Table of Contents

Filed Pursuant to Rule 424(B)(4)

File Number 333-191554

PROSPECTUS |

2,000,000 Common Shares

Kofax Limited

We are offering 2,000,000 of our common shares at an initial public offering price of $5.85 per common share. Our common shares have been approved for listing on The NASDAQ Global Select Market under the symbol “KFX.” Prior to this offering the ordinary shares of Kofax plc have traded, and subsequent to this offering the common shares of Kofax Limited will trade, on the London Stock Exchange under the symbol “KFX.L.” The last reported sales price of Kofax plc on the London Stock Exchange on December 4, 2013 was 398.25 pence or $6.52 (based on the rate of exchange on that day).

Before buying any common shares, you should carefully consider the risk factors described in “Risk Factors” beginning on page 17. These “Risk Factors” include discussion of our status as an “emerging growth company” under the federal securities laws, and the reduced public company reporting requirements that we are required to comply with based on that status.

We are an “emerging growth company” as defined under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements.

Neither the United States Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

Public Offering Price | $ | 5.85 | $ | 11,700,000 | ||||

Underwriting Discounts and Commissions (1) | $ | 0.351 | $ | 702,000 | ||||

Proceeds, Before Expenses, to the Company | $ | 5.499 | $ | 10,998,000 | ||||

| (1) | See “Underwriting” beginning on page 130 for disclosure regarding compensation payable to the underwriter. |

The underwriter may also purchase up to an additional 300,000 common shares from us at the public offering price, less the underwriting discounts and commissions, within 30 days from the date of this prospectus to cover over-allotments, if any.

The underwriter expects to deliver common shares against payment in New York, New York on or about December 10, 2013.

Craig-Hallum Capital Group

The date of this prospectus is December 5, 2013

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 10 | ||||

| 12 | ||||

| 17 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 44 | ||||

| 45 | ||||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 47 | |||

| 67 | ||||

| 80 | ||||

| 99 | ||||

| 101 | ||||

| 102 | ||||

| 108 | ||||

| 120 | ||||

| 121 | ||||

Cautionary Statement on Service of Process and the Enforcement of Civil Liabilities | 129 | |||

| 129 | ||||

| 130 | ||||

| 133 | ||||

| 133 | ||||

| 133 | ||||

| 133 | ||||

| F-1 | ||||

Consent under the Exchange Control Act 1972 (and its related regulations) has been obtained from the Bermuda Monetary Authority for the issue and transfer of the common shares to and between persons resident andnon-resident of Bermuda for exchange control purposes provided our shares remain listed on an appointed stock exchange, which includes The NASDAQ Global Select Market. In granting such consent the Bermuda Monetary Authority does not accept any responsibility for our financial soundness or the correctness of any of the statements made or opinions expressed in this prospectus.

You should rely only on the information contained in this prospectus. Neither we nor the underwriter have authorized any other person to provide you with information that is different from that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor the underwriter are making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus.

We have not taken any action to permit a public offering of the securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of the securities and the distribution of the prospectus outside the United States.

Table of Contents

This summary highlights information contained in this prospectus. It does not contain all of the information that you should consider in making your investment decision. Before investing in our common shares, you should read this entire prospectus carefully, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Kofax plc and Kofax Limited financial statements and related notes for a more complete understanding of our business and this offering.

Except as otherwise required by the context, references to “Kofax,” “the Company,” “we,” “us” and “our” are to (1) Kofax plc, a public limited company organized under the laws of the United Kingdom, and its subsidiaries, or Kofax (U.K.), for all periods prior to the completion of the scheme of arrangement described below, and (2) Kofax Limited, a Bermuda company, and its subsidiaries, or Kofax (Bermuda), for all periods after the completion of the scheme of arrangement.

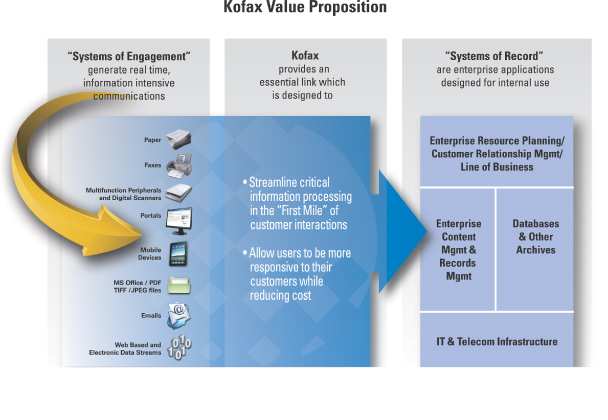

WHO WE ARE

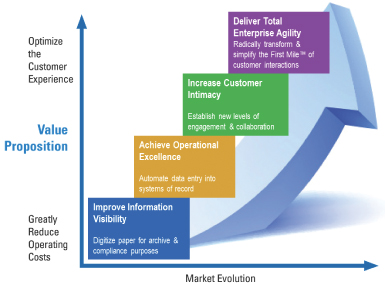

We are a leading provider of smart process applications software and related maintenance and professional services for the critical First Mile™ of interactions between businesses, government agencies and other organizations (collectively, organizations) and their customers, citizens, vendors, employees and other parties (collectively, constituents). The First Mile represents those initial information-intensive interactions customers have with organizations. Our software enables organizations to design, deploy, and operate comprehensive systems that create an essential link between their systems of engagement, which generate real time, information-intensive communications from constituents, and their systems of record, which are typically large scale enterprise applications and repositories used to manage their internal operations. Our software is designed to streamline critical information processing, which we believe allows our users to be more responsive to their constituents and is intended to enable our customers to provide better service, gain competitive advantage and grow their organizations while reducing their costs and improving their regulatory compliance.

We operate on a global basis, and as of June 30, 2013, we had 1,248 employees located in 32 countries. We utilize a hybrid go-to-market model that delivers our software and services through both our direct sales and service employees and an indirect channel of more than 850 authorized resellers, original equipment manufacturers and distributors located in more than 75 countries as of June 30, 2013. We have approximately 20,000 active installations of our software with users in financial services, insurance, government, healthcare, supply chain (manufacturing, distribution, retail and logistics), business process outsourcing and other vertical markets, including 67 of the Fortune Global 100 companies.

Our annual total revenue grew from $170.0 million for the fiscal year ended June 30, 2009, to $266.3 million for the fiscal year ended June 30, 2013, representing a compound annual growth rate (CAGR) of 11.9%. During this same period, our income from operations grew from $3.4 million to $25.1 million, representing a CAGR of 64.8%, and our income from operations as a percentage of total revenue increased from 2.0% to 9.4%. On a non-IFRS basis, our adjusted income from operations grew from $18.0 million to $46.7 million, representing a CAGR of 26.9%, and our adjusted income from operations as a percentage of total revenue grew from 10.6% to 17.5%. For a reconciliation of IFRS income from operations to non-IFRS adjusted income from operations, see “Summary Historical Consolidated Financial Data—Non-IFRS Measures.”

THE CHALLENGE

The business challenge arising in First Mile interactions is that their flow is often controlled by inflexible systems of record, which can make them labor intensive, slow and prone to errors and can adversely affect a customer’s perception of the business. Systems of record are generally large scale, expensive and typically rigid

1

Table of Contents

enterprise applications and repositories of enterprise resource planning (ERP), customer relationship management (CRM), enterprise content management (ECM), records management and other systems that organizations use to manage their internal operations.

Systems of engagement are the ways in which organizations interact with their customers. They range from face to face interactions at “brick and mortar” branch offices to web portals to other demand generating activities that drive customers to an organization’s web or social media sites. An organization’s systems of engagement generate an enormous amount and variety of real time, information intensive communications from constituents on a daily basis via paper, faxes, emails, internet portals, mobile devices, Electronic Data Interchange and eXtensible Markup Language data streams, short message services, multimedia messaging services and other sources, all of which need to be processed in an accurate, timely, and cost effective manner. These communications arrive as both structured and unstructured information in the form of letters, resumes, new account enrollments, loan applications, insurance claims, purchase orders, invoices, regulatory filings and many other interactions.

The information in these communications must be captured, extracted, validated, analyzed and acted upon, and then delivered into an organization’s systems of record for additional processing, use and storage in repositories for archive and retrieval purposes. Delays and errors caused by invalid information and inconsistent processing can adversely impact an organization’s competitive positioning, finances, financial reporting and relations with its constituents and regulatory agencies.

Traditional methods for accomplishing the tasks referenced above typically begin with the aggregation of paper-based documents in a central location or mailroom. The documents are then distributed to relatively highly paid workers who manually enter information into systems of record, before storing the documents in cabinet-based filing systems. The continued use of these paper-based processes is substantiated by data from numerous independent sources. For example, in March 2010, CNN reported that organizations archive 62% of their important documents in paper form. More recently in July 2013, Harvey Spencer Associates estimated that organizations globally spend approximately $25-30 billion a year manually keying information from paper documents.

As a result of these challenges, we believe there is a significant opportunity to automate these processes and thereby address these challenges and limitations.

OUR SOLUTION

Our smart process applications software combines industry leading capture, business process management and dynamic case management, mobile and analytics capabilities to automate the labor-intensive processes needed to capture and extract information, and then analyze, act upon and deliver that information to systems of record.

Smart process applications are a new category of software designed to support business activities that are people-intensive, highly variable, loosely structured and subject to frequent change. Our smart process applications software allows users to scan paper-based communications using desktop scanners, high volume, production level scanners and multi-function peripherals, to take pictures of those communications using cameras in mobile devices to produce digital images and import communications received in an electronic format. Regardless of how the information is captured, any related images are then automatically enhanced for better viewing and information extraction purposes. The captured information is separated into logical parts such as pages, documents and attachments. A variety of optical character recognition, intelligent character recognition, barcode recognition, mark sense, parsing algorithms, and other extraction technologies are then automatically applied. Our users only have to manually correct or enter any erroneous or suspicious information or any

2

Table of Contents

additional content that cannot be effectively captured using automated information extraction technologies. “Check box” and complex custom business rules can also be automatically applied to all extracted information to ensure its accuracy and validity.

Our software then automates the labor-intensive processes needed to analyze, act upon and deliver that information to systems of record. Additional business rules are applied to identify and resolve any inconsistencies or exceptions that arise, users can collaborate with constituents to obtain missing or trailing documents, and users can view and manipulate graphical reports produced by our analytics software in order to make more intelligent decisions sooner than otherwise possible. The resulting information from such interactions is then automatically delivered into systems of record. The entire process is automatically directed and controlled by predefined workflows and incorporates dynamic case management capabilities to deal with unpredictable workflow requirements.

In its July 2013 report, “The 2013-2014 Worldwide Market for Document Capture Software,” Harvey Spencer Associates reported that in 2012 Kofax was the leading revenue vendor with 14% share. In August 2012 Forrester published its “Wave” for Multichannel Capture, or the ability to capture information from a wide variety of different sources, and ranked Kofax as the “Leader” in providing those capabilities. In addition, in January 2013 Forrester published the results of a study commissioned by Kofax, and reported that in 2012 Kofax had a market leading 15% share of the Multichannel Capture market.

Kofax TotalAgility, our business process and dynamic case management software, was shown to be “Visionary” in Gartner’s April 2011 “Magic Quadrant” for Business Process Management (BPM) and a “Leader” in Forrester’s January 2011 “Wave” for Dynamic Case Management. In addition, Kofax was shown as a “Leader” Forrester’s April 2013 “Wave” for Smart Process Applications. As a result of this independent recognition and our business strengths, we believe we can secure a meaningful share of the BPM and smart process applications software markets.

OUR OPPORTUNITY

In June 2010, Gartner reported that chief information officers ranked improving business processes and reducing costs as two of their top three priorities. In November 2010, the Association for Image and Information Management (AIIM), reported that image and content capture yield two of the three fastest returns on investment of any enterprise application software expenditures. Further, 42% of capture users surveyed by AIIM in 2012 report returns on investment of 12 months or less and 57% report returns on investment of 18 months or less.

In April 2012, AIIM published a separate report that estimated the following survey responses:

| • | One out of three small and medium sized businesses and 22% of the largest businesses have yet to adopt any paper free processes; |

| • | 10% or less of the processes that could be paper free have in fact been addressed; |

| • | 70% of survey respondents believed the use of scanning and automated capture improves the speed of responses to constituents by three times or more, and nearly 30% believe the factor is ten times or more; |

| • | 52% believe administrative staff would be 33% or more productive if processes were automated using capture-based technology; and |

| • | Two out of three consider mobile technologies to be important or extremely important to improving business processes, and 45% believe mobile devices would improve the speed of responses to constituents by three times or more. However, more than 75% have made no progress in taking advantage of this opportunity. |

3

Table of Contents

We believe that the size of the market for our smart process applications software can be best estimated by combining the market for capture software and services, the market for BPM software and the market for vertically oriented information-intensive smart process applications that fit our strength in addressing the First Mile™ challenge of business. Capture software automates the labor intensive processes needed to enter business critical information into enterprise applications and repositories. BPM software automates the labor intensive processes needed to understand and act upon that business critical information. Smart process applications software combines capture, business process and dynamic case management, mobile and analytics capabilities to automate the labor-intensive processes needed to capture and extract information, and then analyze, act upon and deliver that information to systems of record.

A July 2013 Harvey Spencer Associates report estimated that the market for capture software and services will grow from approximately $2.7 billion in 2012 to approximately $4.2 billion in 2017, a CAGR of almost 9.2%. In July 2013, Gartner stated that the total market value for business process management suites (BPMS) in 2012 was $2.3 billion and that growth for the years up to 2017 is expected to grow at a compound annual growth rate of 10% over the next five years. These reports suggest that these markets reached $5 billion in calendar 2012.

In January 2013 Forrester published the results of a study commissioned by Kofax, and estimated that the software and maintenance services market for capture, BPM and vertically-oriented information-sensitive smart process applications totaled $7.1 billion in 2012 and will grow to $14.0 billion in 2016, a CAGR of approximately 18%.

OUR BUSINESS STRENGTHS

We believe the following business strengths position us to capitalize on the opportunity for our smart process applications software and compete effectively in the market:

| • | Comprehensive Solutions—Our software allows users to design, deploy, and operate comprehensive systems that connect their systems of engagement with their systems of record, transforming and simplifying the First Mile™ of interactions between organizations and their constituents in a way that is designed to produce an optimized constituent experience and reduced operating costs, which we believe enables our customers to achieve increased competitiveness, growth and profitability. It is a highly flexible and scalable platform that combines industry leading capture, business process and dynamic case management, mobile and analytics capabilities to automate the labor-intensive processes needed to capture and extract information, and then analyze, act upon and deliver that information to systems of record. In addition to our software, we offer a wide range of related professional and maintenance services to better address the deployment and support needs of our users and channel partners, which helps us achieve a greater level of customer satisfaction. |

| • | Large and Diversified User Base—We had approximately 20,000 active installations across more than 100 countries as of June 30, 2013. We serve users in the financial services, insurance, government, healthcare, supply chain, business process outsourcing and other vertical markets. Most users initially license our software to automate one or several processes in a single geographic region, business unit, line of business, function, or department. Over time, many users license additional software to automate other processes and some eventually enter into enterprise-wide license arrangements. As a result, we believe we are well positioned to take advantage of additional opportunities within the same organizations. In addition, we believe our large number of users effectively gives us preferential access to a greater share of the market. We have minimal user concentration, with no user having accounted for more than 5% of our total revenue for the fiscal year ended June 30, 2013. |

| • | Global Reach and Hybrid Go-to-Market Model—We operate on a global basis, with 1,248 employees located in 32 countries as of June 30, 2013. We utilize a hybrid go-to-market model that delivers our software and services through our own direct sales and service employees, as well as through an indirect |

4

Table of Contents

channel of more than 850 authorized resellers, original equipment manufacturers and distributors located in more than 75 countries as of June 30, 2013. Our direct sales and service employees focus their attention on large corporations and government entities, while our indirect channel allows us to better reach small and medium sized organizations and departments of larger organizations. This hybrid go-to-market strategy allows us to penetrate a much broader portion of the market. |

| • | Recurring Revenue Streams—We have significant recurring revenue streams attributable to our maintenance services and to our software license and royalty revenue generated from sales by our channel partners. We have historically had a significant portion of our users renew their maintenance service agreements with us, typically on an annual basis. Our maintenance services revenue was $121.8 million and $113.8 million, representing 45.7% and 43.3% of our total revenue, for the fiscal years ended June 30, 2013 and 2012, respectively. |

| • | Experienced Management Team—Our executive management team and other senior management employees have on average, more than 25 years of software industry experience. We believe that our management team has been, and will continue to be, instrumental in growing our business, both organically and through acquisitions. |

OUR GROWTH STRATEGY

Our objective is to extend our position as a leading provider of smart process applications software and related services. We intend to pursue this objective by executing these key strategies:

| • | Broaden Our Software Offerings and Markets—We believe mobile devices will rapidly transform the way in which interactions occur between organizations and their constituents. Our recently introduced mobile software offers patented functionality that pushes capture and BPM capabilities to the “Point of Origination™”, the time and location where constituent interactions occur and the information is first available. We intend to continue to extend and improve the functionality of these capabilities to take advantage of the opportunity for mobile capabilities. |

We have historically offered our software under a perpetual license model for on-premise or private cloud deployments, and recently began offering portions of it through both a public cloud-based hosted Software-as-a-Service (SaaS) subscription offering and through term-based on premise software licenses. We intend to accelerate the SaaS initiative and eventually offer substantially all of our software as a SaaS offering. We believe that the SaaS offering will allow users to avoid significant capital expenditures and other on-premise deployment costs, while providing immediate access to all of the benefits of our software. We additionally believe that our term-based licenses will attract customers that otherwise may not license our software on a perpetual basis. The software that we acquired through our July 2013 acquisition of Kapow Technologies Holdings, Inc. is predominantly licensed on a term-based model. While we believe that these offerings will ultimately broaden our existing market reach, we did not record a significant amount of revenue from our SaaS offering nor our term-based licenses in fiscal 2013. Additionally, we do not expect that revenue from our SaaS or term-based offerings will adversely affect revenue from perpetual licenses in fiscal 2014.

We also intend to continue to enhance and further develop our proven technologies and introduce new software for sale to our existing users, new users in existing vertical markets and new users in new vertical markets. We believe these new initiatives offer significant opportunities to grow both our addressable market and revenue.

| • | Further Penetrate Our Installed User Base—Most users initially license our software to automate one or several processes in a single geographic region, business unit, line of business, function or department rather than doing so on an enterprise-wide basis. Over time many users license additional software to automate other processes and some eventually enter into enterprise-wide license |

5

Table of Contents

arrangements. As a result, we believe that there are significant opportunities to expand our revenue by selling additional software and services into our large and growing installed user base. As evidence of this, in the fiscal year ended June 30, 2013, our existing user base generated more than half of our software licenses revenue. |

| • | Expand and Optimize Our Hybrid Go-To-Market Model—In the fiscal year ended June 30, 2013 we derived approximately 46% of our total revenue from direct sales and approximately 54% from sales made through our indirect channel, and in the fiscal year ended June 30, 2012 we derived approximately 43% of our total revenue from direct sales and approximately 57% from sales made through our indirect channel. We intend to grow our revenue by improving the execution and productivity of both of these “routes to market” and by adding new direct sales and service employees and channel partners. |

| • | Pursue Strategic Acquisitions—We believe that strategic acquisitions will allow us to better serve the needs of our users, expand our software offerings, augment our routes to market, expand our market opportunities, and broaden our user base. Our executive management team has substantial experience in successfully effecting acquisitions of software businesses and integrating these entities into our business operations. Recent examples of executing on this strategy include our acquisitions ofOptiInvoice Digital Technology AB in October 2008 (electronic invoice capabilities),170 Systems, Inc. in September 2009 (accounts payable automation solutions),Atalasoft Corp.in May 2011 (web capture capabilities),Singularity Limited in December 2011 (BPM and dynamic case management capabilities),Altosoft, Corp. in March 2013 (business intelligence and analytics capabilities) andKapow Technologies Holdings, Inc. in July 2013 (data integration). In the future we intend to evaluate and pursue similar opportunities. |

CORPORATE STRUCTURE

Kofax (U.K.) is currently organized as a public limited company under the laws of England and Wales. A company organized under the laws of England and Wales is not permitted to directly list its common equity (as opposed to depositary interests) on The NASDAQ Global Select Market. Under English law, it is not possible to change the place of incorporation of Kofax (U.K.) from one jurisdiction to another, requiring us to establish Kofax (Bermuda) as the new parent company of Kofax (U.K.). Accordingly, subject to the scheme of arrangement becoming effective, and prior to the closing of this offering, Kofax (U.K.) will become a wholly-owned subsidiary of Kofax (Bermuda). Kofax (Bermuda) was incorporated solely for this purpose. Prior to the Migration (as defined below), Kofax (Bermuda) has or will have nominal assets and has had no historic operations.

The establishment of Kofax (Bermuda) as the new parent company of Kofax (U.K.) will be achieved through a scheme of arrangement under Part 26 of the U.K. Companies Act of 2006. Pursuant to the scheme of arrangement, the shareholders of Kofax (U.K.) have agreed to have their ordinary shares in Kofax (U.K.) cancelled in consideration for (i) the issuance to those shareholders of common shares in Kofax (Bermuda) and (ii) the issuance by Kofax (U.K.) of new shares to Kofax (Bermuda). The scheme of arrangement provides for one common share of Kofax (Bermuda) to be issued in exchange for each ordinary share of Kofax (U.K.).

The scheme of arrangement will have no effect on the manner in which our business is conducted. We refer to the transactions contemplated by the scheme of arrangement throughout this prospectus as the “Migration.” Depending upon the Kofax (U.K.) share price at the effective date of the scheme of arrangement, Kofax (Bermuda) may decide to implement a share capital consolidation (also known as a reverse stock split) on a one for two basis, in respect of the common shares of Kofax (Bermuda) issued pursuant to the scheme of arrangement. This would be done in order to enable the common shares of Kofax (Bermuda) to trade initially on The NASDAQ Global Select Market at a price more readily comparable to its peers.

6

Table of Contents

Although the Company is incorporated in and organized under the laws of Bermuda, the directors intend that the affairs of the Company should be managed and conducted so that it will be resident in the United Kingdom for tax purposes. No guarantee can be given that the Company will be respected as a United Kingdom resident for tax purposes.

RISK FACTORS

Before investing in our common shares you should carefully consider all of the information in this prospectus, including matters set forth under the heading “Risk Factors.” Risks relating to our business include, among other things:

| • | our ability to successfully meet anticipated revenue levels from sales of our software licenses and services; |

| • | our ability to successfully develop, market or sell new products or adopt new technology platforms; |

| • | our ability to continue to grow through acquisitions or investments in other companies or technologies; |

| • | our ability to realize the anticipated benefits of our consummated acquisitions or investments in other companies or technologies; |

| • | risks related to the continued uncertainty in the global financial markets and unfavorable global economic conditions; and |

| • | certain other risks set forth under the heading “Risk Factors” as well as factors that we may not have identified at this time. |

RECENT DEVELOPMENTS

Set forth below is certain limited unaudited financial information as of and for the three months ended September 30, 2013. Kofax (U.K.), which is listed on the London Stock Exchange, provided substantially all of this financial information in a press release issued on November 5, 2013.

As reported under IFRS:

| Three Months Ended September 30, | ||||||||||||||||

| 2013 | 2012 | $ Change | % Change | |||||||||||||

| ($ in thousands, except share amounts) | ||||||||||||||||

Software licenses | $ | 24,444 | $ | 22,132 | $ | 2,312 | 10.4 | % | ||||||||

Maintenance services | 32,098 | 29,876 | 2,222 | 7.4 | % | |||||||||||

Professional services | 8,870 | 8,127 | 743 | 9.1 | % | |||||||||||

|

|

|

|

|

| |||||||||||

Total revenue | $ | 65,412 | $ | 60,135 | $ | 5,277 | 8.8 | % | ||||||||

|

|

|

|

|

| |||||||||||

Income (loss) from operations | $ | (624 | ) | $ | 45 | $ | (669 | ) | (1,486.7 | %) | ||||||

|

|

|

|

|

| |||||||||||

Diluted earnings (loss) per share | $ | 0.03 | $ | (0.01 | ) | $ | 0.04 | 400.0 | % | |||||||

|

|

|

|

|

| |||||||||||

Cash flows from operations | $ | 18,406 | $ | 8,608 | $ | 9,798 | 113.8 | % | ||||||||

|

|

|

|

|

| |||||||||||

At September 30, 2013 we had $72.0 million of cash and cash equivalents compared to $93.4 million at June 30, 2013, a reduction of $21.4 million. That reduction in cash and cash equivalents was primarily due to our having paid an acquisition payment of $39.1 million in conjunction with the acquisition of Kapow on July 31, 2013, offset by $18.4 million of cash flows from operations.

7

Table of Contents

Total revenue increased $5.3 million, or 8.8%, in the three months ended September 30, 2013 compared to the three months ended September 30, 2012 due to a $1.6 million increase associated with our acquisitions of Altosoft and Kapow and a $3.7 million, or 6.1%, increase in organic revenue. Our organic revenue is discussed elsewhere in this prospectus under “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” noting for purposes of measuring our organic performance for the three months ended September 30, 2013 as compared to the three months ended September 30, 2012, we have excluded all results for Altosoft (acquired in March 2013) and Kapow (acquired in July 2013).

Software licenses revenue increased $2.3 million, or 10.4%, in the three months ended September 30, 2013 compared to the three months ended September 30, 2012 due to a $0.7 million increase associated with our acquisitions of Altosoft and Kapow and a $1.6 million increase in organic software licenses revenue. Organic license revenue increased $1.1 million in the Americas and $0.7 million in EMEA, partially offset by a $0.2 million decrease in Asia Pacific.

Maintenance services revenue increased $2.2 million, or 7.4%, in the three months ended September 30, 2013 compared to the three months ended September 30, 2012 due to a $0.3 million increase associated with our acquisitions of Altosoft and Kapow and a $1.9 million, or 6.3%, increase in organic maintenance services revenue. Our organic maintenance services revenue increase was due primarily to continued high maintenance contract renewal rates as well as to the expansion of our installed base from new software license transactions during fiscal 2013.

Professional services revenue increased $0.7 million, or 9.1%, in the three months ended September 30, 2013 compared to the three months ended September 30, 2012 due to a $0.6 million increase associated with our acquisitions of Altosoft and Kapow and a $0.1 million increase in our organic professional services revenue.

Income (loss) from operations decreased $0.7 million or, 1,486.7%, in the three months ended September 30, 2013 compared to the three months ended September 30, 2012 due to a $6.0 million increase in total operating costs and expenses primarily associated with higher sales and marketing expenses, partially offset by the $5.3 million increase in total revenue.

Diluted earnings (loss) per share increased $0.04, or 400.0%, in the three months ended September 30, 2013 compared to the three months ended September 30, 2012 due primarily to a $3.8 million increase in finance income (expense), net, partially offset by the $0.7 million decrease in income (loss) from operations.

Cash flows from operations increased $9.8 million in the three months ended September 30, 2013 compared to the three months ended September 30, 2012 due to a $7.5 million increase in collections of accounts receivables and an increase in deferred income of $4.1 million, offset by an increase in outflows of trade and other payables.

8

Table of Contents

Non-IFRS measures:

Set forth below are certain non-IFRS measures as of and for the three months ended September 30, 2013. For a discussion of our non-IFRS measures, see “Summary Historical Consolidated Financial Data—Non-IFRS Measures.”

| Three Months Ended September 30, | ||||||||||||||||

| 2013 | 2012 | $ Change | % Change | |||||||||||||

| ($ in thousands, except per share data) | ||||||||||||||||

Adjusted software licenses | $ | 25,959 | $ | 22,175 | $ | 3,784 | 17.1 | % | ||||||||

Adjusted maintenance services | 32,405 | 29,876 | 2,529 | 8.5 | % | |||||||||||

Adjusted professional services | 9,184 | 8,127 | 1,057 | 13.0 | % | |||||||||||

|

|

|

|

|

| |||||||||||

Total Non-IFRS revenue | $ | 67,548 | $ | 60,178 | $ | 7,370 | 12.2 | % | ||||||||

|

|

|

|

|

| |||||||||||

Adjusted income from operations | $ | 8,283 | $ | 6,257 | $ | 2,026 | 32.4 | % | ||||||||

|

|

|

|

|

| |||||||||||

Adjusted diluted earnings per share | $ | 0.05 | $ | 0.04 | $ | 0.01 | 25.0 | % | ||||||||

|

|

|

|

|

| |||||||||||

Adjusted cash flows from operations | $ | 19,808 | $ | 11,299 | $ | 8,509 | 75.3 | % | ||||||||

|

|

|

|

|

| |||||||||||

The increases in the three months ended September 30, 2013 compared to the three months ended September 30, 2012 for adjusted software licenses revenue, adjusted maintenance services revenue, adjusted professional services revenue, adjusted income from operations and adjusted diluted earnings per share can each be attributed to the same factors as the corresponding IFRS measures. In addition, these non-IFRS measures also include the impact of the change in the acquisition fair value adjustment to revenue. The acquisition fair value adjustment to revenue increased $2.1 million in the three months ended September 30, 2013 compared to the three months ended September 30, 2012 due primarily to the Kapow acquisition.

The increase in adjusted cash flows from operations was attributable to the same factors as the IFRS cash flows from operations except for the changes in outflows of income taxes paid and payments under restructuring-personnel, which are excluded from the adjusted cash flows from operations measure. Outflows of income taxes paid decreased $0.5 million, and payments under restructuring-personnel decreased $0.7 million in the three months ended September 30, 2013 compared to the three months ended September 30, 2012.

Forward Looking Statement

Additionally, we reported that while we remain aware of the prevailing unpredictable nature of global macroeconomic conditions, we are confident in our outlook and reaffirm our previous guidance for fiscal year 2014, which was, on an IFRS basis, low double digits percentage for software licenses revenue growth and mid to high single digits percentage for total revenue growth and, on a non-IFRS basis, mid to high teens percentage for software licenses revenue growth and low double digits percentage for total revenue growth. You should refer to the sections “Risk Factors” and “Forward-Looking Statements” for a discussion of factors that may affect our ability to achieve our future results.

CORPORATE INFORMATION

Our principal executive offices are located at 15211 Laguna Canyon Road, Irvine, California 92618, our telephone number is(949) 783-1000 and our Internet website address is www.kofax.com. We do not incorporate the information on our website into this prospectus and you should not consider any information on, or that can be accessed through, our website as part of this prospectus.

9

Table of Contents

Common shares offered by us | 2,000,000 shares |

Common shares to be outstanding immediately after this offering | 91,638,519 shares |

Over-allotment Option | We have granted to the underwriter an option, which is exercisable within 30 days from the date of this prospectus, to purchase up to 300,000 additional common shares to cover over-allotments, if any. |

Use of Proceeds | We estimate the net proceeds to us from this offering will be approximately $7.7 million, after deducting the underwriting discounts and commissions and the estimated offering expenses payable by us. We intend to use the net proceeds from this offering for general corporate purposes. Pending our use of the net proceeds as described above, we intend to invest the net proceeds in short-term bank deposits or interest-bearing, investment-grade securities. See “Use of Proceeds.” |

Dividend Policy | We do not currently pay dividends. See “Dividend Policy.” |

Risk Factors | Investing in our common shares involves a high degree of risk. You should read and consider the information set forth under the heading “Risk Factors” beginning on page 17 and all other information included in this prospectus before deciding to invest in our common shares. |

Trading Market | Our common shares have been approved for listing on The NASDAQ Global Select Market under the symbol “KFX.” Prior to this offering, the ordinary shares of Kofax (U.K.) have traded, and subsequent to this offering the common shares of Kofax (Bermuda) will trade, on the London Stock Exchange under the symbol “KFX.L.” |

Share Registrar and Transfer Agent | A register of holders of our common shares will be maintained by Codan Services Limited in Bermuda, and Computershare Trust Company, N.A. will serve as transfer agent and registrar and maintain a branch register of holders of our common shares. |

The number of our common shares that will be issued and outstanding immediately after this offering is based on 89,638,519 common shares of Kofax (U.K.) outstanding as of June 30, 2013, and excludes:

| • | 5,061,862 common shares issuable upon the exercise of outstanding options granted under the Kofax plc 2000 Share Option Plan and 323,900 common shares issuable upon the exercise of outstanding options granted under the 2012 Equity Incentive Plan at a weighted average exercise price of 211 pence ($3.22, based on the exchange rate on June 30, 2013) per share; and |

| • | 2,800,529 common shares issuable upon the settlement of outstanding conditional share awards granted under the Kofax plc Long Term Incentive Plan and 485,000 common shares issuable upon the settlement of outstanding conditional share awards granted under the 2012 Equity Incentive Plan. |

10

Table of Contents

Except as otherwise indicated, all information in this prospectus assumes no exercise of the underwriter’s over-allotment option and any reverse stock split that may be implemented by Kofax (Bermuda).

Emerging Growth Company

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended, or the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, and the requirement to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in the registration statement of which this prospectus forms a part. We are currently utilizing or intend to utilize both of these exemptions. We have not made a decision whether to take advantage of any other exemptions available to emerging growth companies. We do not know if some investors will find our common shares less attractive as a result of our utilization of these or other exemptions. The result may be a less active trading market for our common shares and our share price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We currently prepare our financial statements in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB), which do not have separate provisions for publicly traded and private companies. However, in the event we convert to U.S. GAAP while we are still an “emerging growth company”, we may be able to take advantage of the benefits of this extended transition period.

We will remain an “emerging growth company” until the earliest of (a) the last day of the first fiscal year in which our annual gross revenues exceed $1.0 billion, (b) the date that we become a “large accelerated filer” as defined in Rule12b-2 under the Exchange Act, which would occur if the market value of our common shares that are held bynon-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, (c) the date on which we have issued more than $1.0 billion in nonconvertible debt during the preceding three-year period or (d) the last day of our fiscal year containing the fifth anniversary of the date on which our shares become publicly traded in the United States.

11

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The tables below present the summary historical consolidated financial data of Kofax (U.K.) and its consolidated subsidiaries, which upon effectiveness of the Migration and prior to the consummation of this offering, directly or indirectly, will be wholly-owned subsidiaries of Kofax (Bermuda). The summary historical consolidated financial data of Kofax (U.K.) and its consolidated subsidiaries as of June 30, 2013 and 2012, and for the years ended June 30, 2013 and 2012 has been derived from Kofax (U.K.)’s audited consolidated income statements, statements of financial position and statements of cash flows for those periods, which are included elsewhere in this prospectus. The consolidated financial statements have been prepared and presented in accordance with IFRS as issued by the IASB.

The following summary historical consolidated financial data should be read in conjunction with our audited historical consolidated financial statements and the related notes thereto and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” each of which is included elsewhere in this prospectus. The historical results for any prior period are not necessarily indicative of results to be expected for any future period.

| Fiscal Year Ended June 30, | ||||||||

| 2013 | 2012 | |||||||

(in thousands, except per share data) | ||||||||

Software licenses | $ | 112,228 | $ | 117,255 | ||||

Maintenance services | 121,751 | 113,784 | ||||||

Professional services | 32,339 | 31,442 | ||||||

|

|

|

| |||||

Total revenue | 266,318 | 262,481 | ||||||

|

|

|

| |||||

Cost of software licenses | 10,688 | 11,301 | ||||||

Cost of maintenance services | 18,194 | 16,420 | ||||||

Cost of professional services | 28,343 | 26,784 | ||||||

Research and development | 34,686 | 33,804 | ||||||

Sales and marketing | 98,209 | 96,292 | ||||||

General and administrative | 37,286 | 39,096 | ||||||

Amortization of acquired intangible assets | 6,707 | 5,190 | ||||||

Acquisition-related costs | 4,682 | 5,870 | ||||||

Restructuring costs | — | 4,917 | ||||||

Other operating expenses, net | 2,395 | 669 | ||||||

|

|

|

| |||||

Operating costs and expenses | 241,190 | 240,343 | ||||||

|

|

|

| |||||

Income from operations | 25,128 | 22,138 | ||||||

Finance income (expense), net | (6,929 | ) | 5,294 | |||||

|

|

|

| |||||

Income from continuing operations, before income taxes | 18,199 | 27,432 | ||||||

Income tax expense | (8,198 | ) | (9,995 | ) | ||||

|

|

|

| |||||

Income from continuing operations, after income taxes | $ | 10,001 | $ | 17,437 | ||||

|

|

|

| |||||

Earnings per Share From Continuing Operations: | ||||||||

Basic | $ | 0.12 | $ | 0.21 | ||||

Diluted | $ | 0.11 | $ | 0.20 | ||||

12

Table of Contents

| As of June 30, | ||||||||

| 2013 | 2012 | |||||||

(in thousands) | ||||||||

Cash and cash equivalents | $ | 93,413 | $ | 81,122 | ||||

Working capital (1) | 49,861 | 43,008 | ||||||

Total assets | 379,143 | 357,777 | ||||||

Total shareholders’ equity | 237,127 | 217,940 | ||||||

| Fiscal Year Ended June 30, | ||||||||

| 2013 | 2012 | |||||||

(in thousands) | ||||||||

Cash flows from operations | $ | 30,523 | $ | 18,776 | ||||

| (1) | Working capital is defined as current assets less current liabilities. |

Non-IFRS Measures

Management uses several financial measures, both IFRS andnon-IFRS, in analyzing and assessing the overall performance of the business and for making operational decisions. Our annual financial plan and our multiple-year strategic plan are prepared on both an IFRS andnon-IFRS basis, both of which are approved by our Board of Directors. Historically, we have providednon-IFRS measures to our shareholders. The Board of Directors and management utilize both our IFRS andnon-IFRS measures in a number of ways, including: to facilitate our determination of our allocation of resources, to measure our actual performance against budgeted and forecasted financial plans and to establish and measure management’s compensation. We believe that thesenon-IFRS measures are also useful to investors and other users of our financial statements in evaluating our performance because thesenon-IFRS financial measures may be used as additional tools to compare business performance across peer companies and across periods.

While we usenon-IFRS measures as a tool to enhance our understanding of certain aspects of our financial performance, we do not believe that thesenon-IFRS measures are a substitute for, or are superior to, the information provided by IFRS results. As such, the presentation ofnon-IFRS measures is not intended to be considered in isolation or as a substitute for any measure prepared in accordance with IFRS. The primary limitations associated with the use ofnon-IFRS measures as compared to IFRS results are thatnon-IFRS measures may not be comparable to similarly titled measures used by other companies in our industry and thatnon-IFRS measures may exclude financial information that some investors may consider important in evaluating our performance. We compensate for these limitations by providing disclosure of the differences betweennon-IFRS measures and IFRS results, including providing a reconciliation of eachnon-IFRS measure to IFRS results, in order to enable investors to perform their own analysis of our operating results.

Management’s assessment of certainnon-IFRS measures are included elsewhere in this prospectus, in the section “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Financial and Operational Metrics.”

Adjusted Revenue

We defined adjusted revenue as revenue, as reported under IFRS, increased to include revenue that is associated with our historic acquisitions that has been excluded from reported results for a given period due to the effects of purchase accounting. In accordance with IFRS purchase accounting, an acquired company’s deferred revenue at the date of acquisition is subject to a fair value adjustment which reduces the deferred amount and revenues recognized subsequent to an acquisition.

On July 31, 2013, we acquired 100% of the shares of Kapow Technology Holdings, Inc. (Kapow). Kapow because of its term license business model, recognizes its revenue ratably over the term of its sales arrangements,

13

Table of Contents

and accordingly had a large amount of deferred revenue at the date of acquisition impacted by this fair value adjustment. We include adjusted revenue to allow for more complete comparisons to the financial results of our historical operations, forward-looking guidance and the financial results of peer companies. We believe these adjustments are useful to management and investors as a measure of the ongoing performance of the business. Additionally, although acquisition related revenue adjustments are non-recurring we may incur similar adjustments in connection with any future acquisitions.

The table below provides a reconciliation of IFRS revenue to adjusted revenue related to all of our historic acquisitions:

| Fiscal Year Ended June 30, 2013 | Fiscal Year Ended June 30, 2012 | |||||||||||||||||||||||

| Revenue (as reported under IFRS) | Acquisition Fair Value Adjustment | Adjusted Revenue (non-IFRS) | Revenue (as reported under IFRS) | Acquisition Fair Value Adjustment | Adjusted Revenue (non-IFRS) | |||||||||||||||||||

| ($ in thousands) | ($ in thousands) | |||||||||||||||||||||||

Software licenses | $ | 112,228 | $ | 156 | $ | 112,384 | $ | 117,255 | $ | 366 | $ | 117,621 | ||||||||||||

Maintenance services | 121,751 | 205 | 121,956 | 113,784 | 1,508 | 115,292 | ||||||||||||||||||

Professional services | 32,339 | — | 32,339 | 31,442 | — | 31,442 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total revenue | $ | 266,318 | $ | 361 | $ | 266,679 | $ | 262,481 | $ | 1,874 | $ | 264,355 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| Three Months Ended September 30, 2013 | Three Months Ended September 30, 2012 | |||||||||||||||||||||||

| Revenue (as reported under IFRS) | Acquisition Fair Value Adjustment | Adjusted Revenue (non-IFRS) | Revenue (as reported under IFRS) | Acquisition Fair Value Adjustment | Adjusted Revenue (non-IFRS) | |||||||||||||||||||

| ($ in thousands) | ($ in thousands) | |||||||||||||||||||||||

Software licenses | $ | 24,444 | $ | 1,515 | $ | 25,959 | $ | 22,132 | $ | 43 | $ | 22,175 | ||||||||||||

Maintenance services | 32,098 | 307 | 32,405 | 29,876 | — | 29,876 | ||||||||||||||||||

Professional services | 8,870 | 314 | 9,184 | 8,127 | — | 8,127 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total revenue | $ | 65,412 | $ | 2,136 | $ | 67,548 | $ | 60,135 | $ | 43 | $ | 60,178 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Adjusted Income from Operations

We define adjusted income from operations as income from operations, as reported under IFRS, excluding the effect of acquisition fair value adjustment to revenue, share-based payment expense, depreciation expense, amortization of acquired intangible assets, acquisition-related costs, restructuring costs and other operating expense, net. Share-based payment expense, depreciation expense and amortization of acquired intangible assets in our adjusted income from operations reconciliation representnon-cash charges which are not considered by management in evaluating our operating performance. Acquisition-related costs consist of: (i) costs directly attributable to our acquisition strategy and the evaluation, consummation and integration of our acquisitions (composed substantially of professional services fees including legal, accounting and other consultants and to a lesser degree to our personnel whose responsibilities are devoted to acquisition activities), and (ii) transition compensation costs (composed substantially of contingent payments for shares that are treated as compensation expense and retention payments that are anticipated to become payable to employees, as well as severance payments to employees whose positions were made redundant). These acquisition-related costs are not considered to be related to the organic continuing operations of the acquired businesses and are generally not relevant to assessing or estimating the long-term performance of the acquired assets. Restructuring costs are not considered in assessing our performance as we have not generally incurred such costs for our continuing operations. Other operating expense, net represents items that are not necessarily related to our recurring operations and which therefore are not, under IFRS, included in other expense lines. Accordingly, we exclude those amounts when assessing adjusted income from operations. At times when we are communicating with our shareholders, analysts and other parties we refer to adjusted income from operations as adjusted EBITDA.

14

Table of Contents

We assess adjusted income from operations as a percentage of total adjusted revenue and by doing so, we are able to evaluate our relative performance of our revenue growth compared to the expense growth for those items included in adjusted income from operations. This measure allows management and our Board of Directors to compare our performance against that of other companies in our industry that may be of different sizes. The table below provides a reconciliation of IFRS income from operations to adjusted income from operations and presents adjusted income from operations as a percentage of total adjusted revenue:

| Fiscal Year Ended June 30, | Three Months Ended September 30, | |||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

(in thousands, except percentages) | ||||||||||||||||

Income (loss) from operations | $ | 25,128 | $ | 22,138 | $ | (624 | ) | $ | 45 | |||||||

Acquisition fair value adjustment to revenue | 361 | 1,874 | 2,136 | 43 | ||||||||||||

Share-based payment expense | 1,393 | 3,905 | 749 | 362 | ||||||||||||

Depreciation expense | 6,009 | 5,913 | 1,383 | 1,583 | ||||||||||||

Amortization of acquired intangible assets | 6,707 | 5,190 | 2,224 | 1,607 | ||||||||||||

Acquisition-related costs, excluding share-based payment expense | 4,682 | 5,758 | 2,104 | 1,438 | ||||||||||||

Restructuring costs | — | 4,917 | — | �� | — | |||||||||||

Other operating expense, net | 2,395 | 669 | 311 | 1,179 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Adjusted income from operations | $ | 46,675 | $ | 50,364 | $ | 8,283 | $ | 6,257 | ||||||||

|

|

|

|

|

|

|

| |||||||||

Adjusted income from operations as a percentage of total adjusted revenue | 17.5 | % | 19.1 | % | 12.3 | % | 10.4 | % | ||||||||

|

|

|

|

|

|

|

| |||||||||

Adjusted Diluted Earnings Per Share

We define adjusted diluted earnings per share as diluted earnings per share, as reported under IFRS, adjusted by certain items that are also excluded from our adjusted income from operations and which are discussed above. The most comparable IFRS metrics, ‘income (loss) from continuing operations, after tax’ and ‘earnings per share – diluted’, also include the reconciling items finance income (expense), net, and the impacts of income taxes on each of the other reconciling items. Therefore, we include this non-IFRS measure in order to provide a more complete comparison of our earnings per share from one period to another. The table below provides a reconciliation of our adjusted diluted earnings (loss) per share, and our associated adjusted income (loss) from continuing operations, after tax:

15

Table of Contents

| Fiscal Year Ended | Three Months Ended September 30, | |||||||||||||||||||||||||||||||

| June 30, 2013 | June 30, 2012 | 2013 | 2012 | |||||||||||||||||||||||||||||

($ in thousands, except per share data) | ||||||||||||||||||||||||||||||||

| Per Diluted Share | Per Diluted Share | Per Diluted Share | Per Diluted Share | |||||||||||||||||||||||||||||

Diluted earnings (loss) per share and income (loss) from continuing operations, after tax | $ | 0.11 | $ | 10,001 | $ | 0.20 | $ | 17,437 | $ | 0.03 | $ | 2,454 | $ | (0.01 | ) | $ | (866 | ) | ||||||||||||||

Acquisition fair value adjustment to revenue | 0.01 | 361 | 0.02 | 1,874 | 0.02 | 2,136 | 0.00 | 43 | ||||||||||||||||||||||||

Share-based payment expense | 0.01 | 1,393 | 0.04 | 3,905 | 0.01 | 749 | 0.00 | 362 | ||||||||||||||||||||||||

Amortization of intangible assets | 0.08 | 6,707 | 0.06 | 5,190 | 0.03 | 2,224 | 0.02 | 1,607 | ||||||||||||||||||||||||

Acquisition-related costs | 0.05 | 4,682 | 0.07 | 5,758 | 0.02 | 2,104 | 0.02 | 1,438 | ||||||||||||||||||||||||

Restructuring costs | — | — | 0.06 | 4,917 | — | | — | | — | | — | | ||||||||||||||||||||

Net finance and other income and expense, net | 0.11 | 9,324 | (0.06 | ) | (4,625 | ) | (0.04 | ) | (3,378 | ) | 0.02 | 1,300 | ||||||||||||||||||||

Tax effect of above adjustments | (0.05 | ) | (4,300 | ) | (0.04 | ) | (3,324 | ) | (0.02 | ) | (2,090 | ) | (0.01 | ) | (753 | ) | ||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Adjusted diluted earnings per share | $ | 0.32 | $ | 0.35 | $ | 0.05 | $ | 0.04 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

| Fiscal Year Ended | Three Months Ended September 30, | |||||||||||||||

| June 30, 2013 | June 30, 2012 | 2013 | 2012 | |||||||||||||

(shares in millions) | ||||||||||||||||

Diluted weighted average number of shares | 88.7 | 88.5 | 90.4 | 88.4 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Adjusted Cash Flows from Operations

We define adjusted cash flows from operations as net cash inflows from operating activities, as reported under IFRS, adjusted for income taxes paid or refunded and payments under restructurings. Income tax payments paid/(refunded) is included in this reconciliation as the timing of cash payments and receipts can vary significantly fromyear-to-year based on a number of factors, including the influence of acquisitions on our consolidated tax attributes. Payments for restructurings relate to a specific activity that is not part of ongoing operations. The table below provides a reconciliation of IFRS cash flows from operations to adjusted cash flows from operations:

| Fiscal Year Ended June 30, | Three Months Ended September 30, | |||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

(in thousands) | ||||||||||||||||

NetCash inflow from operating activities | $ | 30,523 | $ | 18,776 | $ | 18,406 | $ | 8,608 | ||||||||

Income taxes paid / (refunded) | 10,749 | 12,172 | 1,302 | 1,851 | ||||||||||||

Payments under restructuring-personnel | 863 | 3,331 | 100 | 840 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Adjusted cash flows from operations | $ | 42,135 | $ | 34,279 | $ | 19,808 | $ | 11,299 | ||||||||

|

|

|

|

|

|

|

| |||||||||

16

Table of Contents

Investing in our common shares involves a high degree of risk. You should carefully consider the risks described below, which we believe are the material risks of our business, our industry and this offering, before making an investment decision. If any of the following risks actually occurs, our business, financial condition and operating results could be harmed. In that case, the trading price of our common shares could decline and you might lose all or part of your investment in our common shares. In assessing these risks, you should also refer to the other information contained in this prospectus, including our consolidated financial statements and the related notes thereto.

Risks Related to Our Business

Sales of our software licenses and the related revenue from those sales, particularly those sales made through our direct sales force, require significant time and effort and are therefore difficult to predict accurately. In addition, since the majority of our expenses are based on anticipated revenue levels, if those revenue levels are not met, we may not be able to reduce our expenses in a timely manner to offset a shortfall in revenue. This unpredictability in the timing or amount of our receipt of revenue may cause our quarterly results of operations to vary considerably and the market price of our common shares to be materially adversely affected.

Many of our contracts, particularly those sold through our direct sales force, are finalized in the latter portions of any given quarter. Additionally, our revenue may vary from quarter to quarter, depending on the timing and size of our license revenue, which may contain individually large contracts in any given period. Our first and third fiscal quarters have historically been seasonally weaker than our second and fourth quarters.

Our direct sales force’s efforts to attract new customers require substantial time and effort, and we cannot assure you that we will be successful in establishing new relationships or maintaining or advancing our current relationships. Further, many of our customers typically require one or more internal levels of approval before they can purchase our products and services. As a result, during our sales efforts, we must identify multiple people involved in the purchasing decision and devote a sufficient amount of time to presenting our products and services to those individuals. The breadth of our offerings often requires us to spend substantial time and effort assisting potential customers in evaluating our products and services, including providing demonstrations and benchmarking against other available offerings. This process can be costly and time consuming, and we often do not know if any given sales efforts will be successful until the latter stages of those efforts. Additionally, if we are unable to forecast market demand and conditions, we may not be able to expand our sales efforts at appropriate times and our revenue and related results of operations could be materially adversely affected.

We plan our expenditures based on anticipated future revenue. If the timing or amount of revenue fails to meet our expectations in any given quarter, our financial performance could be materially adversely affected because only small portions of expenses vary with revenue. Quarterly or annual operating results that are not in line with our own guidance or the expectations of public market analysts and other investors could materially adversely affect the market price of our common shares. As a result,period-to-period comparisons of operating results are not necessarily meaningful and should not be relied upon to predict future performance.

Our failure to successfully develop, market or sell new products or adopt new technology platforms could materially adversely affect our results of operations and financial condition.

Our software competes in a market characterized by rapid technological advances, evolving standards in software technology and frequent new product introductions and enhancements that may render existing products and services obsolete. We cannot assure you that we will be able to compete effectively or respond to rapid technological changes in our industry. In addition, the introduction of new products or updated versions of existing products has inherent risks, including, but not limited to, risks concerning:

| • | product quality, including the possibility of software defects, which could result in claims against us or the inability to sell our software products; |

17

Table of Contents

| • | the fit of the new products and features with a customer’s needs; |

| • | the need to educate our sales, marketing and services personnel to work with the new products and features, which may strain our resources and lengthen sales cycles; |

| • | market acceptance of initial product releases; |

| • | marketing effectiveness; and |

| • | the accuracy of research or assumptions about the nature and extent of customer demand. |

We may need to adopt newer technology platforms for our enterprise software products as older technologies become obsolete. We cannot assure you that we will be successful in making the transition to new technology platforms for our products in the future. We may be unable to adapt to the new technology, may encounter errors resulting from a significant rewrite of the software code for our products or may be unable to complete the transition in a timely manner. In addition, as we transition to newer technology platforms for our products, our customers may encounter difficulties in the upgrade process, delay decisions about upgrading our products or review their alternatives with a competing supplier.

Because we commit substantial resources to developing new software products and services, if the markets for these new products or services do not develop as anticipated, or demand for our products and services in these markets does not materialize or materializes later than we expect, we will have expended substantial resources and capital without realizing sufficient offsetting or resulting revenue, and our business and operating results could be materially and adversely affected. Developing, enhancing and localizing software is expensive, and the investment in product development may involve a long payback cycle. Our future plans include significant additional investments in research and development of our software and other intellectual property. We believe that we must continue to dedicate a significant amount of resources to our research and development efforts to maintain our competitive position. However, we may not receive significant revenue from these investments for several years, if at all. In addition, as we or our competitors introduce new or enhanced products, the demand for our products, particularly older versions of our products may decline. If we are unable to provide continued improvements in the functionality of our older products or move users that are using our older products to our newer products, our revenue may decline.

We may not be able to continue to grow through acquisitions or investments in other companies or technologies which could lead to our revenue not growing at an acceptable rate and may in turn harm our business.

Our business has expanded, in part, as a result of acquisitions of, or investments in, other companies. We intend to consider additional acquisitions of companies, products and technologies, as well as investments in other businesses. We cannot assure you that we will be able to identify other suitable acquisitions or investment candidates. Even if we do identify suitable candidates, we cannot assure you that we will be able to make other acquisitions or investments on commercially acceptable terms, if at all. Even if we agree to purchase a company, technology or other assets, we cannot assure you that we will be successful in consummating the purchase. If we are unable to continue to expand through acquisitions, our revenue may fail to grow or may decline, and our business may be harmed.

Our ability to realize the anticipated benefits of our consummated acquisitions will depend on successfully integrating the acquired businesses, which if not done successfully could adversely affect our operating results and financial condition. If we are unable to successfully integrate acquired businesses, or if an acquired business’ results of operations do not meet our expectations, we may record charges to earnings.

Acquisitions involve numerous risks, any of which could harm our business, including:

| • | difficulties in integrating the operations, technologies, services and personnel of acquired businesses; |

18

Table of Contents

| • | cultural challenges associated with integrating employees from an acquired company into our organization; |

| • | ineffectiveness or incompatibility of acquired technologies or services; |

| • | additional financing required to make contingent payments; |

| • | potential loss of key employees of acquired businesses; |

| • | inability to maintain the key business relationships and the reputations of acquired businesses; |

| • | diversion of management’s attention from other business concerns; |

| • | inability to maintain our standards, controls, procedures and policies; |

| • | litigation for activities of the acquired company, including claims from terminated employees, customers, former shareholders or other third parties; |

| • | in the case of acquisitions made across multiple geographic areas, the need to integrate operations across different cultures and languages and to address the particular economic, currency, political and regulatory risks associated with specific countries; |

| • | failure to successfully further develop the acquired technology; and |

| • | increased fixed costs. |

While we have not experienced any material issues associated with integrating acquisitions completed to date, as a result of these and other risks, if we are unable to successfully integrate acquired businesses in the future, we may not realize the anticipated benefits from our acquisitions. Any failure to achieve these benefits or failure to successfully integrate acquired businesses and technologies could seriously harm our business.

We will incur costs in connection with executing our acquisition strategy. Fees related to our acquisition strategy include amounts incurred during the evaluation of possible acquisition targets that may, or may not, ultimately be acquired by us. These costs, in addition to the time of our management and employees, include amounts payable to attorneys and other professional services firms. All fees relating to our acquisition strategy are expensed as incurred. In addition to costs to consummate an acquisition, we may record a significant amount of other charges to our operating results that are directly related to our acquisitions, including those acquisitions that are deemed to be operationally or strategically successful, including: the amortization of intangible assets acquired; charges to our operating results due to the accounting for contingent payments made in connection with acquisitions; costs incurred to combine the operations of companies we acquire, such as employee retention, redeployment or relocation expenses; charges to our operating results to eliminate certain duplicativepre-acquisition activities, to restructure our combined operations or to reduce our cost structure; charges to our operating results due to changes in deferred tax asset valuation allowances and liabilities related to uncertain tax positions after the measurement period of any given acquisition has ended; and charges to our operating results due to the expensing of certain equity awards assumed in an acquisition.

The accounting for acquisitions requires assets and liabilities to be stated at their acquisition date fair value, which generally results in an increase being recorded to the historic value of net assets, including recording the fair value of assets such as acquired intangible assets and goodwill, and also including a reduction in the value of acquired deferred revenue. The increased value of net assets generally results in lower post-acquisition earnings when compared to thepre-acquisition earnings of the acquired businesses. These costs, when and if recorded, could be material and could differ substantially from similar costs recorded in prior years.

Continued uncertainty in the global financial markets and unfavorable global economic conditions may adversely affect our business, results of operations and financial condition.

Continued uncertainty in the global financial markets and unfavorable global economic conditions may adversely affect us. Our revenue was adversely affected in each of fiscal 2013 and fiscal 2012, in part due to

19

Table of Contents

unfavorable global economic conditions, including the recessionary economic environment in many southern European and other countries, as well as the financial services segment of the market. These macroeconomic developments could continue to negatively affect our business, operating results or financial condition in a number of ways, which, in turn, could adversely affect our share price. A prolonged period of economic decline could have a material adverse effect on our results of operations and financial condition and exacerbate some of the other risk factors described herein. Our customers may defer or reduce purchases of our software licenses and services. Our customers may also not be able to obtain adequate access to credit, which could affect their ability to make timely payments to us or ultimately cause the customer to file for protection from creditors under applicable insolvency or bankruptcy laws. In addition, a significant portion of our revenues are generated from users in the financial services, insurance and government vertical markets, including the U.S. federal government. A decline in revenues generated from these users, including any decline due to a protracted shutdown of the U.S. federal government, could have a material adverse effect on our results of operations and financial condition.

Our future revenue depends in part on our installed user base continuing to purchase software licenses, renew customer maintenance agreements and purchase additional professional services. If existing customers do not continue, or expand, the use of our products or services our results of operations could be materially adversely affected.