[Letterhead of Alon USA Partners, LP]

November 6, 2012

Ms. Anne Nguyen Parker

Branch Chief

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549-3561

| | Registration Statement on Form S-1 |

Ladies and Gentlemen:

Pursuant to discussions with the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”), Alon USA Partners, LP (the “Partnership”) hereby submits the proposed offering terms of the initial public offering (the “Offering”), including the bona fide price range pursuant to Item 503(b)(3) of Regulation S-K. These pricing terms will be included in a future amendment to the Registration Statement on Form S-1, File No. 333-183671 (the “Registration Statement”). The provided terms are a bona fide estimate of the range of the minimum and maximum offering price and the maximum number of securities to be offered as of November 6, 2012. Should the bona fide estimates of these terms change, the figures presented in future amendments to the Registration Statement may increase or decrease.

The Partnership proposes to price the Offering with a bona fide price range of $19 to $21 per common unit, with a midpoint of $20 per common unit. In the Offering, the Partnership proposes to sell up to 11,500,000 common units representing limited partner interests in the Partnership. As discussed with members of the Staff, this range is initially being provided for your consideration by correspondence given the Partnership’s and the underwriters’ concern regarding providing such information significantly in advance of the launch of the offering given recent market volatility as well as our desire to provide all information necessary for the Staff to complete its review on a timely basis.

Additionally, the Partnership is enclosing its proposed marked copy of those pages of the Registration Statement that will be affected by the offering terms set forth herein. These marked changes will be incorporated into a future amendment to the Registration Statement.

The Partnership seeks confirmation from the Staff that it may launch its Offering with the price range specified herein and include such price range in a future filing of the Registration Statement.

Securities and Exchange Commission

November 6, 2012

Page 2

Please direct any questions that you have with respect to the foregoing or if any additional supplemental information is required by the Staff, please contact Gillian Hobson of Vinson & Elkins L.L.P. at (713) 758-3747.

| | |

Very truly yours, ALON USA PARTNERS, LP |

| |

| By: | | /s/ James Ranspot |

| Name: | | James Ranspot |

| Title: | | Chief Legal Counsel—Corporate and Secretary |

Enclosures

| cc: | Sirimal R. Mukerjee (Securities and Exchange Commission) |

| | Mike Rosenwasser (Vinson & Elkins L.L.P.) |

| | Gillian Hobson (Vinson & Elkins L.L.P.) |

| | Sean T. Wheeler (Latham & Watkins LLP) |

| | Divakar Gupta (Latham & Watkins LLP) |

| | David Wiessman (Alon USA Partners, LP) |

| | Paul Eisman (Alon USA Partners, LP) |

| | Shai Even (Alon USA Partners, LP) |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated November , 2012.

10,000,000 Common Units

Representing Limited Partner Interests

Alon USA Partners, LP

This is the initial public offering of our common units representing limited partner interests. We are offering 10,000,000 common units in this offering.

Prior to this offering, there has been no public market for our common units. We anticipate that the initial public offering price will be between $19.00 and $21.00 per common unit. Our common units have been approved for listing on the New York Stock Exchange under the symbol “ALDW,” subject to official notice of issuance.

Investing in our common units involves risks. See “Risk Factors” beginning on page 18. These risks include the following:

| | • | | We may not have sufficient available cash to pay any quarterly distribution on our common units. |

| | • | | The price volatility of crude oil, other feedstocks, refined products and fuel and utility services may have a material adverse effect on our earnings, profitability and cash flows, and our ability to make distributions to unitholders. |

| | • | | Changes in the WTI—Brent or Cushing WTI—Midland WTS differentials or the easing of logistical and infrastructure constraints at Cushing, Oklahoma could adversely affect the crude oil cost advantage that has been in our favor, which could negatively affect our profitability. |

| | • | | The amount of our quarterly cash distributions, if any, will vary significantly both quarterly and annually and will be directly dependent on the performance of our business. Unlike most publicly traded partnerships, we will not have a minimum quarterly distribution or employ structures intended to consistently maintain or increase distributions over time. |

| | • | | Our unitholders have limited voting rights and are not entitled to elect our general partner or our general partner’s directors. |

| | • | | You will incur immediate and substantial dilution in net tangible book value per common unit. |

| | • | | Our tax treatment depends on our status as a partnership for U.S. federal income tax purposes, as well as our not being subject to a material amount of entity-level taxation by individual states. If the IRS were to treat us as a corporation for federal income tax purposes or we were to become subject to material additional amounts of entity-level taxation for state tax purposes, then our cash available for distribution to you could be substantially reduced. |

| | • | | You will be required to pay taxes on your share of our income even if you do not receive any cash distributions from us. |

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | |

| | | Per

Common

Unit | | | Total | |

Initial public offering price | | $ | | | | $ | | |

Underwriting discount | | $ | | | | $ | | |

Proceeds, before expenses, to Alon USA Partners, LP | | $ | | | | $ | | |

To the extent that the underwriters sell more than common units, the underwriters have the option to purchase up to an additional common units at the initial public offering price less the underwriting discount.

The underwriters expect to deliver the common units against payment in New York, New York on or about , 2012.

| | | | |

| Goldman, Sachs & Co. | | Credit Suisse | | Citigroup |

| | |

| | Jefferies | | |

Prospectus dated , 2012.

Our Relationship with Alon Energy. Our sponsor is an independent refiner and marketer of petroleum products operating primarily in the South Central, Southwestern and Western regions of the United States. As of September 30, 2012, Alon Energy operated 299 convenience stores in Central and West Texas and New Mexico, substantially all of which are branded 7-Eleven and all of which we supply. In connection with this offering, we will also enter into a 20-year fuel supply agreement with Alon Energy under which we will supply substantially all of the motor fuel requirements of Alon Energy’s retail convenience stores. We believe that access to Alon Energy’s complementary retail business fosters a mutually beneficial commercial relationship that allows us to benefit from our combined economies of scale and purchasing power. We also believe that Alon Energy’s ownership of our general partner and a majority of our common units will serve to align Alon Energy’s interests with ours and promote and support the successful execution of our business strategies.

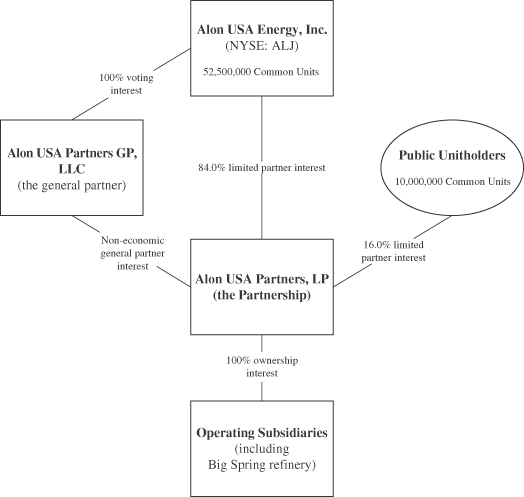

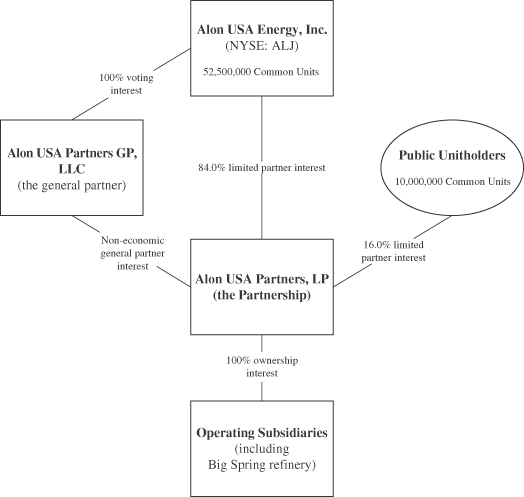

Experienced and Incentivized Leadership. Our executive officers have an average of over 20 years’ experience in the industry. A number of our executive officers and key operating personnel have spent the majority of their careers operating refineries and have successfully managed our business through multiple industry cycles. We also benefit from the management and marketing expertise provided by Alon Energy, who, following this offering, will own 100% of the voting interests in our general partner and 84.0% of our common units.

Business Strategy

The primary components of our business strategy are:

Distribute All Available Cash We Generate Each Quarter. The board of directors of our general partner will adopt a policy under which distributions for each quarter will equal the amount of available cash (as described in “Cash Distribution Policy and Restrictions on Distributions”) we generate each quarter. We do not intend to maintain excess distribution coverage in order to stabilize our quarterly distributions or to otherwise reserve cash for future distributions. In addition, our general partner has a non-economic interest and no incentive distribution rights, and, accordingly, our unitholders will receive 100% of our cash distributions. The board of directors of our general partner may change our cash distribution policy at any time at its discretion. Our partnership agreement does not require us to pay distributions to our unitholders on a quarterly or other basis. See “Cash Distribution Policy and Restrictions on Distributions” beginning on page 49.

Maintain Efficient Refinery Operations and Promote Operational Excellence and Reliability. For the year ended December 31, 2011 and the nine months ended September 30, 2012, our Big Spring refinery maintained a utilization rate of 90.8% and 97.3%, respectively. We intend to continue to operate our refinery as reliably and efficiently as possible to optimize utilization and further improve our operations by maintaining our costs at competitive levels. We will continue to devote significant time and resources toward improving the reliability of our operations. We will also seek to improve operating performance through commitment to our preventive maintenance program and to employee training and development programs.

Enhance Existing Operations and Invest in Organic Growth. We are focused on the profitable enhancement of our existing operations and investment in organic growth by:

| | • | | continuing to make investments to enhance the operating flexibility of our refinery and increase our crude oil sourcing advantage; |

| | • | | evaluating ways to increase the profitability of our Big Spring refinery through cost-effective upgrades and expansions; |

| | • | | pursuing organic growth projects at the refinery to improve the yield of motor fuels we produce and the efficiency of our operations; and |

4

region totaling 3.5 million bpd, causing refiners in PADD III to supply all other PADDs. Despite this high level of refining capacity relative to the refined product demand, refiners who can access advantageous crude supplies are still able to achieve high margins.

Risk Factors

Investing in our common units involves risks that include the volatility of crude oil and other refinery feedstocks, refined product prices, competition, our partnership structure, the tax characteristics of our common units and other material factors. For a discussion of these risks and other considerations that could negatively affect us, see “Risk Factors” beginning on page 18 and “Cautionary Note Regarding Forward-Looking Statements” beginning on page 44.

Our Relationship with Alon Energy

Alon Energy is an independent refiner and marketer of petroleum products operating primarily in the South Central, Southwestern and Western regions of the United States. Following this offering, Alon Energy will own 100% of the voting interests in our general partner and 84.0% of our common units. Our ongoing relationship with Alon Energy provides us with secure fuel distribution outlets and marketing expertise, which we believe provides us with a competitive advantage. Given its significant ownership in us, we believe Alon Energy will be motivated to promote and support the successful execution of our business plan and to pursue projects and/or acquisitions that enhance the value of our business. Under the terms of the omnibus agreement that we will enter into in connection with the closing of this offering, we will have a right of first refusal if Alon Energy or any of its controlled affiliates has the opportunity to acquire a controlling interest in any refinery and related crude oil and refined product logistic assets, including non-retail transportation terminal sales, and that operate in Arizona, Arkansas, Colorado, Kansas, New Mexico, Oklahoma or Texas. In addition, pursuant to the terms of the omnibus agreement, we will have a 60-day exclusive right of negotiation if Alon Energy or any of its controlled affiliates decide to attempt to sell any refinery and related crude oil and refined product logistic assets, including non-retail transportation terminal sales, that operate in Arizona, Arkansas, Colorado, Kansas, New Mexico, Oklahoma or Texas. Additionally, in connection with this offering, we will enter into a 20-year fuel supply agreement with Alon Energy under which we will supply substantially all of the motor fuel requirements of Alon Energy’s retail convenience stores. We will also enter into a 20-year asphalt supply agreement with Alon Energy. See “Certain Relationships and Related Party Transactions—Agreements with Alon Energy” beginning on page 113.

Our Management

We are managed and operated by the board of directors and executive officers of our general partner, Alon USA Partners GP, LLC, an indirect subsidiary of Alon Energy. Following this offering, Alon Energy will own, directly or indirectly, approximately 84.0% of our outstanding common units. As a result of owning our general partner, Alon Energy will have the right to appoint all of the members of the board of directors of our general partner, including all of our general partner’s independent directors. At least one of our general partner’s independent directors will be appointed prior to the date our common units are listed for trading on the applicable stock exchange. Alon Energy will appoint our general partner’s second independent director within three months of the date our common units begin trading, and our general partner’s third independent director within one year from such date. Our unitholders will not be entitled to elect our general partner or its directors or otherwise directly participate in our management or operations. For more information about the executive officers and directors of our general partner, please read “Management” beginning on page 100.

6

| | • | | an omnibus agreement with Alon Energy pursuant to which (i) we will have certain rights of first refusal on refinery and related crude oil and refined product logistic assets in our areas of operations, (ii) we will have certain exclusive rights of negotiation with respect to assets to be sold by Alon Energy, (iii) Alon Energy will agree to indemnify us with respect to certain liabilities, and (iv) we will receive the rights to continue to use the “Alon” name and related marks; |

| | • | | a tax sharing agreement pursuant to which we will reimburse Alon Energy for our share of state and local income and other taxes borne by Alon Energy as a result of our results being included in a combined or consolidated tax return filed by Alon Energy with respect to taxable periods including or beginning on the closing date of this offering; |

| | • | | a 20-year fuel supply agreement with Alon Energy under which we will supply substantially all of the motor fuel requirements of Alon Energy’s retail convenience stores; and |

| | • | | a 20-year asphalt supply agreement with Alon Energy. |

For a more detailed description of these agreements, see “Certain Relationships and Related Party Transactions—Agreements with Alon Energy” beginning on page 113.

| | • | | We will issue to Alon Energy 52,500,000 common units, representing a 84.0% limited partner interest in us (assuming the underwriters do not exercise their option to acquire additional common units). |

| | • | | On the closing date of this offering, we will issue and sell 10,000,000 common units to the public in this offering and pay related underwriting discounts and commissions and all related transaction costs in connection with this offering. |

| | • | | We will use the net proceeds from the sale of 10,000,000 common units in this offering to repay approximately $183.0 million of principal and accrued interest relating to intercompany debt payable by our subsidiaries to Alon Energy and its affiliates. We expect that the remaining balance of the intercompany debt will be eliminated prior to closing. |

| | • | | We will assume from Alon Energy a fully drawn $250.0 million term loan facility, which we refer to as our “new term loan facility.” We expect that the new term loan facility will be guaranteed by Alon Energy and that Alon Energy will be released from all of its obligations thereunder other than with respect to its obligations as a guarantor. |

See “Use of Proceeds” beginning on page 45.

We refer to the above transactions throughout this prospectus as the “IPO Transactions.”

We have granted the underwriters a 30-day option to purchase up to an aggregate of 1,500,000 additional common units. Any net proceeds received from the exercise of this option will be distributed to Alon Energy. The number of common units to be issued at Alon Energy above includes 1,500,000 common units that will be issued at the expiration of the underwriters’ option to purchase additional common units if the underwriters do not exercise their option. Any common units that would have been sold to the underwriters had they exercised the option in full will be issued to Alon Energy at the expiration of the option period. Accordingly, the exercise of the underwriters’ option will not affect the total number of common units outstanding, but if the underwriters option is not exercised in full, Alon Energy’s limited partner interest in us will increase.

8

Organizational Structure

The following chart illustrates our organizational structure after giving effect to the IPO Transactions (assuming the underwriters’ option to purchase additional common units is not exercised):

9

The Offering

Issuer | Alon USA Partners, LP |

Common units offered | 10,000,000 common units |

Over-allotment option | We have granted the underwriters a 30-day option to purchase up to an aggregate of 1,500,000 additional common units. Any common units not purchased pursuant to the over-allotment option will be issued to Alon Energy. |

Use of proceeds | We intend to use the estimated net proceeds of approximately $183.0 million from this offering (based on an assumed initial offering price of $20.00 per common unit), after deducting the estimated underwriting discount and offering expenses, to repay approximately $183.0 million of principal and accrued interest outstanding as of September 30, 2012 relating to intercompany debt payable by our subsidiaries to Alon Energy and its affiliates. We expect that the remaining balance of the intercompany debt will be eliminated prior to closing. |

| | The net proceeds from any exercise of the underwriters’ option to purchase additional common units (approximately $27.9 million based on an assumed initial offering price of $20.00 per common unit, if exercised in full) will be distributed to Alon Energy in whole or in part as reimbursement for certain pre-formation capital expenditures. |

| | Please read “Use of Proceeds” beginning on page 45. |

Cash distributions | Within 60 days after the end of each quarter, beginning with the quarter ending December 31, 2012, we expect to make distributions to unitholders of record on the applicable record date. We expect our first distribution will include available cash (as described below) for the period from the closing of this offering through December 31, 2012. |

| | The board of directors of our general partner will adopt a policy pursuant to which distributions for each quarter will be in an amount equal to the available cash we generate in such quarter. Available cash for each quarter will be determined by the board of directors of our general partner following the end of such quarter. We expect that available cash for each quarter will generally equal our cash flow from operations for the quarter, less cash needed for maintenance capital expenditures, accrued but unpaid expenses, reimbursement of expenses incurred by our general partner and its affiliates, debt service and other contractual obligations and reserves for future operating or capital needs that the board of directors of our general partner deems necessary or appropriate, including reserves for turnarounds, catalyst replacement and related expenses. |

10

| | We do not intend to maintain excess distribution coverage for the purpose of maintaining stability or growth in our quarterly distribution or to otherwise reserve cash for distributions, and we do not intend to incur debt to pay quarterly distributions. We expect to finance substantially all of our growth externally, either by debt issuances or additional issuances of equity. We intend to reserve amounts each quarter in order to fund capital expenditures associated with our major turnaround and catalyst replacements. |

| | Because our policy will be to distribute an amount equal to all available cash we generate each quarter, our unitholders will have direct exposure to fluctuations in the amount of cash generated by our business. We expect that the amount of our quarterly distributions, if any, will vary based on our operating cash flow during such quarter. As a result, our quarterly distributions, if any, will not be stable and will vary from quarter to quarter as a direct result of variations in, among other factors, (i) our operating performance, (ii) cash flows caused by, among other things, fluctuations in the prices of crude oil and other feedstocks and the prices we receive for finished products, working capital needs or capital expenditures and (iii) cash reserves deemed necessary or appropriate by the board of directors of our general partner. Such variations in the amount of our quarterly distributions may be significant. Unlike most publicly traded partnerships, we will not have a minimum quarterly distribution or employ structures intended to consistently maintain or increase distributions over time. The board of directors of our general partner may change our distribution policy at any time. Our partnership agreement does not require us to pay distributions to our unitholders on a quarterly or other basis. |

| | Based upon our forecasted results for the twelve months ending September 30, 2013, and assuming the board of directors of our general partner declares distributions in accordance with our cash distribution policy, we expect that our aggregate distributions for the twelve months ending September 30, 2013 will be approximately $329.3 million, or $5.27 per common unit, including special turnaround reserve and wholesale business rebranding expenses of approximately $14.1 million. See “Cash Distribution Policy and Restrictions on Distributions—Estimated Cash Available for Distribution for the Twelve Months Ending September 30, 2013” beginning on page 53. |

| | Unanticipated events may occur which could materially adversely affect the actual results we achieve during the forecast periods. Consequently, our actual results of operations, cash flows, financial condition and our need for cash reserves during the forecast periods may vary from the forecast, and such variations may be material. Prospective investors are cautioned not to place undue reliance on our forecast and should make their own independent assessment of our future results of operations, cash flows and financial condition. In addition, the board of directors of our general partner may be required to, or elect to, reduce or eliminate our distributions at any time during |

11

| | periods of high prices for refinery feedstocks, such as crude oil, and/or reduced prices or demand for our refined products, among other reasons. See “Risk Factors” beginning on page 18. |

Incentive Distribution Rights | None. |

Issuance of additional units | Our partnership agreement authorizes us to issue an unlimited number of additional units without the approval of our unitholders. |

| | Please read “Units Eligible for Future Sale” beginning on page 139 and “The Partnership Agreement—Issuance of Additional Partnership Interests” beginning on page 129. |

Limited voting rights | Our general partner will manage and operate us. Unlike the holders of common stock in a corporation, our unitholders will have only limited voting rights on matters affecting our business. Our unitholders will have no right to elect our general partner or its directors on an annual or other continuing basis. Our general partner may not be removed except by a vote of the holders of at least 66 2/3% of the outstanding units, including any units owned by our general partner and its affiliates, voting together as a single class. Upon consummation of this offering, Alon Energy will own an aggregate of 84.0% of our common units (or 81.6% of our common units if the underwriters exercise their option to purchase additional common units in full). This will give Alon Energy the ability to prevent the removal of our general partner. Please read “The Partnership Agreement—Voting Rights” beginning on page 127. |

Limited call right | If at any time our general partner and its affiliates (including Alon Energy) own more than 80% of the units, our general partner will have the right, but not the obligation, to purchase all, but not less than all, of the units held by unaffiliated unitholders at a price not less than their then-current market price, as calculated pursuant to the terms of our partnership agreement. See “The Partnership Agreement—Call Right” beginning on page 134. |

Estimated ratio of taxable income to distributions | We estimate that if you own the common units you purchase in this offering through December 31, 2015, you will be allocated, on a cumulative basis, an amount of federal taxable income for that period that will be approximately 50% of the cash distributed to you. Because of the nature of our business and the expected variability of our quarterly distributions, however, the ratio of our taxable income to distributions may vary significantly from one year to another. Please read “Material U.S. Federal Income Tax Consequences—Tax Consequences of Unit Ownership—Ratio of Taxable Income to Distributions” beginning on page 143. |

12

The assumptions underlying the forecast of available cash that we include in “Cash Distribution Policy and Restrictions on Distributions—Estimated Cash Available for Distribution for the Twelve Months Ending September 30, 2013” are inherently uncertain and are subject to significant business, economic, regulatory and competitive risks and uncertainties that could cause actual results to differ materially from those forecasted.

Our forecast of available cash set forth in “Cash Distribution Policy and Restrictions on Distributions—Estimated Cash Available for Distribution for the Twelve Months Ending September 30, 2013” includes our forecast of results of operations and available cash for the twelve months ending September 30, 2013. The forecast has been prepared by our management. Neither our independent registered public accounting firm nor any other independent accountants have examined, compiled or performed any procedures with respect to the forecast, nor have they expressed any opinion or any other form of assurance on such information or its achievability, and they assume no responsibility for the forecast. The assumptions underlying the forecast are inherently uncertain and are subject to significant business, economic, regulatory and competitive risks and uncertainties that could cause actual results to differ materially from those forecasted. If the forecasted results are not achieved, we would not be able to pay the forecasted annual distribution, in which event the market price of the common units may decline materially. Our actual results may differ materially from the forecasted results presented in this prospectus. In addition, based on our historical results of operations, which have been volatile and seasonal, our distributions for the year ended December 31, 2011 and the twelve months ended September 30, 2012, on a pro forma basis, would have been significantly less than the distribution we forecast that we will be able to pay for the twelve months ending September 30, 2013. Investors should review the forecast of our results of operations for the twelve months ending September 30, 2013 together with the other information included elsewhere in this prospectus, including “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The pro forma available cash information for the year ended December 31, 2011 and the twelve months ended September 30, 2012 do not necessarily reflect the actual cash that would have been available over the course of those periods.

Our actual cash available for distribution may differ materially from our presentation of pro forma available cash for the year ended December 31, 2011 and the twelve months ended September 30, 2012.

We have included in this prospectus pro forma available cash information for the year ended December 31, 2011 and twelve months ended September 30, 2012 that indicates the amount of cash that we would have had available for distribution during that period on a pro forma basis. This pro forma information is based on numerous estimates and assumptions. Our financial performance, had the IPO Transactions (as set forth in “Prospectus Summary—The IPO Transactions”) occurred at the beginning of such periods, could have been materially different from the pro forma results. Accordingly, investors should review the unaudited pro forma information, including the related footnotes, together with the other information included elsewhere in this prospectus, including “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our actual results may differ, possibly materially, from those presented in the pro forma available cash information.

For the year ended December 31, 2011, on a pro forma basis, we would not have generated sufficient available cash to have paid the aggregate distributions that we project that we will be able to pay for the twelve months ending September 30, 2013.

We project that we will be able to pay aggregate distributions of $5.27 per unit for the twelve months ending September 30, 2013. In order to pay these projected distributions, we must generate approximately $329.3 million of available cash in the twelve months ending September 30, 2013, including special turnaround reserve and wholesale business rebranding expenses of approximately $14.1 million. However, for the year ended December 31, 2011, on a pro forma basis, we would have generated $312.1 million of available cash. The increase in forecasted available cash for the twelve months ending September 30, 2013 compared to our pro forma available cash for the year ended December 31, 2011 is primarily driven by an increase in forecasted

22

refinery utilization. There can therefore be no assurance that we will generate enough available cash to pay distributions of $5.27 per unit, or any distribution at all, with respect to the twelve months ending September 30, 2013, or any future period. For a description of the price assumptions upon which we have based our projected per unit distribution for the twelve months ending September 30, 2013, see “Cash Distribution Policy and Restrictions on Distributions—Forecast Assumptions and Considerations.”

We may have capital needs for which our internally generated cash flows and other sources of liquidity may not be adequate.

If we cannot generate sufficient cash flows or otherwise secure sufficient liquidity to support our short-term and long-term capital requirements, we may not be able to meet our payment obligations, comply with certain deadlines related to environmental regulations and standards or pursue our business strategies, any of which could have a material adverse effect on our results of operations or liquidity. We have substantial short-term capital needs and may have substantial long-term capital needs. Our short-term working capital needs are primarily related to financing our inventory and accounts receivable. Our long-term needs for cash include those to support ongoing capital expenditures for equipment maintenance and upgrades during turnarounds at our refinery and for costs of catalyst replacement and to complete our routine and normally scheduled maintenance, regulatory and security expenditures. For example, we expect to perform our next major turnaround during the first quarter of 2014. We estimate total major turnaround expense at the Big Spring refinery of approximately $23.0 million in the aggregate over a five year turnaround cycle. The refinery is expected to be shut down for a portion of the first quarter of 2014 to complete the turnaround. In addition, from time to time, we are required to spend significant amounts for repairs when one or more processing units experiences temporary shutdowns. We continue to utilize significant capital to upgrade equipment, improve facilities, and reduce operational, safety and environmental risks. We may incur substantial compliance costs in connection with any new environmental, health and safety regulations. In addition, the board of directors of our general partner will adopt a distribution policy pursuant to which we will distribute an amount equal to the available cash we generate each quarter to unitholders. As a result, we will need to rely on external financing sources, including commercial bank borrowings and the issuance of debt and equity securities, to fund our growth. Our liquidity will affect our ability to satisfy any of these needs. The board of directors of our general partner may change our cash distribution policy at any time at its discretion. Our partnership agreement does not require us to pay distributions to our unitholders on a quarterly or other basis. See “Cash Distribution Policy and Restrictions on Distributions.”

The recent recession and credit crisis and related turmoil in the global financial system has had and may continue to have an adverse impact on our business, results of operations and cash flows.

Our business and profitability are affected by the overall level of demand for our products, which in turn is affected by factors such as overall levels of economic activity and business and consumer confidence and spending. Declines in global economic activity and consumer and business confidence and spending have in the past, and may in the future, significantly reduced the level of demand for our products, including by consumers and our wholesale customers. In the past, severe reductions in the availability and increases in the cost of credit have adversely affected our ability to fund our operations and operate our refinery at full capacity, and have adversely affected our operating margins. Together, these factors have had and may in the future have an adverse impact on our business, financial condition, results of operations and cash flows.

Our business is indirectly exposed to risks faced by our suppliers, customers and other business partners. The impact on these constituencies of the risks posed by the recent recession and credit crisis and related turmoil in the global financial system have included or could include interruptions or delays in the performance by counterparties to our contracts, reductions and delays in customer purchases, delays in or the inability of customers to obtain financing to purchase our products and the inability of customers to pay for our products. Any of these events may have an adverse impact on our business, financial condition, results of operations and cash flows.

23

Our unitholders have limited voting rights and are not entitled to elect our general partner or our general partner’s directors.

Unlike the holders of common stock in a corporation, our unitholders have only limited voting rights on matters affecting our business and, therefore, limited ability to influence management’s decisions regarding our business. Unitholders will have no right to elect our general partner or our general partner’s board of directors on an annual or other continuing basis. The board of directors of our general partner, including the independent directors, will be chosen entirely by Alon Energy as the indirect owner of the general partner and not by our common unitholders. Unlike publicly traded corporations, we will not hold annual meetings of our unitholders to elect directors or conduct other matters routinely conducted at annual meetings of stockholders. Furthermore, even if our unitholders are dissatisfied with the performance of our general partner, they will have no practical ability to remove our general partner. As a result of these limitations, the price at which the common units will trade could be diminished.

Our public unitholders will not have sufficient voting power to remove our general partner without Alon Energy’s consent.

Following the closing of this offering, Alon Energy will indirectly own approximately 84.0% of our common units (or approximately 81.6% if the underwriters exercise their option to purchase additional common units in full), which means holders of common units purchased in this offering will not be able to remove the general partner, under any circumstances, unless Alon Energy sells some of the common units that it owns or we sell additional units to the public.

Our partnership agreement restricts the voting rights of unitholders owning 20% or more of our common units (other than our general partner and its affiliates and permitted transferees).

Our partnership agreement restricts unitholders’ voting rights by providing that any units held by a person that owns 20% or more of any class of units then outstanding, other than our general partner, its affiliates, their transferees and persons who acquired such units with the prior approval of the board of directors of our general partner, may not vote on any matter. Our partnership agreement also contains provisions limiting the ability of common unitholders to call meetings or to acquire information about our operations, as well as other provisions limiting the ability of our common unitholders to influence the manner or direction of management.

Cost reimbursements due to our general partner and its affiliates will reduce cash available for distribution to you.

Prior to making any distribution on our outstanding units, we will reimburse our general partner for all expenses it incurs on our behalf including, without limitation, our pro rata portion of management compensation and overhead charged by Alon Energy in accordance with our services agreement. The services agreement does not contain any cap on the amount we may be required to pay pursuant to this agreement. The payment of these amounts, including allocated overhead, to our general partner and its affiliates could adversely affect our ability to make distributions to you. See “Cash Distribution Policy and Restrictions on Distributions,” “Certain Relationships and Related Party Transactions” and “Conflicts of Interest and Fiduciary Duties—Conflicts of Interest.”

Unitholders may have liability to repay distributions and in certain circumstances may be personally liable for the obligations of the partnership.

Under certain circumstances, unitholders may have to repay amounts wrongfully returned or distributed to them. Under Section 17-607 of the Delaware Revised Uniform Limited Partnership Act (the “Delaware Act”), we may not make a distribution to our unitholders if the distribution would cause our liabilities to exceed the fair value of our assets. Delaware law provides that for a period of three years from the date of the impermissible

36

| | • | | speculation in the press or investment community; |

| | • | | sales of our common units by us or other unitholders, or the perception that such sales may occur; |

| | • | | changes in accounting principles; |

| | • | | additions or departures of key management personnel; |

| | • | | actions by our unitholders; |

| | �� | | general market conditions, including fluctuations in commodity prices, in particular the differentials between WTI and Brent crude oils; and |

| | • | | domestic and international economic, legal and regulatory factors unrelated to our performance. |

As a result of these factors, investors in our common units may not be able to resell their common units at or above the initial offering price. In addition, the stock market in general has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of companies like us. These broad market and industry factors may materially reduce the market price of our common units, regardless of our operating performance.

You will incur immediate and substantial dilution in net tangible book value per common unit.

The initial public offering price of our common units is substantially higher than the pro forma net tangible book value of our outstanding units. As a result, if you purchase common units in this offering, you will incur immediate and substantial dilution in the amount of $17.57 per common unit. This dilution results primarily because the assets contributed by Alon Energy and its affiliates are recorded at their historical costs, and not their fair value, in accordance with GAAP. See “Dilution.”

We may issue additional common units and other equity interests without your approval, which would dilute your existing ownership interests.

Under our partnership agreement, we are authorized to issue an unlimited number of additional interests without a vote of the unitholders. The issuance by us of additional common units or other equity interests of equal or senior rank will have the following effects:

| | • | | the proportionate ownership interest of unitholders immediately prior to the issuance will decrease; |

| | • | | the amount of cash distributions on each unit will decrease; |

| | • | | the ratio of our taxable income to distributions may increase; |

| | • | | the relative voting strength of each previously outstanding unit will be diminished; and |

| | • | | the market price of the common units may decline. |

In addition, our partnership agreement does not prohibit the issuance by our subsidiaries of equity interests, which may effectively rank senior to the common units.

Units eligible for future sale may cause the price of our common units to decline.

Sales of substantial amounts of our common units in the public market, or the perception that these sales may occur, could cause the market price of our common units to decline. This could also impair our ability to raise additional capital through the sale of our equity interests.

There will be 62,500,000 common units outstanding following this offering. 10,000,000 common units are being sold to the public in this offering (or 11,500,000 common units if the underwriters exercise their option to purchase additional common units in full) and 52,500,000 common units will be owned indirectly by Alon Energy following this offering (or 51,000,000 common units if the underwriters exercise their option to purchase

38

USE OF PROCEEDS

Based on an assumed initial offering price of $20.00 per common unit, we expect to receive net proceeds of approximately $183.0 million from the sale of 10,000,000 common units offered by this prospectus, after deducting the estimated underwriting discount and offering expenses payable by us. Each $1.00 increase (decrease) in the public offering price would increase (decrease) our net proceeds by approximately $9.3 million (assuming no exercise of the underwriters’ option to purchase additional common units). Each increase of 1.0 million common units offered by us, together with a concurrent $1.00 increase in the assumed public offering price to $21.00 per common unit, would increase net proceeds to us from this offering by approximately $28.8 million. Similarly, each decrease of 1.0 million common units offered by us, together with a concurrent $1.00 decrease in the assumed initial offering price to $19.00 per common unit, would decrease the net proceeds to us from this offering by approximately $27.0 million.

We intend to use the net proceeds of this offering to repay approximately $183.0 million of principal and accrued interest relating to intercompany debt payable by our subsidiaries to Alon Energy and its affiliates.

As of September 30, 2012, we had approximately $346.6 million in intercompany debt payable to Alon Energy and certain of its subsidiaries with a January 2018 maturity and a weighted-average interest rate of approximately 8.0%. It is expected that an additional $51.5 million of intercompany debt payable, which has currently been eliminated in the Alon USA Partners, LP Predecessor combined financial statements, will be transferred to Alon Energy or one of its subsidiaries prior to closing. The transfer will cause the intercompany debt payable to Alon Energy to increase from $346.6 million at September 30, 2012, to approximately $398.1 million. This intercompany debt was incurred to satisfy working capital requirements, fund acquisitions and for general corporate purposes. We expect that the remaining balance of the intercompany debt will be eliminated prior to closing, and we do not expect that we will incur any significant additional intercompany debt following the closing of this offering. In addition, we expect to have approximately $84.0 million and $250.0 million outstanding under our amended and restated revolving credit facility and new term loan facility following the closing of this offering, respectively. We do not currently expect to draw significant amounts under our amended and restated revolving credit facility following the closing of this offering other than in the ordinary course to fund capital expenditures and our working capital needs. For additional information, please see “Capitalization” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation—Liquidity and Capital Resources.”

The net proceeds from any exercise of the underwriters’ option to purchase additional common units (approximately $27.9 million based on an assumed initial offering price of $20.00 per common unit, if exercised in full) will be distributed to Alon Energy in whole or in part as reimbursement for certain pre-formation capital expenditures. If the underwriters do not exercise their option to purchase additional common units, we will issue 1,500,000 common units to Alon Energy at the expiration of the option period. If and to the extent the underwriters exercise their option to purchase additional common units, the number of units purchased by the underwriters pursuant to such exercise will be issued to the public and the remainder, if any, will be issued to Alon Energy. Accordingly, the exercise of the underwriters’ option will not affect the total number of units outstanding or the amount of cash available to pay distributions on our common units. Please read “Underwriting.”

Certain of the underwriters and their affiliates have engaged, and may in the future engage, in commercial banking, investment banking and advisory services for us, Alon Energy and our respective affiliates from time to time in the ordinary course of their business for which they have received customary fees and reimbursement of expenses. Affiliates of certain of the underwriters are expected to be lenders under our new term loan facility. Certain of the underwriters or their affiliates have performed or will perform commercial banking, investment banking and advisory services for Alon Energy during the 180-day period prior to, or the 90-day period following, the date of this prospectus, for which they have received or will receive customary fees and reimbursement or expenses.

45

DILUTION

Purchasers of common units offered by this prospectus will suffer immediate and substantial dilution in net tangible book value per unit. Our pro forma net tangible book value as of September 30, 2012, excluding the net proceeds of this offering, was approximately $(31.3) million, or approximately $(0.60) per unit. Pro forma net tangible book value per unit gives effect to the pro forma adjustments described in the notes to the unaudited pro forma combined financial statements included elsewhere in this prospectus (other than the issuance of common units in this offering and the receipt of the net proceeds from this offering as described under “Use of Proceeds”) and represents the amount of pro forma tangible assets less pro forma total liabilities (excluding the net proceeds of this offering), divided by the pro forma number of units outstanding (excluding the units issued in this offering).

Dilution in net tangible book value per unit represents the difference between the amount per unit paid by purchasers of our common units in this offering and the pro forma net tangible book value per unit immediately after this offering. After giving effect to the sale of common units in this offering at an initial public offering price of $20.00 per common unit, and after deduction of the estimated underwriting discounts and commissions and estimated offering expenses payable by us, our pro forma net tangible book value as of September 30, 2012 would have been approximately $151.7 million, or $2.43 per unit. This represents an immediate increase in net tangible book value of $3.03 per unit to our existing unitholders and an immediate pro forma dilution of $17.57 per unit to purchasers of common units in this offering. The following table illustrates this dilution on a per unit basis:

| | | | | | | | |

Assumed initial public offering price per common unit | | | | | | $ | 20.00 | |

Pro forma net tangible book value per common unit before this offering(1) | | $ | (0.60 | ) | | | | |

Increase in net tangible book value per common unit attributable to purchasers in this offering and the use of proceeds | | | 3.03 | | | | | |

| | | | | | | | |

Less: Pro forma net tangible book value per common unit after this offering(2) | | | | | | | 2.43 | |

| | | | | | | | |

Immediate dilution in net tangible book value per common unit to purchasers in this offering(3) | | | | | | $ | 17.57 | |

| | | | | | | | |

| (1) | Determined by dividing the net tangible book value of the contributed assets less total liabilities by the number of common units to be issued to subsidiaries of Alon Energy and its affiliates. |

| (2) | Determined by dividing our pro forma net tangible book value, after giving effect to the use of the net proceeds of the offering by the total number of common units outstanding after this offering. |

| (3) | For each increase (decrease) in the initial public offering price of $1.00 per common unit, dilution in net tangible book value per common unit would increase (decrease) by $1.00 per common unit. Each increase of 1,000,000 common units offered by us, together with a concurrent $1.00 increase in the assumed public offering price to $21.00 per common unit, would increase net proceeds to us from this offering by approximately $28.8 million. Similarly, each decrease of 1,000,000 common units offered by us, together with a concurrent $1.00 decrease in the assumed initial offering price to $19.00 per common unit, would decrease the net proceeds to us from this offering by approximately $27.0 million. |

47

The following table sets forth the number of units that we will issue and the total consideration contributed to us by our general partner and its affiliates and by the purchasers of our common units in this offering upon consummation of the transactions contemplated by this prospectus:

| | | | | | | | | | | | | | | | |

| | | Units | | | Total Consideration | |

| | | Number | | | Percent | | | Amount | | | Percent | |

Alon Energy | | | 52,500,000 | | | | 84.0 | % | | | (29,400,000 | )(1) | | | (19.2 | )% |

New investors | | | 10,000,000 | | | | 16.0 | % | | | 183,000,000 | (2) | | | 119.2 | % |

| | | | | | | | | | | | | | | | |

Total | | | 62,500,000 | | | | 100 | % | | $ | 153,600,000 | | | | 100 | % |

| | | | | | | | | | | | | | | | |

| (1) | The net assets contributed by Alon Energy were recorded at historical cost in accordance with GAAP. Our partners’ equity, which is the result of contributions by Alon Energy, as of September 30, 2012, was $45.2 million. In addition, Alon Energy will convert $163.6 million of subordinated debt to our partners’ equity and we will assume debt of $250.0 million before debt issuance costs of $11.8 million. |

| (2) | Reflects the net proceeds of this offering after deducting the underwriting discounts and estimated offering expenses payable by us. |

If the underwriters exercise their option to purchase 1,500,000 common units in full, then the pro forma increase per unit attributable to new investors would be $0.04 per unit, the net tangible book value per unit after this offering would be $151.7 million and the dilution per unit to new investors would be $15.91. In addition, new investors would purchase 11,500,000 common units, or approximately 18.4% of units outstanding, and the total consideration contributed to us by new investors would increase to $210.9 million, or 137.3% of the total consideration contributed.

48

prospective financial information contained in this section, nor have they expressed any opinion or any other form of assurance on such information or its achievability, and assume no responsibility for, and disclaim any association with, the prospective financial information. See “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors.”

Unaudited Pro Forma Available Cash

We believe that we would have generated pro forma available cash during the year ended December 31, 2011 and the twelve months ended September 30, 2012 of $312.1 million and $329.4 million, respectively. Based on the cash distribution policy we expect our board of directors to adopt, this amount would have resulted in an aggregate annual distribution equal to $4.99 per common unit for the year ended December 31, 2011 and $5.27 per common unit for the twelve months ended September 30, 2012.

Pro forma available cash reflects the payment of incremental general and administrative expenses we expect that we will incur as a publicly traded limited partnership, such as costs associated with SEC reporting requirements, including annual and quarterly reports to unitholders, tax return and Schedule K-1 preparation and distribution, Sarbanes-Oxley compliance expenses, expenses associated with listing on the NYSE, independent auditor fees, legal fees, investor relations expenses, registrar and transfer agent fees, director and officer insurance expenses and director compensation expenses. We estimate that these incremental general and administrative expenses will be approximately $1.5 million per year. The estimated incremental general and administrative expenses are reflected in our pro forma available cash but are not reflected in our unaudited pro forma combined financial statements.

The unaudited pro forma combined financial statements, from which pro forma available cash is derived, do not purport to present our results of operations had the transactions contemplated below actually been completed as of the date indicated. Furthermore, available cash is a cash accounting concept, while our unaudited pro forma combined financial statements have been prepared on an accrual basis. We derived the amounts of pro forma available cash stated above in the manner described in the table below. As a result, the amount of pro forma available cash should only be viewed as a general indication of the amount of available cash that we might have generated had we been formed and completed the transactions contemplated below in earlier periods.

51

The following table illustrates, on a pro forma basis for the year ended December 31, 2011, and for the twelve months ended September 30, 2012, the amount of cash that would have been available for distribution to our unitholders, assuming that the IPO Transactions had occurred on January 1, 2011:

Alon USA Partners, LP Unaudited Pro Forma Available Cash for Distribution

| | | | | | | | |

| | | Year Ended

December 31,

2011 | | | Twelve Months

Ended September 30,

2012 | |

| | | (in millions except per unit data) | |

Net sales | | $ | 3,208.0 | | | $ | 3,507.7 | |

Operating costs and expenses: | | | | | | | | |

Cost of sales | | $ | 2,722.9 | | | $ | 2,988.9 | |

Direct operating expenses | | | 98.2 | | | | 98.3 | |

Selling, general and administrative expenses | | | 15.6 | | | | 21.5 | |

Depreciation and amortization(a) | | | 40.4 | | | | 45.2 | |

| | | | | | | | |

Operating income | | $ | 330.8 | | | $ | 353.8 | |

Interest expense(b) | | | (37.4 | ) | | | (40.2 | ) |

Interest expense—related parties(c) | | | — | | | | — | |

| | | | | | | | |

Income before state income tax expense | | $ | 293.4 | | | $ | 313.7 | |

State income tax expense | | | (2.6 | ) | | | (3.0 | ) |

| | | | | | | | |

Net income | | $ | 290.8 | | | $ | 310.7 | |

Adjustments to reconcile net income to Adjusted EBITDA: | | | | | | | | |

Interest expense(b) | | $ | 37.4 | | | $ | 40.2 | |

Interest expense—related parties(c) | | | — | | | | — | |

State income tax expense | | | 2.6 | | | | 3.0 | |

Depreciation and amortization(a) | | | 40.4 | | | | 45.2 | |

(Gain) loss on disposition of assets | | | — | | | | — | |

| | | | | | | | |

Adjusted EBITDA | | $ | 371.3 | | | $ | 399.1 | |

| | | | | | | | |

Adjusted EBITDA(d) | | $ | 371.3 | | | $ | 399.1 | |

Adjustments to reconcile Adjusted EBITDA to pro forma available cash: | | | | | | | | |

less: Incremental general and administrative expense(e) | | | (1.5 | ) | | | (1.5 | ) |

less: Capital expenditures | | | (12.5 | ) | | | (18.7 | ) |

less: Turnaround and catalyst replacement capital expenditures(f) | | | (7.1 | ) | | | (8.3 | ) |

less: Turnaround reserve(f) | | | — | | | | — | |

less: Principal payments(g) | | | — | | | | — | |

less: Cash interest expense(b) | | | (35.5 | ) | | | (38.2 | ) |

less: Cash interest expense—related parties(c) | | | — | | | | — | |

less: State income tax expense | | | (2.6 | ) | | | (3.0 | ) |

| | | | | | | | |

Pro forma available cash | | $ | 312.1 | | | $ | 329.4 | |

| | | | | | | | |

Common units outstanding | | | 62,500,000 | | | | 62,500,000 | |

Pro forma available cash per unit | | $ | 4.99 | | | $ | 5.27 | |

52

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ending | | | Twelve Months

Ending

September 30, 2013 | |

| | | December 31,

2012 | | | March 31,

2013 | | | June 30,

2013 | | | September 30,

2013 | | |

| | | (Dollars in millions except per unit and per bbl data) | |

Adjustments to reconcile Adjusted EBITDA to estimated cash available for distribution: | | | | | | | | | | | | | | | | | | | | |

less: Maintenance/growth capital expenditures | | $ | (11.7 | ) | | $ | (6.9 | ) | | $ | (6.9 | ) | | $ | (6.9 | ) | | $ | (32.3 | ) |

less: Turnaround and catalyst replacement capital expenditures | | | — | | | | (2.9 | ) | | | (2.9 | ) | | | (2.9 | ) | | | (8.8 | ) |

less: Major turnaround reserve | | | (1.2 | ) | | | (1.2 | ) | | | (1.2 | ) | | | (1.2 | ) | | | (4.6 | ) |

less: Principal payments | | | — | | | | (0.6 | ) | | | (0.6 | ) | | | (0.6 | ) | | | (1.9 | ) |

less: State income tax expense | | | (0.9 | ) | | | (0.7 | ) | | | (0.7 | ) | | | (0.6 | ) | | | (3.0 | ) |

less: Interest paid in cash | | | (7.5 | ) | | | (7.1 | ) | | | (7.1 | ) | | | (7.1 | ) | | | (28.7 | ) |

| | | | | | | | | | | | | | | | | | | | |

Estimated cash available for distribution before special expenses | | $ | 106.2 | | | $ | 81.0 | | | $ | 85.0 | | | $ | 71.3 | | | $ | 343.4 | |

| | | | | | | | | | | | | | | | | | | | |

less: Special turnaround reserve | | | (3.5 | ) | | | (3.5 | ) | | | (3.5 | ) | | | (3.5 | ) | | | (13.8 | ) |

less: Special wholesale rebranding expenses | | | (0.3 | ) | | | — | | | | — | | | | — | | | | (0.3 | ) |

| | | | | | | | | | | | | | | | | | | | |

Estimated cash available for distribution after giving effect to special expenses | | $ | 102.4 | | | $ | 77.5 | | | $ | 81.5 | | | $ | 67.8 | | | $ | 329.3 | |

| | | | | | | | | | | | | | | | | | | | |

Estimated cash available for distribution per unit | | $ | 1.64 | | | $ | 1.24 | | | $ | 1.30 | | | $ | 1.09 | | | $ | 5.27 | |

Cash distributions to common unitholders after special expenses | | $ | 102.4 | | | $ | 77.5 | | | $ | 81.5 | | | $ | 67.8 | | | $ | 329.3 | |

| | | | | |

Sensitivity analysis: | | | | | | | | | | | | | | | | | | | | |

Changes in estimated cash available for distribution if: | | | | | | | | | | | | | | | | | | | | |

$1/bbl increase in Gulf Coast (WTI) 3-2-1 crack spread | | $ | 5.6 | | | $ | 5.2 | | | $ | 5.1 | | | $ | 4.9 | | | $ | 20.7 | |

$1/bbl increase in realized crude oil price—Cushing WTI differential | | $ | 6.3 | | | $ | 6.0 | | | $ | 6.1 | | | $ | 5.8 | | | $ | 24.3 | |

1,000 bpd increase in throughput | | $ | 2.1 | | | $ | 1.7 | | | $ | 1.8 | | | $ | 1.7 | | | $ | 7.3 | |

| (a) | For definitions of refining operating margin per bbl of throughput and refinery direct operating expenses per bbl of throughput, see “Prospectus Summary—Summary Historical Combined and Pro Forma Combined Financial and Operating Data.” |

| (b) | For a description of Adjusted EBITDA, see “Prospectus Summary—Summary Historical Combined and Pro Forma Combined Financial and Operating Data—Non-GAAP Financial Measure.” |

| * | Total amounts in the table above may not foot due to rounding. |

56

HOW WE MAKE CASH DISTRIBUTIONS

Set forth below is a summary of the significant provisions of our partnership agreement that relate to cash distributions.

Distributions of Available Cash

General

Within 60 days after the end of each quarter, beginning with the quarter ending December 31, 2012, we expect to make distributions, as determined by the board of directors of our general partner, to unitholders of record on the applicable record date.

Common Units Eligible for Distributions

Upon closing of this offering, we will have 62,500,000 common units outstanding. Each common unit will be allocated a portion of our income, gain, loss deduction and credit on a pro forma basis and each common unit will be entitled to receive distributions (including upon liquidation) in the same manner as each other unit.

Method of Distributions

We will distribute available cash to our unitholders, pro rata; provided, however, that our partnership agreement allows us to issue an unlimited number of additional equity interests of equal or senior rank. Our partnership agreement permits us to borrow to make distributions, but we are not required and do not intend to borrow to pay quarterly distributions. Accordingly, there is no guarantee that we will pay any distribution on the units in any quarter.

We do not have a legal obligation to pay distributions, and the amount of distributions paid under our policy and the decision to make any distribution is determined by the board of directors of our general partner. Moreover, we may be restricted from paying distributions of available cash by the instruments governing our indebtedness. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

General Partner Interest

Upon the closing of this offering, our general partner will own a non-economic general partner interest and therefore will not be entitled to receive cash distributions. However, it may acquire common units and other equity interests in the future and will be entitled to receive pro rata distributions therefrom.

63

Loan Agreements and Interest Expense. We had approximately $200.0 million and $84.0 million of borrowings outstanding under our amended and restated revolving credit facility as of December 31, 2011 and September 30, 2012, respectively. We also had approximately $35.5 million and $84.0 million of letters of credit outstanding under our amended and restated revolving credit facility at such respective dates. Borrowings under the amended and restated revolving credit facility bear interest at the Eurodollar rate plus 3.50% per annum subject to an overall minimum interest rate of 4.00%. We also had $333.6 million and $346.6 million of intercompany debt payable to Alon Energy and certain of its subsidiaries at December 31, 2011 and September 30, 2012, respectively. This intercompany debt bears interest at a weighted average rate of approximately 8.0% and was based on prevailing market rates at the time of issue. In connection with this offering and the transactions described under “Prospectus Summary—The IPO Transactions,” we intend to repay approximately $183.0 million of principal and accrued interest relating to intercompany debt with the proceeds of this offering and will assume from Alon Energy a $250.0 million term loan facility, which will be fully drawn at the closing of this offering. We expect that the remaining balance of the intercompany debt will be eliminated prior to closing and we do not expect to incur any significant additional intercompany debt following this offering.

Product Inventory Valuation. Because crude oil and refined products are essentially commodities, we have no control over the changing market value of our inventories. Therefore, the lower the target inventory we are able to maintain, the lesser the impact of commodity price volatility on our petroleum product inventory position. Our inventory of crude oil and refined products is valued at the lower of cost or market value under the last-in-first-out (“LIFO”) cost flow assumption. For periods in which the market price is volatile and the quantity of inventory on hand changes, we are subject to significant fluctuations in the recorded value of our inventory and related cost of products sold. If the market value of our inventory were to decline to an amount less than our LIFO cost, we would record a write-down of inventory and a non-cash charge to cost of sales. Our investment in inventory is affected by the general level of crude oil prices, and significant increases in crude oil prices could result in substantial working capital requirements to maintain inventory volumes. In February 2011, we entered into a supply and offtake agreement with J. Aron and Company (“J. Aron”) under which (i) J. Aron agreed to sell to us, and we agreed to buy from J. Aron, at market prices, crude oil for processing at the Big Spring refinery and (ii) we agreed to sell, and J. Aron agreed to buy, at market prices, certain refined products produced by the Big Spring refinery. We believe that this supply and offtake agreement significantly reduces our crude inventories and reduces the time we are exposed to market fluctuations before the finished product output is sold.

IPO Transactions. In connection with this offering, in addition to entering into the new term loan facility as described above, we will enter into the agreements and complete the reorganization transactions described in “Prospectus Summary—The IPO Transactions,” which we expect will affect the comparability of our results of operations in the following ways:

| | • | | Our general and administrative expenses will increase due to the costs of operating as a publicly traded company, including costs associated with SEC reporting requirements, including annual and quarterly reports to unitholders, tax return and Schedule K-1 preparation and distribution, Sarbanes-Oxley compliance expenses, expenses associated with listing on the NYSE, independent auditor fees, legal fees, investor relations expenses, registrar and transfer agent fees, director and officer insurance expenses and director compensation expenses. We estimate that these incremental general and administrative expenses, which also include increased personnel costs, will be approximately $1.5 million per year, excluding the costs associated with the initial implementation of our Sarbanes-Oxley Section 404 internal controls review and testing. |

| | • | | Historically, our operating expenses have included allocations of certain general and administrative costs from our sponsor for services provided to us by our sponsor. Upon completion of the offering, we will reimburse our general partner and its affiliates for all expenses they incur and payments they make on our behalf in accordance with the services agreement into which we will enter in connection with this offering. The services agreement does not set a limit on the amount of expenses for which our general partner and its affiliates may be reimbursed, and the amount of such charges could vary from historical amounts. |

68

creditworthy customers, whose credit profile may be more closely monitored. Additionally, our distributors take possession of their motor fuels directly from our inventories at fuel terminals in our distribution system, which limits our commodities risk exposure and risk associated with fuel transportation.

Our Relationship with Alon Energy. Our sponsor is an independent refiner and marketer of petroleum products operating primarily in the South Central, Southwestern and Western regions of the United States. As of September 30, 2012, Alon Energy operated 299 convenience stores in Central and West Texas and New Mexico, substantially all of which are branded 7-Eleven and all of which we supply. In connection with this offering, we will also enter into a 20-year fuel supply agreement with Alon Energy pursuant to which we will supply substantially all of the motor fuel requirements of Alon Energy’s retail convenience stores. We believe that access to Alon Energy’s complementary retail business fosters a mutually beneficial commercial relationship that allows us to benefit from our combined economies of scale and purchasing power. We also believe that Alon Energy’s ownership of our general partner and a majority of our common units will serve to align Alon Energy’s interests with ours and promote and support the successful execution of our business strategies.

Experienced and Incentivized Leadership. Our executive officers have an average of over 20 years’ experience in the industry. A number of our executive officers and key operating personnel have spent the majority of their careers operating refineries and have successfully managed our business through multiple industry cycles. We also benefit from the management and marketing expertise provided by Alon Energy, who, following this offering, will own 100% of the voting interests in our general partner and 84.0% of our common units.

Business Strategy

The primary components of our business strategy are:

Distribute All Available Cash We Generate Each Quarter. The board of directors of our general partner will adopt a policy under which distributions for each quarter will equal the amount of available cash (as described in “Cash Distribution Policy and Restrictions on Distributions”) we generate each quarter. We do not intend to maintain excess distribution coverage in order to stabilize our quarterly distributions or to otherwise reserve cash for future distributions. In addition, our general partner has a non-economic interest and no incentive distribution rights, and, accordingly, our unitholders will receive 100% of our cash distributions. The board of directors of our general partner may change our cash distribution policy at any time at its discretion. Our partnership agreement does not require us to pay distributions to our unitholders on a quarterly or other basis. See “Cash Distribution Policy and Restrictions on Distributions.”

Maintain Efficient Refinery Operations and Promote Operational Excellence and Reliability. For the year ended December 31, 2011 and the nine months ended September 30, 2012, our Big Spring refinery maintained a utilization rate of 90.8% and 97.3%, respectively. We intend to continue to operate our refinery as reliably and efficiently as possible to optimize utilization and further improve our operations by maintaining our costs at competitive levels. We will continue to devote significant time and resources toward improving the reliability of our operations. We will also seek to improve operating performance through commitment to our preventive maintenance program and to employee training and development programs.

Enhance Existing Operations and Invest in Organic Growth. We are focused on the profitable enhancement of our existing operations and investment in organic growth by:

| | • | | continuing to make investments to enhance the operating flexibility of our refinery and increase our crude oil sourcing advantage; |

| | • | | evaluating ways to increase the profitability of our Big Spring refinery through cost-effective upgrades and expansions; |

86

MANAGEMENT

Management of Alon USA Partners, LP

We are managed and operated by the board of directors and executive officers of our general partner, Alon USA Partners GP, LLC, an indirect subsidiary of Alon Energy. Our general partner manages our operations and activities subject to the terms and conditions specified in our partnership agreement. Following this offering, Alon Energy will own, directly or indirectly, approximately 84.0% of our outstanding common units. The operations of our general partner in its capacity as general partner are managed by its board of directors. Our unitholders will not be entitled to elect our general partner or its directors or otherwise directly participate in our management or operations. As a result of owning our general partner, Alon Energy will have the right to appoint all of the members of the board of directors of our general partner, including all of our general partner’s independent directors. At least one of our general partner’s independent directors will be appointed prior to the date our common units are listed for trading on the applicable stock exchange. Alon Energy will appoint our general partner’s second independent director within three months of the date our common units begin trading, and our general partner’s third independent director within one year from such date. Our directors will serve until the earlier of their resignation or removal.

Actions by our general partner that are made in its individual capacity will be made by Alon Energy as the owner of the sole member of our general partner and not by the board of directors of our general partner. Our general partner is not elected by our unitholders and will not be subject to re-election on a regular basis in the future. The officers of our general partner will manage the day-to-day affairs of our business.

Limited partners will not be entitled to elect the directors of our general partner or directly or indirectly participate in our management or operation. Our partnership agreement contains various provisions which replace default fiduciary duties with contractual corporate governance standards. See “The Partnership Agreement.” Our general partner will be liable, as a general partner, for all of our debts (to the extent not paid from our assets), except for indebtedness or other obligations that are made expressly non-recourse to it. Our general partner therefore may cause us to incur indebtedness or other obligations that are non-recourse to it.

As a publicly traded partnership, we qualify for, and are relying on, certain exemptions from the NYSE’s corporate governance requirements, including:

| | • | | the requirement that a majority of the board of directors of our general partner consist of independent directors; |

| | • | | the requirement that the board of directors of our general partner have a nominating/corporate governance committee that is composed entirely of independent directors; and |

| | • | | the requirement that the board of directors of our general partner have a compensation committee that is composed entirely of independent directors. |

As a result of these exemptions, our general partner’s board of directors will not consist of a majority of independent directors and our general partner’s board of directors does not currently intend to establish a compensation committee or a nominating/corporate governance committee. Accordingly, unitholders will not have the same protections afforded to equityholders of companies that are subject to all of the corporate governance requirements of the NYSE.

Upon completion of this offering, we expect that the board of directors of our general partner will consist of eight directors.

The board of directors of our general partner will establish an audit committee consisting of members who meet the independence and experience standards established by the NYSE and the Exchange Act. The audit committee’s responsibilities are to review our accounting and auditing principles and procedures, accounting functions, financial reporting and internal controls; to oversee the qualifications, independence, appointment,

100