Exhibit 99.3

SUMMARY

This summary highlights certain information contained elsewhere or incorporated by reference in this offering memorandum. This summary is not complete and does not contain all of the information that you should consider before investing in the notes. You should read this entire offering memorandum carefully, including the information incorporated by reference herein, before investing in the notes. You should read “Risk Factors” beginning on page 21 for information about important risks that you should consider before investing in the notes.

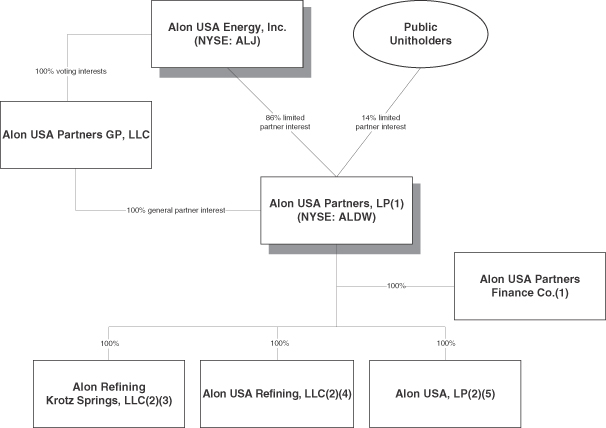

Unless the context otherwise requires, references in this offering memorandum to the “Predecessor,” “we,” “our,” “us” or like terms, when relating to a period prior to November 26, 2012 refer to Alon USA Partners, LP Predecessor, our predecessor for accounting purposes. References when used in the present tense or prospectively give effect to the Krotz Springs Acquisition (as defined herein), which is expected to close concurrently with this offering, and refer to Alon USA Partners, LP and its subsidiaries, including Alon Krotz Springs (as defined herein) also referred to as the “Partnership” or “Alon.” References in this offering memorandum to “our general partner” refer to Alon USA Partners GP, LLC, a Delaware limited liability company and the general partner of the Partnership. References in this offering memorandum to “Alon Finance” refer to Alon USA Partners Finance Co., a wholly owned subsidiary of the Partnership that has no material assets and was formed for the sole purpose of being a co-issuer of certain of our indebtedness. References to “Alon Krotz Springs” refer to Alon Refining Krotz Springs, Inc., a wholly owned subsidiary of Alon Energy, that we will acquire in the Krotz Springs Acquisition. In connection with the Krotz Springs Acquisition, Alon Krotz Springs will convert into a limited liability company. Unless the context otherwise requires, references in this report to “Alon Energy” refer collectively to Alon USA Energy, Inc. and its subsidiaries, other than the Partnership, its subsidiaries and its general partner. We have included a glossary of industry terms in Appendix A hereto.

Alon USA Partners, LP

Overview

We are a Delaware limited partnership formed in August 2012 by Alon USA Energy, Inc. (NYSE: ALJ) to own and operate our strategically located refining and integrated petroleum products marketing business in the South Central and Southwestern United States. Subsequent to the transaction described under “Krotz Springs Acquisition,” we will own and operate two refineries in the Petroleum Administration for Defense District III (“PADD III”) region of the United States, with a combined crude oil throughput capacity of approximately 147,000 barrels per day (“bpd”).

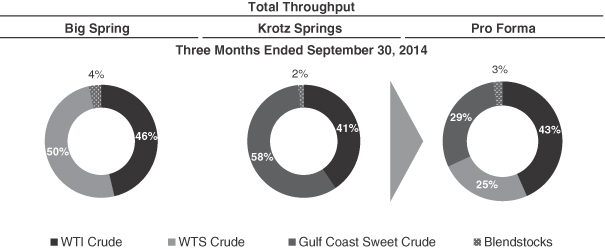

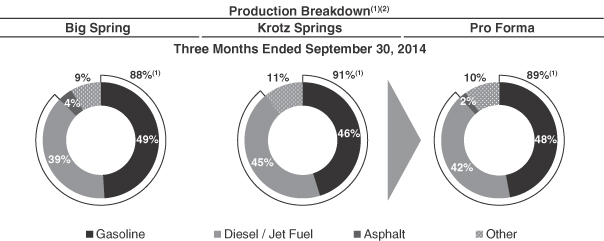

Our Big Spring refinery, located in Big Spring, Texas, is the closest refinery to the prolific Permian Basin in West Texas. Our Big Spring refinery has a crude oil throughput capacity of 73,000 bpd and a Nelson complexity of 10.5. Our configuration and close proximity to the Midland, Texas and Cushing, Oklahoma markets allow us to source and process sour crude oils, such as WTS, and sweet crude oils, such as WTI, each of which currently trades at a considerable discount to imported waterborne crude oils, such as Brent. For the three months ended September 30, 2014, approximately 88% of our Big Spring refinery’s production was comprised of gasoline and distillates, such as diesel fuel and jet fuel, which are primarily marketed through our wholesale distribution network to both Alon Energy’s retail convenience stores and other third-party distributors to markets in West Texas, Central Texas, Oklahoma, New Mexico and Arizona. During the year ended December 31, 2013 and the nine months ended September 30, 2014, our Big Spring refinery had a utilization rate of 94.9% and 97.0%, respectively.