Investor Supplement Third Quarter 2021 Exhibit 99.2

Safe Harbor This Presentation may include certain forward-looking statements, including, without limitation, statements concerning the conditions of our industry and our operations, performance, and financial condition, including, in particular, statements relating to our business, growth strategies, product development efforts, and future expenses. Forward-looking statements can be identified by words such as ‘‘anticipates,’’ ‘‘intends,’’ ‘‘plans,’’ ‘‘seeks,’’ ‘‘believes,’’ ‘‘estimates,’’ ‘‘expects,’’ and similar references to future periods, or by the inclusion of forecasts or projections. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy, and other future conditions. Because forward- looking statements relate to the future, by their nature, they are subject to inherent uncertainties and risks (some of which are beyond our control) and changes in circumstances or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. As a result, our actual results may differ materially from those contemplated by the forward-looking statements. Except as required by law, we are under no obligation to, and expressly disclaim any obligation to, update or alter any forward-looking statements whether as a result of any such changes, new information, subsequent events or otherwise. Market data and industry information used throughout this Presentation are based on management’s knowledge of the industry and the good faith estimates of management. We also relied, to the extent available, upon management’s review of independent industry surveys and publications and other publicly available information prepared by a number of third party sources. All of the market data and industry information used in this Presentation involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Although we believe that these sources are reliable, we cannot guarantee the accuracy or completeness of this information, and we have not independently verified this information. While we believe the estimated market position, market opportunity and market size information included in this presentation are generally reliable, such information, which is derived in part from management’s estimates and beliefs, is inherently uncertain and imprecise. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties. You should not construe the contents of this Presentation as legal, tax, accounting or investment advice or a recommendation to take (or refrain from taking) any particular action. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein. In addition to financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), this press release and the accompanying tables contain, and the conference call will contain, non-GAAP financial measures. We present non-GAAP measures including: adjusted EBITDA, and adjusted EBITDA margin. The non-GAAP financial information is presented for supplemental informational purposes only and is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Please refer to the supplemental information presented in the tables for reconciliations of the non-GAAP financial measures used in this press release to the most comparable GAAP financial measures. We believe that these non-GAAP financial measures provide useful information about our financial performance, enhance the overall understanding of our past performance and future prospects and allow for greater transparency with respect to important metrics used by our management for financial and operational decision-making. We believe that these measures provide an additional tool for investors to use in comparing our core financial performance over multiple periods with other companies in our industry. However, it is important to note that the particular items we exclude from, or include in, our non-GAAP financial measures may differ from the items excluded from, or included in, similar non-GAAP financial measures used by other companies in the same industry. 2

3rd Quarter SaaS Highlights 3 Continued Momentum Revenue +41% YoY Deepened Client Engagement Users spending +28% more time in platform YTD Record Active Users Daily & Weekly +21% YoY ARPU Expansion $340 (+31% YoY) Record Retention 1.7% Seasoned Monthly Churn 95% Seasoned Net Dollar Retention Note: Results U.S. Only APPEALIE Overall SaaS Award Winner Customer Service and Customer Success

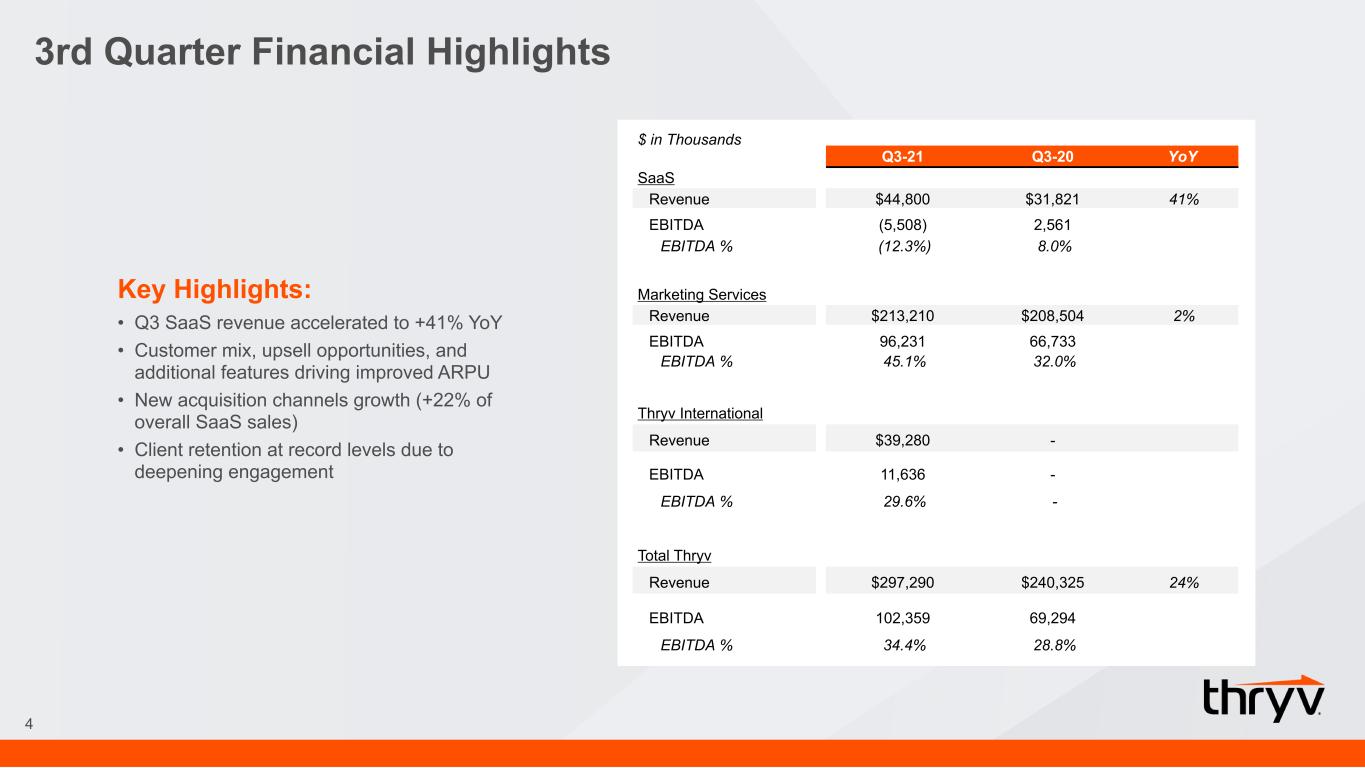

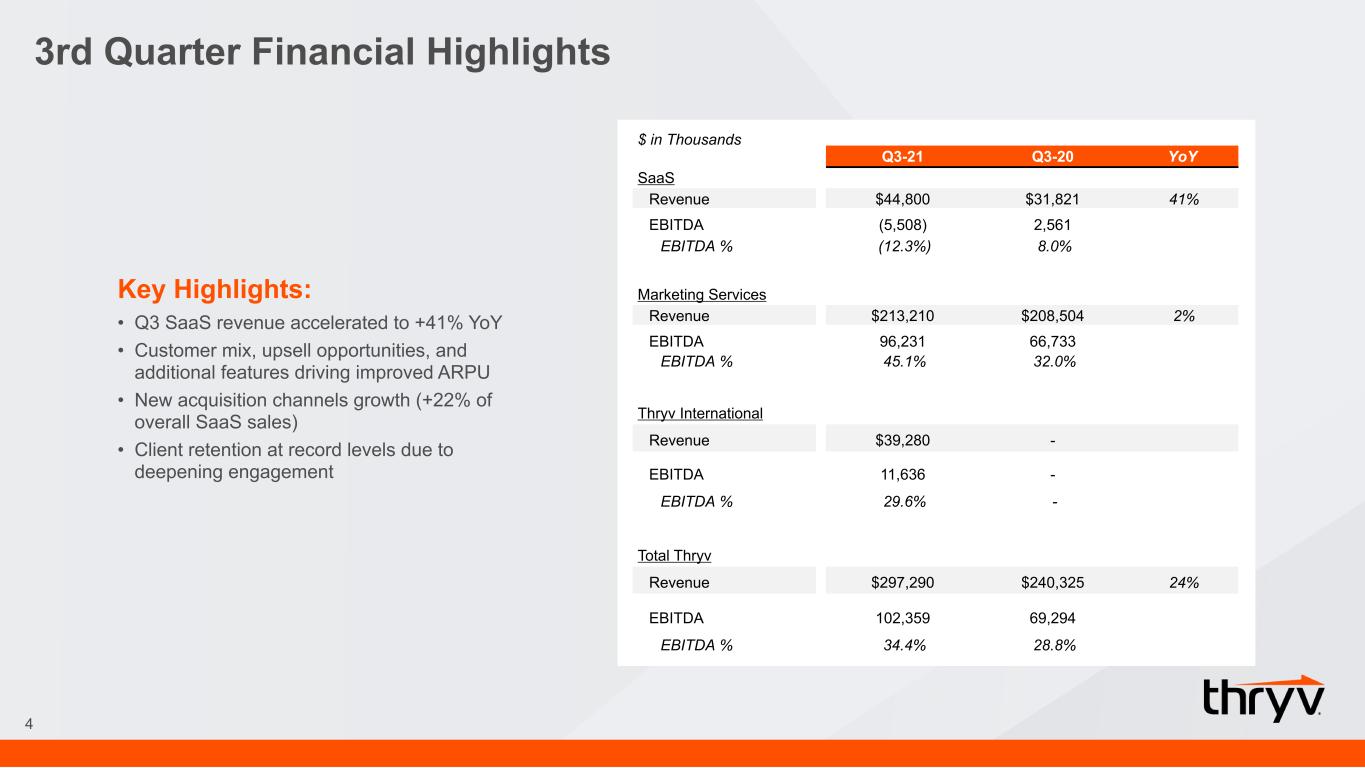

3rd Quarter Financial Highlights 4 Key Highlights: • Q3 SaaS revenue accelerated to +41% YoY • Customer mix, upsell opportunities, and additional features driving improved ARPU • New acquisition channels growth (+22% of overall SaaS sales) • Client retention at record levels due to deepening engagement $ in Thousands Q3-21 Q3-20 YoY SaaS Revenue $44,800 $31,821 41% EBITDA (5,508) 2,561 EBITDA % (12.3%) 8.0% Marketing Services Revenue $213,210 $208,504 2% EBITDA 96,231 66,733 EBITDA % 45.1% 32.0% Thryv International Revenue $39,280 - EBITDA 11,636 - EBITDA % 29.6% - Total Thryv Revenue $297,290 $240,325 24% EBITDA 102,359 69,294 EBITDA % 34.4% 28.8%

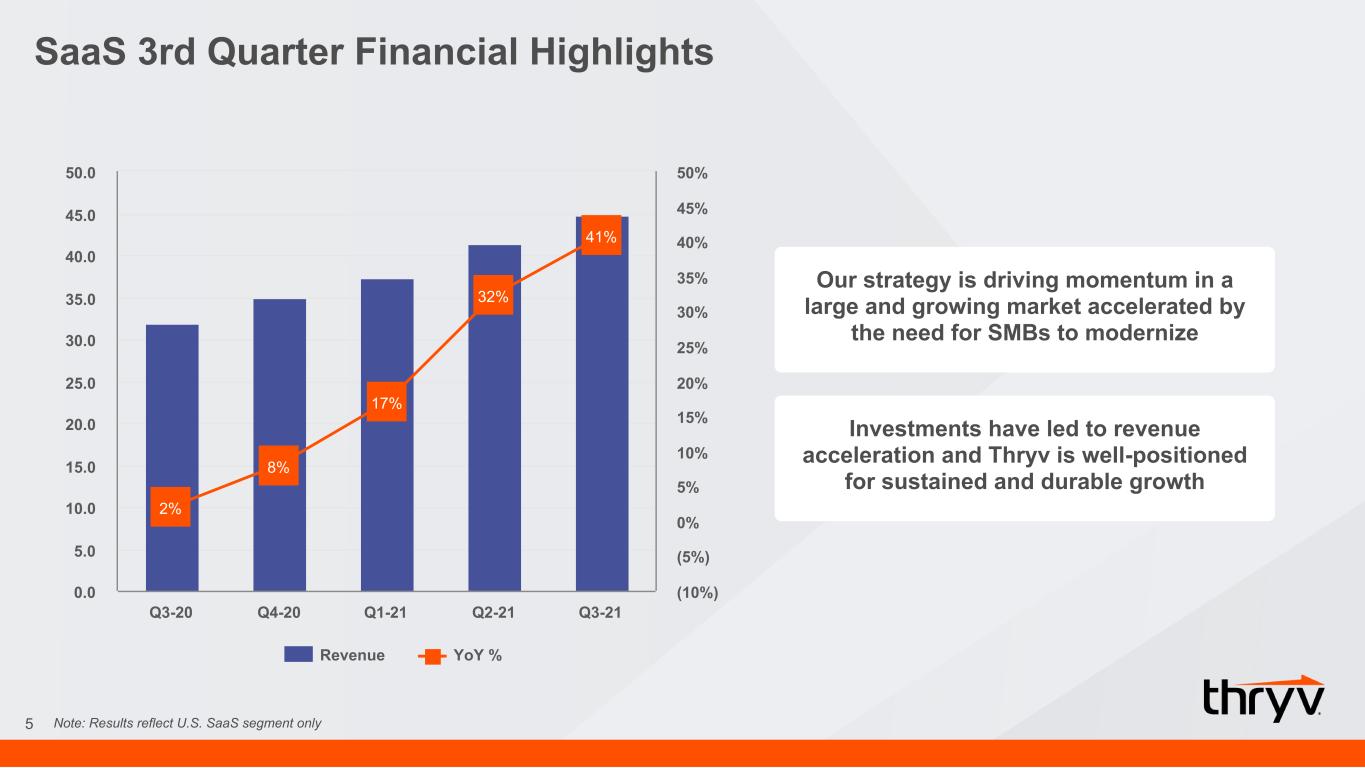

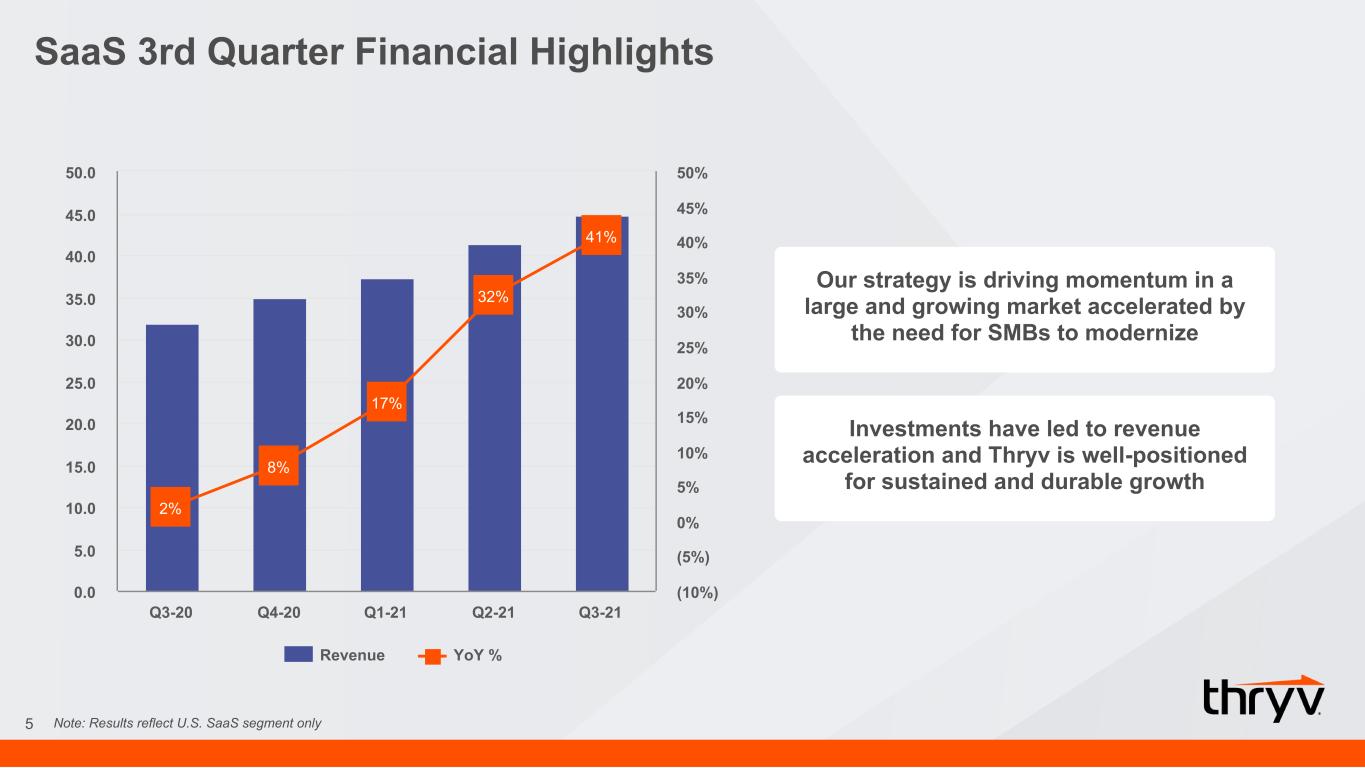

Our strategy is driving momentum in a large and growing market accelerated by the need for SMBs to modernize Investments have led to revenue acceleration and Thryv is well-positioned for sustained and durable growth SaaS 3rd Quarter Financial Highlights 5 Note: Results reflect U.S. SaaS segment only 2% 8% 17% 32% 41% Revenue YoY % Q3-20 Q4-20 Q1-21 Q2-21 Q3-21 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 45.0 50.0 (10%) (5%) 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50%

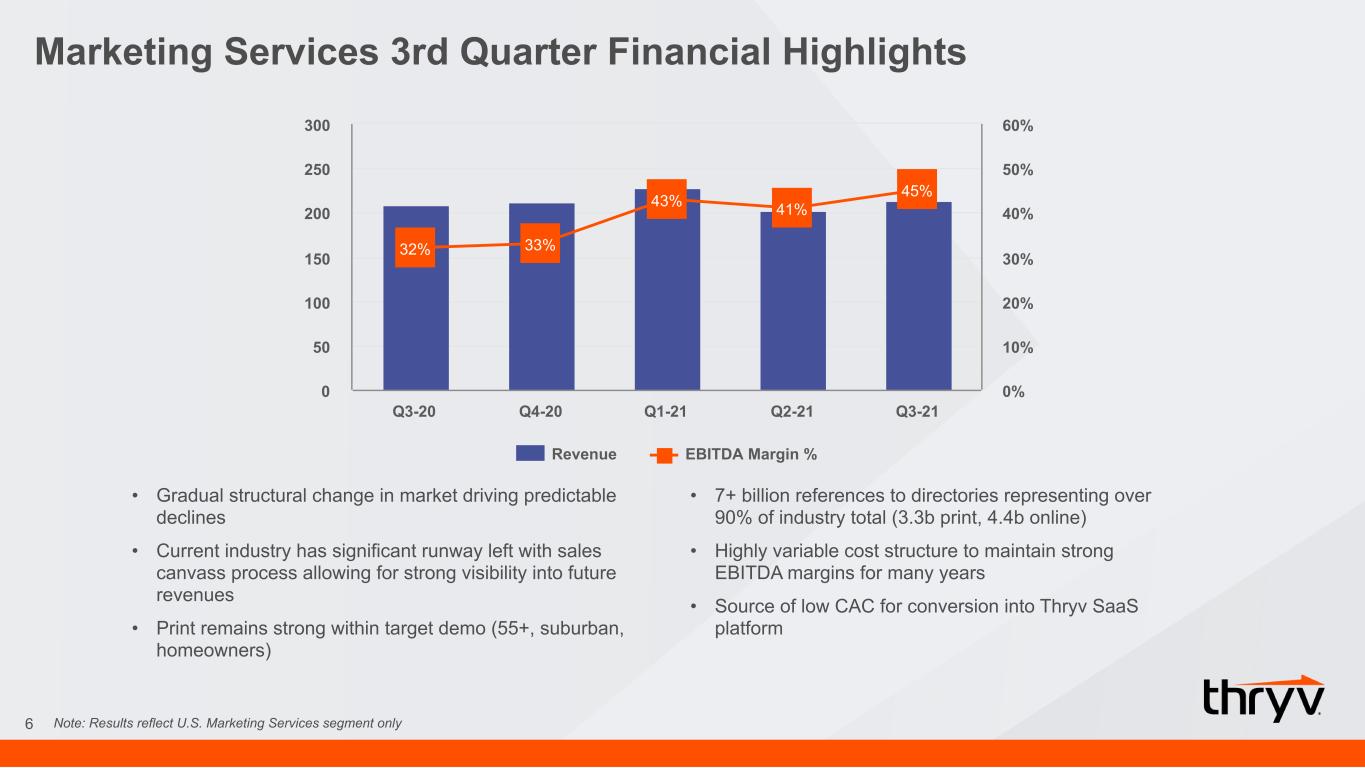

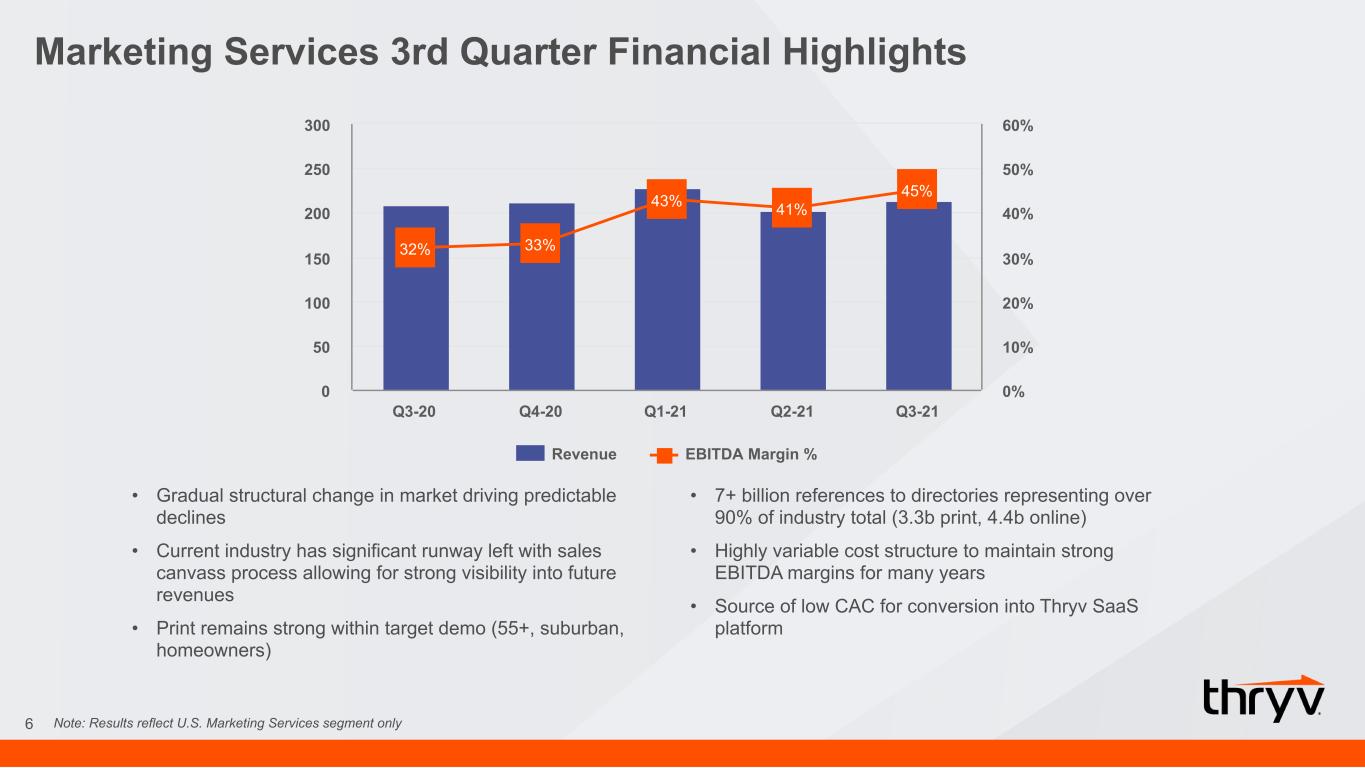

Marketing Services 3rd Quarter Financial Highlights 6 • Gradual structural change in market driving predictable declines • Current industry has significant runway left with sales canvass process allowing for strong visibility into future revenues • Print remains strong within target demo (55+, suburban, homeowners) Note: Results reflect U.S. Marketing Services segment only 32% 33% 43% 41% 45% Revenue EBITDA Margin % Q3-20 Q4-20 Q1-21 Q2-21 Q3-21 0 50 100 150 200 250 300 0% 10% 20% 30% 40% 50% 60% • 7+ billion references to directories representing over 90% of industry total (3.3b print, 4.4b online) • Highly variable cost structure to maintain strong EBITDA margins for many years • Source of low CAC for conversion into Thryv SaaS platform

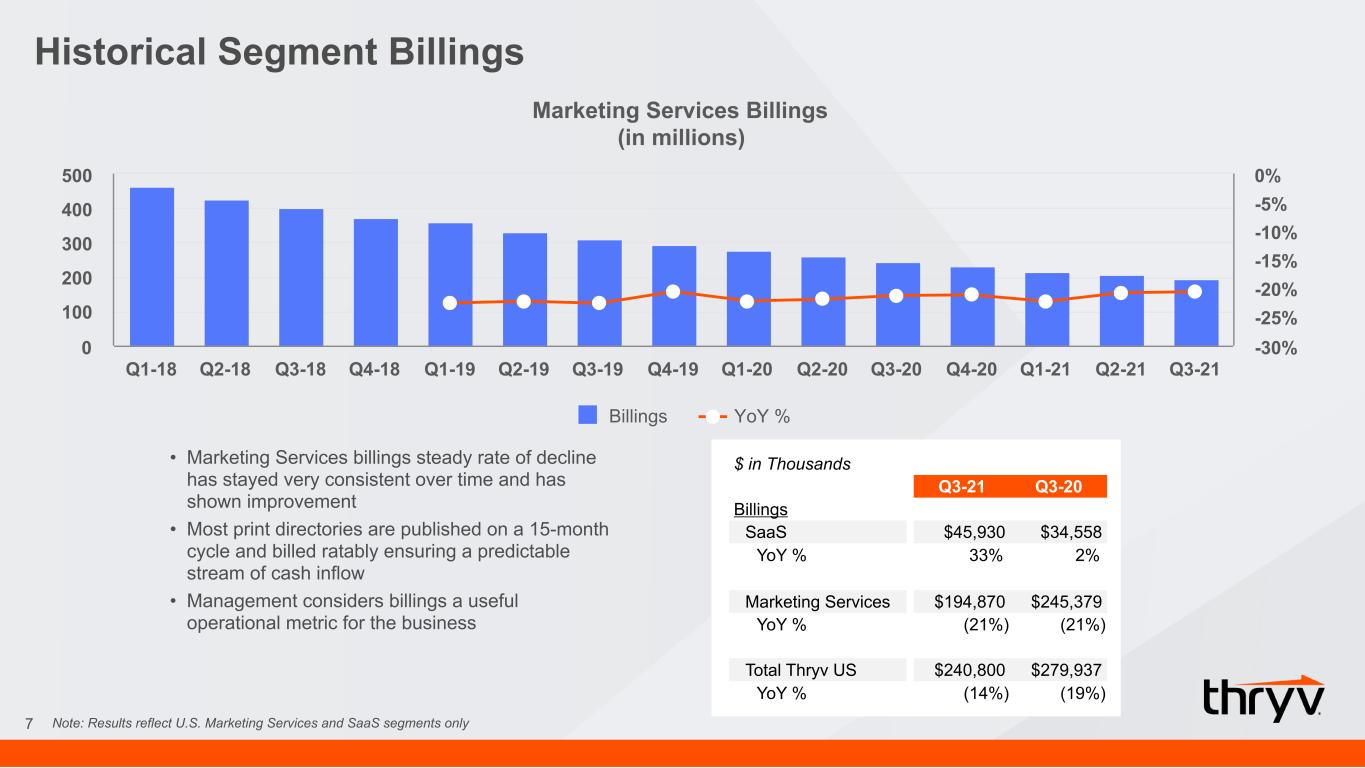

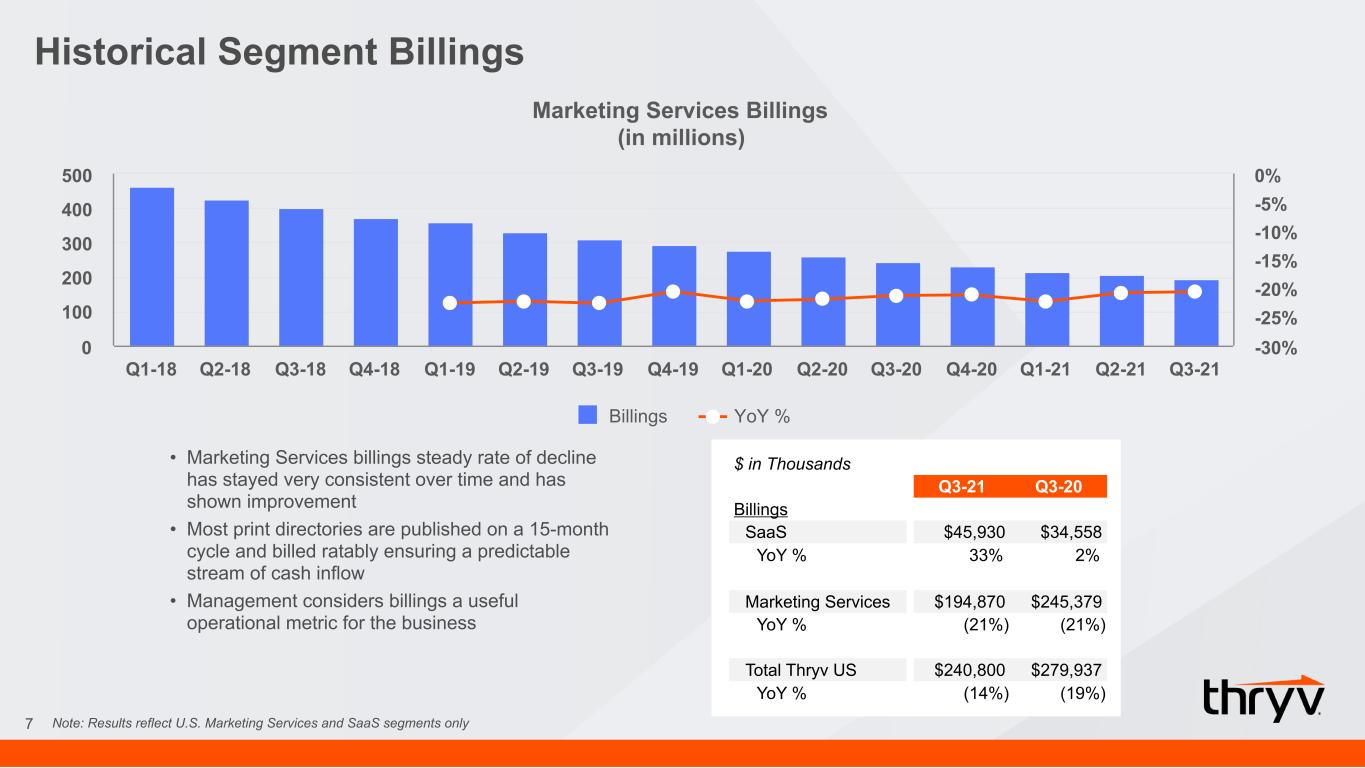

Historical Segment Billings 7 • Marketing Services billings steady rate of decline has stayed very consistent over time and has shown improvement • Most print directories are published on a 15-month cycle and billed ratably ensuring a predictable stream of cash inflow • Management considers billings a useful operational metric for the business Note: Results reflect U.S. Marketing Services and SaaS segments only Marketing Services Billings (in millions) Billings YoY % Q1-18 Q2-18 Q3-18 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Q3-21 0 100 200 300 400 500 -30% -25% -20% -15% -10% -5% 0% $ in Thousands Q3-21 Q3-20 Billings SaaS $45,930 $34,558 YoY % 33% 2% Marketing Services $194,870 $245,379 YoY % (21%) (21%) Total Thryv US $240,800 $279,937 YoY % (14%) (19%)

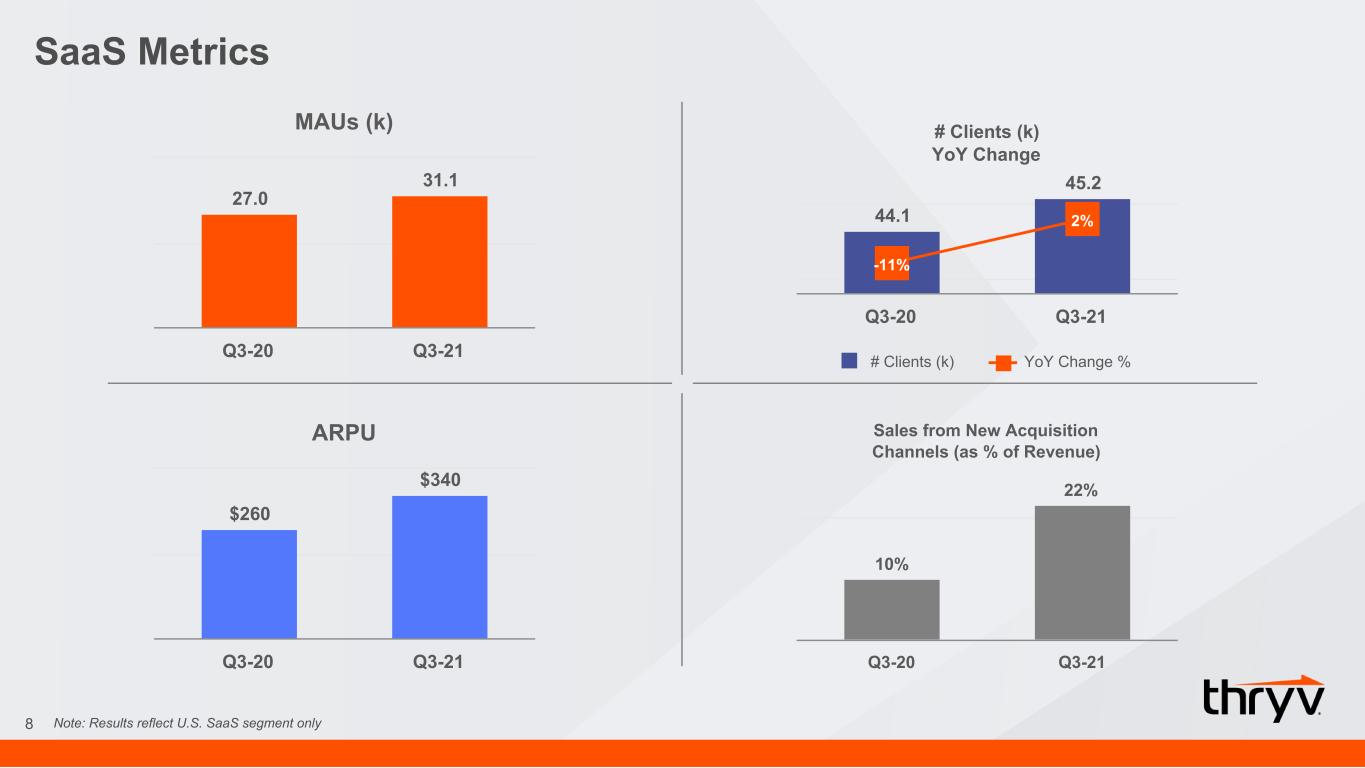

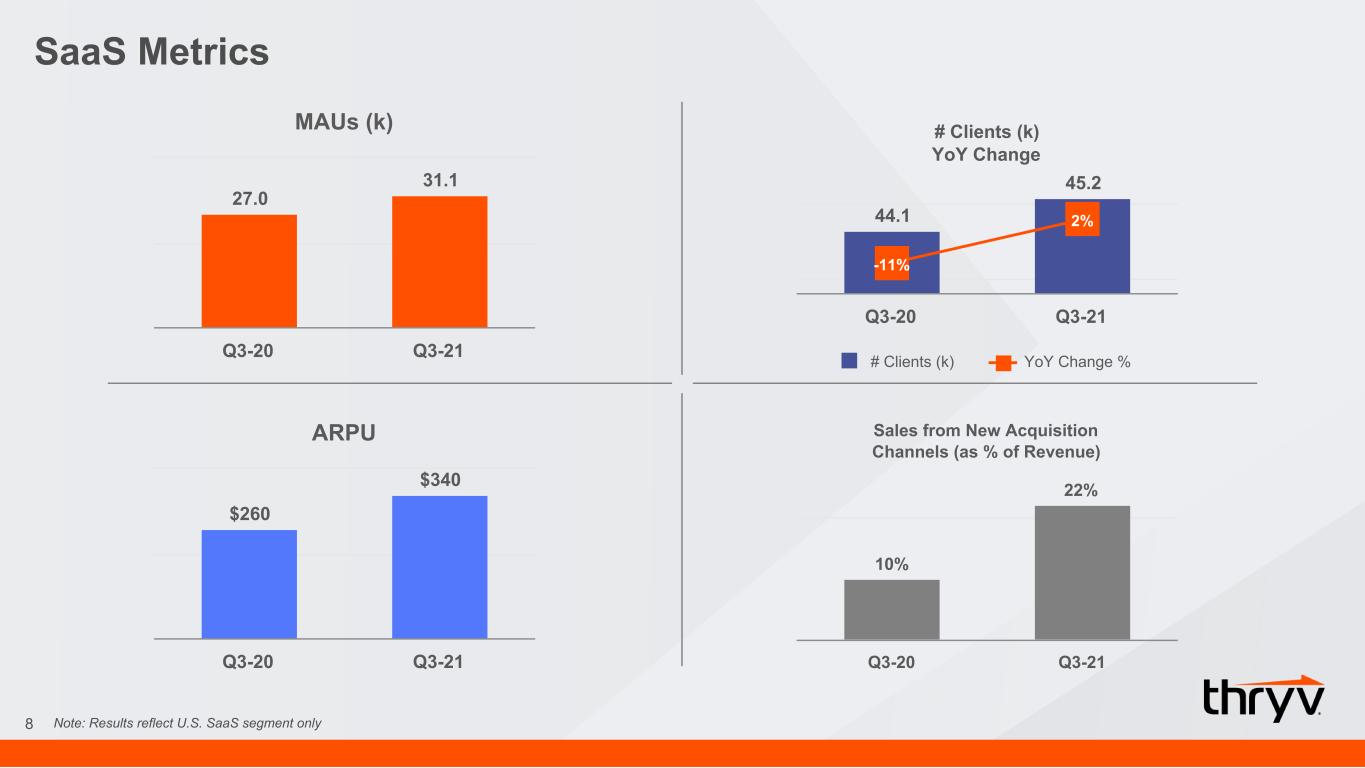

SaaS Metrics 8 Note: Results reflect U.S. SaaS segment only MAUs (k) 27.0 31.1 Q3-20 Q3-21 ARPU $260 $340 Q3-20 Q3-21 Sales from New Acquisition Channels (as % of Revenue) 10% 22% Q3-20 Q3-21 # Clients (k) YoY Change 44.1 45.2 -11% 2% # Clients (k) YoY Change % Q3-20 Q3-21

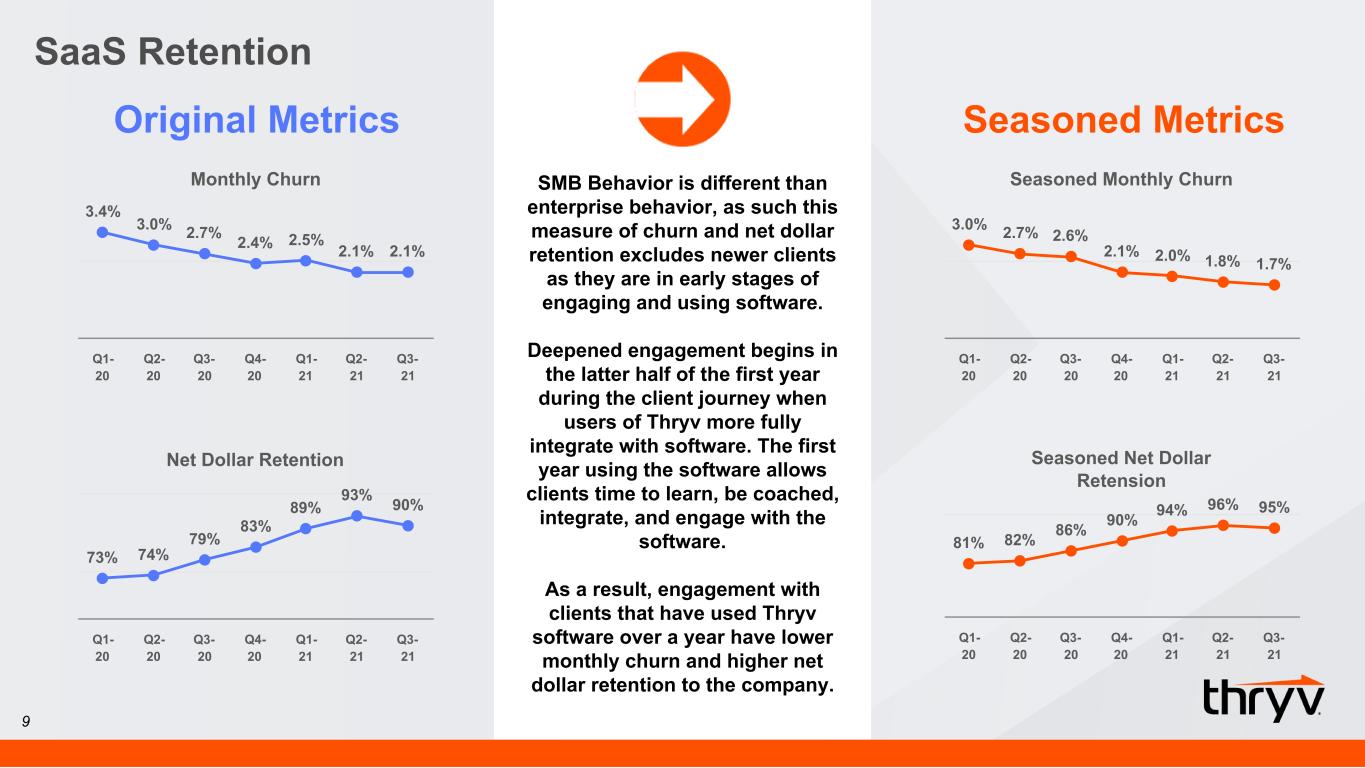

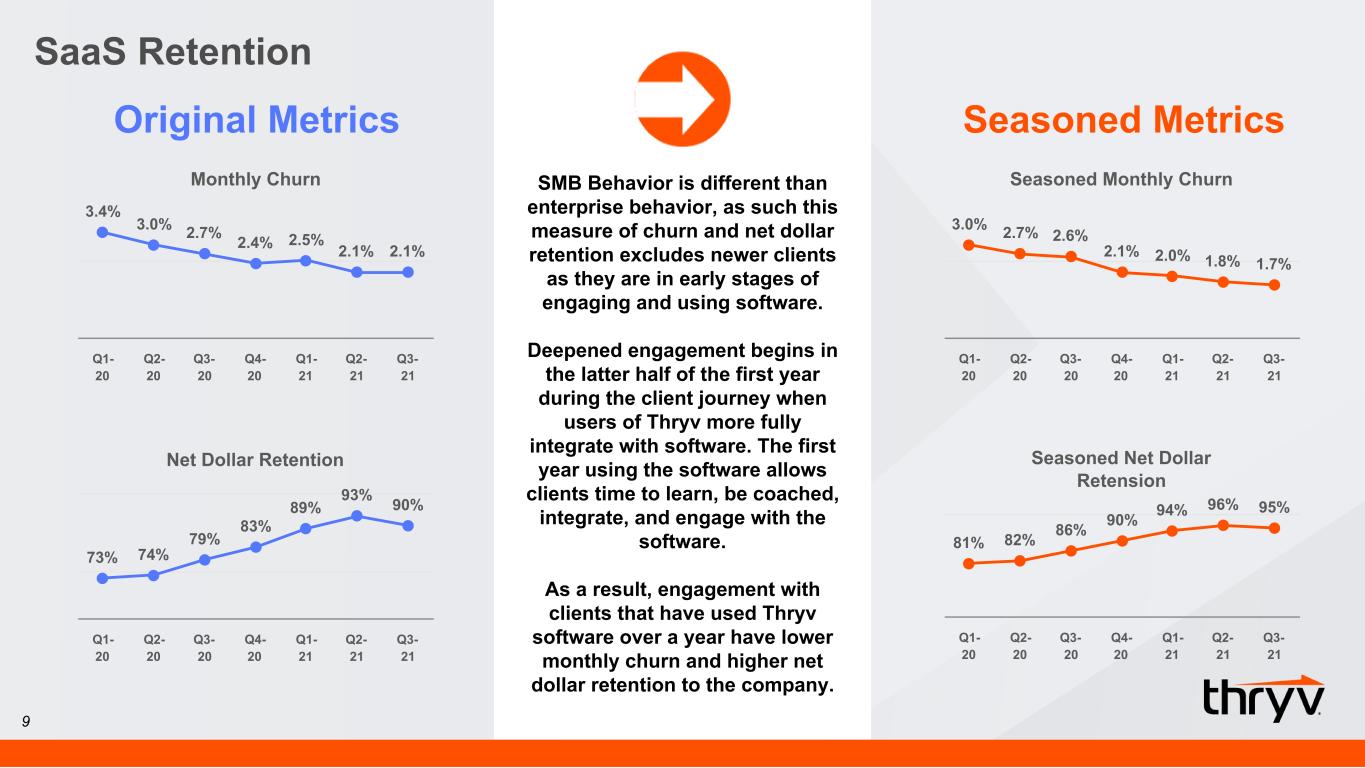

SaaS Retention Monthly Churn 3.4% 3.0% 2.7% 2.4% 2.5% 2.1% 2.1% Q1- 20 Q2- 20 Q3- 20 Q4- 20 Q1- 21 Q2- 21 Q3- 21 Seasoned Monthly Churn 3.0% 2.7% 2.6% 2.1% 2.0% 1.8% 1.7% Q1- 20 Q2- 20 Q3- 20 Q4- 20 Q1- 21 Q2- 21 Q3- 21 Seasoned Net Dollar Retension 81% 82% 86% 90% 94% 96% 95% Q1- 20 Q2- 20 Q3- 20 Q4- 20 Q1- 21 Q2- 21 Q3- 21 Net Dollar Retention 73% 74% 79% 83% 89% 93% 90% Q1- 20 Q2- 20 Q3- 20 Q4- 20 Q1- 21 Q2- 21 Q3- 21 9 SMB Behavior is different than enterprise behavior, as such this measure of churn and net dollar retention excludes newer clients as they are in early stages of engaging and using software. Deepened engagement begins in the latter half of the first year during the client journey when users of Thryv more fully integrate with software. The first year using the software allows clients time to learn, be coached, integrate, and engage with the software. As a result, engagement with clients that have used Thryv software over a year have lower monthly churn and higher net dollar retention to the company. Original Metrics Seasoned Metrics

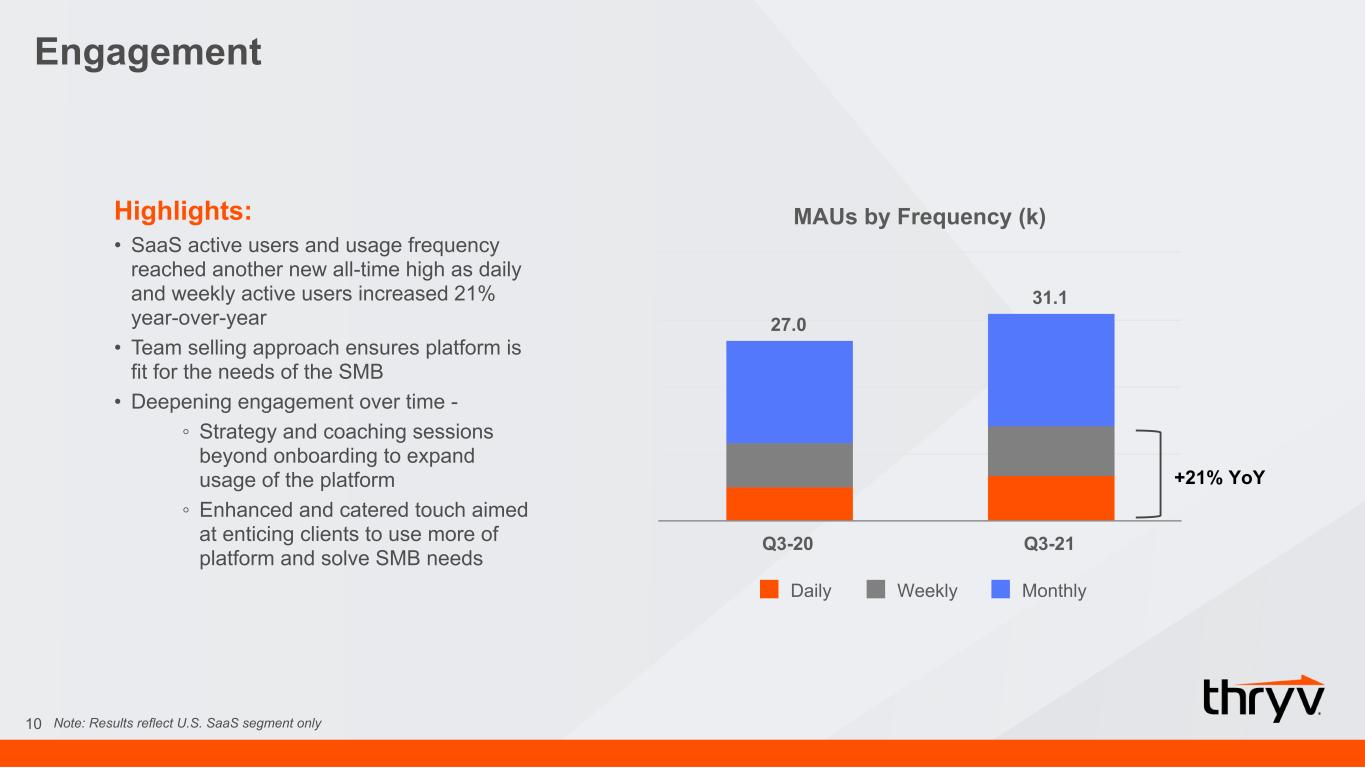

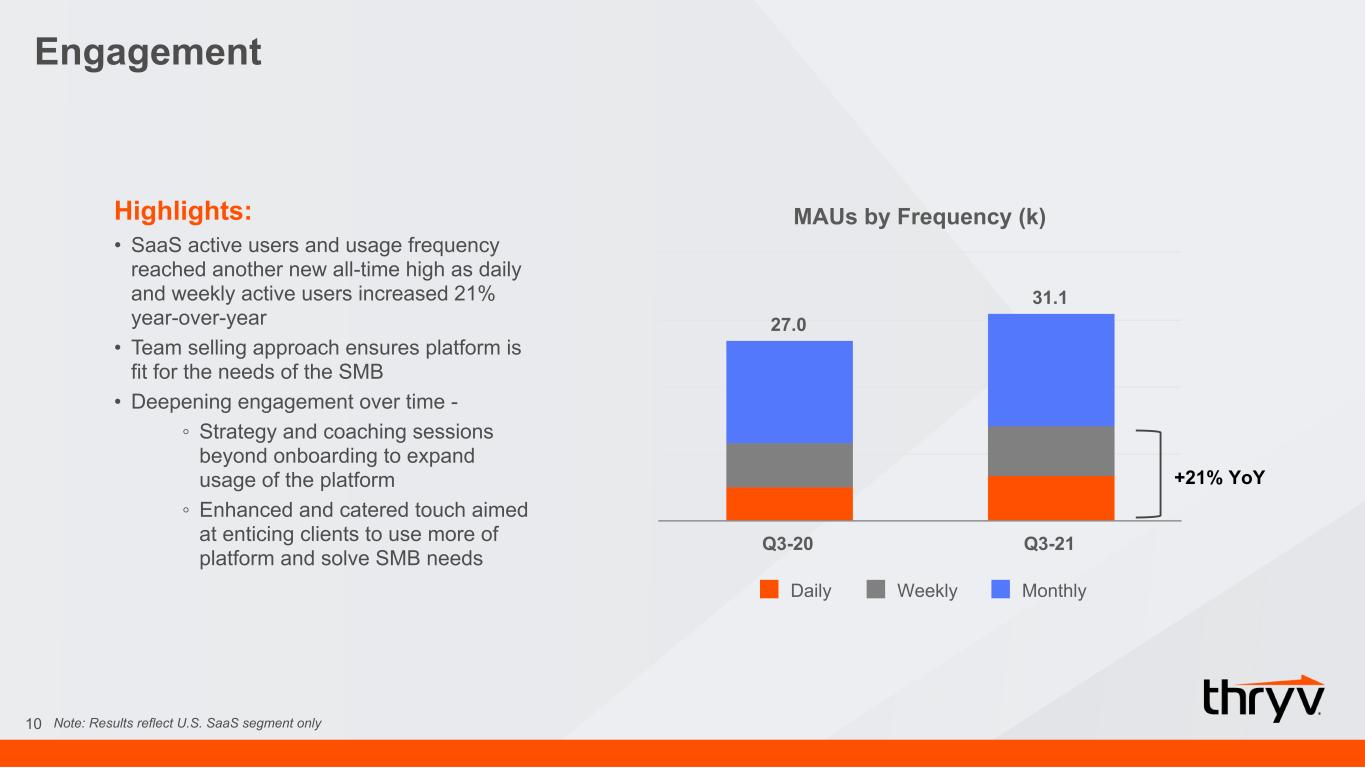

Engagement 10 Highlights: • SaaS active users and usage frequency reached another new all-time high as daily and weekly active users increased 21% year-over-year • Team selling approach ensures platform is fit for the needs of the SMB • Deepening engagement over time - ◦ Strategy and coaching sessions beyond onboarding to expand usage of the platform ◦ Enhanced and catered touch aimed at enticing clients to use more of platform and solve SMB needs Note: Results reflect U.S. SaaS segment only MAUs by Frequency (k) 27.0 31.1 Daily Weekly Monthly Q3-20 Q3-21 +21% YoY

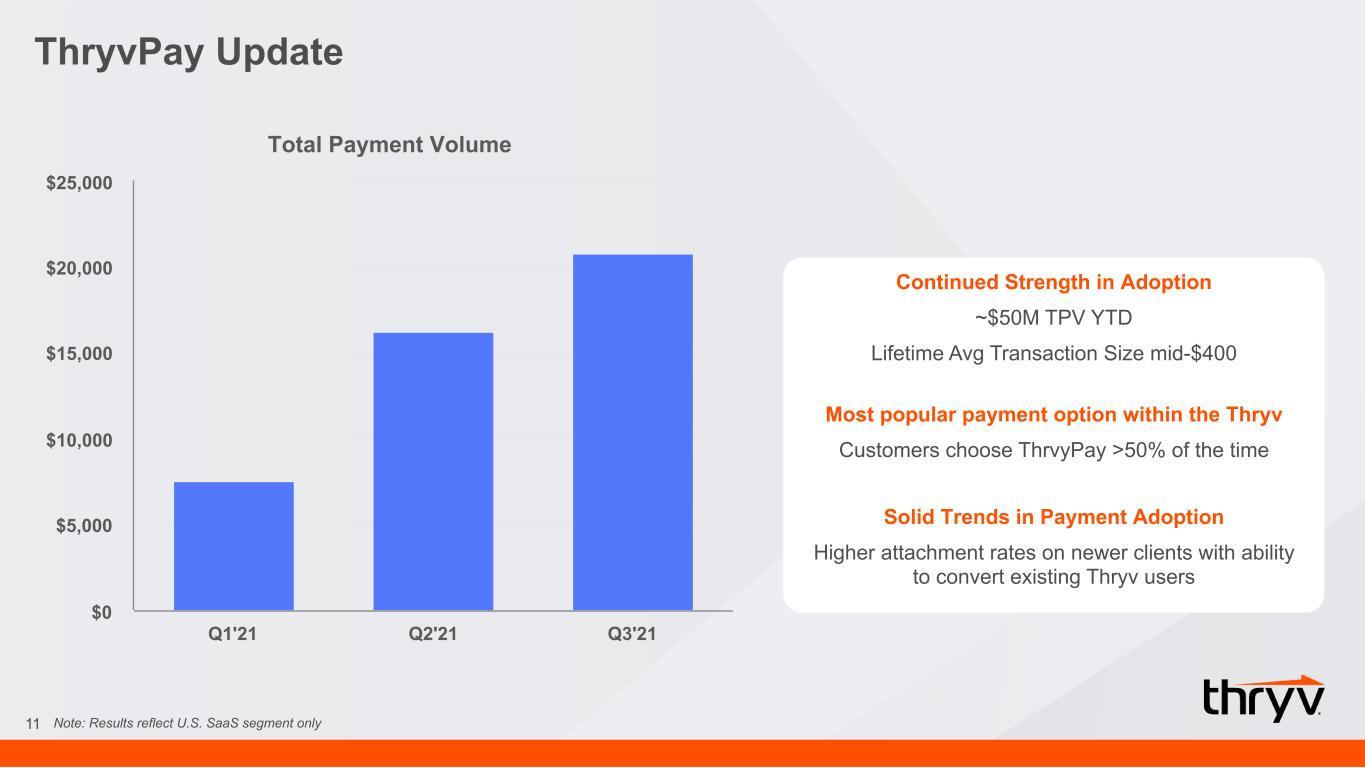

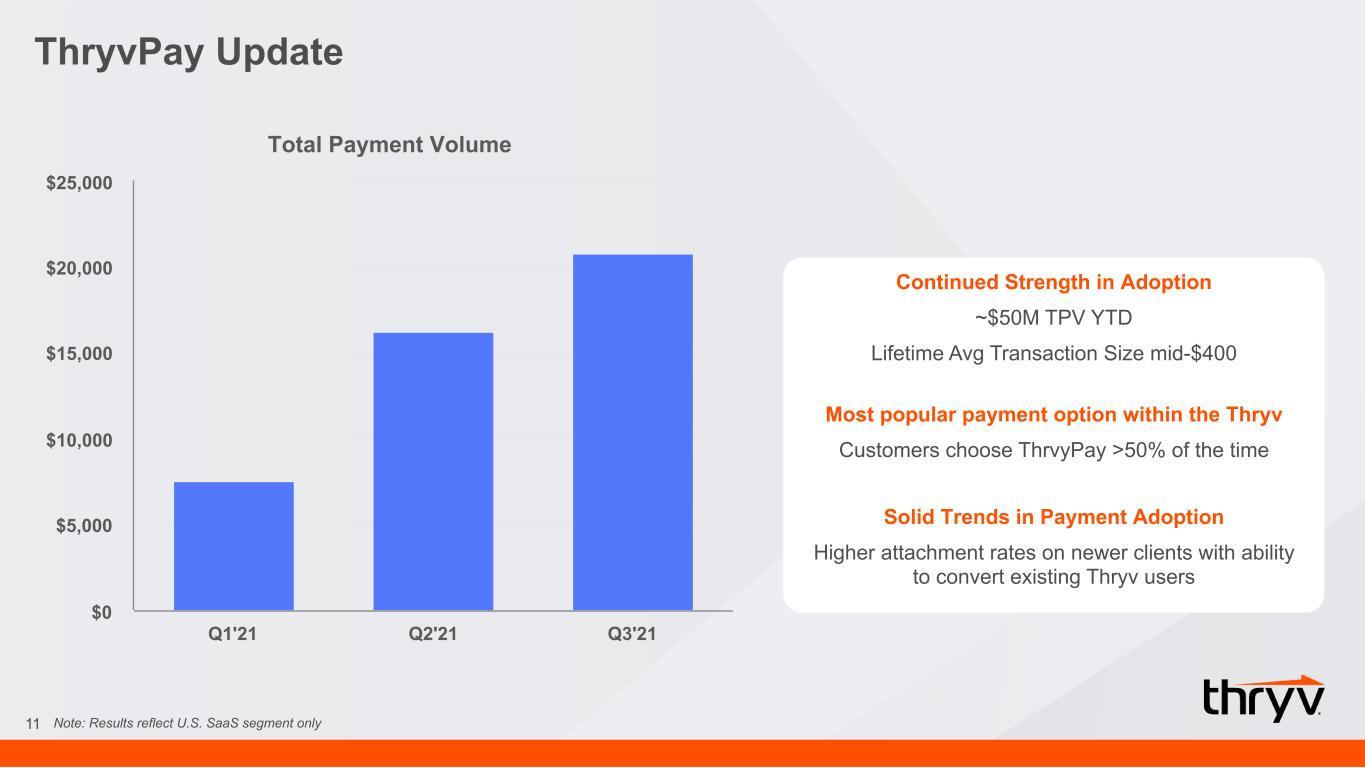

ThryvPay Update 11 Continued Strength in Adoption ~$50M TPV YTD Lifetime Avg Transaction Size mid-$400 Note: Results reflect U.S. SaaS segment only Total Payment Volume Q1'21 Q2'21 Q3'21 $0 $5,000 $10,000 $15,000 $20,000 $25,000 Most popular payment option within the Thryv Customers choose ThrvyPay >50% of the time Solid Trends in Payment Adoption Higher attachment rates on newer clients with ability to convert existing Thryv users

12

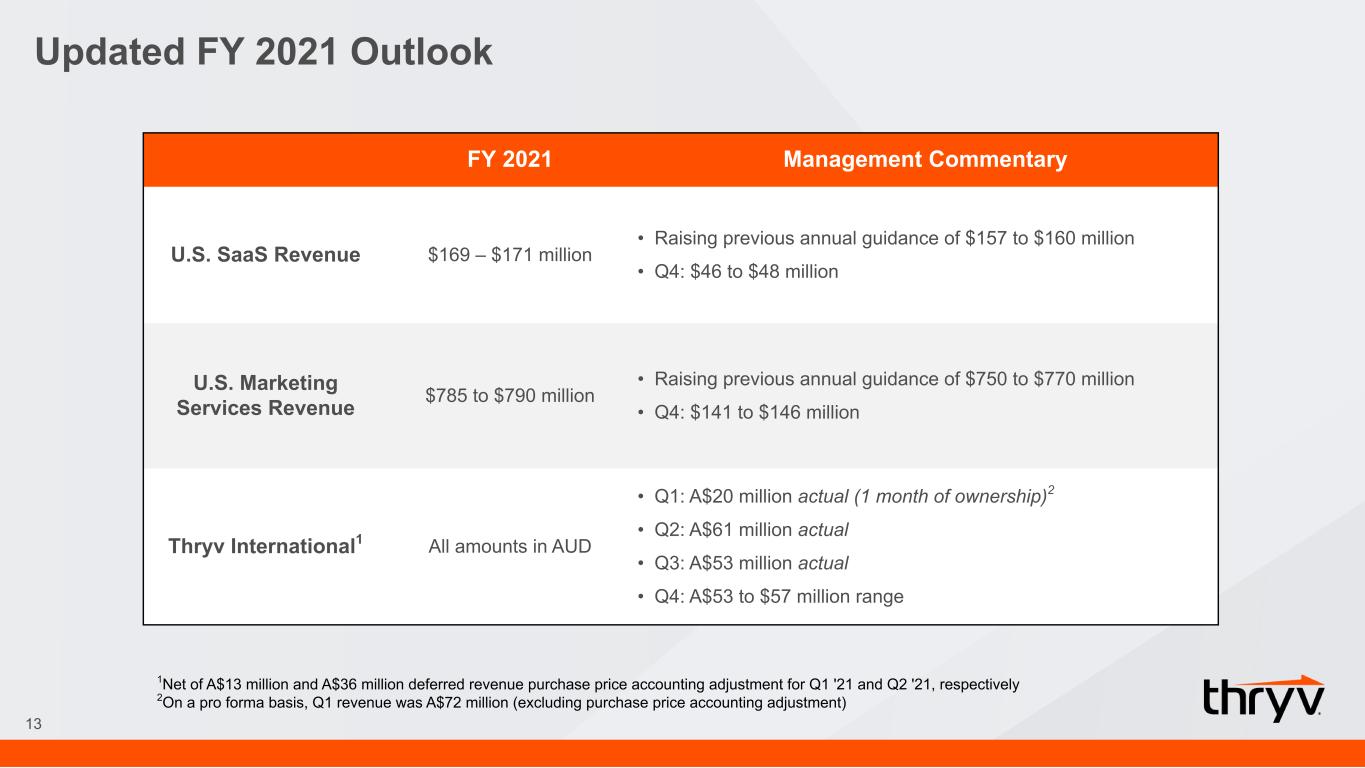

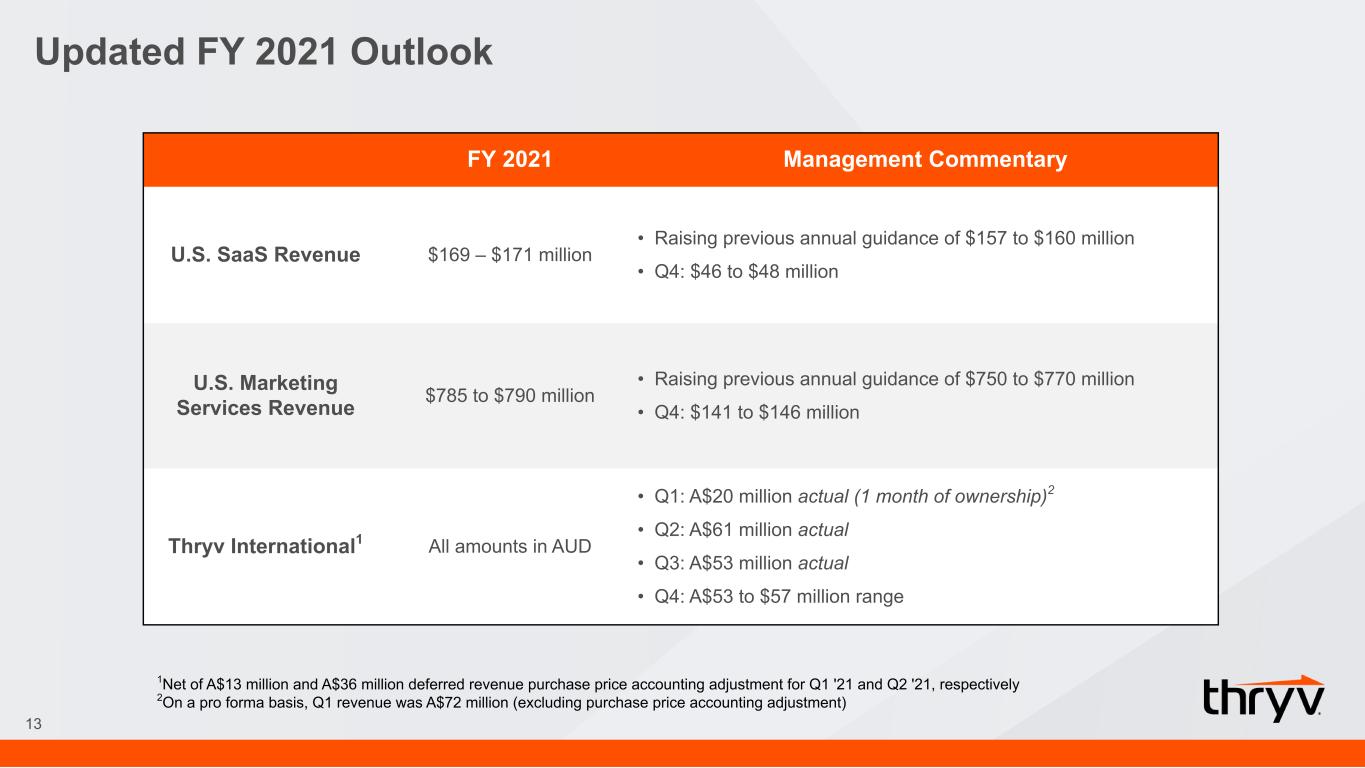

Updated FY 2021 Outlook 13 FY 2021 Management Commentary U.S. SaaS Revenue $169 – $171 million • Raising previous annual guidance of $157 to $160 million • Q4: $46 to $48 million U.S. Marketing Services Revenue $785 to $790 million • Raising previous annual guidance of $750 to $770 million • Q4: $141 to $146 million Thryv International1 All amounts in AUD • Q1: A$20 million actual (1 month of ownership)2 • Q2: A$61 million actual • Q3: A$53 million actual • Q4: A$53 to $57 million range 1Net of A$13 million and A$36 million deferred revenue purchase price accounting adjustment for Q1 '21 and Q2 '21, respectively 2On a pro forma basis, Q1 revenue was A$72 million (excluding purchase price accounting adjustment)

14 Engagement Continue to educate clients on features and how to leverage capabilities within platform. Expand app marketplace and drive time in-app. Drive Cloud Adoption In SMB Market Aggressively sell Thryv via new channels as business environment recovers. Convert “unclouded”. Efficiently and effectively onboard clients. Sensis Integration & SaaS Launch Connect businesses Penetrate existing Sensis clients Sign-up new clients Capital Allocation Proactively and thoughtfully pay down debt. 2021 Priorities On Track

15 Appendix

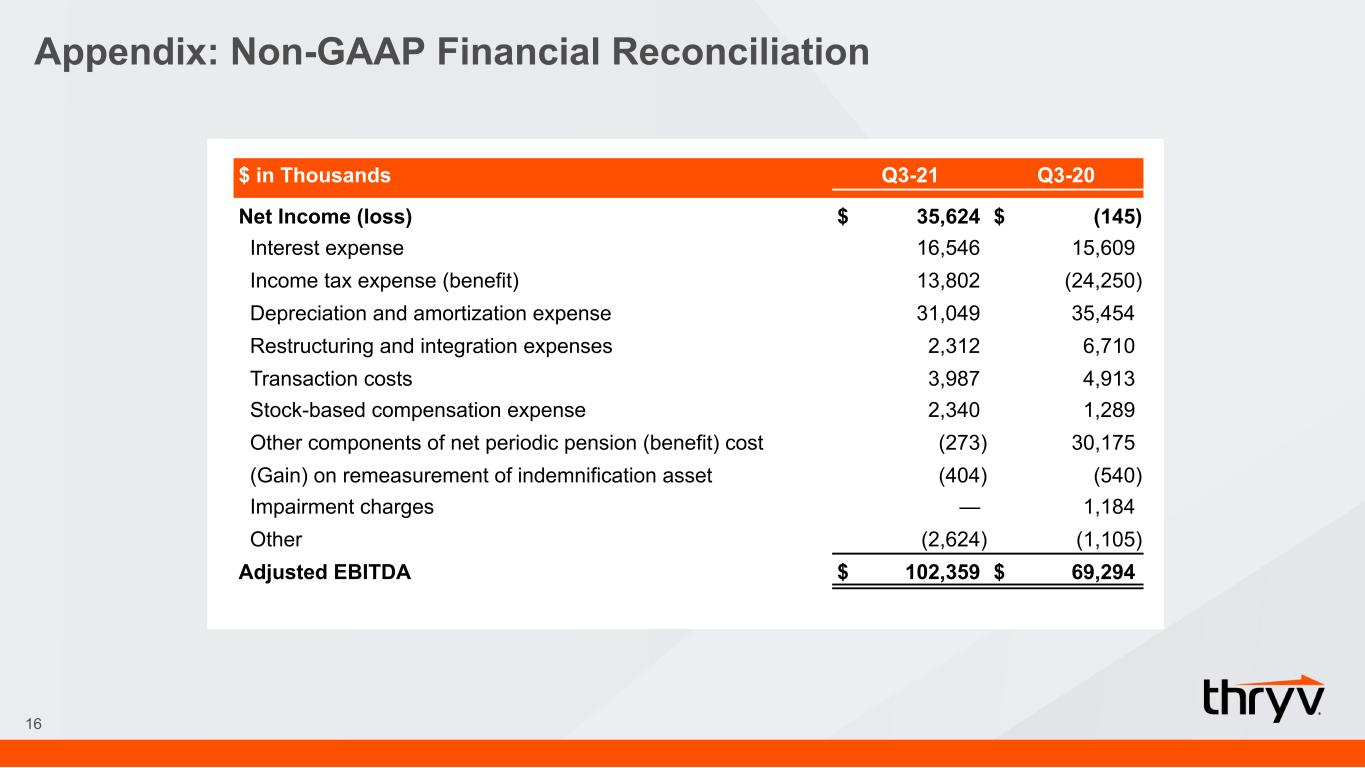

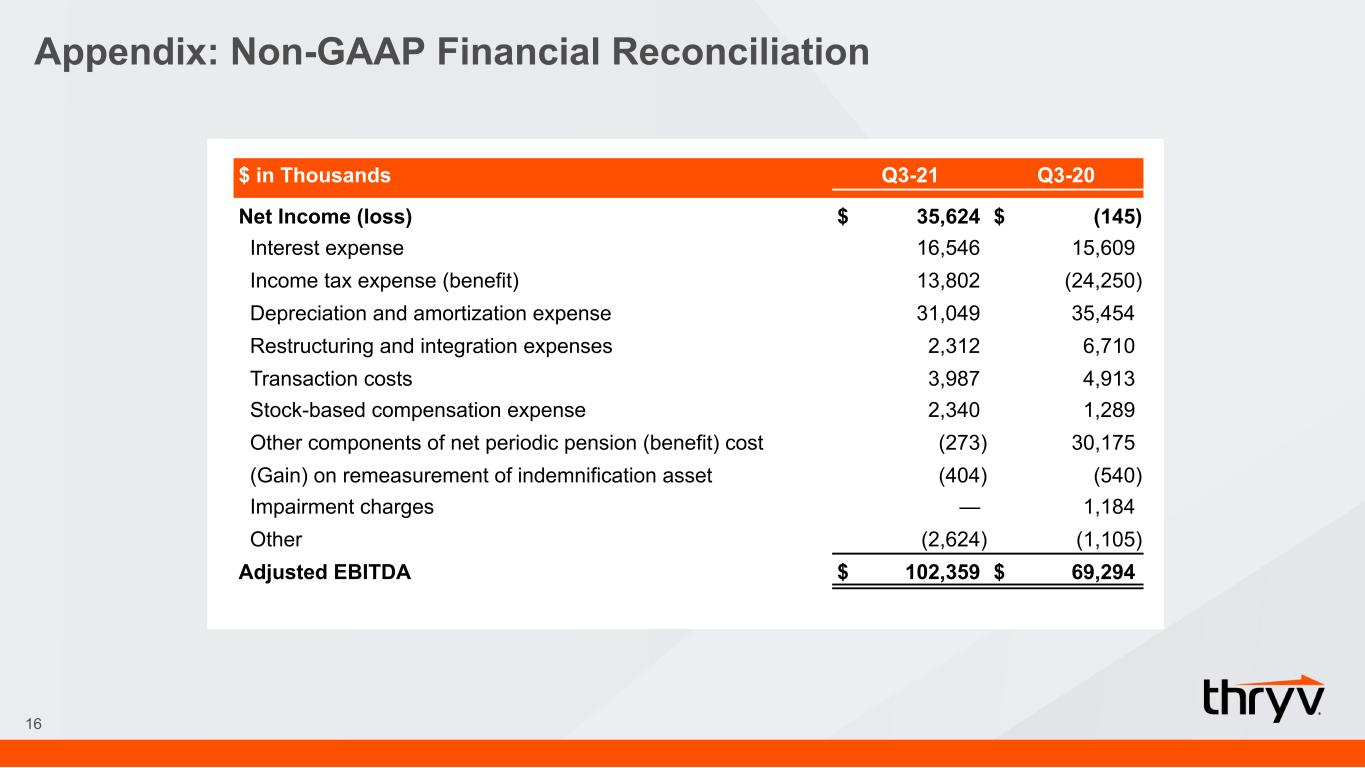

Appendix: Non-GAAP Financial Reconciliation 16 $ in Thousands Q3-21 Q3-20 Net Income (loss) $ 35,624 $ (145) Interest expense 16,546 15,609 Income tax expense (benefit) 13,802 (24,250) Depreciation and amortization expense 31,049 35,454 Restructuring and integration expenses 2,312 6,710 Transaction costs 3,987 4,913 Stock-based compensation expense 2,340 1,289 Other components of net periodic pension (benefit) cost (273) 30,175 (Gain) on remeasurement of indemnification asset (404) (540) Impairment charges — 1,184 Other (2,624) (1,105) Adjusted EBITDA $ 102,359 $ 69,294