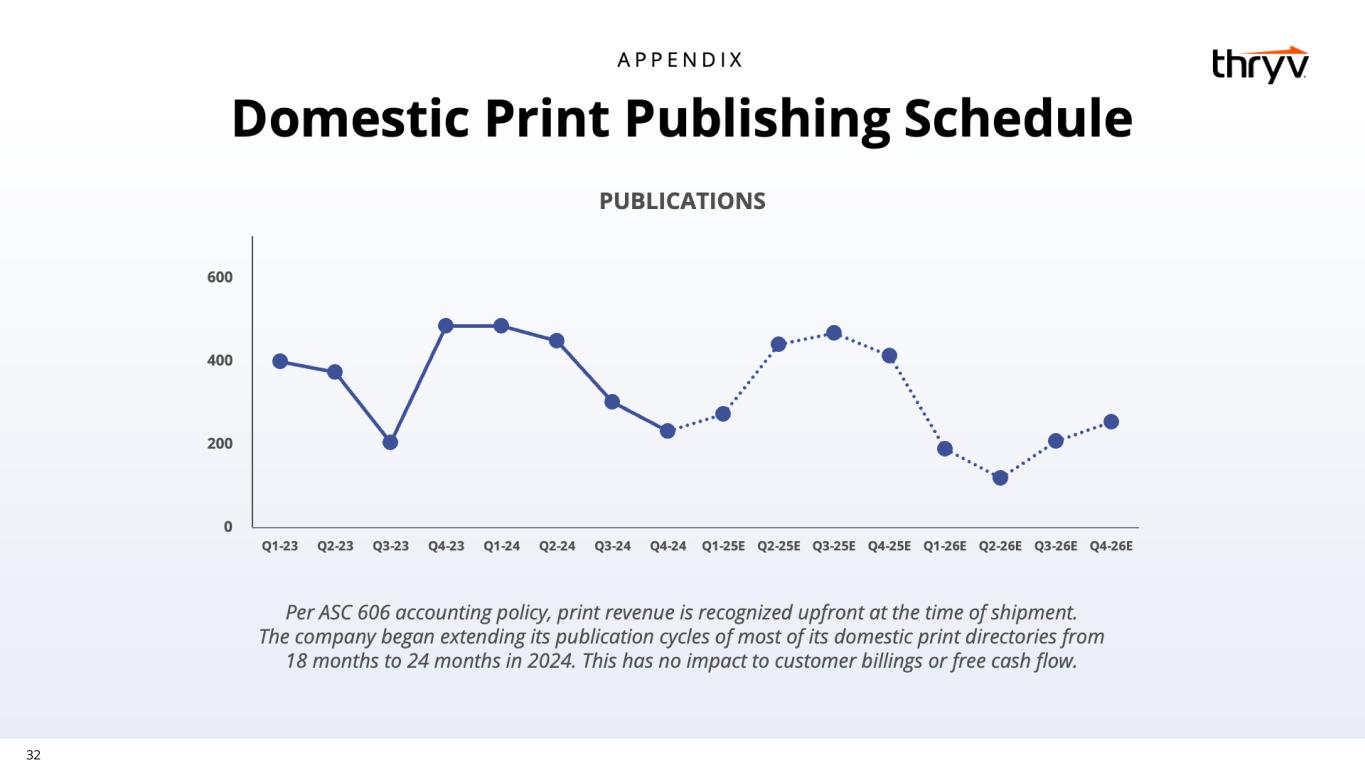

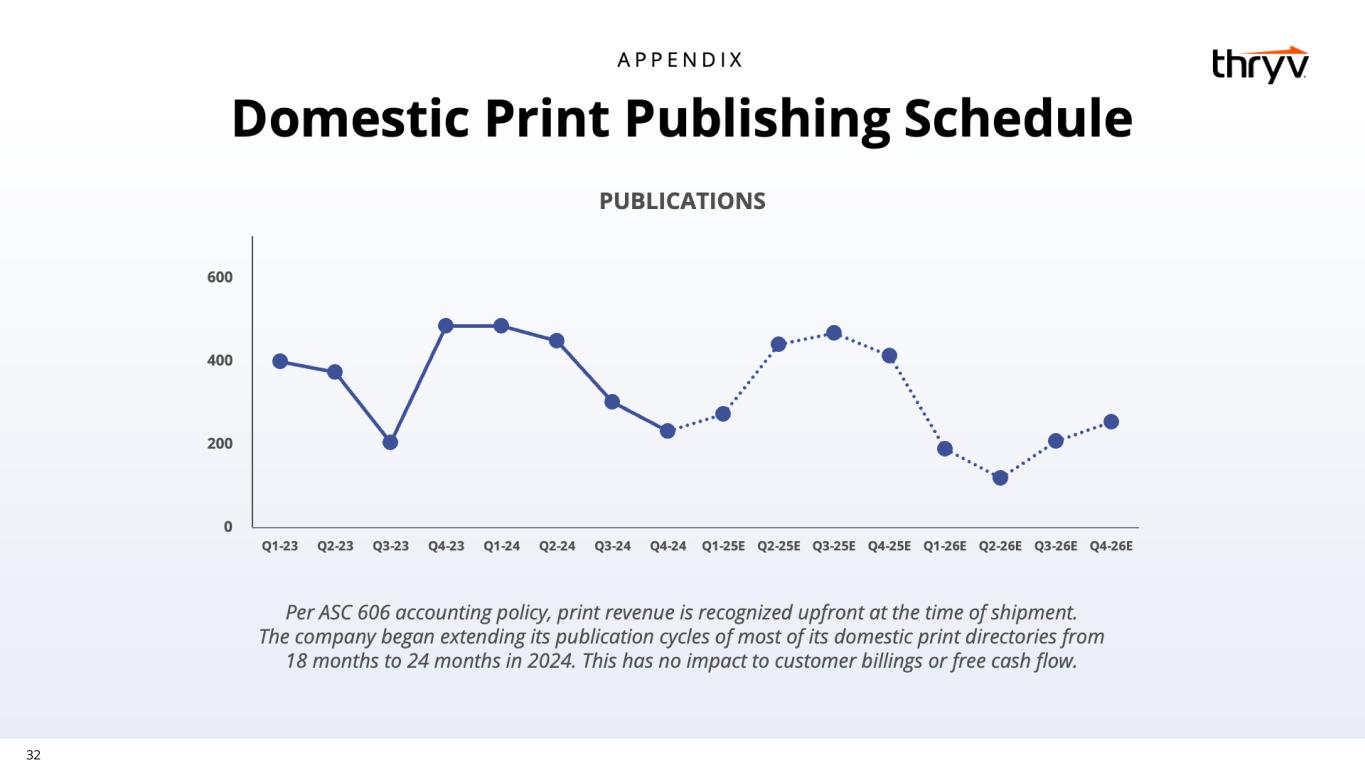

32

33 APPENDIX Definitions Definitions of key terms used in this presentation are as follows: • Total SaaS revenue consists of SaaS revenue recognized by our domestic and foreign operations. • Total Marketing Services revenue consists of SaaS revenue recognized by our domestic and foreign operations. • Total SaaS Adjusted EBITDA1 consists of Adjusted EBITDA recognized by our domestic and foreign operations. • Total Marketing Services1 Adjusted EBITDA consists of Adjusted EBITDA recognized by our domestic and foreign operations. • Adjusted EBITDA2: Defined as Net income (loss) plus Interest expense, Income tax expense (benefit), Depreciation and amortization expense, Loss on early extinguishment of debt, Restructuring and integration expenses, Transaction costs, Stock-based compensation expense, and non-operating expenses, such as, Other components of net periodic pension (benefit) cost, Non-cash (gain) loss from remeasurement of indemnification asset, and certain unusual and non-recurring charges that might have been incurred. • Adjusted Gross Profit and Adjusted Gross Profit Margin2: Defined as Gross profit and Gross margin, respectively, adjusted to exclude the impact of depreciation and amortization expense and stock-based compensation expense. • Average Revenue per Unit (“ARPU”): Defined as total client billings for a particular month divided by the number of clients that have one or more revenue-generating solutions in that same month • Seasoned Net Revenue Retention: Seasoned Net Revenue Retention is defined as net dollar retention excluding clients acquired over the previous 12 months, including clients acquired in the Keap acquisition, which closed on October 31, 2024. 1The supplemental financial information provides Revenue, Adjusted EBITDA and Adjusted EBITDA Margin by our (i) Marketing Services business and (ii) SaaS business. Total SaaS Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. Total Marketing Services Adjusted EBITDA and Adjusted EBITDA margin are also non-GAAP financial measures. These non-GAAP financial measures are presented for supplemental informational purposes only and are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. 2Results included in this presentation include Adjusted EBITDA, Adjusted EBITDA margin and Adjusted Gross Profit, which are not presented in accordance with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP measures are presented for supplemental informational purposes only and are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Please refer to the supplemental information presented in the tables in the Appendix for a reconciliation of Adjusted EBITDA to Net income (loss) and Adjusted Gross Profit to Gross profit. Both Net income (loss) and Gross profit are the most comparable GAAP financial measure to Adjusted EBITDA and Adjusted Gross Profit, respectively. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by revenue. We believe that these non-GAAP financial measures provide useful information about our financial performance, enhance the overall understanding of our past performance and allow for greater transparency with respect to important metrics used by our management for financial and operational decision-making. We believe that these measures provide additional tools for investors to use in comparing our core financial performance over multiple periods with other companies in our industry. However, it is important to note that the particular items we exclude from, or include in, our non-GAAP financial measures may differ from the items excluded from, or included in, similar non-GAAP financial measures used by other companies in the same industry.